There’s security in numbers. Have you ever looked at a school of fish in an aquarium? They stay in a big clump because if a bigger fish is nearby and ready to eat one of them, a single fish is less likely to be captured while swimming in the middle of a pack than alone. We humans also “school” in our everyday lives. When speeding along a barren highway, for example, it’s easier to do so when in the middle of a clump of cars. As the logic goes, “the highway patrolperson can’t pull us all over, and give a ticket to the whole bunch.” It’s sometimes easier to follow the crowd, especially when trading. “The trend is your friend” as they say. Well…it isn’t always.

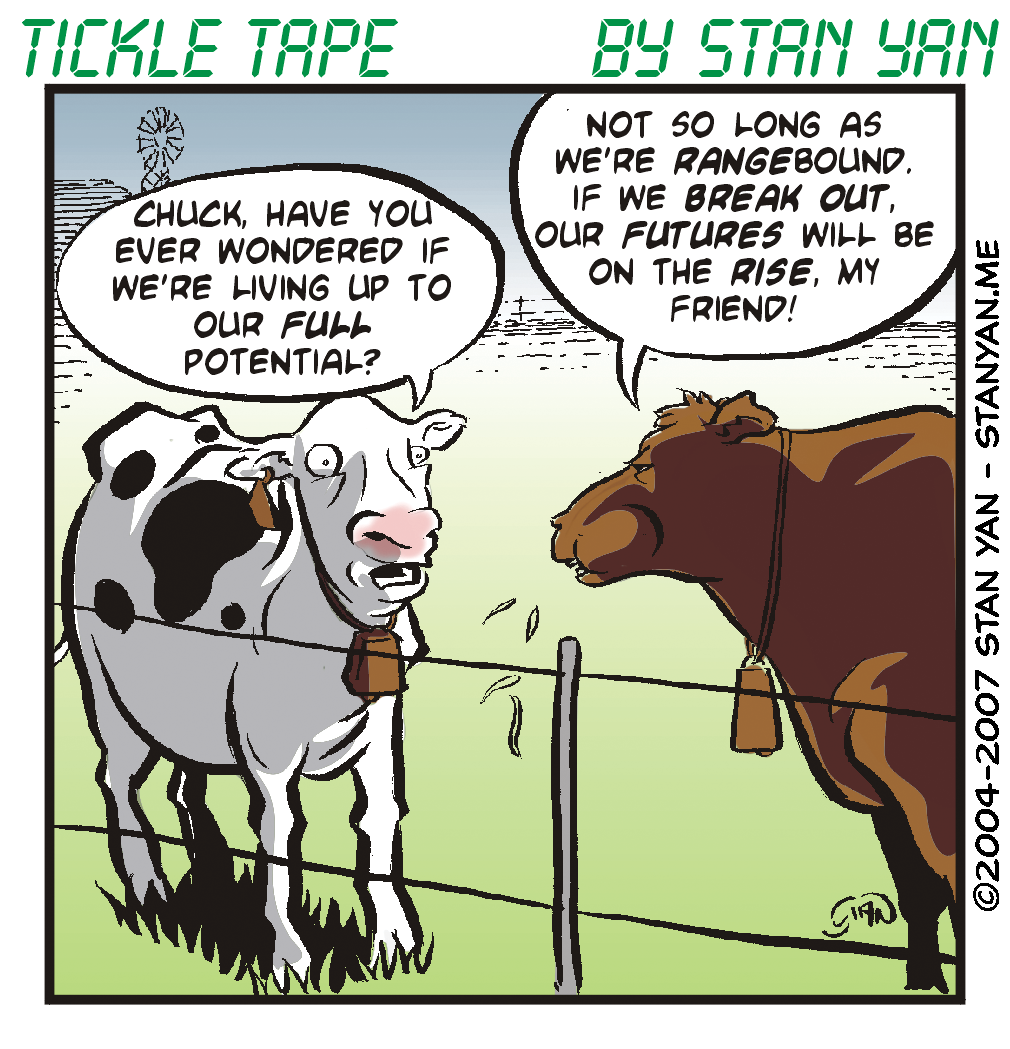

It feels natural for many to follow the crowd. Many times, it’s to our advantage. If none of our well-to-do friends live on the west side of town, it’s in our best interest to find out why, or simply live on the east side with everyone else. But this kind of thinking must be abandoned when it comes to trading. You must learn to anticipate what the crowd will do next, and be the first in line to act alone, rather than wait to follow them. In trading, the primary activity is buying and selling stocks in the short term to make a profit. It’s hard to do that if you are following the crowd.

For example, if you have purchased a large block of stock with the goal of selling it when the price increases a couple of points, you can’t wait for the masses to confirm your expectations. Prices move in cycles. If you wait too long for the price to reach a zenith, and for the masses to buy a large amount of stock, and validate your forecast, you may be trying to sell as the cycle moves the price back downward. And at that point, you’ve missed the buying frenzy, and are likely to be trying to sell your stock at a time when “fear” sets in, and much of the masses are ready to sell their stocks.

Ideally, you must anticipate when the masses are ready to buy, have purchased stock at a lower price than they will gratefully pay, and sell them that stock during the mass buying spree. You need to be the first in line ready to sell, while everyone else is in an entirely different line, ready to join the masses as they buy. You need to anticipate the upcoming trend and do the opposite of what the masses are doing. In terms of the practical methods for doing so, that’s easier said than done.

You’ve got to have accurate momentum indicators, for example, to anticipate the pivot points. But from the psychological point of view, one must also be ready to cast off what we have learned throughout our lives about seeking protection by following others. In this case, there isn’t safety in numbers. When it comes to trading, you’ve got to view the crowd as the opponent, not the ally. You’ve got to anticipate what they are going to do and think of a way to capitalize on their fear and greed.

Keep in mind, the mansions in San Francisco after the California Gold Rush were not built from the mining of precious metals, but from selling food and services to the masses of amateur miners seeking out their fortunes to satisfy their greed. As a trader, you must similarly take advantage of the masses, and capitalize on their “herd mentality.” You need to be the first in line to think of a way to build up your riches from their fear and greed.