12.1 – The other side of the mountain

How many of you remember your high school calculus? Does the word differentiation and integration ring a bell? The word ‘Derivatives’ meant something else to all of us back then – it simply referred to solving lengthy differentiation and integration problems.

Let me attempt to refresh your memory – the idea here is to just drive a certain point across and not really get into the technicalities of solving a calculus problem. Please note, the following discussion is very relevant to options, so please do read on.

Consider this –

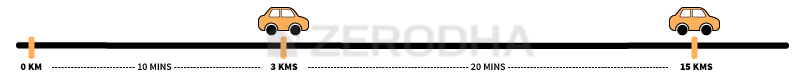

A car is set into motion; it starts from 0 kms travels for 10 minutes and reaches the 3rd kilometer mark. From the 3rd kilometer mark, the car travels for another 5 minutes and reaches the 7th kilometer mark.

Let us focus and note what really happens between the 3rd and 7th kilometer, –

- Let ‘x’ = distance, and ‘dx’ the change in distance

- Change in distance i.e. ‘dx’, is 4 (7 – 3)

- Let ‘t’ = time, and ‘dt’ the change in time

- Change in time i.e. ‘dt’, is 5 (15 – 10)

If we divide dx over dt i.e. change in distance over change in time we get ‘Velocity’ (V)!

V = dx / dt

= 4/5

This means the car is travelling 4Kms for every 5 Minutes. Here the velocity is being expressed in Kms travelled per minute, clearly this is not a convention we use in our day to day conversation as we are used to express speed or velocity in Kms travelled per hour (KMPH).

We can convert 4/5 to KMPH by making a simple mathematical adjustment –

5 minutes when expressed in hours equals 5/60 hours, plugging this back in the above equation

= 4 / (5/ 60)

= (4*60)/5

= 48 Kmph

Hence the car is moving at a velocity of 48 kmph (kilometers per hour).

Do remember Velocity is change in distance travelled divided over change in time. In the calculus world, the Speed or Velocity is called the ‘1st order derivative’ of distance travelled.

Now, let us take this example forward – In the 1st leg of the journey the car reached the 7th Kilometer after 15 minutes. Further assume in the 2nd leg of journey, starting from the 7th kilometer mark the car travels for another 5 minutes and reaches the 15th kilometer mark.

We know the velocity of the car in the first leg was 48 kmph, and we can easily calculate the velocity for the 2nd leg of the journey as 96 kmph (here dx = 8 and dt = 5).

It is quite obvious that the car travelled twice as fast in the 2nd leg of the journey.

Let us call the change in velocity as ‘dv’. Change in velocity as we know is also called ‘Acceleration’.

We know the change in velocity is

= 96KMPH – 48 KMPH

= 48 KMPH /??

The above answer suggests that the change in velocity is 48 KMPH…. but over what? Confusing right?

Let me explain –

** The following explanation may seem like a digression from the main topic about Gamma, but it is not, so please read on, if not for anything it will refresh your high school physics ☺ **

When you want to buy a new car, the first thing the sales guy tells you is something like this – “the car is really fast as it can accelerate 0 to 60 in 5 seconds”. Essentially he is telling you that the car can change velocity from 0 KMPH (from the state of complete rest) to 60 KMPH in 5 seconds. Change in velocity here is 60KMPH (60 – 0) over 5 seconds.

Likewise in the above example we know the change in velocity is 48KMPH but over what? Unless we answer “over what” part, we would not know what the acceleration really is.

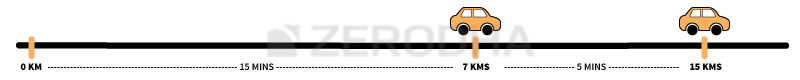

To find out the acceleration in this particular case, we can make some assumptions –

- Acceleration is constant

- We can ignore the 7th kilometer mark for time being – hence we consider the fact that the car was at 3rd kilometer mark at the 10th minute and it reached the 15th kilometer mark at the 20th minute

Using the above information, we can further deduce more information (in the calculus world, these are called the ‘initial conditions’).

- Velocity @ the 10th minute (or 3rd kilometer mark) = 0 KMPS. This is called the initial velocity

- Time lapsed @ the 3rd kilometer mark = 10 minutes

- Acceleration is constant between the 3rd and 15th kilometer mark

- Time at 15th kilometer mark = 20 minutes

- Velocity @ 20th minute (or 15th kilometer marks) is called ‘Final Velocity”

- While we know the initial velocity was 0 kmph, we do not know the final velocity

- Total distance travelled = 15 – 3 = 12 kms

- Total driving time = 20 -10 = 10 minutes

- Average speed (velocity) = 12/10 = 1.2 kmps per minute or in terms of hours it would be 72 kmph

Now think about this, we know –

- Initial velocity = 0 kmph

- Average velocity = 72 kmph

- Final velocity =??

By reverse engineering we know the final velocity should be 144 Kmph as the average of 0 and 144 is 72.

Further we know acceleration is calculated as = Final Velocity / time (provided acceleration is constant).

Hence the acceleration is –

= 144 kmph / 10 minutes

10 minutes when converted to hours is (10/60) hours, plugging this back in the above equation

= 144 kmph / (10/60) hour

= 864 Kilometers per hour.

This means the car is gaining a speed of 864 kilometers every hour, and if a salesman is selling you this car, he would say the car can accelerate 0 to 72kmph in 5 secs (I’ll let you do this math).

We simplified this problem a great deal by making one assumption – acceleration is constant. However in reality acceleration is not constant, you accelerate at different speeds for obvious reasons. Generally speaking, to calculate such problems involving change in one variable due to the change in another variable one would have to dig into derivative calculus, more precisely one needs to use the concept of ‘differential equations’.

Now just think about this for a moment –

We know change in distance travelled (position) = Velocity, this is also called the 1st order derivative of distance position.

Change in Velocity = Acceleration

Acceleration = Change in Velocity over time, which is in turn the change in position over time.

Hence it is apt to call Acceleration as the 2nd order derivative of the position or the 1st derivative of Velocity!

Keep this point about the 1st order derivative and 2nd order derivative in perspective as we now proceed to understand the Gamma.

12.2 – Drawing Parallels

Over the last few chapters we understood how Delta of an option works. Delta as we know represents the change in premium for the given change in the underlying price.

For example if the Nifty spot value is 8000, then we know the 8200 CE option is OTM, hence its delta could be a value between 0 and 0.5. Let us fix this to 0.2 for the sake of this discussion.

Assume Nifty spot jumps 300 points in a single day, this means the 8200 CE is no longer an OTM option, rather it becomes slightly ITM option and therefore by virtue of this jump in spot value, the delta of 8200 CE will no longer be 0.2, it would be somewhere between 0.5 and 1.0, let us assume 0.8.

With this change in underlying, one thing is very clear – the delta itself changes. Meaning delta is a variable, whose value changes based on the changes in the underlying and the premium! If you notice, Delta is very similar to velocity whose value changes with change in time and the distance travelled.

The Gamma of an option measures this change in delta for the given change in the underlying. In other words Gamma of an option helps us answer this question – “For a given change in the underlying, what will be the corresponding change in the delta of the option?”

Now, let us re-plug the velocity and acceleration example and draw some parallels to Delta and Gamma.

1st order Derivative

- Change in distance travelled (position) with respect to change in time is captured by velocity, and velocity is called the 1st order derivative of position

- Change in premium with respect to change in underlying is captured by delta, and hence delta is called the 1st order derivative of the premium

2nd order Derivative

- Change in velocity with respect to change in time is captured by acceleration, and acceleration is called the 2nd order derivative of position

- Change in delta is with respect to change in the underlying value is captured by Gamma, hence Gamma is called the 2nd order derivative of the premium

As you can imagine, calculating the values of Delta and Gamma (and in fact all other Option Greeks) involves number crunching and heavy use of calculus (differential equations and stochastic calculus).

Here is a trivia for you – as we know, derivatives are called derivatives because the derivative contracts derives its value based on the value of its respective underlying.

This value that the derivatives contracts derive from its respective underlying is measured using the application of “Derivatives” as a mathematical concept, hence the reason why Futures & Options are referred to as ‘Derivatives’ ☺.

You may be interested to know there is a parallel trading universe out there where traders apply derivative calculus to find trading opportunities day in and day out. In the trading world, such traders are generally called ‘Quants’, quite a fancy nomenclature I must say. Quantitative trading is what really exists on the other side of this mountain called ‘Markets’.

From my experience, understanding the 2nd order derivative such as Gamma is not an easy task, although we will try and simplify it as much as possible in the subsequent chapters.

Key takeaways from this chapter

- Financial derivatives are called Financial derivatives because of its dependence on calculus and differential equations (generally called Derivatives)

- Delta of an option is a variable and changes for every change in the underlying and premium

- Gamma captures the rate of change of delta, it helps us get an answer for a question such as “What is the expected value of delta for a given change in underlying”

- Delta is the 1st order derivative of premium

- Gamma is the 2nd order derivative of premium

For anyone who is confused or does not understand the 1st Order and 2nd Order derivative concept, let us take a simpler example (Considering only Speed & Acceleration).

Consider you are driving a car and a person is looking at you from outside. You went slow at the start for the 1st second. Then you felt confident and pressed on the pedal to increase your speed a bit for the 2nd second. In the 3rd second, you were feeling even courageous and felt like increasing your speed a bit more.

The person from outside saw that in the first second (alone), you covered 2 meters. In the 2nd second (alone) you covered 4 meters. In the 3rd second (alone), you covered 6 meters.

Now we know that, Speed = Distance/Time. Let’s find your speed for each second separately.

So, Your Speed during the 1st second was 2/1 = 2m/s. [Meaning If you continued going like this (without pressing the pedal anymore), then you would have covered 2 meters every second]

During the 2nd second, it was 4/1 = 4m/s.

During the 3rd second, it was 6/1 = 6m/s.

If you notice how your speed changed in this time period, you will see that it increased by 2 every second (From 2m/s to 4m/s to 6m/s). This is your Acceleration (meaning your speed was increasing by 2 every second).

Here, Speed is a First Order derivative & Acceleration is a Second Order Derivative. Speed told us the rate at which the distance was changing. Acceleration told us the rate at which speed was changing.

Similarly, Delta tells us the rate at which the option premium is changing. Gamma tells us the rate at which Delta is changing.

Sorry for the long explanation. But I’ll be happy if it helps someone.🙂

Thanks Ram, this will help many readers 🙂

Can someone suggest some youtube channel or websites Where can I learn about the basics of stochastic calculus for free.

Try Khan Academy.

Sir, the first figure is wrong as against the explanation and the equation given

Let ‘x’ = distance, and ‘dx’ the change in distance

Change in distance i.e. ‘dx’, is 4 (7 – 3)

Let ‘t’ = time, and ‘dt’ the change in time

Change in time i.e. ‘dt’, is 5 (15 – 10)

please correct it, please correct me if I am wrong.

Ah, let me check this Shyam.

In Second leg How car\’s spped 96 KMPH is calculated? Please explain.

Ah, its discussed in the chapter itself. But eitherway, this particular example, pls use it at the surface level without digging into details. The idea is to use it as an analogy for options 🙂

\”if not for anything it will refresh your high school physics \”

Huhh!! One of the most unexpected & funniest line i found till now in varsity.😂

The entire course is super amazing. Thanks a Ton!!

Happy learning!

Uff Karthik, you are awesome! I hated Paper 2 in 12th so much because of the whole limits/cont/der/int thing. Never understood it. Left it as \”option\” in the boards. Wish I had met someone like you then to clear up the confusion. You, Nithin, Nikhil, Abid, Prateek, and everyone else involved whose names I dont know – you guys are doing a priceless service to the country. I hope more people know how to money themselves up and in the near future, we have the rich take public transport.

Thanks for the kind words, Yash! I\’m glad you liked the content here. Happy learning 🙂

Hello Sir I Have very Basic Knowledge of Physics will it effect in this Chapter bcs there are many terms which are hard for me to understand

You dont really need Physics for this, the example is just for analogy.

what is gamma spike and when does it happen?

what is gamma spikes and when does it happen.

Whenever there is excess speculative activity, gamma spikes.

Really this much matics your are teaching better become math matics teacher.

i lost my patience at the end. Pls simplify

ok.

You complicated the whole concept for no reason, you were just carried away by speed and velocity

A very boring chapter with some needless explanation

Please redo the full thing as this is way below your mark

Sure sir. Meanwhile, you can also check this – https://www.youtube.com/watch?v=koJQc3fqxjk&list=PLX2SHiKfualFiusiT9G5uE9jU3vetvW2x&index=8 and the entire options playlist is here – https://www.youtube.com/playlist?list=PLX2SHiKfualFiusiT9G5uE9jU3vetvW2x

Hai rangappa sir ,

I really appreciate the efforts you have taken for this . I have a doubt like you have calculated the acceleration 868kmph2 and then how it can have a velocity of 72kmph just after 5sec . from my calculations and chatgpts calculations ( used for confirmations ) it will come to 72kmph only after 4.78 minutes ? kindly make it clear for me if am wrong .

Dont read too much into this, I used this example just to convey the concept, I wont be surprised if I\’ve made a factual error 🙂

Hey Karthik thank you so much for the options module 😊

Happy learning 🙂

How to calculate gamma

What is the formula?

Its part of the Black & Scholes formula.

I\’m so stupid for asking this question but how did u get that the car can accelerate from o to 72 kmph in 5 sec. You told to do the math part ourselves but i don\’t seem to understand how u got it

Sorry, I, too, feel really bad for giving such a lame example honestly 🙂 The idea was to explain its a 2nd order derivative. Please ignore the example 🙂

can\’t we install zerodha pi now, where i can get the download link

Nope, Pi is no longer supported.

The acceleration is 864 Kilometers per hour/hour and the salesman selling us the car would say, the car can accelerate from 0 to 72kmph in 5 min is the correct answer, right?

Or Am I missing something? This one engaged me a lot..

In my over-enthusiasm to explain Gamma, I may have messed up with the acceleration bit. Please see the other comments as well 🙂

Karthik Sir, in the 3rd KM how the velocity is 0,

because the velocity is change in distance

(i.e.) 3/10*60 – 0 = 18 – 0 = 18,

So the initial velocity should be 18 know sir?

Muthu, don\’t read too much into the example, please go with the overall flow 🙂

please include dark mode …..

it was very disgusting to go through this amazing notes without convenient way of approach(dark mode)

Noted. Maybe you can switch to the app where darkmode is available.

I’m in awe at your candid humility and ease of expression and more interestingly, if we keep the a(acceleration which is gamma) on the RHS and take everything else to the other side we’ll still get variance. So through it all and through the entire module you’ve been on the point to no fault.

Thanks for the kind words, Ashul. And I\’m really glad you liked the content Varsity\’s content 🙂

Hi Karthik

I know its not a glaring mistake but you have driven home this entire chapter smoothly but the velocity example is a little incorrect because it is not the average of initial and final velocity but the difference of the squares of the initial velocity and final velocity which equals two times the product of acceleration and distance hence it should have been

v^2 – u^2 = 2as & v = u + at

which will be

a = 4 m/s^2

&

v = 72 KMPH

Ansul, that was a very lame attempt by me to explain the concept. I\’m aware of the mistake, thanks for the right solution 🙂

Thank you for explaining this in such a nice and a simplistic way.

Glad you liked it 🙂

Thank you Sir!

How much impact all these options Greeks has when Premium is traded intraday?

Premiums derive value based on this Nilesh. So it has an impact.

Sir,

Do Futures Contracts of a certain Underlying have any impact over Options Contracts of that particular Underlying?

Thank you!

Not directly. But you can take in futures price as an input to calculate the fair value of the option premium.

Is Zerodha still has PI?

Nope.

पाई एप्प का लिंक दो।

The comments are also a learning avenue 🙂

Varsity is a boon for new & pro traders alike. So many points getting clarified at the basic level.

Thank you Karthik for putting this together.

The comments are also a learning avenue 🙂

Varsity is a boon for new & pro traders alike. So many points getting clarified at the basic level.

Thank you Karthik for putting this together.

Thanks,

Namesake (Karthik)

Happy reading, Karthik 🙂

i loved your writing style, personal touch!!

i read upto options 3 times already and have been practicing virtual trading for 3 months.

as a maths enthusiastic i have developed a huge interest on quant approach and working with formulas and algos.

please suggest some quantative trading materials like blogs, books, youtube anything so that i can further develop skills to make beautiful quant logics .

thanks

Happy to note that, glad you are likin the content 🙂

You may appreciate this module if you like quants – https://zerodha.com/varsity/module/trading-systems/

If a car gains/acceleration is 864 kms/hr as in above example, the car seller would say car can gain speed of 72kms/hr in 5 mins, not 5 secs correct??

Not getting into physics bit for now. I\’ve used it only to get a perspective 🙂

Sorry! Wrong question. Please ignore it

In the example given above For example if the Nifty spot value is 8000, then we know the 8200 CE option is OTM, hence its delta could be a value between 0 and 0.5. Let us fix this to 0.2 for the sake of this discussion.

OTM for CE should be in the range of 0.5 – 1.0, isn\’t it?

0.5 to 1 is the range for ITM CE Murali, not OTM CE.

Sorry above is wrong question leave it sir

When u were talking about risk limit, u gave an example of shorting option, then after that when u consider that nifty moved 70 points against,for that example u considered the delta value positive. Why did u took positive delta when it was short gamma

Sorry, was it long or short, CE or PE?

Hi Karthik, As you mentioned..

\”Delta of an option is a variable and changes for every change in the underlying and premium\”

But the change in underlying and premium is something purely depends on the way traders set their prices in selling/buying, right ??

That constitutes a change in price, and that in turn changes the delta. So it is kind of interrelated 🙂

I always wondered where and when in my life i will use calculus that i learned in school and is it even worth studying, now i have thereason

There is a reason for everything in life 🙂

\”…the car accelerates from 0 t0 72 kmph in 5 sec \” is NOT 864 kmph !! Rather 0 to 72 kmph in 5 minutes will be 864kmph- isnt it?

Must be, like I\’ve confessed, this was a rather lame attempt to explain 2nd order derivative. Please excuse me for this 🙂

Two (First and Third) of the three line diagrams in the 12.1 section are incorrectly labelled. They don\’t match the preceding description. Dont you think it needs correction?

Ah, probably. It was my really lame attempt to explain 2nd order derivative. Let me relook 🙂

Hi Karthik Sir,

I am pretty much new to the market and I was wondering how to gain the knowledge about markets and one of my mentor suggested that Varsity is a good start but after going through this I can produly say this is an excellent start and wish I could have seen this content six years back. Thanks for all the hard work you put in for this

Thanks,

Rahul

Very happy to note that, Rahul. I\’m glad Varsity is of help. Happy learning 🙂

Hi,

When you are giving introduction to greeks, you mentioned delta is rate of change of premium based on underlying asset direction

which is dP/dT (rate of change of means wrt to time)

but in this article , you are mentioning delta as change of premium wrt to underlying asset (here its no longer dT in the denominator, where rate of is not mentioned)

which is a bit misleading

pls clarify which one is correct and update the material accordingly

Ah, I\’m sorry if that was misleading. Delta is the rate of change of the premium, wrt to the change in underlying.

Hello Karthik,

Great content. Just want to point out some trivial things.

1. When you did the math for second car example (second car timeline diagram), for the first leg average velocity should be 28kmph and not 48kmph.

2. When you go to the third car timeline diagram, you mention to forget that car was at 7km mark and consider it to be at 3km mark at t=10. Total time elapsed in second diagram was 15+5 i.e. 20 and in diagram 3 it is 10+20 i.e. 30. This seems to be inconsistent. I think both the times should be equal since same example is being carried forward

3. When you mention time at 15th km mark, you take it to be 20 minutes but according to diagram 3 it should be 30 minutes. I think both point 2 and 3 can be corrected by changing diagram 3

4. When you mention the acceleration to be 864, its unit should be km/hr^2

Thanks, Nishank. I should have stuck to the subject I know well and not ventured into areas I don\’t know anything about. I was only trying to explain the 2nd derivative, bad attempt I guess 🙂

Hello…

I have a question.

Suppose for a company XYZ, I buy the call option at 100 strike price and a put option at 150 strike price with the same expiry date. Say the spot price is 130.

So on the expiry day, can I use my call contract to buy the stock at 100 and then sell the stock at 150 using my put contract?

In this case 130 Call is ITM and you are entitled to buy the stock, 150 Put is also ITM, so they will offset.

Sir, I pledge 1 lot of RELIANCE shares which I have in my Demat account currently trading at 2200 each share. And I get 90% of the valuation of lot size ,10% being haircut.what will happen if RELIANCE fall and starts trading at 1800.As I have pledged shares and got valuation at 2200 share price. Please clarify .THANK YOU.

huge fan for your work sir thank you very much sir for this knowledge i always owe you sir

Happy learning, Harsha!

Hello sir, I have question which ian\’t related to this module.

1) Few days ago I was listening to interviews of Rakesh Jhunjunwala and Ramdeo Agarwal (chairman of Motilal Oswal) and they both shared a similar thought process which was

\”To keep holding their stocks during uncertainty time and Crisis\” and that have actually generated majority of their wealth throughout their life, which I do completely agree with them. However my question is, These big players could have easily liquidated their shares in February & March (like how FII\’s and DII\’s did) when US market was crashing and Indian markets shown similar behaviour and would have made huge money. And once the market recovered fairly after bottoming out, BUY Again with long term perspective.

But they majorly didn\’t take this step, Why is it so ?

2) Does the above behaviour Fit perfectly for \’Retail Investors\’ or

More Sophisticated Investors*

**if we assume that the later one doesn\’t hedge

1) The long term attitude is not to react to short term events 🙂

2) Retail investor should also adopt to this 🙂

It would be 72 km/hr in 5 mins and not 5 secs.

Ok.

Is Quantitative trading & Algorithm Trading same thing ?

No, they are different, although Algo trading involves a lot of quantitative concepts.

Velocity @ the 10th minute (or 3rd kilometer mark) = 0 KMPS. This is called the initial velocity

How can there be a 0KMPS initial velocity?

Distance travelled =3km , hence dt =3km

Time change = 10-0 , Hence dt = 10min

= do/dt, = 3/10,=3*60/10,=180/10,= 18kmph

Please explain why 0 is initiall velocity

Vijay, this was just an attempt to giving an analogy. It may not be a perfect example, so please don\’t think too much about it 🙂

An example above said \”This means the car is gaining a speed of 864 km/hour, and if a salesman is selling you this car, he would say the car can accelerate 0 to 72km/h in 5 secs (I’ll let you do this math).\”

There are 12 of 5 second slots in a minute (60/5=12) and 72×12=864, which would mean that the car has an instantaneous speed of 864 km/hour at the end of one minute. So wouldn\’t it be more appropriate to say that car is gaining a speed of 864 km/hour/minute?

Deepu, I used this example just to convey the concept of a 2nd order derivative. Please dont read too much into this 🙂

sir is there ny module on algo trading in varsity

if not then how to gain knowledge about it

or only high tech genius can do , not a normal person

sir can you shed some light on quant trading also ?

We don\’t have anything on algo, as it requires coding and programming skills. We don\’t have anything on Varsity yet. However, you can start with the content here and develop ideas for system-based trading – https://zerodha.com/varsity/module/trading-systems/

sir in this previous query

if spot nifty is at 8000 and we buy 8200 CE which is OTM with delta value 0.2. When the nift spot value moves to 8300 , then my 8200 CE becomes slightly ITM, so delta will changes from 0.2 to 0.8 .

To calculate change in premium we which one is correct:

1. change in premium=300*0.8 or 300*0.2

you answered 300*2 will be the method

but sir as soon spot reaches strike price then 8200 become ATM and delta value shall be around .5

and after spot reach 8300 strike become ITM .

so dont we need to shift delta value again and again for calculating premium

Rajat, in reality, the delta does not change in a stepwise fashion. It changes continuously. So as and when the underlying starts to move, the delta too starts to change, but these changes are very hard for an individual trader to track, hence, for the sake of convenience, we consider the stepwise changes.

hello sir

sir as options derives their value from their underlying securites , underlying securites can be traded by technical indicators , support and resistance . Can the same be used for trading in options ?

No, you should not apply TA on options.

Using the above information, we can further deduce more information (in the calculus world, these are called the ‘initial conditions’).

Velocity @ the 10th minute (or 3rd kilometer mark) = 0 KMPS. This is called the initial velocity

Hi Zerodha Team : Can you explain the above .How do u deduce that the velocity at the 3rd KM mark is 0 when the vehicle has traversed the initial distance of 3 km in 10 mins.

Or you want us to assume this for hypothetical sake ?

Hey Tapas, don\’t get into that, please. The velocity example was just an attempt (lame perhaps) to explain the 2nd derivative and intro Gamma.

Hey Karthik

it might be a bit long but please bear with me.

I have sold a 1900 put option of bajaj finance @ RS.78.9 premium with a view of taking delivery of stock if it gets exercised on expiry otherwise keep the premium. For this position, Zerodha blocked a margin of around RS.147260. now, this morning the position is against me and the position tab in kites showing me a loss of around Rs.6000, therefore, the margin available in the account reduced by almost the same amount I guess it is due to RMS policy.

I would like to know few things assuming the bajaj finance spot reaches 1800 on expiry, therefore, making options in the money.

-it is certain that I would be taking the delivery of the shares and I will have to pay the money for the lot @ Rs.1900 but do I need to pay full money from fresh cash by depositing it into trade account or a portion of the money will be paid from blocked margin hence I need to pay the remaining balance? if i need to pay fresh cash then what would happen to the blocked margin?

-P&L keeps changing in the position tab in kite so if the option would be in the money on expiry then the premium would be high therefore a loss for me in that scenario then would I need to pay for that loss as well? and if yes then why as I am making the payment to take delivery as per contract?

-because P&L keeps changing in the position tab it is also increasing or reducing margin available/free cash under funds. so if loss under P&L exceeds available margin then would I get a margin call and if yes then would I just need to add funds equivalent to the size of purchase in case option ends up in the money on expiry?

-why free cash/margin available is being affected even after paying the required margin?

thank you

Hi Gunjan,

1. Margins for the contract increases when the position moves closer to the spot price as the SPAN and Exposure margins increase for that contract. Options contracts are not settled on a marked to market basis, unlike futures.

2. Margins will increase on the last 2 days of the expiry due to physical settlement due(we’ve explained this here). On the expiry day, if your position is ITM, your margin blocked will be released and since you have a take delivery position, obligation equal to the contract value(settlement price * lot size) will be blocked and you will receive the shares in your account 2 days after expiry.

3. Currently, due to volatility on the expiry day, we block 100% of the contract value, so any changes in SPAN+Exposure margins won’t trigger a margin call.

Hey Sir,

I have been reading your modules thoroughly, it helped a lot, I am very thankful to you.

Your every topic is helping me a lot, the way you explain, I really like the way that you take us to concepts.

But the example given above which was based on speed and example was wrong in terms of the concept of physics, Please correct it, because I faced the problem with that and that can happen with any other student.

As a Zerodha varsity fan , I want everything to be right! ;p

Thanks, Prem. I was only trying to attempt to explain 2nd order derivative, will relook at this 🙂

Sorry lessor known Greeks.

Also, just out of curiosity, how many Greeks are there in total. My count is 13.

Is that it or there are more 🙂

Thanks,

Alok.

Perhaps, my world is restricted to the big three – Delta, Theta, and Vega 🙂

Ok..so a retail trader should do just fine with Delta, Theta & Vega?

I\’m obviously assuming that lessor knows greeks are also a no brainier for retail traders?

Thanks,

Alok.

Yes, a retail trader is absolutely good enough with a working knowledge of Delta, Theta, and Vega.

Hi Karthik,

Truly appreciate what you have done to explain this concept. However, can you explain the practical application of gamma?

As in, how to use it when making a trading decision.

Thanks,

Alok

Of all the Greeks, gamma is one which a retail trader need not worry about. Gamma risk is usually an institutional thing. Because they deal with Millions of $, a slight variation in Gamma results in a big P&L movement for these guys.

[…] 12. Gamma (Part 1) […]

\”A car is set into motion; it starts from 0 kms travels for 10 minutes and reaches the 3rd kilometer mark. From the 3rd kilometer mark, the car travels for another 5 minutes and reaches the 7th kilometer mark.\”

Image below this sentence confusing because as per sentence it should be 5 minutes and 7 kilometer instead of 20 minutes and 15 kilometer.

Please check

Thanks…!!

Hmm, let me recheck this.

Karthik, can you please explain how initial velocity is 0kmph . If I divide 3 km/10min i get velocity of 18kmph. Also for average how you took 144 kmph .

I\’ll have to go back to high school physics now 🙂

The idea was to help you understand that there exists a 2nd order derivative, whose job is to capture the sensitivity to the in the 1st order variable. Case in point being delta and vega. I guess if this is understood, then it is good enough, not really required to get into physics 🙂

This example is difficult for beginners to understand , use simple example to understand the gamma , but overall gamma explanation is so good , and thanks to the person who wrote the zerodha varsity.

Noted, Jogesh. Thanks for pointing out.

Is \”Delta Accelaration\” in quantified term equal to Gamma?

Hmm, tricky bit. Gamma, plays a role but it cannot be equated.

Hi Karthik,

Thanks for such a wonderful explanation. Please clear my doubt below:

if spot nifty is at 8000 and we buy 8200 CE which is OTM with delta value 0.2. When the nift spot value moves to 8300 , then my 8200 CE becomes slightly ITM, so delta will changes from 0.2 to 0.8 .

To calculate change in premium we which one is correct:

1. change in premium=300*0.8 or 300*0.2

Thanks,

Manish

It would be 300*0.2, Manish.

Hi Karthik,

The explanation was real great, but i found it real hard to understand your mathematical problem, as there is a problem with couple figures in the explanation.That may not be big issue,but still it confuses people like me.

Thank You.

karteek, can you please share the details? Maybe I can rework on it to make it better?

>Time at 15th kilometer mark = 20 minutes

>Velocity @ 20th minute (or 15th kilometer marks) is called ‘Final Velocity”

Trying to understand the analogy of average and final velocity and failing at it.

Velocity @20th minute would be 72 kmph, and i am not sure why you are not calling it final, instead you mentioned that is average velocity.

My understanding is that when the car is @20 minute mark, it has traveled a distance of 12 (15-3) km in 10 min, and that should be the velocity @20minute mark. Hence the acceleration should from 10 min (3km) to 20 min (15km) ,is

(72kmph-0) / 10 min = 72*6 = 432 km/h^2 (km per hour square)

Bharath, this was my attempt to explain the 2nd order Derivatives! Please look at this just enough to get the gist of the analogy and don\’t really get into solving the problem 🙂

No problem, thanks for the clarification 🙂

Welcome!

Hello Mr.Kartik

Thanks for sharing every details of Cal&Put options…it\’s very much informative and easy to understand..

I have a request..can you develop a system where all the greeks mentioned and it will change time to time..I have seen in techpaisa.com where all the integral value mention..specially for theta…

Thanks&Regards

P.K.Sarma Sarkar

Kolkata

Do check out sensibul.

Well this was a highly unusual and confusing chapter.

I have lots of queries, but this is my biggest one:

I have a view that ICICI Bank price will go down in coming days. So in order to trade in this scrip i have following options:

1. Short sell ICICI shares in spot market (but this will be only intraday).

2. Short sell ICICI Futures (this will require ~1Lakh margin for overnight position and 40K for intraday).

3. Write a Call Option (choosing an appropriate strike price keeping delta in mind).

4. Buy a Put Option (choosing an appropriate strike price keeping delta in mind).

Now say in few days, ICICI goes down 50 points.

1. If i had traded intraday, i would have made some profit according to that day.

2. If i had sold Futures, i would have made profit of 50 points.

3. If i had written a Call option, i would have collected the premium (which can only happen if i hold it till expiry). If i squared it off before expiry, then i would have made a profit of (50 points if delta is 1; or 25 points if delta is 0.5 …)

4. If i had buy a Put option, i would have made a profit of (50 points if delta is 1; or 25 points if delta is 0.5 …)

So, clearly i can see \’Futures\’ gives the most gain.

Only advantage i see for Options is the low margin requirement.

Please tell me what am i missing!

Thanks.

Yes, you are right. When you have a directional view, then the best way to act upon that is to trade with futures. However, the gains that you make (if measured on % return) is always higher on options. You do this when you compare the money blocked on the trade versus the return earned.

Thanks for the reply.

I have one more query:

In Nifty option chain, i see call option writing at strike price 8500 (current spot price 10325).

There is a very good chance that Nifty would not go down to 8500 till expiry.

So how these option writers will make money after expiry?

Amit, as you said the probability of Nifty going below 8500 is low…given this, option writers have a good chance of retaining the premiums, but buyers will have a tough time making money unless markets falls drastically 😉

In your personal opinion is option trading more profitable then intraday trading in equities ? Also at this point i think options trading is less risky then intraday trading in equity and more importance can be given to risk management in options trading. Is this correct ?

I\’d always prefer options!

Hi Karthik, few queries regarding quants

1. does quant trading occupies a major chunk in international markets?

2. how about indian markets ? does quant trading outweighs retail and other institutional trades?

Just curious to know the extent of impact quant trading has created 🙂

1) Yes, it does.

2) Its gaining popularity now. You can check this for exact details – https://www.nseindia.com/content/equities/cm_mode_of_trading.pdf , most of the Algos employ quant strategies.

Good luck.

If the acceleration is 864kmph, when converting into seconds it would be 864/3600 which equals 0.24 kmps. Multiplying this by 5 seconds would give 1.2 km per 5 seconds which gives 0 to 72 kmph only at 5 minutes right? Please help, im very anxious to know 🙂

Also, the acceleration should be 864 km/square hour considering unit of acceleration is m/s^2. However I still dont understand how you get 0 to 72kmph in 5 seconds. I know in the grand scheme of things, this is a very trivial question. But for me, trivial things matter 🙂

If the acceleration is 864kmph, when converting into seconds it would be 864/3600 which equals 0.24 kmps. Multiplying this by 5 seconds would give 1.2 km per 5 seconds which gives 0 to 72 kmph only at 5 minutes right? Please help, im very anxious to know 🙂

Lol, I\’m not a physics guy, Ashish. It was my lame attempt to explain Gamma of an option. Please spare me the math 🙂

Haha okay. I love the whole varsity series! The explanation is spot on! Please write more on advanced topics of economics and the stock market, or for that matter anything that you want to write about. I will definitely read it, your content is delightful. Cheers Karthik!

Thanks for the kind words, Ashish 🙂

Happy learning!

Very Confused With This Chapter Sir. My 1st Question Is Why The Initial Velocity Is 0? Here DX/DT Is 3*60/10. My 2nd Question Is If A Car Is Travelling Ar 864 Kmph The Acceleration Should Be Be 72 Kmph In 5 Min Not In 5 Sec. Can You Please Explain.

I Dnt Even Remember What Calculus Is. Are You suggesting To Learn Calculus First?

Hi ,

As per the below calculations ;

Velocity @ the 10th minute (or 3rd kilometer mark) = 0 KMPS. This is called the initial velocity

Time lapsed @ the 3rd kilometer mark = 10 minutes

Acceleration is constant between the 3rd and 15th kilometer mark

Time at 15th kilometer mark = 20 minutes

Velocity @ 20th minute (or 15th kilometer marks) is called ‘Final Velocity”

While we know the initial velocity was 0 kmph, we do not know the final velocity

Total distance travelled = 15 – 3 = 12 kms

Total driving time = 20 -10 = 10 minutes

Average speed (velocity) = 12/10 = 1.2 kmps per minute or in terms of hours it would be 72 kmph

the total driving time is 20 min so in the picture shown for illustration above the time between 3KM mark to 15KM mark should be shown as 10 min (20 min is cumulative from 0 KM) right ?

Thanks,

Sandeep

Yes sir – as long as you get the drift 🙂

Hi Sir\’s,

Thank for demystifying options for amateurs. One query, earlier we were able to download the pdf versions of the entire modules, however, no I dont see the download link anymore. Could you please help me with this. Thanks

Will get back the PDFs next week, Nikhil.

Dear Sir,

Thank you for appending the pdf version of the modules. If it not too much of an ask, can we create a similar document for all the Q&A portion for all chapters (consolidated per module as a document). I feel these questions will add value to one\’s learning experience.

Thank you again for all the hard work towards investor education.

Regards

Nikhil

I agree that would make sense Nikhil, but that would take away a lot of bandwidth. Not sure if we can afford to do that at this point.

Hello,

Truly a great blog by karthi Rangappa. Thanks a lot for doing so much for trading community.

I have some doubts here.

\”We know the velocity of the car in the first leg was 48 kmph\”

I guess it should be 28kmph right ??? Based on that whole calculation changes for me.

\”Velocity @ the 10th minute (or 3rd kilometer mark) = 0 KMPS\”

Velocity at 10th minute after 3 kms shoud be 18 KMPH right ??? Only that shouls be taken as initial velocity, because the car is already in motion ?

Thanks and Regards,

Soorrya

I wont be surprised if I\’ve made any silly mistakes in this example…not really a physicist 🙂

I remember seeing the terms long gamma and short gamma somewhere in this module. However I am unable to find them. Could you please tell me where the the terms appear for the first time?

Thank You.

It must be in the same chapter 🙂

Sir, Two editions are available.. First & updated second, kindly check & suggest the edition..

Updated 2nd should be good.

I\’m doing final year MBA in finance & my plan is to become a professional trader. Already I\’m doing swing trading in options(only) with zerodha & getting descent returns. To become well versed in options trading, varsity will pave the good way.As iam having the better financial background, I want to learn the options in depth. Can you suggest the best books which can fulfill my req…

http://tradingqna.com/754/which-are-the-top-books-one-should-read-become-better-trader

you can refer to this link

Thanks for that link Harshendra! I had forgotten about it 🙂

Glad to know this Vijayan, this is a great book on Options – http://www.amazon.com/Option-Volatility-amp-Pricing-Strategies/dp/155738486X

As I am new to Options, will I be able to understand the topics covered in the above book u have mentioned. Because I am sure the explaining art will not be as lucid as yours is Karthik:)

Thanks for that Sumeet 🙂

By the way, that book is a classic. I\’ve personally learnt a lot by reading that book.

I am going to sum up what I have learned so far about option trading and kindly correct me if I am wrong.

To do options trading we need to have a directional view about the underlying stock or index and for doing this we have to look into the charts of the underlying stock or index i.e. do Technical Analysis.

After making a directional view about the stock or index we have to select what we want to do, whether (buy a call option or sell a put option) or (write a call option or buy a put option) and for doing this we need to learn about option pricing.

To learn about option pricing we need to learn about option greeks and Black & Scholes Option Pricing Model.

You seem to get the flow right here. However very soon there will be a twist to this tale 🙂

Just to give you a heads up – To trade options you need to have a directional view on either markets or on Volatility! Please stay tuned for more.

Thanks for replying Sir.

All this knowledge is just because of you.

Thanks again.

All this knowledge is because of your eagerness to learn and not because of me 🙂

Good one. Waiting for some more lessons.

Very soon, thanks for your patience 🙂

nice explanation waiting for next chapters

Keep up the excellent work

Thank you! New chapter will be out this week.

Dear Karthik ,

I am very new to the world of stock trading , in simple words just on the learning phase , I saw amazing collection of your articles on trading right from basics , Its awesome to read them and learn right from basics , just wanted to know if the chapters from 1 to 12 all available in form of pdf or combined book ? i could only see first 3 in form of a book .

Please let me know if PDF or your articles are compiled in form of a book …

Regards

Padmesh

Thanks for the kind words and encouragement. We are working on converting the docs into PDF. In due course everything will be made available.

absolutely marvellous,sir!I\’m a new member of zerodha jus went abt a window-shopping spree on this site(oh!site surfing,shall i say)gr8 learning experience.if not for anything then certainly the calculus made me nostalgic.keep up the gud work

Glad to know that Prasad, please stay tuned for more!

H ii kartik

When will you upload next chapter. I am very excited for it.

Lots of uploads expected this week 🙂

Sir I salute you. Thank you so much for so clear explaination.

Stay tuned Pravin, more stuff coming up 🙂

Ahaa…so \”100 points\” is the answer to to the first part (a)? Oh please say yes! I promise to be patient after that.

Working out an answer for you 🙂 Determined to finish the chapter 13 today !

Hi Karthik, we can\’t thank you enough for making the content so detailed and comprehensible! You\’re going to make turn us into complete pros : ) While I\’ve already started using the delta and theta concepts to shape my options strategy, factoring in the gamma factor will be a heavy-duty number crunching exercise. Please help me out with this one part: If I sell an ATM Call and Put (both having a delta of about 0.5 — positive for the Call and negative for the Put) of the Bank Nifty, how many points (approximately) does the price have to move:

a. to turn one delta into 0.4 and the other into 0.6?

b. to turn one delta into 0.3 and the other into 0.7?

c. to turn one delta into 0.2 and the other into 0.8?

Thanks!

Delta of call ATM = + 0.5

Delta of Put ATM = -0.5

But when you short…

Delta of call ATM = – 0.5

Delta of Put ATM = + 0.5

Total position delta = -0.5 + 0.5 = 0

This means irrespective of much the market moves, the position will not get affected, because delta is 0. In other words, the position is delta neutral.

For example if nifty moves 100 points +ve

Change in premium = delta * number of points moved

= 0 * 100

= 0

However, after the 100 point move the positions will no longer be delta neutral. This is because delta itself changes due to gamma. From your question, I get a feeling you are clear upto this point.

However I would request you to please wait a little longer to get specific answers 🙂

The screen is very Dim. Even when what i am typing can not read. Need to use constant lense. It is really tiresome. Can you please improve visibility.

Sir, we have used maximum possible white space in this initiative. Having a lot of white space increases visibility. I\’m not sure whatelse can be done, however I will check with my technical colleagues if there is any solution to this.

Hi kartik,

Very very thanks for this chapter .This is some different, more interesting and a mathematical chapter. I love mathematical topics. I have read this chapter 5 times and drew following conclusion. Kindly check it and correct me where I am wrong.

Let nifty is at 8000. If we buy Nifty8200 CE at premium of rs. 100. If delta is 0.2. if nifty goes up to 8300 then,

Change in underlying =300 (8300-8000)

New premium =250

Change in premium = 150 (250-100)

DELTA = CHANGE IN PREMIUM / CHANGE IN UNDERLYING = 150/300 =1/2= 0.5

GAMMA= CHANGE IN DELTA / CHANGE IN UNDERLYING = (0.5-0.2)/300= 0.3/300 = 1/1000 = 0.001

CONCLUSION,

• This means for every one point change in nifty, premium changes by 0.5 points

• Also, for every one point change in nifty, delta changes by 0.001 points

• Clearly delta is First order derivative of premium and gamma is second order derivative of premium.

Really appreciate your enthusiasm and eagerness to learn 🙂

Some corrections –

If delta = 0.2

Change in underlying = 300

Premium = 100

Change in premium will be = 300 * 0.2 = 60

New premium = 100+60 = 160

You are broadly on the right path here…but please do wait for the next chapter and you will develop complete clarity on this matter. Thanks for your patience.

Sir clearly,

Change in premium= change in underlying*delta = 0.2*300=60

New premium= 100+60=160

But, how do we calculate new delta and also how do we calculate gamma

Please upload next chapter as soon as possible. I want to get clear concept on this topic.

I\’ll try my best to get the next chapter up this week, thanks for your patience.

your content is excellent one request can you please convert all the chapters into PDF files so that one can easily refer when ever possible

We are in the process of converting each module into downloadable PDF\’s and ibook format. Its available for the first 3 modules…work is on for the rest.

sir,how to draw mave on volume chart$what is pattern recognition &its not working in PI

Just drag the MA indicator on volumes and you get it. It works on Pi.

Is Pi free for zerodha users?

Yes, all trading platform – Kite, Kite Mobile, and Pi are free for Zerodha users.

When will we get PI for mac ?

Unfortunately, there is no timeline on that Shanshank.