Have you ever planned a trade that seemed a sure winner, yet we’re surprised to find it had failed? A plan could look great when you think of it, but after it fails, and you had time to think about it a little more, it becomes obvious that it was a bad idea.

A host of information must be considered in order to trade profitably. For example, conventional wisdom suggests avoiding the open. It may also be wise to stand aside when a rate hike is looming, and make sure the company in which you are planning to invest isn’t about to report earnings. But there are times when conventional wisdom is wrong, and the astute trader has learned that there are times when he or she must break the rules, and go against conventional wisdom. That’s what makes trading a challenge: Essentially, conventional wisdom is only right some of the time, and at other times, it’s just wrong. In the end, you must find a solution on your own, and there are times when you may be wrong. You have to trust your instincts and go with your gut, wrong or right, whether you like it or not.

The human mind has limits. There are times when a fast decision is essential when we have to think quickly. We must use whatever information is available to make these decisions. Behavioral economists, however, have shown that when thinking under pressure, many traders are prone to decision-making biases. For example, we may narrow our focus to what we think is obvious, but upon further consideration, we may wonder why we didn’t see the flaws in our thinking.

For example, we may wrongly think a stock price is impervious to a prevailing trend. Suppose you were trading a company that was about to report earnings, for example, and you had good reason to believe that it would beat analysts’ expectations. Based on your own analysis of the situation, you may decide to go long. Why not? All indications from your point of view suggest an increase in price. However, you may find that a variety of factors ended up decreasing the price of the stock. Consumer confidence may have been lower than you had expected or an adverse world event may have lowered stock prices across the board. In hindsight, you may think, “How could I have missed that? I should have known better.”

It’s impossible to have a God’s eye view when it comes to the market. You can’t know everything. All you can do is use infallible knowledge to make the best judgment you can possibly make. That said, you are bound to make mistakes. All you can do is manage risk and try your best. If you manage risk, you won’t get in much trouble by allowing a judgment bias to cloud your vision.

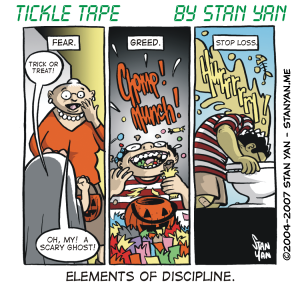

People have a natural tendency to think the best, but there are times that an optimistic attitude can bias our views. And when that happens, we end up making mistakes. It’s vital to stay a little skeptical. Don’t get stuck in analysis paralysis, but on the other hand, don’t act too impulsively; think through your decisions. Make sure you look at your trading plan from multiple perspectives. Remember that what might look like a great idea at first glance may look like an obviously flawed idea when it fails. Think things through beforehand. Don’t wait for hindsight to inform you of your mistakes.