What are the latest headlines? Do they impact the markets? Well, it depends. On Monday, October 17, 2005, here were some of the headlines that may have impacted you. GM reached a tentative agreement with the union. What’s the impact? It seemed to satisfy long term investors. Company profits are bound to improve with lower labour costs, right? The Supreme Court refused to allow the government to pursue a $280 billion penalty against tobacco companies. That should help their profits.

Are you ready to invest? What about oil prices? There’s a tropical storm in the Gulf Coast region that threatens to raise the price of light crude oil once again. And the Federal Reserve Board? What will they do next? The economy has been a little uncertain with tropical storms, oil prices, and possibly lower than expected earnings of major companies. Are they going to tighten interest rates? No one knows for sure, but if only we had a crystal ball.

In the movie “Broadcast News,” the news director tells a newbie anchor, you better prepare. His sarcastic reply, “How do you prepare for tomorrow’s news?” As a short-term trader, however, you may aspire to prepare for tomorrow’s news. Imagine if you had a magic newspaper, like on the television show, “Early Edition.” If you knew the headlines, think of what you could do. On second thought, what could you do? What you really need is the financial section of the magic newspaper.

The notion that you could trade the markets more skillfully if you had tomorrow’s newspaper the day before is a fallacy. It is based on the commonsensical, but erroneous, belief that market participants react to media news in predictable ways, but they don’t always do so. Conventional wisdom about how market participants will behave is only a guess. Conventional wisdom is only correct when it happens to be correct, and thus, history in the markets only repeats itself when it does, and that may not be all the time.

It is not useful to view the markets as following natural scientific laws. Market participants don’t behave like inanimate objects in the physical world. They are irrational. They allow their perceptions and emotions to guide them. Think about how you allowed today’s headlines to influence you. Did you read the headlines? If you didn’t read them, then how could they influence your trading decisions? Even if you did read them, what was your interpretation of them? An interpretation of the headlines is subjective.

How you interpret a headline depends on your past experience with the markets or whether or not you want to admit that a piece of news actually may impact your trading plan. You may unconsciously decide to deny its existence, and if you did that, then it could not have impacted your trading decisions. In addition, consider the different stories about the markets reported on any given day.

How do you weight the information? What stories do you pay attention to? How do you put it all together and draw a conclusion? It all depends on your personality and experience with the markets. If you are that complicated, and hard to predict, imagine how difficult it is to forecast a group of people’s behaviour. They are individuals with their own histories, motives, and biases. People are hard to anticipate.

Because the markets are made up of people, it’s virtually impossible to precisely anticipate what they will do. In the end, you’ll have to accept the fact that no information is perfect. But you aren’t helpless. The markets may be inherently chaotic and difficult to anticipate, but you can take precautions. First, admit that you don’t have perfect knowledge and that you can’t perfectly anticipate what the markets will do.

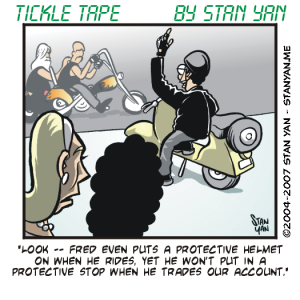

All you can do is look at all the available information as completely as possible, and make an educated guess as to what the market will do. Many times, you can, in fact, accurately anticipate the future market action. It’s a matter of preparation and taking a risk. That said, the second thing you must do to survive is to manage risk. Because the markets are inherently chaotic, you must assume that you will be wrong more times than you would like. There’s no point in risking more money than you can afford, losing it, and suffering dire consequences.

No one knows tomorrow’s news, but more importantly, no one knows how market participants will react to the news. Don’t make the mistake of thinking that you have special knowledge. Admit your limitations, study the markets thoroughly, make an educated guess, and manage risk so that you’ll be protected in the event that you guess wrong. You can’t make the market meet your expectations. You have to go where the markets take you.