20.1 – Volatility Smile

We had briefly looked at inter Greek interactions in the previous chapter and how they manifest themselves on the options premium. This is an area we need to explore in more detail, as it will help us select the right strikes to trade. However before we do that we will touch upon two topics related to volatility called ‘Volatility Smile’ and ‘Volatility Cone’.

Volatility Smile is an interesting concept, something that I consider ‘good to know’ kind of concept. For this reason I will just touch upon this and not really dig deeper into it.

Theoretically speaking, all options of the same underlying, expiring on the same expiry day should display similar ‘Implied Volatilities’ (IV). However in reality this does not happen.

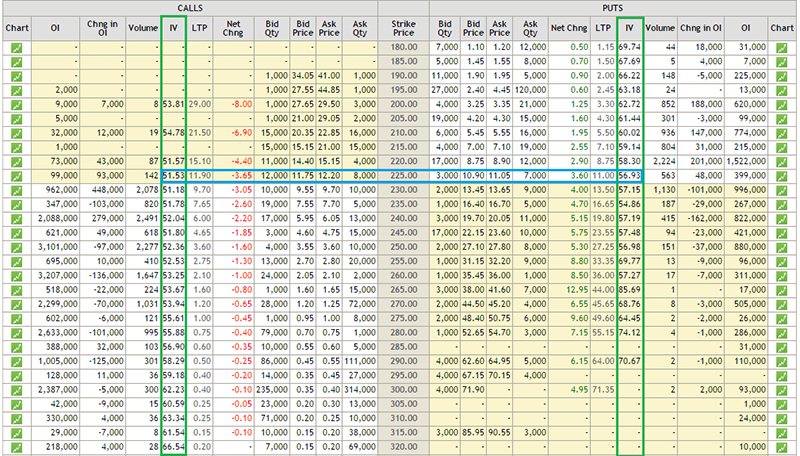

Have a look at this image –

This is the option chain of SBI as of 4th September 2015. SBI is trading around 225, hence the 225 strike becomes ‘At the money’ option, and the same is highlighted with a blue band. The two green bands highlight the implied volatilities of all the other strikes. Notice this – as you go away from the ATM option (for both Calls and Puts) the implied volatilities increase, in fact further you move from ATM, the higher is the IV. You can notice this pattern across all the different stocks/indices. Further you will also observe that the implied volatility of the ATM option is the lowest. If you plot a graph of all the options strikes versus their respective implied volatility you will get to see a graph similar to the one below –

The graph appears like a pleasing smile; hence the name ‘Volatility Smile’ ☺

20.2 – Volatility Cone

(All the graphs in this chapter and in this section on Volatility Cone has been authored by Prakash Lekkala)

So far we have not touched upon an option strategy called ‘Bull Call Spread’, but for the sake of this discussion I will make an assumption that you are familiar with this strategy.

For an options trader, implied volatility of the options greatly affects the profitability. Consider this – you are bullish on stock and want to initiate an option strategy such as a Bull Call Spread. If you initiate the trade when the implied volatility of options is high, then you will have to incur high upfront costs and lower profitability potential. However if you initiate the position when the option implied volatility is low, your trading position will incur lower costs and higher potential profit.

For instance as of today, Nifty is trading at 7789. Suppose the current implied volatility of option positions is 20%, then a 7800 CE and 8000 CE bull call spread would cost 72 with a potential profit of 128. However if the implied volatility is 35% instead of 20%, the same position would cost 82 with potential profit of 118. Notice with higher volatility a bull call spread not only costs higher but the profitability greatly reduces.

For instance as of today, Nifty is trading at 7789. Suppose the current implied volatility of option positions is 20%, then a 7800 CE and 8000 CE bull call spread would cost 72 with a potential profit of 128. However if the implied volatility is 35% instead of 20%, the same position would cost 82 with potential profit of 118. Notice with higher volatility a bull call spread not only costs higher but the profitability greatly reduces.

So the point is for option traders , it becomes extremely crucial to assess the level of volatility in order to time the trade accordingly. Another problem an option trader has to deal with is, the selection of the underlying and the strike (particularly true if your strategies are volatility based).

For example – Nifty ATM options currently have an IV of ~25%, whereas SBI ATM options have an IV of ~52%, given this should you choose to trade Nifty options because IV is low or should you go with SBI options?

This is where the Volatility cone comes handy – it addresses these sorts of questions for Option traders. Volatility Cone helps the trader to evaluate the costliness of an option i.e. identify options which are trading costly/cheap. The good news is, you can do it not only across different strikes of a security but also across different securities as well.

Let’s figure out how to use the Volatility Cone.

Below is a Nifty chart for the last 15 months. The vertical lines mark the expiry dates of the derivative contracts, and the boxes prior to the vertical lines mark the price movement of Nifty 10 days prior to expiry.

If you calculate the Nifty’s realized volatility in each of the boxes, you will get the following table –

| Expiry Date | Annualized realized volatility |

|---|---|

| Jun-14 | 41% |

| Jul-14 | 38% |

| Aug-14 | 33% |

| Sep-14 | 28% |

| Oct-14 | 28% |

| Nov-14 | 41% |

| Dec-14 | 26% |

| Jan-15 | 22% |

| Feb-15 | 56% |

| Mar-15 | 19% |

| Apr-15 | 13% |

| May-15 | 34% |

| Jun-15 | 17% |

| Jul-15 | 41% |

| Aug-15 | 21% |

From the above table we can observe that Nifty’s realized volatility has ranged from a maximum of 56% (Feb 2015) to a minimum of 13% (April 2015).

We can also calculate mean and variance of the realized volatility, as shown below –

| Particulars | Details |

|---|---|

| Maximum Volatility | 56% |

| +2 Standard Deviation (SD) | 54% |

| +1 Standard Deviation (SD) | 42% |

| Mean/ Average Volatility | 31% |

| -1 Standard Deviation (SD) | 19% |

| -2 Standard Deviation (SD) | 7% |

| Minimum Volatility | 13% |

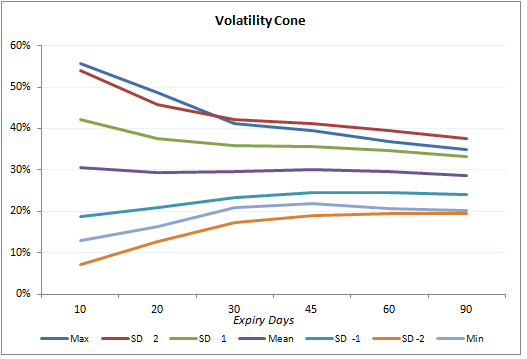

If we repeat this exercise for 10, 20, 30, 45, 60 & 90 day windows, we would get a table as follows –

| Days to Expiry | 10 | 20 | 30 | 45 | 60 | 90 |

|---|---|---|---|---|---|---|

| Max | 56% | 49% | 41% | 40% | 37% | 35% |

| +2 SD | 54% | 46% | 42% | 41% | 40% | 38% |

| +1 SD | 42% | 38% | 36% | 36% | 35% | 33% |

| Mean/Average | 30% | 29% | 30% | 30% | 30% | 29% |

| -1 SD | 19% | 21% | 23% | 24% | 24% | 24% |

| -2 SD | 7% | 13% | 17% | 19% | 19% | 19% |

| Min | 13% | 16% | 21% | 22% | 21% | 20% |

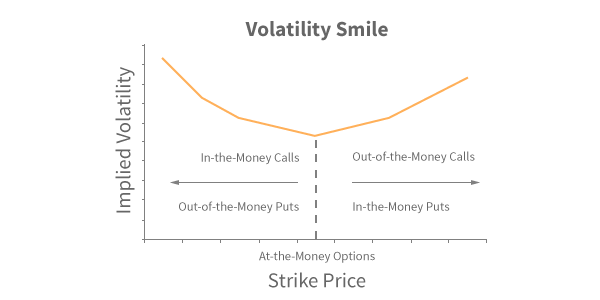

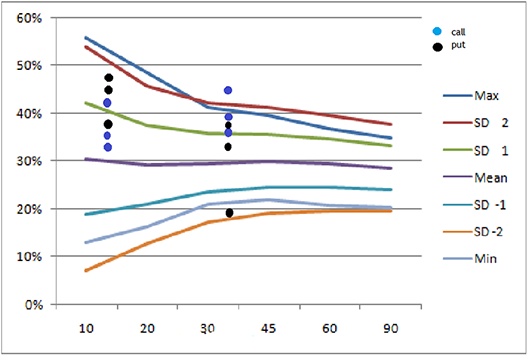

The graphical representation of the table above would look like a cone as shown below, hence the name ‘Volatility Cone’ –

The way to read the graph would be to first identify the ‘Number of days to Expiry’ and then look at all the data points that are plotted right above it. For example if the number of days to expiry is 30, then observe the data points (representing realized volatility) right above it to figure out the ‘Minimum, -2SD, -1 SD, Average implied volatility etc’. Also, do bear in mind; the ‘Volatility Cone’ is a graphical representation on the ‘historical realized volatility’.

Now that we have built the volatility cone, we can plot the current day’s implied volatility on it. The graph below shows the plot of Nifty’s near month (September 2015) and next month (October 2015) implied volatility on the volatility cone.

Each dot represents the implied volatility for an option contract – blue are for call options and black for put options.

For example starting from left, look at the first set of dots – there are 3 blue and black dots. Each dot represents an implied volatility of an option contract – so the first blue dot from bottom could be the implied volatility of 7800 CE, above that it could be the implied volatility of 8000 CE and above that it could be the implied volatility of 8100 PE etc.

Do note the first set of dots (starting form left) represent near month options (September 2015) and are plotted at 12 on x-axis, i.e. these options will expire 12 days from today. The next set of dots is for middle month (October 2015) plotted at 43, i.e. these options will expire 43 days from today.

Interpretation

Look at the 2nd set of dots from left. We can notice a blue dot above the +2SD line (top most line, colored in maroon) for middle month option. Suppose this dot is for option 8200 CE, expiring 29-Oct-2015, then it means that today 8200 CE is experiencing an implied volatility, which is higher (by +2SD) than the volatility experienced in this stock whenever there are “43 days to expiry” over the last 15 months [remember we have considered data for 15 months]. Therefore this option has a high IV, hence the premiums would be high and one can consider designing a trade to short the ‘volatility’ with an expectation that the volatility will cool off.

Similarly a black dot near -2 SD line on the graph, is for a Put option. It suggests that, this particular put option has very low IV, hence low premium and therefore it could be trading cheap. One can consider designing a trade so as to buy this put option.

A trader can plot volatility cone for stocks and overlap it with the option’s current IV. In a sense, the volatility cone helps us develop an insight about the state of current implied volatility with respect to the past realized volatility.

Those options which are close to + 2SD line are trading costly and options near -2 SD line are considered to be trading cheap. Trader can design trades to take advantage of ‘mispriced’ IV. In general, try to short options which are costlier and go long on options which are trading cheap.

Please note: Use the plot only for options which are liquid.

With this discussion on Volatility Smile and Volatility Cone, hopefully our understanding on Volatility has come to a solid ground.

20.3 – Gamma vs Time

Over the next two sections let us focus our attention to inter greek interactions.

Let us now focus a bit on greek interactions, and to begin with we will look into the behavior of Gamma with respect to time. Here are a few points that will help refresh your memory on Gamma –

- Gamma measures the rate of change of delta

- Gamma is always a positive number for both Calls and Puts

- Large Gamma can translate to large gamma risk (directional risk)

- When you buy options (Calls or Puts) you are long Gamma

- When you short options (Calls or Puts) you are short Gamma

- Avoid shorting options which have a large gamma

The last point says – avoid shorting options which have a large gamma. Fair enough, however imagine this – you are at a stage where you plan to short an option which has a small gamma value. The idea being you short the low gamma option and hold the position till expiry so that you get to keep the entire option premium. The question however is, how do we ensure the gamma is likely to remain low throughout the life of the trade?

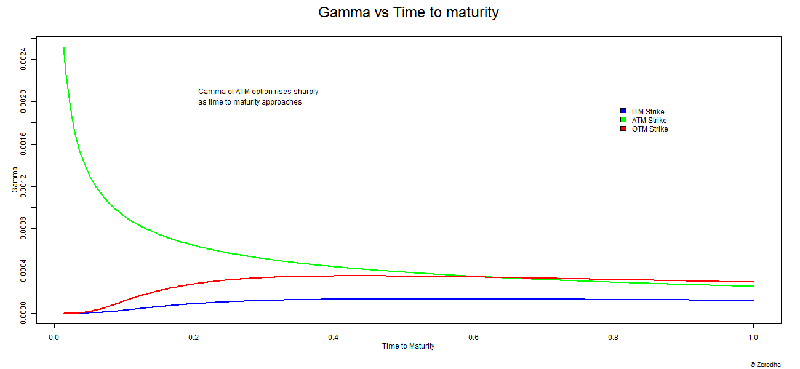

The answer to this lies in understanding the behavior of Gamma versus time to expiry/maturity. Have a look at the graph below –

The graph above shows how the gamma of ITM, ATM, and OTM options behave as the ‘time to expiry’ starts to reduce. The Y axis represents gamma and the X axis represents time to expiry. However unlike other graphs, don’t look at the X – axis from left to right, instead look at the X axis from right to left. At extreme right, the value reads 1, which suggests that there is ample time to expiry. The value at the left end reads 0, meaning there is no time to expiry. The time lapse between 1 and 0 can be thought of as any time period – 30 days to expiry, 60 days to expiry, or 365 days to expiry. Irrespective of the time to expiry, the behavior of gamma remains the same.

The graph above drives across these points –

- When there is ample time to expiry, all three options ITM, ATM, OTM have low Gamma values. ITM option’s Gamma tends to be lower compared to ATM or OTM options

- The gamma values for all three strikes (ATM, OTM, ITM) remain fairly constant till they are half way through the expiry

- ITM and OTM options race towards zero gamma as we approach expiry

- The gamma value of ATM options shoot up drastically as we approach expiry

From these points it is quite clear that, you really do not want to be shorting “ATM” options, especially close to expiry as ATM Gamma tends to be very high.

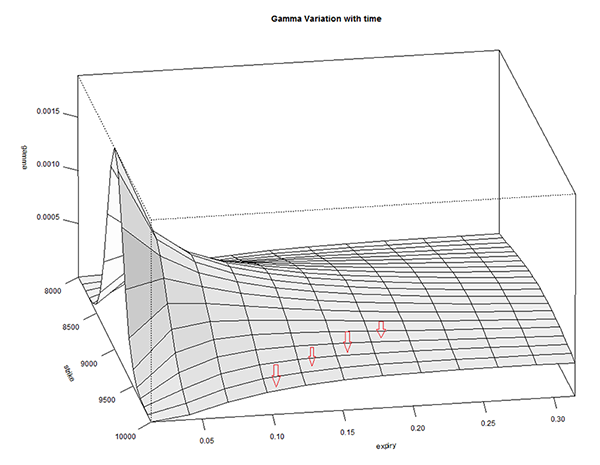

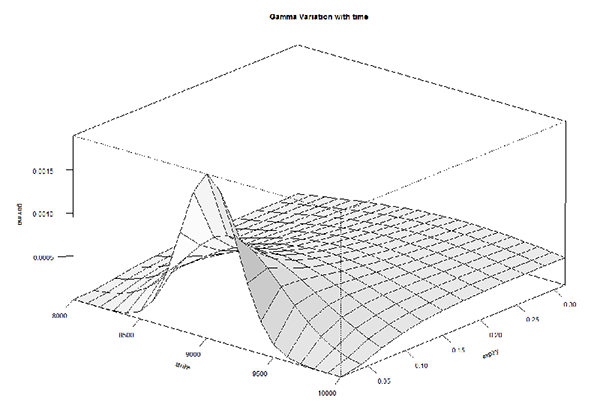

In fact if you realize we are simultaneously talking about 3 variables here – Gamma, Time to expiry, and Option strike. Hence visualizing the change in one variable with respect to change in another makes sense. Have a look at the image below –

The graph above is called a ‘Surface Plot’, this is quite useful to observe the behavior of 3 or more variables. The X-axis contains ‘Time to Expiry’ and the ‘Y axis’ contains the gamma value. There is another axis which contains ‘Strike’.

There are a few red arrows plotted on the surface plot. These arrows are placed to indicate that each line that the arrow is pointing to, refers to different strikes. The outermost line (on either side) indicates OTM and ITM strikes, and the line at the center corresponds to ATM option. From these lines it is very clear that as we approach expiry, the gamma values of all strikes except ATM tends to move towards zero. The ATM and few strikes around ATM have non zero gamma values. In fact Gamma is highest for the line at the center – which represents ATM option.

We can look at it from the perspective of the strike price –

This is the same graph but shown from a different angle, keeping the strike in perspective. As we can see, the gamma of ATM options shoot up while the Gamma of other option strikes don’t.

In fact here is a 3D rendering of Gamma versus Strike versus Time to Expiry. The graph below is a GIF, in case it refuses to render properly, please do click on it to see it in action.

Hopefully the animated version of the surface plot gives you a sense of how gamma, strikes, and time to expiry behave in tandem.

20.4 – Delta versus implied volatility

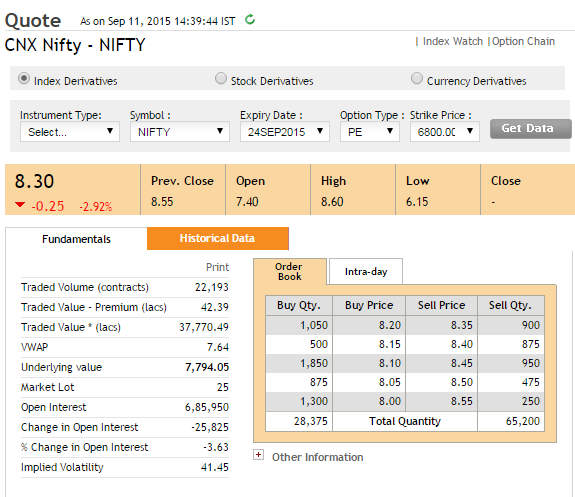

These are interesting times for options traders, have a look at the image below –

The snapshot was taken on 11th September when Nifty was trading at 7,794. The snapshot is that of 6800 PE which is currently trading at Rs.8.3/-.

Figure this, 6800 is a good 1100 points way from the current Nifty level of 7794. The fact that 6800 PE is trading at 8.3 implies there are a bunch of traders who expect the market to move 1100 points lower within 11 trading sessions (do note there are also 2 trading holidays from now to expiry).

Given the odds of Nifty moving 1100 (14% lower from present level) in 11 trading sessions are low, why is the 6800 PE trading at 8.3? Is there something else driving the options prices higher besides pure expectations? Well, the following graph may just have the answer for you –

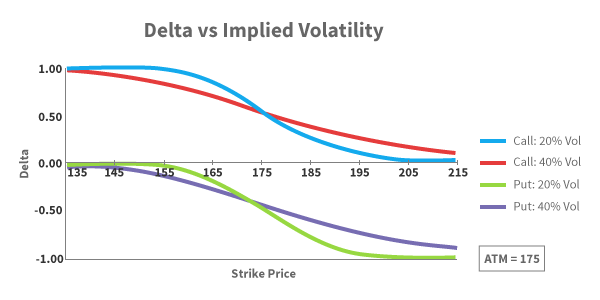

The graph represents the movement of Delta with respect to strike price. Here is what you need to know about the graph above –

- The blue line represents the delta of a call option, when the implied volatility is 20%

- The red line represents the delta of a call option, when the implied volatility is 40%

- The green line represents the delta of a Put option, when the implied volatility is 20%

- The purple line represents the delta of a Put option, when the implied volatility is 40%

- The call option Delta varies from 0 to 1

- The Put option Delta varies from 0 to -1

- Assume the current stock price is 175, hence 175 becomes ATM option

With the above points in mind, let us now understand how these deltas behave –

- Starting from left – observe the blue line (CE delta when IV is 20%), considering 175 is the ATM option, strikes such as 135, 145 etc are all Deep ITM. Clearly Deep ITM options have a delta of 1

- When IV is low (20%), the delta gets flattened at the ends (deep OTM and ITM options). This implies that the rate at which Delta moves (further implying the rate at which the option premium moves) is low. In other words deep ITM options tends to behave exactly like a futures contract (when volatility is low) and OTM option prices will be close to zero.

- You can observe similar behavior for Put option with low volatility (observe the green line)

- Look at the red line (delta of CE when volatility is 40%) – we can notice that the end (ITM/OTM) is not flattened, in fact the line appears to be more reactive to underlying price movement. In other words, the rate at which the option’s premium change with respect to change in underlying is high, when volatility is high. In other words, a large range of options around ATM are sensitive to spot price changes, when volatility is high.

- Similar observation can be made for the Put options when volatility is high (purple line)

- Interestingly when the volatility is low (look at the blue and green line) the delta of OTM options goes to almost zero. However when the volatility is high, the delta of OTM never really goes to zero and it maintains a small non zero value.

Now, going back to the initial thought – why is the 6800 PE, which is 1100 points away trading at Rs.8.3/-?

Well that’s because 6800 PE is a deep OTM option, and as the delta graph above suggests, when the volatility is high (see image below), deep OTM options have non zero delta value.

I would suggest you draw your attention to the Delta versus IV graph and in particular look at the Call Option delta when implied volatility is high (maroon line). As we can see the delta does not really collapse to zero (like the blue line – CE delta when IV is low). This should explain why the premium is not really low. Further add to this the fact that there is sufficient time value, the OTM option tends to have a ‘respectable’ premium.

Download the Volatility Cone excel.

Key takeaways from this chapter

- Volatility smile helps you visualize the fact that the OTM options usually have high IVs

- With the help of a ‘Volatility Cone’ you can visualize today’s implied volatility with respect to past realized volatility

- Gamma is high for ATM option especially towards the end of expiry

- Gamma for ITM and OTM options goes to zero when we approach expiry

- Delta has an effect on lower range of options around ATM when IV is low and its influence increases when volatility is high.

- When the volatility is high, the far OTM options do tend to have a non zero delta value

Sir is it advisable to take advantage of iv spikes during corporate action of companies or is it risky to take naked trades during such scenarios. What should be the ideal strategy to hedge or ignore such spikes and not indulge during such events

IV is expected to spike during corporate events. The right way is to factor this in your trading plan. Maybe with hedged positions 🙂

Hi sir,

Thanks for your wonderful explanation. I have one question regarding below explanation:

\”Do note the first set of dots (starting form left) represent near month options (September 2015) and are plotted at 12 on x-axis, i.e. these options will expire 12 days from today. The next set of dots is for middle month (October 2015) plotted at 43, i.e. these options will expire 43 days from today.\”

Looking at volatility cone exercise and logically thinking about historical volatility as well, we should be calculating volatility on trading days and not calendar days and hence should be drawing inferences based on trading days left for expiry (which would be less than 12 and 43 in above case.

Yeah, trading days is better. But if you are calculating, maybe do it for both to compare results?

How can i find closing price( data) of stocks or index for last 15 to 16 months as on NSE website historical data is available for past 1 year only?

You can look at the chart on the trading terminal for this.

Thankyou but it will take time to note down all these vlues

Yes, it will. But thats the learning process, right?

Thanks sir, yes it is part of learning

Good luck, Saurav!

Hello sir

I tried to understand the volatility cone file, but it has most of the cells just numbers without formulas and it is a real pain to understand what is going on.

If possible than please verify and simplify the excel so that it becomes easier to understand.

Thanks 😊

Ah, sure, I\’ll check that Roopam. Meanwhile, you can also check Sensibull for this.

did you check sir?

any update?

Roopam, unfortunately, the person who wrote this and developed the volatility cone on Excel is no longer available. I\’d suggest you please check with Sensibull.

ok thanks

Hello Karthik,

I am unable to download the \”Download the Volatility Cone excel\”.

Please help

Can you try changing the browser? That should help.

Wow, the volatility cone has a huge amount of number crunching!

Yes sir, its not a straightforward math 🙂

Sir can you teach us how to make Volatile cone in R language . How the R language is helpful in profitable trading???

Ah, I myself dont know that 🙂

Just tell me sir in the last part of this chapter . You have tell that the value of delta is not zero when the high volatility is there . So it\’s mean that the premium changes very rapidly I.e it\’s falling. So Why the value of premium is very high at 8.3 for 6800PE?? as compared to low volatility . As we know the value of delta is almost zero as there is low volatility it\’s mean that the premium is not changing i.e the premium is constant if all other things are same . So the premium should be high in that case . But there is a opposite thing why sir….

Becuase the premium is not just a function of one variable. Its a function of multiple things like – volatility, time to expiry, delta etc.

Hello Karthik sir, is module ke last me jo aapne link diya h

\”Download the Volatility Cone excel\”

ye link open nhi ho rha h, thoda isko sahi kr dijiye ya hme koi other link provide kr denge kya

Jisase hm bhi us formate ka use kr ske, please

Let me check, but do try with another browser meantime?

Unfortunately, download of volatility cone is not available anymore. Is is possible to retrieve the file?

Let me check this, Rajat.

Hi karthik Sir,

This may be out of the box. Can we do swing trading in equity through pledging the G secs and Gilt funds?

Yes, you can. Swing trading is all about holding positions for a few days to a few weeks.

Here in the volatility cone we are comparing implied volatility to the historical volatility of the index price but shouldn\’t we be comparing it with the historical volatility calculated from the variance in the option price rather than the index price itself?

Option price data is not continuous, so its very hard to make any sort of inference out of it. Also, spot data is a great approximation.

so how can I get calls and puts plotted on the volatility cone on a real time basis

Hey Shivansh, these are complicated volatility setups, best done by creating a program yourself.

can you recommend some good other option platforms for volatility cone feature

I only know Sensibull. I\’ve not used others, so cant really comment.

Is there any website or a reliable source for the volatility cone data other than sensibull as I talked with they support team, they don\’t have it

Ah, not sure. Maybe check once with other option platforms?

I asked sensibull support team about this volatility cone feature, they don\’t have it. Is there any website or a reliable source for the same

I wasn\’t able to find anything related to volatility cone on Sensibull, if its there on sensibull can you please guide me where to find it.

Ok. Even I\’m not sure. Let me check once with Sebsibull.

is there a way to automate the process of plotting calls and puts on the volatility cone instead of doing all the things manually every time, or is there any tool or a reliable source like a website which provides this data to find such trade opportunities ?

Ah, perhaps Sensibull has something.

I got this, i was thinking incorrectly, understood, thanks for explaining it.

Sure. Good luck!

Hi @Karthik,

I have one doubt regarding one sentence, mentioned in Volatility Cone, Can you please help me understand pls, Sentence is \”It suggests that,

this particular put option has very low IV, hence low premium and therefore it could

be trading cheap. One can consider designing a trade so as to buy this put option\”

If premium is low and its trading cheap then why to buy put option, shouldn\’t be it sell put option?

Thanks in advance.

It depends on your view of volatility. If you think that volatility will increase, then you can buy these options cheap now with an expectation that the premium will increase after you buy them.

Resp. Sir:

On Sensibull platform, can we find volatility cone?

This concept is tricky. Please suggest an easy way. We want to know skew or cone to know about contengo and backwardation, isn\’t it? Please help me out.

I think you can find volatility data on Sensibul, not sure. Please do check once with the Sensibul platform folks?

Hi Karthik,

Thank you for the insightful content. I have a few questions on the volatility cone and would really appreciate your input.

1) In the volatility cone example, for the 8200 CE option expiring on 29-Oct-2015, if we sell the option close to +2SD, how long should we keep the position open? Should we maintain the position until the volatility again falls within +1SD, or until it moves closer to the mean?

2) For the same call option (i.e. sell 8200 CE expiring on 29 Oct), if the volatility remains high and close to +2SD, then the volatility increases as time goes by instead of cooling off (i.e. 12 days volatility > 43 days volatility) . Can this happen? If so, how do you approach such a scenario?

Please let me know.

Thanks and regards,

Yogesh

1) The position duration depends on the way SDs converge. Cant really fix a time target to it.

2) Yes, this is possible as well. In fact, you should be prepared for situations like this one. The only thing you can do is to maintain SL, unless in extreme situations where your confidence is so high on the trade that you want to build the position by adding more lots.

The volatility cone idea assumes that the options\’ IV and nifty historic volatility are quantities that can be compared. Why can be this done given that

1. their calculation methods are different (they arise from different market behaviours)

2. options expire weekly/monthly whereas NIFTY is a continuous index. Each new options contract would have some discontinuity in IV for each strike price – Wouldn\’t this lead to deviation in behaviour from NIFTY\’s true volatility as the discontinuities get added up over each new contract introduction?

Hope the question isn\’t too confusing 🙂

I will post this question the author of the volatility cone – that section is written by someone else and not me 🙂

But yes, I do get your question. Perhapse its best used as a proxy and not as a definitive indicator of volatility?

namaskar sir

sir zerodha has introduced volatility cone indicator.

is it sufficient or we have to calculate manually.

thank you sir.

Need to check on that, but if you do get volatility numbers readily, then you should probably use it to save time 🙂

Hey Karthik,

Many thanks for this highly informative modules. Really helps someone to get started if one is really interested.

I did notice that the excels linked on these modules dont seem to work. Can you please have a look at it.

Thanks Arun. Can you try downloading the excel from another browser?

Hi karthik

I am having doubt wrt to these statemnts,can you please explain the diferrence between these two comments

1.India VIX is denoted as an annualised percentage

2.India VIX depicts the expected market volatility over the next 30 calendar days

so does it mean the nifty index will trade in particaular range for 1month or 1 year from the given india VIX value

For the above mentioned Moumita Goswami comments,which formula stands correct,if i want to calculate price range for one month provided india vix value

Thanks in advance

It is monthly vol, Rama.

Hi,

If we can also find range through Nifty VIX,say Nifty VIX data on a 01.01.2000 is x% and Nifty is trading for 100 on this day. Could you kindly inform if I am correct on the below?

(i) Nifty can swing between 100-x*100 to 100+x*100 during the upcoming year

(ii) Variation for a month is x/√12. Hence, Nifty can swing between 100-x/√12*100 to 100+x/√12*100 during the upcoming month

(iii) Variation for a week is x/√52. Hence, Nifty can swing between 100-x/√52*100 to 100+x/√52*100 during the upcoming week

(iv) Variation for a day is x/√252. Hence, Nifty can swing between 100-x/√252*100 to 100+x/√252*100 on tomorrow.

Yup, that seems correct.

Hi Karthik,

You have taught how to calculate range variation for a particular period through historical data and running through excel for sd, mean and then ultimately finding range for a particular time frame of a particular stock/index.

(i) My question is can we find the range through Nifty VIX data directly for a particular period also without running through the above exercise?

(ii) If both the above works, do you have any personal preference on which method to apply especially for a week/month/intraday? Request your inputs here.

1) Yes, you can get a rough range using ViX

2) Depends on how much time you have. You can use ViX for faster approximation.

Hey Karthik,

First of all thanks to you for providing great educational content for traders community out there.

I want to tell you that all he excel links which you have provided in this options module are not opening. Can you please ask your team to update them on latest software/versions. That would be very helpful for us.

Thanks 🙂

Manan, thanks for the kind words. Can you please try to download from another browser? Usually that works. Let me know and good luck 🙂

Please correct me if wrong sir,

I have learn the importance of considering volatility in the next chapter if volatility increase one should consider buying the option and if volatility decrease one should consider selling option keeping time exipry and strike selection in the mind

1. my question is which volatility meter should be consider, india vix or the option chain IV from NSE

2. and if we consider IV from Option chain in NSE right now @ 19-2-24 @ 9:45 hrs the IV meter for Call option range from 16 to 30 for different strike price and for put option it is range from 20 to 47 for different strike price are this number in percentage form

3. clearly from the above statement put side volatilty is more and call side volatilty is less should we consider buying put and selling call

Thanks in advance

Mukund, answers as below –

1) YOu can consider both to drawn an inference, no harm doing that.

2) Yeah, this is normal, IV will vary for different option types, different option strikes.

3) Yeah, Puts usually have more IV.

Hello sir

is india vix – implied volatility

and if india vix is implied volatility and it is based on nifty option book can india vix be consider for other underlyings since it purely on nifty option book

Thanks in advance

Yes, you can use it as a proxy for volatility in general.

Dear Mr. Karthik,

Thank you very much for your kind response.

I wish you have a wonderful week.

You too, John. Have a great week ahead.

Dear Mr. Karthik,

Thank you very much for your kind and prompt response.

Please kindly see below additional clarifications and informations:

Thank you

1. Based on the Volatility Smile Diagram as shown in the first part of Chapter 20, is it correct to say that OTM has the highest IV, ITM has the second highest IV and ATM has the lowest IV?

2. Based on the Diagram (i.e. Delta vs IV) as shown in Chapter 20, the blue chart (20% Vol) is steeper than the red chart (40% Vol) around the Strike Price. That means around the Strike Price, a Lower IV (i.e. Blue Chart with 20% Vol) has a greater impact on Delta compared to a Higher IV (i.e. Red Chart with 40% Vol). Do you agree?

Thank you

1) Yes, they generally do.

2) Yes

Dear Mr. Karthik,

Thank you very much for the informative and in-depth article.

I would like to seek your kind guidance on the following 2 points:

Thank you

1. In the 1st Key takeaways of Chapter 20 on “Greek Interactions”, it was stated that Volatility Smile helps to visualize the fact that the OTM options usually have high IVs. However, based on the Volatility Smile Diagram as shown in the first part of Chapter 20, both OTM and ITM have high IVs. Why does Key Takeaways only mention OTM and not ITM?

2. In the 5th Key takeaways of Chapter 20 on “Greek Interactions”, it was stated that Delta has an effect on lower range of options around ATM when IV is low and its influence increases when volatility is high. However, based on the Diagram (i.e. Delta vs IV) as shown in Chapter 20, the blue chart (20% Vol) is steeper than the red chart (40% Vol) which means that IV has a bigger influence on the blue chart. When the Vol increases to 40%, the rate of change of Delta of ATM will reduce.

Thank you

1) OTM have the max volatility, John

2) Sorry, I\’m unable to figure your exact query. Possible to share an example?

Btw love the written and video content.

It\’s to the point as well as easy to understand, which is rare.

Thank you :).

Thanks for that, glad you liked the content 🙂

Hello, I don\’t know if it\’s still active or not.

I am currently learning all this stuff and able to understand the concepts and their maths. But it\’s hard to get a feel of the different parts like for options we have 4 variables: Long Call, Long Put, Short Call and Short Put.

It it difficult for me to grasp the feel of every part at once.

What do you suggest I should do?

I think you should spend more time in reading this module, eventually it will get cleared. Also, you dont really need to know the math, as long as you figure which greek to use and when.

SIR CAN U PLEASE PROVIDE V VONE USING LATEST CLOSING PRICES OF YEAR 2023 (NOV 2022TO NOV2023) , SO THAT I CAN COMPARE MY DATA WITH YOURS,

AS WHEN I TRIED PLOTTING V CONE USING DATA PROVIDED BY YOU ALL VALUES AND CHART MATCHES ,

BUT WHEN I TRIED TO DOWNLOAD DATA OF 12 MONTHS(OF NIFTY-2023) AND PLOTTED USING EXACT STEPS IT SOMEHOW DOSENT LOOK LIKE A CONE .

CAN U PLEASE PROVIDE ME EXCEL SHEET OF VOLATILIY CONE USING NIFTYS OR ANY OTHER SUCH AS WIPRO OR TCS ) CLOSING PRICES OF YEAR2023?

IT WILL REALLY HELP ME TO KNOW IF IM USING RIGHT DATA AND STEPS .

AND I REALLY WANT TO THANK YOU AND VARSITY AS ITS REALLY HELPING TO EDUCATE US,

Prasad, please do check this with Sensibull once. I dont have this data 🙂

SIR CAN VALUES OF MAXIMUM AND MINIMUM(SERIES) GREATER THAN ITS +-2SD DEVIATION VALUES ?,

the reason im asking you this i have calculated h.volatility and plotted volatility cone but its not looking like a cone .as 2sd values are bigger than maximim series,

is it necessary that the v.cone should look like vcone even if there is differnce in values .

If potted correctly, then the resulting graph will more or less look like a cone. So do check the values again.

i think i have found my mistake i was calculating h.volatility sqrt(365) but when i have calculated with sqrt(252) the answer is near to same .

i have used data provided by you and calculated historical volatility by going 45 days back prior to expiry 30-Jun-11 i.e 28 april 2011 to 29 jun 2011 .

then calculated LN then SD And using sqrt (252) i got h.volatility 25.98% .

So glad to note that, I\’m happy you were able to figure this 🙂

SIR i have calculated h.volatility from dec 2022 to nov2023 as you suggested above but the cone is looking different, and i tried to find it on sensibull but i couldn\’t.

DAYS 10 20 30 45 60 90

MAX 16.84 15.02 14.92 14.06 14.17 16.35

2SD 16.34 16.23 15.54 15.21 15.07 16.54

1Sd 13.44 13.8 13.57 13.46 13.44 14.41

MEAN 10.55 11.38 11.59 11.71 11.8 12.27

SD-1 7.66 8.96 9.61 9.96 10.16 10.13

SD-2 4.76 6.53 7.64 8.21 8.53 8

MINIM. 6.64 7.83 8.64 9.56 9.75 9.75

i have plotted above info in chart but its looking little different , please guide me if im missing something or the data im providing is wrong , i have downloaded historical data , then by taking n days back from the expiry of each month calculated h.volatility then plotted above table.

Ah, it will be tough to figure this without actually seeing the actual working. But please check if you are taking the right data set, ensure the underlying data is clean for all corporate actions etc.

If i want to prepare the volatility cone taking 12 months from 1 Dec2022 to 30 nov 2023

And i want to calculate volatility of 10/20/30/45/60/90 days (historical volatility ) before expiry of each month

Then for Dec2022 only

For 10 days historical volatility am i supposed to take 10 days closing prices before expiry day of december

Historical realized volatility for DEC month only

Expiry date – 29 Dec 2022 (Thursday)

Then volatility for 10 days) – closing prices from the date 19Dec 2022 to 28 dec 2022

For 20 days – 9 dec 2022 to 28 th dec 2022

For 30 days – 29 nov 2022 to 28 th dec 2022

For 45 days 12 nov 2022 to 28 th dec 2022

For 60 days 28 oct 2022 to 28 th dec 2022

For 90 days 30 sep 2022 to to 28 th dec 2022

Then same for Jan 2023 to 30 nov 2023 ?

And then plot above information in volatility cone?

Now gathering above information for each month can i plot volatility cone now manually on paper?

Yes, but I\’d suggest you check once with Sebsibull team if they readily provide the volatility cone information.

Sir still not getting it

can u please confirm that if we are taking historical data before the expiry 27AUG of AUG2015 ? i mean are you looking for 10,20,30,45,60,90 days back from the date 27 aug 2015,?

if we take expiry date 30 nov 2023 then am i supposed to look 10,20,30,45,60,90 days back from 30 nov 2023 to get historical data for calculating historical volatility ?

Thats right, Prasad. Keeping the expiry date fixed, you take the historical data \’n\’ number of days back for your analysis.

10,20,30,45 days before expiry

can u please tell if i want to see 10/20/30/45/60/90 days historical data of month november2023 (expirey 30 nov 2023)

then should i see 45/60/90 days historical data before the date 30 nov 2023 ?

I think you should check with Sensibull if they can point you to data source.

WHAT IT MEANS10,20,30, 45 ,60,9 DAYS TO EXPIREY?

Lets say we are looking nifty 1 yr historical data i.e past 12 months from 1 dec 2023 TO 1dec 2024 and if so , then 45 days to expiry means we are looking 45 days closing price before expiry of month -DEC2023?

or 90 days data before the expiry, what does that really mean?

Can u please prepare volatility cone by recent data of 2023, and can i get detailed explanation on these because when i have tried to get that data to calculate volatility THREE major problem arriveD

1) iam unable to find historical data from 2014 and 2015 of NIFTY(nse-historical reports-indices -nifty 50 no data showing on the page .

2) im not getting the concept of days to expiry ? i mean expiry of each month or 10/20/30/45/60/90 days historical d data before the expiry of current month ? example today is 09 dec2023 how can we get 10/20/30/45/ 90 days historical data before the expiry of current month.

OR can u give any link where i can study this (10/20/30/45/90 days before expiry) concept and volatility cone concept

3) can we say that 1sd = mean+34.1%and mean-34.1% and 2SD=MEAN+(34.1+13.6%) AND MEAN-(34.1%=+12.6%).

IF MEAN IS 31% THEN HOW U CALCULATED +/-1SD AND +/-2SD?

we repeat this exercise for 10, 20, 30, 45, 60 & 90 day windows, we would get a table as follows –

Im not able to understand this 10,20,30,45,60,day to expiry , dose this mean 10 days data before expiry of each month

?

if we considering one month we can understand that u might have took closing price of 10 days (before expiry)and then calculated volatility same for each months by taking 20, and 30 days closing prices of each months expiry and then calculated volatility but what about 45 ,60,90 day and so on. im confused about how come we take 45 days closing prices before expiry of each month ,or we taking all thi prices and data before the 15th month? i have read the excel sheet already but a beginner im so confused about expiry of options and getting all the necessary data . i know it will be so much to ask as this module helped me a lot to understand basics but but can u explain volatility cone in simple language .

Yes, that is 10 day, 20 day, 30 day before expiry. For longer expires, you can consider next month contracts.

In the \”Volatility Cone\” Excel file, why is the mean (Sheet1, J4) set to 0? Should it not be the average of returns (Sheet1, Column C) ?

Need to check, this sheet is developed by someone else and not me.

I have tried to download the sheet,But unable to download or open it in new page.can you please check the link once

Its working fine for me, Rama. I use Firefox as my browser.

Hi karthik,

Thanks for the valuable knowledge you are sharing to us.It would be much more helpful,If you provide the excel sheet calcualtions for the volatility cone,Thanks in advance

The excel sheets are put up on the page itself. Please do check. Thanks.

Hello sir,

i have calculated historical volatility of two months for 10 days before expiry (june 2014 and feb 2015).Instead of showing 41% and 56% annualized volatility , results show 16.66% and 12.59% annualized volatility respectively in my excel sheet. i followed exact method of calculating volatility mentioned by you.

step 1: download close price of nifty

step 2: perform log returns with LN method

step 3: run stdev method for daily volatility

step 4: sqrt method for annualized volatility.

Could you please help me in understanding how you arrived at 41% and 56% annualized realized volatility of these two months.

Regards.

The steps look correct, usually this will have issues when the data points are corrupted or if you\’ve missed few data points. Maybe you should double check that once.

Dear Karthik,

Thank you for the valuable course, it is extremely informative. Besides, the course is mathematically inclined which makes it even more interesting.

I have a query,

Bank nifty Spot: 43773

Strike: 43700

days to expiry is 5days

TF: 1min

Premium value of 30thNov43700CE

Time= 15:11, O= 248.10; C=281, change in spot on same candle:- O=43773; C= 43798,

Change in premium= 33pts, change in spot= 25pts

Here, change in premium value is greater in points than change in the spot price movement.

Since, delta is the factor by which option value can increase by maximum and delta being less than 1 always, how is possible for the premium value to increase more than the change in spot value?

I want to share the screen shot of the above scenario for your better understanding but do not know if that is possible.

Thanks and regards

Shrey

Shrey, since you are looking at intrday charts, there could be instances where a random market order would have triggered a spike in prices. Usually when such a thing happens, the market corrects itself and such high or low prices (beyond whats fair price), may/will not exist for long.

Sir , how to make volatility cone for weekly options?

I\’d suggest you check Sensibull for this, Dhruv.

Thanks for this chapter. Although a little tricky to understand, it was really insightful. I feel there are many things to take care of when learning about options. Is there some software or tool that I can use that calculates all these values or some of them?

Thanks, Aniket. You can certainly try to use Sensibull. They have all these things available on their site.

Sir I want to know tha actual range of IV, which number i considered low IV and High IV

For this you can check IV percentiles, I guess Sensibull gives this data.

Thank you so much the knowledge , even for making the efforts to reply at 04:21am 🙂

Happy learning, Abhinay 🙂

Hi sir, by IVP i meant Implied Volatality Percentile. I learnt it from Sensibull\’s platform :), https://blog.sensibull.com/2018/11/25/how-high-is-high-the-iv-percentile/#:~:text=It%20is%20a%20percentile%20number,says%20that%20IV%20is%20low.

Please let me know from your experience about IV Percentile( IVP) , is it as good as volatality cone in giving us the same information if IV is high or low?

Ah, yes, dont know how I missed that 🙂

They both essentially help you with the same thing i.e. to help you figure if the current IV is high or not wrt to the past IVs. Go with either, whatever is easier for you implement.

Hi Mr.Rangappa, like to start by saying I\’,ve been addicted to Varsity though i dont trade. Great teaching prowess. Coming to my question, instead of going through the cycle of calculating & plotting the volatality cone, can we just infer the option\’s IV by considering IVP. Would\’nt IVP tell the same story of volatality cone , in a much simpler way?

Thanks for the kind words, I\’m glad you liked Varsity.

Sorry, need more clarity, but when you IPV, what are you referring to?

In the Volatility – SD table where you took volatility extremes of 56% and 34% and calculated SD 1,2 respectively…But there is no explanation of how to arrive SD 1 and 2 with just Percentage, any calculation to do so???

We have explained that in the volatility chapter, Siva. Do check the chapter.

Can you please tell me where to find the historical data from as in 15 months realised volatility & other data required to spot the volatility cone?

Sahil, maybe check with Sesbibull once?

Hi Karthik, thanks for such wonderful articles. They are too good and articulate. I have just one question. I went through the comments but could not find the answer to this.

Referring to the Volatility smile, IV is least around ATM strikes, but referring to Vega vs Strike graph, I can see Vega tends to increase around ATM. I am not sure why this happens. If there a direct relationship between Vega and IV?

Thanks Raj. This is largely due to the time to expiry effect also 🙂 See the bottom part of the graph.

Sir,

You taught us the effect of delta/gamma/theta/vega. However, to ultimately initiate a trade, should we have to measure the parameters using BS calculator and find the resultant of these parameters to recognize probable increase/decrease of the premium and trade accordingly? Or there is trick somewhere else that we will learn in the strategy? Or is it our personal intuition (as per circumstance at that moment) through which we should fix trade? Please help.

Do check the next module where we have discussed the strategies, some of which involves Option greeks.

Sir,

Options is a bit more challenging than others as I find till date. I learnt your Options module upto volatility cone (without Option strategies module) and come to the below conclusion. Request you to kindly correct me wherever needed, as usual:

1. From price movement perspective only: During trading for any strike, we should compute the price movement range of the underlying\’s movement from the historical annual data from the date. Calculate daily returns, Calculate daily volatility and then calculate the volatility for the remaining days to expiry to recognize the probable price movement for the remaining days. Buy strikes below the lower value and short strikes above the upper value.

2. From volatility perspective only: During trading for any strike, we should compute the historical annual realized volatility for 10,15,20,30,45,60,90 days to expiry for the past 15 months. Find the average, +/- 1 SD, +/- 2 SD for each of these 10,15,20,30,45,60,90 and draw the volatility cone for average, +/- 1 SD, +/- 2 SD for each of each of these 10,15,20,30,45,60,90. Now, plot the strikes\’ implied volatility (IV) corresponding to days\’ expiry from now. Strikes wholes IV is above +2 SD should be considered shorting and strikes whose IV is below -2 SD should be considered buying.

N.B: For calculating realized volatility for the 10 days to expiry, we should take only past 10 days data from the expiry date of that month and calculate the annualized realized volatility based on those 10 days. Likewise for 15 days, we should take only 15 days past data from expiry and calculate the annualized realized volatility and so on.

3. From time perspective only: With more days to expiry, the premium decays slower and less days to expiry, the premium decays faster.

4. Time and underlying price movement : With more days to expiry, the price has a higher probability to transition from OTM to ITM/ ITM to OTM. Thus, buyers should buy early and sellers should sell at the end of series (5-7 days before expiry).

5. Time and volatility movement: With more days to expiry, the premium rises/decays faster with respect to volatility and for less days to expiry, it rises/decays slower with respect to volatility. Thus, buyers should buy early and sellers should sell at the end of series (5-7 days before expiry).

6. One should strictly avoid selling ATM option or when corporate/ monitory events are nearby.

7. One should put a stop loss based on volatility and keep a little minimum than lower value.

8. The position delta of the entire traded option strikes signify the risk of the lot equivalent to futures.

9. The delta value of an option strike measures the probability of the strike to expire in ITM.

10. We should ideally buy the common strikes with respect to volatility and underlying. Buy strikes which are both below lower value of underlying calculated range & volatility is below -2 SD of volatility cone & at the early of series.

11. We should ideally sell the common strikes with respect to volatility and underlying. Sell strikes which are both above upper value of underlying calculated range & volatility is upper of +2 SD of volatility cone & at the late of series.

1) Yes, but the strike-specific calculation can be tough I guess.

2) Yes

3) Thats right. The higher the number of day, the lower the time decay

4) Thats absolutely correct!

5) Yup

6) Yes

7) Volatility-based SL is one of the better techniques, but not the only way

8) The total delta gives the over all directional bias of the position, has nothing to do with Futures

9) Yes

10) Not sure about what you mean by this. Can you give an example?

11) Same, need more context 🙂

Bahut badhiya jankari di hai, thanks sir

Sir,

Request you to kindly share the link from where I can get the expiry dates of the options for the past months.

Its the last Thursday of the month, Anirban.

Sir,

1. Regarding drawing volatility cone, please correct if I am going wrong on the below:

Today is 23.05.23 and I would like to calculate the annualized realized volatility for the duration of 10 days before expiry of an option (Nifty) say expiry date-26.01.23 (Thursday).

Steps to compute in excel:

A. Take the daily data of Nifty in col.A (A2-A12)

B. Take the daily returns of Nifty in col.B (B3-B12)

C. Take standard deviation of col. B through STDEV for B3-B12. This gives the daily volatility of Nifty with consideration for the last 10 days from the date of expiry.

D. Calculate that daily volatility to annualized volatility with multiplying by sqry 252. This gives annualized realized volatility for 10 days.

2. Request you to kindly share the link from where I can get the expiry dates of the options for the past months.

Yes, that\’s the procedure to calculate the 10-day realized volatility.

I did use STDEV function earlier thinking that is how the realized volatility is calculated. But that was not the case. The formula for realized volatility include: 1. taking the squares of the returns. 2. adding them. 3. square root this sum.

Unlike the formula for Standard Deviation, the formula for realized volatility does not include the step where we divide the sum of the squares by number of days.

I did read some of the comments. I understood why people are pointing out that what they calculated does not match with what has been mentioned in this module.

YOu mean to say, most people are not scaling the realized volatility to the desired time scale? It could be the case 🙂

Dear Karthik,

Following are the steps that I have used to calculate the Annualized Realized Volatility for a 10 day period for, let\’s say, June14:

1. Take Historical Data of closing prices of Nifty for the 11 days before the monthly expiry.

2. Calculate the return for each day. We can calculate using the formula ln(B3/B2)*100 OR (B3/B2 – 1)*100

3. Calculate the realized volatility for that period. Realized Volatility is calculated by square rooting the sum of squares of all returns.

4. Annualize the Realized Volatility by multiplying the realized volatility with square root of 252.

Similarly we can find realized volatility for a 20 day, 30 day, 45 day, 60 day period.

And similarly we can find all these annualized realized volatilities for July14, August14, September14 ….. August15.

We can then find the Maximum Volatility, +2 SD, +1 SD, Mean, -1 SD, -2 SD, Minimum Volatility for 10 day, 20 day,30 day, 45 day, and 60 day

We can then plot these numbers on a line chart.

I did all this and the graph that is coming out is a cone but not of the type shown here. If we plot line graphs for Maximum Volatility, +2 SD, +1 SD, Mean, -1 SD, -2 SD and Minimum Volatility, they all increase with an increase in the number of days left to expiry but these lines also converge or come closer to each other with an increase in the number of days left to expiry.

10 days 20 day 30 days 45 days 60 days

Max Volatility 110.159952 115.6138691 123.2860398 131.9979049 142.315105

2 SD 86.14406542 101.0022974 110.6865842 126.3009939 140.4144589

1 SD 65.88716037 83.70900182 94.24230689 111.8077765 126.2304415

Mean 45.63025532 66.41570627 77.79802954 97.3145591 112.0464241

-1 SD 25.37335027 49.12241073 61.35375219 82.82134168 97.86240668

-2 SD 5.116445221 31.82911518 44.90947485 68.32812427 83.67838929

Min Volatility 22.89076738 44.61534856 58.3857228 81.61693628 90.70172645

Calculate the realized volatility for that period. Realized Volatility is calculated by square rooting the sum of squares of all returns.

Why not use the STDEV function?

I think there is some miscalculation while calculating the 10 Day Annualized Realized Volatility. The chart says that the Annualized Realized Volatility for August 2015 is 21%. We can observe from the graph that August 2015 was the most volatile month. Even in the previous chapter, you have mentioned that 24th August 2015 experienced the worst intraday fall of -5.92%.

I did some calculation. It is actually coming out to be 110% and not 21%. I, then, did calculation for all the 15 months you have mentioned. Seems like there is a miscalculation for all 15 months.

Can you check it and tell me if I am right or am I missing something?

Ah, I need to double-check this as well. But what are the steps you followed for this calculation?

nevermind i confused gamma with theta

Ah ok.

I am confused by this statement in the gamma vs time section: \”From these points it is quite clear that, you really do not want to be shorting “ATM” options, especially close to expiry as ATM Gamma tends to be very high.\”

if the gamma is high doesn\’t that mean the premium will go down rapidly? if that\’s the case why is writing the option close to expiry not recommended?

The sensitivity of the option will be very high so the chances of option swinging either ways is high. Hence you\’d not want to risk it with ATM option shorts 🙂

Went above my head 😉

Is there anything in particular that you found difficult? I can try helping you that.

Google chrome didn\’t allow to download, but Microsoft edge helped me in downloading the file.

Thanks for the idea.

Sure, good luck!

Hello Karthik

Great efforts are put to make people understand about the options in a simpler way.

I am one among the beneficiated. Thanks a lot

At the end of blog there is a link given to download the excel sheet which is not functioning. From where can I get that excel sheet.

Regards

Varun

Bengaluru

Glad you liked it, Varun. Can you try downloading it from another browser?

Hi Karthik,

great post. I have become more interested in the maths of it compared to how to make the money. 🙂

I think there is a typo in the part delta to implied volatility.

Nifty is at 7794 and the strike price is at 6800 PE, the fall should be 994 points. the corresponding drop is 12.75 %

Could you also mention the reference materials used for making this entire blog. I would like to dig deeper into this.

Regards

Gourab

Gourab, thanks. Let me check into this. For ref material – I\’d suggest you pick up this book by Sheldon Natenberg on OPtion Pricing. Gives you a clear understanding of option pricing and associated topics.

Sir

1.you said \”buying options may still be ok compared to selling options,when iv is low,why is it so,sir?

2.Sir,atm options have higher chance than otm in case of expiring itm,but still atm iv the lowest?why

3.delta has an effect on lower range of options around atm,and it\’s influence increases when iv increases.Sir,when iv increase, influence of every options remain same, isn\’t it?

4.Sir,is vix and iv published by nse for diff strikes the same,or is it diff?

5.Sir you said \’ATR indicator to get a sense of where the volatility is\’,so can identify present IV for a particular stock is high or low,if it so how can I find it through ATR?

6.Sir,realised volatility is calculating future volatility by taking the historical volatility into account,is it so?

7.\”high option iv,low profit potential\”why it is low profit potential, actually it has to be high profit potential,right,coz when iv is high,risk is high so reward has to be in par, isn\’t it so?

8.any app or site which have live volatility cone in which one can input option strikes to know whether they are over or undervalued?

9.sir,any particular reason why iv in the options chain is Annualized 1 SD

10.Sir,You said”to conclude that the present IV for a particular stock is high or low,you need to calculate daily historical volatility and convert it to annual volatility and compare.”

a)by present iv,is the iv given for each option strike is being discussed here,if yes,is that iv annualized?

b)sir,is annualized historical volatility figure published on nse website or anywhere else?

11.Sir,as the volatility of nifty for last 15 months is given as annualized,when SD is calculated of those,will SD be equal to Daily volatility,i Ask this coz prev chap you said Daily volatility=SD,if it is annual or daily,we have to multiply or divide it with sqrt(10,20,etc) day windows for the next table?

12.Sir,you said the data points in the table just above Volatility cone graph is calculated using R-language,sir where can we access it,or, is live market volatility available in any app or site also in which one can input option strikes to know whether they are over or undervalued?

13.sir,\”large range of options around ATM are sensitive to spot price changes, when volatility is high.\”sir,why is it said options around atm, actually when iv is high all options are sensitive to the volatility, aren\’t they?

And also sir,when options around atm is more sensitive towards premium change when iv is low than when iv is high,as the slope of atm options in the graph is more when iv is low,is it true sir?

1) Low IV implies a lower premium, and options are priced cheaper. Hence buying should be ok.

2) Demand-supply imbalances

3) Yes, but as I mentioned, strike-specific demand and supply imbalance matters

4) Vix is only for index

5) Apply the indicator on the option chart, not the best technique, but works

6) Realised vol is same as historical vol. Check my video on this – https://www.youtube.com/watch?v=JM_M1RPkCR8&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=9

7) Have explained this in chapter

8) Check Sensibull

9) Vol is always annulaised, just like returns

10 a) yeah, you can check strike specific IV

10 b) I think they do

11) Vol is annualized, i.e. 12 month, so it will drop when you bring it down from 15 to 12 months

12) Not sure, please check Sensibull

13) Have explained the chapter itself.

Please Help in selecting correct strike price …

If you also write then how do you select?

Sunny, I\’ve explained this through the chapters. I\’d suggest you check the later chapters.

As you had said that in @delta vs implied volatility (((When IV is low (20%), the delta gets flattened at the ends (deep OTM and ITM

options). This implies that the rate at which Delta moves (further implying the rate

at which the option premium moves) is low. In other words deep ITM options tends

to behave exactly like a futures contract (when volatility is low) and OTM option

prices will be close to zero.)))) ..SIR …BUT the IV is low in ATM OPTIONS as we compare with OTM & ITM.

But then, the delta too matters right?

Hello Karthikji,

Again Sunny here.

Please help in calculation of cone table, as after collecting data of back dates of Jun-14,july-14 and all, final value is varying as shown above.

It will be helpful if you could explain with excel sheet.

Sunny, this was prepared by someone else; unfortunately, I cannot establish contact with the person. Let me try again.

Hi Karthik sir,

How \’Annualized Realized Volatility\’ calculated for JUN-14, JULY-14…. in above table for 15 month.

You scale the volatility by Sqrt of time. So if the daily vol is 1%, the annualized is 1%*sqrt(252), where 252 is the number of trading days in a year.

Sir,then what about Vega of itm options being bigger than atm options?

How is it bigger ?

Theta decay is common for all options. With ITM, the fear of option transitioning from ITM to ATM adds as a factor along with theta decay which works against ITMs (albeit at slower rate).

Hi,

1.Sir,you said \”If you initiate the trade when high implied volatility of options,it incurs high upfront costs and also lower profitability potential,Meanwhile low option implied volatility,lower costs and higher potential profit.\”

But,Sir

Low volatility means low risk,so low risk often corresponds to low profits,that is the natural trading law, isn\’t it so?

2.why do slightly otm options react more towards volatility than deep otm options and also what makes Vega of itm options higher than atm options

1) Low vol also implies lower premiums. So it depends on what you intend to do. For example, buying options may still be ok compared to selling options.

2) The closer to the ATM option, the higher the probability of the option transitioning from OTM to ITM, hence more reactive.

Hi Sir, Did you find it ? I am developing a checklist for intraday trading! Volatility plays a major role in my setup

Ah no, I\’ve not got a response yet.

Thanks a lot for the clarification, Please find out the method and do post it here, It will be really helpful.

Sure. I will.

For 10 day (Volatiltiy Cone):

Exipiry is on 26 June 2014,

1)Which Data set Should We use?

1) 13,16,17,18,19,20,23,24,25,26 (Trading Days prior to Expiry)

2) 16,17,18,19,20,21,22,23,24,25,26 (Days prior to Expiry)

2) What Chart is displayed in the Notes ? (Volatility Cone)

Spot or Futures ? If futures, Can you please mention the name?

3) What Method is used for calculation ?

Method 1:

1) Calculate Daily returns [ (B3/B2)-1 or =LN(B3/B2)]

2) Calculate STDEV for Daily Returns

3) Volatility = STDEV*SQRT(252) [252 or 365]

My Answer = 15.42% [In your method 41%]

Method 2:

1) Calculate Daily returns [ (B3/B2)-1 or =LN(B3/B2) or LOG(B3)-LOG(B2)]

2) Calculate Variance for Daily Returns

3) Find Volatility for 10 days by SQRT(Sum of Variance)

4) Calculate Annualized Variance by multiplying Days

5) Find the Annulized Volatility by SQRT(Annualized Variance)

My Answer = 15.42% [In your method 41%]

What method did you use ? (It would be really helpful for all if you share the method in small steps)

1) You can consider the trading days

2) Spot

3) I need to check this with the author of that section. Let me try and find out.

SIR, I used the STDEV, But I am confused, Like Do I need to take only trading days or all days, The calculation doesn\’t add up for me. Could you please check this excel and comment me where I am wrong?

https://docs.google.com/spreadsheets/d/1jbDPSQS-y00zhum_I49d8MDqhxBTan8FbttxVSgHJKo/edit?usp=sharing

You can consider the trading day, Goutham.

Sir, Can you please explain how did you calculate Annualized realized volatility? I gathered June 2014 data and it no where matches your percent. Please kindly explain sir.

You can use the =STDEV() function on excel for this.

In section 20.4 – Delta versus implied volatility , Volatility means VIX or IV because according to Volatility Smile Implied Volatility are not same different strike price Like ITM , ATM , OTM and in this section we have fixed the volatility at 20% and 40% for all strike price

Referring to the IV of the strike.

Sir,

1.How does the profitability greatly reduces when implied volatility is high 2.Sir,what exactly is realized volatility and also diff between historical realized volatility and historical volatility?

3.are the percentage values given in the table just after the nifty chart(20.2),after multiplying with 252 as they are shown to be annualized realized volatility?

4.Sir,how are the data points given in the table above the volatility cone graph calculated?

5.\”Sir why options of the same underlying, expiring on the same expiry day are said to have similar ‘IV\’s.\”

Why is it said that theoretically,they should have similar\”

6.Sir, any reason why implied volatility of the ATM option is the lowest.

7.Sir,According to you, how well has volatility cone helped you in your trades

1&2) I\’ve done a video on this, please check – https://www.youtube.com/watch?v=2hmF5gqKEUg&list=PLX2SHiKfualFiusiT9G5uE9jU3vetvW2x&index=10

3) Yes, they are annualized

4) This is an output from a program developed in R language

5) Because the factors that affect these options are all the same

6) One explanation is that the ATMs are most liquid and there are no wide spreads owing to demand and supply mismatch

7) I cant attribute the Vol cone as a single reason for a successful trade outcomes, it is one of the factors that help.

am unable to download volatality cone excel

Madhu, can you try downloading in another browser?

unable to download volatility cone excel….

At atm / otm the intrinsic value of option premium is 0 so time value itself is premium, So is there any formula with which we calculate time value if we don\’t know the premium value ?

If the option is OTM, you can attribute the entire premium to time value.

Hello sir,

Is there any relation between vix and option premiums in terms of pricing as when vix is higher ,premiums are higher and vix is lower ,premiums are lower, i wanted to know that how premiums are decided , is there any calculation let\’s say VIX is 18 so premiums for nifty at atm straddle will be XYZ…

Thanks

Yes, there is a lot of connection between Vix and option premiums. Do read this module further to know about it.

In my calculations I am getting negative -1 and -2 SD levels for annualized volatility. Is it possible theoretically? and does it has any practical implications? How do I interpret negative volatility?

Hmm, can you recheck the numbers again?

Just a quick question

I calculated and plotted Volatility cone for Bank Nifty. Currently Bank nifty is at 40800. For the next weekly expiry (29 Sep 2022, expiring in 10 days excluding holidays) I checked option chain and realized that one strike 37800 has IV of 29. As per my volatility cone calculations this IV level of 29 is beyond +2 SD levels that a option contract has in general when there are 10 days left to expiry. So here I should be designing shorting a volatility trade. am I right or something is missing here?

If this is correct then what should I short? a call option or put option? spot is 40800 so 37800 CE is deep ITM and 37800 PE is deep OTM. what to short? CE or PE? (Sensibull shows same IV for same strike of CE and PE)

Also, we are comparing IVs of single strikes (like IV of 37800, IV of let\’ say 40000) with data from volatility cone. Is that correct way to do or I should be checking only ATM IV?

Yes, if you are expecting the volatility to come down, then you should look at shorting options, but that said, I\’d not advice you to short ITM options. Yes, you can compare single strike IVs with the underlying\’s volatility.

Hi sir,

Can u please explain how IV crush and IV spike works and how to use them,

Thanks

I have put everything I know here 🙂

Hi Sir,

One clarification please on the chart of Delta vs Implied Volatility. For the Put section, it looks like you have reversed the delta values. As 175 is ATM, 200 would be OTM for put hence Delta would be closer to Zero and vice versa when Spot is 150, the delta would be close to -1. Please correct me if I am missing anything here. Similarly for Call as well, 135 would have Delta Closer to Zero and 200 will have closer to +1.

Sir

Before plotting the graph of volatility cone, you have shown 15 months nifty chart.

Sir

How you calculated ANNUALLIZED REALIZED VOLATILITY of all the expiry date.

Was that just through calculations or you have just plotted the data from nse website.

Sir, I\’ve studied in previous chapter where you have showed how to calculating the

Annuallized volatility of stocks or if nifty 50

With the help of standard deviation and average percentage change.

Yash, annualized realized volatility is just the historical volatility. I\’ve explained this in the chapter itself.

I want to ask you that can I put stop loss in the BTST Option Trading. In other words, say I bought Nifty Strike Price CE @100 and want to put stop loss @95 and will hold this position as I have belief that the markets will open gap-up. Can I do so. Can I put stop loss for tomorrow but at the same time when I am buying such CE.

YOu can use GTT for this, but only for Index (Nifty + Bank Nifty) options.

can we put stoploss in BTST option trading?

Yes. Place the SL the next day.

Hello Karthik!

In the volatility cone section, when you calculated the table for 10, 20, 30, 45, 60 & 90 day windows, we can see a trend in max volatility. Max volatility seems to be decreasing for larger time frames and I\’m unable to comprehend this. Shouldn\’t the larger time frames capture larger volatility days also? I\’m thinking that more data points for volatility should imply more days with high volatility. Also, if max volatility in 10 days frame is 54%, shouldn\’t that be the max volatility for 90 days frame also?

Please let me know where my understanding is wrong.

Intuitively yes, but let me try and get an explanation for this. Btw, that section on the Volatility cone is authored by someone else, so I need to get his perspective.

Hii sir, I couldn\’t download the volatility cone excel file. If you have it kindly send me. Thanks

Can you try from another browser?

Sir I am unable to understand anything after theta module. Could you please make more comprehensive videos as I\’m sure for most of the people understands better in a video format. If not, could you please suggest some good video sources to understand option greeks?

Do check these videos Nikhil – https://www.youtube.com/watch?v=-mO0YOTcCiQ&list=PLX2SHiKfualFiusiT9G5uE9jU3vetvW2x

Hi, \”Download the Volatility Cone excel\” link not working to download the file.

Very true! Very honest !

Thanks Sir!

Sensibull seems to have everything an options trader seeks,but we have to pay for their pro plans wherein their expert advice is also available. Shall I go ahead? You have taught us a lot and without your nod, I dont want to do anything.

Regards.

AShutosh, people at Sensibull are good friends of mine. So if I yes, it may come across as a biased opinion. Please do look up reviews, ask people, and watch their content on youtube, if you like it then subscribe 🙂

Volatility cone is a very interesting concept – I cant guarantee, but we will try and develop a web based tool for this sometime soon.

Is the tool out now?

I am asking a question out of context. A friend of mine called me to buy CE-BANKNIFTY for 35000 strike. Expiry June 9th. The premium to be paid 350.

The call actually hit the target of 450++

Can you explain the logic?

Pl feel free to not to reply if you dont feel like so.

Hats off to you for your great effort that would really make us pros.

Regards. Ashutosh.

Ashutosh, check this, they may have volatility cone – https://sensibull.com/

Got it. Several readings needed. Thanks! Grateful to you for your patience and hard work.

Cheers! Hope you continue to enjoy learning on Varsity!

Right now,Nifty is at 16655.

ATM STRIKE–16600

DELTA–0.53

Iv–18.6

Theta. -13

Vega. 9

Yama. 0.001

Dear Sir;

When these modules were written,there was no sensibull and no greeks calculator with the option chain showing us the live run of the greeks.

Kindly write a note as to what do we make of the current situation? What is the inter relationship of the greeks?

Regards. Ashutosh.

The option greeks science remains the same as before and in the future too 🙂

Sir – 1st a lot if thanks for your invaluable resources out here. I could have posted these under Calender spreads, but I felt & we are dealing with Greek interactions along time…

1. Say we have 2 Lots each, Short Call & Put positions, Atm, current expiry.

2. Also have 3 Lots each, Long Call & Put, positions +/- 1 Atm, Next expiry.

( The net positions have a Positive Theta & Vega. )

Q1. What best adjustments can be done if the underlying has crossed the Long Call, 2 days still to near expiry.

Q2. What can I Sensibly do with the long positions after the near Expiry, with the Short positions ending with a net loss.

Bi.

Punam, this is a complex set up. The question is adjustment wrt to what? are you trying to adjust for staying delta neutral or trying to do something in order to recover your losses in short position? If its delta neutrality, then its straightforward, but complexity is with different month expiries. If you want to recover losses, then you have to probably look at long futures in current month, because tapping into next month\’s contract leads to buying expensive options.

Resp Sir,

Cant we barter any other indicator for such complicated math in relation to Volatility and greek interactions? You put it up in 2015, and now even the Kite in association with Sensibull gives us ready reckoners!

Hats off to you for your labour and the easy explanations.

Indicators such as Bollinger bands and ATR are based on volatility. You can give that a try once 🙂

Hi Karthik sir,

in volatility cone calculation excel sheet,

1)In sheet 1, x1- where u have calculated daily return then u did (x1-mean)^2

here (x1-mean)^2 – what its meaning and u took mean=0, why?

2)march12 sheet: =SQRT(1/B$5*SUM(OFFSET(Sheet1!$E$2,MATCH(Sheet1!$N4,Sheet1!$A$2:$A$504,1)-1,0,-B$5)))*SQRT(252)

can u plz explain what is the formula doing.

I understood historical calculation in previous chapter and but this volitility cone calculation is tricky, plz explain sir

Pavan, even I\’m not sure as this is done by someone else. Will try and get its explanation.

What is difference between Historical Volatility and Realized volatility?

Both are the same.

Hi , I am getting confused with the excel functions while calculating the volatility cone. =SQRT(1/B$5*SUM(OFFSET(Sheet1!$E$2,MATCH(Sheet1!$N5,Sheet1!$A$2:$A$504,1)-1,0,-B$5)))*SQRT(252)

Could you please explain this to me.

Hey,

Upon downloading the excel file fro the volatility cone I can see that the Cell- F has the implied volatility where its value starts after 250 days but it does not have any calculations in it. Could you please be nod enough to share the calculation of the implied volatility as mentioned in the excel sheet.

Thank you.

Satyam, I\’ve not developed the volatility cone on excel. I\’ll pass your query to the person who developed this. But from what I can guess, maybe it is a yearly average?

Sir,

May I know how the annualized volatility of various months have been calculated?

I have been trying to deduce the logic based on the previous chapters i.e.,

=ln() – for daily returns for 10 days

= stdev() – for daily volatility for 10 days

= stdev()*sqrt(252) for annualized return

May I know where did I go off track?

Instead of 252, use 22 or 30 for monthly volatility.

The concept of not shorting ATM option holds to be true as Gama here high meaning delta will change at a higher rate leading to change in premium at a high rate,However if as a seller I wish to play with premium amount rather than waiting for expiry to receive the entire premium amount and have a bearish view and is am convinced that there will be a huge fall as a seller of a Call option then can I do so ??Of course risk will be high but with a high reward ratio.

Guide for the same

Thanks in advance!!