Dear Readers,

Like this previous chapter, this chapter is too is a guest chapter. We are honoured to have this super important chapter authored by Shyam, who runs Stockviz. We are grateful to Shyam for sharing his wisdom on this topic with us. We hope he can contribute more to Varsity, and enrich Varsity’s content 🙂

Happy reading!

Karthik Rangappa.

28.1 – Asset Allocation, an Introduction

An asset is anything that you own. A liability is something that you owe.

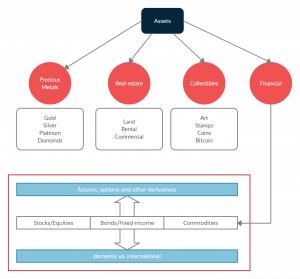

An asset can be anything: livestock, gold, stocks, bonds, collectables, art, copyrights, trademarks, and so and so forth.

Some assets (bonds, for example) throw-off cash (pay interest) when you own them, some (art, for example) don’t. The basic purpose of owning an asset is to transmit wealth through time.

Time value of money

Money, in the form of currency, is designed to depreciate over time. Central Banks call this rate of depreciation their “inflation target.” For example, when the US Fed says that they are targeting 2% inflation, the purchasing power of a $100 note will be $98 next year. In India, RBI’s goal is to manage inflation between 4% and 6%. We ended the year 2020 with an inflation rate of close to 7%. Clearly, stuffing money under a mattress is a loser’s game. So, how do you preserve the purchasing power of your wealth? You buy assets, of course.

Different type of assets

Precious Metals

Since the dawn of civilization, people have been trying to find cost-effective ways to store, transport and exchange wealth. It took a while for us to zero-in on gold and silver as a medium of exchange and a store of wealth:

- They are rare, ensuring a limited supply.

- Takes work to mine, purify, mould, etc. This puts a floor on additional supply.

- Easily understood, measured and assayed.

- Sufficiently dense so that small quantities representing large notional values can be moved around easily.

So, it shouldn’t come to a surprise that most people still think of gold (and precious metals, in general) as a must-have asset. Investors instinctively reach for gold when other assets are facing stress. And for savers in countries with a long history of socialism with their governments trying to confiscate property and inflate away their currencies, gold forms a large part of their savings.

Real-estate

Broadly, real-estate investing covers land speculation, rental-housing and commercial property. They each have their unique characteristics and scale requirements. Each piece of real-estate is different – they are not fungible, like precious metals, nor can they be transported. So every real-estate investor’s experience will be different.

Collectables

Well, known pieces of art, baseball cards, stamps, rare-coins etc. are known to hold their value through time. A mature ecosystem of services that curate, authenticate, promote and store collectables exists to make investing in them relatively painless.

Over the last decade or so, we have seen the rise of digital collectables, like bitcoin. They have the added benefit of being infinitely divisible. To use the bitcoin example, even though a single bitcoin is currently worth north of $40,000, a newbie can buy just $10 worth of it.

Financial Assets

Assets that can be traded on an exchange, like stocks, bonds, commodities, etc. benefit from standardization and the uniform application of laws and regulations. Standardization ensures that investors always get what they paid for and regulations ensure that the exchange doesn’t favour one investor over another while disseminating information, clearing trades, etc.

The most liquid and popular of these assets are stocks/equities, the largest are bonds/fixed-income. Commodities come a close third. Overlaid on top of these are derivatives – instruments that derive their value from an underlying stock/bond/commodity – that are now a bigger market than the assets themselves.

Since the 1980s, the number of different asset types traded on electronic exchanges has increased by leaps and bounds. Assets that were once illiquid because of physical delivery requirements or geographical barriers have seen an explosion of liquidity as they are now traded through derivatives and ETFs.

28.2 – Allocation

The act of splitting one’s savings between the different types of assets described above is called “asset allocation.”

Prediction is impossible

If you knew which of the assets discussed above would give the best returns, then you could just put all your money in that single asset. But unfortunately, no one knows the answer to that question.

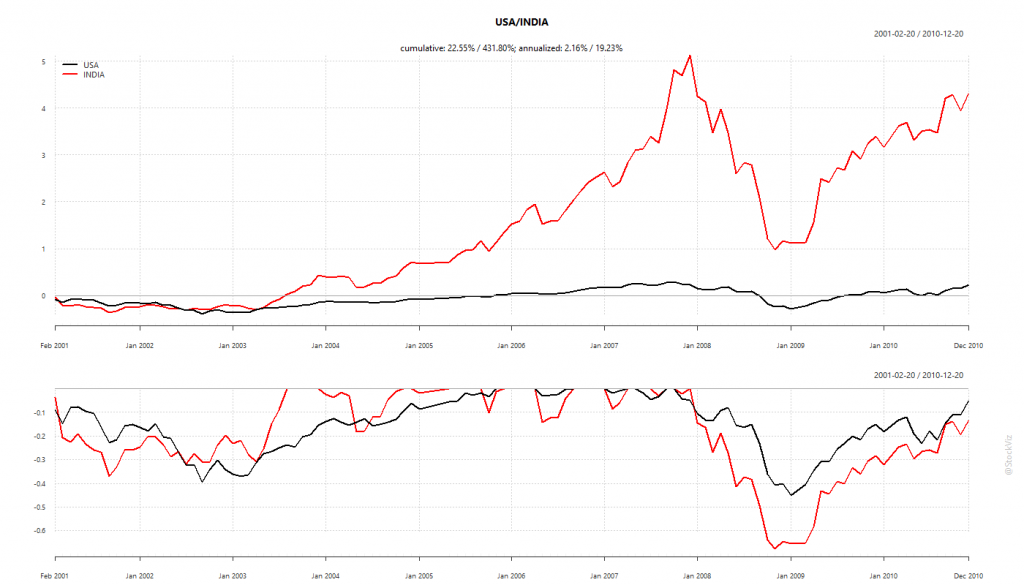

For example, take US and Indian stocks. For the decade between 2001 and 2011, Indian stocks massively out-performed US stocks.

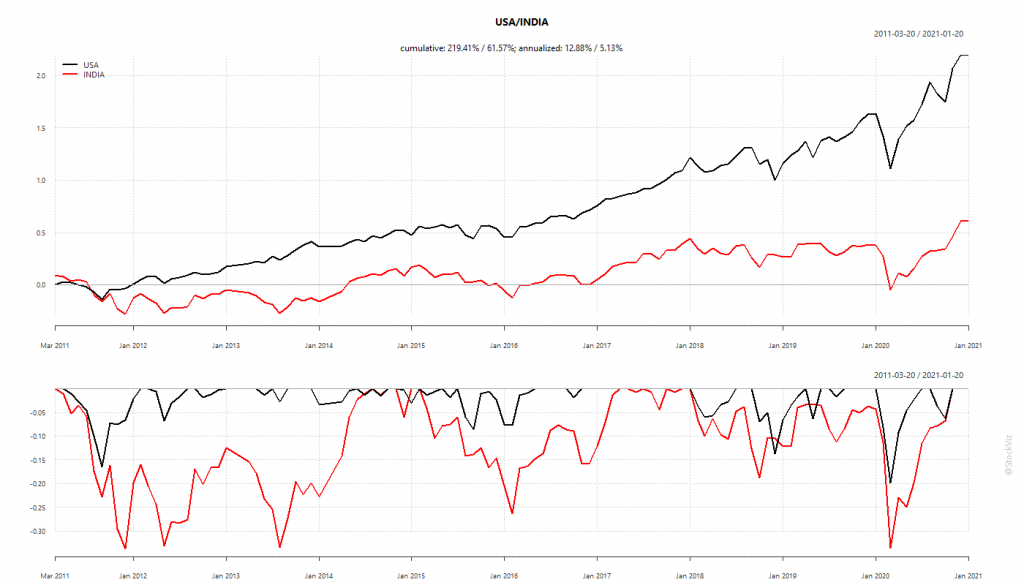

But performance completely inverted in the next decade.

Who knows what is going to happen in the next 10 years?

Once prices start moving, narratives get built around why they are justified and persist forever. The longer the price move, the stronger the narratives. Remember “India shining,” “secular stagnation,” “home prices always go up?”

The only way to protect yourself from decades of underperformance without having to predict is to buy a little bit of all assets.

28.3 – Sequence Risk

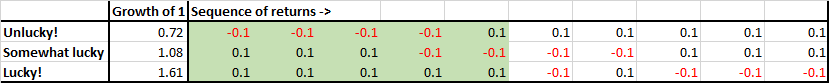

An average investor rarely sees average returns.

Markets have been around for centuries, but an investment’s lifespan is not more than a few decades. This leads to all sorts of misconceptions regarding averages and risk capacity.

Investor: On average, over the last 20 years, the NIFTY has given a CAGR of 10%. So, if I invest Rs 1 lakh for 5 years, I should get at least Rs 1.61 lakhs, no?

Me: No. Consider yourself lucky if you don’t lose money.

Investor: But it has given negative returns only 4 years out of 10. I can survive 2 years of negative returns.

Me: Let me tell you something about sequence risk. Sequence risk means that it is possible that you could have all of those negative 4 years during the 5 year period that you have invested.

Most investors don’t realize that while averages may be true in the aggregate, they may not survive long enough in the market for their personal experience to match up with the statistics.

A simple way to avoid this risk is to invest in a basket of assets whose returns are not correlated to each other.

28.4 – Diversification vs Diworsification

A basket with chicken eggs, turkey eggs, goose eggs, quail eggs, pheasant eggs and emu eggs is theoretically diversified but practically useless when the basket is dropped.

To create a diversified portfolio, you need first to understand the drivers behind each asset class’s returns and how they interact with each other.

Vectors of diversification

Different vectors drive returns of different assets and the correlations between them. A well-diversified portfolio covers these different vectors with minimal overlap. Some examples below.

Currency exchange rates

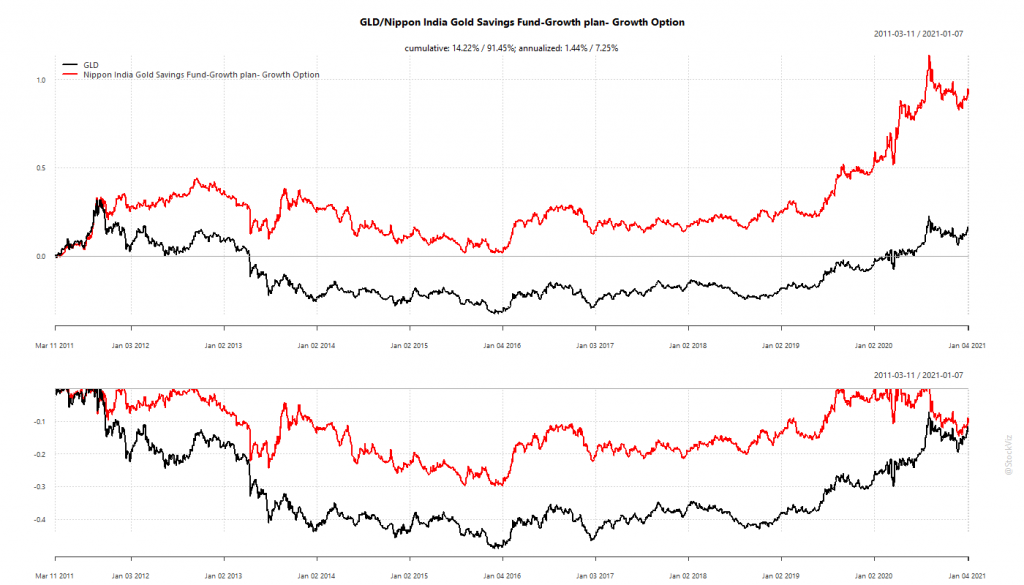

Gold is priced in international markets, so its future price movements in India is both a function of global demand and USDINR exchange rate.

Market composition

“old economy” stocks mostly dominate indian equity markets while that of America’s is dominated by tech (“new economy”) stocks. So they require separate allocations in a portfolio even though they are “stocks.”

Flows during panics

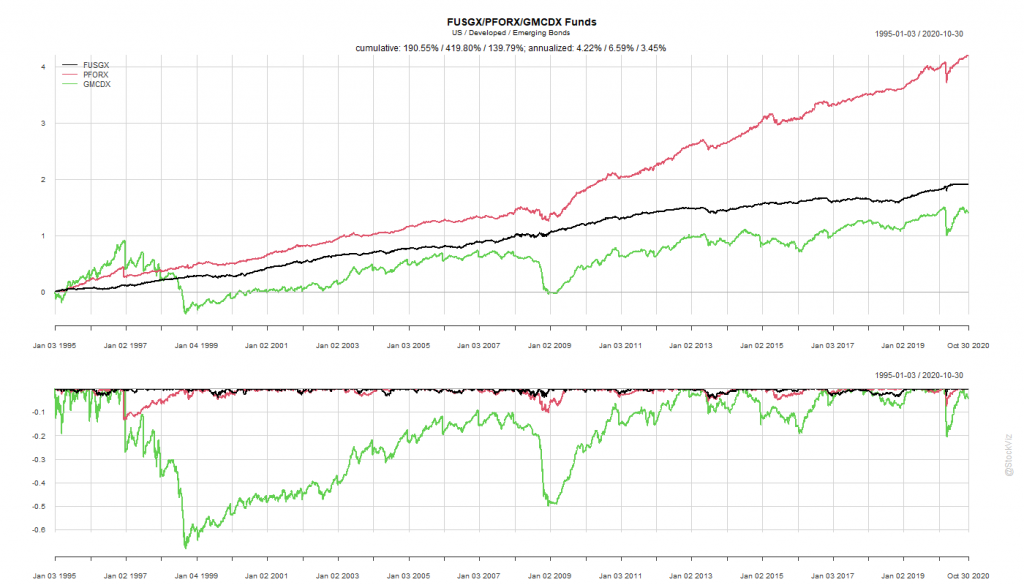

American bonds are “safe-haven” assets. During market panics, US bonds get bid up. However, Indian assets are clubbed along with other “emerging market” assets and sold-off. So, while having US bonds in a portfolio can cushion it during sell-offs, owning Indian bonds may not offer the same benefit.

Here’s how the US, Developed Markets and Emerging Market Bond funds have behaved through time.

Bubble assets

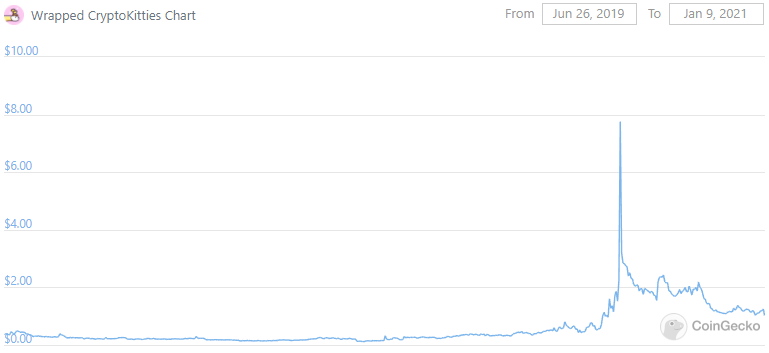

Some assets, especially digital collectables, are prone to boom-and-bust cycles. While Bitcoin gets all the press…

… the fact that CryptoKitties raised a total of $23 million in venture capital funding and people thought paying money to collect and breed virtual cats on the blockchain was a good idea should give investors some pause.

A similar dynamic exists in the art market as well, where investors try to spot emerging artists and bid up their works.

28.4 – Keeping it simple

If you are starting, you will do well to stick with big, liquid asset classes:

- Indian Equities

- Large-cap Index

- Mid-cap fund

- US equities

Since large US companies have significant global footprints, the S&P 500 index gives ample exposure to most developed worlds. Indian investors are unlikely to benefit much from chasing after European, Frontier or other Emerging markets. - Bonds

- Gold

- Real estate

If you are unsure of the relative proportions or you are just getting started, then an equal weight allocation between them is not such a bad idea.

For US stocks, stick to the cheapest S&P 500 index fund that you can find.

For Bonds, find a short-term bond fund that invests only in government or PSU bonds.

For Gold, go for the RBI issued Sovereign Gold Bonds that actually pays you 2.5% p.a. for owning gold.

For Real estate, see if exchange-traded REITs makes sense.

28.5 -Risks to diversification

As more assets get financialized, building a diversified portfolio becomes easier and more accessible. But financialization also changes the behaviour of the assets themselves.

Using real-estate as an example, transactions in the real-world take months and involve a different set of actors than transactions on an exchange-traded REIT that take seconds. The low historical correlations that one might have seen between real-estate and stocks could’ve been a function of the different venues where they were transacted, lower liquidity, long transaction times and inability to cross-leverage. But once you put all these different assets on the same platform and allow investors to lever one asset to buy another, you end up increasing their correlations. So, while financialization makes it easier to diversify, it blunts its effectiveness.

Keynotes from this chapter

- One cannot avoid buying assets.

- Know the different type of assets, and the factors drive their returns.

- Draw-up an asset-allocation strategy (KISS: Keep It Simple, Stupid!)

- Stick to the allocation strategy because prediction is impossible.

- Nothing works all the time. The world around you changes. Be pragmatic.

Thank you, Karthik for the prompt response. Do you plan on releasing a module related to PMS/ AIF? I am aware that this is not for the audience who want to have preliminary education but this market is booming and every other PMS is outperforming NIFTY by >15% based on their websites/ marketing materials. There is a fear of missing out in my network.

What are your thoughts on the PMS? What do you hear about it in your network?

Hey Rujul, I dont really have a plan on doing a full fledged module on this, but a video on SIF, AIF, and PMS is due. Will pick it up sometime soon 🙂

As far as the fomo is concerned, I think its ok. I deeply value consistency of returns (adjusted to risk), vs sporadic returns 🙂

Karthik – Thank you for writing this amazing module!

QQ: Which type of persona should invest into Zerodha Nifty LargeMidcap 250 Index Fund? Please share more about the value proposition of this index fund compared to the other NIFTY 50 or MidCap 150 index fund.

Glad you liked the module 🙂

I\’d say someone who is looking at equities from a really long term perspective. Maybe 10years and updwards.

Hi Karthik sir, thank you so much for these modules. Have learnt so much from it.

I had one doubt in particular on my portfolio

I am investing-

1. 25% in Large cap

2. 15% each in mid cap,small cap and flexi cap

3. 15-20% in gold etf\’s

4. The remining 10-15% I am confused between debt fund/ index fund. Ideally I would want it to be for a short term goal for maybe 5-8 years.

What would you recommend and any shuffling to be done in the holdings ?

Currently I have no holdings in Debt, all of my portoflio is either Equity, FD or Gold

And thats ok. I\’m assuming you are young 🙂

For long term debt funds, look for GILTs maybe?

I am interested to invest in REIT

Sure, please check this – https://youtu.be/XhCeX98vY28?si=ICqpjkjFmtlUIhBt

I don\’t understand one part.

Why should I invest in bonds? Like they give a return of at max 6.9-7% (last I checked on Kite -> Bids -> Govt Securities)

And they aren\’t even liquid.

Am I not better investing in FDs, they give similar or more returns but provide more liquidity?

Replied to your previous query on same topic 🙂

Thanks for replying, Karthik – these modules have been really helpful. Thank you for building Varsity 🙂

Thanks for the kind words, and happy to help 🙂

Hi Karthik Sir,

I have RSU grants ( USD ) from company I work for. I end up selling them when they vest due to volatility. As a result I end up with significant lump-sump ( 70 L). I have got advice to invest FDs or Debt MFs on behalf of parents for tax efficiency but that is cumbersome enough for me. My current allocation is

– 70 % equity ( Index Funds, Flex, SmallCap Fund)

– 20 % Debt

– 10 % SGB

My convenience is managing from single DEMAT account. So I am considering Low Duration Funds/ Govt PSU Funds. Please let me know your opinion. Thanks

This seems fine to me. If I was you, I\’d reconsider smallcap, but its your call. Please do double check once with a financial planner/advisor.

Hi Karthik Sir,

I have asked a question in the previous 2 or 3 chapters Regarding the regular fund and wanted to change it to the Direct fund. You replied that the money has to be withdrawn from the regular fund and need to start a new direct fund.

Hope you could find the comment and recall it…..

Now when i withdraw the regular fund from the 3 years then i might be having a handy amount. Can i invest the whole handy amount as the starting investment and then from the 2nd month will i be able to continue as SIP.

Sir Its not like a recommendation but is this way possible in mutual funds?

Yes, this is possible :). Ideally, you should reinvest the funds quickly and then continue doing your SIPs.

This chapter even though written by external author , it is easy to understand. unlike last chapter

Thank you, Karthik for your recommendation. I appreciate them and will take it consideration. Few follow-up questions:

1) Should I split the equity investment amount over the next 4-6 months and then SIP it into index fund?

2) What could be the consequences of swapping NIFTY NEXT 50 with MidCap 150 given same volatility and returns over the last 10-15 years?

Looking forward to hearing from you.

1) Yeah, you can do that 🙂

2) 150 has higher diversification, volatility will be lower. So maybe you can consider that if you want lesser volatility in your portfolio.

Thank you for writing this module, Kartik. I am 59 years old, retired government employee. I have recently amassed lot of wealth due to inheritance and payout of retirement fund. I do not need this money due to regular pension from the government. Additionally, I do not have any dependents and I am covered on health insurance from my former employer. I plan to allocate my wealth in the following manner:

A) Equity Investments: 40% of Liquid Portfolio (Mostly NIFTY 50 Index)

B) Sovereign Gold Bonds: 10-15% of Liquid Portfolio

C) Fixed Deposits (FD): 45-50% of Liquid Portfolio.

Please find my questions below:

1) What are the other asset classes that you recommend taking a look at? Am I missing out on anything?

2) Should I think of investing in Liquid/ Overnight Fund/ other Debt funds? On FD, I get additional 1% return due to ex-government employee status. Furthermore, I will get additional 0.5% when I will become Senior Citizen. This leads to total return of 8.5%-9% on FD depending on the interest rates and duration. The only benefit of debt funds over FD is tax deferral (as per my awareness).

3) Is REIT equity or bond investment? Does this make sense for my portfolio? I do not prefer dividend payouts.

Looking forward to hearing from you.

Varsha, firstly congratulation on the inheritance and payout. You sound content, I hope that continues for you 🙂

1) Not at all.

2) No, I feel FD is a better.

3) Some small portion of your portfolio in REIT should be ok.

I\’m not a professional RIA, so please take my advice with a pinch of salt. If I were you, here is what I may probably do, epeically since your mentioned that you dont have dependents and dont need payouts.

1) Increase EQ to maybe 55%. Along with Nifty 50 Index Fund, I may look at Nifty Next 50 as well. Basically 1 large and 1 mid cap fund.

2) SGB, I\’d continue at 10%

3) FDs is 25%

4) REIT 10%

But please do check with a professional RIA once 🙂

Why FDs and not bonds?

Or my question can be taken otherwise. When would I prefer Bonds over FDs, and FDs over bonds?

FDs when you want absolute certainty and visibility over your capital and interest payout. Non makret linked.

Bonds when you have a slightly more risk appetite than FDs. Its market linked. Also some bonds have better tax treatment.

Thanks, Kartik for your prompt response. Are there any resources that you could share about reading on over diversification?

In addition, if I have to only to go with 1 Large, 1 Mid, and 1 Small Cap Fund I would prefer to go with Index given chances of selecting Mutual Fund that could potentially beat the Index in 7-10 years is close to nil!

As far as stocks are concerned, I had written about it here – https://zerodha.com/varsity/chapter/hedging-futures/

Yeah, have always been a fan of Index funds 🙂

I understand Index funds are for super long term i.e more than 10years. In the above case Mrs Varsha is looking at 7-10 years in index funds. How re Index funds better than Largecap MF in this scenario? I am confused in selecting between largecap fund and index funds.

In my mind, an index fund is like a large cap fund itself, but with a lower cost.

Super fast reply. Thank you so much for the course….been through the whole course. Very well explained and learnt a lot (on debt assets specifically), though I’ve to revisit few times to grasp fully.

I’ve to rebalance my portfolio anyways,

1. would it be prudent to go for large cap Index funds/ETF/FoF instead of actively managed large cap funds? Same doubt for mid caps too. We’ve been doing SIPs for the past 8-9 years and benefited immensely… though never did directly in index funds.

2. Even if SIP amount is more, say 2L/month, is it advisable to have 2-3equity funds and 1-2 debt funds? What about fear of over concentration ?

3. Also, due to recent withdrawals for our goal, debt portfolio has dropped significantly. Should I move from equity portfolio or do lumpsum and sips in debt to increase it?

4. You’ve not spoken about mid term funds, may be because risk is more. For 5 yrs goal is short term or short duration right one?

Thank you very much.

1) You can choose index for both large and mid cap. But please dont take my word for it, I maybe biased. Pls speak to a professional advisor 🙂

2) That sounds alright. Ensure you diversify across AMCs and not just 1 AMC

3) What is your Debt to EQ ratio? If the debt is under weight, then you have to ensure you bring it back. But also, i hope you have a logic for why you have opted for a certain debt-eq ratio

4) Its kind of short for EQ. But then its so hard to make this call. Imagine if the 5 years you decide not to expose to EQ turns out to be the best for EQ in a 10 year window 🙂

Thanks for writing this module, Kartik. Could you please answer following question:

1) How can one ensure he/ she is not over diversifying? Can you share resources about over-diversification?

2) I plan to allocate my investments to 2 MidCap Index Funds & 2 MidCap Active Funds (total 4). How can I review if this is over-diversification? There is limited overlap between top 10 holdings of these Index and Active funds.

1) Look for the type of funds you have. If you have 2 large cap, 2 mid cap, 2 small cap, then clearly thats too many funds with overlap and over diversification. Basically you just have to figure what you have and arrive at a conclusion. Typically – 1 large cap and 1 mid cap fund should suffice.

2) That is over diversification according to me 🙂

Hi, can you please elaborate more on REITs, as of today there are only 3 reits in Indian Equity Market, moreover last 1 year they have just been a falling knife, when the otherwise equity, debt market have seen significant upwards, why and what is happening with these REITS and how do I know when buying, I am buying at the right price, just like in ETFs chapter, we understood about checking NAV/iNAV.

As new-bie investor, there is no other-way to have a Real estate exposure to me apart from REITS with capital limitation, if it is something relevant for people just starting to build their portfolios, can you please write a module on it, as I couldnt really find any relevant articles on same.

Ujala, I think there are 4 REITs in India now. We just finished doing a detailed video on REITs. Will put it up shortly, do keep an eye on our Youtube channel for it\’s release soon – https://www.youtube.com/@varsitybyzerodha

In case anyone\’s looking for the link:

https://www.youtube.com/watch?v=XhCeX98vY28&t=63s&ab_channel=ZerodhaVarsity

Are MFs allowed to invest in crypto? What are the Asset Classes MFs could invest in?

Nope, not in India Karan.

Hi Karthik, One of the keynote says: \”Draw-up an asset-allocation strategy\”

Are there any thumb rules? I would appreciate if you can share or guide us(common man from non-finance background) to some pre-defined templates? This way all this knowledge gets applied and benefit us. I hope it makes sense.

Vinay, as a thumb rule, you must split your investments between Equity and Debt. If you are young, skew it more towards equity. As you get older, you can skew it towards 50-50 EQ and debt. The closer you get to retirement, you can consider 85% Debt, 15% EQ.

Sir you have mentioned that \’For Bonds, find a short-term bond fund that invests only in government or PSU bonds\’. I have checked portfolio of several short term bonds. I mostly find a mix of govt and corporate bonds within the portfolio of the fund. Any guidance on how to select the one with only govt/PSU bonds pls?

Yes, thats common and you are unlikely to find a fund that does not have this mix. You can choose a fund with more Govt funds and AAA bonds.

What\’s your take on rebalancing? Is it an important activity or just leave the portfolio undisturbed?

Rebalancing helps you weed out the non-performers, Rahul. Good to evaluate your portfolio regularly.

I have added Stepup to my ELSS scheme , Is it good or bad ?

Depends on your tax needs. If you are not doing this for tax purposes, then maybe ELSS is not your best option.

@Karthik – I\’m really grateful that you have created this \’Free\’ resource for every budding investor\’s benefit.

Given that \’Free\’ is the operative word here, some humble feedback – this chapter seems dumbed down. There is NO takeaway for me. Either asset allocation does not matter (highly doubt that), or too complex to discuss. Either way this is the weakest chapter of the module :/

hmm, I\’ll take this as feedback Abhinav. Let me see how I can fix this.

I have a blue chip, flexi cap and thematic funds. Now I want to start investing in index fund is it better to go with nifty index fund or nifty next 50 fund. As I have blue chip fund does it make sense to again invest in nifty index?

You can consider both Nifty and Nifty 50 to cover large and mid-cap stocks.

A well composed article. Helped me get more clarity. Thanks.

Happy reading, Rahul!

Hi Karthik, my doubt is related to REIT\’s.

As per my understanding, land prices have gone up over time, so does that imply the investment made in REIT\’s will also generate higher returns compared to other assets over a given period?

Thats the idea, Omkar. If land price and rental yields increase, so would the value of REITs.

Thanks, Karthik for the prompt reply.

Hi Karthik,

As I see there are two graphs in the same pic. Eg: the graph showing the US and Indian Stock comparisons contains two graphs in the same pic. I have not understood what is the second graph ( the one below). Could you please let me know what is the significance of the second graph.??

The bottom half is the drawdown, indicating how the volatility for the market.

Very useful n practical.

These guest lecturers are really spoiling the overall content s

Thank you Karthik Sir for transforming a difficult subject to very simple one that a layman can understand. Your classes would have made many common men/women to come forward to the world of mutual funds and share market. I am 36 year old salaried man and never understood properly on mutual funds earlier. Now I opened a account on coin and started my investment on mutual fund. I recommended varsity to many of my friends too. When will you starting personal finance part 2? As a beginner I felt guest lecturer chapters are not well conveyed.

Thanks for the kind words, Arun. I\’m glad you\’ve started your investment journey and thanks for recommending Varsity to your fiends. I hope they too like it 🙂

Thanks Karthik for the extensive content.

Is it possible for you to do a chapter on REITs with emphasis on their valuaiton?

Cheers

Krin

Thanks. I\’ll try and incorporate the same in the Part 2.

All these guest lectures especially this one(Asset Allocation, An Introduction) and the previous one(Smart Beta funds) has been a total disaster to the learning curve we had regarding Mutual Fund Investment and Assert diversification. Its just a mere display of throwing around technical jargons and confusing the readers. The first 26 chapters had an incremental learning curve which emphasized on real life examples and as a reader we could relate to it more. Not that it didn\’t have any technicalities but the way it was offered to the reader made it more intuitive. But the last couple of guest topics just baffled it up. The guest authors might be good at their job but definitely bad at conveying their messages to the newbies.Period

Sure, Asish. Sorry this chapter dint appeal to you, I\’ll see what else can be done about this. Thanks for your feedback.

Karthik sir u r doing great job thank u for all knowledge sharing but needed more detailed analysis in asset allocation .

Thanks, Subhashree. Please do suggest what else you\’d need. Will try and add that bit.

Which is better ETF or Fund of Fund of the same ETF ? Apart from having the requirement of DEMAT account to buy ETF – I did not understand the difference between two. Also, can you please throw some light on the expense ratios of both?

I\’d say the FoF. I\’d suggest you read this chapter on ETF https://zerodha.com/varsity/chapter/exchange-traded-funds-etf/

I am ne to investing, my husband has been doing for some time now. Today we just sat to understand how Govt Bonds works and then we went through the Zerodha Varsity, just one word for the content that you have put up here….\”AMAZING…WHY DID I NOT READ THIS EARLIER AND BE MORE FINANCIALLY AWARE\” I must appreciate the simple way in which you have explained the concepts, I have already put a reminder to invest atleast 1 hr of my time atleast twice a week to go through all the course and my next target will be see if my 17 Yr old daughter can also go through…even if she picks up 1% of it she will be much better that what we were at their age

So happy to read this 🙂

I hope your daughter enjoys reading and learning from Varsity. Good luck!

When is next module

Is this module over?

One or 2 chapters in this module, before we move to the next.

Is there a way to subscribe these chapters. I mean that, if new chapter comes, will i be notified through email/phone?

if no, please consider this.

The best way is to follow us on Twitter – @zerodhavarsity, we tweet whenever there is a new chapter.

How can we download this entire module, no option coming for this module ?

This module is work in progress, no download option yet.

Under the 28.4 Section,

Fixed Income instruments like PPF are not included. Any particular reason why you\’re not recommending it?

I think since it gives returns marginally higher than the inflation rate, tax advantage & is risk-free, we can have it as a part of our portfolio.

What are your thoughts?

Yes, you can have PPF but the extent to which you have PPF depends on your overall composition of the portfolio.

N100 is the ETF you need to search for.

Could not find Motilal Oswal S&P500 ETF on Kite. Is it available ?

Aditya, there’s no ETF, there’s an S&P 500 index fund, you can invest in it on Coin.

Hame bhi Dement account opan karna h