19.1 – Volatility Types

The last few chapters have laid a foundation of sorts to help us understand Volatility better. We now know what it means, how to calculate the same, and use the volatility information for building trading strategies. It is now time to steer back to the main topic – Option Greek and in particular the 4th Option Greek “Vega”. Before we start digging deeper into Vega, we have to discuss one important topic – Quentin Tarantino ☺.

I’m huge fan of Quentin Tarantino and his movies. For people not familiar with Quentin Tarantino let me tell you, he is one of the most talented directors in Hollywood. He is the man behind super cult flicks such as Pulp Fiction, Kill Bill, Reservoir Dogs, Django Unchained etc. If you’ve not watched his movies, I’d suggest you do, you may just love these movies as much as I do.

It is a known fact that when Quentin Tarantino directs a movie, he keeps all the production details under wraps until the movies trailer hits the market. Only after the trailer is out people get to know the name of movie, star cast details, brief story line, movie location etc. However, this is not the case with the movie he is directing these days, titled “The Hateful Eight”, due to be released in December 2015. Somehow everything about ‘The Hateful Eight’ – the star cast, storyline, location etc is leaked, hence people already know what to expect from Tarantino. Now given that most of the information about the movie is already known, there are wild speculations about the box office success of his upcoming movie.

We could do some analysis on this –

- Past movies – We know almost all of Tarantino’s previous movies were successful. Based on his past directorial performance we can be reasonably certain that ‘The Hateful Eight’ is likely to be a box office hit

- Movie Analyst’s forecast – There are these professional Hollywood movie analysts, who understand the business of cinema very well. Some of these analysts are forecasting that ‘The Hateful Eight’ may not do well (unlike his previous flicks) as most of the details pertaining to the movie is already, failing to enthuse the audience

- Social Media – If you look at the discussions on ‘The Hateful Eight’ on social media sites such as Twitter and Facebook, you’d realize that a lot of people are indeed excited about the movie, despite knowing what to expect from the movie. Going by the reactions on Social Media, ‘The Hateful Eight’ is likely to be a hit.

- The actual outcome – Irrespective of what really is being expected, once the movie is released we would know if the movie is a hit or a flop. Of course this is the final verdict for which we have to wait till the movie is released.

Tracking the eventual fate of the movie is not really our concern, although I’m certainly going to watch the movie ☺.

Given this, you may be wondering why we are even discussing Quentin Tarantino in a chapter concerning Options and Volatility! Well this is just my attempt (hopefully not lame) to explain the different types of volatility that exist – Historical Volatility, Forecasted Volatility, and Implied Volatility. So let’s get going.

Historical Volatility is similar to us judging the box office success of ‘The Hateful Eight’ based on Tarantino’s past directorial ventures. In the stock market world, we take the past closing prices of the stock/index and calculate the historical volatility. Do recall, we discussed the technique of calculating the historical volatility in Chapter 16. Historical volatility is very easy to calculate and helps us with most of the day to day requirements – for instance historical volatility can ‘somewhat’ be used in the options calculator to get a ‘quick and dirty’ option price (more on this in the subsequent chapters).

Forecasted Volatility is similar to the movie analyst attempting to forecast the fate of ‘The Hateful Eight’. In the stock market world, analysts forecast the volatility. Forecasting the volatility refers to the act of predicting the volatility over the desired time frame.

However, why would you need to predict the volatility? Well, there are many option strategies, the profitability of which solely depends on your expectation of volatility. If you have a view of volatility – for example you expect volatility to increase by 12.34% over the next 7 trading sessions, then you can set up option strategies which can profit this view, provided the view is right.

Also, at this stage you should realize – to make money in the stock markets it is NOT necessary to have a view on the direction on the markets. The view can be on volatility as well. Most of the professional options traders trade based on volatility and not really the market direction. I have to mention this – many traders find forecasting volatility is far more efficient than forecasting market direction.

Now clearly having a mathematical/statistical model to predict volatility is much better than arbitrarily declaring “I think the volatility is going to shoot up”. There are a few good statistical models such as ‘Generalized AutoRegressive Conditional Heteroskedasticity (GARCH) Process’. I know it sounds spooky, but that’s what it’s called. There are several GARCH processes to forecast volatility, if you are venturing into this arena, I can straightaway tell you that GARCH (1,1) or GARCH (1,2) are better suited processes for forecasting volatility.

Implied Volatility (IV) is like the people’s perception on social media. It does not matter what the historical data suggests or what the movie analyst is forecasting about ‘The Hateful Eight’. People seem to be excited about the movie, and that is an indicator of how the movie is likely to fare. Likewise the implied volatility represents the market participant’s expectation on volatility. So on one hand we have the historical and forecasted volatility, both of which are sort of ‘manufactured’ while on the other hand we have implied volatility which is in a sense ‘consensual’. Implied volatility can be thought of as consensus volatility arrived amongst all the market participants with respect to the expected amount of underlying price fluctuation over the remaining life of an option. Implied volatility is reflected in the price of the premium.

For this reason amongst the three different types of volatility, the IV is usually more valued.

You may have heard or noticed India VIX on NSE website, India VIX is the official ‘Implied Volatility’ index that one can track. India VIX is computed based on a mathematical formula, here is a whitepaper which explains how India VIX is calculated –

If you find the computation a bit overwhelming, then here is a quick wrap on what you need to know about India VIX (I have reproduced some of these points from the NSE’s whitepaper) –

- NSE computes India VIX based on the order book of Nifty Options

- The best bid-ask rates for near month and next-month Nifty options contracts are used for computation of India VIX

- India VIX indicates the investor’s perception of the market’s volatility in the near term (next 30 calendar days)

- Higher the India VIX values, higher the expected volatility and vice-versa

- When the markets are highly volatile, market tends to move steeply and during such time the volatility index tends to rise

- Volatility index declines when the markets become less volatile. Volatility indices such as India VIX are sometimes also referred to as the ‘Fear Index’, because as the volatility index rises, one should become careful, as the markets can move steeply into any direction. Investors use volatility indices to gauge the market volatility and make their investment decisions

- Volatility Index is different from a market index like NIFTY. NIFTY measures the direction of the market and is computed using the price movement of the underlying stocks whereas India VIX measures the expected volatility and is computed using the order book of the underlying NIFTY options. While Nifty is a number, India VIX is denoted as an annualized percentage

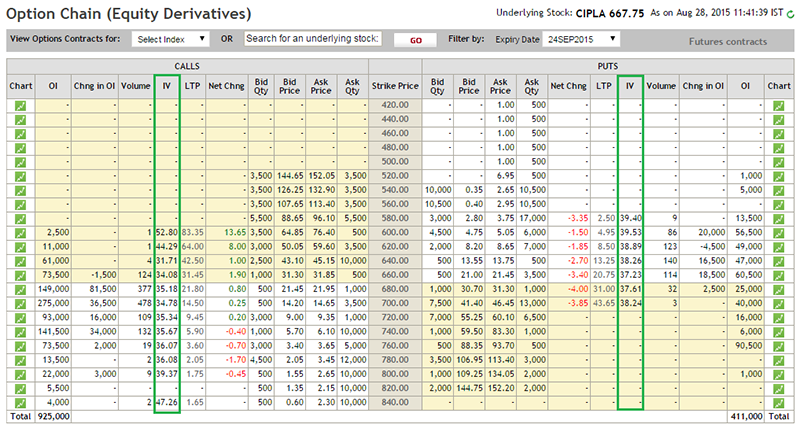

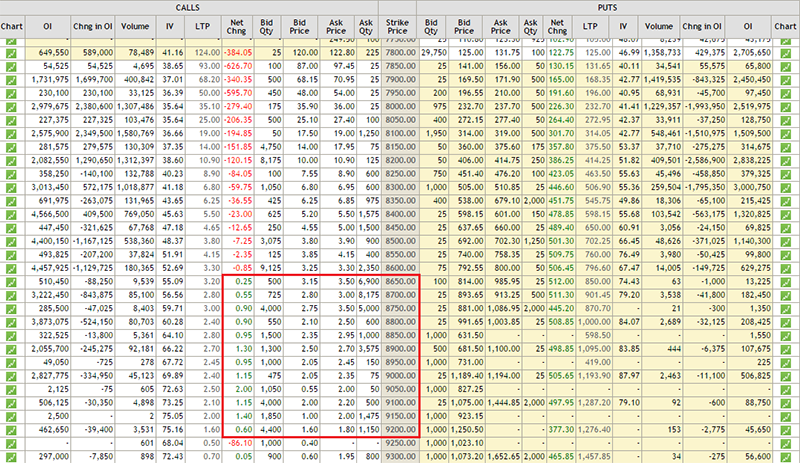

Further, NSE publishes the implied volatility for various strike prices for all the options that get traded. You can track these implied volatilities by checking the option chain. For example here is the option chain of Cipla, with all the IV’s marked out.

The Implied Volatilities can be calculated using a standard options calculator. We will discuss more about calculating IV, and using IV for setting up trades in the subsequent chapters. For now we will now move over to understand Vega.

Realized Volatility is pretty much similar to the eventual outcome of the movie, which we would get to know only after the movie is released. Likewise the realized volatility is looking back in time and figuring out the actual volatility that occurred during the expiry series. Realized volatility matters especially if you want to compare today’s implied volatility with respect to the historical implied volatility. We will explore this angle in detail when we take up “Option Trading Strategies”.

19.2 – Vega

Have you noticed this – whenever there are heavy winds and thunderstorms, the electrical voltage in your house starts fluctuating violently, and with the increase in voltage fluctuations, there is a chance of a voltage surge and therefore the electronic equipments at house may get damaged.

Similarly, when volatility increases, the stock/index price starts swinging heavily. To put this in perspective, imagine a stock is trading at Rs.100, with increase in volatility, the stock can start moving anywhere between 90 and 110. So when the stock hits 90, all PUT option writers start sweating as the Put options now stand a good chance of expiring in the money. Similarly, when the stock hits 110, all CALL option writers would start panicking as all the Call options now stand a good chance of expiring in the money.

Therefore irrespective of Calls or Puts when volatility increases, the option premiums have a higher chance to expire in the money. Now, think about this – imagine you want to write 500 CE options when the spot is trading at 475 and 10 days to expire. Clearly there is no intrinsic value but there is some time value. Hence assume the option is trading at Rs.20. Would you mind writing the option? You may write the options and pocket the premium of Rs.20/- I suppose. However, what if the volatility over the 10 day period is likely to increase – maybe election results or corporate results are scheduled at the same time. Will you still go ahead and write the option for Rs.20? Maybe not, as you know with the increase in volatility, the option can easily expire ‘in the money’ hence you may lose all the premium money you have collected. If all option writers start fearing the volatility, then what would compel them to write options? Clearly, a higher premium amount would. Therefore instead of Rs.20, if the premium was 30 or 40, you may just think about writing the option I suppose.

In fact this is exactly what goes on when volatility increases (or is expected to increase) – option writers start fearing that they could be caught writing options that can potentially transition to ‘in the money’. But nonetheless, fear too can be overcome for a price, hence option writers expect higher premiums for writing options, and therefore the premiums of call and put options go up when volatility is expected to increase.

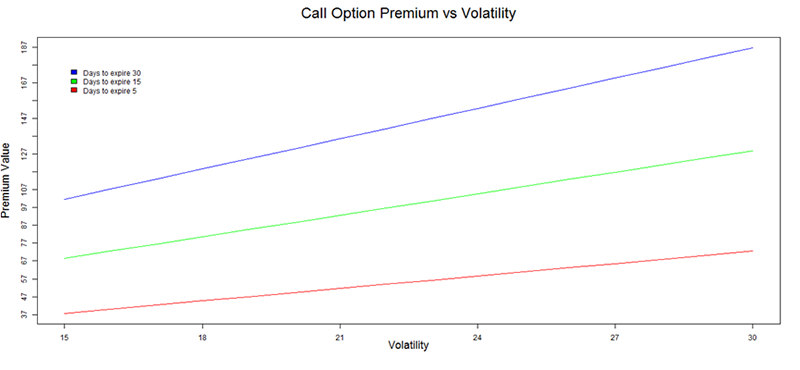

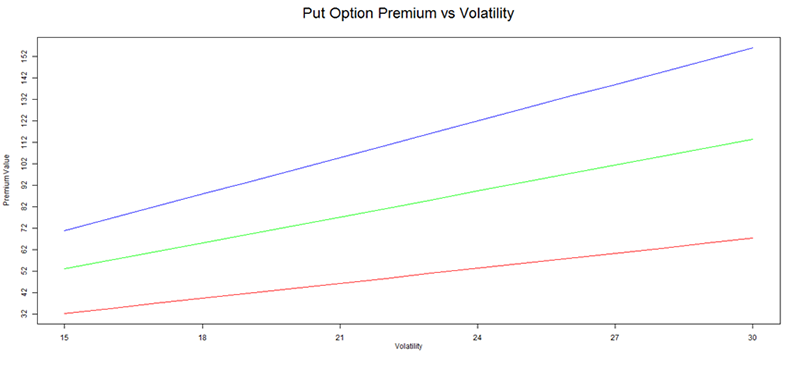

The graphs below emphasizes the same point –

X axis represents Volatility (in %) and Y axis represents the premium value in Rupees. Clearly, as we can see, when the volatility increases, the premiums also increase. This holds true for both call and put options. The graphs here go a bit further, it shows you the behavior of option premium with respect to change in volatility and the number of days to expiry.

Have a look at the first chart (CE), the blue line represents the change in premium with respect to change in volatility when there is 30 days left for expiry, likewise the green and red line represents the change in premium with respect to change in volatility when there is 15 days left and 5 days left for expiry respectively.

Keeping this in perspective, here are a few observations (observations are common for both Call and Put options) –

- Referring to the Blue line – when there are 30 days left for expiry (start of the series) and the volatility increases from 15% to 30%, the premium increases from 97 to 190, representing about 95.5% change in premium

- Referring to the Green line – when there are 15 days left for expiry (mid series) and the volatility increases from 15% to 30%, the premium increases from 67 to 100, representing about 50% change in premium

- Referring to the Red line – when there are 5 days left for expiry (towards the end of series) and the volatility increases from 15% to 30%, the premium increases from 38 to 56, representing about 47% change in premium

Keeping the above observations in perspective, we can make few deductions –

- The graphs above considers a 100% increase of volatility from 15% to 30% and its effect on the premiums. The idea is to capture and understand the behavior of increase in volatility with respect to premium and time. Please be aware that observations hold true even if the volatility moves by smaller amounts like maybe 20% or 30%, its just that the respective move in the premium will be proportional

- The effect of Increase in volatility is maximum when there are more days to expiry – this means if you are at the start of series, and the volatility is high then you know premiums are plum. Maybe a good idea to write these options and collect the premiums – invariably when volatility cools off, the premiums also cool off and you could pocket the differential in premium

- When there are few days to expiry and the volatility shoots up the premiums also goes up, but not as much as it would when there are more days left for expiry. So if you are a wondering why your long options are not working favorably in a highly volatile environment, make sure you look at the time to expiry

So at this point one thing is clear – with increase in volatility, the premiums increase, but the question is ‘by how much?’. This is exactly what the Vega tells us.

The Vega of an option measures the rate of change of option’s value (premium) with every percentage change in volatility. Since options gain value with increase in volatility, the vega is a positive number, for both calls and puts. For example – if the option has a vega of 0.15, then for each % change in volatility, the option will gain or lose 0.15 in its theoretical value.

19.3 – Taking things forward

It is now perhaps time to revisit the path this module on Option Trading has taken and will take going forward (over the next few chapters).

We started with the basic understanding of the options structure and then proceeded to understand the Call and Put options from both the buyer and sellers perspective. We then moved forward to understand the moneyness of options and few basic technicalities with respect to options.

We further understood option Greeks such as the Delta, Gamma, Theta, and Vega along with a mini series of Normal Distribution and Volatility.

At this stage, our understanding on Greeks is one dimensional. For example we know that as and when the market moves the option premiums move owing to delta. But in reality, there are several factors that works simultaneously – on one hand we can have the markets moving heavily, at the same time volatility could be going crazy, liquidity of the options getting sucked in and out, and all of this while the clock keeps ticking. In fact this is exactly what happens on an everyday basis in markets. This can be a bit overwhelming for newbie traders. It can be so overwhelming that they quickly rebrand the markets as ‘Casino’. So the next time you hear someone say such a thing about the markets, make sure you point them to Varsity ☺.

Anyway, the point that I wanted to make is that all these Greeks manifest itself on the premiums and therefore the premiums vary on a second by second basis. So it becomes extremely important for the trader to fully understand these ‘inter Greek’ interactions of sorts. This is exactly what we will do in the next chapter. We will also have a basic understanding of the Black & Scholes options pricing formula and how to use the same.

19.4 – Flavors of Inter Greek Interactions

(The following article was featured in Business Line dated 31st August 2015)

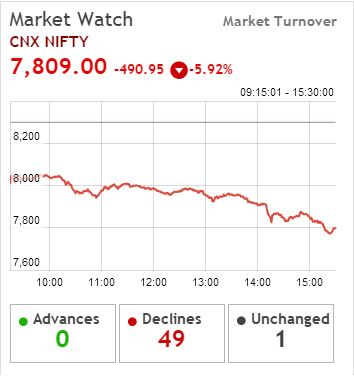

Here is something that happened very recently. By now everyone remotely connected with the stock market would know that on 24th August 2015, the Indian markets declined close to 5.92% making it one of the worse single day declines in the history of Indian stock markets. None of the front line stocks survived the onslaught and they all declined by 8-10%. Panic days such as these are a common occurrence in the equity markets.

However something unusual happened in the options markets on 24th August 2015, here are some data points from that day –

Nifty declined by 4.92% or about 490 points –

India VIX shot up by 64% –

But Call option Premiums shot up!

Traders familiar with options would know that the call option premiums decline when market declines. In fact most of the call option premiums (strikes below 8600) did decline in value but option strikes above 8650 behaved differently – their premium as opposed to the general expectation did not decline, rather increased by 50-80%. This move has perplexed many traders, with many of the traders attributing this move to random theories such as rate rigging, market manipulation, technological inefficiency, liquidity issues etc. But I suspect any of this is true; in fact this can be explained based on the option theory logic.

We know that option premiums are influenced by sensitivity factors aka the Option Greeks. Delta as we know captures the sensitivity of options premium with respect to the movement of the underlying. Here is a quick recap – if the Delta of a particular call option is 0.75, then for every 1 point increase/decrease in the underlying the premium is expected to increase/decrease by 0.75 points. On 24th August, Nifty declined by 490 points, so all call options which had ‘noticeable Delta’ (like 0.2, 0.3, 0.6 etc) declined. Typically ‘in the money’ options (as on 24th Aug, all strike below 8600) tend to have noticeable Delta, therefore all their premiums declined with the decline in the underlying.

‘Out of the money’ options usually have a very low delta like 0.1 or lower. This means, irrespective of the move in the underlying the moment in the option premium will be very restrictive. As on August 24th, all options above 8600 were ‘out of the money’ options with low delta values. Hence irrespective of the massive fall in the market, these call options did not lose much premium value.

The above explains why certain call options did not lose value, but why did the premiums go up? The answer to this is lies in Vega – the option Greek which captures the sensitivity of market volatility on options premiums.

With increase in volatility, the Vega of an option increases (irrespective of calls and puts), and with increase in Vega, the option premium tends to increase. On 24th August the volatility of Indian markets shot up by 64%. This increase in volatility was totally unexpected by the market participants. With the increase in volatility, the Vega of all options increases, thereby their respective premiums also increased. The effect of Vega is particularly high for ‘Out of the money’ options. So on one hand the low delta value of ‘out of the money’ call options prevented the option premiums from declining while on the other hand, high Vega value increased the option premium for these out of the money options.

Hence on 24th August 2015 we got to witness the unusual – call option premium increasing 50 – 80% on a day when markets crashed 5.92%.

Key takeaways from this chapter

- Historical Volatility is measured by the closing prices of the stock/index

- Forecasted Volatility is forecasted by volatility forecasting models

- Implied Volatility represents the market participants expectation of volatility

- India VIX represents the implied volatility over the next 30 days period

- Vega measures the rate of change of premium with respect to change in volatility

- All options increase in premium when volatility increases

- The effect of volatility is highest when there are more days left for expiry

Realized volatility – We will explore this angle in detail when we take up “Option Trading Strategies”. Could you please tell in which option strategy we have discussed about realized vol. I went through option strategies chapter but didn\’t find this topic.

India VIX indicates the investor’s perception of the market’s volatility in the near term (next 30 calendar days)and

India VIX is denoted as an annualized percentage.

Why these two lines contradicting to each other. If i see, India VIX @13.60. what should i consider this value as annualized number or next 30 volatility.

Hello Sir,

I was just studying the nifty50 chart on 25th July 2025 which shows a sharp Gap Down open and after that chart went down, which should reflect in option chain and It was. All ITM, ATM, and some OTM CE option was down but Deep CE OTM has given a profit upto 64-74 % . Is it the same reason that as the incident of 24th aug 2015 you mentioned above ?

And one more thing all the Deep OTM for put options was showing losses of 12-16 %.

Please Reply

Ayush, I\’ve not seen the option chain, but yes, premiums are not just dependent on the directional moves but also dependent on the volatility. So do make sure to check volatility and how that is impacting the option premium.

And why deep OTM PE showing loss I could not figure out?

Because its deep OTM 🙂

See there are various factors (greeks) at play, each exhibiting its own force on the premium. Some forces have bigger impact considered to others.

Got your Point, Thanks

Happy learning!

Still not satisfied volatility,delta and gamma each in favour of PE buyer.

hmm, which area is concern Harsh?

on 7th April 2025, entire trading fraternity knows what happened. Nifty fell more than 1000 points and Vix changed by 67%. According to your findings the call options of April Expiry should had increased. But it did not happen.

Request you to discuss the happenings on 7th April 2025.

The effect of increase in Vix is offset by the the change in delta, hence CE wont increase 🙂

Hi Karthik,

Thanks for amazing explanation provided above. Like you mentioned that due to increasing Vega and non existent delta for CE OTM options, sometimes when the underlying falls, the CE premium increase. However, I have also noticed that sometimes India VIX and the underlying both fall, however the CE premium still rises. Can you please explain this scenario.

Mayank, if both underlying price and vix falls, I\’m not sure if the CE premium increases. Unless there was a change in interest rate at the same time.

Thanks for your response Karthik, I am not able to share screenshot here, but the details of the scenario, I am talking about are mentioned below. If you can check this respond, I would be very grateful

Underlying: Bank Nifty

Option: Bank Nifty 18th SEP 52800 CE

Date: 12 September 2024

India IVX closed lower at 15:27 PM compared to 15:19 PM

Bank Nifty closed lower at 15:27 PM compared to 15:19 PM

Bank Nifty 18th SEP 52800 CE closed higher at 15:27 PM compared to 15:19 PM

Mayank, not fully getting the context. But I guess you have to see the difference between the settlement price (since its expiry) as opposed to closing price.

Hi Karthik,

For

Nifty Strike=23500

Expiry=2025-03-27 15:30:00

NSE website gives

Call Option IV=13.21

Put Option IV=17.02

and Sensibull gives

IV=13.4

Can you please confirm the reason/s behind these differences? Thank you.

Not sure, I think you will have to speak to Sensibull for the IV calculation methodology.

Would love your take on predicting volatility, especially using GARCH or any other model

Thats highly quantitative Bala. I remember we had posted an article around this, forgot which platform. Will share as soon as I find 🙂

Does premiums change only due to change in implied volatility or also because of changes in realized volatility?

Implied volatility. Realized volatility is backward looking, while implied is forward looking.

Hi karthik,Really appreciate your effort of making things understandable & sharing a valuable knowledge.I have understood the concept.But i have confusion,How can we know that at the start of the month volatility is high or low.India VIX is trading in different ranges across different months.Do we have any indication like RSI,which gives clear picture like over bought Or oversold.can you please give some detailed undersatnding on this.Thanks in advance

One easy way is to look at historical volatility and getting a sense of where Vix is today. Gives a quick perspective.

Double diagonal is positive vega strategy while iron condor is negative vega. Which strategy is good in which type of market and when to deploy them ?

Thanks.

Every startegy has its day in the market, based on the market situation. One strategy does not fit all days 🙂

Sir,

Based on what you taught in volatility section to find the range of transition for a stock during a particular period, I have prepared a small Mathematical analysis. I would like you to comment if the below could help while placing Trades (spot/Future).

Scenario: Suppose that a particular stock is falling from its high from 01.01.2020 (stock price-70) to 07.01.2020 (stock price-67).

(i) On 07.01.2020, it has given a hammer at the low with good volume and support.

(ii) The stock is backd by good fundamentals.

(iii) Annual realized volatility for 7 days calculated till 31.12.2019 is 5%. 7 day average return is 3%. Hence, lower range return 3%-5%=-2%. Thus, in general stock price on 07.01.2020 should have minimum value for 70-70*2%=68.6. However, the stock price on 07.01.2020 is 67 (black swan event).

(iv) Besides, annual realized volatility on 07.01.2020 is greater than calculated 1D annual realized volatility since the past 30 days till 06.01.2020.

Can I imply here that this type of scenario can indicate Mathematically (along with Technical & good fundamental) that the price can move upward?

Sir,

I lack the system which you have shown in Futures for Pair trading etc. Hence, I mean to ask that will it be advisable if I place trade in futures based on Technical (Directional) & taking Fundamental along with it?

Yes, but that wont be basis a pair trade, it will be a TA driven trade.

Sir,

You have discussed pair trading and few techniques in futures.

My query- Is it advisable to place trades in futures merely based on Technical analysis? Your viewpoint pls?

Ppl do that, but my advice is to keep fundamentals also in perspective.

Sir,

Is there any mathematical analysis available which will indicate if the price of a certain stock for the upcoming 1 min/1 hr/1 day/1 week is likely to make positive or negative returns?

Ah, dont think so 🙂

Sir,

Just to receive your opinion on the below:

You have shown to find range of swing of a stock/index thorugh collecting each day\’s close data and then chalk out mean, s.d and then ultimately find s.d for a day. Accordingly we then find range for a particular time frame.

(i) Will it be more accurate if we would rather collect historical data hourly basis (rather than day) data and then find range for a particular time frame?

(ii) Also, if we want range for intraday/hourly/minute time frame, will it be more accurate if we collect and consider only recent data say, last 30 days (and not the entire last year)? I am a little perplexed here.

1) Too much data can lead to noise and not necessarily good information. Thats my belief, I\’ve not backtested it. You can maybe backtest and see if you get good results with hourly data. Do share your results 🙂

2) Yes, that seems intuitive.

Sir,

In option chain, I could see \”OPEN PRICE,HIGH PRICE,LOW PRICE,CLOSE PRICE,LAST PRICE,SETTLE PRICE\” indicates?

Its the OHLC of the option premium, just like the way you\’d find for stocks.

Sir,

Suppose, on one day, India VIX value of 16. I hope it means for a year ahead. Suppose again that the time to expiry is 12 days. Then if I want to measure the volatility for 12 days , can we move ahead like – 16/sqrt 252*12

ViX is annualized, yes, you can convert it to whatever time you need by dividing it by Sq root of time.

Sir,

Like volatility helps in prediction of range for the underlying, does implied volatility figure also helps to realize the range of the underlying movement? If no,does it helps if realizing the premium range of options? I am a bit confused.

Nope, not really. But then end of the day, it is a volatility type. So it does help to some extent.

Sir,

Does technical analysis hold good in graph of Implied volatility?

Nope, not at all. Implied volatility is derived and not an asset or an underlying.

Sir,

In one area, you wrote that realized volatility is required when we try to compare today\’s implied volatility over historical implied volatility. Could you kindly elaborate here?

Today\’s realized volatility is tomorrow\’s historical volatility. So all volatility types are related 🙂

Sir,

The implied volatility changes on every day.That means the prediction of volatility for an upcoming period also changes every time. Right?

That\’s right, with change in prices, the IV also changes.

Sir,

What is the implied volatility that is published in NSE suggest? Does that suggest volatility for an upcoming month time or is it annualized?

Its based on the ATM CE and PE premium – what the market expects for the next 30 days.

Sir,

I am finding a bit difficulty in understanding the subtle differences of various types of volatility that you discussed. In between tried to get help of some material in net. Could you kindly help me with the below if I am correct?

(i) Historical volatility, Forecasted volatility and realized volatility- All are measured with respect to underlying movement.

(ii) Implied volatility- Meausred with respect to option premium pricing.

Thats correct. I think I had given a weather example to explain this, did you get a chance to see that?

Hello,

In this statement:

\”The Vega of an option measures the rate of change of option’s value (premium) with every percentage change in volatility\”.

Does \”Volatility\” here refer to the Implied Volatility or the Realized Volatility?

It refers to the implied volatility.

Dear Sir,

If the INDIA VIX is 16, does it mean that the volatility anticipated for the next 30 calendar days is 16 percent from the current value? or is it indicating an annual change of 16 percent from the current value?

\”India VIX indicates the investor’s perception of the market’s volatility in the near term (next 30 calendar days)\”

\”While Nifty is a number, India VIX is denoted as an annualized percentage\”

– I am slightly confused with the above statements. Many thanks in advance

Its 16% annual, you will have to scale it down to the time frame you are interested in looking at.

Sir.. I am nither a programmer nor a statics student… Can i forecast volatility by using GARCH model?? If yes then how?? If no then what is required to do this?? Also suggest me some study material where I can understand GARCH model in a lucid manner..

That would be really tough. But maybe you can try on Excel.

Dear Mr. Karthik, Thank you very much for your prompt response. Basically, I was comparing your statements as stated in the module against 2 other sources. There is a difference in terms of the Vega value for OTM options. Thank you

Sure, good luck John. I\’ll dig this again as well 🙂

Dear Mr. Karthik,

Thank you very much for sharing with us so many of your in-depth and informative articles on Options. To date, you have been the only writer who has been able to provide very unique perspective on Options from a practical approach.

Regarding your following 2 statements in your Modules on Vega:

“The effect of Vega is particularly high for ‘Out of the money’ options”

“High Vega value increased the option premium for these out of the money options”

However, based on the following 2 sources (as attached below), Vega is lowest for OTM and ITM which is different from your above-mentioned statement.

I seek your kind enlightenment.

Thank you

https://www.macroption.com/option-vega/

At the money options have greatest time value and highest vega. Options further away from the money to either side (ITM, OTM) have less time value and lower vega.

https://www.merrilledge.com/investment-products/options/learn-understand-vega-options

Vega is centered around ATM options and falls as it moves OTM or ITM.

Thanks John. Let me review my content again, but these are graphs inferred from B&S model, so I\’m fairly certain about it, but no harm double checking i guess 🙂

Just let me know what are the statistical models are used for predict price of an instrument?

There are many, Suman. One of the most common method involves regression models.

but I could not find trailing sl for delivery trades in kite app

You can mentally trail the stoploss.

Hello karthik sir,

As an aspiring trader, market participant and a varsity learner , my job is to find oppurtunities in the markets, identify the probability of risk and reward (like for bullish position , we need to find the stocks that are in downtrend and a reversal candlestick pattern like bullish engulfing/morning star and hammer with good volumes and take the long trade with determined target and stoploss. But when after exiting , reaching the target price, the stock moves up a lot. If I book profit or book a loss, I am happy but when I see it is going up even after reaching the target, it\’s causing some pain in the mind disturbing the mindset while taking trades, decreasing the confidence level. How to handle this ?For example , I bought voltas for a swing trade at 797 , sold at 870 with a risk to reward of 1:10 now it is above 900rs within a month. It happened with me in several stocks like idfc first bank, irfc , syrma sgs.

I totally understand and it does happen to all of us. One easy way to deal with this is to deploy something called as a trailing stop loss, where you trail your profits and not sell everything at once. Keep pushing the stop loss and let the position move along.

Thank you for putting in so much effort in designing these learning modules. I am a newbie to the markets and have learnt immensely.

Glad to note that, Nandan. Happy learning 🙂

Thanks. That is what I was trying to infer – if Put IV is higher, there is higher Put buy demand vis-a-vis Call buy demand generally by bigger hands, isn\’t it? Conversely or another way to look at it, bigger hands are interested in selling calls aggressively vis-a-vis Puts. I know nothing is certain in the markets, but isnt this the likely scenario that causes this IV or pricing imbalance?

Yes, these are demand-supply forces at play, Jatin and they do tend to impact the IV. Btw, another factor to consider is the liquidity of the contract as well. Lower the liquidity, higher the IV.

Hi Karthik – I cannot thank you enough for the great content, presented in a super-simple format. I have a very lame and basic doubt. I have seen several times in the option chain that the IV for the call and put options vary significantly for same (ATM) strike price or equidistant OTM options. e.g. today, 19th Jul, 10.35 am, below are IVs. If, say, Put IVs are relatively much higher than Call IVs for equidistant OTM strikes, can we assume that it is \’likely\’ that fear is higher on that side (e.g. Put in this case), and hence, market unlikely to go up? If not, what could be the reason for such large differences?

Nifty Spot – 19806

19800 Call – IV – 13.96

19800 Put – IV – 16.3

20000 Call IV – 14.07

19600 Put IV – 19.04

Thanks Jatin, glad you liked the content. Each strike has a its own demand and supply situation, which tends to impact the strike specific IVs, hence the difference.

what is GARCH model??

can you please provide some insights.

Its a statistical method used to make volatility predictions.

hello karthik,

nice article . can you help me with relation of strike prices and volatility. as you mentioned at OTM options volatility was high

Nikhil, I have discussed this in detail in the later chapters. Request you to kindly check that. Thanks.

Hello karthik sir!!!

Vega is generally highest and lowest for which type of options- OTM,ATM,ITM ?

Also, with the increase in volatility, vega increases the most and least for which type of option- OTM,ITM, ATM ?

Closer to expiry, it\’s for ATM strike. Also, with an increase in volatility, its always the ATM which reacts the most. Do check the chapter, I\’ve discussed this in detail.

Karthik Sir

why implied volatility of options (of nearby expiry date ) increases near expiry date ( when compared to far away expiry ) & highest on expiry date ?

Karthik Sir ,

why implied volatility of options increases near expiry date ( when compared to options with far away expiry date ) & highest on expiry day ?

thank you

The non-mathematical explanation is that as expiry approaches, there is greater uncertainty (especially for ATM options) to transitioning to OTM or ITM. Hence the volatility tends to increase.

Sir you have said IV of option strikes can be calculated, please tell how that is done, or maybe i misses something.

As I mentioned, this can be done using the B&S calculator.

Sir u have IV of option strikes can be calculated, please tell how that is done, or maybe i a missed something here.

You\’ll need to use a B&S calculator for this Sagar.

As IV is usually more valued, isn\’t it a good idea to use Implied Volatility (IndiaVIX) to use for the calculation of the underlying\’s range for \’x\’ number of days? Instead of Historical Volatility?

You need a time series of volatility, that\’s why we look at historical vol.

And oh, did I mention this – Amazing content so far. This is the 5th module I am reading and I must say all these modules are very well written and easy to grasp. I can only imagine the sheer work that the author has put in to simplify and organise everything. Wonderful !!!

Thanks for the kind words, I hope you continue to enjoy learning on Varsity!

Everything being said, one important thing to note here is – Quentin Tarantino, getting a lifetime pass for directing Pulp fiction.

Hahah, I agree 🙂

Hi Kartik, In section 19.2 towards the end, you have written that, ‘for each % change in volatility the option will gain or lose 0.15 of its theoretical value’. It implies that the option value may decrease too. How is this possible if vega is always positive. The gain/lose mentioned above does it pertain to value of vega or premium value of the options.

So vega is positive, if the volatility increases, so does the option premium and if the volatility decreases, so would the option premium. For example, volatility moving from 15% to 20% increases the option premium and a decrease from 20% to 16%, which tends to lower the option premium.

Sir,

You said\”to conclude that the present IV for a particular stock is high or low,you need to calculate daily historical volatility and convert it to annual volatility and compare.\”

Sir instead of calculating it by ourselves through Excel,is it ok to use the ones given in NSE website,is there accuracy or any other issues with it

2.sir i donno whether this question makes sense or not,why Implied Volatility in the options chain is Annualized 1 SD if it is the volatility that the market expects over the next few trading sessions

You can actually look at the ATR indicator to get a sense of where the volatility is. That is how volatility is measured 🙂

Sir,

1.daily SD is also the realized volatility and Implied Volatility in the options chain is Annualized 1 SD

Sir,are these statements true ?

How come these are calculated in terms of SD?and also Sir,what is meant by intrinsic volatility?

2.\”volatility based on how much high/low stock went from opening price is intraday volatility. There are quant models to forecast that.It can be looked upon as a method to predict the intraday volatility.\”

Sir,is this true?if yes

How come one know a day\’s high/low until the close of the day?So how does forecasting intraday volatility works?

3.And also,on 24th August 2015 the decline in options premium wasn’t proportional to the decline in spot due to the fact that All options increase in premium when volatility increases,is it correct,sir?

1) Implied volatility is the volatility that the market expects over the next few trading sessions

2) Yes. Your models will consider the previous day\’s high and low and predict intraday vol for today

3) Yes, that\’s correct.

Sir,searched throughout the chapter as you told,but couldn\’t find answer for the question \”Why the effect of Vega is particularly high for ‘Out of the money’ options.\”is it because they have low delta.Sir,Can you please help me with this

And also,on 24th August 2015 the decline in options wasn\’t proportional to the decline in spot due to increase in volatility which eventually increases premium,Am i correct?

Yes, lower delats, and also low probability of expiring ITM. Do check my previous comment.

Sir,

Is it possible to delete or edit a comment?

Dont think you can.

Sir,

This question is in relation to the query i just raised,

\’when calculating using the option calculator vega is higher for OTM compared to deep OTM.\’

But sir,as deep OTM options have lower data,they decline less than OTM options,hence more rise.

Is it so,sir?

You can also think about this from probability perspective. Deep ITM or deep OTM have higher degree of certainty in terms of expiring ITM and OTM respectively. So change in volatility (unless its super large change) does not really impact the outsome of these options. But on the other hand, change in vega impacts the borderline options i.e. ATM and in and around ATM options.

Sir,

Why the effect of Vega is particularly high for ‘Out of the money’ options. And also did the rise in volatility limited the decline in call options strike below 8600 to any extend

Hmm, we have discussed this in the chapter itself no?

Ok sir got it. Thanks.

Good luck!

Sir, suppose I have bought 17600 CE and the volatility of PE side increases because more people are now feeling bearish.

Then should I exit my position immediately and go with people\’s perception or wait with the hope that Nifty will go up?

Please advice.

Sandeep, that\’s a tricky call to be a contrarian or go with the crowd. It depends on your reading of the market and how convinced you are on the outcome. Very hard for me to advice you on what you should do 🙂

Thank you very much sir.

Happy learning!

Sir, then what could be the reason for demand and supply increasing for this PUT side IV?

As you say that such events occur often, generally speaking why does demand and supply increase for one side IV of the same strike

as compared to the other side?

Thanks

If traders feel bearish over the next few days, then they can probably buy and sell more PUTS, thereby increasing the OI for puts, and hence the demand-supply dynamics would impact the IV.

Sir, many thanks for your explanation. I have some doubts..

1. In this case since the PUT side IV has gone up, can we say that more people are expecting price reversal?

2. Do such events occur frequently where IV\’s of the same strike are different?

1) Cant really as there are both buyers and sellers of options

2) Yes

No sir, actually I am curious as to why the CALL side IV decreased while PUT side IV of the same strike INCREASED.

What could be the possible reason? Kindly guide on that.

So one of the contributing factors for IV change is also the demand and supply dynamics. In fact, this is the reason why IVs for the same strike can be different.

Sir, many thanks for your explanation. But I have some doubts.

1. You have taught that when volatility increases, premium of BOTH CALL and PUT increase. But in this case what could be the reason

that the CALL side IV fell whereas the PUT side IV increased?

2. What is the significance of Strike specific volatility? How is it used in trading? Kindly guide sir.

1) That is true, assuming all other greeks are constant. But in reality, all greeks move in real-time. While one tends to increase the premium, others drag them down.

2) You can check the option chain from Sensibull. Its like the volatility of a particular strike; the premium will change based on how the volatility impacts that strike.

Sir, I got it why CALL premium fell despite Nifty going up. But why did the PUT increase?

As per my understanding,

– Nifty\’s volatility is common to both CALL and PUT.

– Time to expiry is same for both.

So what caused PUT to increase? Kindly guide sir.

Look at strike-specific volatility. For example, 17400 CE vol could be 22%, but 17400 PE can be 30%. PE strike volatility must have shot up, there could be no other reason.

Sir, this is the query I had posted —-> (This is from a guy\’s comment above)

1. Nifty is INCREASING.

2. Long CALL and long PUT of Slightly OTM strike and difference between two strikes is 100.

3. Although Nifty is moving in upward direction CALL premium is falling and PUT premium is increasing.

This is quite puzzling because if volatility is increasing both the CE and PE premiums should increase and if volatility is decreasing then both

CE and PE premiums should fall. Please help me understand sir why is this happening.

Got it. So the premium is not the function of directional movement. It is a function of time to expiry, volatility, the speed at which the market is moving etc. So, in this case, while the market\’s direction worked in the trade\’s favor, other factors may not play out well.

Couldn\’t get you sir. What is the effect if CE is OTM? could you please explain?

SOrry, lost the context. Can you post the complete query again, Sandeep?

Sir, time for expiry is the same for both CE and PE option. Both are slightly OTM strikes. Volatility is same for both.

But what\’s astonishing is that while underlying is increasing, the CE is decreasing and PE is increasing. What could be

the possible reason for this ?

Check the monenyess of both options. Most likely, the CE is OTM.

Dear Karthik sir,

In one of the comments above a guy has observed on someday ->

1. Nifty is INCREASING.

2. Both CALL and PUT Strikes are slightly OTM.

3. Even if Nifty is moving in upward direction CALL premium is falling and PUT premium is increasing.

What could be the reason for this? Please guide.

Thanks

That depends on many factors. Time to expiry, which strike etc.

Many thanks sir. Got it.

Happy learning!

No sir I only wanted to know that what perspective we can arrive at if we see

1. Current volatility of the stock/index is more than it\’s historical volatility? and

2. Current volatility of the stock/index is less than it\’s historical volatility? Please guide.

Thanks

Ok. If the current IV is say 23% and the historical is 24%, then the current IV is lesser than the historical, and we can expect it to go higher hence look for option buying opportunities.

Thank you so much sir. Yesterday Nifty\’s historical volatility was 22.86% and current volatility was 23%.

This means that current volatility was greater than historical volatility. Sir, what according to you it indicates when

1. Current volatility is greater than historical volatility?

2. Current volatility is less than historical volatility?

Please guide. Thanks.

Sandeep, 22.86% is as good as 23% 🙂

Sir, many thanks for your help. Today i checked the Nifty ATM\’s IV. On the CALL side, it was 22.73 while on the PUT side it was 24.88.

So which IV should we consider CALL side or PUT side?

Thanks.

Although the IV of both CEs and PEs are supposed to be similar, they don\’t due to the demand and supply mismatch. YOu can take these as a rough estimate, maybe average too works. In this case, I\’d consider the IV around 23-24%.

Thank you sir, but how to know a stock/index\’s current volatility? Kindly guide.

The easiest way is to look at the ATM\’s implied volatility.

Karthik sir,

In one of the comments a guy asked you ->

\”How to conclude that the present IV for a particular stock is high or low? Is it based on vega?\”

You said ->

For this you need to calculate daily historical volatility and convert it to annual volatility and get a “quick” perspective.

My question is with what this annual historical volatility has to be compared to get a quick perspective?

Sandeep, you compare the stock or the index\’s current volatility with its historical volatility to get a sense of how the volatility is moving.

Karthik sir, i read the comment. Quoting you….\”yes, deep OTM options do react to change in volatility – but do bear in mind this has to be a massive change in volatility, like what happened on 24th August. However, such events are not very frequent\”

So this is what I understood —> In normal cases when Volatility increases, the slight OTM reacts more than the deep OTM. Am I right sir?

Yup, that right.

Dear Karthik sir,

The chapter says \”The effect of Vega is particularly high for ‘Out of the money’ options.”

Out of slight OTM and deep OTM, which one reacts more?

Have posted the explanation in one of the earlier comments, Sandeep. Request you to check that out once.

Thanks a lot sir for helping me.

Happy learning!

I want to calculate the realized volatility for today considering today\’s OHLC values. I DON\’T want to take previous closing prices into account.

In such situation can we calculate today\’s realized volatility?

You can calculate the SD of the price. On excel = STDEV(open price, close price). But this won\’t be accurate, as SD is on returns, not price. For return, you need previous close data.

Sir, what you say is predicting the intraday volatility but I asked about calculating the volatility after market closes.

Like how much high/low stock went from opening price. Is that possible? if yes what is the method to do that.

Thanks

Ah, that is the same as historical volatility.

Actually I thought we can calculate the volatility based on how much high/low stock went from opening price. Can we do that sir?

Yes, that\’s intraday volatility. There are quant models to forecast that, but quite complex to develop one. I\’ve never done that.

Thanks sir, you have already taught that method of calculating the daily SD based on the previous closing prices.

But I wanted to know calculating the daily volatility based on the OHLC of any particular day, suppose today.

Is there any such method ?

Thanks

Both are the same no, Sandeep?

Thanks sir.

1. How do we know what was the realized volatility for a stock after market closing?

2. I have gone through the chapters of historical volatility but what is the calculation for realized volatility for a particular day?

Thanks.

1) On a closing basis, you can calculate the SD with respect to the previous few closing. This will give you the daily SD, which is also the realized volatility

2) Its the same.

Got it sir. So realized volatility is another name for Historical Volatility that we learnt in Chapter 17 and 18 right?

Yes, thats right. Today\’s realised volatility becomes the historical volatility.

Dear Karthik sir,

How can we know the Realized volatility of a stock? Thanks

Look at the historical volatility, you can calculate that on excel as well.

And the Intrinsic Volatility in the options chain is 1 SD right sir?

Yes.

Dear Karthik sir,

The Implied Volatility that we see in the options chain is Annualized 1 SD right? Thanks

Yes, its annualised.

Ok sir kindly put a video on this soon.

Dear Karthik sir,

Is India VIX helpful in trading? If it is, kindly explain how to use it effectively in trading.

Thanks

This is slightly complicated, I will try and put up a video on this.

Dear Karthik sir,

Please solve these queries of mine :

1. When the volatility increases then only the Premiums for CE options increase or both CE and PE increase ?

Similarly,

2. When the volatility decreases then only the Premiums for PE options decrease or both CE and PE decrease ?

Thanks

1) Both CE and PE will increase

2) Both

All else equal, only if Volatility increases option premiums increase, likewise with the decrease in volatility, premiums decline too.

Thanks a lot sir for your explanation. 🙂

Dear Karthik sir,

The chapter says that Implied Volatility represents the expectation of the volatility. And the Forecasted volatility is forecasting the volatility.

This forecasting is based on expectation right ? So what is the difference. Please help me understand the difference between these two.

Implied volatility = Volatility thats panning out in the market right now

Forecasted volatility = Volatility you expect

So right now IV can be 20%, but lets say in 2 days there is a RBI meet and hence you forecast volatility can be higher, say 30%.

Since the effect of Vega is highest on OTM options, can we say that for the ITM options, the effect of Delta (0.5 or more) cancels out the effect of Vega? Can we calculate up to what extent Delta will cancel out Vega for say an ITM with 0.8 delta?

Ah no, not really.

Realized volatility matters especially if you want to compare today’s implied volatility with respect to the historical implied volatility. We will explore this angle in detail when we take up “Option Trading Strategies”.

Sir, Can you tell me under which option strategy we have discussed about Realized volatility. I read Straddle, Strangle and Iron Condor strategy but didn\’t see any topic related to Realized volatility there.

Whenever we have compared current volatility with historical (in trading strategies), this is what I mean. Do check this – https://www.youtube.com/watch?v=0CnHdzTE66s&t=1s

India VIX indicates the investor’s perception of the market’s volatility in the near term (next 30 calendar days)

India VIX is denoted as an annualized percentage

Sir, Suppose India VIX valued @ 20. Now, this value is annualized% or next 30 days Volatility. Honestly I didn\’t understand above statement.

So that would be 20% for the year. In finance, most of these %s are annualized, unless specified. Like the interest rate, it is for the year, unless specified.

Lots of thanks, Sir.

Happy learning!

I have been watching markets closely and INDIA VIX seems to be fairly good indicator to point at the direction of the index,Nifty. If INDIA VIX BELOW OR AROUND 20, Nifty is not steep in up or down movements. If IV is above 20 and increasing,Nifty drops down.

The question is while choosing a spread strategy;

1- how to decide IV is low or high?

2- how to know whether volatility is going to increase or decrease?

3- can I look at BB indicator to have a guess?

4- suppose all other indicators point out that Nifty is oversold and INDIA VIX IS below or around 20, can I conclude that Nifty is going up and volatility is not going to create problem?

Many more questions to come as I continue to read.

Regards. Ashutosh.

1) One easy way to compare is to look at historical volatility and compare

2) Same as above

3) Yes, that is a good option. Plot it on Nifty 50

4) Maybe, but you should test your assumption and see how it has performed in the past.

Thanks Sir. Things now little obscured now.

I can try and help if you have queries.

For example – if the option has a vega of 0.15, then for each % change in volatility, the option will gain or lose 0.15 in its theoretical value.

The current vega for Nifty strikes is 17.So the option will loose or gain 17 in theoretical value?

Yes, that\’s what Vega indicates. But remember, there are multiple strikes acting on the premium simultaneously.

In fact this is exactly what goes on when volatility increases (or is expected to increase) – option writers start fearing that they could be caught writing options that can potentially transition to ‘in the money’. But nonetheless, fear too can be overcome for a price, hence option writers expect higher premiums for writing options, and therefore the premiums of call and put options go up when volatility is expected to increase.

If they are writing options,how could the premiums of call and put options go up? They should come down or my concept not yet clear? Pl correct me.

When you write an option, there is someone else buying the options right? Option writers want a higher price, if the buyer agrees to buy, the price increases.

If all option writers start fearing the volatility, then what would compel them to write options? Clearly, a higher premium amount would. Therefore instead of Rs.20, if the premium was 30 or 40, you may just think about writing the option I suppose.

Increasing volatility may still push the premiums even higher? Or not? And the premiums may not expire worthless. Yes, time value depreciates and that could be a chance to win the trade as an options writer.

Please two bits from you!

That right, Ashutosh. Increase in volatility increases premium and that works as an incentive for option writers to write options.

Hey there sir,

Can you please explain when a strike is near expiry the volatility is high but vega is low near expiry

Harshil, I guess it\’s explained in the chapter itself. That\’s the behavior of greeks 🙂

I think you didn\’t got my question let me explain it again the implied volatility for a particular strike is say 35%, then is this it\’s daily volatility or it\’s current month for 30 dys which we need to convert it by sd*sqrt of 30 to get the daily implied volatility for that strike.

Also in case of India VIX as it represents the volatility of 30dys meaning it\’s for 30dys whole say it is 60% , meaning it\’s the implied volatility for the whole 30 days which we need not to convert in daily volatility. Right?

Guide for the same

Thanks in advance!

Paras, so the volatility that you see is annualized. If a stock\’s IV is 35%, then its 35% per year. If you want to get daily, then you have to divide this by Sqrt of time (not multiply).

So is with India Vix, it\’s annualized.

About the Implied volatility of a particular strike is it for the period of 30 days for current month and 60 days for far month or is it the annual volatility which we need to convert into daily volatility??

Same regarding the index IND vix??

Thanks in advance!

It\’s the daily volatility that you need to convert to whatever time period you wish.

So we can say that volatility also depends on current market factors and to set up a profitable trade we need a good combination of Vega+ current market trend which is as you said as market falls volatility increases which means it would be better to be a buyer of put option as market view+Vega+Theta will favour me to earn profit on large scale due to change in premium.

Also can we say that when market rises the volatility decreases??

Yes Paras, thats right 🙂

Hi, is it true for the opposite case? when there is high volatility and the market goes up? will the OTM premium be changing with the same rate?

Premium will certainly change. But to what extent is something that depends on many other variables.

As explained as volatility increases there is a chance that market can go in any direction from the current position either bearish or bullish , whatever the case may be the buyer will be benefited as there is a chance that a particular strike will get converted to ITM.

However if as a call option buyer my view is bullish but the mark falls then in that case will the Premium\’s first change for both call and put option buyers and will further react to the market situation\’s?

That is when we say the premium will increase irrespective of call or put does that mean we have to capitalize only during the first phase when volatility is in our favour and in the next phase whatever the current market position maybe bearish or bullish it is not our concern as we have already done and dusted our trade in phase-1.

Please guide for the same.

Thanks in advance!!

Generally, volatility increases when the market falls. With the market fall the CE premium reduces but of course the increase in volatility also helps hold up the CE premium a bit.

Why will call option writers panics if volatility increases? when the contract closes in the money for them.

Because with increase in volatility, option premium too increases.

Dear Karthik,

Ahh,hmm, sry for the big query, but you are the right person to help me 🙂

I\’ve the below query

Basically my query is when the markets falls due to sudden positive(India VIX shoots up) and negative news(India VIx shoots up)

In both cases what would happen to the premium with respect to the moneyness of option

Consider other parameters are constant

Let assume market up and down based on some events

1.If the market is crashed(market fall) , hence the India VIX would increased, so the option premium would change based on the moneyness of the option

In Case of CE:

==============

->the call options the premium would have decreased its value (ITM and ATM have more impact) ->because of the rate of change of delta

->But the OTM have the low delta but because of Vega, the premium is increased

In Case of PE:

==============

->the put options premium would have increased(ITM and ATM have more impact)

->But the OTM premium also would have increased not as much as ITM and ATM (Vega effect)

2.If the market is up based on some positive news/event, then India VIX would increased

In Case of CE:

————–

– CE premiums would have increased it value(ITM and ATM have more impact)

– But the OTM have also increased(Vega) but not as much as the ITM and ATM because of the rate of change of delta

In Case of PE:

————–

-PE premiums would have decreased(ITM and ATM have more impact)

-But the OTM would have increased because of Vega (rate of change of delta is low)

Please correct my above understanding is correct or not in all cases

Its like this –

1) VIX increases, market crashes.

2) With the increase in VIX, premiums of both CE and PE increases

3) PE is also supported by delta, so put premiums increase

4) Delta works against the CE, hence CE tends to lose value, unless the VIX spike is so much that it can compensate the fall in delta

Thank you for your reply!

I just looked at chapters in that module. Although I couldn\’t understand much out of it but I came to know that these are flooded with statistics and mathematics. So can I say this module is primer to quantitative analysis?

Thats right, think of it as the tip of the ice berg 🙂

Somewhere in previous chapters you mentioned about Quants. I just looked about it on internet and found that it is really a deep thing. Does learning those things (Calculus, differentials and so on for financial markets purpose) helps in generating more neat insight into markets?

I want to know how Quants(People who actually know mathematical models for finance) are different from normal people like me(Who just know 2/3 statistical concepts)?

Check this – https://zerodha.com/varsity/module/trading-systems/

Yes! Thanks for making it more perfect

Thank you so much!

Sure, happy learning!

Yes! But if I want to trade BTST and if I am choosing deep OTM then delta will be small and directional movement will not have much effect on premium. Is this right thought process?

Also, for sake of volatility what do I have to look for? IV of that particular strike (which is deep OTM) or IV of ATM strike or India VIX?

Yes, but BTST or overnight positions, the only problem is gaps up or down opening. For IV, look at the ATM strikes IV.

When volatility increases, option prices increases attributable to vega. So here is one thought, please let me know can I implement it-

– When more time left to expiry, theta will be less for options. Also vega will be considerably high relative to theta.

– Far OTM options also will have low delta. So when market falls there will be very low effect attributable to delta but at the same time, if volatility increases, then option prices will increase.

To conclude, If I am thinking that current volatility is cooled off(on Friday may be or long holidays) and will lift in upcoming sessions (Mondays for sake of discussion) then I can decide to buy OTM call options with low delta and having more time to expiry.

What other factors may affect this implementation? Please add.

Yes, if you feel volatility will increase in the coming few sessions and if you think there is enough time to expiry, then you can consider buying OTMs. But in this situation, what really matters is the underlying\’s directional move. You need to have conviction about it.

Hi Karthik,

Is implied volatility value for any particular option in NSE option chain or in sensibull is for 30 days?

So if we have to calculate the voltility of that option for today, do we have to apply

Iv value for daily = iv value for 30 day / squareroot(30).

Ankush, not sure if I understand your query completely. You can consider the daily IV to get a sense of how volatile the stock is.

Ohh! it means whatever the final premium, it will be due to effect of multiple Greeks but we can\’t really separately tell that which Greek contributed by how much right?

Thats right.

Vega measures increase or decrease in premium for 1% respective change in volatility. So let say

Nifty spot 16600

ATM CALL 16600 has premium of 40

16600 CE Vega = 0.95

16600 CE delta = 0.47

If I expect volatility to increase(as measured by India VIX) by end of day by 6% and Nifty to move to 16700 by EOD then

from delta perspective:

delta of 0.47 translates to 47 points when Nifty moves up by 100 points

so final premium will be 40+ 47 = 87

from volatility perspective:

If volatility shoots up by 6% then premium will go up by 6*0.95=5.7

so final premium value will be 40+ 5.7= 45.7

so what should be actual final premium? 87 or 45.7 or will it be 40+47+5.7=92.7

Yes, provided there is ample time to expiry as well. Remember, the premium of an option is a function of multiple factors acting simultaneously on the option. Some tend to pull the premium up and some tend to pull the premium down.

In the tail end of Section 19.2, the following is stated

\”For example – if the option has a vega of 0.15, then for each % change in volatility, the option will gain or lose 0.15 in its theoretical value.\”

There is ambiguity in the statement. Since vega being represented as one point change, option value change should also be in points. In the above case, option value will be experiencing 0.15% change (Without the %, it may be construed as INR 0.15 for example).

Isn\’t it?

Let me recheck this, Kishore. I have a feeling I may have made another inadvertent error here. Need to re check the content once.

Hi Karthik,

How can we check if volatility of specific option is high or low. What we see in the NSE option chain is IV at that instant. Based on that single number it\’s difficult to say whether it\’s high or low. Are there set benchmarks eg: >30 is considered high and so on?

Thanks!

One quick way is to cross-check the historical volatility of the stock and the intrinsic volatility and get a sense of the current volatility.

Hey Kartik, in the above-mentioned paragraphs, the 6th point from the NSE whitepaper, you have mentioned that with an increase in volatility, the nifty can head towards any direction which contradicts what is written on Investopedia about the volatility. I also feel with volatility rising, the index might fall and therefore make sense to call it a FEAR INDEX.

Please correct me if wrong.

there was option to trade it earlier ?? as I found a blog by Nithin Kamath on z-connect dated February 13, 2014 and also found a pdf related to derivative of vix on Nse website, then if it was tradable earlier why it was stopped from trading

I don\’t think there was enough trading volume for NSE to continue the contract.

can we trade indiaVIX

Nope.

Hello Karthik,

Can we not compare the Annualized historical volatility and Vix india to take a trade in options by checking the IV of each strike and wait for the volatility to cool off in order to analyze in a efficient manner?

Yup, you can to get a rough estimate.

Hey Karthik,

I have been started practicing model based approach to trading. I want to get my hands on a book that can help me understand all the maths related to trading. Can you suggest one. thanks

Suraj, I think there is a book called quantitative techniques to markets, I forget the author\’s name though. Maybe you should check that.

THANKS SIR,

Hi,

Does VEGA affect intraday trades ?

Is it negligible for intraday ?

IF NOT THEN

How should it be used to measure risk for intraday ?

?????????????????????? ??????

Vega has an impact on intrday trades, especially when the rate of change of volatility is high. Its best if you keep track of volatility and take a call.

sir can u please answer Mr. Ajay\’s question on 13 may 2021 based on volatility. I seem to have the same doubt while going through the chapter. Basically my question is, what does the value of implied volatility in percentage represents for different strike prices.

My second question is what does the percentage increase in india vix represents? Does it represent the increase in volatility in nifty only.

thanks

Pranay, each strike has different IVs, which represents the riskiness of the strike as per the market participants. The higher the IV, the higher is the risk for that strike.

Hi,

I checked bid – Ask spread , BID = 5.20 and Ask = 7.35 , Spread – 2.15 ,

Premium closed at 5.95 and gain of +1.35

I understand greek Will increase or decrease the Premium of a particular Strike but I don\’t understand how spread can increase The Premium .

Can I Take These assumptions on this 472 Strike

1. Volume and OI of this strike Was in

thousands where as Strike 482 OI and Volume Was in lakhs.

2. when spot increase , initially buyer increase The Demand of the Contract and it tends to increase in premium as We can see this strike is illiquid in Term of OI and Volume as compare to Other strike . So, neither buyer increase The Price Nor seller decrease The Ask Price and Premium Stuck with a Positive Sign as There is Major Difference in between BID and Ask spread.

I am Confused , May be You Get Point and correct me

Imagine I place a market order in an illiquid option, what do you think will happen? Order will get executed at odd price and premium increases right?

Karthik Sir,

All The OTM strikes which are gaining Yesterday are losing premium today strikes like 472 and 482

and All the other strikes gaining Premium Today which were Losing Yesterday.

Still My Question is why Strike 472 only gained Premium Yesterday

Again, it\’s the closest to the ATM strike, hence slightly better liquidity I guess. Did you observe the bid-ask spreads also?

Hi Karthik Sir ,

I Ask you Lot of Questions . Hope i don\’t Bother you .

Yesterday, I Was watching BPCL Option Chain and observed some Premiums movement . I Hope I can share a screenshot .

I Will Write horizontally each Strike and Their delta Values ..

Spot Closed – 447.50 , Expiry – 28-Oct

Strike CE – 472 , 475 ,477 , 480 , 482

Delta – 0.29 ,0.34,0.35,0.23,0.22

Gamma – 0.0086, 0.0065, 0.0059,

0.0076, 0.0073

Theta – -0.31, -0.48, -0.53,

-0.27,-0.27

Vega – 0.38, 0.4, 0.41, 0.33, 0.3 Premium- 5.95, 12.15, 13.85, 4.80,4.85

Change in premium= +1.35, 0, 0, -0.15,

+0.10

Implied Volatility – 32.18, 51.78, 57.45,

34.41, 36.81

OI = 66,000, X, X, 4,66,200,

1,26,000

Volume – 63,000, X, X, 12,43,800,

46,800

Points to be noted…

1. Why we saw a Positive Response

only in Strike 472, 482 , There is

massive positive Change in Strike 472

only. If we Notice that low delta is the

factor that prevent to Fall in Premium

then Strike 482 has Low delta Than.

Strike 472 ,still 472 has gain More in.

Premium .

2. If we Check IV factor still Strike 482

has more volatile which Help to Rise

the Premium but still 472 Strike gain.

More Change in Premium.

3. Strike 480 also has Low delta but

still it\’s Premium Fall and Have more

IV Than Strike 472.

4. If we consider Volume and OI still

Strike 472 hasn\’t won from Strike

482 and 480.

5. My Question is Why only Strike 472

gain in Premium

When you consider greek, there is an underlying assumption that all options are liquid. If the options aren\’t liquid, what really matters the most is the demand-supply situation of options and their respective strike. Given that, I\’m guessing that the strike under consideration is not very liquid here, hence the greeks don\’t really obey as expected :).

For buying a call option shd i check IV… what shd be IV value for in the money call option

Ravi, IVs can vary between indices and stock, there is no common IV structure across markets.

Hi,

Is there any plan to teach about GARCH.

Nope, I don\’t think I can do that. Also, it may be way too complicated to explain.

You can\’t say, all strikes above ATM are ITM and Deep ITM. it\’s true only for Put options. For call options, All strikes below ATM are ITM and Deep ITM.

Of course 🙂

I think it needs some clarification. Let me know if I am wrong somewhere. Correction is suggested in bracket.

On 24th August, Nifty declined by 490 points, so all call options which had ‘noticeable Delta’ (like 0.2, 0.3, 0.6 etc) declined. Typically ‘in the money’ (I think it should be said ITM and slightly OTM options instead of saying just ITM options. Because before decline of 500 points Nifty would have been 8300. So, upto 8600 all strikes will be slightly OTM, not ITM. Also, slight OTM has some noticable Delta, while deep OTM has very low delta. So more than 8600 strike prices are deep OTM and that\’s why they could not show movement in line with underlying.)options (as on 24th Aug, all strike below 8600) tend to have noticeable Delta, therefore all their premiums declined with the decline in the underlying.

‘Out of the money’ (Deep OTM to be specific) options usually have a very low delta like 0.1 or lower. This means, irrespective of the move in the underlying the moment in the option premium will be very restrictive. As on August 24th, all options above 8600 were ‘out of the money’ (Deep OTM to be specific) options with low delta values. Hence irrespective of the massive fall in the market, these call options did not lose much premium value.

Rajnish, there are two ways to look at this – either from the strike price perspective or simply from the delta perspective. ALL strikes above ATM should have higher deltas (higher than 0.5), hence ITM and deep ITM. All strikes below ATM will be OTM or deep OTM. Delta above say 0.3 and the associated strikes will react more quickly to price change compared to the lower delta strikes.

Hello Sir,

Why IV of options strike price increases ( especially of PE ) near expiry even if there is no big movement on either side.

Thank u

Cant really answer why volatility increases, Abdul 🙂

Hey Karthik!

So nice to see someone consistently providing such quality content and support over a good 6 years !!

Eager to apply the learnings and excited for the subsequent learnings that come up as well!!!

Also, regarding the August 24, 2015 incident (shared in the chapter), are such occurrings not the norm wherein the OTM option prices shoot up (due to low delta and high vega effects) whenever there is a considerably huge crash in the market?

These things can happen in the market, Mahavir. Quite common these days 🙂

Do really one can make enough money in trading to live a desirable life?

Depends on your expectations out of desirable life. But its easier said than done 🙂

Do trading is a good carrer option?

It is not viable for most people, Sam.

Great work, kartik!

One of the best explanations of option greeks

I suggest you to bring a module for quantitative analysis.

Super curious to learn, but can\’t find the best like you 😉

Thanks, btw you can check this module – https://zerodha.com/varsity/module/trading-systems/

1) Delta: High for ITM

2) Theta: High for OTM

3) Gamma: High for ATM

4) Vega: High for OTM

Correct sir?

thank u

All these things really depends on the market conditions. Very hard to genralise.