If you’ve spent any time around trading, you’ve probably run into the Golden Mean. You may have seen it represented as Fibonacci lines on a price chart. The Fibonacci sequence is a string of numbers in which two consecutive numbers are added together to produce the third, for example, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, and so on. Some traders use ratios derived from the Fibonacci number series to define key support and resistance levels, often with the belief that such estimates are more “natural” because they are based on the Fibonacci sequence. Fibonacci claimed that consistent patterns could be found in what appeared to be random numbers. Subsequent followers of Fibonacci extended his theory to the trading of futures and stocks as they attempted to find patterns in random price activity. But are there “natural and pristine” patterns in the seemingly random movements of prices, or is it just wishful thinking?

One way of calculating the Golden Mean Ratio is to add two random numbers together. That result is then added to the sum. After eight reverberations, one can divide the former number into the latter and find a definable pattern, which is represented mathematically as 0.618 or its reciprocal, 1.618. This Golden Mean is thought to reside in the most beautiful architecture, music, and art. It is commonly found in nature in the structure of many of the most beautiful flowers, animals, and seashells. Greek philosophers and mathematicians saw the Golden Mean as significant because it illustrated balance in nature, the arts, and even the human body. It was the epitome of balance—the perfect shape … the most pleasing vision.

In the natural world, it is amazing how consistent patterns abound, but when it comes to human behavior, social scientists have long known that such consistencies are rare and almost non-existent. And what is trading? It is human behavior. It’s not a natural phenomenon but made up by humans. It’s not perfect. It’s not pristine. It is in disarray and unpredictable. To be a successful trader, one must accept the uncertainty of human behavior and engage in the daunting task of finding consistency where there is little.

Nevertheless, many traders find ideas, such as the Fibonacci number sequence, fascinating, almost mystical. But not all traders appreciate the beauty of the Fibonacci number sequence. Indeed, the Editor of a popular trading magazine noted that there might be nothing mystical about the sequence. It may seem to work merely by coincidence (the market is likely to correct somewhere between one-third and two-thirds of the previous trend, which is similar to the commonly used Fibonacci ratios of .382 and .618.) Where you stand on such issues may reveal a lot about your trading personality.

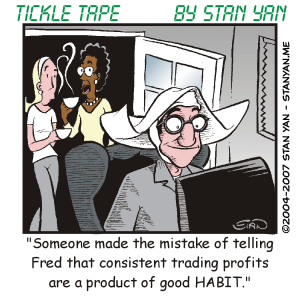

Many traders are drawn to the superstitious aspects of trading. They don’t have confidence in themselves, so they start searching for methods based on the “laws of nature” that can give them a solid, yet false, sense of reassurance. They seek out universal and general rules, all in an attempt to seek out certainty and the security it provides. Concepts, such as the Fibonacci number sequence, do just that. They offer promise. One has the luxury of not believing in oneself but in the greater omnipotent laws of nature. It’s like believing in luck, fate, or destiny.

One can choose to live one’s life passively believing in external forces, waiting for the proverbial stars to line up in one’s favor. But the most successful members of society don’t have time to wait for fate or to depend on luck. And if you want to be a profitable trader, or stay that way, it would be wise to abandon any forms of superstition. The surest way to succeed is to build up your trading skills. Build them up to the point that you can’t wait for so-called “luck” to move against you so that you can demonstrate your actual fortitude. With solid trading skills, and the rock-solid confidence it will give you, you’ll find that you can accept the uncertainty involved in trading the market, and depend on you, your skills, and nothing else.