A reality of trading is that a trader must doggedly make trade after trade, yet may often face loss after loss before realizing a win. Trading requires persistence in the face of seemingly constant setbacks. It takes a rare person to be able to pick oneself up after a fall and be ready to face another potential setback with enthusiasm. Dr. Martin Seligman has studied how an optimistic mindset helps people persist in the face of setbacks. Optimists, for example, do better in school, win more elections, and succeed more at work than pessimists.

He’s studied several occupational groups from top-notch winning athletes to traders on the floor of the exchange. But he claims that one of the most ruthless professions is that of an insurance agent. The common lore among insurance agents is that it’s often the rule that an agent makes nine calls, and receives nine brush-offs, before making a sale. Selling insurance requires optimism. But even relatively enthusiastic insurance agents fail in the end. For example, Met Life hires 5,000 enthusiastic, new agents a year. Half of these quit in the first year and 80% are gone by the end of four years. Dr. Seligman conducted studies to determine the extent to which optimism is correlated with persistence. Findings from these studies illustrate how you as a trader can learn to persist when faced with constant setbacks.

Optimism is related to explanatory style; that is, the reasons people tell themselves for why they failed. Pessimistic people explain their failures by attributing them to global, internal, and stable causes. For example, they tell themselves personal statements such as “I’m no good” or “No one wants to buy insurance from me.” These statements make the person feel pessimistic. They want to give up easily rather than persist. Dr. Seligman developed a measure of optimistic explanatory style. He administered the measure to salespersons at Met Life. Optimistic salespersons sold 37% more insurance than pessimists. Agents who scored in the top 10% on optimism sold 88% more insurance. Dr. Seligman also compared his measure of explanatory style to standard industry measures used for hiring salespersons. He found that his measure of explanatory style was a much better predictor of sales.

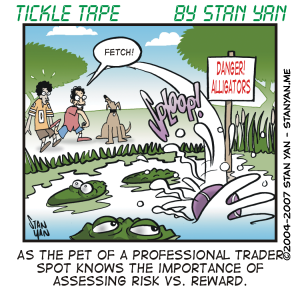

These findings suggest that if you want to succeed as a trader, you must cultivate an optimistic thinking style. You’ll face a lot more losers than winners as a trader, and it will take persistence in the face of the defeat to keep going until you hit upon a series of winning trades. That said, Dr. Seligman warns that optimism may not always be a virtue. Although optimism often leads to superior performance, there may be sound reasons to be pessimistic occasionally. Pessimists, for example, maybe sadder, but they are also wiser.

Studies have shown that pessimists more accurately judge how much control they have over situational circumstances. Pessimists are more realistic in their judgments and thus, it may be beneficial to think pessimistically occasionally. Optimism may make you feel good, but pessimism helps you evaluate the feasibility of your plans, goals, or ideas. Traders, especially novices, are notoriously overly confident. It’s vital for survival to cultivate a balanced sense of optimism. Optimism helps you persist in the face of a setback, but a healthy sense of skepticism will keep you based in reality.

It’s useful to question your trading plan before you implement it, for example. Ask yourself, “Have I accounted for every possible adverse event that may go against my plan? Have I managed my risk appropriately?” Asking such questions and making sure you have the answers will help you survive in the long run. So use optimism wisely. It’s essential to be optimistic as a trader. It will keep you going in a tough game like trading. But also be skeptical. Don’t put blind faith in every trading idea that crosses your mind. Think it through. A balanced sense of optimism will ensure your survival and help you achieve the profits you seek in the long run.