2.1– Decoding the basic jargons

In the previous chapter, we understood the basic call option structure. The idea of the previous chapter was to capture a few essential ‘Call Option’ concepts such as –

- It makes sense to be a buyer of a call option when you expect the underlying price to increase

- If the underlying price remains flat or goes down then the buyer of the call option loses money

- The money the buyer of the call option would lose is equivalent to the premium (agreement fees) the buyer pays to the seller/writer of the call option.

In the next chapter i.e. Call Option (Part 2), we will attempt to understand the call option in a bit more detail. However before we proceed further let us decode a few basic option jargons. Discussing these jargons at this stage will not only strengthen our learning, but will also make the forthcoming discussion on the options easier to comprehend.

Here are a few jargons that we will look into –

- Strike Price

- Underlying Price

- Exercising of an option contract

- Option Expiry

- Option Premium

- Option Settlement

Do remember, since we have only looked at the basic structure of a call option, I would encourage you to understand these jargons only with respect to the call option.

Strike Price

Consider the strike price as the anchor price at which the two parties (buyer and seller) agree to enter into an options agreement. For instance, in the previous chapter’s ‘Ajay – Venu’ example the anchor price was Rs.500,000/-, which is also the ‘Strike Price’ for their deal. We also looked into a stock example where the anchor price was Rs.75/-, which is also the strike price. For all ‘Call’ options the strike price represents the price at which the stock can be bought on the expiry day.

For example, if the buyer is willing to buy ITC Limited’s Call Option of Rs.350 (350 being the strike price) then it indicates that the buyer is willing to pay a premium today to buy the rights of ‘buying ITC at Rs.350 on expiry’. Needless to say he will buy ITC at Rs.350, only if ITC is trading above Rs.350.

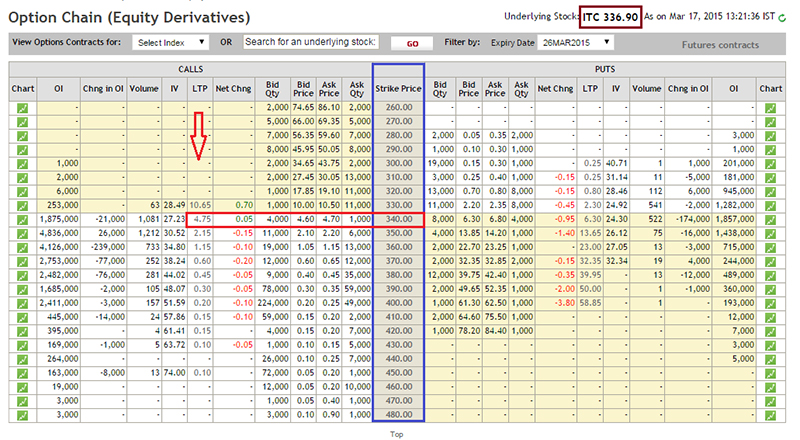

In fact here is a snap shot from NSE’s website where I have captured different strike prices of ITC and the associated premium.

The table that you see above is called an ‘Option Chain’, which basically lists all the different strike prices available for a contract along with the premium for the same. Besides this information, the option chain has a lot more trading information such as Open Interest, volume, bid-ask quantity etc. I would suggest you ignore all of it for now and concentrate only on the highlighted information –

- The highlight in maroon shows the price of the underlying in the spot. As we can see at the time of this snapshot ITC was trading at Rs.336.9 per share

- The highlight in blue shows all the different strike prices that are available. As we can see starting from Rs.260 (with Rs.10 intervals) we have strike prices all the way up to Rs.480

- Do remember, each strike price is independent of the other. One can enter into an options agreement , at a specific strike price by paying the required premium

- For example one can enter into a 340 call option by paying a premium of Rs.4.75/- (highlighted in red)

- This entitles the buyer to buy ITC shares at the end of expiry at Rs.340. Of course, you now know under which circumstance it would make sense to buy ITC at 340 at the end of expiry

Underlying Price

As we know, a derivative contract derives its value from an underlying asset. The underlying price is the price at which the underlying asset trades in the spot market. For example in the ITC example that we just discussed, ITC was trading at Rs.336.90/- in the spot market. This is the underlying price. For a call option, the underlying price has to increase for the buyer of the call option to benefit.

Exercising of an option contract

Exercising of an option contract is the act of claiming your right to buy the options contract at the end of the expiry. If you ever hear the line “exercise the option contract” in the context of a call option, it simply means that one is claiming the right to buy the stock at the agreed strike price. Clearly he or she would do it only if the stock is trading above the strike. Here is an important point to note – you can exercise the option only on the day of the expiry and not anytime before the expiry.

Hence, assume with 15 days to expiry one buys ITC 340 Call option when ITC is trading at 330 in the spot market. Further assume, after he buys the 340 call option, the stock price increases to 360 the very next day. Under such a scenario, the option buyer cannot ask for a settlement (he cannot exercise) against the call option he holds. Settlement will happen only on the day of the expiry, based on the price the asset is trading in the spot market on the expiry day.

Option Expiry

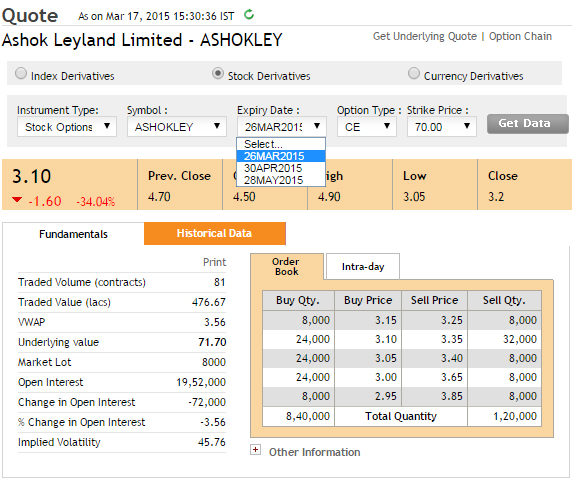

Similar to a futures contract, options contract also has expiry. In fact both equity futures and option contracts expire on the last Thursday of every month. Just like futures contracts, option contracts also have the concept of current month, mid month, and far month. Have a look at the snapshot below –

This is the snapshot of the call option to buy Ashok Leyland Ltd at the strike price of Rs.70 at Rs.3.10/-. As you can see there are 3 expiry options – 26th March 2015 (current month), 30th April 2015 (mid month), and 28th May 2015 (far month). Of course the premium of the options changes as and when the expiry changes. We will talk more about it at an appropriate time. But at this stage, I would want you to remember just two things with respect to expiry – like futures there are 3 expiry options and the premium is not the same across different expiries.

Option Premium

Since we have discussed premium on a couple instances previously, I guess you would now be clear about a few things with respect to the ‘Option Premium’. Premium is the money required to be paid by the option buyer to the option seller/writer. Against the payment of premium, the option buyer buys the right to exercise his desire to buy (or sell in case of put options) the asset at the strike price upon expiry.

If you have got this part clear till now, I guess we are on the right track. We will now proceed to understand a new perspective on ‘Premiums’. Also, at this stage I guess it is important to let you know that the whole of option theory hinges upon ‘Option Premium’. Option premiums play an extremely crucial role when it comes to trading options. Eventually as we progress through this module you will see that the discussions will be centered heavily on the option premium.

Let us revisit the ‘Ajay-Venu’ example, that we took up in the previous chapter. Consider the circumstances under which Venu accepted the premium of Rs.100,000/- from Ajay –

- News flow – The news on the highway project was only speculative and no one knew for sure if the project would indeed come up

- Think about it, we discussed 3 possible scenarios in the previous chapter out of which 2 were favorable to Venu. So besides the natural statistical edge that Venu has, the fact that the highway news is speculative only increases his chance of benefiting from the agreement

- Time – There was 6 months time to get clarity on whether the project would fructify or not.

- This point actually favors Ajay. Since there is more time to expiry the possibility of the event working in Ajay’s favor also increases. For example consider this – if you were to run 10kms, in which time duration are you more likely to achieve it – within 20 mins or within 70 mins? Obviously higher the time duration higher is the probability to achieve it.

Now let us consider both these points in isolation and figure out the impact it would have on the option premium.

News – When the deal was done between Ajay and Venu, the news was purely speculative, hence Venu was happy to accept Rs.100,000/- as premium. However for a minute assume the news was not speculative and there was some sort of bias. Maybe there was a local politician who hinted in the recent press conference that they may consider a highway in that area. With this information, the news is no longer a rumor. Suddenly there is a possibility that the highway may indeed come up, albeit there is still an element of speculation.

With this in perspective think about this – do you think Venu will accept Rs.100,000/- as premium? Maybe not, he knows there is a good chance for the highway to come up and therefore the land prices would increase. However because there is still an element of chance he may be willing to take the risk, provided the premium will be more attractive. Maybe he would consider the agreement attractive if the premium was Rs.175,000/- instead of Rs.100,000/-.

Now let us put this in stock market perspective. Assume Infosys is trading at Rs.2200/- today. The 2300 Call option with a 1 month expiry is at Rs.20/-. Put yourself in Venu’s shoes (option writer) – would you enter into an agreement by accepting Rs.20/- per share as premium?

If you enter into this options agreement as a writer/seller, then you are giving the right (to the buyer) of buying Infosys option at Rs. 2300 one month down the lane from now.

Assume for the next 1 month there is no foreseeable corporate action which will trigger the share price of Infosys to go higher. Considering this, maybe you may accept the premium of Rs.20/-.

However what if there is a corporate event (like quarterly results) that tends to increase the stock price? Will the option seller still go ahead and accept Rs.20/- as the premium for the agreement? Clearly, it may not be worth to take the risk at Rs.20/-.

Having said this, what if despite the scheduled corporate event, someone is willing to offer Rs.75/- as premium instead of Rs.20/-? I suppose at Rs.75/-, it may be worth taking the risk.

Let us keep this discussion at the back of our mind; we will now take up the 2nd point i.e. ‘time’

When there was 6 months time, clearly Ajay knew that there was ample time for the dust to settle and the truth to emerge with respect to the highway project. However instead of 6 months, what if there was only 10 days time? Since the time has shrunk there is simply not enough time for the event to unfold. Under such a circumstance (with time not being on Ajay’s side), do you think Ajay will be happy to pay Rs.100,000/- premium to Venu?. I don’t think so, as there is no incentive for Ajay to pay that kind of premium to Venu. Maybe he would offer a lesser premium, say Rs.20,000/- instead.

Anyway, the point that I want to make here keeping both news and time in perspective is this – premium is never a fixed rate. It is sensitive to several factors. Some factors tend to increase the premium and some tend to decrease it, and in real markets, all these factors act simultaneously affecting the premium. To be precise there are 5 factors (similar to news and time) that tends to affect the premium. These are called the ‘Option Greeks’. We are too early to understand Greeks, but will understand the Greeks at a much later stage in this module.

For now, I want you to remember and appreciate the following points with respect to option premium –

- The concept of premium is pivotal to the Option Theory

- Premium is never a fixed rate, it is a function of many (influencing) factors

- In real markets premiums vary almost on a minute by minute basis

If you have gathered and understood these points so far, I can assure that you are on the right path.

Options Settlement

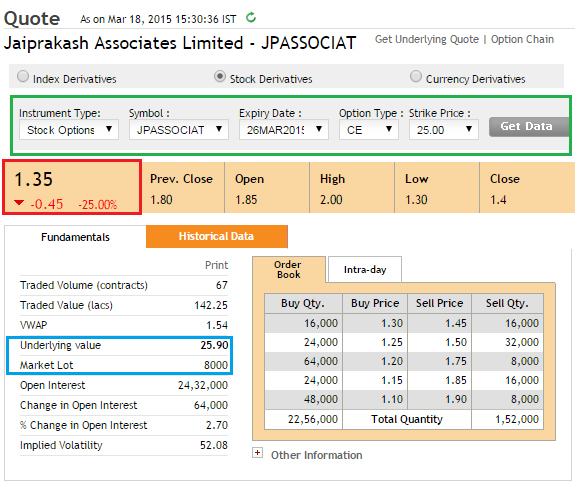

Consider this Call option agreement –

As highlighted in green, this is a Call Option to buy JP Associates at Rs.25/-. The expiry is 26th March 2015. The premium is Rs.1.35/- (highlighted in red), and the market lot is 8000 shares.

Assume there are 2 traders – ‘Trader A’ and ‘Trader B’. Trader A wants to buy this agreement (option buyer) and Trader B wants to sell (write) this agreement. Considering the contract is for 8000 shares, here is how the cash flow would look like –

Since the premium is Rs.1.35/- per share, Trader A is required to pay the total of

= 8000 * 1.35

= Rs.10,800/- as premium amount to Trader B.

Now because Trader B has received this Premium form Trader A, he is obligated to sell Trader A 8000 shares of JP Associates on 26th March 2015, if Trader A decides to exercise his agreement. However, this does not mean that Trader B should have 8000 shares with him on 26th March. Options are cash settled in India, this means on 26th March, in the event Trader A decides to exercise his right, Trader B is obligated to pay just the cash differential to Trader A.

To help you understand this better, consider on 26th March JP Associates is trading at Rs.32/-. This means the option buyer (Trader A) will exercise his right to buy 8000 shares of JP Associates at 25/-. In other words, he is getting to buy JP Associates at 25/- when the same is trading at Rs.32/- in the open market.

Normally, this is how the cash flow should look like –

- On 26th Trader A exercises his right to buy 8000 shares from Trader B

- The price at which the transaction will take place is pre decided at Rs.25 (strike price)

- Trader A pays Rs.200,000/- (8000 * 25) to Trader B

- Against this payment Trader B releases 8000 shares at Rs.25 to Trader A

- Trader A almost immediately sells these shares in the open market at Rs.32 per share and receives Rs.256,000/-

- Trader A makes a profit of Rs.56,000/- (256000 – 200000) on this transaction

Another way to look at it is that the option buyer is making a profit of Rs.7/- per shares (32-25) per share. Because the option is cash settled, instead of giving the option buyer 8000 shares, the option seller directly gives him the cash equivalent of the profit he would make. Which means Trader A would receive

= 7*8000

= Rs.56,000/- from Trader B.

Of course, the option buyer had initially spent Rs.10,800/- towards purchasing this right, hence his real profits would be –

= 56,000 – 10,800

= Rs.45,200/-

In fact if you look at in a percentage return terms, this turns out to be a whopping return of 419% (without annualizing).

The fact that one can make such large asymmetric return is what makes options an attractive instrument to trade. This is one of the reasons why Options are massively popular with traders.

Key takeaways from this chapter

- It makes sense to buy a call option only when one anticipates an increase in the price of an asset

- The strike price is the anchor price at which both the option buyer and option writer enter into an agreement

- The underlying price is simply the spot price of the asset

- Exercising of an option contract is the act of claiming your right to buy the options contract at the end of the expiry

- Similar to futures contract, options contract also have an expiry. Option contracts expire on the last Thursday of every month

- Option contracts have different expiries – the current month, mid month, and far month contracts

- Premiums are not fixed, in fact they vary based on several factors that act upon it

- Options are cash settled in India.

Like future price how option price calculated

Options are priced based on a pricing model called the ‘Black & Scholes’ option pricing model. We will talk about it at a much later point in this module.

Hi Karthik, thank you for the very good explanations!

Below is my understanding of the options. Please correct if I am wrong.

In options market, nobody is a permanent seller or buyer for the option unless they hold the option till expiry.

A new contract gets created when buyer and seller agree on a strike price & premium.

The current buyer & seller both can get out of the contract by selling the option to another buyer (by receiving premium) OR buying option from another seller (by paying premium) respectively.

Both the buyer and seller can square-off their position before expiry, by selling option or buying option respectively.

Their profit or loss will depend upon the premium at which they bought and sold their option.

If they hold onto the option till expiry, for call option, if the spot price is more than strike price, exchange will exercise the option and buyer will receive the difference between spot & strike price. The buyer will be profitable only if this difference is more than the premium paid. If the option gets exercised, the buyer will have to pay higher STT.

On expiry, for call option, if the spot price is less than strike price, the option will be considered worthless expired.

The premium paid will be buyer’s loss and seller’s gain.

Example:

Suppose there is only one option seller S1 and two buyers B1 & B2.

First S1 will tries to sell one call option and B1 agrees on premium and strike price. B1 pays the premium to S1 and one new contract gets created. Now both S1 & B1 wait for the spot price to move in their preferred direction and premium will change accordingly.

Now suppose premium increased and B1 wants to square-off his position by selling this option. A new buyer B2 who wants to enter the contract or Seller S1 who wants to get out of the contract can buy from B1 by paying current premium. If S1 agrees on the premium asked by B1, this contract will get closed. If B2 agrees for premium asked by B1, the contract will just change hands from B1 to B2. B2 will pay the premium to B1. So now B1 is out of the market and S1 & B2 are waiting for spot price/premium to change.

If B2 wants to hold this option till expiry, and there are no other buyers in the market for this option, S1 will be forced to hold this option till expiry. On expiry, whether this option will exercise or expire worthless, depends upon spot price on expiry.

If the spot price is more than strike price, option will be exercised and if spot price is less than strike price, it will expire worthless.

In real market, there will be thousands of traders who will create new contracts between each other and depending upon their current profit/loss will either square-off or hold the option till expiry. In general, if the demand for the option is more, new contracts will get created increasing OI and if supply is more, some of the contracts will get closed thereby decreasing OI.

One correction:

If B2 wants to hold this option till expiry, and if there are no other SELLERs in the market for this option, S1 will be forced to hold this option till expiry, since he cannot buy and square-off his position. On expiry, whether this option will get exercised or expire worthless, depends upon spot price on expiry.

yes Sir!

I’m happy – looks like you got all the points correctly, including the one on STT, which many people miss 🙂

Only one correction – initially S1 and B1 created the contract. When B1 decides to exit the position, the money will get paid to B1 from B2 based on the prevailing premium in the markets. It is important to note here that B1 now transitions to a seller and maybe you can call him S2. There is no direct exchange of money between S1 and B2.

Thanks for the prompt reply Karthik!

I have read through all the comments here and understood most of the answers.

I think, you should create a chapter out of all these Q&A, since some of the questions are repetitive.

Most of the questions are around square-off before expiry, and what happens on expiry.

It will be very much helpful for new readers of Varsity.

If you need help, please let me know, I will be very happy to draft Q&A for you.

Thanks again!

Thanks for the suggesting and for your generous offer 🙂

I will check with my team here and see what can be done. Thanks.

Hi Karthik,

I tried buying few 1 8900 NIFTY call option contracts just to clear a few things in my head because I was unsure how to square-off a contract that I have bought. For squaring-off I clicked the ‘Square-off’ button on pi.

1. If instead of clicking the Square-Off button I would have sold 1 lot (25 units) of the same using the ‘SELL’ button (F2 key) , would that have also meant that I would have ‘Squared-Off’ my existing position or would that have meant that I would have continued to have 1 contract of 8900 Call Buy option and I would have sold a different 8900 call option? (I hope I make sense). I must tell you that I am very scared of selling options due to the infinite risk associated.

2. To write options, do we need to click on the ‘SELL’ button and then proceed?

3. How do we exercise an option on the last day? Does the exchange automatically do it for us or do we ‘Square-off’ or Sell?

On a side note: I was trying to do some intraday premium play on the budget day and once a few days before that. Each time I took a position the market moved in the opposite direction and I lost some money. Apparently it is not as easy to make money in options as a friend told me it would be. It is just amazing how can I keep on taking positions just when the chart reverses. I am hoping I know better by the end of this module 🙂

Appreciate your effort!

Here are the answers –

1) To square off you have two options – either you can select the ‘square off’ button from Admin positions or your can simply select the contract (8900 Call in your case), press F2 (becuase you were long on 8900 Call) and press submit. When you do so the RMS software is intelligent enough to understand that there is an existing open long position against your client id and hence it will net you off and close all position. So as simple as that. Also imagine you have 1 lot of 8900 call option..you decide to press F2 to square off this open position…but instead of 1 lot you enter 2 lots then the system will square off your 1 long position and create 1 short position.

2) To write options you will have to select the contract you wish to write and press F2…or simply call your broker and ask him to write, no other way to this 🙂

3) To excersie an option contract that you own you should leave it ‘just like that to expiry’. Exchange do the rest. However when you have written and option and it is profitable I would advice you to square off the position instead of leaving it to the exchange as it attract taxes. More on this aspect later in the module

Yeah, options is a little tricky instrument to trade. They are multi dimensions unlike futures where only the direction matters. I hope you will fully appreciate this aspect as we progress in this module…and also, I hope I can convince you that option writing is not really a scary thing, as long as you are fully aware of the circumstances under which you are shorting.

On the same topic (Saurabh’s)….the “square off” button helps close an open position at market price, while placing a contrary order gives you the option (choice) to sell/buy at a “limit” price, right? Just confirming an assumption that I’ve made till now.

Absolutely.

Sir, Highly appreciated the way you are answering our questions patiently (some appears to be small/silly). I want to clear myself from my doubt that, if I would have bought a call option on 15.03.15 and the premium/ stock price rose rapidly in two days .Can I square off and take profits or shall I have to wait till expiry. some of my freind told it can be squared off on the same day if were in profits. Thanks/Ragards

You can book your profits as and when you deem appropriate – this means you can buy an option at 9:15 AM for say Rs.10 and a 9:18 AM the premium goes to Rs.11 and you are happy with Rs.1/- profit you can choose to close your option position. There is no need to wait till expiry.

I am confused here. Didn’t you say earlier that we cannot exercise our option until expiry?

Yes thats true, you can exercise options only by expiry, however you can square off your position anytime you wish. Its important to realize that ‘squaring off’ a position is different from option exercise.

sir you are doing a great job… “Priceless” ….. sir it will be great if you can explain the difference between exercising the option and squaring off an option…

Thanks for the kind words.

Exercising the option means that you hold the option till expiry. In this case your P&L will depend on the intrinsic value of the option. However you can also choose not to hold the option to expiry…you can trade just the premium. Like buy an option now and sell few minutes later or hold it for few days.

sir

as said by you i get aprofit of rs 1 then what happens to my premium. will it be returned

Yes – its like this – you paid Rs.100 as premium, and you received 105 as a premium when you sell the same. So you make a profit of Rs.5.

Hi Karthik,

Thanks for the module again.. Here is my doubt.

You said that the call option can only be settled on the date of expiry. So, if I buy a Call option at a particular premium and the stock rallies before the expiry, Can i close my positions to get the benefit of that rally before the contract expires???

Yes of course 🙂 Also, please see my reply for T Rama Devi’s query.

Got that. .Thanks sir.. 🙂

Sorry to butt in on an older thread, i’m trying to learn options and regarding this answer, I’ve a doubt…

What does it mean by ” call option can only be settled on the date of expiry”, if it can be squared off any time ?? doesn’t it sound contradicting ?

You can book a profit anytime you wish. If you chose to hold it till expiry, then it will be subjected to settlement from exchange. Settlement will happen based on the price of the option.