25.1 – Confused Portfolio

In the previous chapter, we picked up an equity fund (Kotak Standard Multi cap Fund) and looked at the steps to analyze and Equity fund. The idea was to highlight the steps involved in analyzing an equity mutual fund. Of course, towards the end of the previous chapter, we also figured that the fund was indeed good, especially when it comes to risk management.

The question is – since the fund is good, should you invest in the fund and include it in your mutual fund portfolio?

While on the face of it, it appears like a no brainer, we’ve has analyzed the fund across both risks and return parameters. The fund ticks off well on all the good qualities, so it makes sense to invest.

However, the decision to invest in a fund (and therefore include it in your portfolio) should not stem from how good or bad the fund is.

The decision to invest in a fund should come from the objective of your mutual fund portfolio. Remember, the objective serves a financial goal. Now, for example, if my financial goal is to build an emergency corpus, then investing in Equity fund may not make sense. So it does not matter how good the fund is, there is no question of investing.

For many, asking them not to invest in a good mutual fund may come across a counter-intuitive thought.

To put this in a layman’s context, think about Dolo 650, if you have a knee pain would you take Dolo 650? No, you would consult a knee specialist to find out if you need specialised physiotherapy/MRI scan to address your problem.

Likewise, an investment should be made only when the portfolio’s objective and the fund’s risk-reward profile matches. In case, you do not follow this approach of aligning the two; then you will most likely end up with a ‘confused portfolio’.

Over the next few chapters, we will discuss how to align funds with portfolio goals, but before we do that, in this chapter lets discuss how to analyze a debt mutual fund.

25.2 – Risk recap

Like in the previous chapter, in this chapter to we will pick a debt mutual fund and analyze the fund. But before we do that, I’d like to quickly touch upon the major risks associated with a debt fund.

Credit risk – Remember the debt MF invests its money in debt obligations. For example, company A wants to borrow 50Cr to fund its operations, decides to float a 5-year bond by paying an interest of 9%. AMC X decides to invest in this bond. Assuming things go smoothly, the company gets the funds, and the AMC gets the interest payment. At the end of 5 years, the company is expected to repay the principal.

As you can imagine, this is fairly standard practice.

The problem arises if something goes wrong with the company during these five years and the company is unable to service the interest payment on time. If things get worse, the company can even throw their hand up in the air and say, ‘sorry’, no cash to repay the principal or the interest.

All AMCs running debt funds carry this risk, i.e. the risk of default; this is called the ‘credit risk’. Many funds in the past have taken a hit due to such defaults.

Now, there is a variation to credit risk. Imagine that as on today, everything is going good for company A, but there is trouble brewing within the company and the credit rating agencies identify the same. The rating agencies downgrade the company’s creditworthiness and lower the credit rating from say AAA to AA. The act of lowering the credit rating itself is a risk; this is called, ‘credit rating risk’.

Interest rate risk – Bonds prices are sensitive to interest rate changes, both bond prices and interest rates are inversely related. We have discussed this earlier. A fall in interest rate tends to increase the bond prices (which means the NAV tends to increase) and increase in interest rate tends to decrease the bond prices, and therefore the mutual fund’s NAV.

The sensitivity of the bond prices to the interest rate risk is captured by ‘modified duration’ of the bond. Higher the modified duration, higher is the risk associated with the changes in interest rate. When a debt mutual fund reports the modified duration, then it is the aggregate modified duration across the various bonds they hold.

Alright, now that we had a quick refresher on the risks involved, let us focus our efforts towards analyzing a debt mutual fund.

25.3 – Portfolio check

I’ve mentioned this earlier in this chapter; I’d like to say it again, invest in a fund not because it is good or spectacular, invest in it because it aligns with your portfolio goals.

Debt funds allure many investors because of the popular perception that it is low risk. Often debt funds get sold as a safe haven for your capital, an alternative to the bank’s fixed deposit. But it is not.

I’m not saying this to discourage you from investing in a debt fund; I’m reiterating this to highlight the fact that debt funds are not risk-free. Debt funds can be volatile and can cause a permanent loss of capital.

Alright, let us move ahead with the analysis part. I’ve picked Mirae Asset Short Term fund for our analysis. The idea is to lay down a template using which you can analyze any debt fund of your choice. Much of the analysis in a debt fund is centred around the risk and the fund’s portfolio, so this will be very different compared to the equity fund analysis.

The fund itself is relatively new, with its NFO sometime in early 2018, so it does not have many data points to track, but it is ok.

As the name of fund indicates, this is a short-term fund, meaning the fund will invest in bonds which have short term maturities ranging between 1 to 3 years.

Have a look at the average maturity graph of the fund, sourced from the AMC website –

The average maturity of the fund is roughly around 2.5 years, which means that the fund is susceptible to default risk, credit rating risk, interest rate risk, and the ‘change in the perception’ of interest rate, risk.

Now, in case any of these risks get triggered, then the fall in NAV will be steep, and the fund will take time to recover from the losses. The only way to deal with this is to ensure you stay invested in the fund for a long enough period.

How long?

There are different theories, but I believe that the minimum time you need to invest in a debt mutual fund should be equal to, at least the average maturity of the fund. So in this case, if I’m investing in this fund, I’d give it roughly 2.5 to 3 years and not below that.

Similarly, if I’m looking at Gilt fund whose average maturity is ten years, then I’d be prepared for a long-haul investment lasting at least ten years.

The investment tenure is something you need to be super clear when investing in a debt fund.

While we did not pay much attention to the portfolio in an equity portfolio, we do have to pay attention to the quality of bonds in a debt portfolio.

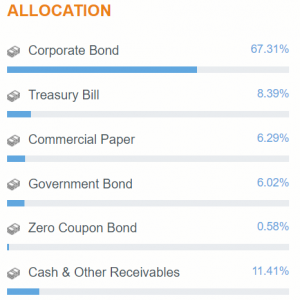

Here is a quick look at the portfolio allocation (AMC website) –

The fund has 67.31% allocation to corporate bonds, which means to the fund is highly susceptible to credit risk. Now, how do we figure out that the debt fund manager is managing the credit risk? Well, we need to check for –

-

- The diversification of the fund

- Exposure to companies – high exposure to a single corporate entity draws a red flag

- Credit rating check on the papers held by the fund.

I dug into the portfolio of this fund; you can do the same by visiting Mirae’s download section – https://www.miraeassetmf.co.in/mutual-fund-scheme/fixed-income/mirae-asset-short-term-fund

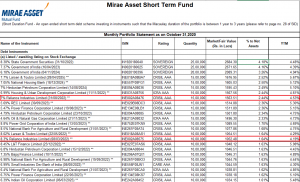

Here is the snapshot of a section of the fund’s portfolio –

The fund holds about 56 papers. Straightaway, I can see that the top 3 holdings (3% or more) are all sovereign papers, so there is no concern about credit risk on single large exposure.

We need to check the exposure at an aggregate level. For example, in the snapshot above, I can see that the fund has invested 2.44% of its assets in 7% RIL bond maturing in August 2022.

The fund has also invested 1.64% of the assets in 8.3% RIL paper maturing in March 2022. So the question is what the total exposure to Reliance Industries Limited is?

To answer the above, you can quickly add up the numbers from the excel or check the quick info provided on the AMC’s website –

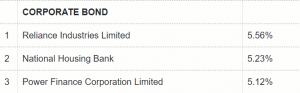

The fund has a total exposure of 5.56% to Reliance, 5.23% to NHB, and 5.12% to PFC. In my opinion, these are slightly concentrated bets.

While 56 papers seem good enough, let us see how the fund holds up compared to the category –

The portfolio aggregates are from Value research online. While the fund has 56 securities, the category average is about 64. The fund has a slightly tighter portfolio compared to its peers, while the difference is not much in this particular case, one should be concerned if the difference is large. For example, I’d have been a bit concerned if the fund held 45 securities against an industry average of 65.

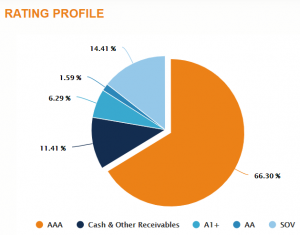

Moving ahead with our research, we now look at the quality of the papers. We can develop a perspective of the quality of papers (bonds) held in the portfolio by looking at the rating profile.

From AMC’s website –

14.41% are sovereign papers, these papers don’t have credit risk, so that’s one less thing to worry. 66.3%, which is the bulk of the portfolio is AAA. But do remember the ratings tend to change as papers are constantly evaluated for credit quality by rating agencies.

A1+ and AA is roughly 8.5%; this is understandable as the debt fund manager’s chase yield to showcase performance. The question, however, is to figure if the fund manager is going out of the way to chase yield.

I’ve got this from Value research online. The fund has a higher exposure to AAA bonds (66%) compared to the category (~45%), which is ok, but this comes with credit risk. The exposure to Sovereign bonds is less (14.5%) compared to the category average of about 25%. Exposure to AA bonds is less compared to the category, and the cash equivalent is higher compared to the category.

The information above tells me that the fund is open to taking on slightly higher credit risk, which to me is not a great sign considering this is a short duration fund. Think about it; this is a short duration fund, people invest in the fund for parking funds for say 2-3 year perspective with a moderate return expectation.

So what is the need to take on credit risk? I’d still be ok with the credit risk as long as there is enough diversification, but the concentrated portfolio is not very comforting to me.

25.4 – Other checks

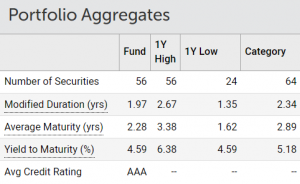

Let us go back to the portfolio aggregates –

The modified duration of the fund is 1.97, while the category is 2.34. Remember, the modified duration is sensitivity to changes in interest rate. The slightly lower modified duration is attributable to the lower average maturity of the fund.

The average maturity of the fund is 2.28, while the category’s average is 2.89.

From this, we can deduce that the fund manager is ok with slightly higher credit risk by placing concentrated bets while at the same time not so ok with interest rate risk.

The yield to maturity (YTM) of the fund is 4.59 compared to the category’s 5.18. Remember, YTM is the total returns expected based on the assumption that the bond is held to maturity and the cash flow from coupons are ploughed back into the bond.

Intuition says that the higher the YTM, the better it is, this is correct. But YTM can also double up as an indicator of risk when compared to the category’s YTM.

For example, if the category’s YTM is 6% and the fund is 8%, then it implies that the fund is taking on additional risk to chasing yield.

Ideally, I’d like to see the fund’s YTM match the category’s YTM, and I’m even ok with slightly lower YTM compared to the category.

I want to look at the fund’s market risk parameters such as the standard deviation, beta, and alpha to get a sense of how volatile the fund is compared to its benchmark. Ideally, it would help if you looked at it from a 3-year perspective, but since this fund is new, we won’t get that information.

Lastly, I did look at the AUM of the fund; this is roughly 650Cr. Not a big fund given its category. When it comes to Debt funds, I’d like to avoid investing in very small funds or very large funds. In a situation where there is a run on the AMC and the AMC faces redemption pressure, then a large debt fund will have issues with debt market liquidity.

On the other hand, a small fund will never negotiate good rates with the issuers and hence is always a price taker. So its always good to avoid both funds with either small or very large AUMs.

So would I invest in this fund? I’d probably hesitate to do so for a couple of reasons –

-

- The fund has a concentrated portfolio

- Credit risk is higher compared to the category

- It’s a new fund, and I’m sure there are better alternatives in the market

- The fund has a low AUM, understandable since it’s a new fund

If you are thinking why I’ve not looked at standard stuff like fund ranking, rolling returns, capture ratios, and other things, well, that’s because it does not matter much for a debt fund.

Before we wrap up this chapters, here are few things for you to note –

-

- Investment in debt funds is mainly for capital preservation. Do not look at returns or chase returns when investing in a debt fund

- Please do not look at ‘star ratings’, of a debt fund. Usually, a debt fund is rated high if the returns are high. If debt fund has a high return, that means the fund manager is taking on risk to chase returns.

- Apart from the standard debt fund risks, keep an eye on the liquidity risk. We have discussed the liquidity risk here – https://zerodha.com/varsity/chapter/the-debt-funds-part-4/. If both the fund’s AUM and the number of securities fall, then it’s a red flag and an indicator of liquidity risk

- SEBI has now mandated the funds to disclose portfolio details on a fortnightly basis, this is a good move. Do keep an eye on the portfolio changes

- Always diversify across AMCs, for example, if you want to invest in a short term fund, then split your money across two short term funds from two different AMCs

- It is best if you avoid investing in a credit risk fund. Credit risk funds take on credit risk to generate a return. In my opinion, you should not look at debt funds for returns. Use debt funds to safeguard capital

- Debt funds sometimes lend to two different companies but with the same promoter. Be wary of such funds.

Please do pick up debt funds and try to analyze them in the way we have done in this chapter. I’d suggest you pick up a fund with at least 5-8 years history.

Over the next few chapters, I’ll discuss financial goals and building a mutual fund portfolio to address the financial goal.

Key takeaways from this chapter

-

- The investment in a mutual fund should align with the financial goal

- Debt mutual funds carry credit risk, interest risk, and change in credit rating risk

- The minimum time duration to invest in a debt fund should be at least equal to the average maturity of the fund

- It is important to analyze the debt fund’s portfolio

- Higher the exposure to corporate bonds, higher is the credit risk

- Sovereign bonds do not carry credit risk but do carry interest rate risk

- One should be concerned about large exposure to a single corporate entity

- One can look at YTM as the measure of risk

- It is best to avoid debt funds with large and small AUMs

Thank you so much for this Karthik. Regarding \”I want to look at the fund’s market risk parameters such as the standard deviation, beta, and alpha to get a sense of how volatile the fund is compared to its benchmark.\”

Are these risk parameters to be looked at in the same way it was done for equity funds? Can you please share a summary on how you will analyse these parameters for a debt fund against the category?

Yes, these parameters remain the same, but with debt fund you also need to look at the portfolio and composition of the bonds.

Should you invest in arbitrage fund via sip or lump sum ?

Either works, depends on your purpose.

Hi Karthik,

I guess if we want to park funds for 3-6 months or lets say 1 year then I guess Arbitrage funds are way more better than other debt funds and its a not brainer because of tax saving especially for those who fall under highest slab. Am I right or I am missing something?

Thats right, I\’d prefer that as well, but be aware that this does not offer capital protection like how debt funds are supposed to offer.

Now it is clear, thanks a ton 🙂

Sure, good luck!

I got that, what I didn\’t understand is why we need to be wary of such funds. Is it because it makes the fund concentrated?

Yeah, the risk gets concentrated. If a promoter is likely to default, then he/she will default across entities.

Hi Kartik,

Thanks a lot for prompt answers to all queries.

One question, I didn\’t understand this line, could you please elaborate? \”\”Debt funds sometimes lend to two different companies but with the same promoter. Be wary of such funds.\” Thank you 🙂

Meaning, two different companies, but the company is run by the same management 🙂

Why do you say to not invest in a debt fund with high AUM?

Liquidity risk is one of the main reasons. But we will probably do a deep dive in this 🙂

Thank you very much sir…

Good luck and happy learning 🙂

Sir, would you please like to provide me the AME pdf download link of Nippon India short term fund for analysising the fund like mirea.

Like I said, please check the AMC website for this.

Sir, would you please like to provide me the pdf download link of Nippon India short term fund .

Please check the AMCs website for this, Paritosh.

at any given time money market funds generally perform better than overnight funds and liquid funds, like if we look at current rates liquid funds and overnight funds yield around 6-7% whereas money market funds yields 7-8% So my question over here is, isn\’t it better to put money in money market funds even if our investment horizon is only a week ?

May not make a big difference, Shivansh.

Hi Karthik,

Thanks a lot for Zerodha Varsity and YouTube personal finance video series.

I just took a debt fund (HSBC Ultra Short Duration Fund) to analyze.

**From the fact sheet, the overall Asset Allocation, rating profile looks good.

**Bonds Breakdown from the morning star website shows fund is invested 100% in AAA grade bonds against the category average of 97.85%. (as per Jun 2023 data)

**Effective maturity is 0.5 higher than the category average 0.46

**Modified duration is 0.48 higher than the category average 0.42

**YTM is 7.23 higher than the category average 7.03

Query:

As per the Bonds Breakdown, the fund is 100% invested in AAA grade bonds and YTM is higher than the category average, so the fund looks good to invest. But Effective Maturity and Modified duration are higher than the category average means the fund manager is taking the risk. So we should consider looking for other alternative funds instead investing in this fund? Is my understanding correct?

Regards,

Pavan

Pavan, there is a marginal difference, so its ok I guess 🙂

Hi Karthik, If we have to look debt to park capital and not to take risk then it is better to put in FD, why do we need to choose debt fund?

Yes, FD is an option.More so after the recent change in taxation.

hey I just dont get one point here i.e why this debt fund as higher credit risk even though it is investing higher proportion in AAA+ bonds compared to the category and lower proportion in lower credit quality bonds like AA+ then category.

For that you will have to inspect the portfolio Tejas 🙂

Hi Sir,

May I know what is the best one online portal to check all of the following parameter for analysing and selecting best mutual funds for investment.

— Avg Returns

— Rolling Returns

— R Squared

— Standard Deviation

— Sharpe Ratio

— Alpha

— Beta

— Chance of Beating the Market

Gangi, some you can find on Coin and some more on portals like Moringstar and Value research.

I was exploring debt funds to park money for a short duration of 3 to 6 months and as normal practice it is that:-

money market funds are which invest in instruments with a average maturity of upto 1 year and

ultra short duration funds are those which in investments in instruments with average maturity of 3 to 6 months

BUT

what I found was that if we look at the average maturity of ultra short duration funds and money market funds it is exactly the same only with a minor difference of a few days (say like 10 days only) and the expense ratio of money market funds is also less than ultra short term funds and this applied for almost every AMC

so isn\’t it better to put the money in the money market funds for a short duration of 3 to 6 months rather than putting it in ultra short duration funds

??

Absolutely. I\’d suggest MM funds for a 3 to 6 months investment period.

and is concentration risk is the right type of risk for the question I just asked above or is there any other term for this type of risk where two mutual funds have almost 40% same portfolio

Yes, it is risky and also offers you no particular advantage in terms of rewards.

I selected two money market funds and went through their portfolio and found that they both have around 40% same portfolio.

so, if anyone wants invest in these two money market funds will that lead to concentration risk as because they have 40% same portfolio. Am I right or wrong on this

Yes, most liquid funds have similar portfolios. Look for the one with the lowest expense ratio.

and where can I get the past factsheets of the fund as on the website of the fund house only the latest factsheet is available

You will have to look at the AMC\’s website for this.

how can a rate hike lead to fall in NAV of liquid funds can you please elaborate

Bond price and interest rates are inversely proportional, Shivansh. So when a rate hike happens, bond prices fall, and therefore the NAV of debt funds.

can liquid funds go down in value on a day to day basis and if yes, then what makes them go down in value as they only give interest on the securities they hold

Yes, it has happened in the past. Usually, a big rate hike leads to this.

where can I get the past portfolio of a mutual fund if I want to find out how much change in cash have been there in a particular fund

Ah, not sure. Maybe you should check the fund\’s historical fact sheet for this.

A thought.

in equity mutual funds we shouldn\’t look at the companies which the fund manager has invested as he is smart enough and if we are that smart why should not directly invest in stocks.

but in debt mutual funds its contrary we should look at the companies the fund manager has invested.

why is it like this.

eg:- if we were to invest in a small cap fund then in this fund there will be companies which will have a low rating. So, in the small cap fund we shouldn\’t bother about the companies invested in, but with the debt fund who invest in low credit rating companies we should look at the portfolio. Why?

In Eq funds, we are taking a risk, Shivansh. In debt funds, we are trying to be double cautious as the objective in debt funds is to protect capital.

ok then should they be judged only on the basis of AUM and expense ratio as because if they all have similar performance then only the expense ratio can make a difference in returns generated

Absolutely. But that said, a quick look at the portfolio does not hurt 🙂

thanks I understand it now.

one more thing, if in liquid funds the interest rate risk and the credit risk doesn\’t matter that much then can they be evaluated using the metrics like capture ratio and other performance based metrics, to find out which fund is better than the other

You can, but as far as I understand, they all have similar performance.

I was thinking the same but that\’s not the case if we look into top 4 holdings of funds for eg:

SBI liquid fund:- 91 DAY T-BILL 6.46%

Small Industries Development Bank of India 5.12%

Canara Bank 4.79%

Reliance Jio Infocomm Ltd. 4.29%

Axis liquid fund:- Clearing Corporation of India Ltd 7.37%

91 Days Tbill 5.64%

Reliance Retail Ventures Limited 4.28%

Hindustan Petroleum Corporation Limited 3.55%

they have invested in corporate bonds not in tiny portion but in large quantities

Thats ok. What you need to look at is the maturity of these corporate bonds. These could be money market instruments issued to meet liquidity requirements.

Sorry I forgot to mention ultra short duration debt funds and some liquid funds, if we look into their portfolios they have some companies bonds, so how can these funds allocate money into those bonds as they invest where the average maturity is about a year.

Are these bonds gonna expire in a year or something else

I think these funds have small flexibility to hold corporate bonds. But its a tiny portion of their overall portfolio.

I was looking at debt funds and off we look into their portfolio they have allocated the money into companies, so what are these are they bonds of companies expiring within a year or something else

Yes, these companies have taken on debt and issued bonds against it. MFs buy these individual bonds and build their portfolios.

but isn\’t the risk measured by analysing the bonds in the debt funds

But the fund is a portfolio of debt papers individually they have their own risk and reward characteristics, but when put in a portfolio they behave differently.

why does a benchmark really doesn\’t matter in case of debt fund and as it doesn\’t matter then why?, to even have a benchmark for debt funds

How will you measure risk and reward in the absence of a benchmark?

how can a debt fund have a YTM of its own if it has invested in different bonds with different coupon rates and maturity

They do a weighted average of different papers to arrive at the fund\’s YTM.

Hello Karthik Sir,

Thank you so much for creating this masterpiece called Varsity!

The personal finance chapter is a gem.

I had a query on debt fund investment horizon based on the average maturity.

Suppose, if I invest in SBI Medium Term Bind which has an average maturity of 4.14 years for a 4 year investment horizon. So, the fund at any point in time during the next four years typically has bonds with a maturity of 3-4 years.

But, at the end of 4 years don’t you think our risk tolerance will not be the same as at the beginning and we shouldn’t be exposed to the bonds of same duration?

I feel maybe an ultra short term or a short term would be better for a 3-4 year investment horizon because at any time a bond may mature in few months.

Please let me know what you think about this.

Thank you!

Thanks, Suhas. Glad you liked the content. Ideally, before investing in the bond, you need to foresee your risk-taking ability throughout the investment, this is an integral part of planning your investment. Both the bonds you mention serve different purposes, hence the investment objective should be clearly defined before making the investment.

Hi Karthik, I\’ve often noticed that data shown on sites like Value Research are inaccurate in certain cases, as in, the crux of it remains the similar to what we see on other platforms but details like modified duration, macaulay duration, alpha, beta etc are not similar to what is being shown on the fund\’s official fact sheet. It could be due to the difference in time period being considered but found it a little disappointing to see inconsistencies in these sites. Money Control is good. Morningstar is also decent.

Pradeep, it is because of the time lag in reporting. I prefer to take the data directly from the AMCs website whenever I can.

Hi, Karthik,

You have mentioned, \”I’d like to avoid investing in very small funds or very large funds\”, just wanted to know. According to your opinion, Funds what AUM do you consider small, medium, large, and very large funds?

Jai Ailani.

This is subjective and may differ from person to person, small funds have issues of liquidity, while big funds may find it hard to find opportunities. Hence the decisions to stay away 🙂

If I want to achieve financial goal of 20 Lacs for down payment of home loan by year 2025, which debt fund with no withdrawal charges should I consider?

Mayur, I can\’t really advise, but I think any well managed short term fund should work.

I guess if we need to take risk for 10 years then investment in equity makes sense.. It might awarded with handsome returns over a period of 10 yrs

The odds of a +ve reward is much higher when you have 10+ years as a time horizon.

Hi Karthik,

Thanks a lot for this series. I have really learnt a lot from these.

I have just started investing in MFs and I am looking to park money somewhere for say ~2-3 yrs till i feel comfortable to invest more. But debt funds seem to have a lot of risk over FDs especially for a short period. I know inflation ends up eroding money from FDs, but to I\’m not sure if risking the entire capital for around ~5% inflation reduction over 2 years is justified. Plus there are MF fees and taxes ofcourse.

Can you write something on how to evaluate and mitigate that risk ? Perhaps like comparison between FDs vs Debt funds.

Another good alternative is the arbitrage fund. These funds behaves like a debt fund, taxed like an equity fund. Do go through it.

Hello Sir,

Could you explain how a rise in bond yield affects the stock market?

Isn\’t a rise in bond yield good for people invested in bonds so that they get a larger return?

If yield is increasing, it means the bond price is decreasing. You need to figure why there is a sell-off in the bond market, perhaps due to a negative sentiment.

Thanks a lot for great knowledge sharing.

Gilt funds are best among all debt funds for consistency, cagr ?

Sort of. Risk is lower, return profile is very predictable.

It\’s really a great journey. Earlier(4 years back). I don\’t ABCD of mutual funds. But after reading & understanding the chapters, now I am confident that I can analyse funds and select as per my goal. This is really very very helpful to all.

I want to know how shall I get other modules related mutual funds for more understanding & knowledge. Pl. Guide.

And thanks for making us understand diff chapters in a simple way & illustrations.

Thanks once again.

Thanks for the kind words, Sanjay. All the content related to MF is in this module itself. I\’ll try and add more sometime later this year.

Dear Karthik,

Please accept my gratitude for putting up such a brilliant series for us to read. My financial intelligence was zero before I stumbled across this treasure & I\’m improving daily thanks to your efforts. I just wanted to point out a minor correction in example (not in finance, you are the expert there). As an Orthopedic surgeon with interest in Knee & Shoulder surgery, I was delighted to see the example on knee pain. Dolo 650 happens to be an excellent pill for knee pain. A slightly better way to put it would have been \”If you have knee pain would you just take Dolo 650? No you would consult a knee specialist to find out if you need specialized physiotherapy/ MRI scan to address your problem\’.

I forgot who quoted this but it says \”Genius lies in making things simple\”. I have no doubts that you know the subject of finance at genius levels of understanding & perception. More power to you.

Dear Dr.Raju, thank you so much for the kind and encouraging words, means a lot :). Also thanks for sharing the right information. I\’ll make the necessary corrections 🙂

How to select a liquid fund?? … should we go with the same template or need to add anything extra for a liquid fund?

Liquid funds, I guess I have discussed it in the module, please check that.

Thank you, Karthik, of course, I already have a couple of SIPs running on Coin.

Also, today I got to know that IDFC First Bank offers a 5% interest rate on a savings account, which is way better than most Liquid Funds.

I agree.

Hi Karthik,

First of all, thank you so much for taking the time to answer every single comment.

I have a question in my mind, which I am trying to get an answer to. Just wanted to know your opinion on it.

At the moment I personally think the market is overvalued and I am not comfortable deploying my capital to equity. So, I have around 10% of the capital in equity and a significant amount of capital in my savings account, which gives a 2.8% interest rate.

Now, do you think it is better to invest the money in the savings account to a liquid or overnight fund given that most of the top funds give around 3-4% return (HDFC, SBI and ICICI). Or is it wise to take additional credit rating, default and interest rate risks through debt funds for an additional 1% return(Plus we have to pay tax on the profit)?

If you were in my situation, would you keep money in a savings account or debt funds? (Of course, this is for the short term, i.e less than a year)

Thank you

Sandesh Shetty

Sandesh, I\’d keep the money in a liquid or savings account, and invest part of it every month via SIP into the equity funds I\’ve selected.

Hi Karthik,

Thank you for sharing this insight. Learnt a lot.

Suppose I invest 10 Lakhs in a liquid fund to park my cash for the next 8-10 months. But for some reason, I may have to liquidate the fund due to some emergency in the next 1 month.

In this case, will there be any exit load or any other changes while redeeming the fund? Is there any locking period for overnight or liquid funds?

Thank you

There is no lockin or exit loan, Sandesh. Liquid fund is supposed to be cash equivalent, so no issues.

Hi Karthik.

Many thanks for Varsity.

You mentioned that one should stay invested at least till the average maturity of the fund. What should be the strategy once the maturity of my fund units is accomplished? Not taking the tax implications into consideration and assuming the portfolio and other fund parameters remain as per my goal, should I stay invested if I want to employ that amount in asset allocation and liquidity is not required at that time?

The idea is to stay invested for longish period. You wont be able to track the individual securities maturity anyway.

Thanks Karthik,

I was able to set up debt funds in my portfolio on my own following the module. Thanks a lot!!

Mission accomplished for me then 🙂

Congratulation!

Do we need to worry if the fund manager is managing too many funds in the AMC?

Most of these guys have this running like a proper process (like a pilot flying an aircraft). So it should be ok.

In one of your previous lesson, you mentioned the risks involved with fund size where bigger fund size might have liquidity problem. When I want to consider a short duration debt fund, what fund size should I look for? The best performing funds(the ones I shortlisted following the above template ) had >14k crores fund size. Do you think this a bigger chunk of amount that we should avoid in those fund.

Mahesh, there are other things you need to consider when looking for debt funds, apart from fund size. But fund size does not really matter that much here since the securities are held to maturity.

What is the risk if the number of securities are far more in a debt fund compared to its category?

For example if I consider, IDFC Banking and PSU debt fund, the number of securities are 193 compared to its category 85. What is the risk with this?

I don\’t see this as a point of concern. What matters is the concentration on funds in terms of the invested amount. For example, compare how many securities are included in 70-80% of the fund value. This will give you a sense of diversification or concentration.

Hi Karthik,

If there is a significant difference in the average maturity and Macaulay duration of the fund what does it indicate?

For example – For the ICICI Prudential Banking & PSU Debt fund, the average maturity is 5.14 and the Macaulay Duration is 2.77. Is this something to get worried about as typically I have not seen such a vast difference.

Thanks,

Dhairya.

Nothing as such. It should not really matter as far as I know.

In Interest Rate Risk, what Interest Rate are we referring here?

The interest rate prevailing in the economy.

Hello sir, is the difference between aplha & information ratio is that alpha covers the beta risk part and information ratio coves the standard deviation part?

Which one should we consider while investing in funds and why?

Why not consider both?

Hi Karthik,

If the below is true and it’s only for capital preservation then we can have it In our bank accounts or fixed deposit right ? Then why debt fund. Asking this to know since it’s mentioned as not for returns

“Investment in debt funds is mainly for capital preservation. Do not look at returns or chase returns when investing in a debt fund”

Yes, that is also possible, but there are use cases for debt MF. Please do check the chapters further ahead.

Hey Karthik,

Great quality content!!! Loved reading it.

Could you please recommend some great books on investing(Stocks) by own.

This is a good book, Farhan – https://www.amazon.in/Masterclass-Super-Investors-Vishal-Mittal/dp/9388304187

Sir I am trying to learn Financial Modelling but could not find the proper resource. When your module comes out you know I\’ll be among the first readers to devour it. But in the meantime, could you suggest me few books that gives introduction to financial modelling? Thank you.

Sundeep, I will try to start work on financial modelling next year. Meanwhile, I\’m not sure about books on financial modelling. Let me look for one.

Thanks. Eagerly waiting for that.

Also, if I need to invest a bulk amount, (one time, not through SIPs), what is the best time to enter assuming it is going to be for a long term investment. In the current dynamic situation, some are suggesting to park funds in FD as the market is quite volatile and may not be the right time to enter for the next 6 months at least.

Whether its 6 months or 12, no one can time. One of the things you can do is to park this in a FD or liquid funds and invest it in SIP mode over the next 6 months. For example, if you have 10L to invest, put that in a liquid fund, pull 1.6L every month for the next 6 months and invest it in a fund.

Hi Karthik,

Thanks for all the comprehensive information about Mutual Funds. I have learned a lot of things that I was not aware of earlier. I started reading this module thinking this will help me in planning my personal finance. It\’s true that I have learned about the various investment options. But with so many options available and also EPF, FD, and other things, I am unable to decide how much % to allocate to each of these instruments based on my age. hoal and risk profile.

Also, I understand the value of SIPs. But for someone like me who has not invested much in the markets till now, I have a collected sum that needs to be invested. I am worried about timing the markets wrong or making huge losses due to incorrect decisions.

If you can guide on the above two points it would be great.

Surobhi, I do plan to write about portfolio composition and asset allocation techniques. Hopefully in the coming few chapters. SIPs is a great hedged against our own inability to time the market. So don\’t worry about going wrong with timing as long as you are sipping and have a long term perspective.

Looking forward for the PDF file for Module 11 ( Personal Finance ).

Thanks

Hi Karthik,

Thanks for all the help and knowledge sharing you have been doing . Big thanks

I request you to please help on \” portfolio compositions\” and how to diversify the investments . Now with all the knowledge I have on Equities , FDs , Bonds , MFs etc , I am unable to figure out the appropriate proportions of investments into these and ending up 100% equity invested which I would like to change with your help

I will write about it in the coming chapters.

Many happy birthday Karthik sir. It was after I started reading Zerodha Varsity, my financial life completely changed. I consider you my manasik Guru. Thank you for all that you have done for me and I\’m sure for many other like myself. No words can express the gratitude I have for you. Thanks again for the good work sir. And Happy Birthday..

Thanks for the wishes and kind words, Sundeep. Means a lot to me!

Hi Karthik,

My query is pertaining to negative cash/cash equivalent of debt mutual fund categories like Low Duration/Short Duration funds. To what extent should the negative cash/CE as a % of AUM of MF should not worry me? For what length of period of persistence of -ve Cash/CE is acceptable?

The -ve cash flow is the amount payable. MFs borrow funds to service redemptions, so this is that amount.

jii sir, will invest as per the goals… Thank you Karthik sir

Good luck, Ketan!

Karthik Sir, I\’m investing in my first fund, I haven\’t decide to invest in equity or debt ( I already have analysed 2 equity and 2 debt ), is it right time to buy as market are at record highs? Or should go with debt? Or wait for a little correction?

Thank you..

Ketan, it depends on the purpose of your investment? You need to know why you are investing and what financial goal you are trying to solve for yourself.

So If I want to invest in both funds, it it alright?

Yes, as long as your portfolio goals permit.

Karthik Sir, I analyzed Franklin India Liquid fund and Quantum Liquid fund, where the former was good to invest and the latter had cash and cash equivalents in negative and other aspects were good .. so does it means we should leave the quantum one as it has liquidity risk?

And Thank you for teaching personal finance, I\’ve gained so much knowledge.. sacchi thank you:)

All MFs, especially the liquid funds borrow funds to meet redemptions. This is because the funds don\’t like to liquidate holdings to meet redemptions. So a -ve cash or net payable is quite common with these funds. To get a perspective, do compare it with other liquid funds.

The fund has also invested 1.64% of the assets in 8.3% RIL paper maturing in March 2022.

How did you come up with 8.3%?

The fund has declared that in the monthly portfolio disclosure. Please check the snapshot.

I understand about safety related to market linked funds.

Say, it is a Short Term Debt Fund. My basic question is how safe are AA- bonds issued by government bodies or by public limited company having strong promoters. Are there instances of government bond AA- failing to pay up?

SDL or state bonds has an implicit sovereign guarantee, but then there is politics, depends on which state, which party and all that 🙂

Do read this to get a perspective – https://www.moneylife.in/article/amaravati-bonds-why-did-franklin-templeton-and-absl-mutual-fund-pump-in-public-money/57854.html

Hi Karthik

My query: A debt mutual fund has 90% investments in AAA/Sov rated bonds but 10% in (1) Bonds of public companies with strong pedigree of promoters (say Tata Power Ltd) carrying AA- rating (2) Bonds issued by State government/PSU banks carrying AA- rating. Further, the mutual fund has consistently given above average returns.

How would you evaluate the fund from risk point of view? Should one consider such fund as a safe investment?

There is no safety in any market-linked fund, Jatin. YOu have to see the fund\’s category and justify if AA bonds in the portfolio make sense. Do apply the same template and see how well the fund fits in.

Thanks, Karthik.

for always replying to our comments. actually many times I copy the content to my notes from the comment section as well.

I have read all the varsity modules (and do refer back when I need to), but many people on youtube advise a proper paid course

to learn profitable trade. does this paid course offer drastically different secrets?

but I think your content and some books you referred for us in the various modules here should be enough to grow from here. I believe you the most for any advice regarding markets and investments.

Thanks

-Ganesh

Ganesh, if I\’m in the business of selling a course, then I\’ll make sure I sell the course 🙂

I this Varsity + few books are sufficient. But if you feel there is something lacking, then go ahead sign up for a course (not too expensive) just to get a perspective of what gets sold as courses and if at all there is a value add, well then it is a bonus.

Hi Karthik,

I really appreciate the efforts taken by you and your team to educate the new investors. The content provided by you is phenomenal and easy to understand. Also I would like to ask why don\’t we have \”Download pdf\” option for two modules viz Personal finance and \’Innerworth- Mind over markets? Reason being I prefer reading it in printed format rather on a screen. If you could help on this it would be great. Thank you in anticipation. Looking forward to read many more articles in future.

Personal finance module is still work in progress, will put up the PDF once its complete. We don\’t plan to put up the PDF for inner worth. Hope you continue to like the content here!

Hi Karthik,

in the image, this debt fund and category YTM is 4.59 and 5.18 respectively but a normal FD gives a return of 6 % in 3 years.

can I assume FD is a better option in this case?

You also need to compare the liquidity and tax factor, Ganesh.

Thanks Karthik for the article.

I agree that usually debt funds aren\’t any safer than equity funds. However, how about the debt funds which heavily invest in GILTs like \”DSP Government Securities Fund\” and other similar debt funds?

They have virtually no credit risk and have a decent CAGR as well.

Yes, no credit risk, but interest rate risk.

Is there a way to get notified when a new chapter is added to this series ?

We usually announce it on social media – Twitter and FB 🙂

No consecutive 8 or 10 years in Indian stock market where nifty has given negative returns

Not until now and I hope it doesn\’t either 🙂

Hi Karthik,

You say … \”Debt funds sometimes lend to two different companies but with the same promoter. Be wary of such funds.\” This is no easy task for a common investor as many a times, the name of the company is not a give away of having the same promoters. Please suggest a simple way to find that out.

Thanks.

I understand. The only way to keep track of this to dig deeper and generally be aware. Start by looking at the portfolio and if you come across any unknown entity, dig deeper and figure who owns it. This is a good place to see the promoters and directors of a company – https://www.zaubacorp.com/

Hello sir,

I want to know the best scheme in debt mutual fund based on specific investment duration.

Like if I want to invest a big corpus in debt mutual fund for 1 month or 3 months or 6 months. then which category which would like to choose which will give good returns with risk very low.

Thanks

Pranav

Its best if you stick to liquid or overnight funds.

@zerodha @varsity

Can you also make a chapter on short listing \”Share/Stocks\” for investing. As this also is biggest dark area for new investors and become traders(Trade once in week or month) at place of investing.

Really appreciate your effort and good work done.

I\’ve done that to some extent in the fundamental analysis module. Will be doing this in the next module as well.

Hi Ajay,

In my opinion, if we need to invest for 10 years then equity is better then rather investing in debt fund.

Also if you even investing for 10 years, purpose is protection and not growth. So, returns will be still out of context.

I agree.

When you say that you haven\’t checked rolling returns, capture ratios because it\’s a debt fund, is it more because this is a fund more dedicated to being invested in for 2-3 years or entirely due to the fact that it\’s a debt fund? Say we are investing in a Sovereign Bond fund that requires a long haul investment like 10 years, will these checks be needed there?

I\’d glance through the rolling returns but would not worry much.