6.1 – Flashback

The retirement problem chapter has laid down a learning path to understand personal finance. We know now that to build a retirement corpus, long-term investments in mutual funds is inevitable. Given the pivotal role mutual funds plays in defining our financial welfare, it is completely justified to spend some time to learn about mutual funds. The learning that I’m talking about is something that goes beyond normal mutual fund investors would know. The objective here is to help you know the basics plus a little more. Hence, the topics I’d like to cover here are –

- What is a mutual fund?

- Who runs a mutual fund and why?

- Regulatory aspects around a mutual fund from an MF investor’s perspective

- The different types of mutual funds – Equity, Debt, FoF, Hybrid, Liquid

- How to analyze a mutual fund? – Risk, return, ratios, exposure

- Factors that matter – MF ranking, Direct vs Regular, Growth vs Dividend

- Setting long term return and risk expectations

- Constructing goal-based mutual fund portfolios

- Logistics – SIP, SWP, STP, CAS statements, DEMAT vs non-DEMAT mode

- Tracking investments

- Mutual fund taxation

Of course, I will add more topics if there is a need for it.

Given this, let us get started on the very first topic i.e. to understand what a “mutual fund” really means.

I’m making an assumption here that you know nothing about mutual funds. I’m assuming that this is your very first attempt to learn about mutual funds, hence we are starting from scratch. You can skip this chapter if you know what a mutual fund is.

Before we start learning about Mutual funds, I’d like to digress a bit and narrate a personal story dating back to 2008-09.

I’m not sure how many of you reading this were trading, investing, tracking or remotely connected to the stock markets in the year 2008. The year 2008 was very interesting (perhaps scary) for people sitting on the sidelines and watching all the action, but for people involved and had their livelihoods tied to the market, 2008 was apocalyptic. The financial services industry was in absolute pits, and I was in the city of London, which was the epicentre of the financial meltdown. I was relatively new in the industry, had very few industry connections, and hardly any working experience in the UK. When the industry-wide job cuts started, I knew it would be me sooner or later. The good thing was I just dint sit on the sideline wondering if I would get the layoff notice. I knew it was a matter of time.

Given the situation, I had decided to head back to India. Of course, not that there many options for me to choose.

By Feb 2009, I was back in Bangalore, luckily I found myself a spot to sit and trade the markets with the (now) legendary Kamath Associates (pre-Zerodha days). Soon, I was in the thick of the action and I was trading anything and everything that moved on the Indian exchanges.

The capital to trade was mainly my own plus a bit from my close circle.

While trading was something I enjoyed, I found investing super interesting. I spent a lot of time reading the annual reports and understanding of businesses. This effort included learning a bit of accounting to help me read the company’s financial statements. I soon realized that stock picking and building long-term equity portfolio was something that I wanted to do for a living.

I slowly branched out from active trading and started building an investing practice. I moved out of Kamath Associates to do this full time. Of course, at that point, Kamath Associates dissolved and Nithin Kamath started Zerodha.

Over time I built a carefully crafted equity portfolio for myself. I had a thesis for each investment made. I was aware of the growth drivers and the risk parameters for each stock I had invested.

While I started doing this for myself, I soon extended my help in setting up an equity portfolio for my family members and later to my close friends. I had few things going right for me and soon people around me and their immediate circle knew I was a good option to consider for equity investing. It was in November 2010, that I decided to do this as a profession.

My idea was to help people build an equity portfolio, manage it on their behalf, grow it, review it periodically, assess the risk, and do everything possible with a single point agenda – to help them generate wealth over a long period.

In short, I wanted to be a ‘Fund Manager’, help people build wealth by investing their money in the stock market.

I continued my journey, by 2012, I was fortunate enough to onboard a bunch of clients and managed a decent sum of money. I was taking an independent decision on which stock to invest in and which stocks to exit. I was deciding how much to invest in each stock and for how long. On the first Saturday of every month, I’d send a report to all my clients informing them of how their portfolio was performing in the market.

I was indeed a fund manager for at least 20-25 families, and I felt happy and responsible being in that position.

However, there was a problem lurking. As per the regulators, i.e. SEBI, anyone aspiring to be a fund manager and manage portfolios, had to procure a license from SEBI. This license is called the ‘Portfolio Management Service’ (PMS) license. Probably I’ll discuss PMS later in the module. Given my situation, the cost of applying for this license and the associated net worth requirements was prohibitive. Hence, I was forced to shut shop in the subsequent years and return the investment capital to the clients.

Anyway, thanks for reading through my rather boring flashback, but I had a reason to share this with you. I want you to identify a few things. As a self-proclaimed fund manager, I was trying to –

- Researching stocks

- Build an investment thesis for each stock

- Estimate the amount of money to invest in each stock

- Build an equity portfolio

- Track individual stock and overall portfolio

- Measure the returns, performance, and risk at periodical intervals

- Report to clients

The points mentioned above captures the role of a typical fund manager. At this point, I want you to be very clear about the role of a fund manager.

Also, a quick reminder – we are in the process of understanding what ‘mutual funds’, means and I hope I’m heading in the right direction, so please do stay with me on this 🙂

6.2 – Large scale fund manager

I guess most of us at some point would have paid a visit to the neighborhood bakery to buy either a loaf of bread or a pack of biscuit baked by the baker. These biscuits usually have a local and unique taste to it, not available elsewhere in the city. It is a local thing. It is nearly impossible for a person in another city to source the same biscuit.

However, think of the biscuits made by Britannia, a large-scale biscuit and cookie manufacturer. It does not matter whether I’m in Bangalore or Delhi. The same Britannia biscuit is available throughout the country. It tastes the same, has the same packaging, looks identical, and weighs the same. Not a grain of salt or sugar varies from one pack to another. It is a highly standardized offering.

Britannia is a large-scale baker, with a distribution network across the country. The baker in your neighborhood is a local baker, with the residents as his loyal customers. He does not have a distribution network like Britannia.

Now think about my ‘fund management’ affair, I guess you would agree that I was comparable to the local baker, catering to a small set of customers in the neighborhood.

On similar lines, there are “fund managers”, on a large-scale basis who can cater to millions of customers and offer the same service to each one of these customers.

Customers in the fund management context are people who are looking for ‘fund management’, services.

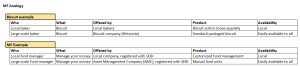

These large-scale fund managers typically operate via a mutual fund structure. Think of the mutual fund structure as a method to offer fund management at scale. I will shortly discuss this in more detail, but before that, let us draw a quick analogy to reestablish the things we have learned so far –

At this point, all I want you to understand is this –

- A fund manager is responsible for your funds

- An Asset Management Company (AMC), is a company where a fund manager works and manages your money

- Think of the ‘Mutual Fund structure’, as a vehicle or mechanism to manage your funds

I hope so far so good. We will now proceed to understand how a mutual fund company is structured and functions. I understand that you do not need to know about this, as long as you know how to invest in a mutual fund. Fair enough, but I have a slightly different objective here i.e. to make you a little more knowledgeable than a normal MF investor.

It is like this, you can buy a DSLR camera, turn on the auto mode and start clicking the pictures. Chances are you will end up taking decent pictures. However, if you take the effort of knowing a little more about your camera, you may end up using your camera more efficiently, which may perhaps result in a brilliant photograph.

Therefore, in my opinion, knowing a bit about the structure of an AMC will not go waste. It is one of those ‘good to know’, things in life 🙂

6.3 – Deconstructing an AMC

Setting up an Asset Management Company (AMC) is a very daunting task. You cannot wake up one day and decide to start an AMC. There are prerequisites to set up an AMC and these prerequisites are laid down by ‘The Securities and Exchange Board of India’ (SEBI). SEBI is the governing authority for all the AMCs in India. SEBI holds the rights to grant or not grant the AMC license to a corporate body.

The process of setting up an AMC is highly stringent and rightfully so. After all, there is a large scale public money at stake and the regulators need to ensure this money is managed by responsible entities.

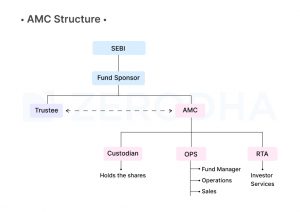

In their effort to bring in transparency and accountability, SEBI has proposed a multi-tier structure for an AMC. Here is the structure of an AMC –

Fund sponsor – Think of the fund sponsor as the main promoter of the Asset Management Company. The fund sponsor is a corporate body, which expresses a desire to set up an AMC. The fund sponsor approaches SEBI for setting up the AMC. The fund sponsor has to follow the 2 stage application process by furnishing all the details SEBI would require. At the end of stage 1, SEBI either denies the licenses or grants an ‘in principle’, approval for the same.

Once the in-principal approval is issued, SEBI demands more documents and details for further scrutiny. Finally, after the stringent due diligence process, SEBI can again decide to either grant or deny the AMC license to the fund sponsor.

Trustees – Once the fund sponsor procures the license from SEBI, they need to register a trust and appoint a board of trustees. The trust ensures that the AMC formed by the fund sponsor carries out its duties in the right spirit and works in the interest of the clients of the AMC (unit holders). SEBI also mandates that the trustee of the fund is independent and not associated with the sponsor in any way.

AMC – The trust in consultation with the fund sponsor appoints an AMC. The AMC is also called the ‘Investment Manager’. The role of the AMC is to float a mutual fund and manage the different investment schemes of the AMC. The AMC houses a chief investment officer (CIO), fund managers, analysts, and everyone responds to run and manage the mutual fund. The AMC is responsible for the operation and management of different mutual fund schemes, in compliance with the SEBI’s rules and regulations.

Think of the AMC as the core engine responsible for running the mutual fund show.

Custodian – The AMC now appoints a custodian. A custodian’s job is to hold all the shares that the mutual fund buys. Think of the custodian as the safe keepers or the guardians of the mutual fund assets.

RTA – The ‘Registrar and Transfer Agents’ is appointed by the AMC. The RTA’s job is to ensure that they serve the clients of a mutual fund (unit holders). The services here include issuing folio numbers, transfer of unit, etc.

The custodian and the RTA are called the ‘service provider’, for the AMC company.

All the parties involved work in synch to run the mutual fund company. For you as an investor, the only two things that matter is –

- Who is the sponsor of the AMC, this is to ensure you are dealing with credible names

- Who the fund manager is – to ensure the money is handled by the right person

Anyway, let us put all of this information in context before we wrap this chapter.

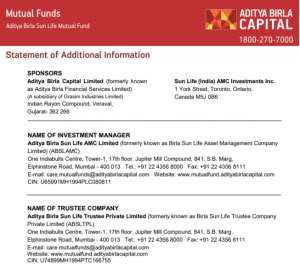

As you can see, these details belong to the Aditya Birla AMC.

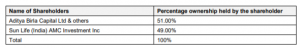

There are two sponsors here i.e. Aditya Birla Capital Limited and Sun Life (India) AMC Investments Inc. These two companies have jointly approached SEBI to procure an AMC license. Since there are two fund sponsors, this is a joint venture and the shareholding is as follows –

The sponsors, after obtaining the AMC license have floated Aditya Birla Sun Life AMC Limited, which is the name of the investment manager or AMC.

They have also formed a Trustee company called, the Aditya Birla Sun Life Trustee Private Limited.

The details of the service provider are as follows –

As you can see, the company has appointed, two custodians (Citi and Deutsche) and 1 RTA (CAMS). Besides, there are other details on the bankers and auditors.

Key takeaways from this chapter –

- A fund manager is responsible for managing the mutual fund

- The sponsor of the AMC is like the promoter of a mutual fund

- The sponsor holds the AMC license

- The sponsors appoint a trustee and AMC company

- AMC is the investment manager responsible for running the mutual fund

- Custodian appointed by the AMC is responsible for holding shares and other assets of the AMC

- The RTA is responsible for servicing the AMC’s unitholders

Didn\’t is misspelled as \’dint\’

Hi Karthik, I am more curious to know how you did the following. I know you covered some of it in this module. But would like to know more.

1. Researching stocks

2. Build an investment thesis for each stock

3. Estimate the amount of money to invest in each stock

4. Build an equity portfolio

5. Track individual stock and overall portfolio

6. Measure the returns, performance, and risk at periodical intervals

Hi Gowtham,

1 & 2) Have you checked the module on FA? That will give you some insights.

3) This depends on your risk appetite and capital available. Maybe check the module on Risk management?

4) Again FA

5 & 6) Will try and do a video on this.

1&2) I know FA will help there. But there are 5000+ stocks on NSE. Obviously, it would be a nightmare for anyone to go over each company. So I just wanted know how would you pick or filter stocks to go over their fundamentals. Do you go over stocks on a popular index? If not an indexed stock, how would you have picked a stock otherwise. Is there any pointers that we can look in a stock to make us look into it\’s fundamentals?

Ah, of course. Filters help. Use portals like Screener or Tijori to filter through these and zero down on a bunch of stocks to track. For example – your filters could be as simple as –

1) Companies that are 1000Crs market cap or above

2) Companies that have a ROE of 12% or higher

3) Companies with PAT growing at 5%

These are a few, but you can come up with as many as possible!

How canI invest in mutual funds through ZERODHA

Yes, please do check this – https://coin.zerodha.com/

Very well explained

Happy learning 🙂

Great Article. Keep doing the work 🙂

Happy learning 🙂

To learn about investing in Mutual Funds, do I need to read everything or just Module 11?

No, just this is good enough 🙂

The below line is given in the blog

\”SEBI also mandates that the trustee of the fund is independent and not associated with the sponsor in any way.\”

But in the example that you showed here Aditya Birla and sun life amc, the trustee is again Aditya Birla group.isnt it opposing the sebi rule tha to quoted above.

Thank you in advance.

Independent in terms of being a legal entity. It has to be two different companies.

Is Zerodha charge dmat charges for mutual funds on exiting

No, Zerodha does not, but the AMC may charge. Look for the exit load for the fund.

Hi Karthik, As In trustees Explanation You mentioned that SEBI made sure that Trustees and Fund sponsor Won\’t have direct connection. But In Aditya Birla example Trustee and Sponsor were both from Aditya Birla Group, So Is anything I am missing? Or it is okay to have connection between Trustees and Fund sponsor.

They are two different legal entities, although they have a common group name.

Karthik making me fall in love with Personal Finance!!

Happy learning 🙂

Hi Karthik,

I have few questions request your input on these

1) What stops a Fund Manager in buying bad stocks. Lets say tomorrow a company prices its IPO very high can the Fund Manager buy stocks of such company based on his personal interest. If he buys and there is a huge market correction will he be penalised.

2) Suppose I invest in a mutual fund and it performs badly compared to the market. As an investor what are my rights since I am risking my capital.

3) Suppose my mutual fund performs badly and I no longer need to stay invested in it can I take legal action as I wont be willing to pay expense ratio/ exit load.

4) Is Insider Trading possible by Fund Managers. If yes is there a way I can avoid such Funds

PS : I know Mutual Funds are subjected to risk, but where do we draw a line in what is correct and wrong in terms of Mutual Fund

Wishing you good Health and Happiness

1) AMCs have process in place, including investment in IPOs, so they cant really do random things like this 🙂

2) Nothing, you need to evaluate the risk and make an informed decision. Risk is inherent in capital market investments.

3) No

4) Yes, but the chances of that happening is very very very low given the tight regulatory environment we are in.

Initially it is mentioned that \”SEBI also mandates that the trustee of the fund is independent and not associated with the sponsor in any way.\” but later when we see the example of Aditya Birla MF we can see that the trustee is none other than the parent company itself, they just have set up a different company for their trustees. How is that independent since it is closely tied with the sponsor?

Sorry, I meant to say that there are at least a few Independent Directors.

Hi Karthik, Can you point me to the chapter covering \”Expense Ratio\” of the Mutual Funds, I could not find them myself? TIA

Here you go – https://www.youtube.com/watch?v=hzAFmR5ll8Y&list=PLX2SHiKfualGsjgd7fKFC-JXRF6vO73hk&index=9

Complete playlist here – https://www.youtube.com/playlist?list=PLX2SHiKfualGsjgd7fKFC-JXRF6vO73hk

Sir,

As mentioned above that SEBI also mandates that the trustee of the fund is independent and not associated with the sponsor in any way(in trustees)

In example below it is Sponsor – Aditya Birla Capital Limited and Trustee – Aditya Birla Sun Life Limited.

Here, the Sponsor and Trustees seem to have an association. So is it okay that Sponsor and Trustee to have an association??

What they mean is that they are two different companies with independent boards etc. They can still belong to the same group.

Sir,what is difference between smallcase and mutual fund?

MF is a formal structure to invest in stocks and bonds, offered by a fund house. Smallcase does the same, but via multiple advisors. You should check this article – https://scripbox.com/mf/smallcase-vs-mutual-fund/

Hey Karthik!

Big fan of you work and zerodha varsity.

If you could elaborate more on “ Build an investment thesis for each stock” that you have mentioned under section 6.2, I would be grateful. What all components would you consider in the thesis?

Thanks Suchitra, I\’ve touched upon this here, please take a look at it – https://www.youtube.com/watch?v=Exbm-Bb5XCk&list=PLX2SHiKfualFGenPFh2onjzsh8TeprEmU&index=10

As mentioned rightly by Zerodha Coin, That Investment through Coin in Direct MF is free of charge e.g. Non commissionable,

With regards,Can i believe that I will get same NAV and Zero Charges for my MF investment in Coin (as well

as) Compared with Direct Mutual fund purchase from Fund House?

Yes, you should.

Hi Karthik,

In case of your Aditya Birla Mutual Fund example, The sponsors, investment manager and Trustee all are somehow connected to Aditya Birla Group, however they are different legal organizations. How do i trust that all activities behind the scenes for managing the fund are acted towards the benefit of people who are investing in the fund?

That\’s where the trust component kicks in. Besides they are all regulated by SEBI.

Sir, here you said that the trustee of the mutual fund should be independent and not associated with the sponsor in any way but in the example you have shown here shows the \”Aditya Birla Sun Life Trustee Private Limited\”, my point is that sponsor is also from Birla and trustee is also from Birla how can they be independent from each other?

Please clarify this confusion of mine.

Group company maybe same, but within the group, its two different companies run by different sets of people.

but how does the expenses of running coin are covered I am still confused and shocked with this part

Our main business (revenue) is from stock broking.

I really appreciate the efforts for this and thanks for providing such a wonderful platform

Thanks, Shivansh! Happy learning 🙂

I get that part but I am still confused that why would anyone do something from which it doesn\’t make any money and as it doesn\’t make any money it would have some expenses for running such a great platform like \”coin\” then how does zerodha cover those expenses for keeping coin operational

Coin is managed by a lean team, Shivansh. For the business, the border context matters 🙂

What?!!! If coin doesn\’t make money then why zerodha is still running it

To ensure we provide all assets types to our customers 🙂

if its a distributor then why it doesn\’t take any commission, does it get its commission from the AMC\’s whose mutual funds get purchased through coin and if that\’s not the case too, then how does coin even make money

No, we distribute only direct funds, so no commissions. We don\’t make any money via mutual fund distribution.

Then where does coin fits in and what is bse star mf

Think of Coin as a distributor of mutual funds. StarMF is BSE\’s platform responsible for ensuring the units are delivered to investors.

as above in the organisational structure explained by you of the mutual funds under the subhead who runs mutual funds and why, I wanted to ask that where does platforms like \”Coin\” gets fit is it a RTA cause all the things it does it seems similar to the things done by the RTA

We don\’t, BSE star MF does.

Hi Karthik sir, I have just started my career and wanted to learn how to manage my finances. I am extremely grateful to you for spreading such valuable information in a beginner friendly way. I am enjoying reading these modules despite being from engineering background. They are easy to understand. Thanks a lot! You are making a great impact 🙂

Hansika, thanks so much for letting me know. Good luck and happy learning 🙂

good article on mutual fund really impress by your knowledge . mutual fund is great to invest.

Happy learning!

Thank you! karthik sir for such a wonderful knowledge

Happy learning, Harsha!

Hi, may I know when will the pdf for chapter five \”introduction to mutual funds\” be available?

The entire PDF is available at the end of the module page – https://zerodha.com/varsity/module/personalfinance/

[email protected]

I have transferred my regular mg from prssb to zerodha coin . Now how can I sell those regular mg from coin

This won\’t show up on Coin. I\’d suggest you create a ticket for this.

Hey Mahesh,

When you transfer the units purchased from a 3rd party to zerodha, you need to send us the purchase details of the fund as on Coin for us to update the details. Can you create a ticket with the AMC transaction statements or the purchase details in an excel format so that we can update on Coin. You\’ll have to send us the the following details in Excel format.

>> Amount invested:

>> Folio Number:

>> ISIN of the fund:

>> Number of units:

Also, you can add the discrepant entry along with the individual buy date on Console. Once the units have been updated on Coin you can redeem em. Please create a ticket here

Hi Karthik,

While explaining about Trustee, you have mentioned this \”SEBI also mandates that the trustee of the fund is independent and not associated with the sponsor in any way.\” But in your Aditya birla example, Sponsors Aditya & Sun life together formed a trustee. Isn\’t this violating SEBI rules ?

Technically they are two different companies with a different governing board, Kamalesh.

To the point, as always!

Happy learning, Sairaj!

Hi Karthik,

Recently my friend contacted me and informed that his dad has physical mutual fund (paper form) which was bought on mid – 1990s…

Name of the fund is Tata Ind shelter plan A – Regular and having 1000 units of it.

I found in Internet that this fund was closed in 2002.

Now whats the solution for this?

1. Whether he will get any money from that fund or any equivalent units in any other Tata fund?

2. From Paper form to digital form, which is better? Only with Pan card using registrar or converting it into Demat form directly from paper? Which is better ?

Please give ur valuable feedback.

The fund would have been merged with another fund. I\’d suggest you contact Tata MF investor desk and get this clarified. I\’d suggest digital form, as the units will be safe in your DEMAT account.

You said that the trustee should not be related to the sponsor, but here in the example we can see they are same. Whats the catch?

Different companies, but could be under the same Group.

Hi

I have closed and transferred my trading and demat account from HDFC to Zerodha. I am having issues with the MF transfer.

Zerodha customer care has not been helpful and has sent me email requesting folio numbers which is not available to me.

Mutual fund houses I contacted could not help, saying I bought the MFs through demat account. They only have my PAN card number.

I was told to contact individual AMCs but I have 35 different mutual funds. Some of these mutual funds are long term. I have no intention to sell them, but I want it reflecting in Zerodha the way it is supposed to.

Regards

Puri

Puri, is there a ticket number?

Hey Karthik

The interest in finance that MBA couldn\’t instil, I am getting it from reading your content on Varsity. I just wanted to take time to appreciate your efforts in creating and sharing such content and resources. Kudos to your efforts!!

Thank you so much Raghav, means a lot to me and my team 🙂

Sir, you write so lucidly even a layman like me can get the courage to get into the jargons of finance and can think of financial independence.

Thanks, Jyoti! Happy learning 🙂

The PDF for this module is still not available. Please look into.

Yes, we will.

sir please explain XIRR concept in mutual fund. Can we plan to increase SIP when PE ratio of market is down

Check this https://zerodha.com/varsity/chapter/measuring-mutual-fund-returns/

In mutual fund sip we have min investment of 5k, so we have to pay 5k in the start and then as installment as per our wish is it?

Yes, that\’s right. I think the min is Rs.500/-.

I am amazed at the clarity you bring innto your lessons. With the recent Franklin Templeton fiasco for 6 funds where investors have taken a massive hit how would you advise us the investors to indentify black sheep\’s in AMC? We all will be grateful if you could enlighten us.

Thanks for the kind words, Yogesh.

The only way is to track the portfolios and question a few basic risk management principles. This will invariably lead you into the right direction 🙂

Hi Karthik,

Are there any mutual funds that \”Short the Market\”. If not, any suggestions on how this can be done without directly shorting in equity market.

Thank You

Regards

Kiran

Not in India, Kiran. There are inverse ETFs in US, which addresses this.

Luckily for us, SEBI/AMFI have tightened up the rules that MFs were misusing for years to sell us on their \’superior investing skills\’. Now that the data shows that the average MF is unable to beat the stock indices, it is time to move from an SIP in active MFs to a SIP in a passive, low cost, index fund. Forget all the fundas about smart mutual investment fund managers who have an information or processing power edge – and push SEBI/AMFI to get NPS level cost (of about 0.1%) for index funds available to the general public!!

I agree Index funds are best suited for hyper long term investing.

So are these research firms trustable and if yes, then which are some of the top firms in India?

I\’d not trust any of these 🙂

I am talking about companies like ICICI securities, HDFC securities, Kotak securities, Motilal Oswal etc. which give targets for stocks. Are they like research division within an AMC or some other kind of company.

Yeah, these are research units.

In news, we hear that some company has given a particular target for a stock. What are these companies and what type of company are they called?

These are stock tipping companies, their practices are often questionable.

Is there a difference between a Mutual fund company and an Asset management company?

They are the same.

You are just amazing…

Hello sir,

Is Financial Modeling and Valuations and CFA Level 1 good enough to get a job as financial analyst in any mutual fund or any other AMC after B.Tech computer science graduation?

Knowledge wise yes. This should help you get going. What you also need is skills to analyse sectors.

Hello sir,

Thanks for your reply, I checked about AIF licence, it says manager of AIF should have at least 5 years of experience but i don\’t have that and it also says investor should invest more than one crore, is there any way to create hedge fund for retail investors?

Nope, this is the only legal way to create a HF in India.

Hello,

Thanks for sharing your story as a fund manager, i have a question, to setup a hedge fund in India, is PMS license required? If not, can you tell me what is required, to start a hedge fund.

Yes, to set up a HF, you need an AIF licence, not PMS.

Sir,

Although i had studied many books but your contents are so far, one stop for all things related to investment banking.

Usually i read something to have a question but so far all questions are already answered in content itself.

Keep up the Good Work !!

Thanks for the kind words, Samir and I\’m glad you liked the content 🙂

Thanks for the reply. If my wife signs a power of attorney mandating me to trade through her account, is it permissible? Please don\’t get hassled by the question, I am just looking at possibilities and clearing doubts in different aspects. Thanks.

Shashanka

You will have to check with your lawyer for that 🙂

Hi Karthik,

Thanks you for taking the effort to provide simple and quality content across all the topics in Versity.

You mentioned that AMC licence is mandatory to manage other peoples funds (read – relatives) wrt to invest / trade in secondary market with the intention to generate money. Can I trade through my wife\’s DMAT account or is it legally forbidden?

Thanks,

Shashanka

Not an AMC licence Shashank, you need a PMS licence. Legally it is forbidden for you to trade from any other person\’s account, you will get into a problem if the person complains to the regulators 🙂

Hi Karthik ,

The chapters of personal finance are hidden gem for any investing beginners. I love reading the chapters..the way you explain things , this will help any investor to become a DIY investor… only thing I have a complain is we aren\’t having all the chapters w.r.t MFs. soon.

I hope you have the strength and time to release all the chapters very soon. Any timeline which you might have thought to release all the chapters?

Thanks

Krishnendu

This module is work in progress. I will be adding more chapters soon. The next one should be out t\’row 🙂

Sir I\’m a 20 years old college boy with ₹5000 per month pocket money. I don\’t have expenditure more than 1000 .How should I manage money long term/short term goals .I started initial trading but these difficult times volatility is too much for me to take and as discouraged me. Should I start with MF or increase my Trading skills/knowledge.

Kunal, I wish I had the foresight and maturity you have when I was 20 🙂

Yes, I\’d suggest you invest in an Index fund and work on improving your trading and investing skills.

Hi Kartik,

Firstly,let me thank you for such an informative module on Mutual Funds.

I am a Chartered Accountacy student.I am interested in making career in Investment Banking/Fund Management after completion of my course.Is there a scope for CA\’s in the above mentioned arenas?Or its just open to B-School Finance Graduates? What extra qualifications or skills are required for the same?

Anyone with an interest in market finance and start their careers here. Make sure you get relevant certifications like a CFA, it helps with the job search.

Hi Karthik,

I want to invest in vanguard funds S&P 500. Is Zerodha offers such facility. Please tell me the pros and cons of investing. Thanks

Vanguard\’s S&P 500 is not available, but you have an alternative – https://coin.zerodha.com/nfo . More info here – https://www.motilaloswalmf.com/mf/nfo

As early said, Mutual funds units bought get stored either in folio number or in DEMAT mode.

As an investor how to to know where it get stored? And if it is in folio number mode how to convert to DEMAT mode?

If you buy ut via Zerodha, then its in DEMAT. To convert to DEMAT from folio, you will have to sell the units and buy back gain.

Hi sir,

I would like to know the difference between nifty bees and index fund?

2. Is it advisable to invest in etf or an index fund?

Thanks

Shyam

1) Nifty Bees is an ETF, index fund is a mutual fund

2) ETF is good, but unfortunately, there isn\’t much liquidity. Hence, index fund.

Sir in the AMC Structure as provided in this chapter, there are three sub-branches under AMC viz. Custodian, OPS and RTA. I want to know about OPS, what it stands for and what is its role in MF AMC.

Ah, OPS is operations i.e. day to day running of the fund 🙂

I enquired in 2017 that \”When Varsity is going to have a module on mutual funds ?\” Glad to see that this module is now available. Thanks a lot.

In the Mutual Fund structure, what OPC stands for and what is its role OPS under AMC ?

Can you please expand OPC for me? I\’m unable to recollect this.

I have been one lazy investor. Your personal story which you have recounted is indeed inspiring and has rekindled my interest, would definitely recommend it to people I know who are stuck in the job rut like me. When you started off with your analysis here in India what were your tools for analysis. Was it only Microsoft Excel or was there any other generic program other than MS Office that you would recommend.

Also, you have made it so easy for anyone to understand by way of the analogy which you drawn to a baker.

Thanks!!

I\’m glad to note that, Kush 🙂

I\’ve not evolved beyond MS Excel!

How do i know, how much amount gets reinvested in my portfolio? and it will be reinvested every quarter or every year?

Thats upto the AMC and Fund Manager, Viji.

I have purchased Mutual Funds Units of a growth fund . What happens, when stock of this mutual funds for which i am holding some units , declares dividend. How it effects my MF portfolio. Pl guide . Thanks

It gets reinvested by the fund manager.

Kartik Sir,

Your explanation about every concept is very simple to under stand.

I want to where does the mutual funds units bought get stored. Like shares are kept at depository where does the mutual fund units stay.?

If they stay with issuing company doesn\’t it a risky thing similar to keeping out share with broker. And the AMC company might do jugglery with process and makes a fraud?

What is sebi direction for saving the Units?

Would desperately want to answer.

Hardik, there are two ways – folio number and DEMAT mode. In the folio number way the RTAs maintain the records and if its in the DEMAT mode, then the units stay in your DEMAT, just like your shares. I\’d prefer the DEMAT mode where the depositary would act as the custodian of these funds.

I just need to know whether stock trading can be taken as a full time profession or is it supposed to be done as a part time job.

You can, but you need to ensure you have saved enough for at least 18 months of expenses beforehand.

Then is it supposed to be done as a secondary job,Your views sir?

Sorry, I didn\’t get the context, Ram.

It\’s great to see this type of initiative by zerodha to increase the financial iQ of indians as mf is still an untapped market in india (with less than 10% household investing in it). people still think of stocks and mf as gambling. I also have my own blog investmindset.com where i aim to share knowledge of finance and its good to see someone sharing the knowledge with so much passion. Keep it up.

If u need help then dont hesitate to contact me

Mohsin, yes, I agree with you, we need as many initiatives as possible to help India move up in the financial literecy chain. We all do our bits to help in that direction. I skimmed through you blog, looks promising. Good luck!

Sir i have a general question.Do you think a 20 year old person can take stock trading as his full time profession?

Although the answer is yes, I\’d advise you against it.

Nicely Going. Keep it up.

Happy learning!

Pdf plz

Once the module is complete, this is still work in progress.

Dear Karthik

Thanks a lot for the great content.

I have learnt a lot and the articles have increased my market and general knowledge.

You guys are doing a commendable job to enhance the knowledge of retail investors. Request you to continue the good work.

Appreciate your time, efforts and the service.

All the best 🙂

Thank you.

Thanks for the kind words, Sri 🙂

Happy learning.

Hi Karthik,

Thank you for writing this chapter. It is a very easy and precise chapter to understand MF\’s. However as mentioned in Flashback, I couldn\’t find the further info. on taxation of MF, risk and analysis, types of MF etc. Please share where I can read about all the aforementioned written by you in varsity.

Thanks & Regards

Mihir, for now you can look at this – https://zerodha.com/varsity/module/markets-and-taxation/ but will be covering taxation separately.

Fan Alert!

I know saying a thank you won\’t be enough for your efforts, but THANK YOU SO MUCH FOR VARSITY, BIG BROTHER.

I got addicted to reading varsity after technical analysis. The blog is rich with contents, it\’s…….it\’s super awesome, I don\’t know how to describe.

God Bless You Big Brother.

Hey Vikas, you made my day 🙂

I\’m glad you liked the content. Happy reading 🙂

Karthik Sir ,

Thanks a lot for such a wonderful content. You really have a good writing skeels , which makes a hard subject easy one to understand . I am waiting for your next chapter what will it be ? Also can you please write a chapter on PF?

Thanks, Raj. The next chapter is about explaining what a fund really means. Yes, will write about PF as well 🙂

Hi karthik,

I installed the mobile app. But I could only see five modules. The app doesn\’t contain all the modules. When can we expect the all the modules to be available on varsity app?

Thank you

The content is getting updated on the app, Koteswar. Soon we will have all the modules on the app.

!FAN ALERT!

Thank you for the stream of knowledge you have created. I do owe you a lot for helping me to find my way towards financial independence. Your initial modules on technical and fundamental analysis have worked wonders for me! However this chapter of yours on \’Personal finance\’ will be the game changer I believe. Again thanks a lot for every word & smiley of course 🙂

Coming to a query, I am using an online portal for managing my MF portfolio through a single platform. The platform claims and I quote \”We are registered with the Securities and Exchange Board of India (SEBI) as an Investment Advisor (INA200005166). As a trusted RIA we deliver unbiased advice.\” However this platform provide complete free services for investing in direct MFs and I have been quite comfortable using it for over a year now.

I just wanted to ask 2 questions:

1) Where does this platform/service provider fits into the structure (of AMC) you have mentioned within this chapter?

2) Is there any way I can cross check that my money is not going in wrong hands? or lets say if tomorrow this platform is not there, will my money be gone?

PS: I do get all details and portfolio updates regularly from fund houses via mail and my PAN details also states the exact numbers as my DEMAT details.

Nirav, thanks for the kind words 🙂

1) If these guys just provide an advice, then these are Registered Investment Advisors (RIAs). Think of them as service providers for the AMCs

2) The funds are invested with the AMCs, the RIA is just an intermediary, so nothing to worry.

Btw, you should try Coin for all your MFrequirements – https://coin.zerodha.com/ 🙂

Can you send PDF of Personal Finance?

Amogh, the PDF will be made available once the module is complete. For now, it is still work in progress. Thanks.

Karthik i read all the time that investing has to be done based on an edge. I know information isn\’t that easily available to everyone. For instance Prof Sanjay Bakshi recommends we get the Pvt Ltd annual reports from MCA website to know how an industry is doing. My question is, where do you get your edge from. Thanks for the treasure that is varsity. I know at least 2 of my friends have started investing in equities after I recommended them FA module.

That made my day, thanks for spreading the word about Zerodha and Varsity 🙂

I guess my edge is my ability to hold my position for a multi-year time frame, I think, I don\’t get influenced by short term noise 🙂

Hello Karthik. Sometime back i had asked you if it\’d be possible for you to continue FA module with individual sector analysis. Now i can you\’ve been crazy busy with this new module, which is very informative if I might add. So I\’m asking how would I go about developing sectoral analysis framework for myself. Please give me some pointers. Some books or videos or resources. Thank you.

Sundeep, I\’d love to write about sectoral analysis framework, but I\’m currently tied up with this module. But here is the thing, sectoral analysis is fairly easy. All you need to do is check the AR of the company and spend time reading the \’Management Discussion & Analysis\’, section. In that, the company would rate their performance using various metrics specific to their sector. At best, there could be 3-5 metrics per sector. For example, the telcos have something called as the \’Average Revenue per user\’ or ARPU, the banks have net interest income. So start by reading the AR of the industry leader, make notes of the metrics they are talking about, understand what it means and probably how its measured, then jump to the next company and check for the same details. If the metrics are not readily available, you can calculate or derive it on your own. Do this across 3-4 companies, and you would have developed a template to understand that sector.

Good luck.