21.1 – Background

So far in this module we have discussed all the important Option Greeks and their applications. It is now time to understand how to calculate these Greeks using the Black & Scholes (BS) Options pricing calculator. The BS options pricing calculator is based on the Black and Scholes options pricing model, which was first published by Fisher Black and Myron Scholes (hence the name Black & Scholes) in 1973, however Robert C Merton developed the model and brought in a full mathematical understanding to the pricing formula.

This particular pricing model is highly revered in the financial market, so much so that both Robert C Merton and Myron Scholes received the 1997 Noble Prize for Economic Sciences. The B&S options pricing model involves mathematical concepts such as partial differential equations, normal distribution, stochastic processes etc. The objective in this module is not to take you through the math in B&S model; in fact you could look at this video from Khan Academy for the same –

My objective is to take you through the practical application of the Black & Scholes options pricing formula.

21.2 – Overview of the model

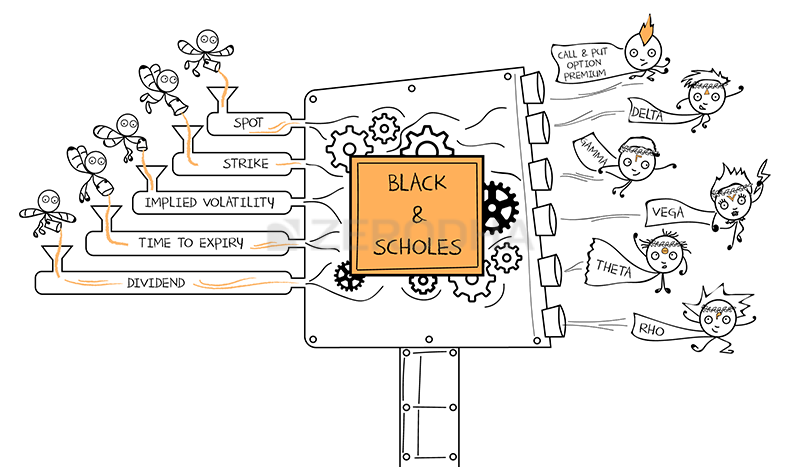

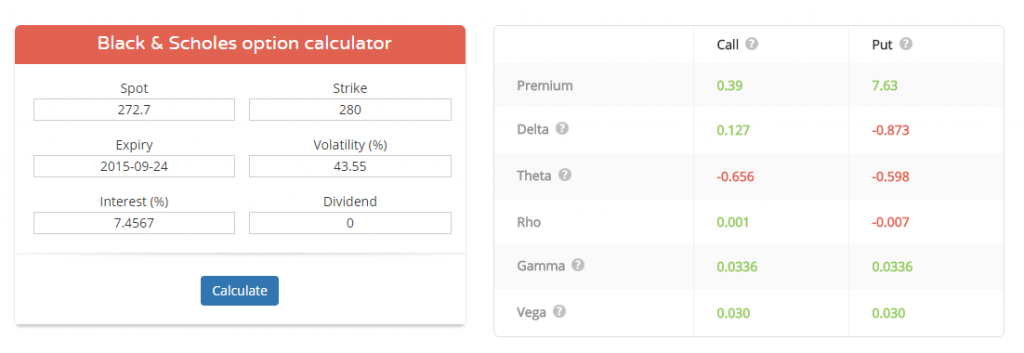

Think of the BS calculator as a black box, which takes in a bunch of inputs and gives out a bunch of outputs. The inputs required are mostly market data of the options contract and the outputs are the Option Greeks.

The framework for the pricing model works like this:

- We input the model with Spot price, Strike price, Interest rate, Implied volatility, Dividend, and Number of days to expiry

- The pricing model churns out the required mathematical calculation and gives out a bunch of outputs

- The output includes all the Option Greeks and the theoretical price of the call and put option for the strike selected

The illustration below gives the schema of a typical options calculator:

On the input side:

Spot price – This is the spot price at which the underlying is trading. Note we can even replace the spot price with the futures price. We use the futures price when the option contract is based on futures as its underlying. Usually the commodity and in some cases the currency options are based on futures. For equity option contacts always use the spot price.

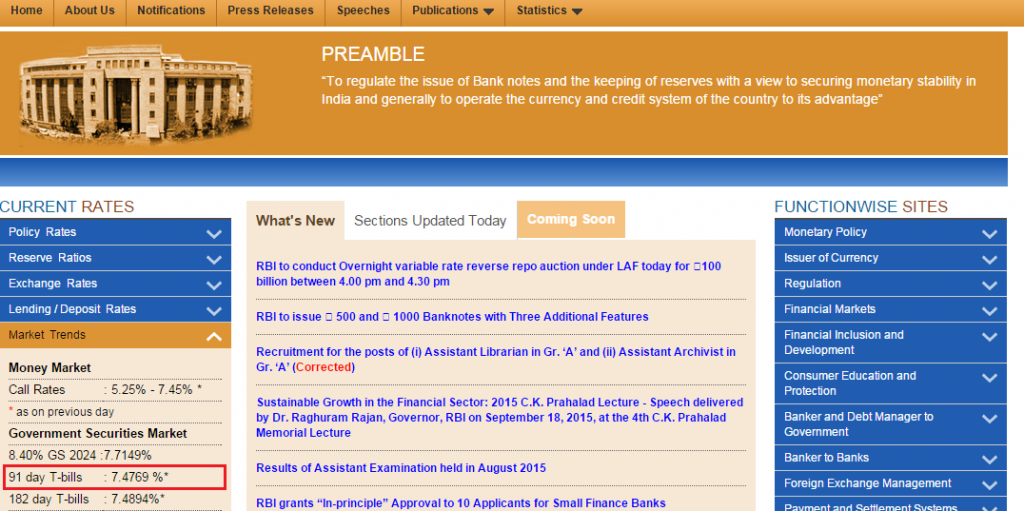

Interest Rate – This is risk free rate prevailing in the economy. Use the RBI 91 day Treasury bill rate for this purpose. You can get the rate from the RBI website, RBI has made it available on their landing page, as highlighted below.

As of September 2015 the prevailing rate is 7.4769% per annum.

Dividend – This is the dividend per share expected in the stock, provided the stock goes ex dividend within the expiry period. For example, assume today is 11th September and you wish to calculate the Option Greeks for the ICICI Bank option contract. Assume ICICI Bank is going ex dividend on 18th Sept with a dividend of Rs.4. The expiry for the September series is 24th September 2015, hence the dividend would be Rs.4. in this case.

Number of days to expiry – This the number of calendar days left to expiry

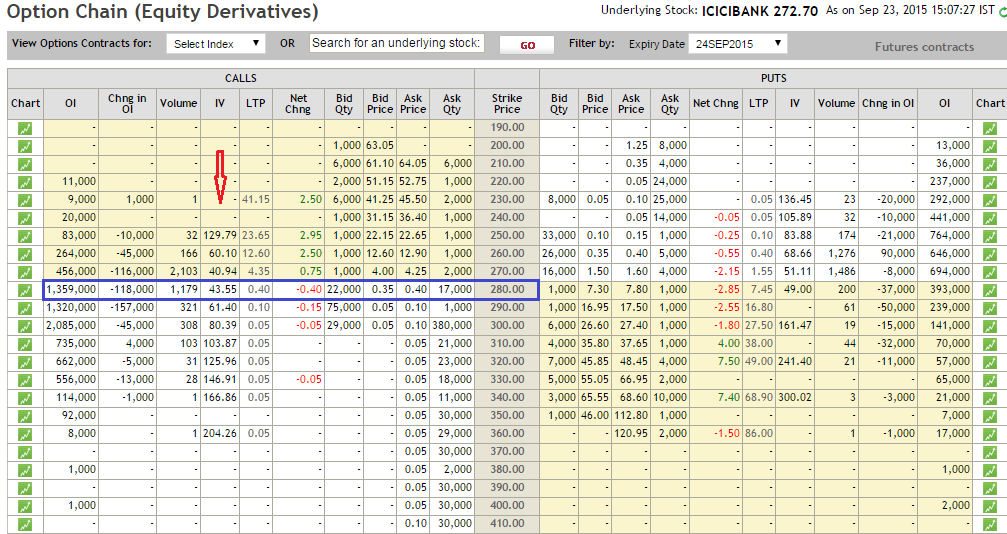

Volatility – This is where you need to enter the option’s implied volatility. You can always look at the option chain provided by NSE to extract the implied volatility data. For example, here is the snap shot of ICICI Bank’s 280 CE, and as we can see, the IV for this contract is 43.55%.

Let us use this information to calculate the option Greeks for ICICI 280 CE.

- Spot Price = 272.7

- Interest Rate = 7.4769%

- Dividend = 0

- Number of days to expiry = 1 (today is 23rd September, and expiry is on 24th September)

- Volatility = 43.55%

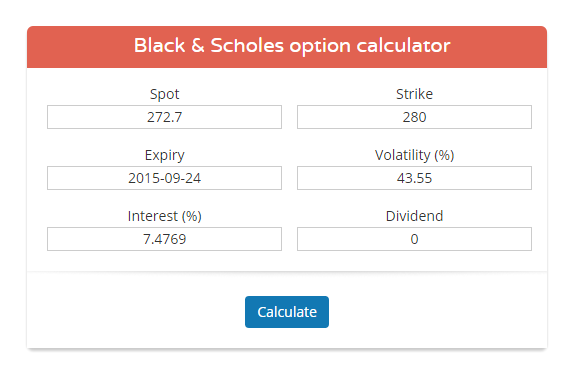

Once we have this information, we need to feed this into a standard Black & Scholes Options calculator. We do have this calculator on our website – https://zerodha.com/tools/black-scholes , you can use the same to calculate the Greeks.

Once you enter the relevant data in the calculator and click on ‘calculate’, the calculator displays the Option Greeks –

On the output side, notice the following –

- The premium of 280 CE and 280 PE is calculated. This is the theoretical option price as per the B&S options calculator. Ideally this should match with the current option price in the market

- Below the premium values, all the Options Greeks are listed.

I’m assuming that by now you are fairly familiar with what each of the Greeks convey, and the application of the same.

One last note on option calculators – the option calculator is mainly used to calculate the Option Greeks and the theoretical option price. Sometimes small difference arises owing to variations in input assumptions. Hence for this reason, it is good to have room for the inevitable modeling errors. However by and large, the option calculator is fairly accurate.

21.3 – Put Call Parity

While we are discussing the topic on Option pricing, it perhaps makes sense to discuss ‘Put Call Parity’ (PCP). PCP is a simple mathematical equation which states –

Put Value + Spot Price = Present value of strike (invested to maturity) + Call Value.

The equation above holds true assuming –

- Both the Put and Call are ATM options

- The options are European

- They both expire at the same time

- The options are held till expiry

For people who are not familiar with the concept of Present value, I would suggest you read through this – http://zerodha.com/varsity/chapter/dcf-primer/ (section 14.3).

Assuming you are familiar with the concept of Present value, we can restate the above equation as –

P + S = Ke(-rt) + C

Where, Ke(-rt) represents the present value of strike, with K being the strike itself. In mathematical terms, strike K is getting discounted continuously at rate of ‘r’ over time‘t’

Also, do realize if you hold the present value of the strike and hold the same to maturity, you will get the value of strike itself, hence the above can be further restated as –

Put Option + Spot Price = Strike + Call options

So why should the equality hold? To help you understand this better think about two traders, Trader A and Trader B.

- Trader A holds ATM Put option and 1 share of the underlying stock (left hand side of PCP equation)

- Trader B holds a Call option and cash amount equivalent to the strike (right hand side of PCP equation)

This being the case, as per the PCP the amount of money both traders make (assuming they hold till expiry) should be the same. Let us put some numbers to evaluate the equation –

Underlying = Infosys

Strike = 1200

Spot = 1200

Trader A holds = 1200 PE + 1 share of Infy at 1200

Trader B holds = 1200 CE + Cash equivalent to strike i.e 1200

Assume upon expiry Infosys expires at 1100, what do you think happens?

Trader A’s Put option becomes profitable and he makes Rs.100 however he loses 100 on the stock that he holds, hence his net pay off is 100 + 1100 = 1200.

Trader B’s Call option becomes worthless, hence the option’s value goes to 0, however he has cash equivalent to 1200, hence his account value is 0 + 1200 = 1200.

Let’s take another example, assume Infy hits 1350 upon expiry, lets see what happens to the accounts of both the trader’s.

Trader A = Put goes to zero, stock goes to 1350/-

Trader B = Call value goes to 150 + 1200 in cash = 1350/-

So clearly, irrespective of where the stock expires, the equations hold true, meaning both trader A and trader B end up making the same amount of money.

All good, but how would you use the PCP to develop a trading strategy? Well, for that you will have to wait for the next module which is dedicated to “Option Strategies” J. Before we start the next module on Option Strategies, we have 2 more chapters to go in this module.

Key takeaways from this chapter

- The options calculator is based on the Black & Scholes model

- The Black & Scholes model is used to estimate the option’s theoretical price along with the option’s Greek

- The interest rate in the B&S calculator refers to the risk free rate as available on the RBI site

- The implied volatility can be fetched from the option chain from the NSE website

- The put call parity states that the payoff from a put option plus the spot equals the payoff from call option plus the strike.

Hi karthik Sir,

and also with the Implied volatility Chapter,

I have understood that it is the market participants expectation about the volatility on selective strike price? but for the ATM options the volatility is less comparatively but when the far strikes like OTM to Deep OTM and ITM to Deep ITM the IV is gradually increasing. How to understand this and select the strike based on IV perspective?

You have to have something to compare, thats why pegging to historical vol makes sense. Also, ATM vols can also be high 🙂

Hi karthik Sir,

I have some doubts.

1. we use the B&S calculator to know the true value of the option greeks and based on the delta, vega and theta we must take the trade based on our risk appetite. Right? or B&S calculator gives some meaningful information like the vega is high and theta is less.

2. In the above ICICI bank example, Theta for call is -0.65 and for put is -0.59. How do we know it is a fair value? and vega is 0.30, What will be the standard vega? (should we use VIX, If so it is for the index right then for stock?).

3. Do we need to calculate the B&S price at each time when we are about to take the trade?

1) Thats right. But B&S calculator does not give any opinions.

2) You will have to compare it with historical data, which by the way is not easy unless you maintain the data. But do check with Sensibull if they do

3) Not really, sometimes you will intuitively know the pricing is cheap or expensive after you gain a lot of trading experience.

Options Greeks calculator for Commodities please

Noted, will share feedback.

Hi Karthik

Wrt my earlier question on the disparity in premiums between B&S calculator and actual premiums, I forgot to paste the actual premium value. So I recalculated for an option for today.

Spot=22473

Strike=22450

Exp 23rd may

India VIX (vol)= 19.8%

Interest rate=6.9885%

Dividend=0.

I get the below values thru B&S calculator.

Premium: 252 (CE), 203 (PE)

But when referring to the option chain for NSE Nifty 50, I get LTPs as 152 & 112.

Isnt this a huge difference?

Yes, thats a massive difference. Usually when this happens, the volatility inputs are not accurate. So do check that.

sir in the example trader A and B

trader B loss some call otion value

how it become a 0 thats become a some less value

i think it is not 0+1200=1200

i think that is like(ex=-20+1200=1180)

I guess I\’ve shared the explanation in the chapter itself. Please do check.

Hi Karthik

I tried using the option Greek zerodha calculator for nifty 50 as of yesterday (1st May\’24) but the put option premium is wildly off from the LTP on the option chain as of yesterday. What may be the issue here?

SPOT

22604.85

STRIKE

22600

EXPIRY

2024-05-02 23:59:00

VOLATILITY (%)

16.53

INTEREST (%)

6.92

DIVIDEND

0.0

Calculate

Call Option Premium Put Option Premium Call Option Delta Put Option Delta Option Gamma

117.15 103.73 0.522 -0.478 0.0014

Call Option Theta Put Option Theta Call Option Rho Put Option Rho Option Vega

-29.759 – 25.476 0.640 -0.598 6.665

Yaqoot, what is the market price of the premium? The premium B&S calculator gives is the fair value, market price will be different but it should not be way too off 🙂

Sir, thank you the informative blog on Option Greeks.

Sir, will it be correct to say that movement of SPOT PRICE is driven by \”Change in OIs\” in Call and Put side only?

Ah no, spot price is also driven by other fundamental factors in the stock 🙂

There is slight difference between the price of call and put option when we use the option calculator to calculate and then compare the same to option chain

Please revert

thanks!

Yes, price from calculator is fair price, price you see in option chain is market price.

SIR but still (present value of the strike and hold the same to maturity, you will get the value of strike itself) im not getting it can u please explain by giving any example?

Also, do realize if you hold the present value of the strike and hold the same to maturity, you will get the value of strike itself?

sir can u please explain this with example? i have read the present value concept but im not able to connect that info with present value of strike and what is mean by –

(present value of the strike and hold the same to maturity, you will get the value of strike itself), and also.

Ke(-rt) please elaborate this .

This one just the mathematical rearrangement, Prasad.

Does option prices always follow Black-Scholes model pricing or just demand-supply, Bid-Ask model?

Fair price is based on B&S model, but then market also factors in the demand and supply situation. So the option premium is essentially a combination of all these factors.

Is B&S pricing good for currency options as well?

Yeah, it is widely used.

To calculate Option Greeks for Call Option, Implied Volatility of CE from Option chain is considered. To calculate Option Greeks for Put Option, Implied Volatility of PE from Option chain should have been considered. But here I notice, IV from CE only has been considered for both the calculations. Will it not yield wrong results for PE Option Greeks and premium?

You can take ATM CE for approximation/quick and dirty calculation. Of course, taking strike specific volatility gives you an accurate figure.

Dear Sir.,

How to find an option premium which are undervalued and options which are overvalued….??..

Can you please explain with any one of the example…?..

Krishna, you will have to use the Black & Scholes option calculator to figure this.

How can I calculate all of them can I get a formulas

You can use any Black & Scholes calculator for this.

Hai

Mr. Karthik.

I have completed option theory module.

Now reading others as well from start.

Really happy and impressed the way you are explaining topics.

I have a problem with greeks calculator.

I have put india VIX in volatility% and also tried nifty strike price IV.

1)Interest rate i have put RBI 91 day rate.

But still the call and put price the calculator shows

Doesn\’t match the option chain.

2)And why zerodha is not providing live greeks?

3) I have seen in your introduction that you will be educating in various cities regarding stock market. Please let me know are you conducting any workshops for option trading, or do you know anyone/institution who conduct workshops for option trading.

What you get from option calculator is the fair price and what you see in option chain is the market price, hence will be slightly different. I\’d suggest you check with Sensibull for live greeks. If we are doing workshops, we will surely announce on social media. Please do keep track there.

Hi,

How do we know that IV will increase or decrease in future. Suppose TCS has a IV of 50% as compare with historical volatility. I got to know that TCS IV has increased but how will i find that it will not increase more in future. Forecast IV through GARCH models, Is the only option to get to know that in near Future TCS IV will not increase above 50%. Is there any other way to find that information.

Do check that video I shared earlier, I have tried to explain the same.

Let us use this information to calculate the option Greeks for ICICI 280 CE.

Spot Price = 272.7

Interest Rate = 7.4769%

Dividend = 0

Number of days to expiry = 1 (today is 23rd September, and expiry is on 24th September)

Volatility = 43.55%

Here, I have a doubt on IV. We are taking only CE IV and when we see output it shows option premium of both CE and PE. Don\’t you think we should take Average of both CE and PE IV.

CE IV – 43.55% and PE IV =49% , Average IV = 46.27%. Don\’t we input 46.27% IV to get a Correct PE and CE premium.

All else equal, the IV of both CE and PE should be same, but it varies because of demand-supply mismatch. I\’m not sure about taking averages, have never given it a thought 🙂

i didn\’t understand how in PCP the put value goes to 100 and also the underlying decreases to 100. can you please explain me in detail about that example.

Put value is the premium, different from the underlying price.

Dear Sir,

In reference to the above topic. I am trying to make an option greek calculator in Ms. Excel. But I am not getting answers for all greeks similar to answers calculated by Zerodha online calculator. All answers differ by certain points even after providing the same inputs to my program. Can you please provide me with the formulas which have been used to calculate the greeks, in the Zerodha platform? It will be a great help.

Ritin

Ritin, I\’d suggest you get in touch with Sensibull for this.

Sir, In B&S, Suppose I want to calculate Greeks of Reliance Ind i.e. 13-04-2022 and Company not announce any dividend in year 2022 then should I pick dividend value of 2021 or what ?

No, dont. Pick only if the dividend is about to be paid.

What will be the current interest for now to be put in BS calculator… Not able to find treasury bill rate.. But below NSE chain they have mentioned 10%interest rate taken for IV calculation. Kindly clarify what is current interest rate. RBI rate very confusing.

10% is on the higher side. I\’d think about 6ish%.

I am getting big difference between outputs of B&S calculator ad actual data shown on NSE option chain. I checked my input many times still issue persists!

Not sure what\’s wrong, but usually it\’s the in IV part.

Nowadays Sensibull is providing us all the data so should I consider using B&S calculator at all? Is there any additional benefit to use B&S calculator over Sensibull?

You can consider the data from Sensibull.

Sir, while wrapping off option theory the last thing that came to my mind was \”is there any difference when we trade different expiries?? Does it makes a difference??\”

Longer the expiry, higher is the premium Chetan 🙂

How to set stoploss and target in options… Like we would use price action of the option premium to set stoploss or the price action of the underlying…

Check the GTT option – https://zerodha.com/tos/gtt

Sir what is Rho one of the output of the BS calculator

Sensitivity of option premium wrt to change in interest rate. Not very important in my opinion.

Hiii karthik sir as you have said when spot moves to 1100 put option gains 100 rs but as per Delta value of -0.5 it\’s only going to gain 50 rs so payoff varies with differ of 50 rs is it true?

When the spot moves, delta changes, which means the new premium will be the old premium plus the new premium.

with malliavin calculus

And what is the latest article that has been worked on?

Thanks, but I want to know what models have not been worked on yet.

Ayub, no one can say that. It really depends on your own risk and reward appetite. What works for me, may not work for you.

Hi, For which models has the calculation of Greeks not been used so far?

For which models has the calculation of Greeks not been used so far?

It used/can be used across all option models.

Hi,

Regarding the above mentioned query, I forgot to ask whether the option is deemed to be overvalued if there is such a huge price difference?

Hi Karthik, hope you are doing well.

My query is regarding the Option Pricing calculator. I used the one Zerodha has provided.

Now the thing is I used it to calculate Bank Nifty option price for 36700 CE (ATM), expiring on 16th Sept 2021 (weekly expiry). The Bank Nifty Spot Price is at 36683.20. According to the calculator, I give all the inputs (Spot, Strike, Implied Volatility, Interest Rate for 91 day T-Bill in 2021, Expiry) it asks EXCEPT for Dividend.

So, after giving the necessary inputs, the calculator gave me an answer of Rs.214 and Rs. 233 as Price for the Call and Put option mentioned above; where as on the Option Chain the Price is shown around Rs. 305 for both Call and Put of the same Strike Price.

So, why is there such a huge difference in price?

Am I missing something here?

Did I take the correct Interest Rate and Implied Vol.?

Has not mentioning the dividend in the calculator created such a huge difference? If so, then what dividend data should I be using to price Bank Nifty Index options?

Awaiting for your guidance, thank you. 🙂

– Soham Pandkar

I\’d suggest you use the B&S calculator in Sensibull to cross-check the rates. The difference exists because of the gap between the fair price (as obtained by B&S calculator) and the market price. But yea, the gap seems like it is on the higher side. So please verify once.

Sir, how and where do we get these delta value and other Greeks.

Check sensibull\’s website for this.

the implied volatility given in nifty options chain is of which time period?

I think it was around the time the article was written, around 3-4 years ago.

While calculating greeks should i use the 10% interest rate as used by nifty or the 91 t bill interest rate? also while using the sensibull calculator, it calculates the implied volatility by itself, However the implied volatility calculated by sensibull is different from that as seen on nse website. SO which implied volatility should i pay attention to, the one on nse or the one calculated by sensibull ?

I\’m not really sure how Sensibull is doing this, I\’d suggest you get in touch with them on this.

Where is the calculator located?

I\’d suggest you take a look at Sensibull website.

Why while calculating historical volatility or calculating realized volatility, we often take the annualized data and not data of more than 1 year ? Any specific logic ?

It just makes life easy 🙂

Hello Karthik,

Once again, wonderful work. I believe you have mastered the art of ELI5, albeit i havent and hence pardon me for the lengthy post, once again! 🙂

I went through the White Paper which you had linked in the Vega Chapter (https://www1.nseindia.com/content/indices/white_paper_IndiaVIX.pdf). And after going through that it is evident that the Implied Volatility (If NSE is calculating every contracts IV via the same formula) is a function f(spot_price, risk_free_rate, bid_ask_mid_point, dividend, ……). But the point to note here is that the only TRUE variables in this equations are spot_price and bid_ask_mid_point. So in effect were i to see the B&S model from mathematical point of view

-> B&S model, a partial diff eq, takes spot_price, strike_price, expiry_date, dividend, risk_free_rate and implied_volatility(this in itself a function of many of the variables mentioned in this list) as input and spits out the greeks and the premium values, and this is happening at NSE real time, correct?

-> Would i be wrong in saying, well mathematically speaking, that the premiums are nothing but a function of spot_price and bid_ask_mid_point(of the contract being traded) effectively? Or are there other variable which you think i missed identifying?

-> You as a professional trader, have you ever wondered of the possibility that NSE might change the pricing model from B&S to a new way of calculation, such as this maybe.. https://www.weareworldquant.com/en/thought-leadership/beyond-black-scholes-a-new-option-for-options-pricing/? If not NSE, then maybe, I, as a trader can look at premium pricing in this light and hope for light down the tunnel . ….

Eagerly waiting

Best

Premium is a function of many things running simultaneously –

1) Changes in the spot price

2) Rate of change of spot price

3) Volatility

4) Time left for expiry

5) Demand and supply (liquidity)

NSE might not change but as a trader, you can use this and develop insights that might help you get a better perspective of trades.

Also i would like to know, in case of index what should be the dividend?

Index dividend is 0.

HI AGAIN Karthik! Why in the example we kept the dividend zero even though above its going ex divedend of rs 4 ..so 4 should be the dividend…..Also I have another question why the volatility is not kept in absolute decimal form and is always kept in percentage ….Is there any mathematical logic behind it or just for the ease of calculation ?

Ravi, index dividends are considered 0. Volatility is expressed as a %, hence.

I wanna can we get IV from nest trader

i wanna ask can we get to know IV from nest trader??

Nope. Btw, NEST trader is no longer available.

what does \”J\” mean Sir,you have used it often….just out of curiosity😊…..like the last sentence \”which is dedicated to option strategies \”J\”….😊

Whenever I type :), it appears as a J. I try to correct it most of the times, but still few of them escape my diligence 🙂

Sir, I tried to calculate price of BANKNIFTY 35700 CE. The spot is 32781.80 and expiry is of coming Thursday, 6 May.

I used the B&S calculator link provided in this chapter.

The premium it calculates is 5.73 but the premium is actually 22.85.

So I tried different strikes of different underlying, but there is always a huge difference like this.

Interest rate I am using is 3.32% as shown on RBI website.

Volatility I am using is IV of strike price given in the option chain.

What is the reason of this discrepancy?

Did you enter the numbers of days to expiry correctly? Ppl usually make a mistake here. Some difference can be attributed to the demand-supply dynamics, but not so much. PLease do double-check the data inputs again.

Hi Kartik,

Thanks for the wonderful and simplified explanation on the options market.

I was just a little confused on this one:

How did you derive \”Ke(-rt)\” from the Present value equation. (Present Value = Amount / (1+Discount Rate) ^ Number of years) ?

Ah, no derivation. I just used the established formula.

Using B&S calculator, if I want to calculate option greeks of strike of 14300 PE, and spot nifty is 14600, in volatility, what should I put?

IV of the strike price i.e. 14300 PE or the IV of ATM i.e. 14600 PE?

IV of the strike if it\’s available, else IV of ATM strike.

Sir, can we use B&S calculator to price the options and get greeks of the options based on indices like nifty and bank nifty?

And if yes, in the volatility box of the calculator, what value do we have to enter? IV of the strike price mentioned in the option chain or India VIX value?

Yes, you can. You can use the Implied volatility of ATM strike and see what kind of results you\’d get.

Thanks Karthik for explaining everything in detail.

Have few questions

1. on Expiry day , premium of every option will become zero?

2. Can I sell call option today and buy the same after few days but before expiry ?

3. If answer for above question is true, as premium will decrease based on time decay. Every time I will get profit whenever I short sell call option and buy after few days. Am I right ?

3. if I short sell option on expiry day and did not buy the same to square off , what happens in below scenarios?

a) what happens if strike price is less than expiry day closing price

b) what happens if strike price is more than expiry day closing price. Please give an example

4. how margin is calculated if we sell call option?

1) No, the premium of ATM and OTM will goto zero. ITM options will have some value based on the spot

2) Yes, you can

3) Yes, that\’s right

3a) For call option premium will be zero, for put option, it maybe be profitable.

3b) Reverse of the above

4) Calculation is based on SPAN technique. YOu can figure how much using the margin calculator.

The IV considered is for the strike of 280. Is it because, this is closest to spot? Or is there some other reason?

I guess it was selected randomly.

Hi Karthik,

I checked Zerodha\’s Greeks Calculator and for PE and CE we have different IV. Should we use average of PE IV and CE IV to calculate the Greeks?

Thanks,

Priyanka

Not really, take the IV of the particular strike, that will be more accurate.

Does the B&S formula hold good for Nifty Intraday trading too?

Yup, it does. B&S is applicable for all options.

when I have giving values for black Scholes in Zerodha, the output result(theoretical CE and PE Prices) is exactly the opposite for practical CE and PE. means (theoretical CE = practical PE) and (theoretical PE = practical CE). can you explain why this is happening?

I\’m not sure at all, this seems peculiar. Can you double-check all the parameters again?

Very nicely written. Can you suggest more books to further dive deep on options, greeks, strategies and practical indian examples.

Thanks, Dyyani. I\’ve tried to consolidate my learnings from various sources into these notes. Btw, you should check out Sheldon Natenberg\’s books on options.

Dear Sir,

Thank you for taking time out of your busy day to reply to me.

If the IV calculated by the NSE is wrong, then all the options chains on Zerodha, HDFC Sec, ICICI Direct etc would be wrong correct as they all take their data from the NSE data..

Historical volatility for stocks would only be there for its futures correct? As mentioned earlier, I cannot find volatility for stocks anywhere online. Does Zerodha offer this?

I\’m not saying its wrong, its just that I don\’t know their philosophy in make that calculations 🙂

Historical vol can be easily calculated on excel. No, we don\’t offer this data.

Dear Karthik Sir,

The current T91 bills is around 3.337% interest rate.

On the NSE website it says that IV is calculated using 10% interest rate. Will this skew data?

Also, you mentioned that VIX can be used as an alternate to Nifty IV.

What about other stocks, bank nifty etc.

It would become tedious to calculate the daily returns and volatility every week to understand vix/writing options. Is there a website that has all this data ready? I\’ve read the above comments and you had suggested sensibull, but I cannot find anything over there. Please do assist me in this matter.

Jason, this may skew the data. Not sure, why 10% is being used. For stocks, you can take the historical volatility and use that as a proxy. Do write to Sensibull and see if they have this data (in case you were unable to figure).

Dear Sir,

I\’m still not sure how I should interpret the fair value price of an option.

In futures, I can potentially set up arbitrage positions.

But what about options??

Should you purchase undervalued options and avoid over valued options??

Yes, naked positions are one of the best things you can do to extract value. But for this to work, you need to be extra sure about the option position and its eventual alignment to fair value.

To follow up

If the fair value price is higher than the actual price it makes sense to purchase the option currently? and if the fair value price is lower than the actual price it would make sense to avoid purchasing the option right?

But what about squaring off the option?

Lets say I purchased an undervalued option, and not the actual price is much greater than the fair value price.

How should I go about it?

Will this be similar to writing options?

Yes, traders do track fair prices vs Mkt price and set up trades. But there is no guarantee that the market price will reflect fair price, in which case the trade can go terribly wrong.

Dear Sir,

With respect to the B & S calculator.

When I input strike, spot, IV, and the 91 day T bill for interest. I get the 4 greeks as well as the theoretical price.

Is this price the price as expiry or what the price of the option should be currently?

Let\’s say the option currently priced at Rs. 15.50 while the theoretical price is 14.44, what should I infer from this>

What if the option is priced at 22 while the theoretical is priced at 25?

Kindly do assist me in this matter. You are truly doing fantastic work sir.

It is the fair price expected in the market as of now. Of course, the market price could be different and this difference is owing to the demand and supply situation in the market.

Dear Sir,

Is there a reason you have not spoken about rho? There is a drawing of rho on your infographic.

Also what the other second/third order Greek finance derivatives? I know you said it is not meant for retail but it can be useful right?

Jamna, Rho has the lowest impact since this is sensitivity to the interest rate, hence decided to skip it. Not sure about the 2nd and 3rd order Greeks. Need to research a bit, but I do remember discussing this in the chapter related to Gamma, please do check that.

The calculation of option pricing with time taken in days has inherent flaws which is significant in last couple of days expiry. The pointer to thought is that option pricing on a given date, opening and closing price has signficant price difference keeping other variable same. It is exploitable flaw.

Not sure Anoop, I\’ve never thought about this.

Hi Karthik,

1. You taken dividend as 0 for ICICI bank example, I hope this is a typo, it should 4 right?

2. If there is no ex dividend for specific stock within expiry then dividend is 0?

3. I didn\’t expect indices also provides dividend, but how do people get this dividend?

4. As per NSE website, dividend for indices is only completed days, means if we have to calculate option premium for 10th December expiry, I don\’t see any dividend data after 4th December. Does it mean Nifty/ Bank Nifty will always have 0 dividend while calculating the formula?

1) I guess there was no dividend at that point, hence 0.

2) Yup

3) You look at the dividend yield of the indices. I guess NSE publishes this info on a daily basis

4) Ah, not really. They publish this info daily – https://www1.nseindia.com/products/content/equities/indices/Dividend_Yield.htm

Hi Karthik,

How can I get IV of a stock? It is not mentioned on NSE website as shown by you.

I\’d suggest you check with Sensibull once.

In elliot wave theory

The theory is subjected to moving averages correct?

So simple moving avg or an exponential should be taken ?

And how many day moving avg should be taken ?

As far as I know, Elliot wave is largely based on the Fibonacci theory.

Sir I was wondering why we do not use Implied Volatility at a particular strike price instead of overall standard deviation pertaining to a particular stock in B&S formula?

Many thanks!

You can, may get a bit complicated though.

How does NSE calculate the volatility of an option? Because it seems like the egg and the chicken problem as if I input the premium I get the volatility and if I put the premium I get the volatility?

NSE takes a slightly different approach. When the calculate volatility, they have margins in perspective. They give more weights to the recent price movement.

Ohh. so our stock broker collects margin in advance in order to be in a safer side. Thank you sir🙏🙂

Happy learning!

Thank you sir, my doubt is why do i even have to maintain margin

What if you decide to square off one leg and leave the position naked?

Sir,

Suppose i buy nifty 11500 ce@x and sell 11700 ce@y. Why do i still have to maintain margin? In this case, if nifty expiry is below 11500, my max loss will be (x-y). If nifty expiry is above 11700, my loss on selling 117700 ce will be adjusted with holding of 11500 ce and still i will be in a gain. Then why should i maintain the margin when my maximum Loss is premium which i already have paid. Pls answer sir

The new margin framework significantly reduces the margin for such positions.

sir does rho interest means the 91day t bills? and is it mandatory to take 91day tbills and not 182?if yes why?

Rho means the rate of change of premium wrt to the change in the interest rate. 91 days since its short term and closer to expiry.

sir, In the greek calculator, the value of theta computed is negative. But theta by defination is positive number irrespective of Call or Put option, right ?

The range being 23000-24000

I guess you can.

Example banknifty Is trading at 23500 and I have sold 2 put option of 18500 so can I buy a put option of 20000?

So having sold a put option contract out of the range

Can I also buy a put option out of the range to increase my profitss?

You can, but do keep an eye on the range which is allowed.

If I want to sell put option strike price 18100 in bank nifty will i be able to?\”

No restriction on selling options.

What is the new rule in bank nifty strike price restrictions ?

Not sure about what you are referring to. Can you throw some context please?

Hi Karthik,

1) Am I right in deducing that the BS calculator assumes constant value for volatility throughout the option duration? If no, kindly explain how the IV input works. If yes, isn\’t the entire assumption wrong?

2) Also, do option traders really need to find the option prices? Can\’t we just trade using volatility, ignoring how prices are derived/calculated? What edge does a certain trader has, by using Option pricing formula?

1) Yes, that\’s right

2) Yup, you can, but having a perspective on price helps. After all, you don\’t want to be transacting at ridiculous option prices.

Sir

Is there effect on option price on date of ex-dividend?

Not really, the F&O contracts are adjusted by the exchanges.

how and where can we get nifty options historical data with GREEKS

You may want to contact the folks at Sensibull for this.

sir do we have a chapter on theoretical and market price of option to know more about this concept.

You should check this Rajat – https://zerodha.com/z-connect/queries/stock-and-fo-queries/option-greeks/how-to-use-the-option-calculator

hello sir,

sir i calculates the option premium through B&S calculator , it is truly helpful .

but sir in a case the put premium calculated by B&S calculator matches with the option chain put premium byt in call premium there was a huge gap of 8 . B&S calculated it at 38 but actually it is prevailing at 46 .

This is because of the difference in the theoretical and market price of the option.

What according to you are the flaws in the model developed by Mr. Merton(if any) and how to take them into account while pricing options?

I dont have an individual opinion on this, but I\’ve read about the assumption of normal distribution of asset returns being considered as a flawed.

Hi Karthik Sir,

Trader A holds = 1200 PE + 1 share of Infy at 1200

Trader B holds = 1200 CE + Cash equivalent to strike i.e 1200

Assume upon expiry Infosys expires at 1100, what do you think happens?

Trader A’s Put option becomes profitable and he makes Rs.100 however he loses 100 on the stock that he holds, hence his net pay off is 100 + 1100 = 1200. Supposed here is received premium 100 & loss 100 ..so the net value is 1200

Trader B’s Call option becomes worthless, hence the option’s value goes to 0, however he has cash equivalent to 1200, hence his account value is 0 + 1200 = 1200. But here He paid premium (-100)+1200= 1100.

So I think it is not the same. Correct if I\’m wrong

Regards,

Paresh

Yes, this is on a theoretical basis. Also, the premium won\’t be 100. It will be around 10 or less, depends on the spot price.

If I want to trade 2 different contracts in options and futures at the same time

is there any feature which would only make the trade if I am getting both the contracts at the specified price ?

Hmm, I dont think so. IOC orders wont help?

Thank you so much Karthik for taking the time to think it though, I really appreciate it.

i have a query can we calculate expected price by Black & Scholes calculator ?

Assuming if i have strike price of Rs.80 and cmp is Rs 100. and IV for particular strike price is 20% (assuming).

can we put all these figure in a calculator and calculate value of option Greeks and then using them to calculate price of a option next day if cmp increases by Rs 5 ?

Thank you!!

That seems like a bit of over-engineering for me 🙂

B&S is best for calculating the fair value of the option price, given a certain amount of volatility. Or you can feed the current market price to extract the current volatility. Not sure if you can play around with forecasting greeks with B&S.

There are some contracts which are not squared off even after expiry

So how are these contracts settled?

Is it on the basis of the intrinsic value of the contract?

Yes, upon the intrinsic value of the contract. However, all contracts expire on the contract expiry date.

Thank you so much Karthik for taking the time to think it though, I really appreciate it.

Thank you!!

Welcome, if I figure something, I\’ll let you know. Good luck!

Thank so much for your response Karthik,

Well, I am doing the following:

Since bloomberg data that i have access to gives limited data points for calibration, I did the following:

1. Calculated implied volatility (IV) based on a function in MATLAB (reserve solved B&S to get IV)

2. Based on obtained IV, I calculated the Theta, and used this as a proxy to the market.

3. I calculated B&S theta (using historical volatility), and calculated the R^2

I used this method in my study for the option price, Delta, Gamma, and Theta, it was giving me expected results for the Price, Delta and Gamma, but Theta was really off..

Thank you so much again

I thought through this, Eman. If the other greeks are right, then theta has to be right. I\’m unable to figure what could be wrong.

Great explanation, thank you Mr. Karthik,

I am currently testing the classical Black-Scholes formula (i.e. using historical volatility) to see its accuracy.

I noticed that sometimes it works for the option price, as well as delta and gamma, but when it comes to calculating theta specifically, it completely fails.

Would appreciate if you can share what you think the reason for this may be

Thanks

Can you share more details on how you are doing this? Theta is an integral part of B&S calculator and its output, I\’m not convinced that it can completely fail 🙂

Thank you for clarifying my doubts

I have some more

There are some contracts which are not squared off even after expiry

So how are these contracts settled?

Is it on the basis of the intrinsic value of the contract?

And I had one more doubt what is the IV of the contracts on the expiring date ?

Thank you

Thankyou for the detailed information

But which is preferred by you including or excluding holidays

N do the options loose more value on on a weekend or not?

I\’d prefer to include all days.

Cause if we do include holidays and if we don\’t the Greeks will differ

Which is a better one to include or to not?

Sir please clarify my doubts ,

Could you please explain the difference between including the holidays and not including them

If the theta is 2 then will the option loose value on Saturday n Sunday ?

Thankyou

The values will be different. You can exclude the holidays and take the values.

In no. Of days for expiry should holidays be included or only trading days ?

You can include holidays.

Should we use the interest rate as 10 %?

Not anymore, rates have lowered right?

Hi Karthik,

Please clarify my doubts,

1. Nifty from NSE option chain 28 may expiry Price 8500 PE trading at Rs 9.6, IV at 36.34

2. when calculated from BS Calclutor – Put Option Premium 16.88, huge difference for the day

3. Tried fitting the VIX (32.38 on May 22) replacing IV and Premium is now 10.43 somewhat close to the NSE premium

4. Did the reverse engineering to get the IV – it shows around 77 as Volatility for the this particular PE.

totally confused how to interpret this, if I want to write 8500 CE does that mean that the IV is high and if thats the case then BS calc shows Rs 16 as the premium when IV is low 36.34.

please clarify how this should be interpreted before initiating a trade.

thanks

Vinod, B&S is a fair price and Volatility calculator. The market price can be different compared to fair price, this is because of market dynamics. Also, high volatility is conducive for writing options.

Thank you sir

Welcome!

Sir please explin this

Also, do realize if you hold the present value of the strike and hold the same to maturity, you will get the value of strike itself, hence the above can be further restated as –

Put Option + Spot Price = Strike + Call options

Mukesh, plugin real values from the market and you can validate the equation.

Where i can check the risk free rate %

Take the FD rates as a proxy for risk-free rates.

Hello sir

Please explain this its really going out of my head

Also, do realize if you hold the present

value of the strike and hold the same to maturity, you will get the value of strike itself

Looks like that is a present value concept. Can you please throw more context to this? Thanks.

Hi,

How options are calculated for USDINR, say for example:

USDINR future price : 75.28 as on 01-05-2020

spot price : 75.28

Strike Price : 76 call

Volatility : ?

Interest Rate : ?

Can you please help me to figure out what is Volatility value and Interest rate.

It works exactly like that in stocks, except that the underlying here is the future, unlike in equities where the underlying is spot.

Hi Kartik,

I dont see it.

Trader A holds = 1200 PE + 1 share of Infy at 1200

Trader B holds = 1200 CE + Cash equivalent to strike i.e 1200

Assume upon expiry Infosys expires at 1100, what do you think happens?

Trader A’s Put option becomes profitable and he makes Rs.100 however he loses 100 on the stock that he holds, hence his net pay off is 100 + 1100 = 1200.

Trader B’s Call option becomes worthless, hence the option’s value goes to 0, however he has cash equivalent to 1200, hence his account value is 0 + 1200 = 1200.

Am I missing something???

Ah, I was supposed to elaborate this in the coming modules, looks like I have missed doing that. Making a note on this will update sometime soon.

Hi Kartik,

While calculating the profit of Traders A and B in PCP section should we not include the premium payed/collected?

Would the equation be still valid if we do so?

Have we not?

When I use B & S calculator, for some of the options(OTM), theta value is greater that premium value(absolute value of theta).

Example: 19500 spot price, 22000 strike price, 87.45 IV: CE premium is 16.53 and CE theta is -23.5.

What does this indicate? I mean does this mean that by tomorrow premium value will be zero, if spot price and IV remain same.

Please help on how to interpret these kind of values.

Yes, it means the value associated with the IV is zero and everything is attributed to the theta, which will hit zero as the theta acceleration increases.

Sir

In Art. 21.2 \”Overview of Model\”, you have shown RHO also. What is RHO as an Option Greek ?

Thanks

That\’s the interest rate sensitivity to option premiums, not really an active greek. Hence skipped.

Dividend yield value in the sample calculation shown in chapter is assumed to be Zero. In actual while inputtimg what value should I give. In the Nse site for calculating dividend yield it is asking for the time frame for which dividend yield to. Be calculated. What time frame should I give

Look for the latest value, Christy.

Suppose current price is 200.delta(. 2).gamma. 001.for a move of 20 point delta change by. 020

Final delta is .220(. 2+.020).so is it right to calculate total move in premium by taking average delta. Ie (initial delta +final delta)/2.ie(. 215).ie a premium change of 4.3 rs (20x.215)

Nope, don\’t average the deltas.

1)Can we use live data from ivx for calculating premium as nse data is updated at the end a day.

2)volatility alternate between high and low. Once there is a squeeze in bollinger band means low volatility. Will be followed by a volatility break in upward dirict ion. Is it a right approach to Use bollinger band as a volatility predictor. When There is a squeeze buy options and reap the advantage of volatility break out. Can you bring some clarity on. How to use bb as a volatility predictor

1) You can use any standard B&S calculator for this

2) Yes, BB is a volatility indicator, measured in standard deviation terms.

Hello,

Are all the calculations of theeta based on number of trading days to expiry or number of days to expiry?

Yes, the days left to expiry is considered.

Hi,

Thanks for the explanation. Have a couple of questions which i have (have mentioned below)

1. For Nifty and Bank Nifty Dividend we need to take only the dividend yield from the NSE website, correct ?

2. Since I am a day trader for me to calculate the option greeks can i take the weekly expiry for calculating or we need to take monthly expiry only ?

3. Being a day index options trader, it makes sense to always trade OTM strike options with 2 or more weeks of expiry ?

Thanks for your feedback

1) Yes

2) I\’d recommend daily

3) If intraday, I\’d suggest you stick to ATM. But yeah, with 2 weeks to expiry, slight OTM also works.

sir u have taken dividend because B&S formula assumes that dividend is not paid on the stock

Yes, not paid but expected within the expiry of the series.

sir in dividend section why have u taken 0 as the dividend was 4 in the above example?

Must be another underlying.

Hi Karthik,

Checked your post on Wall. Thanks, it clarifies the doubt. Once again, you are immensely helping newbies by sharing knowledge. God bless you man!

Thanks,

-Sachin

I\’m glad you found it useful, Sachin! Happy trading 🙂

Hi Karthik,

Option chain dated 20/3/2020 shows -ve % changes for deep ITM Call options, while nifty grew ~6%. Below are all 4 strikes which are in negative, while all other Call options between 8750 to 6750 are in green.

OI |CHNG IN OI | VOLUME | IV | LTP | CHNG | BID QTY | BID PRICE | ASK PRICE | ASK QTY | STRIKE

2 | 1 | 1 | – |1,175.50 | -28.95 | 675 |1,473.70 | 1,866.70 | 7,425 | 7,100.00

1 | 1 | 2 | – |1,200.00 | -41.30 | 7500 |1,310.00 | 1,743.35 | 7,425 | 7,250.00

– | – | – | – |915.70 | -915.70 | 1500 |932.80 | 1,454.25 | 1500 | 7,650.00

14 | – | 3 | – |773.0 | -177.70 | 75 |919.65 | 1,124.90 | 75 | 7,750.00

Since all these options are deep ITM, delta, Gamma are almost negligible. IV is not listed for any of these strike prices. So not sure of Vega. The only other difference between these strikes and all other Call option strikes in green, is that that, these options have OI and volume almost 0.

What could be reason for -ve returns in only these few call strikes when nifty rose substantially on 20th Mar 2020?

Thanks and regards for all the enlightenment you have been giving on these topics.

-Sachin

This is because of the deep change in IV. I had sent a wall push on the Varsity app for regarding the same, explaining why its happening. If you have the app, please check the wall section.

[…] 21. Greek Calculator […]

Now a days IV column is not shown in option chain. Where to find option wise IV other than option chain?

For individual strikes, you can look up the B&S calculator. Else, the option chain by Sensibul also gives you the OI info.

Dividend for is NIFTY 50 and BANKNIFTY will be 0.0 ??

The Index PE and Dividend is published by the exchanges – https://www1.nseindia.com/products/content/equities/indices/historical_pepb.htm

sending diegram

Hello Karthik Sir,

My apologies If I am in any way offending you by calling you Sir but I must call you Sir as I have really loved, learned a lot from your super write-ups. Thank you once again.

After a really long month of Study and working in parallel. I have built a Trading System of my own using Google Sheet. I can do some pattern analysis, Indicator Movements, Potential Hedging, Options Greeks Calculation and few other factors. I have built a system to BackTest my results also for any period I would want to check.

However all these things that I currently did is using Historical Data, So my Google Sheet can only generate a Trade Call after the closing of the market .i.e. around 8PM when today\’s data will be available, then I will have to BUY/SELL that script tomorrow first thing in the morning.

Sometimes I have followed and found that I have missed the rally already and then I dont know what to do. 🙁

My Question:

1) Can I get real time data in my excel or google sheets? Any API or any suggestion how I can get some real time data?

2) How do you think we should decide on the Target for a given script when we get a BUY/SELL call? I just do,1%,2% and 3%

3) A combination of candlestick patterns which gives a BackTest (360 days) of almost 90-95% Success. Can we just blindly trust those calls further?

4) I am planning to start trading Options (1st) and Future (2nd) going forward.

5) Can you suggest some other books or readings which can help me further enhance my strategies?

I have burnt my fingers in the past and have lost very huge amount in the market and that\’s why this time with your help I am working hard before I jump in the fire.

Note: I have not done any trades yet using my System generated calls yet.

Any suggestions or help please.

Suvajit

I have no problem with whatever you;d want to call me, so dont worry about that 🙂

1) Check this https://kite.trade/ and https://kite.trade/docs/connect/v3/websocket/

2) Have you looked at demand-supply zones? You can even look at targets based on standard deviations

3) In general, 90-95% sounds unbelievable, so you may want to double check everything again

4) Good luck on that, make sure you understand these things well before placing the order

5) I\’d suggest you read more on risk and money management techniques, maybe you should check with the Varsity module itself.

Good luck and all the very best!

Thanks Karthik Sir.

One quick thing, I am not a coder and so can I get some help on how to use those API’s to accomplish my tasks? Any documents or any step by step guide?

Yeah at the beginning the BackTest result was around 60-65% and then I did a lot of fine tuning and now in few cases I get even 100% success results. May be if I increase the timeframe to 720 days the results may come down.

I will let you know as I try with 720 days tomorrow.

Thank you!!

The link I provided you has all the technical documentation you\’d need. Unfortunately, I\’m not a coder either so very little help from here on this count.

Hi Sir,

What is Implied Volatility and how it effects our option trading, If you mention in our varsity please let us know the link. I have tried to see but i did not find it.

Regards,

Saikiran Garapati.

Yes, you can check this here – https://zerodha.com/varsity/chapter/vega/

Hello Karthik,

So far from the module I believe that have understood theoretically, however when I am trying to implement these into practice, I am finding it difficult. I need your help in understanding B&S.

Spot value of NIFTY is at 10661.55 and strike consideration in 10800 CE Jan 31st expire. Current option premium Rs. 32.05/-. Please find below B&S output.

Spot: 10661.55, Strike:10800, Expiry: 31/1/2019 @ 15:00, Volatility(%): 20.11, Interest(%):6.60, Dividend: 0

Call Option Premium: 17.80, Put option Premium: 152.35, Call option Delta: 0.202, Put option Delta: -0.798,

Option Gamma: 0.0018

Call Option Theta: -11.556, Put Option Theta: -9.604, Call Option Rho: 0.117, Put Option Rho: -0.475, Option Vega: 2.222

1. I have got the output based on the inputs that have giving.

2. I would like to know if the premium that is derived, is the premium that I should expect on the expiry date & time that I have given

2. I understand Delta value helps in increasing/decreasing the premium based on the directional movement of the underlying for both PUT & Call option, where I have got value as 0.202 for call option and -0.798 for put option. As a seller of call option I have 80% chance that the strike price will expire worthless.

3. Gamma tells us that the delta will increase by 0.0018 based on the movement of the underlying. Would like to know, like delta has range between 0 to 1 and -1 to 0, does Gamma also have any range.

4. Theta – Now i would like to know the value of Theta which is -11.556 for call option is saying that the premium will get reduced by 11.556 each day till expiry. If yes then on the expiry day premium should be 8.938, however B&S is showing premium as 17.80/-. Please explain

5. Vega: Based on the volatility movement the pricing of the option premium will either reduce or increase.

6. Please correct me on this – Since I see that the value of call option Theta is comparitively more that call option delta & Vega, it is obvious that there is time decay and the option premium will go down by the expiry, however how far is this true, because the same doesn\’t work with the put option considering it is ITM.

By the question that i have framed anybody can easily understand that I am confused or did not understand the concept. Please help.

1) Yes, B&S works on that basis. You give a set of input and that B&S will throw out the output

2) No, the premium is just the theoretical value, under ideal market conditions

3) Not really, but the gamma peaks when the option turns into ATM

4) Yes, but this is again under ideal market conditions. While theta erodes the premium, other factors may help in pulling the prices up

5) Yes

6) This is because we are very close to expiry

Good luck and keep going!

Hello Karthik,

Getting back to you again!! I have tried finding the exact formula for B&S in many sites, got few also however I am not getting the output of those when I do the calculation in my Excel and compare it with the Zerodha Calculator. I am hence requesting you, if possible can the formulas of B&S or some sample excel sheet be shared please?

I am just working out on things in practicality and trying to find my own answers to them. Please help.

Suvajit

Check this, Suvajit – https://sensibull.com/

I have this link of yours however it doesnt provide anything apart from the theoretical CE & PE premium. I would want the formula which will give all the greeks. 🙂

http://www.stern.nyu.edu/~igiddy/spreadsheets/black-scholes.xls

It is the standard B&S formula which throws out the greeks. Have you tried using Sensibull platform? https://sensibull.com/

Thanks Karthik.

I have checked Sensibull however for me that is too much of details as I am new the whole concept. I need to understand Few things please:

1) If I go to the NSE Site and Let\’s Assume I select \”WIPRO\” then go to the Options Chain.. Then I see many IV\’s marked as \”-\”. Can you tell me what do we consider in those cases where the value of IV is \”-\” for the Greek calculation?

2) May be very lame question, please pardon my ignorance. In an Option Chain, If I go DEEP ITM for CALL OPTIONS where I see that there is a Bid and Ask Quantity, I dont see and LTP value. How do I buy those Options if I want to buy them?

3) I understood that we BUY CALL Options when we have a Bullish outlook of the underlying. The Current Spot Price of WIPRO is 351, Ideally I should be buying values are ATM or OTM right? Like 355 or 375? So in case the price goes beyond 355 or 375 then I make profit of the difference. Is my understanding correct?

If I go the F&O calculator of Zerodha and put the strike price as 375 and BUY for CALL Options, I dont get any Margin details. However If I select SELL then I get the Margin details.

I may be making some blunder mistakes in terms of my understanding and hence I am getting confused. Please help.

BTW How do I attache the screenshots?

Suvajit

1) Look for the IV of an ATM options

2) Unfortunately, the liquidity in most of the deep OTM/ATM options is quite shallow. LTP shows up only when a trade occurs, in the absence of which there is no LTP.

3) Yes. Think about it this way, you buy an option by paying a premium, the premium increases (for call options) if the chances of the spot going higher than the strike increases. So if you manage to sell the option at a higher price compared to your purchase price, then you make a profit

To buy an option you dont need margins, you need only the premium about. To sell an option, you need margins. Upload the screenshots on google drive and share the link.

Good luck, Suvajit. Keep going!

Thank you Karthik Sir. 🙂

Welcome!

Hi Karthik,

Looking at Greek values, Can we build any strategy for Option buying and selling, any inputs what delta/gamma/theta/vega should be to buy or sell Options.

Do we need to use RBI interest rate for other stocks as well like Infosys, TCS, Tata Motors etc or it is only for banking stocks.

Thanks

Abdul

Yes, you certainly can. Especially things like the straddle and strangle. All of that and more here – https://zerodha.com/varsity/module/option-strategies/

Hi Karthik,

Should I use interest rate from RBI for non banking stock as well like Infosys, TCS etc.

Thanks

Abdul

Yes, that works.

Hi Karthik,

The current page https://zerodha.com/tools/black-scholes/ gives us a way to calculate the premium as seen currently. Is there a tool by zerodha to know the premium with time as future datetime as additional input along with spot price, volatility?

i.e., For example, i want to know what the premium of a certain option will be at Nov 20 or 22nd right now itself? (Assuming spot price, volatility i will input)

If not zerodha tool, can we do the same in excel?

I\’m not sure if this is possible. But however, one way to do this is to reduce the time to expiry to your target date.

Oh right! Thanks for the hack., just didn\’t think of it.

So as per the example i gave, when i want to know the expected premium of option on Nov 20, all i should do is calculate the number of trading sessions from Nov 20 to expiry date, let\’s say N days.

And input the expiry date is calculator as (Todays date+N trading sessions), which should give me the premium. Am i right?

Just one last help the above calculator. It doesn\’t work when the IV is beyond 100 (works for 100 though). I wanted to calculate the premium of option PCJEWELLER18NOV75, where it\’s IV is 101.43 as of now, it doesn\’t give any output.

Thats right, Vishal. Reduce the number of trading days and you will know what the fair price of the option on that day. I think IV has an upper limit at 100…will double check. Thanks.

Hi Karthik,

Thanks for varasity very helpful

I tried zerodha B&S calculator model for maruti 10000CE aug expiry it shows option price18.68 but as of now it is trading at price 24.55 can you tell me why the difference.

I have taken following inputs.

Spot price 9188.35 as on 3 aug

strike:10000

EXPIRY:30/08/2018

VOLATILITY:21.41

INTEREST:6.73

dividend:0

I think the volatility is much higher. Also, if the difference can be attributable to the difference in demand and supply.

does theta decay value shown in b&s calculator also considers non trading days that is saturday and sunday while giving its input.

for example at friday the theta of option is 0.5 and its preimium is 5 .Then all else equal will it open by monday at 3.5 or at 4.5.

It does, Omi.

Hello Sir,

I would like to know suppose if call option is 34 and theta is -4 at the starting of the day at around 9.30 am…If all the Greeks and price remain the same at market closing at around 3.30 pm option premium will be reduced by theta value of -4 and premium will become 30 or on next day opening it will reduce by -4…theta is calculated on hourly basis or daily basis?

Theta is on a daily basis, so all else equal, the next day morning the option will open at 30.

Hi,

I am not able to interpret the premium on the BS calculator. I input 26700 strike and spot as current close 26503 (Thursday close) volatility of 10.22(IV of 26700 strike) and interest rate of 6.48(RBI) and expiring coming Thursday (12th July)

The result is 70.66 Call option premium on BS.

Currently the 26700 closed at 88.5

Question-

How to interpret this? Intrinsic value is 70.6 and traded at 88.5? Ok so what now?

This means the market is valuing the option more than its theoretical value.

Dear Karthik

suppose canara Bnk in running at 255 today and i want to test the 280 CE rate with the help of B&S calculator. at this position which IV have to input , ATM Strike price input or my selected Strike (i.e – 280 CE) IV input? please clear the doubt.

Yes, Khurshid, you can actually input the ATM strike IV.

Hi Karthik

I\’ve heard of IV Rank and IV Percentile. Can you please explain them with examples? How to use them while trading options?

The concept is similar to Vol skew, will try and make a post on this soon. Thanks.

Hi Karthik

I understand that prices are governed by market dynamics but, today I saw 10800 Option closing at Rs2.5 but, BS calculator shows this value as 0.32 (Interest rate 10% + IV 12.85) which is almost 10 times less than the theoretical value – this seems bit too much of a deviation – in your experience is this normal?

Are you sure you\’ve used the right volatility input? Wrong IV inputs can lead to big changes in the premium.

Thanks Karthik. I think I used the correct IV but, will double check next time. Few more questions

1) BS is used for getting both Call & Put option premium but, in Nifty option chain the IVs for put and call (for same strike) are different – Different IVs I do understand the rationality but, then shouldn\’t the BS have different inputs of Volatility for calculating premium / Greeks of Put and Call option in this case?

2) Does is make sense to use dividend yield per the data provided on NSE website when using BS claculator

3) At what time on the expiry day Options stops trading. I am asking this because today (31/05) as you must be aware Nifty went to 10763 around 3:08PM and I had shorted 10750 CE but still the option price was 1.05. Shouldn\’t it have shot up to somewhere around 13Rs? Had the market closed more than 10750 making 10750 CE ITM would the difference have been deducted from my account when the contract was being finalized? – Also, Noted that around the closing 3:25PM the market went beyond 10750 for sometime – in this case should we square off the position or just let it expire because premium price was stuck at 0.05 at this time.

Hope my questions makes sense.

1) Technically speaking, the IV of both CE & PE should be the same for a given strike. But you won\’t see this in the market as each strike has its own demand-supply situation, impacting the IVs. The procedure for calculating the greeks and premium for CE and PE is the same, which is what the B&S calculator does. You need to enter the relevant IVs to get the appropriate figures.

2) YOu can if you are dealing with Nifty

3) It trades till 3:30 PM. Maybe there was no liquidity in the contract?

Thanks a lot sir

Yes there was no liquidity in contract as, there was no one bidding. It was an eye opener for me as even 2SD can sometime not be safe 🙂

Also, say market had closed at 10760 then I would have suffered a loss of 10 Rs (as I wrote 10750 CE) and money would have been deducted from my account – Is my understanding correct?

Yes, this is right, you\’d have a loss of 10 bucks.

Karthik,

Dont remember the exact para in Nse website . Posting here what I copied earlier from Nse notes. .. F = S * e rt where : F = theoretical futures price S = value of the underlying index r = rate of interest ( MIBOR) t = time to expiration. …

https://www.nseindia.com/gsa/NSE_Search.jsp?q=mibor%20rate

you may try this one too.

Sure, thanks, Najeeb.

Dear Karthik,

Seems NSE uses overnight MIBOR rates for risk-free interest calculation .Cant understand the logic why NSE uses 10 percent for IV calculations as showed in the note below option chain.

Not sure, Najeeb. By the way, do you have a link which says NSE uses MIBOR? Can you please share? Thanks.

Hello Sir,

I\’m just curious to know, we calculate our profits based on an assumed Delta value for a given option premium based on whether the strike price of the chosen option is either Deep ITM (Delta – 0.75 to 1), ITM (Delta – 0.5 to 0.75), ATM (Delta – 0.5), OTM (Delta 0.3 to 0.5) or Deep OTM (Delta 0 to 0.3). Obviously the spot price keeps changing during the open market and I\’m assuming that the Delta of any given option MUST also change based on which category (Deep ITM, ITM, ATM, OTM and Deep OTM) it falls under, as the spot price fluctuates. Is my assumption true? If Yes, how often is the Delta for any given option recalculated. If Not, are the Delta\’s of every option fixed throughout the day and decided at the opening price of the contract value? I would really appreciate your answer to this question.

You are right, Clifford. Delta changes with the change in the spot. The rate of change of Delta depends on the Gamma. I\’d suggest you read this chapter on Gamma – https://zerodha.com/varsity/chapter/gamma-part-1/

An applied DV of 5.25 can take AV to over 100 and it is not that extreme Karthik.Its only that its not visible because of lack of liquidity in options and traded price is looked into rather than the settlement price.In a sort Black swans are happening in individual scrips during random walks at many instances on a daily basis.May seem gibberish in economic thoughts but when I tested it seems a fact.

Very interesting. I do get your point on lack of liquidity and the isolated black swan events.

Karthik,

Testing checked for R com 50 CE current month expiry for an IV of 107.34.No output available.Till a volatility of 100 it is ok.

Ok. Looking into this. Btw, IV of over 100 is an extreme case 🙂

Dear Kartik,

Seems in the BS calculator AV input of over 100 is not seen captured in the provided model.Could you pls check?

Let me check this, I\’m dont think this is hard coded. Anyway, well see. Thanks.

Dear Kartik,

Seems in the BS calculator AV

Ok.

Demand and supply role ?

in option premium say ATM option people are doing more trading that means more demand so price will increase, how it differ from voltality ?

Volatility dictates the extent by which the premium varies, demand supply does not.

By seeing chart without indicator people calculate target SL etc. in stocks.

How about option trading without Greeks, expert people calculate the approximate premium ? or Greeks is required only or with experience it will come ?

Delta, helps you identify the premium to some extent but that apart, you can gauge this in the backdrop of your experience.

Karthik, i see for some of the strike priices the IV is 0 then, i am getting the call premium as 0. pls advice.

This is because the option has no trading volume, no liquidity.

Hello sir,

Whenever I use option calculator this gives me the theoretical value of option premium and then I compare this value to the actual value of premiums most of the time I found that the option calculator is providing a value for premium which is less than the actual market price of the premium it means that premiums are expensive to trade from the buyer\’s perspective right sir

So I should not buy the options??? Because they are expensive.

Thanks sir….

Ankit, the value obtained from the calculator is a theoretical value, whereas the value seen in the market is reflective of the sentiment prevailing in the market. If the difference is beyond an acceptable value then it does not make sense to buy…rather you can opt to sell them and collect the premium.

Yes exactly this is the dilemma that what should be the acceptable difference of theoretical value of premium and actual value of premium for buying purpose

Actually sir I have an open position in currency

Where I bought February expiry 63.75PE @0.3675 ITM and position is working for me but after buying this I realise that I paid much more than should I need to pay to buy this option

When I divided this premium into intrinsic value and time value I found that the intrinsic value something near 0.2625

I want to tell you that I got this intrinsic value from the following strike rate -RBI reference rate yesterday which was set by RBI @approx 64.54 like and after buying this the premium value actually dropped to that 0.2625 and came back after touching that level with my experience I observed that time value in ITM option THE TIME VALUE SHOULD NOT BE LIKE ABOVE

So to avoid this silly mistakes in future I have some question

1. is I bought an expensive option

2. How to calculate intrinsic value means what should be the formula

Is it strike -RBI reference rate OR strike – future rate or something else

By the way I was slightly bullish on Rupee but not sure about the future direction actually in coming future so I played safe and bout IDM option I expected some 40 to 50% value gain in 4 to 5 days

Thanks for help sir

Ankit, if the RBI Reference rate is 64.54, then the intrinsic value of 63.75PE is 0. So the entire premium of 0.3675 is attributable to the time value. Such high time value is justified since you\’ve bought the Feb contract, which will expire only next month. Intrinsic value is a non-negative number or 0. It is Strike – RBI Ref, but if it is -ve number, then the IV is considered 0, hence the rest becomes attributable to the time value.

Thanks but I am sorry RBI reference rate was 63.54 not 64.54.

I mistakenly wrote that 64.54

But now I got the point clearly that

INTRINSIC VALUE(PE)= STRIKE PRICE – RBI REFERENCE RATE

Right sir,

Thank you so much sir

Yes, that makes sense now. Good luck with the trade and remember, the intrinsic value of an option is always a non-negative number or 0.

Hello Sir,

1.B&S options calculator is used to know the Greeks values for that strike as per the spot how the premium calculated based on the volatility?

Correct me if I am wrong.

2.If the first point is correct

Now I want to modify the volatility increase/decrease, I can get the theoretical option price as per the B&S options calculator

Is B&S options calculator used for test cases?

3.Ideally this B&S options calculator value should match with the current option price in the market

How can figure out if options are over or under-valued and if volatility itself is under or over-estimated.

Please clarify.

Thanks & Regards,

Siva.

1) Not too clear with this – can you please rephrase it?

2) Yes, you can use B&S to calculate premium prices by altering the implied volatility. So essentially you can test for different scenarios

3) Not necessarily, the market can misprice the option leading to the difference in price.

Hello Sir,

Thank you for clarifying.

Thanks & Regards,

Siva.

Good luck!

Hi Team,

It could be really better if we can view the Greeks in the \’Positions Table\’ in Kite..! Hope you will work on this..!

Thanks!

Noted. Will pass the feedback, Rajesh.

I have made position for Nifty 10600CE on 14.12.2017 (Nifty Spot is 10252) during closing hours of market at a premium of 25.62 in anticipation of market opens gap-up on the back of positive gujrat exit polls which will be announced later in the evening. Later in the day all the Exit polls predicted BJP majority.

Market Today as expected opened gap-up 94 points but not made any follow through. The premium for my position opened at 35.6 and dropped to 27 after 30 minutes of market opening, but the underlying Nifty fell only 20 points.

My question is why premium fell suddenly when underlying not fell substantially.

This is because the volatility dropped the next day and with that the premiums also did.

First of all thank you karthik sir. I learned alot with Zerodha varsity. I tried to calculate Option premium by using zerodha B&S option premium pricing formula for Nifty as on 08.12.2017 closing time. the details are as below.

Case:1

Nifty Spot: 10265.65

Strike price: 10500

Expiry: 28.12.2017 15:30Hrs

Volatility: 13.67% (India VIX)

Interest: 6.15% (91 day T-bill rate from RBI website)

Dividend: 0

The output from B&S calculator is as follows

CALL OPTION PREMIUM- 49.41

The actual LTP premium price is 37.20

Case:2

Nifty Spot: 10265.65

Strike price: 10500

Expiry: 28.12.2017 15:30Hrs

Volatility: 10.57% (IV from NSE website)

Interest: 6.15% (91 day T-bill rate from RBI website)

Dividend: 0

The output from B&S calculator is as follows

CALL OPTION PREMIUM- 27.61

The actual LTP premium price is 37.20

it seems to be there is vast difference between actual premium and the theoretical premium calculated. Kindly explain me where did i got wrong and correct me.