If you’re an eternal optimist, you hate bad news. But the bad news is relative. What is bad news to some is mere information, and possibly good news, to others. (For example, if you were going long last Friday, the sell-off was bad news, but if you were short, you probably felt it was a bonanza.) Some novice traders hate bad news and do anything to avoid hearing it. It takes many forms.

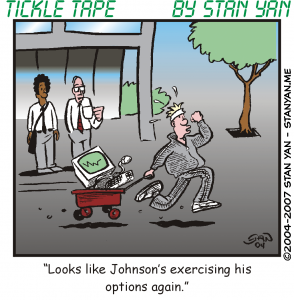

Some traders keep losses on paper to avoid acknowledging them. Other traders avoid looking at performance statistics, such as a win-loss ratio, in order to keep up the illusion that they are making huge profits. Others fudge a little, making a bunch of low-profit trades to artificially boost their win-loss ratio, and still, others feed their accounts every month and hope that someday, they’ll make the huge profits they’ve been hoping for.

In the end, these are all just ways of using psychological “denial,” futile attempts to passively solve problems instead of taking active, decisive steps to solve them. But knowledge is power, and the more you know about your trading performance, the more you will be able to improve your trading potential and take home more profits.

Denial can be useful at times. For example, if you have developed a thorough trading plan and there is very little that can go against it, it doesn’t make sense to focus on the few unlikely events that may ruin your plan. If you focus on what can go wrong, you’ll hesitate.

You may unnecessarily question your plan. At the moment you are ready to execute your trade, a little denial helps matters. You feel carefree and ready to see what will happen next. Over the long term, however, denial does more harm than good. If you are trying to avoid monitoring your trading performance, you will always feel uneasy. You will secretly dread taking an honest look because you are afraid of what you’ll find.

It’s hard to look at our performance when we think things aren’t going well. But if we don’t, we cannot find ways to improve. It’s all a matter of attitude. Winning traders carefully look at their performance. They view it as a process that may need fixing. Just as an auto mechanic tries to fix a broken car, the winning trader identifies what works and what doesn’t. Rather than passively ignoring the problem, winning traders actively identify what’s going wrong and make changes. They stay detached and look at their performance objectively as if they are merely watching a television documentary.

If you haven’t looked closely at your performance lately, think about doing it soon. Keep a positive attitude. Don’t look at it as a dreaded event, but as an opportunity for improvement. Don’t be afraid of what you may find. If you don’t meet your expectations, don’t look at it as a failure. Just look at it as a type of objective feedback that you can use to improve your trading approach. Stay calm and upbeat. If you look hard enough and think about it enough, you’ll find creative ways to trade more profitably.

And if you don’t immediately find new solutions, it is much better to stand aside until you do, rather than keep losing money on strategies that just don’t work. If you take an active problem-solving approach to find ways to improve your performance, you’ll eventually achieve profitability, and if you keep looking, studying, and changing, you’ll stay profitable across a variety of market conditions.