8.1 – Intrinsic Value

The moneyness of an option contract is a classification method wherein each option (strike) gets classified as either – In the money (ITM), At the money (ATM), or Out of the money (OTM) option. This classification helps the trader to decide which strike to trade, given a particular circumstance in the market. However, before we get into the details, I guess it makes sense to look through the concept of intrinsic value again.

The intrinsic value of an option is the money the option buyer makes from an options contract provided he has the right to exercise that option on the given day. Intrinsic Value is always a positive value and can never go below 0. Consider this example –

| Underlying | CNX Nifty |

|---|---|

| Spot Value | 8070 |

| Option strike | 8050 |

| Option Type | Call Option (CE) |

| Days to expiry | 15 |

| Position | Long |

Given this, assume you bought the 8050CE and instead of waiting for 15 days to expiry you had the right to exercise the option today. Now my question to you is – How much money would you stand to make provided you exercised the contract today?

Do you remember when you exercise a long option, the money you make is equivalent to the intrinsic value of an option minus the premium paid. Hence to answer the above question, we need to calculate the intrinsic value of an option, for which we need to pull up the call option intrinsic value formula from Chapter 3.

Here is the formula –

Intrinsic Value of a Call option = Spot Price – Strike Price

Let us plug in the values

= 8070 – 8050

= 20

So, if you were to exercise this option today, you are entitled to make 20 points (ignoring the premium paid).

Here is a table which calculates the intrinsic value for various options strike (these are just random values that I have used to drive across the concept) –

| Option Type | Strike | Spot | Formula | Intrinsic Value | Remarks |

|---|---|---|---|---|---|

| Long Call | 280 | 310 | Spot Price – Strike Price | 310 – 280 = 30 | |

| Long Put | 1040 | 980 | Strike Price – Spot Price | 1040 -980 = 60 | |

| Long Call | 920 | 918 | Spot Price – Strike Price | 918 – 920 = 0 | Since IV cannot be -ve |

| Long Put | 80 | 88 | Strike Price – Spot Price | 80 – 88 = 0 | Since IV cannot be -ve |

With this, I hope you are clear about the intrinsic value calculation for a given option strike. Let me summarize a few important points –

- The intrinsic value of an option is the amount of money you would make if you were to exercise the option contract

- The intrinsic value of an options contract can never be negative. It can be either zero or a positive number

- Call option Intrinsic value = Spot Price – Strike Price

- Put option Intrinsic value = Strike Price – Spot price

Before we wrap up this discussion, here is a question for you – Why do you think the intrinsic value cannot be negative?

To answer this, let us pick an example from the above table – Strike is 920, the spot is 918, and option type is a long call. Let us assume the premium for the 920 Call option is Rs.15.

Now,

- If you were to exercise this option, what do you get?

- Clearly, we get the intrinsic value.

- How much is the intrinsic value?

- Intrinsic Value = 918 – 920 = -2

- The formula suggests we get ‘– Rs.2’. What does this mean?

- This means Rs.2 is going from our pocket.

- Let us believe this is true for a moment; what will be the total loss?

- 15 + 2 = Rs.17/-

- But we know the maximum loss for a call option buyer is limited to the extent of the premium one pays; in this case, it will be Rs.15/-

- However, if we include a negative intrinsic value, this property of option payoff is not obeyed (Rs.17/- loss as opposed to Rs.15/-). However, to maintain the non-linear property of option payoff, the Intrinsic value can never be negative

- You can apply the same logic to the put option intrinsic value calculation

Hopefully, this should give you some insights into why the intrinsic value of an option can never go negative.

8.2 – Moneyness of a Call option

With our discussions on the intrinsic value of an option, the concept of moneyness should be quite easy to comprehend. Moneyness of an option is a classification method that classifies each option strike based on how much money a trader will make if he were to exercise his option contract today. There are three broad classifications –

- In the Money (ITM)

- At the Money (ATM)

- Out of the Money (OTM)

And for all practical purposes, I guess it is best to further classify these as –

- Deep In the money

- In the Money (ITM)

- At the Money (ATM)

- Out of the Money (OTM)

- Deep Out of the Money

Understanding these options, strike classification is very easy. All you need to do is figure out the intrinsic value. If the intrinsic value is a non zero number, then the option strike is considered ‘In the money’. If the intrinsic value is a zero the option strike is called ‘Out of the money’. The strike, which is closest to the Spot price, is called ‘At the money’.

Let us take up an example to understand this well. As of today (7th May 2015) the value of Nifty is at 8060, keeping this in perspective I’ve taken the snapshot of all the available strike prices (the same is highlighted within a blue box). The objective is to classify each of these strikes as ITM, ATM, or OTM. We will discuss the ‘Deep ITM’ and ‘Deep OTM’ later.

As you can notice from the image above, the available strike prices trade starts from 7100 all the way upto 8700.

We will first identify ‘At the Money Option (ATM)’ as this is the easiest to deal with.

From the definition of ATM option that we posted earlier, we know, ATM option is that option strike which is closest to the spot price. Considering the spot is at 8060, the closest strike is probably 8050. If there were an 8060 strike, then clearly 8060 would be the ATM option. But in the absence of 8060 strikes, the next closest strike becomes ATM. Hence we classify 8050 as, the ATM option.

Having established the ATM option (8050), we will proceed to identify ITM and OTM options. To do this, we will pick a few strikes and calculate the intrinsic value.

- 7100

- 7500

- 8050

- 8100

- 8300

Do remember the spot price is 8060, keeping this in perspective the intrinsic value for the strikes above would be –

@ 7100

Intrinsic Value = 8060 – 7100

= 960

Non zero value, hence the strike should be In the Money (ITM) option

@7500

Intrinsic Value = 8060 – 7500

= 560

Non zero value, hence the strike should be In the Money (ITM) option

@8050

We know this is the ATM option as 8050 strike is closest to the spot price of 8060. So we will not bother to calculate its intrinsic value.

@ 8100

Intrinsic Value = 8060 – 8100

= – 40

Negative intrinsic value, therefore the intrinsic value is 0. Since the intrinsic value is 0, the strike is Out of the Money (OTM).

@ 8300

Intrinsic Value = 8060 – 8300

= – 240

Negative intrinsic value, therefore the intrinsic value is 0. Since the intrinsic value is 0, the strike is Out of the Money (OTM).

You may have already sensed the generalizations (for call options) that exists here, however, allow me to restate the same again

- All option strikes that are higher than the ATM strike are considered OTM

- All option strikes that are below the ATM strike are considered ITM

In fact, I would suggest you relook at the snapshot we just posted –

NSE presents ITM options with a pale yellow background, and all OTM options have a regular white background. Now let us look at 2 ITM options – 7500 and 8000. The intrinsic value works out to be 560 and 60, respectively (considering the spot is at 8060). Higher the intrinsic value, deeper the moneyness of the option. Therefore 7500 strikes are considered as ‘Deep In the Money’ option and 8000 as just ‘In the money’ option.

I would encourage you to observe the premiums for all these strike prices (highlighted in the green box). Do you sense a pattern here? The premium decreases as you traverse from ‘Deep ITM’ option to ‘Deep OTM option’. In other words, ITM options are always more expensive compared to OTM options.

8.3 – Moneyness of a Put option

Let us run through the same exercise to find out how strikes are classified as ITM and OTM for Put options. Here is the snapshot of various strikes available for a Put option. The strike prices on the left are highlighted in a blue box. Do note at the time of taking the snapshot (8th May 2015) Nifty’s spot value is 8202.

As you can see, there are many strike prices available right from 7100 to 8700. We will first classify the ATM option and then proceed to identify the ITM and OTM option. Since the spot is at 8202, the nearest strike to spot should be the ATM option. As we can see from the snapshot above, there is a strike at 8200 which is trading at Rs.131.35/-. This obviously becomes the ATM option.

We will now pick a few strikes above and below the ATM and figure out ITM and OTM options. Let us go with the following strikes and evaluate their respective intrinsic value (also called the moneyness) –

- 7500

- 8000

- 8200

- 8300

- 8500

@ 7500

We know the intrinsic value of the put option can be calculated as = Strike – Spot.

Intrinsic Value = 7500 – 8200

= – 700

Negative intrinsic value, therefore the option is OTM

@ 8000

Intrinsic Value = 8000 – 8200

= – 200

Negative intrinsic value, therefore the option is OTM

@8200

8200 is already classified as an ATM option. Hence we will skip this and move ahead.

@ 8300

Intrinsic Value = 8300 – 8200

= +100

Positive intrinsic value, therefore the option is ITM

@ 8500

Intrinsic Value = 8500 – 8200

= +300

Positive intrinsic value, therefore the option is ITM

Hence, an easy generalization for Put options are –

- All strikes higher than ATM options are considered ITM

- All strikes lower than ATM options are considered OTM

And as you can see from the snapshot, the premiums for ITM options are much higher than the premiums for the OTM options.

I hope you have got a clear understanding of how option strikes are classified based on their moneyness. However, you may still be wondering about the need to classify options based on their moneyness. Well, the answer to this lies in ‘Option Greeks’ again. As you briefly know by now, Option Greeks are the market forces which act upon options strikes and therefore affect the premium associated with these strikes. So a certain market force will have a certain effect on ITM option while at the same time, it will have a different effect on an OTM option. Hence classifying the option strikes will help us in understanding the Option Greeks and their impact on the premiums better.

8.4 – The Option Chain

The Option chain is a common feature on most of the exchanges and trading platforms. The option chain is a ready reckoner of sorts that helps you identify all the strikes that are available for a particular underlying and also classifies the strikes based on their moneyness. Besides, the option chain also provides information such as the premium price (LTP), bid-ask price, volumes, open interest etc. for each of the option strikes.

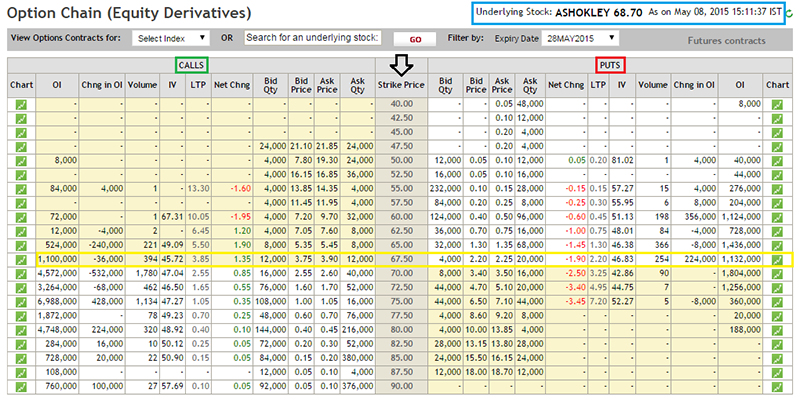

Have a look at the option chain of Ashoka Leyland Limited as published on NSE –

Few observations to help you understand the option chain better –

- The underlying spot value is at Rs.68.7/- (highlighted in blue)

- The Call options are on to the left side of the option chain

- The Put options are on to the right side of the option chain

- The strikes are stacked on an increasing order in the centre of the option chain

- Considering the spot at Rs.68.7, the closest strike is 67.5. Hence that would be an ATM option (highlighted in yellow)

- For Call options – all option strikes lower than ATM options are ITM option. Hence they have a pale yellow background

- For Call options – all option strikes higher than ATM options are OTM options. Hence they have a white background

- For Put Options – all option strikes higher than ATM are ITM options. Hence they have a pale yellow background

- For Put Options – all option strikes lower than ATM are OTM options. Hence they have a white background

- The pale yellow and white background from NSE is just a segregation method to bifurcate the ITM and OTM options. The colour scheme is not a standard convention.

Here is the link to check the option chain for Nifty Options.

8.4 – The way forward

Having understood the basics of the call and put options both from the buyers and sellers perspective and also having understood the concept of ITM, OTM, and ATM I suppose we are all set to dwell deeper into options.

The next couple of chapters will be dedicated to understanding Option Greeks and the kind of impact they have on option premiums. Based on the Option Greeks impact on the premiums, we will figure out a way to select the best possible strike to trade for a given circumstance in the market. Further, we will also understand how options are priced by briefly running through the ‘Black & Scholes Option Pricing Formula’. The ‘Black & Scholes Option Pricing Formula’ will help us understand things like – Why Nifty 8200 PE is trading at 131 and not 152 or 102!

I hope you are as excited to learn about all these topics as we are to write about the same. So please stay tuned.

Onwards to Option Greeks now!

Key takeaways from this chapter

- The intrinsic value of an option is equivalent to the value of money the option buyer makes provided if he were to exercise the contract.

- Intrinsic Value of an option cannot be negative; it is a non zero positive value.

- The intrinsic value of call option = Spot Price – Strike Price

- The intrinsic value of put option = Strike Price – Spot Price.

- Any option that has an intrinsic value is classified as ‘In the Money’ (ITM) option.

- Any option that does not have an intrinsic value is classified as ‘Out of the Money’ (OTM) option.

- If the strike price is almost equal to spot price, then the option is considered as ‘At the money’ (ATM) option.

- All strikes lower than ATM are ITM options (for call options)

- All strikes higher than ATM are OTM options (for call options)

- All strikes higher than ATM are ITM options (for Put options)

- All strikes lower than ATM are OTM options (for Put options)

- When the intrinsic value is very high, it is called ‘Deep ITM’ option.

- Likewise, when the intrinsic value is the least, it is called ‘Deep OTM’ option.

- The premiums for ITM options are always higher than the premiums for OTM option.

- The Option chain is a quick visualization to understand which option strike is ITM, OTM, ATM (for both calls and puts) along with other information relevant to options.

Query 8.3 Moneyness of a Put Option

Spot is 8202, but the example uses 8200 while explaining moneyness. Is this done because 8200 is the nearest ATM strike, or is it a mistake?

Since the spot is at 8202, the nearest strike to spot should be the ATM option. As we can see from the snapshot above, there is a strike at 8200 which is trading at Rs.131.35/-. This obviously becomes the ATM option.

We will now pick a few strikes above and below the ATM and figure out ITM and OTM options. Let us go with the following strikes and evaluate their respective intrinsic value (also called the moneyness) –

7500

8000

8200

8300

8500

@ 7500

We know the intrinsic value of the put option can be calculated as = Strike – Spot.

Intrinsic Value = 7500 – 8200

= – 700

Negative intrinsic value, therefore the option is OTM

@ 8000

Intrinsic Value = 8000 – 8200

= – 200

Negative intrinsic value, therefore the option is OTM

@8200

8200 is already classified as an ATM option. Hence we will skip this and move ahead.

@ 8300

Intrinsic Value = 8300 – 8200

= +100

Positive intrinsic value, therefore the option is ITM

@ 8500

Intrinsic Value = 8500 – 8200

= +300

Sorry, dint really get the query. Spot at 8202 makes 8200 strike ATM. Thats not a mistake.

I think there is something wrong with the calculation of IV in this chapter.

When you are calculating IV in the call part you have used the formula as strike – spot whereas it should be spot – strike.

Let me double check, but I dont think its wrong. Ppl would have pointed otherwise.

Yes You are right. It was my mistake. I got a bit confused but now it\’s clear.

Happy learning, Harsh 🙂

suppose i have nifty 24250 pe and on expiry spot price was 24240 .will i get any benefit ? and if yes what will be the costs involved?

It is 10 points in the money, so yeah, you make 10 * lot size as profits, but then after charges, it may not break even.

charges would be 20rs per side or plus stt gst etc or something more?

You can check all the charges applicable here – https://zerodha.com/brokerage-calculator/#tab-equities

In Sensibull there is a disparity of strike and spot as I use that to place order.

Anyways Thanks!

Ah ok. There must be some reason. Please do check once with them.

If bank nifty is at 51700 then as u said nearest strike to spot has to be ATM. But in monthly expiry when the spot is at 51700 then its showing 51100 as ATM. So 51100 is not the nearest strike to spot then why is evinced as an ATM on option chain ?

Are you sure? I just looked at the option chain on NSE, and the strikes look proper. Check this – https://www.nseindia.com/get-quotes/derivatives?symbol=BANKNIFTY&identifier=OPTIDXBANKNIFTY30-01-2025PE50200.00

Can you please elaborate ??

Elaborate on what? Can you please share more context?

Why is ATM of bank nifty at 51100 when the spot is at 51700 for monthly expiry series?

Nearest strike to spot 🙂

Hello Karthik,

There is a small correction needed.

*In section 8.3 – Moneyness of a Put option

You mentioned – Do note at the time of taking the snapshot (8th May 2015) Nifty’s spot value is 8202.

Based on the example of 8.2 – Moneyness of a Call option, you took 8060 as the spot price (As of today (7th May 2015) the value of Nifty is at 8060)

However for the example below you are taking 8200. 8200 is the Strike price and not the spot price 8202.

My guess is you have to change the values from 8200 to 8202 for the below areas.

Intrinsic Value = 7500 – 8200

Intrinsic Value = 7500 – 8200

Intrinsic Value = 8000 – 8200

8200 is already classified as an ATM option. Hence we will skip this and move ahead.

Intrinsic Value = 8300 – 8200

Intrinsic Value = 8500 – 8200

Apologies if I am wrong.

Hey thanks for pointing this, let me check 🙂

Hi Karthik Sir,

Thank you, I Just saw the video, Like you have spoken about Delta, Gamma and Theta (Greeks). Right from Quantifying the Stock price, Regarding volitality and First half of the month and the second half of the month (Theta). I could get some idea on it but to understand it completely i have to read the Greeks aspects. Just now completed moneyness of the option contract. Ill continue to learn the other aspects may be could understand once i read the other modules.

Please do and good luck to you Prashanth. Happy reading and do let me know if you have any queries, I\’ll be happy to help.

Hi Karthik Sir,

I Just have a Doubt on the premiums of Long Call and Short put of Ashok Leyland Option chain (in the image above).

To be on the bullish view on the stock, I have to have a long call option or the short put option Right?

Now for Ashok leyland Stock above assume i have a bullish view of Strike 75 for the future period. So the long call premium will be 1.05 and for the short put the premium will be 7.20.

My question is The long call is having less premium and the short put is having more premium. Does this make any difference? like explain this view on which side to choose.

I have a video on this topic, do check this – https://www.youtube.com/watch?v=0CnHdzTE66s&list=PLX2SHiKfualEyD05J9JsklEq1JFGbG6qJ&index=1

Good luck!

Deep in the Money Put option has a strange behaviour that when time to expiration is high (and so is interest rate, let\’s say) then the Put Value decreases. Why doesn\’t Deep in the money Call Option at low interest rates show a similar behaviour?

I came here to ask this, I can\’t quite figure out.

Put value decreases with respect to what? I\’m guessing low interest rate in economy is good for markets and therefore puts lose value?

Sir, to trade Index Options, which chart is to be referred Spot OR Futures?

I\’d suggest spot.

why is intrinsic formula for call option is different while calculating moneyness in strike price

Different from what?

What happens if my Spot price is 100 ; premium 5 and strike price is 97 – At expiry am I at ITM out OTM?

Its OTM strike.

I believe a better way to explain why IV can\’t be zero is in the case of CE if the spot price is 918 vs the strike price of 920, one will not exercise the option as he can buy stock from the market at a cheaper price (918). Since you don\’t exercise the option its IV is zero.

I agree, that explains too.

Hi Karthik,

I didn\’t get one thing – you buy call option when you expect spot price to rise and buy put option otherwise. So aren\’t ITM on call side basically a put option? ie expecting price to go down What\’s the logic here?

Not sure how you consider ITM CE as a PUT option. Can you share your rational?

Dear Karthik,

In the above situation, expiry is still one week away (07 Mar 2023) but still option was trading below its intrinsic value.

Ah, then do check for corporate actions?

Dear Karthik, I noticed a weird phenomenon in Nifty Put Option today.

Day 1 28 Feb: The PE strike price was 22300 and 1 week to expiry. Closing price of Nifty was 21951. Hence, the Intrinsic Value of this ITM put option is 349 and last traded price of the option was 409.

Day 2 29 Feb: The Nifty closing price 21982. Hence IV for 22300 strike should be 318. But option price was 281.

How can option price be lower than the IV. This was the case throughout the entire day on 29 Feb.

Can you explain why an ITM Option was trading below its Intrinsic Value though expiry is still a week away ?

This happens due to taxes that get charged to buyers, hence the market adjusts for these charges and therefore on expiry day the market value drops below the intrinsic value.

H karthik sir

I would like to Thank you for Taking such an effort to produce this learning i would really like to thank you from bottom of my heart. i appreciate your time and dedication to bring such and easy learning content

Thanks for the kind words, Mukund. I\’m glad you liked the content on Varsity. Happy learning!

indeed there are liquid strikes

Sure, happy trading!

Today NIFTY BANK spot is at 45818 but in the option chain they are showing 46100 as ATM option

Why is so far away strike shown as ATM option?

Please explain

Thanks!

Perhapse there are no other liquid strikes between spot and strike?

How to calculate otm value of an option strike from the spot

Sorry, I\’m not sure what you mean by OTM value. Can you kindly elaborate your query?

can we place stop loss while buying call option

Yes, you can.

Hi Sir,

You are doing a great job, with this full knowledge of trading you have how much max profit you make per day..do you still have deviation from the guess you make or perfectly hit it? isnt it like eating a jamun for you to make money?

No, its not like eating jamun 🙂

No one at Zerodha is permitted to trade by rules.

Hii

My question is

I have 16000 1 lot of PNB of 60 stirke rate with 26oct expirty

And current price of stock is 74.20

Currently am OUT THE MONEY

And current rate is.05

If i unable to sell those shares

Is it mandatory to physical settlements in this?

Since its OTM, you dont really have to worry about physical delivery. Physical delivery is applicable only for ITM options.

Hello Sir. Can you shed some light on \”open interest\” as many traders consider it as an important parameter ?

Hey Tejas, check this – https://zerodha.com/varsity/chapter/open-interest/

Thanks for the clarrification, could you please tell since there are 2 ATMs which one should one choose for short straddle and long straddle. I assume it will be the one that gives the best credit leading to higher BEP for short straddle. And opposite for long straddle where we choose the ATM option which can lead lowest Debit. Am I correct?

You will have to choose both, Shaunak since the strategy involves both strikes.

Hey Karthik Thank You for this chapter can you please tell which strike are we supposed to consider as ATM. The call one or the Put one because as far as I understand there can only be 1 ATM strike. If I\’m not wrong in short straddle you sell ATM call and ATM put so how do we decide which one is going to be the ATM, the first yellow strike price in call side or the first yellow strike price in put side?

Shaunak, there are two ATMs. One for CE and one for PE.

wonderful and very subtly explained. Best guide on Options, why dont you throw in a video lesson too on You tube

Here you go Manish – https://www.youtube.com/watch?v=-mO0YOTcCiQ&list=PLX2SHiKfualFiusiT9G5uE9jU3vetvW2x

If the majority of retailers and small individuals are trading in the derivative market ( especially calls and put) then what is moving the stock price because if I am right option buying and selling does not affect stock price but vice versa is true.

Its the other way actually…trading action in spot prices moves the derivatives contracts.

Hey Karthik,

I think there is a correction in the Spot Price in calculation of IV for put option in 8.3 Moneyness of Put option section.

For this example, you considered Spot price (8202) as ATM which is 8200.

@ 7500

We know the intrinsic value of the put option can be calculated as = Strike – Spot.

Intrinsic Value = 7500 – 8200

= – 700

Sanket, intrinsic value cannot be negative. Also for PE, the intrinsic value is Strike-Spot. But anyway, let me recheck this.

Very Lucid explanation.Thanks

Happy learning 🙂

Thanks karthik for making it simple

Happy learning 🙂

For ITM we know they carry intrinsic value as well as time value. But OTM option doesn\’t carry intrinsic value they carry time value. Then on a particular day before expiry during live market how do we understand that time value of an OTM strike is at its fair value or it is inflated or it is dicounted?

Its hard to figure the fair value of time. You can make an assessment on intrinsic value…but as you gain more experience across market cycles, you will develop a sense of how time should be priced. It will come to you intuitively 🙂

Thanks for the super quick reply.

I wouldn\’t be receiving any premium here as I bought a Call option, I would rather be paying premium right.

So do you mean to say incase of option selling, we can leave the option go worthless on expiry and that way we will be left with premium?

It may not be the case with option buyer is it?

Yes. Upon expiry, OTM option goes to 0 and you will be left with the entire premium to pocket.

Hello Karthik,

I went through all the comments and observed in a couple of comments where you meant – If option is worthless i.e. OTM on expiry, we can leave it as it is and it doesn\’t matter much. But my question is – doesn\’t it cause higher loss to the trader?

A hypothetical example, Say I buy a CE @ Rs50/-, Strike Price 1000/-, when Spot Price was Rs. 800/- and on expiry the Spot Price was Rs. 900/- i.e. it is still OTM, if I leave the option to go worthless, I lose Rs1000-Rs.900 =Rs.100/-. In such cases had I squared off the position I would have lost lesser isn\’t it?

I am not sure if I quoted the right example, but tried to put forth my question.

Thank You, looking eager for your explanation as usual.

So you leave the OTM option expiry as is, then you will get to retain the entire premium i.e Rs.50, if you sq off early, then you will not get the entire premium.

Sir

I am new to option trading.

Your lesson has enriched my knowledge.

Please advise about your next chapter, regarding how to choose premium while trading.

Happy learning 🙂

Thank you so much for simplifying this very precious information

Happy learning!

Hello Karthik

Today on weekly expiry i bought 42200PE Bank nifty at a premium of Rs.2 and spot price ramained around 42370 so my option was ITM and it should have some intrinsic value (30). but at 3.25 pm premium erode to almost zero. Although at the same time 42400CE premium value was Rs 9 even after -30 was intrinsic value. Now that is pathetic, it has never been taught why this should happen while options trading.

At a spot value of 42,370, the strike of 42,200PE is OTM right? It will be ITM only if the spot goes below 42200.

I have taken long position on expiry day in BankNifty 43100 CE expiry 24-11-22 at a premium of Rs 2.85 quantity 500, at that time Banknifty spot was trading around 43100.

so when banknifty spot moved up around 43122 at 15.20 pm my CE premium price didnt went up instead it was continuously decreasing.

The Zerodha kite showed the wrong data of banknifty spot and because of which it expires worthless on expiry day, even the banknifty closed at 15.30 around 43116 then also my CE premium didnt shootup.

It expired at 0.05, Because of which i have to incurred loss.

why it happened ?

Premium is a function of time, spot value, and volatility. Also, this was 16 Rupee ITM, which is practically worthless considering the statutory charge, hence the premium goes down to 0.

I bought Nifty 18350 PE on an expiry day at the premium of 35 rupees. End of the day, Nifty market value went down to 18310. But the premium was around just 8 rupees. So what happened to the intrinsic value there? I was wondering after seeing this in my position.

The intrinsic value is 40, but then the option premium gets adjusted for STT and other statutory charges and usually tends to trade at a discount.

Sir , next chapter link

How premium and price is decided

Thanks

Here is the index with links to all chapters – https://zerodha.com/varsity/module/option-theory/

hlo sir first of all happy diwali to you my question is when the spot is 8070 and the strike price is 8050 and the expiry is 15 days ahead and i buy at 8050 strike so the difference between 8070-8050 = 20 is it my profit ? please help me with this question.

Thanks and wishing you a happy Deepavali as well. The premium you\’d pay for the 8050CE will be much higher than 20, given that there is time to expiry. For example, it could be 25 or 30. You will profit only if the option price crosses the premium value you\’ve paid.

Nice explanation given…thanks zerodha team

Happy learning!

Nice. I know something from this type written which is option trading

Happy trading!

Very simplistically explained

Glad you liked it, happy learning 🙂

Hi Karthik,

This question is regarding ATM. If the spot price is 8025 and nearest strike price available are 8050 and 8000. In this case which one we need to pick as ATM. Can we take any one or is it vary based on call or put.

Regards,

Rajaram

I\’d pick 8050.

Hello, I think you have made a typo

All strikes lower than ATM are ITM options (for call options)

Shouldn\’t it be out of the money?

So assume ATM is 100, strike of 90 CE, which is lesser than 100 is ITM. 110CE is OTM.

Awesome teaching. Technically very sound.I am fully satisfied.a

Happy learning!

IMPORTANT :(please read)

FNO PHYSICAL DELIVERY –

For in-the-money Long Option positions 45% additional margin will be levied at the end of the day by the exchange for contracts expiring on 25th Aug 2022. A margin shortfall in your account will attract penalty as per the Exchange norms.

Please ensure sufficient margins to avoid penalty.

What does it means sir plz illustrate

It means the option that you hold is ITM and it will be physically settled, for which higher margins are required. You need to ensure higher margins are available in your account to continue holding the position.

What if OTM become ATM in .how to calculate benifit .. using greek

The same way pradip.

Hello Karthik Ji,

Slight correction to previous comment.

Why does the Open Interest shown in NSE option chain is different from Open Interest shown in Sensibull option chain? In fact OI numbers from these two websites are nowhere to each other. Or am I missing something to read? E.g. On 14 July 2022 at 11:22 pm OI shown on NSE open chain for Nifty Index 16000CE & 16000 PE are 1,67,185 & 2,06,550 respectively where as on Sensibull website OI for the same 16000 CE & 16000 PE are 86.3 Lakhs and 103.3 lakhs respectively. Or am I missing something to read? Please Guide.

Hello Karthik Ji,

Why does the Open Interest shown in NSE option chain is different from Open Interest shown in Sensibull option chain? In fact OI numbers from these two website are nowhere to each other. Or am I missing something to read? E.g. On 14 July 2022 at 11:22 pm OI shown on NSE open chain for 16000CE & 16000 PE are 1,67,185 & 2,06,550 respectively where as on Sensibull website OI for same 16000 CE & 16000 PE are 86.3 Lakhs and 103.3 lakhs respectively. Or am I missing something to read? Please Guide.

Thanks for this insightful publication. More of it sir. It\’s very easy to comprehend.

Happy learning 🙂

Kartik thanks for feedback, But in above calculation you have subtracted 8200 in place of 8202. regarding that am asking.

Let me check that again.

We will now pick a few strikes above and below the ATM and figure out ITM and OTM options. Let us go with the following strikes and evaluate their respective intrinsic value (also called the moneyness) –

7500

8000

8200

8300

8500

@ 7500

We know the intrinsic value of the put option can be calculated as = Strike – Spot.

Intrinsic Value = 7500 – 8200

= – 700

Hello Karthik,

Thanks for detail explanation. Here Spot price of nifty is 8202 & but in calculation ATM is subtracted.

IV =7500-8202 is correct.

Correct me if am wrong.

Thanks in advance.

Since the intrinsic value is a non-zero number, -700 will be considered 0 and therefore the intrinsic value of the strike is 0.

Point no.13 from key takeaways from chapter 8 moneyless of an option, looks confusing. It says I.V is least for deep OTMs. I.V is least I.e 0 for an ATM option and thereafter higher Strikes will have zero I.V only.

Kindly throw some more light on this.

Thanks.

Hey, checking on this Palani.

Thanks for reply sir.. I got it.

Hello Karthik Sir,

I have to ask question about deep in the money options. For example I bought 1 lot of 17100 CE of April monthly contract at 478 now I see its price have gone up to 1029. I has turned very deep ITM and I am not able to sell it. Why this is happening? is it risky to have positional

trades in monthly options when they turn deep ITM..?

The risk is liquidity risk. Its fine as long as its a profitable situation because you will get cash-settled by the exchanges. If its unprofitable and you want to sell, then no liquidity is an issue.

Sir ,

Can you please explain what happens when my stock option call goes from atm to deep itm and theres no liquidity and im unable to square off !

Example : If I bought Balramchini 380 CE when spot was at 370 @25 rs and in 3 weeks it shoots up and spot crosses 500 , im extremly profitable but theres no liquidity as its too deep ITM now : So will I be able to square off or if not then what happens on expiry ?

Thanks

Yes, this can happen. If you don\’t get an exit, hold to expiry and let the contract get settled by the exchanges.

My query why a trader will opt for premiums in OTM range, because then its IV value is negative (either in call or put)? Positive IV value what we are looking right to be in profit.

Sorry, I dint get your query fully. Can you add more context please?

Thanks a lot Karthik sir for your explanation.

Sure, happy learning Sandeep.

Dear Karthik sir,

Could you please explain what you mean by \”I usually consider ATM + 3 and deep OTM/ITM\”

in your comment above? I could not understand.

Regards

So lets say spot is at 98 and the strike is 100. Here I\’d kind of consider 100 strikes as ATM. Assuming the strike gap is 5, then I\’ll consider 105 and 110 as OTM and 115 as deep OTM (for calls). 95 and 90 as ITM, and below 90 as deep ITM. Likewise for puts.

Dear Karthik sir,

How far should be a strike price away from the spot price so as to call it a

ATM, slight OTM, Deep OTM, slight ITM and deep ITM option?

I mean what should be price difference. Kindly let me know.

Regards

Sandeep, no set formula for this. I usually consider ATM + 3 and deep OTM/ITM.

Dear Karthik sir,

In the above Dhananjay\’s query, he said Spot = 2300, Strike = 2000 and premium = 500 and on expiry day, the spot = 2200.

and premium became 300. This means that settlement amount = 2200-2000=200. Loss = 500-200=300

Even though the option expired ITM but there is a loss of Rs. 300. But when Dhananjay asked you that there is a profit of Rs. 300, you said

YES. There I have the doubt. Kidnly explain how there is profit.

I\’m assuming this is a Call option. So 2200 CE will have an intrinsic value of 200 upon expiry given that the spot is at 2200. Since premium paid is 300, loss is 300-200 = 100.

Dear Karthik sir,

How far should be a strike price away from the spot price so as to call it a

ATM, slight OTM, Deep OTM, slight ITM and deep ITM option? I mean what should be

price difference. Kindly explain sir.

Regards

महाशय कार्तिक तुमचे आर्टिकल मी वाचले मला ऑप्शनची भरपूर माहिती मिळाली आपण हेच आर्टिकल आमच्यासाठी मराठीतून उपलब्ध केल्यास फार बरे होईल धन्यवाद

Excellent explaination of options chain with illustration, thank you

Happy learning 🙂

Thank you for clarification!

Good luck!

Thank you for clarification!

I couldn\’t get the point of premium being 300.

Anyway so I will make profit here by 300 points of spot. And to enjoy this profit, I would have to go for physical settlement as option has expired ITM. Right?

Thats right, ITM options are physically settled.

Let say I bought deep ITM option of reliance whose expiry is tomorrow (1 day later). Lets assume some hypothetical figures-

reliance spot today- 2300

I bought reliance 2000 CE by paying premium of let say 500 rs.

expiry is in 1 day.

On expiry let say reliance closes at 2200. My call option will loose value. Let say it closes at 425. But still I am ITM.

What will be cashflow here? will I make profit or loss (which will be 500-425=75)?

The premium on expiry will be 300 and not 425. So in this case you get to buy Reliance spot at 2000, when spot is at 2300.

BN 37400 PE was a monthly expiring contract (Feb 24th). Technically speaking, it was just a day away for expiry. However there was another contract BN 37500 PE with the same expiry that opened at 319 and went to high at 335. So, I am not able to understand why one OTM contract turned ATM but not the other.

BN 37400 opened at 374 while BN 37500 opened at 319. Should I assume that BN 37400 was already over priced and that\’s why the change in spot did not impact its premium?

Sorry, I was not tracking BN. So where did BN expire? Was it below 37400? If yes, then 37500 premiums going up is justified right?

Hi Karthik, thank you so much for your articles. They are concise and very clear. I am a newbie and on a learning path. I have a question. Would you mind answering please?

Here is a scenario.

Date Feb 23rd 2022.

Strike BN 37400 PE

Spot 37318 (This was the low for the day)

When the spot hit 37318 on the intraday, this strike should have turned ATM and there should have been a change in the premium. But there was no change there. The strike\’s open and high just remained at rupees 374. Could you please explain this situation as to why the premium never changed?

Was it the weekly expiry you were tracking? If yes, then that\’s not surprising since the expiry is close by right?

Yeah, sorry, my mistake. This moneyness is a relative concept and hence I got confused by it.

No problem. Good luck!

Looks like the moneyness concept illustrated in this chapter for put and call options have been reversed. Do you think this is so?

Nope, its correct only Sahin. But why do you think so?

Hi all, could you grasp all of these at one read? Am a bit confused after the first read.

Give it another read, and let me know if you get stuck somewhere, will be happy to help.

Hello Karthik,

First of all thanks for your efforts. Brilliant job.

But I am still clueless how it works. If the spot price is high at the current moment , why would i not buy a call option with strike price ITM. I guess everyone would do so.

But i thought option pricing was about speculating price move beyond any OTM strike price.

What am i understanding wrong? Thanks again

Alex, there are several moving parts with options. Yes, it is about speculating beyond the price movement, but also about the time to expiry and volatility. You need to take a call on these things while trading options.

Hi,

I have recently purchased the OTM PUT option in last dec\’21 contract (Ultratech 7400put 1lot at Rs.31 premium, so my total premium is Rs.3100) since I did not square off the position on expiry day, the same was physically settled and have incurred Margin shortage ofRs.160000 . Please brief me as how this margin shortage occured . I was new to options trading and this is really confusing .

Please help

During the last week of expiry, the margins increase owing to physical delivery. I\’d suggest your read this chapter – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

Hi Karthik,

Good morning!

My sold OTM CE options has become illiquid after i bought it and if it continues to illiquid until expiry day, what will happen?

Thanks,

lingam

Well, as long as it\’s OTM, you need not have to worry about it. The issue is if it becomes ITM and you intend to sell it. Worst case, you will have to go to expiry and deal with the physical settlement.

Hi Karthik,

Good day!

Should I square off the position on the day of expiry if my sold OTM CE or PE options are still in OTM on expiry day? or can I let it expire without doing anything and get the premium?

thanks,

Lingam

Since it\’s OTM, you can let it be Lingam.

Mr. Karthik, thank you so much for helping understand the option basics

Happy learning, Deepu 🙂

Is the price OTM premium increasing slowly compare to the ITM?

Ex: Market is bullish and I am on a long call with the OTM strike price.

Depends on how quickly the spot moves. The faster the move, the higher is the premium spike of OTM options.

sorry sir, i get it now..

6. For Call options – all option strikes lower than ATM options are ITM option. Hence they have a pale yellow background

6. For Call options – all option strikes higher than ATM options are OTM options. Hence they have a white background

sir, is there some mistake or i have not understood it properly

This is correct, Sunil. No mistake as such.

Very well written and lucid

Happy learning, Rami.

Q2 If the CE price become 0.05 on Monday then i can not square off the position.

Ans 2) Yes, you can, provided the tree goes through

Can please elaborate the ans \’provided the tree goes through\’.

New Q 5 There is any penalty or magin is required to sequare off the position as we stand on the last week of expiry.

My god, don\’t know why I said the \’tree goes there\’, must be a mix up/typo. Pardon me.

What I mean is that the strike is anyway worthless, so it is ok even if you don\’t square off your position. No penalty as such.

Hi

Can you please clarify : in the above example of Ashoka Leyland option chain, if I buy call option @ Rs. 47.50 (ITM) when the spot price is 68.50.

a) Does it mean that I am betting that The under lying prices will be above/higher Rs47.50 by the expiry date.

b) what does it mean by buying ITM options.

Regards

1) That\’s correct. In fact, it holds true for any CE strike you buy

2) ITMs have a higher probability of expiring as ITM, which means to say you can exercise your right to either buy or sell shares. But of course, ITM options also command the highest premium.

Hi

If I bought Bhel 85 CE Oct @ 2 Rs and the CMP is below 85 means 75 Rs then my CE premium is reduced.

As this is last week of weekly expiry on 28 Oct 2021.

Q1 When i can square off this CE.

Q2 If the CE price become 0.05 on Monday then i can not square off the position.

Q3 When the physical delivery of stock comes in the above case.

Q4 What is role of open interest in option buying.

1) You can square off anytime, no need to wait till the expiry of the option

2) Yes, you can, provided the tree goes through

3) No

4) I\’d suggest you check this chapter – https://zerodha.com/varsity/chapter/open-interest/

What happens with the premium when OTM option converts into ITM?

Premium increases.

Awesome writing . Salute to you sir . It feels like im in the classroom . Magically written to understand it with ease . Thank you.

Happy learning, Abhijit 🙂

Very informative. Excellent stuff….great efforts. Thanks a lot.

Happy reading!

Thank you dear. You are making life simple. Keep up the good work..I used to joke options are greek and Latin for me..turned out to be having greek connections. I find future a bit non brainer but I want to learn options for hedging purpose..as any naked position is killing one unless and until you are damn sure of the direction

Surekha, wishing you all the best. Hope you find further reading easy 🙂

Sir, what should we consider to decide whether an option is ITM, ATM or OTM while deploying strategies, spot or future prices?

This depends on the market situation and the trade that you are trying to set up. The reference price is the spot.

Sir, are equity options based on spot prices or the prices of the Futures? Till now I was under the impression that equity options are based on spot prices, but today TechM closed at 1078 and its Futures closed at 1048. Sensibull is showing 1040 as ATM strike. What should we consider to decide the moneyness of options while deploying strategies, spot or future prices?

Equity options are based on the spot price. I think sensibull used the futures price to price the options.

Got it, I misunderstood it

Thanks

Sure.

Hi Karthik

please check IV in Moneyness in put option. here strike price is 8200 and spot price is changing.

it should be (Strike-spot) but it is calculated as (7500-8200).

please clarify whether it\’s a typo or am i reading it wrong?

Looks like this is for a put option, if yes, strike – spot is correct.

Hey Thanks for putting these concepts in very easy and understandable words.

Happy learning, Vinay!

Is selling options based on premium price change more profitable or letting it exercise?

There is no straight answer to this, Siddhart. Everything is based on the market situation.

Really an useful platform for the beginners who can understand the nuances of options trading.

Zerodha and in particular Mr.kartik Rangappa incite and instigate the beginners to probe this part of capital market where meticulously following, understanding and grasping the knowledge and becoming strong in such fundamentals throw up an opportunity to make it better if not big…Thanks Mr.kartik.

Happy learning, Mohan!

If the spot price is 18500, and the strike prices closest to it is 18450 and 18550 then which is at the money.

I\’d consider both in the absence of a 18500 strike.

Thank you for providing valuable info. I am reading the chapters from quite some time, just wanted to know if all the data provided is update regularly or not?

Thanks, Srinivas. Data won\’t be updated, we use the data here to explain just the concept and not to provide the data as such.

But IF BANKNIFTY SPOT IS TRADING AT 32000/-

and I buy an 33000 PE (DEEP ITM )@1000

and on expiry market closes at 32500/-

What will be my profit & loss and how I can calculate.

You will make 500 here. The difference between spot and strike is what you get.

IF BANKNIFTY SPOT IS TRADING AT 32000/-

and I buy an 33000 PE (DEEP ITM ) @1000

and on expiry market closes at 34000/-

What will be my profit & loss and how I can calculate.

IF BANKNIFTY SPOT IS TRADING AT 32000/-

and I buy an 33000 PE (DEEP ITM )@1000

and on expiry market closes at 32500/-

What will be my profit & loss and how I can calculate.

Since the market expires at 34k and you have 33K PE, the option will expire worthless and you will lose the premium paid. @32K, the option is 100 points ITM.

I have read everything till moneyness. U have explained it fantastically. Taken a lot of pain for us. I am new to stock market yet found it easy to understand Tried other platforms but urs is the best. Is there anyway i can also do practical training with u? Plz advise. Thank u

Glad you liked it, Jitendra. Unfortunately, that won\’t be possible, everything I know has been documented here. Plus I\’ll always be available to reply to your queries 🙂

Can you please simplify this statement with an example?

\”The premiums for ITM options are always higher than the premiums for OTM option.\”

I didn\’t understand it clearly.

ITM options are more valuable compared to OTM options, hence they command a higher premium.

Hello sir,

Sir you told that European option cannot be excercised before expiry but above you have traded intraday with option ce. Which one is correct ?

ty

Exercise an option is different from intraday trading of premiums.

@Karthik, You are doing a great job! God Bless!!

Happy reading 🙂

A crystal clear explanation. Thanks for making the whole learning process easier. Grateful to Zerodha varsity team.

Happy learning!

This is the type of stuff you get from a paid course. Thank you so much!

May God bless you with all great things!

Thanks for the kind words, Ankit! Happy reading.

If an option is ITM for buyer then it’s OTM for seller right ?

No, the status of the option is the same for both the buyers and the sellers.

Hi Karthik,

I am wondering about the OI Value and change in OI%. Also, I can\’t calculate the IV value from the options chain link you provided here. I shall be thankful if you shed some light on OI, change in OI, the IV value column, and the reasons why Nifty has more OI data for the OTM option compared to the ITM option? Thanks in advance.

Debayan, I guess we had discussed these in the query thread. Can you please look through the queries once, please? Thanks.

If I buy otm option and on expiry it becomes deep itm and I didn’t exit till it get expired what will be my option price . I ask this because I didn’t see any open interest on that strike .

1.price of option will be whole intensric value?

Please do read the chapter on physical delivery – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

Hi Karthik sir. I\’m a MBA student. I\’m consistently learning your varsity modules. I have seen many YouTube videos to learn about market, but non of them fulfilled my required knowledge. When i started to read your modules, honestly it gives me the essential and necessary aspects of market in lucid manner. I really loves it. Thank you so much. Eagerly waiting for your reply.

Sathish, thank you so much for letting me know, our efforts feel worth it when people like you leave such encouraging comments. Happy learning!

Karthik, I must say, you have amazing writing skill, making it lot easier to understand. Thanks a lot. : )

Thanks, Suraj! Happy reading 🙂

Subject: Physical Delivery Short Delivery Penalty STT

——–

Greetings Karthik

Hope my query finds you well. I want to know some specific insight on \’physical delivery/Short delivery\’ consequences.

*** What I know! ***

ITM Put contract – Long put exercised result in [giving delivery]

ITM Call contract – Long call exercised result in [taking delivery]

?? Query ??

ITM Put contract – What if, I just don\’t have shares to deliver ?

ITM Call contract- What if, I just don\’t have enough margin to take delivery?

In these scenarios, what precisely is the amount I will have to pay as penalty?

Considering ,

1. Wipro lot qty = 3200 | CMP = 430(on expiry) | ITM PE strike = 440 on which I was long

2. SBI lot qty = 3000 | CMP = 250(on expiry) | ITM CE strike = 245 on which I was long

although my view went correct, but my once OTM PE/CE became ITM by expiry,

so can you tell me how exactly the penalty amount is calculated here?

*STT is on short side at the rate of 0.125% of intrinsic value (how much in-the-money the option is) and not on the total contract value. But,

My confusion : Lets say SBI case, is penalty(short delivery) calculated as :

penalty = priceDifference * lotSize * lotNumber

= 5*3000*1 = 15k ~ where priceDifference = 5 (250-245) | lotSize = 3000 | lotNumber = 1

Or I will have to have margin of 3000*250 =7.5lacs in my trading ledger to compulsory take delivery?

Please help me to understand correctly the consequences, & ways to deal with such situations?

Thanks

If you dont have shares, the position will be squared off leading to expiry. YOu need to have 100% of delivery obligation i.e. lot size * strike value.

Hi, I am a little confused about the concept of ITM an OTM. As mentioned above in the case of a Call option, if the spot price is 8060(means current market price is 8060), why would someone buy a call option of say 7500. And how is it that 7500 stike price has high IV? Please explain.

IV here refers to intrinsic value. 7500 is deep ITM, traders buy this for various reasons, dependent on their strategies.

thank u….sir

Good luck!

You said this statement

The intrinsic value of an option is equivalent to the value of money the option buyer makes provided if he were to exercise the contract.

But in real… money is made based on the change in premium for that strike price during the trading hours

I am confused Kindly clear my doubt

The above statement is calculated based on the stock price

Below statement based on the change in premiums

Thats right, Rajesh. Option premiums are tradable like stocks. You can buy and sell premium and profit out of it.

Referring to CHIDA says:

April 18, 2017 at 2:20 pm

What do you mean by \”when the sold OTM option becomes ITM option\”?

It means the option has transitioned from being out of the money to in the money.

Thank you so much karthik :).

One more thing, As i have heard that for every transaction made on zerodha a tax of some kind of rs 50 deduct on a daily basis . Is this ryt? and is there a fixed amount for every transaction

Coz i have read that STT deducts by some 0.005 I believe. Would like you to shed some light on it ??

Regards

That is not true at all 🙂

All our charges are explained here – https://zerodha.com/charges#tab-equities

I am splendid with the efforts u have put to educate us and not misleading us like ther traders or youtubers..

I have been learning a lot and God bless u and ur writing skills trust me u r making everyone\’s life easier. Could not stop myself to applaud you.

Anyways i have a doubt kindly resolve….

Q1:- hypothetically I bought Call option then how can i make money? WIth strike price being OTM ?

If yes then how ? If np then explain.,

Regards

Thanks for the kind words, Aishwarya!

If you bought a call option by paying a premium of say 15/-, then you will make money when the premium increases beyond 15, say it goes to 20. The premium will go up of the price of the underlying goes up.

Excellent explanation, I have never understood ITM/OTM and always under confusion. With this article my confustion is dispelled. Thanks again !!

Happy reading!

Thanks Karthik for confirmation.

I\’m still confused with the IV, why IV is showing as 45.72 instead of 1.2?

Regards,

Shashidhar

IV is expressed as n annualized percentage. Hence you see that value.

Hi Karthik,

Some queries related to the option chain (OC),

How does OC data is helpful apart from identifying the ATM, ITM and OTM?

what do you mean by OI & Change in OI and how does it is useful?

Volume: I\’m assuming it is total number of contracts traded, Please correct me?

IV : Might be intrinsic value. For the ATM it is the closest value, in the highlighted data IV is showing as 45.72. Could you please clarify, Am I missing something here?

Net Change: It is the change in the premium, please confirm.

And if you can through some highlight BID QTY, BID Price, Ask Price and Ask QTY related to Options.

Many Thanks in advance.

Regards,

Shashidhar

Identifying the moneyness of the option is the primary purpose of the option chain. Apart from that, as you mentioned, OI changes are also highlighted. Every other parameter is as you\’ve stated, including the IV.

sir after coming in the money(ITM) when should the option be sold? 3strikes in? 2strikes in?

3 strike.

Hello Karthik.

In Option Chain , there there are separate column for Volume and OI, Please explain the what Volume and OI is signify, means i aware of OI for option chain , how / what exactly volume signifies as. is Volume is no of contract traded including open and closed… and OI is the only open contract at given time..(?)

Yes, the volume is the number of contracts traded, and yes, OI is the number of open contracts.

Karthik ,

Can you please clarify this reasoning

The intrinsic value is negative at strike 8200 should we consider that as ATM only because it is close to 8202 .I am sorry if this is a silly doubt.

Thats right. The strike which is closest to the spot value is the ATM strike.

Hi Karthik,

First of all I am really very very thankful to you, Karthik ; for providing such wonderful material. I am new to trading ,the material provided by varsity is very helpful giving me new perspective.

I have a doubt in the example given above for the moneyness of a put option i.e, the spot price given is 8202/- as per example. The intrinsic value is negative at strike 8200 should we consider that a ATM only because it is close to 8202 or should it be 8250/-. Also for calculations I think it\’s a typo error that spot price is taken as 8200 instead of 8202.

Swarna, 8200 will be the ATM here, 8250 is ITM.

As I have read till now varsity says that while calculating intrinsic value with different spot price strike price remain same . But as shown above in moneyness of put option here spot price is fixed and strike price is varying.WHY ??

That\’s because there are multiple strikes available right?

Hello

I have a clarify if I am getting it right on the following-

1. When the spot price INCREASES, intrinsic value of a CALL OPTION also increases which implies that the BUYER of the call option is moving ITM and the seller of the call option is moving OTM. and vice versa when spot price decreases

2.When the spot price DECREASES, intrinsic value of a PUT OPTION also increases which implies that the BUYER of the put option is moving ITM and the seller of the put option is moving OTM. and vice versa when spot price increases.

1) No, the moneyness of the option works in a single direction. If its ITM, its ITM for both buyers and sellers, the P&L behaviour changes though

2) Same as above

Maximum questions and doubts are clear in very little time…

Thank you Sir

Happy learning, Akshay!

Hi karthik..

The way you are explaining each and every concept is awesome. It\’s just like You are peeling off the banana and put it in mouth. Thank you for this valuable content. Thank you so much from the bottom of my heart.

Happy learning, Surya!

Thanks for prompt reply 🙂

Quoting your statement \”Same as above for option selling and futures as well.\” ..

..

A) you mean to say if I shorted an option, didnt square off and at expiry irrespective if its ITM or OTM, I will have to take delivery?

B) similarly if shorted future and didn\’t square off from my side, I will have to take delivery?

No delivery if its OTM. Physical delivery is only for ITM options. Yes, if you\’ve shorted Fut and held to expiry, then you will have to give delivery of shares

@karthik

Firstly, I would like to congratulate you on the wonderful initiative taken in terms of educating newbies.

—

Couple of questionnaire related to F&O at the time of expiry and charges/penalty..

• If I have bought OPTIONS and by expiry it becomes : [ for instance, I BUY Adaniports SEP 350CE = 13rs ]

• ITM : there are 2 cases I need to understand

1. I didn’t auto square off – ?? what’s the penalty here ??

2. I wanted to square off but I didn’t find any sellers. The seller column under marketDepth was 0.

?? what’s the penalty here ??

• OTM : I think in this case there is no penalty..

• If I have sold OPTIONS and by expiry it becomes :

• ITM : there are 2 cases I need to understand

1. I didn’t auto square off – ?? what’s the penalty here ??

2. I wanted to square off but I didn’t find any buyers. The buyer column under marketDepth was 0.

?? what’s the penalty here ??

• OTM : no penalty

• If I have bought FUTURES and didn’t square off by expiry.

• If I have sold FUTURES and didn’t square off by expiry.

Please help me to understand. Appreciate your help.

1 & 2) There is no penalty. If your option is ITM, then you need to ensure there is enough margin to take delivery. As long as this is there, you will get the shares in your DEMAT, even if there is no seller at the time you want to sell.

Same as above for option selling and futures as well.

Hello @Karthik

I would like to thank you for the wonderful insights.

I ha a query. If I have sold Adaniports 1500CE and 1600PE & I don\’t cover the position before expiry, what will happen?

Please guide.

Then the positions will got expiry and whichever is ITM, that will be physically settled.

Hi Karthik, I recently opened an account in Zerodha and prefer to sell options (with hedging). Though I practiced paper trading, l wanted to do real time trading with only one lot, ie selling 1 lot of any indices. I wanted to continue this way for a few more months until I am confident in my strategy.

1) Now please let me know if the brokerage is high for trading 1 lot in Zerodha.

2) Also please let me know if it is safe to SELL very deep OTM options. (I ONLY prefer to use daily or weekly chart for finding a strike price and that always falls in the very deep OTM options).

Thanks a million for all amazing chapters in Zerodha Varsity!

1) 20 for buy and 20 for sell – 40/- in all

2) Yup, as long as you know what you are doing.

Thanks for lightening fast reply

Good luck, Vijay!

Hey Kartik, Thanks for providing such amazing educational content for free. I just wanted to ask that in future if you can launch a module on Algo Trading as I can\’t find much information on the internet. And I want to learn more about it!

I dont know programming, else probably we would have discussed it here already 🙂

could you please explain. why premium is low in OTM compared to ITM .?

logically, for CE, OTM is yet to be reached so, premium should be high right compared to ITM

Sorry for my ignorance .

Vijay, the premium is a function of how valuable the option is right now as opposed to how valuable it maybe in the near future.

Dear Sir, well explained about Options; But i wish to point one as follows:

Under 8.3. Moneyness Of a Put Option, 4 th line, Nifty\’s spot value 8202.00

I think, it is 8200.00 only ; For Calculations of moneyness for various strikes-7500,8000,8200,8300,8500 Spot is taken as 8200 only.

Ah, let me check this again.

Thank you Karthik.

Cheers!

Hi Karthik, What exactly is moneyness means ?Can we define moneyness as profitability of the given option at the given spot price?

Moneyness is basically how much money you are entitled to receive today, assuming today is the expiry of the option.

No!!! That\’s what I\’m saying!!

A trade results in creating volume, but it need not necessarily impact the OI. OI changes when new positions are created. For example, I buy 1 contract, you sell 1 contract. OI is 1, volume is 2. Now, another guy buys from me and I sell, OI is still 1, but volume is 4.

Ok! I got your point. But, there is a difference between old option chain and new option chain. For example, see today\’s option chain, 11600 CE; OI is 44,543; Volume is 8,02,496. If there is a drastical shift in volume then it must reflect in Change in OI atleast. But, the change in OI is just 934 contracts. In old website it was very clear, whereas here it\’s confusing me.

Does it not match on an EOD basis?

Hello karthik,

In the new NSE website\’s option chain, the traded volume is more when compared to OI. Even if the volume increases or decreases it has to reflect in OI and Change in OI. I\’m very much confused in reading the option chain now.

Could you please help me out? Thanks!

Vinay, OI is on a cumulative basis i.e. it gets carried over on a day to day basis. However, Volume is for that specific day. So there will be differences.

Thanks Karthik…this makes it crystal now.

Good luck!

Good day Karthik,

In the last chapter (chapter 7), you wrote that Intrinsic value formula (spot – strike) for P/L calculation in case of call option is applicable for only ON the day of expiry. But here in this chapter you have calculated the P/L using the same formulae in the middle of the series? Also you said in the earlier chapter that we have to use a separate formulae for P/L calculation for all days except expiry day?

There is a contradiction here or am I missing something? Also you have not mentioned the separate formulae anywhere.

Thanks,

Shashanka

It is not a contradiction Shashank. The concepts criss-cross a bit, let me put this pointwise for you –

1) Before expiry, the P&L depends on the difference between the buy and sell price of the premium. For example, you buy an option by paying a premium of 10 and sell the same after 2hrs ar 12, then you make 2 as profit.

2) At expiry, the P&L depends on the intrinsic value of the option. For example, you hold 11,000 Nitfy CE, Nifty expires at 11,120. Then your P&L is 120.

3) During the expiry, the premium of the option itself is dependent on the intrinsic value of the option. This is what I have written in the chapter. For example, if an option is trading at 10, then the price itself depends on the intrinsic value.

A logical query on moneyness of option.

Say

Strike is 1000 CE

Spot is 900

Premium is 5

I sold this call and got premium of 5

Now on expiry day 3pm spot is 1001.

Trying to understand what would be the premium since IV is -1 hence zero.

If i want to square off the call what would be the indicative price of this call premium as theta would be virtually 0.

The premium will be 1 or slightly above.

Ok Thankyou sir. So how will i actually exrcise my right? Do i have to take delivery of stock first after 2 days of expiry (T+2) and then sell the same on my own ? Or all this happen automatically and the stock automatically gets sold and i get profit credited in my account ??

You will have to take delivery and sell it separately.

Sir one query. Suppose Tata Motors is trading at 110. I buy an ITM or Deep ITM Option 4 days before expiry say 90 CE. Now, suppose i don\’t square off my position till expiry and wait till expiry and after 4 days on the day of expiry the ITM option expires ITM only say 112 rupees.

Now, on the day of expiry what will I earn in the settlement? Will I earn an amount which is equal to difference in premium X 5700

( one lot of Tata) or will I earn an amount which is equal to INSTINCT VALUE 22 X 5700?

IN a nutshell what we will earn in settlement on the day of expiry if we don\’t square off till expiry , Instrinct Value or Premium ?

In this case, you earn a right to buy Tata Motors at a price equal to 90+premium that you\’ve paid while in the open market the same stock is selling at 112. You can take delivery and sell the same at 112 and make the difference.

Could we generalise and say the following:

The intrinsic value (IV) of an option is the amount of money the option buyer could make (or the option writer could lose) when the option contract is exercised, allowing for the premium.

Yes, that makes sense.

Sir if if we buy otm call CE on monday and we make loss and expired on friday.

My question is we need to sell and close that call or it will automatically closes becos call expired that day.

If to be sold by us to close, what happens when we didnot closed on expiry day and sold next day,

Since it is a worthless option, you can just let it be. No need to close it.

Hii kartik

can option seller square off position before expiry date?

in this context , how will be profit and loss.

Yes, he can. P&L will depend on the prices at which you exit the position.

Why should options always trade in lots? Why isn\’t it offered as single quantities too?

Derivatives are delt in pre-specified lots, remember contract standardization is a virtue of derivatives.

Good day Karthik,

Intrinsic value calculation (spot – strike) for call options is applicable only if we exercise the option on the day of expiry.

On the day of expiry, for strike 8400 CE if the spot expires at 8600 (in the money) –

1. What is the return to the trader? Is it (spot – strike) and same is remitted to his account?

2. Is there any additional charges for not squaring of the position and letting the option expire?

Thanks a lot.

Shashanka

1) Yes, but you will have to keep physical delivery in perspective now. More on that here – https://zerodha.com/varsity/chapter/quick-note-on-physical-settlement-2/

2) Nope

Karthik,

Plz.clarify : 1) to make profit Premium needs to be higher than the Premium paid for irrespective of the fact your a Put or Call Option buyer 2) you make money if you Spot Price is higher thn the Strike Price in case of Call Option buyer (opposite for writer) and if Strike Price is higher than the Spot Price for Put Option Buyer (opposite for writer). 3) one can set-off positions anytime if getting the desired premium. There is no need to wait till expiry.

1) Yes, thats right

2) Yes, thats right

3) Absolutely

i think because they have high iv, correct me if i am wrong

Hmm, not really, Aniket. Suggest you continue reading this module, the answer will reveal itself 🙂

why deep ITM\’s have high premium and it goes decreasing as we reach deep OTM\’s

ITM options have a higher probability of expiring ITM, OTMs have a low probability, hence.

Yes,

Got that.

Thank you

BTW Its fantastic material that you and your team has prepared. Good luck.

Happy to note that, Udbhav. Happy reading 🙂

Hi Karthik,

Kindly confirm the understanding that I have developed uptill now or correct me if I am wrong.

Whenever there is an indication by a candlestick pattern (and other technical indicators) in NIFTY in spot market (say bearish,

say 10070). From this data, I ll be selecting the Strike price in options and taking decision (whether to sell a call or buy a put) deciding on the amount of premium that I need to pay.

(NOW MY STRIKE PRICE HAS BEEN FIXED LETS SAY 10050)

Since I have bearish view on the market and my strike price is now 10050 and I am not keeping it till expiry (ie: benefitting from premium), whenever the price of premium will go down I ll be benefitting from the trade. Q1 RIGHT?

Q2 Let say I sell a call @10050 premium 100, now when the price is in OTM I ll be benefitting from the trade as premium is lower and if the premium reaches in ITM range will be lossing money in that case. RIGHT?

Q3 Let say I buy a Put @10050 premium 150, now when the price is in OTM again I ll be beneftting from that trade as premium is lower and if the premium reaches in ITM range will be loosing money in that case. RIGHT?

I got actually confused by reading many comments but Please elaborate the role of ITM, ATM and OTM options with premium.

i)

1) Yes, once you sell/write, the value of the premium will have to reduce from the point you’ve sold. Else, you will lose money.

2) Yes, best is to evaluate the premium – what price you wrote and what price it is now

3) The premium has to increase after you buy the option. This is just the opposite of selling the option.

Hi Karthik,

It is really nice to go through these simple, yet wonderful knowledge base for option trading

i have few questions to be asked.

what happens when we sell In the money option contract on the day of the expiry

lets take an example of nifty currently trading at 9314 (At the time of writing this question) , if somebody sells an option contract of 8500 value or even lesser on the monthly expiry date, what is the profit potential for such trade execution?

zerodha margin calculator shows margin of 142000 approximate is required for selling option (at the time of writing this question) with premium recieved around 46000 rupees.

how the calculations (Profit and loss) are performed while we sell call option \”In the Money or Deep in the Money\” contracts?

please provide your valuable guidance.

If the option expires ITM, then the difference between the positive difference between the strike and spot multiplied by lot will be your P&L. The option will be exercised. But knowingly well that the option is ITM, why do you want to write this option?

Hi Karthik,

Kudos on helping all of us. Really appreciate you taking time to answer our queries.

I have a doubt on Options. Assuming I have taken delivery of 1 Lot of INFY trading at Rs 685 and I sell a Put Option at Rs 800 strike price with Rs 125 premium for 25-June-2020 expiry. What would be my P&L if INFY trades below Rs 800 (i.e. Put Strike price) on expiry day?

Thanks much

Vinay

Vinay, the overall P&L is a sum of the P&l from individual positions. So on the delivery trade, you made 800-685 = 115 and on PUT you will lose to the extent of the intrinsic value of the option. YOur net P&L is the sum of these two trade.

Hai Karthik,

I am new to options. varsity helps me to understand. Your way of explanation is simple and easy to understand for new comers also. I have a doubt in Call option buying. If I have taken a long position in call option at a strike of 360 with premium of 10 rupees. During expiry day if spot price is 363 and premium price reduced to 7 rupees. Will it be profit or loss on the expiry day? Can you please explain?

On expiry, if the spot is 363, then the value of the option is 3, hence the premium will be around 3. Excess time value will decay due to lapse in time.

Hi Karthik,

please help me with following doubts ,

1) As you said in one of your module that Premium = time value + Intrinsic value, Today @ around 15:25 Nifty was trading below 9100 (somewhere around 9097,9098), so that made the 9100 PE option ITM . But to my surprise even though the time value was almost zero( because only 5 mins left for expiry ), and since it was ITM ,it should have been trading at premium of 2 , 3 rupees only because premium = time value (0)+ IV (2,3 rs).But it was trading at the premium of 6 Rs. Why was this so?

2)When nifty closed the price was 9102 but after some time it was 9106 , why so?

3) How nifty arrives at the settlement price ? what formula they use ? Can you pls explain this in detail?

4) Is it possible that even though the premium is almost zero (0.05 or 0.10 Rs), Nifty to have Large Intrinsic value like 10 Or 12? For example , Nifty 9100 PE , premium 0.10 , spot 9110 Or 9112 . Is this scenario possible?

5)How do people trade just few minutes before expiry and double their money ? since premium is almost zero at these times , can zero time value and large Intrinsic value exist simultaneously? If yes how?

6) How can we buy at low premium and let the option expire and then cash in the intrinsic value? is this possible?

1) Weekly options isit? Firstly they are not very liquid, secondly, you need to take the settlement price. You are looking at the LTP

2) LTP vs settlement price

3) It is the weighted average of the last 30 mins

4) No, that is an unlikely situation