Alan Greenspan, in his opening remarks at the August 29, 2003 symposium sponsored by the Federal Reserve of Kansas City, said, “Uncertainty is not just an important feature of the monetary policy landscape; it is the defining characteristic.” He went on to say that macroeconomic models are vastly oversimplified. Indeed, the economy is complex. There are so many forces and variables, known and unknown, that influence the economy, it’s impossible to account for all of them.

The economy isn’t the only complex system. Complex systems proliferate in nature. Ancient philosophers, such as Heraclitus of Ephesus, made this observation long ago. All the elements of the world, such as time, fire, water, earth, and air are constantly in flux and figuratively, it is impossible to “step into the same river twice.” Nature is constantly dividing and reuniting itself. And the market is no different. You will never enter a trade in the exact same river (market) you previously traded. It may look the same, but it will be different. The current will be faster or slower (volatility); it will be deeper or shallower (volume); the water will be clearer or muddier (visibility). There are thousands of variables, and almost none of them are comprehensible.

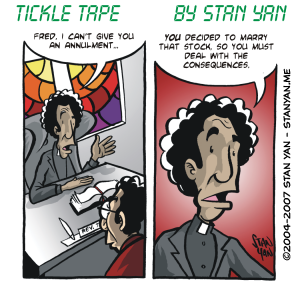

And what would you guess is the biggest variable of all—which you probably assume—is constant? As Pogo so aptly put it, “We have met the enemy and he is us!” Your personal psychology is also constantly in flux. You are happy one day and melancholy the next; you are continuously learning new things about the market and forgetting others; your confidence level twists and turns like the river’s path. When you left the house for your trading floor, did anything go wrong or especially right? What about the trip? How was the mood of your fellow traders when you arrived? How did your first trade go off? Did you have clarity the minute you began trading or did you struggle for it?

Everything is moving, whether we see it or can measure it. This insight is particularly important to the system’s developers or traders using black-box software. It helps explain why certain trading software programs work well for only a short time before they crash and burn. There are many other reasons for this phenomena but the ever-changing interplay among market forces is certainly a big part of it.

How can you deal with constant change? First, always be aware of it. Expect it. Accept it as normal. Second, protect your profits from the ravages of the unexpected. Risk management, such as protective stops, is vital. Constant vigilance can make a big difference; healthy skepticism can be a lifesaver. Third, become a full-time student of the particular market you trade. Develop a passion for trading and your primary trading entity. Work at becoming a Zen-trader, where you become one with the market and feel its moves as you would if you were swimming in the river. None of these approaches are easy, but neither is becoming a successful trader.