3.1 – Money today versus money tomorrow

For a moment, assume a friend of yours is in a very generous mood and he gives you two offers, of which you have to select one of them.

- Option A – He gives you Rs.10,000/- right away

- Option B – He promises to give your Rs.10,000/- exactly two year from now

To add a little twist, assume you do not need the money today, but in two years, you are planning to buy a new car.

Will you take the money today even though you do not need the money or will you take the money two years from now, when you would need the money?

By the way, there is no question of your friend backing out on his promise after two years, he is a good guy and he will certainly give you the promised money 🙂

So given these two options, and the other things around it, which one are you likely to choose?

If I were to guess, most of you reading this will opt for Option B. The rationale being, that there is no real need for money today, so if you were to take the money today, you’d spend that money on unnecessary things and waste the money. Hence you are better off taking that money two years later.

Assuming the above were to be true, here are few questions to you –

- Does it make sense to equate money across timelines i.e money today versus money tomorrow?

- How do you move money across a timeline to ensure we compare the right value of money?

To make the right decision, you need to have clarity on moving money across the timeline. You need to compare the value of money today versus the value of money tomorrow.

The objective of this chapter is to help you understand just this i.e to help you compare money across different timelines.

Hopefully, by the end of this chapter, you will be better equipped to make a sensible decision concerning your friend’s generous offer and of course for more serious things in life as investment planning 🙂

The discussion we are about to have is a core financial concept called the ‘Time value of money’ (TVM). The time value of money finds its application across many different areas of finance including project finance, insurance planning, equity derivatives, valuations, and of course personal finance.

The time value of money has two components – the present value of money and the future value of money.

3.2 – Present value of money

We all buy assets with a hope that it will generate a decent return over time. For example, if I were to buy a piece of land today then I would expect it to grow to a certain value in 15 years. The amount of money I will receive when I sell this piece of land in 15 years will have a very different value when compared to the same value today.

The concept of Present value helps you understand the value of the funds you are likely to receive in the future in today’s terms.

Sounds confusing? Probably 🙂

Let’s understand this with an example.

Consider that you purchased a piece of land for Rs.15,000,000/- today and held it for 15 years. After 15 years, you sell the land at Rs.75,000,000/-. On the face of it, this looks great, after all, you’ve made a five times return on this.

But here is an important question you need to ask yourself. How valuable is Rs.75,000,000/- that you will receive 15 years from now, in today’s terms?

What if in 15 years from today, Rs.75,000,000/- is less valuable than Rs.15,000,000/-?

To find the answer to this, we need to understand two thing –

- What is my risk-free opportunity cost today?

- Given the risk-free opportunity cost, what is the amount that needs to be invested today, such that it grows to Rs.75,000,000/- in 15 years.

The answer to the 2nd question is, in fact, today’s equivalent of Rs.75,000,000/- that you’d receive in 15 years. So let us figure this out.

We are talking about a 15-year time horizon here.

The opportunity cost is the equivalent of what else can be done with the funds available if we choose not to invest this money in the real estate deal. The opportunity cost can be found out by figuring out the risk-free rate in the economy and adding a risk premium over and above the risk-free rate.

So the opportunity cost –

Opportunity cost = Risk free rate + Risk premium

The risk-free rate is the rate at which our money can grow without any risk. Of course, we can endlessly argue that there is nothing like a true risk-free rate, but for the sake of this discussion, let’s assume that the risk-free rate is the Government’s 15-year bond. Usually, the Governments are expected not to default on their payments/repayments, hence the Government or the Sovereign bond is a good proxy for the risk-free rate.

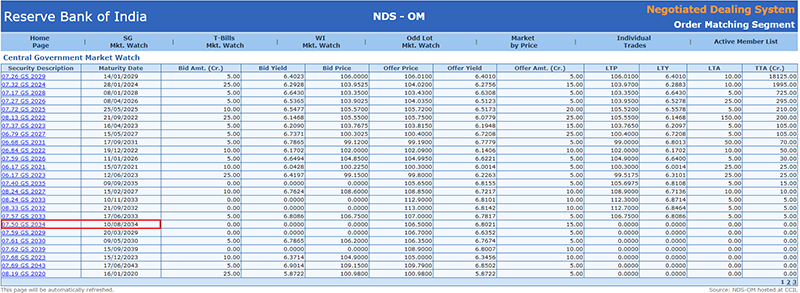

Here is a snapshot of all the available Sovereign bonds –

I’ve highlighted the 2034 bond since we are interested in a 15-year time horizon. As the highlight indicates, the coupon rate is 7.5%. Again for simplicity, let us keep the bid-ask yield aside, we will anyway discuss these things in more detail when we deal with bonds. For now, you need to understand that the risk-free rate for the next 15 years is 7.5%.

To figure out the opportunity cost, we can add a risk premium of 1.5-2% more. The risk premium really depends on many things, keeping it simple for now. So, the opportunity cost would be –

7.5% + 1.5%

= 9%.

Now that we have our opportunity cost sorted, we now need to answer the 2nd question i.e to figure the amount that we need to invest today at 9%, such that it will grow to Rs.75,000,000/- at the end of 15 years.

A trial and error method can figure this amount. Alternatively, we can use the concept of ‘discounting’, wherein we discount Rs.75,000,000/- at 9%, which will give us the same answer.

The opportunity cost at which we discount is the ‘discount rate’.

By discounting we are essentially equating the future value of money (Rs.75,000,000/- in this example) to its equivalent value in today’s terms, also called the ‘Present Value’ of money.

The present value formula is –

Present value = Future value / (1+ discount rate ) ^ (time)

We know,

- Future value = Rs.75,000,000/-

- Discount rate = 9%

- Time = 15%

We can plug these numbers in the equation –

= 75,000,000 / (1+9%)^(15)

= 20,590,353

This means, the present value of Rs.75,000,000/- is Rs.20,590,353/-. In other words, Rs.75,000,000/- in today’s terms is the same as Rs. 20,590,353/- in 15 years.

Given this, if someone makes an offer to buy the property at Rs.20,590,353/- today, then it is as good as receiving Rs.75,000,000/- in 15 years, because if Rs.20,590,353/- invested at the opportunity cost of 9%, will yield Rs.75,000,000/- in 15 years.

The concept of present value is very critical in finance and so is the concept of the future value of money, which we will discuss next.

3.3 – Future value of money

The future value of money is simply the inverse of the present value of money. Going by the real estate example, the future value of money helps us find an answer to a question like this –

- What will be the value of Rs.20,590,353/- in 15 years from now?

To find an answer to this question, we again must find out the opportunity cost. Irrespective of future value or present value problems we are trying to solve, the opportunity cost remains the same.

So, 9% will be the opportunity cost.

To find the future value of money, we must compound the amount at the given rate of opportunity cost.

Recall from the previous chapter, the compounding formula –

= P*(1+R)^(n), which is also the future value, therefor –

Future value = P*(1+R)^(n)

Where,

- P = Amount

- R = opportunity cost

- N = Time period

Applying this,

= 20,590,353 * (1+9%)^(15)

Now, before I post the answer to the above question, what does your intuition say the answer is?

Remember, when we worked out the present value of Rs.75,000,000/- at a 9% discount rate for 15 years, the answer was 20,590,353. Now, we are trying to do the exact opposite i.e compound 20,590,353 at 9% for 15 years. So the answer has to be 75,000,000. When you do this math –

= 20,590,353 * (1+9%)^(15)

= 75,000,000

This is the future value of money.

So in simple terms, if you had an option to receive 75,000,000 after 15 years or 20,590,353 today, then essentially both of these are the same deal.

3.4 – The offer

We started this chapter with a hypothetical situation. Your generous friend gives you two options –

- Option A – He gives you Rs.10,000/- right away

- Option B – He promises to give your Rs.10,000/- exactly two year from now

Chances are that you selected option B. However, can we tackle this situation better? Now that we know the concept of the time value of money aka the present and future value of money? Of course, we can.

The problem here is that we are trying to compare the value of Rs.10,000/- today versus Rs.10,000/- two years from now.

Now, if we were to opt for option A, we will have an option to invest this money in an interest-bearing instrument and grow this money. As of today, a two year fixed deposit will yield anywhere close to 7.5%. Given this, we now have to find out the future value of Rs.10,000/- at 7.5% opportunity rate (or the compounding rate).

= 10000*(1+7.5%)^(2)

= Rs.11,556.25/-

This also means, that if we were to accept option B, we would be essentially accepting a value much lesser than Rs.10,000/-. A fair deal here would be either Rs.10,000/- today or Rs.11,556.25/- two years from now!

This also leads us to one of the most important conclusions in finance – Money today is far valuable than money tomorrow because today we have an option to invest this money and grow it at a risk-free rate.

3.5 – Real-life applications

So before we wrap up this chapter, let us consider a few real-life (like) situations and apply the concept of Future Value (FV) and Present Value (PV) of money. These are just made-up situations, you will appreciate the application of FV and PV better later in this module when the example will be probably more tangible.

Question – So assume you are saving for your daughter’s education at a foreign university. She is ten years today, and she is expected to go to the US when she is 25 years old, which is 15 years away. The tuition fees including the cost of living are expected to be roughly Rs.6,500,000/-. Given this, how much should you have today?

Answer – When you have a situation like this, the first thing to do is to figure out if this is a present value or a future value situation. This may not be very obvious at the surface, so this needs a bit more understanding. One easy way to figure that out is by analyzing the numbers.

We know the cost of education in 15 years will be Rs.6,500,000/-, so what is clear at this point is the future value of our cash requirement.

Given this, we need to figure out the present value of this cash requirement, so that we can save an appropriate amount today. We can do this by the simple present value formula we just learned –

Present value = Future value / (1+ discount rate ) ^ (time)

The 7.5%, 15 year Government bond is a good proxy for the discount rate, so we will use the same.

Present value = 6,500,000/(1+7.5%)^(15)

= Rs.21,96,779/-

So in today’s rate, if we can manage to deposit a sum of Rs.21,96,779/-, we will have the required target funds in 15 years.

Of course, some of you reading this may be in an exact situation wherein you’d be saving for your child’s future education. Do note, this is not the only way to save for it. The different ways to accumulate that corpus is the objective of this module, but for now, we are only concerned about gaining clarity about the concept of the present value of money.

Let us take up an example of the future value of money before we wrap this chapter up. Here is a situation you may be familiar –

Question – Your dad’s close friend at the office also doubles up as a wheeler-dealer, and never hesitates to offer a financial deal/scheme. He comes home for a cup of tea and also decides to sell a financial product to the family. He says you need to invest a lumpsum amount of Rs.200,000/- today and in 15 years, the family will get a gain of Rs.450,000/-.

So will you take up this deal and invest in it?

Answer – This is a tricky question because this can be solved by the application of both future value and present value concept. We will stick to the future value application. Quite straightforward this one –

Investment required today – Rs.200,000/-

Expected value from this investment – Rs.450,000/-

Given this, and the 7.5% opportunity cost, we need to figure if this investment makes sense. We will extrapolate Rs.200,000/- at the opportunity cost to figure this.

Future value = 200000*(1+7.5%)^15

= Rs. 591,775.5

Contrast this with the Rs.450,000/-, and the deal falls apart. You’ll have to politely ask your dad’s friend to enjoy his cup of tea and leave.

Now, here is something for you to think about – how will you solve the above problem by applying the concept of the present value of money?

Think about it and leave your comments below.

Key takeaways from this chapter

- Money today is always more valuable than money tomorrow because money today can be invested in interest-bearing instruments

- The time value of money is a core concept of personal finance

- Time value includes the present value and the future value of money

- The present value of money helps us figure the value of a future sum in today’s terms

- Present value = Future value / (1+ discount rate ) ^ (time)

- The discount rate = opportunity cost + risk premium

- Give a certain amount of money today, the future value of money helps us figure out its value at a future date

- Future value of money and the compound interest concept works the same way

- Future value = P*(1+R)^(n)

- R in the above formula is the opportunity cost, whereas the R used in compound interest is the growth rate. This is the only difference between Future value and compound interest.

I\’m trying to understand what is being more \”conservative\” here. Whether 7.5% or 9%? And what do we mean by being more conservative in the context of \”Present Value of Money\”? Thank you.

Hello sir, i was confused on why weren\’t you taking standard inflation rate (for general purpose) or any other specific inflation rates (for education, medical etc) and using opportunity cost.

For eg, if i am in venezuela where inflation rate is ~200%, by considering Opportunity cost to be 7-9%, am i not fooling myself here? like in 15 yrs, the future value would be much much greater than what we calculated. So why opportunity cost?

Of course, hence the rate at which you discount should be contextual to your circumstances 🙂

It is quite difficult for me to understand mutual funds at the moment. I would appreciate it if you could please suggest which module or topic I should start with to build a proper understanding.

Niraj, please check this playlist on Mutual Funds – https://youtube.com/playlist?list=PLX2SHiKfualGsjgd7fKFC-JXRF6vO73hk&si=iXcSfdpo839bXUB_

Mr. Karthik,

What a simple yet most important explanation of concepts.. Big Thanks

Thanks Ankita, so glad you liked it!

Why we take 2% as Risk premium (7.5%+2%) ?

Because you need EQ to offer you a return better than the risk free rate.

We calculate the present value of money using the formula Future value / (1+ discount rate ) ^ (time). I am using a discount rate of 9% and the present value comes to Rs 1,23,542.

This means, the amount he is promising is worth less than what we are giving today. That is 4.5 Lakhs 15 years from now, is going to be less that 2 Lakhs today.

Is it correct?

Yes, the future value will be lesser when you discount the value.

Time duration can\’t be 15% but instead 15 years.

Yeah, time is expressed in year, not %. My bad, checking this.

Sir, Thank you for all the material here, I\’m truly grateful to everything you have documented. But there are some errors here that some of the users have commented to rectify. I see they have not been rectified yet.

Can you please proofread this and get it rectified?

Thank you so much!

Thanks, I\’ll look at this soon 🙂

isn\’t discount rate = opportunity cost since Opportunity cost = Risk free rate + Risk premium. However in the key takeways it\’s mentioned discount rate = opportunity cost + risk premium

Ah, let me double check this. Thanks.

Why we take discount rate 9% for 15 year, I think it\’s to high can we take discount rate equal to inflation rate which is around approx 6%

Yes, you can take the number that gives you more confidence. But in general, the more conservative you are, the better for you.

Is that Gojo Satorou

Sir, How I can get in touch with you for guidance on my Financial Planning.

This is the best place to interact. But for financial planning, you need to speak to someone else, I dont have the qualification to plan financials.

sir, why havent we considered 9% as the Opportunity cost = Risk free rate + Risk premium. why only 7.5%. Investing a lumpsum amount of Rs.200,000/- today is also risky, as dad\’s friend didnt mention its risk free.

The opportunity cost in this case is an FD or any other investment of that nature. Hence 7.5%. By the way, you can always use 9%. In personal finance, its always ok to be conservative in your assumption rather than aggressive.

Can this programmed conditioning investment statement applicable in good decision making?

If the Present Value (PV) of the future cash flows is greater than the initial investment, the investment is considered profitable.

&

If the PV is less than the initial investment, it results in a loss.

Yes, you can. But I think your input data for this could be tricky 🙂

Hi, my question is are the government bond rates different at global level, if yes then we should have considered the US/foreign government bond rate instead of RBI rates???

No, why would you want to do that? For Indian companies, you;d want to consider RBI rates.

Yes you are right

Happy learning!

Thanks a lot Sir

Happy learning 🙂

the present value of money in the above problem is 1,52,078/-

Sure, let me check if there is a typo from our side.

Thank you Sir.

Hi Sir, Thank you for teaching us through varsity.

I had a doubt regarding the last point you mentioned in the takeaway regarding \’R\’ is the only difference between Future value and compound interest.

In FV we consider the rate that is risk free plus premium that does not change over time(assuming govt bonds) and CI R is the rate at which investment grows?

I am a bit confused. Could you please explain this?

Thanks

Yes, thats right. In CI formula, R denotes the growth rate. Higher the growth rate, higher is the compounding effect. Whereas R in FV is the opportunity cost, usually risk free premium, but this also depends on the context.

Using the concept of Present Value of money, we get:

PV = FV/(1+r)^t

= ₹(450,000/(1.075)^15)

= ₹152,084.71

Are Fixed deposit interest rates a good way to calculate risk free rate of return?

Yes, that is a good proxy.

Hi Karthik. I had a question –

For example –

To calculate the future value, I invest 100000 rupees each year continuously for 10 years at the rate of 7.5 then my present value should be 10 lakh or 1 lakh only?

Since you are investing 1L today, your present value of 1L will be 1L only.

Hey, great article. But I just had a query. Why did you consider the rate premium only for the first example but not in the remaining ones?

You can add a risk premium to pretty much all personal finance math Shankar.

Reply for this @Karthik Sir: Thats right! So, if instead of Rs.200,000/- the offer was for 1.52L, then it would be a fair deal 🙂

Me: Although we invest 1.52L today to get 4.5L 15 years later still, it won\’t be a fair deal because we have just sustained our money (Matched the todays value with future value in a sense), we didn\’t grow it. (Am I correct?)

For that the rate of return should be higher, which means higher risk 🙂

Sir, The future value of money is calculated by inflation . I think your opportunity cost referring to inflation. AM I RIGHT ?

Yes, it does factor in inflation.

i found out my mistake. i thought it was 75 lakh but it was 7.5 crore. I accept my mistake

Sure 🙂

sir i think there\’s a mistake in present value calculation. 20,59,035.30 this is the right answer, i think you forget to put point. Sir please check once and clarify me

Thanks for letting me know, let me check again 🙂

Hello Sir,

There is a small error in section 3.2 – third last paragraph. It reads \”This means, the present value of Rs.75,000,000/- is Rs.20,590,353/-. In other words, Rs.75,000,000/- in today’s terms is the same as Rs. 20,590,353/- in 15 years.\” While it should read \”This means, the present value of Rs.75,000,000/- is Rs.20,590,353/-. In other words, Rs. 20,590,353/- in today’s terms is the same as Rs. 75,000,000/- in 15 years.\”

The numbers are interchanged. Thanks for the content!

It gives the same meening right?

understand. Thanks. Great content and fantastic work !Kudos.

Happy learning 🙂

Hi,

is there any way to calcualte what is the interest rate that will take us from 2L to 4.5L that the friend offered, instead of going through the present and future value methods?

If you have the time, its fairly easy to calculate no?

Hi Karthik, It would be much easier to have the next chapter toggle button at the bottom of each blog. I think in the previous web version there was a side tab where we can skip over to any blog in the module. Now we have to scroll all the way up or go back and look for the next one is a bit difficult from the user experience standpoint. Hope It will get resolved.

Noted, I\’ll pass this feedback Ashok.

1,52,084.71 is the right amount that needs to invested for 4,50,000

Ok. We have the math detailed out.

Hi,

While calculating the future value of money, how can we accommodate the \’Inflation\’ factor?

Thats the discount that you apply, Anoop.

I really appreciate your work Sir, this is very well formulated and easy to understand. Great for building concepts. Thank you so much 🙂

Happy learning, Jashan!

Sir,

In real life application you only chose risk free rate as discount rate and didn\’t add risk premium to risk free rate. Any reason Sir??

Estimating individual risk premiums for each factor can get complicated, Anshul. So took the generic case, which works for almost all cases.

I think a minor correction is needed at this line – “In other words, Rs.75,000,000/- in today’s terms is the same as Rs. 20,590,353/- in 15 years.”. It should be – “In other words, Rs. 20,590,353/- in today’s terms is the same as Rs. 75,000,000/- in 15 years.”.

Ah, sure. Let me relook at this.

Here time should be in years not in %, I think

The present value formula is –

Present value = Future value / (1+ discount rate ) ^ (time)

We know,

Future value = Rs.75,000,000/-

Discount rate = 9%

Time = 15%

Ah, yes. Excuse the typos please 🙂

I found it. It can be calculated using the \”PMT\” function in excel

Sure. Good luck and I hope you get the answer 🙂

where can I get to know about it then

I\’m not sure, Shivansh. YOu just have to google for it.

it seems that I am unable to explain my question what I want to ask let me try form the start with an eg.

if I want 25lakhs 15 years from now which will be approx. 69 lakhs (FV) in 15 years and assuming I get a CAGR of 12% then I would need to start an SIP of around 13781 /- to earn 69lakhs in 15 years. (investing in SIP monthly)

so now how on excel can I calculate the \”13781\” amount.

P.S.- to calculate the above given amount I used calculator given on Franklin amount but I want to know how they calculated it. (link to website of Franklin is https://www.franklintempletonindia.com/investor/sip-calculator

Shivansh, I get your question. They will use concepts of PV and FV. Unfortunately, I cant give a detailed explanation here, it is quite extensive and needs a dedicated chapter.

then on what formula does the SIP calculators work

It works on the basis of the future value of money. I\’ve explained that in this module.

M = Px ({[1 + i]n – 1} / i) x (1 + i)

I found this formula on one website and for calculating the \”M\” maturity value if we invest \”P\” (SIP amount) periodically at a fixed interest rate \” i \”

then if the interest rate is fixed then what kind of assumptions does it take into considerations.

You just have to ensure you are clear about the time duration of your investment. I\’m not sure about this formula and its logic by the way.

not the SIP returns. the SIP calculator which gives an estimate of SIP needed to achieve a certain amount with expected rate of int.

(eg- if I want 10,00,000 after 5 year and expected rate of return is say 12% then what is the amount of monthly SIP to be started)

I want that formula to calculate the SIP required

Its a trial and error method. Pick a SIP calculator, start with a 10,000 Rupee SIP and check the end result after 5 years. YOu can adjust based on that. No two calculators will give you the same because of the inherent difference in assumptions, so use it as an approximation.

what is the formula for calculating the SIP

I searched on Google, there multiple websites are showing different-different formulas

Are you referring to SIP returns? I\’d suggest you stick to any basic calculator that is usually available on the AMCs website.

Hi Karthik,

Hope you are doing well.

I would like to thank you creating such a high quality article and i learned a lot about personal finance from your tutorial.

I am getting difficult of calculating \”present value of money and \”future value of money\” in excel sheet.

I tried to find the \”present value of money and \”future value of money\” in excel sheet but the value is coming in dollar instead of INR even though selecting INR in currency. I find this article that can calculate future value of money with inflation.

https://www.advisorkhoj.com/tools-and-calculators/future-value-inflation-calculator

I can understand the formula being used to calculate \”present value of money and \”future value of money\” but unable to to apply it in excel sheet. I will request you to please help me on this. please share some screenshot with example to calculate both value in excel sheet.

Thank You.

Vijay, can you explain which step is causing the problem? Also, ignore the currency, treat it as a regular number, that will help.

I think we can also solve it by finding the CAGR across the 15 years and comparing it with the risk free rate.

So,

CAGR = ((450000/200000) – 1)^(1/15)

CAGR = 1.014987… %

CAGR ~ 1.015 %

Comparing this with the opportunity cost risk-free return of 7.5 %, we can see that we can get better returns and NO RISK 🙂 (I don\’t trust the uncle) if we invested in the government-bonds. So, no deal, uncle!

lol 🙂

This chapter, just saved my parents money today. Glad I read this chapter a couple of months ago. I literally, had some uncle come home for \’tea\’ today and he was trying to sell an endowment product on the same lines.

Give 12.5 lakhs today, will \”double\” the amount and return – 25 Lakhs in 15 years.

Even at a 6.76 risk-free rate of return, it should be 33 Lakhs. Politely said, \’Thank, you\’. Such uncles, I say 🙂

Happened only an hour ago. I had to post this because I could relate to the real-life applications you explained. Thanks a ton, Karthik for such insightful chapters and helping people like me be a little financially educated, at least.

Please bring out the personal finance – part 2 – eagerly waiting for it.

Anish, thanks so much for posting this. Messages like this keep us motivated to post more content. And I\’m glad the meeting ended up with just \’tea\’:)

Will take up Personal Finance part 2 next year sometime.

Present value of(15 years from now ) 2,00,000 = 67593 , so would not invest the money and will politely refuse.

Yeah.

How do you calculate the ^2 part

^2 means raise to the power of two.

“In other words, Rs.75,000,000/- in today’s terms is the same as Rs. 20,590,353/- in 15 years.”

Something doesn’t look right here. Should this be the other way around? Happy DIWALI by the way!

Its the future value of money, Aravind. It looks correct to me.

>>Time = 15%

A typo, please correct

Thanks for pointing it out. Let me check this.

Can you give formula for compounding at quarterly interest and what is effective annual rate interes

For quarterly, divide the interest rate by 4 and multiply the time by 4.

Great article. How to apply same things when evaluating company ?

Sorry, can you share more context?

I d k ? what is government bond ? Anyone help me out ..

And why we are using government bond ?

When Govt borrows, they do so by issuing Govt bonds.

Thank you!

Sure, sorry for not posting clearly. Please see below:

3.2 – Present value of money

We have 7.5% as the coupon rate for 15 year Govt bond. To this we add 1.5% as risk premium to arrive at discount rate of 9% for calculating present value.

3.3 – Future value of money

We use the same discount rate calculated in 3.2 as the opportunity cost (9%) to calculate future value.

3.5 – Real-life applications

Scenario 1 excerpt:

\”The 7.5%, 15 year Government bond is a good proxy for the discount rate, so we will use the same.

Present value = 6,500,000/(1+7.5%)^(15)

= Rs.21,96,779/-\”

My question is why have we not added 1.5%-2% risk premium to the 15 year Government bond rate in section 3.5 but added it in above sections (3.2 & 3.3).

Hope this clarifies.

Understood, thanks for the clarity. There is no problem in adding the risk premium in 3.5, especially if you want to be super cautions. But in general, when estimating FV of money, you use the inflation as reference. But when making investments (3.2 and 3.3), you also want to be compensated for various risks.

Hello Karthik,

Thanks again for a useful chapter. I have one doubt in this:

While discussing present/future value, the risk premium has been added to 15 year Government bond coupon rate.

However, in the section on real life applications, we\’ve used the coupon rate directly without considering risk premium in either example.

Is there any reason for this?

Many thanks,

Ankit

Ankit, I\’m not sure what this means – \’While discussing present/future value, the risk premium has been added to 15 year Government bond coupon rate.\’, isit possible to point to the exact section where we have discussed this? Thanks.

Hi, I had a question regarding time value of money. Let\’s say I have 10,000 rs today and the future value of the money for a discount rate of 7.5% after 5 years is 1,64,000. So that means the future value of money for an amount of 10,000rs today without any sort of investment is 1,64,000 right?

Thats right, but when you take 7.5%, that means the investment yields so much return. Btw, please double-check the calculation again.

Sorry where is personal finance part 2 ?

Hopefully by the year end.

When you write gain of 4,50,000, does it not mean gaining 4.5 more than the actual amount?

Thats right, Rini.

Hi Karthik,

I have observed in comment section in one of the artice here, you mentioned that index fund needs hyper long term like 15 years to see the compounding and atleast 10 plus years for equity growth fund to see the compounding impact. I have couple of questions

1) Most of the fund managers are having hard time to beat the index fund, how is the compounding impact years(10+) for growth equity fund can be less than index fund which needs hyper long term invested (15+) ?

2) Why index fund needs hyper long term ? this is also going to be 100% equity right ?

3) One personal situation question, Lets say i am investing monthly 50000 for next five years in mutual fund, and stopping my investment after 5 years from now and holding my investment for upto 10+ years from today. Will that be useful to see the compounding effect on the invested money or it wont be that useful since i stopped my SIP after 5 years ?

4) If the above situation will work in favor of compounding , what type of fund you would suggest for my case ?

1) Sorry, I\’m unable to fully understand your query. Can you add more context here? Btw, both index and equity funds require at least 10+ yrs of investments

2) Yes, any equity-oriented funds needs time, this is the only way to deal with volatility

3) Yes, it is possible

4) Equity growth.

Hi sir , I\’m confused in this part, please clarify it. It was written Opportunity cost = Risk free rate + Risk premium , but again in the key takeaway points it was written Discount rate = Opportunity cost + Risk premium .

Sorry, I\’ll fix this. Basically, the opportunity cost should be equal to the risk-free rate + risk premium. The discount rate should be the opportunity cost.

Great Stuff! These articles without too much jargon is very helpful

Happy learning 🙂

Hi Karthik,

While calculating future value, do we take into account the inflation or the opportunity cost?

The reason I\’m asking this is because the opportunity cost may be 9 %, while the inflation may be in the range of 5-6%(have taken historical CPI values) and the final figure will change significantly depending on which variable we take.

Thanks,

Dhairya.

In this case, just inflation is good enough.

Minor correction –

This means, the present value of Rs.75,000,000/- is Rs.20,590,353/-. In other words, Rs.75,000,000/- in today’s terms is the same as Rs. 20,590,353/- in 15 years.

Should be –

This means, the present value of Rs.75,000,000/- is Rs.20,590,353/-. In other words, Rs. 20,590,353/- in today’s terms is the same as Rs.75,000,000/- in 15 years.

I will re-check this again. But – In other words, Rs. 20,590,353/- in today’s terms is the same as Rs.75,000,000/- in 15 years ——> this can be incomplete without stating the growth rate 🙂

Really, a very eye-opening topic for me.

Thank You Sir.

Good luck, Asit.

Present Value = Rs.3,78000/-

Dear Sir, I am responding to your interesting question : \”Now, here is something for you to think about – how will you solve the above problem by applying the concept of the present value of money\”. I calculated as follows :Final Amount = Rs 4,50,000 Initial Amount = Rs 2,00,000 …. So Growth Rate = 5.6%, which 2 % lower than offered by Govt Bonds.

It appears correct, Sanjay 🙂

please correct typo : Time = 15%

Checking on this.

Typo at \’Time = 15%\’.

Checking this.

The article is useful.could you please provide the link for Here is a snapshot of all the available Sovereign bonds and also where do we see 7.5 interest rate in the link.I do not find in screenshot

Here you go – https://www.ccilindia.com/OMMWCG.aspx

Hi Karthik,

I think there is an error in \”Key takeaways from this chapter\” sixth bullet point

The discount rate = opportunity cost + risk premium

It should be discount rate =opportunity cost = risk free rate + risk premium

I hope I am correct

Regards

Ah, thanks for pointing that Yogesh.

Sir in real estate example we purchased for 1,50,00,000 but the real present value is20,590,353 then I should be buying the land which is cheaper than present value of 20,590,353 that is 15000000

Sorry, can you share more context, please?

You need to be a little careful when using terms. In an example above you say, invest 200000 today to get a gain of 450000 in 15 years: this would mean that in 15 years you get back 650000 (principal amount plus gain).

Sure, will keep this in perspective.

Thanks for explaining it so brilliantly sir.

Any plans for introducing video-based-materials. It\’s easier to retain knowledge there. You can even charge for it as it\’s the preferred mode of learning nowadays.

Hopefully in the future 🙂

You are the best teacher in my life.

sale school aur college ke teachers ne to chutiya hi kaat diya

NO one taught us the concept of money .

Thank You Sir 🙂

Happy learning, Tushar 🙂

Hey Karthik,

Are those additional \”J\” intentional or just typos?

Does it signify anything?

J is supposed to be a smiley, but it sometimes renders wrongly 🙂

So discount rate >= opportunity cost ???

Yes, you can think of it that way.

Hello Sir,

This question might not relevant to this module. But anyway I want to ask.

I have stucked in endowment policy. I already paid 4 premium. I need to pay for 6 more years and it will cost me around 1.5 lakh.

Future value of same after 20 years will be 3.00 lakh.

If I surrender I will get half amount which I invested now.

Is it wise to continue?

Thanks

Now that you\’ve started, please complete it. No point stopping.

Hello sir,

I really want to thank you for provide us readers with such amazing content, that too free of cost. You are truly making us financially smart!

I just noticed, in Mod 11 Chap 3 Section 3.2, the present value of Rs. 75,00,000 15 years from now is mentioned as 20,590,353. It seems there is a calculation error and it should in fact be 2059035, that is worth less, instead of worth more.

Please guide, I am may be wrong, but if I am, chances are I haven\’t got the concept correctly.

Thanks!

Kavita, I doubled checked, the value mentioned in the chapter is correct. Can you try doing the math once again?

Hello, thanks for the awesome vlog!! could you send me some links where i can find the risk free interest rate to find the future value of money at present. sorry if the question is obvious 🙈, I am just starting out with my career and finances. Thank you!!

Manas, the risk free rates are available on RBI website, check this – https://www.rbi.org.in/home.aspx

I am a client of Zerodha with Client Id OS9851. Would it be possible for you to send all the modules to me? I am sure, this is a package freely offered for opening of Zerodha Account.

From Module 11 onwards why there is no download option?

Thanks in anticipation. Whatever the mail Id provided above is the official mail for the Account, this is for your information.

No, we dont send this to any one. All the content is available online for you to read anytime you wish.

This is great. I figure, you calculated opportunity cost % by looking at the presently available risk free return product for immediate investment. Can we take PPF into account for that?

Also, I did not understand concept of premium 1.5-2 % addition to opportunity cost. How does that work?

Yes, you can take PPF as a proxy. The additional premium is for the risk you take.

Thank you sir for this informative article,but is there a way to have this Module as a pdf file like the other Modules?Thanks again.

This is still work in progress Rasheed, will upload when the module is ready.

Thanks Zerodha Team for such a wonderful Ocean of Knowledge in Financial markets. Thanks a ton.

Please share your guidance on \”Options buying Strategies- Technical Analysis for options buying\”

Sagar, I\’d suggest you read up the two module on options we have on Varsity.

What is the merit of Government Provident Fund considering 7 percent compound interest rate which is tax free? Should it be one of the preferred option for government sector which still have pension option?

It is not bad considering the Govt Guarantee. I will do a chapter on NPS and PF soon.

Thank you for the reply. Regarding Short term investments to attain goals for the near future , which type of investments would suffice us , as per your modules on MF is mostly about long term investments.

It will be a mix of short-duration debt. Will be addressing this soon.

Sir, I am government employee so it is mandatory for us to invest in NPS teir 1 , I will have 37 years of service so is this a better way of investment for long term purpose or else i need to plan any other investments plans especially for long term purpose. Kindly reply me. Thank you.

NPS is a great investment option. The overall goal of your investing should be based on your portfolio goals.

Also compounding is only applicable in stock market correct ? Or where else we could make our investment to reap the benefits of compounding ?

It is applicable to all aspects of investing, Mahesh.

Hi Karthik,

Should every investment be looked from time value & compounding returns perspective, before a decision is made ? Also compounding is only applicable in stock market correct ? Or where else we could make our investment to reap the benefits of compounding ?

Yes, although these may not very tangible for investments in short duration assets (debt funds), which we have introduced later in the module.

No download option Sir

This is work in progress, will have the PDF once it is complete.

Hello Sir,

If I and not wrong, there is a typo under 3.2 below this formula.

Present value = Future value / (1+ discount rate ) ^ (time)

So the Time should be 15 years, Instead of 15%

Thank you so much for the easy way you have explained 🙂

Ah, yes. Will fix that 🙂

hello sir,

thanks for taking your time and explaining these concepts for free i am really grateful to you.

can you tell how can i find the actual or latest risk free rate and risk premium , i mean where should i look for it on the internet.

Take the bank FD rate, that\’s an approximate reference.

How can we calculate Risk premium exactly can you give some formula for the same or more insight about Risk premium as i\’m not able to get it clearly?. How have you arrived at 1.5 -2 % in your stated example?

We will be revisiting this topic again later in this module, hopefully that will clear your doubts.

In this module we have being talking about the present value and future value of the lump sum investment says 1L ,1CR .

but do these concepts really applicable to investments in SIP mode . say 10k every month for 15 years ? .

Yes Sir, it does.

Why there is no download PDF option in this module

Sir…no PDF until the module is complete.

Hi Karthik,

But how to calculate the intrinsic value of shares? Is there any formula?

You can do that by doing a financial model. That\’s the agenda of the next module.

Hello sir,

How to calculate the discount rate, risk-free rate, risk-free premium? Are these rates depends upon inflation?

Depends on the inflation and the risk-free rate prevailing in the economy, Vedant.

Sir

This is only a suggestion, can you please write your articles with Lacks as the basis instead of millions. For a senile person like me, who loves to read your articles, it takes up lot of time in deciphering which is crore and which is 10 lacks.

Boss also write about ETF (if possible) and is this product good to park a portion of the retired corpus in ETFs. I put in a small amount in NIFTY ETF and though markets fell badly (19.09.2019), the impact on the ETF is not drastic. I do not believe in Mutual Funds at all (debt MF). These are the guys who were paid to ensure our money was professionally managed, do proper credit assessment, but it seems they just invested based on rating agencies.

Please advise.

Ninan

Regards

Ninan

Glad to know that you like reading the article here 🙂

I don\’t think I write this keeping the million in the denomination. Prefer Crore as Indians are used to this. But will try and see if I can tweek this. ETF and indexing is a core concept, I will write about this.

Hii, Team Zerodha. The whole chapters have made me knowledgable about investing in equities.

\”I appreciate for your this work.\”

But, I want to know about \’MUTUAL FUNDS\’ and \’SIP\’. So my concepts will get cleared about these topics

Sharvin, the same will be available here soon – https://zerodha.com/varsity/module/personalfinance/

Dear sir ,

recently i have been reading about the ETF and i have the doubt regarding it.

for example the nifty index has 50 companies listed in it and it tracks their performance. and similarly the niftybees(ETF) try to replicate the nifty index movement. suppose in a year, one of the company gets de-listed form the index and the new company takes it place . then what will happen to the valuation of ETF in this case. As ETF tracks one of the de-listed companies and no the new one.

The ETF company will track the new one. The ETF is an exact mirror image of its underlying.

Karthik I have been a successful trader since the last 6 months thanks to 3 strategies of your I\’ve been able to implement. I\’m curious to know, what is your portfolio of Trading Strategies? Can you let us know? Which strategy do do you use most often? Thanks.

I\’ve stopped active trading, simply because I\’m unable to find the time it requires. I invest in stocks and follow FA which I\’ve discussed here – https://zerodha.com/varsity/module/fundamental-analysis/

I can see learning pdf are available for all modules except last module i.e. Personal Finance. Pl hele me to download

PDFs will be made available once the module is completed, Mayur. This module is just getting started.

Also I do have another request. I think it would be best if you could tell us what you have not covered in Varsity Karthik. I was applying the FA the way you do it (and with very good results – thank you for that), but I did recently learn there are other ways of investing like Contrarian Investing or Quantitative Investing. Do you think you can, at the end of a module, give us pointers towards whatever you have not covered in that module about that topic? Thank you.

I\’ve addressed QA bit here – https://zerodha.com/varsity/module/trading-systems/ but yes, I\’ll share pointers on what else can be done at the end of each module.

Hello Karthik. I hope you\’re doing well. I wanted to ask you, which Investor\’s style do you think is the closest to your investing philosophy and the same with Trading too. Which trader do you think is the closest to your style of trading? Thank you.

I personally believe there are no two investors alike 😉

Also I do have another request. I think it would be best if you could tell us what you have not covered in Varsity Karthik. I was applying the FA the way you do it (and with very good results – thank you for that), but I did recently learn there are other ways of investing like Contrarian Investing or Quantitative Investing. Do you think you can, at the end of a module, give us pointers towards whatever you have not covered in that module about that topic? Thank you.

Karthik I had asked you if it would be possible to come up with a list of suggested reading at the end of each chapter and you said you would. Can you tell me if you\’re still working on it?

Also for the time being, can you let me know which book to read on building a Trading Strategy? Ie. More about the process of building and back testing and all that stuff?

can we expect volatility based trading system anytime soon, Karthik?

Hari, the current focus is on personal finance. Maybe after that.

Hi, Thanks for your extensive work.

Can you put a topic on NPS.

Regards

Aswin

Yes, we will, Aswin. Thanks.

Hi Sir,

For more than two years I am trading with Zerodha. Varsity is something I come back again and again to refresh my learning and to learn new things.

Sir, I have a humble request here. Teach us something about accounting. Or clarify whether a rookie trader should start maintaining his accounts atleast in the form of a cash books. At the end of the day when I try to make trading as my profession, I would like to know how to build a balance sheet, P&L statement, Cost accounts for my trading. I right now manage a cash book. I still wonder how to make entry of span and exposure margin in a cash book. Any Business will not be complete without accounting. Hope you will come up with some module on that

Vinoth, this is a great idea. I\’m not sure if I\’m the right person for this but will try and find someone for this.

https://twitter.com/jackschwager/status/1164393776216854528

Would love to see you in the new Market Wizards book Karthik. I certainly know you\’re qualified to be in there.

Lol, no Sundeep I\’m not 🙂

Dear karthik ji

Thanks for your reply,

I will wait for your recommendation on Elliot wave .

Sincerely

Sir I will be waiting for the chapter on this , for the time being can you provide me with the site or the article so that i can understand/learn how it works

Let me check for good online links, Prashant.

Dear Sir ,

Can you explain what is LIQUID BEES and is it good for the retail investor to park the excess cash in this instrument rather than the bank account?

Think of liquidbees as the equivalent (or better) than parking your money in the bank account and earn a savings account return. I\’ll try and include a chapter on this.

Karthik may I ask why isn\’t SLB services disabled in Zerodha? Can you tell me when it will be available for traders to use? Thank you.

Sundeep, we don\’t have SLB yet on Zerodha. It is on the list of things to do.

Dear karthik ji,

I am very thankful to you that you took notice of my request of making a module on future cost/value of money. This is a great chapter and it will definitely help me and others for achieve financial goals in their life.

I was busy in last few days in accumulating RIL before AGM results. . So didn\’t have opportunity to visit varsity.

You have done a wonderful job as always in explaining such complex topic in such a easy way.

I may sound greedy if i ask more but since you are so helpful , i am requesting you to explain theory, forms and learn to draw \”Elliott waves \”. If there is some good book available on this topic plz recommend ( i have average financial knowledge but can very work hard to understand any financial term needed) .

I am trying to learn it , and it a very complex but very strong tool which can help me and others in this financial jungle.

I have knowledge of Candlestick and use DMA (50, 200), Pivot points, MACD, Stochastic and volume chart for intraday and swing trading. I also thanks to Zerodha work such nice and wonderful trading platform and very low charges.

Again many many thank you and all Zerodha team for making retail traders and investors so knowledgeable.

Sincerely

ashish mourya

Ashish, thanks for the kind words and I\’m really glad that you like the content on Varsity.

Unfortunately, I\’m not too familiar with EW analysis. I somehow did not learn this and frankly, I don\’t know if I\’ve missed much. However, let me try and put some research and try and find you lead for good online content on this topic. Thanks.

Is there any way to get the hard copies of all the modules?

Unfortunately, we do not have hard copies of this. You can download the PDFs though.

If possible please point me toward some good reading material on Corporate Bonds sir. Thank you.

Sir what is the best place to buy corporate bonds in India? Are you planning to put up a chapter on the same in near future? Thank you.

You can buy the Government bonds and bills here – https://coin.zerodha.com/gsec, however, if you are specifically interested in corporate bonds, then you should check this – https://www.goldenpi.com/home

Thank your Sir. I am looking forward to get the next chapters as early as possible.

Your first chapter in personal finance was very interesting and it encouraged me through that 3 sisters example.

Thank for replying,

Vikrant 😉

Glad to know that, Vikrant. Will try and publish soon.

Dear Sir,

While calculating the time value of future did you consider the inflation rate? or the discount rate is the inflation rate?

Please make me clear about it. i am little bit confused about it.

I am well aware about the compounding effect of money by using compound interest rate (CAGR) which should be at least equal to or more than the inflation rate.

Please clear it to me.

Thank you.

Thats right, Vikrant. However, I\’ve not really taken inflation into consideration here, at this point, the idea is to just demonstrate the application of the math. We will get into the inflation part later in the module.

The problem solved by using the present value of the money

future value = Rs.4,50,000

risk free rate of return= 7.5%

no of years = 15

present value = 4,50,000/(1.075)^15

=Rs 1,52,084.70

Thats right! So if instead of Rs.200,000/- the offer was for 1.52L, then it would be a fair deal 🙂

Dear Karthik sir

Happy news that new chapters are flowing….thanks a lot….sir if u could consider a few chapters on mutual funds it would be helpful..

Thanks a lot once again to zerodha & to you for all ur efforts to enlight us from within…..

With regards

Vivek

Thanks, Vivek. MF will form a core part of this module 🙂

sir chart patterns about triangle pattern , flag patterns, rising wedge, bilateral patterns, falling wedge, bullish wedge .

where can we find this chart patterns sir . and how can we analysis

Ah, you mean the dow patterns. I have discussed a few in the TA module. Maybe you should check that.

hai sir interesting topic . next topic sir ?

will you teach about chart patterns and breakouts

Will try and put up the next topic soon. Charts and other aspects of TA is already explained here – https://zerodha.com/varsity/module/technical-analysis/