7.1 – The Family pot

I hope the previous chapter helped you understand the structure of a Mutual Fund company. Although not essential, I believe that the understanding of the Mutual fund structure will help you at some point in your investment journey.

Moving ahead, we direct our efforts to learn more about Mutual fund investing. We will learn about the different fund category, fund analysis, fund schemes, and many other things associated with mutual fund investment. Now, before we learn these concepts, we need to understand a fundamental concept. From my observation, I’ve noticed that many people get a bit lost when we use the term ‘fund’ in the context of a mutual fund.

So before we start digging deeper into the mutual fund concepts, we must get complete clarity on what the term ‘fund’ means.

I will take the liberty to simplify many things in this chapter; the simplifications in this chapter are only to help you get the context right.

So let us started, and as usual, let us build an imaginary story to help relate to the topic better.

Now, think of yourself as the stock market whiz-kid in your family. You have made a few successful stock investments, managed to score few multi-bagger, called the market top and bottom couple of times, and have even managed to get a selfie with Rakesh Junjunwala at an event.

The story of your stock market success has sent a ripple in your family circuit, and you are even the centre of attention in the family WhatsApp group.

As expected, soon, your uncles, aunts, and cousins approach you to help them manage their money. The quasi fund manager status that you have achieved for yourself has gotten you all excited.

The question is – how will you manage this money?

Going strictly by regulations, unless you hold the license for fund management, like the PMS license we discussed in the previous chapter, you cannot manage other people’s money.

Given this, assume that you apply for a fund management license and eventually procure one from SEBI.

Now, you are all set to render your fund management services to your family members and hopefully soon to many others outside the family.

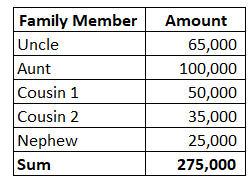

Your family members are happy and are eager to reap the benefits of your fund management skills. The following family members approach you with their money. The details follow –

So you have five individual investors and each one of them has a different amount of money to invest. In total, across these five individuals, you have managed to pool in Rs.275,000/-.

Before you get started, you need to set a few expectations –

- All investors are treated fairly in terms of return generated

- You are permitted to treat these individuals differ in terms of service provided. For example, the aunt has invested the highest amount, so maybe when she visits, you can give her coffees and cookies, while the nephew has invested the least, so you can decide not to offer the coffee and cookies

The above two are critical points, let us spend a bit more time to rivet it.

Imagine you and I walk into a restaurant. You are a regular at the restaurant have been to the restaurant multiple times and have generated enough business for the restaurant. However, this is my first visit to the restaurant.

We both end up ordering a portion of biryani. The quality and quantity of the biryani we both get served will remain the same. However, since you are regular, the owner himself may decide to serve you with fine silver cutlery, and the owner may even spend a few minutes chatting about your well-being. On the other hand, I’d be served with regular cutlery and treated like a regular customer.

However we both get to eat the same dish, no difference there.

So you as a fund manager can differentiate between customers on how much they have invested, but should certainly not differentiate and generate two different returns for two different customers based on how much they have invested. They all should experience the same returns.

In fact, in the mutual fund world, this gets further streamlined in terms of investment objectives, mandates, and other things. We will get to that in the next chapter.

Anyway, now that the expectations are in place, it now boils down to logistic arrangements on how this money gets managed.

To manage this money, you now ask your family members to transfer all the money into one single account. The idea is to pool all the money in the same account and use that to make investments in the market.

Since it’s all pooled into one account, that account holding the funds belongs to all. Think of this as a rationale as to why ‘Mutual funds’ are called ‘Mutual’ Funds.

7.2 – The fund logistics

As a fund manager, it is your responsibility to ensure that those funds are invested in the stock market, and it grows at a healthy rate. The selection of stocks is your prerogative, and you get to pick the stocks, choose for how long to hold them and decide when to sell them. While you do this, you need to ensure that every investor of yours is given the same treatment in terms of wealth creation.

Remember, you are pooling all individual monies and investing it as a whole aka a fund. So the return experienced by the investors should be uniform.

So given this, how do we ensure we have an equitable distribution of returns across all the clients?

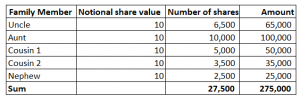

To do this, we can start by issuing shares against the investment made by each investor. We can start by assigning a notional value to each of these shares.

This notional value or the initial value can be anything, and you can assign 5,10,50, or even 100 as the starting value. It does not matter. The most popular notional value is Rs.10, so we will stick to that.

We now issue Rs.10/- notional value shares to all our investors and estimate the number of shares each investor holds. For example, the uncle has invested Rs.65,000/-, so he gets –

= 65,000/10

= 6500 shares.

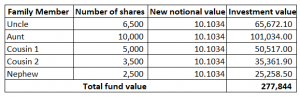

The table now looks like this –

The total number of shares distributed across the five investors is 27,500, which, when multiplied by the notional value, i.e. 10, gives us the total corpus value, i.e. Rs.275,000/-.

Alright, now that the fund is formed and shares distributed across clients, the fund manager gets to work on things he is best at, i.e. to pick stocks and invest the money.

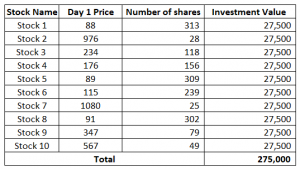

As a fund manager, you decide to invest the funds, i.e. Rs.275,000/- across ten stocks. For the sake of simplicity, you choose to invest the same amount across all the ten stocks. The distribution of funds in this manner is referred to as the ‘equally distributed portfolio’.

The total corpus is Rs.275,000/-, so each stock gets an investment of Rs.27,500/-.

The division of funds across the ten different stocks look like this –

As you can see, the money invested across ten different stocks, each with different share price, but the same investment goes to every stock, i.e. Rs.27,500/-

At this stage, two things are in place –

- The shares are issued to all investors. The number of shares is proportional to the individual investment made

- The funds are invested in the markets across ten different stocks

Now, once the funds are entirely invested in the market, the value of the overall fund depends on how the shares perform daily. A few stocks can go up, and a few can come down, resulting in either a profit or a loss. This profit and loss should be passed to the investors. The quantum of profit or loss experienced by the investors is directly dependent on the amount of money each investor has invested in the fund.

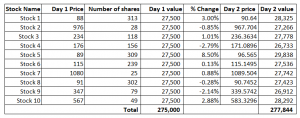

Let’s continue the example to see how the P&L pass through happens. I’ve randomly assigned percentage movement to all these stocks.

As you can see, the stock prices have changed on day 2, thereby the invested value across each share also varies accordingly. As a result of this change, the total value of the portfolio is Rs.277,844. The fund has generated a one day return of Rs.2,844/- or 1.0340%.

The profit of Rs.2,844/- has to be distributed across all the five investors in proportion to their investments. To ensure a fair distribution, all we need to do is, ensure the notional value goes up (or down) by the same percentage as the fund, which is 1.0340% in this case.

Initial notional value (day 1) – 10

P&L % in funds – 1.0340%

New notional value (day 2) – 10 *(1+1.0340%) = 10.1034

So, the new notional value is 10.1034, multiplying this with the number of shares should result in the new investment value for the investor.

As you can see, the investment for each of the investors has gone up by the same percentage point, but the absolute money made by them differs, based on the initial investment amount.

Also, if you add up all the new investment amount, you will get the new fund value, i.e. Rs.277,844/-.

Before we wind up this chapter, I want you to remember these points in the context of a mutual fund –

- An investment fund is formed when different people pool in their money

- The investment objective remains the same across all the investors

- Notional value is assigned at the start of the fund formation, which then fluctuates based on the daily investment value. In the Mutual fund world, this is called the ‘Net Asset Value’.

A mutual fund’s net asset value or NAV is one of the most important metrics. On an end of day basis, the mutual fund company does the following calculations –

- The value of all the investments

- Expenses of running the mutual fund

Based on these two parameters, the NAV of a fund is estimated daily. The formula to calculate the NAV is –

NAV = (Value of all the assets – the expenses)/number of shares (units)

I’ll end this chapter here. I’ll be happy if you have fully understood the concept of what a fund is and the role NAV plays.

We are still in the early stage of the learning curve, and we will revisit these topics. However, before I wind up this chapter, I have a question for you related to the example we used in this chapter. On day 3, suppose your father in law approaches you and wants to invest Rs.75,000/-, at what rate will you issue the shares to him?

Would it be Rs.10 (initial value) or Rs.10.1034/-?

Key takeaways from this chapter

- In a mutual fund, different people invest in a collective investment vehicle with a common investment objective

- Every investor in a mutual fund is treated equally in terms of percentage return

- At the start of the fund activity, every investor is issued shares/units at a notional value

- The value of the shares/units change based on how invested assets perform daily

Hi Karthik Sir,

I really enjoyed the content — thank you for sharing it.

From my understanding, a MF operates much like any other listed company on the stock market. Its core business activity is to invest in other publicly listed companies. The Net Asset Value (NAV) essentially represents the per-unit value of the fund, similar to how the share price reflects the value of a company’s stock.Therefore, when we invest in a mutual fund, it’s akin to buying shares of the AMC-managed portfolio at the prevailing NAV. Kindly let me know if my understanding is correct or if there’s a more nuanced way to view this relationship.

Divyam, yes, thats sort of correct (if it helps you understand the concept). The only difference is that the NAV does not represent the company\’s (AMC) profitability, but it simply reflects the profitability of the stocks the the AMC has invested.

For example, there could be a very poorly run AMC compnay with a very good Mutual fund. So as a share holder of the AMC, your investment may not do well. But as a unit holder, the NAV may increase.

Another real example – HDFC AMC is listed, the shareprice there is different compared to the HDFC\’s various schemes.

Hope this helps.

Can you please clarify what do you mean by expenses. If suppose anyone who invested wants to get their money(current value) back is it considered as an expense in the NAV. How to give weights or numbers to the risk involved in expenses??

The company managing your funds will have expenses right? Thats what I\’m referring to.

New unit rate at 10.1034

Sure. Happy learning!

Hi Karthik,

Why compound interest formula has been used to calculate new notational value not simple interest ?

Sorry, dint get the full context. Can you please elaborate? Thanks.

Plz Bengali language

I don’t understand too much English language.

I have one question which I am trying to understand. I understood the above explanation. My question is that if someone wants to redeem his/her share of investment in a mutual fund, at what price will that be redeemed by the AMC. Will that be the applicable NAV for the day or something else? Because in simplest term an AMC will have to liquidate holding proportional to the member\’s share (assuming in the above scenario which doesn\’t have Cash balance).

Yes, there are cutoff timings basis which you will be allotted NAVs. Check this – https://support.zerodha.com/category/mutual-funds/coin-web/general-questions-coin-web/articles/cut-off-time-for-mutual-fund-transactions-on-coin

Kindly bring everything basic to basic about stocks and finance from zero to top level. And let me know then.

https://zerodha.com/varsity/

I just want to say thank you to you. Zerodha varsity is best resource to start learning about investing.

Thanks for letting us know, Mehul. Happy learning 🙂

Thanks for your explanation of these subject clearly understand 🙂

Happy learning 🙂

Thanks for democratising the basics of the Stock market and Mutual Funds.

More power to you!

Happy learning, Shubham.

Hi Karthick Sir

How does the SIP work does it work in the same way, right?

Same way as in? Can you elaborate your query please?

Thank you so much for this. This is helping me a lot. The content is explained in simple and effective way.

Happy learning, Pratiksha!

so here we can say new notional value is NAV? if it is not can you plz give an example?

Yes. Do check this video – https://www.youtube.com/watch?v=UD2s3RRvW3A&list=PLX2SHiKfualGsjgd7fKFC-JXRF6vO73hk&index=6

Great Narration Skills. Thanks Karthik for your time and effort.

Happy learning, Sandeep!

Simple ! yet effective way of explaining things. At the end of every chapter we are left curious to move to next chapter. Thanks for your kind efforts of making people aware about investing.

Happy learning, Pankaj!

All chapters from 01 to 06 on mutual fund beautifully explained. I am having account but not improved much in trading but hope after reading all chapter, improvement will be there.

I\’m happy that you liked the content here. Happy learning 🙂

Dear Karthick, Good morning, from yesterday only i am reading your modules. I read only 4 modules. Very much happy. Detailed explanation with examples in real life, is very good.

I am thinking of studying your modules and follow the modules further to get more knowledge.

I request you to continue your teachings,

Thanking you,

subbu.

HI Karthik,

Great article !

Had a question, notional value is used during NFO only right ? and then it becomes the NAV after that ?

Yes. Usually sarts with 10 and goes on as the market moves.

Dear Karthik sir,

Awesome chapter !

i have a mathematical question here, please guide .

suppose now new person( Father in law) comes in ur above list with 75000 rupees.

he will be getting new units at 10.1034

*Here i am getting stucked (i know its a stupid question, but i am not afraid to ask from my teacher karthik)*

now, if i am adding 75000 in existing fund 2,77844, suddenly NAV is getting reduced in Excel as it is getting derived ROI from total capital…….

i hope i am able to make my stupid query understand ,please help to resolve sir…….

Jai hind

sorabh dhiman

Not sure if I understand your query completely Sorabh. The new fund makes no difference as it will get used in buying more stocks.

Hi Karthik sir, very nicely explained in lay man level. Thanks a lot !hh

Glad you liked the content, Satish. Happy learning.

Hello Karthik Sir,

I am big fan of varsity and of course you . Lots of love !

Q. suppose a mutual fund contains share A in its portfolio and I buy some units of mf. Tomorrow , company removes share A from its portfolio and add share B to mf portfolio. As I have purchased this mf in the past and holding it , would I be invested in share A? Can company sell portion of share A allocation which I have blocked by purchasing some units earlier and replace it with share B ?

Thanks for the kind words, Amit. Yes, the MF can choose to sell either the complete holding or part of the holding. It is up to the AMC.

why the new notional value i.e. day 2 is calculated in the compound interest formula?

You cannot skip the values right?

Hi Sir, did you get a chance to look into the scenario we discussed above? – 5% difference in returns between Nifty chart and Nifty 50 Index fund within a span of 1 year

I did, I think between two random points, sometimes tracking might seem high due to various reasons like flows, corporate actions etc. Don\’t know where you are checking, but the generally the difference is not much.

Can you make a module on how to invest in IPOs? Like what to look for in the DRHP and all that stuff? It would be really helpful. PS: Great job making these modules!

Do check this – https://tradingqna.com/t/if-a-new-company-went-for-ipo-as-an-investor-how-can-i-determine-that-i-am-investing-in-a-good-company-since-there-is-no-past-data-available-at-the-exchanges/324/2?u=bhuvanesh

Response to Yashwanth – Index Funds are designed to move alongside the Nifty Index. However, we\’ll see that the fund does not have the exact return percentage as the Index. As you guessed, one reason is the expense ratio. The funds are independently managed by to closely align with the index, however, it is possible that the fund outperforms/underperforms the index. Be sure to check the \’Alpha\’ of the fund.

Hi Sir, I was going through the Nifty chart as well as the ICICI Pru / UTI Index fund N.A.V chart. I have taken the starting and ending dates as : Dec,2020 – Dec,2021. What I have found out is that, Nifty has gained 30.5 % over this period , whereas the N.A.V of the fund has grown 24.8% . I understand that some of the percentage here is lost due to expense ratio, but since this is an index fund( direct ) expense ratio being 0.1 % shouldn\’t be effecting much. But still, the difference is over 5 % which is very huge for just 1 year period. Can you please explain why is that? Am I missing something here ?

I guess a few percentage points can be attributed to both the expense ratio and the tracking error. But as you said 5% is on the higher side. Let me dig up more information.

Dear Sir,

Your account on personal finance and mutual funds is riveting like a nice story telling. Thanks for bringing in so much of clarity on the subject. Kindly clear my doubt on this topic of Concept of Fund and NAV:

In the example given above if one of the member wants to redeem his entire units but none of the existing or new investor wants to buy more units then who will pay the amount to the member who is redeeming his units? Will the fund manager pay it or fund house will borrow money from any lender? Pl clarify this point.

Thanks, Arvind, glad you liked the content. In such a case the fund has to do this. As an AMC, they are supposed to fulfil these obligations. For these reasons, AMCs maintain cash position to service redemptions.

Hi Karthik, How are you?

I have a doubt regarding NAV. Based on what you have explained in the last few paragraphs, does it mean that higher the NAV (on average) the better? If so, should one invest in that Mutual Fund?

Thanks

Not really, but of course, you want the NAV to go higher after you invest. But NAV should not be the focus point of your investment decision in a mutual fund.

If i order is set on Sat(16th Oct 2021) and for eg the NAV was 44 at that time.But on monday the NAV went to 43.5.

So which NAV will me allotted to me.

Monday\’s NAV.

Can a mutual fund\’s demand also impact it\’s NAV? Just like in case of stocks the price can increase if it\’s demand is high, can such demand-supply dynamics also affect mutual funds?

you have a brilliant way of simplifying any dreaded concept . Totally in love with the teaching style!! please keep up the good work !!

Also, the answer I am guessing is 10.1034 ? just because it is associated with NAV and we all buy at NAV only

Assumed Explanation : Since the fund has performed well the account now holds the new value 277,844 /- and we need to invest it completely for equal distribution and ease of maintaining records ?? Please clarify why 10.1034 and not 10 ?

Thats right Raj, divide the total assets by the units and you\’ll get the answer 🙂

We give to last nav amount but reduced the unit quantity

NAV is the price at which you transact, both to buy and sell the mutual fund.

Thanks for this easy and elaborative explanation. 🙂

I am having a doubt:

In the above given example, there are 5 persons who have invested in the Mutual Fund.

Now fund Manager will invest the total of 2,75,000/- in stocks etc to generate the profit for their investors.

Now let\’s say after 3 days, Uncle wants to withdraw from this Mutual Fund scheme, and wants his 65,000/- (or whatever the value of that 65,000/- is at the end of 3rd day) back.

Now, at this moment Fund Manager will have to sell some of the stocks to repay back to Uncle.

So, how withdrawl of money by 1 Person(Uncle) will impact the other people(Aunt,Cousin1/2, Nephew)?

Thanks

Aaksha, for this reason, MFs have a cash component that they tap into for accommodating withdrawals and redemptions.

But what about rebalancing? Should we do it on mutual fund?

What if the fund give same return as index? Or if it gives lesser than index?

Please clarify

Yes, you can rebalance your MF portfolio. I will try and put up a chapter on this sometime soon.

I meant, eg. as per example given in the article, lets say as a fund manager of my family fund i decided to completely liquidate \”Stock 10\” worth of 28292 on Day 3 then what will happen to the liquidated amount? does it affect the NAV in any way?

Yes, that will have an impact on the fund. But its treated as the same was stock 10\’s worth increasing or decreasing on any given day.

hey how does the NAV changes and the change is propogated during the event of Re-balancing

NAV changes on a daily basis, Anup. The AMC declares the updated NAV on a daily basis.

Very simple and lucid. I still cannot calculate the percentages.Is it possible to explain step by step.

Percentage change = (current close-previous close) / previous close.

It would be issued at 10 rupees rate na? That is the basic rate we assume? Why would we consider the appreciation of 1.034% for new issue?

It would be issued at 10, but after that the NAV grows right? The growth rate for that particular day is 1.034%.

Hi sir, I did invest in to diversify my portfolio. But the measure of alpha or beta is very low over a period of 6-8 months. So I stopped or paused my SIP. And altered my investment, keeping this fund ideal. I can leave it for long-term but not sure if there\’s any unit\’s charged for not contributing to the fund

Ganesha, I dont think you should alter the SIPs once you start. The idea with SIPs is to keep continuing it regardless of all the short term noise.

I have a flexi cap fund, where the current SIP is stopped because the fund is not performing as expected.

Should I redeem my NAV? or hold for any additional benefits as it grows in future?

Ganesh, this depends on why you invested in SIPs in the first place and why invest in this fund. Ideally, SIPS should be for the super long term and should not be liquidated basis short term performance.

I wonder if standard textbooks cannot be so lucid in explainong topics. Good work Mr Karthik

Thanks, Girish! Hope you continue to enjoy reading the content here on Varsity 🙂

Higher the NAV more the return?

Yes sir.

Hi Karthik, all of this is so wonderfully explained, was wondering if a deep diving into insurance pricing, especially ULIP\’s is something that can be dealt with by Varsity.

Thanks, Harini. I\’ve still not thought about what to cover in Insurance 🙂

Good day Mr.Karthik,

MF, your explanation is very interesting. Is it possible, an investor withdraw his investment after a month or so? If so, how do we calculate the total investment? suppose we informed the investor the activities on daily basis, first of each month, and he wants to withdraw on 5th

can he claim the amount till 5th or until month end.

Secondly, another investor wish to add fund on 6th, do we want to maintain another account with notional value 10/-?

Do we ask the investor, the period of which he wants to invest b4 starting the MF?

Yes, you can. To do so, please look at the overall number of units you own and apply to redeem these many units. Thats it. Same with adding funds.

Hi,

(1) NAV for a mutual fund reflects latest value of invested share and is revised each day. I want to get clarity that the NAV for my mutual fund in the morning is based on previous day closing value and same day opening value of stocks ?

(2) How can I time my investment best in Mutual fund to maximize returns ?

1) Its based on the previous day\’s closing.

2) Multiple research has pointed towards SIPs as the best way to deal with MF investments.

Wonderful and simplified explanation. I love how you explain things from scratch which we\’ve been hearing since years. But I\’m still confused on –

1. Whether buying/selling of MF affect the NAV. If yes, how would it be calculated?

2. What happens to NAV if there are more buyers than sellers or vice versa? Do market forces and value of investment both affects the NAV? If no, who buys if there are more sellers?

1) No, it does not.

2) Nope, unlike a stock, the demand and supply do not directly impact the NAV.

very nice approach for explaining a concept. please continue

Happy learning!

well explained with full clarity. Thanks for this karthik sir

Good luck, Dushyant.

The NAV of day 1 was 10 and day 2 was 10.1034. The NAV for day 3 will be calculated after the market close on Day 3. On that NAV, the shares should be issued to father-in-law.

Am I right or am I just confused somewhere?

Thats right, if the person has bought on day 3, then he will get the NAV of day 3.

Hello Sir, It\’s really wonderful how you explain these concepts with such simplicity.

I think, practically, father in law would be issued shares, neither at 10 nor 10.1034, but at the the notional value of day 3. Am I right?

On day three, the value is 10.1034, so that will be the value right?

Hello Sir, It\’s really wonderful how you explain these concepts with such simplicity.

I think, practically, father in law would be issued shares, neither at 10 nor 10.103

Thanks, Harsh. I will double-check that.

sir does that mean the initial notional value is same as face value of a share? And NAV is like current trading share price of a company? Also sir in order to judge the performance of a company we generally look at the historic share price of the stock and its CAGR(10yr, 5yr etc.). So, as far as AMCs are concerned can we check their past performance comparing its NAV 10yrs Vs. Now? If yes then where can I find such information?

Thats right. The value of the NAV will depend on the market value of the securities in the scheme\’s portfolio. Later in this module, I\’ve suggested few methods to evaluate the mutual fund, you should take a look at that 🙂

Excellent job Karthik. I have sent you a message of appreciation on Instagram as well.

Thanks for the kinds words, let me check your msg 🙂

10 *(1+1.0340%) = 10.1034

Correct me if I\’m wrong

1. 10 == Notional Value

2. 1.0340 == Percentage change on Day 2

The only part I didn\’t get is what is \’1\’ that is added to the Percentage change and why did we add it. If you could please explain, that would be helpful.

Ah, that 1 is a mathematical formula to calculate the new value. Expand the equation and you will know 🙂

Hello Sir,

You\’ve explained the topic very well, easy to understand, especially when it involves these tables and stuff.

The only part that I didn\’t get is how did we calculate the Day 2 notional value, I didn\’t understand the formula you used, can you please explain it.

Thanks Avinasah. The calculation of notional value is simple (have explained in the chapter itself). Which part is confusing you?

Hey Karthik,

Understanding Mutual Funds had been a rocket science all this while for me and with this article and the previous one, i have now a very clear what this is now. I wish i had read this one way earlier than now so that i could have started my investments into Mutual Funds, but as you had explained in your previous chapters it is never too late to start investing. Thank you so much for this.

Good luck, Sonu. Yes, its never too late 🙂

Next and previous buttons at the top and bottom of the article will make navigation simpler.

Also, if the sites remembers which articles user has read and marks them, it would be awesome.

Thanks, noted. Will pass the feedback to the team.

Are we expected to invest in mutual fund after looking at NAV?Do we have option to see past NAV?

Yes, you can look at the historical NAV. It is available on https://coin.zerodha.com/

So if i give this \’investor\’ Rs. 1,00,000 /- today and if the notional value for today is say 10.1212%, I will get shares for 10.1212% ?

You mean a notional increase of 10.1212%? Yes, in that case, you will get the incremental value along with the original investment.

Just turn on Google translate when you are on Varsity webpage modules. Glad this will help.. 🙂

Hello Karthik,

How you calculated new notation value with the given profit?

New notional value (day 2) – 10 *(1+1.0340%) = 10.1034

Explain the above calculation more detailed

You increment the previous day by the % gain, that\’s it.

Thanks a bunch.

Thanks a ton for this article.

◦The value of the shares/units change based on how invested assets perform daily

Q1-On Day1 if NAV=10 and units=50 and on Day2 if NAV=12, then also Units will be 50 only…Right ?

Q2-If new investor/existing investor comes with 500/- then Units will be calculate as 500/12=xxxx)..Right ?

1) Yes, the value of your investment one day 1 is 10*50, and on day 2 is 12*50

2) Right.

Hi Karthik,

As per this formulae (Value of all the assets – the expenses)/number of shares (units). In the above scenario number of shares or units is number of shares distributed(notion value) to family members?

Yup.

In the formula of NAV, what does the expenses include? How much is it approx?

Also, very well explained. Continue with such good work!

The expense includes all AMC expenses towards managing the fund.

Sir, kindly share the pdf.plz..

Will do, once the module is complete.

Thank you for enriching our knowledge about mutual funds. I feel more aware informed.

Happy reading, more chapters to come 🙂

Dear Karthik,

Your use of examples makes the entire concept very simple. Could you please share how should we judge a mutual fund manager as his judgement and experience matters the most?

Any parameters or benchmarks which is available online? How do you rate a fund manager?

That\’s a very tough call. When you look at a fund, you need to look at the fund objectively since taking a call on the fund manager will be really tough.

So then i think mutual funds are great for investment because let\’s say if i invested 1 lac in MFs ,

Because of people\’s pool money and its gets invested in diversified stocks even if my 1lac invested didn\’t perform well in stocks but remaining people\’s money invested performed well thats going to benefit me…if i would have invested 1 lac on my own it would not have do well or might be more likely to not perform well…but the Mf collective pool and diversification i am going to benifit.

Is that right hypothesis…my risk gets reduced in mfs?

Its not entirely correct. Lets say I have invested 10K and you have invested 1L in the same fund. The fund loses 10% value, then both our losses will be 10%…mine will be 1K, yours will be 10K, but 10% applies to both of us.

So total expense ratio 1.04% means does it gets apply everyday ,is it right?

i.e every day expenses =days Asset value *1.04%

No, its 1.04% on a yearly basis.

Karthik I didn\’t see the Personal finance course on the varsity app, so please upload this too on the app and also include Mutual funds certification on it.

Love this Module and enjoying learning with Zerodha.

Rohan, the module on personal finance is still work in progress. This is will be uploaded to the app once the module is complete. I\’m glad you liked the content 🙂

plz upload pdf version for entire topic of \”Personal Finance\”.

YEs, but once the module is complete.

Dear Karthik Sir,

Let us consider two mutual funds. MF 1 has an AUM of Rs. 400 Crore and NAV of Rs. 400/-. This means that there are 1 Crore units of MF 1. Now MF 2 has an AUM of Rs. 200 Crore and NAV of Rs. 2000/-. So, MF 2 has 10 Lac units. Say, both of the funds are giving same percentage of returns over a particular period of time. Now can this \”number of units\” thing be a deciding factor from the point of view of choosing a fund? If yes, please tell why. I found such a situation in – https://www.moneycontrol.com/mf/etf/.

Thanks in advance.

No, the number of units outstanding is just a technicality and has no impact while selecting the fund.

Thanks for your efforts…

What would be the new notional value (day2) if the investment value becomes 265000 instead of 277844?

How it would be calculated?

Ah you\’ll have to do the same math, Suresh.

thank you sir , your doing great .

Good luck to you as well!

thank you sir and what if one gets to invest in a stock were he required more or less than 27,500(according to example )

You adjust it accordingly.

1.what if one gets to invest in a stock were he required more or less than 27,500(according to example )

2.in example the calculation of share price * number of shares ,i think you got it wrong 234*118 = 27,612 (the whole table)

Let me relook at this, but you do get the concept right? That is the key message here 🙂

If buy a share, there STT is 0.1%. So, how is it possible expense ratio of mutual fund 0.1% ?

MF\’s enjoy a pass-through structure. No STT for them.

You said that \”You are permitted to treat these individuals differently in terms of service provided\”. How MF AMCs treat different investors differently in terms of service provided?

That was not in the context of and AMC, Akash. Its explained further in the chapter.

1. how frequent and at what time any fund manager can withdraw am

ount from any stock and invest to other stock.

2. can fund manager withdraw and invest fund on intraday basis or in F&O.

3. for how much period, my deposited amount can not invested in any stock by fund manager.

1) It is upto the FM. He can trade and invest like anyone of us

2) F&O is allowed to hedge and do arbitrage

3) Upto the fund manager\’s discretion

Sir in previous concerns – the intention is ,the initial Price (i.e) 10.00 of any Mutual fund scheme will turn into Zero or the initial price become Negative (ex: initial price as (-9)) in any of the circumstance .

Elamparithi says:

January 7, 2020 at 10:19 am

Hi sir,

Is there any circumstance Allotted NAV in mutual fund will become Zero or Negative Value ?

Regards

Elamparithi R

No sir, -ve is not possible.

Hi sir,

Is there any circumstance Allotted NAV in mutual fund will become Zero or Negative Value ?

Regards

Elamparithi R

Nope, not possible unless everything that the fund manager is holding goes to 0.

Father in law will be issued units at Rs.10.1034. By doing this, it will equalize the impact of new investor entering the fund. Thanks

Happy learning!

Please also explain how do units are calculated and allotted based on NAV. Thanx

Hmm, have illustrated an overview in this chapter Satish.

Exstatic to learn further. Please do publish next chapter as early as possible.

Thanx

Will do, hopefully soon!

Lovely content. Thanks!

Happy learning!

Dear sir, what is liquid bees, liquid fund and nifty bees.?. Thanks

This is a big topic, will be writing about it in details, Keshav.

Thanks for explaining Mutual Fund concepts in a simple manner with easy to understand examples.

Adding more content, Allan. Stay tuned.

Sir I appreciate your efforts for investor like me

Happy reading, Akhilesh!

Great Explanation Karthik.

I have a query for FOF (Motilal Oswal Nasdaq 100 FOF). Since this fund depends on Nasdaq 100 index, if the Nasdaq is going down will the NAV value decrease? Or will NAV remain constant?

I am investing INR 20,000 per month in \”Motilal Oswal Nasdaq 100 Direct FOF\” fund through Coin as international diverfication. Is it a good fund to stick with even when the market goes down?

Thanks in advance.

Regards,

S Kumar

I\’m not sure about the fund, Kumar. Will take a look at it though. The NAV will be depended on the Nasdaq value.

Wonderful explanation. Learnt these things with lot of difficulty. Looking forward to AUM and other stuff. Exciting

Yes, will cover all these concepts and more 🙂

Yay! I already knew this. Yet, i feel like I\’ve learnt something new today. Thanks for such a detailed explanation.

Happy learning, Dibakar!

Thank you for the detail explanation. I understood what is NAV now and how the mutual fund work.

Appreciate your efforts.

Thank you for the detail explanation. I understood what is NAV now and how the mutual fund work.

Appreciate your efforts.

Thanks, please stay tuned. Will add more content on this topic.

Very well explained with relevant analogy. 👍🏽

Will serve as good guidance for Beginner MF Investors, especially during low CAGR, dull market periods. 👏🏽😊

Looking forward to the subsequent sessions.

Thank you.

Thanks, Dheeraj. Will add the subsequent chapters soon!

Nice article and explanation. Please post such informative articles regularly.

Will do, Vinod!

Plz in hundi

Very simple language explaining how mutual funds work. Great

Thanks, Navin and I\’m glad you liked the content.

So easy to understand the concepts and looking forward for the subsequent lessons! Keep it up and Thanks!

Glad you liked it, Bellie 🙂

Karthik there\’s no way anyone is going to get the answer wrong after such a lucid and simple explanation. We would issue the new unit at 10.1034 right?

Thats right, Sundeep 🙂

Pless hindi language me dale this ceptur

I don\’t know English language

Working on it, Dilip.