23.1 – Case studies

We are now at the very end of this module and I hope the module has given you a fair idea on understanding options. I’ve mentioned this earlier in the module, at this point I feel compelled to reiterate the same – options, unlike futures is not a straight forward instrument to understand. Options are multi dimensional instruments primarily because it has many market forces acting on it simultaneously, and this makes options a very difficult instrument to deal with. From my experience I’ve realized the only way to understand options is by regularly trading them, based on options theory logic.

To help you get started I would like to discuss few simple option trades executed successfully. Now here is the best part, these trades are executed by Zerodha Varsity readers over the last 2 months. I believe these are trades inspired by reading through the contents of Zerodha Varsity, or at least this is what I was told. 🙂

Either ways I’m happy because each of these trades has a logic backed by a multi disciplinary approach. So in that sense it is very gratifying, and it certainly makes a perfect end to this module on Options Theory.

Do note the traders were kind enough to oblige to my request to discuss their trades here, however upon their request I will refrain from identifying them.

Here are the 4 trades that I will discuss –

- CEAT India – Directional trade, inspired by Technical Analysis logic

- Nifty – Delta neutral, leveraging the effect of Vega

- Infosys – Delta neutral, leveraging the effect of Vega

- Infosys – Directional trade, common sense fundamental approach

For each trade I will discuss what I like about it and what could have been better. Do note, all the snapshots presented here are taken by the traders themselves, I just specified the format in which I need these snapshots.

So, let’s get started.

23.2 – CEAT India

The trade was executed by a 27 year old ‘Options newbie’. Apparently this was his first options trade ever.

Here is his logic for the trade: CEAT Ltd was trading around Rs.1260/- per share. Clearly the stock has been in a good up trend. However he believed the rally would not continue as there was some sort of exhaustion in the rally.

My thinking is that he was encouraged to believe so by looking at the last few candles, clearly the last three day’s trading range was diminishing.

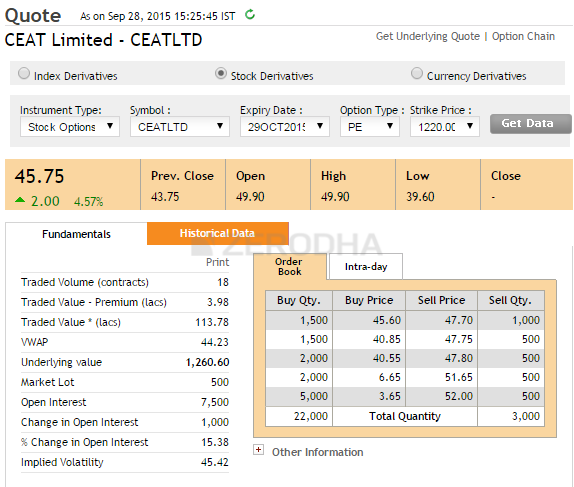

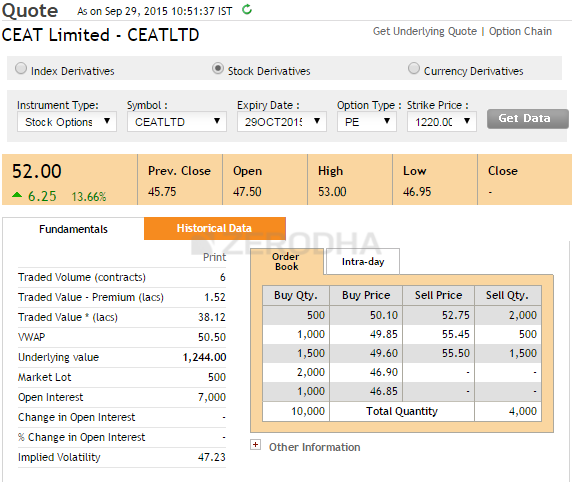

To put thoughts into action, he bought the 1220 (OTM) Put options by paying a premium of Rs.45.75/- per lot. The trade was executed on 28th September and expiry for the contract was on October 29th. Here is the snapshot of the same –

I asked the trader few questions to understand this better –

- Why did you choose to trade options and not short futures?

- Shorting futures would be risky, especially in this case as reversals could be sharp and MTM in case of sharp reversals would be painful

- When there is so much time to expiry, why did I choose to trade a slightly OTM option and not really far OTM option?

- This is because of liquidity. Stock options are not really liquid, hence sticking to strikes around ATM is a good idea

- What about stoploss?

- The plan is to square off the trade if CEAT makes a new high. In other words a new high on CEAT indicates that the uptrend is still intact, and therefore my contrarian short call was flawed

- What about target?

- Since the stock is in a good up trend, the idea is to book profits as soon as it’s deemed suitable. Reversals can be sharp, so no point holding on to short trades. In fact it would not be a bad idea to reverse the trade and buy a call option.

- What about holding period?

- The trade is a play on appreciation in premium value. So I will certainly not look at holding this to expiry. Given that there is ample time to expiry, a small dip in stock price will lead to a decent appreciation in premium.

Note – the QnA is reproduced in my own words, the idea here is to produce the gist and not the exact word to word conversation.

So after he bought CEAT PE, this is what happened the very next day –

Stock price declined to 1244, and the premium appreciated to 52/-. He was right when he said “since there is ample time to expiry, a small dip in the stock price will lead to a good increase in option premium”. He was happy with 7/- in profits (per lot) and hence he decided to close the trade.

Looking back I guess this was probably a good move.

Anyway, I guess this is not bad for a first time, overnight options trade.

My thoughts on this trade – Firstly I need to appreciate this trader’s clarity of thought, more so considering this was his first options trade. If I were to set up a trade on this, I would have done this slightly differently.

- From the chart perspective the thought process was clear – exhaustion in the rally. Given this belief I would prefer selling call options instead of buying them. Why would I do this? – Well, exhaustion does not necessarily translate to correction in stock prices. More often than not, the stock would enter a side way movement making it attractive to option sellers

- I would select strikes based on the normal distribution calculation as explained earlier in this module (needless to say, one had to keep liquidity in perspective as well)

- I would have executed the trade (selling calls) in the 2nd half of the series to benefit from time decay

Personally I do not prefer naked directional trades as they do not give me a visibility on risk and reward. However the only time when I initiate a naked long call option (based on technical analysis) trade is when I observe a flag formation –

- Stock should have rallied (prior trend) at least 5-10%

- Should have started correcting (3% or so) on low volumes – indicates profit booking by week hands

I find this a good setup to buy call options.

23.3 – RBI News play (Nifty Options)

This is a trade in Nifty Index options based on RBI’s monetary policy announcement. The trade was executed by a Varsity reader from Delhi. I considered this trade structured and well designed.

Here is the background for this trade.

Reserve Bank of India (RBI) was expected to announce their monetary policy on 29th September. While it is hard for anyone to guess what kind of decision RBI would take, the general expectation in the market was that RBI would slash the repo rates by 25 basis points. For people not familiar with monetary policy and repo rates, I would suggest you read this –

http://zerodha.com/varsity/chapter/key-events-and-their-impact-on-markets/

RBI’s monetary policy is one of the most eagerly awaited events by the market participants as it tends to have a major impact on market’s direction.

Here are few empirical market observations this trader has noted in the backdrop market events –

- The market does not really move in any particular direction, especially 2 – 3 days prior to the announcement. He find this applicable to stocks as well – ex : quarterly results

- Before the event/announcement market’s volatility invariably shoots up

- Because the volatility shoots up, the option premiums (for both CE and PE) also shoot up

While, I cannot vouch for his first observations, the 2nd and 3rd observation does make sense.

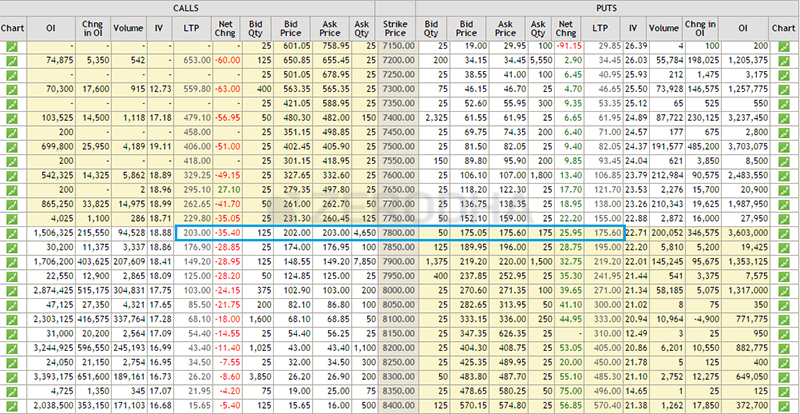

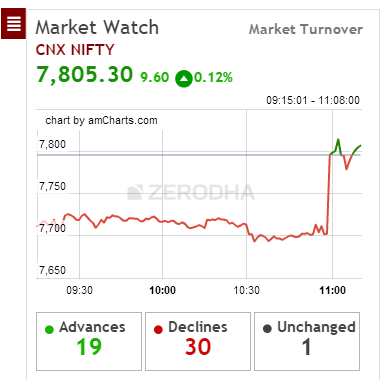

So in the backdrop of RBI’s policy announcement, ample time value, and increased volatility (see image below) he decided to write options on 28th of September.

Nifty was somewhere around 7780, hence the strike 7800 was the ATM option. The 7800 CE was trading at 203 and the 7800 PE was trading at 176, both of which he wrote and collected a combined premium of Rs.379/-.

Here is the option chain showing the option prices.

I had a discussion with him to understand his plan of action; I’m reproducing the same (in my own words) for your understanding –

- Why are you shorting 7800 CE and 7800 PE?

- Since there was ample time to expiry and increased volatility, I believe that the options are expensive, and premiums are higher than usual. I expect the volatility to decrease eventually and therefore the premiums to decrease as well. This would give me an opportunity to buyback both the options at a lower price

- Why did you choose to short ATM option?

- There is a high probability that I would place market orders at the time of exit, given this I want to ensure that the loss due to impact cost is minimized. ATM options have lesser impact cost, therefore it was a natural choice.

- For how long do you plan to hold the trade?

- Volatility usually drops as we approach the announcement time. From empirical observation I believe that the best time to square of these kinds of trade would be minutes before the announcement. RBI is expected to make the announcement around 11:00 AM on September29th; hence I plan to square off the trade by 10:50 AM.

- What kind of profits do you expect for this trade?

- I expect around 10 – 15 points profits per lot for this trade.

- What is you stop loss for this trade?

- Since the trade is a play on volatility, its best to place SL based on Volatility and not really on the option premiums. Besides this trade comes with a predefined ‘time based stoploss’ – remember no matter what happens, the idea is to get out minutes before RBI makes the announcement.

So with these thoughts, he initiated the trade. To be honest, I was more confident about the success of this trade compared to the previous trade on CEAT. To a large extent I attribute the success of CEAT trade to luck, but this one seemed like a more rational set up.

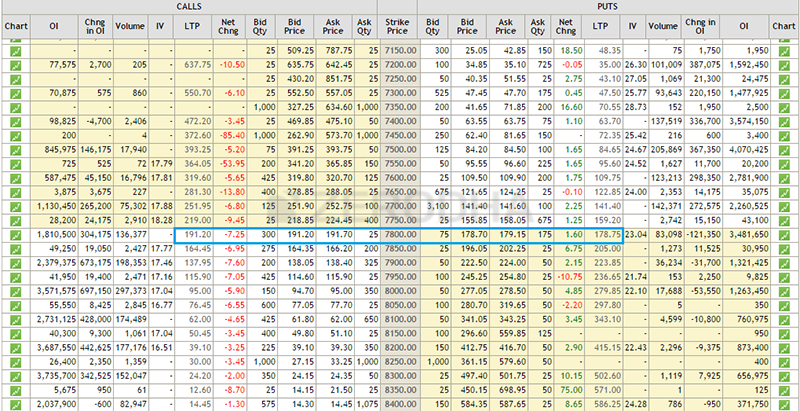

Anyway, as per plan the next day he did manage to close the trade minutes before RBI could make the policy announcement.

Here is the screenshot of the options chain –

As expected the volatility dropped and both the options lost some value. The 7800 CE was trading at 191 and the 7800 PE was trading at 178. The combined premium value was at 369, and he did manage to make a quick 10 point profit per lot on this trade. Not too bad for an overnight trade I suppose.

Just to give you a perspective – this is what happened immediately after the news hit the market.

My thoughts on this trade – In general I do subscribe to the theory of volatility movement and shorting options before major market events. However such trades are to be executed couple of days before the event and not 1 day before.

Let me take this opportunity to clear one misconception with respect to the news/announcement based option trades. Many traders I know usually set up the opposite trade i.e buy both Call and Put option before major events. This strategy is also called the “Long Straddle”. The thought process with a long straddle is straight forward – after the announcement the market is bound to move, based on the direction of the market movement either Call or Put options will make money. Given this the idea is simple – hold the option which is making money and square off the option that is making a loss. While this may seem like a perfectly logical and intuitive trade, what people usually miss out is the impact of volatility.

When the news hits the market, the market would certainly move. For example if the news is good, the Call options will definitely move. However more often than not the speed at which the Put option premium will lose value is faster than the speed at which the call option premium would gain value. Hence you will end up losing more money on the Put option and make less money on Call option. For this reasons I believe selling options before an event to be more meaningful.

23.4 – Infosys Q2 Results

This trade is very similar to the previous RBI trade but better executed. The trade was executed by another Delhiite.

Infosys was expected to announce their Q2 results on 12th October. The idea was simple – news drives volatility up, so short options with an expectation that you can buy it back when the volatility cools off. The trade was well planned and the position was initiated on 8th Oct – 4 days prior to the event.

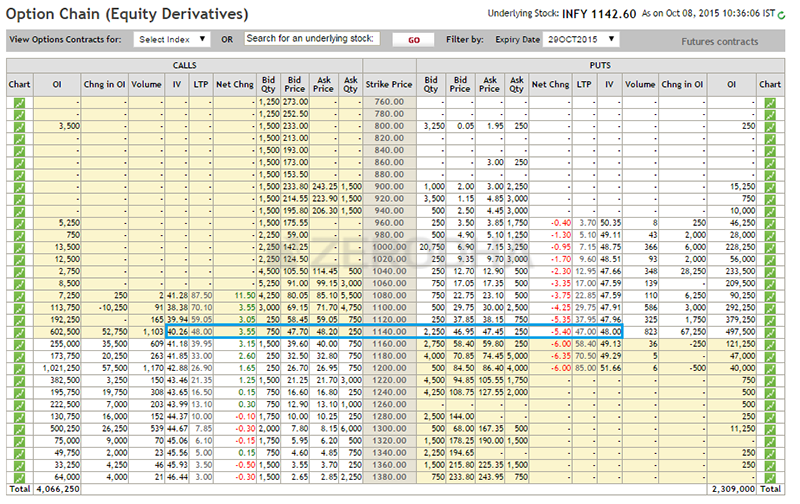

Infosys was trading close to Rs.1142/- per share, so he decided to go ahead with the 1140 strike (ATM).

Here is the snapshot at the time of initiating the trade –

On 8th October around 10:35 AM the 1140 CE was trading at 48/- and the implied volatility was at 40.26%. The 1140 PE was trading at 47/- and the implied volatility was at 48%. The combined premium received was 95 per lot.

I repeated the same set of question (asked during the earlier RBI trade) and the answers received were very similar. For this reason I will skip posting the question and answer extract here.

Going back to Infosys’s Q2 results, the market’s expectation was that Infosys would announce fairly decent set of numbers. In fact the numbers were better than expected, here are the details –

“For the July-September quarter, Infosys posted a net profit of $519 million, compared with $511 million in the year-ago period. Revenue jumped 8.7 % to $2.39 billion. On a sequential basis, revenue grew 6%, comfortably eclipsing market expectations of 4-4.5% growth.

In rupee terms, net profit rose 9.8% to Rs.3398 crore on revenue of Rs. 15,635 crore, which was up 17.2% from last year”. Source: Economic Times.

The announcement came in around 9:18 AM, 3 minutes after the market opened, and this trader did manage to close the trade around the same time.

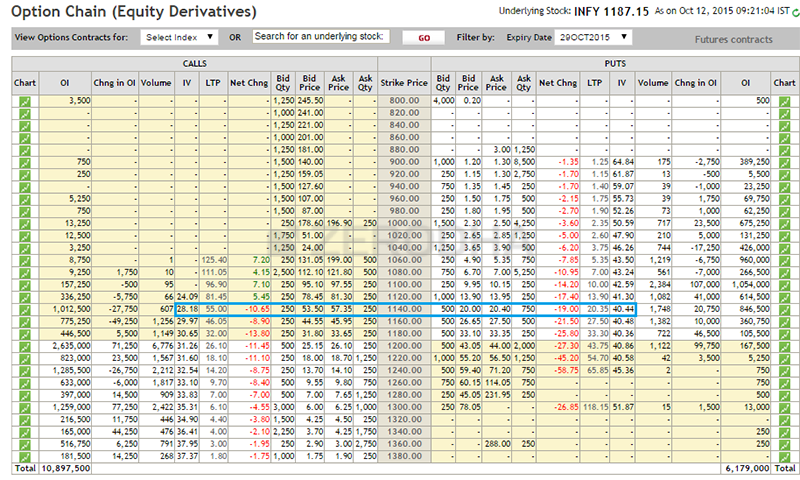

Here is the snapshot –

The 1140 CE was trading at 55/- and the implied volatility had dropped to 28%. The 1140 PE was trading at 20/- and the implied volatility had dropped to 40%.

Do pay attention to this – the speed at which the call option shot up was lesser than the speed at which the Put option dropped its value. The combined premium was 75 per lot, and he made a 20 point profit per lot.

My thoughts on this trade – I do believe this trader comes with some experience; it is quite evident with the trade’s structure. If I were to execute this trade I would probably do something very similar.

23.5 – Infosys Q2 aftermath (fundamentals based)

This trade was executed by a fellow Bangalorean. I know him personally. He comes with impressive fundamental analysis skills. He has now started experimenting with options with the intention of identifying option trading opportunities backed by his fundamental analysis skills. It would certainly be interesting to track his story going forward.

Here is the background to the trade –

Infosys had just announced an extremely good set of numbers but the stock was down 5% or so on 12th Oct and about 1% on 13th Oct.

Upon further research, he realize that the stock was down because Infosys cut down their revenue guidance. Slashing down the revenue guidance is a very realistic assessment of business, and he believed that the market had already factored this. However the stock going down by 6% was not really the kind of reaction you would expect even after markets factoring in the news.

He believed that the market participants had clearly over reacted to guidance value, so much so that the market failed to see through the positive side of the results.

His belief – if you simultaneously present the markets good news and bad news, market always reacts to bad news first. This was exactly what was going on in Infosys.

He decided to go long on a call option with an expectation that the market will eventually wake up and react to the Q2 results.

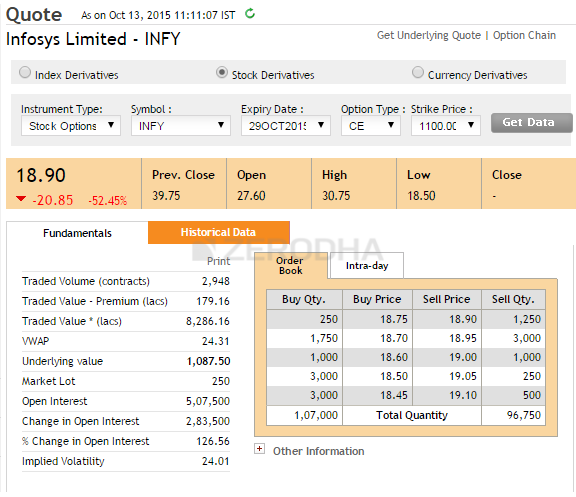

He decided to buy Infosys’s 1100 CE at 18.9/- which was slightly OTM. He planned to hold the trade till the 1100 strike transforms to ITM. He was prepared to risk Rs.8.9/- on this trade, which meant that if the premium dropped to Rs.10, he would be getting out of the trade taking a loss.

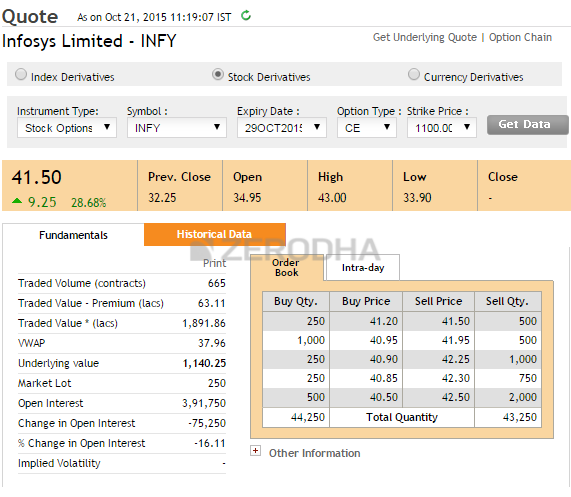

After executing the trade, the stock did bounce back and he got an opportunity to close the trade on 21st Oct.

Here is the snapshot –

He more than doubled his money on this trade. Must have been a sweet trade for him

Do realize the entire logic for the trade was developed using simple understanding of financial statements, business fundamentals, and options theory.

My thoughts on this trade – Personally I would not be very uncomfortable initiating naked trades. Besides in this particular while the entry was backed by logic, the exit, and stoploss weren’t. Also, since there was ample time to expiry the trader could have risked with slightly more OTM options.

And with this my friends, we are at the end of this module on Options Theory!

I hope you found this material useful and I really hope this makes a positive impact on your options trading techniques.

Good luck.

Just found this amazing site…very educational and amazing!

Questions on your case studies…

case #2 – usually IV doesn\’t drop until after the event itself. Is it realistic this trader shorted and IV would drop prior? Instead wouldn\’t a calendar have worked a few days before, and selling right before the event?

case #3 – shorting before earnings and waiting for IV drop only works if the range works. I dont know what the expected move was but did this trader get lucky that the move stayed within the range? usually shorting 4 days before the pricing is pretty high, but if it blew past the expected range he\’d be in huge trouble with little wiggle room since IV is sucked out of the options.

Case #2) That is the general expectation i.e. the IV to drop right after the event. But one more thing – IV kind of peaks leading to the event. So you may want to figure when to short.

Case #3) Of course, in case of a surprise, the range itself breaks. That is an assessemnt for any trader to make i.e to figure what are the odds of the market to spin out a surprise. So maybe it is luck plus skill 🙂

Hi karthik Sir,

On what basis you are saying the infosys fundamental was a naked trade? Is this because the trader is just predicting without the exact numbers or just guessing the direction of the market?

If a trade is unhedged, then it is called a naked trade. Example –

1) Buy Infosys Spot = Naked trade

2) Buy Infosys Spot + Short futures = Hedged position.

Namaste sir.

Now weekly expiry is ending then it is good or bad for option trading?

I think its good for traders in the long run.

Dear Karthik,

In the last case study about the fundamental call on Infosys, would you recommend taking a short position on Nifty too? This would protect against losses due to market-wide price movement. If yes, then would you have any input on the selection of option and strike for such pair strategies?

You can, but then it also depends on your risk appetite and capital.

Hi Karthik,

Thanks for this chapter. I have a few questions on these trades.

1) In the first trade (CEAT India), the stock overnight declined ~1.5% (from 1260 to 1244). Would this price change increase volatility and, in turn, increase the premium? If yes, in this case, is the effect of change in the delta on premium more than the increase in volatility? Further, in your approach, would you sell OTM Call option?

2) In the second trade (Nifty – Delta neutral), why did the decrease in volatility not decrease the PUT option premium? In fact, most of the PUT option premiums increased (even minutes before the RBI announcement). Why so?

3) In the third trade (Infosys – Delta neutral), would it be a good strategy to close the position right after the market opens i.e. ~9:16 AM? It will reduce the impact of INFY quarterly results on the position, and the trader will benefit due to decreased volatility. What do you think?

4) In the fourth trade (Infosys – Directional trade), since the target hit in 25 days, wouldn\’t it be a good strategy to buy an ATM or slightly ITM call option here? I was referring to graphs in the previous chapter.

Please let me know your thoughts.

Thank you,

Yogesh

1) Yes, any rapid price change induces volatility. But then there are multiple factors that impact the option price, in this case it could be delta more than Vega.

2) Perhaps for the same reason as i quoted above. You also need to consider time to expiry.

3) Either before or just after the announcement. Both are ok. End of the day, it all boils down to how much risk you are willing to take.

4) Since there is more time to expiry, slight OTM is fine.

Sir,

If we pledge our investments (stocks and g secs), the margin can be used for selling options and intraday trading. I feel it\’s a good idea, and are there any disadvantages? And If we combine both investment and trading together, the returns can be very high in a year.

I also have a small question, in Broking industry there is an entry of (Zero commission brokers) , mirae asset launched it\’s plan for 2399 rs(one time payment ) which offers lifetime free brokerage and finvasia by shoonya whose cost is 0 for lifetime and they are registered under SEBI. Are there any risks associated there? 🙂

About pledging – yeah, seems good. But the only problem is that you will lose money and stocks if the option goes against you.

About brokers – Yes, all brokers are regulated by SEBI. Please consider a broker from all aspects and not just brokerage charges.

One more suggestion

The comment are sorted in ascending order that means comments which were posted earlier are shown at top and newest comments are shown at bottom, can it be changed from Descending order so that newer comments will be shown first

Like to search my comment I had to scroll all the way down comments 2015

Thanks Komal, its a valid suggestion. Let me check.

Hii Kartik

So far I am understanding the module.. thanks to your easy assimilation and way of putting it

I have a doubt regarding Liquidity

As you said in first case( CEAT) where trader did not chose two to three away OTM because stock is not having much liquidity. How do we know that stock is more liquid or less and what is relation between Liquidity and choosing strike?

A highly liquid stock means its easier to place your orders, and hence easy to transact and lower slippages.

Most importantly new contracts are being created today too such that option price change turned green today…

I have seen nifty option chain today in which i saw people are sellling and buying nifty put option at 19000 level eventhough it is clearly visible that it cant even go down below 19500 level considering 28th sep as expiry…Whats the point of buying such far away options??? why people are stalking around there much??? Please explain sir

When people buy OTM options on expiry day, its like buying a lottery ticket, they are hoping a big move would happen and their option turns ITM 🙂

Hi

Sir,

Whereas all have already been mentioned in your notes itself, I am still trying to align my thoughts if I am rightly moving. I would request if you may please comment on below:

We know For Call option:

Buyer: Take delivery at strike price at expiry

Seller: Give delivery at strike price at expiry

We know For Put option:

Buyer: Give delivery at strike price at expiry

Seller: Take delivery at strike price at expiry

Please correct me on below,if I am going wong somewhere:

For CE:

1. For a buyer to take delivery, he has to keep money in the fund. The fund amount is lot size* strike price*no of lots

2. For a seller to give delivery, the system will debit only the difference amount (spot price minus strike price)*lot size*no of lots from the margin blocked of the seller

For PE:

1. For a buyer to give delivery, he has to keep money in the fund. The fund amount is lot size* spot price price*no of lots

2. For a seller to take delivery, the system will debit only the difference amount (strike price minus spot price)*lot size*no of lots from the margin blocked of the seller

For option sellers – In case of stock options, the system will debit securities, not funds. Index options are cash settled.

Sir,

A. We learnt volatility based future price prediction range is selected based on below few formulas:

1. Current price +/- Current price*sd

2. Current price*exp(mean*t+sd*sqrt (t))

3. Current price*(1+mean*t+sd*sqrt (t))

4. Current price*(1+sd*sqrt (t))

Could you kindly let know when we should be using which formulae?

B. I haven\’t yet started trading options/ futures yet. We know that the stoploss given in simple swing trade is with market price of the stock. Similarly, could you kindly let know the parameter to which SL is given for options? Is it with the market price of the underlying value/ premium value or something else? Please help.

1) You can use the first one

2) One way is to keep a % SL on the premium itself, Anirban.

Hi Karthik.

Could you recommend any good source where traders share their strategies?

I this module you have recommended one book \”Fooled by randomness\”, please give some more book recommendations. like your top 5 book recommendations

Baburao, do check the module on trading strategies. About books, I\’ve been sharing the list of relevant books at the end of every module; request you to check that.

Dear Karthik,

I have come across Opstra. It has got Greeks Data. But it does not auto – backtest strategies. We have to manually do it.

Ah ok. I\’ve never used that product, so would not know.

Thank You Karthik.

I checked Sensibull and Streak. They do not provide Greeks Data. I will try and figure out some other way.

Sure Amit, do drop a message if you find something useful so that others can benefit as well 🙂

Dear Karthik,

I had one more query. Is there any Options Backtesting tool available that provides us with all the Options Greek Data?

I want to Backtest some strategies that include the usage of Options Greeks.

I have tried to search the web but I could only come across Backtesting tools that have only technical indicators as filters. I want to devise strategies based on Greeks, VIX and all other things that you have taught us here. Is there any tool out there that suits my requirement?

Amit, not sure, but please do check with Sensibull for this. Else you can also speak to streak.tech for this.

1. I thought a breakout would have caused an increase in the VIX. Though it could have varied from a small increase to a large increase depending on how strong the breakout would have been.

2. 🙂

3. I would be more cautious about this thing in the future.

4. 🙂

5. 🙂

I actually don\’t know what went wrong there. I went for buying 18500 CE in the first place but my order got rejected. So I ended up buying 18400 CE.

I exited that trade with a 22% return. I exited that trade based on technical analysis on a 5 minute candle. It seemed like the market was starting to lose its short term bull momentum.

Thank you Karthik. This course really helped me a lot. 🙂

Amit, to figure why your 18500CE order was rejected, check this – https://support.zerodha.com/category/trading-and-markets/trading-faqs/f-otrading/articles/what-are-open-interest-limits

Good luck and I hope your profits continue to roll!

Dear Karthik,

I have been learning from Varsity a lot. I have been practically analyzing the old data and have been re-inventing what you have been teaching.

Halfway through this module, I decided to enter my first trade right now as I write this on 4th May 2023 at 13:45. Nifty is at 18185. Following are my observations :

1. The VIX is at around 11.9 which also turns out to be a support level for VIX. This is somewhat the lowest value for VIX if I analyze the chart from 2019 – till date. So volatility is bound to go up a bit from here in the next 2 – 3 days.

2. Nifty is at a level where there had been a price action at this very particular level in the past.

3. The recent results of the Nifty companies were in favour of the perception that the Nifty will break this level.

4. I expect Nifty to grow by 1.2% in next 3 – 4 trading session as I believe that will be the next level where there had been a price action in the past.

5. I am in the first phase if I take May Expiry into consideration.

Based on the above points, I tried buying 18500 CE but I was prompted that it was a bit illiquid and that SEBI had some guidelines. So I bought 18400 CE now with a premium of 101. I am continuously observing 5 minute candles right now. They have been making Higher Highs and Higher Lows. But as I am about to finish writing this answer, the resistance in the 5 minute candle Nifty chart has been broken (at around 14:30).

I was sure when I would exit the position if things would have gone southward but I am still not clear of what should be my target.

1) Look at the data again, maybe ViX can continue to stay in the region for a much longer period? If that happens what happens to your trade?

2) Ok

3) Sure, but like I mentioned earlier, what if that does not happen? What happens to your trade?

4) Ok

5) Ok

SEBI has no restriction, Amit. It is a restriction/limitation at the broker level. Anyway, for the target you can keep a few % or points above your entry as a target, especially since this is your first trade.

Good luck and I hope you have a long and successful trading career 🙂

Hi sir,

In the above examples ATM options have been shorted. But based on the previous modules you had advised not to short ATM options due to very high Gama and especially close to expiry. I just wanted to know if we are making a trade based on volatility given enough time to expiry is it okay to short ATM options.

The logic was lower impact cost, especially since this is a short-term trade. Shorting ATM is generally risky unless you very clearly know what you are doing, as in this case.

Sir, is live IV chart and historical IV for all stocks and indices available anywhere for free?

Not sure, but do check with Sensibull once.

Sir, the Infosys Pre Result case study ..of shorting call and put options of 1140 on 8th Oct 2008 for the result on 12th October 2008 are contrary to the table given in previous chapter..i am confused please enlighten me.

the table which says what strike to buy..like in 1st series of the month and second series of the month..here it is said if target is to be achieved in 5 days than buy call 2 strikes away from ATM.. contrary to this Infosys case study say sell ATM put and call 4-5 days before result to take advantage of volatility.

The volatility strategy is specific to an event, Deepak. You don\’t deploy that otherwise.

What are more ways to Identify the direction of the market?

Sagar, you can use either a quantitative approach, fundamentals, or technical approach.

Hello Mr. Karthik,

Please correct me If am wrong :

i) Theta reduces the premium on a daily basis. Hence after opening premiums will get reduced once and then theta will not impact the premium.

ii) For intraday and scalping traders, the significance of theta will be low and delta and vega will be high. Gamma I am still confused, please clarify.

iii) For intraday and scalping, trading with ITMs will be more meaningful and more impactful.

1) Theta changes continuously, not on an increment basis.

2) Thats right, unless you are trading close to the expiry day. You can ignore gamma

3) I\’d suggest ATMs

Hi karthik,

I have a query please help.

1. I have seen that there is a difference in the values of greeks with differenr brokers. Why so?

2. The BMC formula is there for option pricing, so do brokers have any freedom to change any variable in the formula?

3. Who exactly calculates the values of call and put options, brokers or NSE itself?

3. In the calculation of option price, do they use futures price instead of spot price? Like do they put the interest rate = 0 and simple use the future pirce or they have to stick to the formula which asks to consider spot price only along with interest rate which is usually on the basis of RBI\’s 91 days T-bill.

1) It should not be, as everything is based on the same data

2) Not really given that the B&S formula is price based

3) Market collectively decides a fair price for a given strike

Yes, you can use the futures price instead of the sport price. Thats how it works in commodities.

I went through the option theory tutorial once and will do it again several times to get the grasp of the concepts. Before reading the tutorial, I always wondered how much profit will trader make by \’always selling deep OTM options\’. After reading this tutorial, strategy of such trader looks very naive/emotion-driven. But I am trying to find out which option greeks might go against such trader, assuming that no \’black swan\’ occurs?

All greeks have a role to play, Hardik. You cant really isolate a certain greek 🙂

Thanks a lot

I must say this course material is one of the best and most well organized training material I cam across. Truly marvelous . Thanks for your efforts

Happy learning 🙂

Can you please explain me the statement in the first case study on CEAT tyres based on options theory

“since there is ample time to expiry, a small dip in the stock price will lead to a good increase in option premium”.

Spot was 1260 and strike price was 1220 – OTM option

OTM options have delta less than 0.5. Since there is ample time to expiry theta does not have its effect. If we ignore impact of volatility, the premium increase due to underlying stock price dip should be small due to low delta of OTM options.

In this case Change in stock price is Rs 16 and change in premium is 6.25 (52-45.75). So delta is 0.39 only, which is expected for OTM options

Is the statement , small dip in stock price will lead to good increase in premium correct as per theory? Am I missing something?

Thats right, Kalyan. This is true when there is ample time to expiry.

Could you please explain what is the meaning of slashing revenue guidance?

It means the company expects lower revenue over the next few quarters or maybe for the year.

Hi Karthik, one question – your statement – \”However more often than not the speed at which the Put option premium will lose value is faster than the speed at which the call option premium would gain value\”

Why does this happen? Which greek plays a role in this phenomenon, or is this something you just gave for example sake?

Fear spreads faster than greed in market, Pradeep 🙂

Sir just wanted to thank you for these modules. They have added a new skillset for me, made me much more confident during conversations and thought process, and also has made me some good money while markets are falling. I owe it all to you, thank you so much.

Thanks for the kind words, Prabhat. Hope you continue to learn and like Varsity:)

As explained in the two trades based on volatility without any directional view the trade was executed and was successful.However,for it to be successful the traders had to write/sell both call and put keeping in mind the risk of directional view.Does this mean that while setting up a trade with volatility we have to do the same as by doing this we are neutralizing the risk ,however if the trader had only sold a particular call or put option and market would have not favoured the respective view then losses would exist.

Guide for the same!

Thanks in advance

It all depends on how the volatility moves. When you sell options, a drop in volatility will ensure your odds of position moving to profit is higher.

Hello Karthik,

Excellent explanation of every concept. Could learn a lot about options.

As per my understanding we will analyse underlying stock/index, finalise the strike price based when we are trading/how far is expiry etc.

However my basic question is, should we be analysing underlying asset movement or premium movement to decide stop loss/profit booking?

Apologies if it is very basic question.

I\’d suggest you look at the asset movement since premium movement is a function of the asset movement.

Sir and how to give government securities as collateral to option selling?

Muthu, you can give GSec and SGB as collateral for option selling.

Sir correct if i am wrong,

on 21/03/2022

nifty spot = 17300

nifty 18000 mar CE = Rs. 45

on 31/03/2022

nifty spot = 17900

nifty 18000 mar CE = rs. 150

sir if i am an option seller the premium received on the expiry date is 45*50=Rs. 2250

so sir when the premium have shoot up from 45 to 150, my loss (150-45)*50=Rs.5250

but if i keep the contract open till expiry my PROFIT would be Rs.2250 (since underlying is below 18000)

am i right sir,

thanks in advance sir 🙂

That\’s right, Muthu. As an CE option seller, you get to retain the premium if the market expires at or below the strike price.

sir, in the example of bangalorean you concluded to buy strike that is more OTM(he bought at slightly OTM) but owing to the mindset of the trader he expected the strike to be ITM and exit the trade where it will take ample of time(say 10-20days) in that case a trader should but ITM but not OTM or ITM(you taught in previous module). how here buying OTM makes sense?

Harish, when there is more time to expiry, and you are convinced about the directional movement, then you are better off taking a slightly OTM bet.

since there is ample time to expiry, a small dip in the stock price will lead to a good increase in option premium… What is the logic behind this? Can you please explain

\”Since there is ample time to expiry, a small dip in the stock price will lead to a good increase in option premium\” – How is this happening? What is the logic behind the same?

It\’s a combination of both time to expiry and the movement, Sivanthu.

Where do I get 5 min charts of Nifty call/put options of expiry days of last 1 year ?

I have to backtest my strategy based on intraday trading on expiry days.

I\’m not sure these historical charts are available. I\’d suggest you check with Sensibull once.

Hi Karthik,

Huge fan of your knowledge and thank you for providing such a great content to us.

Can you help me with option strategy where if i am already holding any stocks in my portfolio then how can we earn more income by selling options against holding.

One way is to short OTM CE option and enjoy time decay but if stock moves upwards my profit will be maximum to strike price of call option that i sold.

Any other idea you can suggest?

Thanks for the kind words, Tejas.

Covered calls is certainly one option where you sell OTM CEs and pocket the premium. Another is SLB – https://www.nseindia.com/market-data/securities-lending-and-borrowing , although not related to options.

Hi Karthik Sir,

I Have one Question regarding Today Market Movement , As we see Today Nifty 50 has rose tó 320 points in the Morning after the Positive expectation of GDP. Now , I Want to know Why Market Fell after One Hour from its High . Sentiments of traders were Positive for Market and There was no Negative News beside . So What reasons Make tó nifty Fall all Sudden. Now , Nifty Again Positive tó 80 Points . I Was searching Reason for all Sudden Fall in Nifty , didn\’t Get any Clue . I Got Reason for Rise That is GDP News but no Reason for Drop.

I wish I had an answer to that 🙂

It\’s really hard to make these micro predictions in the market, Shubhika.

in the last trade, you mentioned that the stop loss was not based on logic.

what would have been a logical approach to a stop loss here?

Something like a volatility based stoploss or a stop loss based on Support and Resistance would probably make more sense.

HI

When Banks FDs deposits are giving a 4% return & VPF, PPF 6 to 7% return….why we should invest in stocks/mutual funds/ SIP\’s which don\’t have any guarantee return or capital may become zero

Isn\’t this a starting point for greed…expecting high returns?

4 or 6% is fine in the total absence of inflation. But unfortunately, inflation is real, so you need to find avenues to grow your money. Else over time, the purchasing power of money will be lower.

Hi

If other brokerages are offering 10RS/15RS per trade…Why clients should use Zerodha….Please list few reasons

Any plans for reducing brokerage??

Thanks

You can check this – https://zerodha.com/videos/274880/why-zerodha

No plan to reduce brokerage for now.

Does zerodha report if any client is earning 1 lakh per day to CBI, ED, income tax?

No, we don\’t, unless department official requests us for reports for a specific purpose.

Dear Sir,

I have taken trades on Infosys as per this article.

Results on 13th October 2021, 6pm.

1. First trade on 4 days prior to result. short ATM PE (IV =41 ) and (CE=32). Both IV shoot up. Taken loss

2. Second trade on 2 days before.. IV shoot up and loss.

Today I will see after market opening what will happen to option prices.

Now my question is, if there is big variation in IV should we buy lower IV option and sell higher IV. Both should be at ATM.

THANKS

Ah, thats unfortunate. Its best when you initiate the position just before the event i.e. in this case may be on 12th before market close. IV is expected to cool down, so buying options may not help much I guess.

Sir,

You have not replied. HISTORICAL VOLATILITY is 41 percentile of Mindtree. Now it is in the range of 60. Must be a good time to use straddle.

Request to revert.

Yes, provided you think 60 is high enough. That opinion, you need to develop, don\’t think I can help you with that 🙂

It will drop

Dear Sir,

Mind tree results on 13 October.

Strike price –4300

IV of PE = 61.34

IV of CE = 58.0

Is it best to sort now or should I wait.

Depends on what you think about the volatility 🙂

Hello Sir,

Can you explain the CTM concept??

Can we choose if we want to exercise the ITM option or not?

I will try and put up a note on CTM.

Hello Sir,

Can you explain the CTM concept??

Can you please suggest some books on Options trading for beginners(books covering the topic in advanced level as well)?

Have you completed the Varsity notes on options? Including the strategies bit? If yes, I\’d suggest you move ahead to read Shelden Natenberg\’s book on Option pricing.

Hello sir,

These chapters are amazing, thank you for this valuable content.

I have doubt that

1)You told that you would like to short before a couple of days instead before one day when event is there, this one I did not understand because Actually volatility increases when we close to an event, so I am thinking like that if we short before 1 day of event, we can earn more premium. Can u please clarify my doubt.

2) if we keep options till expiry what will happen like are they cash settled or settlement by physical deliver?

Yes Pavan, you can keep shorting upto the event day. As and when the short positions move in your favour, you can add to your position if you\’d like.

Index options are cash-settled, stock options are physically settled.

I am bit confused regarding the last example..how his money get double

Check the price difference between the buy and sell price of the premium.

Hello dear karthik.

I hope you are doing well.

Yesterday i made 50000 rs in options buying in BANK NIFTY With only 70000 capital. Earlier 31000 and 18000 with same strategy in last week.

I took 50 trades (Buy and sell). OTM. Quantity 400. No stop loss. No hedging.I focused on 5 to 10 points. Every time i saw a profit above 1000-1500, I would exit. Of course i made some losses also but till 3 p.m, There were +56000 green in my portfolio.

Next day about 51000 plus got credited to my funds account after deduction of various charges.

What i know is there is about 123 rs total charges per trade (Buy and sell) in options trading. Are there any hidden /Toll if we take multiple trades in options ?

I mainly focused on price action using 20th depth and candle pattern. I did it when prices were moving up and down in a range bound.

Kindly comment on pros and cons of my strategy. Especially taking multiple trades.

With love.

Kaushal😇

Good to hear, and I hope your profits roll.

1) No hidden charges. You can cross-check the contract note to confirm this.

2) Pros – No overnight risk, so that a good thing

3) Cons – You may end up overtrading, especially on days when you hit 2-3 loss-making trades in a row. This may have a -ve impact on your capital.

Hello sir, I am a 15-year-old who has been studying finance on my own for the past year, and I have never enjoyed it so much. Thank you so much for all these amazing lessons.

Manav, happy to note that. I hope you enjoy reading the content here on Varsity 🙂

Sir i have a question though it was nicely explained by you but still i have a doubt on rbi policy example as i am not able to understand why it is not that much meaningful to go toward long straddle ? And why would the premium of puts will decline faster than the increment of calls premium

Its just that during events, volatility is high and expected to cool off post the event. Hence traders prefer to sell options.

*The tools and indicators that i use are sufficients ??

Yes, but keep exploring 🙂

Hello dear karthik.

I am sharing here my own experince in OPTIONS BUYING, C.E only.

Hope it will help others also.

I started with banknifty C.E buying just 1 lot and booked 40% Profit And came out of the market.

Next day proceeded with same strategy and booked frofit. But went on for another trade. Ended up booking NET LOSS of the day. With a one day break

I again bought bank nifty C.E option, This time 4 lots. Booked frofit FOLLOWING SAME STRATEGY, But again tempted to take another trade, Booked loss.!! To compensate that loss i took another trade. I mean 3rd trade of the day, Booked more losses !!!

I stoped for one week.

I focued on increasing my knowledge in options trading.

After 1 week I again started with options buying . But this time With STOCKS. Not with banknifty.

I took a very good share which was bullish at that time. I chose C.E.Buying option in the start of the month, with MONTHLY EXPIRY, 1 lot of 2850. I booked handsome profit. Took another trade, Booked profit. And RUN AWAY FROM THE MARKET THIS TIME😬.

Then next day repeated the same thing, with same stock, Booked profit Twice. Ran away.

3rd day I increased the frequency of the trades even after booking profits, Resulted in huge losses.

So In my 20 days/12 Sessions, and 16 trades, I booked NET LOSSES of about 5% (abt 5700 rs Which i dnt think is much as compared to the learning i went through)

I am a begginer.

My experience is options trading in easy (Not easier) in Equity than in Banknifty ATLEAST for beginners when it comes to volatility related risk factors.

Its not the BUYING OPTION that make losses (As it is commonly quoted that option buyers book more losses) Its our greed that more often becomes the chief cause of our losses.

If you are deciplined and have all the fundamental knowledge of options trading, You CAN MAKE MONEY with options buying also. Of course you will make losses in the journey But with NET P/L in GREEN.

Patience is very much required. I have seen during trading session my P/L in -16000 RED and again after 1 hour in +13000 GREEN.

Hedging require you to Sell options in most of the strategies Which require more Funds in your account and not everyone can afford that. So people go for option buying despite knowing risks, Me too.

I took Naked call options in all my trades.(Perhaps we call it uncovered call).

Yes. You are right when you say we should go on to device our owbn strategies as there is no limit.

I look Mainly for Volume, O.I, Spread in premium, 20th depth, bullishness of the stock. For technical, I only use Candlesticks, Macd, Rsi and BB. to identify Range bond of spot price is of equal importance.

Yes, Not anything is more helpfull than 20th depth (And of course Smart Money concept you told) When make Entry in the trade (Atleast for)

Emotions play crucial role. If you cant bear to see -50000/Day in RED, You dnt deserve to have +100000/Day in GREEN 😎

Before i ask you new quiry, I just want to say👇 these are not my recomendations please.

You can make money in options buying even without hedging. You do it with scalping or sometime with holding/As situation demands (My individual experience, I managed to do).

But you must have basic knowledge about option trading and some technicals.

BE NOT GREEDY. This was the only factor that ruined money in my case (Atleast In 90% Cases).

Because i am a beginner and a learner. I posted what i personally experienced. I never recommend anything to anyone.

Karthik, Please comment on my strategy on the basis of your experience. Whether the tools or indicators are sufficient for a begginer to enter into a trade ? Maybe i come up with another ones on the basis of my new experiences.

And

If we enter into a trade of monthly expiry in the start of the month, OTM CALL and difference b/w the spot price and strike price is about 15 pounts. How many days should we wait if it goes againts us ? Provided there are still 19 days/14 trading sessions left ? And we are bullish about the stock.

Thank😊

Thanks so much for sharing your options experience so patiently. This will help a lot more traders to reflect back on their own journey.

Options is best understood by learning and experimenting, which is exactly what you are doing. Not all experiments will be successful, but that ok as long as you take back some lessons from it.

As far as the wait time is concerned, it really depends on a ton of other market conditions.

Good luck and happy learning 🙂

in cash market, we buy a share and if we made profit on selling, we get receive share bought amount and profit amount. where as in options market, the premium is non returned to the buyer, only the profit made will be credited right? If we purchase OTM strike and if the price goes in favorable direction of the buyer, even without reaching the breakeven point also it will show a profit amount. If we exit at that time, do we receive premium back and profit? or only profit will be received?

Its just like buying a stock. You buy an option by paying a certain premium and sell it a certain premium the difference between what you pay and receive is your profit or loss.

dear sir, I am confused after seeing few case studies of live trading in options in YouTube. From varsity knowledge base, I understand that any options buyer will not receive total premium back in any case. I see some live trading sessions, where the people are showing a demo on how to trade in options are squaring off their positions by taking an example of OTM option strike which shows a very minimal profit. How are they losing premium money even it shows a profit before reaching break even point. Even if it reaches break even point also, first we need to get our premium back then only if we are receiving more than the premium will be the profit. Is it not a funny to show a profit of 2k by spending a 5K premium? Could you clarify on this please?

Durga, it will be tough for me to comment without knowing the exact context of what these guys are doing. But you can trade options just like that, without really having to wait till expiry.

Hi Mr. Karthik,

Thanks very much for all the Zerodha varsity chapters. Accidentally I came across zerodha varsity & started reading. After reading all this, I reinvented my thought process to look at the market statistics, options trading & opportunities. This really gave me a new direction to my thoughts, trading & investing plans.

Earlier I used to trade like retailer, now I found the new way to put logic behind every trade I am doing & I am doing better & better now. Now I have purchased Taleb\’s \”Fooled by Randomness\” as per your recommendation & I am very excited to read it. Will share the feedback soon.

You are the best teacher, explained everything with proper logic & explanation hence everyone can understand seamlessly with having some experience in trading.

Regards,

MD

Thanks for the kind words Mahadev. Yes, Tabeb\’s books are amazing and puts things in a different perspective altogether 🙂

Hello Sir,

I think you may have missed out my question.

Can you give an example of how gamma change affects large positions?

By large positions would that be more than 10 lots?

Partha, check section 13.2 – https://zerodha.com/varsity/chapter/gamma-part-2/

Hi Sir,

Thank you for your response.

Can you give an example of how gamma change affects large positions?

By large positions would that be more than 10 lots?

Hi Sir,

Thank you for your response.

Can you give an example of how gamma change affects large positions?

I guess I\’ve explained this with an example in the Gamma chapter. Can you please take a look at that? Thanks.

Hello sir,

When exactly does one really need to look at Gamma? Obviously do not short naked atm options as they have the highest gamma, but otherwise when exactly do we need to worry about gamma.

Secondly, in Sensibull it says one should only worry about Gamma if you have 10+ lots. What do they mean by this?

You wont need to look beyond delta, vega, and theta. Gamma changes are very minimal, so if you have 1 or 2 lots, gamma change does not matter much. But if you have super large positions, then even a small change in gamma may have an impact on your profitability.

2) Assume I have just bought a naked otm call option which requires no margin while initiating while position, how much margin does zerodha ask me for?

YOu can check the margins here – https://zerodha.com/margin-calculator/SPAN/

Its also available on the order form in Kite.

Hello Sir,

1) Lets say I have initiated a bear call spread for June 24 with a margin of 35K and pocketing premium of 6710.

Now during the last week my margin will increase but how did I know how much required. Does Zerodha ask me for more money on the Monday of the last week or do they do it automatically?

2) Assume I have just bought a naked otm call option which requires no margin while initiating while position, how much margin does zerodha ask me for?

You can know the margins required in the order form itself, Partha. Plus the system will notify you as well.

bro where to find the option greeks

But the trader did the opposite Sir.

Thank u

23.3 ( RBI news play )

Q1) Though VIX was in an uptrend, the IV of 7800 was low (20-22).

But trader wrote the option.

So far we know that go long on option when IV is low and write option when IV is high (more than 40).

Q2) We have learned that Nifty and Banknifty have high volumes, so less slippage less impact cost.

What\’s ur take on these points sir?

Plz guide

Thank u

Thats right (both Q1 and Q2).

ive made my calculations based on what you\’ve taught in the module. I just want you to go through and please tell whether my calculations are correct or not so that Im able to start my option writing.

will be thankful to you. 21 years old trying to learn new things to gain experience.

Can you outline the procedure used, Abhishek?

Look at the 2nd chart (top right) – here the assumption is that the trade is executed in the 1st half the series, the stock is expected to move by 4%, but the target is expected to be achieved in 15 days. Except for the time frame (target to be achieved) everything else remains the same. Notice how the profitability changes, clearly buying far OTM option does not makes sense. In fact you may even lose money when you buy these OTM options (look at the profitability of 5500 strike).

Conclusion – When we in the 1st half of the expiry series, and you expect the target to be achieved over 15 days, it makes sense to buy ATM or slightly OTM options. I would not recommend buying options that are more than 1 strike away from ATM. One should certainly avoid buying far OTM options.

In the 3rd chart (bottom left) the trade is executed in the 1st half the series and target expectation (4% move) remains the same but the target time frame is different. Here the target is expected to be achieved 25 days from the time of trade execution. Clearly as we can see OTM options are not worth buying. In most of the cases one ends up losing money with OTM options. Instead what makes sense is buying ITM options.

Thats right, when you expect the target him over 15 days, then sticking to ATM or just outside ATM helps.

Thank you very much Karthik for the clarification.

Good luck, Prathit.

Karthik you explain everything amazingly,

just read the chapters and got the concepts very clear, but I have one confusion

in the 22nd ch you told that if there are about 15-25 days left for the expiry it is better to buy ITM option but in the 23rd ch in the Infosys trade based on fundamental analysis, you tell that since there is a more time(somewhere around 15-30 days) to expiry its better to take the OTM options.

Please help me with this

Can you please post an extract of the text from chapter 22?

When you say that, However more often than not the speed at which the Put option premium will lose value is faster than the speed at which the call option premium would gain value\’.\’

Request you to please elaborate the exact reason for the same.

Premium reacts faster to volatility, hence with volatility crashing, the put premium will erode faster and the gain in premium with increase in delta will be slower.

THANK YOU SIR, I\’ll try it out.

Good luck, Lionel.

Sir, If a place a GTT order for buying an option : my order will be initiated only and only after the LTP breaches the TRIGGER, in all cases whether the TRIGGER is higher or lower then the current LTP am i correct ?

I\’am asking this because as per my strategy I want to set the TRIGGER higher then the current LTP for buying an option; and I have a doubt that this order could initiate directlly ( without breaching the trigger ) , as Iam getting better price at current LTP then my TRIGGER PRICE. it is not so correct; because the only purpose of TRIGGER is to initiate the order only after the TRIGGER IS breached right ?

Sir, please clear my doubts, because my doubts which you have solved for me in the past are already making money for me and this too will add to it .

This will go as a Limit anyway, right? So it will get executed at the price specified. Why don\’t you place a GTT for 1 share of a stock which is trading sub 100 to experiment this?

Sir; I have certain question, I need your help with .

1. Are GTT orders allowed for F&O in stocks or it is only available for index ?

2. And if my GTT order gets filled then it can be treated as a normal position, am i correct ? or whether it is neccesary to close my position by using GTT order only ?

3. Can i set the trigger price higher then the LTP for buying and option ? for example suppose HDFC is currently trading at 1580(CMP ); and call option for 1580 strike is trading at 90 ( LTP ); and id i want to buy this call option only if the trend continues in the upward direction from the current levels or else not ; then can i set my TRIGGER PRICE at 92 ( which is higher then the LTP ) and my LIMIT PRICE at 93 and place my GTT order?

4. And please clear me that if i set TRIGGER higher then the LTP; the order will not get executed unless the LTP breaches above the TRIGGER; it could happen that my order gets executed at current LTP as my TRIGGER is higher and I\’am getting a better price for my order at current LTP ?

1) Available for both, please check this – https://zerodha.com/z-connect/tradezerodha/kite/introducing-gtt-good-till-triggered-orders

2) It hits the market as a limit order

3) Yes (but GTT does not check for trend etc)

Hello Sir,

Using an absolute decline or fixed SL does not make sense as it varies from stock to stock. This is an extremely rigid method.

Using volatility based makes sense, so should one use Bollinger bands or ATR or both?? I could write options further than 2 SD and use the ATR to roughly predict the daily movement?

How can you use the entry/exit based on the underlying?

Thank you for your prompt reply.

Yes,

bollinger/ATR are both good measures for Volatility. Entry and exit based on underlying can be drawn from classic TA. For example, enter when you spot a bullish engulfing, exit after

8% profit. Something like that.

Hi Sir,

Can you please explain how I should go about keeping stop losses for my option strategies?

If I write an option, how does one go about creating a stop loss.

Even I use a option strategy like the ones you have mentioned in the next module, what exactly needs to be done to keep a stop loss.

Using a fixed monetary stop loss does not really make sense as each case is different. So could you please explain how one would go about this?

Himesh, there are multiple ways –

1) Absolute decline in premium value i.e. you write an option at 10, wait for it to decline till 5

2) Fixed percentage SL i.e. your SL is fixed at 10% below the entry value

3) % volatility based – have explained this in one of the chapters using Bharthi Airtel as an example

4) Entry and exit strictly based on the underlying

Or you can use the methods described in the risk management modules as well.

Hello Sir,

Lets say for example I think Nippon India will not go over 370 levels. I decide to write a call option for Rs.10.

Nippon drops to 320 ish while the call is worth Rs. 2-3.

There are now 2-3 days for expiry and the stock moves suddenly to 350-355 levels. Obviously, the premium rises to 5-6.

Do I close my position or do I ride this initial wave and hope that till expiry Nippon does not cross over 370.

This really depends on how strong the conviction is is 🙂 Btw this is quite common with option writing, one has to develop the gut to hold through the positions, but yes, the logic and conviction on your trade thesis should be strong.

Dear Sir,

If I have written an option at 11, I would like the option price to decrease right?

If the option decreases by 5 points then it is better for me.

Do you mean if the option increases by 5 points to 16 then I would book a stop loss?

I\’m still confused about writing 1SD, 2 SD away. It seems good on paper, but not sure how to book a stop loss if the trade goes against me.

Sorry to harass you in this matter sir, if you could please explain if possible?

Oh yes, sorry about that. It has to go up for the SL to trigger 🙂

Dear Sir,

I\’m not able to understand what you have written.

If you have sold an option at 11 and exit the position at 5 you make a profit of 6 points.

In the example I mentioned,

If I wrote the option at 15400 and nifty suddenly rises from 14600 to 15000. The 15400 option will substantially increase putting me at a loss.

When do I exit such a trade to quantify a risk vs reward?

If I have written 1 SD, do I keep a stop loss of 0.5 SD??

Please assist me in this matter if possible?

Yes, Jitendra. You can exit at 0.5SD or you can even keep a Rupee value as SL. For example, you wrote the option at say 11, then the maximum loss you are willing to take on this is 5. So your SL is 11-5 = 6. So when the premium drops to 6, you exit.

Of course, at 6, you need to estimate the risk and reward and see if the entire trade makes sense. For example, if your target is 20, then for 5 Rupee risk, you are expecting a return of 20, which is not bad.

Dear Sir,

Using the 2 SD strategy I have decided to write 15400 CE and 14300 PE for March 25 respectively pocketing 11 and 9 premium. This is a short strangle strategy

What exactly is my stop loss?

Lets say I had written a naked call option at 15400. The nifty trading at 14600 rises to 15000. I had written it at 15400 for a premium is 11 now the premium is 22. What should I do?

Can you please advise me?

You can keep the SL based on 1SD reversion on the spot or just keep a Rupee value on the premium as your SL. For example, I\’ve written at 11, I\’ll get out at 5.

Hello Sir,

Hope all is good.

How exactly should one make entries in buying stock options? Most stock options are not liquid so it is very difficult to purchase them.

Using technical analysis and certain fundamental indicators?

Do we generally focus on nifty/bank nifty cause they are liquid?

Do you suggest holding options overnight as most are not liquid so very good chance you would not be able to square of close to expiry?

Himanshu, Index and top 10 stock options are fairly liquid, squaring off is not an issue even if you hold them overnight.

Dear Sir,

Do you recommend looking at liquid option charts?

Or not use liquid option charts?

Is there is a way for one to look at previous Future and Option charts as after expiry charts disappear?

You can look at the futures chart or the spot chart. I\’m not a big fan of the option chart.

Hello sir

In the Infosys Q2 Results trade we were expecting the volatility to increase and hence the premiums would also increase so does it make sense to buy options beforehand and selling them when the volatility increases

If you expect the volatility to increase going forward then yes, makes sense to buy.

It\’s really informative. Thanks for this Sir. I\’m 19 years old,currently pursuing engineering in Computer Science . Found this very interesting. I\’m really interested a lot in mathematics especially calculus. Is this a right time for me to trade in options? I do hold some delivery stocks tho… But i find that options trading requires a lot of practice.

Anyways thanks for this wonderful content…

Thats right, Tushar. Like anything else, Options require a lot of practice.

Dear Sir,

You do not really talk about rho in this entire module? Is there a reason for this sir?

Dear Sir,

So If I were to write spreads what would be the general distance between each spread on nifty for example? like 100 points, 50 points?

As it is the premium of OTM contracts are very low during the week before expiry, making that into a spread would reduce the premium to virtually nothing considering 20/lot X2(buying/selling) plus other fees.

Try setting up the spread when they\’re at least 15 days to expiry, in that way you get to collect a larger premium. The general distance depends on the strategy, for something like a standard bull call spread, 100 – 200 is a good enough.

Dear Sir,

I hope you are doing well.

Do you suggest when buy/writing options we should prefer spreads or naked options?

Like If I am writing weekly expiry nifty/bank nifty should I just write them as a naked option or should I write them as a spread?

Example if I write a 4 strike price away OTM call( Rs. 10) is it generally better to write it as a spread or just naked?

If I write a spread the max gain reduces to maybe 2-3 rupees which is not worth making a position in.

Depends on your risk preference, its better to write spreads if you were to ask me 🙂

Hi Karthik,

\”However more often than not the speed at which the Put option premium will lose value is faster than the speed at which the call option premium would gain value\”

In this statement, let\’s say the market is moving upwards, then the delta of calls would transition from 0.5 (ATM) to 1 (ITM). However, the delta of the puts would transition from 0.5 (ATM) to 0 (OTM).

Considering this, shouldn\’t the calls gain more value than puts because the delta increases in the case of calls?

That\’s right, Raghav. With the increase in the spot price, the option would gain more in terms of intrinsic value and hence the call option gains more.

Thank you so much, i think now im getting a hang of it 🙂

Takes a while, but keep at it. Good luck!

Thanks for the reply,

I mean like, not everyone keeps track of Option Greeks while trading right? Even if they did, like there\’s no tools to accurately tell us at what premium this option should trade at. So, there\’s a chance that the Time value of a premium is a rough guess that traders make?

Whats your thought on this?

Thanks 🙂

It depends on what kind of trade you want to be 🙂

I know for a fact that large institutional traders track the greeks closely and model their option book entirely based on greeks, and I also know traders who blindly follow their gut, both these are successful.

Either which way, there is no doubt that this involves years of practice and sharpening your trading instincts.

First of all, thanks for this module.

Here\’s a issue i have..

When i calculate premium using Zerodha\’s B&S calculator. There\’s like almost 100 points difference in calculated value and actual trading value.

and my 2nd question is,

Even though all these option greeks are acting on option premium\’s price. Aren\’t the traders who ultimately decide the premium\’s price?

The difference exists due to the mismatch between fair price and market price. Yes, its the traders, but their decision is after considering the greeks 🙂

I have doubt about my point 2 above.

(2) Strike price < Spot price < Breakeven point price

Then I will get back my full premium ( No profit / No loss)

If my understanding is correct ????

This depends on time to expiry, volatility, and the speed at which the market is moving.

I do have following understanding.

I purchased INDEX call options then on expiry date following holds true

(1) Spot price < Strike price < Breakeven point price

Then I will loose my premium (Complete loss of premium)

(2) Strike price < Spot price < Breakeven point price

Then I will get back my full premium ( No profit / No loss)

(3) Strike price < Breakeven point price < Spot price

Then I will get money = ( Spot prioce – Strike price) * No of option units

Please let me know if my above understanding is true

Thats right. As long as the spot is higher than you make money, every other situation you lose money.

Good evening Sir,

Happy Christmas.

Based in sensibul suggestions, whenever I want to put covered call my order get rejected due to OI restrictions. Please guide how to solve this issue.

For example

Current nifty price 13700

Expiry 31December 2020

I want to buy 13000 PE and sell 13300 CE.

Order is getting rejected.

Thanks in advance,

Vidyadhan Gedam

Good evening Sir,

Happy Christmas.

Based in sensibul suggestions, whenever I want to put covered call my order get rejected due to OI restrictions. Please guide how to solve this issue.

For example

Current nifty price 13700

Expiry 24 December 2029

I want to buy 13000 PE and sell 13300 CE.

Order is getting rejected.

Thanks in advance,

Vidyadhan Gedam

These are long-dated options, not much liquidity.

Hi Karthik,

How do we interpret option chain. For example how can we know option writing happening at some strikes? how to identify option writing strike so that we can take opportunity to short that particular strike. Please help me to understand the option chain

We have discussed this at length in the moneyness of options chapter here – https://zerodha.com/varsity/chapter/moneyness-of-an-option-contract/

Good Morning Sir,

Weekly expiry trade work yesterday also.

As you asked to concentrate on OI.

At 2:30 range shows11650 and 11700. As soon as 11650CE comes below 5 I bought it. It goes upto 25+

Thanx

Vidyadhan Gedam

Good luck, stay profitable 🙂

Dear Sir,

Pls ignore earlier comment.

I have tried long straddle today at 2:30 on Nifty.

BUY 18850 CE at 6

BUY 18850 PE at 16

Result is positive but humble request pls revert with reasoning.

Thanks in advance.

Vidyadhan Gedam

Same reply 🙂

Dear Sir,

I have tried long straddle today at 2:30 on Nifty.

BUY 18350 CE at 6

BUY 18350 PE at 16

Result is positive but humble request pls revert with reasoning.

Thanks in advance.

Vidyadhan Gedam

Markets were weak, volatility has spiked, good for both long CE and PE, hence you are profitable.

Dear Sir,

Good Evening.

Using covered calls as you guide sometimes back, giving consistently 2 percent weekly returns.

I m leaving both legs on Thursday morning taking profit. Not expected more than this.

But, when I take trade on Thursday failed miserably on weekly expiry after 2:30 as market moves awkward. After Humble request to tell me if I m right to use long straddle at 2:00 pm and close the trade at 3:00 pm on expiry day?

You can, its just that you may have OI restrictions if you are trading bank Nifty.

Dear Sir,

Where to get stock traded in options which moved with high volume and price. I want to find it at 2:00 noon.

Thanx in advance,

Vidyadhan Gedam

You can set an alert on Sentinal, check this – https://support.zerodha.com/category/trading-and-markets/sentinel/articles/how-to-edit-an-alert

Sir,

Is it paid API?

how to use?

Yup, do check this – https://kite.trade/

Dear Sir,

Should we get the minute by minute option premium price from any where.

This requirement is in excel sheet not on chart.

Thanks in advance.

Vidyadhan Gedam

You can get this via the Kite connect API.

Sir after buying a call/put option under overnight (NRML) category in the morning, by the noon if I realise to go for intraday(due to unexpected profit)and square off my position then is that possible? Is a switch to MIS possible later on? Or once entered modifications with regard to overnight Vs. intraday can\’t be made?

Thanks a lot!

Thats ok, Aarti. YOu can square off the position during the day itself. No need to switch to MIS etc.

Like you made a checklist in technical analysis chapter, is it possible for you to make one for options trading too?

It is hard to build one for options, given the complexity of these instruments.

What is meant by naked trading or naked options?

If you buy or sell an option, its called a naked trade. If you have a 2 legged position wherein the risk of one leg is hedged by the other, like in the bull call spread, then its called a spread.

Dear Sir,

Momentum must be there at after 2 pm on expiry day.

From last 3 months I am writing PE or CE based on trend and strike Max Pain +/- 150 points on expiry day. Premium is around 1 at 2.0 pm goes to 40+ at 3.15. is it best strategy to buy these 2-3 strikes at around 2 pm as one may to 40 plus.

Pls guide.

Thanx in advance,

Vidyadhan Gedam

As long as it works for you. Do keep an eye on the stoploss.

Good Evening Sir,

Please give your opinion on vertical spread to be used on expiry day. Strike selection to be done by keeping MAX PAIN in mind.

Thanks in advance,

Vidyadhan Gedam

Vertical spreads are good when you expect some momentum in the underlying.

One more doubt, If a option seller sells A Call option at a premium of Rs. 100 and buys it back at 80 Rs his gain is 20, assuming lot size as 100, here profit = 2000. But just while writing CE/PE option he would be entitled to receive full premium on that.

So, will his total profit be equal to Premium received + 2000(premium gain while trading) ??

Yes, he received the full premium, but when you close the trade i.e. buy it back, you have to pay the premium right? That leaves you with the difference between the buy and sell value of the premium as your P&L.

suppose, there is a strong breakout possible at a support region and price is expected to fall further. And the market conditions are such that it is favoring Downtrend. So, I trade with more quantity. However,after initiating short position, price seems to rise for a while thus exposing myself to risk (especially during intraday trades)

I don\’t mind taking SL if market goes 100% against me, but in this case I supose it\’s volatility. So, I was thinking of hedging to avoid losing my opportunity as well as reducing the risk.

I haven\’t tried it before, so thought discussing with you. 🙂

Fair enough, give this a try and see how it goes. Two things to note –

1) Ensure at support, when you buy, the stock forms a bearish pattern

2) Don\’t forget to honour the SL if the stock goes against you.

sir, It was a great module to earn once again. However I have a doubt

1) Can we hedge in Intraday using same order type i.e Both long position and short positions are Cover orders (CO). My concern is that when I do so it shouldn\’t squareoff my existing position.

2) If above statement is not possible, then should one order be CO and other be Regular order

3) After hedging, It doesn\’t mind where my stop loss is, Right ? because net effect is 0. So, I can have a liberty to move my SL to account for short term market volatility. And once market resumes to move in my favor, then I can remove my hedged quantity

1) Can you illustrate with an example please? I think this will offset the position, but do illustrate with an example please

2) This may work, example will help

3) Hmm, why do you need a SL if you are hedged?

How is it that with ample time to expiry OTM becomes riskier?

With ample time to expiry, its not. In fact, its advisable to buy the OTM only when there is ample time to expiry.

Dear Karthik,

As a checklist which you had given for trading in cash, can a checklist be given for option trading.

Thanks.

No, options work a little differently. So you cannot use the same.