A trader must have discipline. One must develop a scrupulously detailed trading plan and strictly follow it. The more detailed the trading plan, the better. When every single detail is carefully spelt out, from when to enter to when to exit, it’s easier to follow the plan and stick to it. One of the main reasons that traders lack discipline is that they try to follow a trading plan that is just not detailed enough. Too much of the plan is left unspecified, and usually, a trader enters or exits at the wrong time.

Most people can learn to be disciplined, however. Through training and practice, almost any trader can learn to carefully plan a trade and follow the plan. That said, there are some traders who are sensation seekers. They crave excitement. Trading gives them a thrill. Even with extensive practice, it may be hard for them to follow a plan, no matter how hard they try. It’s useful to determine if you are one of these people. If you are a sensation seeker, it’s important to identify this potential problem and work around it.

Sensation seeking is just one of many personality traits that may prevent some traders from following their trading plan. Sensation seeking is a term coined by psychologist Dr Marvin Zuckerman at the University of Delaware. According to Dr Zuckerman, sensation seeking is a powerful need for varied, novel, and complex sensations and experiences.

These needs are so strong that the sensation seeker is willing to take physical and social risks for the sake of such experiences. Sensation seeking is related to the fight-or-flee response, a very primitive biological response in which animals must either fight an aggressor or flee to safety. Most of the time, humans control the fight-or-flee response in order to follow social conventions.

People aren’t lowering animals living in the wild. In order to get along and get ahead in society, they must learn to inhibit this base level fight-or-flee response. The ability to inhibit this response, according to Dr Zuckerman, has significant genetic components. Dr Zuckerman claims that specific areas in the brain are responsible for the inhibition of the fight-or-flee response, with some individuals able to inhibit this response more easily than others.

Sensation seeking consists of many different facets. People who are prone to sensation seeking tend to crave new and exciting experiences. These new and exciting experiences are often non-conventional and usually illegal; examples include spouse-swapping, illicit drug use, and heavy drinking. Sensation seekers get bored easily and seek out new and exciting experiences to combat boredom.

Sensation seeking is not necessarily a bad trait. Indeed, moderate levels of sensation seeking in specific contexts can be beneficial. Sensation seekers tend to be unconventional. They are not afraid to seek out new experiences and are usually original and creative. They are likely to make new discoveries or break new ground. This independent streak can be useful for trading, where independent decisions and the ability to break away from the masses are crucial.

Traders who tend to seek out interesting and novel experiences can more easily tolerate the stress associated with unknown market conditions or the uncertainty of a new trading method. It’s adaptive to be a sensation seeker at a minimal level, but at an extreme, sensation seeking can be problematic. For example, when it comes to trading, extreme sensation seeking is often associated with a lack of discipline and impulsive decisions. But trades must be executed in a calm and rational manner.

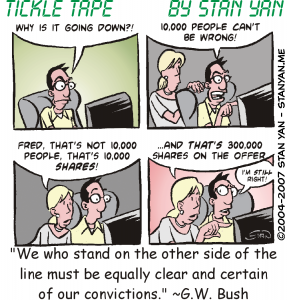

The person who is high in sensation seeking may feel a need to put on trades for excitement or may get bored easily while monitoring trades, and make an impulsive decision to ease the boredom. Scientific studies have shown that individuals high in sensation seeking enjoy risky gambles; they place higher bets than individuals low in sensation seeking just to get a thrill. Unnecessary risks often spell disaster when trading.

It’s important to identify whether you a sensation seeker. Do you seek out unnecessary risks? Are you a thrill-seeker? Do you crave excitement? Are you easily bored and see trading as a way to spice up your life? A moderate amount of sensation seeking can be useful for trading, but at an extreme, it can hamper success.

You may need to take preventative measures if you are a sensation seeker, such as using the automatic settings on your trading platform to enter and exit a trade according to your trading plan or place an order with a broker. It’s vital that you determine whether you are a sensation seeker. And if you are, find ways to work around this issue before you make too many risky trades that quickly wipe out your trading account.