25.1 – Back to Futures

After many years, I’m updating this module with a new chapter, and it still feels as if I wrote this module on options just yesterday.

Thousands of queries have poured in for this module, and one question that has come up repeatedly is – ‘I’ve sold (written) an option, and after which, the option premium has gone up. What is my loss?’

The question comes up because people expect options to have a mark to market (M2M) for options just like the futures contract.

In this chapter, I’ll try and explain why that’s not the case.

Let’s shift focus back to Futures for a moment.

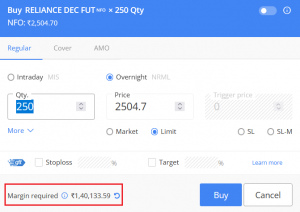

If I decide to trade Reliance Futures, I need to ensure I have the required margins in my account. As of today, the margin for Reliance is Rs.1,40,133.

The lot size is 250 shares, and the contract value is –

250 * 2504.7

= Rs.6,26,175.

The margin is similar even if I want to short Reliance futures.

Margin blocked has two components, i.e. the SPAN and Exposure. If you wish to know the rough breakup, you can always visit Zerodha’s margin calculator to figure the split between SPAN and Exposure.

Now that apart, I want you to think about why futures trading attracts margins. To understand, you need to think about the core premise of a futures contract. Rather, the core premise of a forwards contract. Remember, futures are essentially an improvisation over a forwards contract.

The underlying premise in the futures contract is that buyers and sellers agree to get into a contract TODAY at a pre-decided price and quantity. The actual exchange of goods (stocks) happens at a date set in the future.

For example, suppose I press that buy button and buy Reliance Futures today, then it implies I get the delivery of Reliance shares from the Reliance futures seller on contract expiry in December. Of course, assuming I hold the contract till expiry.

Now, for a moment, assume on the contract expiry day, instead of taking delivery of Reliance, I walk away from my obligation. What happens next?

Walking away from the obligation implies that the person who sold the futures to me, i.e. my counterparty, is left with an open-ended contract. The purpose of a futures contract is lost, and the exchanges cannot afford to let this happen.

The exchange overcomes the default or the counterparty risk by charging a margin and running a P&L mark to market (M2M).

25.2 – Margin and M2M

The structure of a futures contract is such that there is no counterparty/default risk. Of course, there is a price risk, but that’s another thing altogether. Exchanges prevent default in two ways – they block a margin when buyers and sellers enter a futures trade, and the exchange also runs a daily mark to market process.

Margins ensure there is skin in the game, and the mark to market process ensures that daily profits and losses are credited and debited to the relevant parties.

I’ve explained the technicalities of margins and mark to market in the futures module. At this stage, please keep this thought of margins and mark to market and shift gears back to options.

25.3 – Options buyer

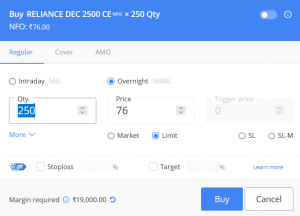

Place yourself in the shoes of the buyer of an option. To buy options, you pay a premium. Premium times the lot size times the number of lots is the total cash required to purchase an option.

For example, if I want to buy one lot of Reliance 2500 Call option –

The call option is trading at 76, lot size is 250, therefore –

1 *250*76

=Rs.19,000/-

As long as I have 19K in my account, I can buy the RIL 2500 CE. In a sense, this is a cash and carry deal, which makes two things very clear –

-

- The amount required to buy an option and get into an options agreement – 19K in this case

- The maximum risk for the buyer – again 19K

Unlike buying futures, the risk is not open-ended when you buy an option regardless of call or put. The risk is predetermined, and since it’s a cash and carry deal, there is no question of default.

Given that the risk of default is zero for an option buyer, do you think it makes sense to block margins for an option buyer? It does not make sense in doing so for obvious reasons.

But is there a need to mark to market the daily profits and losses to the option buyer? We will answer that in a bit.

Shift gears and think about the option seller.

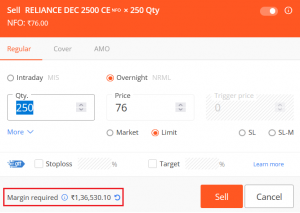

For an option seller, we know the risk is significantly higher compared to an option buyer, and it is similar to a futures trader’s risk.

The risk of option selling is open-ended, and that introduces the risk of default as well.

Since the risk profile of an option seller is similar to the futures seller, the exchange levies a margin (SPAN + Exposure) to option sellers to counter the default risk.

For example, if I were to sell the RIL 2500 CE, the margin I need to bring to the table is Rs.1,36,530/-.

However, unlike in the futures contract, there is no mark to market in options. Think about it – in a futures trade, both the buyer and the seller have to put in a margin to enter the trade. But in options, only the seller puts in a margin. The buyer pays the premium in full.

If there was a mark to market in options, it implies that the notional profits or losses should be credited or debited to the option buyer. However, the option buyer has not placed any margins on the exchange.

Hence there is no concept of mark to market (M2M) in options.

The fact that there is no mark to market triggers another common question – how are profits and loss settled in options?

25.4 – Options P&L for the buyer

Option P&L is pretty straightforward, and the lack of mark to market makes it easier to understand compared to understanding the future’s P&L.

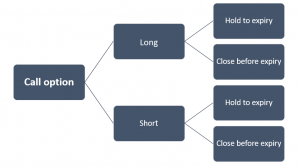

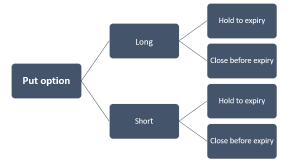

The complication in understanding the options P&L stems from the multiple market scenarios for the position you have. Here is what I mean by that –

A trader can go long on a call option or short on the call, post which the trader can decide to hold the position up until the expiry or close the position before expiry. The P&L in each case varies.

The same goes with the put option –

As an options trader, you need to get comfortable with P&L calculation in each of these cases.

But the good thing is that we can generalize the P&L for both long and short trades for instances where the trader closes the position before expiry.

For trades held to expiry, physical settlement kicks in, making it slightly tricky to understand.

Call and Put option Long, close before the expiry

If the trader decides to close the position before expiry, we can generalize the P&L for a long option trader (both call and put).

P&L = [Difference between buying and selling price of premium] * Lot size * Number of lots.

For example, if I buy two lots of Reliance 2500 CE at 76 and decide to sell the same after a few hours at 79, then my P&L is –

= [ 79 – 76] * 250 * 2

= 3 * 250 * 2

= 1500

Of course, 1500 minus all the applicable charges.

The P&L calculation is the same for long put options, squared off before expiry.

Call and Put option short, close before the expiry

As you know, when a trader shorts an option (regardless of call or put), margins are blocked to the extent of SPAN + Exposure.

Margin charged is a function of premium price and the volatility of the underlying. Generally, margin increases if –

-

- The price of the option (premium) moves against your position

- Volatility increase

Both don’t need to happen; margins can increase even if one of them occurs.

For example, assume you wrote/sold the Reliance 2500 put option at 80; the lot size is 250. If you write the put option, volatility stays the same, but the premium increases to 130, i.e. an increase of 50 Rupees, then the margin also increases by approximately Rs.12,500 (50*250).

Or let us say after you write the option, volatility shoots up, and the price remains the same; then again, the margins increase. Having said that, as you know, when volatility rises, option premium increases; we have discussed that extensively in the volatility chapter.

Have a look at this again –

To short or write Reliance 2500 CE at 76 per lot, I need a margin of Rs.1,36,530. Now, after I write this option, imagine the price increases to 126, the margin for this option increases approximately –

50 * 250

= 12,500.

Therefore, the new margin required is –

= 136530 +12500

= 149030

At, this point the broker will notify to bring in the additional margins (margin call) because the percentage margin utilization is –

Current margin / Margin at the time of writing the option

= 149030 / 136530

=109%

If you fail to bring in the additional margins, the broker can square off the short position because of the penalties imposed by the peak margin policy. Usually, the tolerance is about 120% margin utilization, beyond which the broker squares off the position immediately.

Anyway, continuing with our example, when the premium hits 126, and you no longer wish to hold the position (by adding additional margins to your account) and decide to square off.

The P&L is –

[Difference between the buy price and sell price of premium] * lot size * number of lots

= 50 * 250 * 1

=12,500

When you square off the position, margins are unblocked after adjusting for the profit or loss; settlement of P&L happens on a T+1 basis if you wish to withdraw the funds.

Now let’s shift focus to options trades held to expiry.

Call option, Long, held to expiry

In the money (ITM), options held to expiry get physically settled. If the option is OTM, then the buyer loses the premium paid, and the seller gets to retain the entire premium received at the time of writing the option.

We have discussed the physical settlement in detail in this chapter. However, for the sake of completeness, let’s quickly discuss only the P&L part.

Calculating the P&L if you hold a long call position to expiry is a little tricky since the stock options as physically settled.

Continuing with the above example, assume the settlement price of Reliance is 2650 upon expiry. The 2500 option is In the money (ITM); hence physically settled. Since it’s a call option, the option buyer has the right to buy Reliance at the strike price, i.e. 2500. Premium paid is 76.

The effective price at which you get the shares is strike price + premium paid. In this case,

2500 + 76

= 2576

Assuming the stock price on Monday is 2650, the profit you’ll make here is –

2650 – 2576

= 74

As you know, the expiry of derivatives is on the last Thursday of the month; the delivery of shares happen on a T+2 basis. Hence the shares are delivered on the following Monday.

Call option short, held to expiry

The call option seller sells the 2500 CE at 76. Here the option seller has to give delivery of shares. The price at which the seller gives delivery is 2500, but since the seller receives a premium of 76, the effective price is –

2500 + 76

= 2576.

The stock is trading at 2650, but the seller sells the same at 2576. The loss for the option writer is –

2650 – 2576

= 74.

The shares will be debited from the seller’s Demat account and credited to the buyer’s Demat account.

Put option, Long, held to expiry

Let us change the example from Reliance to TCS, to break the monotony 😊

Here are the trade details –

Underlying = TCS

Strike = 3520

Premium = 55

Option type = Put

Position = long

Settlement price = 3390

Since the settlement price is 3390, 3520 is an ‘In the Money’ (ITM) option, hence physically settled. The buyer of a put option has the right to sell the put option or give delivery of shares.

The put option buyer will give the delivery of shares at 3520, but since the put buyer has paid a premium, the effective price for delivery is –

Strike – Premium

= 3520 – 55

= 3465

The put seller gets to sell the stock at 3465 when the same stock is trading at 3390. The gain here is –

3465 – 3390

= 75.

Put option short, held to expiry

Continuing the same example, the put option seller has to take delivery of shares. The delivery price is the settlement price, i.e. 3390, but the seller has received the premium. Adjusting for that, the effective ‘take delivery’ price is –

Strike – premium

= 3520 – 55

= 3465

The put option seller has to take delivery of shares at an effective price of 3465 when the same underlying is available at 3390 in the market. Hence the loss here is 75.

Of course, physical settlement of options is net off if you have two opposite ITM positions. For example, if you have a spread position in which the ‘give delivery’ obligation arising out of one option offsets another option position, that has to take delivery obligation. I’d suggest you read this chapter to learn about position offsets.

Key takeaways from this chapter

-

- Neither option buying nor selling entails mark to market; M2M is only for futures

- Margins charged for option selling is a function of both price movement and volatility

- As volatility increases, so does the option premium

- Option positions closed before expiry can be generalized to the Difference between buying and selling price of premium multiplied by lot size

- The option positions held to expiry are physically settled

Hi,

I noticed that the premium required for purchasing a put option for LaurusLabs 850PE Sep Expiry changed from around 22K to 1.5L as it went from OTM to ITM.

Now, if I was to sell it after it became an ITM while purchasing it while it was an OTM, is my profit calculation around 1.3L? Or is it the difference in premium paid, that is around (22-13)*1700, which is about a 70% gain?

Yes, your P&L is the difference in the purchase price of option minus the sale price multiplied by the lot size.

Even after posting excess cash collateral, unexplained deduction has happened on free available cash. I have 1 spread position, out of which the short position is in profits(so it cant deduct from available margins).

When asked, the Support teams arrives at some fictious MTM loss which is way more than the actual and says that is taken from the free cash. As you have explained there is no MTM concept in options and the support team does not have any idea. However the next day opening balance is correct.

And how can a broker deduct from free cash for margins when excess cash collateral is available? I have sent an email. I would request you to kindly go through the mail and ticket and help me with a solution if you can. Thank You

Please share the ticket number, this is something only support team can solve for you, I\’d not be in a position to do that.

1. I understand that sir and I\’m aware of that. But I had to post it here for a reason so please here me out. Problem is the support team don\’t even understand the basics of options. They keep saying weird things like option buy contract loss will be deducted from the available margin and they have no idea about how \’margin used\’ section works in funds page. The \”opening balance + total collateral minus margin used\” should be equal to \”available margin\”. And even after showing necessary data that there is a discrepancy in the funds page that does not tally this, they keep defending themselves and you won\’t even believe that the withdrawal page is giving me an option to withdraw even the unsettled option credits without even exiting the trade + Some Free cash vanished without any trades. Clearly something is wrong.

Since nobody is listening to my complaint, I tried reaching Nithin, Nikhil, the compliance officer, you etc, so that someone will here me out. And guess what happened? That mail got created as a separate ticket only for the support team to delete it as a duplicate. So total mail I send to your main team has gone to garbage. Since You are in a known position in the team I thought I could give my last attempt so that you might here me out and convey this to your team members. I posted at [email protected]. But if you could not do much, I totally understand that and had to accept the fact about how bad this system is.

2. I have been following your teachings Sir. I find when the option position goes to deep ITM, I couldn\’t exit it due to lack of liquidity even if it goes in my favour. For,eg, a put bear spread will go to deep ITM if market goes deeply in my favour and I couldn\’t exit with max profits due to poor liquidity even if the trade works. And same can be said when the market goes against us, in a call bear spread as I would like to exit at 50% of maximum loss. Would like to know about how would you deal with such situations? Would you wait till expiry even if you know for a fact that the maximum profit might vanish or close in between taking the slippage cost? Thanks

Sathis, please share the ticket number. I\’ll bounce this off internally.

Open ticket – 20250908731525

Closed duplicate ticket – 20250909106898

Closed duplicate ticket has more details and that is the mail I sent you.

Thank You.

Sathish, I was informed the escalation team is looking into this already.

Hello karthik sir can you please include the last two chapters in the pdf.

Ah, its not there isit? Let me check.

The put seller gets to sell the stock at 3465 when the same stock is trading at 3390. The gain here is –

3465 – 3390

= 75.

Is this correct? Shouldn\’t the put seller have to buy the stock at 3465 even though it is trading at 3390? In this case he loses 75?

Yes, seller has to give delivery, which is what I\’ve explained. Please check once.

Hi Karthik,

I hope you\’re doing well. I am new to options trading, and I have a few clarifications regarding the strike price and profit/loss calculation.

Today, I purchased Nifty 20MAR23000CE (OTM) for Rs. 21.50 (1 lot = Rs. 1612). The order was placed as a carry forward. At that time, the Nifty ATM was 22830. Later, the Nifty 20MAR23000CE increased to Rs. 33.50 (1 lot), and I exited with a profit of Rs. 900.

Now, I have a doubt: If Nifty did not reach the strike price of 23000, how did I make a profit? I\’m not fully clear on how the P&L is calculated in such cases. Could you please elaborate on this in more detail?

Additionally, if the strike price is not reached, is it still possible to make a profit? Is that correct?

Thats possible. Remember, exercising the option happens only on expiry day, but as and when the premiums move, you can buy and sell the same. Do watch this – https://youtu.be/Llp4xW2GI4s?si=lRJD6RIch5fZD3PX

when does physical settelment start like how many days before the expiry ?

The margin collection process starts, but physical delivery is only on expiry day.

Dear Karthik,

Thank you for directing me to the video. However, I noticed that it contains very little information about index expiry, only mentioning it briefly in the key takeaway section.

I believe I have understood the profit and loss calculations for index options upon expiry. Here’s my understanding; please correct me if I\’m wrong:

– **Call Option Buyer:** Max[(Spot – Strike), 0] – Premium

– **Call Option Seller:** Premium – Max[(Spot – Strike), 0]

– **Put Option Buyer:** Max[(Strike – Spot), 0] – Premium

– **Put Option Seller:** Premium – Max[(Strike – Spot), 0]

Your explanation from Varsity, covering modules 3 to 6, was very helpful.

Can you confirm if my understanding is correct?

Thank you.

This is correct Rahul. The only thing you need to remember is that the spot price as such, that is dependent on the settlement price.

Dear Karthik,

First of all, thank you so much for your valuable contributions. Without your modules, I would certainly feel lost in the world of trading.

I have a question regarding the calculation of P&L for index options when held until expiry, as I noticed that there isn\’t much information on this topic. We know that index options are cash settled, but I\’m curious about how this process works when the options are held until expiry.

Specifically, how do we determine the P&L for index options at expiry? Unlike stocks, which have a settlement price at expiry, how do we calculate P&L for index options?

For example, if a long call option expires in-the-money (ITM), will I always be profitable? How is the exact value calculated? Is it possible for my long call option, which expires ITM, to still incur a loss? I would appreciate it if you could clarify this with some examples.

Additionally, I would like to understand the same concept for long put options.

Thank you very much for your help.

Rahul, thanks for the kind words, glad you liked the content useful on Varsity 🙂

Upon expiry, the index value or the settlement price of the index is taken into consideration and the P&L is determined. Have tried to explain it here – https://youtu.be/Llp4xW2GI4s?si=xDB3NCggLVDGsJNw do let me know if this helps. Thanks.

WHY AVAILABLE CASH SHOWING NEGATIVE , EVEN IF I HAVE SUFFICIENT COLLATERAL MARGIN FOR OPTION SELLING POSITIONS

Please do check this with the support desk once.

Hi Karthik,

In \”Call and Put option short, close before the expiry\” paragraph, if I short Reliance 2500 CE at 76 per lot and I want to square off my position at 126 (buy), my P&L should be -12500?

Thanks in advance,

Joseph

Your loss will be the 126-76 multiplied by lot size.

If I have 1 lot equivalent of reliance stocks purchased at 2500 in my demat account.

And I sell one lot of call option with strike at 3000, premium 100, and option expires at spot price 3200.

My purchased stock will be used for delivery.

What will P&L look like?

In this case, you will have to give delivery of RIL at 3000 when RIL is trading at 3200. So you have a notional loss of 200 there.But you\’ve received 100 as premium, which offsets a portion of loss. So your net loss here is 100. However, on the underlying you\’ve gained 500 by holding the stock from 2500 to 3000.

Hi Karthick, why PP is being added in case a. & being subtracted in b. Please clarify.

a. The price at which the seller gives delivery is 2500, but since the seller receives a premium of 76, the effective price is –

2500 + 76

= 2576.

b. The put option buyer will give the delivery of shares at 3520, but since the put buyer has paid a premium, the effective price for delivery is –

Strike – Premium

= 3520 – 55

= 3465

a.Since the seller has received the premium, it is 2500 – 76 = 2424.

b. For buyer it is 3520 + 55 = 3575.

how option seller use agimg ? & option seller required which type of software?

You only need Kite or any trading application to trade options. You can also check Sensibull – https://sensibull.com/

Hello Karthik,

I will be grateful if you remove my confusion. Actually on 29 April 2024 Bank nifty surged around 2.54% in single session and nifty 50 surged around 1.00% signifying strong buying in banking stocks. But when I analyzed cash data of FIIs and DIIs it turned out that FIIs net buy value was 169cr and DIIs net buy value was just 692cr. How this amount can lead to such a big increase in bank nifty.

Could you please help me how to interpret this data.

Thanks in advance.

Its not just FII and DII, there is retail money chasing the markets, right?

sir,

if I am going to deploy iron butterfly strategy from sensibull , the margin showing there is approximately 59000 rs. If I have 60,000 rs in my trading account, will the trade go through , and how much additional margin I have to keep in my trading account to avoid margin call ?

As a best practice, it is always good to have some more funds over and above the margin required.

Hi

If I buy call option today, is it possible to sell the same on the subsequent trading day and book my profit? Or I have to no option but to hold the call option until expiry.

You can sell it whenever you want, Rinaldo. No need to wait till expiry.

Hey Karthik. I wanted to ask how can we calculate the breakeven points and max profit/loss in calendar spread strategy?

Suppose I sold the current monthly expiry call option and brought the same strike next month\’s call option.

As the IV changes, the breakeven points and max profit/loss also expand or shrinks. So is there a formula to calculate it live?

Akshay, earlier we\’d crunch these numbers on excel, but there is no need for that. Simply input your strategy details on Sensibull and the system will share the breakeven points and everything else you\’d need to know about the strategy.

thanks for the reply sir

Happy learning.

Hi sir, what if the stock on expiry is in otm, for example, what if call option buyer wants to really buy?

Then the option is worthless and has no value. Buyers cant buy, sellers cant sell.

Not responding, same response on call also , “we will reply on the thread” thats the standard answer

Anybody here who can give me an email id of senior management, where i can escalate a zerodha kite issue thats been pending fix since 1 year and 3 months.. ?

Any help would suffice, have been posting on support portal but to no avail, executives have stopped responding to the thread,

Its a simple call option ITM expiring and the P&l is not being updated by the team..

Please do call the support desk for this, Ankita.

Hi, I want to know If I sell an bank nifty option 1 lot for Rs. 384 and take a delivery of the same and later on before expiry buy at 524 what will be the loss I will be making it is the difference of (384-524) or any other value.

There is no physical delivery for index options, it is only for stock options.

If I sell an option about 10 to 15 days before expiry, then do I need to square off the position (i.e execute buy) during the end of expiry day?

What if I don\’t square off on expiry day?

Thats ok, if your position is ITM, then it will be physically settled, else it will end worthless anyway.

The explanation can\’t be better than this. Huge respect to you for the same.

Small clarification.

In Call option, Long, held to expiry.

((((You have mentioned Assuming the stock price on Monday is 2650, the profit you’ll make here is –

2650 – 2576

= 74

The shares will be debited from the seller’s Demat account and credited to the buyer’s Demat

account.))))).

What the Call Buyer will get?

One lot Shares or money equivalent to shares?

How much Call buyer to pay for Shares?

Thanks, Rakesh. The call option buyer gets one lof of shares (or how many ever lots the trader has traded in). The call buyer will pay as per the strike price.

Dear Kartik…

Put option long held to expiry… Last paragraph..shouldn\’t it read \”put BUYER(not seller) gets to sell the stock at 3465…\”

Please correct me if i am wrong.

No, its actually correct. Do reread the chapter, hopefully, it will clear out your confusion. Post that we can discuss here 🙂

What would be the loss if I had call option short bank nifty one lot of 15 at strike price of 790.20 @ 44400 CE. The same moves against my direction and the difference between the cost price and the prevailing current price is around 1100 and crossing 45200. Kindly explain the scenario.

You will lose the difference between the buy and sell premium. In this case your loss is 1100-790 = 210.

Sir,

We know For Put option:

Buyer: Give delivery at strike price at expiry

Seller: Take delivery at strike price at expiry

Please correct me on below:

1. For a buyer to give delivery, he has to keep money in the fund. The fund amount is lot size* spot price price*no of lots

2. For a seller to take delivery, the system will debit only the difference amount (strike price minus spot price)*lot size*no of lots from the margin blocked of the seller

Sir,

We know For Call option:

Buyer: Take delivery at strike price at expiry

Seller: Give delivery at strike price at expiry

Please correct me on below:

1. For a buyer to take delivery, he has to keep money in the fund. The fund amount is lot size* strike price*no of lots

2. For a seller to give delivery, the system will debit only the difference amount (spot price minus strike price)*lot size*no of lots from the margin blocked of the seller

I have few questions:

1. For NIFTY and BANKNIFTY options, how the share will be delivered?

2. If NIFTY MAY12000 CE is bought at Rs 10 , 1 lot of 50 shares. On the day of expiry NIFTY is 12015. For the case \”Call option, Long, held to expiry\”, the profit will be (12015-(12000+10))*50 = Rs 250 on the closing of the expiry date of NIFTY MAY12000.

My queries : A. Is the amount of Rs 250 is credited to the account bcozNIFTY MAY12000 CE is expired OR B. The NIFTY share of Quantity 50 will be delivered on T+2 day? and sold only after T+2 day ? C. If NIFTY comes down to 11900 on T+2 ( i.e on the date of delivery of 50 shares ) then is it a loss to the i.e (11900-( 12000+10))*50 = ( -110*50 ) = Rs -5500 D. If the NIFTY share of Quantity 50 delivered, then how can these be sold in the market?

1) Index options are still cash-settled, and no physical settlement

2) Your P&L will be the intrinsic value of the option; in this case, Rs.15 multiplied by 50 = So a profit of 750 minus whatever charges

3) It will be cash-settled and no physical settlement.

I thank you from the bottom of my heart for providing such a comprehensive series on option theory…especially volatility!

The content is so simple and nuanced in delivery!

Best content I have found so far on the internet…all other content pieces led me to lose interest.

Great job Karthik!!

Thanks for the kind words, Rishik. Happy learning 🙂

Dear Mr Karthik,

I have been trading option for one year after watching youtube and reading few Books written by Mr.Lawrence Macmillan and other foreign writers. Things were still confusing.

I read zerodha varsity option trading part-I & PartII. I am grateful to you for simplifying the most difficult part of option trading i.e. \”Option Greeks\”. After reading the complete part I understood so many complicated variables that makes a trader successful.

Best Regards.

Saibal Gupta

Thanks Mr Rangappa!

Happy learning 🙂

Thanks for replying back Mr Rangappa,

In continuation to the above question (part 3)

1. Who controls the liquidity?

2. Is there any alternative way to trade at that strike price?

Regards

1) Market does 🙂

2) Nope 🙂

Thank you Mr Rangappa!

Happy learning 🙂

Hi Karthik,

Thank you for the varsity and your efforts – it has made learning easy.

I am an absolute novice here so please help me out –

Suppose the

Underlying – Banknifty

Spot Price – 42120

Expiry – June23

NRML

I sold one lot at 45000CE and received a premium of 4750/-

Now that the market has gone up to 43000 but still hasn’t reached the strike price,

My Profit and Loss would be –

1.) On expiry – I will have to give the physical delivery of shares as I am an option seller?

The effective price would be – 45000 + 4750 = 49750

Suppose the bank nifty is trading at 43000 on expiry

Then my P&L would be – 43000 – 49750= -6750

Or I just get to keep the premium

2.) If I square off my position with the same values as above then my P&L would be –

[buy price premium (190)-sell price premium (222)] *25*1 = -800

Total loss would be – 800/-

How about the premium which I received (4750), do I lose it or the net P&L is calculated by deducting 800 from 4750?

3.) Also, I was looking at the Banknifty OC, I saw the strike price of 46000 PE June Expiry (there were few more strikes like this) doesn’t have an LTP and trade is not allowed on these strikes, why? What would be the best alternative option if we can’t trade on these strike price?

Thanks in advance!

1) No physical delivery for indices. Anyway, in this case you make a profit as you have sold 45K CE and spot is 43K upon expiry. Your profit the premium you\’d have received for writing the option

2) Yes. Just take the difference between the buy and sell premiums

3) No liquidity in these contracts I guess

Hi sir i have questions. How can I buy more lots of particular strikes

Hello

The P&L that is shown at the end of squaring of a Options position – is it net of all charges too or is it that charges will be computed seperately at end of day?

Respected Sir,

My quires on margin requirements. Lets say I execute short straddle strategy and the margin requirements shows Rs. 145,000 and the final margin shows Rs. 122,000. My question is at Tday my margin blocked will be Rs. 145,000 and on the next day(T+1) Rs. 23,000 will be released from 145,000 and only 122,000 will be blocked for holding the position. Am I right sir?

Could you post the resources/books at the every end of the chapter .

This will be very useful .

Have tried to do that at the end of every module.

Hello Sir,

In the Introduction to Options trading (video series) -chapter 11 i.e. \”Video on margins\”, you\’ve explained how to hedge a Long Future position with Long PUT to reduce margin and risk. Can you please explain it in more details -How to actually execute it? At time of entry, whether Future position is to be executed first or option? similarly, at time of exit, whether I should exit from LONG FUTURE first or PUT OPTION? If I execute my PUT OPTION trade first and LONG FUTURE later, then what will happen?

Priya, always buy the protection for the position which needs margin. For example, if you want to sell a put that needs margin, buy a call option to reduce the margin.

Hi Karthik,

Thanks for explanation.. and wishing happy and prosperous new year

Just wanted to check P&L calculation for options again. Profit as I understood is difference between spot price and strike price and multiplied by lot size. If CE then profit is (spot – strike) and vice-versa for PE. On expiry day, say CE Banknifty 45600 (strike) is trading at 45900 on expiry (last Thursday at 3.30 pm) and hence ITM. Premium paid for CE Rs. 100 (assumed) increased to Rs. 160 (assumed on Thursday 3.30 pm expiry). What would be profit to investor .. would it be (45900 – 45600) x 25 (units in 1 lot) OR (160 – 100) x 25..

My sense.. it should be (45900 – 45600) x 25..

Also what relevance does closing price Rs. 160 has on Thursday @ 3.30pm

Request clarification

Thanks and regards

Jitendra, just take the difference between the buy and sell price of premium and multiply by lot size, that will give you the P&L.

Hello sir,

please suggest a book or a series of books on price action. I searched google and found a set of books written by Mr. AL BROOKS.

Any recommendations from your side ??

I\’d suggest you check this Shalini – https://www.youtube.com/watch?v=z0Rwoz6PduM&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=3

The above question(1st question) in relation to margins is assuming that I\’m currently in a hedged position already. Is there a chance to provide extra margins at the end of expiry due to reasons like volatility or premium increase if I\’m not making a loss.

Excellent explanation Sir. And I just came to know the addition of last chapter which was missed in the pdf format. So thank you for the effort you have given for this. I have some queries.

1. Does the margin increase for option sellers even if we are in profit especially in a hedged strategy like a bull call spread. I\’m asking this because margins usually are lower for hedged positions right? So is there a chance for margins to increase in the last 4 days of expiry even in hedged positions?

2. Lets say my hedged position has a margin requirement of Rs. 30000. In case of basket orders, what if my first buy order doesn\’t get executed due to limit order and is in open position? In that case will the second sell position not get executed due to higher margin requirement or will it get executed. I don\’t want any margin shortfall, but this is quite a possible scenario. That is why I\’m asking.

And would you suggest to execute in market order always to avoid the above situation? Or should we execute them separately with limit order? Is it even possible without a basket order to get the margin benefit in the first place?

If you could answer these, it would be helpful. Thank You Sir.

Hi Sathish,

1. Physical delivery margins also increase for hedged stock option positions. This is because the contract can end up with physical delivery if one of the legs is OTM before expiry. You won\’t see a margin increase for hedged index positions as they are cash-settled and the risk is the same.

2. If the first buy leg is still open, the second leg will get rejected for insufficient margins. About using Market or Limit, it is always better to look at the market depth and place an order to ensure that the contract is liquid. If you want faster execution, you can enter your limit order at a higher price than the LTP(for buy orders).

What happens if ITM INDEX options(BUY or SELL) auto squared off by exchange on expiry day, if there are any extra charges/fine?

No. All charges as listed here – https://zerodha.com/charges#tab-equities

Excellent module. Thanks karthik Rangappa sir.

Hi Karthik,

You have explained these complex concepts in a very nice way for everybody to understand. Thanks for that.

I am new in options trading. my query is –

during market hours many times we hear that these many call writers are trapped on this strike price say Nifty 18500 price etc.. put writers are trapped on this price etc..

– Where can find these details of count/ volume of these call & put writers ?

– Where can we see the Put call Ratio (PCR) ?

– How to analyse these data ?

– Do you have any video or material on above ?

[ I tried looking at Option chain data on nse site. But many things not clear from that data]

Thanks,

Amit

Amit, I\’d suggest you check Sensibull website once for all of this data and their explanation of how to use the same.

Dear sir,

Please consider the scenario.

BANKNIFTY spot: 43150

43100 CE price: 100 (for example)

43100 PE price: 80 (for example)

Suppose BANKNIFTY is moving up and reaches 43250,

In this scenario, I have noticed that the call option premium increases much in comparison to the decrease in put option premium.

Why this happens? Please explain.

The individual strike-specific volatilities are different and that has an influence on premiums.

The put seller gets to sell the stock at 3465 when the same stock is trading at 3390. The gain here is –

3465 – 3390

= 75.

I think it should be \”put buyer\”, there is a mistake in the \”Put option, Long, held to expiry\” section.

Ah, yes. Will correct this. Thanks 🙂

Say I have one 18100 PE sell and one 18000PE buy and the loss on 18100 PE sell is 200Rs and profit on 18000PE is 100Rs. In this case should I have an additional margin of 200Rs or 100Rs(i.e. Loss on 18100PE – Profit on 18000PE ) ?

So on the one you are making a loss of 200 and on the other, you are making 100, so the net loss is 100.

Thanks for explaining the concepts in simple language.

There might be a small typo in Put option, Long, held to expiry section.

In last para, i think it should be Put Buyer instead of Put Seller.

Thanks Amit, will try and fix these typos soon.

Let\’s say, I have shorted 3lots 17650 CE and PE at 70 rs and exited PE at 10rs and CE at 50rs.

My profit is around 12k(50*3*(60+20)) in this case.

Should I need to pay premium of 10rs(exit price for PE) and 50rs(exit price for CE)? this would be deducted from my profit?

Yes, that\’s right. Your profit is the difference between buy premium and sell premium multiplied by the lot size.

I would like to take this opportunity to thank and really appreciate the efforts put in by you and the team for posting such knowledgeable content and videos.

Would like to put in 1 suggestion, every new or updated chapter should be shown in a tab on the main home page as \”What\’s New\” where we will be able to read the content. This chapter was posted much later in Dec 21 I suppose so we don\’t get to know when new posts are out in. Hence this suggestion. Thank you.

Thanks, Meherdad. Feedback noted.

Thank You Karthik Sir.

Happy leanring!

Suppose I sell call option of SBI @ 580 strike price with premium of Rs.3. Spot price is 530. After 3-4 days spot price increases to say 550, which is still OTM, then why should I pay more margin amount? And if I don’t bring more margin amount then what happens to my position? Technically speaking, I am still in profit till such time when spot price crosses 580 strike price, then why I should bring more margin amount? If on expiry SBI price is 579, then will I get to pocket full premium of Rs.3?

As the price moves closer to strike, the probability of the strike transitioning from OTM to ITM is higher, resulting in more risk for seller, hence higher premiums and margins.

Hello sir,

wanted to know what happens to the premium paid while buying the ATM put option and squaring of the position before expiry.

for instance I bought 760PE strike of TATA consumer for 27th October with a lot size of 900 and premium of 20

so total premium paid would be 20*900=18000

I decide to square of the trade when spot price is 750 and the new premium is 30

so then I earn 10*900= 9000 (but I am not even at breakeven at this point since total premium paid is 18000)

My question here is will I get the refund of the premium paid or no ?

Think of the premium as a stock that you trade. There is a price at which you buy the option (buy the premium) and there is a price at which you sell the option (receive the premium back). The difference in price is your profit, or loss.

Zerodha shows last traded price, bid&offer price. How to know the real price of option with respect to the future price?

Hmm, can you explain what you mean by real price?

Normally the P&L is calculated based on Last trade price. Is it possible to get the P&L when selling or buying options at bid/offered prices. Ie if i want to know P&L on immediate exit of options.

Hi,

Is there a sheet where I can input all my trades and the sheet gives the payoffs at different closing points?

Dont think so. Maybe you can try Sensibull once.

Only shares will be physically settled, but not nifty and bank nifty, am I correct

Thats right, Boni.

When my basket order executed all order entry is a one time . Ofter when my orders 1 buy 1 one exit or all or 1 time exit

Only basket order goes as a set, rest are all regular orders.

Hi, I had a debit spread (16000 pe buy n 15900pe sell) 10lots…had profit of 20k…but pe sell had loss of 1lac…so tht is MTM loss of 1lac…for which I need to have additional margin of 1lac?

Margin available was reducing as d position was going in my direction

Please speak to the support desk for this.

Hi sir

1) Supose i have sell call option- i will recive premium of that strike . Can i get exit from my short position any time. Or it is mandatory to hold the short position till expiry to get the premium .

2 ) supose on last day of expiry market spot price is 16400. If i want to sell many lots of 16550 CE @3.0 WHICH is all ready deep in the mony, Can i sell it to get more premium. But time remaing to expiry is very less. Please guide

1) You can exit anytime

2) Its deep OTM, right? Yes, you can sell, but the premium you get depends on the market.

Hi sir

The way you are teaching is. Great

I have some query

1) Supose i have buy call option of nifty at 15000CE @100 AND SELL it at 120 at the same day . What is my profit

2) buying 15000CE @100 & hold till expiry and not sold at expiry . At expiry trade price is 150 will i get profit automaticaly.or need to sell .

3 ) seling the buyed option on expiry day before closing hours or in early morning or mid day will give p&l = buying price -selling price

1) 20

2) You will get it automatically as the broker will settle it for you

3) Yes, that is correct.

Hello sir when the the underlying is bearish the put options could gain premium but the otm options are loosing its value.What force on it sir

It depends, maybe there was a rapid theta decline since expiry was around the corner.

Well explained, and my desire to learn about Options knowing well that it is difficult topic, made it look simple. I am a Senior Citizen and started to keep my mental faculties sharp. Write now I am doing virtual trading and shortly start trading in real. Thanks for the efforts put in.

Happy learning, Sir!

Thanks a lot for these knowledge share! I can see lot of effort has gone into this…

Can you please clarify how do we put Stop Loss….say if I am trading in NIFTY Options.. I am not able to input Nifty levels…it only gives SL option on Margin Values.

Happy learning, Prasad! The easiest way to place a stop loss is to check the spot values and trade the option basis that. For example, if Nifty is at 16K, you want to buy a certain option when Nifty is at 16K and sell that off when Nifty moves 1.25%, irrespective of the premium that prevails at that point.

Hello Sir,

Following up on my previous questions.

1) What if I want to exercise my option, how do I inform the broker?

2) Why would the margin required in the last week go up if now there is an option for DNE and physical delivery is not compulsory?

1) If the option is held to expiry, then it implies that you have an intend to hold to expiry. No need to explicitly inform the broker.

2) Because you don\’t know where the option will expiry right?

Hello Sir,

I hope you are well.

Regarding Delivery of physical stocks via Futures and Options.

Now Sebi has given the option on Do not exercise?? So I have a few questions regarding this.

1) How do tell my broker via the platform that I would like to exercise or not exercise said contract?

2) Does the margin go up in the last week like it did earlier?

1) The broker takes care of this.

2) Yes, it does.

I mean do I have to dig deeper??

PLease see my previous query.

Sir thank you, I have completed this modules. My last question do I have to get more knowledge about options from anywhere else to be a good profitable trader or is this enough??

The knowledge you get here is more than good to get started. Apply this and start experiencing the markets.

A call option writer of ABC stock sells a particular strike with the following details:-

Strike Price:-Rs.50

Premium:-Rs.8

Days to expiry:-5

Lot:-500

Spot price on the day of expiry:-Rs.45

If in the above case if the premium rises on the 3rd day with 2 days left to expiry to Rs.10,then as the risk of the seller has increased he would be required to pay extra margin amount ,i.e 500*2=Rs.1000.

However my question is even if the premium of that particular strike remains same (Rs.10)till expiry but the strike is still ATM or OTM then the buyer will receive his entire Rs.8 as premium and all the earlier margins including the extra margin paid by him will be unblocked na??

Please guide for the same.

Thanks in advance!

Yes, but the thing to note is that the spot should remain at or below the strike on expiry day. If that happens, then the premium in full is retained.

Let say at start of month I have 30,000 Rs capital and I took first trade using whole capital. Assume I booked 2.5% on this trade. Then for next trade, I added more 30,000 Rs to my trading account. Now for 2nd trade I have total capital of 30K+750+30K=60750 (Including profit from first trade). Now I took 2nd trade using whole capital of 60750 rs and I lost 0.5% (303 rs). Now I have capital of 60446 rs. At the end I took 3rd trade and booked 1.5% profit.

Assuming I did only 3 trades that month, at end of month, I will have total capital of 61352 rs (Including capital added by me and net of profit/loss). Here what is total return in %.

I used different capital for 1st trade and different for next two trades.

The easiest way to do this add you capital i.e. 30K plus 30K = 60K. 1352 is your profit, so

1352/60000

=2.25%

What if buy a ce option at night …and market opens gap up..will my order get rejected or executed at yesterday LTP?

How will you buy the option at night? The market closes at 3:30 PM. But you can place an after-market order to buy the call option, which will get executed by market open the next day at the prevailing price at open.

Hi..

Instead of first adding and then subtracting the premium from the strike price,can we not calculate the P&L as explained by you earlier in chapter 3-6,as I.V+premium in case of long call and put and Premium-I.V in case of short call and put as I think it is more feasible.

Please guide for the same

Thanks in Advance.

Ah no Paras, that will give you wrong results. You can actually test it in live markets and see if it works.

I sell options.

premium is credited to my Demat account after T + 1 day.

During the course of the trade, I am in profit more than expected. I square off the position before expiry. Why that profit is not reflected in my Demat accout balance. and instead the account shows Debit balance( Broker sks for more margins). Is it that I have to hold the position till expiry only to see the profits?

I think the margin benefit you\’d have got for the position is no longer available since you are trying to close the position. Check if you have other open positions.

Hi,

can an expert help me with this query please.

Say nifty spot is at 20000. If i sell put – 19000PE at say 100 Rupees, and lets assume at expiry, the spot moved to 19005 with the premium now at say 150. In this case, the premium has increased by 50 and it has expired. so here, will i lose money or since it has closed not below my option strike price of 19000, will i not lose money?

At 19005, 19000 PE is ITM by 5. Since you sold at 100, you will make 95 here.

Small correction , I think in section \”Put option, Long, held to expiry\”

\’ The put seller gets to sell the stock at 3465 \’ should be > \’The put BUYER gets to sell the stock at 3465 \’ ??

please suggest

PUT long is buyer, my bad.

Okay sir no problem 🙂

Sir can you put a PHYSICAL BOOK* on varsity

If it is possible then that would be great sir ☺️

No plans as such 🙂

Just completed the entire options theory. Really helpful and the examples given are excellent. Thanks Karthik.

Happy learning 🙂

Sir can you put a Book on Varsity

We would be very happy to buy it.

All books are available here already and put up for free. No need to buy 🙂

HI Team,

I had one query

If the option seller is having loss unlimited or max to margin paid…?

If unlimited, how to get back that amount from user if he is not ready to pay.

if it is max to margin paid,, how the option buyer is having unlimited profit..?

Loss is to the extent of margin blocked (in 99% of cases).

Dear Karthik,

Completed all the modules in options and it is very simple to understand, I took few options buying trading without any fear and now the way I look options trading is different, thanks to you for teaching us in a simple way.

Now so curious to learn the options strategies, will meet you there 😛

I\’m glad to hear that, Prabhu 🙂 Hope you continue to learn from Varsity!

hi Karthik,

i had a wonderful learning experience through varsity, thank you

Glad to note that. Happy reading!

Hi Karthik,

I have a query on the profit/loss calculation when we sell Stock CE/PE options.

Scenario :

Assume I sell 1 Lot of HDFC 2300PE March\’2022 Expiry and collected a premium of 300*15 -> 4500 Rs

HDFC closes around 2270 on 31-03-2022 Expiry day

since options 2300PE expired ITM, I need to take physical delivery of HDFC shares with price 300*2300 = 690000

what is the profit/loss for the option seller ?

For option buyer : (2300-2270)* 300 – 4500(Premium) = 4500 ?

For option seller : 2300-2270) * 30 = 9000 – 4500 (premium) = -4500 Loss ?

PE option seller need to do cash settlement of (2300-2270) * 30 = 9000 to option buyer ? in addition to taking delivery of stock ?

Scenario 2

same question in case of CE seller and the option expired ITM,

Assume I sell 1 Lot of HDFC 2500CE March\’2022 Expiry and collected a premium of 300*20 -> 6000 Rs

HDFC closes around 2540 on 31-03-2022 Expiry day

since options 2500CE expired ITM, I need to give physical delivery of HDFC shares at price 2500*300 quantity = 750000 credit

Also need to do a cash settlement ? (2540-2500)* 300 = 12000 ?

Arun, no cash settlement. The option is physically settled for both buyers and sellers and the shares exchange hands at the strike price. Holds good for both calls and puts.

I have a small doubt Karthik. If we are closing a position before expiry will we need to cross the breakeven point? Or the breakeven point is valid for the trades closed on expiry? plz clarify.

Yup, it\’s valid only if you hold to expiry. If you sell before expiry, then the difference between premiums is what matters.

Hello Karthik.

I am new to Options. I want to know from you whether I made a profit/loss.

I did one Options trade on 28th February 2022.

I bought one lot of Nifty March 16400 CE at Rs. 525 and sold it (intraday) at Rs. 643.45. According to this, I made a profit of Rs. 5,922.5 ((643.45-525) x 50).

I paid a premium of Rs. 26,250 (Rs. 525 x 50) as margin when I bought. Will this margin amount be returned to me along with the profit?

Please explain.

Thank you.

Abhinav.

Yes, so when you buy, you\’d have paid 525*lot size and when you sell, you receive 643.45*lot size. So the difference is what you make as a profit.

Noted 🤓

Thanks for all your effort!

Cheers and happy learning 🙂

Hi Karthik,

I have officially completed 5 modules. I had never entered FnO, I had the fear of losing money due to the lack of knowledge/tools required to trade here. Now I have the confidence to execute trades so thanks for that.

Currently, I have 2 queries:

1. The strategy mentioned in previous chapters where we short/write options closer to expiry and hold them till expiry hence making small but for sure profit. Is this still valid with new rules of physical settlement? should we square off on the last day?

2. This one is more of feedback or suggestion than a query. Can varsity be translated to local languages? Since it is already present in Hindi should be possible for other languages like Kannada. I know it\’s a large task but the reach of varsity(Financial Education) will be more and many will be benefited. The video series also looks very good with the latest addition to Futures, here too if captions/subtitles in local lang are made available it would be great.

ಧನ್ಯವಾದಗಳು

ಕುಮಾರ್ ರಾಘವೇಂದ್ರ 🙂

Congratulations, Kumar!

1) This is not \’sure\’ profit, in fact, nothing in the market is 🙂 BUt yes, it is applicable with physical delivery as well (since you will sq off the trade before expiry)

2) Thanks for the feedback, Kumar. The translation work is really tough, but subtitles, let me check.

Hi,

For Options GTT can Zerodha remove in SELL OCO the trigger price and keep only the limit Price?

Most of the time Trigger price is hit and the limit price is skipped even if use sell trigger price high and the limit price little lower

I don\’t see a necessity for Trigger price

Ex: If i bought 37500 CE @ & 710..A GTT order is created with a target limit of 715 and SL limit of 700 it is easier for entry and exit

YOu can keep trigger and SL the price Ravi.

HI,

Ex: If I buy 37500 CE At 720 and placed a GTT with a stop loss of 2% and Target 4%

and also kept sell limit order for target 724…

But when the GTT hit for STOP loss it is considered as a new Sell option but I am trying to close the existing position of 37500CE

Kiran, I hope you had selected OCO – https://zerodha.com/z-connect/tradezerodha/kite/introducing-gtt-good-till-triggered-orders

Hi,

Why some times in options market depth (Buy & SELL) price changes

Example current LTP was 750

Sometimes when market depth changes like

Buy 752 sell 753

Buy 755 Sell 756

Buy 758 Sell 759

And LTP suddenly changes to 759

Sundar, buy and sell values i.e. the bid and ask spreads keep changing as per market demand and supply. But the LTP changes only based on the trade.

Hi,

When buying bank nifty I buyed 100@ 703 using target 708 and Stop loss 700

using percentage method

After executing order gtt says already triggered… please enable again

What is the best option to execute this trade with small Stop loss and profit

Nithin, I think the % you quoted must have gotten triggered. Try expanding the % range.

karthik sir what will you recommend buying indexes or stocks in options

I\’d suggest you stick to Index options, they are highly liquid and easy to trade.

Hi,

Why some times in options market depth (Buy & SELL) price changes but LTP price not changes

LTP changes when a trade occurs, Sundar. If there are no trades, then there is no change in LTP.

hello kartik

If i sell call option 18100 at 100 premium of nifty intraday then i will receive 5000 ruppes credit in account ( 50×100)

If i square off at 150 means loss of 2500 and will it get covered from premium or not

Or do i need to put extra money

Tejas, it will be adjusted from the premium blocked and released.

I did not get the premium collected sense in \”Call/Put option short, held to expiry\”. The option must be in the money then how can we ascertain the premium collected ? Tell me where am i going wrong with an example.

Rahul, when you sell the option, you collect the premium.

Some content in pdf not available ….last chapters

I think the latest additions are missing, let me check.

Hello ,

Thanks for wonderful lessons and explanation.

My doubt is why physical settlement is Mandatory for a Option buyer, considering option buyer has right to execute the contract but he/she doesn\’t have any obligation to do it.

What if option buyer decides not to execute the right?

Regards,

If you are executing the right, then it implies that you are taking delivery. If not, you can square off the position before expiry and not deal with the physical settlement.

Thank you Karthik.

Good luck, Srinivas!

Hi Karthik,

Your way of explaining things with examples has made my understanding the concepts easy. Keep up the Good work!

I have one question below

Say I have bought a Call Option Long for say a lot of 100, premium @ Rs 20, at the end of the day , the premium increased to @ Rs 30, I did not square off my position on the same day. Will the profit of the day i.e., Rs 10 * 100 = Rs 1000 will be credited to my account on T+1 day or the entire profit will be credited only on the square off day?

Thanks,

Srinivas.

No mark to market in options, Srinivas. It will be credited when you square off the trade.

If I execute bull put spread with margin around 50000

Here I have already limit my loss

And if volatility increases and so is the margin still I need to pay extra margin though my loss is limited within the margin I have given

Yes, with the increase in volatility the overall margins increase right?

Requires the tips to analyisee the Intra day chart before a day.

I see new Options chapter in Varsity. I click!!!

Thank you Karthick. Your options module have made understanding CFA Levels 1, 2 and 3 option portion and strategies a breeze!!!

Happy learning, Sujeet 🙂

Thank you.