8.1 – The Mutual Fund world

In the previous chapter, we set up a hypothetical situation that helped us understand the concept of a fund and how it gets managed. We discussed the idea of ‘pooling of funds’ to invest in the market with a common purpose. I agree we oversimplified the previous chapter, but that’s ok as the objective at this point is to understand the fund structure and the way it serves its investors.

I also hope you are clear about the concept of ‘Net asset value or the NAV’. The mutual fund NAV or the mutual fund unit is an elementary concept, and I hope you have no confusion about this. If yes, I would urge you to read the previous chapter once again.

We will, in this chapter, take that conversation forward and look at one of the most crucial documents from a fund house, i.e. the Fund fact sheet. The factsheet is a document that puts up all the information related to a fund/scheme. By and large, everything that you need to know before investing in a particular fund is available in the fund fact sheet. In this chapter, we will look at fund factsheet and figure out how to read and understand the same.

Before we get to the fund’s fact sheet, I think it is essential to get a grip on how wide and deep the Indian Mutual fund industry is. The discussion will help you understand the length and breadth of the mutual fund industry –

So here are necessary details for you (as on July 2021) –

The number of fund houses – 45. These are the number of mutual fund companies who have obtained the AMC license from SEBI. Example: Kotak AMC, HDFC AMC, ICICI Pru AMC, Axis AMC, DSP etc.

The number of scheme – 1510. Each fund house (AMC), can run multiple schemes for people to invest. For example, Nippon AMC runs 145 different schemes, probably the highest in the industry. SBI AMC runs about 144, ICICI Pru AMC manages around 143 schemes. A scheme is a fund with a specific investment objective, more about this when we dig into the factsheet.

Money managed by AMCs – 35L Crore. This is the aggregate amount of money managed by the entire mutual fund industry (across all AMCs). For example, SBI AMC, which is one of the largest AMC, manages about 5.23L Crs. Axis AMC, on the other hand, manages about 2.08L Crs. Yes AMC manages about 81 Crs. This money is coming in from retail individuals and corporates. Out of this 35.15L Crs, roughly 18.85L Cr is from retail investors like you and me, and about 16.30L Crs is from the corporates

The number of unique Investors – 2.39 Crs Indians. This is the number of individual investors investing in Mutual funds schemes across all the AMCs.

Again, these are good to know numbers to put things in some perspective. You need not have to know these numbers if your objective is to invest in the markets via mutual funds.

8.2 – The fund factsheet

An asset management company (AMC), manages and runs a mutual fund scheme. An AMC can run many schemes as long as they have SEBI’s approval for it. A mutual fund scheme is essentially a fund with a specific investment objective. An investment objective is the stated goal of the fund. For example, the investment objective of a mutual fund scheme could be an investment in the top 100 large-cap companies in the country or it could be an investment in the top 100 small-cap companies, so on and so forth. The investment objective is stated at the inception of the fund, and the fund manager is expected to stick to this mandate until the life of the fund.

So let us pick a fund fact sheet and dig into what information is available to us. Let us start with Kotak AMC.

By the way, I’ve randomly selected Kotak AMC, please don’t consider this as a recommendation of any sort 🙂

I can go to AMC’s website to find the fund’s factsheet. Here is the snapshot of the same –

As you can see, there are many different tabs right at the top – Equity, Tax Saver, Hybrid, Debt, Liquid etc. These are all different categories of funds. Over the next few chapters, we will understand what each of these categories means and what to expect from investments made in these categories. For now, let us stick to ‘Equity’ as a category. As you can see, there are many different funds/schemes under Equity as a category. Let us pick ‘Kotak Small Cap Fund’ and see what goes in the fact sheet. Click on the link, and you will find the fund’s factsheet. In Kotak’s case, they call this the ‘One Pager’. Fair enough.

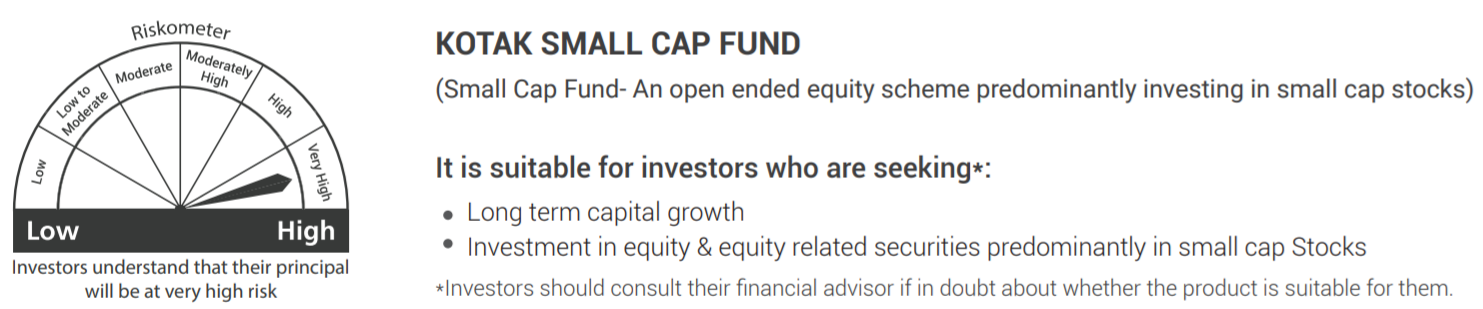

SEBI has mandated that the name of the fund should be indicative of what the fund is like to do. So moment I read, ‘Kotak Small Cap Fund’, I know that this is a fund which focuses on small-cap investments.

I’ve downloaded the fund’s one-pager, and here is the very first page –

The introductory paragraph gives us information on the stated objective of the fund. As you can see, the stated objective says ‘Kotak Small Cap generates capital appreciation from a diversified portfolio of equity & equity-related securities by investing predominantly in the small market capitalisation companies across sectors’

From this, we can infer –

- The fund manager intends to have a diversified portfolio; therefore it is not focused on a specific sector

- Investments are in Equity and equity-related securities. This is mainly stocks

- Investments are predominantly in the small market capitalisation companies, which means as the fund name suggests, they look at investments in the small-cap company

- The second section talks a bit about how they intend to research these small-cap stocks. Frankly, this should not be of concern to you. I mean think about it – if you knew what to look for when investing in a stock or if you had an opinion on what makes a good stock, then you are better off investing in the stocks directly right? Why mutual funds at all?

But since the information is any way out there, here is a sneak peek into their research methodology –

- Look at the integrity of the promoters – necessarily ensure they are not scammy

- Ability to generate cashflow – meaning they look for companies that are operationally profitable and capable of producing a surplus over all the expenses

- Experience of market cycles – ensure that the company has survived through the test of times and has proved its resilience

- Simple business model – No complicated verticals and easy to understand companies

- Quality metrics – This means that all the financial ratios tick right

- Business quality – Good quality business I guess 🙂

- Low leverage – Companies with very little or zero debt

Now, I can decipher this because I belong to the same industry. However, most of the investors cannot read through these terms, and frankly, as I mentioned earlier, you don’t have to worry about this.

8.3 – Other fund facts

The fund fact sheet presents a lot more interesting data points. We will also use this opportunity to understand some of the key jargons used in the mutual fund world. Here is the snapshot for the fund’s other facts –

The initial section is the investment objective, which we reviewed earlier, so we will skip this section. The next thing you can notice is the benchmark of the fund. A mutual fund scheme should essentially benchmark itself to an index. This is required to evaluate the performance of the fund over a period. A mutual fund should have the appropriate benchmark. For example, a small-cap fund is benchmarked against a small-cap index, as in this case. It is almost mis-selling if the benchmark is not appropriate, for example, a small-cap fund being benchmarked against a large-cap index. To put this context, the performance of a family car such as Wagon R should be benchmarked against another family car such as maybe Swift, and it would be futile to benchmark it against a Ferrari.

The next section details the type of scheme; there are a couple of exciting things to note here. The type is– Open-ended, equity, growth scheme. There are three critical parameters here; let us understand what it means.

Open-ended – When an AMC starts a fund, they have the option to let that fund run for either a fixed period or keep it going forever. For example, I can start a fund today and let it run for three years from today, at the end of 3rd year, the fund will cease to exist, and the investor is obligated to collect his money back (along with the profit or losses). Funds with such defined time are called a ‘closes ended fund’. If a fund does not have an expiry date, then it’s called an open-ended fund. For all practical purposes, its always good to deal with an open-ended fund

Equity – This is a reference to the asset class the mutual fund invests. Equity, as you know, refers to the shares listed in the market. Another asset class is debt, which could be either corporate debt or PSU debt. More on this when we deep dive into debt funds

Growth – Let us skip this for now. We will discuss this in a bit.

Apart from this, this section also details a few other things –

Fund Manager – I find this interesting to know who is managing the fund. I do a quick google search to know his background and his past performance. After all, he will be responsible for managing our hard-earned money, so it makes sense to see a bit about his background

Allotment date – This is the date from which the fund commenced its operations. The allotment date gives you a sense of how old the fund is. It is not that it matters, but the older the fund, slightly easy it gets to analyse vis a viz a new fund.

The next section deals with ‘Plans & Options’. Under plans, there are two variants –

Regular plan – This is interesting. Think about a farmer growing onions. He nurtures the onion saplings, waters it, weeds it, and eventually harvests it and gets the onion ready for consumption. Let us say the cost of the onion is about Rs.30/- per Kg at this point. An intermediary now acts as an ‘agent’ and delivers the onion to people like you and me, and we, in turn, pay him Rs.40/- per Kg. The delta (Rs.10), is what the agent earns. Now replace the farmer with the AMC, the onions with a fund/scheme, and the agent as a mutual fund distributor. The mutual fund distributor is like the middleman between the AMC and the investor. If a mutual fund distributor approaches you and sells you a mutual fund, then he is selling you a ‘regular plan’, which means he is entitled to receive a commission from the AMC for selling this fund to you. There is nothing wrong with this, except that the money is going from your pocket.

Direct plan – Now you don’t need to buy the fund via a distributor. If you know which fund to buy, capable of doing your mutual fund research (which by the way is the end objective of this module), then you can buy that fund directly from the AMC. When you buy directly from the AMC, then there is no distributor involved; hence the distributor commissions are not paid, which means you save on commissions, which naturally means a better return on your investment.

Just to let you know, when you buy mutual funds via Zerodha, you are buying a direct plan; hence you will enjoy a better return. We will deep dive into this topic later in this module, but for now, remember when you invest in mutual funds, opt for a direct plan as you will save on commissions and therefore enjoy the better return.

The other bit in this section is about the option. As you can see, this fund has two options –

Dividend payout – Think about it, when you buy a stock of a company and the company issues a dividend, then as an investor, you are entitled to receive these dividends right? Likewise, when the fund manager buys the stock of a company, and the company issues a dividend, then the AMC receives this dividend. Since the funds with the AMC belongs to the investors, this dividend belongs to the investors. The dividend you are entitled to obtain from the AMC is to the extent you’ve invested in the fund. The AMC gives you two options – you can withdraw this dividend, or you can choose to reinvest the dividend amount and buy more units of the fund. The dividend payout option helps you withdraw the dividend as and when the dividend gets paid. This option is now called the “Payout of Income Distribution cum capital withdrawal” option.

There are technicalities here as to how the AMCs issue dividends. We will discuss this at a later point.

Dividend reinvestment plan – This plan receives the dividend on your behalf and reinvests the dividend into the same fund. So necessarily, you don’t get the dividend in the form of cash, but instead more units or NAV of the same fund. This option is now called the “Reinvestment of Income Distribution cum capital withdrawal” option.

Growth plan – In the growth plan, the investor does not receive any dividends. The profits earned are ploughed back to fund and therefore the ‘compounding effect’, works well here. I personally prefer this plan over the other two.

Next up is the SIP details. SIP stands for ‘systematic investment plan’. In a typical SIP, you will invest the same amount of money every month for as many years as possible. Example of a SIP is investing say Rs.5000/- in Kotak Small-cap fund on 5th of every month for as many months as possible. Think of SIP as investing in instalments. SIP is perhaps one of the most significant financial inventions and has many merits to it. Given the importance of this topic, I think a separate chapter on this topic is justified, and we will do that at a later point. For now, think of SIP in its basic form, i.e. to invest a fixed amount of money every month in the same fund for many years.

As you can see, you can SIP on Kotak Small-cap fund, but for that, the AMC has specified that the minimum SIP amount every month is Rs.1000/- and the minimum number of months is six.

The next section talks about the initial minimum investment in the fund. This is self-explanatory, if you choose not to SIP, then the minimum amount to invest is Rs.500/- and Rs.1000/- for the monthly SIP.

The last section of the fact sheet talks about the load structure of the fund. There is a mention of few terms here like the SIP, STP, switches etc. We will club all these in the SIP chapter. For now, let’s talk about the ‘load structure’.

The load structure is essentially the amount of money, in percentage terms; you will have to pay in case you wish to withdraw from the fund. As you can see, there are two types of load structure –

Entry load – This is no longer applicable. However, years ago, you’d have to pay a percentage for investing your money in a mutual fund. I guess AMC’s have to mention ‘entry load’ as nil for legacy reasons.

Exit load – This is the amount of money you will have to pay at the time of withdrawal. As you can see, there is a 1% load if you wish to withdraw before the completion of 1 year and no-load post that.

8.4 – Riskometer

Every AMC is supposed to self-asses the riskiness of the fund and lets the customers know about this. The self-assessment is something that SEBI mandates to avoid cases of the misselling of the financial product. For example, a small-cap fund should not be packaged as a low-risk fund and sold to the investors.

Here is how the AMC does a self-assessment of risk –

The needle of the riskometer points to ‘very high’, meaning that the Kotak Smallcap fund is risky. The text next to the riskometer reiterates this. Now, agreed this is a risky fund, but that should not stop you from investing in risky funds.

Remember, the antidote for ‘risk’ in the mutual fund world is ‘time’; hence the longer you stay invested in a mutual fund, the safer it gets.

More on this in the next few chapters, so stay tuned.

Key takeaways from this chapter

- The factsheet of a mutual fund details all the essential parameters worth knowing about the mutual fund

- The investment objective of a fund is essentially the guiding principle for the investment the fund manager makes

- Open-ended funds don’t have an ‘expiry’ for the fund. It can go on forever

- Close-ended funds are time-bound

- Regular plans pay out distributor commissions, hence lower yield to investors

- The direct plan does not pay distributor commissions; hence the returns are higher for the investor

- The MF investor can choose to receive or reinvest the dividends

- Riskometer is a self-assessment of risk by the AMC

Hello kartik sir , Aditya here , sir i had recently messaged u regarding whether or not i should do TA now and u suggested me to focus on long term trades now and short term could be done at a later point in my life, so sir as i am just 18 yrs old now should i study a bit about mutual funds and invest in them also ? rather than putting most of my money in long term stocks ( as i dont earn most of it is money that either my relatives gave or my parents )

Yes, I\’d encourage looking at MFs as well. These are long term oriented products, so makes sense to get your basics right 🙂

Nothing related to the topic, thanks for the free lessons sir. I only want to ask… Do you actually reply to all comments or do you have a team that takes this role? Because I\’ve seen you give replies to most comments since the last decade!

Thanks for the kind words:)

Yes, I do reply. Its a part of my daily routine now, and its been like that for many years now 🙂

Team replies to the queries for the modules they have written.

huge respect to u sir , getting guidance from someone like u will definitely help me brighten my future

Happy learning, Aditya! Wishing you the best 🙂

Hi Karthik, I\’ve got a doubt, In Zerodha Coin app, when starting a SIP in a mutual fund i get option to opt for AMC-SIP, and if opt for it, some features like step-up, pause etc will not be available. So my doubt is, apart from these will there be any difference in the expense ratio of the mutual fund as well? Basically, if I\’m going not opting for AMC-SIP, am I going for a regular SIP rather than a direct SIP and indirectly paying more charges?

On Coin, you get only direct MFs, weather you choose AMC sip or otherwise. So expense ratio remains the same.

Hello Karthik, Well I have a doubt. What\’s the difference between Dividend reinvestment plan and growth plan? I\’m a bit confused over these two.

Nothing much basically.

in dividend reinvestment plan: added units

Growth: utilise for funds

I the dividend reinvestmen, the fund declares dividends, but instead of paying them out to you, it reinvests them to buy more units at the current NAV.So, the number of units you hold increases, but NAV doesn’t grow as sharply as in growth funds (since some NAV is distributed as dividend).

Hey Karthik,

What is the difference between the growth plan and dividend reinvestment plan? (As both of them are using reinvesting)

How can profits be ploughed back into fund when they are unrealized?? (in growth plan)

Both are essentially similar. I\’d suggest you stick to Growth plan.

Hi you mention here that SIP deserves a chapter of it\’s own, can I know if that\’s written and posted? .

Thank you soo much, this initiative of having a varsity and writing such valuable, educative, great lengths of each topic. Heartfelt gratitude

Nitu, thanks. Not specifically, but we\’ve spoken about SIPs and when possible across all our platforms 🙂

Hi Karthik,

For a person like me who used to run away from reading anything related to finance because of the complex language at times, I am really grateful that everything on Varsity is so simple and comprehensible. Because of the ease to understand I have started developing interest in learning things about finance and now slowly and gradually I am working on better money management. Knowledge is power and I feel empowered as I am going through each concept neatly.

Thank you again and continue the good work! Financial literacy is so important for a country\’s growth.

Rupali, thanks so much for the kind words! I hope you continue to enjoy learning on Varsity. Happy learning 🙂

Helpful knowledge and written content feels better to consumer and learn.

Glad you liked it, happy reading 🙂

Hi Karthik.

First of Kudos to you and the varsity team on creating such a wonderfully crafted and easy to understand user content.

I have a doubt relating to the number of funds an AMC can float.In the video you had said that an AMC can run only one fund in any given category with no overlapping investment objectives, and in the PDF it is stated that ICICI PRU AMC runs 243 different schemes. Does that mean there are approx around 243 different categories of mutual funds ? Or is there something that I am missing here ?

Best regards.

Thanks! I fund under one scheme, Sumit.

Thank you, Kartik Sir, for this eye-opening fact of regular vs direct mutual funds. I am 23 years old, and I realize that I can save crores down the line by just changing my plan from regular to direct. Many thanks to you!!

Thanks. How much you save depends on how much you invest, but yes, you can save quite a bit 🙂

Hey Karthik, I love the Varsity content.

I want to ask about the difference between dividend reinvestment plan and growth plan.

Thanks Kanishk. They are essentially the same 🙂

Do I need to have two different accounts for Kite and Coin or only one account will work for both?

No, its the same account. No need to have two different accounts.

Sir that\’s why you personally prefer the growth plan over the other two.. am I right?🙂

Yeah, Growth plan works best for the full compounding effect to play out.

Sir, in the growth plan you said- \”The profits earned are ploughed back to fund\” but the only way for that to happen is to buy more units of that fund so doesn\’t that mean both growth plan and dividend reinvestment plan are essentially the same thing?

Not really, the reinvestment activity happens at the fund level, so it is tax efficient.

Hi , I have invested substantial amount in Mutual Fund either through SIP or Lumpsum . Now realised that all of them is regular i.e. Agent is there who takes commission

Two questions

1) How can I switch from Regular to Direct , is it possible without selling MF

2) When does this commission agent gets in regular scheme , when we sale or during investment time also

1) No, unfortunately, you will have to sell and buy back.

2) Depends on mutual funds, mostly quarterly payouts.

Hello Sir,

A couple of MFs I had purchased in the past I realised have been purchased as regular (purchased directly with the AMCs). I would now like to switch them to direct.

However I am puzzled. Since I purchased the funds directly in the AMCs portal (LIC and DSP in this case), I would expect them to sell them to me with the default option of direct, why sell them to me as regular. I am not sure I have received any special service with advise or suggestions having purchased them in regular plan, so why sell them as regular.

And if I switch to direct now, I believe the siutation is going to be the same (except the units price), or should I expect any changes while using the AMCs portal after switching to direct?

Thank you.

Ram, I get your point, but I dont have an answer. I think you should direct this question to AMC 🙂

But switching requires you to sell or liquidate regular and buy direct again.

It says growth plan is personally better comparing to the other two. But correct me if I am wrong, the dividend re-investment plan has both dividends and profits getting re-invested in comparison to growth plan having only profits being invested. So naturally, dividend re-investment looks better as it has growth from profits plus dividends?

Both are similar funds, Clayson.

in both the case, Dividend reinvestment plan & Growth plan the divident goes back into fund and you will get more NAV right. Can you explain lit bit more? or correct me if i am wrong

Yes, they work the same way.

Which of the following option of SIP will be best for better results:

Rs 2500/- each once a month or

Rs 500/- after every six days a month?

I\’d suggest monthly SIPs 🙂

Here is good example of difference between Reinvestment of dividend vs growth plan

https://www.etmoney.com/learn/mutual-funds/growth-plan-vs-dividend-reinvestment-plan-of-mutual-funds-which-is-better/

Typo on line 2 \”the longer you stay invested in a mutual fund, safer the investment is\”

Noted.

Hi Karthik,

First of all great work and wonderful writing, big kudos to that. I have a query, when you mention this statement \”the longer you stay invested in a mutual fund\”, does this mean if I stay in a mutual fund for 10+ years mostly will it result in a decent return meaning 7-8% CAGR/XIRR for Large cap/ Large-mid cap, the reason I am asking this is when I look at perfomance of this type of mutual funds, 10 year return seems to be good and I have not seen any fund for which the return is negative in my search. Is my understanding right or still could there be chances for risk to my capital after 10+ years?

Thanks, Baala. Yes, on a long enough time frame, MFs have not delivered a -ve return. But that does not mean it wont happen in the future, while I personally hope it does not 🙂

Sir,

What is the difference between \”Dividend reinvestment plan\” & \”Growth plan\”? I am unable to figure out.

We are putting on a post on this soon on social media; please do look out. But in summary, there is not much difference 🙂

Dear Sir,

Thank you for this wonderful material. However, I am not able to clearly understand the difference between Divident reinvestment and Growth plans. Please through some light on this

There is no withdrawal in growth plan, Nidhi. Whereas in dividend reinvestment, there is a withdrwal and reinvestment.

Okay, thanks Karthik…will have a look!

Sure, happy learning!

Hi Karthik,

Great work in explaining the various terms of the fund factsheet.

Can you please tell with an example what the difference is between dividend reinvestment and growth plans because in both cases investor doesn\’t get the dividends?

Hey Saurabh, I\’ve explained these in the chapter itself. Do check out the video series as well – https://www.youtube.com/watch?v=6sq2o1atWLY&list=PLX2SHiKfualGsjgd7fKFC-JXRF6vO73hk

Hi Sir,

How do we know that this is direct plan or not like you said zerodha is a direct plan we don\’t have to pay any commission, is there any specific way to check this.

Everything you see on Coin is Direct plan, Milan.

Hi Karthik,

Thanks for amazing content and for enlighting us.

1)If I opt for regular plan,the commision will be paid at every installment or will it be one time payble.

2)I am not getting exact diffrence between growth plan and Divudend reinvestment plan, can u elobarate it?

1) Every time you invest 🙂

2) They both serve the same purpose. Slight variation in terms of technicality. I\’d suggest you ignore the dividend reinvestment option and stick to growth.

I am very happy after reading your detail explained of mutual funds and there investment chapters. Really good info shared in easy understanding language with great examples.

Thanks a lot!

Keep it up support!!

I\’m glad you liked the content, Nikunj. Happy learning 🙂

Hey Karthik, really appreciate that you are giving such a wonderful knowledge to people for free where today many sell this content as paid courses.

Really thankful for you….keep up the good work.

I just have few doubts, would be grateful for the answers:

Q.1) I couldn\’t get much different between dividend reinvestment and growth plan….in growth plan do we get more units?

Q.2) In open ended scheme is there any exit load that is chargeable?

Q.3) Last, do exit load time frame of 1 year is for every scheme or it varies across different scheme.

Thank you…..

Thanks, Tejas. Glad you liked the content.

1) Both are same, Tejas, except for some slight change. If you have a long-term approach, I\’d suggest you opt for a Growth plan.

2) No

3) It varies, so do check the fund before you invest. But in most cases (EQ) its 1 year.

1.Sir the what\’s the difference stood between Dividend Reinvestment plan and the growth plan .. we are not getting dividend in any of them and doesn\’t compounding works well with the dividend reinvestment plan too coz we got more units without paying anything ?

2.what exactly happens when the investor opts for the gowth plan does the nav increses ??

3.then is the nav different for all of the options available ?

on note i\’d love to say i haven\’t seen a better explanation of the markets then what is available at varsity ?

Kudos to you guys ! 🙂

1) I\’ve explained this in one of the chapters. Basically DR, you get your units as a dividend, and in Growth that does not happen. Yes, compounding does not work well with DR, so dont opt for it unless you have a specific need for it

2) It increases in line with what the market does

3) Yes, that\’s right.

Thanks for the kind words 🙂

Very good

Keep in up

Dear Karthik Sir,

I feel like I was blind earlier, but after reading your articles, I have got vision. I can see and understand everything in the mutual fund world. Thank you so much to you and Zerodha. God bless you.

I have a query. Is there any way I can find out how much comission is being deducted from my SIP in a Regular plan?

Also how to switch from regular to direct? Thank you again.

Happy learning Virendra. It is hard to figure monthly commissions, but looking at TER, you can get an overall sense of commissions paid during the year.

Hi, I believe that instead of using a gendered pronoun like \”he\” or a \”she\” a more un gendered pronoun would be suitable to prevent any biases as to who a fund manager can be

Yes Sir. Have kept that in mind for all the subsequent chapters.

Hi,

I\’ve one question. Think of a small-cap fund for now and we know that it will have investments in the Small Cap stocks only, what would happen to the portfolio once these stocks turn out to be Mid Cap or Large-cap stocks will they exit, or if not then won\’t it be wrong since the fund objective is to invest in the small-cap companies only? Just curious to know.

Thanks

They need to stick to the mandate, which means they will have to exit companies that are not small-cap anymore and buy small caps again.

I am a starter, though a small investment (Rs.30000) made in a variety of equities ranging 1 share to 10. Due for retirement in 4 years and want to plan for post retirement from now on including period investments.

can you please inform how to go about it

Hari, never too late to start. Unfortunately, I\’m not qualified to advise, I\’d suggest you approach a financial advisor for this.

Hi Karthik,

As you mentioned in this article. Waiting for details about SIP,STP,SWP.

In Zerodha app/Coin in order to create a SIP if initial investment is 5000 and installment amount is also 5000,will my monthly installment 5000 or 10000 ?

It will be 5000 itself, not 10k.

Good content, as usual! However, the divident payout options could have been explained with more details.

Thanks Ajay. I\’ll take that as a feedback.

VARSITY is GOD for learning Stock market or Finance……

Happy learning, Dharmik 🙂

Hi Karithik.. This module is quite informative and forming a good basis of understanding MFs

Only thing I didn\’t understand was the exit load. The sheet mentions exit load of 1% if redeemed before 365 days. Is the 1% of the entire amount (investment+profit) or only on the profit?

Also, I had downloaded Varsity app on my mobile. However, modules 11 and 12 are not reflecting. It\’s still showing coming soon.

Harish, yes, 1% is on the amount you withdraw. Personal Finance module will show up in the app soon.

Quoting a paragraph from the page

As you can see, you can SIP on Kotak Small-cap fund, but for that, the

AMC has specified that the minimum SIP amount every month is Rs.1000/-

and the minimum number of months is six.

@Karthik Rangappa, if taking the SIP route, is it mandatory that I pay installments at least for six months ?

1) Does it mean I can stop paying installments after six months ?

2) What happens , say if I pay installments for just 3 months ?

Thanks Karthik for these educational documents.

Not really. You can keep SIPs for however long you can via Coin. But if you start a SIP via the AMC directly, then you need to maintain the specs.

1) Yes

2) I think there will be an exit load. This is AMC specific.

Happy reading.

I am rereading these articles to revise.

In this article, you have mentioned \”SIP is perhaps one of the most significant financial inventions and has many merits to it. Given the importance of this topic, I think a separate chapter on this topic is justified, and we will do that at a later point.\”

But I don\’t seem to find any chapter on \”SIP\”.

Am I missing something?

Ah, I must have inadvertently missed it. Will try and include this topic in Part 2 of personal finance.

Hi Karthik, thank you for all the modules and insights. Huge fan!

In this module, \’mis-selling\’ is spelled as \’mis-spelling\’. Request you to please take a look.

Thanks once again

Thanks, will do that Sagar 🙂

Hi,

Request you to further elaborate on the difference between (1) Dividend reinvestment plan Vs (2) Growth plan.

In both cases the dividend is invested back in the Mutual fund and investor receives additional NAV. So, what are the key differences ?

They are similar, not much difference. I\’d suggest you stick to growth

Hey! First of all, thank you for these modules. Being young, I realize how much I can invest in my future if I begin now 🙂

What is the difference between the Dividend Re-investment plan and the Growth plan? Aren\’t we investing the dividends in both cases into the Mutual Fund again?

Happy to note that, Bhavana. Hope you continue to learn from the module here. Both the fund types are similar. I\’d suggest you go with the growth type.

Hey Karthik

I didn\’t understand why the \’Growth Plan\’ is better than the \’Dividend Reinvestment Plan\’ as in both cases the dividends are reinvested to the fund back.

Pretty much, I dont think Div reinvestment options are as popular as Growth. I\’d suggest you stick to growth options.

You have enunciated the basic knowledge of Mutual Fund in such a practical way that even a layman if goes through he can develop confidence in the same. Each and every article is very informative and in detail. Although I had been using Zerodha for a long yet I got the article today itself and amazed to have the details available therein.

Happy learning, Deepak!

Hi Karthik,

If you don’t mind can you elaborate little bit on what the below means ? Terms like verticals are new to me so thought of asking about it.

“Simple business model – No complicated verticals and easy to understand companies.”

Verticals is basically a reference to different business interests for example, RIL has petrochem, ecom, Jio, edtech etc, these are all different verticals of RIL.

Looks like the dividend reinvestment plan and the growth plan are almost same by principal as of my understanding. Correct me, if I\’m wrong.

By the way, your articles are very helpful for people like me, who are in nascent stage of learning in MF.

Huge Thanks.

Thanks Naveen.

Yeah, they are kind of the same. I think you can opt for the growth plan directly.

Dear Karthik Ji,

Kindly accept my heartiest gratitude for sharing such wonderful information through these articles. Around 20 years back i read \” Rich dad, poor dad\” and started investing. In between i have read many books. But the kind of clarity your articles has given is more than many books combined. These articles combined can help a lot many people if in Hindi and other languages. I sincerely appreciate your work.

Ishwar aap par apni kripa banaye rakhe.

Hari Om,

Venkat Das

Thanks for the kind words, Venkat. I\’m glad you liked the content. Yes, we will translate the content in Hindi soon.

Just one newbie Question,

Suppose I\’ve started SIP in particular Fund Let\’s say Axis Top-Small 50

And that Fund life has ended so How I\’ll get my money?

You can redeem the same, Avdhut.

Sir, could you pls help in understanding the analysis of mutual funds of various types…like large cap , small cap and all..

I\’ve done that in this module, please continue to read 🙂

HI Karthik, its always good to me to read any chapter from Varsity.

I have a question as you mentioned in this chapter there are three modes to invest in a MF namely, Groth, divident plan and dividend repayment plan. As you told, growth plan dont distribute dividends and uses it to get more units of the MF.

Then what is the difference between the Growth plan & dividend repayment plan? Please explain in detail.

One request, please correct spelling for \”mis-selling\” for couple of times in this chapter. Please read it carefully, you will get the spelling mistakes.

Waiting for your answer 🙂

Viki, the only difference between Dividend reinvestment and Growth is that in dividend reinvestment, the dividend is calculated, and units are bought to that extent. WHile this does not happen in growth. For all practical purposes, Dividend reinvestment is not so useful, hence fewer and fewer AMCs are offering this option to investors.

Hi Karthik,

Could you elaborate a little more on the difference between Growth and Dividend re-investment options? Is the difference only in terms of tax for Dividend that is first paid and then re-invested?

Thats right. Dividend reinvestment means the units are sold and you are given the dividends. This does not happen with growth.

Why are all SIP calculators only for a period of 30 years?

Is there a limit for the number of years a SIP can be done?

There is no restriction as such, but I\’m curious as well, I never realised this 🙂

Hi Karthik,

I\’m a newbie to MFs, planning to invest some.

SIP looks like a great option & let\’s say I\’ve bought it. But, if I want to opt-out of monthly SIPs and invest chunks once in a time, is it possible?

Thats possible, you do have a lot of flexibility with Coin wherein you can pause and edit your SIPs.

The best explanation to mutual fund fact-sheet I have read ever. Great work! Thank you very much.

Thanks, Harini. Happy reading!

Dear Sir,

Upon checking the portfolio breakup of any mutual fund on sites like moneycontrol, there is always a small percentage attributed to \”Net Receiveables\”.

Upon googling this, I found the definition to be: \”The total money owed to a company by its customers minus the money owed that will likely never be paid\”

But I am finding it hard to grasp this in context of mutual funds, could you please shed some light on this?

End of the day, AMC is also a company, they can have debts outstanding. But this is a very small portion I suppose.

Thanks for the content. It helps me to get educated financially.

I\’d like to highlight a grammatical error on this page.

\”The next section talks about the initial minimum investment in the fund. This is self-explanatory, if you choose not to SIP, then the minimum amount to invest is Rs.500/- and Rs.1000/- for the monthly SIP.\”

Here Rs.5000/- should be used in place of Rs 500/-. I almost got confused while reading but then saw the fund facts image and understood this a typo.

Thanks,

Ah, ok. Thanks for highlighting this, Alka.

I love the way you have explained the concepts… I am engineer, never thought learning finance is so easy 🙂 … Thanks for your great articulation of ideas

Happy reading and I\’m glad you liked the content 🙂

hey ,pdf of this 11th and 12th module is available?

Hello Karthik,

Thanks for the knowledge,

Can i know one place/scenario where dividend re-investment option can be considered over growth.

Thats a paradox, won\’t happen 🙂

Thank you for such an awesome and simple resource for finance education.

What are the changes in the NAV in growth and dividend reinvestment plan ?

In dividend option, units are sold and the proceeds are given to you as dividends. This does not happen with growth.

Pl provide a button to go to the next chapter in mobile view instead of going back and selecting it.

Checking on this.

Can you explain the difference between Dividend Reinvestment plan and Growth Plan a bit more clearly?

Essentially the same.

Sir, all thanks to your great efforts for creating financial awareness. You are creating enormous value for retail investors in India. I will always be grateful for the fact that I got introduced to Varsity and Zerodha at an early age itself 🙂 . And already recommended about it to few of my friends.

Moving on to questions from this module.

1) If I liquidate my mutual fund (MF) holdings within a year, i would have to pay 1% as exit load charge. Can I show this charges as expenses to offset my STCG tax ?

2) Do mutual fund fact-sheet also shows, in which stocks they invest the funds and what are their respective weights, like how SMALLCASE shows the portfolio.

3) Can you explain in simple terms, \’What is the difference between mutual funds and Hedge funds ?\’ (I tried to find it out via google, but didn\’t got the clear answer)

Thank you sir

Happy to note that, Vaishakh 🙂

1) I\’m not sure about this, I\’ll have to find out too. Best to consult with a CA

2) Yes, they do and it gets updated regularly

3) Mutual fund is fund management services for everyone, right from someone who has just started his/her job to the ultra-rich, but hedgefund is only for the ultra and super-rich :). Apart from this, conceptually they are similar.

This is good also give details to check fund performance

Thats right.

Hi Karthik,

Thanks for your material. I have a question regarding the returns of the Mutual fund.

If the Annualised returns of a mutual fund is 8% for a year and expense ratio is 1.5%, then which one of the condition is true:

1. The actual performance of the fund is 9.5% (8+1.5)

2.The actual performance of the fund is 6.5%(8-1.5)

The return you experience is anyway post expenses, so no point considering the expenses.

Hello sir,

Could you please let me know if there is a chapter added for different ETFs in India stock market and how to read and download the factsheets of these ETFs. ?

Thanks a lot in advance,

In the process of adding that.

Varsity is just AMAZINGGG!!!!!

I have a doubt. What happens to the dividends that AMC receives under growth plan? If they are reinvested, isn\’t it the same as dividend reinvestment?

Thats right, Shalini. The dividends are reinvested back to the funds.

I HAVE PURCHASED SEVEN DIFFERENT SIP OF RS.5000 EACH .CAN I STOP ALL THE SIP AND CONTNUE WITH THE AMOUNT I HAVE INVESTED TILL TODAY FOR ANOTHER ONE YEAR TO AVOID EXIT LOAD AND CHANCE TO GAIN SOME PROFIT?MEANS CAN I REMAIN INVESTED IN FUND DESPITE STOPPING ALL MY SIP?

Yes, you can stop and continue to stay invested in the same fund.

Hi Karthik. First of all, thanks for the entire Varisty series.

With respect to differences between open ended and close ended funds, whether time boundedness is the only difference? Or all the other differences stem from this aspect only?

Thats the only difference, Ram.

Hey Karthik, i really appreciate this Initiative to spread financial literacy for free. Kudos to the great work,

I have a doubt, I have been investing in regular plan mutual funds for over 2 years now as suggested by the agent. He is quite knowledgeable and suggests us to invest in different mutual funds. To have such a knowledge & grip over a topic like this requires constant reading of various funds & being updated with market information. So for a passive investor in mutual fund isn\’t it better to go for regular plans? As direct & regular plan may defer in returns for about 1-1.5% but on an overall basis we will at-least not end up investing in wrong funds(This is what our agent says & persuades us to go for regular plan). Just wanted your view on this

Thanks

That\’s right Sudarshan. If you know nothing about MF and want advisory then it makes sense to have an agent who can give you good advice. But from my experience, there are hardly good advisors doing a good job. Your advisor could be different, so its really up to you to evaluate him. You can still go in for a direct plan but hire advisor for advice only. Do check out folks from Prime Research, I\’ve heard they do a good job.

Hello Karthik,

Good information.

Could you please let me know that Debt fund are still beneficial for investor as they were before. Now I see most of the equity funds are in loss whereas Debt. fund are in profit. Now since interest rates are getting lower & lower, still are they beneficial ?

Yes, the key is to asset allocate between both debt and equity, Kamal.

Can i shift my existing Fund prtfolio from other AMCs to Zerodha ? and will the regular plan become Direct ?

Thats right, but I guess to do that you need to sell the MF and rebuy the same from Coin.

Hi Karthik.

Great articles

You mentioned that you manages some funds for some time. So what was your selection criteria.

Also if you can provide article on when to sell the stock before ita too late that will be very helpful

Thats right. Selection criteria was a mix of basic fundamentals plus a bit of quant. Selling the stock was based on how the company is faring in its operations. You sell when you find gaps in the original thesis.

Hi Sir,

1. You\’ve mentioned \”For all practical purposes it\’s good to go with open-ended funds\”. Can you please elaborate on this?

2. Also I\’ve read Close-ended funds give the fund managers their liberty to stick with the original objective of starting the fund rather than adding new units and satisfy their clients by buying expensive stocks (high PE) for getting more fee.

3. Where can I find the shareholding pattern (Promoters, fund managers, analysts and public) of any fund?

Sorry for adding too many questions. Please explain…

1) Open-ended funds don\’t have any lock-in or associated exit load. Hence it makes sense to opt for open-ended funds

2) Not true

3) You can check Tijori Finance or Screener for this. I guess they have this functionality.

Hey

In MF if entry load nil exit load nil then how can MF houses make money what\’s the compensation structure.

Thanks

Arun

They charge a % of fee, called the expense ratio which is charged on the money you\’ve invested.

What is the difference between dividend reinvestment plan and growth plan?

1)How to compare two similar mutual funds from different AMC?

For example small cap fund from Axis AMC, Kotak AMC…etc

2)Selecting mutual funds based on past returns is correct way? Or Any metrics need to be considered before selecting MUtual funds?

1) I will write about this in the coming chapters

2) Not the only way, as I mentioned, will write about soon 🙂

Appreciate that you are putting such a wonderful knowledge on 1 platform.

1) What should we look for while we select AMC. Should we diversify across AMCs?

2) While I was going through fund manager part,I was going through research about my fund managers. It was hard to get information about their past investments? Any good source where to do this research.

3) Fund managers keep changing. So , how big role should it play while we are selecting funds?

1) Good to diversify as that\’s the only way we can hedge institutional risk

2) No, you just have to do the classic google research for this 🙂

3) The fund managers role is highly process-driven (like pilots), so look at who they are but also look that AMCs investing philosophy.

Thanks for wonderful content and sharing knowledge, Karthik.

As you have said, I am motivated enough to switch from my ac However , it has been just 3 months of SIPs with total of 50k so,

1) Is it worth to take exit load and quit?

2) What is step by step by process to do it. My broker had my account with NSE. So any app which I can use convenietely and complete the whole process?

1) No, dont take the exit load. Futures SIPs can be on coin

2) Check this – https://support.zerodha.com/category/mutual-funds/moving-to-coin/articles/how-do-i-convert-my-regular-mutual-fund-investments-to-direct

Sir,

Which chapter should I refer for \”how to analyse which MF & AMC to choose out of all the information?\”

I am not able to find that chapter.

Thank you in advance

That will be added in the upcoming chapters, Anurag.

My parents had gotten into a close-ended regular growth plan – Canara Robeco Capital Protection Oriented Fund– Series 8 back in 2017 which matures in 2020 July. They were unaware of what they were getting into and made the investment based on the advice of a friend who happens to be the agent when I review the document now. Thanks to you, I know the meaning of regular and close. I see the fund has not been doing very well. Is there a plan of action to minimize the losses if one gets stuck in MF\’s like this one where they realize their mistake later?

I\’ve been through it myself, unfortunately, there are only two options – closeout and cut the loss or just let it be and live through it.

sir, please write on the index fund and also share some videos regarding how to invest.

Yes, will do.

As the benefit is good in direct plan, then why there is a need of regular plan?

MF is still a push product in India. The industry still needs good advisors to push this product to masses, hence.

Hi Karthik,

Great work. Just want to know, how to evaluate fund manager. what metrics has to be checked.

Will discuss that in the coming chapters.

In the dividend plan of a mutual fund, I think it comes from the corpus of investor\’s money only whereas in case of dividends from stocks, it is over and above the amount invested by an investor. So in dividend plan of mutual fund, an investor is not getting anything extra unlike what he/she is getting from the dividends of a stock.

Thats ture, I think I had made that change? Let me check this again, Akash.

Hi Kartik,

I would like to say a big thank you for putting your knowledge and the content out here in such simple language.

I always wanted to invest but was scared of the market world/terminologies until I stumbled upon Varsity and more specifically, personal finance. Eagerly waiting for the next chapter 🙂

Thanks, hopefully, I\’ll update the new chapter within this week.

I want to start investing in mutual funds. I am at the start of my career. I read till this chapter and I want to know everything before I start investing. As the further chapters will take time to be posted , can u suggest me books are website were I can find similar trusted content. Thanks for the amazing content sir. I am a big fan of varsity .

I\’m happy to note that you\’ve decided to invest in MF at the start of your career. This is heading the right direction 🙂

There are many good articles posted on the FundsIndia website, I\’d also recommend spending some time on Valueresearch and Morningstar.

some more detailing about risk meter in terms of example will be good.

Will try and address that in the next chapter, Murali.

Dear Karthik,

Thanks again for taking your time and educating us. While we wait for the chapter that tells us how to choose a mutual fund, i have a request. I have already invested my capital in mutual funds and am targeting to achieve portfolio distribution of 50% (equity) and 50%(debt). In this context, i currently have some capital which i would need to invest in a debt fund. Request to guide me to material which i can refer to make investment in debt funds.

Kiran, I think there is some material in Value research or Morningstar. But yes, eventually will cover it here as well.

Is there any difference between Dividend reinvestment plan & Growth plan as in both the cases dividends are being reinvested.

Hmm, yes. Dividend reinvestment pays out the dividend and then reinvests the same back into the fund. So you need to pay taxes on it. Growth does not do this.

Sir, This chapter provides a lot of information about mutual fund fact sheet but we don\’t have the time to read the fact sheets of all the mutual funds so I go by the star ratings/rankings given to mutual funds by different apps, how reliable are those rankings and is it wrong to only see the ratings before investing.

Sir, a bit of effort to know the fund is justified no? After all, you are putting your hard-earned money in the fund. Btw, the rating bit too is good to know, more on that in the coming chapters.

Hi Sir,

what\’s the source of details like the number of unique investors?

Tons of information here – https://www.amfiindia.com/

Love ur work Karthik, BIG FAN..!!!..keep enlightening us..thanks a ton, in all the PAST, PRESENT and the FUTURE tenses.

Coming to the chapter, In the benchmark description, don\’t know if its in the pipeline, but can u plz include a table citing the various benchmarks and their applications and also the meaning of TRI and other such prefixes and suffixes given with those benchmark names. Thank You

Ah yes, maybe I\’ll have a section called benchmarking in one of the chapters, and thanks for the kind words 🙂