2.1 – Simple Interest

When it comes to personal finance, one of the key things to learn is the math that surrounds this topic. Once you understand the math bit, the rest is just the application of it and life becomes easy after that.

In this chapter, I’ll try and explain the most basic math involved starting from simple interest. I know this is explained across multiple chapters across multiple modules in Varsity, but for the sake of completeness let me include all of it in one single chapter.

Let us run through an imaginary transaction, my guess is that this a familiar situation for most of us.

Imagine that one of your friends needs money urgently and he approaches you for it. Being a friend, you agree to help him with the money but being a capitalist at heart, you also expect your friend to pay you ‘interest’ on the cash you lend to him. I know we don’t usually ask a friend to pay us interest, but let’s just assume he is a friend whom you’d like to help, but not at the opportunity cost of your money.

The transaction details are below –

- Amount – Rs.100,000/-

- Tenure – 5 years

- Interest (%) – 10

As you can see, your friend agrees to repay Rs.100,000/- over a 5 year period and also agrees to pay you an interest of 10%.

Given this, how much money will you make at the end of 5 years? Let’s do the math and find out the details.

Remember, the yearly interest is paid on the principal amount.

Principal = Rs.100,000/-

Interest = 10%

Yearly interest amount = 10% * 100,000

= Rs.10,000/-

Here is how the math looks –

| Year | Principal Outstanding | Interest payable |

|---|---|---|

| 01 | Rs.100,000/- | Rs.10,000/- |

| 02 | Rs.100,000/- | Rs.10,000/- |

| 03 | Rs.100,000/- | Rs.10,000/- |

| 04 | Rs.100,000/- | Rs.10,000/- |

| 05 | Rs.100,000/- | Rs.10,000/- |

| Total Interest received | Rs.50,000/- | |

So as you can see, you can earn Rs.50,000/- in total interest from this payment. The amount you earn from the interest can also be calculated by applying a simple formula, which you may remember from your school days –

Amount = Principal * Time * Return

Where the return is the interest percentage.

Amount = Rs.100,000 * 5 * 10%

= Rs.50,000/-

I’m sure you’d agree that this is quite straightforward and most of you would remember that this is simple interest.

In simple interest, the interest gets charged only on the outstanding principal.

Imagine a bank transaction, you deposit Rs.100,000/- in a bank’s Fixed Deposit scheme, which promises to pay you a simple interest of 10% year on year for 5 years. At the end of 5 years, you’ll earn Rs.50,000/- as interest income. The math is still the same.

Banks don’t pay simple interest, they pay compound interest. What do you think is the difference between simple interest and compound interest?

2.2 – Compound interest

Compound interest works differently compared to simple interest. If someone agrees to pay you compound interest, then it essentially means that the person or the entity is agreeing to pay you interest on the interest already earned.

Let’s figure this out with the same example discussed above. The transaction details are as follows –

- Amount – Rs.100,000/-

- Tenure – 5 years

- Interest (%) – 10

- Interest type – Compound Interest (compounded annually)

The math is as follows –

Year 1

At the end of 1st year, you are entitled to receive a 10% interest on the principal outstanding and previous interest (if any). For a moment assume you are closing this at the end of the 1st years, then you would receive the principal amount plus the interest applicable on the principal amount.

Amount = Principal + (Principal * Interest), this can be simplified to

= Principal * (1+ interest)

Here, (1+interest) is the ‘interest’ part and the principal is obviously the principal. Applying this –

= 100,000 *(1+10%)

= 110,000

Year 2

Now assume, you want to close this in the 2nd year instead of the first, here is how much you’d get back –

Remember, you are supposed to get paid interest on the interest earned in the first year, hence –

Principal *(1+ Interest) * (1+Interest)

The green bit is the amount receivable at the end of 1st year, and the blue bit is the interest applicable for the 2nd year.

We can simplify the above equation –

= Principal *(1+ Interest)^(2)

= 100,000*(1+10%)^(2)

= 121,000

Year 3

In the 3rd year, you’d get interest on the 1st two year’s interest as well. The math –

Principal *(1+ interest) *(1+interest) *(1+interest)

The green bit is the amount receivable at the end of 2 years, and the blue bit is the interest applicable for the 3rd year.

We can simplify the above equation –

= Principal *(1+ Interest)^(3)

= 100,000*(1+10%)^(3)

= 133,100

We can generalize this –

P*(1+R)^(n), where –

- P = Principal

- R = Interest rate

- N = Tenure

So, if you were to have this open for the entire 5 years, you’d receive –

= 100,000*(1+10%)^(5)

=Rs.161,051/-

Contrast the difference between the 50K received in simple interest versus the Rs.61,051/- received via compound interest.

Compound interest and compounded return work magic in finance. At the end of the day, every aspect of personal finance boils down to the compounded return. For this reason, I think it is best to spend some more time trying to understand the concept of compounding of money.

2.3 – Compounded returns

The concept of compounded return is similar to compound interest. The concept of return and interest is very similar, just like the two sides of the same coin. The interest is what you pay when you borrow money in any form and the return is what you earn when you invest your money in any asset. Therefore, if you understand interest, then it is easy to understand the return.

In this section, you will learn about how the return is measured. Based on the time horizon of your investment, the return measurement differs.

You will use the absolute method to measure the return if your investment horizon is less than a year. Otherwise, if your investment horizon is more than a year, you will use CAGR or the compounded annual growth rate, to measure returns.

I guess the difference in absolute and CAGR is best understood with an example.

Assume you invested Rs.100,000/- on 1st Jan 2019 in a financial instrument which yields you a 10% return (per year) and you withdraw this investment a year later. How much money do you make?

Quite straight forward as you can imagine –

You will make 10% of 100,000 which is Rs.10,000/-, in other words, your investment has grown by 10% on a year on year basis. This is the absolute return. This is straightforward because the time under consideration is 1 year or 365 days.

Now, what if the same investment was held for 3 years instead of 1 year, and what if instead of a simple return of 10%, the return was compounded annually at 10%? How much money would you make at the end of 3 years?

To calculate this, we simply have to apply the growth rate formula –

Amount = Principal*(1+return)^(time)

Which as you realize is the same formula used while calculating the compound interest. Applying this formula –

100,000*(1+10%)^(3)

= Rs.133,100/-

Referring to the previous section, if you were to charge compound interest, then this is the same amount of interest you receive from your friend in the 3rd year.

Continuing on the same lines, here is another question –

If you invest Rs.100,000/- and receive Rs.133,100/- after 3 years, then what is the growth rate of your investment?

To answer this question, we just need to reorganize this formula –

Amount = Principal*(1+return)^(time)

and solve for ‘return’.

By doing so, the formula reworks itself to –

Return = [(Amount/Principal)^(1/time)] – 1

Return here is the growth rate or the CAGR.

Applying this to the problem –

CAGR = [(133100/100000)^(1/3)]-1

= 10%

2.4 – The compounding effect

Apparently, Albert Einstein once described ‘compound interest’ as the 8th wonder of the world. I guess he could not describe it any better. To understand why you need to understand the compound interest in conjunction with time.

Compounding in the finance world refers to the ability of money to grow, given that the gains of year 1 get reinvested for year 2, gains of year 2 gets reinvested for year 3, so on and so forth.

For example, consider you invest Rs.100 which is expected to grow at 20% year on year (recall this is also called the CAGR or simply the growth rate). At the end of the first year, the money grows to Rs.120.

At the end of year 1, you have two options –

- Let Rs.20 in profits remain invested along with the original principal of Rs.100 or

- Withdraw the profits of Rs.20

You decide not to withdraw Rs.20 profit; instead, you decide to reinvest the money for the 2nd year. At the end of the 2nd year, Rs.120 grows at 20% to Rs.144. At the end of 3rd year, Rs.144 grows at 20% to Rs.173. So on and so forth.

Compare this with withdrawing Rs.20 profits every year. Had you opted to withdraw Rs.20 every year then at the end of the 3rd year the profits collected would be Rs. 60.

However, since you decided to stay invested, the profits at the end of 3 years are Rs.173/-. This is good Rs.13 or 21.7% over Rs.60 earnt because you opted to do nothing and decided to stay invested.

This is called the compounding effect.

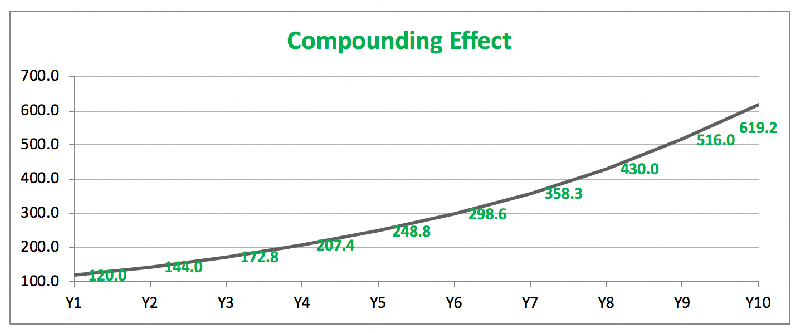

Let us take this analysis a little further, have a look at the chart below:

The chart above shows how Rs.100 invested at 20% grows over a 10-year period.

In the next chapter, we will understand the other crucial concept in personal finance – Time value of money.

Key takeaways from this chapter

- Simple interest is the interest that gets paid only on the outstanding principal

- Compound interest is paid on both interest and the principal outstanding

- Interest and return are like two sides of the same coin

- Absolute return is a measure of the growth in return when your investment is for less than a year

- Compounded annual growth rate (CAGR) is the measure of your return when your investment duration is more than a year

- Compounding works best when you give your investments enough time to grow

Sorry sir, for giving trauble again, I was thinking that any interest obtained from principle if again reinvested in principle amount, this is done for many times, then this called compounding.

But how compounding occur if we keep 100 stocks of itc for 10 yrs as it is without adding nothing.and even not the dividend

Thanks

Roshan, what you explained is also compounding, where there is a reinvestment. But when you buy a stock at 100 and sell the same at 500 a few years later, the price appreciation is also called as compounding.

Ohh yes there is nothing like compounding interest 👍

But how compounding occur in this case where I had kept stocks for 10 yrs as it is without adding nothing.

The price appreciation adds to the compounding effect 🙂

Hello sir,

I have query regarding compounding internet in stocks. Suppose, if I purchase 100 shares of certain company and kept as it is for 10years without adding any shares. Does compunding interest applicable here , if yes , then how. Thanks

Yes, compounding works as long as there is price appreciation. But there is nothing like compounding interest 🙂

ALL ABOUT SIMPLE INTEREST AND COMPOUND INTEREST

SIMPLE INTEREST IS ALL ABOUT INTEREST ON PREMIUM MONEY

COMPOUND INTEREST IS ALL ABOUT INTEREST ON INTEREST

Hmm, you got that right.

Hi Karthick, I have been following varsity modules for few months. Thank you so much for the content. Its in simple laymen language which makes its alot easier to understands for a non finance back ground person like me. the practical examples are of great help. I have started started stock investing because of the knowledge and confidence I have gained on your platform. Hats off to you and the team.

Thanks for the kind words, Amit. Happy learning 🙂

Varsity modules not only improve your financial knowledge it also improves your thought process.

Happy learning 🙂

However, since you decided to stay invested, the profits at the end of 3 years are Rs.173/-.

—

Above statement needs to be corrected as in this case profit is 73/- and return is 173/-

After the end of 3 years, profit would be 73 instead of 173, right? Should this be a correction in the above module?

Ah yes, 173 is the total amount. Will fix.

Hi, where can we download a PDF on this content? Will really help in doing some offline reading! Great content btw 🙂

Glad you liked the content 🙂

You can scroll to the end of this page to download the content – https://zerodha.com/varsity/module/personalfinance/

Yaaa they are doing but lm talking about direct equity investor.

I think zerodha should work on to provide a option to reinvest profit from demat ac .

It will make big diffrence in stock market.

Mutual funds do that right? Growth funds.

There is correction in this chapter, please do the needful

\”This is good Rs.13 or 21.7% over Rs.60\”

should be

\”This is good Rs.173 or 21.7% over Rs.60\”

Checking on this.

Hello Karthik Sir,

I have a FeedBack:

Add Next and Previous Buttons at the end of each Lesson

Will share the feedback with the team. Thanks.

Very informative modules, Karthik. Keep up the good work!

Happy learning, Sohail!

Can I pledge Tax free bonds for collateral margin.

Is studying all other Modules necessary for personal fin.? I\’m kind of more interested in personal finance and I\’m 20,tho graduating in commerce, please enlighten me sir!!

Not really. You can start directly with the PF module.

Compounding is not directly applicable to mutual funds and stock market investments because rate of gain is not constant every year and sometimes there are even losses. Something I learnt recently.

Thats right, Pulin. Compounding as a concept works best for FD. Thing with stock market returns are that its volatile 🙂

Please compile all the chapters of Personal finance & make it comprehensive module like you have made other modules. Also request you to add the remaining module in varsity app.

Its compiled into a single module right? Will feature this in-app by next month.

I understood the concept of compound interest but I\’m not getting where should I invest for tat compound

No separate investment as such. You let the original investment continue and it will take care of compounding.

Sir I\’m still confused. If we let our positions continue untouched, our principle amount remains the same and gains are purely in accord to simple interest right? Compounding is gains on gains so how will that work if we just hold a stock for say a period of 20 to 30 years.

Returns are always on the present value of the investment. So it keeps getting added.

Are profits from stocks automatically reinvested in zerodha or do we have to liquidate our holdings each year and reinvest that money ourselves to see the compounded effect? Please reply.

Instead, you can let your position continue and not liquidate anything.

Thank you so much. I\’ve following your every module. It is wholesome. I was thinking of doing ncfm stock market certification but I don\’t think. I need it anymore. You explained every topic. Yes I hope you upload more topic zerodha varsity app. And keep writing blogs.

Thanks, Abhay. Hope you will continue to enjoy learning on Varsity!

Hi Karthik,

I tried many times but unable to find the resource/information on Inflation-forecast. Could you please provide information where we can get inflation details.

Its a very complex task to estimate inflation, Mohan. I\’m not sure myself.

I will use personal finance module as my reference but I need to come to the website every time. Could you please share a soft copy of this module.

We are working on it, Mohan.

will you please send me pdf of all finiancial modules

No, these PDFs are available online, you can download the same.

Thank you Sir for this well-addressed documentation. I\’m able to learn many things in a very simplistic manner.

Happy learning, Asit!

hey..why there isnt any option to download pdf for personal finance module.

That is because the module is not complete, it will be published once the module is complete.

You explained in one of the previous comments about compounding with example how 100 becomes 120 next year (if 20%) and then 120 becomes the \”base\” for next compounding and so on. How does it becomes the base? When does it happen?

Thank you sir.

This works in the context of FD, Varun. But can\’t expect the same with respect to stock markets as the returns are lumpy and cannot be timed.

I wanted to know how does compounding work in stock market? For example in Zerodha? Does my stocks get compounded?

Does the gains of year 1 get reinvested for year 2? And when does it happen?

I heard the money also gets compounded into negatives/loss if the company is going through losses.

Please explain thank you.

Nope, compounding as a concept is generally referred to in stock markets, but it wont work as it would in FD. In reality, stock market returns are lumpy, where in the bulk of returns is generated in few years and the rest could just be a drag.

Sir, There is no PDF to Download for this Module 11 Personal Finance.

Can you Please Share that.

Can you make a charter for Every Downloads/Attachments in a Single Sheet/Charter for easy accessibility.

PDF will be uploaded after the module is complete, this is still work in progress.

please update new chapters in varsity app (google play) also

We will do the same soon, thanks.

\”Here is something I want you to pay attention to. If you notice, it took 4 years for the money to grow from Rs.100 to Rs.207 (about 107% return in absolute terms). However as time progressed, from the 7th year onwards the acceleration of growth increased and it took only 3 years for a similar return of 107% to be generated (from 298 to 620).\”

After readig this, I am doubting your financial literacy. Doubling time remains constant given that interest rate remains constant. 298 to 620 also took 4 years. Should I invest my time reading this further?

Hey Mayank, that was a slip-up. I guess I have wrongly communicated the idea. I\’ve been meaning to correct it, but somehow I didn\’t. Doing it now. Please do continue to read, if you spot anything else that is wrong, I\’ll be happy to correct, while I hope you don\’t 🙂

Think of it as helping a much larger community visiting the page to learn. Thanks.

When will the PDF be released for the Personal Finance module?

Once the module is complete.

If you notice, it took 4 years for the money to grow from Rs.100 to Rs.207 (about 107% return in absolute terms

Sir how you calculated this absolute returns can only be calculated for year but how 4years

Avi, use this formula —- Ending value – starting value / Starting value.

Hi Sir, How can we download PDF file of Module 11 : Personal Finance. Thanks!!

This is work in progress, will upload when the module is complete.

Where can I find the all-in-one pdf book format pls?

We will upload the PDF once this chapter is complete, right now this is work in progress.

Karthik – you have written an article on compounding. You explain the benefits of compounding. But your example is incorrect – several commenters have mentioned the problem, but you have not corrected the text and do not seem to understand the issue. The growth rate, a multiplier of (1+interest rate) is the same for every year. If the money doubles in 4 years, it will always double in any 4 year interval. The absolute return is over 100% over any four year interval. It is not possible in your example, for the absolute return to exceed 100% in three years.

It is better that you fix the text, and avoid confusing readers.

Ashok, yes, I do get this. Thanks for correcting me. I\’ll review this in the coming week and fix, as I\’m travelling and have limited access.

Your example in compounding – that initially the money takes 4 years to double, and later on takes just three years – is incorrect. The formula you use (amount=principal*(1+interest rate)**time period) will show the same growth rate over any three year period.

But its not the growth rate, I \’m referring to the absolute amount of money.

Where can I get the PDFs of these from?

PDF is not available for this module yet.

\”However as time progressed, from the 7th year onwards the acceleration of growth increased\”, this is not correct. If you start counting from any point in time during the whole 10 year period, the time taken to gain some x percent of the amount at the starting point should always be the same (given that the intrest rate is same).

What I mean to say here is the acceleration of wealth accumulation.

I\’m not sure who the author is, but they made a big mistake & have confused the readers. @Karthik Rangappa you have been active on this comment thread so I\’ll direct this to you.

In the Compounding Effect sub-heading, it\’s stated that by Y4 the net growth is 107%, but from the Y7 to Y10 again the growth is 107%. The data used for the second statistic is incorrect, since amt. 298 is corresponding to Y6 & not Y7. Also logically even in compound interest, the net % growth is fixed once the CAGR is fixed, independent of the time period of observation.

Kindly correct the error.

I\’m the author, Abhijeet. Let me recheck this.

Hello Karthik,

Thanks for the incredible body of work on Varsity.

In the example explaining Compounding Effect, I think there is an error.

It takes 4 years for 298 to compound to 620 at 20% annual. Not 3 years as written.

Thanks, let me re-look at that.

From 298 to 620, it takes 4 years, and not 3 years

298*1.2*1.2*1.2*1.2 = 618

Let me recheck.

Can you give me the PDF link to this module. Why can\’t I see this module in varsity app

This module is still work in progress. Will be updated once done.

why this module doesn\’t have download option

As soon as it\’s complete.

Hi Karthik,

Thank you for this valuable information.

I am 30 years of age, I wish I would have started SIP when I was 25. Now, can I compensate the years lost by investing a few lakhs at once via flexible SIP and then monthly some X amount?

As the market corrected to almost 3 years low, the cost of NAV is low. I personally feel this is the good time to buy few lost years by investing a few lakhs.

For example, if I had started a SIP back in 2017 for 10k . By now I would have invested almost 4 lakhs. What if I decide to invest 4 lakhs at once to begin by SIP with and then 10k for every month for next 25 years. Will I get same compounding effect as if I had started investment back in 2017?

Please correct me if I am wrong.

This is the only way to compensate for lost years 🙂

You have to invest as much as possible and then keep SIPing every month. Good luck!

Need PDF copy of Innerworth — Mind over markets & Personal Finance.

Will be available once the module is complete.

Here is the link to file – https://drive.google.com/file/d/1AcM2mWiLFHXFc4ANDR2BGpyrZl5ZmKVz/view

Please do share your thoughts on this. I have stretched it over 30 years period, though the maths behind it remains the same, so it doesn\’t add value to test it over a longer period.

Ah, I see your point. This is because we have assumed a 20% constant return, so this is intuitive.

Hi Karthik Sir, thanks again for this module. I believe there is a small correction needed in this chapter- you have mentioned that \”However as time progressed, from the 7th year onwards the acceleration of growth increased and it took only 3 years for a similar return of 107% to be generated (from 298 to 620).\”

I did calculate this in excel and even in your graph, it is visible that the return of 107% is in every 4 years. If we are taking all the variables as same, the 107% return is what we get after every 4 years and that period can\’t be shortened.

Let me know your thoughts on this. There is no option to attach excel file here, otherwise, I would have shown you my working.

Can you try uploading on Google drive and share the excel? Also, try extending this across 20 years and see if you overserve the same.

Hii sir,

Now it\’s free time please can you make pdf of module 11 and 12 we can read it and share in this free time. And the reading is so simple and so I says to you that please upload the pdf and if you completed the book then you could upload the pdf.

If you see this message then please reply.

And thank you soooo much for your knowledge sharing.

PDF for module 11 will be available once it is done, we wont publish the PDF for 12.

Firstly, I\’ve been and continue to be a big fan of your work, Karthik.

The doubt for me regarding compounding effect is this – The way you have defined about compounding suits well when companies share prices grow linearly, which is not the case in reality. Say I go long on a stock for the long run. After a few years, say if I knew (economic trend like Covid-19) a bear market is ahead, I could maximize profits, by swing trading where I could short in the near term till the bear market ends and reinvest the profits made in the swing trade to stay invested without having to infuse fresh capital from pocket.

Guess this quote summarizes my doubt- Bulls Make Money, Bears Make Money, Pigs Get Slaughtered!

Do you say to be a pig (metaphorically) and irrespective of the market noise make wealth in the long term?

My question is that isn\’t the optimal behavior for a good investor is to leverage buying/selling opportunities due to market breakers like COVID-19, 2008 crisis, or a long bull run and use the profits made during these times as additional capital to your initial investment.

Of course, it does. These profits get ploughed back to your overall capital and as the wealth increases so do the growth rates. End of the day, the colour of the money is the same, does not matter where it comes from (long or short)!

Hello Sir,

I wanted to clear regarding compounding effect. We invest 100 in year 0 and get a return of 207.3 in year 4, taking 4 years to get the 107% return. We get a return of 298.6 in year 6 and a return of 619.2 in year 10. So it takes 4 years only to get 107% return. How did you come to 3 years?

Check this – https://zerodha.com/varsity/chapter/mindset-investor/

Sir…

Some saving schemes giving interest with quarterly compounding….

Is there any other formula for that to calculate final return after a certain tenure?

Hmm, it can be tough to calculate without understanding the scheme fully, Syam.

Dear Team

The educating material provided by you guys is amazing, crisp and concise.

Keep up the good work!!

P.S. – When can we get the PDF of Module 11 and Module 12?

Waiting!!

Glad you liked the content, Saurabh. The PDF will be made available when the module is complete

Sir will liquid funds and debentures topics will be covered in this module after mutual fund chapters

Yes, from the next chapter onwards we will start discussing the debt funds, within which the liquid fund is an important element.

Ok. The module is not finished yet.

Very informative. Need a pdf copy for print-out.

PDF will be available after completing the entire module.

Is PDF for the last chapter not available?

The PDF will be available once the entire module will get completed.

Hi Karthik, Namaskara.

Let me congratulate you and appreciate your effort in educating people with financial literacy. Unfortunately in our education system such things are not taught at early stage.

I have a very fundamental and humble question. Me being in the timeframe where I am going through\”midlife crisis\”. Stuck in the vicious cycle of \”job-job security-salary-liabilities\”. In such situations can a person like me make a living with these stocks, MFs, derivative trading etc. If yes what\’s the league that I have to play with.

Appreciate your candid and factual advice.

Best regards

Raj

Thanks for the kind words, Raj.

The straight forward answer is – no. Trading income cannot substitute your business or salary income unless you have a large amount of capital specifically designated for this. This also means you have \’other\’ capital to take care of your lifestyle and family requirements. Since this is a tough ask for most of us, trading and investment income can only complement our salary. Its very hard to replace a salary/business income with trading income.

I got it. Sir

You are the best teacher I have ever seen…

Lol 🙂 as long as you enjoy reading 🙂

Sir, it means reinvesting can done only by dividends? Becoz if I stayed invested in stock it won\’t be reinvesting it will grow in linear way….? Compounding means profit on profit right? I understood about dividend no issue.. About share still Little confused… Help me regarding and sorry if I bother you…

No Mayur, equities is not about the dividend play, it is about capital appreciation. For example, you invest 100 in stock this year, next year it grows to 120. The year 3rd year, your base is 120 and not 100. So your money grows with a higher base. That\’s how compounding works wrt equities investing.

please tell me, process of reinvesting with example. I am damm confused about it from last year I didn\’t get my answer from anywhere? hope you will help me… Please

I hope my reply to your previous query helps.

Respected Sir,

i understood compound interest very well, its a 8th wonder as a said by the albert einstein..

but can you tell how it work for share market , compound interest means reinvesting the INTREST again, ok i got it?

so do i have sell share of company which i bought at lower and sell at high and whatever profit i got, have to reinvest again and buy that share again annually but big investor says think long term? so can you tell WHAT EXACTLY i have REINVEST? and hoplease help me regarding this question?

Mayur, in the context of the stock markets, you have to stay invested in the stocks and let the stock accumulate its capital gains. You can even buy the stock from the dividend you receive from the company.

Hi sir

Only three modules are uploaded on varsity Android app

Eagerly waiting for fundamental analysis module to get uploaded and to give the tests.

I know, Prateek. Over the next week, we will upload the Options module, followed by the FA module.

Sir thanks for the reply. I\’ll look into CFA programme. Can you tell me what blogs or websites you regularly use to keep yourself updated with markets and economy? It\’ll be greatly useful. Thank you.

For now, I\’m looking at Capital Mind and Finception – https://finception.in/

Hello sir. I am a newly minted CA and I am very much interested in getting into capital markets and Investment Banking, thanks to Varsity. It has been a great learning experience for me outside of academics. My question is, CA are generally not preferred by IBs and AMCs. What skills do I need to develop on my own to be a good candidate for IB? What are the core skills needed? Thanks for the great work you are doing by spreading financial literacy.

Being a CA adds a huge value especially if you want to get into the asset management side. I\’d suggest you look at CFA certification, I guess with both CA and CFA, you\’ll be on a great track.

I think what Chidambaram was saying is that, it takes the same 4 years (not 3 as mentioned in the post) for the return to grow from 298 to 620, as it did to grow from 100 to 207.

Ah, true if you count the base year.

Hi Sir,

towards the starting of seventh year Rs. 298.5984 is the amount present and towards the 10th year end its Rs.620. Hence absolute return is 107.36 only. same is applicable throughout the term invested, when you calculate for 4 years duration.Kindly check

Absolute return is about 330, right? i.e 620-298?

Hi Sir,

You have mentioned that \”Here is something I want you to pay attention to. If you notice, it took 4 years for the money to grow from Rs.100 to Rs.207 (about 107% return in absolute terms). However as time progressed, from the 7th year onwards the acceleration of growth increased and it took only 3 years for a similar return of 107% to be generated (from 298 to 620).\”

But as per my calculation, when Rs.100 is invested at 20% CAGR the obsolute return remain same for the same period throughout the term invested.Please help me to understand. Below are my calculations:

Year Principle intereset A=P+I Obsolute return for 4 yrs [ formula used-(A-P)/P*100 ]

1 100 20 120

2 120 24 144

3 144 28.8 172.8

4 172.8 34.56 207.36 107.36

5 207.36 41.472 248.832 107.36

6 248.832 49.7664 298.5984 107.36

7 298.5984 59.71968 358.31808 107.36

8 358.31808 71.663616 429.981696 107.36

9 429.981696 85.9963392 515.9780352 107.36

10 515.9780352 103.195607 619.1736422 107.36

I\’m unable to get your calculation. Can you put this up on excel and share the link?

Thanks very much for replying.

Welcome, Yusuf!

Recently watched your video with smallcase but didn\’t understood what\’s the worst advice given to you sir , can you please elaborate that. Thanks.

Someone asked me to invest in Suzlon, Yusuf because it is supposed to be a \’deep value\’ stock. So I jokingly said that that was one of the worst investment advise 🙂

Hi karthik i had completed my pg in finance and having intrest in the field of markets.recently i had Passed NISM modules with help of varsity.what are the some good jobs to apply.Required skills for the future .

Yogi, I\’d suggest you look for jobs on the Asset Management side.

Karthik I read an article saying that companies have pledged their shares as a result of their share price falling down a certain limit and margin calls were triggered. Can you please explain what it means? How does a company get margin calls? Thank you.

Nithin, promoters of companies pledge their shares to raise funds. The companies lending them the funds will give them based on the condition that they service the loan without any defaults. However, if the promoters default, then the lenders have to right to sell the shares and make good the money. When the lenders start selling the shares in the market, the stock price falls.

Sir I owe a lot of my trading success to yourself and Varsity. Thanks to you I have been taking trades based on TA and Momentum. The results have been as expected if not slightly better. Thanks a lot again for that sir. I wanted to know what are the newspapers, magazines and blogs that you read to keep up with the news? Would you give us the exhaustive list of all the resources that you use? Thanks.

I\’m super humbled to hear that, Sundeep. I guess it all boils down to your own discipline in the end. Hope your success continues 🙂

I occasionally read stuff on ET/Businessline. Most of the news these days if from Twitter 🙂

for compound interest you said..

Principal *(1+ Interest) * (1+Interest)

The green bit is the amount receivable at the end of 1st year, and the blue bit is the interest applicable for the 2nd year.

We can simplify the above equation –

= Principal *(1+ Interest)^(2)

= 100,000*(1+10%)^(2)

i guess \’The green bit is the amount receivable at the end of 1st year\’ as per calculations is 110,000 and not 100000. pls help ,i could be wrong!!

Yes, 1.1L is the amount receivable at the end of 1st year, provided you wish to withdraw the funds.

Sir, could you tell me the options to get the 12% ROI mentioned in the module without risk? If not 12%, what is the highest ROI I can get in India?

Darshan, the highest risk-free return in India is about 6-7%, from the bank\’s fixed deposits schemes.

Sir, I have been doing the SIP in the mutual funds on regular basis till I reach my goal. I would like to ask you that how should I exit from it, whether to take out all the money from that scheme at once or should I take the small amount of money on the regular basis ?

It depends on your requirements, Prashant. If you don\’t have an urgency to pull funds, then stay invested. If you need it over time then withdraw small amounts on a regular period of time (this will also ensure your money stays invested for a longer period). Finally, if you need funds urgently, then you have no option but to withdraw the full amount at once.

Thanks a lot sir … I came across Zerodha Varsity when I was searching about F&O. I really loved those 3 modules and doing some paper trading in options now. You are a great teacher and thank you for putting up these awesome contents.

Hey Vikas, I\’m glad you liked the content on Varsity. Happy reading 🙂

i taken data 10 minutes time frame for 60 days in excel i got nearly 1640 cells .

correlation bpcl vs hpcl 0.72

but, density curve reaches to 0.000234 below or 0.99986 above near to 1

my question was what is the differences between collecting data for 2 years and 10 minutes time frame for 60 days ?

which one should i need follow ? sir

Dear karthik,

I recently entered in stock market (since 30 may 2019) by opening account in zerodha only because it allowed online opening.

Then i use marketgurukul app videos as my guide and started intraday trading .

But since market gurukul \’s edwardji is npt available anymore. Don\’t know where he went, hope he is fine.

There are many queries in mind when We trade in share market, so i used varsity as my guide. And since last 20 days i am reading constantly your all module step by step and benifits greatly from them. Even managed to increase capital by 2%.

I always wanted to know about personal finance and by the grace of god you started this module .

I have a query how can i calculate my future expense on child education etc. Tried googling it but it always give link to various financial product .

Kindly post any formula about it,

Also if you have any blog about financial freedom kindly share it .

Again many many praise to zerodha and you for making trading and investing safe and happy.

,🙏🙏

I\’ve met Edward a couple of times, I hope all well with him.

I\’m glad you liked the content on Varsity, Ashish. Yes, budgeting for a future financial event will be a critical component of this module. I will surely discuss this.

Hey

It\’s really helpful and easy to understand 🙂 excellent initiative.

Wating for IOS app. (When are you launching?)

Thanks!

Thanks, Zaid. Happy reading 🙂

Tell me one thing , why do you guys do it for free , just curious ,( pleasse dont make it paid after reading this comment ) i just want to know the reason thats all !

Shiva, we believe in good Karma 🙂

Sir,

Your teaching skills are god level.

Lol 🙂

I hope you found the content easy to understand! Happy reading, Jaydip!.

Simple and easy to understand.

Glad you liked it Vivek. Happy reading 🙂

Karthik,

Thanks for this Personal Finance module. This chapter will be really helpful for the people who wants to understand the effect of compounding…

i think there is a typo

Under section 2.4 Compounding effect

Withdraw the profits of Rs.2 —> It should be 20 instead of 2

Thank you again 🙂

Ah, will fix that Dilip. Thanks for pointing it out.

Hey Karthik,

What happened to the Financial Modelling module?

We will try and put this up next, Ram.

Hi, do u publish all your modules as a book. Definitely its a must read book with full of learning and knowledge. I have almost read. But I would like to keep it for any time quick reference and learning. Anyways? Thank You.

Santhosh, unfortunately, n physical book. We have a PDF though which you can download.

suggest some books for good financial literacy related

Varsity itself 🙂

good initiatives basics but some times we forget basics and make investment complicated.

Thanks, Sushil! Happy reading!

sir next chapter ?

Hopefully next week or so.