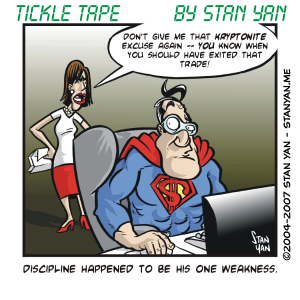

Despite what we might wish for, it’s hard to make profits month after month. Even established hedge fund managers have months where they fail to make a profit. It’s a fact of trading: There are times when profits elude even the most skilled, seasoned trader. There’s little you can do but keep your hopes up, actively try to get back in tune with the markets, and patiently wait to return to profitability. Many traders, however, have trouble getting past a slump unscathed. They take it too personally. They start to believe it is entirely their fault and become upset. They are especially anxious and emotional.

They can no longer think straight. Their confidence is severely shaken. At that point, they find themselves in a severe psychological slump as well as an economic one. They can’t trade efficiently and start making trading errors. Matters just seem to get worse and worse. It’s vital for your psychological survival to prevent a lapse in your trading success from turning into a major psychological slump. Fortunately, you don’t have to, though. You can take proactive steps to avoid a psychological slump.

How can you avoid a psychological slump? First, put matters in perspective. Many traders make matters worse by holding unrealistic expectations. They believe that a skilled trader makes profits month after month, regardless of market conditions. However, even the most seasoned professional trader experiences low profitability at times. It may mean nothing about you, and even if it does, it doesn’t help matters to dwell on your perceived sense of inadequacy.

It is essential that you stay optimistic and don’t take any of it personally. Second, it’s necessary to take an active, problem-solving approach. Don’t passively think you are a victim. You may not be able to turn a financial slump around as quickly as you would like, but with enough effort, you can put the odds back in your favour. Actively study the markets. Try to figure out if there is something wrong with your method or whether a slight change in market conditions is all you need. Whatever you do, though, keep your mind active. Stay upbeat. Don’t give in to pessimism.

Finally, when you do decide to continue trading to recover from the slump, trade with a detailed trading plan. If you leave trading decisions up to your discretion while in a psychological slump, you’ll be more likely to make trading errors and make impulsive decisions. If every aspect of your trading plan is clearly specified, however, you can follow it even when your mood is a little off. But it must be clearly defined. You must know when to enter and when to exit. And most important, control your risk. If you know that it is relatively little you can lose on a given trade, or a series of trades, then you can more easily feel calm as you try to regain profitability.

Don’t let an economic slump impact your mindset. It may be hard not to feel a little disappointed that you are not profitable, but if you can remain calm and optimistic, you can work through the slump and return to profitability.