15.1 – Context

I understand we concluded the previous chapter by hinting that we would discuss Index funds next. However, I’m taking a bit of a detour to introduce how one can invest in Bonds directly.

Why am ‘I doing this now? Well, that is because we have just discussed debts funds and the associated terms, given the similarity between debt funds and bonds, I thought we could extend that discussion and talk about bonds as well.

Remember, when you invest in any sort of debt mutual fund, you primarily invest in a mutual fund whose fund manager invests your funds in various bonds and bills. But you also have the option to directly invest in the bonds, just like the fund manager would. There are many platforms in the market that let you invest directly in bonds.

15.2 – Studying bonds before investing in them

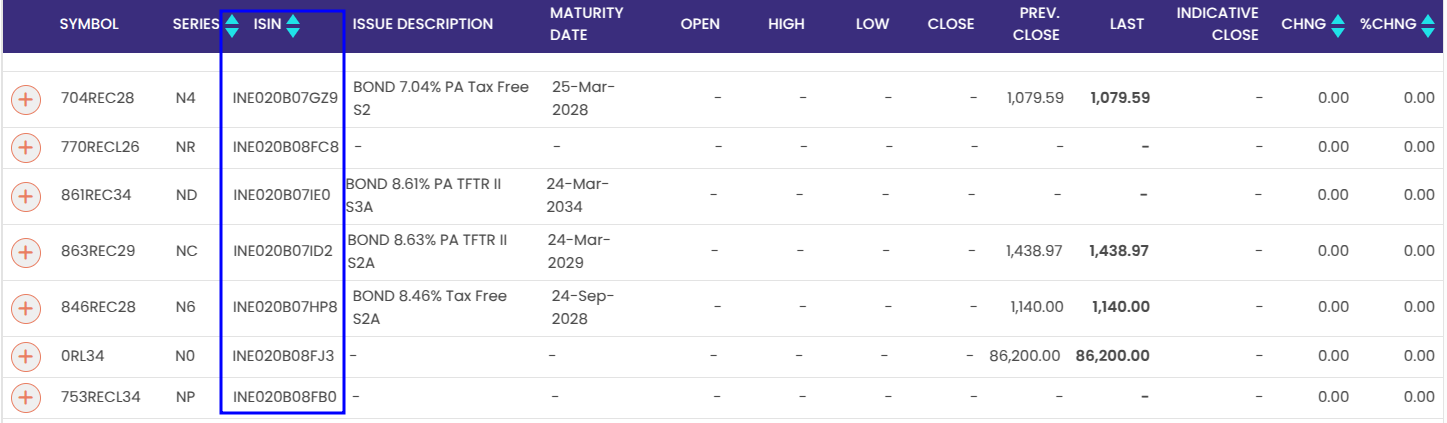

For the sake of illustration, I pulled all the available bonds of REC, a PSU, from NSE’s website.

You can see the bond’s ISIN. Each bond issue is a unique security. And it must have a unique identification number. ISIN is that number. NSE lists all REC bonds on its website. Check the snapshot below. The list contains ISIN of every unique issue by REC.

Once you click on the plus sign on the left of any symbol, you will see more details about that bond.

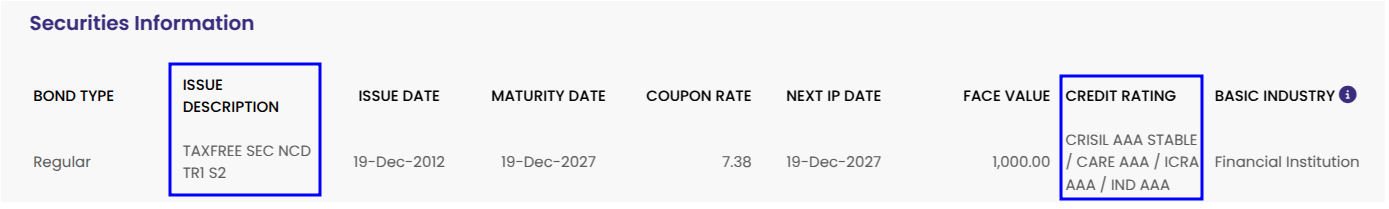

The following snapshot shows a summary of one such bond on NSE’s website.

There are two things (highlighted) to note here; these give you vital information on the bonds.

- Tax-free – Remember, REC is a PSU and PSUs carry an implicit Sovereign guarantee; hence, the credit risk in these PSU bonds is very low. The tax-free bit indicates that the interest income received from these bonds is 100% tax-exempt. The tax-free bit makes these bonds extremely attractive to investors. However, the “tax-free” status is applicable only to interest income. If you hold the bond till maturity, there will be no taxation on your interest earnings from this bond. However, if you manage to sell this bond before maturity at a price more than what you had purchased, then you get capital gains, which are taxable.

- Credit Rating – REC Limited’s bond is rated triple-A (AAA) by CRISIL; the rating is an indication of the creditworthiness of the borrower. AAA is the highest-ranking, so one need not worry about the creditworthiness of the borrower, i.e. REC in this case.

Apart from these tags, there are other specs available to you. Some of these are easy and intuitive, while the others are not.

Let us look at what else you can draw from this information on NSE’s website.

After Taxfree, you can see “SEC”. It means “secured debt”. A secured debt is a loan backed by security. The classic example is a Gold loan.

In a gold loan, you pledge the gold and raise a loan against it. When you repay the loan, the pledge on gold goes away, and you get back the gold. In case you don’t repay the loan, the lender is free to take your gold and make good for his loss.

Given this, if you look at it from the lender’s perspective, secured debt gives the lender more comfort than unsecured debt. So, the credit risk associated is also relatively low. That explains the AAA Stable rating of this bond.

You can also see the Issue date and Maturity date. REC paper was issued in 2012 and is maturing in 2027, making it a 15-year bond.

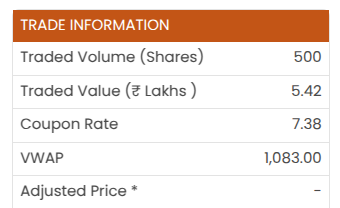

Next is the coupon rate, which I will explain along with the face value. This bond’s coupon rate is 7.38% and face value is Rs. 1,000.

Understanding the face value of a bond is essential for three reasons –

- Gives you a sense of the premium or discount the bond is trading to its face value. In the case of REC, the VWAP of this bond is Rs.1083/-, which is at a premium to face value.

- The coupon is paid as a percentage of the face value. The coupon for this bond is 7.38%, which means that every bond you hold gives you Rs.73.8/- as interest income until it matures. Certain bonds may pay coupons/interest semiannually, but this one seems to pay them annually. Other bonds may pay interest quarterly or even monthly.

- Upon maturity, the redemption value depends on the bond’s face value. More on this later.

Now that you know these details, everything mentioned in the snapshot should be clear, except for the YTM.

15.3 – Yield to Maturity

The concept of ‘Yield to Maturity’ or YTM is one of the most important concepts to understand when dealing with bonds. While the bond’s coupon is essential, as an investor in bonds, you need to be more concerned about the YTM than the coupon itself.

I think the concept of YTM is best understood if we look at it from transactions we are familiar with. Given this, let us build a hypothetical situation around this.

Scenario 1

Your friend informs you about a fantastic commercial property, capable of giving you a 20% rental yield on the investment.

Rental yield = Total rent collected in the year / Amount invested in the property.

You get all excited, because, from your research, the average commercial rental yield is about 15%, so the deal your friend proposed stands out. You ask your friend for more information.

He tells that the fair price for the commercial property is 3 Crores. You do not bat an eyelid; you pay 3 Crore cash down and buy the property.

From the next month, you start receiving a rent of Rs.500,000/- into your account.

Twelve months pass by, and rental income is flowing smoothly.

However, at the end of 12 months, you have a premonition that a virus will hit the world, people will start working from home, and therefore the commercial real estate will lose its sheen.

You decide to sell the property and cash out. Assume the property market stayed flat; hence, you get to sell the property at cost, i.e. 3 Crore.

The question is, how much did you make on this entire transaction? In other words, what was your Net Yield? For the sake of simplicity, forget about taxes and charges.

This is a straightforward calculation –

Buy Price = 3 Crore

Sell Price = 3 Crore

P&L on Property = 0 ———- (1)

Rental per month = Rs.500,000/-

Number of months rent collected = 12

Total Rental income = 12 * 500,000 = Rs.60,00,000/- ————– (2)

Net P&L = (1) + (2)

= Rs.60,00,000/-

Net Yield = Net P&L / Buy price

= 60 Lakh / 3 Crore

= 20%

The net yield equals the rental yield.

Scenario 2

Everything remains the same, except that at the time of buying, instead of 3 Crore, you bought the property at 3.3 Crore. What is the net yield?

Buy Price = 3.3 Crore

Sell Price = 3 Crore

P&L on Property = A loss of 30 Lakh ———- (1)

Rental per month = Rs.500,000/-

Number of months rent collected = 12

Total Rental income = 12 * 500,000 = Rs.60,00,000/- ————– (2)

Net P&L = (1) + (2)

= Rs.30,00,000/-

Net Yield = Net P&L / Buy price

= 30 Lakh / 3.3 Crore

= 9.09%

Notice, everything remained the same, except for the buy price. However, this had a big impact on the net yield.

Scenario 3

Everything remains the same, except that at the time of buying, instead of 3 Crore, you bought the property at 2.9 Crore. What is the net yield?

Buy Price = 2.9 Crore

Sell Price = 3 Crore

P&L on Property = +10 Lakh ———- (1)

Rental per month = Rs.500,000/-

Number of months rent collected = 12

Total Rental income = 12 * 500,000 = Rs.60,00,000/- ————– (2)

Net P&L = (1) + (2)

= Rs.70,00,000/-

Net Yield = Net P&L / Buy price

= 70 Lakh / 2.9 Crore

= 24.14%

Notice, in all the three scenarios, the rental yield was fixed at 20% that didn’t change at all. But the net yield changed, based on the transaction prices.

In summary –

- The rental yield and the net yield matches only when the buy and sell remains the same

- The net yield is lesser than the rental yield when the buy price is higher than the selling price

- The net yield is higher than the rental yield when the buy price is lower than the selling price.

The point that I’m trying to make here is that net yield is very different from the rental yield.

Now, let us snap back to the bonds world and make few comparisons –

Buy price of the property = Buy price of the bond

Sell price of the property = Sell price of the bond

Rental yield = Coupon

Net yield = Yield to maturity or YTM.

Most bonds will have a YTM lower than the coupons. Why do you think the YTM is less than the coupon itself?

Well, that is because you buy this bond at Rs.1083/-, receive coupon payment based on the face value, and upon maturity, this bond is redeemed at Rs.1000/- (scenario 2).

So the effective return you experience here is 5.5%.

15.4 – Accrued Interest

The concept of accrued interest is straightforward to understand.

We know the REC bond pays a coupon of 7.38% on Rs.1000/- face value. The Rupee value of the coupon is Rs.73.8/-.

The coupon of Rs.73.8/- gets paid once a year or once in 365 days. We know the date of payment is the 19th December every year.

The last coupon was paid on 19th December 2024, and the next coupon will be paid on 19th December 2025. Between the previous coupon paid and the next coupon date, interest accrues daily.

If you do the math –

Daily accrued interest = Yearly coupon amount / 365

= 73.8/365

= 0.202192 Paisa.

Therefore, by holding this bond, the bondholder earns 0.202192 daily.

Today is 16th July 2025; it is 209 days since the last coupon paid. Therefore, by holding this bond for 209 days, the owner of this bond is entitled to receive –

0.219452 * 209

= Rs.42.258/-

So the settlement price of Rs.1083/- also includes the accrued interest. Therefore, you can break the settlement price into two components –

Settlement Price = Price of the Bond + Accrued Interest

= 1040.742 + 42.258

=1083/-

So why does the settlement price include the accrued interest?

Well, this is because when you buy the bond, you need to compensate the bond seller the interest he has earned for the duration he has held the bond. Hence, the settlement price includes accrued interest. Also note that when the next coupon is paid by REC, you as the current bondholder will receive the full coupon amount of Rs.73.8/- (thus compensating for the accrued interest that you paid to the seller).

While we are at it, a bit of bond terminology for you.

The settlement price is also called the ‘Dirty Price’ of the bond and the settlement price minus the accrued interest is called the ‘Clean price’ of the bond

15.5 – Should you invest in Bonds?

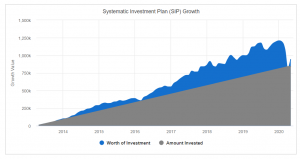

If you’ve read Varsity by now, you’d probably know me as a one hundred percentage equities guy. I’ve mentioned this in several places with due caution that 100% equity is not perhaps the right approach to build a long term portfolio. I always knew that I have to fix this and start to diversify my little savings. It’s just that I pushed my asset allocation plans further and further.

Well, thanks to COVID, this happened –

A 40% decline in the Index in less than a month. All gains wiped clean. For the first time since I started investing in the markets, I saw that the ten year SIPs go negative as well. I do not think this had happened in the 2008 market crash either. Look at this chart; I’ve got this from Value Research website –

Perhaps this is strong enough reason for me to get started asset diversification. Maybe it is a good idea for you as well if you have not thought of asset allocation yet.

On the asset side, you now have access to –

- Direct Equities

- Equity Mutual funds

- Direct Bonds

- Debt Mutual funds

- Sovereign Gold bonds

- Fixed Deposits from your bank

I think with these assets; you can build any combination of the portfolio with different asset allocation patterns to achieve any portfolio goal.

In the coming chapters, I will discuss portfolio compositions and how you can set up portfolios to match your goals, but before we do that, we will next discuss the Index fund.

Stay tuned.

Key takeaways from this chapter

- In a tax-free bond, the coupons are tax-free

- PSU debt carries an implicit sovereign guarantee, and hence very low credit risk

- The coupon is paid as a percentage of the face value

- YTM of a bond is the effective yield the bondholder experiences

- The bond buyer pays accrued interest to the bond seller

for certain reasons, I want to buy NCD only via Kite.

1. What do I lose by doing that vs other bond platforms?

2. When bond matures then will I get the money back comfortably without hassles if the bond was purchased via Kite?

Puneet, these are secondary NCDs, listed on exchange that you can buy via Kite. Fresh issues, you cant. Maybe speak to a support executive for more details on this.

I was checking wint wealth to invest, and I am going through this post to understand the technicalities.

What is YTM actually mean? \”Muthoottu Mini Gold Sep\’25\”(https://www.wintwealth.com/bonds/listing/Muthoottu-Mini-Gold-Sep25-393/) in wint wealth says 11.25% YTM.

I invest 975.15(purchase bond)

Pre-tax returns = 1,126.96 after 17 months.

Net Yield(YTM) = Net P&L / Buy price

YTM(according to the url above) should be = (1,126.96 – 975.15) / 975.15 == 0.1556 which is 15.56%

So the YTM should be 15.56% instead of 11.25% right?

Is my settlement calculation correct at least?

Settlement Price = 975.15 + (1126.96 – 975.15) == 1126.96

Settlement Price = 975.15 + 151.81 == 1126.96

Rakshith, you should actually post this query on Wint\’s support portal, I\’m sure they will have a good explanation to this 🙂

Posted at wint wealth chat, thank you.

Cool, I hope you get the answers 🙂

Rakshith, Hi could you Please share what they shared

In the real world, isn’t the calculation of Yield to Maturity (YTM) based on the assumption that all coupon payments will be reinvested at the same rate as the YTM itself? Am I right or wrong?

Yes, thats right.

so in this chapter when calculating YTM why this assumption is not mentioned or considered

We have not really gone into the math, we have just touched upon the contextual understanding of YTM Shivansh.

Hi Team,

I tried in zerodha kite, for investing in bonds.

Could not find any. Any you please help with this ?

Hmm, can you check out Wint or GoldenPi platform?

Hello,

How can I invest in bonds when they are just issued from the issuer itself?

It will be available on platforms like Wint. Please do check that once.

Calculation error in article.

1. Effective return is 6.81 instead of 5.5.

2. In Accured interest for holding 209 days check it is 0.202192*209 =42.258

Let me take a look at this, thanks.

Hello Sir,

I don\’t think we have Corporate Bond IPOs on kite. Also, say I want to invest in a corporate bond say Adani Enterprises NCD. There I see interest rate of 9.3% for series 7. Is it like a fixed rate of interest I\’ll be receiving? Also, the security that I\’m getting (1000Rs per unit, is it against 1 share of Adani Enterprises? Like I\’ll get one share for every unit I hold of Adani Enterprise default on interest payment.

I\’ve actually not seen the contract, but if the coupon is 9.3%, then thats the coupon you are entitled to get.

My coin platform is not showing bonds option

Please do call the support desk for this, Amit.

Why my coin platform not showing Bonds?

Please do write to the support desk, they will help you with it.

Hello Sir,

Thank you for making the concepts so easy to understand. I have been buying government bonds in Kite but I can\’t ever see the RBI floating rate bonds that are at 8.05%. Can you please shed some light on it?

Amrita, unfortunately these are not yet available in DEMAT mode.

Hey Kartik sir,the average interest on bonds are 6-7 percentage as far as I know. So why shouldn\’t I invest in Fixed deposit of banks if the interest rate is similar or say higher sometimes? Please help, I am confused 🤔, I think FD are better than bonds and safer. But I think I might be wrong here, it would be nice if you could clarify this please.

Thats right. Go for Bank FD if you want full visibility on capital protection and returns. Opt for debt fund if you are slightly risk tolerant as there is credit risk. Besides, not all FDs are liquid, but debt funds are liquid.

You did not mention about FD security .. in FD guarantee is only for 5 lac and is taxable .. is my understanding right

Thats right.

So are bonds not taxable or less taxable?

Depends on the issuer. Corporate bonds dont offer any tax benefit, while some Govt bonds do.

Thanks you so much sir for your clarification and your valuable time 🙂❤️

Happy learning 🙂

How to adjust the taxes on Accrued interest? In your example, the buyer has paid around 37.86 to the seller but when the next coupon/interest is paid to the new buyer, this 37.86 will be shown as interest earned in the new buyer\’s financial year statement which actually is not the earnings rather it is the price he has paid to the seller. Buyer has to unnecessarily pay tax on this 37.86 amount.

My question is how can new buyer avoid or adjust this tax. Is there any provision?

Yes, the accrued interest (₹37.86 in the example) paid by the buyer to the seller gets included in the total interest payout when the coupon is received — even though it’s not actual “income” for the buyer. This can lead to a tax mismatch, where you\’re taxed on interest income you technically didn’t earn.

> Buyer pays ₹37.86 to the seller as accrued interest (already compensating the seller).

> Later, buyer receives the full coupon (say ₹100), and the entire ₹100 shows up as interest income in their tax statement.

> Buyer pays tax on the full ₹100 — including ₹37.86 which was not earned.

I\’m not sure if there is a provison for this under the Indian IT act. I\’d suggest you speak to your CA about this, and maybe share your findings here as well 🙂

\”The tax-free bit indicates that the interest income received from these bonds is 100% tax-exempt\” So as per This REC example here no tax expected to be paid on interest earned. Is that right Karhik ?

Yes, but do check the latest changes to tax treatment, if any.

The Link https://coin.zerodha.com/bonds does not work at all. So Coin/Kite no longer support investment in corporate or Govt bonds?

Check this Ravi -https://support.zerodha.com/category/trading-and-markets/general-kite/govt-securities/articles/buy-gsecs

This is about gsec.

Does Kite/Coin support purchasing of Corporate Bonds?

I am not seeing any corporate funds in Kite. I am able to see only T-bills. So I think, the corporate bonds are not available now in Kite.

Sundar, please speak to our support desk for this. Thanks.

Yes, I\’d suggest you speak to the support desk for this.

I have a doubt:

As rental yield is dependent on amount invested in the property, then in the scenario 2, the monthly rent should come to 5,50,000 {(20% of 3.3 cr)/12} — scenario 2… leading to increased Net yield of 10.90%… But here it is mentioned 9.09%…..Pls explain!!

I think that is a typo. Have discussed in the comments.

Is the platform linked to Zerodha an OBPP registered with SEBI? Could you please share the details? What I read was that bonds etc can be exchanged through these platforms. Please guide.

Ah, no, its not live yet.

Happy Saturday, Karthik. Hope you are keeping well.

I am not sure if this is an appropriate blog to request these data points but taking my shot:

1) Which websites/ materials do you refer to for LTCG/ STCG taxations on Bonds/ Debt Funds? There were lot of changes in the past 2 years budget regarding LTCG/ STCG on taxations.

2) Do you or your team intend to publish updates rules and regulations on LTCG/ STCG taxations on Bonds/ Debt Funds? I could not find any other website on the internet that could articulate it as well as you would do it. Can provide the support here if required.

Rudo, happy Sunday 🙂

Do check – https://quicko.com/, get in touch with their support team. They will be happy to help you with both your queries.

Hi karthik. Are you AI? You know so much.😊

I wish I was 🙂

Is Goldenpi is linked with Zerodha coins? Advice me for buy the gov-bonds through Coins

GoldenPi is a portfolio company of Rainmatter.

Cant find bonds too for me. tried coin, console and kite all. This is 20205.

Hello thank you for wonderful insights. I little out of context doubt. How are bonds different from debentures?

They both are debt instruments, Ankur. The difference is in terms of maturity of these instruments. Bonds can be long dated, while debentures are shorter maturity insruments.

And how do i invest in corporate bonds?

Is the bonds feature released yet? I see some documents on Varsity but the links leading to coin are broken.

Please do check on Kite.

It is 15 March 2025. Why I can\’t see \’Bonds\’ on my Coin-Zerodha home page?

Please check on Kite.

Are the bonds available on Coin/Kite to buy yet or the idea of selling bonds is dropped?

Listed bonds are available on Kite itself.

Hi,

This is very informative and comprehensive article. However, link provided for bonds investing in zerodha goes to 404

https://coin.zerodha.com/bonds

Wanted to check if url has changed, as i am looking to invest on bonds

Check this Shubham – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/govt-securities/articles/buy-gsecs

DOES YOU HAVE ADDED BOND PLATFORM IN COIN APP?

I have 2 questions:1) Why Do Bond Prices Fall When Interest Rates Rise? 2) What makes bond prices fluctuate?

1) When interest rates increases, bonds which offer lesser coupon compared to interest rate becomes less attractive, hence the price tends to fall.

2) Expectation on the interest rate, which is again dependent on the way economy is moving has an impact on bond prices, and therefore they fluctuate.

Hi,

I am not getting option to invest in Bonds in my App. How can I invest in bonds/NCDs via Coin app

Manish, I\’d suggest you speak to the support desk for this. They will help you with this.

Hi, this page \”bonds platform for zerodha\” https://coin.zerodha.com/bonds erroring with message \’404 not found\’. please look into and let me know how to invest in bonds via zerodha.

Thanks, will do.

What is the link to buy AAA bonds in the Zerodha site, i tried the link given in this page (https://coin.zerodha.com/bonds) which is not working and throws 404 error.

Vijay, can you please call the Zerodha Support desk for this?

Sir,

Regarding investing in Debt instruments, you have said that these are mainly for capital protection.

Now, is there any alternative to debt instrument for this? Can gold substitute this place? If I buy and store coin/bullion can it meet the purpose?I have specifically asking this as I feel there is still areas where I can loose money? So instead of parking cash here, can mixture of investing in FD and gold meet the purpose to some extent?

Request your advise here

Yeah, Gold is an alternate to EQ and helps you build an uncorrelated long term portfolio.

Sir,

Regarding the REC bond which you had explained, the tenure is mentioned 41 months in coin snapshot. However, while digging deep and there the tenure is given for 10 years maturity.

Is there any contradiction or am I missing somewhere?

Maybe just 41 months left of the 120 month (10 yrs) tenure? Is that the case?

No corporate bond option available in Coin/Kite

Where do I get the bonds feature? Can\’t see it in coin mobile or desktop

What features are you looking for? Its there on Kite.

Hi Karthik,

bonds platform on Zerodha link is broken now.

Can you share the link please?

Hi Karthik,

I am looking to buy the REC bonds but I can\’t find it on the Coin app. Is there a way I can buy it.

Check this – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/govt-securities/articles/buy-gsecs

The bond feature is not available in my Coin app. Is it rolled out to everyone?

Its still not there how can i see bonds

Thanks for the link. But it\’s only for GSecs and T-bills right? I am curious how to invest in corporate bonds, the AAA rated ones, the A– rated ones, etc. via Zerodha. I greatly appreciate the time you take in answering these questions Karthik.

Ah, no corporate bonds on the platform yet, Mike.

Is there a varsity section on Market Linked Debunture (MLDs) such as this one – https://bonds.incredmoney.com/market-linked-debentures/mld3/details/ ?

https://bonds.incredmoney.com/market-linked-debentures/mld1/details/ – 14% minimum returns!!?? How?

How are they guaranteeing returns, and that too at 1.5x Nifty?

We dont have a section on MLDs yet. Will try and add content around this soon. Thanks.

At the beginning of section 15.2, the link to bonds platform – https://coin.zerodha.com/bonds is broken. If I have to invest in bonds via Zerodha, how do I do it?

Let me check, meanwhile please see this – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/govt-securities/articles/buy-gsecs

Hi Sir,

I am still not able to see bonds in my coin or zerodha account on phone or web. From above, I understood it was in beta stage in 2020. Can you confirm if it is now available to invest directly in bond through zerodha/coin?

Regards,

Jainam

Please do check this – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/govt-securities/articles/buy-gsecs

Is the bond platform not operational anymore under Coin App? or it has moved else where? Asking since the above mentioned link doesn\’t seem to work & returns \”404 – Page does not exist\”

Reg: The \”bonds platform on Zerodha\” is a part of Coin, our mutual fund platform

Check this Vamsi – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/govt-securities/articles/buy-gsecs

This link https://coin.zerodha.com/bonds gives 404 – Page does not exist

Ah, check this for more details. I think the page was redone – https://zerodha.com/z-connect/kite/invest-in-government-bonds-and-sovereign-gold-bonds

Hi Sir,

Could you please add a dedicated module for fixed income securities explaining the various complex calculations with bonds?

Noted.

Thanks Karthik for this chapter, i have one question:

Suppose i have bought the bond on the issue day at its face value (1000 ₹) and at the time of its maturity the bond is trading at premium or discount on the exchange then what amount will i get on maturity the face value or the trading value(premium/discount)?

On maturity, you will get the face value of the bond, and not really at the trading value, which could be at a premium or discount.

Hi Sir, My question is in context of \”Bond vs Debt MF, which one to choose for using it as cash component for taking margin benefits in trading\”?

Earlier Debt MF used to carry indexation benefits for tax calculation, now that is gone. Additionally, in Debt MF, interest is re-invested automatically by fund manager and hence individuals don\’t have to do that stuff. Apart from this stuff, I don\’t think there is any benefit if I go for debt MF. Please show some light on my concern of choosing which one of them.

P.S.: I am an aspiring trader, and I want to do systematic trader with the help of taking margin benefits from my investments.

Debt funds should be used for aligning with your portfolio goals, indexation benefit came in later 🙂

Sir , i have some following questions

1) IN EALIER CHAPTER you told that bond price and yield are inversely proportionate but here yield is also getting higher when selling price is also higher.

2) at maturity , there is no guarantee that we will sell the bond on bought price ?

3) if bond yield is increasing it means bond price is decreasing ( as you told in previous chapter ) it also means interest rates are also increasing how it is a cause of concern , specially when recently saw that in US bond yield is all time high at 5 percentage ?

4) I want to build a mutual portfolio for 25-30 years , what one should do if covid like situation arise after 5 or 10 years .? should we resort to redemption or continue for intended 25 to 30 years ?

1) Not sure in which context you are reading this, but yes, when bond prices increases the yield decreases and vice versa.

2) No, but you will the face value

3) Bond price is also a function of demand and supply. By the way, sensitivity of bond prices to interest rate also depends on the tenure of the bond.

4) Stay on the course is what I\’ve suggested.

Still I am not seeing the PSU Bonds buy option.

Hi

I would like to invest in Bonds through zerodha. But I\’m not able to see any corporate bonds in Coin apps.Only GOI dated bonds is availaible as of now. Is there any difference between the Corporate and GOI bonds?

The difference is in the fact that the issuer is different, Govt guarantee vs a corporate guarantee 🙂

Regarding [this comment](https://zerodha.com/varsity/chapter/investing-in-bonds/?comments=all#comment-328195), the rental yield should be different in each case since the BUY price of property changes. Can you please update the document. Thanks for Varsity!

The idea is to only convey the broad concept, Kushal. I\’d suggest you take the broad idea from it and ignore the smaller details 🙂

Hi Karthik Sir,

Thanks for the info.

Is Zerodha currently working on making corporate bonds available on Coin app & web? Currently, I am not getting the option for Corporate bonds on Coin app and on Coin Web, it is saying \”Check back again after a few weeks.\”

Thanks

Its on the cards, may take sometime Saurab.

Hello Karthik Sir,

I wanted to find 2023 Indian bond market size and CAGR of same. Which reliable published reports can tell me the same, any links will help.

Thanks

Check this – https://www.indiabonds.com/news-and-insight/size-of-the-indian-bond-market-is-us-2-trillion/

Hi Karthik,

I would like to know, whether to buy a bond with selling price lesser than face value or above than the face value.

Is their a recommendation or criteria which we can check to buy a Bond?

It depends on your outlook on the bond prices and the interest rates. Just basing your opinions on bond price in comparison of the face value may not be the best strategy 🙂

Can capital gain bonds (54EC bonds) be pledged at zerdodha platform for F&O margin ?

How to find these bonds on Zerodha Platforms

Please do call the support desk for this.

Thanks

Hello, I have opened DMAT account at Zerodha & have to buy National Highway Authority of India (NHAI 54EC) bonds. I tried to find out but could not find.

Please advice how to buy.

Regards

Vikas Pathak

Try here Vikas – https://coin.zerodha.com/gsec

Hi, Karthik. I have a question reg. the YTM calculation from this statement

\”The coupon is 8.01%, but the YTM is 5.4%. Why do you think the YTM is lesser than the coupon itself?

Well, that is because you buy this bond at Rs.1115.03/- and upon maturity, this bond is redeemed at Rs.1000/- (scenario 2).

So the effective return you experience here is 5.4%.\”

In the later para, you mentioned that

\”Settlement Price = Price of the Bond + Accrued Interest

= 1077.609 + 37.8615

=1115.47/-\”

The question is- does the YTM include accrued interest? This is something that I am getting compensated for when the interest is paid at the year-end, which means that I have only effectively paid 1077.609

Yes, YTM calculations assume the coupons are paid and plowed back.

In coin zerodha app,I found no option of corporate bond,can someone explain I trade it in zerodha platform

If you are looking at G sec bonds, you can check this – https://coin.zerodha.com/gsec

Hi, I just wanted to share a small tidbit – thanks so much for doing this! This content is super useful, easy to understand and extremely detailed but also not complicated. I\’m really in awe at the values of your company and the reasoning behind doing this – it seems to be primarily focused on fair investor education. I was recently revising one of my relative\’s portfolios to a shift to direct MFs as he\’s lost a bunch of money thru commissions – educational initiatives like these are paving the way for just and sustainable market corrections. Kudos to you and the team and once again, I just wanted to say that this content is very much appreciated. I was also recently studying for the cfa program and found that i did not understand fixed income from their material. Post that, i started varsity to finally get down to portfolio diversification. reading this has honestly helped so much in understanding cfa material also! THANK YOU!

Thank you so much for the kind words and encouragement. Words like this is what keeps up motivated to do better 🙂

The bond feature is not available in my Coin app?

How is interest paid out for a g-sec bonds? Annually or at the time of maturity?

how do we see the price of the g-sec bonds as we have only option to place the order in coin but no price of the bond is displayed.

I placed my order in gsec bond when will it get settled, I mean how many days needed to settle

Its paid semi-annually, but do check the bond\’s factsheet to get the exact details. You can see the price by loading on the market watch (Kite). I guess the settlement is T+5.

I recently bought a bond (not thru coin) and got credited in my Zerodha Dmat as per cdsl email.(received on 25th August 2022).How to find it in Zerodha ?

Please check your holdings.

I invested in Bonds via another platform but created a zerodha brokerage account for holding these. I am not able to see those bonds on my coin app. Is there another place or way I can see bonds linked with my zerodha account?

Check your holdings in Kite. Please do call the support desk to know more.

Is the bond platform live yet?

I still see 404 not found error when I try to open the link in the article above.

699GS2051 alloted at price of 93.33 but LTP during pledging shows price of 88. So the difference will be credited back ? And the YTM for the above will be based on 88 rs ?? The current yield should be then 7.95 ??

LTP is a traded price, which is market-driven. The allotted price is an outcome of the acution.

As on 07-07-2022 the GSec 710GS2029 is available on Coin app for 105.01 Rs but shows an indicative yield of 7.36 . If the bond is availabe at premium of Rs 5, then why indicative yield is shown higher as 7.36 as compared to coupon rate of 7.10. Aren\’t the bond market price and yield inveraly proportional ??

105.01 is not the final selling price, the exchanges block an additional amount to cover extreme cases. You will get a refund of the additional amount after the price is discovered in the auction. The price will typically be closer to the current market price of the bond.

How is taxation managed, if I pay accrued interest to seller and my acquisition cost would be increased however I will recieve full interest and will pay tax on the whole interest income as a buyer

While paying taxes, you will consider the buying price as well right?

Does the secondary market for Government Bonds (G-Secs) have enough liquidity If I want to sell them?

Ah, not that much I guess.

I will be buying government securities through zerodha kite as they are listed on exchanges… Just like stocks.

As I am thinking of buying them at discounted price..

Will then I be elligible for semi annual interest on my investment??

Yes, you will.

Hi Sir,

I am thinking of purchasing government securities from kite platform of zerodha ( not from coin platform via non competitive bidding).Will I be elligible for semiannual interest payment from those g secs?

Thank you..

But how can you place your bids? We don\’t have the platform right?

Hi, I had a question. For tax purposes , how does this work?

For example, suppose I buy a Rs. 10,000 face value, 2032 maturity G-Sec with 10% coupon at Rs. 9000 clean price, 9200 dirty price in 2022. In 2032, at maturity, I will get Rs. 10,000 face value + Rs. 500 (last half-year coupon).

In 2032, are my Long Term Capital Gains Rs. 1000 or Rs. 800 or something else (1500 or 1300, but that seems unlikely?)

In 2022, are my Short-Term Capital Gains (taxable as per income slab) Rs. 1000 (total coupon) or Rs. 800 (subtracting accrued interest I already paid in the dirty value)?

Thanks!

Sarang, I guess its best if you post this in taxation module or maybe you should check with CA. As far as I know, it gets clubbed with your income and gets taxed according to your slab.

Hi…I intend to invest the Capital Gains from sell of land / plot in Bonds issued by the National Highway Authority of India (NHAI) or Rural Electrification Corporation (REC) have been specified for this purpose, to save long term capital gains tax. Can I pledge these bonds as collateral to obtain margin for trading? Thanks….

In my view, the rental income was the same but the rental yield changed because of the change in the denominator. I am at divergence with the assertion below:

\”Notice, in all the three scenarios, the rental yield was fixed at 20% that didn’t change at all. But the net yield changed, based on the transaction prices.\”

Could you clarify if I have mis-understood this point?

That\’s right. The price you pay to acquire these assets plays a role in determining the overall yield. As the denominator changes, so does the yield.

Thanks Karthik, He does not have a Demat account yet, he has tax saving bonds with physical documents for now. If we get a him a new demat account. can we link/request for those bond to be shown under his account..

Yes, thats right. Here is the process to do the same – https://support.zerodha.com/category/your-zerodha-account/transfer-of-shares-and-conversion-of-shares/articles/how-do-i-convert-physical-share-certificates-into-demat-form

Hi, If we open a new Demat account for my dad in Zerodha, Will his existing bonds, be shown there?

Not unless you transfer it to the new demat account.

I want to buy 100 gms of Gold from RBI SGB VIII Series through my Zerodha DP account.

Please describe the step by step procedure for the same. Thanking you in advance.

Please login here with your Kite credentials – https://zerodha.com/gold/ check this as well – https://support.zerodha.com/category/console/portfolio/articles/how-to-buy-sgb-bonds

Does Zerodha has a list of top picks in MF/Equities/Bonds etc. That will surely a great feature for many new investors. As far this topic I would like to know how to choose a bond for investment and would like to know which ones are available for investment as of today Nov 21.

Seema, unfortunately, we don\’t advise clients on what to buy or sell, so I\’m afraid we cant do this for now.

what do you mean by we are yet to see the platform

as you must know that rbi recently launched its platform to invest in bonds for retail investors so what\’s the difference between the rbi platform under rbi retail direct scheme and coin platform by Zerodha

and as rbi claims that they will charge zero fee for everything (am I right on this or there are any hidden charges or anything like that) and what are the charges on coin by zerodha

Shivansh, RBI platform will just be focused on bonds. Btw, we are yet to see the platform. In Coin, along with bonds, you can also transact in mutual funds. There is no charge for using Coin.

Hi Sir,

In India, in every talk about bond investing, I cannot find any description about Inflation Indexed National Saving Securities – Cumulative (IINSS-C).

I found about this recently and sounds good tool for any portfolio, as it gives compensation to Inflation. it looks providing more interest pay than any other bond types.

Please provide your view on this.

Please let me know, is there any planning at Zerodha for allowing the Demat holders to invest in this securities?

Not really sure, need to figure more 🙂

If we are buying debt. bonds in zerodha site. what are the charges/commission applicable ???

No brokerage charge, Jeyaraj.

Thanks for the in-depth information. Is there an easy way to calculate YTM?

Hi Karthik,

Thank you for taking efforts to produce such awesome and easy to understand chapters. 🙂

One small correction. While calculating YTM in Scenario 3, the buy price should be 2.9 Cr rather than 3 Cr.

Thanks, Parag. Let me check this 🙂

Hi

I wanted to know if I wanted to buy say an existing bond frm the market & ask price is 11,159 face value is 5,000/- maturity is in 3 months ytm is 7.57% so on maturity I will be making around Rs.95/-is that correct. Is there any other charges

Thanx in advance

Best regards

You will get back the face value, Akhil.

Hello sir,

I am interested to know more about the educational programs and tie-ups for students. kindly share the details with whom i can connect. Thanks.

All the content we have is already here 🙂

NCD of indiabulls housing finance ltd is open now, how i can buy ir from primary market ?

You will have to do it vis Bank ASBA, we don\’t support debt IPOs yet.

Hi Karthik,

Needed one clarification and I think this echoes Rohit Dua\’s question (2nd point above). His question was why would one buy a bond at a premium because in that case, one would be getting a lower YTM. This is my observation – Buying of a bond at a premium/discount only happens in the secondary market and in the primary market where the bond is issued for the first time it is always done at par (except in cases like PSU bonds/zero coupon bonds). So when you say you bought a bond at a premium/discount, it usually means it is bought from the secondary market. Is that correct? When a bond is trading at a premium, it means the current interest rate is lower than the coupon rate of the bond and people try to take the benefit of that. Is it the right way of looking at it?

That\’s absolutely correct, Pradeep.

Max 150 units only we can buy or can we place in another order?

My first question. If I sell bond before maturity then will all previous interest income fall under taxable income category ? As if bond is for 5 years but I sold after completion of 3 years, then will my all previous interest income be taxable(tax in this case will be accrued) or only 3rd year interest income is taxable ?

2nd question- Can we sell bond before maturity ? And will we get premium over what actual amount we had paid to buy bond ? Do bonds trade @ premium on exchanges ?

1) I think so, but its best if you check with your CA about this

2) Yes to all. Bonds can either trade at a premium or discount based on the market condition.

Hi, just one clarification.

Premium addition to the face value happens only when one sells in the secondary market due to the prevailing rate of interest which is less than the actual interest offered by the company at the time of issuing the bond, that is new bond offer. In our example actual closing date 16.09.2013.

what is the max amount one can invest in these Tax free bonds? as per what i saw and understood, one can only purchase 150 units which amounts to 1.5 L (plus the premium amount). this is very small amount esp when the bond tenure in 10+ years.

request you to guide me if my above understanding is correct or am i missing something.

thank you in advance.

This is beta, hence the restriction. The cap is per order, you can try placing multiple orders though.

I want to invest high quality PSU corporate bonds. Whereas, i couldn\’t find this option in COINS app. please advise.

thanks

sudharsan mohandoss

Please check Golden Pi as as well – https://goldenpi.com/

Hi,

Can we pledge these capital gains saving bonds/54EC in Zerodha and use it as collateral for option selling?

Will we still get the capital gain savings from the immovable property sold right?

Please check this list, Ajay. If the security is listed, you can pledged – https://docs.google.com/spreadsheets/d/1vRI4NKpJ-3mnOWxUhSRMSQD5txy8QNumzSQrdfGKyL0/edit

Hi,

Need to understand PFC Corpoate bond,Face Vlaue is Rs.1000, but paying Rs.1157/-what is the percantage of Benfit, If I Invest 50K for 29 months,pls advice.

I\’ve tried to explain all these things in the chapter itself, please do give read.

Currently for REC, it shows Accrued Interest as negative value of -0.4449. What does it mean.

Not sure, but it cant be -ve.

corporate bond or corporate bond fund, which is the best choice. Pls compare its cons and pros

Bond fund since its diversified and does not carry the risk of a single bond.

Hi,

This article was really useful. Can you also tell me about the procedure to redeem bonds after maturity?

The bond will be extinguished and the funds will hit your bank account.

HI!

I have few queries as below;

1. Does Zerodha platform enables buy/sell in Govt Securities ( like Indiabonds platform or Bondskart Platform)? I am interested in investing in long term dated Govt Securities, SDLs for my retirement income instead of annuities.

2. Can you also please tell the disadvantage of Govt Bond vs LIC Annuity for regular post retirement income?

Thanks in advance.

1) Yes, check this – https://coin.zerodha.com/gsec

2) That would be a big post, Dabasis 🙂

Case b) Sell after 1 Year

>> for this case in my query.. Is my understanding right.. Returns will be higher if we can get liquidity in market .

Yes, provided you manage to sell at a price higher than the face value.

Hi Sir,

If I understood correctly.

if Selling price > Face value then we pay more money to buy bond but if we get face value only so the effective interest rate is YTM and not coupon rate.

If selling price = Face Value then YTM & coupon rate are same.

Question:

1) Is my understanding is right ?

2) How about if we buy the bond at high rate and if I see increase in price in bond from the date of my purchase and sell that bond in market. This way Can I increase my returns.

Example :

Face value = 1000

Buy Price = 1100

Quantity = 10

Coupon rate = 10%

Tenure = 2 Years

Amount paid = Buy Price * Quantity = 11000

Case a) Wait till end date of bond

Refund = 1000 * 10 = 10000 — (1)

Interest = 1000(1st year) + 1000 (2nd Year) = 2000 —- (2)

Additional return (excluding principle) = (1) – Amount Paid + (2) = 1000

Case b) Sell after 1 Year

Selling Price (same as buy)= 1100 * 10 = 11000 — (1)

Interest = 1000(1st year) + 1000 (2nd Year) = 2000 —- (2)

Additional return (excluding principle) = Amount Paid – (1) + (2) = 2000

Is my calculation right ? If so selling bond in between is better

If you buy the bond at par i.e. by paying the face value, then the YTM wont be equal to the coupon because there is also time component, which YTM captures and coupon wont. Bond math is not straightforward. Broadly speaking if you buy the bond at a higher price, your yield is lower.

I want to if I can invest in govt 7.75% taxable bonds through zerodha, if yes, could u guide me

You can invest by buying from the secondary market if its listed.

Dear sir

I have registered with Zerodha with a clear intention of investment in bank bonds and govt bonds.

I hope I can directly invest in SBI bonds from Zerodha and hold bonds in my demat account.

Also I happen to hit up on goldenpi.com. they also say you can invest online using their app. Since they say they partner with Zerodha, it makes sense to invest directly from Zerodha. Pl reply and copy reply to my mail id

[email protected]

Vasuki

You can invest, Vasuki.

Can I use covered bonds as collateral in zerodha ?

I\’m guessing you want to know if you get margin benefit. No, this won\’t be possible.

Hi,

Why do I see only 2 bonds at https://coin.zerodha.com/bonds/invest. Only 2 bonds are there for investment? Can you please clarify?

Thanks in advance.

That must be the latest available, Gourav.

What about the liquidity of Bonds? Are these bonds as liquid as most equities? In other words, can i find a buyer for my bond easily (if i wanna sell)?

These aren\’t very liquid, Puneet. Your best bet is to try and sell them in the secondary market.

Want to know about Debentures

Can I invest in NHAI capital gains tax savings bonds through Zerodha?

You can if it is listed and available.

Is the annual interest payment taxable? Do we receive it every year or at the time of maturity.

Depends on the issuer of the bond.

How did we get YTM as 5.4% in the example? Can you post the calculation please?

I guess that was picked up by the information provided. YTM calculation is a bit hard, have not discussed that in Varsity.

Hi Karthik

1- Is the golden pi website backed by Zerodha?

2- Where can I find the advertisement of bonds in order to buy them from primary Market ?

1) We have an investment via Rainmatter in GoldenPi

2) I\’d suggest you check this with the folks from GoldenPi

I am NRI user of Kite . When I am trying to access coin it shows my account is inactive.

I want to invest in NRI bonds and Gov sec through FAR route. Please guide how I can do it through Zerhoda. ??

Sourabh, I\’d suggest you create a ticket for this on the support portal. Thanks.

Hi,

This is what I see in the above link

Currently no corporate bonds are open for sale. Please check back later.

Is this correct?

Yup, thats right.

Hi,

I have checked in coin app, I cudnt find any bonds in it. Am I missing something here.

And also I have checked in goldenpi, which has only very few bonds listed.

Can you please let me know what are the other places where one can find most of the bonds for purchase. Thanks

Here – https://coin.zerodha.com/bonds

Hi Karthik,

I shall first appreciate your patience in responding to each comment in detail. Kudos for that.

I have one doubt lingering in my mind, I\’m hoping to get clarity from you

1. What is the limitation for someone to directly buy bond from issuer during the IPO in primary market. Is it the availability or demand or taxation or liquidty or tedious process?

If we manage to buy then the YTM would same as coupon rate(8-9%) which is much more than market interest rate(4-5%). Once it hits the secondary market, bond price gets adjusted as per the prevailing market interest rates. So it makes sense for anyone to buy from primary than secondary. Please shed some light.

1) it is not, you can buy corporate bonds via various platforms. But I think Govt bonds is an issue

2) Yes, at the time of offer, YTM is close to coupon (little more usually)

What is the meaning of frequency here .Suppose in frequency it is written yearly so in this case should i have to pay for the said amount on an yearly basis upto tenure period or it one time investment Can,t understand it .Plz help me

No, in this case, you receive the payments i.e. the coupon on the said frequency. So if the freq is yearly, then you will receive yearly coupon (or interest) payments.

Hi Sir,

Hope you are well.

I would like to know what is the IP date of the bond. Once I purchase them do I have to pay some additional amount each year?

Thanks,

Himanshi

No, there is no additional amount to pay after you purchase the bond.

Hi Karthik,

Just a note of gratitude.

Your articles well articulated and easy to understand, one of the best I\’ve read so far.

Thank you.

Thank you so much for letting me know, Aakash. Happy reading and learning 🙂

Hi Karthik Sir,

How can one find the ISIN number and the trading symbol of the bond which is listed in the Coin ?

I tried the NSE website and google but could not find any method which conclusively maps one to the other.

Regards,

Ravikiran

The fastest way is to Google for the bond name and look for the ISIN. Results from CCIL will show up giving you the ISIN.

Hi Sir,

Very comprehensive list of topic covered under Debt funds. As you mentioned, it\’s something that caught my attention for asset allocation. With that came up a question on whether an SIP would be better or a lumpsum approach ? If Debt funds are meant for capital protection – it sort of implies a lumpsum approach , however even with these funds there\’s an inherent risk involved. Hence the confusion.

Yes, lumpsum is ok for Debt funds, Jayant.

As an investor should I concentrate on YTM or Coupon% ?

As an investor I have to concentrate on YTM or Coupon% ?

Both, Raj. But yes, if you plan to hold to maturity, then maybe just the coupon.

great work.

just wanted to ask

1. so even if we buy the bond at a premium ,at the time of maturity we will receive the face value only? (keeping apart the ytm and coupon)

Thats right, Varun. Upon maturity, you get the face value.

Beautiful class.Thank you

Good luck, Vinod!

Thanks for your valuable knowledge

1. YTM is minimum secured or final return.?

2. On the Maturity of bond , during selling per unit price will be applicable that time real price not less then 1000/- or fixed 1000/- per unit.

1) Final return

2) It will always be at par value.

Hi

Very easy to understand. Nice Read. Request you to kindly come with a read on :

A) Portfolio allocation for 25 yrs Guy- Income 10 L / Annum. Savings 5 L per annum

B) Portfolio allocation for 53 Yrs Guy – Income 5 L / Annum. Savings 2 L per annum.

C) Which one will you prefer – Gold ETF or Sovereign Gold Bond ?

With lots of respect

Asha, towards the end of this chapter, have highlighted a few portfolio strategies that you can use. Do check that chapter. Thanks.

Dear Team,

Please confirm if we can buy National Highway Authority bond through Zerodha?

If yes, kindly provide step to buy it.

Vishal, you can buy whatever is available here – https://coin.zerodha.com/bonds and do check this as well – https://goldenpi.com/

Hello,

Thanks for all your efforts,

I have a query in SBG, Whether can we get the 2.5% interest if we buy an SGB (SGBJUL28IV or SGBAUG28IV) unit from the trading account.

No, that will be credited to your Bank account associated with the DEMAT account.

What are different ways to invest in all types of bonds? Where can we get details of ETFs that can be purchased through kite? Can we purchase taxable bonds through coin?

Please check the explore section in Coin – https://coin.zerodha.com/gsec

Hey,

Is it possible to pledge Bond holdings for F&O Margin and if yes will it we considered as a cash component or a non cash component?

Where do i find the ISIN code? It\’s not listed on the Bond\’s Investment Page.

I NEED INFRASTRUCTURE BONDS WHICH COMED UNDER TAX EXEMPTION UNDER SETION 80CCF FOR INVISTING

If the coupon rate is on the face value of the bond, on a long run the FDs should give a better returns as it compounds your money on renewal (even though the stand-alone interest rate would be low). Or am I missing something here to understand?

Purely from a compounding perspective, yes. However, you can always reinvest the coupon back to another asset, but I agree that\’s a bit cumbersome.

Sir will REC interest rate goes down when bond price increases and vice versa

Do you mean coupon rates? That is fixed and won\’t change unless its a floating rate.

Hello sir,

yesterday I was going through information of the NCD bonds issued by \’Sri Ram Transport Finance\’ in which they have mentioned something as follows ;

Initial Price Guidance = 4.65% area & Coupon = Fixed, semi-annual, 30/360.

so, what is this Initial price guidance ?

Ah, I\’m not sure. Must be an indicative price. Let me figure this.

Nice Article. I think there is a typo in the calculations in Scenario 3. The Buy Price should be 2.9 Cr and not 3 Cr.

Sure, let me check.

Is the coupon percentage calculated on a compounding basis or only on the face value of the bond?

Its always on the face value of the bond.

@Karthik Rangappa

Couple of questions ,

There are some bonds ,which are tradable in the primary market, as per below link.

https://www.nseindia.com/market-data/bonds-traded-in-capital-market

Can i buy/sell these bonds directly from Kite ?

If yes then ,

What are charges ?

Where the interest will be deposited? in Bank Account or Zerodha account.

Yes, you can Amol. No special charges for these. Interest will hit your bank account.

How can we invest in Bond market.

Check this – https://goldenpi.com/

I wish to purchase SHRIRAM TRASPORT FINANACE/Tata /M & M / NCDS from market through ZERODA

1.What is a procedure

2.Any Brokarage

3 Where shal I see the NCD list for sell and their quotation

I\’d suggest you look at this – https://goldenpi.com/

Also, if some of these are listed, you can buy these from the secondary market as well.

Hi Karthik,

Thanks a lot for this. You made me understand the YTM concept really good with the illustration.

I would like to know where can we look up the detailed version of the bonds in zerodha. i.e. where can i infer details such as redemption date,Frequency of interst payment etc?

Thanks Raam. The quicket way to get the details is from the RBI site itself. Search for the bond and you\’ll get the RBI link for that particular bond.

Hi karthik!!

If one purchase the bond on the issue price on the issue date and holds till maturity, will the yield is same as in scenario 1?

Thanks in advance.

Yup, it would.

hello sir!

I wanted to know if there is an average YTM figure for each category of bond( as in AAA, AA, BBB, C etc.) with similar maturities that could help me find whether my own bond is trading at a premium or discount? Because if i had an average benchmark figure for YTM of bonds similar to my own i can easily find whether my own bond is trading over or below its fair value.

Thanks in advance!

Not sure if there is a ready reckoner of this sort available, Aarti. Maybe you should touch base with folks from GoldenPi for this – https://goldenpi.com/

Sir help needed!I am confused after reading the following sentence:

\”A bond that\’s issued at Premium will always trade at a Premium, including at maturity.\”

I remember that last time when i had asked you whether bonds are first floated in the primary market at their par value or not, you said that they are usually quoted at par. So, in those unusual circumstances when bonds are issued at premium. how\’s the premium decided on? And can they be issued at discount(below their par) in the primary market? Investment bankers do that, like they do for shares entering IPO?

And two if even if they are issued at a premium why can\’t they ever fall below the par value? Let\’s say the interest rates have risen significantly in the market, won\’t it cause people to shift away from the already issued low coupon bonds?

Hoping for a very elaborate response! Pls sir my head just spins badly every time i hit this topic, called Brutal Bonds!

Brutal bonds if funny 🙂

The answer to both your question is the same – depends on three things (1) Demand supply situation (2) Perception of interest rates in the economy (3) Issuer\’s credit rating. The premium is simply a function of these variables.

Like equity IPO we can find details in exchange/broker platforms , for bond where we can find, if a company going to issue bond ? Thanks

Not sure if there is a place to get this consolidated information. Usually spread across multiple places.

Are PSU tax free bonds sold to the subscriber at a premium to the FV even at the time of initial public offering by the PSU or is the the price/unit indicated in the above example the secondary market price from another bond seller .

Sort of since these are always in crazy demand.

sir when bonds are first floated in the primary market then do they get offloaded at the face value itself (say, $100)? Or their floating price is determined by the demand and supply forces in the primary market on which the issuing entity has no control whatsoever? In other words, assuming the bond is subscribed more than once can the entity be 100% sure of the amount it could raise?

Yes, it does.

sir when bonds are first floated in the primary market then do they get offloaded at their face value itself (say, $100 or Rs 1000)? Or their floating price is determined by the demand and supply forces in the primary market on which the issuing entity has no control whatsoever? And hence can\’t be sure of the amount it will end up raising?

Many thanks!

Usually, the primary market allotment is at par, once it comes to secondary it fluctuates.

Hi Karthik,

Why is REC not listed now in coin. I was assuming it to list until its maturity date(2023). And I dont see others as well like PFC, NHAI etc which is shown in the screenshot.

I see only Indian railways bond.

Thanks,

Shankar MR

All the available bonds are listed here – https://coin.zerodha.com/bonds

How to buy NCD in secondery market.

Look for it in the market watch.

the REC bond pays the interest on 1st Dec every month, till the bond matures.

Shouldn\’t that be 1st of Dec every year?

That\’s right Rahul. Changing that.

YTM at 4.34% shows that the ROI is clearly less compared to FD ROI. So to diversify the portfolio i don\’t see bonds are giving any advantage over FDs.Please correct me if i still missed to understand the bonds.

You are right, but do think about it from the liquidity and taxation perspective as well.

How to sell the bonds on Zerodha platform

Please get in touch with the team support desk for this.

Hi,

You explain these terms so well. Can you please explain with a example, amount wise what happens at the end of the maturity of the bond, if its not too much to ask for.

That would be getting into bond pricing, I think it will be a little out of scope for this discussion, hope its ok with you if I skip it 🙂

PSU/corporate bond is it possible to exit before reaching maturity?, if so what is the policy and implications.

Yes, you can sell the bonds in the secondary market.

I need to bought the REC bond for capital gain tax free bond.

How I purchase from this a/c?

Check the secondary market quote for this Pravin.

Hi Karthik, What do i do if I want to buy bonds at the issue time so that i dont lose on YTM. Is it possible through Zerodha portal ? Also is there a limit as an individual, i can invest at one time or in mulitples ? thank you

YOu can transact bonds in the secondary market through us, for the fresh (primary) issue, you may want to check with someone like GoldenPi.

Thank you for the excellent content.

My query is if I purchase NCD(SRTRANFINS-YQ) today (17-Nov-2020) from secondary market at 1005 ,having face value of 1000, with maturity date as 02-Nov-2021.

what will be the effective yield rate, if I hold till maturity?

Regards

Jim

Check the YTM, that\’s the indicative yield.

I am in awe of your series

Where do we find ISIN number listed

The easiest way is to Google, that will lead you to the right link on RBI site.

Where can one find the ISIN of a bond which is available on coin platform?

It is visible on the 3rd screen in the order placement workflow.

Can I invest in corporate bonds through Coin?

The Muthoot Finance bond issue which is open now is not available for investment.

Similarly, Muthoot Fincorp\’s bond issuance, last month, was not available for investment through Coin.

Please help me identify the webpage/link in the website for investment in corporate bonds.

Thank you.

Regards

Ramesh.

Yes, few bonds are listed here – https://coin.zerodha.com/bonds

Hello sir ,

Yes I am sure that GOLDENPI provides government bonds like NHAI ,REC bonds etc for lock in period of 5 years.

Need to check, I\’m not sure about this.

There is a misprint in third from last para in chapter 15.2. It should be 1st Dec of every year not month.

How is the bond value 1077? How is this premium calculated??

Changing the typo.

Bond is priced at 1077, which is basically a function of the demand and supply of the bond.

You might want to change \’every month\’ to \’every year\’ in the sentence \”REC bond pays the interest on 1st Dec every month, till the bond matures\”.

its just above point 15.3

Ah yes, thanks for pointing that 🙂

I have head we can covert bond into equity. If yes ? May I know how that process works ?

Nope, not available as a retail instrument I suppose.

Hello sir,

My question is if I invest in government bonds like NHAI 54EC bonds ,REC bonds etc at goldenpi ,then i can invest from only those amount which are capital gain and also those bonds are for lock in period of 5years ,but in case of Zerodha ,if I invest in NHAI ,REC bonds ,then I can invest from my own savings also and additionally there is also not lock in period of 5years i.e. I can sell bonds at any point of time, so why there is such a difference in terms and conditions of the same bonds at goldenpi and at Zerodha platform?

Sonali, I\’m not sure about the terms and conditions of transacting directly on Golden Pi. But are you sure about the lockin period?

Investing in Bonds is available in Hindi language ?

Will be available soon.

How do i search other bonds for eg if want to invest in Muthoot Finance Bonds, where will i find search panel on the coin portal.

Urmil, the bonds available are listed here – https://coin.zerodha.com/bonds

Hi Karthik Rangappa,

Hope you are good

Thanks for the article

I have following query, please help me to understand better

1). How much amount will I get after maturity period if I bought 1 lot of above REC bond example is it Rs.1115.03 or the face value Rs1000?

2). Also who will buyback my bond after maturity, is it REC or do I needs to sell in open market?

3). How can I buy bond which crossed half tenure of maturity period from the person holding it through open market, will there be any advantage if I buy like that?

4). If I hold the bond up to maturity period, I will be receiving an annual interest of 8.04% every year, am I correct?

5). Do I needs to sell mandatorily after maturity period or REC will continue to give me interest of 8.04% up to the time I am holding?

Have a great day

Thanks

Krishna

1) YOu will get the face value i.e. Rs.1000

2) REC, upon maturity.

3) In the secondary market

4) Yes

5) Yes, since the bond would no longer exist.

Also, when we calculate the overallreturns on a bond investment, should we use the simple interest or compound interest formulae with YTM as the interest rate?

You need to use the YTM, which anyway takes in CAGR.

Hi Karthik,

Great explanation again! With respect to the list of the \”PSU Tax-free bonds\” available in coin right now, I wanted to confirm if this is a comprehensive list of the available government bonds at the moment. If not, could you let me know where can we find the complete list.

Regards

All the PSU Tax-free bonds are listed here – https://coin.zerodha.com/bonds/invest and Gsec bonds are here – https://coin.zerodha.com/gsec

Hi Karthik,

Sovereign Gold Bond scheme has opened yesterday. However, not sure how gold investment is going to look like in coming years as Gold prices saw sharp increase in last few months.

Any view on that , Karthik?

I wish I had an answer for that 🙂

Hi ,

Currently the YTM of PFC is 4.39%, and for NHAI it\’s 4.38% which means if I bought one bond at a premium price of 1200 which is having a facevalue of 1000 I will be having a profit of approx 4.39%

1. Don\’t you think this interest is very less compared to FD\’s interest rates of many banks

2. when my bond is matured will I get face value or premium value

3. will the premium value be same during the maturity time.

4. who is the seller of these bonds Zerodha or PFC.

Thats right. The YTM considers both the FV and coupon flow.

1) You need to adjust for tax as well

2) Face value

3) No, you will get the face value

4) Bond houses

Hi Karthik,

Thanks for the article. You mentioned SGBs for diversifying portfolio. I\’m planning to buy 1 Kg in the upcoming RBI issuance at 5k/unit.

Would love to know your thoughts if this would be a good investment or should I invest less/more?

Thanks

This depends on your outlook on Gold. Are you bullish on gold over the next few years, if yes, go ahead and buy 🙂

Thanks a lot for your reply

For the 4th one, is there a difference between the \’off-market\’ bonds listed on goldenPi and the one\’s available on Kite ? And if they\’re off-market, how is the premium for these decided ?

The one available in the secondary market is supposed to be more liquid, but unfortunately, that\’s not the case.

You can ignore the first one, I think I understood that.

Just verify if this calculation of annualised YTM is correct, for the REC example: ((4*80.1 – 115.03)/1115.03 *100)*12/41 = 5.39%

Hi Karthik,

1) I have a slight confusion between YTM and Coupon rate. Let\’s say a bond a bond has coupon rate of 8%, FV = 1000 and current price is 1100. Technically YTM should be = ((-100+80)/1000)*100 = -2% but this is given the bond matures in 1 year. Let\’s say Time to maturity is 2 years. In that case the price premium loss will remain same = -100 but coupon interest would be 160, so in that case my net PNL is 6%, annualised to 3%. So in this case the YTM I see on the Coin UI would b 3% or 6% ?

For simplicity assumed 0 accrued interest rate (I am investing exactly on a day 2 years before the coupon payment date)

2) Given I don\’t hold till maturity, I can still sell these bonds on the exchange right, just that the redemption price would be higher than FV, in that case my YTM would be improved right?

3) When I sell a bond on the exchange I will just sell at the price based on bid-ask so is it assumed that naturally the accrued interest I deserve would be factored in by the market in it\’s bond price ?

4) Just like I can sell my bonds on the exchange and exit, can I buy bonds straight from KITE as well? what\’s the difference in the bonds I see there versus the one\’s I see on GoldenPi here ?

Thanks in advance 🙂

2) Yes, but then you may not have full liquidity

3) True

4) Yes, Kite allows you to buy/sell from the secondary market. GoldenPi is off market

Hi Sir,

Power Finance Corporation is currently showing total accrued interest -22.68. What does this negative value indicates?? And is it beneficial for an investor(Since it is to be subtracted from price of the bond), So does this means investor needs to pay less than its current settlement price?

That means that the buyer of the bond will receive the interest from the seller.

Hi,

Today, I have purchased \”National Highway Authority of India\” bond. I can see in order basic details of bond on \”Order bond\” secction. So, where I can see my bond detials? And how I can get the bond certificate?

Hi,

Considering the ytm formula as

Ytm equals annual interest+par value/#-market price/# # no of yrs to maturity

______________________________________________

par value/##+market price/## ## 2

The ytm calculation dor the above example goes as

89.3139+38.3433

______________________ equals 12.07 percent which is 5.7percent in the above case.

1057.515

Please explain.

Btw very well written. Keep it up!

YTM calculation is not straight forward, requires the trial and error method. I\’d suggest you use the excel function for this 🙂

Hi Sir,

I want to invest some money but not in equity. can you please suggest what will be the best place to invest

To get started I\’d suggest you start with any decent large-cap equity fund or even an Index fund.

Does bond sell as fast as stock? How liquid is it?

If on maturity you get only the principal amount then why would anyone buy the bond at higher price?

Not really, there is not much liquidity in the bond market. You buy the bond for the coupons.

Hi Team, Need your valuable inputs here.

I bought PFC Tax-free bonds with (YTM: 4.43%, Coupon Rate: 8.30%, Frequency: Yearly, Maturity: 77 months).

Q1: As per my understanding from above lesson, I will get dividends of 8.30% on my principal amount every year for 77/12 years period and 4.43% interest on principal on maturity. Am I right?

Q2: How and where will I be credited 8.30% annual interest as I used coin to buy the bond?

Thanks in advance.

1) Thats right

2) To your bank account linked to your DEMAT account.

Please make it available this module in Hindi asap…

If I buy a sovereign gold bond in secondary market and if I keep the bond till maturity , can i get the capital gain tax exemption for the matured amount.

Yes, exempt from capital gains. Do check with your CA once.

Sir, In the section 15.3/ Scenario 3, For Net yield you have mentioned 70 lakhs /3 crore. But it should have been as 70 lakhs / 2.9 crore. Thank you.

Ah, ok. Let me check, but as long as you get the concept 🙂

Hi,

Many thanks for the really detailed and lucid explaination! Really nice!

I found this material on BSE website (https://www.bseindia.com/downloads1/Clean_Price_Booklet.pdf) which states that BSE \”has

commenced Clean Price based trading mechanism from August 08, 2016\” and that \”Orders will be matched on the clean price\”. The NSE website (https://www.nseindia.com/market-data/bonds-traded-in-capital-market) mentions that \”The bonds are traded & settled on Dirty Price i.e. including accrued interest, if any.\”

Does this mean that we can buy only on clean price on BSE but only on Dirty price on NSE?

Regards,

Kaushik Dana.

Guess this is a different segment. Let me find out.

So basically YTM is the actual rate of interedt if I compare it with bank deposite?

Yes, you can think of it that way. It basically measures the rate at which your investment grows.

How to find ISIN of a bond, Coin does note display it. And searching by company name we can find many bonds for the companu and difficult to find the right one.

E.g National Highway Authority Of India . I see one option to invest but dont know the exact ISIN to look at details.

Check this link – https://www1.nseindia.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=NHAI&series=N1

Easiest way is to look up on Google 🙂

Hi Karthik,

Thank you so much for Varsity. It has been of great help.

I know it is hard to put up such quality content in short time but can you kindly mention when would you be able to discuss on the following point in Varsity.

\”In the coming chapters, I will discuss portfolio compositions and how you can set up portfolios to match your goals,…..\” .

Will it be after discussing the Mutual Funds metrics?

Thank you again. 😊

Thats right, before going ahead with portfolio construction, it is important to get familiar with few basic technicalities. Hence I\’m spending time to discuss these, once done, we will transition in portfolios and fund selections.

Hello Sir,

Am really appreciate your work on Bonds..

The way you give scenario\’s is really unbeatable.. anybody knows English can understand easily !! Thanks again.

Now i would like to know,

1. Where i can get the complete list of bonds available ?

2. I have account with Zerodha so no problem for me but outside Zerodha how one can buy this Bonds from there broker ?

3. As you said Diversification, whats your suggestion on percentage of allocation for Bonds ?

4. Is there any documents on varsity for more understanding on bonds ?

Thanks for your time..

Thanks, Hari! Glad you liked the content.

1) The bonds page has whatever is available. Will list out more as and when they are available

2) Not sure about that

3) At present about 20%, but I\’m also in the process of building a small portion of my savings to a balanced fund, which has debt component

4) No, this is the only chapter.

Hi Karthik

There is a typing error in 15.2

REC bond pays the interest on 1st dec every ‘month’ .it should b year I guess.

Thank u for the content🙏🏾

Ah yes, thanks. Will do the correction.

In which exchange can we sell the bond before its maturity? Does Kite allow it? or should we have to approach a third party platform?

YOu can try this on NSE. Yes, possible on Kite, but there should be liquidity on NSE.

Sir the content is amazing , please add more topics in bonds like rbi bonds , soveŕeign bonds , corporate bonds , debentures , sovereign gold bond , international corporate bonds , foreign country bonds and ways to invest in them properly

Will do, Somitra!

thank you very much sir for sharing such great knowledge with us

Happy reading!

Hi at present only 2 bonds are displayed in COIN. Is there any provision of buying other bonds like sbi n5 or so through coin. The kite app shows these bonds but ytm and other info are not present kindly clarify.