10.1 – Model Thinking

The previous chapter gave you a sneak peek into the first option Greek – the Delta. Besides discussing the delta, there was another hidden agenda in the previous chapter – to set you on a ‘model thinking’ path. Let me explain what I mean by this – the previous chapter opened up a new window to evaluate options. The window threw open different option trading perspectives – hopefully, you now no longer think about options in a one-dimensional perspective.

For instance, going forward if you have a view on markets (bullish for example) you may not strategize your trade this way – ‘My view is bullish, therefore it makes sense to either buy a call option or collect a premium by selling a put option’.

Rather you may strategize this way – “My view is bullish as I expect the market to move by 40 points, therefore it makes sense to buy an option which has a delta of 0.5 or more as the option is expected to gain at least 20 points for the given 40 point move in the market”.

See the difference between the two thought processes? While the former is a bit naïve and casual, the latter is well defined and quantitative in nature. The expectation of a 20 point move in the option premium was an outcome of a formula that we explored in the previous chapter –

Expected change in option premium = Option Delta * Points change in underlying

The above formula is just one piece in the whole game plan. As and when we discover the other Greeks, the evaluation metric becomes more quantitative and in the process, the trade selection becomes more scientifically streamlined. Point is – the thinking going forward will be guided by equations and numbers and ‘casual trading thoughts’ will have a very little scope. I know there are many traders who trade just with a few random thoughts and some may even be successful. However, this is not everybody’s cup of tea. The odds are better when you put numbers in perspective – and this happens when you develop ‘model thinking’.

So please do keep model thinking framework in perspective while analyzing options, as this will help you set up systematic trades.

10.2 – Delta versus the spot price

In the previous chapter, we looked at the significance of Delta and also understood how one can use delta to evaluate the expected change in premium. Before we proceed any further, here is a quick recap from the previous chapter –

- Call options have a +ve delta. A Call option with a delta of 0.4 indicates that for every 1 point gain/loss in the underlying the call option premium gains/losses 0.4 points

- Put options have a –ve delta. A Put option with a delta of -0.4 indicates that for every 1 point loss/gain in the underlying the put option premium gains/losses 0.4 points

- OTM options have a delta value between 0 and 0.5, ATM option has a delta of 0.5, and ITM option has a delta between 0.5 and 1.

Let me take cues from the 3rd point here and make some deductions. Assume Nifty Spot is at 8312, strike under consideration is 8400, and option type is CE (Call option, European).

- What is the approximate Delta value for the 8400 CE when the spot is 8312?

- Delta should be between 0 and 0.5 as 8400 CE is OTM. Let us assume Delta is 0.4

- Assume Nifty spot moves from 8312 to 8400, what do you think is the Delta value?

- Delta should be around 0.5 as the 8400 CE is now an ATM option

- Further assume Nifty spot moves from 8400 to 8500, what do you think is the Delta value?

- Delta should be closer to 1 as the 8400 CE is now an ITM option. Let us say 0.8.

- Finally assume Nifty Spot cracks heavily and drops back to 8300 from 8500, what happens to delta?

- With the fall in spot, the option has again become an OTM from ITM, hence the value of delta also falls from 0.8 to let us say 0.35.

- What can you deduce from the above 4 points?

- Clearly as and when the spot value changes, the moneyness of an option changes, and therefore the delta also changes.

Now this is a very important point here – the delta changes with changes in the value of spot. Hence delta is a variable and not really a fixed entity. Therefore if an option has a delta of 0.4, the value is likely to change with the change in the value of the underlying.

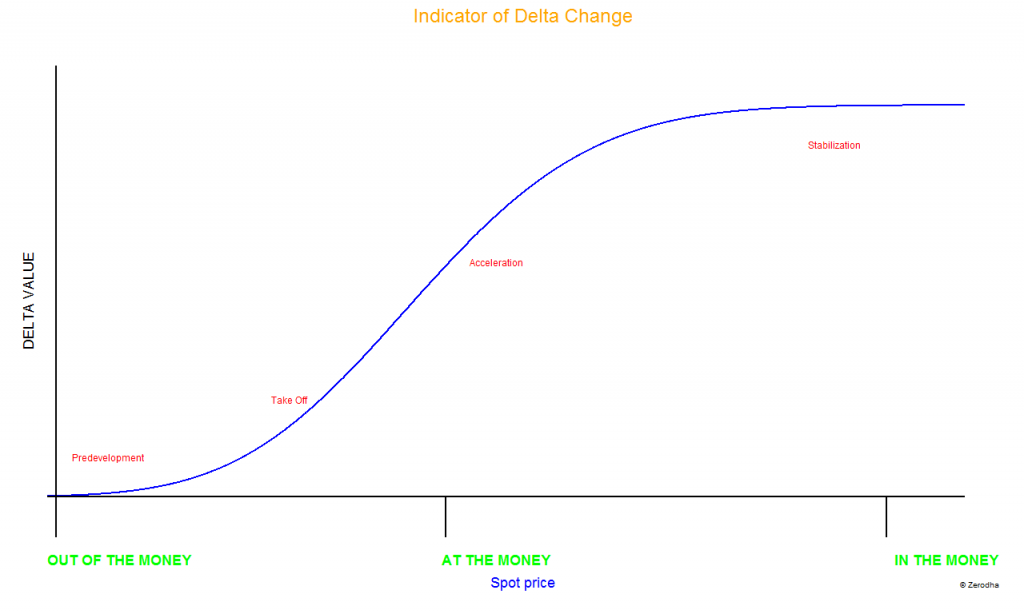

Have a look at the chart below – it captures the movement of delta versus the spot price. The chart is a generic one and not specific to any particular option or strike as such. As you can see there are two lines –

- The blue line captures the behaviour of the Call option’s delta (varies from 0 to 1)

- The red line captures the behavior of the Put option’s delta (varies from -1 to 0)

Let us understand this better –

This is a very interesting chart, and to begin with I would suggest you look at only the blue line and ignore the red line completely. The blue line represents the delta of a call option. The graph above captures few interesting characteristics of the delta; let me list them for you (meanwhile keep this point in the back of your mind – as and when the spot price changes, the moneyness of the option also changes) –

- Look at the X-axis – starting from left the moneyness increases as the spot price traverses from OTM to ATM to ITM

- Look at the delta line (blue line) – as and when the spot price increases so does the delta

- Notice at OTM the delta is flattish near 0 – this also means irrespective of how much the spot price falls ( going from OTM to deep OTM) the option’s delta will remain at 0

- Remember the call option’s delta is lower bound by 0

- When the spot moves from OTM to ATM the delta also starts to pick up (remember the option’s moneyness also increases)

- Notice how the delta of option lies within 0 to 0.5 range for options that are less than ATM

- At ATM, the delta hits a value of 0.5

- When the spot moves along from the ATM towards ITM the delta starts to move beyond the 0.5 mark

- Notice the delta starts to fatten out when it hits a value of 1

- This also implies that as and when the delta moves beyond ITM to say deep ITM the delta value does not change. It stays at its maximum value of 1.

You can notice similar characteristics for the Put Option’s delta (red line).

10.3 – The Delta Acceleration

If you are fairly involved in the options world you may have heard of bizarre stories of how traders double or triple their money by trading OTM option. If you have not heard such stories, let me tell you one – It was 17th May 2009 (Sunday), the election results were declared, the UPA Government got re-elected at the center and Dr.Manmohan Singh came back as the country’s Prime Minister to serve his 2nd term. Stock markets likes stability at the center and we all knew that the market would rally the next day i.e. 18th May 2009. The previous day Nifty had closed at 3671.

Zerodha was not born then, we were just a bunch of traders trading our own capital along with a few clients. One of our associates had taken a huge risk few days prior to 17th May – he bought far off options (OTM) worth Rs.200,000/-. A dare devil act this was considering the fact that nobody can really predict the outcome of a general election. Obviously he would benefit if the market rallied, but for the market to rally there were many factors at play. Along with him, we too were very anxious to figure out what would happen. Finally the results were declared and we all knew he would make money on 18th May – but none of us really knew to what extent he would stand to benefit.

18th May 2009, a day that I cannot forget – markets opened at 9:55 AM (that was the market opening time back then), it was a big bang open for market, Nifty immediately hit an upper circuit and the markets froze. Within a matter of few minutes Nifty rallied close to 20% to close the day at 4321! The exchanges decided to close the market at 10:01 AM as it was overheated…and thus it was the shortest working day of my life.

Here is the chart that highlights that day’s market move –

In the whole process our dear associate had made a sweet fortune. At 10:01 AM on that glorious Monday morning, his option were valued at Rs.28,00,000/- a whopping 1300% gain all achieved overnight! This is the kind of trades that almost all traders including me aspire to experience.

Anyway, let me ask you a few questions regarding this story and that will also bring us back to the main topic –

- Why do you think our associate choose to buy OTM options and not really ATM or ITM options?

- What would have happened if he had bought an ITM or ATM option instead?

Well, the answers to these questions lie in this graph –

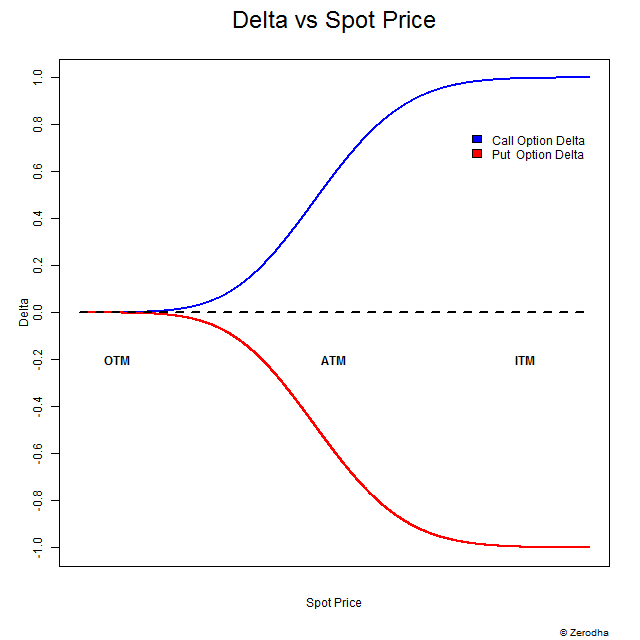

This graph talks about the ‘Delta Acceleration’ – there are 4 delta stages mentioned in the graph, let us look into each one of them.

Before we move ahead with the following discussion some points for you here –

- I would advise you to pay a lot of attention to the following discussion, these are some of the really important points to know and remember

- Do recollect and revise the delta table (option type, approximate delta value etc) from the previous chapter

- Please do bear in mind the delta and premium numbers used here is an intelligent assumption for the sake of this illustration –

Predevelopment – This is the stage when the option is OTM or deep OTM. The delta here is close to 0. The delta will remain close to 0 even when the option moves from deep OTM to OTM. For example when spot is 8400, 8700 Call Option is Deep OTM, which is likely to have a delta of 0.05. Now even if the spot moves from 8400 to let us say 8500, the delta of 8700 Call option will not move much as 8700 CE is still an OTM option. The delta will still be a small non – zero number.

So if the premium for 8700 CE when spot is at 8400 is Rs.12, then when Nifty moves to 8500 (100 point move) the premium is likely to move by 100 * 0.05 = 5 points.

Hence the new premium will be Rs.12 + 5 = Rs.17/-. However the 8700 CE is now considered slightly OTM and not really deep OTM.

Most important to note – the change in premium value in absolute terms maybe small (Rs.5/-) but in percentage terms the Rs.12/- option has changed by 41.6% to Rs.17/-

Conclusion – Deep OTM options tends to put on an impressive percentage however for this to happen the spot has to move by a large value.

Recommendation – avoid buying deep OTM options because the deltas are really small and the underlying has to move massively for the option to work in your favor. There is more bang for the buck elsewhere. However for the very same reason selling deep OTM makes sense, but we will evaluate when to sell these options when we take up the Greek ‘Theta’.

Take off & Acceleration – This is the stage when the option transitions from OTM to ATM. This is where the maximum bang for the buck lies, and therefore the risk.

Consider this – Nifty spot @ 8400, Strike is 8500 CE, option is slightly OTM, delta is 0.25, Premium is Rs.20/-.

Spot moves from 8400 to 8500 (100 points), to figure out what happens on the premium side, let us do some math –

Change in underlying = 100

Delta for 8500 CE = 0.25

Premium change = 100 * 0.25 = 25

New premium = Rs.20 + 25 = Rs.45/-

Percentage change = 125%

Do you see that? For the same 100 point move slightly OTM options behaves very differently.

Conclusion – The slightly OTM option which usually has a delta value of say 0.2 or 0.3 is more sensitive to changes in the underlying. For any meaningful change in the underlying the percentage change in the slightly OTM options is very impressive. In fact this is exactly how option traders double or triple their money i.e. by buying slightly OTM options when they expect big moves in the underlying. But I would like to remind you that this is just one face of the cube, there are other faces we still need to explore.

Recommendation – Buying slightly OTM option is more expensive than buying deep OTM options, but if you get your act right you stand to make a killing. Whenever you buy options, consider buying slightly OTM options (of course assuming there is plenty of time to expiry, we will talk about this later).

Let us take this forward and see how the ATM option would react for the same 100 point move.

Spot = 8400

Strike = 8400 (ATM)

Premium = Rs.60/-

Change in underlying = 100

Delta for 8400 CE = 0.5

Premium change = 100 * 0.5 = 50

New premium = Rs.60 + 50 = Rs.110/-

Percentage change = 83%

Conclusion – ATM options are more sensitive to changes in the spot when compared to OTM options. Now because the ATM’s delta is high the underlying need not really move by a large value. Even if the underlying moves by a small value the option premium changes. However, buying ATM options are more expensive when compared to OTM options.

Recommendation – Buy ATM options when you want to play safe. The ATM option will move even if the underlying does not move by a large value. Also as a corollary, do not attempt to sell an ATM option unless you are very sure about what you are doing.

Stabilization – When the option transitions from ATM to ITM and Deep ITM the delta starts to stabilize at 1. As we can see from the graph, the delta starts to flatten out when hits the value of 1. This means the option can be ITM or deep ITM but the delta gets fixed to 1 and would not change in value.

Let us see how this works –

Nifty Spot = 8400

Option 1 = 8300 CE Strike, ITM option, Delta of 0.8, and Premium is Rs.105

Option 2 = 8200 CE Strike, Deep ITM Option, Delta of 1.0, and Premium is Rs.210

Change in underlying = 100 points, hence Nifty moves to 8500.

Given this let us see how the two options behave –

Change in premium for Option 1 = 100 * 0.8 = 80

New Premium for Option 1 = Rs.105 + 80 = Rs.185/-

Percentage Change = 80/105 = 76.19%

Change in premium for Option 2 = 100 * 1 = 100

New Premium for Option 2 = Rs.210 + 100 = Rs.310/-

Percentage Change = 100/210 = 47.6%

Conclusion – In terms of the absolute change in the number of points, the deep ITM option scores over the slightly ITM option. However, in terms of percentage change, it is the other way round. Clearly ITM options are more sensitive to the changes in the underlying but certainly most expensive.

Most importantly notice the change in the deep ITM option (delta 1) for a change of 100 points in the underlying there is a change of 100 points in the option premium. This means to say when you buy a deep ITM option it is as good as buying the underlying itself. This is because whatever is the change in the underlying, the deep ITM option will experience the same change.

Recommendation – Buy the ITM options when you want to play very safe. When I say safe, I’m contrasting the deep ITM option with deep OTM option. The ITM options have a high delta, which means they are most sensitive to changes in the underlying.

Deep ITM option moves in line with the underlying, this means you can substitute a deep ITM option to a futures contract!

Think about this –

Nifty Spot @ 8400

Nifty Futures = 8409

Strike = 8000 (deep ITM)

Premium = 450

Delta = 1.0

Change in spot = 30 points

New Spot value = 8430

Change in Futures = 8409 + 30 = 8439 à Reflects the entire 30 point change

Change Option Premium = 1*30 = 30

New Option Premium = 30 + 450 = 480 à Reflects the entire 30 point change

So the point is, both futures and Deep ITM options react very similar to the changes in the underlying. Hence you are better off buying a Deep ITM option and therefore lessen your margin burden. However if you opt to do this, you need to constantly make sure that the Deep ITM option continues to remain Deep ITM (in other words make sure the delta is always 1), plus do keep an eye on the liquidity of the contract.

I would suspect that at this stage the information contained in this chapter could be an overdose, especially if you are exploring the Greeks for the first time. I would suggest you take your time to learn this one bit at a time.

There are few more angles we need to explore with respect to the delta, but will do that in the next chapter. However before we conclude this chapter let us summarize the discussion with the help of a table.

This table will help us understand how different options behave differently given a certain change in the underlying.

I’ve considered Bajaj Auto as the underlying. The price is 2210 and the expectation is a 30 point change in the underlying (which means we are expecting Bajaj Auto to hit 2240). We will also assume there is plenty of time to expiry; hence time is not really a concern.

| Moneyness | Strike | Delta | Old Premium | Change in Premium | New Premium | % Change |

|---|---|---|---|---|---|---|

| Deep OTM | 2400 | 0.05 | Rs.3/- | 30* 0.05 = 1.5 | 3+1.5 = 4.5 | 50% |

| Slightly OTM | 2275 | 0.3 | Rs.7/- | 30*0.3 = 9 | 7 +9 = 16 | 129% |

| ATM | 2210 | 0.5 | Rs.12/- | 30*0.5 = 15 | 12+15 = 27 | 125% |

| Slightly ITM | 2200 | 0.7 | Rs.22/- | 30*0.7 = 21 | 22+21 = 43 | 95.45% |

| Deep ITM | 2150 | 1 | Rs.75/- | 30*1 = 30 | 75 + 30 =105 | 40% |

As you can see each option behaves differently for the same move in the underlying.

Before I wrap this chapter – I narrated a story to you earlier in this chapter following which I posted few questions. Perhaps you can now revisit the questions and you will hopefully know the answers .

Key takeaways from this chapter

- Model Thinking helps in developing a scientifically streamlined approach to trading

- The Delta changes as and when the spot value changes

- As the option transitions from OTM to ATM to ITM, so does the delta

- Delta hits a value of 0.5 for ATM options

- Delta predevelopment is when the option transitions from Deep OTM to OTM

- Delta Take off and acceleration is when the option transitions from OTM to ATM

- Delta stabilization is when the option transitions from ATM to ITM to Deep ITM

- Buying options in the take off stage tends to give high % return

- Buying Deep ITM option is as good as buying the underlying.

Hi,

I noticed a small inconsistency between the Hindi and English versions of the Delta Acceleration section (10.3).

In the Hindi version, it is mentioned that the associate bought ATM options worth ₹2,00,000.

But in the English version, it says he bought far OTM options worth ₹2,00,000.

This creates some confusion for readers, because the later questions (\”Why did he choose OTM instead of ATM/ITM?\” etc.) match the English version, not the Hindi one.

Could you please clarify which one is correct—did the associate buy ATM or far OTM options?

Just pointing this out so both versions stay consistent.

Thank you for the great content!

Hi Karthik,

I understand that delta changes as the spot price moves. Given that delta is not constant, how do we estimate the change in an option’s premium if we start only with the initial delta?

Cues should come from the change in underlying prices. No other parameters influences delta. For example, if no change in underlying, delta remains same.

Dear Sir,

I have a small querry. What would be quantity of NIFTY ETF I should physically hold, If I write deep ITM call option with delta 1, so that I do not incur loss in any situation,

You can match it to the options contract value.

Hi Sir,

I have a very small and stupid doubt. In Zerodha, I couldnt see the value of Delta while buying the CE Option. Where can one find the Delta values

Do check Sensibul platform, you can login using Kite itself.

Answers for those questions plz.

what i think is he bought the OTM options so the premium is low and he might not lose as much compared to the ATM or ITM options also he has large space for his option delta to be saturated at 1

This question is to Karthik. I am curious to know about the counter party, who sold the CE to your associate and in the process lost 28 Lakhs! Are they not protected by margin call or was there a default? or did your associate did multiple trades and the loss to counter party was spread across many traders. Please let me know.

There would have been a margin call for sure. Unfortunately, no one knows who the counterparty is. Actually, no one can – that would defeat the purpose of electronic trading right?

Its about ROI when you are expecting big moves you buy OTM because its delta is still near to zero and very high chances that it may go near 1 ( if very big move comes) even after when its delta becomes 1 it may rally further so its like you buying it when its delta was less so ROI will be very good

Hi

Do we have videos of each chapter?

Here you go, the complete playlist – https://youtu.be/-mO0YOTcCiQ?si=wr-h6IO-w2c_Ua7n

Hi karthik,

Regarding intraday trading for options can i buy slight ITM ATM or slight OTM. And why

Hello Karthik,

One observation about the delta plot for put option with respect to the spot price change:

This red plot is incorrect. The correct one will be mirror image of it about x-axis.

For obvious reason, strike is constant, now if spot is lesser than strike -> ITM PUT then how delta can be around -0.2 (say), rather it must be around -1.

Kindly correct.

Also gamma can not be postive for put option as per this plot, which is again wrong

so this plot needs to be corrected.

If the PUT is ITM, it should be closer to -1 rather than 0.2. Let me check this again.

Your way of explaining the difficult concept in simple and elaborate way…is awesome…thanks Sir…

Thanks, glad you liked it 🙂

So how can i select best options for expiry ,where Time decay can help me in my favour if my vision is bullish on index?

There is nothing like best options, it all depends on your trading strategy 🙂

Why Call options premium decay more than Put options.-5 September my view was right about bullish and took position on shorting PUTS but time decay didnt played in effect. on otherhand call options had tremendous time decay seen even though market didnt showed bearish rally(market was sustained in range)

Not really, but since volatility has different impact on CE and PE, this is not surprising.

Hi,

Just to clarify, the ATM, OTM & ITM will be defined on basis of underlying values with respect to the spot price or with respect to the corresponding delta that each strike price holds?

The classification is based on where the spot price is with respect to the strike. Delta has nothing to do with it. Of course, the delta in turn depends on how much the moneyness of the strike is wrt to the spot price.

Hi, I think below statement is incorrect. I havent found a single stock where Slightly OTM option is expensive. instead they are affordable. Am I missing something here?

Recommendation – Buying slightly OTM option is more expensive than buying deep OTM options, but if you get your act right you stand to make a killing. Whenever you buy options, consider buying slightly OTM options (of course assuming there is plenty of time to expiry, we will talk about this later).

Sure, but how are you measuring whats cheap and whats expensive?

Hi Karthik sir,

You really deserve all the praises for this educational session. especially for a beginner like me. All the points are really superbly explained. I had just a doubt sir.. in the above example the spot price and the strike price mentioned is 8400. What i understood by the difference of 100 is that its the amount by which the stock is expected to move and its different from strike price. If im wrong, please explain. Thanks a lot.

Thanks Pradeep, glad you liked the content.

Yes, in this context it is the expected price movement of the underlying.

Thanks for the explanation. As a beginner I have one doubt what is the significance of the strike price if the premium depends on the spot price? Suppose the spot price is 8000 and I bought a slight OTM 8200 with delta of .4.

Now if the spot is moved by 100 points which becomes 8100 then the premium will increase by 40 points(.4 * 100) so I am gaining right no matter whatever is the strike price. As the new spot is still less than the strike price. or I can sell Call option only if it crosses the strike price???

Strike price is your reference price basis which the premium of the option you are dealing with gets its value. All your option trading is dependent on how the spot behaves with respect to the strike.

dear kartik sir,

you are doing your work very good

Thanks, Sahil. Happy learning 🙂

in the example for takeoff for ATM

Spot and strike have the same value then how the difference in the underlying is 100? is it not 0?

Which difference are you referring to?

hii Kartik sir,

i have doubt. Suppose spot price is 8400 and i buy a 8500 CE which is OTM with delta of 0.3 and premium of 85. Now as spot price move from otm to atm and then itm the premium increases as delta increase but as mentioned in earlier chapters that i will only start earning when spot price will be more than strike price(in case of call) as IV = )spot price – strike price) – premium * no of shares.

Yes, so basically the premium will have to move beyond the breakeven price.

Very helpful. I was having a hard time understanding this. Still have not understood this well enough to start trading with options. Will give it some more time, as Karthik has mentioned.

Will try to look for DEEP OTM opportunities like your client did during 2024 elections.

Happy learning, Aditya. Good luck with options!

Hi Karthick sir,

this chapter really useful to understand how the system working behind the screen and also importance on select the strike price.

Sure, happy learning 🙂

Let us take this forward and see how the ATM option would react for the same 100 point move.

Spot = 8400

Strike = 8400 (ATM)

Premium = Rs.60/-

Change in underlying = 100

Delta for 8400 CE = 0.5

Premium change = 100 * 0.5 = 50

New premium = Rs.60 + 50 = Rs.110/-

Percentage change = 83%

in this example you said change in underlying as 100,what it means?

because if spot price moves 100 points from 8400 to 8500 then will it not considered as from ATM to ITM

It means that the underlying stock/index has moved by 100 points. Yes, as the underlying moves, so would the moneyness.

less than 0.5 delta OTM

less than ATM money will be ITM

HERE RANGE SHOULD BE DELTA > 0.5

For ITMs, yes, delta will be higher than 0.5.

When the spot moves from OTM to ATM the delta also starts to pick up (remember the option’s moneyness also increases)

Notice how the delta of option lies within 0 to 0.5 range for options that are less than ATM

i know this , please explain

less than 0.5 delta = ITM

In and around 0.5, it could be 0.5 for ATMs but not more than 0.5. For the delta to pick up more than 0.5, underlying has to move, meaning, the option has to transition from ATM to ITM.

when Market Moves 20 points OTM CE with 0.20 delta moved 4 points but from that 20 points market came same level but 8 points difference showing y like this which factor made more loss in reverse direction in just 30 mints move i want to know

Thats because Delta is just one contributing factor to the premium movement.

Superb writing !!! Superb explanation !!

Happy learning 🙂

Sir can you explain this sentence in recommendation section :

\”When I say safe, I’m contrasting the deep ITM option with deep OTM option.\”

I\’ve explained the moneyness of the option (deep ITM, deep OTM) here – https://www.youtube.com/watch?v=3J9I0U9w4Ww&list=PLX2SHiKfualFiusiT9G5uE9jU3vetvW2x&index=6

These theory pdfs are such a great source till date , i have learned about option greeks already but damm the explanation provided here is such extensive , totallly loved it ..

thank u karthik .

Thanks for the kind words, Ayush. Glad you liked the content 🙂

Hello Sir

First of all, I would like to say that I am a big fan!

Your course have helped me immensely to understand finance and investing in general.

I\’m following your complete series for a very long time.

I would just like to ask if you can suggest some book on F&O for further study.

Thanks

Thanks for the kind words, Karamjit 🙂

Regarding the books, I\’d suggest you pick John C Hull\’s book on Derivatives. Its not in Indian context, but gives you a perspective.

Karthik Sir,

\”Do not attempt to sell an ATM option\”, please explain.

I\’ve explained that in the chapter itself, Viraj 🙂

Dear Karthik sir

Above in one of your comments you said –

\”For indices if you place a BO/CO order while buying options you get margin benefit\”

Kindly tell what is the meaning of margin benefit?

Ah, that needs to be updated, Sandeep. There are no more BO/CO order types anymore.

Dear Karthik sir,

Above you said the Delta for Deep ITMs and Deep OTMs remains same until a huge movement.

And ATM delta keeps changing. What about the slight OTM ones? Does the delta remains same or changes

just like the ATM.

Delta for Deep ITMs/OTMs do change, but not as much as the ATM option. But yes, the Delta change for slightly ITM, ATM, and slightly OTM is quite rapid and is also dependent on how the markets are moving.

Thank you sir. Suppose there are 2 deep OTM options of Nifty 18700 and 18750. Can we say that

18700 will have more delta because in the option chain it is lesser than the 18750 (more deep)

Kindly help.

That\’s right, the closer the ATM, the higher the delta.

Dear Karthik sir,

How to know Delta of 2 similar options, e.g. 2 CE OTM options knowing that delta changes every minute.

Deltas will be below 0.5 if these are OTM. You can use a B&S calculator to figure the exact values.

Sorry for the earlier query. I could not write what i thought.

No problem, I\’ve shared my view anyway.

Dear Karthik sir

Suppose we want to select a strike based on the delta. How can we do that knowing that option geeks change every minute?

Kindly help.

Hmm, OTMs and ITMs, especially the deep ones will stay the same unless there is a massive move in the market. The only thing that keeps changing is the ATM.

How to find trend In Nifty Using Delta and Premium Price of Option ? If it is possible please Comment

Yes, do check these 2 videos – https://www.youtube.com/watch?v=bCRw8YN-4QY&list=PLX2SHiKfualE4o4joBMXM_YHGBKnZSQbs

This is brilliant stuff.. thank you so much

Happy learning, Pri 🙂

Hi Karthik,

Good Day!

Hope you are doing good.

I am slowly but steadily going through the options chapter and I am confident that will complete it with proper understanding in a months time.

As usual, Thank you for all the efforts you have put in to bring this wonderful knowledge to us. God Bless You.

I have a question in this module regarding Delta:

Delta of a strike price changes with the change in spot price and we know approximately delta of premiums based on their moneyness.

When looking into Delta before considering an option strike, Can we chose the strike price directly based on the moneyness of the option (ATM/ITM) as the Delta would be more than 0.5 or should we have to go and check the delta of the option in any website/sensibul before placing an order?

because wanted to know if there can be cases where the Delta of ATM/ITM options be less than 0.5 due to other Market factors?

Glad you like the content, Sai. You can directly pick up strikes, over time as you gain more experience, you will intuitively know what delta is doing.

In the \”predevelopment\” example, when the spot price moved from 8400 to 8500, the delta should also change from 0.05 to something else (say 0.10). Then the new option premium should be 12 + (100*0.10) = 22 instead of 17. Am I going correct on the logic that since the moneyness of the option changes with change in the value of the underlying, the upmove then should be multiplied with the new delta figure.

By considering 0.1, you are almost doubling the delta value and intend that the premium should double for 8700CE. This wont happen. In reality, the change in the delta will be very small.

Hi Karthik, Thanks for the amazing tutorials

I would like to understand the meaning of below sentence that was regarding the Deep ITM

\”plus do keep an eye on the liquidity of the contract.\”

So some of the contracts do not trade that often, which means you cannot easily buy or sell them, so the chances of you getting stuck in a position are high. So do watch out for that.

Why should one buy call option at strike price lesser than spot price?

Call option is to expect underlaying market price would increase

For below example, one would expect market price to drop to attain ATM

Wouldnt this be contradicting to purpose of a Call Option

Eg:

TCS CE 3300 at premium 350, spot price 3400

So there are multiple factors at play. Most importantly, how much do you expect the market to move? Basis this, you choose a strike.

Sir,

1. So you mean to say that for a OTM option to work in our favor, the stock should move 5-8%?

2. How much percentage the stock should move for the ATM option to work in our favor?

3. How much percentage the stock should move for the ITM option to work in our favor?

1) Yes, that\’s a rough %, and assuming other things are constant.

2) 2-3%

3) Same as above

Frankly, these are numbers I\’m suggesting just because you are forcing me to 🙂 But options don\’t work this way 🙂

Dear Karthik sir,

I know that other greeks too affect the price of the premium. But here let\’s assume only underlying movement is working.

Now my question is..

The chapter says.. “In order for the OTM option to work in our favor the underlying has to move massively”

Generally speaking, how many points a stock has to move for each of these options to work in our favor ?

1. Buying a OTM option

2. Buying a ATM option

3. Buying a ITM option

Can we quantify the movement in terms of % (like suppose i say that the stock should move 4% for the OTM to work.. likewise) ?

By massive, I guess, anything more than 5-8%.

Thanks for the simplified and wonderful teaching. ATM value is clear which reflects the strike place close to the SPOT price. How can you estimate OTM and ITM values?

For a call option, all strikes above ATM are OTM and strikes below ATM are ITM. For puts, all strikes below ATM are OTM and above ATM are ITM.

Dear Karthik sir,

The chapter says.. \”In order for the OTM option to work in our favor the underlying has to move massively\”

Generally speaking, how many points a stock has to move for each of these options to work in our favor ?

1. Buying a OTM option

2. Buying a ATM option

3. Buying a ITM option

Can we quantify the movement in terms of % (like suppose i say that the stock should move 4% for the OTM to work.. likewise) ?

Its tough to quantify as there are several moving parts involved in determining the premium of an option.

Thank you so much sir for your reply.

Happy learning!

Dear Karthik sir,

When you say \”market participants perception on prices\” I could not understand. Please give a real-life situation where

demand & supply of a particular strike increases.

You can be extremely bullish on an underlying and, therefore, willing to buy an OTM strike, but at the same time, I could have a flatish opinion on the same stock, hence the seller of the OTM strike. So the collective opinion of all participants on this particular strike leads to a demand and supply situation for this strike, which further translates to movement in the premium. This is what I mean by market participant\’s perspective.

Dear Karthik sir,

I have one doubt.. Why does strike specific movement increase. Why does demand & supply of a particular strike increase?

Thanks

That is driven by the market participants perception on prices. Its kind of like a circle, one thing leads to another with no definite end points 🙂

Ok sir got it. Thanks

Happy learning!

Dear Karthik sir,

Good evening. This is regarding Delta acceleration where we find that in terms of %change in premium, ATM > Slight ITM > ITM.

But today I found this puzzling situation. Please go though this and let me know where is my mistake.

Change in underlying is same 100 points in all the 3 cases.

Now.. Case 1 (ATM) : Let Delta be 0.5 Premium = Rs. 60.

Premium change = 100*0.5 = 50.

%change in premium = 50/60 * 100 = 83%

Case 2 (Slight ITM) : Let Delta be 0.8 Premium = 90

Premium change = 100*0.8 = 80

%change in premium = 80/90 *100 = 88%

Case 3 (Deep ITM) : Let Delta be 1.0 Premium = 110

Premium change = 100*1 = 100

%change in premium = 100/110 *100 = 90%

I find here just the opposite that in terms of %change in premium, Deep ITM > Slight ITM > ATM.

Please let me know where is my mistake.

Sandeep, sometimes the strike-specific movement, demand, and supply influence the premiums. This could be one off such instances. In general, ATM > Slight ITM > ITM this holds true.

Change in premium for Option 2 = 100 * 1 = 100, Isn\’t it should be 200 points (8400-8200)?

Checking this again.

Was that one associate who made whopping 1300% profits Nikhil Kamath? Just kidding😀!!

Thank you, Karthik for sharing knowledge and teaching us things in a simpler manner.

Happy learning 🙂

Hi ,

After the \’Delta Vs Spot Price\’ graph , In the point number 3, you say \”Notice at OTM the delta is flattish near 0 – this also means irrespective of how much the spot price falls ( going from OTM to deep OTM) the option’s delta will remain at 0\”

But do you mean- \”spot price rises \” in the above statement ?

-Sid

No, I mean the fall in spot, which translates to the delta staying flat at 0, for OTM options.

1. How ATM option is safer then OTM?

2. Is ATM option is safer for seller also?

3. What about put option which option is safer?

Please reply sir

1) Depends on your position in the market. If you want to write, then OTMs are better

2) OTMs are better

3) Same as above.

Hello Sir,

When your friend made 28lakh, that means the option seller lost almost equal to that (ignoring premiums). The exchange doesn\’t block that high of a margin. What if the seller doesn\’t even have that much money in the trading account? What happens then?

That is an issue; hence, margins go up around big events.

Sir please tell if nifty is at 17530 & I choose strike price of 17400 CE and nifty closes at 17450 how do I calculate my loss as per delta,let me clear if I am wrong that delta will be around .5

Upon expiry the value of the option will be the difference between strike and spot, which is 50 in this case. So this is your profit.

DEAR SIR,

when you said \’as and when the delta moves beyond ITM to say deep ITM the delta value does not change. It stays at its maximum value of 1. \’

does that means after a point of time .. change in nifty will be equal to change in premium..

I mean like if nifty is up by 100 points then in deep ITM .. premium will also be up by 100 points?

thank you!

Yes, this is especially true for deep ITM option.

This is the 1st option i bought just for the sake of trial so i will explain exactly what happened.yesterday i e wednesday i bought nifty 17100 ce at the premium of 1.40, nrml type ,then the spot price was 16540.Today ie thursday the spot price increased to 16914,but why my premium is still decreasing, instead of increasing?

Thankyou sir

That is because y;day was expiry and the option has no value left in it. Hence it will goto 0.

Dear Karthik,

i have started My trading Journey 3 years back with Zerodha Account, as Long term investor.

recently planned to work on day trading .

i got some queries.

if we trading only on Wednesday and Thursday , in which strike price we can make good profit.

ATM or near ITM .

also can you clarify , out of candlesticks or Heikein Ashi , which one is better.

Regards,

Manjunath

It is hard to generalize Manjunath as it is on the basis of the situation in the market. I\’ve tried to explain this in subsequent chpater/modules.

Can you please help me understand the transaction psychology from the seller\’s point of view?

A seller won\’t have the right to void a contract, it\’s the buyer who has the right to void the contract because he has paid the premium.

So, how can a seller book his Profit/Loss before the expiry? I\’m not able to imagine how the Seller can square off his position before the expiry and book his P/L. Does it mean that after squaring off this contract(From the seller\’s perspective) will be forwarded to some other seller?

Aman, the seller\’s obligation to fulfill his/her contract is basis the assumption that the contract is held to expiry. But in reality, I can quickly trade in and out of the contract without holding to expiry. Do check this – https://zerodha.com/varsity/chapter/options-m2m-and-pl/

Also, this chapter is in consideration with respect to the buyer perspective, Right?

Not really, why do you think so?

Hi Karthik,

please help me understand this:

Though we get considerable returns in Slightly OTM and ATM (Returns close to 100 to 130% in the above examples), but we also need to cross the breakeven point to get ourselves to be profitable.

Case 1 : Premium is 10, so we need at least 100% return to touch breakeven and 100%+ to become profitable.

Case 2: Premium is 10, (we consider Deep OTM, Slightly ITM, and Deep ITM) in all these cases the return was less than 100%, meaning we are in loss, even though the premium change was 95%(In case of ATM).

Am I right, or I\’m missing something?

Looking forward to hearing from you.

thank you

Aman, its always a tradeoff between risk, breakeven, and reward. But I\’m not sure if I fully understand your query – why would your strategy not cross breakeven even if you were to generate 100%? Not sure if I\’m missing something.

as you have given the example for the 3rd point of 10.2 delta versus spot price.

i didnt understand the example that how 8400ce is an OTM option.

sir please explain.

Compare it with spot, Yash. If Strike is higher than spot, then its a OTM CE.

Hi Karthik Sir, One doubt, Let\’s say Nifty is trading at 15850, Nifty 15900 CE (OTM) is at 100 & Nifty 15900 PE (ITM) is at 150. Now, the question is if I am of a view that Nifty won\’t expire ITM and looking at this scenario, I would want to short sell 15900 CE then the delta for Buy as well as Sell will be same which would be 0.3, right?

Yes, the delta will remain the same for both buy and sell of the option.

Karthik Sir!

Thank you so much for what you have done through these modules.

I am learning from very first module till here and I\’m confident enough to move mountains now!!

Whoever asks me who taught you all that!!

I , without taking a sec, reply, Karthik Sir!!!

You are my \”Guru Dronacharya\” sir!!

Accept my pranamas !!

Himanshu, thanks so much for the kind words. It means a lot. Hope you continue to learn and progress on Varsity. Good luck.

Dear Sir,

In the illustration given under the heading \”Take off & Acceleration, should not the new delta be 0.5 instead of 0.25 as the call option is now an ATM option?

ATM options delta is 0.5. Let me recheck the maths.

Grateful to you, Karthik sir, for helping me understand the concept.

Happy learning, Sandeep!

Thanks Karthik sir, i went through the bid and ask price. I only wanted to know

when we say \”bid ask spread\” we mean the difference between bid price and ask price or

the difference between bid quantity and ask quantity? Kindly let me know this much.

Sandeep, bid-ask spread or just the spread refers to just the difference between the bid and ask price. Not the bid-ask quantity.

Thanks Karthik sir, please let me know by bid ask spread you mean to say the bid and ask price difference

or the bid and ask quantity difference.

Sandeep, check section 9.6 – https://zerodha.com/varsity/chapter/the-trading-terminal/

Dear Karthik Sir,

Could you kindly explain how to use bid-ask spread to get a view of volatility.

Please help me.

Regards

Sandeep, the smaller the spread between the bid and ask, the more liquid is the contract. Not so liquid otherwise.

Dear Rangarappa sir,

Is there any means to know the liquidity of an options contract? Is there any indicator or parameter to know?

Kindly let me know.

You just have to check the bid-ask spread to get a sense of liquidity.

Sir…

If I sell either call option or put option so can I square off my position any time or I have to wait till the expiry date to exercise my contact?

As per my knowledge I can square off my position any time if I buy call option or put option…

What about selling an option???

Its the same thing with the sell option. You can square off anytime you wish.

when we read a article ,understand in dept rather than watching video on youtube

Thank you so much

Both are different format, Rohit 🙂

Karthik sir I am glad that you are putting your knowledge for people like us to learn new things. Your way of explanation is just at another level 🔥

Thanks for the kind words, Dhananjay. Happy learning 🙂

Hi Kartik

U have mentioned that \”Buying Deep ITM option is as good as buying the underlying\”, but Buying deep ITM option has same change in terms of premium and underlying value,but % return and risk is very different

Risk-wise options are different, but deep ITM\’s pay-off profile is the same as the underlying.

hi Kartik,

as u have explained in an earlier chapter the seller of call option and seller of a put option have limited profit which is to the extent of the premium received and unlimited loss if their directional view goes wrong,but how does change in premium affects them ,even if there directional view is correct because they have profit to the extent of premium received

If the premium increases beyond what they have received, then that will be a loss Sarvesh. For example, I have sold an option at 20 (which I plan to buy back at 10), but if the premium increases to 30 instead of 10, then my buy price is 10 higher than the price at which I\’ve sold, therefore my loss is 10. Another way to think about it is the price at which I buy and the price at which I sell. In this case, it, is 30 (buy price) and sell price is 20, so loss is 10.

Hi Kartik

U mentioned below statement in this chapter

\”Buy the ITM options when you want to play very safe.\”

Can you explain what you want to convey by above sentence

When you want to restrict your risk emerging from all other greeks, then one of the safest strategies is to buy ITM options.

Hi Kartik,

As you said Slighty OTM is where acceleration takes place, but as per the example of Bajaj Auto at the end of the chapter, where the strike is 2275 and the spot is 2240, though premium change is 129%, the trader is still not profitable as for him to be profitable, the spot should move above strike + premium amount which is 2275+7=2282

please correct if my understanding is wrong

The spot should move higher than the premium the trader would have paid to purchase the option Sarvesh.

So, as per the graph:

–> for a CE, as Spot price increases (from left to right), the Delta moves from 0 to +1

–> for a PE, as Spot price increases (from left to right), the Delta moves from 0 to -1

Is that so?

Yeah, have explained that in the chapter itself.

Dear Mr. Karthik,

In the first graph of this chapter (Delta vs Spot Price), shouldn\’t it be called \”Delta vs Moneyness\” instead? since for CE, moneyness increases with increasing spot price for a certain strike, and so does delta; but for PE, moneyness increases with decreasing spot, and so does the delta. Kindly correct me if my understanding is wrong.

Regards

Moneyness is an attribute dependent on the spot price, so in my opinion, its better as Delta vs Spot.

Thanks very much Rangappa sir, please tell me how can we know liquidity of a options contract?

Is there any way to know it?

Sandeep, stick to Nifty/Bank Nifty and the top 5-6 stocks. Thats where maximum liquidity is.

In section 10.3, you have mentioned \”If you choose Deep ITM Option (over futures) you need to constantly

make sure that the Deep ITM option continues to remain Deep ITM (in other words make sure the delta

is always 1), plus do keep an eye on the liquidity of the contract\”

Here what do you mean by \’liquidity of the contract\’ and whose liquidity are you talking about?

Liquidity means how easy or difficult it is to buy and sell the contract, Sandeep.

Hi Kartik,

Why delta differs by the moneyness of the options? What is the logic behind it?

The delta is dependent on Gamma, hence 🙂

Absolutely amazing explanations in the most easiest and practical way…

I read some books for understanding Greeks, but the concept is clear after going through varsity..

Great Sir….

Happy learning, Rishi!

Hi Karthik Rangappa….a big thanks to you for simplifying Option Greeks. I was SO intimidated to even attempt to start reading it….but once I started, just devoured it greedily 🙂 Its an interesting topic put together so well. My sincere thanks once again.

Happy learning, Bhavesh 🙂

apart from greeks does the buying and selling ( demand and supply) of the option also affect the premium?

Yes, the demand-supply situation also impacts the option premium.

Hi Karthik, excellent guide on options. I’m really enjoying. Here I calculated how the delta impact the returns in terms of percentage.

Moneyness Strike Delta Premium Change in Underlying X Delta = Profit Returns (%)

ITM 17500 .50 328 50*.98 = 49 14.9

ITM 17600 .73 243 50*.89 = 44.5 18.3

ITM 17700 .62 176 50*.65 = 32.5 18.4

ATM 17800 .50 119 50*.50 = 25 21

OTM 17900 .43 75 50*.43 = 21.5 28.6

OTM 18000 .25 45 50*.25 = 12.5 39

OTM 18100 .16 26 50*.09 = 7.5 44.1

Correct me if anything is wrong. Thanks

Kumar, glad you like the content! Yes, this look absolutely correct 🙂

Hi Karthik, excellent guide on options. I\’m really enjoying. Here I calculated how the delta impact the returns.

+———–+——–+——-+———+—————————————+————-+

| Moneyness | Strike | Delta | Premium | Change in Underlying X Delta = Profit | Returns (%) |

+———–+——–+——-+———+—————————————+————-+

| ITM | 17500 | .98 | 328 | 50*.98 = 49 | 14.9 |

+———–+——–+——-+———+—————————————+————-+

| ITM | 17600 | .89 | 243 | 50*.89 = 44.5 | 18.3 |

+———–+——–+——-+———+—————————————+————-+

| ITM | 17700 | .62 | 176 | 50*.65 = 32.5 | 18.4 |

+———–+——–+——-+———+—————————————+————-+

| ATM | 17800 | .50 | 119 | 50*.50 = 25 | 21 |

+———–+——–+——-+———+—————————————+————-+

| OTM | 17900 | .43 | 75 | 50*.43 = 21.5 | 28.6 |

+———–+——–+——-+———+—————————————+————-+

| OTM | 18000 | .25 | 32 | 50*.25 = 12.5 | 39 |

+———–+——–+——-+———+—————————————+————-+

| OTM | 18100 | .15 | 17 | 50*.09 = 7.5 | 44.1 |

| | | | | | |

+———–+——–+——-+———+—————————————+————-+

Hi Karthik,

Continuation to the previous message, in case if i don’t square off (not exercising my option)the position on the last day even if i loose my premium case (i.e. after buying call option the market did not move in upward), what will happen?

In both cases, manual square off is needed or zerodha will square off at the end of market closing hours (i.e on Thursday) and settle the money to my account if anything ?

Thanks,

Lingam

If the option is OTM, then nothing to worry about. However, if the option is ITM, then it needs to be settled physically.

Hi Karthik,

Assume i have bought an option at slight OTM and on the expiry day it becomes an ITM option, in case if i don\’t square off (not exercising my option)the position on the last day, what will happen ? ( btw,I have an account with zerodtha).

Thanks,

Lingam

The ITM option will be settled physically, Limgam.

sir for a call option if spot price is above ATM then it is ITM if spot price is below ATM is OTM, but in delta acceleration concept why higher spot price is OTM and smaller spot price is ITM sir please clarify my doubt sir

Darsha, the graph shows how the Delta value changes, delta is higher for ITM and lower for OTM options.

Current ATM option Delta is showing as 25 & -25 (can interpret as 0.25 & -0.25) on the sensibull option chain, accessed from kite. Whereas this article suggest ATM Delta as 0.5 or -0.5

Hello Karthik!! First of all, thanks a lot for these articles. 🙂

I am not convinced with the statement.. \”when is delta is 1, buying the option is as good as buying the underlying itself. \”

Because..

Though the increase in premium and the increase in spot of underlying will be same(when delta is 1), the percentage increase may be different, right? I\’m assuming value of premium would be quite smaller than the value of underlying(please let me know if this is not necessarily true.) So, for example, when spot of the underlying moves from 1000 to 1100, the premium would also move by the same 100 points.. but, say, from 200 to 300. The percentage changes are not the same.

So, this makes me state that.. buying the option and the underlying is not the same even when the delta is 1.

Please let me know if I\’m wrong or my understanding is incomplete.. as I just started to learn about options. 🙂

Thank you!

Yes, percentage-wise it will be different, I\’m talking about absolute point change here.

sir, you are melting away all the fog i had in my head regarding option trading.

thanks

Happy learning, Kiran!

I bought Banknifty at 37500 strik for 36365 spot with primium of Rs. 296. At the end of the dat spot at 36471 and premium at 229. Will i still be able to coverup my losses with 3 days still to go or will my premium keep coming down even the spot stays below 36500

Depends on the way market moves right 🙂

Best explanation sir thanks

lets think the stock is trading at support level i want to buy i.e., call option but which is better to choose ATM Strike or Slightly OTM Strike?

This depends on how much time to expiry is there. If its more time to expiry, selecting slightly OTM is fine, else ATM.

Awesome lesson! I wish i learned that before Covid and i would have been millionaire by now!

Good luck and happy learning 🙂

Hi

The first two are buy option for put mentioned in your table

I.e 2400 pe premium rs 3

And 2275 pe premium rs 7

Dear Sir, as one goes to buy OTM strike and if there is a large move in the market like the situation as you said, we will make a huge money. Even if you spend the same amount of money for ATM strike, if there is a large move, still the premium goes into ITM and there will be a relatively good change in premium for the same change in Spot price due to Option Delta will be nearly 1. What makes him to chose the OTM strike instead of ATM strike

Durga, the decision to buy OTM or ATM really depends on factors like time remaining to expiry, volatility, and the premium as such. For example, when there is a lot of time to expiry, you may want to trade OTMs, but closer to expiry, you\’d want to stick to ATMs.

How we can get all the deltas associated with different strike price of any stock/Index

Check Sensibull site, Satyajit. They give out the deltas and other greeks of all option strikes.

Lovely Explaination with simplicity……! Thank you..!

Happy learning, Sankar!

Hi karthik…… Can u plz clalify why ur friend chose deep otm option on 17 th may….. M still not able to solve this?

That\’s the strikes which he thought was most conducive for a profit 🙂

Thanks Karthik for your reply. Sorry I have just reached till this chapter. Can you please elaborate what you mean by \”permanent loss to capital\”?

To lose all the money you have 🙂

Hi Karthik,

quick question – if Deep OTM moves slowly, is it not the safest? Because if there is a reversal (opposite of what you expected), premium will not change much and you can exit trade without much loss.

Also, if that would have been an ITM, there would be a 100% impact on premiums and huge loss on reversal. ITM could be unsafe?

Sort of, but what you also need to remember is that the permanent loss to capital in these options is also quite high.

Dear Mr Karthik,

I like to know the answer to the question you had asked in this chapter regarding the great achievement in the story. As I am new to options , I am not able to analse and arrive at the result.

Regards,

K N NAIDU

No problem. Please do check the comments, you will find the answers posted by others with explanations.

Hi sir I am very thankful to you for this wonderful tutorials. Just general question how should we select the best stock for option is there any material you have uploaded on website please let me know if available. Thank you so much

I\’d suggest you stick to index and maybe the top 4-5 stocks.

One does not need to wait for the contract to expire and then exercise the option as he/she can make money from the difference in the premiums when buying and selling is what is being taught in this chapter, right??

You can make money from the difference in premium, no need to wait till expiry.

Sir my question is assume I bought CE option at 0TM delta will be 0.05

Trade goes in my favour and now it becomes ATM

Now delta will be 0.5 or 0.55

In option premium

Hope you got my question

Finding difficult to put my thoughts/question

Please check my previous reply 🙂

If Nifty is at 15000 ATM delta would be 0.5 and expect to reach 15100 which is OTM

Consider premium now is 60

Now new premium would be 0.5×100=50

New Premium 110

After 100 point move now 15000 becomes ITM considering spot is now at 15250

Does the delta value transition to slightly ITM that is 0.6

Now the option premium changes with respect previous delta of 0.5

Or new delta of 0.6?

Am I going right?

Thats right. Delta will be higher than 0.5, whether its 0.6 or 0.7 cant really say 🙂

Varsity is doing a great job !! Hats off to you guys

Happy reading.

Sir, I would like to thank you from the bottom of my heart.

Thanks so much and happy reading!

Sir to answer the question why your friend choose OTM and not ITM or ATM because premium will be low and risk is underlying should move more so that trade goes in his direction

True, thats one of the reasons.

Dear Sir,

I hope you are doing well.

Lets say I think Nifty/Stock is going to make a move but it will slowly make that move and target will be achieved by the end of the month.

In the module where you talk about which strike price to purchase, you mention that it is best to buy Deep ITM options to counteract theta.

Would it be better to purchase 1 lot of a future or to purchase Deep ITM options that have a delta of 0.8-1? The future will not undergo changes in theta compared to the option?

Most Deep ITM is not really liquid so what should one do?

Yes, if it\’s a bet on the direction, then futures is a better play.

because… just like your premium, you gains will also be \’good as nothing\’ [if any thing at-all] and theta\’s effect will be more pronounced

here\’s and example:

Last Friday (trading session before budget 2021) I went YOLO and bought Nifty 16000 4th Feb CE for 2.85

Last Monday (day of budget) Nifty shot up 646 points in a single day – 4.74% [3rd highest single day gain in history], contract was valued at 1.10

so as you can see, even that big a move couldn\’t keep up with the loss in theta and drop in voltility…

You said it well 🙂

Why should\’nt we choose deep OTM as a buyer. If we choose deep OTM our premium payment value will be as good as nothing so why should\’nt we choose to trade it??

The chance of deep OTM turning ATM or ITM is low, hence there is a high probability that you may lose the entire capital invested on the option.

This content is pure gold. Do we have the pdf\’s available now?

Yes Ritesh, you can download the PDF, scroll to the end of this page – https://zerodha.com/varsity/module/option-theory/

What happens if we have sold an option. But around expiry liquidity runs out and we are unable to square off

In that case, the contract will be settled physically (but no physical settlement for stocks).

Thanx for ur reply.. I am new in option trading. You said about OTM but I want to know which type of options is right to buy in this condition Deep ITM or ATM?

Well, the answer to that really depends on multiple things, Rajiv. When in confusion, it is always best to stick to the ATM.

Thanx Karthik for your extensive article.. I have a question to u, suppose NIFTY spot price is 13750 and there are 4 days to expiry of options. Market is overall bullish. Then which CE option is right to buy deep ITM or ATM?

Theoretically yes, but this will be a losing proposition as the OTM options tend to lose the premium rapidly due to theta decay.

After reading chapter on Gamma, as an option writer,

1. I think if one is moderately bullish, we should look at shorting put option with delta of -0.2 to -0.3 (Slight OTM) [or buying call option with delta of 0.2 to 0.3 (Slight OTM) as an option buyer] for maximum % returns.

2. If one is strongly bullish, we should look at shorting put option with delta of -0.8 to -1 (Deep ITM) [or buying call option with delta of 0.8 to 1 (Deep ITM) as an option buyer] for maximum % returns.

3. The reason for not going with Deep ITM for moderately bullish/bearish is that when option becomes ATM Gamma could hit you. Is that right?

4. If there are many days left for expiry, and you are (not sure moderately or strongly) bullish, as an option writer, would you choose to go with 1 or 2?

1) As far as possible, avoid shorting puts. If you are moderately bullish, buy ATM CE or sell deep OTM CE

2) Strongly bullish = buy otm calls

3) Yes, plus they are usually expensive options

4) I\’ve stated in 1 & 2 🙂

Hey Karthick!

Crux of my previous question being:

Analogous to buying call option with delta of 0.2 to 0.3 (Slight OTM) or buying put option with delta of 0.8 to 1 (Deep ITM) for maximum bang for the buck. Would writing a put option with delta of -0.2 to -0.3 ( Slight OTM) or writing a call option with delta of 0.8 to 0.1 (Deep ITM) give maximum % returns relative to writing options of other deltas? Correct me if I\’m wrong.

Thanks!

Irrespective of call or put options, it makes sense to buy ATM or two strikes within and sell OTM options.

Hey Karthick!

1. My understanding is that the Delta vs Spot graph is in the perspective of the buyer of options. How would the graph change/interpret if it had to be plotted in the perspective of the writer? How should an option writer look at delta of call and put?

2. Bang for the buck for an option buyer lies in buying slight OTM i.e. delta of 0.2 to 0.3, taking take off and acceleration into consideration. What would be the same for an options writer, keeping only delta in perspective?

3. For the 1300% return you friend made, he would have been more profitable if he had bought slight OTM rather than deep OTM, of course at the expense of more risk, right? Since he wanted to allow a margin of safety for being wrong, he went for deep OTM?

Thanks!

1) The option seller experiences a P&L which is a mirror image of the buyer. So in that sense, the same graph suffices, just the sense of direction changes

2) Bang for the buck for the seller is OTM, I\’d say ATM for buyer 🙂

3) That\’s right

Dear Shri. Karthik,

Thanks a ton for this wonderful article. Your explanations and examples are simple and very easy to understand. Before reading this Zerodha Varsity, all these terms where like cryptic codes for me. God Bless you and Zerodha for helping people like us to understand these concepts.

Thank You.

Thanks so much for the kinds words, means a lot to me. Happy reading!

Dear sir

Yes you are the best teacher I have ever met ! I would like to know whether the PDF book is launched or not as said by you. Im new to versity but enjoying a lot.

Best regards

Sanjay Pandey

Thanks Sanjay. The PDF is available at the end of the module page and you can download the same.

Hey kartik, what\’s the reason behind being advised not to sell ATM options?

Risker right? Has a fair amount of probability of the option turning ITM.

Will it be accurate to say that the graph in 10.2(Delta vs Spot) is actually a graph of delta vs option strikes?

Yes, and another way to look at it to understand that as the underlying moves, so would the moneyness of the option, which is what the graph is all about.

Good explanation..!! I have a doubt.

How did you come to conclusion to buy strike price of 0.2 or 0.3. Is it good to buy immediate OTM option or the next 3-4 OTM options, in general what is preferable range of delta for a strike price which can give max returns whole lot of times? Specifically asking for BankNifty.

Atish, these strikes are selected based on how the B&S formula behaves given different situation of volatility etc. As a thumb rule its always good to stick to strikes which are 2-3 strikes away from ATM.

Ref. 10.2.3

It says ATM option has delta 0.5. That means the spot price = Strike price.

Does this mean for every 1 point change in spot price, premium changes by half?

No, it means the probability of the strike to either become ITM or OTM is 50%. You are right about the premium change.

Awesome

Ohh…sorry…I got confused a bit ..now clarified…

Sir, I really appreciate the efforts you put in to make this modules. I never found anything simpler than this on the internet. People can access the simplest study material on stock market for free. Any layman can understand and clear the stock market concepts after reading this…

Happy learning, Rajesh 🙂

10.2 Delta verses spot price

in example strike price is 8400

Point No. 04.1 Spot crashes from 8500 to 8300. how it turned out to become OTM from ITM?

I mean spot price is 8300 and strike price is 8400 then it should be ITM contract no? as spot price is below than the CE strike price.

Please advice

CE becomes ITM only if the spot is higher than the strike right?

In this chapter, I think there is some error in the last table (Bajaj auto example) of the chapter, instead of OTM its written ATM and vice-versa.

Let me check that, Pratik.

If premium comes down from say Rs 10 to Rs 0. Is there a chance that it will again recover from Rs 0 or it will be lost completely

That depends on how the underlying moves within the expiry of the option.

Hi Karthik, Your explanation is really wonderful. It is creating interest in learning and making it simple to understand.

However I have one doubt, when moving from OTM to ITM, the strike price should move in ascending order, right?

But in the table at the end, the strike prices are in descending order. Is my point correct? Could you please clarify?

Thank you in advance,

Murthy, this depends on which option and the position (long or short) you have.

Hi Karthik sir,

Before going to next concept I would like to share my experience with this lesson.

This chapter was completely a new fairy tale for me with extreme emotions at play i.e. the Idea of huge Gains & the deep thinking on huge losses,

Firstly, I never thought of Nifty 50 breaching the circuits( I thought it\’s impossible), but your example of 2009 showed me even markets hit the circuits (though a very rare event).

Secondly, at the back of my mind I thought following a very good news, There would be a big gap up opening and I would have been more cautious to take position but markets opened flat and went up like a rocket !

3) After the day\’s end, my thought process was to BUY put option at OTM as the market was in overbought state and at a profit booking stage. But the correction was way less than expected !

All these things again reminds me that , \’Market is the king, no one can actually time it\’

Lastly, Thank you so much for this amazing work you are doing. Your teachings puts my mind under work.

Of course Vaishakh, markets is the ultimate guru 🙂

I wonder if such a drastic decrease of Volatality happens in intra day given that the underlying has so volatile that.

Let\’s say even if that is the case iy cannot simply ignore the other Greeks specially Delta. I wonder if something else is at play.

Oh yes, volatility can increase intrday 🙂

I have been observing Reliance and its options for few days. I observed contradicting (at least in my understanding) today. I see that Reliance has fallen around 40 Rs but 2000PE AUG Expiry not increased, infact it fell 4 rs. How and Why is that?

Reliance fell from 2112 to 2067.

2000PE AUG is not at all a deep OTM

The volatility too would have dropped, hence the premium has declined.

Hi Karthik – A basic doubt on Delta – Ideally speaking, shouldn\’t the delta really be same for all expiries for the same strike price? My understanding is Delta is only governed by how far the option is from Spot, irrespective of the Time to Expiry. Reason is when I see the delta for the different options contracts of the same strike price, the delta values are different.

Jatin, this is true for ATM strikes. Other strikes do not obey this since the expected volatility changes for each strike with respect to time, and this has an effect on other greeks including delta.

Respected Sir,

Greetingsts..

I took some observations yesterday (17-07-2020) when the nifty spot moved up almost by 160 points. When nifty was trading at 10800 ( 10800 ATM), started observing 10600 PE ad 11000 CE who were 200 points away from ATM. At the EOD when nifty closed at 10900, 10600 PE lost Rs. 24 while 11000 CE gained Rs. 43. Is it because the acceleration of Delta on the Call side its much faster than the deceleration of Delta on the Put side? Theta for both strikes was almost same. My understanding is that the Theta decay had the same effect on both the call and put option prices (equal strikes away from ATM). Sudden raise in the spot too had the similar effect on the option prices and India VIX fell by 4.5%. So, only factor which was affecting the option prices is Delta.

In effect, buying a call yield better profit instead of selling a put if view goes right. We will not be benefited much if the spot moves up substantially in a short duration (Intra day) by selling a put. Please correct me sir if I am wrong. This may be for the reason that the Call OTMs will move towards ATM (Deltas would be increasing) and Put OTMs will move towards Deep OTMs (Deltas would be decreasing).

I request your insight into another important thing sir. I have also observed during current expiry week that for Nifty Options, Put option prices would be more than the call option prices when the spot is increasing & Call option prices would be more than the Put option prices when the spot is decreasing for the equal strikes away from the ATM. Also the Deltas of the Call and Put options strikes which are equidistant from the ATM are not symmetrical (They differ almost by 0.06 to 0.08. What could be the possible reason Sir?

Requesting you to kindly post a writeup/guidance on the weekly expiry of Nifty and Bank nifty too Sir.

Thanks in Advance & Regards

Premakumar K S

Your observation is perfect, there is no questions on that. Delta and volatility matters on a intrday basis. However, the 2nd part of CE increasing while markets are down and then the PE increasing when the market is up is something you cannot generalize. This is possible when we have extreme volatility in the market.

Hey karthik

Generally I was lazy to ready article bcz of lengthy and hard to understand but really this article is point to point and very understandable. Even I am very excited to read whole article. Really good job…. Keep doing good work… Cheer 🙂

Que – I am pure intraday trader so what is better for me to buying or selling. And what value I need to check. With the help of delta I can make my decision what should i do be buyer or seller for particular day?

Thanks for wonderful Work again.:)

If its just intraday that you are interested in, then you should maybe look at just the volatility. Based on which you can decide to buy or sell.

Thanks for the kind words on the content 🙂

Hello Karthik,

Thank you so much. As everyone says, stocks are probably hardest place to make money. I am trying my best and learning every day. I developed a custom stock screener for myself earlier, recently also programmed advanced features like trailing stop loss for delivery orders using Kite API. Even with all this, stocks are just hard. But what I learned from here has definitely helped me a lot.

I will keep working on myself. Hopefully, it will pay off someday. Thank you again.

I\’m sure it will. Programing skills is a great value add, I\’m sure you\’ll hit gold one day 🙂

Hello Karthik,

I finally did my first options trading this week. It was Reliance and profitable too 😀

I also noticed something today. https://i.imgur.com/2BBuy7S.png

It seems like farther you go from ATM towards OTM, the more gains increase. While Reliance only gained 2.95%, 2080 CE option gained 176% compared to the ATM option 1880 which only gained 76%.

You said ATM options are most profitable for small changes. Then why 2080 CE was most profitable in this example?

Congrats, Varun. Hope you continue to stay profitable!

Yes, that is right. But for the OTM to react that way, the move in the underlying has to be share and quick. If the same move had happened across say 10 or 12 days, you\’d not have seen the same behaviour in OTM options.

-Continuation from above question

But sir, in case 2&3, since the premium doesn’t hardly move and so if I square off my position before expiry, Don’t I regain the premium that I’d paid. 🤔

Ah, that depends on what price you buy and sell right?

Hi sir, here is my understanding, kindly correct me if I’m wrong.

Similar to the example that you have explained above, here is what I speculate.

I expect the nifty to crash in a month and so if I bought the deeply OTM put option with delta value of nearly 0, there are three possible outcome.

Case 1: nifty crashes, then my OTM option would become ITM and I would have made some fortune 🙂

Case 2: If nifty rallies, then since the delta value off my option is 0, premium wouldn’t change and option becomes even deeper OTM option, so I wouldn’t incur any loss

Case 3: If nifty stays at the same level, then the premium wouldn’t change since the delta value is 0, and so no loss.

It seems win-win situation, but where is the catch, am I missing anything 🤔

Case 2 – Your loss is restricted to the extent of the premium paid.

Case 3 – Same as above.

As you can see, in case 2 & 3, you do have a loss. Only in case 1 you make money.

Sir i had a doubt.

Suppose the index right now is 5000 and i expect it to go to 5500, why would i buy a call option for Deep OTM, say strike price of 5800?

You will buy deep OTM not just based on the directional move, but also on the time to expiry.

Hi Kartik. First of all, thanks a lot for excellent tutorials you have made on options.

Pls refer to recent previous query .

Let’s say :

I buy call option of HDFCBANK with strike price of 960 and spot price is 900, I bought HDFCBANK 960 CE at premium of 17.00 with lot size of 500 shares. Lets take we have around 20 days left for expiry so time is not the factor in it.

Now, my question is:

\”2. Let’s say in above case I didn’t sell stock before expiry but 960 CE premium increases as spot price moves till 950 and premium which was 17 when I bought is at 34. But at the day of expiry or even before expiry date, it doesn’t crosses 960, so will I make profit here by selling at 34 or not ?\”

Here,

A)why I can\’t get the difference in premium price(34-17=17) as my profit ? (For case where stock is unable to cross my strike price but premium gets increased.

B) Is it really necessary for spot price of a stock to cross the strike price to get / register profit in options trading, even if premium has increased? What if we sell it before it has crossed the strike price and book the difference of increased premium as profit ?

Pls advice.

Yes, if you manage to sell @34, then you get 34-17 as your profit. However, if you hold to expiry, then your profit depends on the settlement price on the expiry day. YOu can sell the option anytime before the expiry if you find the premium to be trading at a higher value.

Hi,

Let\’s say I sell call at spot 420 CE spot price is 390, and premium is 15.00. Let\’s assume price we have time to expiry.

If market goes down and let\’s say price goes to 360 then premium will also go down let\’s say 10, then if I buy back at 10 then will I make profit of (15-10)*lot size or I make profit of 15*lot size which is premium amount ?

Yes, you will make a profit of Rs.5.

Hi,

Let\’s say :