14.1 – Liquidity Risk

In the previous chapter, we discussed the Franklin debt fund saga. Thanks to this episode, as investors, we now very clearly know that investing in debt fund should not be based on useless parameters such as the past returns or the current fund ranking. The market has taught us one two many times that this approach to fund selection is a pointless affair.

The evaluation must be based on risk metrics. Unless the investor develops a sense of all the risk involved while investing in a debt fund, he or she should not even venture into the debt fund arena. The same holds for equity funds as well. However, thanks to the tag line ‘Mutual funds are subject to market risk’, investors somehow perceive market risk as a risk associated (only) with equity funds. Still, at least they are aware of the fact that equity funds are risky.

Unfortunately, the same set of people assume that the debt funds do not carry any risk.

If you have read the previous chapters, you know that debt funds are risky too, and you are even familiar with the risk types associated with debt funds, i.e. default risk, credit risk, and the interest rate risk. The recent Franklin episode formally introduced us to another dormant risk factor called the ‘Liquidity Risk’.

We will start this chapter with a quick discussion on liquidity risk and then proceed to learn the other categories (sub) of debt funds.

Liquidity risk, from the debt fund perspective, can mean two things –

- The lack of liquidity in the underlying market the debt funds invests in, i.e. the Indian bond markets.

- The lack of availability of funds with the AMCs to service investor’s redemption

Both these are tightly related though.

The lack of liquidity in the bond market implies that the AMCs cannot quickly liquidate the papers they hold in the bond market, which means to say that they are obligated to keep the paper to maturity, which further implies that the money is kind of ‘locked-in’.

Now the primary job of an AMC is to collect money from an investor, invest that money on their behalf, generate returns for the investors, and return the funds when the investor redeems the units.

To honour the investor’s redemption, the AMC must hold enough cash across each of the schemes. If the AMC does not have enough funds, then they cannot service the redemption requests that come in, especially in case the redemption requests come in large numbers.

Think about it for a second – on the one hand; the AMC has invested in debt papers which it cannot sell as and when they wish (lack of liquidity in bonds market) and on the other hand, it has to maintain a cash pile to service redemptions. In the event redemption comes in large numbers, the lack of cash causes a liquidity crisis.

Franklin India faced this same situation. One a day to day basis, AMCs maintain enough cash to service redemptions, after all, redemptions are a regular affair for an AMCs.

However, if there is a surge in redemption, then the AMC will need extra cash to service the redemption. Question is where they will get this money?

You guessed it right, they borrow.

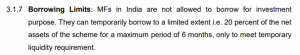

Under SEBI’s guidelines, an AMC can borrow up to 20% of its net asset under management (AUM). You can read the detailed directions here –

Here is the extract on AMC’s borrowing limits –

So, if an AMC is pulling this lever to borrow funds, then it probably indicates that the AMC’s usual cash pile is depleting; hence they need to borrow more to service redemption request.

How do we get to know if the AMC is borrowing? Well, one needs to look at the monthly portfolio declaration that the AMC makes. If the cash component is positive, that means to say that the AMC is not borrowing funds, if it is negative, then that shows the presence of debt.

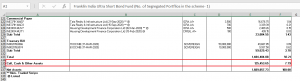

Take a look at Franklin’s Ultra-short Term fund’s portfolio from Jan 2020 –

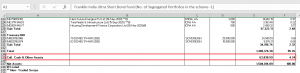

Portfolio in Feb 2020 –

Portfolio in March 2020 –

As you can see, the cash component turned negative in March 2020, which means to say that the AMC had borrowed funds, showing some early signs of liquidity stress. Franklin folded this particular fund along with five others on 23rd April 2020. So there was some warning on the wall.

There are a couple of things to note here –

- Just because you see a negative cash value, do not jump into the conclusion that the fund is about to go bust. Develop a sense to connect the dots to understand what is happening.

- The negative cash component can be a lagging indicator – remember the AMC’s portfolio details comes out with a delay; nevertheless, this is still a good indicator of trouble.

So if you are a ‘do it yourself’ investor, then do keep an eye on this every month. The onus is on you to figure the development in the market and connect these dots. What do I mean by ‘connect the dots’? Could I connect the dots and developed a foresight into what would happen to Franklin in March itself?

These are tough questions to answer. Today, I have the benefit of hindsight, and therefore I can lay down a list of things –

- Franklin’s Vodafone episode was the first warning sign.

- The individual portfolios consisted of papers below AA+; this was always questionable.

- Cash decreased, borrowings increased.

- The market itself was weak, thanks to COVID 19

- The street sentiment was negative.

When you connect these things, you’d somehow see trouble brewing. I understand it may not be straightforward for a regular investor (or for that matter even seasoned analysts), with more market experience the ‘connect the dots’ bit becomes more intuitive and the call will eventually come from your gut 🙂

We will discuss more on this and other aspects of risk in the ‘how to select mutual funds’, chapter. We will now proceed to understand three different types of debt funds – Banking & PSU Debt Funds, Credit risk funds, and the Gilts.

14.2 – Banking and PSU Debt Fund

Ideally, I’d have stopped discussing debt funds right after the medium duration funds, because in my opinion, all the other types of debt funds are entirely pointless for a typical retail portfolio.

However, I think it is important to discuss other debt fund types to let you know what they are and what to expect.

Let us kick start this discussion with the Banking & PSU Debt Funds.

Before we proceed, think about this a bit and try to imagine what the ‘Banking and PSU debt Fund’, really means.

If you are someone like me, I’m sure you’d have thought that the Banking and PSU debt Fund, as the name suggests is a fund that invests in papers from the banking and PSU sector. The banking and PSU sector is one of the safest in India.

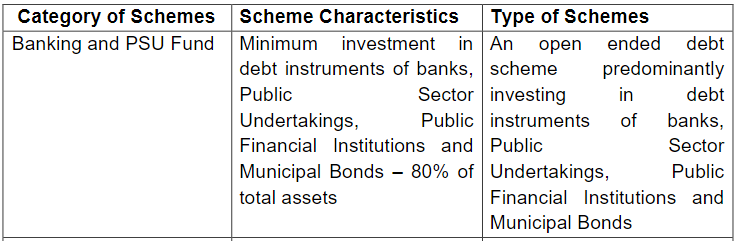

Fair enough now let’s see what SEBI has to say –

Well, it looks like we were almost right 🙂

The fund invests in banking and PSU debt to the extent of 80%. Pay attention to the 80% part here!

The remaining 20% gets invested in any paper.

Suddenly what seemed like a harmless debt fund turns out tricky.

This is an 80-20 cocktail, and there is a problem with it. Think about this from a regular retail investor, when he reads the fund’s title; it is only natural for him to expect the fund to be 100% Banking and PSU debt, he would not expect the fund to have papers from the private sector.

If a default occurs in any of the paper from the 20% bucket, then the fund’s NAV takes a hit. Who is to blame here? The investor for expecting a pure-play Banking & PSU fund, the fund manager for lousy investment, or SEBI for permitting this cocktail?

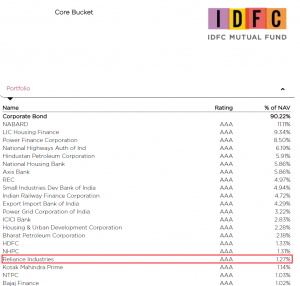

Have a look at IDFC AMCs Banking & PSU Debt Fund –

The portfolio consists of paper from Reliance Industries to the extent of 1.27%, not that Reliance is terrible, could be a fantastic paper to hold. Still, the question is, does it belong here?

Anyway, the good part of the Banking and PSU Debt fund is that the credit risk is kind of on the lower side, mainly for two reasons –

- RBI provides liquidity support to banks and NBFCs

- Implicit Sovereign guarantee by the Govt of India for PSUs

But remember, the ‘credit risk comfort’ is for 80% of the portfolio; the same is not valid for the balance of 20% of the portfolio.

Also, if you notice, SEBI has no specs on the Macaulay’s duration of the portfolio, which means the fund manager is flexible with the duration of the papers held in the portfolio. Given this, the modified duration will be on the higher side for these funds.

Here are the parameters for the IDFC’s Banking & PSU Debt fund –

The average duration is about 3.1 years, which is in line with any mid duration fund. The modified duration is about 2.6, which for a debt fund is on the slightly higher end of the spectrum. If the interest rate goes up, the fund will take quite a bit of time to recover from the fallen NAV.

Given this, an investor looking at investing in these debt funds should have at least 3-5 years perspective while investing in the Banking & PSU Debt fund.

At this point, I think it is important to remind the readers that so far in this module, we are only introducing different types of fund. We have made few passing comments on some of these categories, but we still haven’t figured how and why one should invest if at all one has to.

At a later point in this module, we will try and figure two significant bits –

- How to analyse a Mutual Fund?

- How to build an MF portfolio?

When we do this discussion, we will tie all loose ends and develop a holistic approach to personal finance.

14.3 – Credit Risk Funds

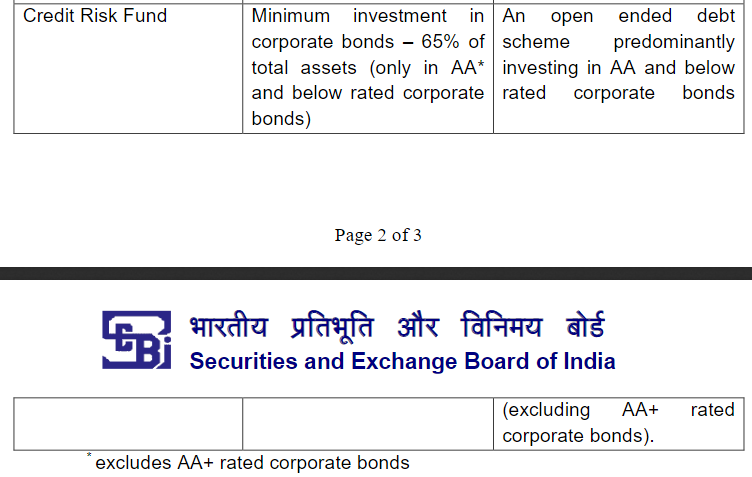

Before October 2017 (before SEBI’s huge MF reclassification circular), Credit Risk Funds were called ‘Credit Opportunities Fund’.

Do you notice the change in perception here?

Credit Opportunity Fund – the emphasis is on the opportunity, returns, and generally has a positive feel to it, hence easier to sell 🙂

Credit Risk Fund – It’s the same fund, but by highlighting the term risk, the emphasis is on the risk, and rightly so.

Anyway, the name ‘Credit risk fund’, should give you a heads up on what to expect in this fund 🙂

Yes, you guessed it right, the fund is loaded with Credit Risk!

As usual, let us start with SEBI’s definition –

And if you are wondering what the little circumflex next to the name points to –

SEBI here simply specifies that an AMC running a credit risk fund should invest 65% of the assets in corporate bonds, which are AA* and below investment grade, which means –

- These bonds carry maximum credit risk, hence the probability of both, default by the bond issuer and credit downgrade is very high

- No spec on where the balance 35% gets invested

The Credit risk fund is where the fund managers cut themselves lose to chase yields. Think of it like a hungry kid in a buffet dinner party. The plate will be loaded, with zero control on what gets packed in the plate.

Similarly, a fund manager running a credit risk fund loads up the portfolio with risky papers to chase yields. Let me explain this.

The objective of a credit risk fund is to take on as much credit risk as possible to ensure a higher yield to the investors. What does this mean?

This means the fund will lend the investor’s funds to corporates whose repayment track record or repayment capability is questionable. Why would the fund manager deliberately lend to a corporate who is unlikely to repay?

He does so because the corporates in need of the fund say, ‘give me the money, and I’ll compensate you with higher interest rates’.

You see the point, right? Corporate with bad credit history has to entice new lender by paying a higher coupon rate.

The debt papers of such corporates usually have a lower rating. When the fund manager lends to such entities, he hopes for the following –

- The borrowing entity will repay and honour the interest paid regularly.

- He also hopes the corporate entity improves its creditworthiness.

- If the creditworthiness improves, then the rating of the bond/paper will improve.

- If the ratings improve, the bond price goes up, hence the NAV increases

If these things were to happen, not only will the fund manager get higher interest rates for the money he has lent, but will benefit from the credit rating upgrade and the eventual increase in bond prices.

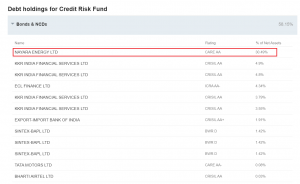

Let us look at a portfolio of a Credit Risk Fund; this belongs to DSP’s Credit Risk fund –

The fund manager here has decided to allocate nearly 30% of its assets to just one company. You can imagine the hit on the NAV of this fund if this company were to default on its obligation.

The credit ratings of the other companies are not excellent either; well, this is expected from a credit risk fund. Still, the combination of concentrated positions coupled with lousy credit ratings makes this a hazardous category to invest.

The credit risk fund is a complicated category to understand, but the good part is that a retail investor does not need to endure this pain.

Almost all portfolio goals of a retail investor can be achieved without credit risk funds in the portfolio. So do avoid investing your money in a credit risk fund.

14.4 – GILT Funds

Back in the early 19th Century, when the Government would borrow money, they would do so by issuing a bond (a physical paper), on which the terms of the borrowing were written and signed. The edges of such a bond were laced in Gold, to showcase the sanctity of Government borrowing. Such bonds issued by the Government were called the ‘Gilt-edged bonds’, because of golden edges.

The presence of Gold does not eliminate the credit or interest rate risk, at the end of the day, this technically is still a bond 🙂

However, the fact that the borrower is the Government implies that there is virtually zero Credit risk, because, well, the Government cannot default on debt obligations.

The legacy continues, and even today, the bonds issued by the Government is called a GILT, there is no gold lacing today, but the Sovereign Guarantee still exists.

Now, as you can imagine, a mutual fund that invests predominantly in Government bonds or Gilts is called a ‘Gilt Fund’.

Here is SEBI’s definition of a GILT fund –

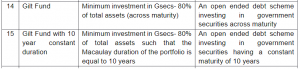

There are two types of GILT funds –

- Gilt funds – Invests a minimum of 80% of its assets in Government securities. This implies 20% can go anywhere (again the cocktail problem)

- Gilt with ten-year constant duration – This fund is the same as above with the added clause that the Macaulay’s duration is at least ten years. By defining the duration, the entire risk profile of this fund changes.

Agreed, there is no Credit risk for the investor here. We expect the Government never to default. But think about the interest rate risk in these funds, especially the constant duration one. As you can imagine the interest rate risk is quite significant in these funds, probably large enough to compensates for the absence of credit risk.

I would urge you to look into the fact sheet of any GILT fund and observe the duration and modified duration to get a sense of how risky these funds are.

If you ever decide to invest in these funds, then do so only with a long, really long term perspective. I’m talking about 8-10 year time frame here.

I really don’t see a need for a GILT fund in any retail portfolio; you are better without this.

Anyway, with this, we will wrap up our discussion on debt funds. Up next is ETFs and Index funds.

Key takeaways from this chapter

- A debt fund investor should watch out for liquidity risk

- The cash borrowings of a fund is an indicator of liquidity risk

- The Banking and PSU debt funds invest predominantly in banking/financial services, and PSU debt

- The banking and PSU debt carries less credit risk (relatively) compared to its peers

- Credit risk fund carries a high degree of credit risk. A retail investor is better off avoiding this fund

- GILTS don’t have credit risk but have a significant amount of interest rate risk

Since you have mentioned that the debt fund types beyond medium duration funds don\’t make sense for a retail porfolio . could you tell me if dynamic bonds are a good addition to a portfolio since it is actively managed and is adjusted for different interest cycles.

Mohit, not sure if I have blanket ruled out funds beyond medium duration, what I mean is that each fund has a place in portfolio based on the financial goal.

Which is better for parking cash (and maybe getting some returns) for a period of 6 months?

Ultra short duration fund or short duration fund or low duration fund?

Ah, if its 6 months why not liquid funds?

Hello kartik sir Aditya here, u said in the banking and psu debt funds there are no specs for macaulay duration so the fund ought to have a high modified duration , but how are the both realted

There are no specs for Macaulay duration for banking and PSU debt funds – what this means is that, the fund\’s mandate doesn\’t specify limits on how long the average maturity of bonds can be. This gives the fund manager flexibility to invest in longer-maturity bonds.Why this leads to high modified duration – without Macaulay duration constraints, fund managers might invest in longer-term bonds (say 10-15 years instead of 2-3 years). Longer-term bonds have higher Macaulay duration (more years to receive cash flows) and these bonds have higher modified duration (more price sensitivity to interest rate. changes).

Karthik sir, Zerodha has recently launched Overnight Fund. I was looking for overnight fund over liquid fund to park cash.

(1) Why Zerodha has zero expense ratio in its recently launched Overnight Fund?

(2) Should I consider Zerodha overnight fund to invest as it has 0 expense ratio or other overnight fund?

Please your suggestion.

1) You will have to ask this question to Zeordha Fundhouse 🙂

2) I\’d say yes, but you know I work for Zerodha right 🙂

Come on sir, you are trustee director of Zerodha fund house. 😅

sir, Which debt fund is good for parking cash ?

Look for liquid funds if the requirement is to just park funds.

Karthik sir, thanks a lot for your generous help. This is appreciation post.God bless you.

Hope to meet you in person someday and will thank you personally for all the knowledge you\’ve provided for free and so generously. thanks a lot again and sorry for the stupid questions.😅

Thanks for the kind words, Prinkesh. I hope we meet as well 🙂

Where can i get the cash flow statement of portfolios?

In the annual report itself 🙂

Going through all the risks and returns associated with the debt funds, I am wondering isn\’t it just better to invest in FDs which offer 7% ish returns and not much of risk? Plus any layperson can invest easily in FDs. Am I missing something here?

You can, there is nothing wrong with it, especially if you are starting fresh.

Hey Karthik,

I\’m bit confused between bond price and interest yield??

As a fund manager I invest/lend to certain company for higher yield.

After maturity I will be getting back principle+ interest.

So what is the co-relation, why should the fund manager be worried abt the bond prices going up/down??

But the price of the bond fluctuates during the period you hold the bond, and from time to time, the fund manager has to report its value (mark to market), which is why they get worried 🙂

In the current context where interest rates are about to go down, is gilt fund good option to park money in next couple of years?

Well, your guess is as good as mine 🙂

I would like to reframe the third question actually. Its incomplete. Sorry for that. What am trying to ask is can you recommend any other funds that I can make use of for diversification of my investment.

And yea, I am in my early age (20s) of investment.

Lets say i have 25k to investment how would I diversify it? Just a idea.

Thanks & Regards.

Broadly speaking – a large portion of equity within which you can consider a largecap, and a mid cap fund. These two funds will give you the full market exposure. Next you can consider a hybrid fund for debt exposure. This should do I guess 🙂

However, I cant really give you a fund specific advice.

Hi, I understand that for growth over long time, its better to invest in equity and debt only for parking excess funds. But we also have to diversify the funds. So I have some questions:

1. How much percentage of my monthly investment must go towards equity & debt?

2. In debt funds, which particular fund is better for long term investment because am a bit confused with long term or medium duration fund because of higher risk or is it that over long time, the risk normalizes?

3. Other there any other funds we may invest in?

4. I also saw a comment on initial investment where you have mentioned about a NPS. Which will be better NPS or PPF? [Taking into consideration both risk & returns]

Thanks & regards.

The answers really depends on your age and risk appetite. Assuming, you are young and have the appetite to take on risk –

1) A large part, like at least 60-65% should be towards EQ. But remember, your EQ investments should be given enough time to unfold.

2) I\’d suggest GILTS if you are looking at long term.

3) You will have to figure this, maybe talk to a financial advisor?

4) I\’m biased, I prefer NPS 🙂

HI Sir, I would like to ask a major doubt i could\’nt get the answer anywhere. I am 28 years old planning to invest for my retirement. In order to have a good asset diversification i have allocated 15% to debt for 25 years . Then slowly increasing to 100% for my retirement . My question here is in which debt fund should i invest at my starting stage(for that 15%) for long term debt investment.Do you have any suggestions?

I\’m happy you are thinking of retirement at a young age. Keep at it 🙂

I\’d suggest you take a look at GILTs or long tenure G Secs bond funds.

karthik rangappa is a GEM

Happy learning 🙂

Please clarify. Using your IDFC/Bandhan banking psu debt fund example, if and look at the past 3 years (mid-2000 to mid-2003), are you saying that since interest rates went up ~2.5% (4.0 to 6.5) and modified duration was roughly 2.5, that the fund\’s NAV should have gone down by 6.25%? But the NAV has gone from 18.7 to 21.45 over last 3 years (which is a 4.5% CAGR). Greatly appreciate your clarification.

Its a bit tricky, the portfolio is ever-evolving with all the changes the fund manager would do.. MD is one aspect that will impact the NAV, the actual demand-supply of the bonds within the portfolio also has an impact on the bonds.

Kartik, all your modules are timeless.

Just wanted to understand are gilt funds the best instrument to play the down-ward interest cycle let\’s say after 3-6 months

hanks Rachit. No, don\’t touch GITL fund to play the interest cycle 🙂

Hi Karthik sir, just wanted to ask are dynamic bond funds a better option to play the interest rate cut cycle? Especially since their performance over the last 2 rate cuts. I couldn\’t find the section on dynamic bond funds on Varsity.

Perhaps, since the fund manager takes the effort of managing the bond portfolio based on his/her perception of the rate cycle in the economy.

Excellent article ! Thanks. Can you please tell which is the best debt investment for retail investors? Something which does not have much of a liquidity and credit risk and at the same it gives decent post-tax returns. Can arbitrage funds be considered for this purpose?

There is no such thing as a best fund, it depends on what financial goal you are trying to chase.

Hi Karthik,

I am using Debt funds as a part of my collateral portfolio which I pledge for margin and trade in index derivatives. The portfolio is something like this:

Cash, SGB, Equity MF and Debt MF – 25% each

I buy MFs in lump sums of 1 L each and do not have a time horizon on redeeming them, i.e. as my account size grows I\’d like to keep adding more funds to my portfolio. I am a bit confused as to which debt funds would meet my needs best. Any suggestions?

Since you are not looking at any time to redeem, I\’d suggest you look at short to medium-duration funds.

Hey Karthik,

I have completed all the articles written under Personal Finance until the Debt Funds. Thank you for putting all your experiences online in such a structured format. What is your opinion about corporate debt funds ? Should it be a part of investor\’s portfolio

Glad you really liked it 🙂

The decision to include a fund in your portfolio or not should be dependent on your goal and risk profile. Very hard to generalize this.

This is an excellent series of articles on debt funds. Thanks for writing this.

Have learnt a lot about debt funds, credit and other types of risks.

Grateful to Zerodha Varsity team for providing this to public free of cost.

Ragav, glad you liked the content here. Happy learning 🙂

Why only Reliance Industries is marked in \”Banking and PSU Debt Fund\” section ? We can see other private cos also part of that portfolio ?

Sorry, I dint get this. Can you share more context?

Hi sir,

During these period of learning of MF world, I also learned about significance of CRISIL like credit agencies. Now i understood why Mr. jhunjhunwala invested in CRISIL Stocks.Isn\’t it?

Sir, thanks for providing such high worthy content free of cost. Now I can say I am financially literate. So you become a Guru of my life. I have still many doubts which I know I can clear by further reading. God bless you sir.

Thanks for the kind words, Jyoti. I hope you continue to enjoy reading Varsity. Happy learning!

Hi Karthik,

Safe to assume that higher the modified duration, higher the YTM in a debt fund(regardless of the type), the underlying assumption being you are getting a higher return for the higher risk you are taking by holding it for longer?

Thanks,

Dhairya.

Higher the risk, higher is the bond price, lower is the yield.

I\’m not getting few things clearly here.

What exactly is modified duration? who modifies it and why?

How exactly interest rate can affect the bond?(Don\’t say inversly please). Isn\’t that interest rate or coupon value fixed?

No one really modifies the modified duration. Like I\’ve explained, MD is the sensitivity of security price wrt to change in interest rate. Coupon rate is fixed, interest is not.

Hi..have you covered dynamic bond fund

I think I have.

I was trying to find cash holdings of other funds in their portfolio without any results. Where can i look them up?

In the monthly portfolio disclosure?

First of all thanks for the excellent material. I am a long time investor in MF in Zerodha Coin Platform and have some basic knowledge of MF investing – though had never invested in Debt Funds.

1. Given currently some of the little known banks (like IDFC First, DCB etc etc) giving 6-7% return in Savings bank account – does it make sense to invest in Debt funds maturing less than a year?. I know there can be a possible tax advantage in Debt fund – but for less than a year investing – this is also same. We know these days there are even risk with banks – but in that wany every investment has some risk except Govt bond. Given most of the indians come in lowest tax bracket – I do not see much gain in taking up Debt fund route for parking fund. After all keeping money in bank savings / FD is much simpler. This I am only talking about fund needs for emergency – for long term wealth creation we all know Equity MF is a good route.

2. What is your view on VPF (Voluntary Provident fund) contribution? This is highly secured – give around 8-8.5% return – almost forced disciplined investment (as money goes from Salary every month). Only problem is liquidity. I like this for Retirement Corpus – what is your view? Though you may not get Equity kind of return.

1) If its less than a year, you\’d rather let your money stay in the bank itself. 6-7% is still a decent return 🙂

2) I\’ve not done much research on this, so cant really comment.

Hi karthik!!

Advance happy new year 2021..🎉🎉

I have a doubt. If a fund has Modified duration of 3 years, does it means it is a close ended fund? Can an investor hold the fund beyond the duration?

Thanks in advance.

😊😊

Thanks, wish you the same!

No, this is not a close-ended fund. The modified duration indicates the sensitivity of the bond prices to the interest rate in the economy.

Hey Karthik, kudos on your writing skills and the brevity of the content keeps the reader glued. Thanks for making reading interesting for folks like me who are more inclined to visual aesthetics.

Jus had one question with respect to interest rate risk which I though would reserve till the end of Debt funds – the increase decrease in Interest rate indicates the repo rate that the RBI fixes? Or is it something else which I could have failed to comprehend.

Could you please clarify? ( If possible with a logic of why it is inversely proportional to debt fund\’s NAV)

That\’s right, the interest rate risks are the repo rates that RBI fixes.

Sir regarding modified duration risk, how and why do interest rates change?? Are these repo rates, rates of bonds in secondary market or what?

Yes, these are repo rates.

Sir you have repeatedly mentioned change in interest rates will lower/raise NAV. Which interest rate is being referred here? How does it change?

The monetary interest rates set by RBI is what I\’m referring to here, Deepak.

This entire course was quite helpful.Thanks a lot!

Happy learning!

I am with zerodha since 2014,but have started looking into varsity in lockdown days….it seem being with zerodha really pays,great to read and language is just right for all to understand.

Happy to note that, Biswarup. Hope you enjoy the content here 🙂

Is it possible that it is actually the amount that investors have opted to redeem from the mutual fund pool and that\’s what is due on the AMC to pay the investors?

Because I see that the cash margin hasn\’t reduced. If there was something troubling or worth noticing regarding liquidity risk, I guess cash margin would be the correct one to reduce in amount hence showing lack of liquid cash with the AMC right?

And also, a very Happy Diwali to you. Hope the new Samvat brings you more wealth and you create good returns during Muhurat Trading 🙂

Payables from an AMC\’s perspective leads to that, so this is possible.

Wishing you the same, hope you have abundant health, wealth, and happiness.

Hi Karthik

This is \”DSP Strategic Bond Fund\”

Need to check, I suppose this is a balance sheet related, not sure though.

Hi Karthik,

I wanted to include an image here but couldn\’t so adding a link if you want to check (https://www.dspim.com/about-us/mandatory-disclosure/portfolio-disclosures).

The Portfolio details for October 2020 shows Net receivables/payables and total Cash Equivalent as Negative.

However, the Grand total below, shows a positive number.

What do we get to know from this information? Is this what you talked above in the chapter that such instances are signs of liquidity stress or is this a normal instance in this factsheet?

Thanks in Advance

Ajay

Which fund is this, Ajay?

Thank you for taking up this wonderful work of education on personal finance.

I have added your personal finance module to the carriculam of my 18 year old son who is doing his b tech in computer science.😀 I do recommend this to be taught in all degree programs of all Universities.

One question regarding gilt funds. Why it is not advisable for a conservative retail investor looking for moderate returns with capital protection?

Eagerly waiting for next chapter…

So happy to note that, Manoj. I hope your son like the content and finds it useful 🙂

The things is that with Gilt, you need to stay invested for a long time, say 8-10 yrs. If you are willing to give your investments so much time, then maybe you should consider equity itself.

sir can any bonds or any debt instruments change the interest rate(coupon rate) after the issue.

Depends on the bond issue. If yes, they would have stated the fact sheet.

1) is interest rate risk mean volatility risk?

2) if it is right. The relation between modified duration and volatility is still confusing even after reading.

1) No, these are two different types of risk

2) No, its not true 🙂

The concept and what NOT to do is crystal clear and I should understand the risks involved to choose a fund.

But, if a fund manager, an expert can make mistakes in analysing risks, how can I get sense of risks involved and choose between funds. I should not rely on credit ratings also. Then WHAT should I LOOK for?

You are absolutely right. As a retail investor, the best we can do is apply common sense while investing and hope for the best 🙂

Why do you say that there is no need for a GILT fund in the retail portfolio? Are you assuming that the returns from a equity fund will be higher than the GILT fund in 10+ years horizon? Or am I missing something?

The point is that you need to stay invested in GILTS for long-duration. You are better off giving the same investment time to equities right?

Hi Sir, I am one of the affected persons in the Franklin saga. They have recently emailed saying most of these wound up funds have turned cash positive. Does it mean they now have enough cash to pay every one and settle 100% of the units or just a small percentage?

Thank you for the very informative content as always.

Manoj, depends on how much cash they have recovered.

Hello Karthik,

Excellent content !!!

I have some doubts regarding debt funds. How interest rate impacting NAV? Who decides the interest rates? What is meant by modified duration and how it is related to interest and NAV?

Interest rates are decided by RBI in their monetary policy. Also, the modified duration bit I\’ve explained in the chapter itself (or maybe the next).

Can i invest in any of the duration fund and redeem at any time irrespective of ultrashort, short or medium duration fund as these are open ended or there is any restriction on redemption timing. Which s best to take advantage of LTCG on debt fund.

You can invest and redeem anytime you wish. All debt funds are treated the same in terms of debt, there are no distinction from a taxation perspective.

Hi Karthik,

Thanks for the very informative articles. I was going through the debt fund details. On value research websites when I list the funds they show % Returns column and when I go into that particular fund I see YTM as lesser than this returns.

For ex. Axis Ultra Short Term Dir show 7.51% returns. When I go to axis mf website check YTM its 4.61%

So what will be my actual return here if I invest this fund? Is it 7.51% or 4.61% ?

Thanks.

Hmm, you need to look at the actual return here since this is a debt MF. I will be coving this aspect in the next couple of chapters under the mutual fund metrics.

I meant Mutual Fund portfolio – percentage split between different investment options such as – equity, debt funds, FDs with banks etc

This is planned in one of the upcoming chapter, Rohit. Will put this up.

Hello Sir,

I understood that if interest rate increases by 1% then NAV would decrease to the extent of modified duration. But what\’s the reason and process behind this? Is this a rule of thumb or this is how it all bound to happen?

Let\’s say that the RBI increases the repo rate by 1% which is followed by increase in FD rates and all the people invested in bonds with low yield will turn to other traditional fixed income securities and so the prices of the bond will decrease and subsequently the NAV of a fund will decrease. Please tell me whether this reason is right?

1. Even if this all happens, when the bond price and NAV decreases, the yield will increase and by holding it till maturity we can get good return right?

2. Are all these debt funds (from overnight to gild funds) hold only floating rate bonds? Or can the debt funds hold fixed rate bonds?

The relationship between bond prices (NAV) and interest rate can be defined, but its quite quantitative in nature. But yes, your logic is more or less right, although you will have to replace the FD bit with other bonds.

1) As a fundholder, the maturity of the bond does not matter. Remember you hold the fund and not the bonds directly

2) They have a mix of bonds. You need to check the portfolio.

Thanks a lot Sir for explaining things with simplicity. Can you please share the link on chapter of investment portfolio building- unfortunately I am not able to find it yet

Do you mean this one? https://zerodha.com/varsity/module/fundamental-analysis/

Hello Sir, Thank you. Can you please clarify the below statement. Which Interest rate are you referring to and how it impacts the debt funds or the bonds? I am understanding there will be a fixed Interest rate called Coupon rate which is going to be constant across the duration. So please clarify. Thank you.

\” As you can imagine the interest rate risk is quite significant in these funds, probably large enough to compensates for the absence of credit risk.\”

In debt fund, you should not be worried about the coupon. The interest rate I\’m discussing here is the interest rate prevailing in the economy.

What are the average return percentages in GILTS and credit risk funds??

Check the return profile here – https://www.valueresearchonline.com/funds/ , scroll to the end.

Hi Sir,

1) Does Macaulay duration consider remaining maturity in its calculation?

2) If all overnight funds invest in Tri repo securities then why is expense ratio different across such funds?

1) I\’m not sure need to check this.

2) Does not make sense to me either 🙂

Thanks for the reply!

So from an equity MF perspective an ELSS scheme made sense(read tax saving) as my investments already had a reasonable exposure to the market via shares and the rest split between gold bonds and liquid funds. Since the markets started going south, was looking to invest in a proper debt instrument, so G-Secs via NSEGobid felt like a good option but I later felt that a GILT fund(instead of a short duration or corporate fund) would be a better way to go about it instead of investing directly, what say?.. 🙂

GILT funds are decent, as long as you have a 10+ year exposure to it.

Clear and in detail, thanks for the write up!

Don\’t you think given the current dip in the interest rates and no immediate recovery of the same in the near future, it\’s a good time to invest a bit in GILT funds? Especially with some of these funds having an 18% annual return.

Hmm, depends on your long term interest rate view 🙂 But here is the thing, you are better off investing in an equity fund if you are willing to give it 10+ years waiting. Dont you think so?

Thank you so much sir..

Nice platform for beginners to learn and enhance knowledge about mutual funds..

Eagerly waiting for ur next chapter..

Sir,Doing a great thing in spreading positivity and making us more productive during this lockdown period ..

Happy learning, Rashmi!

Dear Karthik,

You have nailed the art of story telling. Personal finance in a much easier way of understanding.

Looking forward for new topics of ETF and index funds.

Kudos to all the team involved here.

Thank you.

Thanks for the kind words, Neeraj. There was a slight change plan, the next chapter is on investing in bonds directly. Post that on Index funds. Will do ETFs later.

Sir ,

This fund has given around 6.2 percent for the last three years.

And my advise for making this module beautiful is that there should be 1 or two chapters on making personal saving portfolio for long term or short term duration with a mix bag of small saving schemes , mutual fund , and equity etc…. Just like for example somebody has 100 rs as cash for where he should invest it and in how much percentage with reason.

And other is somebody save 100 rs.. per month where he should invest it for short term and long term with reason.. I suppose that would be very helpful for all of us..Thanks.

Yes, absolutely. This module is work in progress. I will discuss more on this.

Sir ,

My father on bankar advise invested 25 lakh in sbi credit risk regular growth mutual fund … In September this investment will complete 3 years… Plz tell should I redeem my investment.. plz guide… There is no financial advisor for me except me and you sir…

Vipin, Can you please share what sort of returns you\’ve had with this fund? Credit risk funds are risky. I\’m guessing this is a retirement fund for your father. Please park this in a long term FD.

That\’s awesome ,

So plz tell what we should do for future and present… .. I have decent money as cash in hand due to father retirement… And 40 thousand per month saving..In saving account… So plz tell what and how I should invest… This money for good….For .. present and future…. God bless you.. and kids… Is it possible that I can call you for advise..

Thanks…

Call won\’t be possible, Vipin. I\’m not a qualified financial planner, so cant advice. In the upcoming chapters, I will detail how to build a portfolio. Hopefully, that will help. Request you to please wait for a bit. Thanks 🙂

Thanks ,

I am 38 my concern are retirement and two 8 and 4 years old girls education… What mutual fund or investment I should buy….And plz tell as a normal invester how much return per year we should feel satisfied.

We are in a similar situation, just that I\’m 40 and have a 10yrs and 5 year old 🙂

First thing, dont look at yearly returns, look at the longer time period. I will address this section soon, and help you understand how to build MF portfolios soon.

1. Sir, the interest rate (along with modified duration) you have mentioned here, refers to which interest rate?

2. I was observing the returns of a GILT fund is very attractive. Though now I came to know about the risks associated with it (Thanks to your great effort once again). Is it not worth taking the risk for that much amount of return? Is not the return percentage a worthy variable while selecting a MF?

1) The monetary policy rate, the one which RBI sets. That is the rate I\’m referring to here

2) It is, but it is backwards-looking. Best not to get carried away with it 🙂

Thank you very much Sir for this wanderful chapters. I\’ve already finished many of your modules and eagerly waiting for more to come up. It is helping me a lot to understand about the stock market and personal finance. Thanks again for your great effort. 🙂

Happy to hear that, will be adding lots more here 🙂

Sir any module on asset allocation?

Yes, in the coming few chapters.

amazing content explained in laymen\’s language….keep going.

Happy reading 🙂

Your content is filling a void in my personal finance education. Thank you very much for beautifully crafted chapters. Waiting eagerly for your uploads.

Happy to note that, Sanjeev. I\’ll try and upload more chapters soon 🙂

Sir suppose currently you were doing first year of job, you are 25 years old.

How will you plan to invest your salary. what kind of portfolio you would build? 🙂

The first thing I\’ll start with is a low-cost Index Fund SIP plus an NPS account 🙂

Sir, Once again thanks for the wonderful knowledge.

How many chapters will be coming in this module?

I have no visibility into that. Maybe another 5 or 6 easily or more 🙂

How can I buy listed bonds from the secondary markets?

Look for quote on your MarketWatch.

Very educative.

How can one know who the borrowers of a debt mutual fund are and the rating/duration of the papers.

All of this is present in the monthly portfolio declaration.

Thank you so much for us

Absolutely clean and nice, loved reading and learning about it. Recently heard that gilt funds carry duration risk, can you throw some light on that? Thank you. 🙂

Happy reading!

Yes, GILTS has modified duration risk, basically the sensitivity to change in interest rate to change in NAV. They dont have credit risk though.

Simple and clearly explained. How to get other previous chapters? Kindly provide me the link for previous chapters

Here you go – https://zerodha.com/varsity/module/personalfinance/

Are ultra short term funds like SBI\’s ultra short term one\’s relatively safe ?

Please educate o this too.

We have discussed the ultra short term bonds as well. Do check the previous chapters.

Sir after Personal Finance module have you thought about what the next module is going to be? I am excited to know sir. Thank you.

Working on a fixed income mini-series in parallel. Hopefully soon.

Great Content and nicely curated sir, You just make my quarantine productive. Thank You So Much ! Waiting for your another modules.

Hopefully soon 🙂