2.1– Decoding the basic jargons

In the previous chapter, we understood the basic call option structure. The idea of the previous chapter was to capture a few essential ‘Call Option’ concepts such as –

- It makes sense to be a buyer of a call option when you expect the underlying price to increase

- If the underlying price remains flat or goes down then the buyer of the call option loses money

- The money the buyer of the call option would lose is equivalent to the premium (agreement fees) the buyer pays to the seller/writer of the call option.

In the next chapter i.e. Call Option (Part 2), we will attempt to understand the call option in a bit more detail. However before we proceed further let us decode a few basic option jargons. Discussing these jargons at this stage will not only strengthen our learning, but will also make the forthcoming discussion on the options easier to comprehend.

Here are a few jargons that we will look into –

- Strike Price

- Underlying Price

- Exercising of an option contract

- Option Expiry

- Option Premium

- Option Settlement

Do remember, since we have only looked at the basic structure of a call option, I would encourage you to understand these jargons only with respect to the call option.

Strike Price

Consider the strike price as the anchor price at which the two parties (buyer and seller) agree to enter into an options agreement. For instance, in the previous chapter’s ‘Ajay – Venu’ example the anchor price was Rs.500,000/-, which is also the ‘Strike Price’ for their deal. We also looked into a stock example where the anchor price was Rs.75/-, which is also the strike price. For all ‘Call’ options the strike price represents the price at which the stock can be bought on the expiry day.

For example, if the buyer is willing to buy ITC Limited’s Call Option of Rs.350 (350 being the strike price) then it indicates that the buyer is willing to pay a premium today to buy the rights of ‘buying ITC at Rs.350 on expiry’. Needless to say he will buy ITC at Rs.350, only if ITC is trading above Rs.350.

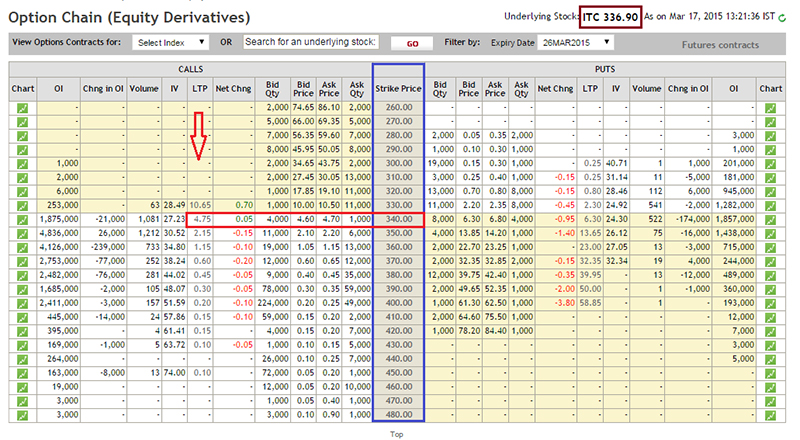

In fact here is a snap shot from NSE’s website where I have captured different strike prices of ITC and the associated premium.

The table that you see above is called an ‘Option Chain’, which basically lists all the different strike prices available for a contract along with the premium for the same. Besides this information, the option chain has a lot more trading information such as Open Interest, volume, bid-ask quantity etc. I would suggest you ignore all of it for now and concentrate only on the highlighted information –

- The highlight in maroon shows the price of the underlying in the spot. As we can see at the time of this snapshot ITC was trading at Rs.336.9 per share

- The highlight in blue shows all the different strike prices that are available. As we can see starting from Rs.260 (with Rs.10 intervals) we have strike prices all the way up to Rs.480

- Do remember, each strike price is independent of the other. One can enter into an options agreement , at a specific strike price by paying the required premium

- For example one can enter into a 340 call option by paying a premium of Rs.4.75/- (highlighted in red)

- This entitles the buyer to buy ITC shares at the end of expiry at Rs.340. Of course, you now know under which circumstance it would make sense to buy ITC at 340 at the end of expiry

Underlying Price

As we know, a derivative contract derives its value from an underlying asset. The underlying price is the price at which the underlying asset trades in the spot market. For example in the ITC example that we just discussed, ITC was trading at Rs.336.90/- in the spot market. This is the underlying price. For a call option, the underlying price has to increase for the buyer of the call option to benefit.

Exercising of an option contract

Exercising of an option contract is the act of claiming your right to buy the options contract at the end of the expiry. If you ever hear the line “exercise the option contract” in the context of a call option, it simply means that one is claiming the right to buy the stock at the agreed strike price. Clearly he or she would do it only if the stock is trading above the strike. Here is an important point to note – you can exercise the option only on the day of the expiry and not anytime before the expiry.

Hence, assume with 15 days to expiry one buys ITC 340 Call option when ITC is trading at 330 in the spot market. Further assume, after he buys the 340 call option, the stock price increases to 360 the very next day. Under such a scenario, the option buyer cannot ask for a settlement (he cannot exercise) against the call option he holds. Settlement will happen only on the day of the expiry, based on the price the asset is trading in the spot market on the expiry day.

Option Expiry

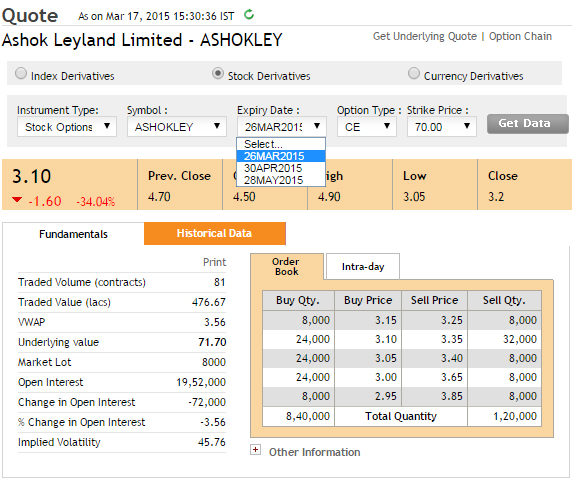

Similar to a futures contract, options contract also has expiry. In fact both equity futures and option contracts expire on the last Thursday of every month. Just like futures contracts, option contracts also have the concept of current month, mid month, and far month. Have a look at the snapshot below –

This is the snapshot of the call option to buy Ashok Leyland Ltd at the strike price of Rs.70 at Rs.3.10/-. As you can see there are 3 expiry options – 26th March 2015 (current month), 30th April 2015 (mid month), and 28th May 2015 (far month). Of course the premium of the options changes as and when the expiry changes. We will talk more about it at an appropriate time. But at this stage, I would want you to remember just two things with respect to expiry – like futures there are 3 expiry options and the premium is not the same across different expiries.

Option Premium

Since we have discussed premium on a couple instances previously, I guess you would now be clear about a few things with respect to the ‘Option Premium’. Premium is the money required to be paid by the option buyer to the option seller/writer. Against the payment of premium, the option buyer buys the right to exercise his desire to buy (or sell in case of put options) the asset at the strike price upon expiry.

If you have got this part clear till now, I guess we are on the right track. We will now proceed to understand a new perspective on ‘Premiums’. Also, at this stage I guess it is important to let you know that the whole of option theory hinges upon ‘Option Premium’. Option premiums play an extremely crucial role when it comes to trading options. Eventually as we progress through this module you will see that the discussions will be centered heavily on the option premium.

Let us revisit the ‘Ajay-Venu’ example, that we took up in the previous chapter. Consider the circumstances under which Venu accepted the premium of Rs.100,000/- from Ajay –

- News flow – The news on the highway project was only speculative and no one knew for sure if the project would indeed come up

- Think about it, we discussed 3 possible scenarios in the previous chapter out of which 2 were favorable to Venu. So besides the natural statistical edge that Venu has, the fact that the highway news is speculative only increases his chance of benefiting from the agreement

- Time – There was 6 months time to get clarity on whether the project would fructify or not.

- This point actually favors Ajay. Since there is more time to expiry the possibility of the event working in Ajay’s favor also increases. For example consider this – if you were to run 10kms, in which time duration are you more likely to achieve it – within 20 mins or within 70 mins? Obviously higher the time duration higher is the probability to achieve it.

Now let us consider both these points in isolation and figure out the impact it would have on the option premium.

News – When the deal was done between Ajay and Venu, the news was purely speculative, hence Venu was happy to accept Rs.100,000/- as premium. However for a minute assume the news was not speculative and there was some sort of bias. Maybe there was a local politician who hinted in the recent press conference that they may consider a highway in that area. With this information, the news is no longer a rumor. Suddenly there is a possibility that the highway may indeed come up, albeit there is still an element of speculation.

With this in perspective think about this – do you think Venu will accept Rs.100,000/- as premium? Maybe not, he knows there is a good chance for the highway to come up and therefore the land prices would increase. However because there is still an element of chance he may be willing to take the risk, provided the premium will be more attractive. Maybe he would consider the agreement attractive if the premium was Rs.175,000/- instead of Rs.100,000/-.

Now let us put this in stock market perspective. Assume Infosys is trading at Rs.2200/- today. The 2300 Call option with a 1 month expiry is at Rs.20/-. Put yourself in Venu’s shoes (option writer) – would you enter into an agreement by accepting Rs.20/- per share as premium?

If you enter into this options agreement as a writer/seller, then you are giving the right (to the buyer) of buying Infosys option at Rs. 2300 one month down the lane from now.

Assume for the next 1 month there is no foreseeable corporate action which will trigger the share price of Infosys to go higher. Considering this, maybe you may accept the premium of Rs.20/-.

However what if there is a corporate event (like quarterly results) that tends to increase the stock price? Will the option seller still go ahead and accept Rs.20/- as the premium for the agreement? Clearly, it may not be worth to take the risk at Rs.20/-.

Having said this, what if despite the scheduled corporate event, someone is willing to offer Rs.75/- as premium instead of Rs.20/-? I suppose at Rs.75/-, it may be worth taking the risk.

Let us keep this discussion at the back of our mind; we will now take up the 2nd point i.e. ‘time’

When there was 6 months time, clearly Ajay knew that there was ample time for the dust to settle and the truth to emerge with respect to the highway project. However instead of 6 months, what if there was only 10 days time? Since the time has shrunk there is simply not enough time for the event to unfold. Under such a circumstance (with time not being on Ajay’s side), do you think Ajay will be happy to pay Rs.100,000/- premium to Venu?. I don’t think so, as there is no incentive for Ajay to pay that kind of premium to Venu. Maybe he would offer a lesser premium, say Rs.20,000/- instead.

Anyway, the point that I want to make here keeping both news and time in perspective is this – premium is never a fixed rate. It is sensitive to several factors. Some factors tend to increase the premium and some tend to decrease it, and in real markets, all these factors act simultaneously affecting the premium. To be precise there are 5 factors (similar to news and time) that tends to affect the premium. These are called the ‘Option Greeks’. We are too early to understand Greeks, but will understand the Greeks at a much later stage in this module.

For now, I want you to remember and appreciate the following points with respect to option premium –

- The concept of premium is pivotal to the Option Theory

- Premium is never a fixed rate, it is a function of many (influencing) factors

- In real markets premiums vary almost on a minute by minute basis

If you have gathered and understood these points so far, I can assure that you are on the right path.

Options Settlement

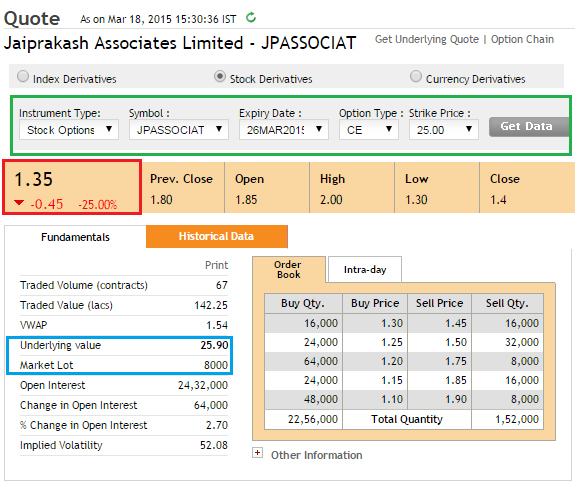

Consider this Call option agreement –

As highlighted in green, this is a Call Option to buy JP Associates at Rs.25/-. The expiry is 26th March 2015. The premium is Rs.1.35/- (highlighted in red), and the market lot is 8000 shares.

Assume there are 2 traders – ‘Trader A’ and ‘Trader B’. Trader A wants to buy this agreement (option buyer) and Trader B wants to sell (write) this agreement. Considering the contract is for 8000 shares, here is how the cash flow would look like –

Since the premium is Rs.1.35/- per share, Trader A is required to pay the total of

= 8000 * 1.35

= Rs.10,800/- as premium amount to Trader B.

Now because Trader B has received this Premium form Trader A, he is obligated to sell Trader A 8000 shares of JP Associates on 26th March 2015, if Trader A decides to exercise his agreement. However, this does not mean that Trader B should have 8000 shares with him on 26th March. Options are cash settled in India, this means on 26th March, in the event Trader A decides to exercise his right, Trader B is obligated to pay just the cash differential to Trader A.

To help you understand this better, consider on 26th March JP Associates is trading at Rs.32/-. This means the option buyer (Trader A) will exercise his right to buy 8000 shares of JP Associates at 25/-. In other words, he is getting to buy JP Associates at 25/- when the same is trading at Rs.32/- in the open market.

Normally, this is how the cash flow should look like –

- On 26th Trader A exercises his right to buy 8000 shares from Trader B

- The price at which the transaction will take place is pre decided at Rs.25 (strike price)

- Trader A pays Rs.200,000/- (8000 * 25) to Trader B

- Against this payment Trader B releases 8000 shares at Rs.25 to Trader A

- Trader A almost immediately sells these shares in the open market at Rs.32 per share and receives Rs.256,000/-

- Trader A makes a profit of Rs.56,000/- (256000 – 200000) on this transaction

Another way to look at it is that the option buyer is making a profit of Rs.7/- per shares (32-25) per share. Because the option is cash settled, instead of giving the option buyer 8000 shares, the option seller directly gives him the cash equivalent of the profit he would make. Which means Trader A would receive

= 7*8000

= Rs.56,000/- from Trader B.

Of course, the option buyer had initially spent Rs.10,800/- towards purchasing this right, hence his real profits would be –

= 56,000 – 10,800

= Rs.45,200/-

In fact if you look at in a percentage return terms, this turns out to be a whopping return of 419% (without annualizing).

The fact that one can make such large asymmetric return is what makes options an attractive instrument to trade. This is one of the reasons why Options are massively popular with traders.

Key takeaways from this chapter

- It makes sense to buy a call option only when one anticipates an increase in the price of an asset

- The strike price is the anchor price at which both the option buyer and option writer enter into an agreement

- The underlying price is simply the spot price of the asset

- Exercising of an option contract is the act of claiming your right to buy the options contract at the end of the expiry

- Similar to futures contract, options contract also have an expiry. Option contracts expire on the last Thursday of every month

- Option contracts have different expiries – the current month, mid month, and far month contracts

- Premiums are not fixed, in fact they vary based on several factors that act upon it

- Options are cash settled in India.

The expiry day has been changed to Tuesday in INDIA. Could you please update the modules. Also, if you can put your views why expiry day changed from Thursday to Tuesday?

Nothing really changes, Sheraf. But yes, I\’ll update shortly.

This was a bit confusing. you should have added if the settlement happened upon expiry the premiums are not paid back so the profits are 45200 substituting the premium.. but if the contract was called off before the expiry i get to pocket the whole 56000 premium paid + the profits earned..

Yes, we have spoken about it in subsequent chapters.

Please ignore. I just saw your last comment

Sure. Happy learning.

Dear Karthik and team,

Could you please update the content to reflect latest settlement mechanism. I think stock options are no longer cash settled? Please clarify.

Thats right. Only index option is. Will do.

Aren\’t equity options physically settled in India after 2018?

Yes, hence the updated chapter at the end.

Hi Karthik,

In the example where the price was hiked from ₹25 to ₹32, you mentioned that the profit would be ₹56,000 (₹8,000 multiplied by 7). However, the call option was bought for ₹1.35, and there was no mention of the premium for the CE. Could you please explain how the premium and other factors were considered in calculating the final profit? Was the premium of ₹1.35 already factored in, or should it be subtracted from the profit calculation?

Regards,

Pavit Kapoor

Pavit, so its the difference between the strike and spot, in this case 32-25 and minus the premium paid, i.e. 1.35. I have explained this eventually, wanted to keep it simple at this stage 🙂

The last chapter of futures trading module talks about physical settlement of FnO, but in this article it is still written as cash settlement for options, I think it needs to be corrected…

PS:

Thanks for all the articles, I am enjoying them a lot and learning a lot!

Yes, last chapter is an update on settlement.

Dear sir

While trading an option which chart we have to focus upon either spot price chart or strike price chart

Please clarify

I\’d suggest spot prices.

First of all, thank you so much karthik and team zerodha for wonderful content.

I would like to know about the type of option i.e. European and American option.

American option can exercise on any day over the expiry and European option can only exercise on expiry date.

I have read on internet that CE stands for call European but in market we can exercise option any time during the expiry.

Why we write CE or PE? Instead of CA or PA.

Jay, thats right. The difference is only with the way option exercising happens. What you are refering to is the fact that options can be bought and sold anything you want (by trading premiums), but exerting of an option is only upon expiry.

E in CE or PE stands or European.

That\’s right.

Thank you Sir 🙂,

I will enable the kill switch after having profit or loss in a trading session. I won\’t be able to trade anymore on that day. 2 rules of trading I will follow 1)whenever I take a option trade , I will always hedge my position even if I am 100% sure about my judgement.

2) I will never trade a naked option.

Rule 3 – Stay humble and always and always acknowledge the role of luck in your trading activity.

Sir 🙂,

I have taken my first option trade in my life for just trying on this friday. I bought 25 lots of USDINR 9TH FEB PUT AND SQUARED off the trade within 30 SECONDS. I GOT A PROFIT OF 175 RS. The heart was rapidly beating after seeing the M2M. I feel its very hard to see this kind of highest price volatility after practicing swing trading and having a position worth Rs 20 lacs🙂, paying just 3000rs.It\’s very very very very addictive.

Congratulation on your first options profit. Please pay attention to what you said towards the end – \”It’s very very very very addictive\”, which is 100% true. You will always need to evaluate yourself and the reasons as to why you are trading. Otherwise, you\’ll start over trading without even realizing the same 🙂

What happens if i exercise NIFTY options, will i get entire NIFTY portfolio or a NIFTY ETF or will it be cash settled

Nifty is cash settled, not physically settled.

Please update or delete this article. Exercised options are compulsory delivery, NOT cash settled.

Excellent!

Happy learning!

After buying a call option (say strike price 100, premium 10), the stock value went above strike price (say 120), but premium has come down (say 5). If I square off the position before expiry what will be my P&L.

You will lose 5 here, basically the difference between your buy and sell price of the premium.

IN \”\”EXERCISING OF AN OPTION CONTRACT \”\” THIS IS MENTIONED

Here is an important point to note – you can exercise the option only on the day of the expiry and not anytime before the expiry.

IS THIS MEANS,IF A CALL IS BOUGHT AT A CERTAIN STRIKE PRICE PAYING A CERTAIN PREMIUM,IT CAN BE SOLD OR EXCERCISED ON ONLY THE DAY OF EXPIRY,NOT BEFORE THAT?

PLEASE REPLY

REGARDS

AMARJEET CHHABRA

8817504379

DSA326

Amarjeet, do check this – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

Sir,

Thank you so much.

Regarding put options, at the time of exercising the right from the buyer, does he buy the underlying at spot price and sell at strike price to the seller?

Sir,

(i) Regarding Call options, if the buyer exercises his right at the expiry, is the mechanics follow like below?

The buyer will buy lot at strike price from the seller and sell at the spot market price in the spot market.

(ii) Regarding Put options, if the buyer exercises his right at the expiry, is the mechanics follow like below?

The buyer will buy lot at spot market price from the spot market and sell at the strike price to the seller.

(iii) Suppose an underlying is trading at Rs. 10/- in spot market. A particular strike price of a call option agreement is Rs. 15/- (Lot size:10) with a premium of Re. 1/- when underlying trading at Rs. 10/- . Price shoot up Rs. 20/- on the expiry day. With view of the above, I have the below queries:

(A) With view of the above example, suppose at the expiry when the underlying price is Rs. 20/-, the premium goes down to Rs. 0.50/-. If the buyer exercises his right then P&L= IV- Premium, as we studied. However, will the change of the premium price i.e, Re. 1/- minus Rs. 0.5/- will also affect the P&L of the buyer at expiry?

(B) If the buyer exercises his right, for the seller we know that P&L= Premium- IV. Will the change of premium ( Premium received minus premium at the expiry) will affect the seller at expiry?

(B) Is there any general trend that follows with the premium price? I mean to say that as the underlying price from Rs. 10/- (OTM/Deep OTM) will move towards the strike price (Rs. 15/-), will premium also increase accordingly? Also, if the underlying price moves above Rs. 15/- (ATM) to Rs. 20/- (ITM/Deep ITM), will premium increases accordingly? Kindly help understand how premium follows from “Deep OTM—->OTM—–>ATM—–>ITM—–>Deep ITM” for CE.

1) Yes. But for this, the delivery of the stock has to happen

2) From a Put buyers point of view, the buyer has to give delivery at the strike rate

3 -a) If the underlying goes to 20, how will the Call option strike of 15 have a premium of 0.5?

3-b) Yes, loss for buyer is the gain for seller and vice versa

3-b-b) Yes, that\’s generally how option premiums transition.

Sir,

I learnt those two last chapters once. But I have few fine doubts. It would be really helpful if you may kindly specifically respond (may be in Y/N) on the above please. It would help me gain confidence on my learning.

Sure, I\’m trying to answer all your questions 🙂

Sir,

(i) Regarding Call options, if the buyer exercises his right at the expiry, is the mechanics follow like below?

The buyer will buy lot at strike price from the seller and sell at the spot market price in the spot market.

(ii) Regarding Put options, if the buyer exercises his right at the expiry, is the mechanics follow like below?

The buyer will buy lot at spot market price from the spot market and sell at the strike price to the seller.

(iii) Suppose an underlying is trading at Rs. 10/- in spot market. A particular strike price of a call option agreement is Rs. 15/- (Lot size:10) with a premium of Re. 1/- when underlying trading at Rs. 10/- . Price shoot up Rs. 20/- on the expiry day. With view of the above, I have the below queries:

(A) With view of the above example, suppose at the expiry when the underlying price is Rs. 20/-, the premium goes down to Rs. 0.50/-. If the buyer exercises his right then P&L= IV- Premium, as we studied. However, will the change of the premium price i.e, Re. 1/- minus Rs. 0.5/- will also affect the P&L of the buyer at expiry?

(B) If the buyer exercises his right, for the seller we know that P&L= Premium- IV. Will the change of premium ( Premium received minus premium at the expiry) will affect the seller at expiry?

(B) Is there any general trend that follows with the premium price? I mean to say that as the underlying price from Rs. 10/- (OTM/Deep OTM) will move towards the strike price (Rs. 15/-), will premium also increase accordingly? Also, if the underlying price moves above Rs. 15/- (ATM) to Rs. 20/- (ITM/Deep ITM), will premium increases accordingly? Kindly help understand how premium follows from \”Deep OTM—->OTM—–>ATM—–>ITM—–>Deep ITM\” for CE.

Anirban, I think most of these questions are related to the physical settlement of derivatives. I\’d suggest you check this chapter once – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/ and also this chapter – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

Sir,

Suppose an underlying is trading at Rs. 10/- in spot market. A particular strike price of a call option agreement is Rs. 15/- (Lot size:10) with a premium of Re. 1/-. Price shoot up Rs. 20/- on the expiry day. With view of the above, I have the below queries:

(i) If the buyer wants to exercise his right on the expiry day, should he have to mandatorily possess Rs. 15*10=Rs. 150/- to exercise his right?

(ii) On the other side, if the seller has to fulfill his obligation, does he also have to possess Rs. 20*10= Rs. 200/- to first buy those shares from spot market and then sell them at Rs. 150/- to the buyer or possessing only the balance amount i.e, Rs. (200 minus Rs. 150)*10= Rs. 50/- will be sufficient for the seller?

(iii) Can the buyer exercise his right anytime on the expiry date or there is any particular time say, 3:20 pm at which he has the option for exercising right?

(iv) Regarding exercising right from the buyer perspective, does the buyer need to do it manually on the day of expiry or the system will automatically do this on behalf of buyer without taking his consent?

(v) Regarding fulfillment of obligation from the seller perspective, will the system automatically deducts money from the margin hold?

1) Yes, the trader should have the necessary cash to take physical delivery

2) Thats right

3) The position goes to settlement post the market closes. So you need to hold the position to expiry

4) No, just let the position as is in the system and it will be settled

5) Yup

Could you please help me understand how to calculate Intrinsic value with time value? I don\’t know how to calculate could you help me understand this? If bank nifty is trading at 42800 I but ce of 42700 and Nifty expires at 42000 what will be my profit? how to calculate profit or loss

Check this, Vatsal – https://www.youtube.com/watch?v=fDLJlU8OdP8&list=PLX2SHiKfualFiusiT9G5uE9jU3vetvW2x&index=9

Amazing content Karthik sir.

Would the premiums vary even after entering into a contract ? Are they dynamic even after entering into an agreement ?

at present stock options and index options both are european style or american style

Every option in India is European in nature.

Thanks sir. I forgot to mention that I was referring to only index options.

Sure, I hope the explanation is clear.

Do you suggest to leave the option contract to expire in case of a profit situation or is it advisable to exit just before 3.30pm. Which would be a better option in case of charges acquired? I understand STT is 0.125% of IV and No brokerage on sell side in case of OTM expiry. But not sure which is a low cost method. Would also like to know your personal way of approaching this. Thanks Sir.

If you are short position profitable, and the option is OTM, let it expire. If your long is ITM, and you are profitable, sq off before 3:30 to avoid physical delivery. Of course, avoiding physical delivery is my personal preference, really depends on what your intent is.

The article says \”Options are cash settled in India\”, but from what I know this is not the case anymore. I guess this article needs to be updated with latest regulations.

Suraj, check this – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

we need to wait till expiry date exercise our right ? cant we sell intra ot BTST ? if in profit ?

YOu can square off your position whenever you want, Dayananda. No need to wait till expiry.

if we use stop loss and we trail our stop loss can we take exit our position before expiery?

Yes, you can.

Hi Karthik,

Do you want to correct the content that options in stock are more cash settled? Now its delivery settled. I see this reflected in some of your other articles.

Thanks,

Raj

Raj, we have updated the chapter here – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

Sir, just one doubt.

if we book profit then there is no need to exercise, if not we need to exercise on the expiry. Is my understanding correct.

Yes, thats correct.

Hello kartik,

My question is, if i have call option for example say 200 strike price now i hold the contract till expiry and price is go higher to 230 ,then i can recive 30 rs profit per share and also let exercise stock at price of 200 ,so i can make 30rs profit per share and also get stock at price of 200 ,right?

It will be ITM to the extent of 30 Rupees. The option will be physically settled.

I have understood the chapter well.

Happy learning, Ajay!

squaring off before expiry gives a profit because of the difference in price of premiums. is it possible to square off before expiry so that a profit from spot price -strike price can be enjoyed? Is it possible to square off on the expiry day before the closing time to enjoy the difference between spot price and strike price without attracting STT?

Yes, you can.

sir, the condition to the option buyer to be profitable is spot price should be more than strike price on the day of expiry, is n\’t it?

so, if we select the strike prices much lower than the spot price, then there is high chance to spot price to stay above strike price on the day of expiry. for ex: bank nifty is trading at 38500(spot),now instead of selecting near strike price, if we choose 35000 strike price, even if market down for 2000 points till the expiry, still we will be in the profit according to the first line.correct me if i am wrong

But this particular option will come at a very high premium right? To be profitable, you need to ensure that you also recover the premium you\’ve paid.

dear sir here is my little doubt we can book the call option profit before expiry but the settlement of funds will be done after expiry please explain i am bit confused is there difference between settlement and profit booking ?

You can book the profit anytime. The settlement is on T+1 basis.

sir,u said like if the strike price is below the spot price on the expiry then only we will get profit,considering this point y can\”t we

take the much lower strike prices while buying, so that there is higher chances for strike price to stay below the spot price?

Shiva, can you share the context? I guess this is with respect to put options?

I have a doubt. I am a call option buyer and I paid premium of rs 10 to seller GOVIND to buy a contract. Govind has to stay in the contract till expiry as its his obligation . If the premium increased to 11 and when I am happy with the 1 rs profit I will sell the contract to another person RAJ and I booked 1 rs profit. but now I am the new option seller right? so shall I need to wait until the expiry or i am already out with the profit?

Firstly, neither the buyer or seller are obligated to hold the contract to expiry.

When you sell to Raj, you are squaring off your position. So Raj is the new buyer and Govind is still the seller.

In Option-Chain different strikes have different IV. But Why? when VIX is the same?

How do they calculate IV? If we use Black-Scholes Model to calculate options prices. The Black-Scholes model requires five input variables: the strike price of an option, the current stock price, the time to expiration, the risk-free rate, and the volatility.

Out of five variables, four are easy to collect. but How do I know what is the IV?

for knowing the IV we need the Option price. for calculating options price we need IV. In an equation How is it possible to get two variables at a time?

I’m totally confused :confused:.

1) Due to the strike-specific demand and supply situation

2) YOu can feed in price as input and extract the IV as an output

You can check this – https://zerodha.com/z-connect/queries/stock-and-fo-queries/option-greeks/how-to-use-the-option-calculator

is it mandatory to wait till the end of the expiry to Exercising of an option contract ? can\’t we Exercising of an option contract before expiry date if price move up ? please can anyone gives clarity on this .

Exercising can be done only on the expiry day, but you can square off the option anytime you wish.

Sir,

For stock options swing trading, only buying call or put, ( to hold 3 to 10 days ), what strike price should be selected and also whether from ITM/ATM/OTM?

What is the role of IO /change in IO and volume in this case. Please clear my doubts. Thanks

When in doubt, always stick to ATM option 🙂 I\’ve explained OI here – https://zerodha.com/varsity/chapter/open-interest/

Thankyou very much sir for ur prompt answer.Mr.kartik u are a very nice person,kind at heart and humble who answers to even our silly questions.that too again n again.God bless u n ur family with all the happiness.

Thanks for the kind words, Pallavi. Happy learning 🙂

(continued)sry,I mean if the spot price has not gone above the strike price.

Sorry, can you share the context? I may have missed your previous query.

Sir, suppose if I buy call option at premium of rs.10 and strike price 100,and then say within half an hour the premium increases to rs.15, but the strike price has not yet gone above rs.100 and if i decide to sell,will i earn rs.5 as profit?

Yes, you will.

Options as cash settled in India, is this statement true. What I know is we need to take delivery

Index options are cash settled, stock options are physically settled.

Are BANKNIFTY & NIFTY options European style while stock options are American style?

All options in India are European in nature.

Dear Karthik,

So what you are saying is that if you square of before the expiry you only gets the profit from the difference in premium prices and also could you explain the P&L of exercising the call option on expiry date ?

That\’s right, you can check the detailed explanation here – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

Karthik Sir,

First of all, thank you so much for excellent explanation of concept. Now i am at 2 chapter \”Basic option Jargon\”

I got stuck with a typical question, hope it get answered. Is it necessary to buy option and then sell? or otherwise? How one buy sell /put option, when one does not preowned any shares? In other words, how one sell option when he doesn\’t own it. please explain this point.

Thanks in advance.

Ahmad, you can easily buy and sell options, remember these are contracts based on underlying and not the actual underlying itself.

Hi Karthik

My query is we buy CE when there is an uptrend from the current price. But when we look at the options chain, why is the premium of PE higher compared to CE as there is an increase in strike price?

E.g. CE Premium for Strike price @33400 is 443 and PE premium for Strike price @34000 is 898. Why would anyone buy PE at such a high premium when there is CE available?

Praveen, that also depends on the overall market expectation. If the markets are expected to tank, then obviously put premiums will be higher, right?

Terms like Short covering, Long unwinding, etc. are they used for both options and futures or only futures?

Used as a generic term, so applicable to both.

If option contract expires on last thursday of every month then how can 3 types of expiries work … Current month , mid month and far month !??

The tenure of these expiries varies over 3 months.

Hello sir!

As you have explained the settlement procedure here with respect to spot price-strike price+premium which the buyer pays leading to the actual profit.

However in the next modules the intrinsic value and premium have been separated and focus was shifted to only premium.With respect to above example of settlement can we not directly find out the net profit as change in premium *by lot size.

Ex.Premium=Rs.1.35

New Premium=Rs.5.35

Change in Premium=Rs.4

Net profit=Rs.4*lot size

4*8000=Rs.32000

Please guide for the same

Thank you in advance!!

Paras, you are right. I\’d suggest you check this for more details – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

Here we are trading premium of contract and at expiry we are exercising the contract

Yes Rahul. Both are different things.

Hi karthik,

is it better to wait for the expiry date and exercise the option? It seems like that is more profitable than selling your options before expiry date.

Depends on so many factors, Manish. Cant really generalize this.

Hello Karthik Sir,

Can you please explain how can we choose a strike price for a stock which has right premium value i.e. premium of the strike price of a stock in neither high nor low. It is adequate.

Also can you please explain how can we make profit with premiums before expiry of the contract?

For that you will have to read the entire module 🙂

sir options can get expired on every thursday then why is it written above that \’option contracts expire on the last Thursday of every month\’ ?

Yash, the material was written only when there were monthly contracts. Now there are weekly contracts as well, which expire every week on Thursdays.

I\’m a regular options trader and I like to keep refreshing my knowledge, personally I find your interpretations far more comprehensible than the thousand books I read from either popular publications or authors.

Worst is CMT Association, Wiley and NISM, their study material makes me feel that most of their authors are substance addicts and they may have drafted their material under some influence.

Nothing comes for free these days, especially education, and you sir have done a praiseworthy job.

I profoundly Thank You for your work.

Glad you found the content on Varsity useful. Happy learning, Dev 🙂

8th point from Key takeaways from this chapter \”Options are cash settled in India\”. Is it still same or due to recent SEBI changes it is settled in underlying.

Ah no, options are physically settled now. Will change this, thanks for pointing it out.

Are the options traded in India of European style? I saw somewhere that they are of American style…

Yes, all options in India are European in nature.

In the text it is mentioned that, \”you can exercise the option only on the day of the expiry and not anytime before the expiry.\” So as an example, lets say,

underlying share = ITC

call option = ITC 400 call of 24-02-2022 expiry

today\’s date = 12-02-2022

ITC share price today = 360

ITC share price on 15-02-2022 = 500

So now even though when price is 500 (on 15-02-2022), and I am not in expiry day (on 24-02-2022), but if I could exercise my right to buy at 400, I could make a profit of 100. But because of price date not being on expiry date, you are saying that the bought option cannot be exercised?

Sahin, you can sell anytime you want and there is no need to wait for an expiry. But if you plan to hold to expiry and take delivery, then you can do it only by exercising the option on expiry day.

Sir the snapshot you used to explain the option chain …. ITC underlying price says 336 and you outlined the premium on strike price of Rs. 340 can\’t we buy option for strike prices 260-330? Coz many column in these prices are left blank …

Chetan, it is because there is no liquidity in these contracts.

Can the strike price be lesser than the current underlying (spot) price of the asset in a call option? With reference to the example cited in the explanation above, SP is 25, Underlying price is 25.90.

Yes, that\’s certainly possible!

Sir what we know is that the premium of an option decreases with decreasing time, does it means that on expiry date if the intrinsic value of stock is greater than strike price but premium is lesser than our given premium, we can go for exercising the option rather than squaring off?

The time factor is just one of the variables that influence the price of an option. Other factors include the speed at which the market is moving, direction, and volatility.

Hi karthik

Suppose underlying value of commodity is 25.90 Rs. I buy a strike price of Rs24.90 currently when it is still trading at 25.90. My question

1 is it possible to do it?

2. Even after buying this call , I will have a profit of Rs 1 per share??

Can u pl explain this situation

1) Yes, as long as its liquid

2) As long as it expires in the money.

I am first time investors in options. How to buy or sell options in Kit app? HOW to identify which CE OR PE TO SELECT?

I\’d suggest you call the support desk, they will help you with this.

Hay kartik agar me nakad ki bajay stock lena cahu to kya me esa kar sakta hu

Sir ,

Could u pls explain with example the difference between option expiry and square off .

Options are still cash settled in India

Index options are, stock options are physically settled.

Has this information been updated, to trade in options in 2021 ? a lot of the content seems outdated

I will be happy to update, but what seems to be outdated except the cash settlement part?

Please update the information. options are no longer cash settled in India since 2019

Updated in the last chapter.

We Can\’t read more in Ebook if hardcopy is there please provide the details of that and do the needful.

You can always download the PDF and print the same, Sridhar.

If i bought option of 5 rupees premium then premium increases to 8 rupees and I sold the premium at 8 rupees .

If someone bye premium 8 rupees from me and hold to expiry date then he exercise the contract then will I need to pay cash settlement . If i am not paying cash settlement , then who will cash settle for him ,nse or broker

Then will it be my loss

No, once you sell the option at 8, you are out of the market, no further implications.

Can the strike price for a long call be lower than the spot price 15 days before expiry ?

And if so, aren\’t we actually betting on the fall of spot price ? How is a long call bullish view then ?

Yes, strike price can be lower than spot. Such strikes are called ITM or In the Money strikes. The premium for these are much higher.

Sir,

I have one doubt.First of all i am a novice in the option trading so it may possible that what i ask seems to be of foolish type but i want to learn it thoroughly.

As you have explained in the chapter that the price of premium is chageable, my question is,

Suppose the xyz stock price in the spot market is 120 and i have a strong information that after one month the price will be 145 so i buy Call option .My doubt is whether i need to buy Call at 120 or 130 or 140 or 150.Please clarify.

Since there is a lot of time to expiry, you can consider 130 Strike.

If I square off I won\’t be getting the profits from exercise on expiry?

Hi Karthik,

Thanks for the Nice Explanation on Options. Big fan of Zerodha varsity. I have one doubt:

If I am an Option writer and my trade goes wrong within the expiry period , then how can one close contract in between , since option seller are not obliged to do it.

Thanks, Manish. YOu can close the option position anytime you wish before the expiry. No need to wait till expiry.

Suppose i sell an option of Bank Nifty 35500 @ 200 and the nifty goes below 35500 before expiry, how do i exit from this agreement. whether i will be profitable

You can exit at any time you\’d want.

Thank To Karthik for content and the answers to all queries

I have query – Assume i sold Titan 1900 CE at premium 6 today. I dont want to hold it and premium goes 7 or 5. I want to buy it before expire, what will be profit to me in both cases?

Yes, you can exit. The P&L will be the difference between the purchase and sale price of the premium.

Sir, when we square off a position – what it means is actually we are making profit(typically/loss) by selling our contract to a new buyer – is it correct ?

If this is correct, when we sell the contract do we choose the strike price / premium at which we want to sell the contract ?

By square off I just mean that we are closing out the existing position either for a profit or for a loss. The P&L depends on the purchase price and the sale price. To square off, you only need to select the price because the strike is already selected when you initiated the trade.

Hi Karthik Sir, I have a doubt if my p&L is in profit and spot price is above strike price on expiry and It is told that options are setelled in both ways cash settlement or physical delivery of shares what if I dont have full money to buy full lot of any share eg TCS so in that case what will happen and will my broker will confirm me for cash settlement of phisical delivery or shares will be directly be delivered to my dmat and amount will be deducted.

Stocks are physically settled and not cash. Only index is cash settled, Sarthak. In case you dont have sufficient margins, the position would be squared off before the expiry itself.

Since options can be exercised only on the day of expiry is there any difference between \”exercising the option \” and expiry ?

Sir,

Excellent module.

I read the entire module. If you had explained the concept of \”Square Off\” and \”Expiry\” in the beginning, students could understand the module better because till the end of the chapter i am understanding the module from only one angle i.e. Expiry.

When i read the questions and answers 2nd time i came to know that option can be implemented in two ways.

Kindly insert \”Square off\” and \”Expiry\” concept in the beginning.

Secondly.

Q&A part is very helpful. However, one cannot MARK any particular Q&A. One has to scroll the entire Q&A part if one has to find out specific Q&A which is a tiresome process. Many reader has already raised this concern but no action is taken till date. Please develop some mechanism in Q&A so that reader can easily find a specific Q&A.

I completely agree with you. Missed doing it. About the QnA, yes, that\’s something we are looking at, will check with my team again.

Sir can we square off half of our derivative and hold the rest till expiry

YOu cant split a lot. But if you have multiple lots, then you can split them into multiple lots and buy/sell.

Exercise the option only on the day of the expiry and not anytime before the expiry. WHY?

Thats is the structure of the contract, Kamal.

the way you are explaining in these modules are amazing, even a totally newbie in stock market can grasp it in a shot by the explanation u have made. thank you so much for this, keep doing it

Happy reading, Basavraj!

so which is profitable for a option buyer.

Let it expire if buyer is in profit on the day of expiry or square off before market closes on the day of expiry?

As long as its profitable, both options are ok. I\’d prefer to sq off the position just before expiry.

Sir, you said that there are Three Expiry options of a stock at any given point in time, But why is that there are Expiry every 7 days for Nifty/Bank Nifty options and that too as far as yr 2025 for Nifty options?

Three monthly options, I mean 🙂

Kartik Sir, Thanks a lot for this deep information and knowledge by you. Kindly post a video showing a live trade explaining every aspect on KITE to make our understanding clear about options trading. As many of us feel scared. Of this due to the big volume and price. This will make us to understand this process smoothly.

Regards

Jaya

Thanks, Rajeev. We are evaluating the possibilities of making videos. Hopefully soon 🙂

Sir iam reading the modules, by the way great lessons.

but my doubt in the middle was , did the option seller needs the shares in his holdings to do an option selling.

Yes, physical settlement of options requires you to have shares in your DEMAT.

i have some doubts sir, if options are only cash settled then cant an option buyer have real shares on the expiry date rather only getting the difference amount ? and another qstn is if it is cash settled then y the equity market is said to be volatile on the expiry date, as the expiry dosnt make any real equity share trasnfers?

Yes, you do need to have cash physical shares for settlement. I\’d suggest you read this chapter to understand this better – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

For Example :

In Intraday trading, I bought 1 lot (75 qty) of NIFTY21MAR15200CE at price 270 (Total Margin req. = 20250) and sold it in 10 mins at price 290,

Then net profit = (290 – 270) * 75

= 1500

there will not be any premium deduction from profit in the case of intraday trading. Am I right sir?

Thanks & Regards,

Ashish

Thats right, 1500 minus charges is your net profit.

Dear Sir,

If we square off our position in a call option before the expiry date or say we square off on the same day we bought, will the premium amount be deducted from the profit? How will be the calculation of Profit/Loss? Please explain with an example if possible.

Thanks & Regards.

The P&L will depend on the premium price you paid to buy and sell. Your P&L is the difference between the buy price and sell price multiplied by the lot size.

Hi Karthik!

The work you and your team are doing is simply superb and deserves a lot of respect. Thank you.

It will be great if you can answer my question! I can\’t get answers to any of the questions on google or any forums.

1. Would it make sense to square off your position being an options buyer when you can be potentially exposed to greater risk being an options seller?

2. If you do square-off your position as a buyer then wouldn\’t you stay in the market/trade as a seller till 3:15 pm and be exposed to further losses if the trade reverses?

3. How often does an options buyer square-off his/her positions on intraday?

4. How would Zerodha square-off all open intraday positions at 3:15 pm. Suppose if i am a seller and losing money at 3:15 pm- would Zerodha find an appropriate buyer at that limit price and/or market price and handover/exchange the contract to him/her?

5. Suppose you are an options seller when you initiate the trade and if your stop loss hits, then you would just pay the premium at that price and turn into a buyer. Being a buyer now, are you still in the market/trade till 3:15 pm intraday and would you make monet if the trade reverses?

6. Wouldn\’t the instrument be highly liquid for all the above to make sense for both the broker and trader?

Hopefully you can answer all these questions.

Thanks once again for your humongous efforts!

Forever grateful and Kind Regards

Ashish Dsilva

1) Yes, you have the option to square off your long call option position anytime before the expiry.

2) No, \’square off\’ implies that you are fair and square and have no open position in the market. Ex – you buy an apartment, square off, in this case, implies that you sold the apartment you have

3) As many times as you wish

4) If these are intraday positions, we try to square off the position, but the onus is on you to sq off all your intraday positions. The availability of the buyer or seller depends on the market situation and liquidity.

5) No, once I sq off, I\’m out of the market.

6) Yes, liquid instrument means it is easy to buy and sell.

can one buy both ce & pe for the same instrument simultaniously , and what are the scenerio

Yes, you can buy that. No issues.

Suppose I buy Call Option today and I square-off my position before expiry.

Now, futures & options are physically settled, right?

So at the day of expiry, will I be required to take delivery of underlying from the person whom I originally bought and then deliver it to the second person whom I sold? Or it will be directly done between those two and I\’m out of this?

No, once you square off the position, there is nothing more to worry about.

this question is related to Rama Devi question. let us say i buy NIFTY at strike price of 14000 but the market is at 13750, can i sell this contract to someone else to reduce my loss

Yes, you can. No need to wait to expiry.

Is this statement Still true about settlement in the literature above ? \” if Trader A decides to exercise his agreement. However, this does not mean that Trader B should have 8000 shares with him on 26th March. Options are cash-settled in India,\”. Can you confirm if the settlement is physical delivery of stock or still cash settlement?

This is no longer true, please see the last chapter in this module for the updated info.

hi Karthik, you are genius…Thank you for your wisdom, I have an another query that \” is that possible the stock price and paid premium may move in reciprocal directions? Eg. Spot price of stock crosses the strike price but paid premium to buy that particular stock moves downward from Rs.5 to 4 ,3 and so on ..

That\’s possible too, because the premium is not just depended on the stock price, but also on other factors such as time and volatility.

Thank you for clearing my doubt Karthik.

So if squaring off before expiry would give us profit then why don\’t all traders buy a call option with higher strike price which is not actually possible for spot price to reach? Because that would help trader pay less premium as the strike price is very far and it is unlikely for spot price to reach within expiry.

And considering your previous answer to my previous question, call option buyer squaring off with even small difference of of LTP would give him profit benefit as premium is returned back to him.

Please clarify.

You can, in fact, many traders do buy OTM options. But do remember, the position will benefit only if the premium moves higher from your buy price (at or before expiry), else it will expire worthlessly.

Hi kartik….Nice explanation…….Just have one doubt…..

Suppose I buy a call option of ABC company having premium of Rs. 5, strike price 110, lot size 1000, Current Market price of share is 100. On the day of expiry the share price will be Rs.130 and i exercise my right to buy. In that scenario do I have Rs. 110000/-(110*1000) in my trading account to purchase the shares at Rs. 110/share or the differential amount i.e. Rs.20000/-(20*1000) will be paid to me by the seller? Please clarify.

The contract will be physically settled, hence you get to buy the stock @ 110.

Hi Karthik,

Please clear this doubt for me.

Lets take the below scenario:

Ram buys a December Call Option of BANKNIFTY(currently running at 29600) for a derivative value of 600. Since lot size is 25, premium paid by Ram to enter contract is 15000 which will be deducted from his funds.

Now Ram sees that BANKNIFTY crossed 29700 and so did the derivative price from 600 to 800. But there is still time for expiry as expiry is at last Thursday.

1. Can Ram Sell/Square-Off his option contract at derivative price of 800?

2. If we could Square-Off at 800, what happens to premium amount of 15000?

3. What is the Net profit for Ram? Is it ((800-600) x 25) – PREMIUM= -10000 OR Is it (800-600) x 25 + PREMIUM = 20000 (5000 PROFIT)?

1) Yes sir

2) You get back 20K, which includes the premium of 15K plus a profit of 5K

3) 5K is the profit i.e. 800-600 times the lot size.

Sir what do you mean by anchor price?

american or european options in india

Which type used in India _?

How they are differ ,can you please explain

We have European options in India.

hello Kartik,

since you mentioned that we should not let written option to exercise on his own if it is profitable. Regarding this , i have below queries.

1. How much STT will be levied on such written option if we let it to be exercised by exchange ?

2. If we square off position(written option) by our self then we may not get to retain full premium. how to tackle this problem?

3. Is there any STT charges on long options if let them to exercise by exchange? if yes, how much?

1) STT is 0.125%. DO check this – https://zerodha.com/marketintel/bulletin/230019/no-more-stt-trap-on-exercised-options-from-today

2) If you have written an option and its expiring worthless, then nothing to worry if you let it expire right?

3) No STT here.

Options are now physically settled or cash settled or both?

All stock options are physically settled. Check the last chapter.

In this chapter, it is mentioned \”To be precise there are 5 factors (similar to news and time) that tends to affect the premium.\”

but there are only 4 option greeks, is there any 5th factor ?

The last one is rho, which I\’ve not discussed since it does not have an active impact on the premium.

Since 2018 options on expiry may result in delivery if not settled in cash. This article was written in 2015. Please update the information.

We have updated and put up a note on this – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

Thanks Karthik!

Cheers, happy learning!

I hope this works!

Dear Sir,

How to square-off the Call on Mobile app like Kite in Zerodha?

I\’d suggest you call the support line for this, easier to explain this on the phone.

is that 25 premium ? or strike price as mentioned above ?(last example of JP )

Thanks, Karthik.

as you confirmed options are just game earning from the premiums of the option chain. can you explain by a short example of why options are so famous?

how traders books higher profit in this then equity market?

Thanks again and you are doing an incredible job.

Ganesh, options are popular because of the their asymmetric pay off structure. Hard to explain in an example, I\’d suggest you read up the module to get a complete view 🙂

Sir,

if we square off the option contract instead of holding it till expiry (exercising the option ), don\’t we lose the real profits of options(unlimited profit on expiry)?

isn\’t playing on premium becomes like normal equity trades(normal profits)?

Thats right, you trade just the premium.

Hi,

This varsity is superb….thanks for putting it together.

Would love if you can have online interactive tutorials for first timers and esp kids.

Thanks for the explanations and replies to all queries.

Pls help me understand the following:-

1) If premium is lesser when closer to expiry then why would one buy beforehand ??

In your JP Associate example the premium on 18/3 is 1.35 for 26/3 expiry so what would be the premium on 08/03 and what would be the premium on 22/03 ?

Which will be more beneficial to whom and why ?

2) What would be the difference in futures and options ? Can you compare with some example of same company same expiry please

Thanks in advance

1) The premium depends on the stock price as well. So your decision to buy or not really depends on your expectation of stock prices.

2) I cant cover this in the comments, request you to read the respective modules 🙂

Can I excercise call option before expiry, if price exceeds strike price ?

No, not possible since we have European options in India.

Sir, for years I have been wondering how to learn derivatives trading. But after I read your notes, I think I can rely on your help and proceed to trade. Thanks a lot. The complex issues are made very easy to understand even by a layman. Thanks a lot again.

Happy learning, Prakash. Will be happy to help you through your learning journey 🙂

sir, a great job. things are getting clear with your examples. I have a querry.

As you said that a buyer can book p&L any time but cannot exercise the agreement. suppose I have paid a premium of underlying infosys at strike price 2200/-. And after two days infosys price is 2250. can i book the profit.what is the

difference between booking the p&l and exercising the agreement.

Yes, you can book the profit, not an issue.

This is option trading explained at its finest. The concept is clear and easy to understand. I am new to trading and this article helps me a lot to understand and clarify my doubts. Kudos to the author of this article.

Happy reading, Zama. Hope you continue to enjoy reading the module 🙂

Sir ,

Today I go through your fantastic lessons on option trading . I have one query that today CMP of Escorts is 1155. I think it will go 1180 within 30th Aug. That means I should now buy escorts @ premium Rs. 33. lot size 1100 shares .

Then my query is :-

1) If really escorts will touch Rs.1180/ -what will happen for me ? How many rupees shall I profit ?

or

2) If the Escorts go upto only 1170 within expiry – then what will happen ?

or

3) If the share price will fall in 1125/ , then what will happen ?

1) Profit depends on the prevailing premium at the time of selling, hard to say how much it will be

2) & 3) Same as above.

The point is that estimating the premium value before expiry is tough. At expiry, it is simply the intrinsic value.

It is said in the above article that \”you can exercise the option only on the day of the expiry and not anytime before the expiry.\”

If I am correct, in India the options we trade are with the style \”American\” and not \”European\” where the buyer can exercise the option at any time before expiry, so I am surprised to find the above statement in this article where they said Exercise is allowed only on the expiry day.

Please help me understand this point.

No, all options in India are European in nature, check this – https://www1.nseindia.com/products/content/derivatives/equities/contract_specifitns.htm

Thanks a lot Karthick for your time. for other readers, Multiply Notional Value with Traded Volume It will give you Traded Notional Value. Thanks & Happy Trading

Happy reading!

Hi Karthick, Thanks a lot for the great material. Kudos to you and the team.! Can you help with Notional value in options trading as i can not find it in tutorials. Following data is from nseindia.com today evening for NIFTY index options expiring today at strike 11000.

Traded Volume (Contracts) 1,04,870

Traded Value (₹ Lakhs ) 13,948.23

Traded Value – Notional (₹ Lakhs ) 8,79,125.73

VWAP 177.34

Market Lot 75.

I found out equation for, Traded Value = VWAP * Traded Volume * Market Lot. But i am not clear how to get Traded Value – Notional from these figures? Please help. Thanks again for the materials

Notional value = lot size *(strike + premium).

i think this module needs to be updated, as we have weekly expiry of options.

I have 1 question – do we still follow cash settlements in India?

No, we have physical delivery. Check this – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

THANK YOU SIR

Welcome!

Sir,what is the best free options strategy builder app

Monu, I\’m not sure about free ones, but this my favourite – https://sensibull.com/

Hi, can you please also mention the increasing margin requirement by Zerodha few days before expiration of an option?

That is to cover for physical delivery, please do check this – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

Hello Please update the information as Sebi changed rules from cash settling to delivery based settling.

You have mentioned this in one of the comments, it would be helpful in the main content

Prashanth, are you talking about physical delivery for futures and options? If yes, do check this – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

When I tried doing a protective call strategy (buy call and short future on banknifty) yesterday my margin blocked was about Rs. 18000. Today when I tried doing the same strategy Rs. 28,000 was blocked. In both trades is bought ATM calls. Why was the required margin increased for todays trade?

Change in SPAN, which is based on volatility.

Thanks Karthik for explaining in such a simple language…Understood most of the concept wrt to call options…I just have one doubt…In the example of Ashok Leyland, The Underlying Price is 71.70 and the strike price considered is 70..then how is that a call option as by definition of call option , we expect that price is going to go up in the future which means Strike Price will have to be higher than that of underlying price.. pls clarify…

The spot price has to be higher than the strike in case of a call option, Ravi.

Hi Sir,

Can you please explain the process of exercising Intraday Options?

For Example, If I purchase Intraday UPL 370 Call (1900 lots) at premium of 5Rs., and the price at 2.30 pm today went to 400.

Then in that case, will I be able to settle the option at 2.30 pm with profit of [{(400-370)*1900}-(1900*5)] ??

If not then please explain.

There is no exercising on an intraday basis. You can sell the position anytime, your P&L will be the difference between the premium.

If i used leverage for buying option then how much interest rate is for used leverage?

There is no interest for the leverage provided.

Hi Karthik,

Thanks once again. Based on my understanding buyer would pay only the premium if the price is falling and seller has to pay the difference of price in case if the buyer is exercising the contract. Here seller is getting only premium but paying more money during the expiry (exercising the contract)

But you have mentioned that statistically seller makes more profit in options, Is it because, the buyer often call of the contract so the seller gets the premium? Please correct me if my understanding is wrong

That\’s because out of the 3 possible outcomes, 2 favor the seller.

Hi Karthik,

Do index options have weekly and stock options have monthly expiry i.e. Thursday of every week for indexes and last working Thursday for stocks?

Bank Nifty has weekly, stock options are monthly. Monthly expiry is the same for both stock and indices.

Hi karthik,

I have few doubts not related to options though,

1) When i opened account with ZERODHA , they also got my demat account opened. So now this demat account , is it linked to zerodha account or to my primary bank account?

2) If i open account in some other bank , then can i open another demat account with that bank?

3) or can one person have only one demat account no matter how many bank accounts he has?

4) so does that mean one person can link his single demat account to any number of bank accounts?

5) suppose i open another trading account with some other broker(with different bank account),then will he create new demat account or i will have to provide him the details of the same demat account which i have with zeordha?

1) Trading, DEMAT are linked. Trading and bank account is also linked. Money flow happens between your linked bank account to your trading account

2) You can, but a DEMAT account along is useless.

3) YOu can have many

4) One to one only

5) You can link, but its better if you open a fresh DEMAT.

I had a call option for a strike price of Rs 100/- with a premium of Rs 10/-. Let\’s take a case wherein some bad news on the stock and it went down by 20%. In this case, my loss would still be capped at the premium amount I paid even if I forgot to square off the position?

Yes, as a buyer your loss is capped to the extent of the premium paid.

Hi, Firstly thanks for nicely explaining the concept. As I understand one can sell the option even before the expiry date and need not wait for the last day of expiry to close the contract? I buy a call option at Premium X and when I goes to x+delta the same day I can sell it off. So when u say exercising, are you referring to the same?

If you let your option position go into expiry, then you are exercising your position.

Sir

1. What is the basis behind to have last Thursday of every month as the settlement date in case of F&O ? Is last Thursday followed the world over or it differs from country to country ?

2. In India, derivatives are cash settled. Is there any nation where the derivatives are physically settled ?

Thanks

1) Nope, its just a India thing

2) In India stocks are physically settled, indices are cash settled.

Sir

You said that options can be exercised only on the date of their expiry, not before that. But in real trading scenario, how one can sell his call option anytime before expiry (in the context of call option) ?

Regards

Exercise is on expiry, but you can trade whenever you want. Trading and exercising are two different things.

Sir

I have following queries:

1. Why there are some stocks whose derivatives (F&O) are not there ?

2. What is the criteria for a stock to have its derivatives (F&O) ?

3. Can it be possible for a stock that its OPTION is there without FUTURE or with FUTURE without OPTION ?

4. How lot size for a stock option/future is decided?

5. Can lot size of future and option differ for any particular stock?

Thanks and regards

1) Stocks have to pass through few trading criteria to get included in F&O.

2) Check this – https://www.nseindia.com/products-services/equity-derivatives-selection-criteria

3) Nope

4) Check this – https://www.nseindia.com/products-services/equity-derivatives-contract-specifications

5) No, its standard across F&O

Hey,

How much is the minimum money is required to enter into the option trading?

The premium amount of the strike is the least required, Vignesh.

Varsity is nice but in the varsity app this section is mismatched (Basic Option Jargons[Chapter 2] > Options Settlement> Card 11) so it was completely confusing. Here you exampled of JPAssociates only but in app first you spoke about IDFC (On card 11)and merged in JP associates(Card 12) so it was not making sense properly after visiting this page it makes sense to me. I would like to request you to update this info in varsity app also. Also it would be awesomely great if you can add Takeaways also as a Takeaway cards in the end of the every chapters.

Because personally I felt that Varsity app is more fun to learn because of those unique quiz.

Thanks for the so much informative app.

Need to check this, thanks for pointing.

[…] 2. Basic Option Jargons […]

[…] I have used few Jargons in this blog, for better understanding kindly go through this. […]

In this chapter it\’s mentioned that settlement of options can happen only on expiry. But later chapters mention about squaring off of positions..

Is it not contradictory?

What understanding am I missing here?

Settlement upon expiry and trading the premium are two different things. You can buy and sell options any time you want and profit from the difference in premium.

Hi sir

I have simple question..

Premium of option=Intrinsic value +Time value

It has been written that Time value can not be zero

But sometimes it becomes

On 9 Jan BN spot 32145

BN 32100 CE @ 41.5

So formula is

41.5=45+time value

It means time value must be negative

Actually it happens many times on day of expiry mostly after 2:30

So it means many factors depend upon Demand and supply , psychology of traders etc

One more thing some people say Time value in American options can not be zero but in European style can be

Please comment

The time value cannot be zero or negative. I guess this was mispricing, which I guess did not last long.

Hi Karthik,

The premium of an options is dependent on two factors

1) the underlying asset value

2) expiry date of a option lot

is there any other factor?

Also can you tell about more possibilities here , like one is \” even when the value of underlying asset is increasing the premium of call option might not increase, even though its far away from the expiry date\” reason can be high volatility of the underlying.

Neha, not just that. It depends on others too. They are all discussed in the Greeks subsection. I\’d suggest you read through this to get a full understanding of how option premium behave.

Hi Karthik,

Basically as and when the strike price increases, the premium decreases. as the buyer is taking more risk. right?

Thats right, you can generalize this by saying that the premium reduces as the strike moves away from ATM and goes OTM.

Dear Karthik,

Currently underlying price of ICICI Bank is 469.20. Suppose I buy call option 31 Oct Expiry of ICICI bank @ strike price 450 at premium around 24 then i need to pay 33000 for 1375 shares.

But now suppose ICICI trade @ 490 before expiry then my profit would be around 53,800-33000=20,800.

My question is is it allowable to buy share @strike price (450) which is very low as compare to Laste traded price(469.20) ?

Yes, you certainly can, Sanket. No issues with that.

Dear karthik. First of all Happy diwali to whole ZERODHA family. I have one question related to the new rule made b SEBI which is related to physical delivery. I am asking this question in context of both futures market and option market. Suppose there are two traders trader A and Trader B. On the first day of the month trader A buys a call option of a stock X with lot size of 1000 and a premium price of 10 when spot is at 90 with a strike price of 120. And trader B has sold this position to trader A. Now i have some questions. Please try to answer even if questions sound stupid. 1. According to this contract the trader a has paid a premium of 10000 and trader B has received a premium of 10000 in his account . am I right or not. If i am right, can trader B who has received this premium from trader A of 10000 Rupees can use these 10000 rupees for buying any other position which is related to any other stock in the market and not X script. 2. Now if both of them want to exercise this option so accordingly on the last Thursday of the month the trader A will by 1000 shares from trader B and suppose trader B does not have these 10000 shares with him so does Trader B has to buy 10000 shares from the cash segment market and deliver it to trader A or how he has to proceed if trader A wants to take a delivery and there is no liquidity in the market and there is no other market participants who is selling these shares.

1) That\’s right, the buyer of the option pays the premium and the seller receives it.

2) Yes, he can

3) Both of them cannot exercise the contract. Only the buyer can. Seller is obligated. As per the new physical delivery policy, trader B will have to own the shares as he comes closer to the expiry. Else his position will be closed.

Hi Karthik,

One doubt need you clarification on it: As you said \”Here is an important point to note – you can exercise the option only on the day of the expiry and not anytime before the expiry\”. So if I need to exit from contract on the day itself or later in few day but before expiry , so will it possible or how it will work ?

Really nice explanation. Thanks for sharing such knowledge in simple words.

You can exit anytime before the expiry. There is no question of exiting after the expiry as the contract would have ceased to exist.

Hi Karthik,

Thank you very much for guiding us so well about Options Trading.

I have one query suppose I book my profit before expiry then in such case Profit get subtracted from premium amount ?

And How premium works in zerodha ? Do we need to pay premium before expiry ?

When you buy options, you need to pay the premium upfront. If you make a profit, it will be over and above the premium you\’ve paid.

Under call option, please answer the following

1. How can call option buyer and call option write can exit from their open position before expiry?

2. what happens on expiry between them if they are not able to exit their open positions.

3. if call option write doesn\’t have enough money in his account to pay the price differential as profit or actual delivery of

stocks to call option buyer , then what happens?

4. who is more interested to buy existing call option of an \’\’existing writer\’\’??

5. Can you present an entire scenario of multiple ( 5 buyers and 5 sellers ) call option buyers and sellers ( writers ) with their their role reversal

1) They just have to square off their positions and exit it completely. There is no need to wait till expiry

2) The contract will be settled based on the settlement prices

3) The moment money the losses exceeds the margins blocked, the position will be squared off by the broker, unless the writer funds the account with more margin

4) Whoever is more bullish (for the call) or bearish (for the put)

5) Not in an exact manner, but have explained this across various chapters in this module.