1.1– What’s in the name?

I recently heard Joe Rogan’s podcast with Naval Ravikant. This is a 2-hour conversation and I think this is one of the most thought-provoking and stimulating conversations I’ve heard in a while. The topics discussed are quite scattered and covers a diverse set of topics, but it has a great flow to it with one thing leading to another. I’m awestruck with Naval’s multi-disciplinary approach to many things in life including inner peace, creativity, capitalism, and of course, wealth creation. The granular clarity he has on these topics is quite impressive. I’d suggest you check out the podcast/YouTube video if you’ve not already done that yet.

For obvious reasons, the wealth creation bit lingered on in my mind for a while. I was thinking about what Naval said in this podcast and it resonated with everything I have ever learned and experienced with money and my own pursuit to generate wealth. I’m nowhere close to the ‘financial freedom’ state he describes in the podcast, but at least I know that I’m not deviating much from the track. While I continue this journey, I thought why not share some of my experiences and learning with you all.

Hence this topic on ‘Personal Finance’.

When you think about personal finance, it often circles around planning your financials today, so that you have a better tomorrow. While some can do this themselves (or so they believe), few consult a financial advisor to chart this map for them. However, I’m not a big fan of approaching a financial advisor to help you chart a plan for yourself and your family. You should be able to do this yourself and your family.

After all, you know your family and their requirements best. You know what is good for the family and what is not. You work hard for your family today and dream of a secure future for them.

Your ‘Financial Advisor’, won’t do any of this.

He is most likely eager to peddle you a financial product that will earn him a good return. He will do the same with you and 20 other clients he may have.

So eventually, the onus is on you to secure your family’s and your own financial wellbeing. Remember, this is called ‘Personal’ finance for a reason. Its best kept personal and dealt with care and diligence.

Good news is, this is not rocket science. If you have the skills to do basic arithmetic, then half the battle is won. The rest of the work is just the application part where you’ll figure what is good and what is not.

This is exactly the objective of this module. At the end of this module, you will be in a position to do these things –

- Develop a deeper understanding of financial products and what goes under the hood

- Set up a financial goal and work towards achieving that

- Identify financial setbacks and address towards correcting them

I hope you are as excited as I’m about this module!

1.2– I’m not ready yet

Getting my first job was a struggle. I spent 6-8 month meeting tons of people, desperately looking for a job. I finally landed up with a ‘job’ to do. This was my first job and it was special. After working for a month, I got my first pay cheque ever and I was ecstatic. I felt responsible for the first time in my life.

I had a bunch of things planned with my first pay. Right from buying my mother a saree to taking my girlfriend (now my wife) out for dinner 🙂 . Being in a position to do things for your loved ones always feels good.

After all the expenses, I still had some money left in the account, albeit very little.

A good friend of mine suggested that I should invest that money. I brushed away his advise, thinking that the money left in my account was very little and would not make any difference whatsoever. However, I convinced myself that I would start saving next month onwards.

As predictable as it can get, next month to a similar story. I spent all the salary money and had nothing left to save. No points of guessing, this continued for years and I never saved a dime.

Even today, I regret doing this. In fact, this probably is one of the top regrets in my life. I wish I had started saving early on in life.

I’m sure most of your reading this may relate to my story. We all brush aside saving money today because the ‘amount’ of money we intend to save is very small. We all keep waiting to receive a sizable amount of money so that we can start our savings journey with that.

This never happens and unfortunately, we never start saving in life.

Here is an advise – even if it is a small amount, save it. This will make a huge difference in your financial life.

Allow me to tell you the story of 3 sisters to help you understand why you need to start saving early in life.

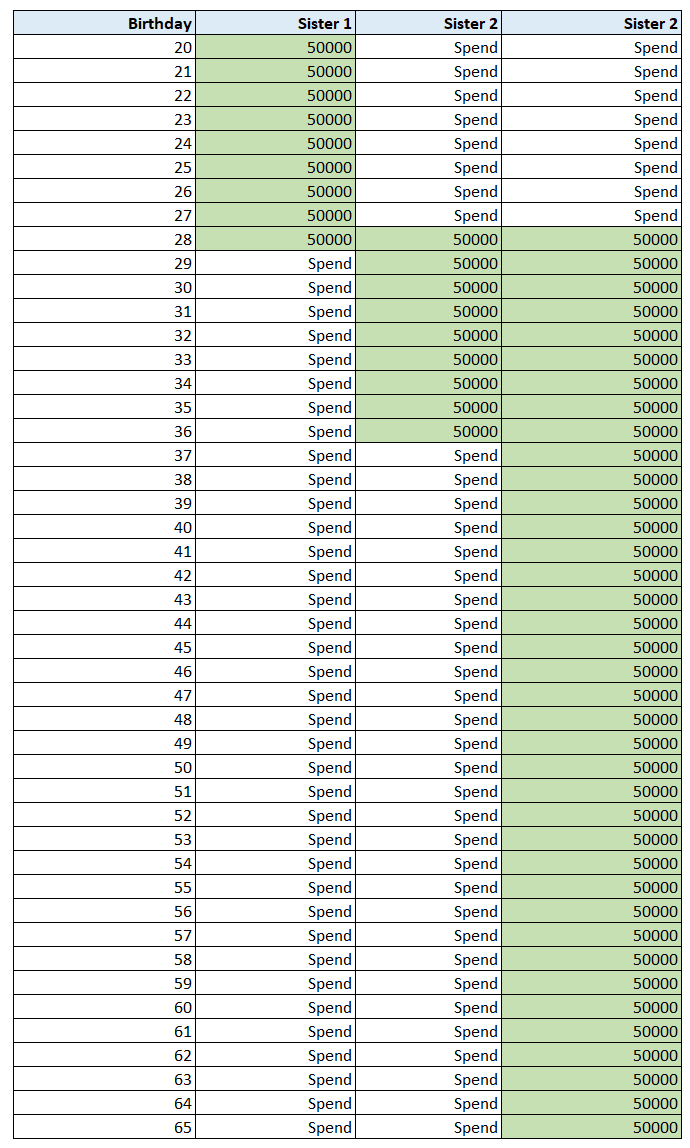

A father had triplet daughters. On their 20th birthday, the father declared that he would pay each daughter a sum of Rs.50,000/- on their birthday, till they were 65 years old. They were free to use this money in whichever way they wanted.

As a good father, he also suggested to his daughters that they could invest this money in a promissory note, which would pay them a return of 12% compounded year on year, with a condition that once invested, they were prohibited to withdraw that money till they turn 65.

Although they were triplets, their attitude towards money and savings were very different. Here is how each daughter utilized this money –

- The first daughter started investing right away i.e on her 20th birthday. She invested the first nine 50Ks that she received in the promissory note, and then the remaining 50K that she received (from 28th birthday to her 65th birthday) were all spent on frivolous things.

- The second daughter initially spent all the money she received. However, on her 28th birthday, she got a little serious. She decided to save the same amount as her other sister. So she saved 50K from her 28th birthday till her 36th birthday, and the money she received from 37th to 65th was spent.

- The 3rd sister was a bit casual till her 28th birthday. She spent all the money she received from her dad. However, on her 28th birthday, she got a little serious and decided to invest the 50k cash all the way up to 65 years.

Here is a summary of what each sister did with the money –

- The first sister saved for the first 9 years (between 20th to 36th birthday) totaling Rs.450,000/-.

- The 2nd sister saved for 9 years (between her 28th birthday to 36th birthday), totaling Rs.450,000/-

- The 3rd sister started saving from her 28th birthday, but saved all the way till her 65th birthday, totaling a sum of Rs.1,900,000/-

I have a question for you now – on the 65th birthday, which sister do you think would have saved the most? Remember, once the money gets invested the promissory note, it gets locked till the 65th birthday and do not forget the promissory note gives a 12% compounded return year on year.

Pause and think about it for a moment.

Chances are here is how you’d think about this –

- The first sister saved too little, very early on, so she would not have saved much

- The 2nd sister again has saved very little very randomly, so she may not have much on her 65th birthday

- The 3rd sister, although started late, has saved quite a bit and continued to save for the entire duration, hence she must have the highest savings on her 65th birthday

This is expected (in fact I’d be surprised if it is anything else) as we humans see things in a very linear fashion. Here we equate the future value of our savings to the amount of money saved today. But there are two other variables at play here – time and return, both of these when concocted together, works in a beautiful nonlinear way.

So, here are how the numbers stack up for the 3 sister problem, the numbers may put you off guard so hold your breath –

- The 3rd sister saves 19L, which grows to a massive 3.05Crs by the time she turns 65

- The 2nd sister saves 4.5L, which grows to an impressive 1.98Crs by the time she turns 65

- The 1st sister saves 4.5L, however, she ends up with a whopping 4.89Crs by the time she turns 65!

Are you confused?

I’m sure some of you are. So here is what I want you to note –

- The first and 2nd sister saved similar amounts, but the difference was the amount of time they both gave their money to grow. The first sister gave full 45 years for the investment to grow, but the 2nd sister gave only 38 years. See the difference it makes? This is the reason why I regret not starting to save early on in my life

- The 3rd sister ends up with the 2nd highest corpus, but for to that happen she had to save for a very long time. But please note, this still does not match up to the 1st sister’s corpus.

So if you are someone like me, who missed savings during my early days, then the best option we have now is to save for a really long time.

I hope by now, I’ve convinced you why you need to start saving early. By starting early, you use time to your advantage and it does play a major role.

Wait for a second – how did I calculate the growth of money for each sister? How did I figure sister 1 saved 4.89Cr and sister 2 saved 1.98Cr?

Well, this is calculated by applying the core concept of ‘Time value of money’. Time value of money is the central theme of personal finance. Hence, for this reason, we need to understand this concept right at the beginning. So in the next chapter, we will discuss time value and its application in more detail.

Download the excel sheet used in the chapter below.

Key takeaways from this chapter

- Personal finance is best when kept personal to oneself.

- Eventually, you as an individual should be able to build a financial plan for yourself and your family

- Savings early on in life makes a huge difference in the savings corpus at the end of the tenure

- Time value of money plays a key role in personal finance.

Good to hear that you are not only a trader hero but also a great lover too.. Hahaha

Hey, love the content. Just a correction – In the table (4th column), the title should be \”Sister 3\”, and not \”Sister 2\”.

Noted. Thanks 🙂

Sir,

Do Zerodha has provision to invest in US growth Index funds/MFs? I found one for Motilal oswal. However it allows for SIP. However, I am a lumpsum investor. Could you kindly help me how to proceed?

No, not yet Anirban. But if its via a mutual fund, then you can via Coin right?

Hey Karthik, I think for the first 9 years, it works same as the SIP. The formula for those 9 years is FV = P × (((1 + i)^n – 1) / i) × (1 + i).

Hey, I need to double check this. But looks like you\’ve done that already.

Hi, I have found how the first sister\’s money accelerated to 4.89 crores. Do have a look at this sheet.

Principal Interest(%) Interest (INR) Amount

50000 12 6000 56000

106000 12 12720 118720

168720 12 20246.4 188966.4

238966.4 12 28675.968 267642.368

317642.368 12 38117.08416 355759.4522

405759.4522 12 48691.13426 454450.5864

504450.5864 12 60534.07037 564984.6568

614984.6568 12 73798.15881 688782.8156

738782.8156 12 88653.93787 827436.7535

This data is for the first 9 years and then the last amount i.e. 827436 gets compounded for the rest 36 years.

827436 * (1+12%)^36 = 48930902.7492 i.e. 4.89 crores.

let me know if you have any formula for the first 9 years because simply the compound interest formula won\’t work there as the amount is reinvested every year. So the principal amount becomes (Amount of the previous year+50000).

I need to double check this. But your formula seems right.

Hi,

Please explain me how 4,50,000 turned into 4.89 crores. Your sheet does not help me. Please guide me through calculation.

Did you check the formulas linked to the excel? If not, please do let me know.

Hi!

If the 3rd sister invested Rs. 19 lakh, then it means she invested 28 years annually from 28 to 65 years. So, that means even the amount received on the 65th birthday was invested. Shouldn\’t the amount be 3.41 crores instead of 3.05 crores?

Also, for the 1st & 2nd sister the amount stayed invested till their 65th birthday, so the amount received by them should be 5.48 crores and 2.21 crores respectively. Please confirm

About the math, I think my sheet is correct, but I will double check.

Sir,

Recommending a small correction –

In the Excel screenshot which you shared, the headers should be sister1, sister2 and sister 3. As of now it\’s sister1, sister2 and sister2 🙂

Hope you don\’t mind.

Thanks,

Mayank

Ah, thanks for pointing that Mayank. Will surely look into this and fix.

The difference in certification value which is paid on website and free on mobile application. So, can you put some light on it?

The mobile certification is a more of a casual certification, which you can give anytime, on your own. But the one on the website is proctored and scheduled. Its like a proper exam.

Hi Karthik,

Please do tell the difference as early as possible. Thankyou in advance!!

Sorry, what difference are you talking about?

Hello Karthik,

Firstly the modules of varsity are too good and easy to understand. So, thank you so much for it. Also, the podcast you suggested is just too knowledgeable and insightful.

I have one general query regarding the certification. On website it shows a paid certification but on mobile application for individual modules it is free. So, what is the difference in both?

I love varsity and its commitment to providing accurate, unbiased knowledge. As such, the linked podcast seems extremely out of place, irrelevant, and biased. Not that I disagree with any of the points in there, but this is not the scientific rigor that I appreciate varsity for.

Natij, I thought it provides a good framework to think about personal finance. Not sure if you\’ve sat through the entire podcast, if not, I\’d suggest you do once.

Can there be a video series published for this modules as well ?

Its already there, Sanket. Check this – https://www.youtube.com/watch?v=6sq2o1atWLY&list=PLX2SHiKfualGsjgd7fKFC-JXRF6vO73hk

Naval Ravikant is the inspiration of my life, and I am a huge fan of his philosophy around life, his philosophy revolves around the purpose of life which is health , wealth and happiness.

Health = A calm mind and A fit body

Wealth = Money that works when you sleep ( Zerodha Varsity comes into the picture for learning about ethical wealth creation)

Happiness = Enjoying moment to moment in life on doing things you love to do that makes you happy, it\’s a choice.

Living far below my mean is Freedom. (Spending less than I earn , reducing spends to save money and have freedom and no debt )

And another quote of him is

\”The ideal school would teach health, wealth, and happiness.

It‘d be free, self-paced, and available to all.

It‘d show opposing ideas and students would self-verify truth.

No grades, no tests, no diplomas – just learning.

Actually, you’re already here. Careful who you follow.\”

Zerodha Varsity is the school for ethical wealth creation in the world. I love your content.

Thanks for the kind words, Swarnava. Yes, Naval Ravikant and his words of wisdom are truly enlightening.

Sir try to allow GTT for intraday trades.

Karthik sir pls ask nithin sir.

Amazing example, simple, concise and draws the point home!

Happy learning!

Great content. I just wanna point out one minor issue, the heading of 3rd column has sister 2 instead of 3. Someone might misunderstand.

PS – Do not publish this comment, it\’s just a simple feedback

Thanks Madhav. Will check this 🙂

Thank you for spreading knowledge !!

Happy learning, Hiren!

Hi Team Zerodha,

Thanks for making varsity free for all. Nice modules and very easy to grasp. However one suggestion from my end – if we can put these chapters just after fundamental analysis i.e. 4, 5 & 6. These are more appropriate for people don\’t want to do option & future trading. Just one though came to me while reading the various chapter 🙂

8. Currency, Commodity, and Government Securities

11. Personal Finance – Mutual Funds

7. Markets and Taxation

Thanks for making varsity. Thanks

Thanks for the feedback Subhodhi. Noted, let me check if we can sequence it 🙂

Hey Karthik! Loved Zerodha Varsity.

Would really apperciate if you could provide Certification for This module. i.e. Personal Finance.

It will be included soon in the main certification program we have 🙂

https://zerodha.com/varsity/certified/

Respected sir,

I Palash Sarkar a central govt. employee want to invest in ELSS mutual fund to avail tax benefits.My question is what should be the minimun lock in period for this benefit?

Thanking in advance,

Palash Sarkar

Sir, as a beginner which module to start first? Can you please help in the chronology one should start to read the Varsity Module.

Start with module 1, after that you can choose either TA or FA based on your preference. Then you can probably look at Futures and options. But do read inner worth module as well.

great as always

Happy learning 🙂

Topic says Personal Finance – Part 1. So can we assume that there another part , if yes then pls. Publish it soon. I am planning for my financial Goals by myself and started with this module. Will it be really help me to achieve my financial goal through Miutual Funds?

Will try and do that, but it will take sometime 🙂

Thank you sir.

Good luck Muthu.

Sir can you add a chapter on LIFE INSURANCE POLICIES in personal finance module – it would be more helpful in knowing the important concept & terms related to that, as well as to choose the BEST policy out there

a humble request sir, Thank You.

Yes, we will.

It will be great to have the link to next chapter at the bottom of the article for easier accessibility. Just a suggestion

Thanks, I\’ll note this as feedback and share it with the team.

Hi Karthick,

This stuff on Personal Finance in amazing detail with example is so very usefull. I have been searching for such stuff for Indian market, as investopedia like stuff are more US focussed and that too freely available,means the intent is noble and you guys wants the larger population to become more aware/wise investors.

I have taken a personal goal of completing this entire reading this year to help my investment /personal finance knowledge and mindset.

Thanks & God Bless you ,Kamath and the Zerodha leadership for this.

Cheers to Life,

Edward

Thanks for the kind words, Edward! Hope you like the content on Varsity 🙂

God bless you…. I have for some years & never save because my salary was too small which I even managed with it. But you have enlighten me tonight. 2022 will be a good year.

I\’m learning 😀

Thanks for the kind words! I hope 2022 is a fantastic year for you!

\”No points of guessing, this continued for years and I never saved a dime.\”

Did you mean to say

\”No points for guessing, this continued for years and I never saved a dime.\”

Yes, I meant to say that I dint save for the first few years 🙂

I want to thank you from core of my heart for such a set of constructive efforts towards educating us and that is too free of cost .Here I understand the true meaning of altruism.The way the topics are explained here is very much interesting.Thank you very much.Hope we will be fortunate enough to receive many more related articles.

Thanks for the kind words, Ujjal 🙂

What a conversation!! Naval hits the nail on its head on so many things.

You bet, he does!

Hi,

Why is this module not available on the app?

Why isn\’t module this available on the varsity app?

Very soon, working on it.

I read lots of documents about personal finance, every writer tries to motivate for early saving to get the time work in growing money in long term. Every writer mentions minimum return which compounding.

But nobody tells where to invest like mutual funds or stocks etc.

Nitin, please go ahead and read the contents here, I\’ve suggested how to invest in MF and even laid down a template for you to choose your MFs.

The story of three sisters was eye opening. But the main problem is where they were investing.I am 21 but I don\’t know where to invest. Mutual funds, I guess are only for 5-7 years. Can you suggest this 12-14 returns every year for long term like 50 yrs.

The rest of the module is dedicated to helping you how to select the mutual funds 🙂

It would be great if you could introduce bookmark feature!

Its available in the app.

Bahut dino se intajar tha es pdf format ka thanks God

Nice read. Good work

A small correction in the line below

The first sister saved for the first 9 years (between 20th to 36th birthday) totaling Rs.450,000/-.

Should be 28th instead of 36th

Thanks for pointing that out. Let me check this.

Thanks Karthik for sharing this , i have started going through it.

I didn\’t understood the excel sheet of \’growth in savings column\’ of how it started from 81 lakhs for 1st sister, and 31 lakhs for other 2 sisters in pdf attached.

Can you please explain how it works.

What i was expecting

4.5 lakh * 0.12 = 54000 + 4.5 lakh for 1st year

5.04 lakh * 0.12 = 60,480 + 5.04 lakh for 2nd year and so on

It is basically a growth of 50K over 20 years at 12%.

50K*(1+12%)^(20 yrs)

20 yrs can me in yrs or months.

Why is the Module 11 \’Personal finance \’ not present in the Varsity mobile application ?

We are working on it, Bhupesh. Should be up soon.

hi Karthik,

Thanks for the amazing content. Just wanted to check, is there a downloadable pdf for this module of personal fin? was able to find the pdf for other modules but not able to find one here.

Not yet, will upload one soon.

Sir, plz provide us the pdf of this module too.!

Very soon.

Hey Karthik,

Please provide a PDF download link like all the other modules. I am not finding a hyperlink for this module

Yet to do.

plz provide download option for module 11,12

Hi, one correction below the table showing money saved by each of them for sister 1 it is mentioned that she saved from 20 to 36 th birthday whereas it is 28th.

Checking this, thanks Rohan.

Sir

:- suggestions for improvement.

SUB :- Watchlist.

With recent increase in ipo and over all number of Good shares have increased.

Zerodha has a watchlist of Five into fifty =250shares watchlist.

I suggest at least doubling of the watchlist. OR may be upto 1000 in Number.

It will support faster trading to All your clients.

Also,just like our mutual fund investments stay hidden from main trading platform.

Similarly if any platform can be created for LONG TERM investments…which will not be visible on Trading platform portfolio.

So it will not Disturb or Distract our direct trading activity.

Thanks

Tushar

Tushar, it will be impossible to track 25 stocks on a daily basis, let alone 50 or 250 🙂

Long term investment = you can simply choose not to add it to the watchlist no?

hi sir your explanation is very simple.

.do you have book which covered all chapters in varsity ..

kindly publish it ..i am interested to buy it

AJAYKUMAR B NIGASHETTY .ASSISTANT PROFESSOR

MBA ,KSET(.PHD ) IN MANAGEMENT

ZERODHA ACCOUNT HOLDER. MUTUAL FUND ADVISOR

No sir, everything is made available online. No hard copies.

Hey, why am I unable to see this chapter on the Varsity app?

Will be updated soon.

Hello sir, amazing write up.. love the way you try to enlighten your audience. My request is for the technical team.. can we have a next chapter link available at the end of each article? Would be a great help for people to continue reading as long as time permits.

Thanks to the author and also to the technical team.

Personal finance or Inner worth ko Hindi me convert kare

when PDF will be available ?

Soon, hopefully, this week.

Hi Karthik, Thanks for providing such amazing content that helped me start investing and trading. A slight request though, can you please provide a pdf version of the Personal finance module. Thanks in advance.

Sure Naren, will upload the PDF soon.

The content is really great and the effort to enhance financial literacy through these modules is commendable.

What I miss is a \’Previous\’ and \’Next\’ navigate button so that one could easily move from one chapter to next without having to scroll all the way up to the top of the page and then go to the next chapter using the index. Hope this feature gets added soon !

Thanks, Khushboo. But the chapter index is on the left is sticky, you can click on the next chapter name there. I\’ll anyway pass this feedback to team. Thanks.

Reading this page, I am regretful that I am starting very late. I am in my mid 30s

Hi karthik,

I loved your writing style. Its very simple, easy to understand. I am from an engineering background didn\’t know any basics of markets. But, after reading the modules from Zerodha varsity, I understood many concepts of share markets. Thanks a lot.

Below are my suggestions for you

Why there is no pdf link for module 11 personal Finances? Please, activate the pdf link.

Please, write a book on Income tax. It will be helpful for people like me who are from science background and also helps engineers to understand our salary slip, taxation process and also the Tax savings.

Thanks a lot again,

Thanks for the kind words, Ramakrishna. Yes, the PDF will be updated soon. We have a module on taxation already, have you checked that out? https://zerodha.com/varsity/module/markets-and-taxation/

Sir can the pdf of this module be provided as i need to take a printout and read.

Will upload soon.

Awesome. I didn\’t know that there are more modules available on Versity website. I was just checking the app and it doesn\’t have much modules and they didn\’t updated. This module is a great gift for people like me who comes from poor background.

Happy reading, Srikanth. We will update the app soon.

One great thing about these modules in varsity is its ease in language coupled with examples such that people who are not from the same background can able to understand things clearly .( Like the Excel sheets done in this chapter) .

Thanks Sripriya. I\’m glad you liked the content in Varsity. Happy learning!

Very good article…. Need correction in this \”The first sister saved for the first 9 years (between 20th to 36th birthday) totaling Rs.450,000/-.\” this needs to be changed \”The first sister saved for the first 9 years (between 20th to 28th birthday) totaling Rs.450,000/-.\”

Thanks, Vamsi. Checking on this.

Modul हिंदी में नहीं हैं क्या?

Hello Sir its a request, please give an option to download in PDF format

Praveen, we will upload the PDF soon.

Can you provide pdf for Personal Finance Module?

After the module is completed.

There is a mistake in writing regarding saving of 1st sister, she save 20th birthday to 28th birthday, not 36th,

Will check on this.

Please Make its PDF

Dear Karthik,

Can you please provide pdf version of Chapter 11 and 12

Going through on a monitor is too strenuous for the eyes.

Thanks & Best Regards,

Milind Kolekar

PDF for 12 won\’t be possible, 11 will go up once the module is complete.

This may applies to most of us. We are middle class Indians we don\’t get to be the first sister generally. And we are fortunate enough to get here to learn the personal finance from Karthik Sir. So, Karthik Sir had stopped us from becoming the 3rd sister. So, Now for those who are starting as 2nd sister (Or some of us are even so lucky that they get to be the partial 1st sister). We can achieve the level of 1st Sister By investing more in our time frame. The corpus of 1,25,000/year will help you achieve that. No need to get depressed/disappointed, And hide behind the reason that i didn\’t had a job back then or the money to invest in that age Or our parents didn\’t know about that either. You can still beat the first sister just 1.25L/Yr which would result into whooping 4.94Cr. And we won\’t stop at that because we know what we have lose already. So, we are not going to stop at the age of 36 either. And Why should we, because by then we would be having stable life and everything settled. All the backup you need is 2 insurances 1.Life(Term) 2.Health And then forget about everything and keep investing. Today i just completed my target for 1st year, the 1st milestone, (That is what got me here, to visit this page/blog/Lesson again) Now 8 more to go. Thanks Karthik Sir.

You said it right, Adarsh! Happy learning and investing 🙂

sir can you please elaborate the diffrences in investing in mutual funds through demat and direct mutual fund by app. Thanks

Direct MF in DEMAT means the units are sitting your DEMAT like stocks, otherwise, it is in a folio record with AMC. Always prefer the DEMAT mode.

I was going through the chapter 1.2 of personal finance. While reading, i think there is some typo error below the summary table sheet:

\”The first sister saved for the first 9 years (between 20th to 36th birthday) totaling Rs.450,000/-\”

The year of 36th birthday should be replaced with \”28th birthday\”.

Thanks, Vijay. Let me check that. Could be an oversight, but the gist of the story still remains 🙂

Karthik, would it be possible to have a tutorial on income tax, income tax returns, filling. And ways to save tax.

\”Compounding effect is 8th wonder of the world\” – Albert Einstein

You bet!

Sir can i get pdf of this module

This module is still work in progress, PDF will be done once completed.

Sir , will this compounding calculation beat the Inflation ??

As long as the rate at which compounding occurs is higher than the inflation rate.

Do I need to finish previous all modules to read & understand this ? or I can read this and then go back to modules form 4/5/6 ? Pls suggest.

You can choose to read this on an individual basis, especially since the module is highly concentrated on Mutual funds.

I am read all hindi modules

I don\’t understand English very well

Plz this module and next module made in hindi and put it

We are working on it, Sanjay.

Kartik sir pls provide module 11 and module 12 hindi version and also need some correction in hindi version which i pointed but till now there is no step taken

Translation work has started for 11. 12 we cannot translate.

Karthik sir pls provide module 11 and module 12 hindi version and also need some correction in hindi version

Personal Finance PDF will be done when the module is complete. Inner worth PDF wont be available.

Hello there,

Where are the pdf files of module#11 and module #12?

PDF for for 11 will be done when module is complete. No PDF for 12.

Sir why this is not available in pdf format? Please provide the same as other modules

Hello Sir ,

would there be pdf versions too for new modules like others? I prefer to read on moving to kindle.

Thank you so much for all the awesome modules.

It will be uploaded once the module is completed.

Respected Sir,

Yes, by overseeing your reading material on TRADING, I am glad to go through in detail to LEARN and start investing (of course in small amount). I haven\’t observed through internet but often connecting or asking for good material i came through your site and atlast got it.

BIG Thank you before closing and awaiting such good content.

Happy reading, Ajay 🙂

Very good information to every Invester and trader . But no pdf available to download for 11,12 modules . Please provide them

It will be available once module 11 is complete. No PDF for module 12.

please enable the download option for the module no.11 & 12

thank u for ur valuable contents………..

11 and 12 is not ready yet. 12 we wont have PDF.

Good content. It\’s Simple also

Happy reading!

Sir thanks for replying . Eagerly waiting for the PDF. I would say the best material available that too free, really appreciable please continue the good work. Please make available PDF as soon as possible

Happy to note that, PDF will be updated once the module is completed.

Thanks 🙂

Sir, is PDF available for Personal Finance module?

Thanks and Regards

It will be, once the module is complete.

Hi karthik sir

Thanks for sharing your knowledge

this is really brilliant work.

Sir can you provide this module in hindi..???

This module is work in progress, Hindi will be available soon.

Nice articles , some of the best content i have seen on Personal Finance . Good work

Happy reading, Mohit 🙂

Sir please give the option of downloading PDF for all modules. your modules really amazing and extra ordinary

This module is work in progress, PDF will be available once its complete.

Hi Sir,

Thank You for providing good content for free. Really appreciate your effort.

I have one request, Could Modules 11 and 12 be made available for download as PDFs? As I am due to join ship in next month or so, it will be difficult to access this content onboard.

Mod 11 will be once its complete, M12 I\’m afraid cannot be converted to PDF.

Hi Karthik,

Thanks for all these wonderful work.

Why hasn\’t the varsity app updated with these contents? It has much cool features rather using the website.

We are constantly working on the app. We now have nearly 6-7 modules on the app.

Amazing, Looking forward for the same. It will be great if its covers what and all parameters one should look before investing in the funds, Fund manager credibility etc

Yup, will list down everything that I think would be relevant, the rest we can explore via discussions 🙂

Karthik, How to review the mutual funds performance, what the parameters i should look at to move away from my mutual funds, some of the funds have given negative return even in 10 years of investing, how to sense early that this fund will not do well.

Rajan, I will be covering this shortly in the coming few chapters. Request you to hold till then, thanks 🙂

That podcast had hit my mind so harder that I can\’t even explain, Thanks a lot Karthik!

You bet 🙂

Thanks, Karthik Sir for all your efforts. I have just started reading varsity from this module only as I believe this is the most important one to read first. May I know in case if you update this chapter in future, how would a reader know that you have inserted some new information into this chapter? Do you highlight new information added to the chapter?

Please do follow our Twitter handle Bhuvan – @Zerodhavarsity, all updates are posted there.

I have completed all the 10 modules that are available in the pdf form and the way in which each and every concept has been dealt here as well as the humour used while dealing with the important topics (eg. showing a glenmorangie brewey while dealing with the commodities) is really remarkable.This is really something that a kid can start reading and by the end of the course, he can graduate as a good trader/investor.

Thank you so much Kartik sir.

would surely meet you in future.

Stay safe

Happy trading

Hey, thanks so much for your kind words Shantanu. It is a privilege for us. Hope you continue to learn and grow 🙂

To my previous comment, I got my answer. It is kind of amount invested overtake the time value of money.

Thanks.

Yup.

Good example to know the time value.

But when I reduce the interest rate to 8% I see that sister3 ends up with more money.

sister1 : 1.08

sister2 : 0.58

sister3 : 1.10

Can you please explain this?

Hmm, I\’m not sure if that is correct. The relationship should hold irrespective of the rates.

Hi Kartik,

As I reading this artical one thing suddenly populated in my mind that why varsity should publish in regional language too this will break the language barrier. I hope this will help to increase financial literacy across nation.

We have started that effort, the contents are now available in Hindi as well 🙂

Namasthe Karthik sir

You are really ossum

Any beginner can easily learn stick market with your lessons

Thank you very much for helping us

One request from my side

Please do update all these chapters in mobile app as small bite sized cards, it will be very much useful for revision

Please sir please

Thanks for the kind words, Abhishek. Yes, we are working on it. Will be available soon.

Sir I don\’t have words to appreciate your efforts

Sir please pdf of last two chapters.

Priya, this is a work in progress module. We will put up the PDF once the module is complete 🙂

Sir

there is no PDF download feature for module 11 and 12 which is there for all other modules. This is very convenient to read when we get time. Can you please add this feature to module 11 and 12. It will be a great help. Thanks. Santosh

PDF for 11 will be available once the module is complete. PDF for 12 won\’t be, as we only have the publishing rights.

Karthik, this is super helpful and a very interesting topic indeed. Have you ever used any tools that you found particularly helpful to manage your personal finances better? There are a few I know of but I\’ve stayed true to using excel sheets.

Depends on what exactly you are looking for Anshul. Most of my requirements are taken care of by Kite and Coin 🙂

Hey Karthik,

Great Article!!!

Is the story of triplets an inspired story or Zerodha\’s own thoughts? I wanted to use it in one of my you tube video and wanted to know who should be given credit for.

Thanks

Arif

Its a popular story to convey the power of starting early with investments 🙂

Hello Sir,

I\’m into final year of engineering and got interest in trading. I searched a lot on internet all about trading but couldn\’t find one, until I found this. Thank you so much sir. You\’re doing such a great job.

Can you please tell what will be the total number of models and what else would be covered under those modules? (which would be uploading further)

I\’m glad you liked the content here, Aryan. Currently, there are two modules in progress – Personal Finance and Inner worth. Post this, I plan to take up Financial Modelling.

please add the button useful for comment this way best comment and answers will come up on top automatically

This is on the list of things to do. Hopefully soon.

it would be great if i could download the last two chapters (as there is an option at the end of all your chapters for download and save it as PDF) …Zerodha I would like to convey my gratitude to the team..as they invested time to put all this info for free…I had decided to trade with you more than any other brokers in the market ..good intentions…whatever the business interests or marketing strategy that runs behind this..I dont care as long as it is helping me…all the best…

PDF is available only when the module gets completed. This is work in progress. Thanks so much for the kind words 🙂

Request you to please publish the pdf version of this topic – PERSONAL FINANCE.

This is work in progress, PDF will be published once completed.

Thank you for the module sir.. By the way, in case return rate is around 8%; maybe Sister 1/time value may not be in favor for her; rather for Sister 3? Again, big thanks for sharing..

The return will be same across all three sisters, right? It is the time that is making all the difference here.

Very nice way to convince, start saving right now at any age, however it will be more useful for childrens.

Thanks for awaking dear.

Happy savings 🙂

Loved the example of the three sisters.. Surely something I can use to explain my friends 🙂

Happy to note that, Omkar. Good luck 🙂

Pdf of of Module 11 would have been nice.

PDF gets done when the module is complete, this is work in progress.

Great Module.

Thanks for educating financially all the generations.

I am a Physics lecturer and I often tech my student importance of finance education with strategy from your modules.

The 3 daughters example is excellent.

Thanks

Thanks and happy to note that, Sir 🙂

Hi,

Invest early is best option, then for children anyone can start,it will help children.

Please advice about children plans also.

Thanks,

Santosh

Yes, we will cover that as well Santosh.

Hi Karthik,

I was waiting for this module badly. I\’m doing my own personal finance and for my family\’s finance. I had been doing this for long time. I\’m personally an electrical engineer and working in power sector for last 8 years. I don\’t have any degree in finance. Can you suggest options or opportunities for me with this background to switch career to personal financing? Your own experience, knowledge or reference to someone or any other website where I can explore the opportunities will be of great help.

Thank you!! Keep writing,keep inspiring!!

Thanks for letting me know, Govil. If personal finance interest you, then maybe you should check out the CFP certification. That will put you on the right track.

Hi Karthik,

Is there any topic/article exclusively on intraday trading/BTST in Varsity?

Thanks!

The modules on TA/Futures/Options can be used for intraday trading.

Dear Sir,

I love your work and have been reading them since weeks. The best thing about it is the way you put the most complicated(which I used to feel before) things into the simplest way possible and easy to understand. I have asked some of friends to go through it and they too are very happy to find such usefull content.

Thanks a lot.

In this module, I just found a small typo error. I hope it will help you in correcting it.

The first sister saved for the first 9 years (between 20th to 36th birthday) totaling Rs.450,000/-.

It Should Actually be- The first sister saved for the first 9 years (between 20th to 28th birthday) totaling Rs.450,000/-.

Hey thanks for the kind words, Bobba! Let me look at the numbers again, thanks for pointing that out 🙂

Thanks a lot Karthik…. 🙂

Cheers! Happy reading, Raja 🙂

Ohkk.. So how the recent Interest rate cut by RBI affects the yield of the bonds? so does the rate cut mean increasing in the Bond\’s yield and decreasing Bond price ?

As the interest rate goes down, the price of the bond increases, and therefore the yield of bond drops. Likewise, if the interest rate increases, the price of the bond decreases, and hence the yield increases.

Dear Karthik,

Could you please tell me what are the technical and Theoretical factors which influence the yield of GOI Bonds.

Regards,

Raja

Two main things –

1) The perception of the risk factor in the economy, which will, in turn, influence the monetary decisions

2) The monetary policies itself.

THANKS KARTHIK.

Welcome!

Dear Karthik,

Could you please provide me any study material, information or link with respect to Interest Rate Futures

MARKET which is there in NSE. It would be a great help. Thanks in advance. 🙂

Raja, check this, hope this helps – https://www.nseindia.com/content/press/interest.pdf

Good content. Simple to understand. Nice effort. The table needs a small typo correction for the column heading. \”sister 2\” repeats two times

Hey Rohit, thanks for pointing that out. Will make te change.

Good article for kids

This article is not for people who wants to be in fast train.

Retire Rich Retire early.

Well, if you can find that fast train, then don\’t forget to educate the rest of us 🙂

Good luck!

Thank you karthik anna and team for writing this module.When can we expect valuation module

Thanks Shivam 🙂

We already have a module on valuations here – https://zerodha.com/varsity/module/fundamental-analysis/

how would you manage to have a GF before even getting your first pay cheque. You surely were saving from your pocket money right from your early school days 😀

Lol 🙂

Luckily a few things in life are still not associated with money!

Daughter turns 65 but father still alive and gives 50000 to each.

No, at 65 it stops 🙂

Hello,thank you for all the modules, can you introduce an upvote button for your chapters?? Many times i want to \”upvote\” after reading the chapters and your answers to question but cannot!

Your good wishes are the biggest upvote for us 🙂

sir will you discuss about multi regression analysis ?

Not anytime soon, Jaya.

When will the remaining chapters be published?

Yes sir, one chapter at a time: 😉

Y\’all are growing in a fantastic manner. Love y\’all for creating varsity!

Keep at it.

You\’ve got a lot of admirers who are millennials 😀

Sarthak, I\’m happy to note that 🙂

We will do our best to put up great content regularly!

WOW

Waiting for TIME VALUE OF MONEY.

😆😆😆

Preparing for CAIIB. this module helps me for both (career & personnel life).

Good luck for CAIIB. Will try and put up the chapter soon.

Sir… A big thank you for starting on this topic. I recently gave my Level 1 CFA. In the process learnt a lot. And realized a lot. As per Ethical Standards, advisors should have client interests first. But I guess it doesn\’t happen in the real world. Everyone is after referral fees and commissions which is sad. I also think as a normal person who doesn\’t have much financial knowledge, nor is in the finance industry, investing completely on own is very challenging as time passes on. Yes one should still strive to increase their financial literacy if they want to generate wealth. If Advisors truly remained failthful for their client needs, much more can be achieved.

I believe the best way for them is to invest in passive funds, either Index or ETFs. But there is a huge lack of sectorial ETFs in India. I was impressed with Smallcase after realizing it\’s value. Thank you to Zerodha for seed funding such a platform.

I know you are 100% believer in equity (as said in Module 1 of varsity). But hope you talk about other options in this personnel finance too. Varsity focused primarily on trading. But this is a much needed module. Thank you again for bringing it out 🙂

Thanks for the kind words, Sujeet. Yes, the idea is to focus on everything that matters to the financial life of an individial.

Sir I am personally excited about the module completely dedicated to personal finance. I just want to know what are some other chapters that we can expect in this Module? Thanks.

Sundeep, plan to cover everything from the math involved in personal finance to MFs and insurance. Let\’s see how this goes 🙂

Thank you karthik Sir for this beautiful story and the BIG thank you for the lessons from this story. I may be find myself in this story as not saving or not investing for long term. I will try to save first and spent later. I am hoping you may post some more learning lessons in near future. Thank you sir again….

Welcome, Rajesh. I\’m glad you liked the content. Will try and put up the next lesson soon 🙂

Hi Karthik. Your work is really inspiring. I am facing a difficulty, would appreciate your help. I\’ve cleared CFA level-1 and gave level-2 a week back. I am a fresher with an engineering background. Could you please tell me how does one get a good job in an investment banking firm, Private Equity firm or an asset management firm with no prior experience with just CFA certification. Thank you.

Rahul, I think the best place to look for jobs is in the asset management side (mutual funds) and credit rating agencies. Cracking through anything else without prior work experience could be a challenge. However, few IBs do accept freshers.

Thanks a lot for putting up the Module on Personal finance. This will help us who are very conservative and want safe method of savings. I have the same feeling of third sister narrated in the story and did not understood the importance of saving early on life.

I hope we can deliver a good module on this topic, Sankar. Yeah, as I\’ve mentioned, I too feel bad for not starting from early on.

One feature suggestion for Varsity site:

Allow us to read through all the recent comments in descending order instead of top five.

1. More like a \”Read more\” link below the top 5

2. This link will take us to a Varsity wide commend feed in descending order.

3. An option to view thread beside each comment to take us to respective page (with auto scroll to that comment in respective page)

This way, it would be easier to keep track of conversations developing and to get interesting insights from fellow traders

Hey thanks for the suggestion, will pass this feedback to the tech team.

Awesome Sir. Finally A new module. Still going through the previous ones over again in the mean time :))

Hope you like this new module as well, happy reading 🙂

sir next chapter

Will try and put it up soon.