16.1 – Calculating Volatility on Excel

In the previous chapter, we introduced the concept of standard deviation and how it can be used to evaluate ‘Risk or Volatility’ of a stock. Before we move any further on this topic I would like to discuss how one can calculate volatility. Volatility data is not easily available, hence its always good to know how to calculate the same yourself.

Of course in the previous chapter we looked into this calculation (recall the Billy & Mike example), we outlined the steps as follows –

- Calculate the average

- Calculate the deviation – Subtract the average from the actual observation

- Square and add up all deviations – this is called variance

- Calculate the square root of variance – this is called standard deviation

The purpose of doing this in the previous chapter was to show you the mechanics behind the standard deviation calculation. In my opinion it is important to know what really goes beyond a formula, it only enhances your insights. In this chapter however, we will figure out an easier way to calculate standard deviation or the volatility of a given stock using MS Excel. MS Excel uses the exact same steps we outlined above, just that it happens at a click of a button.

I’ll give you the border steps involved first and then elaborate on each step –

- Download the historical data of closing prices

- Calculate the daily returns

- Use the STDEV function

So let us get to work straight away.

Step 1 – Download the historical closing prices

You can do this from any data source that you have. Some of the free and reliable data sources are NSE India website and Yahoo Finance.

I will take the data from NSE India for now. At this point I must tell you that NSE’s website is quite resourceful, and in terms of information provided, I guess NSE’s website is one of the best stock exchange websites in the world.

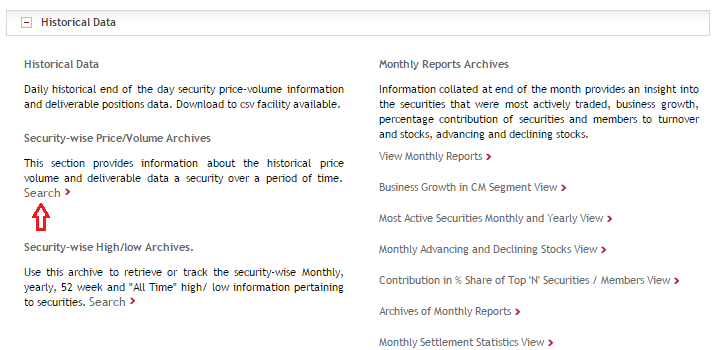

Anyway, in this chapter let us calculate Wipro’s volatility. To download the historical closing prices, visit – http://www.nseindia.com/products/content/equities/equities/equities.htm and click on historical data and select the search option.

Here is a snapshot where I have highlighted the search option –

Once you hit search, a set of fields open up, filling them up is quite self explanatory – just fill in the required details and hit ‘Get Data’. Do make sure you get the data for the last 1 year. The dates that I have selected here is from 22nd July 2014 to 21st July 2015.

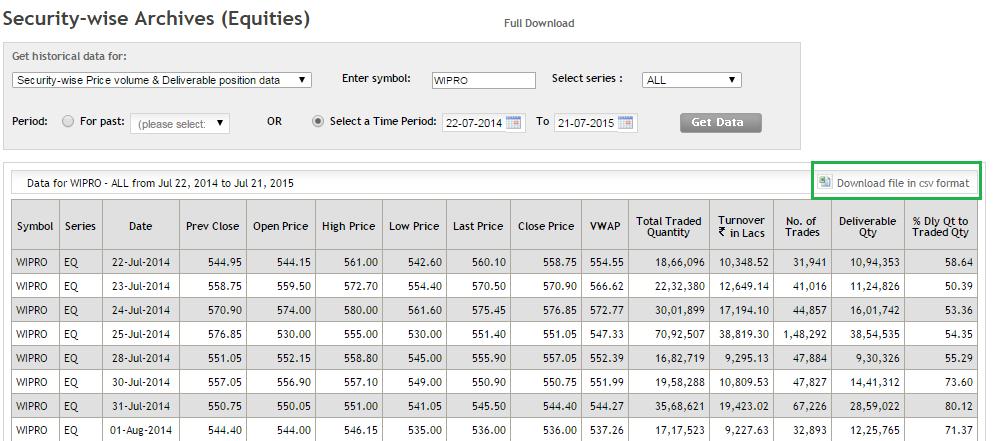

Once you hit ‘get data’, NSE’s website will query your request and fetch you the required data. At this point you should see the following screen –

Once you get this, click on ‘Download file in CSV format’ (highlighted in the green box), and that’s it.

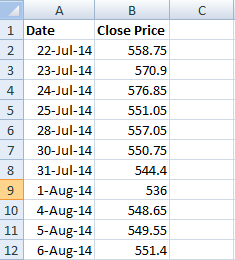

You now have the required data on Excel. Of course along with the closing prices, you have tons of other information as well. I usually like to delete all the other unwanted data and stick to just the date and closing price. This makes the sheet look clutter free and crisp.

Here is a snapshot of how my excel sheet looks at this stage –

Do note, I have deleted all the unnecessary information. I have retained just the date and closing prices.

Step 2 – Calculate Daily Returns

We know that the daily returns can be calculated as –

Return = (Ending Price / Beginning Price) – 1

However for all practical purposes and ease of calculation, this equation can be approximated to:

Return = LN (Ending Price / Beginning Price), where LN denotes Logarithm to Base ‘e’, note this is also called ‘Log Returns’.

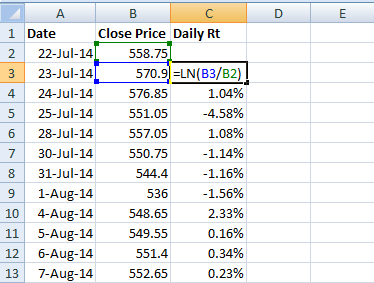

Here is a snap shot showing you how I’ve calculated the daily log returns of WIPRO –

I have used the Excel function ‘LN’ to calculate the long returns.

Step 3 – Use the STDEV Function

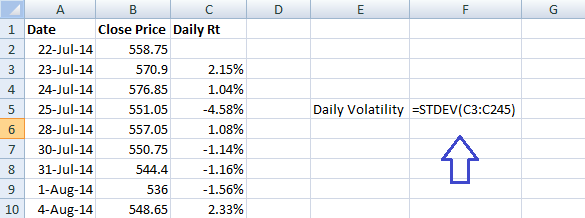

Once the daily returns are calculated, you can use an excel function called ‘STDEV’ to calculate the standard deviation of daily returns, which if you realize is the daily Volatility of WIPRO.

Note – In order to use the STDEV function all you need to do is this –

- Take the cursor an empty cell

- Press ‘=’

- Follow the = sign by the function syntax i.e STDEV and open a bracket, hence the empty cell would look like =STEDEV(

- After the open bracket, select all the daily return data points and close the bracket

- Press enter

Here is the snapshot which shows the same –

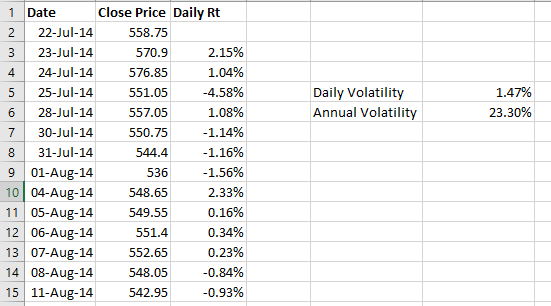

Once this is done, Excel will instantly calculate the daily standard deviation aka volatility of WIPRO for you. I get the answer as 0.0147 which when converted to a percentage reads as 1.47%.

This means the daily volatility of WIPRO is 1.47% !

The value we have calculated is WIPRO’s daily volatility, but what about its annual volatility?

Now here is a very important convention you will have to remember – in order to convert the daily volatility to annual volatility just multiply the daily volatility number with the square root of time.

Likewise to convert the annual volatility to daily volatility, divide the annual volatility by square root of time.

So in this case we have calculated the daily volatility, and we now need WIPRO’s annual volatility. We will calculate the same here –

- Daily Volatility = 1.47%

- Time = 252

- Annual Volatility = 1.47% * SQRT (252)

- = 23.33%

In fact I have calculated the same on excel, have a look at the image below –

So with this, we know WIPRO’s daily volatility is 1.47% and its annual volatility is about 23%.

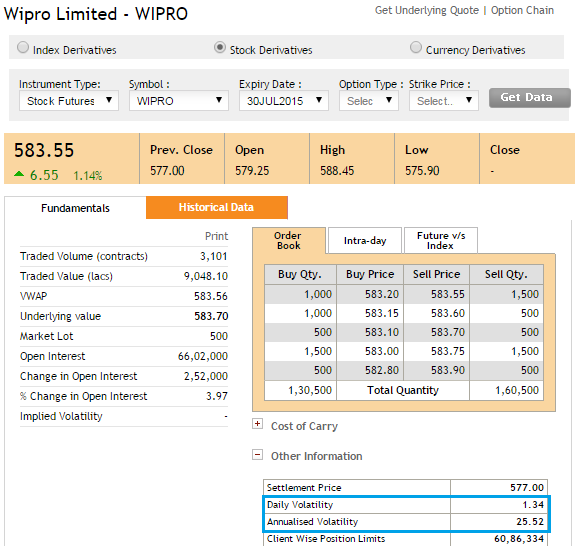

Lets double-check these numbers with what the NSE has published on their website. NSE publishes these numbers only for F&O stocks and not other stocks. Here is the snapshot of the same –

Our calculation is pretty much close to what NSE has calculated – as per NSE’s calculation Wipro’s daily volatility is about 1.34% and Annualized Volatility is about 25.5%.

So why is there a slight difference between our calculation and NSE’s? – One possible reason could be that we are using spot price while NSE is using Futures price. However, I really don’t want to get into investigating why this slight difference exists. The agenda here is to know how to calculate the volatility of the security given its daily returns.

Before we wrap up this chapter, let us just do one more calculation. Assume we directly get the annual volatility of WIPRO as 25.5%, how do we figure out its daily volatility?

Like I mentioned earlier, to convert annual volatility to daily volatility you simply have to divide the annual volatility by the square root of time, hence in this particular case –

= 25.5% / SQRT (252)

= 1.60%

So far we have understood what volatility is and how to calculate the same. In the next chapter, we will understand the practical application of volatility.

Do remember we are still in the process of understanding volatility; however the final objective is to understand the options greek Vega and that really means. So please do not lose sight of our end objective.

Please click here to download the excel sheet.

Key takeaways from this chapter

- Standard Deviation represents volatility, which in turn represents risk

- We can use NSE website to get the daily closing prices of securities

- Daily return can be calculated as log returns

- Log function in excel is LN

- Daily return formula = LN (Today’s Value / Yesterday’s Value) expressed as a percentage

- Excel function to calculate volatility is STDEV

- Standard Deviation of daily return is equivalent of daily volatility

- To convert daily volatility to annual volatility multiply the daily volatility by the square root of time

- Likewise to convert annual volatility to daily volatility, divide the annual volatility by the square root of time

sir i checked on nse website and they had given volatility estimates for non fno stocks as well. example gtl infra.

could you please comment on it\’s reliability.

Hello Sir,

Could you tell me the reasoning behind why do you take one year time period for volatility calculation?

To get a sense of the yearly volatility.

+Hello Karthick,

I like to thank you for your effort to educate us with such an approach which is so easy to understand. I just have a small doubt which is more related to the calculation. Just one doubt with respect to the below snippet

Daily Volatility = 1.47%

Time = 252

Annual Volatility = 1.47% * SQRT (252)

= 23.33%

How we came to a conclusion of 252 days since from my opinion it should be 243 days

Thanks Souvik, the idea is to take the total number of trading days. 252 is the usual number of trading days in a year.

for the daily volatility calculations of Wipro stock, we are taking the previous close and the current close into consideration.

Would it not be accurate and reflective of the daily volatility if we took (days close – days open)/days open

as a measure of the daily volatility.Would the results be different ?

Here, volatility is measured by the returns and on the price movement. So if the idea is to calculate volatility of price returns, then the current formula makes sense. However, if you want to calculate the volatility of price movements, then yes, what you suggested makes sense.

You have given a snap shot of Wipro details from the NSE website and have shown that the annual volatility matches the one which we have calculated from daily volatility.

But how is annual volatility calculated from first principles (not from daily volatility)

Will if be the Stdev of (close of the last day of the year – open of the first day of the year)/( open of the first day of the year) for the past several years ? Approx how many years should be taken ?

You can take last 1 year daily data Bhushan. That will work. Taking the last day or the tear and first day of the year will still give you just 1 day;s of data and not yearly.

No Sir, I haven\’t made any such changes.

I Calculated it purely based on what I read in this chapter & copied the data from the NSE site.

Kindly Enlighten me more?

You can check this Aditya – https://youtu.be/MX-6rdHDPbE?si=qbculG4XBhKvSm8P

Hello Sir,

I have a Doubt. Kindly Help.

If I check Daily and Annualized Volatility of Dabur as of now:

https://www.nseindia.com/get-quotes/equity?symbol=WIPRO

Daily Volatility 1.74

Annualised Volatility 33.24

& the calculated Volatility of Dabur comes out to be

Daily Volatility 4.756509385

Annual Volatility 75.0564521

https://1drv.ms/x/c/a6df9bade8b2fec2/EVIKWYZsD_FPsfHl99rrsL8BwEpEs1HIm5iOjkWrIGGbJQ?e=jVk9iu

Why is there a Mis Match?

I have Shared Links of both.

Aditya, have you made sure the data is cleaned for bonus, splits, and other corporate actions? Usually that is one common mismatch area.

I think this is the valid link for NSE historical data now: https://www.nseindia.com/reports-indices-historical-index-data

Ah you found it, thanks for sharing it here 🙂

Hi Karthik,

The link to historical data is not valid anymore…

http://www.nseindia.com/products/content/equities/equities/equities.htm

This leads to a stle page and it needs to be updated.

They keep changing the site, need to look for where its hiding now 🙂

Hello Karthik.

Thank you again for so wonderful explanations. Can you please check the wipro excel? You have used sqrt(365) well as here you have used sqrt(252) to convert daily SD to annual SD. Hence here Wipro\’s annual SD is 23.33% well as in Excel Wipro\’s annual SD is 28.04%. Which time should we use 252 or 365? Thank you.

Ah, sorry about the confusion Rahul. Please consider 252, the actual number of trading days. Thanks.

While calculating daily returns, do we have to separately calculate like B3/B2,B4/B3,B5/B4 …. till all 252 ratios or is there any simpler method to do that?

If you are doing it on excel, it is one click calculation right?

in excel sheet ,it is written in bracket that =STEDEV(C3:C245).STEDEV means standard deviation & C 245 MEANS NO. OF WORKING DAYS IN A YEAR OR SOMETHING ELSE?If 245 denotes no.of days than formula c3:C remains confusing.Is it C3:C2 OR????

C3 to C245 indicates the range within which the cells are selected to calculate the standard deviation.

Daily volatility =STEDEV(C3:C245) in the snapshot above the blue arrow in chapter 16 is confusing. Can u help me with this?

What exactly is confusing Hiren? Do let me know.

Hi Karthik Sir,

Actually I could\’nt get the concept of sq. root of time? Like how you have arrived with the number of 252?

There is a mathematical derivation for this. I dont know the math part, but end useable result is square root of time 🙂

A small correction. At the the end of step 2 it is written “ long returns” which I think should be “ log returns

“.

That’s all

Thanks

You have done a Great job sir

Ah, thanks for pointing that. Let me check 🙂

Sir in time you have taken the value as 252. How you have taken this value?

252 = Number of trading days.

Sir i am having three questions regarding this chapter

Q.1 – The data you have taken is the spot data or futures data

Q.2 – For the daily returns why you have not taken the formula –

Daily Return (%) = ((Today closing price – Yesterday closing price) * 100) / Yesterday closing price

Q.3 – In the screenshot above you have used LN(P3/P2) and the values in the first two cells are 558.75 and 570.9 respectively. And with this formula the value is coming 0.009. So how should i use this formula correctly to match with the excel value?

1) Spot

2) Its the same thing, try it on a data set 🙂

3) Convert this to %.

Sir i am having three questions regarding this chapter

If \”Daily Return = Y;day’s price/Today’s price -1\”, then in the excel screenshot you have put ln(b3/b2), where I assume b3 is today\’s price and b2 was y\’day\’s price. It is confusing, can you please clear it up?

Thank you

Sorry, I made a typo.

Daily Return = Today\’s price/Y\’day retrun, this will give you return, but then you will have to subtract 1 to express this in %.

Daily Return = (Today\’s price/Y\’day retrun) – 1. Here don\’t have to subtract 1 as its already baked in the formula.

But both are essentially the same.

Hi Karthik,

If I need to to calculate the daily average, I should add up the daily returns and divide by the number of days, right?

eg: for a year with 252 days (sum of daily avg of 252 days)/252, in this should I divide by 252 or 251 as the first day\’s daily return would be 0.

Thank you:)

Daily Return = Y;day\’s price/Today\’s price -1

Hi,

We are taking closing rice of previous day as opening price for the next day? It may differ everyday.

Yes, the close price and opening price need not be the same.

Hello karthik,

Can you please explain the difference in vol. calculation by using spot, forward and future prices? please it will help to understand better. Thanks!

The technique is the same and does not differ, Rahul.

Why 252 as time?

Thats the number of trading days.

HI Karthik, thanks for explaining things in such a layman language.

I have a question on Nifty daily returns graphical representation in attached excel file. What does it represents?

How I can interpret this info of these two numbers on chart. Bin array of 0.10% and o.26% is getting maximum frequency of 89 and 88 respectively.

Or

How I can relate back aforementioned info to nifty spot?

Sorry, I\’m unable to see the graph. Bin array is basically the size of the bin, a distribution of return range. For example all returns from 0.5% to 1%, will be contained within the 1% bin.

Not sure if that helps 🙂

hi karthik

Iam unable to compute SD on the excel sheet.I tried for Nifty, either the log function retuens a null value or the SD returns a divide by zero error. Can you help?

Ah, it must be a syntax error Suriya. Please double check each step, thats the only way to fix it 🙂

How did you get the LN output in percentage?

YOu can use excel.

hi sir,

loved every module so far on options trading.

Time is the number of the trading days?

please specify because i\’m new to this topic.

Thanks, Priyanka. Yes, time refers to the number of days till expiry.

If we have more than 1 year (say 3 years) of daily returns , how can we calculate the annualized volatility.

Yes you can, but I\’d suggest you take 1 year data, thats good enough.

CAN SOMEONE PLEASE SHARE DIRECT LINK OF NSE SITE PAGE WHERE ANNUAL & DAILY VOLATILITY OF EQUITIES AND CURRENCY BE FOUND ?

They keep changing the page, best if to look for it under historical data section on the website.

Hi Karthik, thank you for this blog.

If I want to find the volatility 10 days from today, will it be

(Daily volatility) x (10)^0.5.

Have I got it right.

Daily vol * Sqrt(10) – this should work.

Hi Karthick,

Just I have doubt using Historical Stock price as a variable will be comes under Monte Carlo Distribution? if you clarify that It would be great for my academics.

Thank you.

What variable are you talking about, Ram?

252 ?

252 = number of trading days in a year.

Thank you so much for all your efforts Karthik.

Also, I can see you have responded on almost every comment which is very appreciating.

My question here is that I tried the same steps which you have mentioned for Wipro stock just for trial.

However the date range is from 15th Jan 2023 to 15th Jan 2024 (One year).

My figures are not matching with the NSE website.

I am getting 1.26% as daily volatility and 19.68% as annual volatility.

On the website daily volatility is shown as 1.45% and annual volatility is 27.70%.

Can you please help?

Thanks Gaurav. Yes, the difference exists becuase NSE looks at the \’recency\’ of data and gives weight age to recent price movements. Their interest in calculating volatility if from margin collection perspective. Where as in our method, we are paying attention to the variance from average returns i.e. volatility. Hence the difference.

MY QUESTION IS WHEN CALCULATING ANNUAL VOLATILATY, WE NEEED TO MULTIPLY SQUARE ROOT OF TIME WITH DAILY VOLATILATY. HERE THE TIME VALUE HAS BEEN CONSIDERED AS 252.

FROM WHERE THIS TIME VALUE 252 CAME? PLEASE CLARIFY

Becuase volatility and time are proportional by the factor of time. Time in case of trading is 252 days after adjusting for weekends.

Hi Sir, Can you explain what is the format of time we need to include in the formula ?

Volatility = Sqrt of time.

hello sir I tried To apply =STEDEV(C3:C248) this formula in exel but I am getting error it says formula contain Unrecognized text

and Exel file is also no downloading

I clicked multiple time to download it but nothing happened

Not sure about the error, you will have to debug this by following the cues on excel itself.

About downloading, I\’d request you try and download from another browser.

How to download historical data now? The Nse site has changed too much.

Rishu, only the links have changed, but both exchanges still provide the end-of-day historical data on their sites. Do check once.

I saw your video where you said that you can forecast volatility by comparing historical volatility and implied volatility. Currently NIFTY daily historical volatility is 0.72. ATM IV is 8.7 from Sensibull. So should the comparison be between 8.7% and 0.72% ? I\’m not sure whether this comparison is right, since ATM IV is always significantly high compared to Daily historical average or is the implied volatility figure I assumed wrong?

That wont be right Sathish. The comparison works as a quick and dirty method. In this case, you are better off considering the ATM IV.

As volatility is nothing but standard deviation,so to get range we should subtract and add from mean of daily returns .but we r not doing here y so?please answer me

We are, do check the subsequent chapters.

The above calculation was very productive. I have one query. in the calculation of Annual Volatility, time is taken as 252 , it should have been 242. Correct me if I am wrong; I have taken 242 as time because these many are the total number of days.

Totally baffled because of this 252 vs 242.

Thank you.

Ah, it should be 252 right? 252 = total number of trading days?

Dear Karthik sir

In case of Weekly expiry series, from which day Theta starts playing out more?

Hello Karthik,

Nice mathematical approach, able to follow it very well.

However, I did not understand what is the meaning of “Return” when you are defining daily returns.

Secondly, how is Daily Average calculated ??

Third, how is Daily Return different from Daily Average to Daily Range?? Can you add or explain this as well.

Thanks

Varun

Daily return is the % change in stock prices, Varun. I\’ve shared the example of calculating the daily return in the chapter itself.

Dear Karthik sir

How can we use the concept of volatility smile while trading? Kindly explain with an example.

Yes, I\’ve explained Volatility smile in the subsequent chapters.

Sir,

(i)To calculate the daily/annual volatility, you have suggested to calculate in with a look back period of 1 year. Sametime, you have suggested to get the data of daily spot close prices of instrument (stock EQ/index) from NSE website. Now, we have an option in zerodha terminal called \”Table view\” where similarly we are given with a populated excel sheet of instrument (stock EQ/index). Can we use this data from zerodha in \”Table view\” to calculate the annual/daily volatility of stock/index?

(ii)Alternatively, can you please share the link of NSE website from where we can also get the historical data of index spot prices as well as any stock EQ historical data? (The link you have shared in material no loner exists)

(iii)Also, after calculating the annual/daily volatility of a particular stock EQ/ index, request you to kindly share the link from where I can crosscheck my daily/annual volatility findings.

1) Yes, idea is to get the data from a good source

2) Goto NSE India > Market data > Script or Index of your choice. For example, this one – https://www.nseindia.com/get-quotes/equity?symbol=ADANIPORTS

3) This, I\’m not sure from where you can.

Dear Karthik sir,

Does a gap up/gap down increase volatility of that particular stock/index?

Yeah, it does add to volatility.

Sir,

Will you pl tell how to get the volatility data for a stock from the NSE web site referred here?

Dear Karthik sir,

Do candlestick patterns, indicators work in VIX chart too so that we can predict the VIX?

Ah no, I\’d suggest you dont use CS patterns on ViX 🙂

Hi Kartik,

While calculating annual volatility by the square root of time from were did you get the time value = 252

252 is the number of trading days in a year, Deepak.

how did you come up with 252 as time … may look silly . no of entries in excel are 245

252 is the number of trading days in a year, Nikhil.

Hi,

As you said to download the file to calculate the daily return from NSE, i think NSE the website got makeover and currently it is redirecting to error page.

However, i tried to figure out the url, not sure that is correct or not, pasting it below

https://www.nseindia.com/get-quotes/derivatives?symbol=NIFTY&identifier=OPTIDXNIFTY27-04-2023CE17700.00

Question 1:

Can you please confirm whether that is the url

Question 2:

to calculate the Mean and SD, do we need to have 1 year data or 3 months past data is sufficient enough. Because, i see that NSE is allowing to retrieve past 3months data only, if not we are getting duplicate records.

Can you please through some light on this

1) You\’d want the historical data of stocks I guess. Look for a stock symbol, in the stock page, look for historical data (its there in one of the tabs)

2) Both are ok and is dependent on how you intend to trade in the market

NIFTY daily volatility comes to around -0.01% according to my calculation. This is taken from 1 year data. Is there anywhere I can cross check this information, as NSE only gives this information for deliverable securities? Or if you can, please let me know whether this is right. Thank You.

NSE or maybe Sensibull you can check to validate the data? Btw, most places they calculate the volatility keeping margins in perspective.

hi karthik, can you tell me when converting the daily volatility to annual, why are we multiplying or diving the returns with the square root of (365)??

You need to multiply or divide by time to scale up/down the volatility. There is a mathematical derivation for this, you can look it up online if you interested in the math part.

To get the daily volatility, do 1 year of historic data will always require?

What if we use 6 months of data? Will it conclude the daily volatility range?

You can use 6 months also, you will get the daily vol of 6 month. I generally prefer 1-year data.

how can we look for volatility on NSE official website now to double check and for nifty from where to get the historical data

You can check the option chain on NSE. I\’d even suggest you check out Sensibull for this.

Sr. the Average/Mean that we have to consider is of DAILY RETURN right ?

Yes, that right Rohan.

Excel link at the end of section is not working

Please try using another browser.

while converting daily volatility to annual volatility you have used factor of square root of time

where time is 252

My question is what exactly is 252

252 = the number of trading days in a year.

No issue, I downloaded from another site

Cool.

Hello sir, that link to open excel sheet is not working…

Can you try downloading this from another browser?

What is this time constant you\’ve used here \”252\”.

Its the number of days in a year.

Possible typo below:

\”I have used the Excel function ‘LN’ to calculate the long returns.\”

Should be \”.. log returns.\”

That\’s what I meant. Will fix the typo 🙂

Hi Karthik,

In your explanation your above you have shown the closing price of ten days for calculating the Volatility. And in the excel sheet given in your article has the data for almost an year (245 days). Could you please help me understand what is the right number of days to consider for calculating the volatility?

Regards,

Sudheer

Sudheer, so these are conversions based on yearly and daily calculations. So if you have calculated yearly vol, then you can scale it down to 10 days or whichever time frame you\’d need. Likewise, with daily vol…you can scale it up to 3 months, 6 months or whatever time scale you\’d want.

Hi karthink,

if we are trading a credit speared on on a particular stock and that stock daily volatility is [ 2.5 ]. and Nifty daily volatility is [1.08], so if i have created same credit speared on nifty with same MAX RISK and i have received 1000 rupees as primum so should i compare this with a stock which has 2.5 daily volatility and if that stock is fetching me 1000*2.5[2500] as primum then only i should consider trading on that particular stock ? or should i consider stock beta ?

The risk profiles of both stock and Nifty are completely different, Amal. So are the returns. Comparing Nifty, a basket of 50 stocks may not make sense with a single stock. I\’d suggest you go with your risk appetite and how much you are willing to risk on the trade 🙂

hii kartik sir, the excel file which is there in Volatility Basics is not downloadable.

Let me check, meanwhile can you try from another browser?

Hi, i just want to know that you mentioned as you calculated average of 0.04% and mentioned from previous chapters we can see the calculations, but previous chapter you dicussed about the daily volatility and annual volatility to find from wipro stock but never mentioned the average %. so please explain if i missed somewhere

I\’m guessing its in an earlier chapter, and I must have generally said \’ previous\’ chapter. Can you kindly check once? Thanks.

Why you have taken 252 days as time period for annualized return ?

Number of trading days in a year = 252

Hi Karthik,bI just have one doubt in whole calculation part the daily volatility in case of the nse screenshot shows 1.34 while when we do according to the formula that is daily volatility=annual volatility/√time period (that is 252) why do we get the daily volatility as 1.60?

There is a slight difference in calculation, and this is because NSE gives more important to recent trading days to calculate margins. In our case, we give equal importance to all data points.

If we use in excel =STDEV(-1.67,1.33,-0.67,2.33,-2.67,1.33) answer is 1.96 around while in previous chapter it was 1.79 in billy and mike’s data

Are the data sets the same? Can you check if its STDEV and not any variations to the SD function?

Kartik sir tell me when you check

dear sir how time here is 252 can you help me with this

252 = Number of trading days in a year.

If we use in excel =STDEV(-1.67,1.33,-0.67,2.33,-2.67,1.33) answer is 1.96 around while in previous chapter it was 1.79 in billy and mike\’s data

Hmm, need to double-check this once. Let me do that today.

hi kartik sir while using STDEV function in excel i got different answer other than using manually calculation first find variance and then its sqrt

i took example of last chapter billy and mike \’s put all 6 value and then use STDEV fun in excel and answer is different pls help me

Most likely, you\’d missed some step. Its unlikely to get two different numbers. Can you please recheck again?

Hi Karthik

Thanks a lot for putting together your thoughts on this complex stuff in such a simple way.

I have one question on Volatility, when you used daily closing price for one year as in example for July 2014 to July 2015..the volatility calculated is daily volatility for that period?

if we take 10 day\’s closing price and calculate volatility, then is that a daily volatility for that 10-day period? and can it be used to calculate annualized volatility by multiplying SQRT(252)?

If we take 5 year closing price and calculate volatility, then is that an annual volatility for that 5-year period? or something else….

Yes, if you calculate the daily volatility, then you will have to scale it accordingly by multiplying it with Sqrt of time. If you calculate for 10 days, then divide by sqrt of 10 to get the 1 day vol and then multiply with Sqrt of 252 for yearly volatility.

Hi! Thanks for the crystal clear explanation. But the historical data which I tried to download shows different closing prices for WIPRO(22-jul-2014 to 21-july-2015). More over when I tried to download the excel it is not getting downloaded. Please provide the proper link so that I can calculate and understand the concept better.

Maybe it is not cleaned up. Maybe try downloading from BSE website?

Hey, please help me with this.

Suppose I calculated the standard deviation(1SD) of nifty for the last six months and its 0.0109. Hence the daily volatility is 1.09%. Now volatility for the next three months(63 trading sessions) comes out to be 8.65%(1.09*√63).

Now how do I calculate the range for the next three months. So the upper range would be avg+ 8.65% or spot +8.65%.

Spot plus 8.65%.

Sir, why did we use the LOG (LN) FUNCTION to calculate Daily return?

I have explained this in the chapter and comments, request you to look at it once. Thanks.

Hi Karthik, I think the reason why we are seeing a difference between what shown on NSE website and your calculation is because I think NSE is taking SQRT of 365 instead of 252. When I take 365, it comes very very close to NSE number. Not sure if this is so, but just wanted to point it out.

Yes, this could be one of the reasons. This is called the time count convention. We are using actual by actual, so in that case, we consider 24 trading days (ignore weekends) and 252 total trading days. Or you can use 30 monthly days and 365 days in a year, which NSE seems to be using. Either way you need to be consistent with what you use, cant use 24 and 365.

NSE द्वारा

★ निफ्टी फ्यूचर में भी डेली और ऐनुअलाइज्ड वोलाटिलिटी दी जाती है

और

★ India VIX भी दिया जाता है

और दोनों का प्रयोग डेली, वीकली, ऐनुअल रेंज संभावित रेंज निकलने में होता है

तो

★ india VIX और निफ्टी फ्यूचर की ऐनुअलाइज्ड वोलाटिलिटी में अंतर क्या होता है,

★ दोनों की वैल्यू में अंतर होने से एक ही चीज की रेंज अलग अलग मिलती है

ऐसा क्यों?

Dear Karthik,

I am unable to figure out why LN is used It is mentioned Long Returns which i am unable to figure out. Can you please explain if time permits? Also can we just work this out without Natural Log .

Dear Karthik,

Can you please clarify on that LN function used. It has been mentioned a s Long returns which is confusing for me.

Please see the earlier comments.

Dear Karthik,

I am unable to figure out why LN is used It is mentioned Long Returns which i am unable to figure out. Can you please explain if time permits?

I\’m copy pasting an earlier reply for a similar query –

Here is the exact calculation for determining the price range

1. calculate daily log returns

2. calculate mean & SD of log returns series

3. 68% confidence interval is current price * exp (mean*time +/- SD* sqrt(time))

4. 95% confidence interval is current price * exp (mean*time +/- 2*SD*sqrt(time))

The process involves computationally intensive tasks such as calculating log returns, calculating exponential of a value etc.

Under the following circumstances, the above calculations can be approximated with more simpler calculations

1. Short periods of time: When time is small, (mean * time) is so small that it hardly makes any difference to the final value i.e. mean * time << SD * sqrt(time)

2. When daily percentage movement 20%, recalculate with accurate method, otherwise you can process with approximation.

unable to download excel sheet. 🙁

Sir,

In question asked on July 20,2022,

I didn\’t get the clarity,sir.As all the closing prices of an year(22nd July 2014 to 21st July 2015) has already been taken up for daily return calculation,why again seperately we need to calculate annual volatility.

Daily return is on a per-day basis, you need to find the yearly from this right?

Sir,

In the Image given just above step 3,the return of 22nd and 23rd July is not shown and also in the very next image only 23rd July daily return is shown,why is it so,sir?

For return calculation, you need two reference prices. If you want to start from the 22nd, then there is no data on for 21st, right? Hence you cannot proceed.

Sir,

Instead of using the formula for calculating return ,why this formula Return = (Ending Price / Beginning Price) – 1, is used, can\’t we calculate return just by subtracting ending price-beginning price.

Sir,Please tell where I went wrong

That will give you the absolute change in price, you divide the absolute change by y\’day\’s close you get the return.

Sir,

dates that have selected in the calculation to calculate the daily return is from 22nd July 2014 to 21st July 2015, that\’s a total year.As it has involved daily closing prices of an year,can\’t it be considered as annual volitility.why is it required to multiply the answer with sqrt.255.

Because the number of trading days in a year is 252, not 365.

Thanks for clearing doubt,sir

Sir,

First of all thanks for the work you put in to make all these study materials and also in answering the queries.

Sir,few doubts

1.Daily return formula = LN (Today’s Value / Yesterday’s Value) expressed as a percentage.

As it is used to calculate the daily return,why yesterday\’s value is used here.

Also,in step 2 of Calculating Daily Returns

Return = (Ending Price / Beginning Price) – 1

Here in formula,it is beginning price,is the open price of the day being meant here as beginning price,I ask this because in pic of the excel sheet just below this formula,it\’s shown LN(B3/B2),B2 and B3 are closing prices, aren\’t they?

2.in the step 3,\”After the open bracket, select all the daily return data points and close the bracket\”.

What all are the daily return data points mentioned here,which all values are said to be involved in daily return data points.

1) Return is calculated based on a reference value. For daily return the reference value is y\’day\’s closing price

2) Ending price = today\’s close and beginning price\’s is y\’day closing price

3) Just y\’day and today\’s close.

Hi sir,

How can we find intraday volatility?

Is there any method to find intraday volatility?

Is ARCH a good method to find intraday volatility?

Thank you sir.

Yeah, the ARCH and GARCH models are good but quite computationally intense.

Dear Karthik sir,

The chapter says the formula to calculate Log returns in Excel is LN(Today’s price / Yesterday’s price).

But what is the formula to calculate the % returns ?

Normal return = (Today price/Y\’day price )-1

Dear Karthik sir,

The chapter says the formula to calculate Log returns in Excel is LN(Today\’s price / Yesterday\’s price).

Similarly what is the formula to calculate the % returns ?

Yup, that is correct.

Hi ..thanks for such detailed chapters on Option..I dont think such resource exist anywhere else in web…for Free of Cost..

Now for my query ..Can you pls share me exact link where I can Snapshot for Future option ( like you shared for Wipro in NSE website)..Tried searching could not found..

Thanks in advance….

Rajiv

Rajiv, NSE has changed the site. Goto the home page and click on derivatives section.

Now a days, I am going through one of varsity module 5. Each topic was very well explained in each chapter by you. currently I am stuck at calculation of annual volatility. I could not find \”Annualised Volatility\” value calculated by NSE at the link provided in chapter. I can see \”security wise delivery position\” and \”Value at Risk in %\” over there. I had calculated annualized volatility of a stock according to method taught by you in this module. How can I cross check whether it is correct or not?

Hardik, I think NSE has changed the location of file. Maybe check the bhav copy file once?

If there is a person like you to teach and support ,I WILL become a very very successful trader and then I will declare that I have two gurus. 1)Mr.Eckhart tolle, my spiritual guru and 2) Mr. Karthik Rangappa my trading guru.

For calculating annual volatility from daily volatility why time is taken as 252 , while it should be 1 year ?

252 is the number of trading days in the year.

Hi Kulsum,

Thank you for your reply, sorry for replying late. Yes, the link is working, seems there was an issue with my Opera browser. tried a different browser and its working. Thank you for looking into this.

Sir ,

I have an account with Zerodha , my client code is mentioned above, can you please check whether the download excel link is working or not. Not able to download the excel sheet. Thank you.

Hi Bhaskar, we have added the link again, could you please check now? There seems to be no issue with downloading the excel.

sir how to calculate volatility for 1 hour or smaller time frames???

That will be tough, the closest thing is to consider 1-day volatility.

Hello sir, how do we calculate daily average return of index or stocks?

I\’ve explained that in the chapter itself, Nipul.

Hi Karthik,

Very good efforts to explain concepts in a simple form that that can be understood by most people.

Reference to above calculations, when we calculate daily volatility by using Annual Volatility, the number 1.60% does not match the daily volatility number (1.34%) of NSE. Assume NSE is using different data to calculate the annual volatility versus daily volatility, like Annual Volatility could be calculated by calculating the standard deviation % of annual data of the stock as well, using closing prices for each of the past years. What are your thoughts on the same?

Also, for intra day volatility can\’t we use the same logic as we used for daily volatility calculations but instead applying it on the respective frequency\’s data e.g. when calculating minute level volatility, one can use minute data points. However, the question is how much data is enough to calculate volatility?

Avinash, I think NSE uses a slightly different approach, wherein they calculate the volatility keeping margins in perspective. So they kind of give more importance to the recent data points compared to the technique taught here, wherein there is equal weightages to all the data points. Hence the difference.

Sir,

I have tried to download your excel sheet but its not downloading to refer.

I have under stood how to calculate standard deviation as u mentioned, but mean u have not mentioned but its imp in next chpter for normal distribution. So

daily avg/ mean =sum(daily return) / no of rows

for above sheet wipro= Sum/243=0.012

I got this value.

is this correct value?

No of trading days = 252 days, not 243.

Another related query as while explaining you have always taken a year\’s data and calculated log returns and then converted it into the time frame as an when required,ex-15dys,30 days.However can we not directly find the log returns of only 30 dys and calculate the Standard Deviation??

If you take monthly time series (12 data points per year), you will directly get 30 days\’ data. The same goes for taking weekly data.

Hi there!

A small query regarding time,do we always have to consider 252 days as number of trading days or it may change?

Thanks in advance!!

252 is the average number of trading days in a year. Plus or minus 3-4 days.

Sir, Suppose I calculated daily and annual volatility from period 11-04-2021 to 10-04-2022 then when my daily and annual volatility data expires ? In a nutshell, When I come to know I have to start calculating such volatility for next period ?

It kind of stays good for at least 1 week, you can recalculate again after a week. Technically, you can calculate the next day also 🙂

Can someone please tell me how to get the data for Bank Nifty and Nifty 50 to calculate daily returns, SD.

Its what you can find in the chapter right?

Hi Karthik sir, How you Calculated Annual Volatility

I didn\’t understand SQRT(254)

Annual volatility = Daily volatility * Sqrt (time).

Time = Number of trading days which is 252.

Dear Karthik sir,

Can we download the historical closing values of Nifty and Bank Nifty, i am unable to locate.

Please share the link.

It should be available on NSE site. Look for it under \’market data\’.

one doubt regarding the calculation of annual volatility. should we take square root of 365 days for calculating annual volatility or 245 days ( as actually there is only 245 trading days after sundays , saturdays and holiday )

YOu can consider 252 days, which is the actual number of trading days.

I am new to option world but I am serious in making study. I am not good in mathematics. My question is now a days nseindia publish VAR and extreme loss rate and not volatility. Can you explain what it is how it is useful https://www1.nseindia.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=SUNPHARMA&illiquid=0&smeFlag=0&itpFlag=0

In previous chapter you explained standard deviation and explained method of calculation. But in this chapter you have calculated by calculating LOG METHOD what is difference

Rajiv, VAR, and extreme loss are for calculating margins. For volatility, you can calculate using the same technique that we discussed in the chapter. Log method is just another technique to calculate the returns. You can stick to the regular method.

Sure! Thanks a lot!

I don\’t know why but link you provided for downloading excel sheet of Wipro is not working. It just redirect but doesn\’t download anything

Can you try another browser, please? Thanks.

Here is quick question- We have calculated the volatility for underlying by using its past 1 year data and then we proceed to calculate the range for it for next some days as per our interest. So how much past data I should use when I have to calculate range let say for next one week (Assuming I am thinking about trading weekly contracts). Should I go with same classic past 1 year data or should I give more weightage to recent data. Or should I go for more than past 1 year data? Please clarify

You can consider both actually to develop a wider perspective. Start with 1-year data and then maybe 3 months as well.

Karthik Sir, in the downloaded excel sheet i am getting 28.04% instead of 23.3% dont no why!

Ah, not sure myself Muthu. Need to check.

from where we get historical data of nifty 50 or bank nifty

YOu can check NSE site for this.

Hi. Why are you using log returns and not a simple – current close price / previous day close price?

Thanks.

Have explained that in the chapter/comments, request you to please check the same.

Hi kartik,

I just want to confirm about the global market situation that impact the nifty prices in India? Kindly explain sir or My link you share.

People are earning only on the basis of global market. How much is it true sir

Would obliged and thankful for your response sir,✨☺️

Ujjwal, that cant be true. You need to have a view on both global and local markets. Trading on the basis of global cues alone cannot be an edge.

why time is taken as 252 while calculating annual volatility ?

252 is roughly the number of trading days in the calendar.

Can anyone tell me from where I can double-check my volatility calculations on NSE website? The information provided there now is different from what is there in the screenshot in the article.

Dont think NSE publishes volatility information anymore.

while calculating annual volitility time is taken as 252. how we got this ?

It it the count of rows of daily data for one year we downloaded that is equivalent to 252?

Thats right, Manoj. 252 is the number of trading days in a calendar year.

Good article.

I cross-checked with NSE figures. I think they are using 365 days, not 252 days.

Must be.

Hi,

While calculating weekly volatility, from Friday end of Day to Thursday expiry, What should be the value in sqrt time, no. of trading sessions remaining i.e. 4. Right?

Thats right.

I calculated the avg daily return of Nifty 50 index for the past 11 years(2010-2021). It comes out to be -0.04. Does the negative sign requires to be dealt in a different way or should I follow the same procedure because the Avg Annual return is coming out be -10%.

Hmm, I\’m not sure if the number is right. Markets have trended up quite well since then. Maybe you should double-check? 0.04% is ok, but I\’m not convinced about the +ve sign.

STDDEV function is no more supported in the latest version of the excel sheet. When it\’s calculated for the TCS using STDDEV.S function from 17-Dec-2021 through 16-Dec-2021, abnormal difference around 5% between what NSE is showing for the Annualized Volatality vs the calculation using Excel.

Ah is it? I\’m still using the old version. Can you check if there is stdev.p, if yes, can you use that and check?

shouldnt monthly factor be root 21 , as 21 working days in a month ( by logic that 21*12=252 )

Yup, you can consider the actual number of months assuming you are considering the yearly number of days as 252.

thank you sir , followup will be :

how to convert month wise average to

> week wise average

> day wise average

> annualized average

and

how to convert month wise volatility to

> week wise volatility

> day wise volatility

> annualized volatility

yes sir i will look to it i use shorter time frame than 91-21 thank you so much sir

hoping for a positive reply

Best is to first convert to daily and then scale the daily to whichever time frame. If monthly is 7%, the to convert monthly to daily, you have to divide by sqrt of time…so in this case it will be 7%/Sqrt(30). This will give you daily.

Now from daily, you can convert to any timeframe for example if you want 45 days, then daily vol * Sqrt(45).

Hey Karthik , I hope you are still active here on the forum answering doubts –

I have data from 1991 april to 2021 november ( monthwise) and i have found the standard deviation of 30 years and 8 months .

1)the volatility / std dev i have found : is it called month wise historical standard deviation/volatility ?

2) can i convert this to weekly or annual or daily standard deviation of this historical month based volatility ?

I have also found the mean ( month based historical ) for the same

3) is it called month wise historical average ?

4) can i convert this to weekly or annual or daily averages of this historical month based average ?

4 questions above

hoping for a positive answer

thank you

Aditya, yes, I\’m active across the entire portal.

1) Yes, that correct

2) Yes you can

3) Yes

4) Yes

YOu can convert any time frame to any time frame you\’d wish, there is no problem with that. By the way, I don\’t think taking 30 years SD is helpful, market dynamics have changed completely over these years. SD is best across the last few years.

Sir time 252 how?

252 is the number of trading days in a year.

Hello Sir,

I could get the historical closing price for 1 year for all the stocks but how to get the data for Nifty and Bank Nifty.

Monali, I\’d suggest you get in touch with an authorised data vendor for this. Make sure you get the continuous futures data.

Can not download excel sheet, can you please share on my email ID

Hi Karthik! My question is regarding the calculation of annual volatility. You have mentioned that in order to convert the daily volatility to annual volatility just multiply the daily volatility number with the square root of time. But I did not understand how you got the 252 figure in the example of Wipro. There are 365 days in a year so should it not be the square root of 365?

252 is the approximate number of trading days in a year, Devansh. 365 is the total number of calendar days in a year.

The difference in your calculation and Nse calculation for annualised volatility number is because you multiplied the SGRT with 252 and NSE does that with 365 days

thanks love your content

Thats right Madhu. There is (could be) another reason. NSE uses a lambda approach wherein they give more weightage to variance in returns for the recent few days as opposed to our approach where we give equal weightage to all returns. NSE\’s idea of volatility is to figure how much margins to charge given the recent volatility in the market, and our idea is to figure the riskiness of the stock over a period.

Hello Karthik,

I am not very good with excel sheets. Is there a formula to calculate the Daily returns for the entire year? it is time consuming to calculate individual rows. Thanks in advance

Victor, I\’d suggest you look at Sensibull for this.

The time used in calculating volatility(here252) , how do we get that?

252 is the approximate number of trading days in a year.

Hi Sir,

To convert to annual return i need to consider the number of trading days last year right?

Yes, which will be in and around 250 trading days.

Sorry for this silly question…I am very much new to stock market..so hope you don\’t mind. My question is why time value is 252 ?

252 is the number of trading days in a year Om, hence that number.

Sir,

Can we calculate the volatility of bank nifty using the method explained in this chapter.

OR is there INDIA VIX like tool available for Banknifty?

Yes, you can.

Why we use log to distributre the return? and we take time as 252??

Karan, I guess we have discussed this in the comments section already. Can you please check once?

Got it Sir! Thanks for the prompt response.. really appreciated!

Learned a lot.. still learning.. thanks for the quality contents and efforts..

Happy learning, Prashant.

Hello Sir,

But from NSE data annual volatility showing 25.52 seems derived with 365 days and we have taken 252 trading days. Please confirm.

252 is the number of trading days in the year (approximately). I\’d suggest you take both and see which one you get better results in.

Hi Sir,

What period should we use to calculate historical volatility comparable with Nifty India VIX?

Depends on your trading stye, you can check at least 1-year data.

Thanks a lot for the detailed explanation Karthik.. Couldnt imagine the kind of efforts would have gone in to build this wonderful modules.. Really appreciate your teams effort on this.

we are not able to download the Excel link attached here.. is the link chagned?

Thanks, Nilakantan. Checking this.

I have question. We calculated annualized volatility using daily returns.

Therefore, if we calculate volatility using annual prices, then both the value should be same. But they aren\’t! Why?

Volatility is based on returns, not prices, Kunal.

How you have selected time as 252

I guess so, Manjunath.

Very insightful. I am not able to download the XLs from chapter 16 n 17, could you pl check.

Checking. Meanwhile, can you try downloading it from another browser? Thanks.

from where i can get daily and annual volatility on NSE site?

I\’m not sure where they are publishing this info, Vicky. Its best if you can check with NSE directly.

Hi Mr. Karthik,

Your lessons are very simple, practical and interesting.

Keep up the good work.

I have a query in the above chapter

For calculating volatility, time was considered as 252, why?

raja

Raja, 252 = number of trading days in a year.

Excel sheet link is not opening ? Another way to get the sheet ??

Dear Karthik,

Thanks a lot… I will go by our calculations… But Will keep on troubling you again again, if and whenever I am stuck… in different modules…

Please do, good luck 🙂

Dear Karthik,

I am absolutely new to the Stock Market but it has always been fascinating me since my student times. But I neither got an opportunity to learn nor did I ever got a good material or teacher to make me understand the stock market. But Varsity has been so nicely designed in a step by step manner that it\’s actually easy to learn and understand all the concepts. You have even taught the formulas for coming to the values which are already given on different websites, which is the best part as we should also know how to calculate. Thanks to you mate for all this.

As I mentioned to you in the beginning that I new to the stock market, hence, I will be coming out will lots of questions, which you or many other sisters or brothers may feel are useless, but I love to be clear on every doubt.

Now my question to you here is regarding the Volatility.

1. We have discussed about the calculation of volatility and based on the excel sheet you have given, it\’s on the basis of four years. I have prepared similar kind of spread sheet in my excel. Now I wanted to know, that the Daily and Annual Volatility already available on the NSE website is based on how many years data?

2. When we calculate the 1SD, 2SD, 3SD, which Volatility Data to use – the one given on the NSE website or the one to which we have reached by our calculations?

Thanks for all the kind words, Abhigya 🙂

1) NSE data is probably for a year, but their approach to calculating volatility is different. They do this with an intention to calculate margins, hence give more weightage to recent data points, unlike the method described here wherein there is equal weightage for all the data points

2) I\’d suggest you use the method described here.

Hi Karthik,

Can we not rely on the volatility provided on NSE website? Is there any benefit in calculating it ourselves when they\’re so close?

You can, but the NSE calculates the volatility by keeping margins in perspective. Hence they give more weightage to the recent data points so the NSE\’s volatility will be different compared to calculating it via the stdev function.

Sir, what about the number of trading days in the NSE website(has considered 365days for Annual volatality). Ideally the no. of trading sessions should be used which is 252days in our case??

I\’m not sure what they use, I guess they take in 365 days. Maybe you should check with them.

Hello Sir,

I tried to calculate the Volatality using Standard deviation(from 4June\’20 to 4June\’21) but there is a huge difference in the daily volatility and the annual volatality.(Though it is of futures but the difference is significant, can this be considered??). I have tried 4-5stocks but the case is the same for every stock.

Can you please check in the excel sheet and let me know if i went ahead correctly.

I am sharing the google drive link where you can check the sheet.

https://drive.google.com/file/d/1OGxpJnIV5NUS_2VrtyNuj8lAxksuo4dk/view?usp=sharing

Also for calculating the Annual Volatality, in the NSE website , the daily volatality has been multiplied with the sq. root of 365 instead of 252?? Since there were 252 trading days during the above period, so the daily volatality should have been multiplied by 252. Isn\’t it??

Thank you.

The difference between NSE\’s volatility and the way you\’ve calculated is because NSE calculates volatility from a margins perspective. NSE gives more weightage to recent data points where as in your calculation, it does not weigh the data points. HEnce the difference. I\’d suggest you stick to your method to get a fair sense of what the volatility of the stock is.

I am very new to Stock Market. So, my question might seem very trivial 😅. Still asking, Why has time been taken as 252 in the calculation?

252 = number of trading days in a year 🙂

Sir! How can I get to know about the range of the underlying by using the percentage(In NSE website they provided Daily and annual volatility in percentage).

YOu can make these calculations yourself, it is quite easy. Have explained the method in the chapter itself.

Hi karthik sir,

nice explanation.

i would like to ask why you took time 252 to calcualte annulasied volatility.

as on today I calculated the volatiity for wipro then it came for daily= 2.3% , and annulasied= 35.5% but on NSE website it is showing for daily=2.89% that is ok but annulasied =55%. can u clarify plz

252 = number of trading days in a year.

NSE calculates the volatility keeping the margins in perspective. Hence the difference.

I never knew options are going to be this much easy,All thanks to you Sir. By the way Sir I am facing 1 problem, Sir when i am trying to get data for nifty(symbol). for last 1 year it is showing \’\’no records\’\’ Kindly help SIR. 🙂

Apoorva, what data are you trying to look for?

I calculated Wipro Daily and Annual Volatility ( 15/05/20 to 14/05/21)

I got answers

Daily: 2.21%

Annual: 42% (251 days)

While you cross-checked at nse website ( in the last pic highlighted by a blue box), I am unable to crosscheck at nse. ( historical data is showing only historical price not daily nor annual volatility)

Also where I can check Nifty annual volatility?

thank u sir

https://www1.nseindia.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=WIPRO&illiquid=0&smeFlag=0&itpFlag=0#

Its on the NSE site, please check the details once in Bhav copy. But the values will anyway be different since NSE now calculates volatility from the perspective of margins.

In calculation of annual volatility where does 252 come from? Is it number of total trading days in a year? If yes then how to know the number of total trading days in previous year?

Yes, 252 is roughly the number of trading days in a year.

Hey Kartik. You have used the formula of LN here while calculating daily volatility. However, when we have to calculate the final values (+1SD, +2D etc.) we have to use exp function. However, when the values are more than 1 (X>1 for e^x) the values go too high. What to do in such a case? For eg. some stock can have an annual average return of more than 100%.

Priyank, you can stick to regular calculation itself (non log).

Thank You for the rich value you provide on the internet.

I calculated along the steps for \”TATAMOTORS\” for the past 1 year but my data and NSE\’s data differ quite a bit.

For e.g My daily volatility is 0.66% while NSE\’s 3.55% and My annual volatility is 10.53%but NSE\’s 67.90%. Where did I go wrong?

and Why is the time value \”252\” while calculating annual volatility?

NSE calculates volatility mainly in terms of computing margins, which differs from the regular way of calculating volatility.

Thank You for the rich value you provide on the internet.

I calculated along the steps for \”TATAMOTORS\” for the past 1 year but my data and NSE\’s data differ quite a bit. So asking for help. 1. Why is the time value \”252\”

252 = Number of trading days in a year.

HI,

Pls can you able to say in volatility annual calculation has been selected as 252. What is a logic behind this. Pls explain why 252 selected it is a constant valve or any other parameter.

252 = number of trading days in a year.

Sir, today is Friday and it\’s past 4 PM so the trading time for today is over.

I have calculated daily volatility using past one year return.

I want to know the volatility of the next expiry of nifty weekly options i.e. coming Thursday (06 May, 2021).

So what will be the formula?

(i) Daily Volatility*SQRT(6) (Saturday, Sunday, Monday, Tuesday, Wednesday, Thursday, i.e. taking both trading holidays and expiry day into consideration)

(ii) Daily Volatility*SQRT(5) (Saturday, Sunday, Monday, Tuesday, Wednesday, i.e. taking trading holidays into consideration but not expiry day)

(iii) Daily Volatility*SQRT(4) (Monday, Tuesday, Wednesday and Thursday, i.e. taking expiry day into consideration but not trading holidays)

(iv) Daily Volatility*SQRT(3) (Monday, Tuesday, Wednesday, i.e. not taking both expiry day and trading holidays into consideration)

Please answer. Thank you.

Amit, either (i) or (iii), both are used. I\’d prefer (iii).

In the start of this chapter it’s written –

Square and add up all deviations – this is called variance

While it must be divided with no of observation as per last chapter.

It’s contradictory Pl check

hey karthik! loved the module… just couldnt understand one thing that why did you take time to be 252 when u took the data for an year?

Thanks Pranav. 252 = number of trading days in a year.

Hello Karthik,

A wonderful and simple explanation of such complex topics. Thank you for making option easy n simple for me to learn, understand and analyze.

Why are you calculating log daily returns, any particular logic behind it?

Thanks for the kind words, Chandan. Returns can be calculated using log or simple returns. Usually when the data set is large, it\’s the log return.

Hi Karthik, I never had so much clarity on greeks before I read your content on Varsity. I cannot thank you enough for what you have given me FOC. My doubt. The calculation of Wipro Daily returns, Standard Deviation, Daily Volatility done on 23rd Jul 2014 is based on the yearly data until 21st Jul 2015. Right?. But on 23rd July if I want to do the calculation, how will I get the data of 24th July, 25th July, and so on?. In this case, should I take data of 1 year from 24th July 2013? If I take data for 6 months I should take 126 days?.

In an option chain, there is volatility for each strike price. Is this also Annual volatility?. I use the Interactive Broker portal to trade US stocks. I can see an IV at the top on the Option chain and also with each strike price. How are the 2 different. Sorry, too many questions. Appreciate your response. Thanks

Thanks, Ajay. The data can be downloaded by subscribing to a data vendor, who will supply you with the daily dump of data. Yes, IV is usually an annual number. I\’m not sure what that means, maybe you should check with them 🙂

Hi

Please refer to you last part of the tutorial, reproduced below.

So in this case we have calculated the daily volatility, and we now need WIPRO’s annual volatility. We will calculate the same here –

Daily Volatility = 1.47%

Time = 252

Annual Volatility = 1.47% * SQRT (252)

= 23.33%

Can you please tell how you deduced time as equal to 252. In actual there are 244 trading sessions in the trading year selected for excel calculation.

Thats right, a year has roughly 252 trading days in a year.

Hi!

Good work! Where did you pull-out the time of 252 from? In your excel sheet it\’s not 252, it\’s 365. So please explain that. For monthly, I have to sqrt 30 days and weekly 7 days, right? And yearly 356

Thanks a lot.

Tayaan, 252 is the number of trading days in a year.

got it from tradingqna

https://tradingqna.com/t/why-stock-returns-are-calculated-in-log-scale/806

Glad, was about to post the same link 🙂

Karthick

First, Thank you. Everything i know about the markets, f&o etc is from here.

why ln to calculate returns?

Dear Sir,

I did download the Nifty historical data and calculated avg, std etc.

But it is constantly annoying to calculate this every week manually.

Is there better way like a website or anything that does this?

Could you recommend such a site?

Jatin, maybe you should check Sensibull site, they may have a this ready.

Hello Kartik,

So far so good,

Just to relate the current part of excel calculations with the previous chapter where you have taken the examples of Bill and Mike.

Just correct me wherever I am wrong.

In this chapter the Nifty closing prices are nothing but runs scored by Bill and Mike in the previous chapter.

The Daily nifty returns (which are log returns in % percentages) are nothing but deviations from Mean.

Here we did not calculate the Mean as excel allows us to use a shortcut to calculate standard deviation by using the direct formula \”STDEV.P\” on the values of deviations from Mean.

Thats absolutely correct, Rajnish! Keep going 🙂

Dear Sir,

In your last calculation you converted annual volatility to daily volatility.

= 25.2% / sqrt(252) = 1.60%

The nse website got 1.34% as they used 365 days while you used 252 days.

Isn\’t your calculation more accurate compared to the NSE as markets are not open on the weekend and that .3% can sway entry and exit points.

I\’d like to believe that, but many traders find comfort in sticking to the exchanges\’ convention.

Thanks, Karthik. Got it.

Good luck!

Hello Karthik,

Thanks for the detailed learning. Quoting from your session \”So with this, we know WIPRO’s daily volatility is 1.47% and its annual volatility is about 23%.

Lets double-check these numbers with what the NSE has published on their website. NSE publishes these numbers only for F&O stocks and not other stocks. \”

I\’m unable to find this on the nse website. Could you help pls.

Priya, you will have to scout through NSE\’s site. They keep changing the site often 🙂

Okay, I have almost understood how it works. But why is variance linearly proportional to time? Shouldn\’t S.D be the term which is linearly proportional?

Check the reply to your previous comment.

Hey Karthik,

Can you provide me with a link with a clear explanation/derivation for why we should multiply or divide by SQRT(252). I googled it and I do understand it has something to do with the variances adding up but I don\’t think I understood the full derivation.

Check this – https://www.macroption.com/why-is-volatility-proportional-to-square-root-of-time

hello karthik,

so to calculate the weekly volatility form daily volatility do we need to multiply the daily volatility by sqrt(5) or sqrt(52)??

thanks you.

5, since there are 5 working days in a week.

Sir you\’ve mentioned here that to convert daily volatility to annual volatility, multiply the daily volatility by the square root of time; and the time value is taken as 252. What is 252 here? Are they the number of trading days between 22nd July 2014 to 21st July 2015?

252 is generally the number of trading days in a year.

Bro How Can I Get All Days Return In % By One Click, It\’s Hard To Apply Formula Everyday And Find Return For Everyday, How Can I Do It Easily?

Sahil, not easy unless you program this.

Thanks Karthik.

is volatility on daily and annually calculated at each day EOD.

YOu can calculate volatility on both daily and EOD basis.

HELLO KARTHIK, WHY YOU TAKE 252 UNDER LEBEL TIME WHILE CALCULATING ANNUAL VOLATILITY?

252 is the number of trading days in a year.

Is it possible to trade options, using price action and indicators just like we do with stocks, without considering the options greeks? If yes, what would be the difference? If no, why?

Yup, you can.

Sir I am looking for the historical data to download for NIFTY to do the calculations and I can\’t find it. (in this chapter we downloaded WIPRO)

I\’d suggest you look for it on NSE website.

Hello sir, thank you for your clear explanation. I am wondering how can I get data for NIFTY options in the derivatives section. I want to learn how to do projections for NIFTY options. Could you suggest me a few tips on doing projections for NIFTY options?

thank you!

What kind of data are you looking for? Do check here – https://www.nseindia.com/market-data/equity-derivatives-watch

Hi Sir, i have one confusion what if we calculate standard deviation of price itself in place of standard deviation of return. Like i have calculated standard deviation of daily return (21 days) for Nifty at 0.57% whereas standard deviation of absolute price comes at 172 points as on 31st Aug 2020. now 172/11387 comes at 1.51%. why there is such huge difference in absolute and SD of return?

You cannot do this on prices, as prices trend to trend, and are not normally distributed. However, stock returns are normally distributed, which is what I\’ve explained in the chapter. You can apply principals of SD only if its a normal distribution.

Thanks for all your effort, this is awesome.

There is a discrepancy in data between the downloadable excel sheet and what has been taken for annual volatility calculation in this article.

In excel the time value is 365 where you have written 252 in the article. Kindly clarify.

Thanks for pointing, Bipin. Let me check this.

Sir, I calculated the volatility for HDFC Bank, it shows annual volatility of 96%, seems there is a stock split and I can\’t able to get the clean data.

As an alternative, can we use the value from current month Future Contract from the NSE website. 🤔

You need to ensure that the calculations are run on clean data which is adjusted for splits and bonuses.

Suppose i bought a share at 500, with Reward to risk as 1:1 , i would keep SL at 496 and imaginary target at 504, and when the price reached 504, i would manually change SL to 501 so that at least my capital is preserved. Or sometimes modify SL to price little less than target in this case let\’s say new SL is 503 and SL gets hit and price increases from there on. So booking only small profit even though things were going good.

And given the fluctuations in prices, I face a difficulty while deciding at what value should i keep new SL, whether it should be little above buy price or at target price ?

(NOTE – currently BO orders are not available to trade due to increased volatility , this statement can be seen in Zerodha\’s Bulletin segment)

I hope you got my question 🙂

Got it. YOur technique of trailing is right. If I were you, I\’d buy at 500, SL is 496. I\’d trail the SL to 500, if the underlying moves to 504. If The underlying moves further ahead, lets say 508 or 510, I\’d increase the SL to 502, @ say 512, SL moves to 504….the point is that you have to wait for the underlying to move in your favor and then trail accordingly.

Sir, When to start trailing your stoploss ? I have tried to do it while trading but found that i am not able to properly make decision regarding it

Can you explain how you did it?

Sir,

Your work is commendable, these modules are really helping many new traders like me. I understood almost everything till this chapter along with evolving crystal clear concepts of market. All thanks to you Sir!

Just two questions i have. (i) In calculating annual volatility why you put the figure 252 in the formula and second thing is when i downloaded the same excel file you mentioned above there in which you have placed the figure 365 instead of 252 in the Excel Sheet Formula.

Please clarify

Thank you Sir!

Glad you liked the content 🙂

1) 252 is the number of trading days in a year and 365 as you know is the calender number of days. NSE considers 252, I\’d suggest you do the same as well.

Thanks again Karthik for your insights. This reinforced the thought to wait patiently for the opportunity from market.

Good luck 🙂

True, it depends on how much premium we are collecting. Say after calculating nifty upper range, we identify a strike trading at 20Rs premium, then returns works out to be ~1.25% [ 1500/127000 ] which is still decent returns.

But not sure if we get such strikes where Rs.20+ premium can be collected consistently.

Possible, you just need to track the market and you will get an opportunity sometime during the series, especially when there is a spike in volatility.

Hi Karthik,

With Nifty options lot size 75, margin requirement for collecting premium comes some where around 127000.

returns after adjusting brokerage looks very less. I agree this is consistent approach, but considering risk/reward,

do you still think returns are decent enough ?

Hmm, depends on how much margin you collect right? Also, the thumb rule is – anything higher that 2% a month is worth considering.

In Kite, for any given stock, if you go in fundamentals in kite, you show the Beta of the stock right ? for what period do you calculate that Beta

Ah, that comes from tickertape. We don\’t compute that.

For Beta calculation what period is considered idea.

Sometimes companies use 60 month period / 24 month period etc.

Also, what period does Zerodha use in calculation for beta

Regards

We dont calculate beta. But yes, you can take the last 12 months data at a minimum.

No sir. I don’t no how to increase the decimal points sir?

Excel has a feature for that, request you to please check online for this.

To find the estimated range over a period of time of any stock or index , we need daily standard deviation/volatility and Daily Average/Mean. In this I am able to calculate the daily S.D of nifty index but daily average of nifty index is showing 0% when I calculate with log daily returns sir. So I am unable to calculate that and I tried many times. So can you please tell how to calculate that daily average/mean or what is the daily average of nifty index sir.

0%? Did you try increasing the decimal points?

Hello sir,

First of all thanks for those wonderful content sir. After reading all I have a doubt. I am able to calculate the daily volatility and annualised volatility Of nifty index and got similar results with what they published in nse website. But I tried calculating daily average of nifty index for tooo many times but I couldn’t get the values it shows 0%. Can u please tell how to find that or if possible kindly share the daily average of nifty index alone. It will be helpful for many of us. Thanks in advance sir.

I think its good if the values match with NSE\’s. But which average are you talking about?

Hello Sir,

For calculating Historical volatility, what is the minimum period to be taken in to consideration (Close prices). For example I tried 01-01-2019 to 17-07-2020 the value of 1 yr SD I got is 26.68%, where as when I considered 01-01-2016 to 17-07-2020 the value of SD is 18.6% but actual nifty spot Annualised volatility is 35.73 %. there is so much difference in the values, so how much data to be considered for calculating Annualised volatility.

You get different values for different time period. I\’d suggest you stick to 1 or at the most 1.5yrs, this should be good enough.

What if the stock is split during the time period. Will the volatility calculation using the above method still holds true?

Yes, it does.

Hi Karthik,

No I am taking ln[today’s value/y’day value] only. I had no idea about the other formula. After log method when I took average I got negative result.

Ok, in that case, the stock has clearly trended down quite a bit.

Hi Karthik,

I did download you excel and copy pasted your formula only. But that gives me daily returns. I need to find out the Daily Average return. So how to do this? So I put Average(C3:C247) [Column C contained all the daily return percentages] and it got me -0.14%. Stock was in a downtrend in the last 1 year.