“Trading is like gambling.” Some say trading “is” gambling, but for now, let’s just focus on the proposition that trading is analogous to gambling. An analogy is a comparison between two things that are similar in some respects. People use analogies to explain a complicated topic, or to understand a complicated topic. Trading must be complicated since it seems that 95% of those who attempt to trade end up failing. It’s either complicated, and thus, we need to use an analogy to understand it, or it’s an impossible task, like trying to survive jumping off of a high cliff. Some people survive the fall, but most do not. If it’s impossible, an analogy isn’t going to give us much help. But assuming that trading for a living is viable under the right conditions, most novice traders are willing to use analogies to understand complex trading issues.

In considering any analogy, it’s essential to avoid confusing the analogy with the actual phenomenon that one is trying to understand: Trading is like gambling, but it’s not exactly like gambling. A dictionary definition of gambling is “playing games of chance or betting in the hope of winning money.” At Innerworth, we sometimes get letters rebuking us for propagating the “myth” that “trading is gambling.” Now, look at that dictionary definition. Trading is indeed a “game of chance,” since it is not a 100% certainty that one can put on trade (or a long-term investment for that matter) and be guaranteed a profit. And why do you trade (or invest)? You do so with the “hope of winning money.” So from a purely semantic argument, trading is gambling.

“But casinos are the only officially permitted institutions that allow legal gambling and the institutions that oversee trading and investing are quite different,” is what critics of the gambling analogy shout with fervour. All right. We’ll give you that one. Here’s another debating point we will give you. In the “Diagnostic and Statistical Manual of Mental Disorders,” the “bible” used as a reference by all mental health professionals, there is a disorder called “pathological gambling.” It usually refers to the base aspects of gambling.

Gambling can be an addiction, like alcoholism, and no reference is made to “pathological trading.” So I guess that means that society as a whole has yet to recognize a pathological version of trading. If it’s so important to you to argue to your friends and loved ones that you are not gambling by trading, there’s some ammunition. But whatever you call it, it’s just a form of denial, because like it or not, you are gambling. So now that we’ve temporarily kept the critics at bay, let’s get down to business. How is trading like gambling? And how can using this analogy help you understand trading?

No one has developed the ultimate signal or indicator that allows a trader to anticipate the next market move with 100% certainty. There’s some risk involved. And again, that’s what makes it gambling. So the gambling analogy is useful. The fact that you can lose money should be at the forefront of your mind; you aren’t putting your money in an FDIC insured savings account.

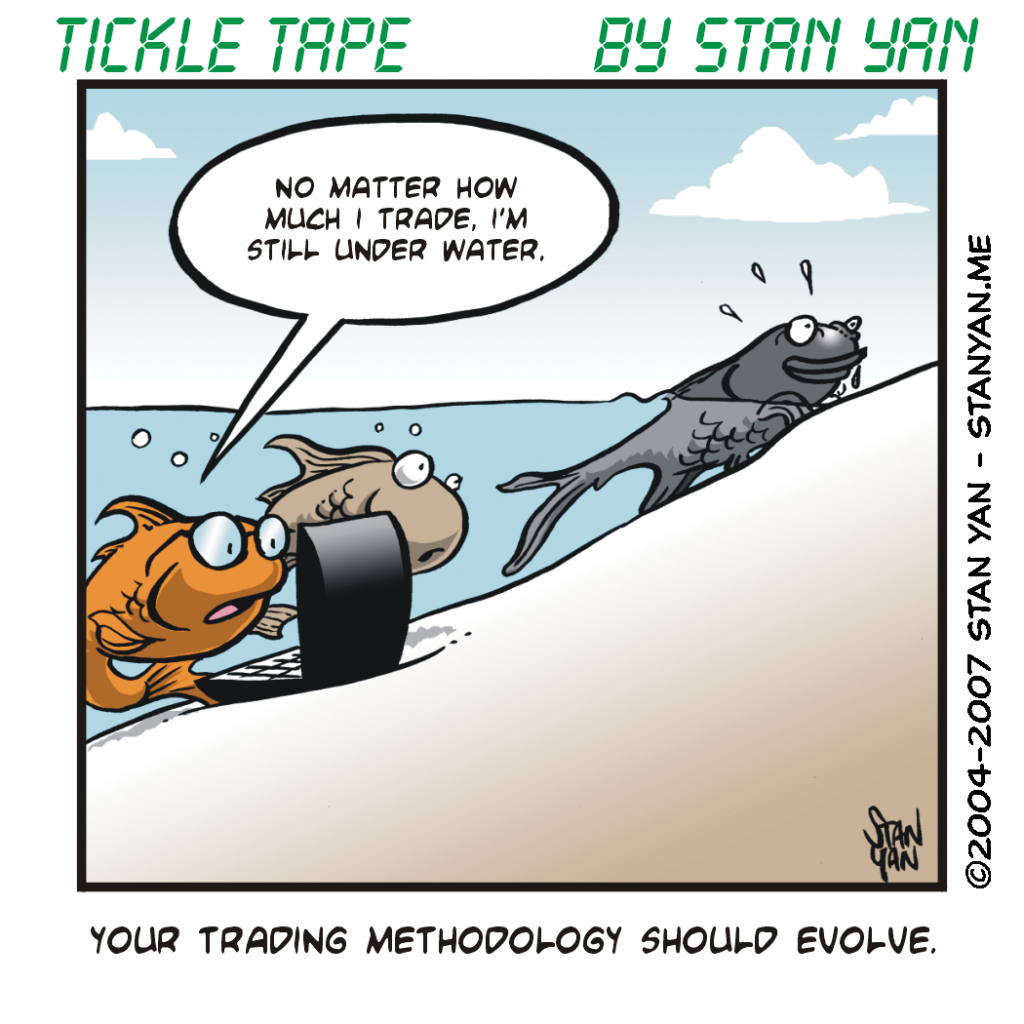

Once you acknowledge the risk, you can take precautions to protect yourself. Unless you want to act like a “pathological” addictive trader, it’s wise to define your risk clearly before entering a trade, take measures to protect yourself, and set up an exit strategy, should fate move against you. Since trading is a matter of probabilities, it’s to your advantage to limit your risk to a small percentage of your total trading capital on any single trade, for example. That will help you survive a severe drawdown and stay in the game. You’ll be acting like a professional gambler rather than an amateur.

Perhaps the greatest value of the gambling analogy is the mindset it offers the trader. If you look at trading as a game of chance, it allows you to think in terms of probabilities: trading is a matter of capitalizing on chance across a series of trades. The outcome of a single trade is of little importance since if you make enough trades, you end up with an overall profit. Mark Douglas wrote one of the best expositions of this thinking strategy in “Trading in the Zone.” When you play some games of chance, the distribution of all possible outcomes can be represented by a probability distribution in which some outcomes are more likely than others.

For example, when you throw a pair of dice, there are 36 ways for the dice to fall, and about a 3% chance of getting a 2 or 12, and about a 20% chance of getting a 7. Traders try to find the high probability trades; it’s like betting on getting a 7. You may try for a 7, but there’s still a small chance of getting a 2 or a 12. But the more times you throw the dice, the more the law of averages works in your favour. That is, about 20% of the time you’ll get a 7 if you throw the dice enough times (but theoretically, there’s still a chance you will never get a 7).

Throwing dice is analogous to using a trading strategy with a proven track record. If you use a trading strategy with a historical track record of 80%, for example, you should expect it to work 80% of the time. It’s all a matter of executing the strategy effortlessly and mechanically over and over so that the odds will work in your favour. (But unlike casino gambling, where someone knows the odds, and the “problem space” is essentially identical time after time, a trading strategy is rarely executed in an invariant problem space; history only repeats itself when it does. The gambling analogy in this instance doesn’t hold. The professional gambler has better odds because theoretical laws of probability apply to traditional games of chance, but not to trading strategies.)

When you work under the assumption that you are doing nothing more than playing a game of chance, where the more trades you execute, the more the outcomes will follow a probability distribution where the outcomes are skewed in your favour, the more confident you will feel. As you execute the strategy over and over, you can remind yourself, “I’ll trust my strategy, repeat it over and over, and the odds will work for me.” The gambling analogy in this case gives you an edge.

It puts trading in manageable terms. You’ll feel more relaxed, confident, and trade effortlessly in a peak performance state. In the end, there are more advantages to viewing trading as gambling than not. By doing so, you will acknowledge the potential risk immediately, and take steps to minimize it. At the same time, you’ll also be able to use the thinking strategy of looking at trading as a matter of probabilities. The relaxed, confident approach you will achieve from this mindset will give you a mental edge.