6.1 – Building the case

Previously we understood that, an option seller and the buyer are like two sides of the same coin. They have a diametrically opposite view on markets. Going by this, if the Put option buyer is bearish about the market, then clearly the put option seller must have a bullish view on the markets. Recollect we looked at the Bank Nifty’s chart in the previous chapter; we will review the same chart again, but from the perspective of a put option seller.

The typical thought process for the Put Option Seller would be something like this –

- Bank Nifty is trading at 18417

- 2 days ago Bank Nifty tested its resistance level at 18550 (resistance level is highlighted by a green horizontal line)

- 18550 is considered as resistance as there is a price action zone at this level which is well spaced in time (for people who are not familiar with the concept of resistance I would suggest you read about it here)

- I have highlighted the price action zone in a blue rectangular boxes

- Bank Nifty has attempted to crack the resistance level for the last 3 consecutive times

- All it needs is 1 good push (maybe a large sized bank announcing decent results – HDFC, ICICI, and SBI are expected to declare results soon)

- A positive cue plus a move above the resistance will set Bank Nifty on the upward trajectory

- Hence writing the Put Option and collecting the premiums may sound like a good idea

You may have a question at this stage – If the outlook is bullish, why write (sell) a put option and why not just buy a call option?

Well, the decision to either buy a call option or sell a put option really depends on how attractive the premiums are. At the time of taking the decision, if the call option has a low premium then buying a call option makes sense, likewise if the put option is trading at a very high premium then selling the put option (and therefore collecting the premium) makes sense. Of course to figure out what exactly to do (buying a call option or selling a put option) depends on the attractiveness of the premium, and to judge how attractive the premium is you need some background knowledge on ‘option pricing’. Of course, going forward in this module we will understand option pricing.

So, with these thoughts assume the trader decides to write (sell) the 18400 Put option and collect Rs.315 as the premium. As usual let us observe the P&L behavior for a Put Option seller and make a few generalizations.

Do Note – when you write options (regardless of Calls or Puts) margins are blocked in your account. We have discussed this perspective here, request you to go through the same.

6.2 – P&L behavior for the put option seller

Please do remember the calculation of the intrinsic value of the option remains the same for both writing a put option as well as buying a put option. However the P&L calculation changes, which we will discuss shortly. We will assume various possible scenarios on the expiry date and figure out how the P&L behaves.

| Serial No. | Possible values of spot | Premium Received | Intrinsic Value (IV) | P&L (Premium – IV) |

|---|---|---|---|---|

| 01 | 16195 | + 315 | 18400 – 16195 = 2205 | 315 – 2205 = – 1890 |

| 02 | 16510 | + 315 | 18400 – 16510 = 1890 | 315 – 1890 = – 1575 |

| 03 | 16825 | + 315 | 18400 – 16825 = 1575 | 315 – 1575 = – 1260 |

| 04 | 17140 | + 315 | 18400 – 17140 = 1260 | 315 – 1260 = – 945 |

| 05 | 17455 | + 315 | 18400 – 17455 = 945 | 315 – 945 = – 630 |

| 06 | 17770 | + 315 | 18400 – 17770 = 630 | 315 – 630 = – 315 |

| 07 | 18085 | + 315 | 18400 – 18085 = 315 | 315 – 315 = 0 |

| 08 | 18400 | + 315 | 18400 – 18400 = 0 | 315 – 0 = + 315 |

| 09 | 18715 | + 315 | 18400 – 18715 = 0 | 315 – 0 = + 315 |

| 10 | 19030 | + 315 | 18400 – 19030 = 0 | 315 – 0 = + 315 |

| 11 | 19345 | + 315 | 18400 – 19345 = 0 | 315 – 0 = + 315 |

| 12 | 19660 | + 315 | 18400 – 19660 = 0 | 315 – 0 = + 315 |

I would assume by now you will be in a position to easily generalize the P&L behavior upon expiry, especially considering the fact that we have done the same for the last 3 chapters. The generalizations are as below (make sure you set your eyes on row 8 as it’s the strike price for this trade) –

- The objective behind selling a put option is to collect the premiums and benefit from the bullish outlook on market. Therefore as we can see, the profit stays flat at Rs.315 (premium collected) as long as the spot price stays above the strike price.

- Generalization 1 – Sellers of the Put Options are profitable as long as long as the spot price remains at or higher than the strike price. In other words sell a put option only when you are bullish about the underlying or when you believe that the underlying will no longer continue to fall.

- As the spot price goes below the strike price (18400) the position starts to make a loss. Clearly there is no cap on how much loss the seller can experience here and it can be theoretically be unlimited

- Generalization 2 – A put option seller can potentially experience an unlimited loss as and when the spot price goes lower than the strike price.

Here is a general formula using which you can calculate the P&L from writing a Put Option position. Do bear in mind this formula is applicable on positions held till expiry.

P&L = Premium Recieved – [Max (0, Strike Price – Spot Price)]

Let us pick 2 random values and evaluate if the formula works –

- 16510

- 19660

@16510 (spot below strike, position has to be loss making)

= 315 – Max (0, 18400 -16510)

= 315 – 1890

= – 1575

@19660 (spot above strike, position has to be profitable, restricted to premium paid)

= 315 – Max (0, 18400 – 19660)

= 315 – Max (0, -1260)

= 315

Clearly both the results match the expected outcome.

Further, the breakdown point for a Put Option seller can be defined as a point where the Put Option seller starts making a loss after giving away all the premium he has collected –

Breakdown point = Strike Price – Premium Received

For the Bank Nifty, the breakdown point would be

= 18400 – 315

= 18085

So as per this definition of the breakdown point, at 18085 the put option seller should neither make any money nor lose any money. Do note this also means at this stage, he would lose the entire Premium he has collected. To validate this, let us apply the P&L formula and calculate the P&L at the breakdown point –

= 315 – Max (0, 18400 – 18085)

= 315 – Max (0, 315)

= 315 – 315

=0

The result obtained is clearly in line with the expectation of the breakdown point.

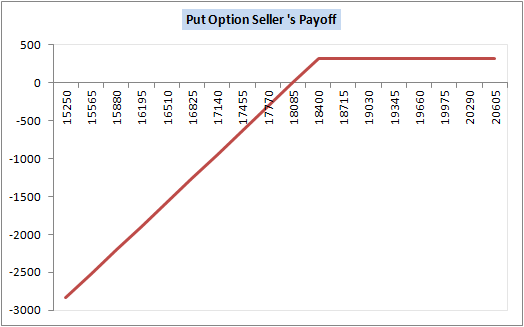

6.3 – Put option seller’s Payoff

If we connect the P&L points (as seen in the table earlier) and develop a line chart, we should be able to observe the generalizations we have made on the Put option seller’s P&L. Please find below the same –

Here are a few things that you should appreciate from the chart above, remember 18400 is the strike price –

- The Put option seller experiences a loss only when the spot price goes below the strike price (18400 and lower)

- The loss is theoretically unlimited (therefore the risk)

- The Put Option seller will experience a profit (to the extent of premium received) as and when the spot price trades above the strike price

- The gains are restricted to the extent of premium received

- At the breakdown point (18085) the put option seller neither makes money nor losses money. However at this stage he gives up the entire premium he has received.

- You can observe that at the breakdown point, the P&L graph just starts to buckle down – from a positive territory to the neutral (no profit no loss) situation. It is only below this point the put option seller starts to lose money.

And with these points, hopefully you should have got the essence of Put Option selling. Over the last few chapters we have looked at both the call option and the put option from both the buyer and sellers perspective. In the next chapter we will quickly summarize the same and shift gear towards other essential concepts of Options.

Key takeaways from this chapter

- You sell a Put option when you are bullish on a stock or when you believe the stock price will no longer go down

- When you are bullish on the underlying you can either buy the call option or sell a put option. The decision depends on how attractive the premium is

- Option Premium pricing along with Option Greeks gives a sense of how attractive the premiums are

- The put option buyer and the seller have a symmetrically opposite P&L behaviour

- When you sell a put option you receive premium

- Selling a put option requires you to deposit margin

- When you sell a put option your profit is limited to the extent of the premium you receive and your loss can potentially be unlimited

- P&L = Premium received – Max [0, (Strike Price – Spot Price)]

- Breakdown point = Strike Price – Premium received

market fell drastically my sold and bought put options of stock gone deep in the money. now what should during the expiry day.

Well, exit and cut the loss is the best thing to do 🙂

Can we set trailing SL for options?

As of now this is not there, but will be made available soon.

can you explain what is actual contract in put selling . can you explain like Ajay Veru story . because in call selling it is spot-strike. but in put selling it is strike-spot . so how contract works in put selling. sorry for basics

Sharad, when you sell a PUT, you are obligated to take delivery of the contract, exactly like buying a call option.

Sir.

If I sell the PE, do I need to buy it before expiry or it will automatically square off at the expiry?

It depends on the Moneyness. If its ITM, and if its a stock option, then you will have to take delivery of the option. If its an index option, then no physical delivery.

If its OTM, then there is nothing you will have to do.

Hi

I want to understand few things in option trading

If I see market depth of put option for few ahead strike prices then spot price, it has more ask quantity and less bids quantity, so does that mean market is bullish or prices of that asset will rise?

Or put options are made to sell only and not buy??

It just means that that particular option is more liquid 🙂

Can I sell options and carry them with margin against shares held with zerodha and pledging them ? Will there be anycsgirt margin penalty in this case if I do not have any cash balance in account and only margin on pledged securities. Kindly advice.

Please do check this – https://support.zerodha.com/category/console/portfolio/pledging/articles/what-is-pledging

Follow up question: if the Put is simply squared off, then is there an ETF or some sort of Index tracker where I can get delivery of the underlying should it be ITM?

No, as I mentioned, only stock options are settled physically. Not, index options.

Hi,

If I write (sell) a Put on Sensex and its assigned (and adjusted against the funds in my account), what exactly do I receive? Do I get allotment of a Sensex ETF or representative shares or something else?

Thank you!

There is no physical settlement for index right? Only for stock options.

I have sold PNB put at 105. PNB closes at 108 on expiry.

Do I just get the premium amount or am I obligated to buy the lot of shares of PNB. 8000 shares.

Since 105 PE option remains OTM, there is no settlement in this case.

pls help me with this doubt. Lets take an example of nifty 50. Lets assume now nifty 50 value is 25000, i buy a put sell at 24500, and then the market reachers 24600 . assume option value was 200rs and at the time of expriy, the option value reaches 0.05 at the time right. So i do get proft.. Am i right?

You wont make a profit since your option is worthless at expiry. YOu will lose the premium paid i.e. Rs.200 here.

If the premiums are high in Put Option, then why does a buyer buy it?

Because the buyer feels the premium will go higher.

Can we short(sell) monthly expiry pe because at the expiry it will be zero right ..?

Yes, you can as long as there is sufficient margins.

Sir,

You are doing a trmendous job of imparting knowledge to lakhs of unknown asperants.it is a spiritual duty that you are doing.In Kaliyug persons like you are real Guru as defined in Hindu philosophy.

Thank You for the link provided by you today due to examples. It gave me some understanding.Thanks once again.

I have to re read it and apply and see for different situations. Reading several books did not help. You helped me to understand. If need be I shall get back to you Sir.

But, I request you to avoid the phrases: \”market is against you\” or \”market is in your favour\”. Kindly use if market \”goes up\” or \”goes down\”.

Sir, if I can be of help to you, I shall be greatful.

Very kind regards.

Thanks for the kind words! Your point is noted 🙂

On 08 May 2024 LTP of BANKNIFTY PE 49200 is ₹. 1183.75. IV is ₹ 19.53. So, if I square off on 08th the one lot sold on 03 May (see my comments dt. 04 May above)what will be my return.

For selling one lot of BANKNIFTY PE 49200 on 08 May, the margin required is ₹ 1,10,107/-

For P&L,take the difference between buy price and sell price of the premium and multiply by the number of lots.

Sir, Not understood. I gave in my comments LTP of CE & PE which will be the BUY & SELL PRICES. Can you kindly help me by giving example of detailed calculation. Alternatively can I contact you on email. I need your email address Or I earnestly request you to please send me example calculation for arriving at profit/loss to my email.

Here you go – https://zerodha.com/varsity/chapter/options-m2m-and-pl/ have explained this in detail 🙂

On 07 Mat 2024 if I square off 1 lot of BANKNIFTY PE 49200 @LTP ₹659/-, the money I suppose to receive, I presume, will be 25×659=16,475 and margin that I paid I.e ₹ 95,692/- i.e total ₹ 1,12,167/-.

Please correct me if I am wrong.

Dr. Saaie

Yes, and your P&L will depend on your buy and sell price of the premium.

Sir, I am a retired engineer and am new to OPTIONS. OPTIONS is latin to me. I read some famous books. I am not able to break the sheeth. It flys above my head.

So I am limiting my self to intraday trading in OPTIONS.

With the hope that you will kindly enlighten me I am posting this comment.

I want a practical example of BANKNIFTY. So I am giving below the details of BANKNIFTY expiry 08 May 2024. Please correct me if I an wrong.

Strike Price: 49200

LTP of PE 49200 = ₹436.1 (03 May 2024)

IV of PE 49200= ₹36.06

Premium= ₹436- ₹36= ₹400

LTP of CE 49200 = ₹243 (03 May 2024)

Which SPAN of following is correct?

SPAN = ₹436.1-₹243=₹193.1

OR

SPAN = ₹243-₹436.1= – ₹193.1

If I sell 1 lot of PE 49200 on 03 May 2024, Margin required to be paid by me is ₹ 95,692/-.

Now let us presume that on 07 May 2024, the LTP of PE 49200 will be

SCENAREO(1) ₹659/-

SCENAREO(2) ₹120/-

SCENAREO(3) ₹0/-

What will happen in these three scenareos if

[1] I will square off on 07 May 2024?

[2] I let the contract expire on 08 May 2024?

I shall be highly greatful to you for your help.

Regards

I\’m not sure how you are arriving at SPAN by subtracting premiums. SPAN is a margin amount levied and its depended on the volatility. Irrespective of when you square off, the P&L is dependent on the buy and sell price of the premium.

Sir, suppose I sell a put of bank nifty today dated 12th April and the expiry is on 16th April. So if on expiry the price of bank nifty is more than the price at which I sold put, I will make profit right? Eg, if Bank nifty is today on maybe 49000 and I sold put at 48300, then at the time of expiry if bank nifty is at 48400, I will be in profit? And what will happen if I let it expire automatically?

Yes, in this case since you have sold a put option, the strike is worthless, and therefore you get to keep the premium. Upon expiry, your option will be settled and you get to retain the entire premium money received.

how about if there are no buyers at the end of exipiry

The contract will be settled by the exchanges upon expiry.

Hi all , Pls guide why Put Option premium is increasing while Nifty is getting down ..as i have done Put sell and Nifty get up for ariund 50+ Points instead of Premuium decay of Put Side it gets increasing

Pls let me know why this is happening

This happens due to an increase in volatility also, Sudeep.

How much amount will be needed if i SELL both ( call & put ) banknifty monthly expiry at the same time…

Please do check the margin calculator for this, Shivani.

P&L = Premium Recieved – [Max (0, Strike Price – Spot Price)]

Would this formula be different in case of PE sell for ITM?

In case of ITM put sell, spot-strike should be there, am I right?

This is the formula to find out the intrinsic value of the option, it will remain the same for buy and sell positions.

considering the situation selling will profit me but to extent of premium received but suppose one buys put option the trade goes opposite so the maximum loss can be the total margin blocked but if one don\’t have stop loss or he may have certain amount sitting in his demat so will this trade effect the amount sitting in demat once the trade has moved exponentially in opposite direction please let me know before i make a mistake in live market

Sourabh, so when you buy an option, the loss is only to the extent of premium paid. There is no margin blocked when buying options.

I sell put option and i got 147 profit but amount shown my acciunt only 97 ruppess why like this i am not understand .can give me suggetion

There are charges to pay right?

What will happen if I sell a CE

what will happen if I sell a PE

how will i make profit

To profit from selling –

1) Call position, then the market has to decline

2) Put position, then the market has to rally.

SUPPOSE I SOLD BAJFINACE 7000 AUGUST PUT AT THE PREMIUM OF 95 SPOT PRICE IS APPROX 7300 WHAT CAN I DO IN EXPIRY IF THE PUT IS IN THE MONEY AT EXPIRY.

Nothing really as the option is worthless.

sir, in longterm we are bullish on nifty. so, why not we sell nifty (pe) for long term and collect premiums , rollover at every expiry.

if, nifty spot price is in our favour(bullish),above our strike price , we will collect premiums.

if, nifty spot price is not in our favour, below our strike price , we will carry forward losses, because at last nifty is bullish in long term.

if, above trades are done without any leverage,can it be profitable???

Not easy, you need deep pockets to hold a short option position and maintain the margins, Saurav 🙂

Hi

I have buy put option for Idea share at price 0.05₹

Idea share price is 6 and I buy put for Idea 8.

And now unable to sell it due to lower circuit. What will happen if it gets expired on coming Thursday without sell?

If the option goes to expiry and its ITM, then it will be Physically settled, Nikhil.

I am rishabh saurabh

Ok. Hi!

How can option sellers (put seller) loss be theoretically unlimited as stated in this chapter (generalization 2)? Let\’s say i sell Put option of Adanient expiring on Feb 23 at strike price of 800 and collected premium of 30/share , spot price is 2000 , the maximum share could tank is 0 , then i would have to fulfill my obligation as put seller to the put buyer ie to buy the lot of shares at 800 which is trading at 0, so my loss would be limited to 250(lot size)x800 (strike price ) -7500 (premium collected) = 192500

Yeah, there is a cap at stock price going to 0. But then, if that were to happen, then you\’d lose pretty much all your capital and more 🙂

Mene 90 pe gail buy kiya he magar spot 100 ke uper he kal expire he 26 jan 23.

Aur put sell nai ho raha he to kya hoga.

Sir,Can we short put option premium..for example if the price of put option premium is 95 Rs and if it goes down to 80 Rs..do we make profit like equity and or the stop loss should be kept above 95 that is 98 ..

Yes, you can short both call and put option.

लिपटी 17600 पर है और मैंने 13600 की पुट बेची जो कि 50 पैसे पर थी ओर निफ्टी 500 पॉइंट नीचे या 500 पॉइंट ऊपर हुआ तो मुझे एक्सपायरी पर कितना प्रॉफिट होगा या नुकसान होगा

sir maine artiind sell pe 23feb 2022 ka 15 rs me liya hua hai

is situation me mujhe maximum profit or maximum loss kaise hoga

Sir, can I sell half of the share of 1 lot of bank nifty in options trading?

No, you will have to trade in terms of lot size.

Good example driven concept.

I have a question/clarification.

If currently today 22-Nov-2022, NIFTY is 18200 and 2 Month Expiry 29-Dec-2022 premium is 200, what is the expected premium for Expiry 29-Dec-2022 on 25-Nov-2022 when 2-Month Call Option becomes 1-Month Call Option

Thanks,

YOu can use a Black & Scholes option calculator to figure this out. I guess Sensibull has this on their site.

Hi,

I am new to options, I am just trying to understand sell put option. Suppose if I am selling a put, the maximum what I can earn is the premium, rite if the price goes above the stike price. Why wouldn\’t I then buy a call option to the next nearest strike price while it\’s more cheaper to buy.

Secondly, about the expiry date. Is it maditory to wait till this date or can I can just close it when I am in a position to get the premium??

1) You can do that. Btw, there is a difference between buying a call versus selling a put option. Check this https://www.youtube.com/watch?v=0CnHdzTE66s&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=1

2) You can close the position whenever you want.

I would like to know which options strategy( buying a pe/ce or seliing a pe/ce) has limited loss,

Pretty much all spreads have limited losses and limited profits. I\’ve explained this in the next module, please check. Thanks.

Nifty Or bank nifty sell kai se kare

Check the video series, Dinesh – https://www.youtube.com/watch?v=-mO0YOTcCiQ&list=PLX2SHiKfualFiusiT9G5uE9jU3vetvW2x

Lets say I have sold the call option for 34200 call at premium of 994 and nifty closes at 32200 and but premium of my call is 1000 will i be in loss ?

What are the possible a tions that can be taken

I understand that wait for expiry is one action and square off is another one. Anything else?

That\’s it. These are the two sensible actions that you can take 🙂

Sir,

I sold 1 lot Reliance PE 2200 Expiry 30 Jun at a premium of Rs 14. Now it is at 2.9. The P&L is showing as Rs 2775.

Please guide me as to what action is to be taken and What is my risk.

You are in Profit as of now. If you continue to hold the position to expiry, you will get another 2.5 (max), but you also carry the additional risk of the position reversing directions. So keep this in mind and decide on what you\’d like to do 🙂

Only a very very little advantage I see to \”sell option\” is when \”market remains flat\”.

If some is is bearish he will obviously \”buy put\” , right ?

Please see that video I shared in the previous comment.

Karthik Sir, Have you ever sold options ?

I unable to convince myself \”why would anyone ever sell an option agreement\”. It logically doesn\’t make sense to me to take unlimited loss & also depositing higher margins.

Though I read several times trying to make sense that \”options sellers have statistical advantage\” & obviously there are same number of sellers as much as buyers that\’s why market exists but doesn\’t appealing to my intellect to \”sell options ever\”

Ankur, coincidently, we just dropped this video and it may help – https://www.youtube.com/watch?v=0CnHdzTE66s&t=243s

Isn\’t it better to buy call option as in put selling risk is unlimited and profit is restricted to premium

We just dropped a video on the same topic, check this – https://www.youtube.com/watch?v=0CnHdzTE66s&t=243s

For example if I bought a call option in order that underlying asset price will rise but happened reverse so here can I compensate my loss by buying a put option?

Technically yes. But you will have to ensure its well-timed, its easy said than done 🙂

Sir, lets assume i sell a put option for 100Rs and within few seconds(lets assume nifty does not move and option price as well), i will exit this(buy it), lets assume the put option price is still 100Rs.

In this case, did i make a profit?

No, since the premium price has not changed, you will not make a profit.

Great efforts Karthik… Creating this big documentation and answering every reply are commendable job, kudos!

one question… (Put Option Seller)

lets say today morning I sell 19th May 15950 PE at premium 167Rs

and after some time I exit this with the premium of 173Rs.

1. now the P&L is calculated as … 167 – 173 = -6Rs and then -6 * 50 = -300Rs .. so 300Rs loss.

is this correct calculation?

2. on the ledger, option sold premium price, exit price(buy back) premium price only shown.. the spot prices are not shown on the ledger.. so how can we calculate the \”P&L = Premium received – Max [0, (Strike Price – Spot Price)]\”

Thanks for the kind words, Gayathri.

1) Yes, this is correct.

2) Since the premium is traded (and option not held to expiry), the difference in premium is shown. Do check this – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

For Option Sellling which strike price is best i mean which one…

1. In The Money (ITM)

2. At The Money (ATM)

3. Out Of The Money (OTM)

OTM. But there are so many nuances to it 🙂

Sir I have sold HDFCBANK 1400PE qty1100 @21.

Now it is at 50.

I\’m thinking to hold it till expiry.

I have 240000/- left unused in my account.

Is it enough to hold it till expiry.?

Not sure, please do speak to customer care once. Check my previous reply.

Sir I have sold 1400PE qty1100 @21.

Now it is at 50.

I\’m thinking to hold it till expiry.

I have 240000/- left unused in my account.

Is it enough to hold it till expiry.?

Depends on the stock and the volatility of the stock.

sir \”why writing the Put Option and collecting the premiums may sound like a good idea\”

can we buy Call Option?

can you give a specific reason sir.

Thanks

While writing put options price change is postive or negative like in call writing price change in to negotiate please explain

There is no negotiation Likkith. Maybe I\’m not understanding your query fully. Can you please elaborate?

Sir I am new to trading. I ve a doubt. In banknifty pe when should we sell or buy. And in bank nifty ce when should we sell or buy. In banknifty pe should buy in peak and sell in low. Please reply.

It depends on what you expect from the market right? If you are bullish then you can buy call or sell put, and if you are bearish, you can buy put or sell call.

Hi Sir

How do we square off a position. Eg I sold puts for nifty 16700 mar expiry. Do I buy nifty futures to square off or just exit my position in zerodha?

Thanks

No Vinod, buying futures creates a new position. To exit, you will have to buy back 16700 Mar expiry Puts in the same quantity that you sold.

Hi Sir,

I made a simple reference flow chart for most things discussed till now, if you prefer I can share it with the community, but I don\’t see a way to add any attachments, please let me know if by any means I can send it to you and you can then share it with the community…

Dev, thanks for that. You can share it on TradingQna saying its a summary from Varsity and share the link here.

Sir my question is

BANKNIFTY can I sell the option and hold tell expiry

Yes, you can Govind.

Since cash settlement is no longer valid I\’ve a doubt about the current settlement process.

Scenario

The buyer of a Call or Put option is in profit, but on the expiry date they lack sufficient funds to take delivery of the underlying at strike price, what happens then?

A) do they forfeit the trade and lose their premium?

B) is there any other way for the buyer to save the trade and not lose money?

So when you head towards the expiry, the broker expects you to park more funds as margins lacking which, the positions will be closed by the broker. Hence your question a & b won\’t arise. I\’d suggest you read this chapter on Physcial delivery – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

If I sell one lot of banknifty Mar 32000pe

@200

My margin amount approx Rs 140000

Then please let me know after end of March month expiry if it goes out of the money, then how much would be my profits?

I am asking because lot size of bank nifty 25. So what is the calculation process

Premium Rs200 multiple 25 =?

Or only Rs 200 premium?

If you sell the option and at expiry, if the option is OTM, then you get to retain the entire premium.

Hi Karthik,

can you please provide dark mode to versity website?

it will help in reading without straining eyes.

And thanks for the amazing content on versity. It is benefitting me a lot.

Will pass this as a feedback, Pravin.

Sir,

Suppose I exercise Wipro Mar 600 CE Selling. Premium received is 10.25 x 800 (lot size). I hold 1 lot of Wipro @ 500 per share.

On expiry date, if the spot price is ITM, how to calculate my total profit (consider the on expiry, the premium is 11 rupees).

Is it (10.25 x 800) + (100 x 800) ? or I should consider the difference in premium as well ?

Kindly reply.

Anoop, I\’m a little confused. Which is the strike price and which is the spot price? Anyway, assume you sold 500CE and 10 and the spot upon expiry is 600. In this case, 500CE is ITM, and you will have to give delivery of Wipro shares at 500, but since you received 10 as a premium, the effective rate after adjusting for the premium received is 510.

Sir if we sell put option of any stock at primium of rs 5 and strike price is 120

What will be the nett delivery cost of the stock if it\’s ITM n we take delivery

120-5=115

Yes, you will have to take delivery of the stock at 120, but since you have received 5 as premium, the effective rate is 115.

Sir,

Thanks for your reply.

In options selling, if we exit prior to expiry date, do we receive Margin money on the same time or we need to wait until expiry date ?

Kindly clarify.

Your margins will be released right after you close the position.

Sir

I have doubt on following scenario.

Consider TATASTEEL FEB 1000 PE sell with premium 5.3/- per share, Lot is 425.

On expiry, the spot price is more than 1000. Then what will be my net profit ? Is ist 425×5.3 or the difference in premium will be adjusted from the premium received ?

Kindly reply.

If the spot is more than the strike, then the put option will be worthless and you will retain the entire premium received.

Sir

Please consider the following situation.

I sold call option of a share and have 1 Lot of same share in my demat account.

What will happen on expiry date If the spot price is more than the strike price.

Also, in this case, do we need to add fund as exposure margin?

If the call option is ITM (spot higher than strike), your short call option will result in you giving delivery of shares. So the shares in your demat will be debited. Yes, you will also need to add funds towards physical delivery margins.

Sir

Incase on expiry, if market price of share is above strike price , how much I will get as profit ?

Is it premium agreed (14.5) X lot size (125) ?

Anoop, check this – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

Sir,

I have done PUT OPTION SELL of DRREDDY Jan 4300 PE. The stock price fell below the strike price on expiry date.

How to calculate my loss. The premium offered was Rs. 14.50/- per share.

Your loss is the difference between the buy and sell price of premium, multiplied by the lot size.

What happen if I hold put option for 2 days ?

Charges applicable ?

I hold one put option over night whole amt of that option debited from my account , if I decide to hold it for one more day what will happen?

Will amt again dr from my account ?

Ankita, charges are the same for intraday and overnight for derivatives.

The put option seller is bullish on the market. You have said that the maximum loss a put option seller can incur is basically unlimited, that would be the case if the underlying can go negative. If the underlying cannot go negative, the maximum loss put option seller can incur is the actual cost of the underlying right?

In a way yes, the maximum if the stock price going to 0.

I am novice to nifty50 trade.can you enlighten me 8f nifty is purchased is it necessary to sell.

Please do refer to my previous comment.

I am novice to nifty trade.can you enlighten me if put or call is purchased is it necessary to sell.

It depends on your point of view and how long you intend to hold the trade. But the maximum you can hold on to is till the expiry.

Sir

If I am selling a NIFTY CALL option today at strike 17500 after receiving a premium of Rs 100.25 (Expiry 30 December 2021,NIFTY spot price 17054) , also paying the margin required .

If I Buy the CAll option today evening can I get Rs 100.25 ???

Yes, thats right.

What do you mean by settling in Cash ? When we sell a put option we are obligated to buy share at the given strike price and keep the premium if the share price is in the money. If the stock price stays out of the money then the collateral get released and you still keep the premium if it it expires without buying back the position. I like to understand settling in cash if I’m in the money what will happen to my collateral amount + premium if I let it expire worthless

Thats right, the policy was to settle in cash when I wrote this chapter. It changed to physical delivery later. Have covered physical delivery here – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement/

Hi sir,

The question I have is regarding options selling payoff ?

Eg-

Net credit – 100

Max.loss – 90

Max.profit – 50

Q.1

If market expires at max.loss, am I still making a profit ???

i.e. Net credit – max.loss ( 100-90 = 10 )

Q.2

If I square off intraday/nextday at mtm loss i.e. Net credit – mtm.loss (100-70 = 30), is my trade in profit ???

This may not be relevant with the above topic discussion but I can\’t find any simple answer/explanation anywhere else.

Hope you can clarify my doubt

Really appreciate your work

Thanks

When you short an option, you only know the max profit i.e. to the extent of the premium received. Max loss is left open. If you sq off the position, then the P&l is to the extent of difference in premium. Please check this – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

what will be the profit calculation, if i sell put option in otm in 25, and buys once the LTP comes down at 2,

25-2 = 23 Rupees. Check this – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

Hi sir,

I bought NIFTY 16500 PE at 11.10 * 50 and sold at 11.45 * 50. P&L shows 17.5 profit. Since it is Put option and still hasn\’t reached expiry, is that why I am making profit? I am a bit confused. Could you please clarify my doubt ?

Thank you

Sushma, you can sell the option anytime you wish. There is no need to wait till expiry. In this case your profit is 17.5.

A trader writes Nifty PE at Rs.76/- when the

spot is at 10,875. At what price will the trader

get square off the trade, assuming he has set a

15% stop loss on the premium.

When the premium drops to

Rs.64.6/-

2

When the spot hits 12,506

3

When the premium increases to

Rs.87.4/-

When the spot hits 9,243.75

Sorry, dint get the query 🙂

As the expiry nears, do the option sellers need extra margin?

Yes, this is with respect to the physical settlement.

Thank you for your teaching

Happy learning!

Dear Karthik, Example.. i have sold RBL bank 190 Put option at Rs.7… At expiry the underlying is at 210 Rs.. in today\’s rules SEBI is saying take physical delivery. So do I have to buy RBL at 190 X lot size on expiry

No, 190 PUT option will be worthless when spot is at 210.

I am unable to Sell Far OTM nifty monthly option 16800 PE and 18700 CE , please advise.

What error message are you getting?

Banknifty Market is at now @ 37800 , i wish to place order to sell call option of Dec for strike of 41100

Case 1.

no buyer is available , how can i place order

case 2

Order placed appearing in option chain with huge bid and ask quantity without any trade and no LTP price appearing in option chain

Case 1 – Not possible, since there are no buyers.

Case 2 – Yes, that\’s because there is no liquidity. When more traders trade the instrument, liquidity gets created and you can trade easily.

Pls tell about net profit with respect premium received and total p&l

Your ROI is profit divided over premium paid for buy or profit divided over margin blocked for sell positions.

May I know what will be the charge if we decide to take delivery of a stock after selling put options in zerodha?

Gaurav, all charges are mentioned here – https://support.zerodha.com/category/trading-and-markets/margin-leverage-and-product-and-order-types/articles/policy-on-physical-settlement

Hi. If I sell a PUT of any stock, do iam obligated to buy the stock on expiry if it goes below my strike price. I heard NSE has planned to implement this system.

No, you can exit before expiry. But if you hold to expiry, then you will have to fulfil the physical delivery obligation. So in case of put sell, you will have to buy the stock.

How can I calculate put writing or call writing in rupees per day?

YOu need to look at the Open interest, Subham.

I sold out of money Nifty put option. I didn\’t close it in expiry day.

What will happen in this case ? I will be getting the premium collected right

It will expire worthless anyway.

Sir, pls guide

If I sell put option of particular stock and same is goes in the money within series or expiry day, than it is possible to take delivery of stock with balance paying amount?

Yes, you can.

Please suggest which option will be beneficial. I was wondering if I sell either a call or a put they both fall near to zero on expiry date so I can sell any of them.

Depends on many other factors, Ravindra. Volatility, premiums etc. Do consider all these and arrive at what really works well for you.

Thank you, Karthik, for this wonderful content!

Happy reading, Pranav!

As far as I know the premium falls near or to zero on expiry date, so can I make profit by selling a put option on expiry date and exiting the position before close of the market on expiry date?

Yeah, but this also depends on which option you are trading.

As I understand it, there is no need, or wise counsel even,to hold till expiry. I can buy the option, if it\’s giving desirable profit and square off my position.

Please explain what actually happens, from a seller\’s point of view, if option is held till expiry and it expires OTM and ITM both.

If I were to take a reasonable guess, I would say, in earlier dispensation prior to change in settlement as physical, seller would receive/give Premium – IV for ITM expiry and have his remaining margins unblocked. For OTM, he will receive entire premium and have his margins unblocked. Buy clearly, as I see it, he won\’t receive premium untill the option has expired. Am I right?

Now, how it will be in physical settlement of options?

Thanks for bearing with the likes of me.

If the option expires OTM, then the seller will get to retain the entire premium. If the option expires ITM, then there is a delivery obligation for the options seller and will get physically settled, which is basically give delivery of stock or take delivery of stock. Depends on your position.

Sir, a few questions.

1. Options price is dictated by Greeks. But what we really see is options price is dictated by market participants as per their view of the stock price. When buyers are putting out their Bid prices and sellers are putting out their Offer price, certainly they are calculating bases on Greeks. Are they?

2. Its also a fact that, say, for an OTM Call, price of Call at times falls even after rise in underlying stock. Clearly Greeks are in play. But here again, it\’s more of their (sellers\’ and buyers\’) intuitive sense in putting out their prices than actual number crunching based on Greeks calculations. Am I right in concluding this?

3. In selling options, are we assuming that we hold it till expiry and let it expire, and pocket the premium if our market view proves right? Coz if sellers wants to square off, he would have to buy the option, which, in a volatile market may be a loss making act even if the option is yet OTM. Say a seller sold SBI 400 strike Jul PE for RS 10 when spot was 430. If spot reverses and keep going down, option premium will keep increasing. At 410 spot, premium reaches 15. His current position is net loss. He may panic and square off at loss. Although, it would have been wiser to hold off and wait till expiry.

So my question is, while selling options, is basic premise to hold till expiry?

4. After recent change in regulation on physical settlement, this may change that premise. Does it mean that Physical settlement will happen for all options expired ITM or will it be compulsory for options expired OTM too? How does physical settlement of options really work?

Thanks.

1) Yes, professional traders factor in the greeks

2) Yes, but the greeks are kind of baked into this price

3) That\’s right, hence the conviction to hold plays a very important part in options trading

4) It happens only for ITM options. Check this – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement/

Need to undestand P&L in case of stock put writing becomes ITM.

Its always the difference between the buy and sell price of the premium, Ajit.

Sir

Indeed I have doubt.

Is M2M is applicable on option contract? After buying PE can be exit before expiry and similar way again can v buy same PE?

No, only futures contract has M2M.

As per NSE rules pledged debt mutual funds should be consider as cash component, but why zerodha is not considering debt mutual funds as cash?

Not all debt funds, just liquid funds and a few gilt funds are considered as a cash component.

My question is when we enter a call option contract we should have the shares, even we don’t have shares in our dmat account we are able to sell CE the call options and receiving the premium

So how the exchange is allowing it, even we don\’t have the shares in hand?

If we have shares in our dmat account then only we should be able to sell CE call option right ?

I m new to options, thanks for your patience:)

No Satya. A derivative is a contract that draws its values based on the underlying. Think of Gold bonds, if I have a gold bond with me, its value is as much as gold, does that mean I have physical gold with me? No right? Its just like that.

Hello sir,

My question is even we don\’t have shares in our dmat account we are able to sell CE the call options, why the sebi or sensex is allowing for such kind if trades ? People are playing with money like gambling in options even they are not ready to buy shares they able to sell put options and they don\’t have shares in there hand to hand over able to sell call options, can you please explain it .

How is it gambling? These are two different segments right?

Let\’ say

EP 2280

CMP 2175

Call Option Sold

Held till maturity

Since I am entitled to receive the premium (Rs.27 say) but brokers kept it and return on maturity after adjusting profit or loss.

Now at Maturity MP = 2180

Will I get same Premium Rs.27 back or with some changes?

YOu will receive the premium as long as the spot price is below the call strike.

Hi,

Today I buy bankniftyPE 35000 on nrml .

But not sale.Now its.05paise.

It will be loss for me or I can sale in next trading

You can sell it tomorrow also.

Hi

Can I sell a PUT Option QTY 75 ( when premium is at Rs. 100/- ) and buy the same PUT Option QTY 75 ( when the Premium is at Rs.50/- )

Will I gain Rs.50 X 75 = Rs.3750/-… Is this possible or Should i Wait till the expiry to know my trade result. Kindly Answer..

Yes, thats right. No need to wait till expiry.

Hello Karthik sir,

Thank you so much for sharing this wonderful knowledge.

My doubt is

1. why IV is non negative to call option?

Implied Volatility (IV) is a non-negative factor for both calls and puts.

But sir , I short 280 strike PE , I suppose to get a loss when it goes down 280 strike price and even after break even . Which is ( strike price – premium ).

Means the stock is still above my short .

But the premium will move, right?

Q2. Suppose banknifty is at 35000 and I SHORT 35000 PE and the index is very bullish ( 1000+) a single day , so I suppose to get intrinsic value also or my premium would decay fast as compare to market bullishness .

Can I suppose to collect the intrinsic value + time decay also in this . Scenario . Both benefits .

Pls tell sir .

To get the intrinsic value, you need to wait for expiry.

Q1. if the stock is at 300 and I short 280 PE why I shown loss in p&l when the stock price COMES DOWN to 290 .

When you short a PE, you want the stock price to go up. If it comes down, you make a loss.

Hi….

I think you have not mentioned anything about options freezing. I want to know about that. Also in that situation why I can\’t able to square off my positions.

Thanks.

Option freezing meaning?

Before my Break even itself I came out means I will Be profit

Not always necessary right?

Sir Im SHIVA

option seller will be knowing is maximum profit but I have a small doubt

for example

Titan company is trading around 1600 and I am thinking it will not go below 1560 and I am selling it with premium of Rs.29 and my breakeven is 1531

*Now my doubts starts still 1531 I will be in profit or not

The next one is At 1570 itself I am making my maximum profit it is real or not if it is real means I can book me profit Immediately or I should wait for still expiry

And the last one is my p&L will be decided by premium price what I bought I bought for 29 and when I exit the trade it can be 30 so my profit will be 1 +lot

YOu can book the profit at any time, no need to wait till expiry. Yes, you will make 1/- i.e. the difference between buy and sell price of the premium.

Sir can we sell buy put before expire and buy sell put before expire.

Reply please sir.

Yes.

Pl clarify

If I in option, I write/sell put of June 24 @19.30 premium (I will receive) e g

Hdfc Ltd June 2200 PE

(june24 ,2021)

Can I take delivery if strike price is attained after paying 2200×300 + commission of delivery before June 24 if possible reply on my e mail I will be grateful

No Deepak, physical delivery of shares happen only upon expiry of the contract, not before that.

Can a writer of put (seller of put)have/obtain delivery of a lot he is writing/selling put option at strike price after full payment of a lot

Yes, upon expiry he/she can.

I have done option writing on voltas 2 days back and on that day my position profit was Rs1000 and my fund was Rs40000 and when I saw today my position profit is Rs3000 but my funds was Rs26000. I am not able to understand the reason. Can you explain it?

And also while exiting this trade it require Rs 12000 on 2 days back and yesterday it showed Rs25000 and today it shows about Rs1100. This also I wasn\’t able to understand. Can you explain this?

Maybe you had another open position, please do check with the support team once.

Last week I had sold a NIFTY put option – Spot was 14800 at a strike of 14650 and premium received was Rs 60. I let the put expire and on closing on Thursday it was Rs 0.05 Premium and It did not reduce to 0. Why is this so as i expected the put to expire worthless to 0. If it had expired to Rs0.05 what is the implications to me in terms of profit and taxes if any?

The closing price will be 0, please check the settlement price.

Wheather it is beneficial if I sell both put option &call option of next month in NIFTY or BANKNIFT

Depends on multiple factors, Shivaji.

I want to know can I buy share through option selling, Suppose I have analyzed Reliance Industries is a perfect but at 1850 currently it is 1931 so I sell put option of strike price 1860 if it will reach that I want to exercise my sell put option and want to take delivery by adjusting the amount which I have opt for put selling

Yup, you can either sell PUT or buy 1850 CE.

Sir plz tell me ,if spot banknifty is 22300 and if one person sell 22300 PE and second Person sell 22700 CE

Then what is view of these person

Spot price: 22300

1) sell 22300 PE – market will be bullish ( and will not go below 22300 )

2) sell 22700 CE – market will not go above 22700

Both option will expire worthless.

Kartika good evening I have a question

Contract buyer in both put and call optiond if he sells contract before expiry or on the date of expiry why does he needs to keep margin.

Margin has to be kept by seller of contract put or call. Please explain. Who all have to keep margin when and why

Margin is not required for squaring off the position. But at times when you have multiple positions open, then it maybe possible that the position that you are closing had hedged another position (hence reduced margin) and with the closure of one position, margin requirement may get back to normal. Which means more margin from you would be required.

if I sell a put or a call option, when is the premium credited to my account and if the premium is immediately credited to my accounnt I immediately buy back the positions as the profit would remain fixed(is this correct) as because why should I wait for the market to move if I immediately receive the premium in my account

Yes, but when you close the position the premium is also deducted from you. Essentially you make the difference between the buy and sell price of the premium.

I have sold a put option and it expires worthless today but my net margin is in negative. When will i get the premium amount and why is my net margin is showing me -ve just from before expiry and on the day of expiry ? Should i have to add margin ? Please help me out…

Settlement is on a T+1 basis. DId you have any other positions?

Hi Karthik

Can you give a thumb rule/generalisation for the strike prices w.r.t to spot price when

a) buying call

b) selling put

Have generalized quite a bit in this entire module 🙂

If I hold for example SBI 3000 shares (as delivery) and sell put option of SBI, then in this situation is it also necessary to have sufficient margins (to be blocked), despite I have one lot size of SBI shares ?

If I hold for example SBI 3000 shares (as delivery) and sell put option of SBI, then in this situation is it also necessary to have sufficient margins (to be blocked), despite I have one lot SLsize of SBI shares?

Yes, margins will be required.

Put sell in stocks – What happens when strike price is reached . Does exchange allows to use margin blocked for buying shares? If I decide to take put sell option of baja fin services of ( spot 9800) say at 8800 and 80 thousand is blocked as margin . If strike price is reached I would like to buy 125 shares at 8800 . Or this is separate decision to be taken and margin is released only after expiry . In case price falls to say another 1000 , will broker charge additional margin even if I buy shares ?

The margin will continue to be blocked till the position is open.

You are using the term breakdown point in most of your texts above. The correct term should be breakeven point, which you have used initially. I suggest that this needs correction. Breakeven point is always considered as no profit – no loss in all business transactions.

Sure, Vijay. Let me see what I can do about this.

Hi, I purchased ICICI BANK PE 580 25 Mar 2021 at 6.25 and sold it at 7.65 same day on 17 Mar 2021. I am new to this options trading. Current ICICI Bank price ia 589. Is there any issue for me on margin to pay? Kindly reply.

Not really since you squared off the position and you are out of the market.

I don\’t understand a fundamental point here. How can sell something which we don\’t have? Like selling a put option when I never bought it?

Thats essential like buy – sell transaction, just that the transaction happens in reverse order.

Sir I have this question about settlement. Suppose I opt for put sell and that option is ITM for buyer then I\’m obliged to receive the shares in a physical settlement that is shares in my demat account or cash based settlement.? And for F/Os which type of settlement does NSE and BSE follows?

Thats right Soniya, you are eligible to receive the shares in your DEMAT, provided you have enough margin blocked in your trading account.

Hi,

Can you please suggest on the possible actions for the below use case..

ABC Stock Option Expiry –> Date –> Spot Price –> Strike Price –> Premium Received –> Action

25th FEB –> 1st FEB –> 920 –> 950 –> 70 –> Sell PUT.

25th FEB –> 24th FEB –> 890 –> 950 –> 70 –> Position in 10 profit and tried square-off but NO SELLER available.

25th FEB –> 25th FEB –> 960 –> 950 –> 70 –> What will happen to my put option, as my strike becomes OTM?

25th FEB –> 25th FEB –> 870 –> 950 –> 70 –> What will happen to my put option, as my strike becomes ITM?

25th FEB –> 25th FEB –> 890 –> 950 –> 70 –> What will happen if I don’t square-off and broker auto square off, seller available at 100 premium?

25th FEB –> 25th FEB –> 960 –> 950 –> 70 –> What will happen if I give consent for physical delivery but I don’t have sufficient funds in my trading account for delivery?

No sellers – order won\’t go through

Premium reduces

Premium increases

It Will be squared off at 100

The position will be squared off.

Hi Sir,

I am getting what is mean by call option and put option with respecive of sell and buy, but here is my quetion

suppose i have buy call option at 18400 and its gone upto 18600 and then expiry date is come, so here i got, i have right to buy stock at 18400 as per contract buy call option, so should I claim to buy this at price 18400 from seller at the expiry date or broker itself settel this with both buyer and seller account?

The settlement will happen from the broker, Swapnil.

Suppose I sell a a put option for Rs. 580 in the morning and buy it back in the afternoon when the price becomes 520, what is the gain ?

580-520 = 60.

Thanks Karthik for detailed explanation. I have a question on put option selling.

Lets say I write a put option with below:

Stike: 950, Spot: 920, Premium received: 70

At this point, my pnl is 30. As seller has obligation, Can I still exit with 30 premium profit, if other sellers are available. Or do I need to wait till the expiry.

What are all the possibilities for a seller if he want to exit before expiry.

Yes, you can square off your trade anytime you wish. There is no need to wait till the expiry of the series.

Hi Kartik,

I sold put option of ITC with strike price of 220 in this month. Today it closed @ 217.

I guess currently this is ITM option. Let\’s say it closes on 215. Then it is compulsory to buy ITC in physical settlement.

1. Is there any penalties in case I need to buy ITC @ strike price. As, I sold without any shares in my demat account.

2. What is best way to avoid loss/ physical settlement. Should I buy call option of same strike price. Then no need to go for physical settlement.

3. I collect the premium of ₹6 in this put writing. So my break even is 220-6= 214. Let\’s say it closes 217 on expiry day then also I need to do physical settlement.

Thanks in advance

1) No penalty, this is a part of the regular settlement process.

2) Yes, as long as both options are ITM, it will get netted off and no physical delivery.

3) YEs, you will have physical delivery.

I have sold put and kept margin money. Do I need to keep full margin during expiry (if not squared off before) even if it is well above strike price? For ex: I have sold Feb HUL put of strike price 2000, currently stock is hovering around 2240. On 25-26 (just before expiry), what would be margin required? Will it be 2000*300= 6 lac?

Yes, you need to ensure margins are fully available in the week leading to expiry.

if we are doing put option selling, if our loss gets exceed the margin we paid,it will get auto square off or not? please tell me.

Yes, it will.

I have a SELL PUT done for Reliance for 1 lot. On expiry day if in loss, i plan to close this by taking deliverables of the stock . How can i do it on Zerodha app?

You have to ensure there is enough margin to take delivery of the stock, rest the system/process will take care.

What does OTM MEANS

Please check this – https://zerodha.com/varsity/chapter/moneyness-of-an-option-contract/

Hi. I have a question in cash secured put ..for example if I sell HUL put option for Feb expiry and if price goes below strike price..need to know how I can buy in cash delivery..tks

You will have to ensure there is enough cash as margins as you approach the expiry, and the settlement process will take care of the rest.

Hi Kartik ,

As i see it buying a call option has a finite downside compared to selling a put option.

That and the difference in premium are the two diffrentials.

Am i correct?

True, thats right Sanjiv.

Hi Karthik,

When should we exit to get profit in selling put .can we exit immediately after selling put to get profit? Can we do intraday .

Yes, you can Manoj.

If i buy an put option at 114 and it rises to say 200 so am i in profit or loss i am new in options market please help

That would be a loss, Harshil.

Please help me understand the above points…

Do check the previous comment.

Hello

TRYING TO Understand PUT Selling, say, I HAVE SOLD INFY PUT OF 1180 STRIKE PRICE and Again bought PUT Infy 1100 strike price of same expiry

1.what is my maximum loss and profit?

2.If the position moves against me will broker square off my position?do I have deposit additional margin?

3.On the day of expiry stock price is below 1180 and above 1100 how things will be settled…what will happen?

shall I shall the 1100 position and buyback 1180 position or Broker or Exchange will do that?

4.if price moves below both 1180 and 1100 then what happens

5.Do I have to take physical delivery or will it be cash settled on day of expiry..in cas stock price is below 1180

?

what happens to the 1100 PE I bought?

This creates two different positions, Deven.

1) I\’d suggest you use the Sennsibull P&L calculator for this

2) You can hold as long as you have the margins with you

3) The strike which is ITM goes into the physical settlement, the other expires worthless. If both are ITM, then they net off.

4 & 5) Same as above

What we be the margin requirement if I sell put in bank notify

Please check this – https://zerodha.com/margin-calculator/SPAN/

Hello all,

What happens if I sell put option 3 days before the expiry? (Case:- BANKNIFTY is partially or violently bullish)

What about time decay and delta values? Will it be favourable to the seller or buyer?

Please someone clear by doubt!

The theta acceleration will be higher closer to expiry provided the stock is not trending down. So it maybe favourable to write. However, on a personal note, I\’d avoid writing put options.

You are saying that the loss potential in selling a put option is unlimited, which I believe is not correct. This is because there is a limit for loss which is Premium Received – (Strike Price – 0), because the minimum price a stock can reach is 0. Please clarify.

Thats right, but if you do the math, you\’ll realise that the loss will be few lakhs per lot.

test

Sir,

You are doing good work by sharing your priceless knowledge.

Thank you😊

Happy learning, Niraj!

What if I SELL call option n it becomes zero before expiry

I shorted a lot of 5nov 27000 put option at 688.6a nd exipry day I have buy it due to some reasons…closing price is at 685.

So now what happens…would I get difference of 3*25 alon with my premium paid ?? Or I loss total 688.6*25 ??

YOu shorted at 688 and bought back at 685, so you make a profit of 3, but this will get offset against the applicable charges. May even result in a loss if the charges are higher than the profit you made.

Hello Karthik

If i have a 2500 call option for reliance for nov expiry, what can be my strategy to maximise profit by selling a put option.

Should i:

Sell a put option at strike 2200 (current premium 224) and also by a same strike call (straddle) for a premium of 38

That would reduce the overall profitability. What is your target? Maximize profit potential or contain risk?

Hi Kartik,

Can you please help me to understand how PUT writing stop loss is working.

For Eg.

If I write Bank Nifty PE 24400 and collect the premium of 131. My target 60 and SL is 160.

Write @ 131, SL 160, and target @ 60 is write in terms of trade setup, Jeevak.

If I am trading company shares(not nifty) and if my put selling hit the strike price, do I need to buy the stocks? can you explain the loss scenario?

If you hold to expiry, then yes, you will have to give delivery of this. Do check this chapter on the physical settlement – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

Why I shouldn\’t buy the value of share 0.05 in nifty option in both Call & Put optiin.Please suggest

The chances of losing 0.05 are higher than making profits out of it.

what happens if I don\’t have money to buy the shares after selling put options? should i pay the money before?

I\’m guessing you are asking this in the context of physical delivery. In the absence of margins, the position will be closed.

I have a query on how do we exit put writing position? E.g. as in above case where strike price is rs 18400 now any time before expiry strike price goes below rs 18400, can i exit that position to limit my losses? If yes, how do I do that? Do i need to buy put of rs 18400 at that point of time at whatever premium it is sold? Since it is before expiry so will theta value be added to IV to arrive at likely premium at that point of time? Can i manage the risk by buying the put at higher strike price?

Thats right, you can choose to sell the position anytime you wish. To square off, you just have to buy back the option by paying the premium.

Whether i can sell stocks on T 2 day after expiry of in the money put option

Yes, you can once its in your DEMAT.

Hi, I would like to know the short put delivery in case of I have exercised the short put before expiration and received the premium. In kite I am not able to see the short positions so not sure what is the next action item for me.

Your response will be appreciated.

Thanks,

Tush

Exercising the option happens only on the day of the expiry and not during the series. I suppose you have bought and sold the Put option hence the position is zero.

Please confirm on this part

Spot of Tata motors is 150

if I do cash secured put keeping mind at 135 strike price for premium approx @5 if suppose market went bearish and Tata motors reached 100 so my premium for sell put 135 strike will be approx 35

if I have sufficient funds to buy the lot and take physical delivery so in my demant I will get the lot at rates of 135

but on expiry do I have to bear the 35 premium loss

Please explain this with an calculation wat will be amount debit on my account on expiry day

when I am read to take the physical delivery

account will be debit for 135 * 5700 lot size and also for loss of 35* 5700 premium

Since this is a PUT sell, you will have to take delivery of shares at 135. So your net obligation will be 135*lot size.

Could we close the covered put before expiry? Let’s say I collected $300 for strike price of $1000 and the stock price already moved to $1500 so could I close the contract ?

Yes, you will be settled according to the prevailing premium.

Hi,

I found all these modules very helpful. Thanks for your efforts on it.

I also found the queries / comments from other readers helpful. My only query is that, to read the latest query, I need to come all the way down. Instead isn\’t it possible to have latest query on the top and then the old one. Just a kind suggestion if it\’s possible and it will benefit to other users as well.

Regards,

Ajit

Thanks Ajit, we just had a major overhaul on Varsity. Will share the feedback with the team anyway.

Sir, I have ZERODHA ACCOUNT I want to know if I sell Reliance 1800 Strike price PUT and if Reliance goes below or = 1800, in such case if I want to take delivery of these shares then what is the process in ZERODHA PLATFORM. I will keep sufficient funds in my zerodha account. Please let me know.

Thats right, you will have to ensure you maintain sufficient delivery margins.

Hii Karthik,

Please guide me. Suppose I short ICICI 350 PE @ 8 when spot was 370. Due to increase in Volatility spot price decline to 362 and premium increased to 12.

Although the spot price is well above my strike price but premium increased sharply. Does the broker ask me for more margin money in this case if I continue to hold the position?

The broker will ask for margins only if the premium has increased quite a bit. In this particular case, I don\’t think the margin will increase a great deal.

So i will lose/gain money depending on the situation and i wont have to give/take delivery as far as my option is not naked….right?

Yup…as as long as the physical delivery requirement is offset.

hello kartik,

My question is, if we have a multi leg strategy on a stock and on the date of expiry one of its leg ends itm then what will happen….physical delivery or cash settlement

For example– Reliance is now at 2132

Now i am selling a 2100 PE and then buying a 2000 PE to get the margin benefit, now what will happen if

1) The 2100 PE expires itm on expiry? (reliance is at 2050 on expiry)

2) There is still a week or two left before the expiry and reliance is already 1900….

What will happen in such cases? Will i have to buy the reliance @2100 in case number 1 or will i have to give the delivery for reliance for my buy option…Please guide me as i want to take some strategies in stock options ….

Also please make a module on firefighting and adjustments(Roll over,etc) when our view goes wrong which it will someday

1) The position will be offset, check this – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

2) Physical delivery is only upon expiry, before expiry there is no physical delivery

Hi Mr. Karthik,

While searching some topic, I happened to see this page. You are awesome..!! You have lots and loads of patience to answer to each and every question, which is so admirable. The way you explain the topic is amazing.

I am new, but know some basics. I will go thru all the topics. Kindly let me know the link if any. Happy to learn from you. Thanks a lot again !!!

Thanks for the kind words, Natarajan 🙂 Happy learning. Do let me know if you have any queries.

Sir i have buy 31st fri 2020, PUT of 10800 of 6th Aug. what is the next stratergy? can hold or exit?

What do you expect from markets? If you think markets will fall, then hold the put. If you think market will go up, then exit the position. So this really depends on what you expect.

Thank you Karthik for your time in clarifying our doubts.

Btw, I meant NIFTY Aug6th 11500CE weekly expiry option contract in question 2 :). I believe that contract expires on August 6 😉

Ah ok 🙂

Hi Karthik, some new set of questions I like to clarify

Assume I sell 1 lot NIFTY Aug6th 11500CE on monday August 3rd having required margin of 1.3lacs. Spot at 11120

Premium is say 20Rs. So 75*20 is total premium I reveived excluding other charges.

Next day, Nifty goes up to 11230, so the premium of 11500CE might hv increased and let\’s say it is 32 now.

1. So in this case, will required margin be revised and I need to add more balance to my account since the premium increased ?

2. Finally assume, Nifty closed on 11370 on Aug 6th expiry. My profit will be the premium 75*20 . Correct?.

3. In case of nifty, can we say all options are naked , because no one will be actually owing underlying nifty , as opposed to stock of company like TCS, IOC etc . Right? ,

4. If the writer of Nifty PUT option loses money, will buyer of PUT option exercise his position and sell the actual nifty index to writer?

If answer to 4th question is related to hedging, plz share link if any to learn more about hedging.

Thank you once again for all your time and effort to answer our queries.

1) Yes, but for such a movement, the change in the margin will be really small. The existing margin block should cover for it

2) Yes, btw Aug expiry would be on Aug 27th, not Aug 3rd

3) No, a naked trade is when you are exposed to directional risk. For example, short Nifty 11500CE is a naked trade. But short nifty 11500CE and 11300PE is a spread position

4) Nifty is cash-settled so the differential money goes from seller to buyer

Thank you Karthik for the superfast update. I have been going through Option modules in Varsity. Such an exhaustive read especially the chapters on Option Greeks. Thank you Karthik and the team for this great work of sharing the knowledge and helping us to understand Markets and Trading better. It keeps us motivated and guide us to continue learning.

Learning never stops.

Thank you Zerodha team !!!!

Happy Reading!!!

Absolutely, learning never stops 🙂

Hi Karthik,

I have a similar question w.r.t to margin requirement to Sell PE options.

Premium of Jul 11000 PE was 0.45.

Nifty Spot was 11285

To sell 2 lots of Nifty Jul 11000 PE using NRML on 30th July 2020, the margin required is 2,64,426

To sell 2 lots of Nifty Jul 11000 PE using MIS on 30th July 2020, the margin required is 68438

Question 1 : Why does NRML and MIS margin requirement vary even on the day of expiry ?

Question 2 : If margin required is 68438 for intraday Nifty Jul 11000 PE, the Spot has to close 450 points below 11000 after which the writer starts to make loss.

Assumption : Nifty close at 10650 then loss for writer is 150*450 = 67500.

Why is such high margin required when it is quite rare to see Nifty loose 500+ points in a single day ?

Appreciate your feedback and comments.

Thank you

A % factor is set for product type (MIS/NRML), which does not change based on expiry day. I get your point, but that just leads to an operational nightmare for brokers. As far as the % movement of Nifty is concerned, we have seen 500 points move one too many times, especially early in this year right 🙂

As you said earlier that MIS order will get square off anyway. Does I have to pay automatic square off charge for that?

Thanks.

No, but if you do not square off the MIS yourself, then auto square off charges are applicable.

Hi Karthik,

I am doing options trading from past 2 months in Zerodha. I mainly Sell deep OTM PE and deep OTM CE. On expiry premium remains 0.05 or 0.10. Question is – If I do not square of my position is there any charges like automatic square off charge or any other charges in the following cases:-

1. Sell deep OTM PE or deep OTM CE (remains OTM at end of expiry) with order type MIS.

2. Sell deep OTM PE or deep OTM CE (remains OTM at end of expiry) with order type CNC.

Thanks.

No, you cal let these OTM options be without square off, its ok. But if its MIS, it will get squared off anyway.

Hi Karthik,

Thanks for you reply.

Idea here is I will hold those share for some time and sell when right time comes. That way I can save myself from big loss.

Can you please guide how to buy those stocks in same position in Zerodha. Service brokers like hdfc security provide that facility.

Not sure how that can be done in Zerodha.

Regards,

Vikas

Got it. In that case, you just have to ensure you have the margins to buy. Do check this – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

M bank nifty jul 22900 ce sell m book karta hu 1000 rs m or wo 700 aa gyi to usey exit kaisey karege or kya normal m lekar next day posting m show karega ya same day exit karna padega

If i have sold a put but stock price has fallen enough. At the expiry instead of booking loss I want to buy the stocks and keep them. How can I do that in Zerodha?

Vikas, if you\’ve sold a PUT, then you want the market to stay flat or increase. In every other circumstance, you will have to book a loss. In this case, you will have to buy the stock at a higher price, so that\’s a loss again.

Hi karthik,

Today morning I short the NIFTY 09JUL2020 10700CE with premium 130.19/- ,when the nifty is trading at 10800 .so my breakeven point is 10700+130=10830.

1.Nifty crossing after 10830 only I make loss right?But today morning when nifty is still in 10820-830 ,it is showing me \’-ve\’ in P&L,why is that?

2.Howmuch money will I get as profit (max)if nifty close exactly at 10750 tomorrow?

(130-50=80;75*80=6000(profit),Is this correct answer?)

1) The calculation you mentioned is true for expiry, not before expiry

2) YOu will lose 30 and retain 80 from the premium received.

Today is expiry day. When I try to sell 21900 option under \’NRML\’, Zerodha says that Margin required as \’83000\’. But, if I change the type to \’MIS\’, the margin reduced to \’35000\’. On an expiry day, both \’NRML\’ and \’MIS\’ should be treated as same since you cannot take your positions overnight and it will squared off the same say. Is there any difference ? Please correct me if my understanding is incorrect. Thanks.

If I have an NRML open, then I would close the same. But yes, you are right, NRML will be closed by 3:30 on expiry day.

Hi Karthik,

I have a question to ask long time in my mind, please do clarify it.

For instance, xyz market price is 100rs i am selling Call option with strike price 105rs at a premium of 1rs on expiry date or two days before expiry date assuming the price wont spike. However on expiry the price decayed and came to 0.5 and standing in profit but i dont have buyer to trade on expiry date. Will the broker square off my trade and credit my profit along with square off charges or what happens further.

Please bare with the explanation, i believe u understood. Kindly response.

Thats right Bala, if on expiry the option is worthless i.e. it is trading less than 105, then you get to retain the entire premium. The broker will settle this for you.

Hi Karthik, regarding margins for selling cash covered put. For example: if I sell SBIN JUL PE @ 175 for premium of 5rs/share (current price is 185), what are the margins (cash/collateral) that are required to be maintained? How do these margins change over time as we move closer to expiry?

The zerodha page for FnO delivery suggests that 10% margin is required E-4 days etc. but the margin required to sell this option already shows ~30% (1.6Lakhs) on June 29th although the expiry is only 30th July.

Arun, check this for margins – https://zerodha.com/margin-calculator/SPAN/

This for how margins change as we approach closer to expiry – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

Okay understood, thank you! So in this case my profit/loss will be the difference between the two premium values, right? I can receive a profit of the full premium at which I sold only if I wait until expiry, right?

That is correct.

This might seem like a silly question. Please correct me if I am wrong.

Can\’t I sell a put option, collect the premiums, and then exit the position by squaring off?

Or is that only allowed when buying an option?

Yes, you can do that. While you exit the position, you will have to buy back the option. When you buyback, you make a profit if the premium has gone lower from the price at which you sold, else you will make a loss.

Isn’t it a good strategy to sell put at an attractive price far below the spot price with a return of 12-15% on margin money as premium, supported by purchasing power to buy the underlying shares at the strike price, if the spot price falls below the strike price?

A small correction, return of 12-15% p.a. on margin money.

Like I mentioned, when markets correct (like in early March 2020), this strategy will bleed and wipe your account clean.