14.1 – Time is money

Remember the adage “Time is money”, it seems like this adage about time is highly relevant when it comes to options trading. Forget all the Greek talk for now, we shall go back to understand one basic concept concerning time. Assume you have enrolled for a competitive exam, you are inherently a bright candidate and have the capability to clear the exam, however, if you do not give it sufficient time and brush up the concepts, you are likely to flunk the exam – so given this what is the likelihood that you will pass this exam? Well, it depends on how much time you spend to prepare for the exam right? Let’s keep this in perspective and figure out the likelihood of passing the exam against the time spent preparing for the exam.

| Number of days for preparation | Likelihood of passing |

|---|---|

| 30 days | Very high |

| 20 days | High |

| 15 days | Moderate |

| 10 days | Low |

| 5 days | Very low |

| 1 day | Ultra-low |

Quite obviously higher the number of days for preparation, the higher is the likelihood of passing the exam. Keeping the same logic in mind, think about the following situation – Nifty Spot is 8500, you buy a Nifty 8700 Call option – what is the likelihood of this call option to expire In the Money (ITM)? Let me rephrase this question in the following way –

- Given Nifty is at 8500 today, what is the likelihood of Nifty moving 200 points over the next 30 days and therefore 8700 CE expiring ITM?

- The chance for Nifty to move 200 points over the next 30 days is quite high, hence the likelihood of an option expiring ITM upon expiry is very high

- What if there are only 15 days to expiry?

- An expectation that Nifty will move 200 points over the next 15 days is reasonable, hence the likelihood of an option expiring ITM upon expiry is high (notice it is not very high, but just high).

- What if there are only 5 days to expiry?

- Well, 5 days, 200 points, not really sure hence the likelihood of 8700 CE expiring in the money is low

- What if there was only 1 day to expiry?

- The probability of Nifty to move 200 points in 1 day is quite low, hence I would be reasonably certain that the option will not expire in the money, therefore the chance is ultra-low.

Is there anything that we can infer from the above? Clearly, the more time for expiry the likelihood for the option to expire In the Money (ITM) is higher. Now keep this point in the back of your mind as we now shift our focus on the ‘Option Seller’. We know an option seller sells/writes an option and receives the premium for it. When he sells an option he is very well aware that he carries an unlimited risk and limited reward potential. The reward is limited to the extent of the premium he receives. He gets to keep his reward (premium) fully only if the option expires worthless. Now, think about this – if he is selling an option early in the month he very clearly knows the following –

- He knows he carries unlimited risk and limited reward potential

- He also knows that by virtue of time, there is a chance for the option he is selling to transition into ITM option, which means he will not get to retain his reward (premium received)

In fact at any given point, thanks to ‘time’, there is always a chance for the option to expire in the money (although this chance gets lower and lower as time progresses towards the expiry date). Given this, an option seller would not want to sell options at all right? After all, why would you want to sell options when you very well know that simply because of time there is scope for the option you are selling to expire in the money. Clearly, time in the option sellers context acts as a risk. Now, what if the option buyer in order to entice the option seller to sell options offers to compensate for the ‘time risk’ that he (option seller) assumes? In such a case it probably makes sense to evaluate the time risk versus the compensation and take a call right? In fact, this is what happens in real-world options trading. Whenever you pay a premium for options, you are indeed paying towards –

- Time Risk

- The intrinsic value of options.

In other words – Premium = Time value + Intrinsic Value Recall earlier in this module we defined ‘Intrinsic Value’ as the money you are to receive if you were to exercise your option today. Just to refresh your memory, let us calculate the intrinsic value for the following options assuming Nifty is at 8423 –

- 8350 CE

- 8450 CE

- 8400 PE

- 8450 PE

We know the intrinsic value is always a positive value or zero and can never be below zero. If the value turns out to be negative, then the intrinsic value is considered zero. We know for Call options the intrinsic value is “Spot Price – Strike Price” and for Put options, it is “Strike Price – Spot Price”. Hence the intrinsic values for the above options are as follows –

- 8350 CE = 8423 – 8350 = +73

- 8450 CE = 8423 – 8450 = -ve value hence 0

- 8400 PE = 8400 – 8423 = -ve value hence 0

- 8450 PE = 8450 – 8423 = + 27

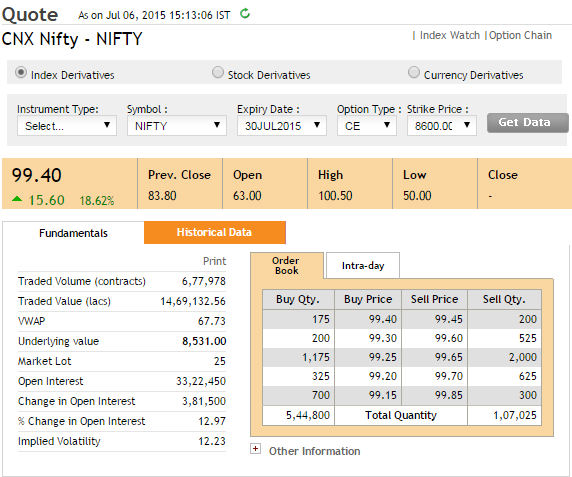

So given that we know how to calculate the intrinsic value of an option, let us attempt to decompose the premium and extract the time value and intrinsic value. Have a look at the following snapshot –  Details to note are as follows –

Details to note are as follows –

- Spot Value = 8531

- Strike = 8600 CE

- Status = OTM

- Premium = 99.4

- Today’s date = 6th July 2015

- Expiry = 30th July 2015

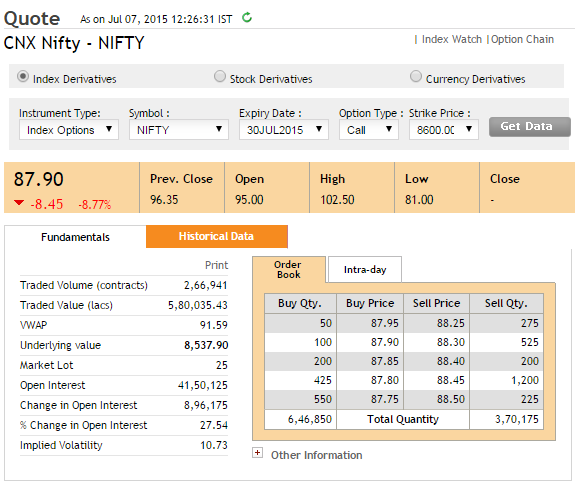

Intrinsic value of a call option – Spot Price – Strike Price i.e 8531 – 8600 = 0 (since it’s a negative value) We know – Premium = Time value + Intrinsic value 99.4 = Time Value + 0 This implies Time value = 99.4! Do you see that? The market is willing to pay a premium of Rs.99.4/- for an option that has zero intrinsic value but ample time value! Recall time is money ☺ Here is a snapshot of the same contract that I took the next day i.e 7th July –  Notice the underlying value has gone up slightly (8538) but the option premium has decreased quite a bit! Let’s decompose the premium into its intrinsic value and time value – Spot Price – Strike Price i.e 8538 – 8600 = 0 (since it’s a negative value) We know – Premium = Time value + Intrinsic value 87.9 = Time Value + 0 This implies Time value = 87.9! Notice the overnight drop in premium value? We will soon understand why this happened. Note – In this example, the drop in premium value is 99.4 minus 87.9 = 11.5. This drop is attributable to a drop in volatility and time. We will talk about volatility in the next chapter. For the sake of argument, if both volatility and spot were constant, the drop in premium would be completely attributable to the passage of time. I would suspect this drop would be around Rs.5 or so and not really Rs.11.5/-. Let us take another example –

Notice the underlying value has gone up slightly (8538) but the option premium has decreased quite a bit! Let’s decompose the premium into its intrinsic value and time value – Spot Price – Strike Price i.e 8538 – 8600 = 0 (since it’s a negative value) We know – Premium = Time value + Intrinsic value 87.9 = Time Value + 0 This implies Time value = 87.9! Notice the overnight drop in premium value? We will soon understand why this happened. Note – In this example, the drop in premium value is 99.4 minus 87.9 = 11.5. This drop is attributable to a drop in volatility and time. We will talk about volatility in the next chapter. For the sake of argument, if both volatility and spot were constant, the drop in premium would be completely attributable to the passage of time. I would suspect this drop would be around Rs.5 or so and not really Rs.11.5/-. Let us take another example –

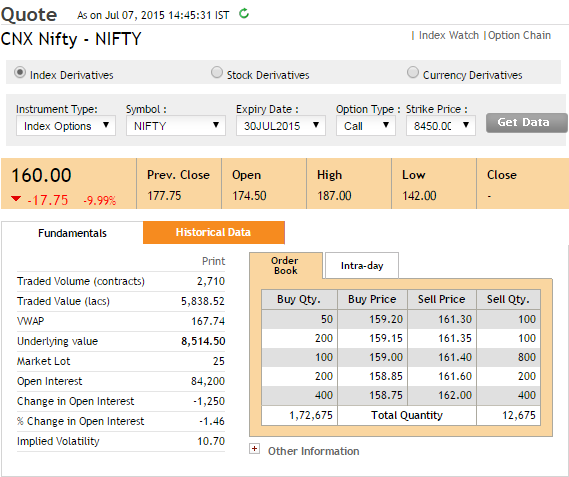

- Spot Value = 8514.5

- Strike = 8450 CE

- Status = ITM

- Premium = 160

- Today’s date = 7th July 2015

- Expiry = 30th July 2015

Intrinsic value of call option – Spot Price – Strike Price i.e 8514.5 – 8450 = 64.5 We know – Premium = Time value + Intrinsic value 160 = Time Value + 64.5 This implies the Time value = 160 – 64.5 = 95.5 Hence out of the total premium of Rs.160, traders are paying 64.5 towards intrinsic value and 95.5 towards the time value. You can repeat the calculation for all options (both calls and puts) and decompose the premium into the Time value and intrinsic value.

14.2 – Movement of time

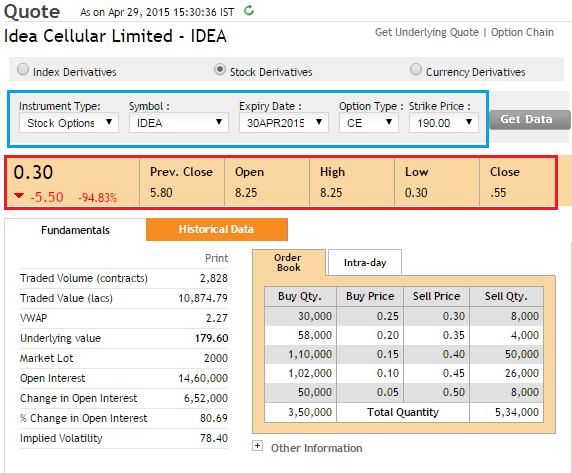

Time as we know moves in one direction. Keep the expiry date as the target time and think about the movement of time. Quite obviously as time progresses, the number of days for expiry gets lesser and lesser. Given this let me ask you this question – With roughly 18 trading days to expiry, traders are willing to pay as much as Rs.100/- towards time value, will they do the same if the time to expiry was just 5 days? Obviously, they would not right? With lesser time to expiry, traders will pay a much lesser value towards time. In fact here is a snapshot that I took from the earlier months –

- Date = 29th April

- Expiry Date = 30th April

- Time to expiry = 1 day

- Strike = 190

- Spot = 179.6

- Premium = 30 Paisa

- Intrinsic Value = 179.6 – 190 = 0 since it’s a negative value

- Hence time value should be 30 paisa which equals the premium

With 1 day to expiry, traders are willing to pay a time value of just 30 paise. However, if the time to expiry was 20 days or more the time value would probably be Rs.5 or Rs.8/-. The point that I’m trying to make here is this – with every passing day, as we get closer to the expiry day, the time to expiry becomes lesser and lesser. This means the option buyers will pay lesser and lesser towards time value. So if the option buyer pays Rs.10 as the time value today, tomorrow he would probably pay Rs.9.5/- as the time value. This leads us to a very important conclusion – “All other things being equal, an option is a depreciating asset. The option’s premium erodes daily and this is attributable to the passage of time”. Now the next logical question is – by how much would the premium decrease on a daily basis owing to the passage of time? Well, Theta the 3rd Option Greek helps us answer this question.

14.3 – Theta

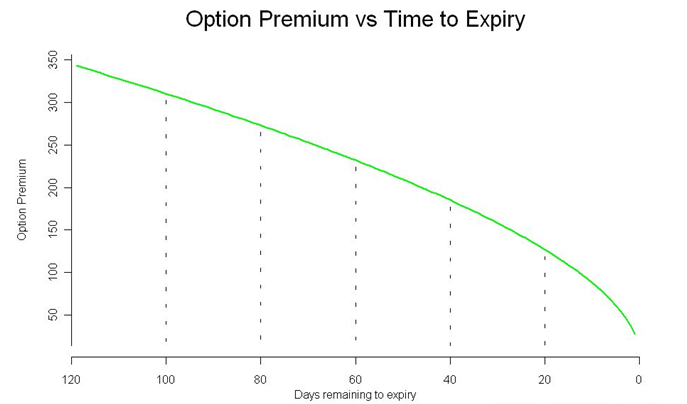

All options – both Calls and Puts lose value as the expiration approaches. The Theta or time decay factor is the rate at which an option loses value as time passes. Theta is expressed in points lost per day when all other conditions remain the same. Time runs in one direction, hence theta is always a positive number, however, to remind traders it’s a loss in options value it is sometimes written as a negative number. A Theta of -0.5 indicates that the option premium will lose -0.5 points for every day that passes by. For example, if an option is trading at Rs.2.75/- with a theta of -0.05 then it will trade at Rs.2.70/- the following day (provided other things are kept constant). A long option (option buyer) will always have a negative theta meaning all else equal, the option buyer will lose money on a day by day basis. A short option (option seller) will have positive theta. Theta is a friendly Greek to the option seller. Remember the objective of the option seller is to retain the premium. Given that options lose value on a daily basis, the option seller can benefit by retaining the premium to the extent it loses value owing to time. For example, if an option writer has sold options at Rs.54, with a theta of 0.75, all else equal, the same option is likely to trade at – =0.75 * 3 = 2.25 = 54 – 2.25 = 51.75 Hence the seller can choose to close the option position on T+ 3 day by buying it back at Rs.51.75/- and profiting Rs.2.25 …and this is attributable to theta! Have a look at the graph below –  This is the graph of how premium erodes as a time to expiry approaches. This is also called the ‘Time Decay’ graph. We can observe the following from the graph –

This is the graph of how premium erodes as a time to expiry approaches. This is also called the ‘Time Decay’ graph. We can observe the following from the graph –

- At the start of the series – when there are many days for expiry, the option does not lose much value. For example, when there were 120 days to expiry the option was trading at 350, however, when there were 100 days to expiry, the option was trading at 300. Hence the effect of theta is low

- As we approach the expiry of the series – the effect of theta is high. Notice when there were 20 days to expiry the option was trading around 150, but when we approach towards expiry the drop in premium seems to accelerate (option value drops below 50).

So if you are selling options at the start of the series – you have the advantage of pocketing a large premium value (as the time value is very high) but do remember the fall in premium happens at a low rate. You can sell options closer to the expiry – you will get a lower premium but the drop in premium is high, which is advantageous to the options seller. Theta is a relatively straightforward and easy Greek to understand. We will revisit theta again when we will discuss cross dependencies of Greeks. But for now, if you have understood all that’s being discussed here you are good to go. We shall now move forward to understand the last and the most interesting Greek – Vega!

Key takeaways from this chapter

- Option sellers are always compensated for the time risk

- Premium = Intrinsic Value + Time Value

- All else equal, options lose money on a daily basis owing to Theta

- Time moves in a single direction hence Theta is a positive number

- Theta is a friendly Greek to option sellers

- When you short naked options at the start of the series you can pocket a large time value but the fall in premium owing to time is low

- When you short option close to expiry the premium is low (thanks to time value) but the fall in premium is rapid

Hello sir

How is theta calculated? I mean premium\’s time value is decreases every day, so how they calculate it?

Thank you very much for the wonderful way that you have described the concepts.

After reading the Theta module, I have a query. In Sesnsibull,other than Theta there is another Greek is mentioned \”Decay\”. What\’s the difference between Theta and Decay and how it influences a buyer and / or seller of an option.

Decay is not really an option greek. Its the characteristic of theta, which basically measures the rate at which theta loses its value. Hence decay.

Is there any source to find out what is the theta value for a particular stock? Like 25000 ce on 2nd September expiry?

Also I read changing expiry to Tuesday is to curb retail participation. Please explain this as I dont see how the retail participation changes just because expiry day is changed

You can look up on Sensibull for Theta values.

As far as the changing of expiry days, dont really know the logic. Maybe you should ask the exchange for this 🙂

How does public holiday affect theta decay? For example, if I sold an option on 25 August 2025.

26 August 2025 was a holiday. So when the market opens on 27 August, will theta decay consider two days or only one day (since 1 day was a holiday).

In other words will the option price on 27 be the same if 26 was a holiday vs if it was a working day

It has very little effect.

Can you explain why it has little effect? Because in one case it is one day and in the other case it is two days?

Hmm, actually I must have phrased my answer better 🙂

Theta does its thing over holidays also because its a function of both calendar days and trading days. Its just that during trading days, the traders know that theta is at play (especially closer to expiry), and would want to sell option. This adds to the overall pressure of theta decay.

does Theta Decay effect the intraday trading? If all other things are equal then from 9:15-3:30 for a day, because of the Theta premium will decay?

Yes, slowly at the start..wont be noticeable, but will accelerate as you approach expiry.

Does theya decay affect ITM, ATM & OTM options differently for the same underlying?

Yes, the acceleration is higher for OTM and ATM options as we approach expiry. Its lesser for ITM and deep ITM options.

I meant; I tried all four combinations.

actual spot, Sensibull based IV

actual spot, NSE website based IV

Nifty Mar Fut, Sensibull based IV

Nifty Mar Fut, NSE website based IV

I tried

Spot=Nifty Mar Fut

& NSE website based IV( Last time I used Sensibull based IV. ).

Unfortunately problem persists.☹

Am I doing anything wrong?

Ah no, it could be some mismatch in input variables. Please do talk to Sensibull customer desk.

1) My query was about FORMATTING.

2) If call option value depreciates by 1.259 every day, then same will be CLOSE to 0 within 13.5÷1.259=10.72 days; however expiry is 23 days( including 5th n 27th March ) away.

hmm, got it. I need to find out as well. Ideally the theta decay to zero should coincide with the expiry. I\’m sure both of us are missing something obvious 🙂

Hi Karthik,

For

Spot=22000

Strike=23500

Expiry=2025-03-27 15:30:00

Volatility=13.4

Interest=6.44

Dividend=0

I got

Call Option Premium=8.54( Actual value is 13.50 )

Call Option Theta=-1.259( in Red )

Put Option Theta=2.871( in Green )

Can you please confirm;

1) has Call Option Theta value been formatted from option buyer\’s perspective & Put Option Theta value from option seller\’s perspective?

2) is given Call Option Theta value reliable if we consider ACTUAL Call Option Premium & Expiry?

Thank you.

1) Theta is not specific to either the buyer or seller. Its from the strike\’s perspective

2) Yes it should be. Why do you think it wont be?

Thanks for the article sir , it is very helpful for the new traders.

I just want to confirm that which trade is more profitable to option buyers , Is it ITM, OTM or ATM , if the market is little bullish or neutral.

There is no one trade the benefits everytime. You really need to understand the market and the situation in the market and deploy a trade that has better odds of working in your favor.

Hey Karthik I know I am a bit late for queries but while writing CE if we\’re gonna buy back the options at the closer date to expiry how are we gonna exit from this trade as I want to avoid physical settlement?

When you close, you get out of the trade completely. You no longer have an open position.

But currently, if i see, the strike prices that have long gone has higher LTP. Does it mean, if i buy a strike price after 90 days, and by the time if that respective strike price crosses the spot price, the premium keeps on increasing to certain value?

Yes, the deeper the strikes becomes ITM, the higher the premium.

How can I determine, when(time) the option reach the predicted target on intraday?

That is a hard call, Gopinath. Not sure if its possible to establish it 🙂

Can you please make a video series for NISM Series VIII – Equity and derivative exam. Your videos are really helpfull!

We have put up a lot of videos here – https://www.youtube.com/@varsitybyzerodha

plese keep varsity up to date…

it is very helpfull…

thanks

These concepts dont really change, Jay. But yes, will try and update as and when required.

Hello Karthik,

Could you tell me that whether theta erodes second by second during markets hours or it erodes its value day after day. For example if theta of 22500 strike is 30 and premium is 150, then theta value drops every second given the other factors remains stable or premium will drop by 30rs next day.

I am bit confused about this.

Thanks in advance.

Theta works on a continuous basis, but at the same time there are other greeks working on premiums too. The effect of theta is enhanced towards the expiry and sort of works as a dominant greek.

Hey Karthik,

I have just asked Gemini to go to Zerodha Versity\’s Theta chapter and give me some answer:

Question (me): Can you tell me relation between theta and different strike?

Answer (Gemini) :

\”Imagine Theta as a rate of ice melting. A larger ice cube (higher strike price, OTM option) melts slower than a smaller ice cube (lower strike price, ITM option) because it has less initial volume to lose. However, a flat sheet of ice (ATM option) with a larger surface area might melt the fastest due to having the most exposed area for heat transfer (time decay).\”

AI is Amazing, isn\’t it?

AI is amazing, but this example, I\’m not sure 🙂

It could be right or wrong depending on call or put 🙂

Sir,

Please consider the below two scenarios, considering Expiry=30th Jul,2015-

Day 1 (6th Jul,2015):

Strike=8600 CE

Spot Value=8531

Premium=99.4

We know premium= Time value+Intrinsic value

Intrinsic value=0

So, time value=99.4

Day 2 (7th Jul,2015):

Strike=8600 CE

Spot Value=8510

Premium=94

Intrinsic value=0

So, time value=94

Please assure if I am correct with the below statement-

From the above two situations, and through the equation, premium= Time value+Intrinsic value, we understood that although the spot price drops but the drop in premium is attributable to only Theta. However, since the price is dropping this premium dropping should also come from drop in Delta (Due to Gamma) and due to Delta. Am I correct? I am ignoring the effect of Volatility for the time being.

You cant really ignore the effect of volatility 🙂

The effect of option premium is an outcome of all these greeks.

For deep ORM options, the premium value is low. Right? Even though we get a buyer (for Nifty or Bank Nifty) the returns might be low. Is this correct understanding?

Hmm, yes premiums are low for OTM options, but returns being low is subjective 🙂

It is possible if I carry Iron Butterfly for overnight. I deploy it at 3:15PM on Wednesday and exit at 9:16AM on Thursday. And hypothetically if market remain at the same price. Do I make profit?

Sure, you can. In fact, its best if you plan your trade in such a way that it can be carried out and held to expiry.

Does most of the theta decay happens overnight? Because I\’m playing with short straddle strategies in sensibull. App showing me total one day decay of 2048 rupees. But when I changed time frame to 3:15PM to see what my P&L would be ( if spot & IV is unchanged. ) It was just 448 rupees.But when I changed time to 9:15AM of next day my p&l become 2048. Does that mean large chunk of theta decay happens overnight?

It feels like that, but theta decay happens with the passage of time 🙂

Hi, Karthik Sir, I have a question about Weekly Calendar Spreads. Here is some data of today\’s date (16 Jan 2024) that contextualizes my query:

Put Calendar Spread:

Sell: 1x 25JAN2024 22000PE – ₹166

(Put IV: 13.02)

Buy: 1x 01FEB2024 22000PE – ₹219.6

(Put IV: 13.59)

Positional Greeks:

Delta: 1.91

Theta: 274.99

Gamma: -0.02

Vega: 454.25

Probability and Profit/Loss Metrics:

Prob. of Profit: 44.35%

Max. Profit: ₹ +5,238 (20.33%)

Max. Loss: ₹ -3,353 (-13.01%)

Max. RR Ratio: 1:1.56

Breakevens: ₹21,732.0 – ₹22,303.0

Estimated Margin/Premium: ₹ +25,763

Call Calendar Spread:

Sell: 1x 25JAN2024 22000CE – ₹188

(Call IV:12.74)

Buy: 1x 01FEB2024 22000CE – ₹295.9

(Call IV: 14.38)

Positional Greeks:

Delta: 1.58

Theta: 148.51

Gamma: -0.03

Vega: 455.59

Probability and Profit/Loss Metrics:

Prob. of Profit: 27.98%

Max. Profit: ₹ +3,664 (15.19%)

Max. Loss: ₹ -5,395 (-22.37%)

Max. RR Ratio: 1:0.68

Breakevens: ₹21,834.0 – ₹22,182.0

Estimated Margin/Premium: ₹ +24,118

My Questions:

1. Why Theta is more in Put Calendar Spread, although IVs do not have so much of a difference and DTE is the same for both.

2. Generally, I have seen that when I design put calendar spread, it shows better Breakevens and Max Profit-Loss Ratios. How does this happen?

Please explain.

1) I need to investigate this as well, but my guess is the put call parity is at play here.

2) Perhapse the puts have more premiums. Generally fear comes at a higher price 🙂

CAN WE SEE MONTHLY GRAPH / CHART OR TABLE FOR BANKNIFTY

Yes, change the frequency from daily to Monthly and you have it.

Considering volatility has no changes in intraday time frame,

why is delta even active for an OTM option if it only has none other than a depreciating time value?

I cannot understand the logic behind an OTM option having a fluctuating value (other than decrease in Theta).

Please recfity what I am missing to understand.

PS: I have read this whole module.

With the change in prices, volatility too changes every second.

Hi Karthik!

In the above, you said that the intrinsic value of an OTM option is zero. In the previous chapters of delta, we learned for OTM option delta is in btw 0.05 to 0.2 and the premium increases by this factor while the spot is moving in the positive direction for that option. My question is what do we call the increase in premium value while the spot price turns OTM option into almost ATM status but remains just short of the strike price ? Is that intrinsic value (considering the option is still OTM)?

If the intrinsic value is greater than zero only when the spot is above the strike price(for in case of CE), should not the premiums start moving only when the strike price is in ATM status?

That value can be largely attributed to time value of option as there is no intrinsic option value. Option moves due to other factors that influence option premiums, mainly volatility.

Will the theta decay continue if the stock goes in the ban list due to high traded volumes?

Yup, thats right.

Hi , so for a option buyer is it okay to buy in delivery?

Yes, you can hold options for overnight delivery as well.

Sir uper jisne bhi primium k uper swal puche mujhe kuch nhi aaya Mera swal intraday pr nahi h Mai premium ko hold karna chahta hu poore month us pr swal h

Sir agar Mai strike price ka primium buy karta hu aur nifty meri direction me move kre pura month to kya mera primium theta ki wajah se zero hoga ya expiry Wale din mujhe pura profit milega aur us pr time decay or theta ka koi frk nhi pdega sir please give response soon e-mail pr response Krna kyoki e mail roj dekhte hai yaha dobara kb dekhu pta nhi

Premium = Time value + Intrinsic value 87.9 = Time Value + 0

What is Intrinsic value 87.9 Why 87.9 is with Intrinsic value

87.9 is the premium What we Paid ?

Please Breakdown this

Premium = Time value + Intresic value

If the premium = 87.9 and the intrinsic value of an option is 0, then the entire premium can be attributed to the intrinsic value of an option.

Sir in the months of July I used to sell OTM options on every expiry. Let assume if Banknifty is on 46000 then I used to sell 46200 CE at 1:45 so if market stays lower then 46200 I used to get all the money as it becomes 0.. in July I used to get it on price between 30 to 45 but later on I only used to get on on 6 to 7 RS at the same time only on 1:45…. Can you explain this?

Premiums are a function of many factors including Volatility. Maybe the volatility has dropped on these contracts? Also it depends on how many days to expiry.

hi sir ,

Sir if we buy an otm call option with weekly expiry , suppose 6 days to expiry , with option premium being 48 and theta being -8 , so if we reach till only one day remaining to expiry , with no change in asset price as well as volatility , so will the option premium lose 8 rs ( aka theta -8 ) every day from day 6 to day 1 , or will the theta gradually increase from day 6 to day 1 ( from -8 to approx lets say -28 on the last day ) . if taken options contract for 1 week aka weekly expiry does theta decay remains constant for each day or does it increase as we approach last day . thanks a lot sir .

The option will lose money, but the premium will erode quickly on the day of the expiry.

Dear Karthik,

I have gone through this module and learned a fair understanding of the option and it\’s pricing. but here what\’s NSE is tell about pricing of derivative (NIFTY 50 F&O):

Excerpt from https://www.nseindia.com/products-services/equity-derivatives-nifty50

\”

Base Prices

Base price of the options contracts, on introduction of new contracts, would be the theoretical value of the options contract arrived at based on Black-Scholes model of calculation of options premiums.

The options price for a Call, computed as per the following Black Scholes formula:

C = S * N (d1) – X * e- rt * N (d2)

and the price for a Put is : P = X * e- rt * N (-d2) – S * N (-d1)

where :

d1 = [ln (S / X) + (r + σ2 / 2) * t] / σ * sqrt(t)

d2 = [ln (S / X) + (r – σ2 / 2) * t] / σ * sqrt(t)

= d1 – σ * sqrt(t)

C = price of a call option

P = price of a put option

S = price of the underlying asset

X = Strike price of the option

r = rate of interest

t = time to expiration

σ = volatility of the underlying

N represents a standard normal distribution with mean = 0 and standard deviation = 1

ln represents the natural logarithm of a number. Natural logarithms are based on the constant e (2.71828182845904).

Rate of interest may be the relevant MIBOR rate or such other rate as may be specified.

The base price of the contracts on subsequent trading days, will be the daily close price of the options contracts. The closing price shall be calculated as follows:

If the contract is traded in the last half an hour, the closing price shall be the last half an hour weighted average price.

If the contract is not traded in the last half an hour, but traded during any time of the day, then the closing price will be the last traded price (LTP) of the contract.

If the contract is not traded for the day, the base price of the contract for the next trading day shall be the theoretical price of the options contract arrived at based on Black-Scholes model of calculation of options premiums.

\”

As I understand, once derivative of contract added with new expiration date, then only balck-scholes formula is working to decide the option base price after that only BID-ASK is working i.e. supply and demand only. I think price is decided on that not delta, gamma, vega or theta, or I\’m totally confused with option pricing.

Could you help me to understand?

Thanks,

Mayur

So the way to think about it is – how do traders bidding and asking arrive at their price? They must have a perception of what price to bid and ask for? This is where B&S option pricing comes into play.

Are you trying to tell me that only BID and ASK prices decide the price of derivative instead of underlying?

It is a combination of all things, Mayur.

Yes, Karthik I know that it is international market, but my question is why it\’s moving when underlying is not moving?

It is the perception that the underlying will move when the makrets open, that idea makes the futures move 🙂

Sir, suppose I buy options, for example, I held it for one week, if price went up during those one week and my analysis are correct, will theta decay still affect my profits.

To sum up, in buying options , do theta decay matters even if the price is going up, or theta decay affect on if price went down in option buying.

Yes, theta decay will happen, but the loss via theta decay will be set off by the gains in delta and volatility.

Karthik,

My question is not related to option but its related to derivatives i.e. future

Consider below:

1) Indian Market timings: 9:00 AM to 3:30 PM

2) GIFT NIFTY timings:6.30 am to 3.40 pm and 4.35 pm to 2.45 am

Now if GIFT NIFTY is future derivative of NIFTY, then why price of GIFT NIFTY is changing when market is closed? since GIFT NIFTY is changing while NIFTY is not changing.

Could you just explain what is happening??

Thanks and Regards,

Mayur

Because it is considered an international market, Mayur.

Sir, will theta decay affect my position if I hold it for 1 or 2 days. And for the 2nd question, if i buy PE then am i also on the option buying side or does it apply for only CE. Sorry for the question it may sound stupid , but I am new to options. Thank you.

Sam, so for 1 or 2 days theta decay may not matter much, but only if you\’ve bought early in the cycle. If you buy closer to expiry, then it will impact your position.

Option buying is same for CE and PE, does not really matter.

1) Think of it in terms of daily theta loss, easier that way.

That\’s means due to Theta premium is erodes at EOD only not during intraday.

Am I right?

Yes, that\’s right. Technically, it is continuously eroding, but it is easier to think of it and build strategies by assuming its a EOD thing.

Hi Karthik,

Could you please clarify two things on Theta:

1) Clearly Theta is depreciating the option premium but due to Theat, option premium lost its value by days or by hours or by minutes or by seconds?

2) if it is depreciating daily or hourly or minutely or secondly then it would be market days or all the days, market hours or all the hours, market minutes or all the minutes, market seconds or all the seconds?

Thanks,

Mayur

1) Think of it in terms of daily theta loss, easier that way.

2) Ref the earlier comment.

Sir I have already bought an option which is in decay, in this situation should I sell or what

I mean premium decay

What should I do in option decay situations?

Just need some recommendation

You can benefit from it by selling options, Saroj.

Karthik Sir,

I have a question, I was looking nifty option chain for october expiry. The ATM strike\’s(19400) theta is -2.5 . My question is that in every trading day -2.5 rs will be deducted from the premium amount and gradually the value of theta will also arise with time ?

On one hand, theta reduces the value and on the other hand, there are other factors that also reduce or increase the value of the premium. So look at it from a complete perspective.

Mere ko bhut ache se samjh me aya sb kuch bhut betreen tha bs Hindi ke kuch word complicated the

\”For example, if an option writer has sold options at Rs.54, with a theta of 0.75, all else equal, the same option is likely to trade at – =0.75 * (3**) = 2.25 = 54 – 2.25 = 51.75 Hence the seller can choose to close the option position on T+ 3 day by buying it back at Rs.51.75/- and profiting Rs.2.25 …and this is attributable to theta! Have a look at the graph below –\”

Sir, I could not get this – how you got the \”3\” number here, if the option seller sold the premium at 54 rs , then next day the premium will become (54-0.75) 53.25 rs. is it correct ?

You mean 3 in T+3? Thats indicates the number of days.

Dear Karthik sir, as you said above,

1. In case of Weekly expiry, if contract is created on Tuesday, I can expect theta peak on Friday? But the contract itself would have

already closed on previous day, Thursday itself.

2. In case of Monthly expiry, you say that the theta peaks around 4th day so it\’s 4th of the month. But the chapter says that it peaks

during the last week of the month.

Please clarify these anomalies.

1) The peak is on expiry day, post expiry, there is no contract, and there is no question of theta peaking.

2) In case of a monthly contract, the peak happens around the last week of contract expiry.

My question was quite simple sir. Just as in case of monthly expiry, theta decay is the max during last week,

so in case of weekly expiry from which day onward theta rises rapidly?

It peaks around the 4th day of contract creation.

Dear Karthik sir,

I know that sir. But what I wanted to know is that in a weekly expiry series, from which day onwards theta decay starts

effecting more.

Regardless of which expiry, theta decay starts at the time of contract creation.

Dear Karthik sir

In case of Weekly expiry series, from which day Theta starts playing out more?

Please help sir.

Theta is at work the moment the contract is created.

Hi Karthik, have you covered the behaviour of Theta for OTM, ITM & ATM options in a separate article?

If yes, please do point me in that direction.

Thanks again for all the great work!

Siddharth, yes I\’ve discussed this across greek interactions and in the query section.

Sir,

We learnt that option premium varies with underlying through the effect of Delta & Gamma. Now, while studying the chapter of Theta, we come to learn that Premium= Intrinsic value+Time value. Now, intrinsic value is purely based on underlying\’s price traversal.

(i) I want to understand if this intrinsic value effects through the involvement of Delta & Gamma or it affects separately.

Your reply on the above will help me get deeper.

I am waiting for your kind reply.

Yes, it does. No option greek works in isolation, eventually, they are all interconnected, and you will have to understand how it impacts the option premium.

Sir,

I studied upto Theta. With this, Please correct me if I am wrong in below statements:

Without consideration of volatility (vega), the premium of a strike (CE/PE) changes as per below:

(i) As long as a strike is in OTM domain, premium changes with changes with delta, gamma, theta abut not intrinsic value (since it is 0). Here changes of premium with change in underlying is only reflected through Delta & Gamma and not IV.

(ii) With the strike being flown to ITM domain, premium changes with changes with delta, gamma, theta and intrinsic value (since it is +ve). Here changes of premium with change in underlying is reflected through Delta, Gamma as well as IV.

1) Yes. Intrinsic value kicks in only after the stock becomes ITM

2) Thats right.

Great. Thank You.

Happy learning 🙂

Please note, above Buy call option. Strike 17350 CE

Dear Karthik Sir,

We observed the following details from payoff chart as below

Nifty 17359.75.

B/S Expiry Strike lots price

B 06 Apr 17350 1 100

When price is at 17380,

Expected P&L on

Mon, 03 April -775

Expiry day -3500

we understood here that total loss on expiry is (3500) . (PL=Spot-strike-premium paid=17380-17350-100=-70, total loss=-70*50=-3500 )

1. What about on Mon 03 Apr loss (775). This is because of time value is higher start of series? How can we calculate this loss?

2. Delta of the option=+.52 (from the option chain).

premium is supposed to increased by (17380-17359.25)*0.52=10.79 , from this premium increased can we correlate with PL.? if we sell on 3rd April.

Thank you very much for your great support.

The P&L can be different based on for how long you intend to hold the position. For example, on expiry, its purely based on the intrinsic value of the options, but if you hold the position during the expiry, many factors are at play (mainly the greeks). I guess Sensibull gives you the payoff before expiry.

Remember, Deltais just one factor to impact the premium. There are others as well like vol and theta.

Thanks a lot Karthik, but the premium decay i observed was not on expiry but what I observed was on the first day of the expiry series.

I read in the comments where you stated that for intraday trading Theta doesn\’t have much impact. If that is the case, time decay factor may not be the one that caused the decay isn\’t it. Not sure, but wanted to understand what could be the reason if it is not time decay.

Thank You

Got it, if its not expiry and other days, especially early in the series, then it can only be attributed to the drastic change in volatility. Remember, volatility also impacts the way option premiums are calculated.

Hello again Karthik,

Hope you are doing good.

Today for the first time I observed Nifty to see how it is moving and how premiums are moving correspondingly. (I actually observed the market yesterday to see how markets works on expiry day, but today I stuck my eyes to the screen and observed every single movement)

All Thanks to you for the way I progressed in my journey in Options learning.

Today momentum in Nifty was very very slow. I I was observing 17,200 CE April 6th Expiry when the spot was around 17,230 the premium was 130. Market kept on trading in this zone (17,200 to 17,250) for almost 45-60 min, what I observed is, initially the premium was increasing whenever the spot was increasing but after it traded in this zone for an hour so the premium didn\’t increase much even when the spot increased considerably. In fact the same strike was available 130 even when the spot moved to 17,250 (Remember I saw the 130 premium when spot was 17,230).

What is the reason for this? I tried searching google and watched some youtube videos but wasn\’t clear on their explanation. The common term they used was premium erosion or premium decay. They are sayin the Market is trading in the same zone for long time to erode premiums. I honestly didn\’t understand what they meant.

Can you please explain me what it means by premium erosion/decay and why it happened.

From this chapter I understood about Time Decay factor (but since I am looking at intradat perspective, time decay factor shouldn\’t be high right?)

Looking forward for your explanation as usual 😊

Thank You

Sai, so with passage of time, the option premium reduces. This, as you know is called time decay. The rate at which the time decay happens keeps increasing as the expiry progresses. The acceleration starts to peak on expiry day (maybe around post-noon), and even if the market increases, the time decay kind of weighs in and drags the premium down, unless the movement in the underlying is strong. So this is exactly what you noticed in the market.

Thank you very much.

Sure, happy learning 🙂

Here Time value calculated based on the price of the underlying

(spot) as below.

\”Spot Value = 8531

o Strike = 8600 CE

o Status = OTM

o Premium = 99.4

o Today’s date = 6th July 2015

o Expiry = 30th July 2015

Intrinsic value of a call option – Spot Price – Strike Price i.e 8531 – 8600 = 0 (since it’s

a negative value) We know – Premium = Time value + Intrinsic value 99.4 = Time

Value + 0 This implies Time value = 99.4! Do you see that? The market is willing to

pay a premium of Rs.99.4/- for an option that has zero intrinsic value but ample

time value! Recall time is money Here is snapshot of the same contract that I

took the next day i.e 7th July\”

When we checked the option chain , we observed that actual time value calculated based on futures price.Please if you explain why this difference, it will be very helpful for us.

Thanks.

Prasanta, so for option pricing, its ok to consider futures price but settlement is always with spot.

From the point of option seller, What will happen if i let option contract expires worthless? How much money i will earn or will i lose entire holding or will i lose just the profits? Kindly guide.

You will earn the entire premium, Aditya.

Thanks a lot Sir🙏☺️. Started with your fundamental and technical analysis chapters like one and a half years back. Pretty impressed with the explanations especially about income statement, balance sheet and cash flow statements. Use them almost daily when I read a financial statement. I found only one other book impressive apart from that on balance sheet thereafter. All your options materials are in a PDF format with me always in all my devices. Highlighted, Bookmarked them. Comes in handy all the time. And the cherry on top of it is that I\’m able to connect with the author. Watching all of your youtube videos as well. Nice presentation and good editing. Can\’t ask for more. Wish I was given this quality of financial education during college days. Happy to learn from one of the best. Please Keep educating us sir!

Thanks for letting me know, Sathish. This motivates us to do better 🙂

Happy learning!

Does theta decay happen during trading holidays, weekends also? Thanks Sir.

Sort of, yes 🙂

Thanks for the reply. But I didn\’t catch you Sir. Isn\’t the IV I gave(460) the associated IV? And LTP at that time was around 433 only. The reason I mentioned the narrow bid ask spread is because I thought it translates to high liquidity. Is there anything I\’m missing in terms of lack of liquidity? I still don\’t understand what I should be looking for?

Ah, I missed your point on the narrow bid ask. Yes, a narrow bid-ask represents higher liquidity. So assuming ample liquidity exists, the option should not trade below its intrinsic value; even if it does, algos will pick up such an anomaly and plug the gap.

18000 PE March. Yesterday it traded around 610. Even as of writing this the intrinsic value for 18000 PE itself is 460. (NIFTY is around 17540). Premium is around 433. Bid ask spread is very narrow like hardly 1 rupee differencel. I don\’t understand how it is trading below intrinsic value.

Check the liquidity once Sathish, and not just the last traded price. What you need to look for is the last traded price and the associated intrinsic value at that point. For example, the lack of liquidity may result in thin trading activity and while the spot has changed, the LTP reflects a price at old IV. So do check for LTP along with the associated IV at the time of trade.

Currently NIFTY is around 17340. But the premium for March monthly Put option is around Rs.610. Intrinsic value itself is 660. Added with time value it should come above 660 right? I don\’t understand how this option premium is trading below intrinsic value. Please clarify sir.

Which strike are you referring to? Yes, the option cant trade below its IV. Do check the bid-ask for a more accurate view on the price.

I have sold OTM Option and its going against my view point hence there is a increase in the premium however I am closer to expiry and market stays near to breakeven as the premium went high will i still get the benefit of entire premium because i contract closed just an inch below expiry even though high premium?

Yeah, as long as the spot is below the strike for call and above the strike for PUT, the option will expire worthless, and you will get to retain the premium.

How can we calculate theta value for each day until time of expiry?

YOu can look up on any Black & Scholes calculator for this.

Hi Karthik, thanks for your revert. Actually I want to understand at what theta value I should exit from the loss making leg to avoid further decay. The leg which will become ITM will be hold till expiry.

Regards

Rahul Chaudhary

Theta accelerates as you move closer to expiry. Again there are other factors at play here…delta, vega etc. So taking a call just based on Theta may not help.

Hi, good morning. I am an option seller but this time basis some past studies for budget month, I have bought BNF 40600 (Both PE and CE) 23rd Feb expiry.

Seek Your views that at what theta value I should exit the leg which is in loss rather than waiting till expiry or till what date I should hold the loss making leg.

I do take the same trade on weekly expiry.

STUDY – https://twitter.com/kirubaakaran/status/1619999152775249920?t=aCgCAGeBne4MB7ZBVfrS2A&s=08

Regards

Rahul Chaudhary

Can\’t really advise you on when to exit, but if you are a seller, then the theta decay accelerates close to expiry and your best bet is to exit then 🙂

\”All other things being equal\” there would be no market.

I mean, all other forces acting on option premiums. To make the concept easier to explain 🙂

Sir does Theta decays even on Saturdays and Sundays?

Sort of, it does.

Thank you for your answer sir.

By the way I have another query sir

For Nifty current month option ATM theta decay is less for the first half of the month when compared to second half. So is it good to use long strangle/straddle for the first half of the month and short strangle/straddle for the second half of the month? I know its all depends on me and other Greeks but I wish I get clear answer from you sir.

Thank you inadvance

You are right, the theta decays at a lower rate in the first half as opposed to the 2nd half. So if at you want to buy options, its best if done in the first half.

Hello Karthik sir,

theta decays affects the premium price on the end of the day or each and every minute/second of the day or movement of the premium price sir? (consider when other things being equal)

It is on a continuous basis, Sudharshan.

Thank you sir….

Hi sir,

Today though spot was above my strike price ,actually premiums were not moving when strike crossed the spot.

There are still three days to expiry.

Hw timedecay affects ATM calls.

It is not just about time decay. Other greeks too play a role in this.

I have seen theta decay which is higher than option price ! eg,

Theta decay = -8.459804206

Option Strike = 18000 CE

Underlying = 17786.80

Option Price = 43.4

IV = 12.63

Days to expiry = 6

total decay = -50.758 (theta * 6)

price = 43.4

Can you please explain this ?

But here you are assuming that the option price is just a function of time. But there are several other factors that act on option prices at the same time.

Theta decay = -8.459804206

Option Strike = 18000 CE

Underlying = 17786.80

Option Price = 43.4

IV = 12.63

Min_left = current_time(7.19PM) to 3rd Nov 3.30 PM

Decay per min = 0.00587 (Theta/24)

Total decay = 49.468 (Decay per min * minute_left) [Which is higher than option price]

How is this possible ? Could you please explain what I am missing?

I\’m unsure if you can divide theta and get a per-minute decay rate. Something I\’ll have to figure out. That said, a demand and supply situation also adds to the premium.

मान लिजिए कि किसी प्रीमियम का भाव 100 रुपये हैं। यदि उसमें (1 point ) की गिरावट हुई तो कितने प्रतिशत की कमी आयेगीं।

Hi. I understood the concepts so far. One question is that how do I choose which stock ( company) option should I choose?

So this decision of yours should come from your analysis on the underlying.

Why do some stocks have high decay and some stocks have lower decay?

Thanks in advance 🙏🏻

Depends on the time to expiry. The longer the time to expiry, the lower is the time decay.

Hello Karthik,

I may have a very basic question, but still here it is:

– If for an option contract, suppose the closing price (premium) is 50 & the Theta is 3. So does it mean by next days opening I will see the premium as 47?

– The Theta gets applied only after closure of one trading day? Or this Theta value is seen getting reduced from the premium within the same day itself?

Will the options also loose time value from morning to evening in a day, other than day to day decay.

It is a continuous process.

Hi Karthik,

First of all, thank you and your team for this wonderful content.

I have a query w.r.t to below statement made in this chapter.

\”For example, if an option writer has sold options at Rs.54, with a theta of 0.75, all else equal, the same option is likely to trade at – =0.75 * 3 = 2.25 = 54 – 2.25 = 51.75 Hence the seller can choose to close the option position on T+ 3 day by buying it back at Rs.51.75/- and profiting Rs.2.25 …and this is attributable to theta\”

Q1: T+3–> here does T refer to date & time of selling the option?

Q2: What does it mean \”Seller can choose to close the option position on T+3 day by buying is back at Rs.51.75/-\”? Could you please elaborate a bit on this, step by step.

1) T+3 means, trade day plus 3 days. So if you shorted on Monday (T), Thursday is T+3.

2) It means that you can close the position on that day.

You can sell options closer to the expiry – you will get a lower premium but the drop in premium is high- Why sir?

Because of the theta decay, Nikhil.

How can we calculate every hours theta decay ??

Not possible, you just have EOD calculation.

Sir please suggest me where do I learn option trading

You are in the right place 🙂

hi kartik

where can i find theta value of particular stocks???

You can use any B&S options calculator to get the Theta value.

Hello Karthik Sir, I completely understood how theta really works but couple of questions. Where can I find the real-time theta values that would tell me the impact of holding a specific contract for a given period of time? If I am of a view that Nifty in the current weekly contract would not cross 16100 then according to your statement that we should sell OTM contracts, in this case should I be selling 15900, 16000 or 16100 if the current spot price is 15850 & what would I be selling a CE or PE?

The decision to sell CE or PE, depends on not just your view of the market, but also your sense of which premium is expensive. Usually, with an increase in volatility, the premiums too increase.

Sir can you please guide how time is calculated for weekly options. For eg how time value is calculated for Banknifty on last day? is it calculated hour wise? if any guideline please share

Nirav, not sure if I understood your query correctly. Sensitivity of time is captured by Theta and it accelerates to maximum by end of the expiry, especially on the last day.

Time decay affect which strike price the most??

I mean in which strike price premium decreases very 1st ?? It is ITM OR OTM?

I\’d say ATM and OTM.

Dear Karthik sir,

The chapter says –

1. At the start of the expiry series, the seller has the advantage of pocketing a large premium

but the fall of premium happens at a low rate.

2. When closer to expiry, the seller gets a lower premium but the drop in premium is high.

Which of the 2 you suggest is better from your experience ?

Both, depending on your experience in the market 🙂

Dear Karthik sir,

From what I understood Theta decay for OTM > ATM > ITM. But what is the reason behind this behavior ?

Please explain.

Thanks

Thats just the way options behave.

Sir, Should one consider greeks at the time of option selling only ?

Both at the time of selling and buying.

Dear Karthik sir, Pls answer the below questions or if necessary try to add any important point also at each answer so that I remember next time. Below is the assumption data. Thank you

1) Should one taken into consider Option Buying only for intraday to get rid of theta effect for weekly+ monthly expiry for both stock + index option ?

2) For Option Buying, Should one consider only technical chart ?

3) For long stock + Index option, Slightly OTM strike price is good to select ? so that it converts to ATM and then ITM if my view is right

4) Spot: 8000, Strike Price:- 8200 CE, Position:- Sell. So this is OTM sell na ?

5) Spot: 8000, View:- Bearish, Strike:- 8200 CE (Sell), Delta:- 0.3, Premium:- 200. If spot increases to 8200 then my premium becomes 260 right ? If spot decreases to 7900 then premium becomes 170 right ?

6) Sir, If I buy/sell any option on Monday and then on Tuesday, If both this (Delta + theta) affect on my premium ?

1) If you are buying, then this is true especially if you are closer to the expiry. Not necessarily true if you are early in the series (more time to expiry)

2) YOu can combine both tech and fundamentals

3) Yes, that\’s a good outcome to aspire for

4) Sorry, don\’t get that query. Yes, it is a sell or a buy based on what you want to do

5) Theoretically based only on DELTA yes, but there are several other factors at play

6) Yes, not just delta and theta, gamma and vega and supply and demand, they all affect your premium.

So we can think of ATM as safe thing wrt Theta acceleration?

In terms of theta decay, yes, its slightly slower compared to OTMs.

I believe there would be slight change in the behavior of theta wrt ITM, OTM and ATM.

Please guide on that. Thanks

The theta acceleration would vary basis the moneyness of the option. Its higher for OTM and relatively lesser for ITMs.

Dear Karthik sir,

Pls explain theta vs time for expiration w.r.t ITM,OTM & ATM options.

You told you will be adding it in the module long back in 2015. It\’s 2022 and still missing.

Any info when we can expect it?

The most generic thing to note is the theta decay, which I\’ve already explained. Is there anything else you\’d like to note?

We have to use ATM strike IV but as market moves, ATM strikes also changes. So do we have to check new ATM IV or old ATM strike\’s IV?

Yup, keep track of ATM IVs.

I just checked theta values for 2 expiries- 24th March (Today expiry) and 28th April (around 1 month to expiry) for Nifty 18700 CE

Theta for 24 March expiry Nifty 18700 CE= -3

Theta for 28 April expiry Nifty 18700 CE= -0.25

as we are near to expiry, theta is more and when there is more time left to expiry, theta will be low. Then how can this happen? Near expiry (24 March) has less theta than far expiry(28 April). Please clarify

-3 is greater theta than -0.25 right?

Sir as you mentioned option seller has time risk of option expiring ITM so they ask for high premium as days for expiry are more similarly option buyer also has time risk of option expiring OTM then why we consider seller risk(high premium for there risk) and not buyer risk?

Sometimes when the premium shoots up due to increased volatility, then it makes sense to sell options rather than buy options, Abhishek. So it really depends on the market conditions and the wat options are moving.

Hi karthik,

On the expiry day, for intraday if my view is correct I can buy and exit the call option within couple of hours(before market closing), in this case the theta decay will affect the premium ?

Theta wont impact the premium much on a intraday basis, unless you are very close to expiry.

Please Explain the concept of VIX and how its value is defined…

Also please explain how the premium value is made..?

Do check the subsequent chapters, Dhruv.

SInce option value is the sum of time value and Intrinsic value i.e

Premium = Intrinsic Value + Time Value(and other factors)

and if the underlying value changes by 1 point then that implies that the value of intrinsic value should also change by one for ITM, which further implies that the for ITM Premium could change its value by Equal to or more than one point w.r.t change in underlying value by 1 point. But Delta could not be more than one. Can you tell where I am wrong ?

Harman, if it\’s ITM (deep ITM), then one point change in underlying leads to 1 point change in the premium. In fact, for this reason, deep ITM option behaves like a futures instrument.

sir in the last graph shouldn\’t it be Time value vs Time to expiry??

Since we comparing to time to expiry, it represents the movement of time 🙂

How the theta is calculated in Nifty or Bank Nifty options with weekly expiry with a Holiday in between? For e.g. last week of January will have only 4 days with 26th January as a holiday. 27th Jan is the expiry day (Thursday). Will the theta benefit on Wednesday be given to the options on Thursday morning ? Or is it distributed proportionately among actual working days in a week? How is the theta calculated if there is a holiday in between?

It will be considered equally across all days remaining for expiry.

Hi Karthik, I have a query regarding the theta decay graph. Will this be with respect to only OTM options? In an ITM option won\’t the probability of the underlying price closing below the strike price become lesser as time goes forward, thereby increasing the premium/theta value? Or does the concept of theta not come into play at all in ITM options?

Akash, theta decay is a generic principle. It impacts all options regardless of its moneyness. Of course, it is more for OTM as we approach the expiry.

So when everything else remains the same, time decay works in favour of ITM options, right?

Yes, in a sense the decay is slower for ITM options compared to the OTM options.

Hi Karthik,

Suppose I buy a far ITM CE 2 days before expiry, shouldn\’t the premium increase the next day due to time decay? (considering everything else remains the same).

Rationale behind this – As expiry day approaches, the probability of CE ITM option to remain ITM increases.

That probability is already baked into the premium, Amit.

How does theta decay works over weekend in weekly and monthly options. Will option loose theta value considering 5 market day or 7 calendar days in weekly options ?

Considers all days of the week, Pawan.

Hi Karthik,

It is about theta and Decay effect.

Actually, I want to know when theta and decay effect on the premium price kicks in.

First is, what is decay effect? is it same theta or something different?

Second is, for example, when the theta & decay effects come on premium price if I buy a particular strike around market closing time (i.e., 3.15 pm)?

Is it happening after market closing hours (i.e., between today 3.30 pm to next day 9.15 am)? Or

Same day at 3.30 pm? or

Has the price at 3.15pm itself included theta effect for next day? or

Next day morning at/ or after 9.15 am? Or

Next day from 9.15 am to until market closes, this effect will happen continuously? Or something else?

Thanks,

Lingam

Decay effect, time decay, theta decay all refer to the same thing. The phenomenon where the time value of the option is lost due to the passage of time is called theta decay.Theta decay happens on a daily basis, it is accelerated closer to the expiry. Don\’t bother much about exact timings and all.

Time decay graph

1st point

At the start of the series – when there are many days for expiry, the option does not lose much value. For example, when there were 120 days to expiry the option was trading at 350, however, when there were 100 days to expiry, the option was trading at 300. Hence the effect of theta is low

Sir what is tha theta value at 350..how to find

Rakesh, I\’ve explained theta in great detail in this chapter itself, Rakesh. Suggest you read through this again.

Hi Karthik, I\’m learning a lot from your articles. Do options premium changes based on buy/sell volume excluding greeks, iv, underlying movement?

Yes, the demand and supply situation in the market does have an impact on the premium, but not to the extent of the option greeks.

Hi,

Does THETA affect intraday trades ?

Is it negligible for intraday ?

IF NOT THEN

How should it be used to measure risk for intraday ?

?????????????????????? ??????

Graph regarding the change of Theta in all cases: ITM, OTM, ATM

Sir, i have one doubt that if market is sideways and on Trading tick website i have observed Premium is Decay is

CE premium change is 1159

PE premium change is -2059

my doubt how to calculate decay percentage and which side has more decay.

Thanks

You can look at the option greeks for this, look for Theta in particular. Higher the theta value, higher is the decay.

Sir, can you pls update how theta will behave with OTM, ITM and ATM options as asked above by Amit Pathak.

Thank You

Sure, but in a nutshell, the rate of decay is highest for ATM and OTM, lower for ITM.

Every time I read any chapter of varsity i find something new to learn

Very precisely written

Very helpful sometimes confusing also …

Happy learning, Soundnya 🙂

Hi,

I need to clarify for the entry in call options… May this question already asked by anyone one on their view. Asking from my side for understanding…

Say for example, Nifty trading on 16250 ryt now,

If I bought in 16200 CE (ITM), the market down below 16250.. still am I in profit side??

may I buy 16250 ATM is safe or 16200 ITM is safe?? Not considered the premium.

Pls clarify it.

There is nothing like a safe strike to trade, its the strike which has better odds of closing ITM upon expiry. But generally yes, staying in and around ATM is better than going OTM.

Dear Karthik,

amit pathak says:

July 9, 2015 at 9:28 am

Sir,

Pls explain theta vs time for expiration w.r.t ITM,OTM & ATM options

Reply

Karthik Rangappa says:

July 10, 2015 at 5:11 am

Amit, makes sense, not sure how I missed this…I’ll probably make an addendum to this chapter.

Reply

The above topic on theta vs time for expiration w.r.t ITM,OTM & ATM options is still awaited. It\’s be 6 long years. Looks like theta (the graph guy) for this one is asleep somewhere.

Thanks for the reminder. I\’ll try and get this done sometime soon.

Hi rangappa ji, you said you will add addendum about how theta changes with time of OTM, ITM, ATM options in one of the comments initially, is that added somewhere? I am not able to find it.. Thank you

I need to check this 🙂

Sir, in a monthly premium after one week, which will decay more…. deep OTM or near OTM assuming that market is range bound , plz clarify..

Deep OTM.

Is time value decay truly on daily basis ? I see on the expiry date option value decreases within few minutes. If option time value decays truly on daily basis then if i buy option solely for intraday basis than theta decay does not effect me, am i correct ?

Dear SIr,

Can you explain the weekend effect and the change in IV during the second and last week of expiry and its effect on theta?

Weekend effect is the perception of option premium losing its value owing to the passage of time on Saturday and Sunday.

Hi

I have observed that for OTM options the theta is greater than option premium on Wednesday. For example on Wednesday after market closure the premium of 15000 PE was 5 where as theta of 15000 PE was 8. How is that even possible that the decay is greater than the premium itself?

That\’s possible, think about it…what real value does an OTM option have? Nothing right? So whatever value is attributed, its for the time.

So, what if i sell a call OTM well ahead at the beginning of weekly expiry? will i risk a huge amount, or will get profits?

No, but do track the position closely. You don\’t want to be in a position where the OTM position transitions into an ATM or ITM position.

There must be a mathematical expression to reach the premium value. It is more important to understand that to take a decision what is the best time to take a call or put option. Shall be thankful if anyone can share the mathematical equation.

Yes, that\’s right. You can use the B&S option pricing formula for this.

Option buyer makes loss if premium goes below his premium paid price

Option seller makes money either way the option premium moves

I m assuming I won\’t wait till expiry

Yup, thats correct.

Say I\’m option buyer

I pay a premium of 60 and

If premium goes high I make money if premium goes down I lose money

Even the premium rises to 75 I don\’t need to wait till expiry and get out next day

I can sell the contract at 75

Yes, you can sell at 75, no need to wait till expiry.

Sir how fall in premium favours option seller

Say I write an option and collects premium 60

If nothing else changes due to time decay the option value comes to 55

How is option seller made profit

You sold at 60

You bought it back at 55.

You make a profit of 5.

If you look at the same transaction in reverse order –

You bought @ 55

You sold @ 60

Hence made a profit of 5.

Both are the same, the order of trades is different.

Hi Karthik, can you explain theta vs time for expiration w.r.t ITM,OTM & ATM options

The effect of theta is highest for OTM, followed by ATM, and ITM.

Why not premium of call and put option is same for the same underlying, strike price and time to expiry ?

These have their own demand-supply dynamics, Ashwani. That impacts the prices.

Thanks Karthik

Good luck, Ram.

Hi Sir,

kindly please clarify on the most optimal selection of strike price for the following scenarios

1)Lets say nifty is trading 14850 as per spot chart . on the weekly expiry day I expect the market to move up and I prefer selling OTM put option as I am bullish towards market

In this case which strike price to select provided if my direction is correct

2)lets say nifty is trading 14850 as per spot chart and I expect the market to move down and I prefer selling OTM call option as I am bearish towards market.

In this case which strike price to select provided if my direction is correct.

As option sellers have edge i.e if market is in sideways or bullsih (if my direction is bullish view) and if market is in sideways or bearish (if my direction is bearish view) .I will keep stop loss based on the spot chart and based on my directional strategies as for option seller risk is unlimited and profit is limited.

Kindly please clarify .

On non expiry days ,I am going to follow the below plan .please correct me if I am wrong.

1)for weekly expiry ,on friday which is starting of the week ,I am bullish and nifty is trading at 14850 on spot chart ,and I will select 14850 ATM option and buy 14850 ATM call option with stop loss

2)for the same ,if I am bearish ,I will sell ATM call option stop loss ,provided if my direction is correct.

Thanks in advance

kind regards,

Ram

1) You can use the standard deviation concept to identify the range, have explained that later in the module

2) Same as above

Yes, this is ok. I\’d suggest you paper trade for few weeks before you deploy the trade.

At which strike I mean ITM, ATM, OTM has more Theta decay

OTM, ATM have higher Theta.

is it theta will affect premium on intraday basic, if yes then where can I check that

Not on an intraday basis, but it does on an EOD basis.

Dear Sir,

Unlike the other options, theta does not change its value during the day right?

Obviously the theta value increases daily but unless you count it theoretically it should stay roughly the same during the day?

Thats right. But Theta value only decreases with time, won\’t increase.

Sir,

Pls explain theta vs time for expiration w.r.t ITM,OTM & ATM optiodont

think you have not answered this

Theta decay is highest for OTM and ATM, lowest for OTM. This accelerates as you move closer to expiry.

Thank You ; Sir.

Good luck, Lionel 🙂

SIR;

AS WE KNOW THAT THE THETA INCREASES EXPONENTIALLY AS WE APPROACH CLOSER TO THE EXPIRY ; AND HENCE DECREASING THE TIME VALUE DRASTICALLY ( ESPECIALLY FOR ATM OPTIONS ); BUT I WANT TO ASK YOU; ABOUT THE BEHAVIOR OF THETA AND TIME VALUE FOR THE WEEKLY OPTIONS IN ( INDICES ); DOES THETA ALSO INCREASE EXPONENTIALLY AS WE APPROACH THE WEEKLY EXPIRY FOR WEEKLY OPTIONS ?

Not exponential, but yes, theta decay is on the higher side as we approach expiry.

THANK YOU .

Good luck!

THANK YOU SIR FOR SOLVING ALL MY QUERIES IN A SIMPLE AND UNDERSTANDABLE WAY.

AND PLEASE HELP ME WITH ONE MORE QUERY THAT I HAVE .

1. DO TIME DECAY TAKE PLACE ON HOLIDAYS AND WEEKENDS ALSO ?

Yes, Lionel. It does.

SIR;

FOR EXAMPLE SAKE IF THE TIME VALUE FOR \”ABC\” STOCK OPTION ; TODAY IS = 10 AND THE THETA CURRENTLY IS \”2\” ; HERE ARE MY QUESTIONS

1. FOR TODAY INTRADAY TRADE WILL THE TIME VALUE CHANGE ?

2. AND IF THE TIME VALUE CHANGES ON INTRADAY BASIS ALSO THEN WHAT IS THE FACTOR TO CALCULATE THIS CHANGE AS ; THETA IS CHANGE IN TIME VALUE PER DAY PAST ?

3. AND WHILE CALCULATING DAYS LEFT FOR EXPIRY WHETHER WE HAVE TO CONSIDER ONLY THE TRADING DAYS OR WE HAVE TO CONSIDER ALL THE DAYS ?

4. AND IF WE HAVE TO CONSIDER ALL THE DAYS THEN WHILE CALCULATING THE ANNUALIZED RETURN OR VOLATILITY BY USING DAILY RETURN AND VOLATILITY ; WHAT SHOULD BE THE MULTIPLICATION FACTOR WE SHOULD USE ( 252 ) OR ( 365 ) ?

1) Not really, but may change rapidly on expiry days

2) As I mentioned, does not really matter

3) Trading days

4) 252

Sir;

AS WE KNOW THAT THE TIME VALUE OF PREMIUM DECREASES AS THE TIME TO EXPIRY APPROACHES CLOSER; BUT WE USE THETA TO CALCULATE THE DECREMENT IN TIME VALUE AND THETA IS DEFINED AS \”POINTS LOST PER DAY ON PREMIUM\”; DOES THAT MEAN THETA DOES NOT DECREASE THE TIME VALUE CONTINUOUSLY ( ESPECIALLY ON A INTRA-DAY BASIS ) RATHER IT DECREASES THE TIME VALUE ONLY WHEN THE DAY IS PAST AND DO NOT DECREASE THE TIME VALUE SECOND TO SECOND ?

SIR; PLEASE REPLAY BECAUSE I WANT TO USE A OPTION STRATEGY BASED ON THIS CONCEPT.

Thats right, you will not experience theta decay on an intraday basis (unless you are close to expiry). Theta decay in quite tangible on a day to day basis.

Thanks got my doubts clarified in full

Good luck!

Hi Karthik,

Thanks a lot for clarifying the doubt.

One more doubt.

1. In the above scenario, if the spot price reaches 2700, then my put option will be ITM and hence I would gain. However, my call option would be worthless. Please suggest on this point if I am correct.

2. Further, Seeking a little more insights as per your point 3. If there is no momentum and the spot price moves sideways, I am bound to loose entire money at expiry due to time decay. So, How will a low momentum be helpful?? I was of a impression that if the momentum is high in one direction, I would make good profit from at least one of the trades?? Please suggets if I have missed accounting for any critical variable.

—

Regards

1) Yes, provided you are long 2700 PE.

2) In case of low momentum and the sideways market conditions prevail, you can consider options selling and benefit from theta decay.

Hi All,

I have been in Equity and Futures trading for quite sometime i.e. 3 years.

I have a question related to Options trading as I am new to it and look forward to your support.

Paramerters:

Stock Name: TCS

CMP: 2902

Date: 26/12/2020

I Plan to buy one lot of TCS JAN 3000CE @ Premium of 67 and simultaneously buy 1 lot of TCS JAN 2850PE @ Premium of 69 expecting TCS to fall to 2750-2700 levels but minimising my loss in naked put option by buying a call option as well also expecting volatility to increase by 15th Jan 2021

Doubts:

1. Will this be a long straddle strategy?

2. What are the odds of me loosing the entire money.

3. Is it advisable to play with this startegy or long stradlle is applicable and suggested only at ATM with expectation of High Volatility.

Regards

1) This is a long strangle, not straddle.

2) If markets gain momentum and move in either direction, then you will lose money

3) Both these strategies are similar in their behaviour. Depends on how the market momentum. Higher the momentum, higher is the probability of you losing money. These strategies are best executed when you don\’t expect much movement in the market.

Dear Sir,

Can you please add an explanation for ITM/ATM/OTM options (theta vs time to expiry)?

Please do check this chapter – https://zerodha.com/varsity/chapter/moneyness-of-an-option-contract/

sir why theta increae and decrese in intraday. please reply

Theta does not increase, it only decreases as we move closer to expiry.

Does theta decay happens throughout the day? Meaning if the delta is zero will I see an increment in p/l with every tick or will it get added to the account after day closing? ( from option seller perspective)

It does, but it is more recognisable on an EOD basis.

By saying that option buyer loses money on day to day basis you mean that the earliest he gets into contract i.e. from maximum number of days to expiry, the better for him.

Hmm, that is possibly good for the sellers.

hi sir…what does total theta 1200 means??

1200? Where are you getting these values from, Neev?

Hi Karthik..good day to you. Your team\’s and especially your replies have definitely added a special set of skills in my life.

My query today is on the theta of deep OTM strikes. For example, weekly nifty expiry, strike of 11700 has premium price of 7.5 rs and theta today(tuesday) is 6.79

How does this work? 6.79 a day doesn\’t add up at all, and I cant say 6.79 is for tomorrow either, because there are still 2 days to expiry.

Why I\’m asking this, I want to get out of a position where I have already realised around 80-85% target profit, and get into another position. For that, I want to calculate ahead when I can realise that 80% mark.

In this example, from the looks of it, 6.79 should decay tomorrow itself, but I don\’t think that happens practically. There would still remain 2 or 3 rs tomorrow, right?

Is the gap entirely attributale to demand/supply price? If so, can you steer me to a direction where I can calculate that 80-85% range and when exactly I might realise that (except of course on expiry date opening, where a deep OTM definitely loses almost 95% its value)

Thanks

I quite doubt the theta value is correct. However, this is a weekly option and the theta decay is quite rapid. Also remember, while on one side the theta decreases and on the other there are other factors which influence the premium.

Hi Kartik,

Reduce of premium due to time should constant even if all other factors are variable. Because time factor is fixed For e.g.

Option – Nifty

Premium – 100

Expiry – Weekly

Premium reduction due to time should be –

100/7= 14.28 per day.

Time Reduction should be constant. However premium can fluctuate with other factors too.