10.1 – Multicap funds

We discussed the equity scheme and a few of its subcategories in the previous chapter. We will take that discussion forward in this chapter.

Next up is the multi-cap funds. As the name implies, a multi-cap fund is not bound to particular market capitalization. The fund manager is free to pick stocks from the entire market and create a diversified portfolio (the diversification is mainly in terms of market capitalization). In a sense, the fund manager is chasing opportunities that he thinks make sense. The only mandate for a multi-cap fund is that it should consist of 65% investments in equity and related instruments.

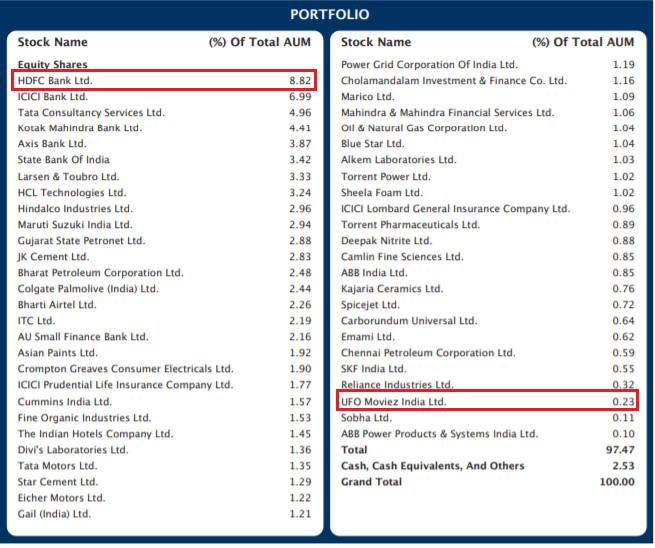

Have a look at the portfolio of SBI’s Multicap fund –

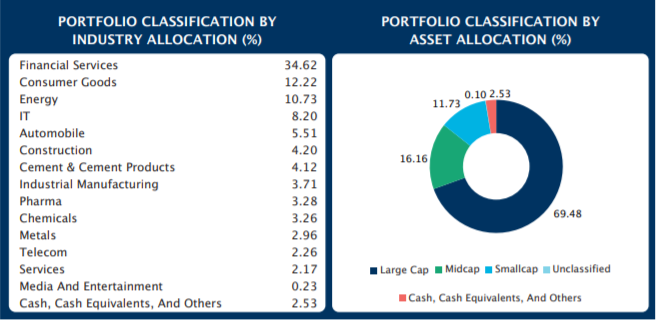

The portfolio contains large-cap stocks like HDFC Bank Ltd to a relatively small company like UFO Moviez Ltd. Of course, the investments in these stocks are of varying degrees; this is the Fund manager’s call. The portfolio mix in terms of capitalization is also dependent on the fund manager. The portfolio mix for SBI multi-cap fund looks like this –

Now, given the fact that the fund is diversified across the different market capitalization, the AMCs tend to benchmark multi-cap funds to the S&P BSE 500 index or the Nifty 500 index. These indices are broad and contain the top 500 companies by market capitalization.

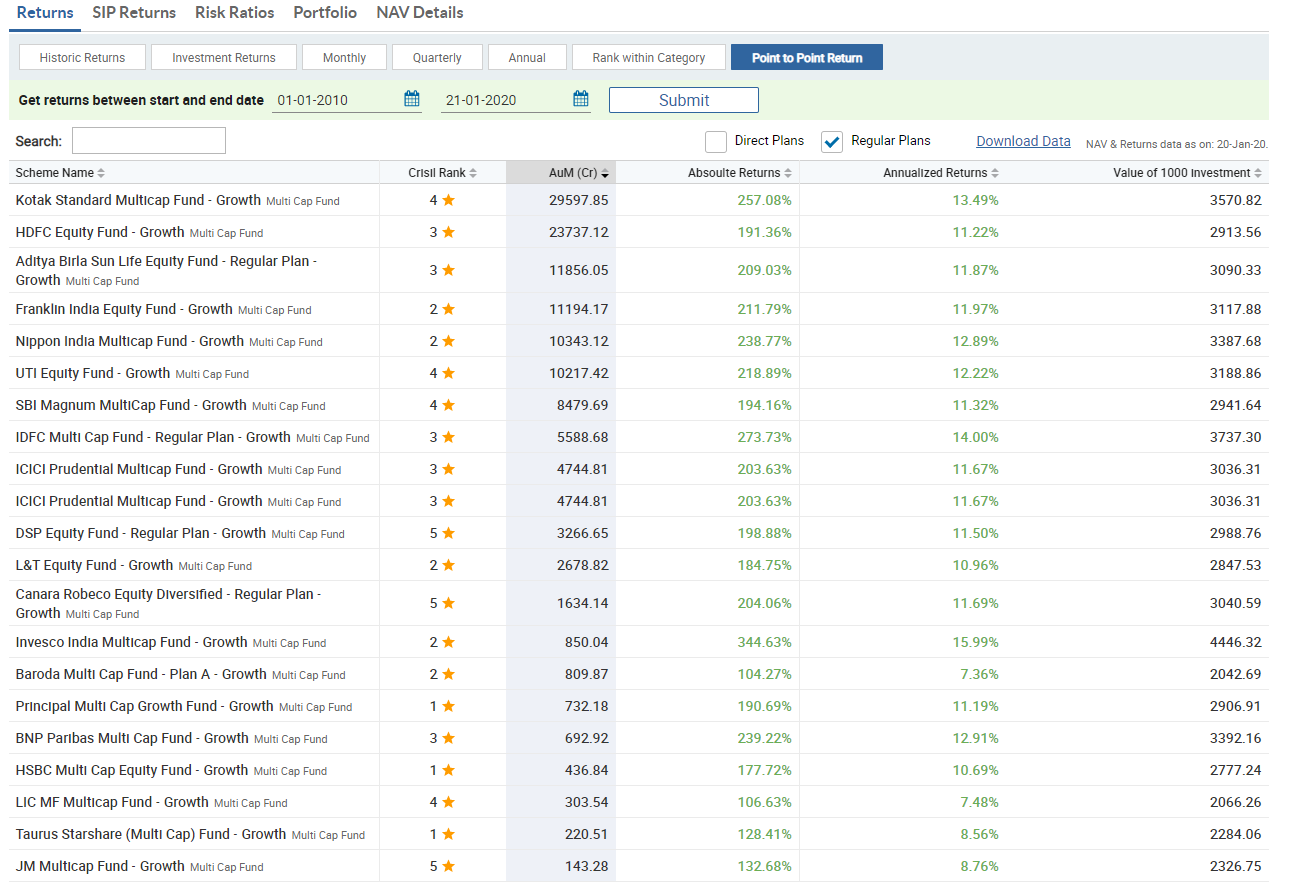

Given the fact that the multi-cap fund has a mix of market capitalization, the return expectation is on the higher side. The higher return expectation is also associated with a higher risk. Here is a summary of the returns from Multi cap funds for 10 years –

As you can see, the returns average about 10 – 11%, the lowest being 7.36% and higher is around 16%.

This leads us to an interesting point. The AMC is an asset-gathering machine. It tries to attract more and more funds to its schemes. Imagine, a multi-cap fund does the asset gathering part very well and gathers a ton of assets. What do you think will happen to this fund?

Well, as the asset size grows, they will have to deploy this fund into stocks. Unfortunately, in the Indian stock markets, the liquidity in the small-cap space is not much, hence the fund is forced to invest the funds in large and mid-cap space.

Hence, as the asset base grows, a Multi cap fund tends to work like a large and mid-cap fund. This probably explains why the SBI Multicap fund (8.5K Crore in AUM) has nearly 70% of its investments in large-cap stocks.

The one thing you need to keep in mind when investing in a multi-cap fund is the ‘fund manager’ risk. Since the fund invests in stocks across the spectrum, the performance is largely dependent on the kind of stocks and the proportion the fund manager decides to invest.

By the way, in my opinion, if you are completely new to mutual funds and don’t know where to start and which category to pick, then I’d suggest you start with a multi-cap fund. Think of this as going for a buffet dinner, where you get a bit of everything.

10.2 – Focused Funds

We have discussed a few equity categories by now. I hope you’ve looked at the fact sheet and portfolio composition of some of the funds. If you have, then one thing that comes across quite evidently is the number of stocks in the portfolio. It is very common for equity mutual funds to have a large portfolio size (in terms of the number of stocks), the numbers average to about 60-70 stocks in a typical equity portfolio.

The common theory is that the higher the number of stocks, the lower is your risk (and of course the return).

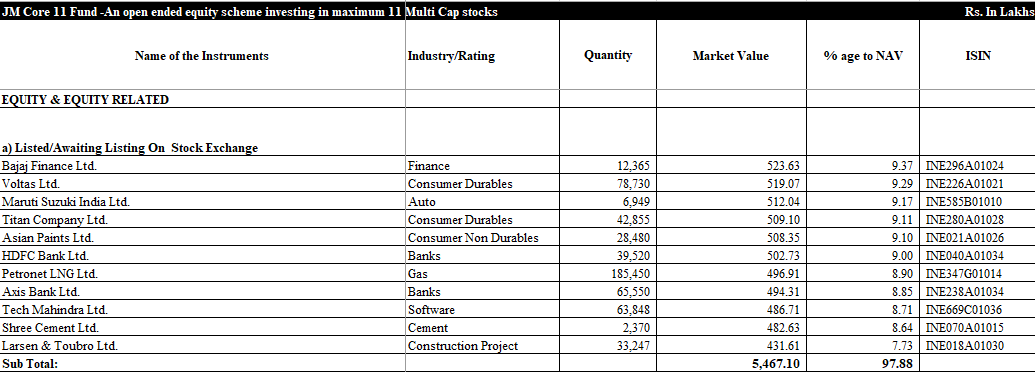

A focused fund does things differently. The focused funds, as the name suggests, contains a maximum of 30 stocks in the portfolio, thereby creating a concentrated portfolio. A concentrated portfolio is a portfolio with few stocks (max 30 in this case), but each stock is picked only after rigorous due diligence. In the investment world, they call this high conviction bets. The average number of stocks in focused funds is about 25 and if I’m not wrong, JM Financials’s focused fund is perhaps the only fund with just about 11 stocks. They call this fund the core 11. Their portfolio looks like this –

Since the number of stocks is limited in a focused fund, the risk and return profile of the focused fund changes drastically compared to other equity mutual funds. As you can imagine, the focused funds offer the possibility of a higher return along with higher risk.

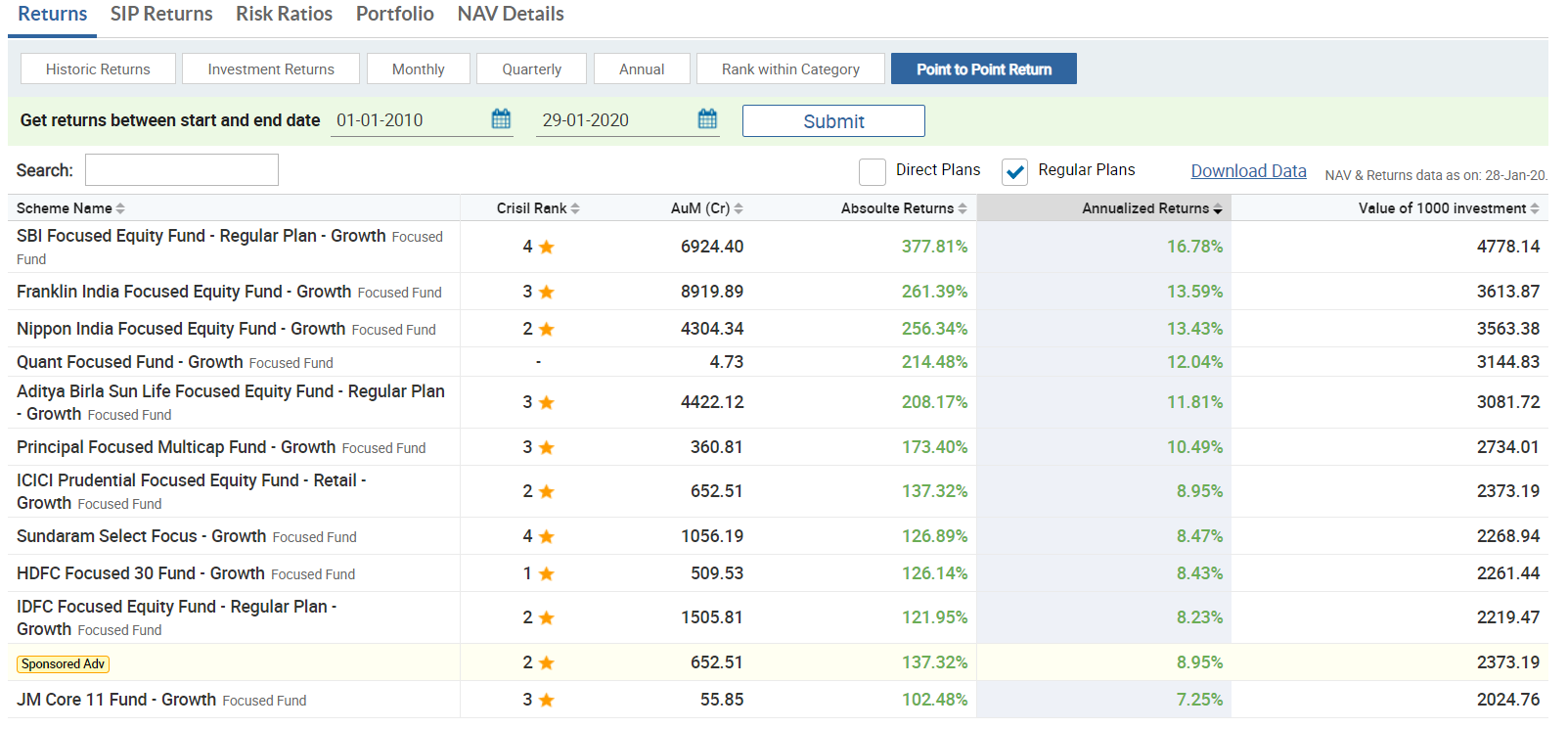

Have a look at the return profile of the focused mutual fund –

Over the last ten years, the returns range from 7.25% on the lower side to 16.75% on the higher side. These returns should give you a sense of how the risk profile of the focused funds.

I like to think of a focused fund as a poor man’s ‘Portfolio Management Services’, you get similar returns at a much lower cost and entry criteria.

This also leads me to the next point – the focused fund is not for someone who is starting his or her mutual fund investment journey. I’m saying this because the focused fund will be a lot more volatile compared to a diversified mutual fund. I think it is very important to familiarize oneself with the volatile nature of these investments and slowly ease up to the idea of market-linked investments. If you start straight away with Focused funds, I’m afraid this experience will be a bit harsh and may convince you to never look at MF as an investment option. I think a focused fund will be a great addition to the mutual fund portfolio at a slightly mature state in the investment journey.

10.3 – Dividend yield funds

I wish there were a different name for this mutual fund category. The moment you see ‘dividend yield’ as a part of the fund’s name, it is only natural to expect that the mutual fund pays out regular dividends to its investors. However, this is not true at all. A dividend yield fund (or for that matter any other mutual fund) is under no obligation to pay out a dividend to its investors.

Given this, why do you think a dividend yield fund is called a dividend yield fund? Well, the name is representative of the strategy the fund follows. The strategy as you can imagine involves investing in companies that payout (high)` dividends regularly.

Dividend yield = Dividend paid during the year/ stock price

For example, if Infosys trading at Rs.780/- per share pays a dividend of Rs.22/- for the year, then Infosys’s dividend yield is –

= 22/780

= 2.8%

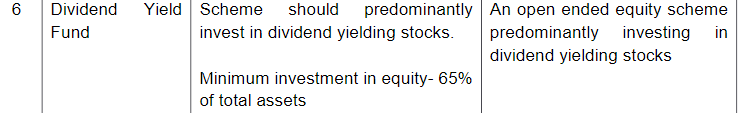

Here is SEBI’s definition for this category –

As you can see, the fund is predominantly invested i.e. at least 65% in dividend-yielding stocks. There are two aspects to this –

- The fund invests 65% of the corpus in dividend-yielding stocks; the balance 35% is open for other investments, which means that this portion (35%) may be invested in non-dividend-yielding stocks

- Ideally, these funds should invest in high dividend-yielding stocks. So one has to define what ‘high dividend’ really means. The lack of clear definition leads to inconsistencies in-stock selection. For example, a fund manager simply states that high dividend yield is anything greater than 0.75% and another fund manager may want to benchmark it against the indices dividend yield.

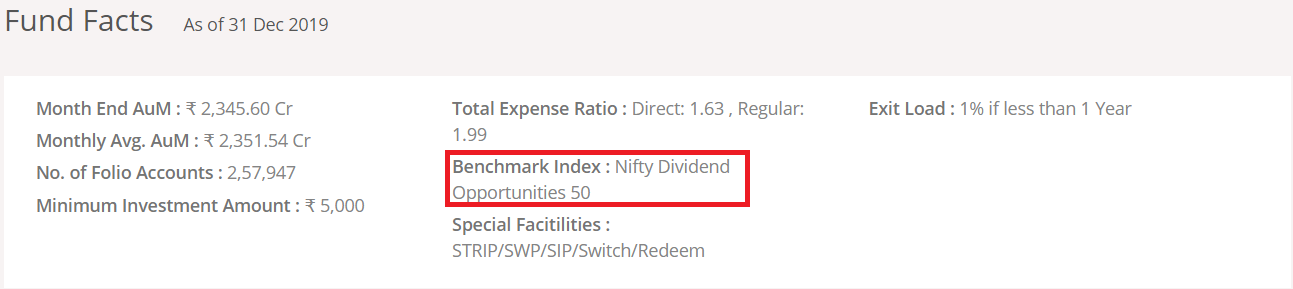

For example, check out the UTI Dividend yield fund –

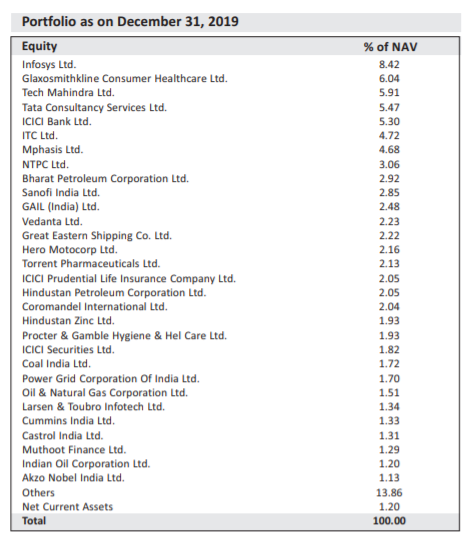

They benchmark themselves to the Nifty Dividend opportunity 50 indexes. The fund’s portfolio, as you can imagine consists of companies which are well established and consistent dividend-paying –

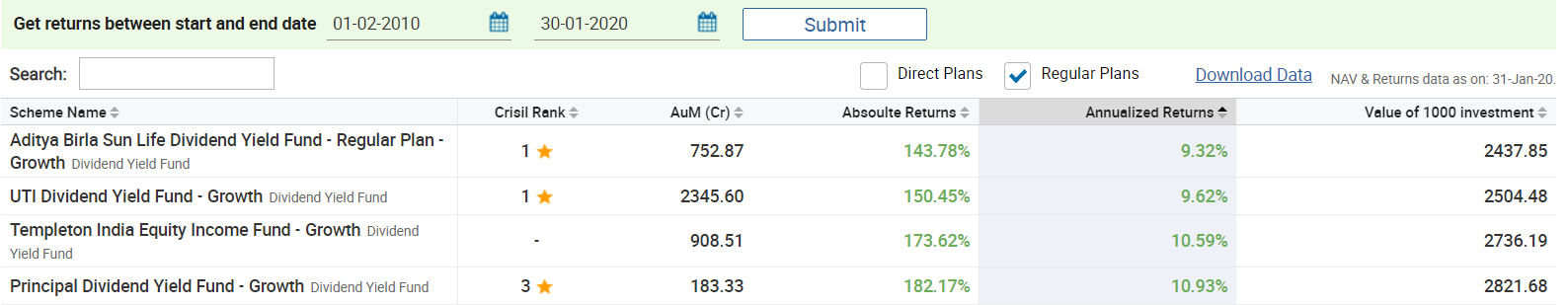

The last ten-year performance of dividend yield funds are as follows –

As you can see, the performance is fairly standard across these funds.

I’m personally not a big fan of dividend yield fund simply because I prefer to take that extra risk with growth stocks. Of course, the decision to invest or not to invest depends on the portfolio goals of the individual.

10.3 – ELSS Funds

The ‘Equity-linked Savings Scheme’ or the ELSS funds are a special category of mutual funds that enjoy tax exemption on investments made under section 80C of the Indian Income-tax Act, 1961.

As you may be aware, section 80C in the income tax act allows you to reduce your tax burden by accommodating for certain investments and payments made during the financial year, the reduction in the tax burden, however, is up to Rs.1,50,000/- per year.

For example, if you have a total gross yearly income of Rs.1,200,000/- then you can choose to invest Rs.1,50,000/- in various 80C options and reduce the tax burden. If you do so, your taxable income reduces to 1,050,000/-.

Amongst the various investment options permitted under section 80C, investments in ELSS mutual fund is one of them. You can choose to invest either the entire permitted amount of Rs.1,50,000/- in ELSS or split this amount across many different schemes such as Life Insurance, Public Provident Fund, five year FD, Sukanya Smariddi Yojana, etc.

The decision to do so depends on your overall financial planning strategy. Of course, we will discuss this more as we progress in this module.

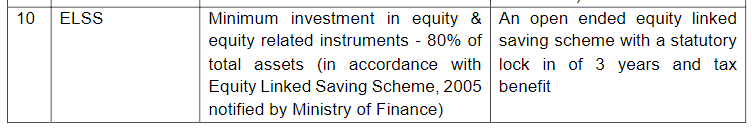

Here is how SEBI describes an ELSS fund –

There are two important things to note here –

- ELSS funds have a mandatory lock-in of 3 years. I guess this is the Government’s way of inculcating long term investing behavior 🙂

- ELSS funds have a mandate to invest 80% of the funds in equity and equity-related instruments. There is no restriction on the market capitalization of stocks.

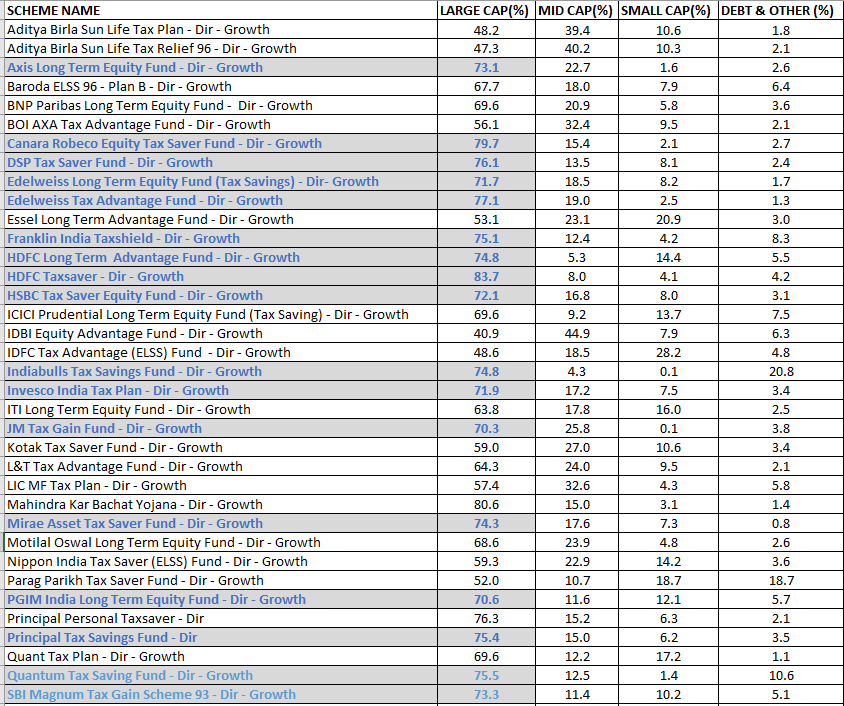

Many people wrongly assume that ELSS funds are a proxy for a pure large-cap fund but this is not entirely true. ELSS mutual fund, in general, can probably be considered as a proxy for a multi-cap fund. The data below helps you understand this –

That’s the list of the 40 top ELSS funds and as you can see, 23 funds have less than 70% in large-cap stocks and 17 of them have over 70% invested in large-cap stocks. Some of the funds like the IDFC Tax Advantage Fund have a fairly decent mix across all market capitalization, which makes it a clean multi-cap fund.

Again, when you select an ELSS fund, the decision should depend on your overall portfolio structure. For example, there is no point in having a large-cap fund and again opting to invest in a fund like HDFC Taxsaver, because HDFC Taxsaver has 83% invested in the large-cap stock.

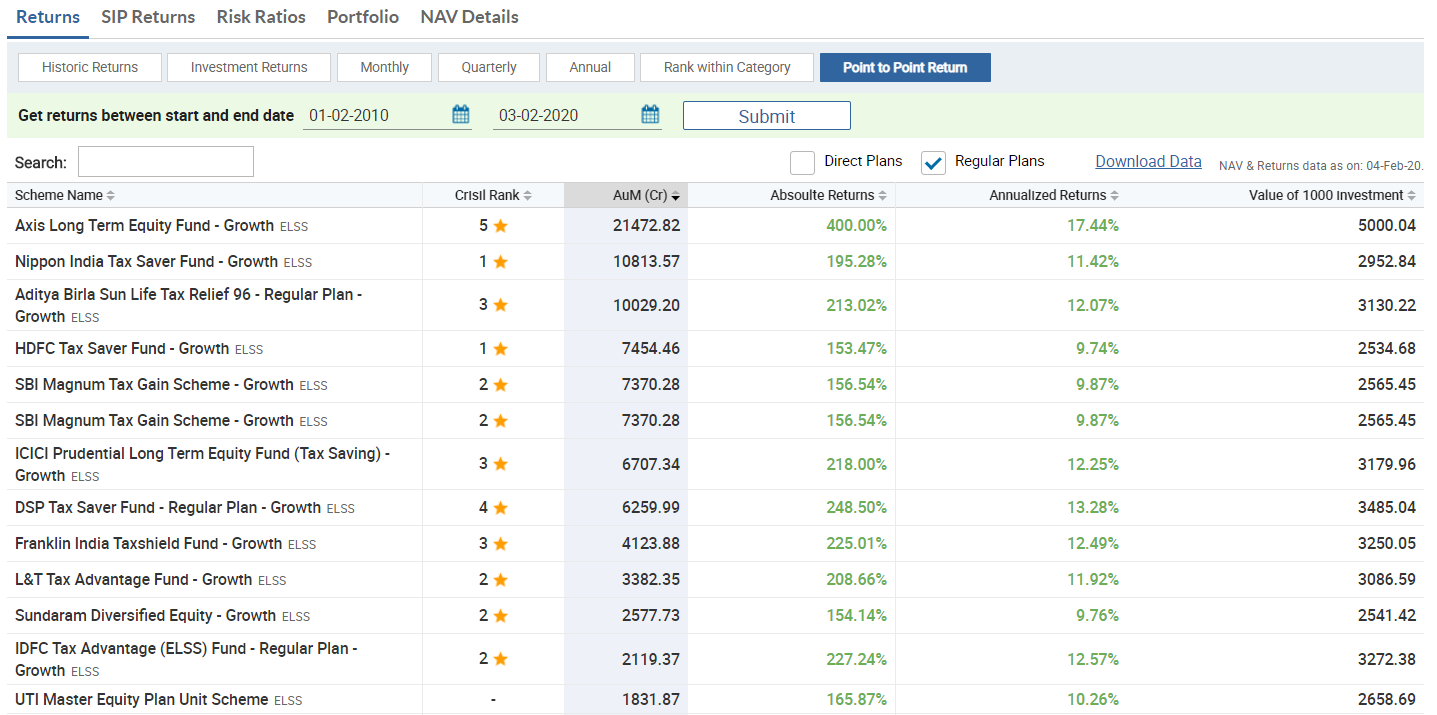

The performance of ELSS funds for the last ten years is as follows –

These are for a few of the top funds in terms of AUM. As you can see, the returns average about 11-12%, which I think is in line with the multi-cap fund.

I think the last two chapters have laid down a brief introduction to equity mutual funds. We will now proceed to understand the basics of debt funds and cover as many subcategories as possible. Once we are through with this, we will proceed to understand the techniques of selecting a mutual fund and building a mutual fund portfolio.

All of this and more in the coming few chapters. So stay tuned for more 🙂

The key takeaway from this chapter

- A multi-cap fund does not have any restrictions on where it can invest. The manager invests in any stocks across market caps (large, mid, and small) where he sees opportunities.

- One of the risks to watch out for in a multi-cap fund is the ‘fund manager risk.’

- A focused fund consists of not more than 30 stocks in its portfolio. These are high conviction bets by the fund manager

- The risk and return of a focused fund is higher compared to any other equity oriented fund

- A dividend yield fund does not mean the fund pays regular dividends to its investors

- The dividend yield fund invests in high dividend-yielding stocks

- ELSS funds are tax saving funds under section 80C of the Indian Income Tax act 1961

- A maximum tax saving of 1,50,000/- is permitted when investing in ELSS funds

- An ELSS fund is considered a proxy for a multi-cap fund

What about Value Or Contra fund andd felxi cap?

What about it Sayak? Can you please share more context to your query.

Can Share more details about Contra,and felxi cap?

I\’ll try and put up a video on this, thanks.

hello kartik sir aditya here , how are sectoral funds and contra funds as an option i read about them online , i wanted to know your view about it

These funds come to limelight when there is a sectoral theme playing out in the economy and fizzes out when the the theme dies. My suggestion is to avoid these sectoral theme based funds.

Hi Karthik,

This is all great matertial for someone who wants to understand personal finance and invest in Mutual Funds. Wanted to check if you can also add information on Thematic & sectoral Funds

Thanks Yatharth, I was not thinking about it, but maybe I will 🙂

Hi Karthik, thank you for these wonderful articles which has been very helpful for investors like me who have trying to learn and become DIY investors instead of relying solely on fund advisors/agents. It would be good if you expand this series (on Equity mutual fund) to other equity funds like sectoral/thematic etc which has gained tractions over the years. I believe on varsity we have far more writing on Debt than Equity.

Thanks, Abhishek. I\’ll try and do that 🙂

I think you have said something wrong here. You have said that in Multicap, the fund manager has the flexibility to decide where he wants to invest. But you have given example that in SBI\’s Multicap Mutual Fund, he has invested 70% in Large Cap. But this is not possible because according to SEBI, a Multicap Fund has to invest at least 25% in each three small medium large asset. But in this, you are saying that SBI\’s Multicap Fund has invested 70% in Large Cap. How is it possible according to you? These both are contradicting statements according to you and SEBI Circular.

Ah yes, here is circular – https://www.sebi.gov.in/legal/circulars/sep-2020/circular-on-asset-allocation-of-multi-cap-funds_47542.html . Guess the circular was issued to fix the issue of Multi cap funds behaving quasi large cap fund. Btw, this was the case when I wrote the chapter, I should have updated it with the circular, my bad.

Hey Karthik,

In high dividend yield fund, SEBI mandates to invest in 65% in equity stocks (high dividend yielding stocks)

So does that mean the fund manager has the liberty to invest remaining 35% in non-equity space??

or is it a compulsion for fund manager to invest the remaining 35% in equity space only

Thats right, the fund manager is free to invest in non high yeild stocks. It could be stocks with lower or no dividends too.

Hi is it possible to discuss about Flexi cap funds. their pros and cons.

Sure, maybe we can do a video on this. Thanks.

Hi Karthik, I have few doubts related to equity MF

1. Is expense ratio of a fund subject to change over time or it is same throughout?

2. Suppose one has figured out the Multi Cap as a scheme to invest. Now looking at various available options in this category, how can one choose which one to go with. What are the key parameters to look after among AUM, Expense Ratio, past returns, age of the fund etc.

1) It can change during the course of the fund.

2) I\’ve a chapter later in this module on how to analyze an equity fund, maybe you should check that.

I called them today and they said that himanshu mange is a very experienced guy although he is associated with nippon india MF for the past 4 years only and he can manage it and they will share my concern about tracking error with himanshu mange. Basically unhone clear answer nhi diya…

Should I start SIP in nippon india midcap 150 tri index fund assuming fund mgmt will take place at an auto pilot mode and tracking error will come down over time ?

I cant really give you a fund specific advice Abhishek 🙂

There is one fund mgr named himanshu mange of nippon india. He manages nifty mid cap 150 tri index fund along with other 27 nippon india schemes. I wanted to invest in this nifty mid cap 150 index fund but one point concerns me and that point is can himanshu mange bring down tracking error overtime ? I am saying this because he is managing 27 other schemes so can he allot enough effort to this particular scheme of midcap 150 tri index fund to reduce tracking error over time ?

Is my concern right or am I overthinking ?

Most fund management today has reduced to an auto pilot mode since every fund manager follows a mandate. But maybe you should write to them and check what they have to say 🙂

Hello kartik !!

Recently I decided to invest in nippon india nifty midcap 150 TRI index fund and it had a tracking error of 0.09% (lowest among all mutual funds ) and expense ratio of 0.3% but when I compared funds return with benchmark, there was difference of approximately 1.7 to 1.8 percent and when I did the same comparison with two other mutual funds with similar expense ratio (around 0.3%) and tracking error (ranging between 0.10% to 0.12% ) there was around 2% difference.

So my doubt is nippon india ka jo ye index fund h uske returns and its benchmark returns ke beech ka jo difference h wo in future narrow ho skta h ? and kya tracking error overtime km ho skta h ? Because i think difference of around 2% will have great imapct on my final corpus after 10

years.

Yes, all fund houses aims to bring down the tracking error overtime.

Hello Karthik

Could you please let me know the difference between Multip cap and Flexi cap?

Sir, what about flexi cap. Any details on it.

Please do check the videos as well. By the way, with the structure of this module, you should be able to pick up any fund and understand how it functions.

Hi Karthik, firstly I want to thank you for all the amazing, exhaustive and systematic study material you have provided here for complete beginners like us to educate ourselves. It is indeed a truly commendable effort from Zerodha and you.

I wanted to know about what exactly happens to the dividends that we earn through our mutual funds- in an equity, dividend mutual fund per se. I have never received any dividend payouts from my mutual funds? Are they taken by the AMC\’s or is that amount converted to NAV units of that mutual fund. What exactly happens to this amount?

Thanks Surbhi. The dividends are usually baked back into the NAV.

Sir, I have few doubts regarding the elss tax saving funds

1. Is there any limit for investment amount to get eligible for tax relief of 1,50,000 each year? For example, do I get tax relief of 1,50,000 rupees even if I just invested 10,000 rupees?

2. Let\’s say I just invested one time investment of rs 10,000 in elss fund and continue to stay invested for long term, so does this mean that I will be eligible to get tax deductions of rs 1,50,000 every year as long as this fund is in my portfolio?

3. I can understand, during the lock in period, I can\’t be able to redeem the units. But when will I be eligible to get tax deductions of 150,000 rupees, during the lock in period itself or only after the lock in period expired?

1) Your tax relief is to the extent of your investment.

2) No, its only to the extent of your investment.

3) You get the tax benefit for the same financial year you invest in, not for later years.

Hi Karthik,

Loving your content here. I had a query regarding ELSS Murtual Funds. How does it benifit the Government if you invest in them? Is it just beacause of the lock in of 3 years? If I had to choose between a midcap and ELSS, and I don\’t want to consider the tax saving part(Assume I\’m in the new tax regime), can i say investinfg in non-ELSS makes sense?

ELSS does not benefit the Govt, it is just an incentive for you to stay invested for at least 3 years.

Why multi cap and not large cap, if you a new to MF?

Which fund really depends on your overall portfolio strategy 🙂

Hi Karthik,

Hope you are keeping well and keep up the brilliant work!

Could you please shed some light on investing in the US markets via the Indian mutual fund route?

There are options to invest directly in US stocks which requires depositing INR and converting into USD and other transaction costs.

This could make an interesting module to diverse one\’s investment allocation.

My investment plan involves allocating funds to the US markets through Indian mutual funds that, in turn, invest in US indexes via ETFs with transactions denominated in INR.

I would like to understand the effectiveness of this investment strategy as a hedge against INR depreciation in relation to the US Dollar (USD). Which is a better choice between the NASDAQ 100 and S&P 500 Indexes for long term growth?

Thank you in advance for your time and guidance.

Bets,

Nithin

Nithin, direct investment is a mess with all the fees and conversion charges. Its best if you can invest via MFs. More than hedge, I\’d like to think about it as an exposure to US tech companies, which is lacking in India. From that perspective, I\’d prefer NASDAQ 100, but this is a personal preference 🙂

Hey Karthik, I did not understand the following two paragraphs very clearly I guess. Can you please explain further –

Well, as the asset size grows, they will have to deploy this fund into stocks. Unfortunately, in the Indian stock markets, the liquidity in the small-cap space is not much, hence the fund is forced to invest the funds in large and mid-cap space.

Hence, as the asset base grows, a Multi cap fund tends to work like a large and mid-cap fund. This probably explains why the SBI Multicap fund (8.5K Crore in AUM) has nearly 70% of its investments in large-cap stocks.

It means that the fund manager has bigger inflows of funds, they find it hard to invest the money in small and mid cap stocks. So they are forced to invest in large-cap stocks. Hence as the fund grows (in AUM), the fund objective sort of changes.

Hi Sir,

Is there any way by which an equity investor, can do SIP but the SIP amount changes with the moving average of nifty every month, so that when nifty is cheap one invests more and when it is pricy one can invest less

? Is there option on coin which can help me with this?

These are conditional SIPS, not sure if anyone provides this Shubham. But the way SIPS work is that you can buy more units when market is down and lesser when markets are higher anyway.

Sir,

It is a sincere request to please clarify the difference betweeen flexicap and multi-cap, and what is better for a 20 year old guy like me, with the aim of wealth creation in long term (~10-20 years)…

Here is a good article explaining the difference – https://www.valueresearchonline.com/stories/51736/flexi-cap-vs-multi-cap-which-is-better-for-you/

I\’d suggest you look at a large-cap fund and do a hyper long-term SIP in that.

Nice article. My investment also started with Equity funds since I am investing for long-term accumulation. I came across this good Mutual Fund scheme Aditya Birla Frontline Equity – it has a good track record of 20 years and has been giving me good returns. You too can explore and invest: https://bit.ly/3BqXACf. Most of my investments are into equity any good schemes for debt investment?

Please suggest

Cant suggest a scheme as I\’m not a financial advisor. But I\’ve explained how to select one in this module.

Thanks a million dear Karthik.

Happy learning, Hemant!

Dear Karthik R.,

HAPPY TEACHER\’S DAY.

In the previous chapter 9, you have mentioned about Multicap and Flexicap sub-categories under Equity in the table.

In this chapter you have discussed Multicap at length.

However I did not notice anything on Flexicap.

If my understanding is correct, as per SEBI categorization in November 2020, there is minimum limit of 25% each in Large, Mid & Small in Multicap.

However there is NO such minimum and/or maximum limit in Flexicap.

My query:

If my understanding is correct then please throw some light as to which is better for a retired person at 63 years – Multicap or Flexicap or none of them? If none, then which category is advisable in your valuable opinion?

The intention is to redeem poor performing equity fund schemes in my portfolio, and move them to top performing equity fund schemes, so as to maintain the equity allocation.

Regards and thanks a ton in advance.

Thanks, Hemant.

Flexicap can invest in any market capitalization with at least 65% invested in equities, and the rest can be invested in other asset classes like debt. But I\’d suggest you skip this because most of the fund managers invest in small caps to take chase performance, which also makes it risky.

I\’d suggest you look at large caps. Please do speak to your financial advisor once before deciding.

Great content and presentation!

Well done Zerodha Varsity and team!

A suggestion for your consideration: I think this chapter needs to be updated clarifying the difference between multicap funds (min 25% in large, mid and small caps) and flexicap funds (where there is no such restriction).

Great content and presentation! Well done Zerodha Varsity and team!

A suggestion for your consideration: I think this chapter needs to be updated clarifying the difference between multicap funds (min 25% in large, mid and small caps) and flexicap funds (where there is no such restriction).

Ah, thanks for pointing out Ajay. Let me check this again.

Sir what\’s the difference between a Multicap fund and a flexi cap fund?

Hi Karthik,

Hope you are doing well.

First of all, I would like to say a big Thank you for your simple & detailed explanation of these topic !! Great fan of yours 🙂

Would you mind If I ask you about screen shot that you have put having details about the various fund, how I can get them basically the source from where I can get this. It would defiantly help me to research at my end. Thanks in advance.

Thanks for the kind words, Manish. The screenshots are from the fund houses websites themselves or an aggregator site like Morningstar. I guess I\’ve mentioned the source right below (or above) the image.

How frequently Fund Managers changes the holdings in companies. And from where I can see all the changes?

You can keep an eye on the monthly reporting in the factsheet. That gives you a view of all changes in the portfolio.

Damn Karthik, this is an awesome resource. No amount of praise can describe my elation reading your modules. May you prosper and bring more insights. Loving it.

Thanks for the kind words, Manipal! Happy learning 🙂

I meant to ask, is there any obligation or mandate that every 6 Months or 1 year, the AMCs are required to revisit the \”trueness\” of the schemes to their respective objectives? As some Large Caps for example Yes Bank landed in a lot of fraud and loose market cap to no longer qualify as a large cap.

They are always supposed to do that, not one in just 6 months 🙂

Great content Karthik! Would love to know more about how are the underlying equities governed / rebalanced.

That is AMC\’s strategy 🙂

Hello Karthik,

Thanks for the guidance. In the debt funds we have two similar kind of funds \’ Low duration fund \’ and \’Short Duration Fund \’. I saw this also in the matrix sheet you have provided. The duration ( fund maturity & holding duration) seems to be the only difference between them. Also, this duration is marginally apart between the two funds. Is there any other major difference which has given rise to these two funds ? Which one would be better suited for parking lumpsum ?

Secondly, would Zerodha be launching the STP feature in Coin this year(2021) ?

Not much difference apart from this, Vinod. STP – hopefully soon, its my personal feature request to Coin team as well 🙂

Thanks Karthik for providing this knowledge bank, where we can keep coming back for better perspective. I had two queries :

1. Based on our goal-based-investment-strategy, supposing if we have to do a SIP for a particular fund type ( say Large or Mid Cap etc), if the monthly SIP comes to Rs.2000/- Is it good to put it one fund ( which we judge as best) or divide (maybe Rs 1000 each) it between two funds ( 1st best and 2nd best), so that we are investing in two fund houses ( of the same category) so that if one does good and the other bad, we are safe by atleast 50% ?

2. It would be good to have some exposure to Small Caps to take advantage of the market dynamics. Hence, would it be better to do a SIP or Lumpsum when dealing with Small Caps, say for a tenure of 1-3 years ?

1) Yes, you can split this into two different types of fund, for example large and mid cap

2) I\’m not a big fan of small-cap funds, they are too volatile for my liking. But if you decide to do, then please ensure you give at least 10+ years.

Hi Karthik.. What are annualized returns and Absolute Returns? Why have you captured both in showing past performance of MFs.

Are they some kind of indicators? Which one to consider?

I\’m asking because the difference is huge between them for some of the MFs.

Here you go – https://zerodha.com/varsity/chapter/measuring-mutual-fund-returns/

Sir

All modules please provide in kannada

Hi Karthik,

As per my research, multi-cap funds should have at least 25% of allocation in each small, mid and large-cap stocks. But, it is not true in the case of the SBI multi-cap fund. I am a bit confused here.

Also, what is the difference between multi-cap and Flexi-cap fund?

Thanks

Sandesh Shetty

Can you please check the latest fact sheet again, Sandesh?

Hello Sir,

Is it wise to consider a quant tax plan for ELSS investment judging the outstanding return it has provided in recent years?

These are factor funds, you need to be fully prepared in terms of understanding its logic, associated risk and reward. If yes, then go ahead.

This content is good.

Just wanted to check why is this also not reflecting in iPhone app of Varsity ?

Ah, not sure. Let me check.

Please tell us that what type of books you may refer us for mutual fund and stock market (for value investing for longterm). Any type of course we should go with or any thing you want to tell us regarding all . i am very initial to is beginner can say please Karthik Sir Help regarding this .

mail id- [email protected]

Everything is on Varsity already, Umang 🙂

Can you also add a chapter on Zerodha Small Case? I understand the concept in principal – but will be great to have more insight?

Sure, maybe I can take smallcase\’s help for the chapter 🙂

Karthik – Excellent material. I invest in stocks through Zerodha and uses Coin Platform for MF investment almost since it\’s inception. Just few inputs

1. I think Rules for Multicap Funds had changed now – and they need to invest across different fund categories in certain proportion – it is not fully left with Fund Manager. This was a popular category among investors.

2. This category is named as Flexi Cap. I do not know how many Multi Cap had changed to Flexi Cap 9Few like Parag Parirkh had done)

3. Will be good to cover International MF also – Some of them had given good return for last few years. Is there any additional risk in this?

4. Your views on Value / Contra fund?

1) True, I need to update this on the chapter. I\’ll do this.

2) Yes

3) I will try and do this

4) These are good, but takes time for the theme to unfold. If you are investing, then please do ensure you are investing for a long enough period.

Hi Karthik,

The new guidelines on multi-cap funds mandate them to maintain a fixed minimum ratio of 25% in large-caps, mid-caps and small-caps. Would be great if updated here.

Yup, I will do that.

After recent SEBI announcements \”multicap\” section can use a refresh, can be renamed to \”flexicap\” I guess. Thanks for the blog, really useful.

Hey yes, I\’m supposed to do that. I will update it soon.

I love this module much more than others, I\’m not saying I don\’t like other modules, I have completed my 5 modules and 4 certificates 😎

Compare to others this one is really close to me since this is helping me to create my way towards my great future.🎯

I thought I wish to share my comments in the last chapter of this module, but today is a special day, \”Happy Birthday Mr.Karthik\”🎂

Thank you so much.🤝

Thanks so much for the wishes and kind words, really means a lot!

You mentioned that in multi cap fund, the AMC is responsible for investing atleast 65% of the funds in equity or related instruments. What about the other 35% of funds ? In which instruments are they invested in ?

There was a new reclassification with multi-cap funds (Sept 2020), which said that at least 25% should get invested in Large, mid, and small-cap stock. The rest can go back into any of these categories itself.

Kindly update multi cap fund SECTION as per new guidelines

Will do.

Hi Karthik,

I totally loved this article and already start investing . Thanks a lot for that.

You haven\’t talked about international funds yet. Should we invest, if yes, than what should we see while investing in international funds. Any fund you can think of? Would be great if you can suggest some good articles to read for international fund to enhance our knowledge.

Thanks again!

I\’m not sure about these funds myself, maybe they are worth a look from a geographic diversification point of view. Will share more details soon.

You are good teacher able to explain things in a systematic way to help novice..

Thanks to you…

Happy reading Sridhar!

Respected Sir,

Regret to forgot to inquire about your and your team. Hope that you all all doing WELL and SAFE.

Yes Sir, we are all doing fine and thank you for the concern 🙂

Hi Karthik,

I haven\’t gone through the entire module yet (not sure if you have mentioned in future chapters) but there is one thing which is very important to mention to the investors is that dividend is payed to the investors through the profits realized from sell of securities. I only came to knew about this through COVID-19 crisis when my mutual fund stopped paying dividend.

https://economictimes.indiatimes.com/mf/mf-news/sebi-leaves-mfs-with-little-for-dividend-pay/articleshow/5695747.cms?from=mdr

I wanted to know that what do Mutual Funds decide to do with the money earned through the dividends or interest in case of debt funds? How does the investor benefit from it? As per SEBI, AMC cannot distribute this money directly to the investors. Moreover, why did SEBI decide to do this?

Thanks,

Eshan

Thats right and I guess I have mentioned this point in one of the chapters in this module, don\’t remember which one 🙂

AMC\’s reinvest the dividend/interest back into the fund.

Hey Karthik Sir. Hope you are doing well.

Say a company \’A\’ has a market cap of 100 rs.

Now the fund has 10% weight in the company \’A\’.

Now i have invested 10 rs in this fund.

So who is the on-paper owner of the 1 % of company.

Me or the fund?

Thanks in advance.

That would be the fund, Neil.

Karthik Sir, I hope you are doing well. I have a doubt, sir in dividend-yielding funds, are the dividends reinvested by the fund managers?

I\’m doing good, hope the same with you. No, in the dividend funds, units are sold and given to you as dividends.

sir ,

My question is about options contract , in kite or zerodha pi how to place a bulk order or multi legs order ?

thank you .

Hi Karthik

You are really doing an awesome work. Making my lockdown quite productive.

I have 2 questions:

1. Regarding 80C Investments – Currently I over the whole amount 1,50,000 by putting it in EPF account as I consider it to be more secure and we can get risk free return of ~8.5%. What is your take on it when you compare this strategy with investing in ELSS based on risk (assuming I am a long term investor)?

2. Since the markets are in bearish phase due to Covid19, would you suggest to continue SIP in large cap funds or should I shift to Index funds for the coming few months?

Looking forward for your response.

Thanks

piyush

1) Its not bad to put 1.5L in EPF and skip ELSS completely. But do make sure you have other equity exposure too

2) Yes, dont stop your SIPS, keep at it for long term. The index fund is a good replacement for largecap fund.

Sir, thank you so much for your efforts. I have a question sir.

1) Is CRISIL score indicates a better MF among others? The facts that you taught us to check from a MF fact sheet to evaluate a better MF among others in terms of risk involvement and selection of funds/bonds. Is CRISIL rating doing the same job to indicate a the best among the peers? (Though many funds do not have the CRISIL score😒)

You need to consider the score from a credit risk perspective, but as you will read in the debt fund chapter, this is not the only deciding factor.

Hey Karthik,

Thanks a lot for your reply!

AS you said ,\” You can replace the large-cap and mid-cap with Nifty Index fund and Nifty next 50 index fund. These are low-cost funds, and performs as well or better than its active peer\”

So, what I understood from this is it makes little sense to look into researching mutual funds(Large+Mid cap) . Formula is simple, just simply invest in Nifty indexes(for relatively safe+ Good return investments )+ small caps (For increased risk profile).

Correct me If I am wrong.

Absolutely!

After wandering here and there for financial literacy which many of the books like Rich Dad poor dad talks about, I am here to find my one step solution! And , still can\’t believe it is so organised and step by step. Thank you is surely not enough!

As you are talking about ELSS as an investment option to be claimed under 80c , I am wondering if I should continue with PPF or go for ELSS for that matter. In all, what do you think about PPF as an investment option? My understanding says, it is safe and good option if you don\’t have liquidity issue.

Also By this time , you have motivated me enough for posting You have defined different fund categories over here. How should one think about it:

1) Diversfying into different AMCs is what I have thought.

2) Diversifying into different fund categories . As I have 40k Corpus for a month and being 28 and businessperson I have moderetely High Risk profile here. , I am thinking of investing

* 10k In large cap to be safe

* 10k in Mid cap

* 10k in Small cap

* 10K in Large and Mid cap.

Is it right strategy , or should I think it other way?

Hope not too many questions to answer!

Thanks a lot advance!

PPF is a great option, please continue with that 🙂

1) Good idea as it hedges away from the institutional risk

2) You can replace the large-cap and mid-cap with Nifty Index fund and Nifty next 50 index fund. These are low-cost funds, and performs as well or better than its active peer

Good luck!

Hi. Few clarifications-

1. Do investments made via SIP in ELSS MFs also qualify for 80C exemptions or will they be applicable only if I invest in lumpsum?

2. For investments in ELSS MFs via SIP, an investor will not be able to redeem MF units purchased in any given month until 3 years from the date of purchase of said MF unit, correct?

1) Yes, SIPs also count and not just lumpsum

2) Yes, each SIP will have a lock in for 3 years.

Not sure if my comments are going through. Had some browser issue. Had to submit multiple times.

Please delete if submitted more than once and let me know if ther are any issues with the comment.

Thanks

Not an issue, I replied to your comment as well.

In the above comment, it should have been

For example, ~80% of large cap funds are out performed by Index in last 5 years in India. So, for a avg. investor, 80% of time he would be making a mistake of NOT buying a right large cap mutual fund instead he could have bought index.

Yup, I got that.

Write up is excellent.

At the same time, you could cover important topic. How many mutual funds falter. It is found across the world that buying index is good enough most of the time.

Here\’s the report snap shot

https://www.dropbox.com/s/6y77tzy73i6ws54/mf.png?dl=0

For example, ~80% of large cap funds are out performed by Index in last 5 years in India. So, for a avg. investor, 80% of time he would be making a mistake of buying a right large cap mutual fund instead he could have bought index.

Report snapshot is taken from : https://us.spindices.com/resource-center/thought-leadership/spiva/

thanks

Yes, of course, will cover index funds also in this module.

Hi Karthik,

Please do write on ETF.

Thanks.

Soon, we will cover that as well.

Sir,

Zerodha is providing any financial advising / planning service? And any training on trading?

No, we don\’t do advisory. All the training is via Varsity.

Sir,

Can you please explain how the compounding effect is applied in MF investments through SIP..

Do read this Shyam – https://zerodha.com/varsity/chapter/mindset-investor/

hiiii my query is why the NAV of direct fund is more thn the regular of same fund …..

Its better no? This means the value of your investments indirect is higher 🙂

Hello Karthik,

First of all, a very very heartfelt thanks to you for writing this information in such a consolidated and easy to consume format.

I have been investing in Mutual Funds since the start of my career(2015). I decided to do so by gathering information from various sources (quora, moneycontrol, blogs) and have taken a few actions as I got more informed over years ( Regular -> Direct, switching to higher ranked funds). You have presented all this information in such a beautiful and organized way. I wish it was there earlier. This would truly have saved me a lot of time and effort. With this, I have now gained more insight on how returns are calculated. It\’s actually financial wisdom. (You should seriously give some thought to that book discussed above).

All the best for that AMC license. Look forward to investing with you guys in future.

Coming to a question that I had in the recent days, should I consider parking funds in a ELSS ( over and above 80C) rather than large cap fund? Since it comes with a lock in, some discipline is guaranteed and also fund manager is in a better decision making position because he/she knows investors wont take out their funds before 3 years. Let me know your thoughts on this.

Thank you again. 🙂

Regards,

Nikhil

Nikhil, thanks for kind words. I\’m glad you liked the content here, I hope you continue to do so 🙂

I\’m personally not a big fan of ELSS funds so I invest only as much as I need, so my views are biased. It is best if you can invest in other funds with the same discipline 🙂

Dear Sir

First of all thank you so much for providing really good help for beginners.

MY QUESTION

I have search all the chapters but didn\’t find……….

the techniques of selecting a mutual fund and building a mutual fund portfolio…….. as you promise in last lines of this chapter… Thanks

Yes Varun, that chapter will come up soon. We are still discussing debt funds for now 🙂

wating for PDF to download ?

Will be available when the module is complete.

WHEN CAN WE EXPECT THE NEXT WRITE UP KARTHIK?

Hopefully within this week.

Hi Kartik!

Congratulations to you for such a great initiative. Varsity is very useful in increasing financial literacy among investors. Please keep making such modules.

Glad to know that Zerodha has received AMC license. Any plans to introduce index funds based on nifty strategy indices?

We have not yet received the licence, we have only applied for one 🙂

Hello,

It is an awesome information you have been sharing with all of us. I have been reading through all varsity modules and it\’s been awesome journey so far.Many thanks for this.

Eagarly waiting for upcomming chapters . Cheers.

Happy to note that, Tejas. Hope you continue to enjoy reading Varsity 🙂

Dear sir

I am eagerly waiting for fixed income portion.if you could explain on hw it works also .it will be more usefull if the same is discussed in depth like valuation of bonds, NCD..how to link a companies / countries financial to a bond performance .. and markdown concept , DHFL, iifl issues ..an humble request 🙏

Sukumar, yes, will do that 🙂

Sir why Module 11 & 12 is not available for download. Is more material / content to be added in both of them.

Module 11 is work in progress, PDF will be available only after the module is complete. We don\’t intend to put up the PDF for module 12 as we only have the publishing rights for it.

Sir is small case same as mutual funds is there lock in period for that or can we exit anytime as we do for equities. And they announce the cagr for every risk category upfront only before we buy the small case does we get the same returns as they propose.

They are different. No, lock in for small cases. The CAGR is historical, does not mean you\’ll get the same return going forward.

Hi Karthik.. I knew about varsity a couple of months back and I have been going through various modules.. they are very informative and you use very lucid examples to explain difficult concepts.. and anyone from any educational background can understand them.. I only wish I read your modules when I was in my early earning years.. thanks for the effort..

Thanks for the kind words, Swetha.

Its never too late to learn, happy learning 🙂

Hey Karthik, I have just ordered The rupee tales and I would like to know when can I expect to recieve it as it is for a birthday the coming week and I would like to get it before that. Also, since I have the order id can I track it in some way?

It gets shipped out on Monday I think. It will reach you within 2 days based on your location.

Hey Karthik,

You have been wonderful with all the modules and I\’ve read them all. I made you as a mentor last October and I\’ve never seen back from then. Thanks for all the teaching.

Can you please shed some light on nifty bees and topics related to that?

Thanks

Humbled to know that, hope you continue to like the content on Varsity. Yes, I\’ll write a chapter on Niftybees and other ETFs.

can i transfer sip from my liquid fund to my regular sip of other company

You can. By the way, can you share more details, please?

Seyar market investment

Sir,

I humbly request you to answer my question in module 10 chapter 11(the ADF test).

Sorry for inconvenience caused

Sorry, I must have missed it. I will reply.

how come Zerodha able to provide direct plans to investors for FREE!*

Please look at the reply to your previous query.

Dear Karthik,

What an amazing reading experience!!

I cannot thank you enough for finacial clarity I got after reading your articles. It is so direct and actionable, without any intent to hold back on distinct information. Though thank you is not enough, Thank You so much!!!

I have printed your modules and suggest you if you can collate the content in the form of a book for everyone. Your way of disseminating such of complex subject with ease, comprehension and lucidity is applaudable.

I have many questions to ask, but to start with – When are you planning to put next chapter on techniques of selecting a mutual fund and building a mutual fund portfolio, secondly how come Zerodha able to provide direct plans to investors (distributor not taking commission), is it a short term offer by zerodha and will it change (commision is charged) for me after i have subscribed to SIP.

Thanks once again.

Regards,

Sumant

Sumant, thank you so much for the kind words, this motivates us to do better 🙂

1) Book format may not be possible as it involves logistical arrangements. We are pressed for bandwidth

2) The next 1 or 2 chapters are on debt fund and then we move ahead to discuss the MF portfolio construction and analysis

3) We make money on the trading side of the business which enables us to subsidise the investing bit. So yes, this is free and will continue to remain so, for as long as I can imagine 🙂

Dear please start options like perpetual s i p top up sip and power sip in Coin.

1. All SIPs are perpetual on Coin

2. You can modify your SIP with just a couple of clicks on Coin anytime instantly, this is essentially like topping up your SIP. But we are working on having a predefined option.

3. Power SIP requires you to time the market, which kind of defeats the purpose of a SIP. It is better not to do this

Also, do check this – https://support.zerodha.com/category/mutual-funds/coin-app/articles/modify-cancel-sip-coin-app

Would be great if Zerodha strat accepting equity funds for margin. Any plans in near future?

We are looking at this, Ammit. Hopefully soon.

Dear Karthik,

I am new to this university. Just saw this and is stunned to see your so big effort to educate society. I could not find this much stuff at one place that too so systematically. I gathered information in bits and pieces.

Is mutual funds related material is in module 11 only or any other module also.

I am interested in mutual funds only, not in stocks (trading or investment).

Do you cover topics like \’How to calculate rolling returns of 3/5/7/10 years from nav data of 15-20 years in Excel\’, Ratios lime Beta, Alpha, SD, Sharpe, Sortino, R-squared etc. Which may help in selecting a particular scheme among its peers etc.

Once again thanks for providing such beautiful material at one place.

Regards.

Kumar A

Bangalore

We have discussed someone these concepts such as beta, R-Square etc in different modules under different circumstance but not in the context of MF. I will probably do this again in the context of MFs. Thanks for suggesting.

Dear Karthik,

I am new to this university. Just saw this and is stunned to see your so big effort to educate society. I could not find this much stuff at one place that too so systematically. I gathered information in bits and pieces.

Is mutual funds related material is in module 11 only or any other module also.

I am interested in mutual funds only, not in stocks (trading or investment).

Once again thanks for providing such beautiful material at one place.

Regards.

Kumar A

Bangalore

I\’m glad you liked Varsity, Kumar 🙂

The content on Mutual fund is getting build in Module 11, we have not discussed this anywhere else.

Hi Karthik,

Is there any plan to give some guidelines to select professional management services (PMS)

Thank You

Do you mean Portfolio Management Services (PMS)? If yes, no plans for now.