5.1 – Getting the orientation right

I hope by now you are through with the practicalities of a Call option from both the buyers and sellers perspective. If you are indeed familiar with the call option then orienting yourself to understand ‘Put Options’ is fairly easy. The only change in a put option (from the buyer’s perspective) is the view on markets should be bearish as opposed to the bullish view of a call option buyer.

The put option buyer is betting on the fact that the stock price will go down (by the time expiry approaches). Hence in order to profit from this view, he enters into a Put Option agreement. In a put option agreement, the buyer of the put option can buy the right to sell a stock at a price (strike price) irrespective of where the underlying/stock is trading at.

Remember this generality – whatever the buyer of the option anticipates, the seller anticipates the exact opposite, therefore a market exists. After all, if everyone expects the same a market can never exist. So if the Put option buyer expects the market to go down by expiry, then the put option seller would expect the market (or the stock) to go up or stay flat.

A put option buyer buys the right to sell the underlying to the put option writer at a predetermined rate (Strike price. This means the put option seller, upon expiry will have to buy if the ‘put option buyer’ is selling him. Pay attention here – at the time of the agreement the put option seller is selling a right to the put option buyer wherein the buyer can ‘sell’ the underlying to the ‘put option seller’ at the time of expiry.

Confusing? well, just think of the ‘Put Option’ as a simple contract where two parties meet today and agree to enter into a transaction based on the price of an underlying –

- The party agreeing to pay a premium is called the ‘contract buyer’ and the party receiving the premium is called the ‘contract seller’

- The contract buyer pays a premium and buys himself a right

- The contract seller receives the premium and obligates himself

- The contract buyer will decide whether or not to exercise his right on the expiry day

- If the contract buyer decides to exercise his right then he gets to sell the underlying (maybe a stock) at the agreed price (strike price) and the contract seller will be obligated to buy this underlying from the contract buyer

- Obviously, the contract buyer will exercise his right only if the underlying price is trading below the strike price – this means by virtue of the contract the buyer holds, he can sell the underlying at a much higher price to the contract seller when the same underlying is trading at a lower price in the open market.

Still, confusing? Fear not, we will deal with an example to understand this more clearly.

Consider this situation, between the Contract buyer and the Contract seller –

- Assume Reliance Industries is trading at Rs.850/-

- Contract buyer buys the right to sell Reliance to contract seller at Rs.850/- upon expiry

- To obtain this right, the contract buyer has to pay a premium to the contract seller

- Against the receipt of the premium, contract seller will agree to buy Reliance Industries shares at Rs.850/- upon expiry but only if contract buyer wants him to buy it from him

- For example, if upon expiry Reliance is at Rs.820/- then contract buyer can demand contract seller to buy Reliance at Rs.850/- from him

- This means contract buyer can enjoy the benefit of selling Reliance at Rs.850/- when it is trading at a lower price in the open market (Rs.820/-)

- If Reliance is trading at Rs.850/- or higher upon expiry (say Rs.870/-) it does not make sense for contract buyer to exercise his right and ask contract seller to buy the shares from him at Rs.850/-. This is quite obvious since he can sell it at a higher rate in the open market

- An agreement of this sort where one obtains the right to sell the underlying asset upon expiry is called a ‘Put option’

- Contract seller will be obligated to buy Reliance at Rs.850/- from contract buyer because he has sold Reliance 850 Put Option to the contract buyer

I hope the above discussion has given you the required orientation to the Put Options. If you are still confused, it is alright as I’m certain you will develop more clarity as we proceed further. However, there are 3 key points you need to be aware of at this stage –

- The buyer of the put option is bearish about the underlying asset, while the seller of the put option is neutral or bullish on the same underlying

- The buyer of the put option has the right to sell the underlying asset upon expiry at the strike price

- The seller of the put option is obligated (since he receives an upfront premium) to buy the underlying asset at the strike price from the put option buyer if the buyer wishes to exercise his right.

5.2 – Building a case for a Put Option buyer

Like we did with the call option, let us build a practical case to understand the put option better. We will first deal with the Put Option from the buyer’s perspective and then proceed to understand the put option from the seller’s perspective.

Here is the end of day chart of Bank Nifty (as on 8th April 2015) –

Here are some of my thoughts with respect to Bank Nifty –

- Bank Nifty is trading at 18417

- 2 days ago Bank Nifty tested its resistance level of 18550 (resistance level highlighted by a green horizontal line)

- I consider 18550 as resistance since there is a price action zone at this level which is well spaced in time (for people who are not familiar with the concept of resistance I would suggest you read about it here

- I have highlighted the price action zone in blue rectangular boxes

- On 7th of April (yesterday), RBI maintained a status quo on the monetary rates – they kept the key central bank rates unchanged (as you may know RBI monetary policy is the most important event for Bank Nifty)

- Hence in the backdrop of technical resistance and lack of any key fundamental trigger, banks may not be the flavour of the season in the markets

- As a result of which traders may want to sell banks and buy something else which is the flavour of the season

- For these reasons I have a bearish bias towards Bank Nifty

- However shorting futures maybe a bit risky as the overall market is bullish, it is only the banking sector which is lacking lustre

- Under circumstances such as these employing an option is best, hence buying a Put Option on the bank Nifty may make sense

- Remember when you buy a put option you benefit when the underlying goes down

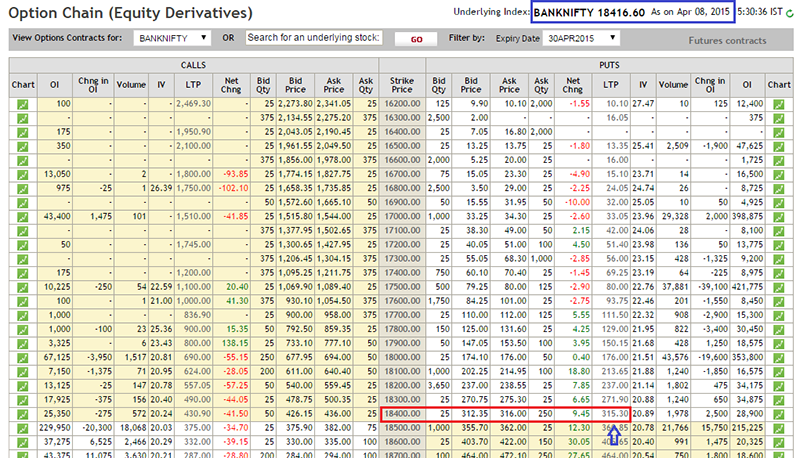

Backed by this reasoning, I would prefer to buy the 18400 Put Option which is trading at a premium of Rs.315/-. Remember to buy this 18400 Put option, I will have to pay the required premium (Rs.315/- in this case) and the same will be received by the 18400 Put option seller.

Of course, buying the Put option is quite simple – the easiest way is to call your broker and ask him to buy the Put option of a specific stock and strike and it will be done for you in a matter of a few seconds. Alternatively, you can buy it yourself through a trading terminal such as Zerodha Pi We will get into the technicalities of buying and selling options via a trading terminal at a later stage.

Now assuming I have bought Bank Nifty’s 18400 Put Option, it would be interesting to observe the P&L behaviour of the Put Option upon its expiry. In the process, we can even make a few generalizations about the behaviour of a Put option’s P&L.

5.3 – Intrinsic Value (IV) of a Put Option

Before we proceed to generalize the behaviour of the Put Option P&L, we need to understand the calculation of the intrinsic value of a Put option. We discussed the concept of intrinsic value in the previous chapter; hence I will assume you know the concept behind IV. Intrinsic Value represents the value of money the buyer will receive if he were to exercise the option upon expiry.

The calculation for the intrinsic value of a Put option is slightly different from that of a call option. To help you appreciate the difference let me post here the intrinsic value formula for a Call option –

IV (Call option) = Spot Price – Strike Price

The intrinsic value of a Put option is –

IV (Put Option) = Strike Price – Spot Price

I want you to remember an important aspect here with respect to the intrinsic value of an option – consider the following timeline –

The formula to calculate the intrinsic value of an option that we have just looked at is applicable only on the day of the expiry. However, the calculation of the intrinsic value of an option is different during the series. Of course, we will understand how to calculate (and the need to calculate) the intrinsic value of an option during the expiry. But for now, we only need to know the calculation of the intrinsic value upon expiry.

5.4 – P&L behaviour of the Put Option buyer

Keeping the concept of intrinsic value of a put option at the back of our mind, let us work towards building a table which would help us identify how much money, I as the buyer of Bank Nifty’s 18400 put option would make under the various possible spot value changes of Bank Nifty (in the spot market) on expiry. Do remember the premium paid for this option is Rs 315/–. Irrespective of how the spot value changes, the fact that I have paid Rs.315/- will remain unchanged. This is the cost that I have incurred in order to buy the Bank Nifty 18400 Put Option. Let us keep this in perspective and work out the P&L table –

Please note – the negative sign before the premium paid represents a cash out flow from my trading account.

| Serial No. | Possible values of spot | Premium Paid | Intrinsic Value (IV) | P&L (IV + Premium) |

|---|---|---|---|---|

| 01 | 16195 | -315 | 18400 – 16195 = 2205 | 2205 + (-315) = + 1890 |

| 02 | 16510 | -315 | 18400 – 16510 = 1890 | 1890 + (-315)= + 1575 |

| 03 | 16825 | -315 | 18400 – 16825 = 1575 | 1575 + (-315) = + 1260 |

| 04 | 17140 | -315 | 18400 – 17140 = 1260 | 1260 + (-315) = + 945 |

| 05 | 17455 | -315 | 18400 – 17455 = 945 | 945 + (-315) = + 630 |

| 06 | 17770 | -315 | 18400 – 17770 = 630 | 630 + (-315) = + 315 |

| 07 | 18085 | -315 | 18400 – 18085 = 315 | 315 + (-315) = 0 |

| 08 | 18400 | -315 | 18400 – 18400 = 0 | 0 + (-315)= – 315 |

| 09 | 18715 | -315 | 18400 – 18715 = 0 | 0 + (-315) = -315 |

| 10 | 19030 | -315 | 18400 – 19030 = 0 | 0 + (-315) = -315 |

| 11 | 19345 | -315 | 18400 – 19345 = 0 | 0 + (-315) = -315 |

| 12 | 19660 | -315 | 18400 – 19660 = 0 | 0 + (-315) = -315 |

Let us make some observations on the behaviour of the P&L (and also make a few P&L generalizations). For the above discussion, set your eyes at row number 8 as your reference point –

- The objective behind buying a put option is to benefit from a falling price. As we can see, the profit increases as and when the price decreases in the spot market (with reference to the strike price of 18400).

- Generalization 1 – Buyers of Put Options are profitable as and when the spot price goes below the strike price. In other words, buy a put option only when you are bearish about the underlying

- As the spot price goes above the strike price (18400) the position starts to make a loss. However, the loss is restricted to the extent of the premium paid, which in this case is Rs.315/-

- Generalization 2 – A put option buyer experiences a loss when the spot price goes higher than the strike price. However, the maximum loss is restricted to the extent of the premium the put option buyer has paid.

Here is a general formula using which you can calculate the P&L from a Put Option position. Do bear in mind this formula is applicable on positions held till expiry.

P&L = [Max (0, Strike Price – Spot Price)] – Premium Paid

Let us pick 2 random values and evaluate if the formula works –

- 16510

- 19660

@16510 (spot below strike, position has to be profitable)

= Max (0, 18400 -16510)] – 315

= 1890 – 315

= + 1575

@19660 (spot above strike, position has to be loss making, restricted to premium paid)

= Max (0, 18400 – 19660) – 315

= Max (0, -1260) – 315

= – 315

Clearly both the results match the expected outcome.

Further, we need to understand the breakeven point calculation for a Put Option buyer. Note, I will take the liberty of skipping the explanation of a breakeven point as we have already dealt with it in the previous chapter; hence I will give you the formula to calculate the same –

Breakeven point = Strike Price – Premium Paid

For the Bank Nifty breakeven point would be

= 18400 – 315

= 18085

So as per this definition of the breakeven point, at 18085 the put option should neither make any money nor lose any money. To validate this let us apply the P&L formula –

= Max (0, 18400 – 18085) – 315

= Max (0, 315) – 315

= 315 – 315

=0

The result obtained is clearly in line with the expectation of the breakeven point.

Important note – The calculation of the intrinsic value, P&L, and Breakeven point is all with respect to the expiry. So far in this module, we have assumed that you as an option buyer or seller would set up the option trade with an intention to hold the same till expiry.

But soon you will realize that more often than not, you will initiate an options trade only to close it much earlier than expiry. Under such a situation the calculations of breakeven point may not matter much, however, the calculation of the P&L and intrinsic value does matter and there is a different formula to do the same.

To put this more clearly let me assume two situations on the Bank Nifty Trade, we know the trade has been initiated on 7th April 2015 and the expiry is on 30th April 2015–

- What would be the P&L assuming the spot is at 17000 on 30th April 2015?

- What would be the P&L assuming the spot is at 17000 on 15th April 2015 (or for that matter any other date apart from the expiry date)

Answer to the first question is fairly simple, we can straightway apply the P&L formula –

= Max (0, 18400 – 17000) – 315

= Max (0, 1400) – 315

= 1400 – 315

= 1085

Going on to the 2nd question, if the spot is at 17000 on any other date apart from the expiry date, the P&L is not going to be 1085, it will be higher. We will discuss why this will be higher at an appropriate stage, but for now just keep this point in the back of your mind.

5.5 – Put option buyer’s P&L payoff

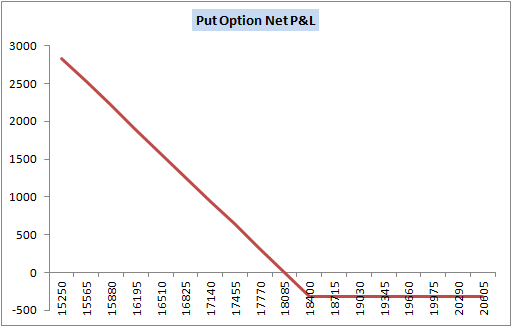

If we connect the P&L points of the Put Option and develop a line chart, we should be able to observe the generalizations we have made on the Put option buyers P&L. Please find below the same –

Here are a few things that you should appreciate from the chart above, remember 18400 is the strike price –

- The Put option buyer experienced a loss only when the spot price goes above the strike price (18400 and above)

- However, this loss is limited to the extent of the premium paid

- The Put Option buyer will experience an exponential gain as and when the spot price trades below the strike price

- The gains can be potentially unlimited

- At the breakeven point (18085) the put option buyer neither makes money nor losses money. You can observe that at the breakeven point, the P&L graph just recovers from a loss-making situation to a neutral situation. It is only above this point the put option buyer would start to make money.

Key takeaways from this chapter

- Buy a Put Option when you are bearish about the prospects of the underlying. In other words, a Put option buyer is profitable only when the underlying declines in value

- The intrinsic value calculation of a Put option is slightly different when compared to the intrinsic value calculation of a call option

- IV (Put Option) = Strike Price – Spot Price

- The P&L of a Put Option buyer can be calculated as P&L = [Max (0, Strike Price – Spot Price)] – Premium Paid

- The breakeven point for the put option buyer is calculated as Strike – Premium Paid

Hello Kartik,

I want to clearify on hoe to select weather to buy call or sell put, cause both will be benifited if the market goes up. Same thing for selling a call and byuing a put, both will be profitable if market goes down. Then how to make choice or right decesion? Is it depends on margin money needed more for selling and amount to be invested is less if byuing an option? Or some other technical points or there.

My next question on hoe to make use of volatility of the underlying stock?

Thanks

Well this depends on how cheap or expensive the premiums are. We will discuss this topic shortly very soon in this module, request you to stay tuned. Thanks.

Hi karthik,

First of all thanks for the best stuff.

I have a query to be resolved.

Call option buyer buys the right to buy stocks from the call option seller at strike price by paying the premium.

Put option buyer buys the right to sell stocks to the put option seller at strike price by paying the premium.

My doubt is: Here call option seller and put option seller are receiving premiums as well as putting themselves into a riskier situation i.e., if trade goes against them then they’ll be losing huge amounts of money.

IF A CALL OPTION SELLER IS BEARISH ON A STOCK THEN HE MIGHT BE A PUT OPTION SELLER

SIMILARLY IF A PUT OPTION SELLER IS BULLISH ON A STOCK HE MIGHT BE A CALL OPTION BUYER

**THIS REDUCES THEIR RISK RIGHT??

Could you please explain this for me??

Thanks, Vinay.

If you are bearish about a stock then you can write the call or buy a put. Likewise, if you are bullish, you can write put or buy call. The reason why one would choose to sell an option as opposed to buying one really depends on the way the premiums are positioned.

Thanks for the reply Karthik!!

I have one more doubt.

Let’s take the most recent example of INFIBEAM AVENUES stock which came all the way down to 27 rupees from 195!!!

Suppose I’ve already bought a put option @ 194. The next day stock came to 27 rupees.

1. Would I get all the money as you said the put option buyer has unlimited profit potential i.e., IV = 194-27 = 167 rupees per stock for the entire lot?? (Considering the day as the last day of expiry)

2. All the margin amount blocked for the put option seller would be vanished. Then from where do I get the remaining amount??

Please do explain this for me.

1) Yes Sir, you would

2) As and when the stock starts moving in the opposite direction of the seller, the broker would demand more margins from the seller.

Hi Karthik,

Thanks for the reply.

One more doubt!!

1. In the first four chapters you are saying that option buyers will pocket the profits as they have unlimited profit potential i.e., Intrinsic value. And also said that options can be excersied only on the last day of expiry!!

2. But, In the next chapters you are saying that most of the traders in India trade options just to pocket variation in premiums on a daily basis??

As you explained me in the INFIBEAM AVENUES example that as a PUT OPTION BUYER, I will be pocketing the IV. Then what about the variation in premium?? According to what you said I have to pocket the variation in premiums as well??

I.e., I mean I will get IV + variation in premiums?????

Totally confused!!

Please get me out of this!!

There are two things here Vinay –

1) You can buy the option (premium) now and sell it immediately even after 30 secs. This is trading on the premium, no need to wait for the expiry

2) You can exercise the option but this can be done only upon expiry. If you exercise the option, you will get the intrinsic value of the option.

Please do read through the comments, the same query has been asked by many.

Thanks man!! Perfect!! 🙂

Good luck, Vinay!

Hello karthik,

Suppose I bought 2 lots of RIL DEC 1160 CE today i.e, on 24-12-2018 by paying 1 rupee premium. Assuming today is Monday, you said options expire on last Thursday of every month. Then, 1160 CE expires on 27-12-2018.

I will be pocketing the profits if it moves above breakeven point i.e., above 1161 rupees on the last day of expiry.

** My query is: Suppose the stock is trading at 1125 rupees on last day of expiry. Any how I know that I would lose my premium!! But, Assume the premium moved to 1.50 rupees(I paid 1 rupee premium). IS THERE ANY CHANCE ON THE LAST DAY TO EXERCISE THE OPTION AND POCKET THE PREMIUM DIFFERENCE I.E., 1.50-1 = 0.5 RUPEES INSTEAD OF LOSING ENTIRE PREMIUM??

You can book the profits anytime you want, Vinay. No need to wait for the expiry.

Hello,

I want to know how to trade options in the last 10 days before expiry,as i read that an option loses 2/3rd of its value in the last 15 days.If i buy call or put and banking on increase in its premium but the time decay (theta) increases during the last 10-15 days and everyday the option loses some value due to time decay.So can you please clarify how to trade in this situation.Is it better to stick to intraday option trading in the last 10 days? Thanks in advance.

The time decay is just one of the force that acts upon the option premium….which by virtue tends to lower the option premium. Simultaneous there could bbe another force (say Vega) which can increase the option premium. The net increase or decrease of option premium is a sum of all these individual forces, collectively called the ‘Option Greeks’. So make sure you understand the Option Greeks well.

karthik, i gone through abv blog, but could not get my answer ie how to protect loss created by shorting option? . and how to calculait stop loss while shorting any option call or put.

The best way to protect your loss is to have a stoploss. You can set up the stoploss based on 2 factors – (1) Support & Resistance Levels (2) Volatility of the stock. We have discussed the S&R levels here – http://zerodha.com/varsity/chapter/support-resistance/ . Volatility based stoploss is something we have not discussed yet on Varsity, we will do it in the options module.

thanks, karthik, pls arrang descussion on volatility based stoploss. in the mean time , i am confused that whether stoploss sould be put on b premium value or on nifty spot price basis, for example- i short nifty put option of 8350 @ 22/- when spot nifty was 8600, now whether i should put SL on premium that if it goes rs. 44 or 50 trade should sq off. or on basis of nifty spot that if nifty goes down to 8500 or 8450 trade should be sq off, i want to know the base of stoploss it sud be price of undertaking or premium value. pls reply, very important to me.

Yes, we will discuss volatility in great length very soon.

The SL should always be based on the underlying spot.

hi kartik

thanks for your previous reply!

Q.- since NSE or BSE opening bell is at 9:30 am. if i want to place an order before market open at first market price i.e. i want to place an order to buy or sell at first market price can i place an order at 9:00 am because opening and closing periods are very volatile the order to get stock at screen displayed price is very difficult. is the above is possible with futures, options, currency and commodity

Dear Sir,

your module on options are really very good, we are also learning patience in waiting for next chapters which takes longer time.

Thanks/regards

Regards

Sorry for the delay, we are trying our best to put it fast…thank you so much for your patience 🙂

i have asked it earlier but you have not given reply. my question is

Q.- since NSE or BSE opening bell is at 9:30 am. if i want to place an order before market open at first market price i.e. i want to place an order to buy or sell at first market price can i place an order at 9:00 am because opening and closing periods are very volatile the order to get stock at screen displayed price is very difficult. is the above is possible with futures, options, currency and COMMODITY

Sorry to have missed your query earlier. Also, the market opening bell is at 9:15 AM and not really 9:30 AM.

Yes, you can place orders before market opens. This is called Pre market order, suggest you read about it here – http://zerodha.com/z-connect/queries/stock-and-fo-queries/pre-marketpost-marketafter-market-orders

hi very new to trading. at this age of 68, i am very much confused between call sell and put buy both are in the bearish, premium is more in call sell, when actually we have to plan call sell. let me know. I have gone thru many books, out of all u people are very good knowledge, easy to undertand, very thankful to u. somasekhar.

Thank you for the kind words Sir.

For selling a call you will need to deposit margins but for buying puts you dont need margin. I would suggest you just stick to buying puts till you get comfortable with options. You can try call option selling once you are comfortable with derivatives.

sir, can i do option trading in commodities

Nope, options on commodities is not yet available in India.

so sad…

anyway thanks sir…

Hopefully over the next few years 🙂

what about commodity futures ?

Futures on commodity is quite active on MCX exchange.

Hi Karthik,

Thank you for this option module.It is really good.I am having one query.

Call Option sell and put option buy both represents bearish situation.But why would any one sell call option,if he/she is bearish he can buy put option.As in call option sell we have to add margin amount , profit is limited to premium amount and loss is exponential where as in put option buy it is vice-versa.

So if any one is bearish then why he would sell call option insteasd he can buy put option.

Please explain.

Umang you do have a point, however there could be circumstances where the volatility is high and therefore the option premiums would be high. In such circumstances it makes sense to write options and collect premium rather than buy options at an expensive rate.

hi Karthik..you have really made it simple.i want to ask if i see the open interest of call is increasing and put option decreasing what should we perceive …its bullish or bearish..because as i have checked the past data of nifty i have found that trading in puts is significantly higher than trading in call option(as mentioned at the lower bottom of option chain ..right/right)..and i also observed that PCR increasing while its moving up and decreses while trend goes down..please help me with this..thank you

Ajit – instead of reading the OI data directly, I would suggest you use the ‘Options Pain’ theory…we will discuss the same shortly. I think Options pain is a slightly better indicator than the plain vanilla OI data.

Dear Karthik, very good and informative blog on option greeks, pls continue educating your client, God bless you. how to contact you personaly in any emergency.

Thanks for the kind words :).

I;m usually quite active here..so you could drop in a message here itself.

THANKS, Dear Karthik, i was going through your option modul-5 chapter-17 heading VOLATILITY & NORMAL DISTRIBUTION. i was confused when i reached to para 17.4 normal distribution……..

1. how you came to daily average as – 0.04% as well daily standard deviation as 1.046%. i have tried my best and by going through earlier chapter, but could not, hence request to mail me excel file of this

2. in solution -1, while getting andannualized number , you * by 252, why not 365. and even when i calculat on 252 it comes – 10.08% and not 9.66%.

3. while caculating upper range of 8337 ,what do you mean by word EXPONTIAL, how it effect calculation, as per my calculation it is 10559 instead of 10841. same way lower range comes 7758.instead of 7777.

pls let me know where i am wrong ?

You can download the excel sheet towards the end of the chapter, this should solve your 1st query.

365 is the convention used by NSE, hence I’ve used the same.

Guess I’ve used exponential in a contextual sense. Suggest you refer the excel for more clarity on numbers.

Karthik, further to my earlier mail of taday, just now as per yr theory for daily return and annual volatility, i calculated nifty spot daily and annual vol… for 23-09-2014 to 22-09-2015. the result is daily

volatility is .. 1.033 and annual 19.73 (by1.033 * sqrt(365) ). where as nse website shows daily as 1.47 and annual as 28.13. pls advise why so much difference. which one is applicable.

Extract from chapter 16 – So why is there a slight difference between our calculation and NSE’s? – One possible reason could be that we are using spot price while NSE is using Futures price.

Having said so, I really dont think there should be so much difference. Let me do the calculations once again..thanks.

i am very eagerly waiting for pain theory Karthik…thanks for help

As soon as possible Ajit.

Thanks, karthik for prompt reply, specialy, for your personal advise/suggestion in CHAPTER-18, i guess , i would have read it earlier than i could have saved

my heavy loss incurred in august and september. any way few further queries– for doing option writting trade in each month and if we start it from 15 days from expiry as greatly suggested by you—

1. to get average, how many days old data , we should take to calculate average number?

2. to get annual figure which number , we should take ie 252 or 365 ?

your suggestion and advise will be highly helpful to us.thanks

1 year historical data should be good….also suggest you take 365 days.

Thanks, pls keep posting yr advise, it will be very useful to your clients.

Cheers.

from where do i get this data?

zerodha rocks,you guys have done a very good job in helping us with zerodha varsity,thanks a lot 🙂 ,one more thing(probably not the right place to say it) if you can also start offering us the IPO facility we no longer will need to have our other brokerage accounts.

Glad you liked it Himanshu. With our own DP in place, IPOs should be possible soon.

Why there are no difference in chart. Even though they are different strike price.

Ex: Nifty 8100, 8200, 8300 PE(CE)

Everything same in chart even though premium price is different.

P.S: I know it derives from Underlying price. But still I want to have little bit clarity on this.

Thank you

For 2 reasons –

1) 8100 to 8300 are not very far off strikes

2) Point 1 is further supported by the fact that time to expiry is high, hence all these strikes are considered nearly the same

3) See the same set of charts very close to expiry and you will see a difference

Hi, can you please re-upload the screenshots?

Hi Karthik,

Here it is,

http://zerodha.com/varsity/wp-content/uploads/2015/04/20185.png

I deleted from my system. But I guess it’s still present is blog.

Thanks Sam..just wanted to reconfirm if I was looking at the right image. Btw, your site is quite nice 🙂

Take a guess. It was founded by one of your best tech man.

I just keeping it alive.

And you know it also.

That’s why you put smiley in the end.. Please upload options strategy soon.

Yup, I was just fooling around 🙂

Will start work on Options strategy soon.

Hi Karthik, I have few queries..

1. Does the variation of the premiums purely depends on the Options Greeks? Buyers and Sellers does not have anything to do with it?

2. Suppose LTP of Premium = 100. Now I put a buy order at 80 and someone sells it at 80.. So, my order gets executed and now the latest LTP=80.. It will remain at 80 till the next order gets executed right..Now, where does the Option Greeks comes into picture for determining the Premium value??

1) Demand supply matter, which is captured via greeks (Delat)

2) Correct

3) Chance of you getting an option @ 80 when its trading @ 100 is low, greeks does not let you do this 🙂

Hey Karthik,

Won’t the premium will get change when the spot price will change on the basis of strike price ?

It does!

sir,

On friday I buy 2 qty of put option banknifty at 140.00. Then I kept stop loss order for the same. When the price was reached at148.00 I modified st loss order 1 qty for the price 148.00 and 1 qty sold . Now there was no open order. And then when I tried to put 1 stop loss order for the remaining 1 buy order qty at the price 140.00 the order executed at 140.00 and sold for 140.00 even though the price was running at148.00. It shouldn’t remained open for the price 140.00. Why it happened ? And how to put stop loss order after removing partial buy order qty.? please reply.

Devanand – I would suggest you speak to [email protected] about this.

karthik i have a few doubs how is nifty spot traded how do i monitor the price of nifty spot in my trading platform . when u trade nifty options what is the underlying asset nifty spot or the current month future price

Nifty Spot is the underlying and not the Futures. You can track the spot data from your trading terminal.

Hi sir, .

You have done a great job in explaining stock market in simple language and examples.

I have one doubt, in call options or put options I have read that open interest of for example of 10500 CE of nifty is more , so it will act as resistance and similarly some 10000 PE OI is more so it will act as support for nifty.

Explain me this please.reply on [email protected]

Regards.

Irfan

Not really, Irfan. YOu need to read the chapter on OI to get more clarity on this. Check this – https://zerodha.com/varsity/chapter/open-interest/

i thought indexes are traded only in futures. but what is the concept of trading nifty spot

Yes, indices in India can be traded via futures or options.

Can anyone suggest suggest good candlestick pattern to predict bearish fall in stock? So that after analyzing that I can go for put option.

Eg- Pole-flag candle stick pattern is very good for predicting that stock will go up or not?

Some of the patterns that I like – Bearish Marubuzo, Bearish engulfing followed by a doji, and Evening star.

thanks….these patterns are good. But can you suggest any patter where we can calculate target, stop loss etc?

like in pole- flag bullish pattern, we can calculate target, time to target etc.

Rohan – you can do this for each and every pattern. The trick is to develop a logic and quantify it.

Have a look at this – https://zerodha.com/expert-advisors/code/bullish-engulfing-with-ema

Hi,

Is anyone aware of the following / attached excel sheet… if case if you are aware kindly provide me the link

Looks like a regular heat map.

I have question regarding buying put options when the companies declare dividend. Generally when the dividend is distributed, the stock price falls down by the same amount. can we buy put option for the stock & sell on Ex-dividend date? i know if the Div is very low against the stock price the movement may not be significant, but if the dividend is 4-5% like 5 Rs. on 100 Rs stock price, can we take a chance? or the drop in price will be adjusted in the put option pricing?

Usually the drop in price is factored in and the premiums reflect the effect of dividend. So I suppose there is not much gravy left in this strategy.

I have purchased 4 lots of icici bank put option at strike price 180 @rs 7.60 as premium. After few days price of icici bank come down to 178. Now premium price of 180 put of icici bank raises to 11. Now i want to sell my 4 lot of put option @rs 11 as premium before. My profit would be 3.40 per share. is it write. plz explain

You are right, your profits will be 11 – 7.6 = 3.4.

I am a new trader & have never traded in Options, but am thinking of doing so, but before so doing, I have been going through the modules on Options. In the above module while explaining, you said the following, “If Reliance is trading at Rs.850/- or higher upon expiry (say Rs.870/-) it does not make sense for contract buyer to exercise his right and ask contract seller to buy the shares from him at Rs.850/-. This is quite obvious since he can sell it at a higher rate in the open market.” Does this mean, in such a situation, I can sell these shares in the open market? Kindly explain.

This is just a comparison…it means that you can literally sell the stock at a higher price in open market, why bother to settle for a lesser price via options.

Thanks Karthik. Today is the first day, I tried to trade in OPTIONS. What I actually did is I used the “Call & Trade” facility because I simply could not understand how to initiate the trade. From where to find the Charts which showed all the Strike prices of a particular Stock or Index, which strike price to choose from them, etc. Suppose I want to option trade on SBI, where from do I get the chart showing all the details…..etc? My question I know is silly, but I believe once I get accustomed to the mechanism, it won’t appear so difficult. Until then, I need your kind support. Thanks.

Indrani – If you are a Zerodha client, I would suggest you login using Kite….Kite is quite user friendly and I’m sure you will find it lot easier to use. Also, I’d suggest you give a call to Zerodha, our support executives will hand hold you.

Yes dear Karthik. I am actually going through these modules as well as using the help from Zerodha support.Thanks a lot.

Super, good luck Indrani 🙂

Why PUTs are cheaper ?

Nifty Spot closed @ 7615, but 7600CE closed @78, where as 7600PE closed @ 22.

7600CE is just 15 points ITM, but the difference b/w premiums is very high. Any specific reason for the same.

Thanks in Advance

Generally speaking puts are cheaper to calls (belonging to same strike). Lots of factors contribute to this, including something called as the ‘Put call Parity’.

Hi ….. Good to see u are guiding so many people… Today is my first day in options… I bought put options nifty 7700 @124 …. So I paid 9300 as margin…. Now nifty closed at around 7602.. So can I square off now… If I square off now will I get both profit and the margin I paid… Or only the profit… I mean what happens to the margin I paid…?

If you have bought options then there is no margin that gets blocked. So yes, you would be profitable here – you can choose to square off and book profit.You will get back premium + profits.

Dear Sir,

If I have bought 3lots of put buy of bhel in intraday. How to square of my position in intraday?

You just have to buy back 3 lots Pradeed, this would square off the short position.

sir , if i buy options on expiry day MIS basis and if i didn’t square it off will i will be charged extra stt or it will be automatically squatre off by the system ,please tell in which case i have to pay extra stt.

It will be automatically squared off by 3:20. Also, make sure you dont buy ITM options and leave it to expiry as you will have to pay a STT, check this for more information – http://zerodha.com/z-connect/queries/stock-and-fo-queries/stt-options-nse-bse-mcx-sx

Dear Karthik Sir,

Whenever I try to buy options of the stocks not index following problems occur:

1) I can’t buy them at market price

2) while selling or buying I have to use limit orders…

Why this is happening?? is there any other procedure to buy stock options ?? because I dont find such problem while buying index options..

I can get any detailed process on how to buy and sell stock options?? and does trailing stoploss work on stock option premiums??

This is mainly because stock options are not as liquid as index options. It is recommended you look at liquidity before placing orders.

Hi,

How do we calculate the Support and Resistance Levels for Premium prices ie, for individual Stock Options like for example, SBI 180 Call option is trading at Rs.4.50. How do we calculate the Pivot Point, Support and Resistance for this premium price of Rs.4.50 for the stock SBI.

Regards,

T Venkatesh

Please do NOT apply TA to options. Apply TA only to spot.

Sir isn’t futures better than options with a strict stop loss and discipline especially since you can follow technical analysis like stochastics (and others) and more simpler ?

This is not true as we cannot really compare the two instruments. The characteristics, payoff, leverage etc are all different. You use them as per the situation.

please confirm which is the right way to calculate.spot is 550,strike is 540 and choose to put buy at premium rs 12, and after 3 hours spot moves down 545 ,premium get 14 rs ,then i want to square off my position then what calculation would be applicable.(1).IV=strike-spot,p&l=IV-12 in that case i will get loss ,but conversely in case of (2).difference between premium (14-12=2*lot size) in that case i get profit ,so can you confirm me which calculation will get executed ,please clear it .

In this case it is quite straight forward as you are just trading the premium. You will make 14-12 = 2 as profits.

Kindly cleat the doubt ,i am using zerodha PI for trading .If i have rs 5000/- in my trade account and i buy a put option at premium rs 4,lot size 1000 .and after few times or day as premiun increases to rs 10/- in that case i square off my position and want to get the profit difference ,then it is necessary to have (10-4=6*1000=6000/-) in my trade account for square off the position ,or no extra fund required and rs 5000/- is sufficient .because i am selling to square off my position .Because as we buy then sell must be compulsory for square off the position .

No. It is very simple here – you bought something for Rs.4 which is not valued at Rs.10, hence you make Rs.6 as profits.

What happens if I own an out of the money put option on expiration day and I don’t square it off?

You will lose money to the extent of premium paid.

Hi Karthik,

Since Put and call options individually cover the both, bearish and bullish, movements, how do we decide when to use put and when to use call. For example, if I am bearish on the stock, I can buy put or sell the call option or vice-versa. The only difference I could see between these is the extent of profit, which is limited in selling the call option. Is there any other point to be considered in such case?

Thanks,

Rajat

Well, it really depends on the premiums are playing out. If volatility is high and the premiums have gone up significantly, then writing a call and collecting the premium is a much better idea than buying an expensive put.

It is observed that questions and replies by MR Karthik pertains to year 2015. Now it is year 2017, whether this question answer session is still active?

Yes Sir, site is very active. Comments are updated everyday here and new chapters are added once in 10 – 12 days.

hello sir,

If i want to exercise the put option( in profit) what is the procedure to do it. will it be done automatically by zerodha or do i need to do something.

You can let the option expire. However, you may not really want to do it due to high amount of STT. Please do check this – https://zerodha.com/z-connect/queries/stock-and-fo-queries/stt-options-nse-bse-mcx-sx

hello karthik,

i have a doubt about futures margin. for suppose i bought ITC futures contract at 350rs with a margin of 90000rs and lot size is 2400. recently one day ITC had gap downed nearly 50 to 60 points and came to 280 rs . In that case my loss is 120000 rs. so i lost my entire margin and i want to square off my position in order to avoid further loss. so who is going to face that extra 30000 rs loss ? i can afford loss only upto 1 lakh rupees, beyond that i dont have money . please explain this scenario.

Ravi, Margin is made up of two components. SPAN and exposure margin. The moment you lose your exposure margin and start losing from SPAN margin, your position is squared off. Think of it as two halves…moment you lose one-half, the entire position is closed. This is a part of the broker’s risk management policy.

Hi Kartik,

A pretty basic question here…the Option seller has to hold the option till expiry…is that correct??

Not necessary. Both the option buyer and seller can trade the premiums…meaning they can buy and sell for any time frame they deem suitable. Could be few seconds, few mins, few days…or even hold till expiry.

Sir,i’m new to option trading .Today I bought 2 lot of nifty 9850 put option ,expiry 28th Sep and Index is trading at 9912. My P&L showing -1860 .Suppose i sell the contract now ,will I lose the whole premium or only 1860 .?

Only 1860 (plus applicable charges).

Hi,Kartik, if I have bought a stock in future can I hedge it by buying the put option of the same stock?

Thanks

Yes, you can.

Sir,

I feel that put option profits are not unlimited, as mentioned in the article.. as spot price can theoretically be lowest to zero only, and not negative..

In a sense yes. But that hardly happens.

Hi,

I had 1 query with regards to what you mentioned above in case of Buying a Put option.

How can “The gains can be potentially unlimited”??

If the underlying falls to Zero, that is where your Profit will stop isn’t it? So how can it be unlimited?

Can you clarify??

Technically yes, but stocks, especially in F&O segment seldom fall to 0.

In simpler terms, can you explain the change which has happened to the STT trap (for which you shared the link somewhere in the comments above) since 31st Aug, 2017? I understood what used to happen before that date, that is, the STT which got applied if one didn’t square off his position before expiry used to be very high, and eat away a lot (or all) of the profit. But what exactly has changed w.r.t to that rule?

Thanks!

Here is the link – https://tradingqna.com/t/no-more-stt-trap-on-exercised-in-the-money-options/18977, explained really well 🙂

Yup, this was the link I was talking about. Read it but didn’t exactly understand what had changed.

Earlier, STT was charged on all exercised option. An option is assumed to have been exercised even if it slightly in the money upon expiry. A slight ITM option may not really be worth exercising since you’d have ended up paying huge STT. This was the case until recently. Now exchanges have given the option for brokers to select which options to exercise and which ones not too. So If an option is slightly ITM, we can always not exercise it and save massive STT payouts.

After reading your comment & going through the link again, I think I got it. Thanks!

Cheers!

Dear Sir,

I have doubt regarding premium movement and settlement of options.

1) what will be, if there is no trade for option which I have already purchased on 1st Dec17 by the end of expiry date of it. In this case how the settlement will be done.

Ex:1) If I purchased “Nifty Dec 10200 CE” @ Premium Rs.200/- on 1st Dec17.

2) If I sold “Nifty Dec 10200 CE” @ Premium Rs.200/-on 1st Dec17.

If there is no trade on expiry day what will be the settlement?

1) The exchange will settle this for you on the expiry day

2) The settlement value will be dependent on the intrinsic value of the stock. However, the settlement itself will be carried out by the exchange if there are no buyers/sellers for your contract

Hi Karthik,

For a option Call buyer the profit can be potentially unlimited as the stock can reach any highest point. However, for a option put buyer their profit reach saturation point as underlying stock cann’t fall below zero. Am I correct?

Yes, that is right.

Dear Sir,

Thanks for good information on Put and Call options. I also read on investopedia that put option can be used for hedging.

I hold shares. Out of my portfolio, I want to hedge the shares of very good comanies, like Maruti, RIL, Britannia etc. Although I have understood the concepts of Put and Call options, I do not know how to hedge my existing good shares. I would appreciate if you explain.

best regards,

Tushar.

Check this – https://zerodha.com/varsity/chapter/hedging-futures/

If OI increases more than 95%, then security will go in Ban. This Ban starts immediately when it reaches to 95% or it is applicable from next day?

It starts right away.

Then how we get information that particular security is in ban now ?

I checked NSE’s website their they update security in ban for particular day but if security is going in ban say at 11 am then how traders come to know about this ?

You will have to check this – https://zerodha.com/margin-calculator/SPAN/ , the banned securities are noted in red.

Please help me in knowing the margin money required for executing the following transactions.

1. Buying a lot of Nifty option, strike price 10,500 @ Rs. 200

2. Selling a lot of Nifty options, same strike price

1 lot = 75.

1) You only need to pay the premium i.e 200 * 75 = 15000

2) Check the margin calculator – https://zerodha.com/margin-calculator/SPAN/

Hi,

Bank nifty PE 24,200 is available at the premium of 427 and Bank Nifty CE at the premium of 460. Strike date for both is 28 th march 2018. If we sell the both PE and CE then will get Rs.887 as premium. So ultimately we will be in profit upto the decline or increase in the actual price of bank nifty upto Rs.887 from the strike price of 24,200…. Am I correct??? Is it happen like this? Are we safe upto the change in price by Rs.887?

This is a short strangle, I’d suggest you plug in the numbers on the excel sheet here and check the range – https://zerodha.com/varsity/chapter/the-short-straddle/

Sir,

Currentlly nifty is at 10790 near.

I want to buy nifty put option at 10800.

Premium is 12000approx that is 154.

Wht will be the breakeven point for me?

10800 – 154 = 10646 is the breakeven for this trade.

When i Place an order in optons Buy Call/Put it shows MIS/DAY Pleae describe the differencce

Select NRML if you want to buy and hold the position overnight. If you want intraday trade, select MIS.

In the P&L behaviour How does the premium – 315/- remain the same when the spot prices keep changing?

Premium is a function volatility as well, Shyam 🙂

Hi Karthik,

You are doing a great job answering queries of traders and investors.

For the first time, I bought Options and want to understand P&L associated with it. I bought 105 India Cements PE at a premium of 1.80. Currently, it is trading at 107.55 (LTP as of Jun 21).

Assuming India Cem Spot price on expiry is 104, will I make a loss of 0.80 (Considering Max (0, 105-104) – 1.80?

Assuming India Cem Spot price on expiry is 103, Will I make a profit of 0.20 (Considering Max (0, 105-103) – 1.80?

This would happen If I alllow contracts to expire ITM on the expiry day or else I square off my positions in between the difference in premium paid will be my actual P/L.

In case the spot price remains above 105 on expiry day, I will lose the entire premium of 1.80… Right?

Please correct me if I am wrong on any of the above statements. Thank you in advance!

1) Yes, at 104, you will lose 0.8.

2) Yes, at 103, you will make a profit of 0.2

3) Yes, if you sq off the position before expiry, then you will make the difference between the buy and sell price of the premium

4) Yes, at 105, you lose the entire premium paid.

Good luck!

Is it possible to do intraday trading on options?

if yes how will expiry date be managed? As options expiry only on last Thursday.

kindly reply me, sir.

Hello

I have buy put option of Nifty 10600 @ RS 3 on 28th June 1018.

Nifty spot closed @ 10589 on expiry.

What is value of this position on expiry ?

How settlement price be calculated by NSE ?

The option will be settled at 11/- i.e 10600 – 10589. Since you have paid 3 as premium, your profit will be 11-3 = 8. However, I’m assuming charges and STT would have eaten this up.

Hi Karthick,

Where can I check the liquidity of options. Today I expected Bajajfinsrv prices to go up following the results. So I wanted to implement a long straddle. When I checked NSE page there were enough contracts for call options but there was nothing for put option. So I was hesistant to take the trade as I was worried whether I could sell back the put option. Please let me know if my understanding is correct.

More over there is a decent number of contracts for call options in all stocks but for most of the stocks there is not enough contracts for put options. Can we use contracts to determine the liquidity of options. Please correct me if I am wrong.

Vinoth, this a problem with the stock option. The contracts are not too liquid. To check the liquidity, you can check –

1) The spread between the bid and ask. The larger the spread, the lower the liquidity. The lower the spread, higher the liquidity

2) You can also track the number of contracts being traded to get a sense of liquidity.

Hi Karthik,

Thanks a lot for your reply. I have back tested (paper traded) some option strategies (intraday) on various stocks for some time now and it seems to be working. Initially I did not think that liquidity will come as a barrier. Is there any other way we could overcome this?

The reason I have chosen stocks over index is that we could see more than 2% to 3% movement intraday and that really is essential for making profits. Please correct me if I am wrong.

Once again thanks a lot for your help.

Vinoth, no, unfortunately, you cannot do anything much with liquidity. It is a real risk. Also, I hope you are aware of the new physical delivery for F&O settlement that has been introduced. If not, I’d suggest you check this link – https://tradingqna.com/t/how-does-the-new-physical-settlement-of-stock-derivatives-work/37830

Hi,

Good chapter. To test I bought 1 PUT option of Nifty at strike 11100 at 25 Rs (20×75 rs = 1500 Rs). Suppose, if NIFTY goes back to 11050 how do I exercise the option? In Zerodha Kite, I have 2 options: 1 – Exit and 2 – Convert. Exit gives the price of premium. I know the value will decay with expiry. For tomorrow expiry if the premium value is less than 50 points NFITY profit how does it work?

Its confusing can’t I exercise the NIFTY at 11050 and get 50 points profit instead of premium? or will premium change to 70rs? How does it work.

It useful to link the Kite platform to understand the chapters here.

In Nifty expires at 11050, then the 11100 PE option will expire with a 50 point intrinsic value. I’d suggest you exit the position.

is CE seller is analogy to PE buyer is some sense ? as both has bearsish view

Yes, but there are differences in terms of views on volatility.

Is their any specific guideline for buying a option contract in zerodha ? Today’s bank nifty is 28300 & I was trying to buy 27200 put option but zerodha was not allowing to put the order … plz explain

Dear Karthik,

I would like to mention, that I was always hesitant to learn and trade in options because, it used to seem very confusing to me. I tried few educational sources to enlighten me. But my perception about options was same. After I started to read your lessons on options, I found how easy options are. It is easiest way of understanding options using your lessons.

A big thumbs up to you for all of your efforts for this series.

Regards,

Sunil

Hey Sunil, thanks so much for the kind words, glad you liked the content 😉

Hi Karthik,

Thanks for this great module on options. Im very confident with how buying a call and a put works but few queries on selling both of them.

Once i receive a premium after selling a call or put, is it possible to exit the position before the expiry? (Similar to the case if i would have bought either of them). Or do i need to hold it until expiry ?

Thank you.

Yes, you can exit the position anytime you wish. No need to wait till expiry.

Hi Karthik,

Recently I went for Put Buy on BankNifty and the next day Bank Nifty was moving up which throwed me in loss.

Broker asked me to add margin as the put option went in loss. But I didn’t . Broker squared off half 75% of my Bank Nifty put holdings.

Could you please help me that was it correct what broker did?

In any case , do I need to pay extra margin( When margin shows short fall either in Call buy or Put buy)?

Thanks in advance

Rajasekhar

Nope, your broker does not have the right to close a long option position as you’d have paid the full premium to buy the option. You may want to question your broker as to why he did this.

Karthik,

Thanks for the quick reply.

Mail has already been sent to the broker one week ago but still no response but at-least as per your confirmation I got confidence to question the broker on this.

Thanq Karthik.

Yes, please do. Good luck.

Hi Karthik,

Here is the reply for the Broker.. Could you please validate !

So that I can ask the Broker again.

Thanks in advance

—————————–

Dear RAJASEKHAR NELLURU,

Thank you for giving us the opportunity to serve you.

This is with reference to your communication with us regarding the squaring-off of your open position.

We would like to bring to your notice that you are required to maintain requisite margin for your open position(s) at all times and fund the shortfall amount (if any) immediately. We also wish to state that squaring-off of an open position is a last resort of risk containment.

On 21/09/2018, your ledger net margin is in negative of Rs.6818/- and the market is up hence your PUT position value is eroding hence your open position of OPTIDX BANKNIFTY Sep 25500.00 PE is liquidated.

In view of the above, we express our inability to compensate for any loss incurred in your account.

Request you to quote this reference number ******** for any future correspondence in this regard.

I’m confused, were you long or short? If you were long that means, you have paid the full premium, hence there is no question of how much money you have in your ledger. However, if you are short, then the broker has the right to close your position.

Karthik,

Below are the details

OPTIDX BANKNIFTY Sep 25500.00 PE – Buy

Please clarify.

If this is a long option position with full premium paid, then there is no way the broker can close the position on your behalf.

Hi Karthik

Why PUT writers dosent buy CALL to protect their loss?

GAJANAN

They do, why do you think they don’t?

Sir,

To Hedge 1 Lot of Nifty for minimum 3 months, which strike of Put ption should be bought, At the Money today or Far month Future Contract price or 1 strike up from far month Future Contract price.

Darshan

I;d suggest you look at a slightly ITM option for this.

Hi Karthik,

How the long PUT options premium adjusted to stock dividend? Could you please provide more information on the PUT option pricing before and after EX-Dividend date. Vedanta has declared Rs 17 as dividend, Now currently trading at 207, Yesterday it was at 223.

if we have bought PUT 210 PE yesterday( as it was far Out of the money) the premium might be less. Could you please shed some light on this.

Thanks

Satya

Satya, the contract would be adjusted for the dividend and the strikes would be accordingly adjusted on the ex-dividend date.

Does kartik sir still trade . If yes how much return on capital employed is expected in one month.

I’ve not been trading actively, most of my personal funds are invested for the long term.

‘Option buyer risk is limited to paid premium, but reward is unlimited….’

Theoritically

– Option Call buyer

spot = 150, bought a call say 170 at 4/-

on expiry pnl = (Spot – Strike) – premium paid

spot value goes to +ve infinity reward is ‘unlimited’

– but hows that true for PUT buyer

Spot = 150 bought a 120 Put at rs 4/-

on expiry (Strike – Spot) – Premium paid

Spot can go max 0 so

(Strike – 0) – premium paid

unless Spot can go to -ve infinity the genaralization wouldn’t stand true.

(Strike – -veInfinity) – Premium paid = ‘Unlimited’

pretty am sure missing something….

Well, yes…the spot can go to 0 (theoretically) and the put can grow to that extent, but in terms of % this will be huge. Hence the term unlimited.

Karthik sir

I want to know how to place long duration call or put option in zerodha terminal.

Today I tried to buy March 26500 put but it showing order open but not excuted why

I guess there was is no liquidity, Parvez.

i’m option trader, every dayi start trading near in 1st hour. but once in a week your server down, and you claim you are no.1 broker of india. this error is common in every week “Something went wrong while placing order: Request failed (kitefront-upstream). Please check the orderbook before placing the order again.

“

Milan, once is a week is an extreme exaggeration :). We would not be where we are if such things were to happen every week.

Hey,

First of all thanks for providing such great writing. I could imagine the effort and patience it would have taken.

Though I have a doubt.

Suppose I sold McDowell 550CE for a premium of 10 and held it till expiry. On the day of expiry, McDowell’s Priced ranged from 540 to 560 and finally closed at 550. Similarly, the premium also moved from 0.5 to 12 and finally closed at 1. Is it possible? Will the exchange adjust the price of the option to 0 from 1 or they will take last 30 mins volume-weighted price? If they will take volume-weighted Price what will happen if in last 30 mins stock was mostly trading at 555 and therefore the option at 5?

Please Give clarity on this doubt. Thank you.

It will be the weighted average price of the last 30 mins.

Hi Team,

First off, you have been doing an amazing job in terms of empowering common retail investors in such vast and interesting concepts. Thank you so much for your efforts.

My question is this, to enter into a contract a clear directional view on the underlying is essential, now why would a person write (Sell) a call option when he can limit his loss and gain unlimited profits by buying a put option when his view is of a down trend? Likewise, why would a person write (Sell) a put option when he/she can buy a call option when they are expecting a uptrend in the market and gain unlimited profit while limiting their risk?

Directional View: Uptrend.

Options available…

1.Buy Call Option: Limited Risk & Unlimited Profit

2.Sell Put Option: Limited Profit & Unlimited Loss.

Directional View: Down Trend.

Options available…

1.Buy Put Option: Limited Risk & Unlimited Profit

2.Sell Call Option: Limited Profit & Unlimited Loss.

In both cases, option 1 looks very attractive, considering known risk and exponential profit potential. Then why would people take the riskier deal.

Now if its just the statistical edge that makes the latter attractive, I don’t feel its a strong argument, or am I missing something.

Please Help. 🙂

Hi Lavish,hope you are doing good.Buying call options is expensive most of the time because of time value and implied volatility.When you buy call or put options,you will be paying more than the real value of it.For example,a option value which should have its real price i.e intrinsic value as 10 might be available for 20 due to time value and IV.So you will be paying extra 10 to buy.This extra 10 will get reduced by some points every single day.We call this as time value decay.Your profits will start only once your options value goes past the strike price you selected plus the premium value you paid.This why buying options when the value is really low is preferred.When stocks drop by 10-20 % in 2-5 days your nearest call option value will be too low and you can buy it.This is how I buy options and vice versa.

Selling Options

In selling options contracts, you do have unlimited risk if you open one single position like selling just a call option or selling just the put option.But when you create credit spread positions like short strangle i.e selling out-of-the-money call and put at same time,your one position will give you guaranteed profits.And in selling you will receive the net premium. You will make losses only when there will be a big move and that too can be adjusted or minimized with proper risk management and trade adjustment.

Final Words

Selling options has higher risk only if you don’t know how to control it.Overnight risks you cant control in any financial instruments.By controlling overnight gap risks and doing proper trade adjustments sell position goes against you,you have better chances of making money with selling options.So don’t get excited with low risk and unlimited profits concept of buying options.Trade accuracy of buying options are too low if you compare them with selling options as time value is always depleting and in your favor when you sell options.Hope I was able to provide you valuable information.Thank you.

Thanks Jai, that was really helpful… 😊 And I’m gonna take back few technical terms you used and learn them to understand discreetly what you meant, though I seem to have got the crux of the matter. 🙂

That’s absolutely right, Hari. Thanks for pitching in 🙂

Hi Lavish, I think Hari has answered your question in great detail 🙂

Page 48 point no. 9

“However shorting futures maybe a bit risky as the overall market is bullish, it is only the banking sector which is lacking luster.”

Can you please explain this point favouring Put option buy.

Guess it means to convey that the overall market is bullish, except for the banking sector.

Hi sir, I’ve a doubt, by the first day I’ve started reading varsity, you’re telling sometimes a news came on this stock or a news is going to come this week or reserve bank policy release. My question is where to look at this news for a stock or some bank policies?? Can you suggest anything to watch these news other than watching Tv finance channels

Bala, I’d suggest you start reading the business newspaper. With that, you will get a good grip on all the upcoming news bit and event. Also, you have a notification of the upcoming events on the Kite widget, check this – https://kite.trade/docs/kite/marketwatch/#stock-widget

Hi Sir,

I have a doubt. Could you pls clarify.

I bought OTM PUT on last Friday and I didn’t exit it as it is in loses. Can I hold it till expiry date and sell it on or before expiry date though it is im profits or loses.

Thanks in advance.

Yes Krishna, you can sell it anytime you want.

Thank you very much Karthik for your quick response.. You are awesome 👍👍

Good luck, Krishna!

1. By squaring off before expiry, we’re essentially trading the premium prices. If our directional view is strong, why not trade futures which give us exposure to a much greater lot size?

2. Since we’re trading premium prices, why not just trade in spot?

1) Yes, I agree. In fact, if the agenda is to play the direction (especially in the shorter term), futures is a

better deal

2) If you are fine with no leverage, then spot is good.

Is it OK to buy 1 year PUT OPTION for Hedging the Equity Portfolio. If Zerodha offers 1 year PUT Option. Which Broking Firms offer

1 year or more PUT Options. What can be cost of Hedging. If it mayl be app. 2% per year

Prakash, long-dated options are called ‘Leaps’, which is not possible on Indian markets due to lack of liquidity.

Hello Zerodha Varsity Team,

I have read options concept at multiple blogs/videos but still i was unclear of the concepts, at the last came to the rescue was Zerodha Varsity i thank so much to the team for the effort spending on creating a wonderful learning experience with charts/graphs and pictorial representations and step by step approach of teaching the concepts, i was in Awe with the way you have explained . Kudos to the Zerodha Varsity Team ..

Cheers !!!

Ajaykumar B

Thanks for the kind words, Ajay. You made the day for us 🙂

Happy learning!

Dear Sir,

I want of know if the Put Option buyer wants to exercise his right to sell the stocks, then he must have stocks in his account ? Or, it is simply cash settled ?

Regards,

Rahul Mishra

If you take this to till the expiry, then you need to have the stocks in your account. This is a part of the new physical settlement policy. More on that here – https://support.zerodha.com/category/trading-and-markets/margin-leverage-and-product-and-order-types/articles/policy-on-physical-settlement

Respected Karthik Sir,

Could you please let me know what is the potential for my below position which I initiate on 3rd January, 2020

Below is my position, Which I planning to hold till expiry.

1) Suppose I Sell Reliance ATM 1540 PE @ 37 (oblige to buy at the expiry day)

2) Buy Deep ITM Reliance 1800 PE @ 265 (Right to sell at the expiry day)

I understand for my above position at expiry day I oblige to buy Reliance @ 1540 and I have right to sell Reliance @ 1800.

Is the system will automatically adjust the position at the expiry day or I need to do it manually?

A) If I need to do it manually and at the expiry if reliance Trade 1500 from whom I need to buy reliance at @1540 and how? Also To whom I will sell reliance @ 1800 and how?

B) If I need to do it manually What if Reliance trade at the expiry @1560 or above, What I know on that situation PE buyer will lapse his right to sell and how and whom I need to buy stock to claim my right to sell @1800 PE

C) I also kept Ready extra Fund 1540*500 of Rs. 7, 70000/- if required to buy shared at the expiry. ( IS IT MANDATORY TO KEPT THE EXTRA FUND READY INTO TRADING ACCOUNT)

I get premium 37 for 1540 PE sell and Paid extra 5 for 1800 PE (1800-1540= 260, where I have paid Rs. 265 for 1800 PE) my Total Maximum Gain is 32 each share at the expiry for any market condition!

I do not understand what will be my maximum lose/Risk for the above explain position, could you please explain.

Thanks in advance for your time and effort.

Best Regards,

Soumen Sen

1 & 2) Based on the spot at expiry, you will have to either bring cash of stock. This is due to the physical settlement of stocks. Check this – https://support.zerodha.com/category/trading-and-markets/margin-leverage-and-product-and-order-types/articles/policy-on-physical-settlement

A) If you are headed to expiry with a position, then its better you track the position and adjust based on the margin requirements.

B) Reliance is a liquid stock, so it is likely that you get a fill

C) Going into expiry, if the option turns ITM, then yes, you will need to bring in cash

I’d suggest you key in these options position on Sensibull, you will get the exact payoff and risk chart. Will be easier to analyse.

Sir, I am not getting the concept of selling the options (both call & put) before the expiry date although I go through all the comments. In India we use the European Options then hoe can we exercise them before expiration ?

I am confuse, please get me out of this.

Thanks

Nischal, think of the option premium as a stock. You can buy or sell the stock anytime you want right? Just like that, you can buy or sell the premium anytime/any number of time you want. There is no need to wait till expiry.

Got it. Thanks

Dear Sir ,

A Underlying is been Currently priced @ 557.00 I expect it to go down more can i select Options Put option ( BUY ) priced at 600 or more ? the Premium is around 40 . As it is already 600-40 premium Means already in profit . also what happens if the price of the underlaying on the date of Expire is about 540.00, will i get 20 per share , if the price is 555 on the day of Expire will i get 5 per share ? can i select 600PE and make the purchase when the underlying is just 557 ? is it wise or i am all wrong .

If on expiry the underlying is 540, then the intrinsic value for the 600 PE is 60. Since you have paid 40 as premium, your profit is 20.

Hello sir, in the above bank nifty example why don’t we just buy 18500 or 18600 instead of 18400.. ???

18400 is the ATM option right?

[…] 5. The Put Option Buying […]

Hi kartik sir,

Based on pre open market data and I bought 17000 bank nifty puts apr contract. At 492. Though I had planned to scalp some points in opening trade ,the price just crashed and hit my sl.

I m wondering where did I go wrong? Bank nifty index was down and I was expecting the puts to increase.. Also there was hardly any movement in box.

Can You help me understand where did I go wrong?

Tks,

Shyam

That would be very difficult to figure given the context we are in Shyam. Our markets are closely aligned with global mkts, so as you can imagine, multiple factors at play.

Sir

I have a suggestion. In the graphs shown for the probable P&L, kindly show profit line in GREEN and loss line in RED. It will be lot easier to comprehend.

Regards

Thanks, will try and do that.

Going on to the 2nd question, if the spot is at 17000 on any other date apart from the expiry date, the P&L is not going to be 1085, it will be higher. We will discuss why this will be higher at an appropriate stage, but for now just keep this point in the back of your mind.

Can you please share the link for the above?

Link is the chapter itself, right? Sorry, I don’t know if you are looking for anything else.

Hi Karthik,

Thanks for all the info.

Can you explain why would anyone not short instead of buying a put option and vice versa? Because the user is bearish, he can also short right? How do you make that choice?

Thanks!

The decision to buy or sell an option depends on two things –

1) Volatility expectation

2) Current premium owing to the current volatility

Have explained both these concepts in the chapters related to Volatility.

Hi Karthik,

Sorry for not being clear in my previous query. I wanted to know the reason for choosing Options over futures and vice versa.

For ex: If I’m selling Call Options, why can’t I sell futures since they both involve margins.

Thanks

You choose options when you want to de-risk (especially at times you are not sure about the market direction). Futures is best when you are certain about the market direction.

it is very easy.but end of month it becomes lower

i want to buy a put option of cipla APR FUTURE @580 0N 20TH APR AT RS 21. AT THE END OF THIS TIME IS THIS WRITE DECISION. ONLY PAPER TRADING PURPOSE

Yes, as long as you are paper trading and learning from its outcome 🙂

If I bought a put option, once I try to exit the put option, will I be asked for a margin. If yes, then why ?

Thanks

In 5.3 Last paragraph, “Of course we will understand how to calculate (and the need to calculate) the intrinsic value of an option during the expiry”. I’s this “during the series” or “during the expiry Of course we will understand how to calculate (and the need to calculate) the intrinsic value of an option during the expiry”? Can you pl explain if it is not typo

Series and expiry are kindly of loosely used, both are interchangeably used.

If I buy below Nifty Option what will be the expiry date

NIFTY MAY 8500 PE

Why there is no date with this Put Option

You must be buying the May expiry option expiring on 28th May.

Hi Karthik,

Pls help me with following questions

1) I have seen various fascinating trading terminals . All blue and red lights flashing on the screen alongside the script name as and when it moves up or down. NO chart only scripts names especially at the trading houses.

what are those softwares karthik?. do you know any of these ?.I have only used Kite as of now?

For example :- I have seen nse NOW has same software . DO you know any other then that.

2) DO you guys design personal softwares for your clients . I ask this because in one of the comment i read it . I am talking about this :- https://zerodha.com/varsity/wp-content/uploads/2015/04/20185.png

3) Which softwares do these mutual funds/Hedge funds etc use for trading ?

I might seem foolish but pls answer me not limiting yourself to the questions i have put up.

Or suggest something where I can learn about it.

Thanks .

1) There are two different kinds – (a) trading + charting Softwares, which basically lets you look at the chart plus trade. Kite is like this, (b) Charting software – where you can only look at the charts, like an AMIbroker. I’m not sure which one you are referring to 🙂

2) No, we don’t 🙂

3) Depends on the purpose. However, I know few funds who use Kite for placing orders 🙂

how would i know whether the premium i paid for a particular strike price is right or more than its actual value ??

YOu can check the fair value of it on B&S calculator.

Dear Kartik Sir,

Greetings of the day!!!

Sir the above details on put option is good, but i still have confusion, would be highly appreciated if you could help me.

Firstly let me tell you that i am novice and new to the trading world, so forgive me if i am asking a stupid question.

please help me with the below scenario –

With the current situation, the Nifty Bank will go down to say my assumption strike price is 16800

So can i really “BUY 06 LOT’s PUT OPTION FOR BANK NIFTY” but with expiry on June 18th.

And by any reason on the 11th June itself the Bank Nifty is on 16400 so how do i proceed with or do i have to wait till the expiry???

Do i have to square it off or the seller of the contract will buy if from me at the value when the contract was made i.e if i buy the put option and on that day the Nifty Bank was @ 17100 or how does it happen???

please advise/suggest me with your expertise.

regards

KPM {KITNA PAISA MILEGA 🙂 }

No, you need not have to wait till expiry, you can sell it whenever you want even before the expiry.