Seasoned traders frequently describe moments when they trade in a peak performance state. There are various names for it: “trading in the zone” or “flowing with the markets.” But the defining characteristics are focused and concerted attention on the markets and a carefree, unemotional approach. Traders in this ideal mental state almost completely lose themselves in what they are doing. They are focused only on the ongoing process of the moment. They are not self-conscious, concerned with how well they are doing, or worried about doing poorly. Everything just seems to “click” as they move effortlessly with the ebb and flow of the market. Most traders agree that a peak performance mental state is a necessary condition for trading profitably. It’s worth reviewing some of the ways that you can enter and maintain this optimal level of consciousness.

Resolve personal conflicts. Not everyone who trades has personal conflicts that need resolution. But if you are prone to carry “unfinished business” with you, it will always be there in the back of your mind, haunting you, interfering, and inhibiting you from entering a peak performance mental state. Examples of some common psychological conflicts include the need for self-worth, the need to prove one’s value, the need to be right, or the desire to feel superior to others.

Many traders discount these issues, thinking they are just a lot of psychobabble. They think, “That doesn’t apply to me.” Well, it may not apply, but it is people with these kinds of issues who tend to be drawn to trading. Ironically, these conflicts are what drives them to pursue a challenging trading career that requires them to beat overwhelming odds to become one of the select few who make a high salary relative to the vast majority. Before you disregard these issues, make sure that you really don’t have psychological conflicts that interfere with your ability to enter a peak performance state.

Think in terms of probabilities. In his book “Trading In the Zone,” Mark Douglas discusses a “thinking strategy” called “thinking in terms of probabilities.” In a nutshell, a trader should not focus on the outcome of a single trade. Instead, he or she should focus only on the big picture, the overall outcome across a series of traders. When it comes to trading, you should go in expecting to lose more trades than you win, but mathematically, with the use of proper risk management, it’s possible to achieve a profit across a series of trades, even when many are losers. It’s wise not to make such a big issue of losses. Put them in a proper perspective.

It’s useful to view trading in the same way that a profitable professional gambler approaches gambling, according to Douglas. Professional gamblers look at gambling objectively; they place bet after bet with the assumption that the law of large numbers will work in their favor if they make enough trades. Traders should use a similar “thinking strategy.” An essential prerequisite is a trading strategy that has a proven track record. But once you have it, you must execute it many times to take advantage of this winning track record. The trading strategy may fail a few times, but your goal is to replicate the past odds of success by giving it an opportunity to work across a series of trades. Once you understand and accept the idea that your overall success is all that matters, it will ease your mind, and allow you to approach trading with a more carefree attitude.

Use proper risk management. Careful risk management is a key component of trading in a peak performance state. If there is a real danger that you will lose large amounts of capital, or money that you just can’t afford to lose, you’ll feel the stress, whether you are conscious of it or not. But if you limit your risk on any single trade, you will know deep down that you have little to lose. And when you know that even a worst-case scenario is of little threat, you will feel less emotional, and be able to enter a peak performance mental state more easily. So follow the advice of seasoned traders who risk only a small percentage of their trading capital on a single trade, and use protective stops to further limit your risk.

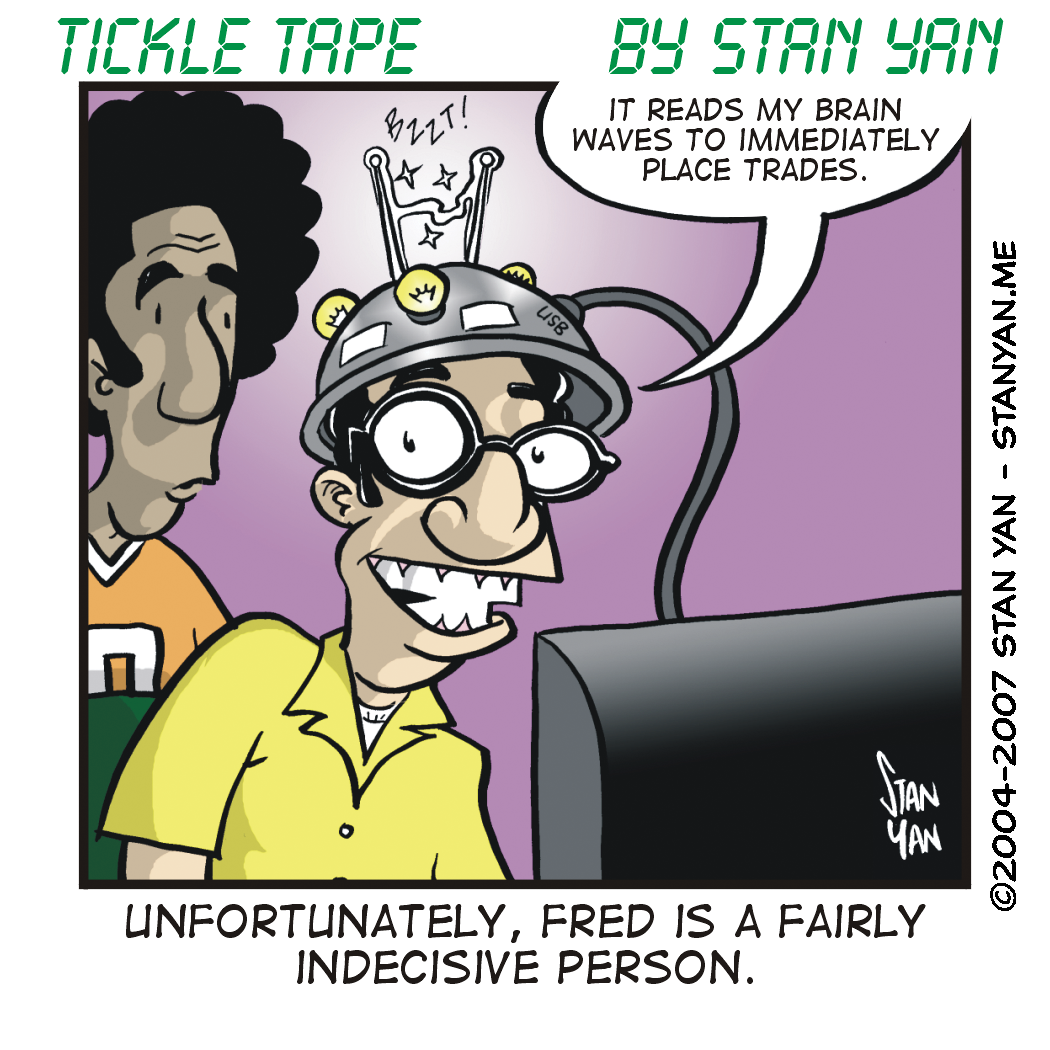

Trade an extremely detailed trading plan. Perhaps the most essential key to entering a peak performance state is to have a scrupulously detailed trading plan. Outline the plan completely from the necessary market conditions for its use to the specific entry and exit points. Unless you have every aspect of the plan outlined, there will always be an opportunity for indecision, and that will take you out of the peak performance mental state. Do your preparation before you enter the markets, not during. It’s too hard to remain objective when you are trying to make unnecessary last-minute decisions. Plan out your strategy as much as possible and it will allow you to stay focused and trading in a peak performance state.

Many traders believe trading in a peak performance mental state is a key factor for trading profitably. Not everyone has a natural affinity for entering this ideal mental state, but it’s possible to do with the right preparation and practice. It’s worth the effort to learn how to do it.

Why this Module isn\’t available in to be downloaded as PDF. I personally prefer to get the print and read and make necessary notations on the book for my reference. I have gone through some of the sub heads and its really worth reading the whole module. Request you to send me at least the pdf version of this module