Winning traders cut their losses early. Indeed, they work under the assumption that they will see many more losing trades than winning trades. Knowing how to take a loss in stride and to just move on is a key skill that all traders must hone. It’s often easier said than done, however. Behavioural economists have outlined many psychological processes that prevent most traders from accepting a loss and moving on. There are times when several factors combine to make it especially difficult to cut one’s losses. By gaining awareness of these processes, you can neutralize them, so they will no longer influence your ability to take a loss.

Humans are naturally risk-averse. They don’t like taking losses. They would rather gamble on taking a large loss, for example, than just accept a small loss upfront. For example, long term amateur investors will hold a losing position for weeks in the hope that the trade will turn around. Many times, the trade doesn’t turn around; losses continue to mount and the need to hold onto the trade is intensified.

One reason for holding on to a losing trade is the sunk cost effect. The more financial and psychological costs we sink into a trade, the harder it is to take the loss and move on. It’s like thinking, “I’ve waited so long and I’ve lost so much of the initial stake that I can’t give up now.” There’s a strong need to justify the effort and expense one has put into holding a losing position. The need to justify the loss is so great that it can be difficult to write off the loss.

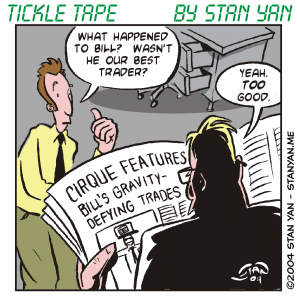

There are also social processes that may prevent some traders from taking a loss. It’s hard for some traders to keep their wins and losses to themselves. Trading can be a lonely profession, and it is often useful to set up a social support network.

The downside, however, is that some people in the network may compete with you, just waiting for you to have a setback so that they can feel superior. You may look forward to relishing your wins, but dread having to admit your losses. The need to save face can prevent some traders from taking a loss. The best antidote to this problem is to stay humble. Don’t brag about your wins. If you avoid getting a swelled head, you’ll be able to admit your mistakes and shortcomings more easily, and people in your social network will offer warmth and understanding rather than enjoy seeing you lose.

Cutting your losses is vital for success. You’ll see many more losses than wins, and the only way to survive is to take a carefree attitude toward trading. Expect to lose. Don’t overly personalize losses. All traders face losses. It says nothing about your self-worth. It’s just a fact of trading. Realize that you have a natural human tendency to avoid losses, and minimize this impact by staying humble and open to the possibility that you have shortcomings, and that it is impossible to win on every trade. The more easily you can accept a loss and move on, the more profitable you’ll be in the long run.