17.1 – Arbitrage

We were to move ahead and discuss MF attributes and gradually steer our way to identify techniques of building a mutual fund portfolio. While I was all set to do that, I just remembered we hadn’t discussed the ‘Arbitrage Funds’, which for some reason has all the market attention these days. So I’ll keep this chapter short, consider the Arbitrage fund and move ahead.

Before we understand the ‘Arbitrage Fund’, we need to understand what ‘Arbitrage’ means. Of course, if you are a regular Varsity reader, then this is something you guys are familiar. We have discussed arbitrage on a couple of occasions, in particular, we have looked at arbitrage in the form of calendar spreads, pair trading, and put-call parity.

For others who are not familiar with ‘Arbitrage’, here is a quick note.

All of us, at some point in life, would have carried out an arbitrage transaction. For example, when I was in my 1st-year college, I’d pay my cousin in Singapore to buy me Rock n Roll audio cassettes from Rs.100/- per tape and sell the same here in Bangalore for Rs.150/-. People here would happily buy the tape at Rs.150/- because there was no other source for them to buy these tapes.

The above is an arbitrage transaction.

In an arbitrage transaction, you buy an asset (like the audiotape) from one market (Singapore) where the asset is selling cheap (Rs.100/-) and sell the same asset (the audiotape) in another market (Bangalore) for a higher price (150). The arbitrageur (i.e. me in this example), makes a risk free profit (Rs.50/- in this case).

If you think about this, arbitrage is beautiful, right? If the above were to hold, all I had to do in life was buy tapes from Singapore and sell the same in Bangalore. I do this in large quantities, and I’d be sitting on a massive pile of cash.

But if only life was that easy 🙂

The assumption here is that there are continuous supply and demand in both markets. I mean imagine a situation where I buy tapes worth Rs.100,000/- with a hope to sell it for Rs.150,000/- and suddenly I realise that people in Bangalore are no longer interested in Rock n Roll, but instead prefer listening to Boyzone! Then my money is gone, right?

So the point is, unlike the popular notion, arbitrage is not risk-free. What we discussed is an example of the supply-demand risk associated with the arbitrage opportunity.

But it is not just that.

Imagine another scenario, where a friend of mine figures my little trick, and he does the same, i.e. buy tapes from Singapore at Rs.100/- but sells the same at a slightly lower rate at say Rs.140/- to ensure he beats me at my own game.

What do you think would happen next? A price war would break, I’d offer the same at say 135, he would then reduce to 125 so on as so forth till all the margins evaporate.

Point being, arbitrage opportunity or arbitrage profits shrink when more people try to exploit the same opportunity.

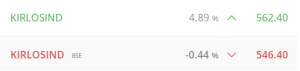

Now, think about the stock markets. Take a look at the snapshot below –

What you see here is the quote for Kirloskar Industries, on NSE it is trading at 562.4 per share, and on BSE the same company is trading at 546.40 per share. There is a difference of 16 Rupees.

The above is an arbitrage opportunity. All you have to do is buy Kirloskar Industries at 546.4 in BSE and sell the same stock in NSE at 562.4. After all, it’s the same asset but two different prices in two different markets.

If one were to execute this transaction well, then a 16 Rupee profit is more or less guaranteed.

A mutual fund scheme that manages money by mostly chasing such arbitrage opportunities in the market is called ‘The Arbitrage Fund’.

17.2 – The Arbitrage Fund

While we looked at one type of arbitrage opportunity in the previous section, in reality, there are many types of arbitrage opportunities in the market.

For instance, one of the most attractive arbitrage opportunity that the mutual fund looks for is the ‘Spot-Future’ arbitrage, wherein the futures trade at a price which is significantly away from its fair value when compared to its underlying price.

In other words, at any given point, the fund is continuously long or short on the stock in either the equity or futures market.

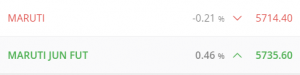

Did the above line confuse you? Let me elaborate this a bit just to give you clarity on what happens under the hood of an Arbitrage Fund. Take a look at the snapshot below –

As of today, i.e. 18th June 2020, the stock price of Maruti is at Rs.5,714.4/- per share. However, Maruti’s future’s is trading at Rs.5,735.6/-.

The difference between cash and futures is –

5,735.6 – 5,714.4

= 21.2

The difference between cash and futures is called the spread or the basis. One can capture the spread by setting up an arbitrage. Remember the thumb rule in arbitrage is to buy the asset in the cheaper market and sell the same asset in the expensive market. Hence, all one has to do here is –

Buy Maruti @ 5714.4 in the cash market

Sell Maruti Futures (Exping in June)@ 5735.6

It is important to ensure the above transaction is simultaneously executed. Once you do, you’ve locked in the spread, and it no longer matters where Maruti trades because the spread of 21.6 is guaranteed.

The key here is the fact that on the expiry day, Maruti in cash and Futures will trade at a single price (unlike today). The phenomenon is called ‘Cash-Futures Convergence’. So this trade has to be unwound or squared off or closed on the expiry day.

For example, assume on the expiry day, Maruti trades at 5780 in both the cash and futures market. The P&L is as follows –

Cash market trade

Buy @ 5714.4

Sell @ 5780.

P&L =5780 – 5714.4

= + 65.6

Here you make a profit of 65.6.

Futures market trade –

Sell @ 5735.6

Buy @ 5780

P&L =5735.6- 5780

= -44.4

Here you make a loss of 44.4.

So, on the one hand, you make a profit of 65.6, and on the other, you lose 44.4, but overall you make 21.2, i.e. 65.6 – 44.4.

The point here is that the spread is locked and you make that no matter what happens. I’d encourage you to do the same math at few other price points and see what happens.

Of course, there are other technicalities like rollover, transaction costs, execution risk, etc. But there is no point getting into these details. All you need to do is understand what arbitrage is and what happens in an arbitrage fund.

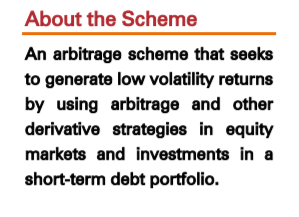

Have a look at the following; this is an extract of the investment objective of DSP’s Arbitrage fund –

As you can see, the fund simply states that they aim to generate income through the cash and derivatives market, without getting into specific strategy details. Some of the funds also use the term ‘low volatility returns’ in their scheme description.

A pure arbitrage trade such as the spot-futures arbitrage is inherently less risky with a predictable outcome; hence it is naturally low volatile.

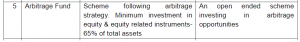

However, one should not take this at face value. Yes, if the fund is 100% focused on arbitrage opportunities, the low volatility bit would have been valid. But then, look at SEBI’s definition of the Arbitrage Fund –

An Arbitrage fund has a minimum of 65% of the funds in Arbitrage strategies, which implies that they are free to do whatever they want with the balance of 35% of the funds. There is no restriction on that. The usual practice for Arbitrage funds is to invest the balance 35% in debt funds, and since there is a restriction on duration, funds usually chase yields. Given this, an arbitrage fund is not a ‘low volatile’ 🙂

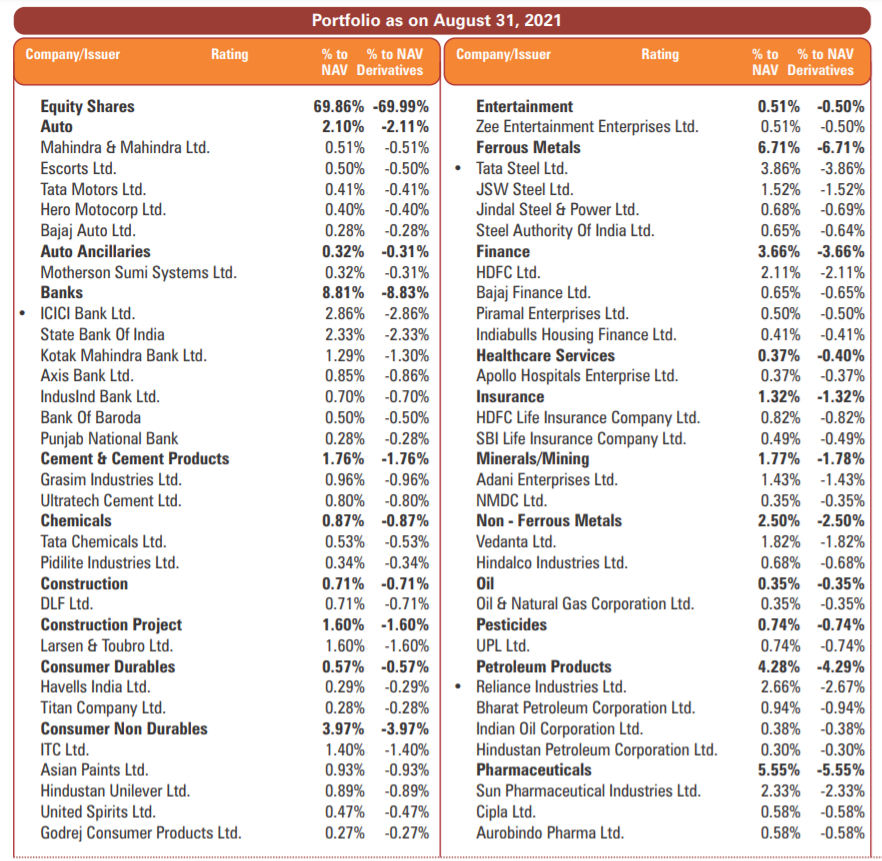

Have a look at the portfolio of ICICI Pru’s Arbitrage fund –

Every single equity position is hedged with its futures; these are mostly arbitrage positions. As we can see, nearly 65% of the exposure is the arbitrage position. The balance 35% is parked in debt and cash –

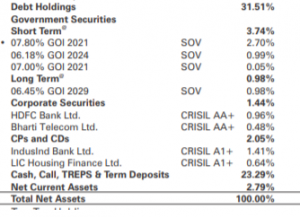

The presence of debt papers is what makes the arbitrage funds risky. How risky may you ask? Well, look at this –

If I’m not wrong, Principal Arbitrage Fund held a concentrated debt position in DHFL bonds, which DHFL defaulted upon sometime in October 2018. Naturally, the fund took a hit, and the NAV nose-dived from 11.5 to about 10.9, translating to a run of 5.22%.

In all fairness, 5.22% is not a big hit, but the problem is the time spent on recovery. It took nearly 1.5 years to recover 5.22% and push the NAV back to 11.5.

This chart teaches us three lessons about the Arbitrage fund –

- As many investors believe, Arbitrage funds are not risk-free. Thanks to the debt component, there is an element of risk.

- Returns hover in the range of about 5-7%, which can get wiped out in a single shot if things go wrong.

- Recovery takes time. Hence it is prudent to have a long term investment horizon while investing in an arbitrage fund.

I hope I’ve not scared you away from investing in an Arbitrage fund 🙂

The good part of an arbitrage fund is that it behaves as a debt fund but gets taxed as an equity fund. We will have a chapter dedicated to mutual fund taxation, till then, here is how taxation works (very broadly) –

- Gains from Equity funds sold within 12 months are treated as short term capital gain, attracts a 15% tax.

- Gains from Equity funds sold after 12 months are treated as long term capital gain, attracts a 10% tax, after an exemption of Rs.1,00,000/-

- Gain from debt funds held for less than 36 months is treated as short term capital gains, attracts a tax as per the investor’s income tax slab.

- Gain from debt funds held for more than 36 months is treated as long term capital gains, attracts a 20% tax post indexation.

Given the tax treatment, in my opinion, if you are prepared to take some risk, then use the Arbitrage fund as a proxy for say low duration or a short duration fund. The risk and return profile are similar for these funds.

Hence, in my opinion, the real arbitrage in an arbitrage fund is the tax arbitrage, i.e. it behaves like a debt fund and gets taxed as an equity fund.

Lastly, when you look for an arbitrage fund, it is essential to look at the debt component of the portfolio. Ensure the fund does not have concentrated debt positions and also ensure the there are no papers which are below investible grade.

Also, it is crucial to confirm that the arbitrage fund is not holding any unhedged equity position because this defeats the purpose of an arbitrage fund.

Next up is Mutual fund metrics. Stay tuned.

Key takeaways from this chapter

- Arbitrage funds are hedged position

- SEBI mandates AMCs to invest a minimum of 65% in arbitrage strategies

- Mutual funds usually spend up to 35% in debt

- Arbitrage funds can be volatile

- One can consider Arbitrage funds as a proxy for low/short duration funds

In the previous chapter, you told about that you will discuss ETF in the chapter, then, where is that part?

Here you go – https://zerodha.com/varsity/chapter/exchange-traded-funds-etf/

Karthik,

Thanks for this wonderful chapter!

I have sorted out the mutual funds for long term. After going through this chapter, I did some study to where to park my emergency fund (FD vs Liquid fund vs Ultra short term fund vs Arbitrage fund).

– I have easily removed FD from the list because of the lockin period (liquidity issue) and also the preclosure results in 1% reduced returns. after tax, this amount seemed less when compared to other entities.

The problem I have is, I\’m so confused between the rest three.

1. In terms of returns, AF>USTF & LF

2. In terms of liquidity, LF&USTF > AF

3. In terms of risk, LF > USTF > AF

4. In terms of taxation, AF (taxed as equity) > LF & USTF (taxed as debt)

With the above cases, I feel arbitrage funds have upper edge considering the returns after tax. Also, i can compromise on the slightly higher risk in AF and that extra days taken for liquidity.

5. Please let me know whether my understanding is correct!

6. Also, when it comes to emergency fund, the situation may arise any time. May it be 6 months or 5 years. Is it advisable to park debt fund for 5 years time considering lower returns?

Once again thanks for leading us in right path with the help of these modules!

The key with emergency funds is –

1) It should avaialble as and when you need it. Remember you can use your credit card to pay for the emergency and then repay it using the emergency fund. CC, becuase its avaialble immediately.

2) It should not be volatile.

3) Risk profile should be lower. Think of reward or return later.

From this perspective, I find liquid fund quite convenient. But that said, I also have a soft corner for the AF 🙂

sir intraday nhi kr skte kya arbitrage k liye ?

in cash market

You can if you spot opportunities 🙂

sir

suppose buy a xyz stock at 100rs NSE

and sell a xyz stock at 115rs bse

this is possible buy and sell differnt exchange?

100-115=5rs arbitrage?

NSE (xyz stock buy on 100rs and sell on 115 = +5rs )

BSE ( xyz stock sell on 100rs and buy on 90 = -10rs)

total = 5rs IS ARBITRAGE

CORRECT ME SIR WHICH ONE IS CORRECT AND ARBITRAGE IS IN DERVITATVE MARKET WITH POSSIBLE , ONLY EQUITY IN NOT POSSIBLE LIKE MY EXAMPLE

This is a correct understanding of an arbitrage trade, Nikita.

Hey Karthik, thanks for a the beautiful material, so nicely explained.

suggesting a simple correction :

\”Gain from debt funds held for more than 36 months is treated as long term capital gains, attracts a 20% tax post indexation.\” This sentence in the above content needs to be modified as taxation with respect to the debt funds has changed

Noted, Prashanth. Thanks.

its very and useful informatiom…

i also badly need to know the process and procedur to initiat the arbitrage trading in Future

There are many ways to arbitrage, we have discussed a few here – https://zerodha.com/varsity/module/trading-systems/

How can i do arbitrage trading on kite. Do you have examples. Pls Explain in layman terms.

We have discussed it here – https://zerodha.com/varsity/module/trading-systems/

Hi sir the modules have been fantastic and great for anyone looking to learn more about personal finance and investment. Wish came across it sooner but better late than never. I had a doubt in this chapter

Can you please explain this a bit more the technical terms used her like concentrated debt, papers below investible grade, unhedged equity has kind off confused me

“Lastly, when you look for an arbitrage fund, it is essential to look at the debt component of the portfolio. Ensure the fund does not have concentrated debt positions and also ensure the there are no papers which are below investible grade.

Also, it is crucial to confirm that the arbitrage fund is not holding any unhedged equity position because this defeats the purpose of an arbitrage fund.”

Much thanks

Concentrated bets = Here the fund manager will invest heavily in one or two papers. If the bet goes wrong, the chances of losing entire capital is high.

Papers below investible grade = These are bonds that are very risky and carry high amount of credit risk

Unheadhed equity = Basically, ensures the equity positions are protected with a hedge. The hedge will be a counter position in the derivative segment.

Hello Sir,

You post nice articles. My question was that if I buy in cash and short the futures to earn difference of Arbitrage , Do I have to hold the Futures on expiry after 3:30 pm to get cash settled on expiry ? Or do I have to sell future before 3:30 pm on expiry day. Can you please explain when to book profit – Hold even after 3:30pm or square off before market ends on expiry. Also what will be minimum investment to take such cash and carry arbitrage positions. Thank you.

You can book profit at any point, Vishal. No need to wait till expiry. Nim investment will depend on the stock. Check the margins to get an idea of how much capital are required.

Hi Kartik

I want to switch from my existing regular fund to direct fund of same AMC. Among the options available as Switch and STP, which option is better in view of taxation.

Thanks in advance

I\’d suggest switch, but do check with your financial advisor once.

This seams like a very easy way to make money.

Sir could u also explain the risks involved in this.

Th biggest risk is execution. You will profit only if you execute the trade at a particular price, which is not easy.

Got it.

If the futures trade at a premium over the cmp I generally always have a spread.

So if i just execute the above transaction I\’ll make 250(lot size in futures)*16(spread)=4000

Is this correct or am I missing something

Also,Thank u for ur reply sir.

Yes, thats correct.

Reliance is available at cmp of 2631

and nov futures is available at 2647

so the spread is 16 atm

Now suppose I buy at cmp

and sell the futures at 2647

and the price during expiry is 2670

I make 2670-2631=+39 on selling

and 2647-2670=-23 on buying

still I\’m making 16

Is this correct or wrong and when do I lose money in this

Also I\’m just learning and and feedback about mistakes is appreciated

Yes, this is correct. Basically you make the difference between the fut and spot rice, called the spread. In this case, its 16.

Hello Karthik,

Can we buy stock in Spot Market and sell in Far Future Market where the price difference would be higher.

Thankyou In advance

You can buy in spot and sell futures if you wish.

Why SEBI discourages the 100% arbitrage?

It is the same with all other schemes as well. The majority is towards allocating to the stated mandate, the rest goes for other things.

Thankyou bhaiya

Good look, Keshav!

Sir, in which module you have fully addressed regarding Arbitrage concept as I have just skipped some modul .so that I need not to checkout

every module

Check this, Keshav – https://zerodha.com/varsity/module/trading-systems/

Have discussed paid trade here, that is also a form of arbitrage by the way.

So in this way arbitrage opportunity is also quite risky ?

Not really, it depends on the kind of arbitrage and the way you\’ve identified the set-up. If the profit potential is very small, then it may not be worth the trade given the transaction charges.

Sir,is the arbitrage only mean to buy shares from one exchange and sell shares at another exchange.

Is there no need to reverse the transactions means to buy share from the exchange where we sold earlier and sell where we bought earlier ?

I hope that you understood my question.

There are other types of arbitrage as well. But yes, if you buy and sell on two exchanges, you will have to sq off the trades as well.

sir is there going to be any module on hedge funds ? i tried to learn it online but I become habitual of learning things from you, in an easy manner.

Not really Rajat. Hedge Funds are not really accessible for retail, no point discussing it here 🙂

Is zerodha consider arbitrage fund equal to cash ?

No, an arbitrage fund cannot be considered as cash.

Hey Karthik, Thanks for such a simple yet elaborate material on stock market, it\’s been really helpful.

I have a query – When an arbitrage trade is providing a very low risk high profit scenario, then why don\’t the funds invest completely in this category? Why do they go for 35% in other areas like debt? A 100% arbitrage portfolio would mean a much higher return than debt funds with a low risk profile – an ideal mix every trader/investor is looking for in Stock markets! Pls let me know if I\’m missing any major risk involved in Arbitrage trading by Fund Managers.

Its not high return, arbitrage risk and return, both are low 🙂

Very useful article, just I want to know max risk in this trade in expiry day datet 28 Jan I was done .

NIFTY FEB FUTURE 14020 SELL

NIFTY JAN FUTURE 13982 BUY

Trade 9.45 am And exit on 3.10 pm

Regards

Madan shah

Nifty Feb goes up and Jan fut goes down 🙂

I particularly appreciate the history of what went wrong with the category of the investment. It really helps to understand the risks involved. This allows individuals see if the instrument is suitable for their risk profile. Please provide more such real life instances, not just the negatives but also positives.

Please keep up the good work.

Will try and include where ever possible 🙂

There are three modules. 1) Futures Trading 2) Options Theory for Professional Trading 3) Options Strategy

Which shall I read. I do not want to go into trading. I am only interested in learning to hedge. Also Hedging if the portfolio of stocks created is for a long term. Thanks for replying

In that case, I\’d suggest you read the Futures module.

Hey, I have been a FAN of your work. It\’s gem of a work. By any chance will u prepare or are u going to prepare a similar dedicated module for Futures & Options or Derivatives or Hedging in derivatives? What all is there in it and its nitty gritties ? I really really want to understand this too from you, u cudn\’t be better. I hope and wish that u teach us entire derivatives. Kindly reply. Thank You

Hey Kaizer, thanks for the kind words. There is a detailed module on Futures, options, and options strategies. Look at the home page where you\’ll find all the modules – https://zerodha.com/varsity/

Sir if I sold more than face value then we need to pay STCG or LTCG

How much should one pay for interests/coupon received and minimum limit

That\’s right. It is best if you speak to your CA about this.

Sir then one can comfortably invest FD which has no risk and capital gaurante

FD is good enough too. Really depends on your objective and expectations 🙂

Avery good artical but how is the pricedur on the exchanges at a point can I buy at bse and sell at nse. Can I do only in equity on both the exchanges and not derivatives pl explan

Yes, you can.

sir,

can we do arbitrage equity trade in intraday also ? like buying from BSE and Selling at NSE on same day or vise versa

Yes, you can.

Dear Karthik,

Very good article on Mutual funds with examples and well curated articles for other topics as well. It helps to understand the concepts. Thanks for the mammoth efforts gone into creating these topics.

Thanks for the kind words, Vindo. I hope you continue to like the content.

Hi Karthik, Your articles are so informative. its like attending an online course. Many thanks for your efforts.

Happy to note that. Hope you continue to enjoy the content 🙂

Sir

First of all big thankyou

You are my mentor,guru and everything

I learn too much on varsity

To many reasons thankyou

I have a problem on applying NEUTRAL STRATGEY in WEEKLY CURRENCY OPTIONS

Please help me with example of

(Long box or conversion) and (put call parity) in WEEKLY CURRENCY USDINR OPTIONS

Please understand sir give me answers

I lost 95000 rupees in my father account and also I have no any income source to return to my father.

Only I want answer on the topic of NEUTRAL STRATGEY, this event I told you because take it seriously.

Thank you

Your client

TT4248

Thanks for the kind words, Vishal.

I\’d suggest you stick to simple strategies such as long/short straddle or strangle and not venture beyond these. YOu can even consider the iron condor.

As of right now, I see Maruti FUT SEP at 7211 while Maruti at 7193. So this is the same as the example you mentioned and seems like confirmed gains? Why is not everyone doing this? What am I missing her?

What is a fair price? You need to calculate that as well right?

Hi Karthik

I am awed with how can anybody simplify finance the way you do! Hats off to your efforts to simplify our understanding.

All the best wishes for you to get more consistent readers

Regards

Aswathi

Happy reading 🙂

Thank you Karthik. I came to zerodha varsity searching for taxation and stock investing, and now I am loving every module. I have one suggestion though, it would be very good if Zerodha publishes books on some of the modules. Especially on personal finance and taxation. These will form invaluable part of many libraries.

Thanks, Rahul. That\’s a nice suggestion, will think about it 🙂

Sir

Thanks for giving so much insight on mutual funds.

In the arbitrage funds, the fund has to invest a minimum of 65% in arbitrage strategies. I want to know if this 65% is with respect to AUM ? If this is so then AUM changes on per day basis because of change in NAV.

Suppose NAV decreases next day, then in that case it may happen that the limit of 65% of previous day (based on previous day NAV) will exceed today because of decease in NAV today. Please clarify.

Regards

Yes, this is based on AUM. The % change on a day to day basis won\’t be this much, besides they review the ratio once a month or once in a quarter. I guess SEBI\’s regulation permits this 🙂

can i use my mutual fund balance in coin as margin money for equity purchase?

Your mutual fund balance is anyway fetched from Kite, so it is the same.

Hi

Thank you for your reply for my earlier queries. Great Efforts too….

1. How & where to find the arbitrage trades.

2. How much the min difference should be there so that we can make a profit.

1) You need to keep an eye out for opportunities in the market

2) Depends on the scrip and the applicable charges. We cannot generalise this 🙂

Hi

Is F & O trade is same as arbitrage. Or both are different.

No, both are different. Arbitrage is a type of trading and F&O are instruments to trade.

your modules are wonderful!!

when is the next module be ready?

Next chapter you mean, that will be uploaded t\’row.

First of all Thanks a lot sir for helping us with financial literacy.

The personal finance module can\’t be downloaded as pdf?

Not yet, will be available to download once the module is completed. This is still a work in progress.

It\’s a wonderful read! I am curious about learning more. When is the next chapter expected to be published?

Thanks!

Unfortunately, its been delayed quite a bit, but I\’m working on it. Hopefully by this weekend.

In the spot future arbitrage , from the above example i understand we have to sell the asset in the expensive market. so if the spot is higher how can we short sell it till the end of the month ?

You can by borrowing from the SLBM market, but it is not really easy Faiz. You can find all the information about it here – https://www1.nseindia.com/products/content/equities/slbs/slbs.htm

sir, can u do a special chapter on arbitrage trading ?

We have a detailed post on pair trading and calendar spreads, both are sort of arbitrage opportunities.

Hi Karthik,

Happy Sunday! Hope you and your family are doing well.

I started reading Zerodha Varsity in first week of June 2020. The best thing I did in this lockdown period..I regret not starting it before. Thank u very much for the wonderful materials.

Can u please provide a material on ETFs and ETFs liquidity.

I\’m glad you liked the content Vinay!

Yes, will cover ETFs also. Hopefully soon.

Sir what were the last 3 books you read? Could be those not related to finance also. Just asking you as a fan.

Thank you for the great work.

Storybooks for my kid, don\’t remember the names as I tend to fall asleep faster than she does 🙂

Karthik I have been searching long and hard on resources to conduct back test on strategies. I have looked at Streak but it does not accommodate complex strategies.

1. Can you let me know which data vendor you use?

2. How can I get started in strategy back testing?

Thank you.

1) I dont use any data vendor, so I\’m really not sure. But I\’ve heard Truedata is good, please do check them out

2) You\’ll need to have some trading and coding background for this, more of coding actually. If you know coding, start by importing data, defining your conditions to generate a signal, check how many time signals have been generated, measure the outcome, tabulate and analyse the same.

I am new here, I\’ve started reading Introduction to Stock Market but the content is overwhelming. I really want a secure future via trade or invest. Can someone suggest me book on trading and investing for an absolute beginner. I have tried reading Trading in the Zone but most stuff is like philosophy. Please. Thanks in advance

I suggest you look at all the modules posted here before you can buy any book, Mridul. Hopefully, this will set you on the right path.

How to place hedged position in kite ?

You will have to place the trades one after the other.

Sir, can a retailer do this cash future arbitrage effectively(i mean to execute at the intended price) using kite or is it only possible for big traders with their specialised terminals?

It is possible, but the problem is that these opportunities don\’t come by easily.

can we buy shares in equity market and sell it in futures?

Yes, that\’s an arbitrage trade.

Karthik all these years I have been reading Varsity and I have never noticed how cool the sketches in between are. Anyways, I have a question regarding Arbitrage as a trading strategy. I know you have put up arbitrage strategies like pairs trading and calendar spreads. But would it be possible to build a trading system (Automated) that only detects pricing discrepancies in the market? Do you think it would work? What are your thoughts on this? Thanks.

Yeah, the our illustrator does a great job at this 🙂

Yes, you can setup a system, but it will be an expensive affair, Sundeep, especially if you get into colo of servers and all.

what did u mean by the execution risk? can u please explain? what is the probability of a normal retailer pulling it off successfully.

So let\’s see the spot price is 102 and futures is 108, the spread is 6. I will get to retain the entire spread only when I buy at 102 and sell at 108. If I execute this at 103 and 107 instead (say you place a market order because you need to act quickly), I will lose out on the spread and make 4, which may just be enough to cover the costs. This is called the execution risk.

Sir, seems to me it involves zero risk in cash futures arbitrage trading. Pls tell me if its possible for retail traders to do this.. what are the risk , if any, involved.?

Yes, retailers can also do. The only issue is the execution risk. Arbitrage holds as long as you execute the trade at the given price, else it will fall apart.

So.there is no loss at all.in arbitrage funds.

(Other than debt fund part)

Of average returns is 6%

Why should one choose arbitrage funds.?

They can simply choose debt fund?

The taxation of an arb fund makes it attractive over a debt fund, Sharath.

In Kite, how can i place cash and future arbitrage order. Like sensibull, don\’t you offer arbitrage software to find opportunity and click to get the opportunity. Why such opportunities are not easily available on zerodha that help us to male stable money?

The product has to be created by the exchange and only then we can offer it to you. That said, hopefully we should have something on these lines soon.

Nice article

Happy reading, Satish.

That means there is no arbitrage opportunity when futures are trading on discount?

The reverse is true, sell futures, short the stock. AMCs can short in the SLB market.

How can buy in one exchange and sell in other

Once the stock comes to delivery, at the time of selling you can choose the exchange at which you want to sell.

How can I buy in one exchange and square off in another?

You can Kunal, there is no problem with that. However, wrt to the example in this chapter, it\’s supposed to be an intraday trade.