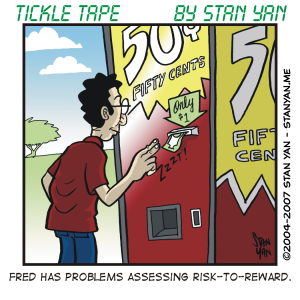

Have you ever made a small losing trade and thought, “It’s all right. I’ll win on the next one.” The next trade comes along, and you lose. And then the next one is a loser, and so on, and so on…until finally, you are in a severe drawdown. Before you dig yourself into a hole that is virtually impossible to climb out of, it is vital for survival to constantly monitor your progress. Take a good hard look at the facts and make adjustments.

Humans are notorious for their eternal optimism. Who wouldn’t want to think they were making a killing in the markets. When you aren’t profitable, though, it’s easy to fall into a state of denial. In order to build up our ego, we ignore how poorly things are going and tend to look at the world through rose-colored glasses. There are times when it is useful to look on the bright side. To win in the markets, you have to truly believe that you can succeed. Focusing on your limitations or the inherent challenges the markets often pose may get you down. And when that happens, you may think it’s impossible to master the markets.

On the other hand, too much denial may prevent you from taking the steps you need to improve your trading performance. Denial can go too far. If you feed your account every month, you may not face the fact that your trading strategies just aren’t working. Successful traders carefully monitor the process of trading. They keep a trade diary in order to identify those strategies that work from those that don’t. They identify the specific market conditions that are optimal to their methods. They also report their moods in an attempt to isolate psychological factors from market factors. Some strategies just do not work under particular market conditions. And if you are bogged down with psychological factors, no trading method is going to produce a profit. It may be hard to face the facts, but unless you do, you’ll never be able to identify your weaknesses, make midcourse corrections, and hone your trading skills.

Don’t be afraid to keep a trade diary. Identify what works and what does not. Don’t let denial prevent you from taking a good honest look at what you’re doing. You may be surprised to find that you are doing a lot right, and that by making a few minor changes, you can greatly improve your trading. The aware trader is the winning trader. By taking an honest look at your limitations, you’ll be able to hone your trading skills, reach ever-higher levels of performance, and take home huge profits.