Would you rather have a job that pays a low salary but provides a steady income or a high paying job that may not be around next year? The answer to this question reveals a lot about your preferred trading style. If you are like most short-term active traders, you don’t mind exchanging a little bit of security for a higher salary. Compared to typical jobs, trading in the short-term is risky, and one of the main factors influencing your preference for risk is your overall feeling of confidence and security.

If your overall confidence is easily compromised, and if you strongly need to feel safe and secure, you’ll have difficulty trading in the short term. You’ll often feel anxious and uneasy. Can you build up risk tolerance? Yes, but it depends on your psychological makeup. The need for security is often based on early childhood experiences, and for some, can be difficult to change.

Money and security go hand in hand. The more money we have, the more easily we can acquire food and shelter. When our money is on the line, it’s understandable to also think that our sense of safety and security is on the line. But what is a mere monetary loss to some can feel like a threat to safety and security to others. Losses take on a greater personal significance when your self-confidence is on shaky ground. For some traders, self-doubt, fear, and uncertainty may go back to the early bond formed between parent and child.

Early parent-child relationships can shape people’s expectations, especially the extent to which a person feels safe and secure. Many people who feel confident and secure tended to have parents who provided what psychologists call a “secure base.” Parents and loved ones were dependable, reliable, and available. This allowed the child to explore the uncertain and terrifying outside world in a carefree manner.

They knew that if they encountered fear, they could quickly return to their “secure base” and gain comfort and safety. Other children felt less safe and secure. Their parents were less caring and reliable, and thus, they were fearful of leaving their parents’ side because they didn’t believe their parents would be there when they returned. They were afraid to venture out, did not learn to cope with uncertainty, and in adult life tend to unrealistically expect failure and rejection. Taking risks as adults is especially fearful.

People that are the most comfortable taking risks always felt safe, as children and as adults. It’s as if they feel significant loved ones are always there with them to provide safety and support. That said, there are also risk-seeking gamblers. People who had parents who were psychologically absent also take risks. They tend to have a “who cares” approach to life. They may be able to take risks, but they don’t have the discipline to develop specific plans and follow them. Many people fall somewhere in the middle. They can take a few risks, but they are often undisciplined. The lack of discipline usually reflects fear. They fear loss and hurt, and over-react to setbacks. A losing trade has a greater symbolic meaning: it is a loss of safety and security.

If you have low-risk tolerance, how do you beat it? First, you have to be realistic. If you are afraid to take risks because money represents safety and security, you’ll have to make small trades and carefully manage them. Second, you may also have to adjust your trading style to match your personality. Some people with major risk tolerance issues prefer long term investing; when done properly, it can be less risky.

You can identify stocks that are relatively stable and increase in value over the long term. You won’t make as much with this approach, but your emotions won’t be as wobbly. You’ll feel calmer, and enjoy trading the markets. Third, you may want to work a stable job on the side to pay basic living expenses. If you know that your basic living expenses are relatively secure, you’ll feel more comfortable “moonlighting” as a trader.

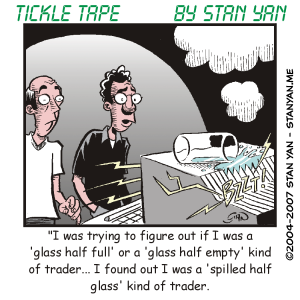

Winning traders have high levels of risk tolerance. If you have trouble taking risks, you’ll have trouble trading the choppy, volatile markets in the short term. You won’t feel comfortable, calm, and secure. And you’ll likely make trading errors. But that doesn’t mean you have to stop trading. You just need to be aware of your personality and work around it. If you match your trading style to your personality, you’ll make profits in the end.