Winning traders approach trading scientifically. They develop hypotheses, devise sound trading plans, and test out their theories by executing a trade and seeing what happens. It’s very systematic. Sometimes a hypothesis is supported, and a method is confirmed to produce a profit under specific market conditions, but at other times, a theory is not supported. Revisions are then required. It’s vital to determine what went wrong, and what went right and make any necessary changes. That said, all these analyses must be done unemotionally and rationally, otherwise, one is bound to feel a little pessimistic tearing apart one’s strategies.

It’s easy to start thinking, “Things are not going very well. There’s a lot wrong here. Things could have been better.” This kind of thinking can make even a happy-go-lucky trader feel like a pessimist. When pessimism sets in, denial may be used to cope with feelings of despair, and when denial sets in, one is likely to act emotionally and impulsively. Losses usually follow.

When things aren’t going right, it’s tempting to look on the bright side: Remember that things could be worse. When you lose $10,000 on a sure thing, for example, you might as well think, “At least I didn’t lose $20,000.” It works to think positively. A study by Dr Chris Davis, a professor of psychology at Carleton University, and his colleagues illustrates the usefulness of looking on the bright side. Participants were asked to imagine they had just experienced a major setback. Some of the participants were instructed to look on the bright side in that they were asked to consider the fact that matters could have been a lot worse.

Other participants were asked to consider how the situation could have been much better. The mood of the participants was measured and compared. Research findings clearly favored looking on the bright side of things. People who focused on how matters could have turned out much worse felt happier after a major setback than people who focused on how events could have been more favourable. So if you want to be happy after you encounter a setback, look on the bright side.

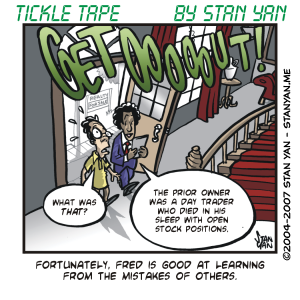

How you look at a setback strongly influences how you recover from it. If you view a setback as a dreaded event and imbue it with strong personal significance, you’ll feel so emotionally overwhelmed that you will be tempted to engage in avoidance and denial. Rather than taking decisive action, you will waste precious psychological resources denying the reality of the situation. It’s better to take setbacks in stride, find solutions, and move forward. Don’t mull over what went wrong. Instead, figure out what you can do next to improve your strategies and methods and take home huge profits.

When carefully analyzing how a trading plan went awry, it’s easy to start beating yourself up for not having a trading plan that was foolproof. But if you mull over the possibilities too much and start thinking, “Why did things turn out so wrong?” then you will feel disappointed. It’s vital that you stay focused on taking active steps to solve problems. Think like a scientist. Pretend you are merely solving a mundane problem, like finding the solution to a basic math problem. Figure out what you can do next. Don’t question your abilities. Self-doubt is a complete waste of time and energy. Look on the bright side for a moment, optimistically search for ways to pick yourself up off the ground, and make a winning trade.