32.1 – Investments

This is the sexiest part of the personal finance journey and one that most people focus on. The amount of time people waste fussing over XYZ stock or mutual fund always surprises me. In the grand scheme of things, as long as you get a few basics right, investing doesn’t matter.

Before you review your investments, it’s important to keep a few things in mind:

- Your portfolio is meant to reach your goals, not to achieve the highest returns. Your investments are subservient to your goals.

- Your benchmark in life is not to beat the Nifty 50, but to reach your goals. Have the right benchmark.

- Savings rate is more important than the rate of return on your investments.

- Asset allocation, risk management, and behavior determine your returns—not picking the “best fund” or “best strategy.”

- A sub-par portfolio that you can stick with is much better than the perfect portfolio you can’t.

- The portfolio you need is not the same as the portfolio you want.

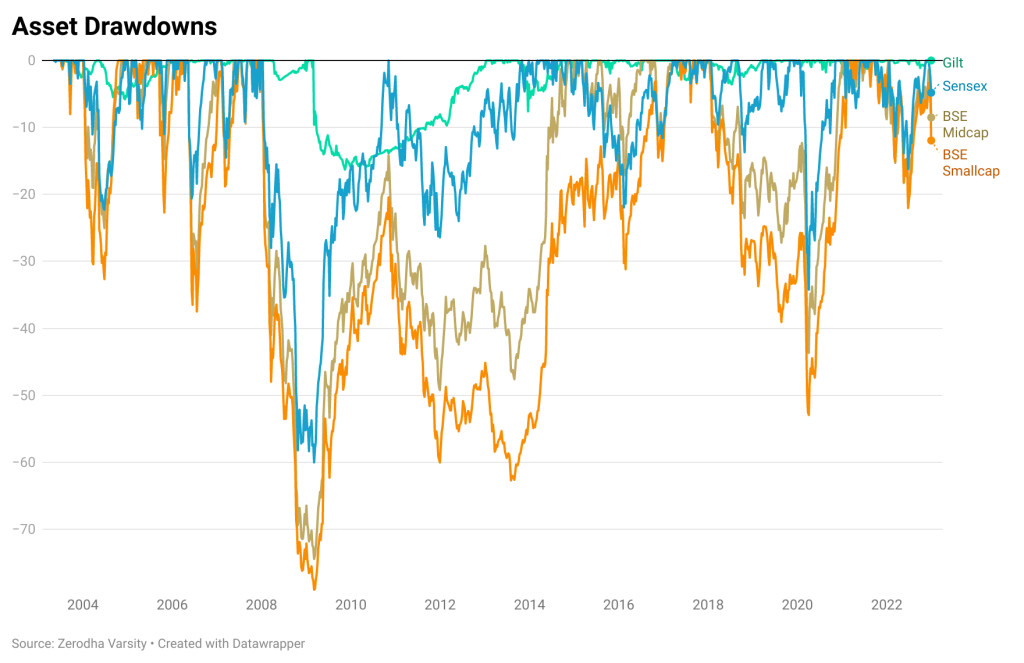

- Risk management will make or break your portfolio. You have to reduce the risk as you grow older.

- When planning for retirement, people often consider average life expectancy which can be misleading. It’s better to be overprepared and save more than less. Karthik has explained this in detail in the below video:

32.2 – Diversification and asset allocation

Diversification

One of the oldest clichés in the markets is that diversification is the only free lunch. But just because it’s a cliché doesn’t mean it’s not true. Diversification is the process of investing in and within different asset classes. A good portfolio will always be diversified across asset classes.

Why?

As a reminder, humans haven’t yet figured out a way to predict which asset will do well. Until we do, the best way to build wealth slowly is to allocate between different asset classes.

Action item

Make sure your portfolio is diversified across the following asset classes.

Equity: Domestic equities, and international equities.

Debt: Between various durations and risk levels.

- Taking too much risk in your debt portfolio makes no sense. Stick to funds with high exposure to AAA-rated bonds and government bonds.

- I’m also not a fan of taking duration risks. Most investors are better off with short to intermediate-duration funds.

- Categories like long-duration funds, dynamic asset allocation funds, and credit risk funds should be avoided unless you are an expert in debt

Precious metals: Gold can act as a diversifier if you understand the risks. Gold can go a long time not doing anything, it can fall as much as equity, and doesn’t always have a negative correlation with equities.

Off late, a lot of silver ETFs and funds have been launched, but it makes no sense to me. Silver is all risk and no returns.

Diworsification

I remember reading somewhere that the average retail investor holds between 20-30 mutual funds in a portfolio. In case you’re wondering, that’s not diversification; that’s diworsification.

Let me explain.

According to SEBI guidelines, large-cap mutual funds can invest in the 100 largest companies by market cap. If you were to hold 3 large-cap funds, you would not just be holding similar funds with similar portfolio exposure, but you would also be replicating an index fund by paying more. The average expense ratio of a direct plan of an index fund is about 0.25%, but the average expense ratio of direct large-cap funds is about ~1.3%.

If you have multiple funds in the same categories, that’s a red flag. You need to review and trim your portfolio.

Review your portfolio

Are you well diversified? As I explained above, make sure you are well diversified across various asset classes and sub-asset classes.

Is your asset allocation in line with your goals and risk capacity?

Asset allocation is how you divide your portfolio between various asset classes. The younger you are, the more risk you can take by having a higher equity allocation. As you get closer to retirement, it’s better to reduce your equity allocation and increase your debt allocation.

How are your funds performing?

Check the performance of your active funds against their chosen benchmarks and not against category averages. Don’t judge their performance just based on 1-2 year performance, no fund can outperform all the time.

How?

That’s the million-dollar question. When you pick an active fund, you’re betting on the fund manager. Some prefer to pick funds and managers only based on quantitative measures like;

- Consistency of returns across market cycles based on metrics like rolling returns.

- Looks at various ratios like Sharpe ratio, Sortino ratio, information ratio, and capture ratios.

- Decomposing the fund returns based on factor models to assess exposures toward factors like value, quality, momentum, and volatility. Holdings-based analysis by decomposing returns to styles, asset classes, and other exposures.

- Fees. Does the manager still deliver alpha (risk-adjusted outperformance) after fees?

Some use qualitative measures with quantitative measures like the personality and temperament of the manager, processes, risk management, alignment of interests, reputation, and track record of the AMC. There’s an entire CFA book on the topic if you’re interested.

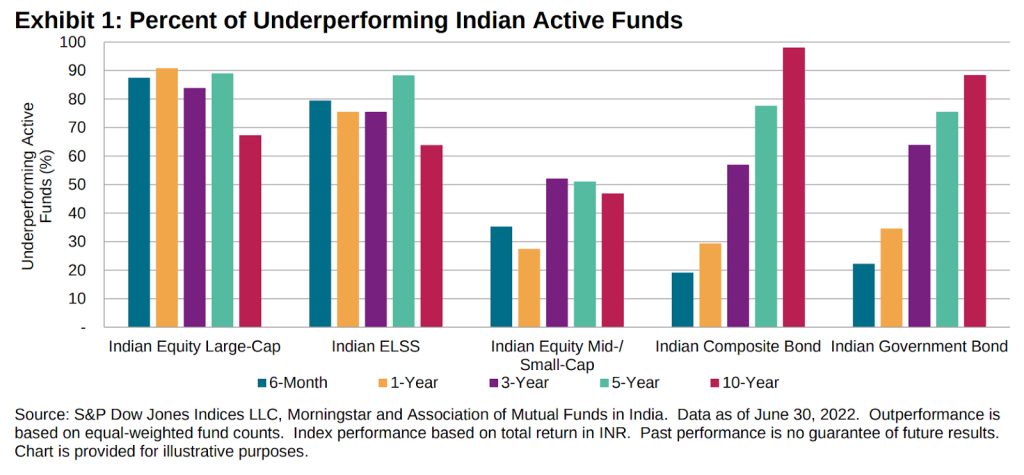

You can use all fancy tools, techniques, artificial intelligence, and machine learning, but most active fund managers fail to beat their benchmarks. The underperformance of active funds is quite sharp in the large-cap category, with 70-80% of all funds underperforming S&P BSE 100.

In mid-caps and small-caps, the argument you’ll hear is that they are “inefficient” and that active fund managers can “add value,” but the evidence says otherwise. The number of underperforming active mid-cap funds is increasing when compared against the S&P BSE Midcap 150 or the Nifty Midcap 150 indices. At best, picking a good active fund is a coin toss.

(Source: S&P Global)

(Source: S&P Global)

Based on the evidence, these are the building blocks of your core portfolio:

Large-cap: Nifty 50

This index consists of the 50 biggest companies in India, and it’s 62% of the free float market capitalization. Buying a Nifty 50 index fund is as good as owning 62% of all listed companies.

Large-cap: Nifty Next 50

NSE categorizes this index as a large-cap, but it behaves like a mid-cap index. The index consists of the 50 biggest companies after Nifty 50 companies. It accounts for 10% of the free float market capitalization of the stocks listed on the NSE.

Mid-cap: Nifty Midcap 150

This index consists of the 150 biggest companies after Nifty 100 and accounts for 12.9% of the free float market capitalization of the stocks listed on NSE.

Small-cap funds are risky, and they are not for most investors.

Debt

Except for target maturity ETFs, funds, and some G-Sec ETFs, we don’t have passive debt funds. But if target maturity funds suit your goals, you can check them out.

Point to consider

Though Nifty Next 50 is categorized as a large-cap index, it behaves more like a mid-cap index. For most of its history, the performance of the Nifty Next 50 and Nifty Midcap 150 look similar, barring the last 5 years. So, it’s unclear whether adding a mid-cap 150 fund to a portfolio offers additional diversification.

But if you still believe in your active fund manager:

- You have to give the fund at least 5 years before judging. Some prefer shorter time periods, but that’s noise.

- On shorter timeframes, if an active fund underperforms its chosen benchmark by more than 5-10%, that’s a red flag.

- If there’s a corporate governance issue, change in the strategy of the fund, the fund manager, or the acquisition of an AMC, whether to stick with the fund or not is another judgment call you have to make.

Reviewing stocks

You should review your portfolio if you are investing in direct equities.

- Check if the thesis behind your stocks still holds.

- If there are any financial or corporate governance issues.

- Ensure your portfolio is well diversified. A lot of retail investors tend to hold 50+ stocks in their portfolio. It’s not just hard to monitor it, but hard to maintain it. There’s no right number of stocks, but beyond a point, there are no diversification benefits, and the portfolio becomes hard to monitor.

Check out these chapters to dive into more detail:

32.3 – Rebalancing

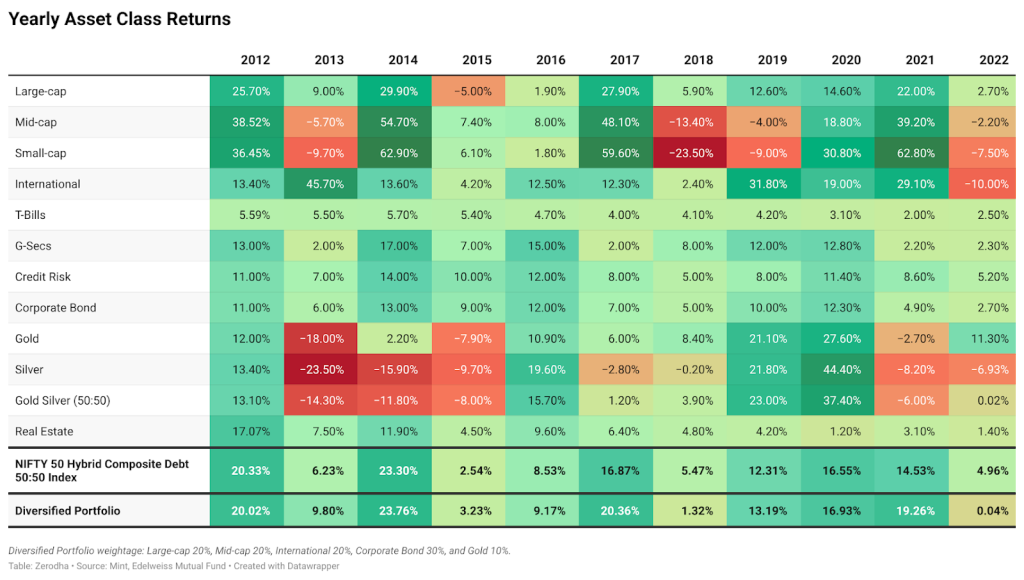

Asset allocation is the process of allocating a percentage of your portfolio to an asset class. Let’s say you decide that 60% equity, 30% debt, and 10% gold is the right asset allocation for you. After a year, if equities go up, the equity allocation in your portfolio would’ve gone to 70%, and debt and gold would’ve become 25% and 5%. If you let the portfolio, be as is and don’t readjust them, the risk in your portfolio increases and so does the volatility.

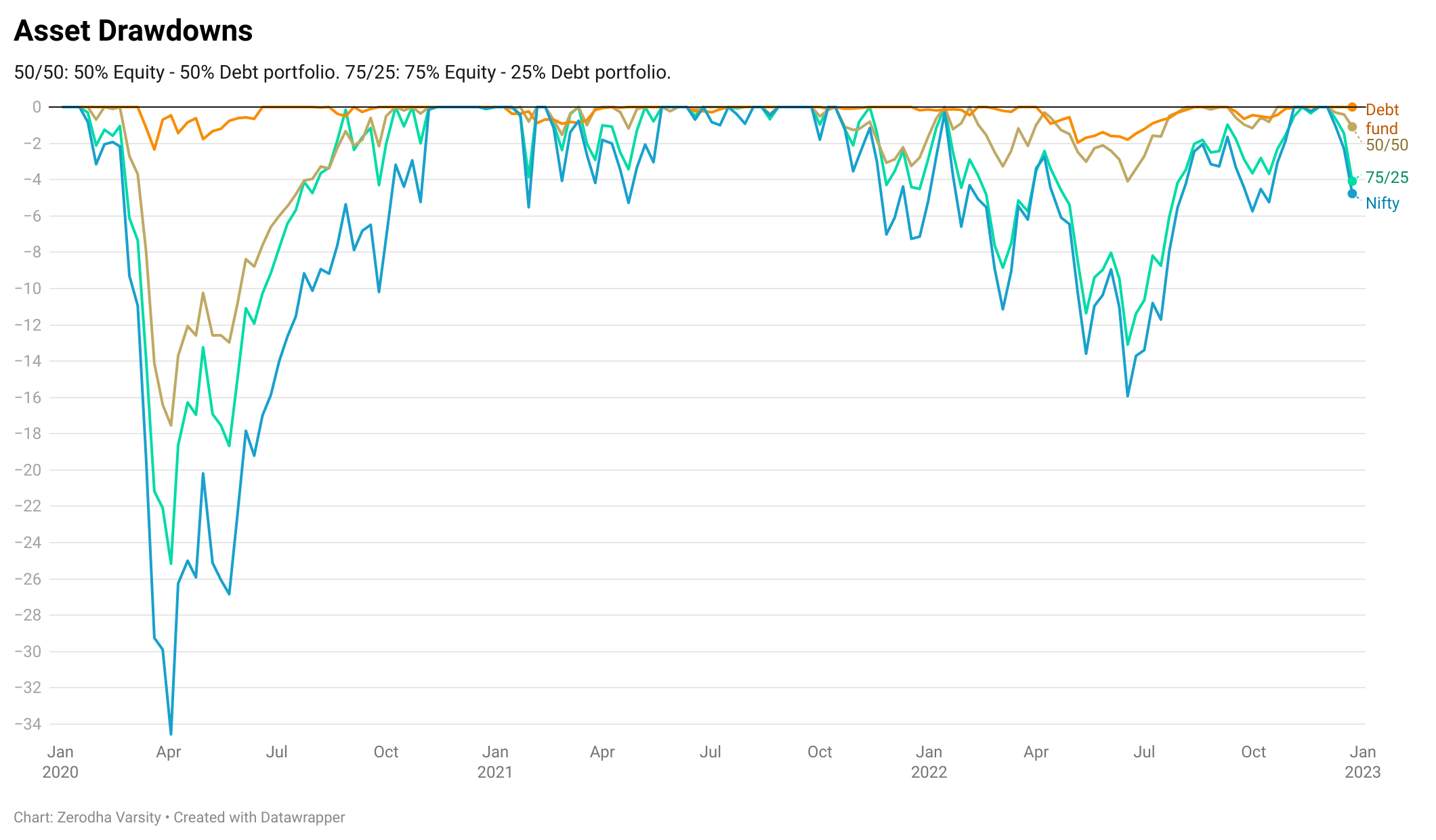

The higher your portfolio volatility, the more variation in the odds of reaching your goals, especially if you are closer to your goals. To reduce the volatility of your portfolio, you need to rebalance your portfolio periodically to reduce the risk.

How do you do that?

You sell the assets that have gone above your desired allocation and buy those that have fallen below. In the above example, you would sell 10% of your equity allocation and 5% of your debt allocation to bring it back to 70% and increase your gold allocation to 10%. This is called rebalancing.

I know what you’re thinking—the dreaded T word. Yes, by rebalancing, you will incur taxes, but saving taxes is not the objective of investing, reaching your goals is.

A few things to remember:

- The tax impact of rebalancing won’t always be huge. It’ll be a small part of your overall portfolio. Remember, LTCG in equity only applies after Rs 1 lakh of gains, and indexation is available for debt funds.

- Rebalancing is not about the returns, but about reducing risk. Taxes are a small price to pay for it. The image above shows how much various portfolios would’ve fallen during the 2020 COVID-19 crash.

- You don’t always have to rebalance every time your allocation changes. For example, you can stick to an annual rebalancing frequency and have a tolerance band of 5% for each asset class. You do nothing if your equity allocation increases from 60% to 63%. But if it goes to 65%, you rebalance.

- You don’t always have to sell a part of your portfolio. You can use fresh investments to adjust the weights by investing in an asset class that has fallen below your target allocation.

- Rebalancing will reduce the risk of your portfolio—that’s a given. As for returns, rebalancing can reduce returns or increase them, depending on luck, how you rebalance and when you rebalance.

- You can exploit rebalancing opportunities with sub-asset classes. Let’s say equities have fallen, but mid-caps and small-caps have fallen more, and valuations are low. You can allocate more to mid and small-caps when rebalancing to increase your equity allocation. This is likely to increase your expected returns.

Here’s a handy guide to the taxation on equities and debt.

32.4 – Savings rate matters more than the return on investments

Remember that old Maruti Suzuki advertisement about Kitna Deti Hai? That sums up most investors. They waste a lot of time worrying about the returns on their investments without realizing that the savings rate matters more than the return on their investment. What’s more, you can control your savings rate, but not the return on your investment. The market will give what it wants to give.

A simple example.

| A | B | |

| Monthly SIP | 10,000 | 10,000 |

| Rate of return | 9% | 13% |

| Annual SIP increase | 10% | 0% |

| Duration | 30 years | 30 years |

| Final investment value | ₹ 5,53,21,220 | ₹ 4,42,06,469 |

In the long run, your rate of savings will matter more than the rate of return on your investments.

What’s a good savings rate?

The simple answer is whatever you can save without being miserable in life and foregoing coffee, soap, and toothpaste. But if you are starting your personal finance journey, aim to save 15-20% and increase your savings every year. The “increase every year” part is the most important aspect.

What if I can’t save much?

This is where the next point comes into the picture.

Your biggest asset

If you were to build your personal balance sheet, it would look like this.

| Asset | Amount | Liabilities | Amount |

| House | 3,000,000 | Home Loan | 180,000 |

| Car | 1,200,000 | Car loan | 100,000 |

| Cash | 200,000 | Credit card | 30,000 |

| Investments | 500,000 |

But let me ask you this, what’s your biggest asset?

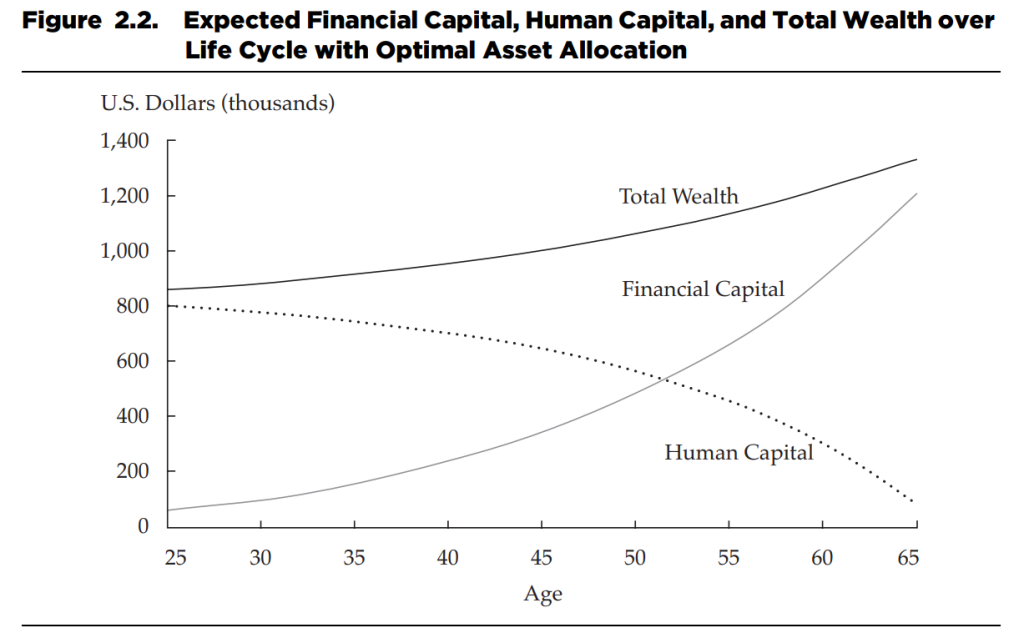

It’s not your house, land, or your investment portfolio, it’s your human capital. In other words, human capital is the present value of your future earnings potential. We think that we are working to build financial assets to retire comfortably. But we’re converting our human capital into financial capital.

(Source: CFA Institute)

(Source: CFA Institute)

People don’t understand this concept well, and most financial planners don’t even include this as part of the financial planning process. All the conversations revolve around stocks, mutual funds, and asset allocation. They don’t understand that the source of financial wealth is human capital, not the other way around.

In summary, the most valuable asset that requires the utmost amount of care and consideration is not your investment portfolio, but your human capital.

The younger you are, the higher your human capital. If you’re reading this, you’d be well aware of the magic of compounding on your investments. But imagine the power of compounding your skills. The rate of return from improving your skills and knowledge will be far greater than the rate of return on your investments.

The rate of return on your human capital determines your savings rate. It is far more important than the rate of return on your investments.

So, what does that mean?

- The younger you are, the more valuable your human capital is. Its value diminishes as you grow older.

- Any investment you make on improving your education, skills, and knowledge when you are younger will pay off in terms of better opportunities.

- You can also think of human capital as a financial asset. If you have a stable and predictable job, then your human capital is like a bond. But if you have a volatile and unpredictable job, then it’s equity-like.

Human capital should be a consideration in your asset allocation. The nature of your job and your skills can influence your risk preferences.

32.5 – Behave!

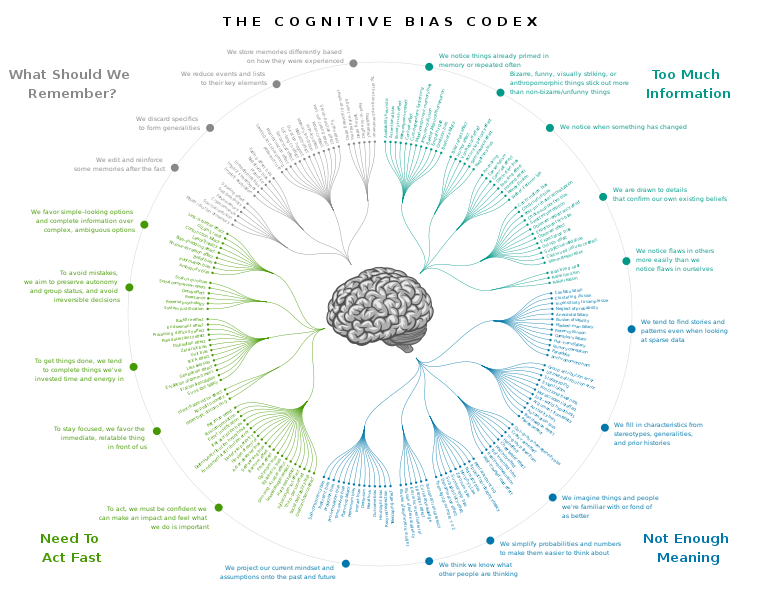

One of the best things to have happened in finance in the last 40-odd years is the rise of behavioral finance. This is one of my favorite images ever, not because I’ve memorized all the biases and live a perfect life but I like it because it shows humans aren’t the cold, calculating, and rational beings that they are made out to be. We’re capable of some dumb things too.

But somewhere along the way, behavioral science lost its way. The focus shifted from finding solutions to help people to creating a laundry list of biases, labels, and cute experiments. The term “bias” also became a dirty word. People started throwing them around to paint people as dumb and stupid. But that’s the mainstream, nonsensical interpretation of behavioral science.

Our biases are not a bug, they’re a feature. Research has shown that these biases have an evolutionary explanation—they helped our ancestors survive. While these “quirks” helped us survive, they are unsuited for the task of investing. Our ancestors lived in a harsh world where there was no guarantee of tomorrow, so saving for tomorrow made no sense. But the world is a different place today.

Coming back to the point, the core idea of behavioral science remains true—that we don’t always act in our best interests and make “utility-maximizing decisions.”

We make mistakes like:

- Not saving enough even though we can.

- Inability to balance enjoying today vs. saving for tomorrow.

- Leaving money on the table by keeping money in bank accounts, staying invested in costly funds, having a sub-par asset allocation, excessive conservatism, etc.

- Sticking to default options even if they are terrible.

- Being driven by greed and chasing quick money and other investment fads.

By now, it must be obvious that investing is a giant distraction once you have taken care of key basics. Once you have covered the key bases, the success or failure of your portfolio doesn’t depend on stock or fund selection but rather on your behavior. You can build the perfect portfolio, but it’s pointless if you can’t hold it through the good times and bad times. Being disciplined with your investment is one thing, but behavior matters more.

How do you behave?

The best way to behave is to get out of your way, so automate your finances.

- Invest systematically through SIPs. Create a mandate for your SIPs to automatically debit money from your bank account.

- Create a SIP to build up your emergency fund.

- Automate the payments for your health and life insurance policies.

- Set up automatic repayments for your credit cards and other loans.

- Automate your rent and bill payments.

The other aspect is to minimize the odds of you doing silly things.

- The best antidote to stupidity is learning the basics of finance. Once you have a working understanding, you’ll realize that building wealth is slow, and there are no get-rich-quick schemes.

- Don’t check your portfolio often. The more frequently you check, the higher the odds of you doing something that you’ll regret. In fact, uninstalling all your finance apps and installing them at the end of the year to review your investments isn’t a bad idea.

- Understand that the odds of you picking the best stock or best fund is zero. Look at the evidence. Once you have, invest in low-cost broad market index funds and move on with your life.

- Be mindful of external influences on your money behavior. This often happens subconsciously but can cause a lot of grief. Don’t benchmark your net worth to some random people on the internet or in your circle. Be ok with having less. Be ok getting rich slowly.

32.6 – Money and mental health

In this section, I want to talk about something that is near and dear to my heart, and I had written about it earlier as well. If there’s just one thing I want you to take away from this post, it’s this.

For better or worse, money looms large in our lives. It’s easy to say “money doesn’t matter” or “money isn’t everything in life” when you have a lot of money. But you don’t have that luxury when you are living paycheck to paycheck and have bills to pay. But given how central money is in day-to-day decisions, it can be a source of significant stress and anxiety.

The American Psychological Association conducts a survey to gauge the perceptions of people toward stress and also identify the sources of stress. Since the survey started, money has consistently ranked as one of the top sources of stress. We don’t have robust data about financial anxiety in India, but I have no doubt it’ll be the same.

Financial stress and anxiety can occur due to a host of reasons, both external and internal. In the last three years, we’ve had a pandemic, a war, and tremendous economic uncertainty. These events have led to financial shocks of a lifetime and have caused immense stress and anxiety, but they are not in our control.

But financial stress can also be caused by having a bad relationship with money. We don’t realize it, but there are a lot of overt and covert influences on how you think about money. Your earliest experiences with money and the money beliefs of your parents have a large impact on your own money beliefs. These beliefs manifest in a multitude of ways. For example, people who face hardships early in life or grow up during economic downturns tend to become more conservative. These beliefs impact everything from how they eat, save, and spend to their chosen jobs.

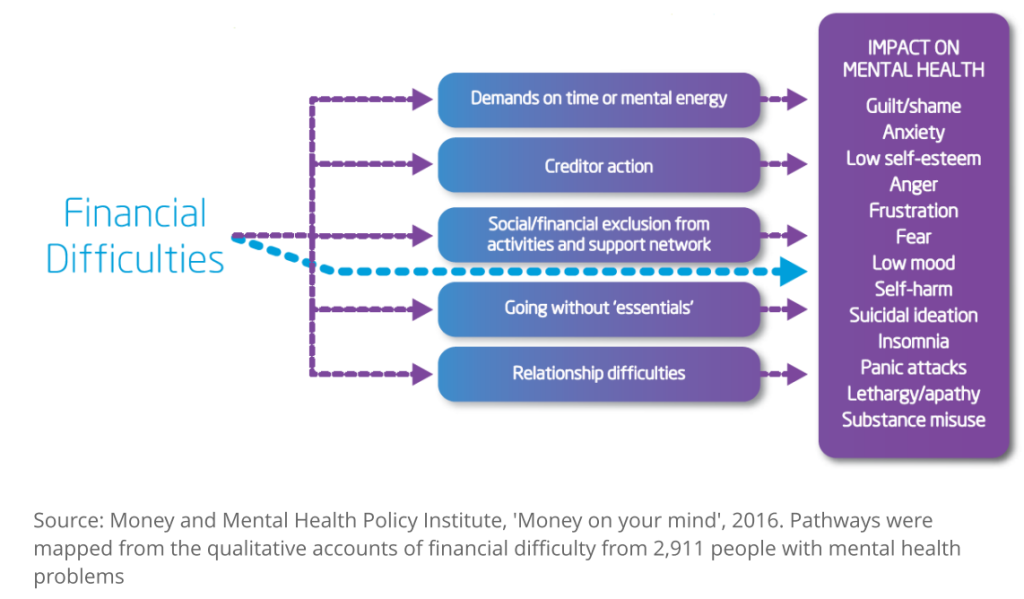

I cannot overstate the importance of understanding how money affects the rest of your life. Money is a source of significant financial stress and anxiety. Financial stress and anxiety can impact your mental health, which affects your physical health. Knowing this relationship is important if you want to learn how to deal with financial stress and anxiety.

(Source: Money and Mental Health)

(Source: Money and Mental Health)

Financial stress and anxiety are complex issues, and there’s no one-size-fits-all solution. For example, in an uncertain economic environment like 2020-2023, when there had been a recession, recovery, and another economic downturn coupled with job losses and business closures, there’s very little in our hands. The only choice is to adapt to the environment.

But there are things in your control that can cause significant financial stress:

- Spending too much on unnecessary things.

- Not saving enough, even if you can.

- Not having adequate emergency savings and insurance.

- Not upskilling yourself to deal with an ever-changing workplace.

- Being secretive about money with your partners and family.

- Benchmarking your net worth to others.

- Defining your success and failures with money.

These are things you can control and change. All you can do in life is control what you can and make peace with the things you cannot. Have you heard of the serenity prayer?

God, grant me the serenity to accept the things I cannot change, the courage to change the things I can, and the wisdom to know the difference.

32.7 – Create a what if? folder

Did you know that according to an Economic Times estimate, there’s over Rs 80,000 crores of unclaimed money in investments, banks, and insurance policies?

This is because of two reasons:

- No nomination

- Not telling the nominees even if there’s a nomination

Someone who works in financial services told me one such story recently. His friend had passed away due to COVID-19, and he had over a crore in investments, which his parents didn’t know. But since he knew, he helped them claim. Otherwise, his parents wouldn’t have known about it.

When we work hard to ensure our loved ones have a comfortable life, not ensuring that they are taken care of in the event of our passing is stupid.

Things to keep in mind:

- Have nominees for all your investments and insurance policies. All you have to do is fill out a form online or courier it.

- Tell your nominees that you’ve nominated them. Otherwise, what’s the point?

Now, this is the most important thing, create a physical or digital folder with the following details:

- Details and documents related to all your investments. What, where etc.

- Details of all your bank accounts.

- Details about all your insurance policies.

- Details of all the liabilities like home loans, loan against investments, etc.

- Documents of your properties and other assets.

- Copies of your identity proofs, educational documents, etc., used to open accounts and purchase products.

- A document detailing the claims process for all the assets and investments.

Create a folder on a platform like Google and share it with your nominees. But before you share, make sure your nominees have a strong password on their emails, and two-factor authentication enabled.

32.8 – Beware of financial fraud

From hacking to identity theft, financial fraud is rampant everywhere.

- Use strong passwords for all your investment accounts and bank accounts. Make sure you enable two-factor authentication.

- Enable two-factor authentication on all your emails.

- Enable biometric and two-factor authentication on your mobile devices in case you lose them, or they are stolen.

- Never share account-specific information, documents, or other personally identifiable details on phone calls and WhatsApp.

- Make sure to verify the authenticity of websites because phishing scams where lookalike websites are created to steal passwords are rampant.

- Never share personal information or passwords with anyone.

- Never deal with platforms and services with bad reputations. It’s subjective and tricky, but the worst offenders often stick out like a sore thumb.

32.9 – Your information diet

Be mindful of the financial information you consume. We live in an age of excess, where there’s more garbage than sensible content. Then there’s the issue of social media influencers who are not just saying ridiculous things, but dangerous things. We saw a demonstration of how things can go badly when a crypto platform promoted by these influencers went bankrupt. Those people making funny faces and teaching you how to invest in a 60-second Instagram reel—the odds are they don’t know what they are talking about.

- 99% of day-to-day financial news is garbage.

- Making portfolio decisions based on what you read in the news or what your auto driver told you is a guaranteed way to lose money.

- The key principles of personal finance are timeless. For example, “A person should always divide his money into three: one-third in land, one-third in commerce, and one-third at hand.” This basic idea of diversification is from the Talmud. You won’t discover some new get-rich secret from some loudmouth on YouTube.

- Read some good books on personal finance and investing. I recommend the following to start with

- The Behavioral Investor by Daniel Crosby

- Psychology of money by Morgan Housel

- Common Sense on Mutual Funds by Jack Bogle

- Triumph of the Optimists by Elroy Dimson, Paul Marsh, and Mike Staunton

- The Delusions Of Crowds by William Bernstein

Sir,

Considering that there is ample amount of investment in equity MF and FD/ other fixed Govt. instruments like PPF etc., can someone consider investing in Gilt fund as the next most reliable instrument to at least retain (if not increase) the purchasing power of a certain amount of money after long duration say 20 years? Kindly advise.

Crazy good content about personal finance. Thanks Karthik. It\’s very useful.

Thanks, Shyam! Happy learning 🙂

All these informations provided by you are very helpful in shaping my thought process in the field of finance. But, i dont know whether someone has ever told you or not, the readings are somehow addictive in nature. I have gone through most of the modules multiple times in last few years and every time it feels refreshing to me.

Thanks a lot for your efforts. This is the least that we readers can offer you.

Regards,

Niraj Tiwari

Niraj, thanks so much for your kind words. It does indeed encourage us to do more 🙂

Happy learning:)

Hi Karthik!

Amazing amazing module first of all. Written from a very objective point of view which helps trust the content. Cheers!

Few questions

1. Asa a beginner, starting to start my investment journey with an equal split of Nifty 50 Index fund (for hyper long term goal of retirement, 30 years or so) and a flexi cap fund for my goals that lie 10 years or so from now. What do you think?

2. Which one would you suggest between a flexi cap and a Midcap 150 Index fund for 10 year period? How are they different from a returns and risk pov?

3. What do you think of S&P 500 indexed funds?

Thanks Akshay, glad you liked the module 🙂

1) That is a good way to think about it, especially the timelines. Anything less than 8-10yrs can be tricky for EQ investments

2) I\’d suggest Flexi. Dont have the returns profile handy. But please check once with a professional financial advisor 🙂

3) Maybe a small portion 🙂

Hey Karthik sir, I had a question. I have learnt the entire mutual fund module and now I am analysing the index funds to invest in. I have got information about all the ratios and key mutual fund metrics, but I can\’t find capture ratios, and rolling returns data anywhere. I have tried using AI to find the data online but no luck. Can I find this information in value search pro subscription? Is it available there? Or morning star subscription? Because it might be possible that this data is hidden behind a paywall, as it\’s hard to obtain and all. Am I right? Should I try the value Research subscription to get the information? Please guide me Kartik sir. Thank you for your time 🙂

Maybe its available there, not sure. But glad you found the module useful 🙂

Hi Karthik Sir,

1. If I am initiating the SIP of some fund on 15th March 2025, I would be paying the initial amount on Coin right? This units for the initial fund will be delivered in my demat account before the first installment?

2. For example, I have been continuing the SIP for 4 years, Now i have some cash (2L) amount and wanted to invest in the same fund. Should I add lumpsum on the same fund or have to do the next month SIP of 50K and continue with regular sip from the preceeding month?

3. If i pay the initial amount on 10th March 2025, then the first installment will be on the 10th april 2025 right? or we can change the first installment to 5th april 2025?

4. If we do not create mandate, then we have to manually place order in coin?

1) Yes, on Coin via the payment gateway/UPI to BSE.

2) You can add lumpsum to same funds and then continue your regular SIPs from next month

3) You can, but for this please do talk to our support desk once

4) Yes, thats right. You will have to do this every month.

Hey Kartik, I just gave the varsity certificate exam yesterday and my score was 63% . And I didn\’t get the certificate and that\’s fine as 65% was the criteria. But what I didn\’t like was atleast you could have mailed me that you didn\’t passed this time try again later. I wanted to know if I did pass the test, where will I get the certificate, like on my mail or what? And yes the test difficult was crazy bro, the test was nicely designed 👍

Hey Rishi, sorry about that. We will ensure a mail is sent out.

Hey Karthik sir, thank you for such a priceless content that you are sharing without any charges. Thanks for your efforts. You recommended some books to read, can I ask you why haven\’t you included the INTELLIGENT INVESTOR book by Benjamin Graham ? Do you not find it good or relevant enough to mention? Or did you forget to mention it? Cause I that book on my shelf and I will read it next. So it would be nice to know what are your thoughts and opinions on that book. Thank you again for your precious time that you give us, I will make sure to not let it be in vain. I promise

It is a great book, please do read. You will appreciate the general principal and the spirit of buying undervalued stocks discussed there. But the exact techniques maybe irrelevant in today\’s day and age.

Sir,

Which one is good to consider- AMC SIP or Coin SIP for long term investment?

The one that gives you more comfort. For me, both are similar.

Sir,

Actually I am a little confused as to if SIP & SWP are two separate schemes that needs to be invested. Or can I do the SWP after doing the SIP for say 20 years?

You can do SWP after doing SIP for many years 🙂

Sir,

In your MF chapters, you have vividly described ways to invest. Meanwhile, I am a regular investor in MFs/Index funds in large cap, mid cap and small/micro cap(very less amount).

However, currently, I have come across through SWP concept. Now, I would like to know that is it advisable to do the SIP plan or SWP plan? Or we can do both the things. I would like you to provide some insight keeping an ultra long term view point (+20 years).

SWP is for withdrawal and SIP is for investment. These two are different right? SIP is what you need to begin with, and SWP for withdrawals.

Really Thank You Karthik sir for given this invaluable knowledge. And written this really thaks.

Am after completed ur personal finance book am one of biggest fan.

Don\’t know how many people\’s have this kind of heart.

I assure ur efforts will not be wasted.am really very happy in heartly after completed ur portfolio management chapter.

Thanks,

Sasikumar G.

Thanks for the kind words, Sasikumar! Your message made my day 🙂

Karthik ji,

Good Evening!

These chapters are simply amazing !

Want you to Make such of these pieces on SWP also.

I am searching how an SWP works during retirement age.

Sure, noted.

Hi karthik Sir,

As i said earlier, I have been looking for index funds in the market. I have gone through the TER and the returns of ICICI, UTI, SBI, HDFC as their TER is around 0.17% to 0.20% and the returns are also quite similar over the long period of time. But when i saw bandhan index fund for nifty 50 their TER was 0.10% and the return is also not that much difference. But the difference is the timespan. all the 4 funds was there more than 20 years in the market, but bandhan MF was started in 2013.

1. My question is what made them to offer less TER when compared to other funds?

2. Other 4 funds would have overcome the 2008 crisis and 2019 pandamic but bandhan MF would have seen only 2019 crisis. Does this impact the fund in anyway?

3. Do i have to look other metrics for any analysis?

1) Just to be more competitive in the market.

2) Not really since its an index fund

3) It should not really matter.

Hi Karthik Sir,

Lets say im investing in 3 or 4 mutual funds with different categories, other than that say investing some random money in buying random blue chip stock directly in the demat account for a long time would that make any sense or it will be like overshadowing the Mutual funds?

MFs are portfolio of stocks, cant really compare this to a single stock exposure.

Hello karthik sir,

I am a beginner investor, i have invested for past 2 years with an agent and suddenly one day he asked me to remove few of sip\’s i am doing ( axis growth oppurtunity fund, pgim mid cap fund ) , and we couldnt start again, he is busy and not kind of responding. as of now i had 2.75 k sip in motilal oswal micro cap 250, 2.75k in quant small cap, 3.6k step up sip ( 10%), so could you please suggest me for another 8 k sip, and i am okay with rebalancing as well.

Hope u will reply me , Thanks in advance.

Hi Sandeep, I unfortunately cant suggest funds. But please do talk to a good financial advisor for this who can hand hold you and guide you properly.

Thanks alot for sharing such a valuable content.

However, I would like to know how to plan portfolio with retirement funds, if they are not needed on immediate basis and everything else is taken care of. How to invest them and what will be the approach?

Thanks

Not sure if I get your query fully. But here is the thing – the funds are more or less the same, the segregation of funds, earmarked for different purposes.

Hi sir,

Your modules on Fundamental Analysis and Mutual Funds have been immensely helpful. Further, it would really help newbies like me if you could make a seperate module dedicated to capital allocation.

Thank you.

Thanks for letting me know, Sujal! Happy learning 🙂

Sir,

The varsity has been extremely useful for me in understanding the basics of investing. Thanks so much!

My question is on comparing MF returns within my portfolio. Would it be fair to compare absolute returns of one MF(less than 1 year investment) with XIRR of another MF (invested for more than a year)? XIRR of MFs with less than 1 year show very high returns and as you have mentioned, it is not the right measure.

Thanks and Regards

Ah no, if you are comparing MFs, then its better to compare over the same metrics.

Hi Karthik.

I\’m at 27 years of age and I\’m entirely new to investing in equity / Mutual funds. Big thanks to you for making such wonderful contents. it really helped me to understand things clearly. Also, You made me feel like that I\’m very late to start the investments. I really feel terrible that I didn\’t come across your modules 3-4 years before.

My portfolio is:

1. I\’m salaried employee with Net monthly income of 1.1L

2.I have invested in buying new house (apart from own house, as part of investment) (50L) and I\’m paying monthly EMI of 30K which will go for another 18 years.

3. Fixed Deposit : 5,00,000

4. Recurring deposit : 10,000 every month. upon maturity, I put that in FD.

But now you enlightened me how my investment returns are just on par with inflation.

I\’m planning to start SIP. Initially I would like to start with 2 SIPs of 5000 per month each.

I have done some research based on your module guidance and sorted out the funds.

1. ICICI prudential Bluechip fund direct growth (number of holdings are more. lesser risk compared to category. rolling returns are good. trustable fund manager. risk ratios and expense ratio are reasonable)

2. Parag Parikh flexi cap fund direct growth (as you advised, considering age factor, I\’m taking little risk to go for flexi cap fund)

You advice on this will mean a lot to me.

when I have gone through all your comments in mutual funds topics, you have suggested to go with index funds for long term investment. that is something not clear for me. I could see large cap funds consistently performed better than their indices barring slightly higher expense ratio. Please help me get through this.

Apart from these two SIPs, I\’m planning to invest 5k on stocks for long term. My plan is to invest in Nifty 50 companies.

Is this advisable? or instead of investing 5k in stocks should I add one more SIP? if so, which category would be preferable considering that I already have one large cap and one flexi cap??

My investments are for long term. It will go for at least 20 years.

Please guide me on this. Let me know what you will do if you are in my shoes.

PS: Thanks for your extended support and guidance through your modules. Your content has changed my view on life and savings. After 20 years, I will still think how these modules have shaped my life in a better way. Still few more modules I\’m yet to cover. Happy to learn more.

Hey Jaden, better late than never. If it helps, I too started ard 26-27, and I had far lesser amount to invest compared to you 🙂

Both the funds are good, but I\’d suggest you dont take my word for it as I\’m not a registered advisor. People suggest index funds mainly considering the tenure of the investment. If its for a hyper long term (10-15 years plus), then you are better off with a low cost funds like an index fund. Also over longer terms, data points do suggest that the index funds tend to beat active funds.

My advice would be to build a solid MF portfolio first and then look at stocks.

Good Morning,

I’m doing SIP of 15K from the past 2 years.

My SIP plan will continue for another 18years for sure without any Break and redemption in between.

Just would like to share my monthly SIP plan with you. How I can reach out to you, any mail I’d?

Sorry, but I dont think we can review this, I\’d suggest you speak to a qualified financial planner or an advisor to help you with this.

Thank you 🙂

Hi Karthik,

Thanks a ton, for this Ocean Full of Knowledge by Zerodha Varsity. I\’m additcted reading to these modules and can\’t put down a module before completing it, the language, the style and the pace of the topics which you have designed are wonderful without using any jargon.

1. Can you please provide the updated PDF’s of all the modules. It\’s easy to read the PDF, as we can do highlight and note down additional points, than reading online.

2. I have read PDFs, but later I see there\’s some additional chapters and content added when I see the online content. We can get to know about what all are the additional chapters added by visiting website, but it will be difficult to find the difference between content which you have updated on portal vs PDF.

For example, in Module 1 on stock markets, I see some chapters have additional content in the portal like change in Settlement period, brokerage charges, PMS limit etc., when compared with PDF.

Please can you confirm which module PDFs are updated so that I can read them from PDF and the rest of the modules online, albeit concepts in the PDF are still valid, instead of reading PDFs and visiting again online portal for updated content, your suggestion will help me to go with one source for the respective module.

Thanks for your efforts in creating these modules.

Thanks for the kind words, I\’m glad you liked the content on Varsity 🙂

1) Will do, please allow us sometime on this.

2) It is hard to update PDFs as we have to render the entire document again, but will certainly try and do that going forward.

I think there is a way to convert the web browser content into PDF, I hope you can explore that, you can read PDFs on the go.

Sir, Will it be a good idea to invest my money in MF spreading over 4-5 houses? Can it be treated as diversification? What will be your advice here?

Only if there is a need to do that 🙂

Dear Karthik,

Can you please provide information on the following:-

1. Timelines for selling units of a Mutual Fund. Like If I initiate a request on Kite to Redeem units of a particular Mutual Funds when will I get the funds into my account. Also I am assuming that the units I am redeeming is based on the NAV for the past day (please correct me if I am wrong).

2. Suppose If I am placing a SIP order on Monday at 1000 hrs when will the units get allotted to me. Also if I place a SIP order after market hours when will the units get allotted.

Wishing you good health and happiness

1) T+2. Also, MF redemption is on Coin, not Kite.

2) The next day

Hi sir

12 to 15 model,

This model or when comeing sir to zerodha varsity app , I am interest to reading sir this model not there in app.

Thank

It will, but will take sometime Shivu.

Hi,

I\’m 43 and a long term investor. I have about 45% of my savings in the nifty50 and large cap stocks. I am holding about 55% in cash which is now being deployed in Nippon India small cap mutual fund as an sip which will go on for atleast 6-7 months. Considering that the returns have been great over the last 10 years, am i taking too much risk with my exposure to this fund, also considering that nippon India small cap fund is exposed to the small, mid and large cap stocks.

I\’m not a fan of small cap funds especially when I\’m saving for retirement. But if you can give at least 8-10 years, then its ok. Also, its not a good thing to look at past returns and expect the same for the future.

Hello Karthik,

Your content is unarguably the best – thoroughly researched, reasoned with data, and distilled by experience. In a market like ours – where most financial agents / intermediaries mis-sell funds to middle-class population, the content by Varisty is privilege.

Thanks to you and the team at Zerodha for sharing such invaluable financial knowledge through this platform, Cheers! 🙂

Thanks so much for the kinds words, Soumik. Happy learning 🙂

Varsity hindy me uplabd kraia

Hi Karthik,

Thanks a lot for the wonderful chapters on Personal Finance.

I am correcting all the investment mistakes I have done in the past.

Zerodha Varsity helped me to ignore the noise and pick the right kind of investments(at least for me & family) as per my risk appetite.

I am still learning and do have a few queries in my mind for sometime w.r.t Mutual Funds 🙂

Requesting your suggestion on the below:

1. Diversification: {AMC diversification vs AMC Investment strategy diversification}

Most of them recommended splitting our investment and putting it into 2-3 AMC for the same product so that we can sustain to an extent if one of the AMC is doomed.

For. eg: Instead of 5000 SIP in an index fund with one AMC, split the SIP into 2500 and put them in 2 different AMCs index funds.

I don\’t think AMC diversification is required as we will be paying the expense ratio to multiple AMC of the same investment scheme.

Is my understanding correct? What\’s your opinion on this?

For the same investment scheme(for eg. small-cap funds). Is it good to invest with one AMC or split our investment with multiple AMCs who are having different investment strategies/holdings?

2.Rebalancing: {Rebalancing/Exit}

As per the asset allocation, we can either book the profit or make fresh investments to have desired allocations to reduce volatility & risk.

We can do it by midyear/yearly. We all don\’t want to keep the underperforming assets as well.

How long one should wait before exiting an underperforming fund? Is it as per our rebalancing frequency or based fund\’s past 3-4 quarters\’ underperformance?

We have learned a lot of \’W\’ questions before investing, it would be really helpful if we have a couple of chapters on when to exit or how long one should hold the investment even the underperformance asset. Maybe a few scenarios based would help.

Most of us were panic during covid time and exited our investments due to fear in the market, if at all one had the patience could have excelled in that uncertainty.

Regards,

Pavan

Glad to note that Pavan, thanks for letting me know 🙂

1) AMCs are heavily regulated so the risk of AMC going down in terms of mismanagement is less, but its not entirely ruled out. So in a sense its ok to split between two AMCs. But not for the same fund. For example, if I invest in AMC 1 for largecap, then I\’ll goto AMC 2 for a mid cap fund

2) I\’d say give the fund at least a year before you decide on its performance. Sometime funds do take time to get over cycles.

Hope that helps 🙂

Hi Sir, Can you provide as the exit strategy for mutual funds before achieving the goal like in what scenario\’s we need to think of exiting a fund and also can you provide us what should be the ideal mutual fund portfolio looks like which will be useful for most of the people like 1 index, 1 midcap and 1 smallcap?

We will write about this. But one of the good things to do is to systematically withdraw funds from your corpus.

These articles are perfectly curated. Everything is clear and easy to grasp, and the examples are provoking. Your passion for teaching is unmatched. Thank you so much for this gem.

Happy learning, Priyansh.

Hi,

Images viewed in the pdf are not clear. On the varsity site there is no problem but when as a pdf across different readers a lot of the images are blurred. Could you please look into it. Thanks

Checking this, thanks for bringing it to my attention, Prateek.

Thank you so much Karthik sir for educating us with all the knowledge on Personal Finance. I feel like we uncover different dimension of thinking about money and investment after this. I am currently 30 and regret not reading it earlier. Sincerely Thank you again!

Better not late than never 🙂

Hi Karthik,

Thanks for posting an excellent stuff on University. Most important is that you have shared your personal experience and above all is in most simplified manner. Once again many thanks to you and your team.

Thanks for letting me know, Bahadur. Happy learning 🙂

Thankyou so much for all this modules. I have just completed all the 32 chapters which are phenomenal. I express my deepest gratitude to you sir. Thankyou.

Congrats on completing the module! Wishing you the best 🙂

\”Remember, LTCG in equity only applies after Rs 1 lakh of gains, and indexation is available for debt funds.\”

Please correct this like, indexation benefit is no longer available for debt funds.

Yes, will do that.

Sir, I am a regular reader of varsity and a Zerodha user. I really want to thank you for giving this immense knowledge. It has helped me a lot. I have a request. Can you please upload PDF files of module 12, 13, 14 and 15. It becomes very easy to read from a PDF file. Thank you.

Module 12, no PDF. For the rest, we will put up shortly.

Nice one and keep \’em coming!

I\’m 35 & have a portfolio of ~1 cr with below high-level breakdown

– 70L fixed-income (13 in liquid fund, 6 in tbills/gsec, 6 in FD…rest is all illiquid in PF,PPF etc.)

– 30L equity (11 in nifty50 index, 7.5 in large cap, 2.5 in S&P500 index, 4 in NPS, 2.5 in ESOP, some midcap & stocks)

– 1L in SGB

– Some emergency cash in bank

Please suggest how I can make it better, especially the rebalancing. The market always seems high after Covid & in current market conditions to put into equity, so even the new monthly savings end up in fixed income which makes it worse.

Congrats on accumulating a good corpus at a young age. I hope this compounds better for you in the years to come.

Regarding the composition, I suggest you consider increasing your equity component to at least 50 or 60%. Age is by your side, you can afford to take more risks. Also, Nifty 50 and large-cap is essentially the same, so maybe you can relook at that.

Do talk to a professional financial advisor for this to help you restructure the portfolio a bit.

I express my gratitude for your valuable suggestion, which has provided me with a thoughtful direction to explore. Your guidance is much appreciated, and I am thankful for it.

Thanks, Sampath. Happy learning 🙂

Thank you for providing the comprehensive information. I seek advice regarding a decision I\’m struggling to make. At present, my NPS (National Pension System) account holds a sum of slightly over 10 lakhs, with 75% invested in HDFC Pension Scheme E and the remaining 25% in Scheme G. I have a term insurance policy worth Rs. 1.5 crores. Now, I intend to initiate a SIP of Rs. 10,000 per month. Considering I am 36 years old, what would be the most suitable option for me? Thank you in advance.

Sampath, I\’d suggest you speak to a financial advisor on this. But if I were you, I\’d consider starting a SIP in Nifty Next 50, considering you have age by your side and also you\’ve taken care of basics.