It is vital for one’s survival to know when to stay out of the markets. There are times whey you should stand aside and wait for the right moment. Not only can market conditions change, but also your psychological outlook. When market conditions aren’t conducive to profitable tradition, it is a good idea to stay away. Even seasoned professionals must frequently step back and reevaluate their methods. Don’t be afraid to acknowledge your limitations, take a rest, and enter the markets when you’re ready. There are many practical reasons for standing aside.

There are psychological reasons for staying out of the markets. Some days you feel tired, down, or just not feeling at your best. It’s at these times that you may not be able to maintain the positive, objective mindset you need for trading. You may act emotionally or impulsively because your psychological resources are depleted. Some may be tempted to work through such a down spell and put on trades even though one is not in the right mental state, but that could mean putting on bad trade after bad trade.

Not only will your account balance take hits, but your ego as well. The next day, when you are feeling up to par, you may feel the residue of the slump when you look at your account balance. And that can create feelings of stress on a day when you would have otherwise felt carefree, optimistic, and ready to take on the markets in earnest. For the most part, it’s better to stand aside when your spirits are down, and start new and refreshed when you are once again feeling at your best.

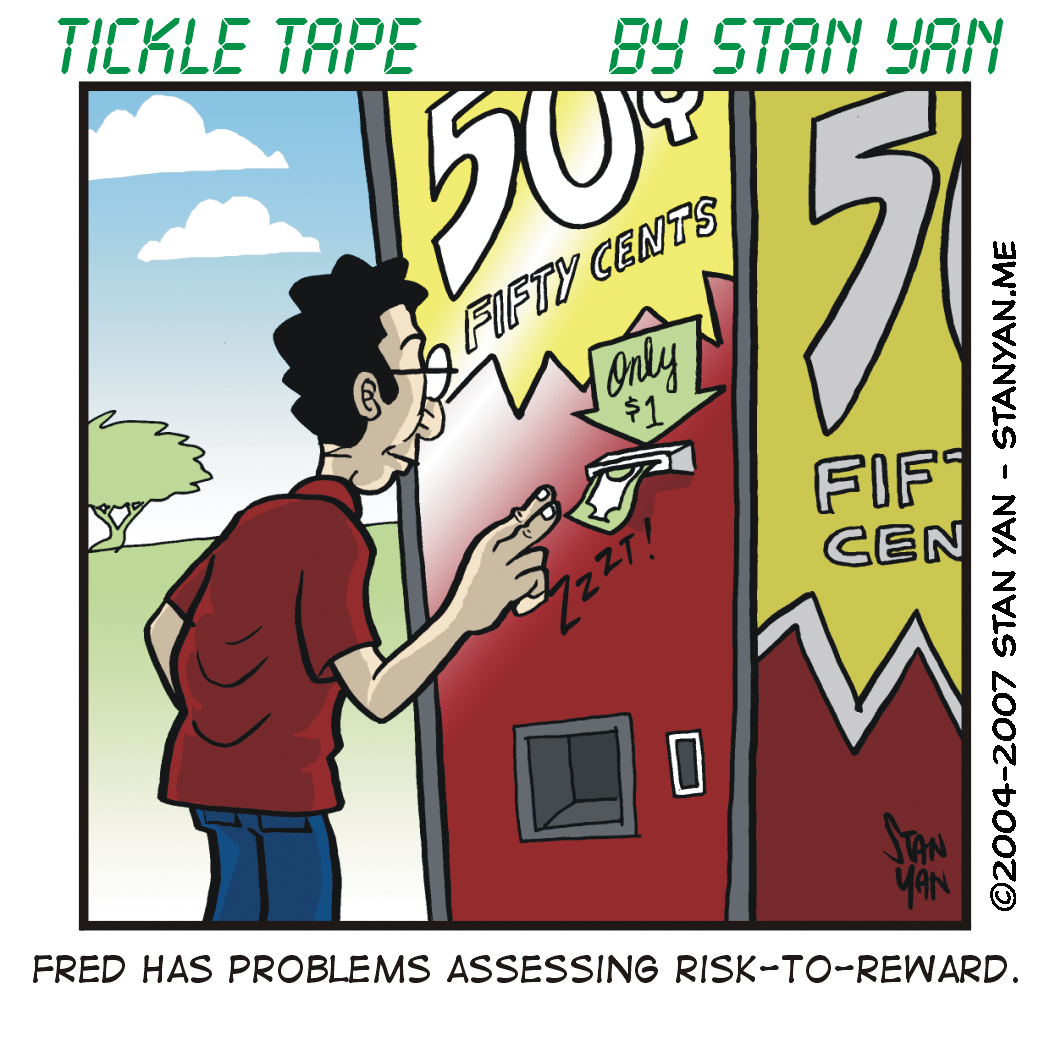

Another good reason to stay out of the markets is when your method seems to lose it’s winning edge. No trading method works indefinitely. When market conditions change, even a “foolproof” method can stop working. Many novice traders make this situation even worse by continuing to trade. When a method stops working, it can really stop working. Your account balance will decline with each trade. Another mistake is to lose your cool when your method stops working. Rather than view such events as a time for worry and self-doubt, it’s wise to view them as an intellectual challenge.

Seasoned professionals often say that they are at their best when their old method starts to falter and they have to devise a new one. They view the situation as a puzzle they must solve. They step away from the markets and take a close look at their methods. They try to identify what went wrong with the method and look forward to tweaking it until it works again. They search for market factors that may have changed, and when they think they have found the solution, they put on a few small trades to test out their new, revised method. So when your method stops working, don’t continue trading at the same level of activity. Step back, look things over, and wait until conditions are just right before entering.

Trading profitably requires that you monitor the market moods and your psychological moods. When either one is not conducive to trading, it’s best to stand aside and wait for the situation to change. Don’t make the mistake of thinking you should trade even in these potentially debilitating conditions. By staying out of the markets, you can survive to trade another day, when you’re in a peak performance mental state and the market conditions are optimal.