3.1 – Buying call option

In the previous chapters we looked at the basic structure of a call option and understood the broad context under which it makes sense to buy a call option. In this chapter, we will formally structure our thoughts on the call option and get a firm understanding on both buying and selling of the call option. Before we move ahead any further in this chapter, here is a quick recap of what we learnt in the first chapter –

- It makes sense to be a buyer of a call option when you expect the underlying price to increase

- If the underlying price remains flat or goes down then the buyer of the call option loses money

- The money the buyer of the call option would lose is equivalent to the premium (agreement fees) the buyer pays to the seller/writer of the call option

We will keep the above three points in perspective (which serves as basic guidelines) and understand the call option to a greater extent.

3.2 – Building a case for a call option

There are many situations in the market that warrants the purchase of a call option. Here is one that I just discovered while writing this chapter, thought the example would fit well in the context of our discussions. Have a look at the chart below –

The stock in consideration is Bajaj Auto Limited. As you may know, they are one of the biggest manufacturers of two wheelers in India. For various reasons the stock has been beaten down in the market, so much so that the stock is trading at its 52 week low price. I believe there could be an opportunity to initiate a trade here. Here are my thoughts with respect to this trade –

- Bajaj Auto is a quality fundamental stock, there is no denying this.

- The stock has been beaten down so heavily, makes me believe this could be the market’s over reaction to volatility in Bajaj Auto’s business cycle.

- I expect the stock price to stop falling sometime soon and eventually rise.

- However I do not want to buy the stock for delivery (yet) as I’m worried about a further decline of the stock.

- Extending the above point, the worry of M2M losses prevents me from buying Bajaj Auto’s futures as well.

- At the same time I don’t want to miss an opportunity of a sharp reversal in the stock price.

To sum up, I’m optimistic on the stock price of Bajaj Auto (the stock price to eventually increase) but I’m kind of uncertain about the immediate outlook on the stock. The uncertainty is mainly due the fact that my losses in the short term could be intense if the weakness in the stock persists. However as per my estimate the probability of the loss is low, but nevertheless the probability still exists. So what should I do?

Now, if you realize I’m in a similar dilemma that was Ajay was in (recall the Ajay – Venu example from chapter 1). A circumstance such as this, builds up for a classic case of an options trade.

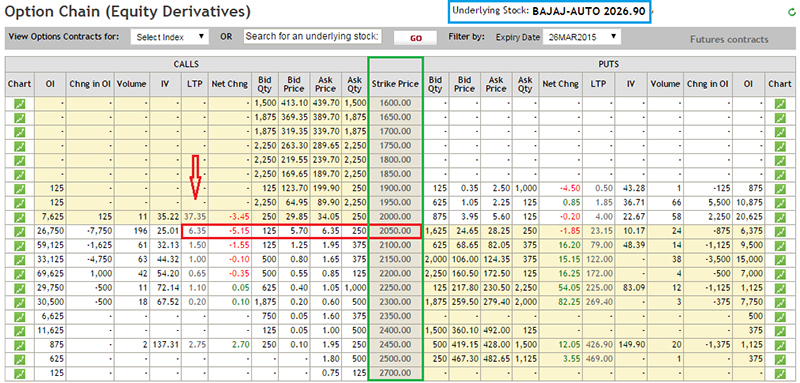

In the context of my dilemma, clearly buying a call option on Bajaj Auto makes sense for reasons I will explain shortly. Here is a snapshot of Bajaj Auto’s option chain –

As we can see the stock is trading at Rs.2026.9 (highlighted in blue). I will choose to buy 2050 strike call option by paying a premium of Rs.6.35/- (highlighted in red box and red arrow). You may be wondering on what basis I choose the 2050 strike price when in fact there are so many different strike prices available (highlighted in green)?. Well, the process of strike price selection is a vast topic on its own, we will eventually get there in this module, but for now let us just believe 2050 is the right strike price to trade.

3.3 – Intrinsic value of a call option (upon expiry)

So what happens to the call option now considering the expiry is 15 days away? Well, broadly speaking there are three possible scenarios which I suppose you are familiar with by now –

Scenario 1 – The stock price goes above the strike price, say 2080

Scenario 2 – The stock price goes below the strike price, say 2030

Scenario 3 – The stock price stays at 2050

The above 3 scenarios are very similar to the ones we had looked at in chapter 1, hence I will also assume that you are familiar with the P&L calculation at the specific value of the spot in the given scenarios above (if not, I would suggest you read through Chapter 1 again).

The idea I’m interested in exploring now is this –

- You will agree there are only 3 broad scenarios under which the price movement of Bajaj Auto can be classified (upon expiry) i.e. the price either increases, decreases, or stays flat

- But what about all the different prices in between? For example if as per Scenario 1 the price is considered to be at 2080 which is above the strike of 2050. What about other strike prices such as 2055, 2060, 2065, 2070 etc? Can we generalize anything here with respect to the P&L?

- In scenario 2, the price is considered to be at 2030 which is below the strike of 2050. What about other strike prices such as 2045, 2040, 2035 etc? Can we generalize anything here with respect to the P&L?

What would happen to the P&L at various possible prices of spot (upon expiry) – I would like to call these points as the “Possible values of the spot on expiry” and sort of generalize the P&L understanding of the call option.

In order to do this, I would like to first talk about (in part and not the full concept) the idea of the ‘intrinsic value of the option upon expiry’.

The intrinsic value (IV) of the option upon expiry (specifically a call option for now) is defined as the non – negative value which the option buyer is entitled to if he were to exercise the call option. In simple words ask yourself (assuming you are the buyer of a call option) how much money you would receive upon expiry, if the call option you hold is profitable. Mathematically it is defined as –

IV = Spot Price – Strike Price

So if Bajaj Auto on the day of expiry is trading at 2068 (in the spot market) the 2050 Call option’s intrinsic value would be –

= 2068 – 2050

= 18

Likewise, if Bajaj Auto is trading at 2025 on the expiry day the intrinsic value of the option would be –

= 2025 – 2050

= -25

But remember, IV of an option (irrespective of a call or put) is a non negative number; hence we leave the IV at 2025

= 0

Now our objective is to keep the idea of intrinsic value of the option in perspective, and to identify how much money I will make at every possible expiry value of Bajaj Auto and in the process make some generalizations on the call option buyer’s P&L.

3.4 – Generalizing the P&L for a call option buyer

Now keeping the concept of intrinsic value of an option at the back of our mind, let us work towards building a table which would help us identify how much money, I as the buyer of Bajaj Auto’s 2050 call option would make under the various possible spot value changes of Bajaj Auto (in spot market) on expiry. Do remember the premium paid for this option is Rs 6.35/–. Irrespective of how the spot value changes, the fact that I have paid Rs.6.35/- remains unchanged. This is the cost that I have incurred in order to buy the 2050 Call Option. Let us keep this in perspective and work out the P&L table –

Please note – the negative sign before the premium paid represents a cash out flow from my trading account.

| Serial No. | Possible values of spot | Premium Paid | Intrinsic Value (IV) | P&L (IV + Premium) |

|---|---|---|---|---|

| 01 | 1990 | (-) 6.35 | 1990 – 2050 = 0 | = 0 + (– 6.35) = – 6.35 |

| 02 | 2000 | (-) 6.35 | 2000 – 2050 = 0 | = 0 + (– 6.35) = – 6.35 |

| 03 | 2010 | (-) 6.35 | 2010 – 2050 = 0 | = 0 + (– 6.35) = – 6.35 |

| 04 | 2020 | (-) 6.35 | 2020 – 2050 = 0 | = 0 + (– 6.35) = – 6.35 |

| 05 | 2030 | (-) 6.35 | 2030 – 2050 = 0 | = 0 + (– 6.35) = – 6.35 |

| 06 | 2040 | (-) 6.35 | 2040 – 2050 = 0 | = 0 + (– 6.35) = – 6.35 |

| 07 | 2050 | (-) 6.35 | 2050 – 2050 = 0 | = 0 + (– 6.35) = – 6.35 |

| 08 | 2060 | (-) 6.35 | 2060 – 2050 = 10 | = 10 +(-6.35) = + 3.65 |

| 09 | 2070 | (-) 6.35 | 2070 – 2050 = 20 | = 20 +(-6.35) = + 13.65 |

| 10 | 2080 | (-) 6.35 | 2080 – 2050 = 30 | = 30 +(-6.35) = + 23.65 |

| 11 | 2090 | (-) 6.35 | 2090 – 2050 = 40 | = 40 +(-6.35) = + 33.65 |

| 12 | 2100 | (-) 6.35 | 2100 – 2050 = 50 | = 50 +(-6.35) = + 43.65 |

So what do you observe? The table above throws out 2 strong observations –

- Even if the price of Bajaj Auto goes down (below the strike price of 2050), the maximum loss seems to be just Rs.6.35/-

- Generalization 1 – For a call option buyer a loss occurs when the spot price moves below the strike price. However the loss to the call option buyer is restricted to the extent of the premium he has paid

- The profit from this call option seems to increase exponentially as and when Bajaj Auto starts to move above the strike price of 2050

- Generalization 2 – The call option becomes profitable as and when the spot price moves over and above the strike price. The higher the spot price goes from the strike price, the higher the profit.

- From the above 2 generalizations it is fair for us to say that the buyer of the call option has a limited risk and a potential to make an unlimited profit.

Here is a general formula that tells you the Call option P&L for a given spot price –

P&L = Max [0, (Spot Price – Strike Price)] – Premium Paid

Going by the above formula, let’s evaluate the P&L for a few possible spot values on expiry –

- 2023

- 2072

- 2055

The solution is as follows –

@2023

= Max [0, (2023 – 2050)] – 6.35

= Max [0, (-27)] – 6.35

= 0 – 6.35

= – 6.35

The answer is in line with Generalization 1 (loss restricted to the extent of premium paid).

@2072

= Max [0, (2072 – 2050)] – 6.35

= Max [0, (+22)] – 6.35

= 22 – 6.35

= +15.65

The answer is in line with Generalization 2 (Call option gets profitable as and when the spot price moves over and above the strike price).

@2055

= Max [0, (2055 – 2050)] – 6.35

= Max [0, (+5)] – 6.35

= 5 – 6.35

= -1.35

So, here is a tricky situation, the result what we obtained here is against the 2nd generalization. Despite the spot price being above the strike price, the trade is resulting in a loss! Why is this so? Also if you observe the loss is much lesser than the maximum loss of Rs.6.35/-, it is in fact just Rs.1.35/-. To understand why this is happening we should diligently inspect the P&L behavior around the spot value which is slightly above the strike price (2050 in this case).

| Serial No. | Possible values of spot | Premium Paid | Intrinsic Value (IV) | P&L (IV + Premium) |

|---|---|---|---|---|

| 01 | 2050 | (-) 6.35 | 2050 – 2050 = 0 | = 0 + (– 6.35) = – 6.35 |

| 02 | 2051 | (-) 6.35 | 2051 – 2050 = 1 | = 1 + (– 6.35) = – 5.35 |

| 03 | 2052 | (-) 6.35 | 2052 – 2050 = 2 | = 2 + (– 6.35) = – 4.35 |

| 04 | 2053 | (-) 6.35 | 2053 – 2050 = 3 | = 3 + (– 6.35) = – 3.35 |

| 05 | 2054 | (-) 6.35 | 2054 – 2050 = 4 | = 4 + (– 6.35) = – 2.35 |

| 06 | 2055 | (-) 6.35 | 2055 – 2050 = 5 | = 5 + (– 6.35) = – 1.35 |

| 07 | 2056 | (-) 6.35 | 2056 – 2050 = 6 | = 6 + (– 6.35) = – 0.35 |

| 08 | 2057 | (-) 6.35 | 2057 – 2050 = 7 | = 7 +(- 6.35) = + 0.65 |

| 09 | 2058 | (-) 6.35 | 2058 – 2050 = 8 | = 8 +(- 6.35) = + 1.65 |

| 10 | 2059 | (-) 6.35 | 2059 – 2050 = 9 | = 9 +(- 6.35) = + 2.65 |

As you notice from the table above, the buyer suffers a maximum loss (Rs. 6.35 in this case) till the spot price is equal to the strike price. However, when the spot price starts to move above the strike price, the loss starts to minimize. The losses keep getting minimized till a point where the trade neither results in a profit or a loss. This is called the breakeven point.

The formula to identify the breakeven point for any call option is –

B.E = Strike Price + Premium Paid

For the Bajaj Auto example, the ‘Break Even’ point is –

= 2050 + 6.35

= 2056.35

In fact let us find out find out the P&L at the breakeven point

= Max [0, (2056.35 – 2050)] – 6.35

= Max [0, (+6.35)] – 6.35

= +6.35 – 6.35

= 0

As you can see, at the breakeven point we neither make money nor lose money. In other words, if the call option has to be profitable it not only has to move above the strike price but it has to move above the breakeven point.

3.5 – Call option buyer’s payoff

So far we have understood a few very important features with respect to a call option buyer’s payoff; I will reiterate the same –

- The maximum loss the buyer of a call option experiences is, to the extent of the premium paid. The buyer experiences a loss as long as the spot price is below the strike price

- The call option buyer has the potential to realize unlimited profits provided the spot price moves higher than the strike price

- Though the call option is supposed to make a profit when the spot price moves above the strike price, the call option buyer first needs to recover the premium he has paid

- The point at which the call option buyer completely recovers the premium he has paid is called the breakeven point

- The call option buyer truly starts making a profit only beyond the breakeven point (which naturally is above the strike price)

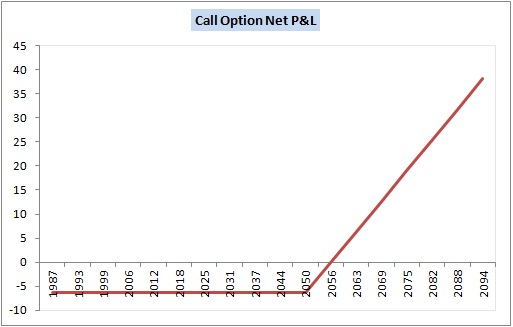

Interestingly, all these points can be visualized if we plot the chart of the P&L. Here is the P&L chart of Bajaj Auto’s Call Option trade –

From the chart above you can notice the following points which are in line with the discussion we have just had –

- The loss is restricted to Rs.6.35/- as long as the spot price is trading at any price below the strike of 2050

- From 2050 to 2056.35 (breakeven price) we can see the losses getting minimized

- At 2056.35 we can see that there is neither a profit nor a loss

- Above 2056.35 the call option starts making money. In fact the slope of the P&L line clearly indicates that the profits start increasing exponentially as and when the spot value moves away from the strike

Again, from the graph one thing is very evident – A call option buyer has a limited risk but unlimited profit potential. And with this I hope you are now clear with the call option from the buyer’s perspective. In the next chapter we will look into the Call Option from the seller’s perspective.

Key takeaways from this chapter

- It makes sense to be a buyer of a call option when you expect the underlying price to increase

- If the underlying price remains flat or goes down then the buyer of the call option loses money

- The money the buyer of the call option would lose is equivalent to the premium (agreement fees) the buyer pays to the seller/writer of the call option

- Intrinsic value (IV) of a call option is a non negative number

- IV = Max[0, (spot price – strike price)]

- The maximum loss the buyer of a call option experiences is to the extent of the premium paid. The loss is experienced as long as the spot price is below the strike price

- The call option buyer has the potential to make unlimited profits provided the spot price moves higher than the strike price

- Though the call option is supposed to make a profit when the spot price moves above the strike price, the call option buyer first needs to recover the premium he has paid

- The point at which the call option buyer completely recovers the premium he has paid is called the breakeven point

- The call option buyer truly starts making a profit only beyond the breakeven point (which naturally is above the strike price).

Dear sir,

Can you explain how the premium of call options got diluted while nearing the expiry ? Is there ant formula ?

Time decay besides other factors. We will talk about all of these things eventually in this module. Request you to stay tuned.

Hi I wanted to know if we buy 8600 PE at 15 ,75 quantity is the minimum required so how much I have to pay to get those shares and what ij case if it goes down to 5 rupees what will be the total loss .. can u pls reply on this as it will be really helpful

You will have to pay 15 * 75 = 1125. If it goes to 5, then the value will be 5*75 = 375 and your loss will be 750.

Sir,I bought ACC AUG 1840 CE 1 LOT(400) @ 33 Rps and now would lkie to sell @ 40 today so please help me,what will be my profit and will I lose all my 13200 if I sell today as ACC CMP is 1816 now?

You will make a profit of 7 per unit. Since lot size is 400, your total loss would be 400*7 = 2800

Hi,

Just observed 1 point above so the same is posting below:-

Question by one of the member – Sir,I bought ACC AUG 1840 CE 1 LOT(400) @ 33 Rps and now would lkie to sell @ 40 today so please help me,what will be my profit and will I lose all my 13200 if I sell today as ACC CMP is 1816 now?

My view – I think he will make profit of 7*400=2800 if sell before expiry.

Remarks – excluding question regarding ACC CMP 1816.

Yup, he basically makes the difference between the premium he paid and will receive, multiply that with lot size. So 40-33 = 7 and 7*400 = 2800.

Hi Karthik

With regards to the earlier query from another member, please could you assist on my query.

Sir,I bought ACC AUG 1840 CE 1 LOT(400) @ 33 Rps and now would lkie to sell @ 40 today so please help me,what will be my profit and will I lose all my 13200 if I sell today as ACC CMP is 1816 now?

1. Is is possible for the premium to increase to 40 when the underlying value comes down to 1816?

2. Should i look out for the increase in premium to consider that i will be in profit or should look out for the underlying value as well?

3. Wouldn’t the total loss be 13200 as the underlying value is below the strike price?

Thank you in advance

You bought the option at 33 and selling the same at 40, which means your profit will be Rs.7, multipled by 400 which is 2800. When you sell the option, you will get 40*400 = 16000, which includes the premium and the profit.

1) Yes, for this to happen the volatility should also increase. This is explained later in the module

2) If it is a short-term trade, focus on the premium

3) No.

I knew that CE and PE are to be bought, never sold for huge risk of loss is involved. So forget selling options altogether. If my view is price will go up, I have to buy CE and if my view is price will go down I have buy PE. Be it PE or CE, I have to buy of the strike price which is at the near by value of CMP. Expiry of current month options is always on the last Thursday that month. My questions are ” 1-Can I first buy and then sell PE or CE from last Friday of current to last Thursday of next month at any time in the live market hours?”

2- ” I bought CE on last Friday of current month. Lot 75. Premium 150. I paid 11250. Mon, Tue, Wed. On Wed Premium is 250 on live chart of my that CE. Can I sell or not? If yes is my profit= 75(250-150)=75*100=7500 ( including brokerage+ charges)?

3- If I have to day trading of options (only first buy then sell of PE and CE) I need lot size * current premium as capital. For buy today and sell on any day any time before expiry, do I need same capital to buy now? Means lot size * current premium of that option?

1) Yes, you can.

2) Yes, you can. Yes, you make 100 in profit

3) Yes, it is the same. No additional margins for buying options. Check this – http://zerodha.com/z-connect/tradezerodha/margin-requirements/zerodha-margin-policies

Dear Sir,

If i am able to sell my option before expiry then what do you mean when you say ,” Here is an important point to note – you can exercise the option only on the day of the expiry and not anytime before the expiry.”

Exercising an option is only on the day of expiry. However, you can buy and sell the premium at any time frequency.

As you are saying “Exercising an option is only on the day of expiry. However, you can buy and sell the premium at any time frequency”….. that means we may not get profit sometime when even price of the stock increased but its premium price not…before expiry…!!!!

Think of the premium in terms of buying and selling a stock. You make a profit as long as you buy at a lower price and sell at a higher price.

EX: A Bajaj AUTO option Contract lot of 500 CE strike price 2950 bought on on 15 march at premium 45, expiring on 28 march now premium got increased to 52 and spot price is 2951. If i sell my premium at 52 i will make of 7 rupees on premium and do i have anything to do with spot price at the time of selling my premium and also at the time of expiry date. If spot price increases to 3000 do i incur into any losses.

No, you just have to sell it and pocket the premium of 52. Your profit will be 45-52 = 7.

how do i put stop loss i have brought options in normal orderand its in profit but i want to trail stop loss so i dont lose profit in case market turns so how do i put stop loss in this scenario

2) howdo i put stop loss after i have brought options

ty

You can do this by placing a regular stop loss and then you can keep modifying the limit price as and when the premium goes higher.

Hi Karthik, Do we have facility in PI to see payoff charts since it’s required when we play on option strategies (straddle,strangle etc.) ?

Thanks,

Ashish

No, I dont think so, but we are exploring an idea similar to what you have mentioned.

How to calculate break even point in real market

Which price take as strike price day starting share price or close price

And which premium price I take month starting or take everyday different premium prices

Plz explain it with real market example

Breakeven point is = Strike + Premium paid. It is the same in theoretical and practical world.As I have mentioned in the chapter, selecting the strike price requires some amount of background knowledge on options theory, towards the end of this module you will get a fair understanding on the same.

Sir, Toaday I bought 8600CE at 75/- Pr. and sold at 85/- with a profit of 10/-per lot. Iam unable to understand, as per formula Break even pt. Strike price + Pr.( 8600+75) indicates nifty should trade above 8675 to be in profit. but I have already got 10/- profit per lot even though nifty not even crossed 8500. Pl. explain. Thanks

Regards

I too had a same question similar to Rama Devi. Can you please explain ?

Rama / Suren – The break even point is applicable only if you hold the option till expiry. It is not applicable during the series.

Hi rama,

You said you made a profit of Rs 10 per lot. so here if you have bought one lot what is your total profit ?. Is it 10 rupees or 75*10 = 750 rupees (taking lot size of nifty is 75).

Answering on behalf of Rama – yes, it would be 75*10 = 750.

Dear Sir,

Appreciated for your efforts in teaching for novice traders/investors, I have a doubt; As stated in the above chapter, on 26.03.15 Bajaj Auto 2050CE is at Rs.6.35/- while stock is trading at 2026.90 , today at 3.15pm stock trading at 2025.10 but 2050CE trading at Rs.50/- i.e a profit of Rs. 43.65 per lot. Hence, what is the role of breakeven point, as per rule buyer of 2050 CE option would be in profit only when stock price trades above 2050+6.35= 2056.35. Pl. clarify. Regards

Dear Sir, On my above query, I have noted that expiry dates differs, still my question remains same, if we take todays Nifty 8600 CE of April is low 72.50 and at 3.20Pm is Rs. 114.90. If I bought the same CE option when it is at a premium of 80/- and closed at 110/- for a profit of 30/- per lot at the same time Nifty is trading at 8492 Spot. Please clarify.

As I mentioned, during the series, the profitability depends on many other factors. We will get to that as we progress through this module. Request you to stay tuned 🙂

Two things Kishore –

1) As you have noted it correctly (in your next message) you are looking at two different expiry series. Hence the huge difference.

2) The break-even point we are discussing in this chapter is ‘Upon Expiry‘. During the series besides the breakeven point there are other important factors that will determine the profitability of the trade. More on these factors when we take up option geeks.

sir,as they say to become ELITE TRADER

sir,as they say to become ELITE TRADER we should not watch TV&GET CONFUSED is it true,if it is how come we know why mkts r falling&rising r we should MUTE & watch clarify

Elite Trader is a fancy word used to refer to someone who employs complex trading strategies. However, any trader who is consistently profitable is an Elite Trader…you can achieve this by watching TV or by completely avoiding it. It is all in your mind and depends on your market discipline.

t-u work smartly to achieve

Sorry, dint quite get that!

Sir it was thank u

🙂

Sir, is this bullish engulfing?

Yes, this is a great example of a bullish engulfing pattern.

Thank u sir.,

Sir, Waiting for other chapters, when will be uploaded. Regards

We will upload at least 2 more chapters this week. Thanks for your patience.

T RAMA DEVI

April 7, 2015 at 7:33 am

Sir,

In Technical Analysis module Chapter 10 clause 10.4, Iam unable to understand this rule “As a rule of thumb, higher the number of days involved in a pattern the better it is to initiate the trade on the same day`. Is it to enter on day 3 i.e P3.

Thanks

I had posted this answer earlier – re-posting the same again, also request you to keep the comments under the relevant chapters so that we can keep it well organised.

It means, for example – a bullish engulfing pattern (2 day pattern) is more dependable than a hammer (1 day pattern) and a morning start (3 day pattern) is more dependable than a bullish engulfing (2 day pattern). So higher the number of days in a pattern the higher the conviction to trade. Please note this is just mu personal observation while trading.

Let’s say, i buy tata steel call option of Rs350 April series @ premium of 10 Rs & I sell tata steel call option of 370 April series @ premium of 10 Rs.

For me it looks win win for me. I get premium squared. If it goes above 370 my profit is locked to 20 Rs. If it goes to 330, the 370 buyer will not exercise option of buying. So will I for 340 option. For intermediate price e.g. 360, I get 10 Rs.

Is my understanding correct?What will be the other risks on this trade?

What will happen if these contracts are not squared before expiry? Also what are ways for a buyer to exit contract or what will buyer has to do so that his option of not buying is executed if the price goes in opposite direction of call?

Btw, the premiums I mentioned are hypothetical. Though there could be some cost covering when I sell & buy option of different cost in same series. For example The CE 350 is @ 9.25 & CE #370 is @ 3.3 so effectively my risk is only for 5.95 *500 = ~ 3000. But I am not sure about all risks involved in this trade. How a buyer can decide whether to execute his option & how will he do it?

There are many things involved here kaushik – however I’m really glad you are able to think in terms of an option strategy. Request you to please stay tuned…we will discuss all this and more shortly.

Kaushik – if 350 Call option is trading at Rs.10, then there is no way 370 Call option will also trade at Rs.10. This is because of many factors involved in option pricing….we will soon discuss option pricing in this module. Also, the strategy that you are talking about is called the ‘Bull Call Spread’…again we will discuss this stratergy along with many others in the next module i.e ‘Option Strategies’.

You can buy a call option now and sell it within few minutes if you wish…so exciting an option is not a problem provided a counterparty is available.

If I buy some call option @ 5 RS & hold it till expiry. Lets say @ expiry the value is 2 Rs. or 8 Rs. Will I get that money?

Yes sir, you will!

Sir, how to select a strike price? e.g on 1st May,15 I decide to buy a call option of June 26,15 and the option is open then do it make sense to buy a call option of second month and also please suggest the criterion to select a strike price. How much difference of strike price to the spot price is safe?

Aarti – Selecting the right strike to trade is a huge task and a very critical task. We will take it up in this module shortly. Please stay tuned till then 🙂

“The profit from this call option seems to increase exponentially.”

Shouldn’t this be linear?

If options are linear then the gains and losses should be equal. However this is not the case when you buy an options. When you buy the loss is restricted to the extent of premium paid and gains can be unlimited. Hence one tends to say that there is a scope for exponential gains. I agree mathematically ‘exponential’ may not be the right word to use – but its just to drive the point across.

I think in the interest of precision and correctness you should not use the word exponential, simply for the fact that derivatives do exist whose values vary exponentially relative to the value of the underlying(perhaps we’ll see these and stuff like CDOs in a future module?) therefore it’s ambiguous.

Also you mentioned limited liability but unlimited potential profit – same applies in direct equity, too.

Alright, Sir. Noted.

The line that claims the exponential increase in profit when the spot price moves higher is clearly misleading. The profit actually increase in a linear fashion rather than in exponential form. Please rectify.

Options are non linear instruments Batchu. Futures are linear – meaning for every 1 point move in the underlying your P&L reacts by 1 point.

It’s ‘linear’ even if the value of the derivative changes by k points for every 1 point change in the underlying.

If I buy a call option at say Rs. 10, can I set a stoploss higher than 10, as in say Rs. 20, so that whenever the option premium reaches double its value, the trigger is activated and the option premium is sold? What happens when I set a stoploss of a call buying option higher than the buying price in Pi?

You can create a limit order and keep it pending in the system. Suggest you email [email protected] to figure out how to get this done on Pi.

Hello Karthik,

July Contract for Nifty at Strike Price 8600 trading at Premium of Rs.64/-

With a bullish perspective, I can buy a CE of the above contract of say 4 lots, thereby 64*100=6400 will be my F&O obligation amount which will be debited from my A/c at EOD.

But can I also short it for intraday trading just like we do for Nifty Futures and also hold the short position for a few days?? And if I can short the above contract at the above price, will I become a Seller of the Option Contract and get 64*100=6400 credited to my account or will I still have the same F&O obligation and 64*100=6400 will be debited from my account at EOD ?? If it is possible to short the above contract, will it be better to buy a PE instead of shorting a CE?? I am confused. Please help.

Regards,

Sunil.

On one hand you buy the position and on the other hand if you sell it….it leaves you with a net obligation of 0, meaning you do not have an exposure to the instrument. So you cannot do this. If your view point is this – Nifty will cross 8600 by expiry but over the next few days it will correct before crossing the 8600 then in my opinion you are better of buying calls and shorting futures.

hello karthik,

my apologies for confusing u. I didn’t mean to buy and sell the same option. That obviously would nullify everything. What I meant was , what happens when i sell a CE ? In the above example, if i sold 4 lots of a CE (the way we short a futures contract) trading at 64 premium for a 8600 Strike Price, will my account get credited with 64*100=6400 at the end of day due to premium collected from the buyer? And suppose I buy the same CE tomorrow at a premium of 60, in that case 60*100=6000 will be debited from my account at end of day? Thereby causing a profit of Rs.400/-. Till now, I have only bought a CE or PE. Never sold one as I am confused how the payment settlement works. Please clarify my doubts.

Thanks & Regards,

Sunil.

Oh yes, this is exactly how it works 🙂

So when you short options your account would be credited and when you buy it back money would be debited. The difference is what you end up making. Also, this is pretty the same way long trade works – when you are long you buy first and sell later…and when you short you sell first and buy later…its just that the order is reversed. Either ways the Profit or loss you make is the difference between the debit and credit.

can u kindly elaborate more on the shorting of CE concept ?

continuing same example given by mr.sunil .

in first scenario , he sells CE at 64 and buys back next day at 60 … thus earning 400 profit.

similarly if his buying price is more than selling , he will make a loss ….upto here i got the idea.

what happens when he doesn’t buy back and expiry date is reached ? kindly explain pls

Well you seem to have got the concept completely 🙂

On expiry day if the option is worthless then it will have a price of 0. So you would have sold at 64 and exchange will assume you are buying back at 0, hence your profit will be 64. In case of any other positive value for option then your profits will decrease accordingly. For example if its 15, your profits will be 64-15, if its 30 ..profits will be 64-30….and its its 80 then you will incur a loss 64 – 80.

As you said we can short the options till expiry, As on expiry every option nears to Zero or becomes zero, isn’t shorting options then always profitable, like if we short 2-3 days before expiry and on expiry it going to become zero, so buying back on expiry date. Please clarify

Only OTM options goto 0 (or expire worthless). All In the money options have a non zero value.

karthik,

i have a doubt iv= spot-strike,when i see the option chain in nse website this formula not working — nifty spot at 8567

8800 ce iv =11.16 ,8750ce iv=11.20,etc please explain what it is

Sarath – the IV mentioned in the option chain is Implied Volatility and not intrinsic value.

thank-you very much sir

Welcome!

hello sir i m new to option… n have just signed up with zerodha… my question is today say nifty is at 8415, and i m bullish on it , so i predict the mrkt to go up so i buy a call option .. nifty trading @ 8415, i buy CE option with stike price 8450 and in return pay the premium for the same which is say 75 , so my queery is what will happen to my premium of 75 when nifty shoots from 8415 to 8435 , will my premium of 75 also move up i.e say 79 for that instance.. or will it remain at 75 only and will move up only once nifty moves above 8450 … bcoz i have purchased a call option with strike price at 8450 .. plz eplain..

Hi AMOGH,

The premium changes as and when Nifty value changes. If Nifty goes up, the premium goes up and vice versa. How much the premium will change wrt the change in Nifty depends on the delta of the strike price. The change in premium is directly proportional to the change in Nifty. You can book profit when the premium goes up just like u do when the price of a stock goes up. Hope that answers ur query. Happy trading.

I dint notice your comment Sunil, thanks for pitching in 🙂

If Nifty moves up, the call option will also move up..to what extent it will move depends on the Delta of the option.

Hi Karthik.,

U have taught us soooo many things. So I consider it my responsibility to pass on the knowledge gained from u to others. After all, knowledge increases by sharing. 🙂

Sunil, I’m very happy to hear this ! Have you read this – http://zerodha.com/z-connect/queries/stock-and-fo-queries/introducing-varsity

It talks about our rational behind starting Varsity.

Yes Karthik, I had read that article. I’m really glad to see the effort you guys take to educate people. And best part is that you are giving the knowledge for free at a time when hardly anything comes without a price. Won’t be surprised if some day we also have to pay for the air we breathe. Lol. Zerodha not just offers an amazing and low cost trading experience , but also connects well with people. That’s what sets Zerodha apart. Keep up the good work. God bless the team.

Thank you so much for the kind words Sunil 🙂

Good day Karthik,

I need a little help from you. I am doing intraday nifty options trading and I want to develop a strategy for the same. I tried looking up online. But didn’t find anything relevant. Could you please help me with it.

Thanks in advance.

Sunil – please do let me know if you need anything specific.

Hello Karthik,

I want to know how to analyze nifty chart and what things to consider to decide whether to go for CE or PE….. And what strike price to trade…..Is there some intraday trading strategy for nifty options?

My question might seem too generic, but I myself am confused what to look for…. Technical Indicators and candlestick patterns don’t seem to be helping much while I’m trading options in intraday….. Kindly advise…

Thanx

Sunil – you should not be looking at technical charts of options, it is pointless. Will be including 1 or 2 case studies towards the end of this module which I suppose will help you get a better picture.

Thanx Karthik. I will wait for it. As of now I am trading the OTM options for CE/PE and looking at the price action from the option charts, I’m determining my entry, stop loss, target and whether to go for CE or PE. In case I bought CE, and my CE stop loss order is about to get triggered, I am placing a SL buy order for PE and vice versa. This strategy seems to be doing fine till now. But I want something better. The Option Strategies I found online are all for holding the position till expiry. Nothing for intraday. Anyways, will wait for your future modules.

In fact most of the options are designed for expiry. The next module is all about Options strategy…hopefully it should give you an insight into devloping something for intraday as well.

yea.. thanks sunil… my queery got cleared..

thankz karthik….

hey karthik, i was always under the impression that the option on expiry day trails to zero. the HDFC CE1180 ended the day at 12 rs odd. why would any one hold on to options after expiry?

Madhu – Only ATM and OTM options expire worthless..but HDFC closed at 1193 yesterday…so 1180 CE had an intrinsic value of 13.

blooper!!! missed that….ok, so from the above e.g of HDFC if i chose a strike and am confident that the spot would be above that on expiry by say 13 points as it was then, would it be prudent to buy the option when its trading at a price below 13 and then sell it when it hits the price equivalent to its intrinsic value ( i.e 13)….of course this is based on the premise that the stock will not dip below 13 points to its strike 11 eight zero.

Madhu – selecting a strike such that you gain the most form the expected outcome is the most trickiest job of the options trader. Towards the end of this module, I will attempt to explain this…request you to please stay tuned 🙂

hi karthik ,

great forum.

for eg: if I bought nifty 8100 call @142 CMP 8002, my doubt is even if the spot reaches the strike price I will make a profit of 98/- rs per share but i’m paying 142 premium per share ,so will 8142 be my breakeven pt, please clarify.

My frnd said it does not matter if spot reaches that strike price i can book profits as premium increases , and square it off.

please clarify possibly with an example of how premiums change with time.

Thanks in advance

Yes, your breakeven point is 8142. However the breakeven point matters only if you intend to hold till expiry. In case the spot reaches the strike and there is ample time to expiry then like your friend mentioned, your premium is likely to be much higher than 142.

Dear karthik

I have a small doubt …plzz tell me can we earn profit on premium even if the market price doesn’t reach the break-even…???

Eg- suppose if I buy NIFTY 12000 CALL at 5rs …so my breakeven should be 12000+5=12005

So if the market price do not cross 12005 but premium increases to 10 rs….

Then in this case what will be my profit or loss if it has not reached expiry???

Yes, you can Prakash. But like you mentioned, the premium should increase.

Dear karthik

I think the break even in the above case should be the strike price+premium so it should be 8100+142=8242

Kindly correct me if I m wrong ???

M bit confused here ??

Plzz reply to this

Thanks

Yes, thats the breakeven for a call option.

is it possible that the MP of the stock goes up but at a particular strike price on the same day for buying call the premium price goes down?

Possible, please do check the chapter on Vega – http://zerodha.com/varsity/chapter/vega/

On exercising a call,do the shares need to be sold immediately?Or can they be sold later?

Everything is cash settled, so there is no need for actual buying/selling of stocks.

The commission paid is not included in calculation of Break Even point.

The break Even formula should be modified as below :

B.E = Strike Price + Premium Paid + Commissions

Agreed…also it should be noted that the commissions vary broker to broker.

I got a little confused after reading the comments.

1. If I buy an option today, can I sell it before the expiry date?

Yes you can sell it before expiry.

Hi Karthik,

I am beginner in options. Its very nice information about options. I have below queries:

1. How to select Strike price? U mentioned in few comments that u will take it up and add about it in this module. but I am unable to find about this. Can you please elaborate this?

2. About option strategies, U mentioned one or two comments u will give one or two scenarios for better understanding of option trading and strategy..Also I am not able to find Option Strategy module…

Thanks in advance!

The next chapter (chapter 22) – will upload next week) is all about strike selection.

In chapter 23 I will discuss few case studies – simple option trades and the rational behind. Hopefully this will help.

Hi Karthik,

Wonderful, truly amazing an initiative the whole Varsity is. IMHO, Its one of the best resources for uninitiated aspirational traders/Quants to get started.

Just one thing specific to the Options – Everywhere you have indicated 3 scenarios while taking a Call Buying decision. (lemme take Ajay-Venu’s example).

1. Price of Land can go higher than 500,000, say 800,000

2. Price of land goes lower, say 300,000

3. Stays same @ 500,000.

Mind you, the premium was 100,000 to start with, right ?

Now, you have indicated that under Scenario 1, Ajay stands to gain. i.e, if price of Land upon expire is > 500,000(> Strike Price).

Should scenario 1 be sharpened to say that Ajay stands to gain when {Land Price > (Strike+Premium) } ?? I mean, what happens if Land price increases from 500,00 but only till 575,000 ? In that case, Ajay pays = 100,000(Premium) + 500,000(Strike Price) but his in-flow will be only 575,00. Doesn’t he lose 25,000 in this case though it meet criteria of Scenario 1 ?

Maybe, I am missing a very basic point while raising this question. Do help me get clarity.

Rgds,

Anurag

P.S: Keep up the great, GREAT work !!!

Got it by getting to the B.E point later in the chapter. 🙂

Ignore the question. But still keep up the great work !!

Rgds,

Anurag

Good luck 🙂

Anurag – Thanks for kind words 🙂

Yes, it does make sense. However the idea at this stage is to slowly introduce the concept. Eventually I have discussed the Premium angle as well.

Hi, I was trying to calculate Total margin required using SPAN calculator. My question is whenever I am checking margin for any Buy (either CE or PE), margin required is shown as zero. Why is this so?

Sir supose nifty was at 7820..i bought 7900ce with premium of 90…nifty has reached 7860 day high premium at 150 can i squre off my position and book profit..or do i need to wait until nifty to toucch7900 to book profit..

You can certainly book profits and get out of the trade.

What about Exercising the option. I dont see it anywhere. As you said we cant exercise the option untill its expiry date. How can you square off before the expiry date.

It is assumed that you wish to exercise the option if you let your ITM option expire (meaning you do not square off the position on expiry).

Just no where I have seen such a simple and wonderful tutorial to teach Options. Excellent!!!! Keep Rocking!!!! 🙂

Merci Beaucoup …meaning ‘thanks a lot’ in French!

🙂 🙂

I don’t see our beloved Sir, instead I see an EDHEC grad here 😀 😀

Ah, EDHEC is very close to my heart! It helped me see the financial markets from a completely different perspective 🙂

🙂 🙂

as u advised me earlier, I am on the way to pursuing cmt and cfa now.

these give me a huge insight to develop how financial market works. And my every aspiration started from this varsity module.

It’s beyond my words how much I respect and how much Zerodha, Varsity, You, Nithin Sir means to me ??.

Thanks for the very kind words, Arijit. We feel privileged to receive so much love and respect 🙂

In the given example, even if the price increases from 2026.9 but stays below 2050, loss of 6.35 per share occurs.

Won’t it make more sense if one buys futures (cover/bracket) instead of options?

I’m asking this as it was mentioned that options are more attractive choice.

(I appreciate your efforts, plz dont kill me)

Well the whole deal with options is that there is protection on the downside and we clearly know what is the loss in the worst case..since loss is pre defined, hence the preference of options over futures.

Also, I suppose between 2026 and 2050, the loss is being minimized as we approach the breakeven point.

And don’t worry, I will not kill you 🙂

Hi ,

Just a quick query.what all factors affect the open price of a option. Is there any technique to guess it. There is a huge gap in previous day close and present day open. Which we don’t see in equity.

The opening price of an option depends upon how the underlying opens….and this really depends on the overnight news flow!

Having said this, do note certain illiquid options do tend to gap up/down.

Hello Sir,

I want to ask you that suppose I bought 2 lot Nifty 7900CE @ 80 and holding it till expiry. Now on expiry day Nifty is trading @ 8000. that means I can execute my contract since I am in profitable condition. but I could not understand how to execute the contract? I mean what happens on expiry day? Do ‘executing the contract’ means selling 2 lot that I have been holding ? Please clear my doubt although looks silly…!!!!

Sooraj – In a profitable situation like this you can choose to let the contracts ‘expire’ (meaning you do nothing) and the exchange will ensure you are settled to the extent of your profitability. In other words if you are supposed to get Rs.100 as profit, exchange mechanism will ensure you get this money to your trading account.

Alternatively if you want to go ahead and sell it yourself, you can do that as well.

Okkkkk…..You mean I just have to do nothing and let it expire if I am in a profitable situation….. got it..

Thanks a lot Karthik Sir…

You are really doing remarkable job for beginners like me..keep it up…God bless you..!!

Yes Sooraj. Although if you have bought an option and it is profitable, it makes sense to square it off yourself just before expiry to avoid high taxation. Please do read through this to understand this better – http://zerodha.com/z-connect/queries/stock-and-fo-queries/stt-options-nse-bse-mcx-sx

Right Karthik Sir, I even don’t keep contract until expiry.. I usually hold them for 1 or 2 days…because We can never be sure what happens next in market….!!!

Some perspective 🙂

Hi Karthik,

I want to ask, I purchased CE 8100 @6.80 with 28JAN expiry.My order type is “NRML”. Now NIFTY is going down NIFTY is @7640, so obvious CE 8100 becomes 5.90. So am in loss right now. But till expiry I have time & hope NIFTY will gain. Suppose NIFTY will trend to 7800/7850 on date 18 JAN, Call which i bought become to 10. So I would get profit of Rs 3.20 per lot. At that moment on 18 JAN can I sell the call option directly or shall need to convert from order type “NRML” to “MIS” and then sell?.

am confused on this. Please assist.

Yes, you would be in profit of Rs.3.2 (in case the option goes to 10). You can square it off from the position using NRML…no need to convert to MIS.

Hi Karthik,

I am beginner in Option trading.

This is really a good material for beginner.

But I have a doubt that when will I make profit? Means when premium goes up OR strike price goes up.

Please clarify. Thanks in advance

When premium goes up. Strike price will not move like premium. In equities you have choice of many stocks like Infy, SBI, Reliance & so on… while in Options if you take one stock e.g. infy which trading at 1160 right now….it has strike prices with a gap of 20 rupees….1180, 1200, 1220, 1140,1120,1100 like that…..each has different premiums…..all the strike price have two options again Call (CE) & Put (PE)…..so if you are bullish on infy you can buy call 1160 or 1180 or above and if you are bearish you can ‘BUY’ put options 1160,1140,1120 & below. farther the strike price…moneyness changes….and so the option greeks also. e.g. now u r bullish on infy and bought 1160 call option….if spot price of infy moves up from 1160….its premium will also move up…. provided it is ATM or ITM option and not so near the expiry.

Am i explained right Karthik?

Perfect 🙂

Strike price is a constant and it does not move. You make money on the premiums.

Ok thank you SHREYADR and KARTHIK. Now i got it that we make money when premium goes up and we lose money when premium goes down. right?

Your are right KASHYAP buy that is when your buyer of the option. if you are writer(seller) of the option, going down of premium is favourable for you.

very thank you SHREYADR to help me.

Perfect!

Well, that depends on your position. If you are long on options you make money when premiums go up…but if you are short (have written options) then you make money when premiums go down.

Now If I buy a lot of 800 of CENTURYTEX MAR 500CE at the Rs.16 premium (my total premium is 800*16=12800), after few hours premium is increased to Rs.20, so If I do square off at the profit of 20-16=4 Rs, how much total value I get?

20-16 = 4

4*800 = 3200 will be your profit.

If premium goes high and i am in profit as premium, but breakeven point is not reached then what happened? Am i in loss or profit?

If you are doing intraday then there is no concept of breakeven. For you to be profitable, the premiums have to move in your desired direction.

that means if i do BTST (or before expiry) then breakeven is applicable, right?

Breakeven is applicable for trades held till expiry, all other cases it does not.

ok now i have cleared my doubt. Thank you very much KARTHIK…

Welcome!

1) u r into gross profit of Rs.3200/- i.e. excluding brokerage n taxes.

2) Which break-even point you are talking about?

Hellow SHREYADR,

2) I am talking about, in the case of i have mentioned above example (CENTURYTEX MAR 500CE), if I have bought lot qty=800 premium=16 strike price=500. So my breakeven point value 500+16=516, right?. Now, after few hours premium goes to 20 and spot price is 510 then in this situation am i in profit or in loss?

Technically speaking 516 is ur breakeven point. but traders don’t trade like that…they just trade premiums….keeping target and stop loss in mind.

secondly premium will definitely rise from 16 to some upper value when spot price moves from 500 to 510….but it may not rise by Rs.10 (510-500) and become 26 (16+10) because of the option greeks comes into picture.

ok thanks…but i don’t know about option greeks. I have to learn about it.

Greeks are explained in this module, maybe that will help.

ok

Hi Karthik,

When I make a profit due to the increase in premium, i.e., when i buy a CE and later on sell that CE back for a higher premium before expiry, will it be like, I would be obliged to exercise my selling CE on the expiry date?

No, it simply means that you bought an option by paying a certain premium and sold it later for a higher amount and pocketed the difference. That’s about it. When you buy – sell before expiry then its just a play on premium…exercise of options is applicable only upon expiry.

Thank You So Much Karthik. So nice of you

Welcome!

Hi Karthik,

Is it possible to first sell a call option and then buy it back at a lesser premium making a profit

Yes, of course.

Thanks for the reply. So its like, we can short sell a call option

Yes, you can short a put.

Hi,

If I bought 2000 lot size of Justdial MAR 750 CE today with premium 25 (2000*25=50000). After few hours premium is 23. If i book loss then how much total loss i receive?

25-23 = 2. Your total loss will be 2*2000 = 4000.

50000 is premium so total loss is 50000+4000= 54000.am i right? Or loss is only 4000

You will have to consider the difference in the premium multiplied by lot size for P&L.

And If i leave this position for expiry, then what?

It depends on the stock price on the expiry date.

for example stock price is 780, then?

Then your profit will be 30, out of which 25 will get adjusted with the premium paid. Hence you will be left with 5.

5*2000=10,000/-.

Just an addition. There will be a large outflow of money as STT charged which will be [(780*2000)0.125%] = 1950/-

(Comparatively as other charges are very minimum, I’ll keep those out of calculation).

Sir, am I right?

I’m assuming you are talking about ITM option expiring. If yes, check the latest circular from NSE – https://tradingqna.com/t/no-more-stt-trap-on-exercised-in-the-money-options/18977

So no more STT trap.

Sir,I am new to f&o. My question is if I have to trade in options, should I have the entire

Margin for call buying or should I pay only the premium. For suppose if I want to

Buy bhel Apr220 call at 5 premium, if I have 50000/- in my trading account ,can I purchase 10000 shares with that amount or should I have the entire margin for buying the call option.

Pradeep – When buying options (either call or Put) you only need to pay the premium amount required. But if you want to short options (either call or Put), then you need to pay margin amount.

In your example the amount you will have to pay for 220 Call option is 5 * BHEL lot size.

Sir, if bhel 220 april (lot=2000) CE premium is rs 5. If a lot of bhel is rs35640. If I have 50000rs in my trading account. Can I purchase three lots with the amount that I have in my account or I should have

the entire marginal cost(3*35640) in my account to purchase the call.

Lot size of BHEL is 2000. Premium is 5, hence to buy 1 lot of BHEL you would need 2000 * 5 = 10,000/-. Since you have 50K in your account you can buy 5 lots.

Dear Karthik Sir,

I want to know about stoploss for option premiums..suppose I purchased 2 lots of nifty 7900 PE @ 56 with a stoploss 50 on BTST basis. later in the next day Nifty open gap up and Nifty premium opened @ 29 then what happens to my stoploss?? will my order get executed on 50 or 29?? Plz reply.

When you purchase a put option, you want the prices to fall, hence your SL should be higher than 56 and not below.

Sir you actually didn’t get me.. I mean I have 2 lots of 7900 Put options @ premiums 56..My intention is market would fall tomorrow so I held them so that premium go above my purchase price…and I kept my stoploss to 50..

but what happens is next day market opens gap up then definitely my premium would fall…and suppose gap up was so sharp that put option premium opened @29 then would my stopploss trigger @ 50..??

I hope you get me..

Sooraj – thanks for pointing this, clearly my mistake 🙂

SL has to be set everyday and cannot be carried forward. Meaning if I have set the SL at 50 today but by end of day the SL has not been triggered then it automatically gets canceled at market closing. The next day you will have to set the SL again….either by placing a Pre market order (http://zerodha.com/z-connect/queries/stock-and-fo-queries/pre-marketpost-marketafter-market-orders) or you can place the SL order after market opens.

Ok I got it…that means We can not carry SL overnight…pre market order is available in Pi but not in kite.. right??

Hi Karthik,

I have bought 8200CE at premium of 7(7*75 = 525 ), Now the premium rate is 14.

1. If i squared off now, theoretically i will get profit of 7*75=525. But technically there is no profit/loss, since my premium amount is tallied there(525 – 525 buying price). right ?

2. if i squared off at 15 i will get profit of 8*75 = 600 and technically 75(i.e., 600 – 525 buying price) ?

3. Let’s assume i will squared off at premium of 6. Is’t possible to squared off less than entered premium ? If yes, then will i get my premium amount back with calculation of 1*75 loss and 6*75 remaining balance ? Again if yes, i don’t understand logic here, If i squared off my position less than the premium which i bought then i will get 6*75 but if i am in profit premium of 15 i will got only 1*75 profit(i.e., (8*75 = 600) – (7*75 = 525 buying price) )… big confusion, pls clarify ?

You will be making a profit…thing about it as buying a stock at 7 and now its trading at 15…so you have more than doubled you money here. If you square off at 6, then you will make a loss….as you bought something at 7 and sold it at 6…so a loss of Rs.1.

Thanks for your prompt reply.

Let me ask one more question to get more clarity.

Bought at 7 and sold it at 6.. so a loss of Rs.1 –> yes i understood and here is my qus… is’t mean that remaining 6*75 will get credit into my account ? (because i read somewhere the premium amount is not refundable once contract made, so pls clarify).

Bought at premium 7 and sold it at 8, so a profit of 1.Rs. How much amount will get credit into my account, whether 8*75 or 1*75 ? (Again the same question, because of premium confusion).

Yes, the premium amount will be credited to your account. It will not be refunded if you hold it to expiry, but in this case you are trading the premium.

In first case you get 6 * 75 in your account…and in the 2nd you will get 8 * 75….the credit will reflect by end of day.

Thanks a lot and Thanks in advance.

Let me ask few more questions about expiry, (This confusion came, because the spot price and premium is not equally increasing in real time, as explined in this article)

I bought 8200CE at 7 when spot price is 7900.

And assume,

1) The spot price is 8200 or below at the time of expiry, then the premium will become big ZERO and i will get nothing, right ?

2) The spot price is 8200 or below, premium is something around 87 and i EXIT explicitly before the auto expiry, then i will get premium*lot_size, right ?

(Below qus, because of big confusion – who is the hero spot price or premium?, Please answer profit/loss and the corresponding amount)

3) The spot price is 8206 and premium is 100 at the time of auto expiry then what will i get ?

4) The spot price is 8206 and premium is 100 and i EXIT explicitly before the auto expiry then what will i get ?

5) Now fortunately the spot price hits 8300 and the premium is 160 at the time of auto expiry, what will i get ?

6) The same flow, spot price hits 8300 and the premium is 160 and i will EXIT explicitly before the auto expiry, what will i get ?

Hope, i am not confusing you 😉

1) If you buy 8200CE for 7, then you will make a profit only if the spot moves above 8207, below 8200 you will not get anything.

2) Yes

3) Spot influences premium. If spot expires at 8206, and if you continue to hold the option to expiry, then you will get only 6 as 6 is the true value of the option

4)100

5) 8300 – 8200 = 100

6) 160

So basically you can exit before expire , then you will get the last traded price of the premium. If you choose to hold till expiry then you will get the intrinsic value of the option.

SIR , WE CAN EXIT ANY TIME BY TAKING PROFIT OR LOSS ON ANY OPTION AND NOT TO WORRY ABOUT WHAT IS UNDERLYING SPOT PRICE OR THE STRIKE PRICE PREMIUM ON EXPIRY DAY.LIKE IF I HAVE CE+ 140, PREMIUM 5 AND I WRITE OFF CE- 140, PREMIUM 8, RS 3 * LOT SIZE IS MY PROFIT

Yes, you can exit it at any point in time. No need to wait till expiry.

I bought voltas 340 ce jun, its going down, now its below my buying price, i dont want to book loss, but confident it is bullish, but expiry of june month is coming near.

So question is can i hold on this option? since if i am bulish on this stock.

can i carry forward to next month expiry?

Yes, as long as you are convinced you can. But remember a wise man once said “Markets can be irrational longer than you are solvent”.

@KARTHIK,

@SARATH

What does carry forward mean ?? Selling june option for loss and buying next month option ?

It just means you sell/buy this month’s contract to buy/sell the next month’s contract. There is no P&L angle here.

Hey Karthik,

Awesome contents. Thank you for enlightening every nuke doubts.

On option expiry either CE or PE, the cash settlement takes place between buyer and seller. But in the case of premium how the settlement happens ?

Upon expiry, the premium of all ITM options are settled in cash. The value of the premium will depend on the intrinsic value of the option. Do note, all other options will go worthless.

My question was before expiry if we square off our position, our P&L would be the change in premium. How does the pay off depending upon premium take place ? Hope you get my query !

Yes, if you wish to square off the position before expiry then your P&L is basically the premium differential. The payoff before expiry would therefore depend on the greeks and the way they change.

On Equity, Buy on Less and Sell on High. Profit settles between buyer and seller counterparts.

On Option CE (square off before exercise) Buy on Less premium and Sell on High premium. Profit settles between option buyer and seller counterparts for the same strike price.

Correct me If m wrong.

Thanks

Absolutely, that’s the way it would work.

I CHANCED UPON YOUR SITE. I T IS WONDERFUL. iI COLD NEVER UNDERSTOOD FUTURE AND OPTIONS. I T MUST VERY USEFUL FOR THOSE WHO ARE IN STOCK MARKET AND ARE BEGINNERS. EVEN I FEEL ENCOURGED, .

Glad to know this Balbir 🙂

Sir, Completed this chapter again. And many questions are solved after reading Q&A section. Thanks for such wonderful effort to teach.

Welcome!

Hi,

I would thank you for helping us understand the tricks and trade of different trading mechanisms.

I have gone through zerodha varsity for call and put options. However need to brush up on delta, theta and other later chapters.

I am interested in placing an order for a buy call option for HCLT 28-jul CE, strike at 730, 1 LOT-700, underlying – 739.85, premium – 12.45.

So please clarify on the below points and correct me if I am wrong.

1.) The current premium is 12.45, so as per the guide will Zerodha be charging only premium multiply lot, i.e. 12.45 x 700 = 8715.

2.) So, as the strike is at 730, anything above 730 (ex. 740, 750) is considered a profit trade, and any below 730 then I tend to loose the premium i.e. 8715.

3.) Expiry for the above is 28-Jul, if for until 27th, the underlying is 750, can I square off or conclude the trade; or is it essential that I keep it until 28th itself, i.e. expiry.

Please help me on the above points as I am excited to know and educate myself.

1) Yes, premium amount payable is 12.45*700, and this is paid to the option seller, and not Zerodha

2) Yes, you will lose the premium as long as the spot remains at or below 730

3) Yes, you can exit the position whenever you want

Karthik avre, thanks for the confirmation. i missed out on HCLT, which made spot high of 747.

1 more question : Can we carry forward the contract(f & o) to next month. if yes than can you tell me whats the procedure.

You can buy Aug/Sept contract today and hold this till expiry, this is as good as a carry forward.

1.) but supposedly, say the Aug contract CE i had taken, did not meet the target, then can i carry forward this contract to september.

2.) for intraday or short term, as you have described in the later chapters that one can earn on difference in premium, say on the above case where the premium difference was 22.95 – 12.45 = 10.5, where 22.95 is current premium for the above contract. so the profit is 10.5 * 700 (1 lot)=7350. is that right?

Sir, pardon my questionnaire, its just that i want to know the concept thoroughly before jumping in. i am enjoying reading the chapters and respect the time you give to us by answering every queries.

Thanks again, Guruji of Zerodha.

1) No you cannot as the Aug contract expires in Aug. However you can close the Aug contract (or let it expire) and buy/sell the Sept contract. This is also called rollover.

2) Yes

Please feel free to ask as many questions as you want, you need to be knowledgeable before you place your first trade! Good luck.

Thanks,

Sir Couple more queries.

1.) in the above scenario if i wanted to hold CE sell contract for short term or square off – intraday, and if the premium is reduced from 12.45 to 10, and i had to close the contract then the loss would be 12.45-10 = 2.45*700(1 lot)=1715. is that right?

2.) suppose i am bearish on the stock for intraday, say on above scenario where the stock would have gone down from 12.45 to 10. Can i place PE option for an ATM strike. here the difference i.e.12.45-10=2.45*700(1 lot)=1715 is considered a profit.

Thank you for humble advise on option strategies in module 2, have read the option modules. need to go through strategies. i understand the above scenario is something you would not advise us newbies, however i understand and just wanting to clear some thoughts.

lastly, I am reading this chapters in july 2016, wherein this chapters were written a year back, your calculation were bang on when it was said “Nifty could be at 8600 with 40% chance in july 2016”.

Thanks again..

1) If you have sold the option, and the premium falls, then you make a profit and not a loss.

2) If you are bearish you can either buy a Put or sell a call option

Good luck and happy trading 🙂

Hi Sir,

I have a following doubts in options:

1) what is the maximum time allowed to buy call option buy on the expiry day? I tried to place a order at 3:28.it says rejected even though i tried to place a Market Order?, Please tell me order allowing time levels at Zerodha and Exchange side?

2)For an Instance, on the Expiry date (28-Jul-2016) HDFC 1400CE the Premium was at 0.40 at 3:28 and seller was also ready in the system at 0.40, Stock was at 1406 and closed at 1402.15, In this case if my 1400CE Order with premium of 0.40 executed means,what will be my profit and losses? since it has closed above strike price(1400), Will i get remaining amount (my premium is 0.40, Strike price is 1400 so 1400.40, stock closed at 1402.15, So the diff b/w 1402.15 – 1400.40= 1.75) or not?

I hope you understands my query,if not feel free to ask me again?

Please tell me your views on this please?

Regards,

SaikiranGarapati

1) Technically the order should go have gone through, did you have enough funds?

2) You will have the difference in spot and strike minus the premium paid as your profits….i.e 1402.15 – 1400 – 0.4 = 1.75

Thanks for your answer Sir,.

1)Can you tell me when closing price generally displays in the system and On Expiry day?

2) What price settlement will happen, Is it on LTP(3:30 PM on expiry day) or Closed priced on that day?

3)There are some cases i have seen at 3:30 LTP was some price and closed price was different So what will be reason for this? What transactions will happen in 3:30 to 4:00?

Please tell me your views on the above queries..

1) At 3:40 PM you will know the exact prices closing price

2) Closing price

3) The price you see at 3:30 PM is the last traded price, but at 3:40 PM you will get to know closing prices.

Thank you very much for your answers…May i know why there is a difference between LTP(at 3:30 PM) and Closing price? Can you give me one example?

Closing price is the weighted average price of the last 30 minutes, where as the LTP is just the price at which the last trade happened. You can find the example here – http://tradingqna.com/2512/how-to-determine-closing-price-in-f%26o?show=2512#q2512

Hi,

If i buy a call option at 3:28,If i do not square off,but closing is more than my strike price and premium,what percentage of fine exchange will put for that transaction?

There is no fine from the exchange for this. Why do you think exchange would fine you for this!

Thank you very much for your answers..I read it some where,That is y i thought ,there will be some fine..May be i am wrong..

If i do not square off,Exchange will charge STT on total traded value of my Option right? That is what i am speaking about…

Yes, but that is not a fine. It is a hefty STT that the exchange charges. More on that here – http://zerodha.com/z-connect/queries/stock-and-fo-queries/stt-options-nse-bse-mcx-sx

Sure, no problem.

Suppose yesterday I paid Rs 3500 as premium of option @0.05 lot size 6800. If after 1-2 days the value of the premium rise to @0.10. then in that case .Can i sell the option premium to get instant profit before expiry..? will i get net profit of Rs 3500 ..??

Yes, you can do that. No problem with that.

Will there be any kind of risk of loss like unlimited loss after selling the purchased option. Actually I m very new to option trading so kindly answer as simple as u can

No, when you sell an purchased option you are essentially closing the position. So you are out of the market.

Dear Karthik first of all thanks for making these complex things so easy for us. I have a quaestion here, suppose i create a sell position of call option of ABC comp, strike price 100 rs, primum 5 rs, lot 1 that consist 100 nos. So i will get 500 nos as premium to be credited to my account. and after 10 min if i find that there is no change in premium. So if i close my position on same premium after 10 min then what will be my profit? thanks

If you happen to buy it back at the same price i.e Rs.5, then you will have no profit no loss. Of course, you will lose brokerage and all the applicable charges and taxes.

He guys it was my first time buying an call option of JPASSOCIATE. I had bought the 15CE at 0.05 per lot which is going to expire this thursday. Any Idea what should I do since I couldn’t exit this position?

1) If I square it on the expiry day how much would I get?

2)If I just leave it to expire what would happen and how much would I get?

Gautam – if you read through the entire module carefully, you will realize the answers yourself 🙂

Dear sir, what is the actual thing we do when we say exercise an option?

Means in our bajaj auto example if before say 5 days before expiry apot price touched 2080 and if i say want to exercise option means what i have to do…do i have to purchase real shares to exercise it?

Second thing if when my call option ITM and if i sell it before expiry..then difference in premium is the only profit that i earned?

Exercise an option means that you hold the option which you have bought to expiry. You can choose to close your position before expiry this is just termed as booking your P&L.

All equity derivative contracts in India are cash settled – so it is not required to purchase shares.

Yes, you earn the difference in premium.

Hi sir,

Just having query

If today I buy call option in sbi strike price 300 price 1.60 exp 29dec 2016

If sbi move till 270-280 still I can square off this option or not?

Also we have to square it off at market price?

You can certainly square off, but by using limit orders.

Thanks KARTHIK great work

Can you please share any video link or any steps to square off above option in zerodha

Any option buy and then square of with zerodha ( video or ppt ) is great full

thanks

Check this – https://www.youtube.com/watch?v=S8fRxNaN-Pg&list=PLkxTRam6E2V_YYRSqzCjRq20fYPh9bkSL&index=3

Cheers!

Any option buy and then square of with zerodha is great full

thanks

I went through the entire module and was very confused although I understood around 40-50%. Read it the second time, things started becoming a little clearer than earlier because I made sure that I understood each and every line of yours but still had some confusions. I still understood only around 60-70%. Nevertheless, I took the pain to read the entire module yet again and guess what, it is like I knew Options right from the time I was born (lol). It is so much clear now. Thank you so much Karthik!

I have shared my experience so that other readers need not get disheartened if they don’t understand it the first time. Keep reading it again and again and I assure you that things will start becoming clearer in your head.

Khan, thank you so much for the kind words and the practical tip to readers here 🙂

However I do not want to buy the stock for delivery (yet) as I’m worried about a further decline of the stock. I did not understand this point and what is stock for delivery please explain and yes hatss off for simplfied explanation of all the topics of all the modules

‘Stock for delivery’ means buying the stock with an intention of holding it for many days/weeks/months/years. So what I mean to say is that I dont plan to buy the stock on delivery basis as I fear the prices may go down further, thereby giving me a notional loss.

can i close a option buy call before my expiry date

Yes, you can.

Hi Karthik,

STT, yesterdays(9/02/2017) appeal, i am confused, a person buys 3000 nifty 8622 call for .05 paisa at 3:20 p.m , how come he has thought, that before 3.30 his call will be bought by some trader, besides this , if he leave the entire lot unexercised , what was he expecting, exchange would bear the losses?

Please help me to understand this.

Regards,

MSP

What he did was very simple – at 3:20PM he estimated that Nifty will close above 8600, I guess at 3:20, spot was just shy of 8600…so he went ahead and bought 8600CE. As per his expectation markets did close above 8600…I guess at 8602…so his call options turned profitable (and therefore ITM). But unfortunately, he was not aware of the STT implication on ITM the options. So he ended up paying a huge STT, which was way above the profits he made. Check the implication of STT here – http://zerodha.com/z-connect/queries/stock-and-fo-queries/stt-options-nse-bse-mcx-sx

zerodha has currency buy call option know otherwise it has buy call option only for nifty and banknifity alone for trading

There are options on USD INR, Nifty, and Bank Nifty.

to find option premium we hake to multiply the lot size with ltp of corresponding strike price to get premium value

No, premium is a price that prevails in the market. Check the option chain.

the premium value is only the ltp value

Yes, since the premiums are traded, it has an LTP value.

option have lot size know

Yes, keeps changing as per market conditions.

Hello Sir,

I am new to the Zerodha Varsity and am following the chapters intensely.I must say you are doing a gr8 job of educating us that too for free.I have read a couple of books on options and watched lots of youtube videos but till now I wasnt able to grasp the topic.Reading ur chapters h has cleared many of my doubts.Keep up the good work and educate us on more and more successful strategies.Also i want to ask can I just be an options trader exclusively and make good profits with minimum risks(till now I was doing futures and cash and lost quite a bit}.Plz enlighten.

Shreya, I’m happy to know that you like the contents here.

You can choose to trade any financial instrument (equity spot, futures, options, commodities, currencies etc)…your profitability depends on your trading strategy and how well you execute the same.

try to explain me more detail about premium calculation profit and loss calculation

now i am buying a wipro contract of strike price 490 now the ltp is rs1.80 no of lot is 1200

if i buy 2 no of lot means i have to pay 2*1.80=3.60rs (or) 1200*2*1.80=4320

now if current wipro is trading at 500 means my profit will be =10*1200-3.6 (or) 10-3.6 (or) 10*1200-4320

It will be lot size * number of lots * premium, so in your example it will be 1200*2*1.80=4320

Your profit will be lot size * number of lots * (premium received- premium paid) and in your example it would be – 1200 * 2 * (10-1.8)

i.e 1200 * 2 * 8.2 = 19,680/-

thank you zerodha support for providing continuously for support

Cheers!

If for a particular series of option, there is significant change in the open interest every day but no major change in volume then what does this indicate?

Very unlikely, if the OI changes, so should volume.

sir,

if i purchase jswsteel 195 CE at 6 (3000*6=18000) and if stock price goes to 200 from 190 then how to calculate profit ?

If it goes to 200, then the premium will also increase. The difference between how much premium you paid and received times the lot size is your profit. Good luck.