When it comes to trading decisions, everyone has their own style. Although styles change as one gains more experience, each trader has his or her own natural style. Some people are intuitive while others are more concrete and analytical. Many traders are risk-averse, while others are impulsive and seek out risk. Each style has its advantages and limitations. It’s useful to know which style suits you, and it’s important to know how your inherent style may influence your trading decisions.

There are at least three basic decision-making styles: Data-oriented, Intuitive, and Impulsive. The data-oriented trader focuses on concrete evidence and is extremely risk-averse. He or she tries to seek out as much supporting data for a trading decision as possible. The trader who prefers to do extensive backtesting of a trading idea exemplifies this decision-making style. It’s useful to incorporate elements of this style into your overall trading style regardless of your natural inclinations.

It’s vital to make sure that you have adequate information before executing a trade, and it’s particularly important to trade a detailed trading plan in which risk is minimized and entry and exit strategies are clearly specified. But the data-oriented trader may take things a little too far. He or she may search for “perfect” knowledge that just doesn’t exist in the trading world. Knowledge is always fallible and the markets only repeat themselves when they do. At some point, one must accept the fact that he or she is taking a chance and no amount of data analysis can change this fact.

The intuitive trader is the opposite of the data-oriented trader. He or she bases trading decisions on hunches and impressions rather than on clearly defined data. There’s a difference between being an intuitive trader who develops this style over time and one who is naturally intuitive. Traders who are naturally intuitive discount data-driven decisions. They aren’t used to making detailed analyses of problems and situations, and thus, tend to take unnecessary chances without sufficient justification.

The experienced intuitive trader, in stark contrast, bases decisions on data and specific market information. But, since he or she is a seasoned trader, one analyzes the data quickly and efficiently. It happens so quickly that it seems like it occurs intuitively, but it is actually based on solid information. Ideally, all traders should gain extensive experience to the point where sound decisions are made with an intuitive feel.

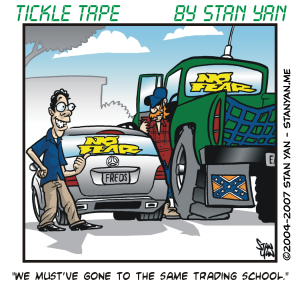

Finally, the last decision-making style is the impulsive trader. This is the most dangerous style. The impulsive trader allows his or her decisions to adversely influence trading decisions. Rather than looking at information logically and analytically, information is discounted completely. The impulsive trader seeks out risk and enjoys taking risky, exciting trades. Impulsive traders can often make huge profits one day and see large drawdowns the next. Many traders may have this style to some extent, and it’s something to rein in. Don’t let a need to seek out excitement get the better of you.