22.1 – Why now?

I suppose this chapter’s title may confuse you. After rigorously going through the options concept over the last 21 chapters, why are we now going back to “Call & Put Options” again? In fact we started the module by discussing the Call & Put options, so why all over again?

Well, this is because I personally believe that there are two learning levels in options – before discovering option Greeks and after discovering the option Greeks. Now that we have spent time learning Option Greeks, perhaps it is time to take a fresh look at the basics of the call and put options, keeping the option Greeks in perspective.

Let’s have a quick high-level recap –

- You buy a Call option when you expect the underlying price to increase (you are out rightly bullish)

- You sell a Call option when you expect the underlying price not to increase (you expect the market to either stay flat or go down but certainly not up)

- You buy a Put option when you expect the underlying price to decrease (you are out rightly bearish)

- You sell a Put option when you expect the underlying price not to decrease (you expect the market to stay flat or go up but certainly not down)

Of course the initial few chapters gave us an understanding on the call and put option basics, but the agenda now is to understand the basics of call and put options keeping both volatility and time in perspective. So let’s get started.

22.2 – Effect of Volatility

We know that one needs to buy a Call Option when he/she expects the underlying asset to move higher. Fair enough, for a moment let us assume that Nifty is expected to go up by a certain percent, given this would you buy a Call option if –

- The volatility is expected to go down while Nifty is expected to go up?

- What would you do if the time to expiry is just 2 days away?

- What would you do if the time to expiry is more than 15 days away?

- Which strike would you choose to trade in the above two cases – OTM, ATM, or ITM and why would you choose the same?

These questions clearly demonstrate the fact that buying a call option (or put option) is not really a straightforward task. There is a certain degree of ground work required before you buy an option. The ground work mainly revolves around assessment of volatility, time to expiry, and of course the directional movement of the market itself.

I will not talk about the assessment of market direction here; this is something you will have to figure out yourself based on theories such as technical analysis, quantitative analysis, or any other technique that you deem suitable.

For instance you could use technical analysis to identify that Nifty is likely to move up by 2-3% over the next few days. Having established this, what would you do? Would you buy an ATM option or ITM option? Given the fact that Nifty will move up by 2-3% over the next 2 days, which strike gives you maximum bang for the buck? This is the angle I would like to discuss in this chapter.

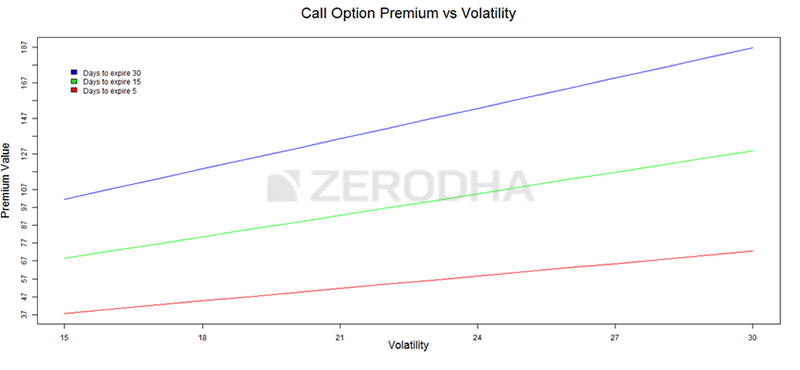

Let’s start by looking at the following graph, if you recollect we discussed this in the chapter on Vega –

The graph above depicts how a call option premium behaves with respect to increase in volatility across different ‘time to expiry’ time frames. For example the blue line shows how the call option premium behaves when there are 30 days to expiry, green for 15 days to expiry, and red for 5 days to expiry.

With help of the graph above, we can arrive at a few practical conclusions which we can incorporate while buying/selling call options

- Regardless of time to expiry, the premium always increases with increase in volatility and the premium decreases with decrease in volatility

- For volatility to work in favor of a long call option one should time buying a call option when volatility is expected to increase and avoid buying call option when volatility is expected to decrease

- For volatility to work in favor of a short call option, one should time selling a call option when volatility is expected to fall and avoid selling a call option when the volatility is expected to increase

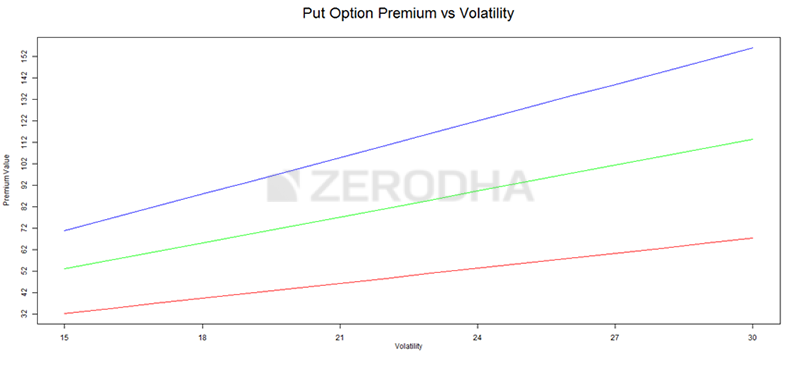

Here is the graph of the put option premium versus volatility –

This graph is very similar to the graph of call premium versus volatility – therefore the same set of conclusions hold true for put options as well.

These conclusions make one thing clear – buy options when you expect volatility to increase and short options when you expect the volatility to decrease. Now the next obvious question is – which strike to choose when you decide to buy or sell options? This is where the assessment of time to expiry comes into play.

22.3 – Effect of Time

Let us just assume that the volatility is expected to increase along with increase in the underlying prices. Clearly buying a call option makes sense. However the more important aspect is to identify the right strike to buy. Infact when you wish to buy an option it is important to analyze how far away we are with respect to market expiry. Selection of strike depends on the time to expiry.

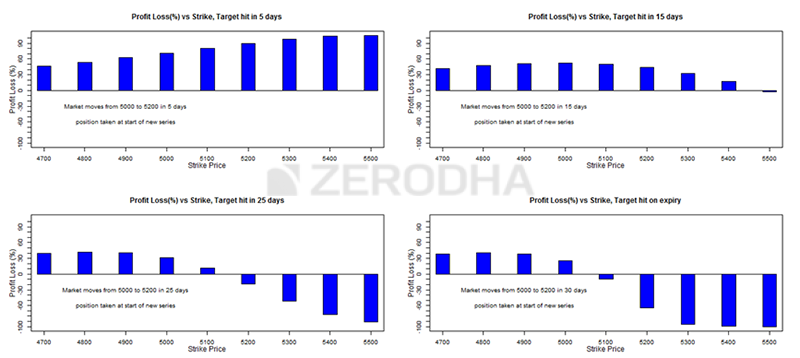

Do note – understanding the chart below may seem a bit confusing in the beginning, but it is not. So don’t get disheartened if you don’t get it the first time you read, just give it another shot

Before we proceed we need to get a grip on the timelines first. A typical F&O series has about 30 days before expiry (barring February series). To help you understand better, I have divided the series into 2 halves – the first half refers to the first 15 days of the series and the 2nd half refers to the last 15 days of the F&O series. Please do keep this in perspective while reading through below.

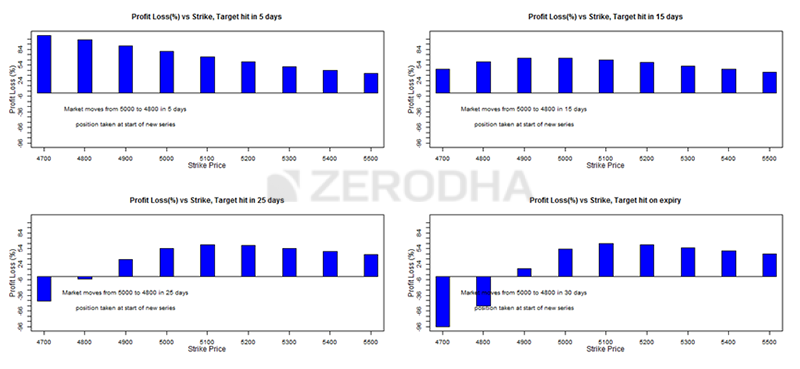

Have a look at the image below; it contains 4 bar charts representing the profitability of different strikes. The chart assumes –

- The stock is at 5000 in the spot market, hence strike 5000 is ATM

- The trade is executed at some point in the 1st half of the series i.e between the start of the F&O series and 15th of the month

- We expect the stock to move 4% i.e from 5000 to 5200

Given the above, the chart tries to investigate which strike would be the most profitable given the target of 4% is achieved within –

- 5 days of trade initiation

- 15 days of trade initiation

- 25 days of trade initiation

- On expiry day

So let us start from the first chart on the left top. This chart shows the profitability of different call option strikes given that the trade is executed in the first half of the F&O series. The target is expected to be achieved within 5 days of trade execution.

Here is a classic example – today is 7th Oct, Infosys results are on 12th Oct, and you are bullish on the results. You want to buy a call option with an intention of squaring it off 5 days from now, which strike would you choose?

From the chart it is clear – when there is ample time to expiry (remember we are at some point in the 1st half of the series), and the stock moves in the expected direction, then all strikes tend to make money. However, the strikes that make maximum money are (far) OTM options. As we can notice from the chart, maximum money is made by 5400 and 5500 strike.

Conclusion – When we are in the 1st half of the expiry series, and you expect the target to be achieved quickly (say over few days) buy OTM options. In fact I would suggest you buy 2 or 3 strikes away from ATM and not beyond that.

Look at the 2nd chart (top right) – here the assumption is that the trade is executed in the 1st half the series, the stock is expected to move by 4%, but the target is expected to be achieved in 15 days. Except for the time frame (target to be achieved) everything else remains the same. Notice how the profitability changes, clearly buying far OTM option does not makes sense. In fact you may even lose money when you buy these OTM options (look at the profitability of 5500 strike).

Conclusion – When we in the 1st half of the expiry series, and you expect the target to be achieved over 15 days, it makes sense to buy ATM or slightly OTM options. I would not recommend buying options that are more than 1 strike away from ATM. One should certainly avoid buying far OTM options.

In the 3rd chart (bottom left) the trade is executed in the 1st half the series and target expectation (4% move) remains the same but the target time frame is different. Here the target is expected to be achieved 25 days from the time of trade execution. Clearly as we can see OTM options are not worth buying. In most of the cases one ends up losing money with OTM options. Instead what makes sense is buying ITM options.

Also, at this stage I have to mention this – people end up buying OTM options simply because the premiums are lower. Do not fall for this, the low premium of OTM options creates an illusion that you won’t lose much, but in reality there is a very high probability for you to lose all the money, albeit small amounts. This is especially true in cases where the market moves but not at the right speed. For example the market may move 4% but if this move is spread across 15 days, then it does not make sense holding far OTM options. However, far OTM options make money when the movement in the market is swift – for example a 4% move within 1 or say 2 days. This is when far OTM options moves smartly.

Conclusion – When we are at the start of the expiry series, and you expect the target to be achieved over 25 days, it makes sense to buy ITM options. One should certainly avoid buying ATM or OTM options.

The last chart (bottom right) is quite similar to the 3rd chart, except that you expect the target to be achieved on the day of the expiry (over very close to expiry). The conclusion is simple – under such a scenario all option strikes, except ITM lose money. Traders should avoid buying ATM or OTM options.

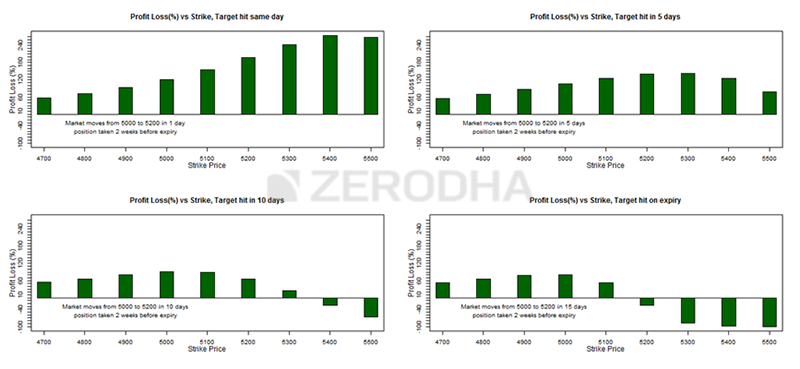

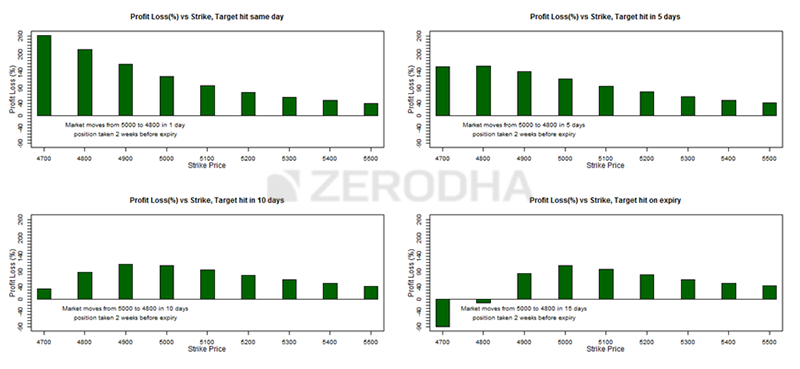

Let us look at another set of charts – the idea here is to figure out which strikes to choose given that the trade is executed in the 2nd half of the series i.e at any point from 15th of the month till the expiry. Do bear in mind the effect of time decay accelerates in this period; hence as we are moving closer to expiry the dynamic of options change.

The 4 charts below help us identify the right strike for different time frames during which the target is achieved. Of course we do this while keeping theta in perspective.

Chart 1 (top left) evaluates the profitability of different strikes wherein the trade is executed in the 2nd half of the series and the target is achieved the same day of trade initiation. News driven option trade such as buying an option owing to a corporate announcement is a classic example. Buying an index option based on the monetary policy decision by RBI is another example. Clearly as we can see from the chart all strikes tend to make money when the target is achieved the same day, however the maximum impact would be on (far) OTM options.

Do recall the discussion we had earlier – when market moves swiftly (like 4% in 1 day), the best strikes to trade are always far OTM.

Conclusion – When you expect the target to be achieved the same day (irrespective of time to expiry) buy far OTM options. I would suggest you buy 2 or 3 strikes away from ATM options and not beyond that. There is no point buying ITM or ATM options.

Chart 2 (top right) evaluates the profitability of different strikes wherein the trade is executed in the 2nd half of the series and the target is achieved within 5 days of trade initiation. Notice how the profitability of far OTM options diminishes. In the above case (chart 1) the target is expected to be achieved in 1 day therefore buying (far) OTM options made sense, but here the target is achieved in 5 days, and because the trade is kept open for 5 days especially during the 2nd half of the series, the impact of theta is higher. Hence it just does not make sense risking with far OTM options. The safest bet under such a scenario is strikes which are slightly OTM.

Conclusion – When you are in the 2nd half of the series, and you expect the target to be achieved around 5 days from the time of trade execution buy strikes that are slightly OTM. I would suggest you buy 1 strike away from ATM options and not beyond that.

Chart 3 (bottom right) and Chart 4 (bottom left) – both these charts are similar except in chart 3 the target is achieved 10 days from the trade initiation and in chart 4, the target is expected to be achieved on the day of the expiry. I suppose the difference in terms of number of days won’t be much, hence I would treat them to be quite similar. From both these charts we can reach 1 conclusion – far OTM options tend to lose money when the target is expected to be achieved close to expiry. In fact when the target is achieved closer to the expiry, the heavier the far OTM options bleed. The only strikes that make money are ATM or slightly ITM option.

While the discussions we have had so far are with respect to buying a call option, similar observations can be made for PUT options as well. Here are two charts that help us understand which strikes to buy under various situations –

These charts help us understand which strikes to trade when the trade is initiated in the first half of the series, and the target is achieved under different time frames.

While these charts help us understand which strikes to trade when is the trade is executed in the 2nd half of the series and the target is achieved under different time frames.

If you go through the charts carefully you will realize that the conclusions for the Call options holds true for the Put options as well. Given this we can generalize the best practices for buying options –

| Position Initiation | Target Expectation | Best strike to trade |

|---|---|---|

| 1st half of the series | 5 days from initiation | Far OTM (2 strikes away from ATM) |

| 1st half of the series | 15 days from initiation | ATM or slightly OTM (1 strike away from ATM) |

| 1st half of the series | 25 days from initiation | Slightly ITM options |

| 1st half of the series | On expiry day | ITM |

| 2nd half of the series | Same day | Far OTM (2 or 3 strikes away from ATM) |

| 2nd half of the series | 5 days from initiation | Slightly OTM (1 strike away from ATM) |

| 2nd half of the series | 10 days from initiation | Slightly ITM or ATM |

| 2nd half of the series | On expiry day | ITM |

So the next time you intend to buy a naked Call or Put option, make sure you map the period (either 1st half or 2nd half of the series) and the time frame during which the target is expected to be achieved. Once you do this, with the help of the table above you will know which strikes to trade and more importantly you will know which strikes to avoid buying.

With this, we are now at the verge of completion of this module. In the next chapter I would like to discuss some of the simple trades that I initiated over the last few days and also share my trade rationale behind each trade. Hopefully the case studies that I will present in the next chapter will give you a perspective on the general thought process behind simple option trades.

Key takeaways from this chapter

- Volatility plays a crucial role in your decision to buy options

- In general buy options when you expect the volatility to go higher

- Sell options when you expect the volatility to decrease

- Besides volatility the time to expiry and the time frame during which the target is expected to be achieved also matters

Hi Karthik,

Great explanations on the topic. Is it possible to get the data/ spreadsheets that have built the blue and green column graphs. I am trying to build intuition around how strike of 4700, 4800, 4900 are profitable when ATM strike = 5000 (since premium & Greek values are not known/ indicated in the example).

Thanks!

Thanks Jha, unfortunately dont have the spreadsheet relating to that 🙂

Hello Karthik,

For intraday,ITM (1 strike away) will be good choice right?

I mean, just for Points and sqare off

Not for shorting 🙂

hi sir,

thanks for detailed write up on volatility, forgive me if the question is lame. When we are sure about the increase in price of infosys by 4%. 5000 to 5200. buying call option beyond 5200 (OTM) is not meaningless?. profit= 5200(target price)-5700(OTM strike price)-premium. which means buying otm leads to loss?

Along with that, you also have to look at time to expiry 🙂

Hello

More or less understood what has been written here but did not quite get the logic behind this. like why will the ATM option not be profitable even if the target is reached in 25 days. if its going to expire in positive?

Becuase there are other factors at play and not just the movement of the underlying Mansi. You need to consider other greeks.

I think the target and strike prices are different here. Target is 5200, but the strike price is what you choose to buy. Remember, the strike price is expected to be lower than the spot (for call buyers) only on expiry, but you can square off even before the expiry if your target of 5200 is achieved. As long as the market is moving up, you will make money, but the charts tell you which strike price will fetch you the maximum.

Yes, target can be anything, its your call. But strikes are fixed.

Thank you!

Sure, good luck Pranav!

I read the next chapter and the case study about trading volatility around RBI Monetary Policy event answered the second question. It seems that there can be easy pickings in options markets.

~Thank you!

Ah ok, I just posted a reply 🙂

Dear Karthik,

Thank you so much for explaining the interaction of input variables in such a simple manner. If I knew the topic and tried to explain, I would have shown partial derivatives and 90 people out of 100 would have walked away 🙂

I have two questions:

1) Please look at the fourth/last chart showing the profitability of call option when the target of 5200 is achieved on expiry. Shouldn\’t the profitability of the strike price of 5200 should be -100%? On expiry, the option is worthless (strike price of 5200 and spot price of 5200) so my entire investment is lost.

2) This is more of an intellectual curiosity about arbitrage in interlinked financial markets. Consider that an important event, say FED Policy meet, is to be held after a few days, and there is no agreement about the expected decision on interest rate policy yet. For some reason, say limited rationality or market inefficiency, volatility of the underlying asset has not increased yet but we expect it to increase when we are close to the event. This would make options more valuable at that time. Since I can borrow to buy options today and sell them when volatility increases to make profits, the price of options should already be higher today. Or is the constraint of limited rationality / market inefficiency of the underlying binding on the option also and the price of the option will be low today since the realized volatility of the underlying has not increased yet?

My guess would be that efficient options markets would not give an easy opportunity to profit from widely anticipated events, so the option price would have increased already. This would be reflected in the implied volatility of the option. If true, this could be a reason why we use implied volatility rather than realized volatility.

Glad you liked the content, Pranav.

1) The idea is to showcase which of the strikes has are likely to profit if the underlying was to move in the expected desired direction. Point to note is that it is not necessary to hold to expiry.

2) This does not happen. The nature of markets is such that it likes certainty. Whenever there is uncertainty or confusion, the implied volatility always increases, and when this happens option values increases.

Hope that helps 🙂

Sir in the blue chart series in the second chart you have. mentioned that buying an ATM option or slightly OTM option is good, but you have not mentioned about ITM option. But in the chart it is clearly visible that ITM options is also profitable. So can we buy it or not?

If the underlying moves, most strikes turn profitable, but the question is which amongst them is the most profitable. Thats what we try to find.

These above examples are for put and call buyers rights? and not writers?

That\’s right.

Are these above examples based on assumptions or they happen on day2day basis?

These are not assumptions, these happen regularly in market 🙂

Strictly speaking based on the summarised table, if we were to initiate a long option position on a Thursday (weekly index expiry) with the expectation of the target being achieved on the same day:

1) would that be considered 2nd half of series and same day –> OTM option

OR

2) 2nd half of series and expiry day –> ITM option

Ofcourse, it is more nuanced than this

The point to note here is that if there is enough time to expiry, then you can consider an OTM option even if you expect the target to hit the same day. Otherwise, you can consider ITM option. So yes, time to expiry does make a difference. Also, more nuanced yes, especially since there are other factors at play – delta, volatility etc.

In that case how do i figure at what strike should i enter the trade Karthik? Are there any thumb rules?

Coz in this chapter we specifically discuss the payoffs with respect to number of days it might take to reach the target right? So just trying to figure how do i match both and figure a strike.

You can take the same trades, just that the timelines shrink. Also, do use Sensibull to figure the payoffs for strategies where the position will be closed before expiry. You will get an approximate view on the payoff.

Hi Karthik

How to figure whether the target hitting will happen in 4 days or 14 days?

That wont be possible, Malavika. You can only figure what could be the likely target, but how many days it would take to hit that target is something you cant figure.

it would be good if you reupload the charts and graphs with some clarity. all your graphs and charts are very hard to read. and some of your link are outdated. it\’s been 9 years , it would be good if you update the entire module.

Thanks, yeah meaning to do that. Will do.

Hi,

Great job sir. The whole module is very informative.

I also agree with the point that option shorting could have been explained the same way option buying has been described.

Thanks

Thanks Ayush. Point noted 🙂

Sir,

I have \”zero\” idea of options in practical scenario.

Just wanted to know the below:

1. Whether all stock options have monthly expiry (Last Thursday) and all index options have weekly expiry?

Sir,

Could we trade options in currency/commodities market just like we trade in equities?

Yes, you can. There are options on currencies and commodities.

Sir,

Thanks so much for all your answers.

I want to club this statistical approach with TA & FA to trade for a little prolonged time say for weeks. What would be your advise on this approach?

Thats probably the right way to go about 🙂

Sir,

Suppose we are on the 5th day since a stock is falling. Before starting to fall, the stock\’s price was 100. The stock\’s 7 day SD is say, 10%. Then we can say that the stock was supposed to trade between 90 and 110 during the 7 days from falling.

(i) Suppose on the close of today i.e, 5th day , the stock is trading close to 90. Can we infer that the statistical analysis is confirming that the stock price is likely to increase from tomorrow (6th day) till atleast 7th day?

Please confirm Sir.

Yes, but its only a possibility and no certainty 🙂

Sir,

Suppose today\’s closing price of a stock is 100 and the daily volatility is 2%. Then we can say that the stock will trade between 98 and 102 on tomorrow.

In respect to the above, can we long on the stock if it comes to 98 and short if the stock prices reaches 102 on tomorrow?

Yup, you can. Back test before you trade. Also, 2% is 1SD, maybe you can test 2SD.

Sir,

You had responded to one of my queries as \”There are quantitative technique which traders use to predict the future move\” ….. Can you please help me with a source or advise how can I able to learn that technique? I am specifically want to know this as this could help me club with other directions and to take the trading decision accordingly.

For Quants, you will have to take this approach – https://www.cqf.com/

Sir,

(i) Is IV data annualized?

(ii) Like ViX, is IV data says for the upcoming 30 days or is it an instantaneous value?

Yes dude, its annualized.

Sir,

Besides TA to know whether a stock/index will rise during the upcoming period, is there any statistical study available which can predict the probability of a stock moving up/down too?

There are quantitative technique which traders use to predict the future move.

Sir,

To predict range of a stock\’s movement, say for tomorrow, which data will be better to consider while calculating the range? Is it the historical spot data or IV of ATM strike?

I\’d suggest IV of the ATM strike.

Sir,

In NSE website and under derivatives section of a particular scrip, we could find data against Daily Volatility & Annualised Volatility.

(i) Do these figures mean the same as we calculate the historical realized volatility from excel through last 1 year spot prices?

(ii) If the above answer is \”Yes\”, can I alternatively consider this data without actually calculating the historical volatility through excel? Your viewpoint please.

(iii) Do NSE publishes this Daily Volatility & Annualised Volatility through stock futures or they consider spot prices? Any idea please.

1) No, this could change given the fact that the exchanges calculate volatility from a margin perspective.

2) Although different, you can use these numbers without calculating as majority of the industry uses these numbers.

3) Mostly spot as far as I know.

Sir,

I meant to know that is there any approach (as per probability wise) to understand whether a particular stock/index will rise or fall in an upcoming period of time?

Ah, sorry, I mistook your earlier query. While volatility as a measure gives you a sense of the price band, it wont tell you if the stock is moving up or down. Maybe you can use some TA here to develop a view.

Sir,

You have nicely described process for upper limit and lower limit probable range of a movement of stock/index.

In between, could you kindly tell if there is any study of futuristic prediction of whether the price of a stock will decrease/increase in terms of probability also? If yes, request if you could kindly help me with the same.

You can use the volatility based projection for stocks as well.

Sir,

Suppose I want to gauge current Nifty 50 Index volatility. Can I do with all the options below?

Method 1: I plotted the historical Nifty 50 index volatility of all the past 252 trading days and plot today\’s volatility in the graph to understand where it is now.

Method 2: I plotted the volatility cone and then plot the IV of various strikes to understand.

Method 3: I compared ViX with annualized historical volatility.

Method 2 & 3 you can. Not sure method 1 is possible. The input for calculating volatility is a time series data, so if you want 1 year volatility, then you will have to give 252 days of daily return as the input to get the volatility number.

Sir,

We find ViX fluctuates in real time during the trading day. Likewise,do IV also changes in real time whole through the trading day?

I\’m finding it confusing…you\’ve asked so many queries related to the same thing so many times 🙂 Please consolidated and ask.

Sir,

(i) I am finding that we are comparing the historical volatility with IV. Now as I understand IV is a forward looking volatility of the stock. Now, is it that we are taking this forward looking IV to mean the current volatility only? Pls confirm. I am messing here.

Yes, its current volatility.

I can\’t understand 1st half and 2nd half of the series

If there are 30 days to expiry, then 1st 15 days is 1st half and 2nd 15 days is considered 2nd half.

Sir,

Please confirm if both the below will signify for buying generically:

(i) IV Hisorical volatility

Sir,

Please confirm if I am right on below:

(i) We can know the historical realized volatility through excel calculation.

(ii) We can know the current volatility through IV of strikes. If I am wrong here, please put your thoughts.

(iii) We can know the future volatility through ViX

1) Yes

2) Current IV of the strike, but not a generalization for the market as such.

3) Like I mentioned earlier, you can use it as a rough indicator.

Sir,

Like ViX, is IV also a forecast volatility?

It is not a forecast, but rather an estimate.

Sir,

We know VIX, is a real-time market index representing the market\’s expectations for volatility over the coming 30 days. Now, does the IV also forecasts volatility for the upcoming 30 days or does that predict the volatility for the remain period of the expiry of the option? Please help.

You can use it as a proxy for where the Vol will go over the next 30 days.

Sir,

1. Is there any source from where I could get the realized historical volatility of Nifty 50 index of the past 1 year for all the respective trading days?

2. Can I get the realized historical volatility of some stock of the past 1 year for all the respective trading days?

1.Not sure

2.Not sure

But I think you can calculate this yourself on excel.

Sir,

Can the below be correctly inferred to gain understanding from volatility perspective?

1. Compute historical annualized volatility and compare with today\’s IV of strikes.

2. Compute historical annualized volatility of ViX value and compare with todays ViX value

When today\’s IV is half of historical annualized volatility and today\’s ViX is close to -2SD of historical annualized ViX, then we may look to buy.

Yeah, thats fine. But see my previous comment as well 🙂

Sir,

You had suggested in one of my previous query that I will need to compare historical volatility with ViX to understand market volatility in general.

With the view of the above, could you kindly confirm which method should I apply to know the current situation of Vix?

Method 1:

Compute historical annualized volatility of Nifty 50 through spot data and compare this with ViX. If today\’s ViX<historical annualized volatility, then buy else sell.

Method 2:

Compute historical annualized volatility of ViX value. If the present ViX value is close to -2SD of historical annualized volatility of ViX , then trigger to buy and if present ViX value is close to 2SD of of historical annualized volatility of ViX, then trigger to sell.

Your thoughts will help me immensely here.

The interpretation is correct, but I\’m not sure what you are buying and selling.

Sir,

During my last three communications with you, regarding comparing historical volatility with today\’s volatility, I could understand that the same could be done by two methods in general:

(i) Compute historical volatility and compare with ViX.

(ii) Compute historical volatility and compare with implied volatility (Preferably with ATM strike).

Am I correct on the above or missing something?

Implied volatility if you are comparing strike specific volatilty and Vix if you are looking for market volatility in general.

Sir,

In one of your answers, you have said “Yes, essentially it is about predicting where the volatility is headed and basing your option position that that volatility view. GARCH is a complex piece, you can generally stick to simpler practice of looking at historical volatility with respect to today’s volatility.”

Now with respect to above, how shall I compare today’s volatility with respect to historical volatility? Can I approach like below?

(i) Compute annualized volatility till yesterday with all past 1 year historical data.

(ii) Again compute annualized volatility taking past 1 year historical data and also today’s data.

(iii) Then compare the above two data.

Kindly confirm if it will work.

You can compute historical daily volatility and compare it with today\’s implied volatility.

Sir,

In one of your answers, you have said “Yes, essentially it is about predicting where the volatility is headed and basing your option position that that volatility view. GARCH is a complex piece, you can generally stick to simpler practice of looking at historical volatility with respect to today’s volatility.”

Now with respect to above, can I compare today’s volatility with respect to historical volatility like below?

(i) Compute annualized volatility till yesterday with all past 1 year historical data.

(ii) Look the IV of strikes.

(iii) Then compare the above two data.

If the above process is good, which strike’s IV should I consider to compare with historical volatility.

Yeah, that works. Not sure about the comparison of individual strikes but you can certainly look at ATM strike\’s vol for a proxy of volatility.

Sir,

In one of your answers, you have said “Yes, essentially it is about predicting where the volatility is headed and basing your option position that that volatility view. GARCH is a complex piece, you can generally stick to simpler practice of looking at historical volatility with respect to today’s volatility.”

Now with respect to above, can I compare today’s volatility with respect to historical volatility like below?

(i) Compute annualized volatility till yesterday with all past 1 year historical data.

(ii) Look the Vix value.

(iii) Then compare the above two data.

Is the above process a right way?

Yes, that works. But remember, this is a quick and easy method.

Sir,

In one of your answers, you have said \”Yes, essentially it is about predicting where the volatility is headed and basing your option position that that volatility view. GARCH is a complex piece, you can generally stick to simpler practice of looking at historical volatility with respect to today’s volatility.\”

Now with respect to above, can I compare today\’s volatility with respect to historical volatility like below?

(i) Compute annualized volatility till yesterday with all past 1 year historical data.

(ii) Look the IV of strikes.

(iii) Then compare the above two data.

If the above process is good, which strike\’s IV should I consider to compare with historical volatility.

Sir,

In one of your answers, you have said \”Yes, essentially it is about predicting where the volatility is headed and basing your option position that that volatility view. GARCH is a complex piece, you can generally stick to simpler practice of looking at historical volatility with respect to today’s volatility.\”

Now with respect to above, how shall I compare today\’s volatility with respect to historical volatility? Can I approach like below?

(i) Compute annualized volatility till yesterday with all past 1 year historical data.

(ii) Again compute annualized volatility taking past 1 year historical data and also today\’s data.

(iii) Then compare the above two data.

Is it that want you want to mean? I am perplexed.

Sir,

In one of your videos, you have taught how to compare the historical volatility with respect to IV and thus forecasting upcoming volatility. Now, my query is which strike\’s IV should I consider here to judge the volatility situation for now w.r.t historical?

Sir,

Regarding volatility, you have given concurrence on the below in my last comment.

—>Simply take the historical annualized volatility of the spot till yesterday. Compute 1SD,2SD,-1SD,-2SD. Compute today’s annualized volatility of the spot. If today’s annualized volatility is somewhere around 2SD, the volatility is expected to drop else if it is around -2SD, it is expected to rise.

Now, if we could understand simply through the above only regarding volatility, what is the specific purpose of volatility cone?

Please help to understand.

Volatility cone is a simple visual representation of volatility (spikes), using which you can spot opportunities related to volatility variance. I know \’volatility variance\’, sounds off, but you know what I\’m saying 🙂

Sir,

1. Request you to kindly comment if the below process could be followed while analyzing volatility of today?

—>Simply take the historical annualized volatility of the spot till yesterday. Compute 1SD,2SD,-1SD,-2SD. Compute today\’s annualized volatility of the spot. If today\’s annualized volatility is somewhere around 2SD, the volatility is expected to drop else if it is around -2SD, it is expected to rise.

2. Also, kindly comment if the below method will also work to analyze volatility?

—>Understand how far we are from expiry. Based on that we compute the historical annualized volatility of the same no. of days from the expiry for the previous 15 months. Then we draw the volatility cone. Then we look today\’s implied volatility of strikes and try to find out if any of the strikes is there around 2SD/-2SD and accordingly choose to sell/buy respectively.

3. If both the above methods are good, then I would request you to kindly help understand which one should I go? Also, request your more advice please.

Sure, I think you could take the 2SD approach. I think its easy to backtest it as well. I\’d suggest you do. Not sure about 2, have never dealt with long dated options.

In the \”Effect of Time\” section explained above, the following 2 assumptions are taken,

1. Option is of monthly expiry.

2. Volatility increases.

Do charts explained with the above 2 assumptions hold in other cases like for options with weekly expiry or volatility decreases etc.?

Yes, the option behavior is the same, regardless of the type and expiry. Only thing that changes is the timlines.

if you buy option nearer to ATM just few minutes before expiry , whether we need high margin money

Yup, you\’d need.

Sir,

Is there any genuine place which shows the forecasting volatility of the upcoming days?

Not that I\’m aware of.

Sir,

You have discussed somewhere in your module as below:

To follow below steps while trading options:

1. Feel the directional movement of the underlying first.

2. Long when volatility is going to increase in upcoming days and vice versa.

3. Strikes to choose based on time to expiry.

Based on the above understanding, regarding the above point 2., did you want to mean prediction of upcoming volatility of strikes through plotting volatility cone or prediction of entire volatility of the underlying through some other methods like GARCH etc.?

Afterwards, you have discussed through various days to expiry and selected the strikes. I believe you have tried to mention the entire India VIX. If that is so, how can we forecast/predict the future volatility. Please help

Yes, essentially it is about predicting where the volatility is headed and basing your option position that that volatility view. GARCH is a complex piece, you can generally stick to simpler practice of looking at historical volatility with respect to today\’s volatility.

Is there a source where I can understand the trends in the indices – mainly NIFTY and BANK NIFTY. I\’m know basics of TA and many a times I\’m able to build conviction as well. But since I\’m new at it I would also want to listen to more experienced people and what directional view they have?

Can you help me on where can I find such content or any TA ideas on indices that are reliable?

There is nothing specific to indices, Siddhanth. TA as a concept works the same across all assets. So if you know how to use TA on RIL, then it is the same way TA on the indices as well. The only thing you need to know is the difference in the underlying assets.

1. What is the exact practical use of the BS calculator? I already understand how it works and what output it gives to us when we give it certain inputs. What I\’m not able to understand is what situation do I use a BS formula and for what broader purpose?

2. Do you believe in \”Quant Finance\” where trades are placed on the basis of complex formulae without human intervention. And why?

1) You use that to factor in all variables that impact options and calculate the premium based on these variables.

2) Quant has a lot more statistical and mathematical reasoning for trades. If you like those reasoning, then maybe you will like quant 🙂

Providing additional detail regarding the above query posted, I\’m talking about purchasing a BANKNIFTY 48300 CE, either 16APR or 24APR as expiry.

Thats ok. Please do check my previous message.

Hi Karthik,

Wonderful content on Options specifically, learnt a lot and its very surprising this is for free. Thanks a ton!

Coming to my query, as of today (04/04/2024), based on technical analysis, I believe that BANK NIFTY will reach 48500 (currently trading close to 48100) in the next 7 days.

Now I have 3 expiry options:

1. 10 APR (6 days) – obviously, theta too high hence no point talking about this expiry

2. 16 APR (12 days)

3. 24 APR (20 days – monthly expiry)

Questions:

1. Since the upmove is expected to happen in the next 7 days, I will buy either an ATM option or 1 or 2 strikes below ATM. Which expiry should I choose? – 16 APR or 24 APR?

2. Is there any technical or behavioural difference between monthly expiry and weekly expiry of index options?

1) Since you are buying options, its best if your option has time value. So, either 16th or 24th. For a buyer, theta works against…so more time to expiry, the better. Its the exact opposite for sellers.

2) More time, better for buyers as theta is lower, otherwise for sellers.

Hello Karthik,

Sure. You have explained the premium variation with respect to time i.e. call/put option bought in the first half (first 15 days) and 2nd half (last 15 days) of the F&O series.

NIFTY Index options are available with one week expiry (weekly contracts). In that case,

1. How are the first and second half relevant here?

2. If no market/corporate events are happening in a particular weekly options contract, would volatility play any crucial role?

Please let me know.

Thank you,

Yogesh

1) You can divide the week into two halves and apply the same theory.

2) It does play a crucial role regardless 🙂

Hello Karthik. What is the significance of \’first-half\’ and \’second-half\’ in the context of index options, considering that these options can be traded with weekly expirations?

Ah, can you pls share more context?

Hello Karthik,

Thank you for your response.

It is not clear to me how profit will be more in OTM compared to ITM, with change in time to expiry.

My understanding is with increase in time to expiry, profit at ITM will also increase from that of OTM.

e.g. (I have used some random numbers to exemplify my concept)

For the 5 days of trade initiation

Profit of 4700 CE will be 525 = (500 intrinsic value + 25 premium increase for changing ITM to Deep ITM)

Profit of 5500 CE will be 15 = (15 premium change for changing Deep OTM to OTM)

For the 15 days of trade initiation

Profit of 4700 CE will be 550 = ( 500 intrinsic value + 50 premium increase for changing ITM to Deep ITM)

Profit of 5500 CE will be 40 = ( 40 premium change for changing Deep OTM to OTM)

For the 25 days of trade initiation

Profit of 4700 CE will be 590 = ( 500 intrinsic value + 90 premium increase for changing ITM to Deep ITM)

Profit of 5500 CE will be 65 = ( 65 premium change for changing Deep OTM to OTM)

On expiry day (30 day ) trade initiation

Profit of 4700 CE will be 620 = ( 500 intrinsic value + 120 premium increase for changing ITM to Deep ITM)

Profit of 5500 CE will be 85 = ( 85 premium change for changing Deep OTM to OTM)

The graphs shown for Long calls to be executed in first half of the cycle is different from my understanding.

Hence it would be helpful if you kindly help to rectify my concept.

If my concept is corrected for these set of graphs I hope I will be able to apply the same knowledge to other graphs as well.

Regards,

Manas

The way to think about this is – with more time to expiry, the volatility will be higher as there is more time for uncertainty to play out. So OTM options premiums which are already higher due to volatility and time will only get more expensive, which means the buyer of OTM will benefit much more than the ITM ones.

Hello Karthik,

Thank you for your response.

It would be helpful if you kindly elaborate more.

My understanding is – premium is directly proportional to volatility. Also higher premium works in favour of Option writers and against option buyers in general.

Please confirm whether above understanding is correct.

If above understanding is correct, please explain how following statement holds true.

\”For volatility to work in favor of a long call option one should time buying a call option when volatility is expected to increase and avoid buying call option when volatility is expected to decrease.\”

I\’m trying to identify if any point I have missed to understand.

Regards,

Manas

Yes, premiums are a function of volatility. Yes, higher premium favor option writing, but this has to be on the back of premium being expensive and not fairly valued.

If after you buy an option, the volatility increases, then obviously the premium will increase, which is what the buyers would want.

The query is related to first four graphs in the section 22.3 – Effect of Time.

I\’m, confused about the logic behind this result.

Let me try to analyze four charts related first half of the charts.

For the 5 days of trade initiation ( top left chart), the profit is expected to be maximum, if the call ends in ITM. But in the graph it is seen the profit is maximum at OTM.

It is true, due to the effect of volatility the value of premium may rise or fall for Buy calls. But if calls expire in ITM, intrinsic values will increase the profit. Hence it is not clear why OTM buy calls result maximum profit.

I\’m trying to understand how this result will vary with number of days from expiry.

Regards,

Manas

These graphs are only to the extent of delta movement, but yes, it is true that with volatility increase the premiums too increase and decreases likewise.

Thank you for your response.

If my understanding is correct then it contradicts following statement –

For volatility to work in favor of a long call option one should time buying a call option when volatility is expected to increase and avoid buying call option when volatility is expected to decrease.

Please confirm.

Yes, and its not just true for a call option, but options in general. When you buy an option, you will gain if volatility is low at the time of buying and is expected to go up after you buy.

I would like to understand following implications of volatility –

For volatility to work in favor of a long call option one should time buying a call option when volatility is expected to increase and avoid buying call option when volatility is expected to decrease

Higher the volatility higher the premium. My view is – with higher premium , major portion of the profit will be taken away from intrinsic value. Hence with same intrinsic value at the expiry higher premium will reduced profit.

Let\’s take an example:

Stock 1

Strike price – 100 CE

Spot price at buying – 80

Premium (low volatility) – 20

Spot price on expiry – 170

Profit = (170-100)-20 = 50

Stock 2

Strike price – 200 CE

Spot price at buying – 180

Premium (High volatility) – 40

Spot price on expiry – 270

Profit = (270-200)-40 = 30

We can see with higher premium (due to volatility) call was not favourable for stock 2.

Please validate my understanding and identify if there is any gap in understanding.

Regards,

Manas

Yes, for this reason we need to time buying a call option when the volatility favors (low volatility) buying not just call but put options as well.

Sir as u explained the strike prices about monthly expiry can we know which strike price to choose in weekly expiry …..?

The method to select strikes for weekly is also similar, its just that the timelines shrink. In weekly strike, think of Tue-Wed as half way through the expiry series. That will help in strike selection 🙂

Hi Karthik,

I have recently started learning Options and I must say the contents that you have put in is mind blowing and it is certainly helping naive investors / tradors like me to understand the entire concept much better. Thank You so much for all your efforts.

I have some fundamental questions –

1. How do we expect the targets to be achieved in 5/15/20 days?

2. For Nifty and Bank Nifty since we have a weekly expiry, which scenario of Strike Selection would be applicable?

Thanks, Niju. I\’m glad you liked the content here.

1) We expect that based on the underlying\’s price action. Look at the momentum of the underlying and figure how quickly the target can be achieved.

2) Again, it depends on the underlying and the momentum. Higher the momentum, sooner is the possibility of achieving the target.

Hey Sir

In this module u gave the example of INFY spot price -5000 , and the scenarios on options if it increased 4% i.e5200

So while discussing the best strikes to buy for eg(2-3) strikes OTM are u considering 5000 as ATM or the amount that we expect the stock to increase to i.e 5200 as ATM.

Like if the target of 4% is achieved in a day far OTM options make more money is this scenario also the same if we chose 1% as the target cause a target of 1% has a much higher probability of being achieved in one day.

Not sure if i fully understand your query, but yes, if you expect the movement to be fast and your target achieves within a day, then OTM is not a bad strike to consider, especially when you have many days to expiry.

Sir, i have a basic question. How to know When a contract opens & where to find/see it. I mean now we are in Aug end. Now already september contracts are trading. But how to know when the september contracts opened? How to identify and expect the october weekly contract opens.?

So when one contract expire, another one is immediately made available. For example, when August expires, from next day Nov will be made available.

I found following on NSE website:

https://www.nseindia.com/products-services/equity-derivatives-nifty50

\”Base Prices

Base price of the options contracts, on introduction of new contracts, would be the theoretical value of the options contract arrived at based on Black-Scholes model of calculation of options premiums.

The base price of the contracts on subsequent trading days, will be the daily close price of the options contracts. The closing price shall be calculated as follows:

If the contract is traded in the last half an hour, the closing price shall be the last half an hour weighted average price.

If the contract is not traded in the last half an hour, but traded during any time of the day, then the closing price will be the last traded price (LTP) of the contract.

If the contract is not traded for the day, the base price of the contract for the next trading day shall be the theoretical price of the options contract arrived at based on Black-Scholes model of calculation of options premiums.\”

Here is my question:

1) If option price is derived from Black-Scholes model then why \”The base price of the contracts on subsequent trading days, will be the daily close price of the options contracts\”?

Next day also it should be derived from Black-Scholes model, what Am I missing?

2) Now if all day price is derived from Black-Scholes model then why the Bid-Price and Ask-Price? as it is already decided by Black-Scholes model. For example, I want to buy call option which has ask-price suppose Rs. 100 but premium is Rs. 90 then what price I will get option Rs. 100 or Rs. 90?

Could you help me? I\’m confused little bit.

Thanks.

1) Because B&S model does not consider the contract\’s liquidity. This has to be considered as well.

2) The answer is same as above 🙂

Hello sir

could you suggest how to assess that market volatility will go up or down in future?

and also can methods of technical analysis be used on india vix to predict market volatility

Pranay, predicting volatility can be a complex affair. There are statistical models, like \’Garch models\’, to predict volatility, but they are fairly complex.

Sir,

During any corporate event/ RBI policy/ political issues, we learnt trading options 2 days before the cooling.

(A) If the incident occurs in the first half, what should be our better decision with moneyness & strike to trade?

(B) If the incident occurs in the second half, what should be our better decision with moneyness & strike to trade?

1) Stick to ATMs in most cases. But then based on your specific strategy strikes can change too.

2) Since direction and clarity would have come, you are free to pick a strike to benefit from directional movement.

Sir,

Thank you so much for your valued comments. Your writings mean so much to a novice like me

Good luck and keep learning, Anirban 🙂

Sir,

I would like if you could go through the below points without skipping. I have tried to put the four combinations of volatility versus underlying price movement keeping the perspective of timing in the same frame. Most of the concepts are received from your chapters only, however, I tried to figure out the entire probable situations in terms of volatility, underlying movement and time to expiry in one frame. Please comment if I have rightly predicted or missing somewhere:

(1) Circumstance-1: Current underlying price is expected to increase

I should try to look for either of the below:

(A) Action-Buy CE options with low volatility (recognized from volatility cone)

From underlying price action perspective-

Strikes to buy (For first half of series) : For target achievable in 5 days-2-3 OTM strikes away ATM, For target achievable in 10 days-ATM/1 OTM strike away ATM, For target achievable in 25 days- Slightly ITM, For target achievable on expiry- ITM

Strikes to buy (For second half of series): For target achievable at same day-2-3 OTM strikes away from ATM, For target achievable in 5 days-ATM/1 OTM strike away ATM, For target achievable in 10 days- Slightly ITM/ATM, For target achievable on expiry- ITM

(B) Action- Sell PE options with high volatility (recognized from volatility cone)

From underlying price action perspective-

Strikes to sell (For first half of series): For target achievable in 5 days-2-3 ITM strikes away ATM, For target achievable in 10 days-ATM/1 ITM strike away ATM, For target achievable in 25 days- Slightly OTM, For target achievable on expiry- OTM

Strikes to sell (For second half of series): For target achievable at same day-2-3 ITM strikes away from ATM, For target achievable in 5 days-ATM/1 ITM strike away ATM, For target achievable in 10 days- Slightly OTM/ATM, For target achievable on expiry- OTM

(2) Circumstance-2: Current underlying price is expected to decrease

I should try to look for either of the below:

(A) Action-Sell CE options with high volatility (recognized from volatility cone)

From underlying price action perspective-

Strikes to sell (For first half of series): For target achievable in 5 days-2-3 ITM strikes away ATM, For target achievable in 10 days-ATM/1 ITM strike away ATM, For target achievable in 25 days- Slightly OTM, For target achievable on expiry- OTM

Strikes to sell (For second half of series): For target achievable at same day-2-3 ITM strikes away from ATM, For target achievable in 5 days-ATM/1 ITM strike away ATM, For target achievable in 10 days- Slightly OTM/ATM, For target achievable on expiry- OTM

(B) Action- Buy PE options with low volatility (recognized from volatility cone)

From underlying price action perspective-

Strikes to buy (For first half of series): For target achievable in 5 days-2-3 OTM strikes away ATM, For target achievable in 10 days-ATM/1 OTM strike away ATM, For target achievable in 25 days- Slightly ITM, For target achievable on expiry- ITM

Strikes to buy (For second half of series): For target achievable at same day-2-3 OTM strikes away from ATM, For target achievable in 5 days-ATM/1 OTM strike away ATM, For target achievable in 10 days- Slightly ITM/ATM, For target achievable on expiry- ITM

I would like if you could go through the below points without skipping. Just a thought, given that so many queries pour in, reading such long queries can get a bit overwhelming. It will be nice if you could break this down into smaller ones 🙂

C1(A) – Yes. But the closer you move to expiry, I\’d suggest you avoid buying options, unless the underlying price movement is heavy, like 8-10% over 1 or 2 days.

C1(B) – Selling options is fine, but I\’d think twice before selling a PE. I\’d prefer selling a OTM CE instead. The reason is that in case of a sudden panic, the price crash can be quick.

C2(A) and C2(B) – Yes.

Sir,

Requesting you to kindly ignore my query from the 3rd & 4th from the last. I am still making modifications in the query. Will send once done to verify.

Sure, I\’ve replied anyway.

Sir,

Considering all other ( Delta/ Gamma/ Vega) fixed, with decay of time, which strike is affected the most through Theta?

OTMs lose time value faster.

Sir,

Again pls correct wherever required:

1. Volatility (via Vega) affects the OTM strikes most.

2. Price transitions (via Delta) affects the most in transition situations of \”Slightly OTM to ATM\”/ \”ATM to Slightly OTM\”/ \”ATM to Slightly ITM/ \”Slightly ITM to ATM\”

3. Price transitions (via Gamma) affects the ATM strikes most.

4. With expiry nearing by, the Gamma (rate of change of delta) shoots up for ATM. Thus we should avoid shorting ATM options and that specially as it nears expiry.

Whereas, with expiry nearing by, the Gamma for both the ITM/ OTM reduces to zero.

5. For low volatility: The delta for CE ATM strikes is 0.5, deep ITM flattens to 1, deep OTM flattens to 0. For high/increased volatility- The delta for CE ATM strikes is 0.5, deep ITM doesn\’t flatten to 1 but it linearly increased to 1 from ATM, deep OTM doesn\’t flatten to 0 but it linearly decreased to 0 from ATM.

Yup, again these are things we have discussed in the chapter 🙂

Sir,

1. What should be our decision for the below circumstantial situations:

Circumstance-1: Volatility high for few strikes as predicted from volatility cone and expected to cool off soon, but price is low for the same strikes as per prediction from price volatility range and expected to rise soon.

Circumstance-2: Volatility low for few strikes as predicted from volatility cone and expected to rise soon, but price is high for the same strikes as per prediction from price volatility range and expected to fall soon.

Should we better avoid these circumstantial situations or there is any other way out to predict?

1) This depends on time to expiry. If there is ample time to expiry, then you can expect delta to have a higher influence on the premium and therefore look at buying options. Else you can avoid buying in time to expiry is short.

2) Same as above. Look at it from time to expiry perspective.

(A) At the first half of series:

(1) Circumstance-1: Volatility low for few strikes as predicted from volatility cone, price is also low for the same strikes as per prediction from price volatility range.

Action: We should buy CE options for the common strikes having low volatility as well as low price

Strikes to buy: For target achievable in 5 days-2-3 OTM strikes away ATM, For target achievable in 10 days-ATM/1 OTM strike away ATM, For target achievable in 25 days- Slightly ITM, For target achievable on expiry- ITM

(2) Circumstance-2: Volatility high for few strikes as predicted from volatility cone, price is also high for the same strikes as per prediction from price volatility range.

Action: We should sell CE options for the common strikes having high volatility as well as high price

Strikes to sell: For target achievable in 5 days-2-3 ITM strikes away ATM, For target achievable in 10 days-ATM/1 ITM strike away ATM, For target achievable in 25 days- Slightly OTM, For target achievable on expiry- OTM

(B) At the second half of series:

(1) Circumstance-1: Volatility low for few strikes as predicted from volatility cone, price is also low for the same strikes as per prediction from price volatility range.

Action: We should buy CE options for the common strikes having low volatility as well as low price

Strikes to buy: For target achievable at same day-2-3 OTM strikes away from ATM, For target achievable in 5 days-ATM/1 OTM strike away ATM, For target achievable in 10 days- Slightly ITM/ATM, For target achievable on expiry- ITM

(2) Circumstance-2: Volatility high for few strikes as predicted from volatility cone, price is also high for the same strikes as per prediction from price volatility range.

Action: We should sell CE options for the common strikes having high volatility as well as high price

Strikes to sell: For target achievable at same day-2-3 ITM strikes away from ATM, For target achievable in 5 days-ATM/1 ITM strike away ATM, For target achievable in 10 days- Slightly OTM/ATM, For target achievable on expiry- OTM

Yes, these are things we\’ve discussed in that chapter itself 🙂

Hi sir,

Thank you for this amazing lesson. I had a doubt regarding selecting a strike based on time to expiry. For example, the assumptions made were \” if you expect the stock/index to hit the target price in 5 days, or 15 days with X no. of days to expiry then buy certain type of option. Using what method can we determine how many days will it for the stock/Index to hit the target price? I have read the TA module as well of Varsity but could not find the answer.

The time target is purely based on the stock\’s momentum. Very hard to estimate this, but TA does help to some extent.

How do we assess the premium with it\’s fair value if we don\’t know the fair value. This is what i want to understand how to derive fair value of an underlying asset particular strike price.

And suppose any underlying asset has weekly expiry which expires on thurseday of the week, so how do we know that what should be the time value of a particular strike , I know how we can calsulate the time value , but what I want to know is, what should be the time value on monday or tuesday or thurseday? is there any way to know it?

Anupam, to find the fair value of an option, you need to use the B&S calculator. This article is a bit dated, but it should give you a good working knowledge of how to use the B&S calculator – https://zerodha.com/z-connect/queries/stock-and-fo-queries/option-greeks/how-to-use-the-option-calculator

Yes, There is . Strike specific fair value can be done. I know one of the Trader who figured it out and takes trade strike specific which has value lower than its fair value while buying and while selling he chose strikes which has its value at premium than its fair value.

For the 2nd part :

I want to know since there are writers at 17800 who took short position by selling at 17800, when will they panic such as if spot price goes to 17900 or 18000 after that they will panic and leave their position, in this way we can predict when short covering can come and took position based on that. Is there a way to figure it out. You know like smart money play us by taking our stoplosses at pivots they assume at this point retailers have put their stoploss In the same way if can figure out where these smart money will panic and cover their losses.

For the first part – yes, this is a simple assessment of premium wrt to its fair value.

2nd part – Yes, if the activity is usually high around a certain strike, and if the market tends to cross that level, then there is bound to be panic with option writers leading to panic square-offs. This is one of the main reasons to track strike-specific open interest activity.

And 1 more thing Let suppose Spot is at 17720 and at 17800 heavy call writing has been done (lets say it is monday). Now for that day or next subsequent days till weekly expiry, I want to understand or kind of predict that at which level of spot price these writers will feel pain or will face loss.

How can i understand that?

So in this case, you can consider 17800 as a price at which there will be some resistance, given that heavy activity surrounds that strike.

But, whereevr I use Option Calculator it asks for implied future price. What i want is to understand at any point of day trading, when I open option chain nd look at strike price and whatever calculation is required, to find the whether the premium of that strike price is at fair or high or low in mind , and understand. Because suppose any strike price, let it be ITM, If its premium is already at high then if market goes against my view then its premium will decay faster as compare to that ITM strike price which has premium at its fair value or below fair value. In this regard can you please help me. How can i do that.

Regards

Understood, but I quite doubt that there is a strike-specific fair value, ready reckoner available. You will have to use the B&S calculator to estimate the fair value. But please do check with Sensibull once.

At any point of time for any strike price of an underlying asset, if we have to understand whether the strike price is at premium value of it has fair value or discounted value, How can we Identify it or find it or calculate it ? Can you please explain on this?

Anupam, so one quick way is to look at any option calculator and get a sense of how the option is priced wrt to the market price.

Hi Karthik,

Thank you for the wonderful explanation 🙂

Are the best strikes to trade same for both option seller and buyer? I went through the chapter keeping the buyer in perspective, wanted to understand what would be the best strikes to trade for a seller.

Thank You

Sort of, Sai. You need to look at this P&L profile of these options like a mirror image for buyers and sellers.

Sir everything I understood but my question is ,these things are perspective from buyers, if I\’m seller ,which is the best strike to select or choose according to time to expiry

The buyer\’s and seller\’s perspectives are mirror images, Divakar.

Hi Sir,

Where do we get this profit / loss probability chart / graphs from ?

That was generated using a program.

Hi Karthik,

This post throws light on Effect of Time on buying an option. How about Effect of Time on Option selling?

Its the inverse of buying. If time decy is positive for buyer, then not so good for seller and vice versa.

Exemplary,honest & practical narration without any reservation. This kind of lectures are available in Indian colleges & universities coupled with suitable infrastructure, I am sure our students will not approach foreign universities for higher education.

Best wishes sir.

Thanks for the kind words, Chandrapalan. Happy learning 🙂

Hi Karthik Sir,

Should we consider first half and second half also in case of weekly expiry of index options?

YOu can consider writing the option on Friday for the upcoming expiry on Thursday.

Also, a doubt regarding ITM and ATM option shorting (might be the wrong chapter for this though).

As per my understanding delta of an ATM option is most sensitive to spot changes, so we should generally beware of shorting ATM options.

But, since the premium price itself of an ITM option is more sensitive to spot changes due to inherently high delta, isn\’t it riskier to short ITM options than ATM options (since the strike would move faster from OTM to ITM)?

Thanks!

Of course, for this reason, you dont short ITM. I\’ve explained this in the chapter as well.

Hi Karthik, absolutely fantastic content you have here! Just needed a small clarification regarding options selling.

So if spot price is expected to rise and IV is low, it should make sense to short put options.

Can you mention which put options would be best for these situations (OTM/ATM/ITM)?

1) Target reached within 2 days

2) Target reached in around 15 days

3) Target reached around expiry

Thanks in advance!

I\’m not very comfortable selling put options in particular, given that they can fall quite rapidly when markets fall. That said, I\’d suggest you stick to ATM or OTM options.

This is incredibly useful but I would like to know if the same logic regarding Effect of Time applies to American Style options as European Style options? Since they\’re less reliant on the expiration date… ?

Thanks!

It does, but the impact of greeks is quicker in American style expiry.

One more question – the above bar charts will be working in reverse for an option seller, right? For example, the seller of the call option will benefit from selling OTM options when the target is expected to achieve by expiry.

Yes, the option seller\’s and buyer\’s payoff are mirror images.

Hi Karthik, I have a question – if by expiry every option goes to zero, then why don\’t people sell them in the beginning of the series or in the middle of the series and keep it until expiry? if the market goes up/down, should it matter because the premium will anyways decay and the seller will benefit from it. Sounds so good to be true, I\’m definitely missing something, please help me understand this

Hi Karthik, one question – In the last chart (green bar chart for the put option), I see that when there are 10 days left to expiry, the OTM option is yielding more compared to ATM or ITM option. However, in the case of Call Option chart (blue bars), I see that when there are 10 days left, it is ATM or ITM that is more profitable. Why is put option behaving this way? Ideally, OTM put option premium should also get impacted when the target is acheived in 10 days. Could you tell me if I\’m missing something?

There is always some fear involved with selling put options, which gets backed into the premiums. Remember, panic spreads faster than greed in markets.

Does this 15 days chart work for weekly expiry of nifty and bank nifty ?

Yes, you can use it.

Heylo sir.. i really loved the insight on the strike price and the table demonstrated..can u illustrate the table for a weekly expiry in the same manner for the correct strike price for reference.

The same thing is applicable, just that the timelines get shrunk.

sir i am trying the effects of time chart on realtime market data and i made a mistake in my calculation thats why i am confused all my doubts are clear now and

thankyou soo much sir sharing this knowledge with us

Happy learning, Shubhashish 🙂

can you please explain me the calculation behind those effect of time graph on choosing strike price or i have to just learn them as they are

Which part are you stuck with? Do let me know.

sir can you please explain the effect of time with real market examples

undertaking theta and permium

Theta is the easiest greek to understand. With the passage of time, the value of options (premiums) keeps reducing. This is true more so when you get closer to expiry.

Sir, first of all thank you so much for explaining each and every thing in a simple and lucid way…so that a novice like me can understand.

Sir can you please brief How can we make same bar charts representing the profitability while shorting options? Thank You sir!

Glad you liked the content, Raj. These are generic charts applicable to both buying and selling. The exact opposite applies to people selling options.

Thanks, Karthick for this key input for buying right options. Does the same logic applied for selling options?

Yes, similar technique Arun 🙂

Hello Sir,

For proper selection of strike for a particular strategy the above charts are useful and to generate these \”P & L vs Strike chart\” I assume following should be the procedure:

1) Generate the option premium price using B & S option calculator on the expiry date

2) Calculate the P & L for each of the strike which requires spot price(already known), strike price and premium value(calculated using 1).

3) Plot the graph

But, this process may take some time. So, is there any platform where these charts are readily available on providing the required inputs?

Thank You.

Samir, you can check the Sensibull platform for this – https://sensibull.com/

Hi Kartik

Thanks for this.

I understood the graphs and the conclusions but I am wondering why the strikes are behaving in the way they are. For eg: Why does FAR OTM gives max returns when target is achieved quickly?

Could you please explain the reasoning behind all the 8 scenarios?

Nikhil, that\’s the intrinsic behavior of options. For a deeper understanding, you will have to dig into the Black & Scholes module.

Hi Sir,

How do we find that volatilty of a particular stock or index has increased or decreased. I use opstra (trading platform) sometimes to check volatility of a stock under Volatility Dashboard and it shows all F&O stock volatility with IV change. Suppose we take TCS as a example IV – 44% and Change in IV – 20%. How they got a value that change in IV is 20%.

1. Did they calculate a historical IV of last one year till 26-06-2022 and on 27-06-2022 then they looked at closing ATM IV on option chain and compare current IV with historical IV. For example I calculated a historical IV of TCS from 26-06-2021 to 26-06-2022 and it valued at 45%, on 27-06-2022 on option chain ATM IV 60%. Does this show TCS IV has increased by 15%. This is a one way to look at IV either it is increase or decrese .

2. Second way, compare yeaterday closing ATM IV with today\’s opening IV from Option Chain. Example yesterday ATM strike TCS 3200 has Average IV of both put and call at 45% ( closing IV @ 03:30 ) and today I will check TCS 3300 ATM strike IV at 55%. It means TCS IV has increased by 10%.

Which one method are they using and for own purpose which one is best way to calculate ? If there is any other way to calculate the increase or decrease in IV. Please let me know.

They are probably comparing today\’s IV with y\’day\’s IV, but I\’m not sure, please do check with them once on the methodology they are using. Both the methods you mentioned are valid, but I\’m not sure which one they are using 🙂

I agree, when volatility go up it drives the premium up for both CE and PE but I am talking about volatility with spot. When market go down volatility go up and vice- versa. Isn\’t it true? If it is true then can be assume that the volatility is expected to increase along with increase in the underlying prices. Clearly buying a call option makes sense. I got this line from above topics.

Yes, its generally true. But there are instances where volatility goes up along with the spot market.

Let us just assume that the volatility is expected to increase along with increase in the underlying prices. Clearly buying a call option makes sense. I got this information from above topics.

What I think Volatility and increase in the underlying price has a inverse relationship. When Index and Underlying go up, India VIX come down as market get a relax mood and no huge panic in the market. Can we think a positive relation between volatility and bull mode.

Ah no, an increase in volatility drives the premium up for both CE and PE.

If the spot is 5000

We are in first leg of the series, start of the month and knows that share price will reach 5200 target.

Let\’s say the 5100 strike price (out of the money) option premium is 20 (hypothetical)

My doubt is

irrespective of when the target hits, even if on expiry.

The buyer of the option will make profit of 5200-5120

Am I mistaken?

Since you said that if it moves in 25 days or by the expiry ATM, OTM all lose money. But it should be profitable upto the point where target is greater than strike + premium

If you are trading before expiry, what you make depends on the premium. More on that here – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

Right Sir!

Karthik Rangappa says:

October 26, 2015 at 7:32 am

1) Increased volatility does not mean market will go down

2)Likewise decrease in volatility does not really mean that the market will increase.

However the reverse is experienced. Even today (May 31-2022) increasing volatility kept the Nifty at bay.

Nifty formed a Doji today. Whats your take,Sir? I suppose, we may see 15900 again.

So what I\’ve stated here is that increase in volatility may not necessarily always translate to a crack in the market, although most of the time it does.

Hi Karthik sir,

1) which factors cause increase in volatily?

2) How can we predict volitity is going to be increase in future?

3) For stocks, how much % do we consider as normal volatility?

1) Greed and fear

2) By observing the markets and events surrounding the markets

3) No set %, varies from stock to stock.