15.1 – The classic approach

I had briefly introduced the concept of calendar spreads in Chapter 10 of the Futures Trading module. Traditionally calendar spreads are dealt with a price based approach. Here is a quick recap on how this is done –

- Calculate the fair value of current month contract

- Calculate the fair value of the mid-month contract

- Look for relative mispricing between the two contracts

Based on the mispricing, you either buy the current month contract and sell the mid-month contract or sell the current month contract and buy the mid-month contract. Here is an example of a Calendar Spread –

- Buy TCS Futures expiring 28th June 2018 @ 1846

- Sell TCS Futures expiring 28th July 2018 @ 1851

Here you buy and sell the futures of the same stock, but of contracts belonging to different expiries like showcased above. The difference between prices of the two contracts is what is expected to made here. The risk is extremely low in calendar spreads so therefore the money you make on calendar spreads is also small. If you are trader like me, who is averse to risk, then this is something you may like.

This approach to performing a calendar spread is a decent one.

By the way, if you are not familiar with what I’m discussing, then I’d suggest you read Chapter 10 in the Futures Trading module to get a quick perspective on the classic calendar spreads approach. I think it forms a crucial foundation on top of which you can build other variant/styles of calendar spreads.

So let’s get started straight away.

15.2 – Calendar spread logic

If you have read the chapters on pair trading, then understanding the calendar spread logic is quite straightforward. This simplified approach assumes that the current price of futures is a reflection of everything known in the market. The known set of information can extend from news on the stock, corporate action, discount/premium, fair value, and literally everything out there which is relevant to the stock.

Now, if the above assumption is valid, then probably we can use the price itself as a trigger to identify opportunities to set up a calendar spread trade. This kind of simplifies the whole approach. Calendar spreads are a low-risk strategy so therefore do not expect big bucks from this strategy. However, since you simultaneously buy-sell the same asset, you take out the directional risk involved in the trade, hence it does make sense to top up the leverage. Also, unlike pair trade, the calendar spread trades can be ultra-short term in nature, with most of the trades closing within the same day. Before I take up an example to explain this, I’ll quickly give you an overview of this is done.

Start with downloading the continuous futures closing prices of the stock for both near month and next month contracts.

Calculate the daily historic difference between the two contracts and generate a time series. Calculate the mean and standard deviation of the time series. Using the mean and standard deviation data we can estimate the range for the difference. A trading signal is triggered when the difference between the two contracts move to mean plus or minus 1 standard deviation and the trade is closed when the difference collapses to mean.

You get the point, don’t you ☺

15.3 – Calendar spread example

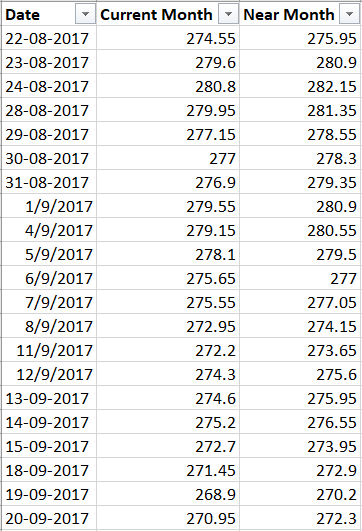

I’ve taken the example of SBIN to illustrate calendar spreads. I have download the continuous futures data from Zerodha Pi (Zerodha’s desktop trading application) for last 200 trading days. I have got the closing prices on excel sheet, and this is how it looks –

The next step is to calculate the difference between the two contracts. It is advisable to subtract the price of near month contract from the current month contract. This is because, all else equal, the futures price of Near month contract is always higher than the previous month contract owing to the ‘cost of carry’. Chapter 10 of futures module explains this in more detail.

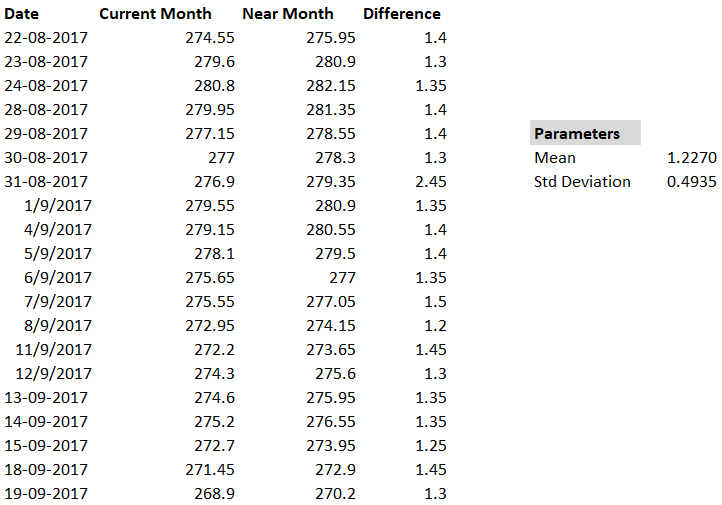

The difference is calculated and the time series data is generated, as shown below –

I will now calculate the mean and standard deviation on this time series. The mean will give me an estimate on how much of the difference is acceptable on a ‘day to day’ basis and at the same time, the standard deviation will give me a sense of variation in this difference. Here is the snapshot.

You can calculate the mean and standard deviation on excel using the ‘=Average ()’ and ‘=stdev()’ functions respectively.

The mean of 1.227 tells me that, all else equal, the difference between the two contracts should be 1.227 or in that vicinity. This essentially means, there is no trade opportunity if the spread (or the difference) between the two contracts hovers around this value.

We now use the standard deviation value and the mean value to calculate the range of the spread –

- Upper range = 1.227 + 0.4935 = 1.7205

- Lower Range = 1.227 – 0.4935 = 0.7335

I had mentioned that the spread can hover around 1.227, but I had not quantified ‘vicinity’, which is quite important. The range calculation does just that, it helps us quantify the range within which (vicinity) the spread can vary on a daily basis.. Any value of the spread outside this range gives us an opportunity to set up a calendar spread.

If the spread has increased beyond the upper range of 1.7205, it means either the near month contract has increased in value or the current month contract has reduced in value.

The rule of thumb in any arbitrage is to always buy the asset in the cheaper market and sell the same asset in the expensive market, hence the trade here would be to buy the current month contract and sell the near month contract.

Likewise, if the spread has fallen below the lower range value i.e 0.7335, this means the current month has become expensive and near month has become cheaper. Hence, the trade here is to sell the current month and buy the near month contract.

With this logic in perspective, let’s evaluate the if SBIN has given us any opportunities over the last 200 trading days.

15.4 – Spotting opportunities

Keeping the above pointers in perspective, we can conclude the following –

- Sell the spread when the spread increases beyond 1.7205. Sell spread means, sell the near month contract and buy the current month contract

- Buy the spread when the spread shrinks below 0.7335. Buy spread means, buy the near month contract and sell the current month contract.

If you find it hard to figure out which contract to buy and which one to sell when a signal originates, then simply think in terms of the near month contract. Sell spread means sell the near month (therefore buy current month) and buy spread means buy the near-month (therefore sell the current month contract).

In the excel sheet, I now look for the historical opportunities. I will identify the sell spread opportunities first. To do this, I simply have to apply a filter, to filter out all values above 1.7205. I’ve done the same, here are the results –

As you can see, on 6 occasions, the spread increases beyond 1.7205 or the first standard deviation levels. On all these occasions, there was a trigger to sell, implying the spread would fall back to mean.

In fact, here is how the spread behaved –

| Signal Date | Sell spread value | Trade closing date | Buy spread value | P&L |

|---|---|---|---|---|

| 31-08-2017 | 2.45 | 1-09-2017 | 1.35 | 1.1 |

| 28-092017 | 2.6 | 29-09-2017 | 1.15 | 1.45 |

| 30-11-2017 | 2.35 | 01-12-2017 | 1.55 | 0.8 |

| 28-12-2012 | 3.8 | 29-12-2017 | 1.45 | 2.35 |

| 22-02-2018 | 2.5 | 23-03-2018 | 1.3 | 1.2 |

| 26-04-2018 | 1.85 | 27-04-2018 | 0.6 | 1.25 |

As you can notice, signals originate around month ends, probably due to expiry dynamics. Also, every trade has resulted in a profit (although small) and closed the very next day.

Let us see how the buy spread trades have performed. I have filtered for all values below 0.7335, and here are the results –

There are close to 28 trade here and not all of them are successful. Of course, the losses are as small as the profits, if not smaller. I’ll let you do the exact calculation, like the way I’ve shown for the short trades.

I hope this example gives you a general sense of how to carry out calendar spread. I’m sure you’d agree that this is far simpler and intuitive compared to the classic approach to calendar spreads.

I have summarized my thoughts on Calendar spreads here and this will also double up as the key takeaways for this chapter –

- The expected profits and losses are small in calendar spreads

- Directional risk is eliminated, hence you go can go full throttle on leverage

- All the short trades in SBIN were successful but longs were not – this implies that I would only look for short opportunities in SBI. In other words, you need to backtest the P&L profile of each futures contract and figure out which contract you can go long on and which contract you can go short on

- Since the P&L is small, ensure your trading costs are minimum, a discount broker like Zerodha is most suited for such trades J

- Trades usually close within a day or two

- Trades usually originate around expiry due to expiry dynamics

Think about this, if you can backtest this across the entire universe of equity and commodities futures contract, you will essentially have at least a signal or 2 every day!

I’d love to hear your thoughts, so please do post your queries.

PS: I won’t be posting any new chapters for a while, but that does not mean I’m not working on new content, it is just that the delivery format will be different and way more exciting!

Stay tuned ☺

Hi Sir,

Does this strategy works on commodity options as well. The spreads in contracts of commodities like Crude and Natural Gas are way too wayward. e.g Natural Gas current and next month contract are trading with a spread of hardly 1%, however the spread between Oct & Nov contracts is as high as 10%. Also the historical data with end of day prices is very erratic, spreads ranging from as high as 20% to negative 16%.

I\’ve personally never tried, but end of the day, its a time series data and the same principals should apply. If you are evaluating, please let us know your finding as well 🙂

I fetched the data for RELIANCE, and the trading range between the current and next month futures is around 6 to 10 (from lower to upper bound). However, since the beginning of this month—about 20 days by now—and with expiry approaching, the spread between the current and next month futures has only been trading within a narrow range of 2 to 3.5 points.

Thats quite normal, Shivansh. Spreads increase and decrease as with the change in demand and supply dynamics.

So how can we tackle the issue of changing spreads? If we go purely by the historical range, we might think there’s an opportunity—but in reality, we may never be able to close the position profitably

You need not stick to the regular fixed entry exit rules, in fact this is where optimizing your strategy for entry exits comes into picture.

So, how can we optimise it and know that the range of the spread is changed from regular spread

Yes, you can create models to help you do this.

Sir in real time order placing the bid and ask spread eating away most of the profit when taking position and while square off. Limit order is favourable but chances of missing one leg and risk increases. What is your thoughts on this?

I agree with you. Execution risk is quite high in these strategies. Also opportunities will shrink going forward, thanks to the institutional algos.

Do we still get such arbitrage opportunities? I tried for last 3 months and I usually get 8 to 10 such trades per month at maximum. Is it correct or there are more and I am missing those?

It depends on various things. For example, there could be no arbitrage in a short term play, but maybe there is one in higher time frame.

While entering a position, there can be a difference between the bid and ask prices of the contracts—and the same risk exists when squaring off the position.

Let’s say we enter a trade based on the current bid/ask prices, and the prices of the contracts later converge back to their range, showing a profit in our positions. However, the actual bid/ask at that moment may still differ, affecting our ability to realize that profit.

How can this be tackled?

Thats right, and thats the execution risk which is maximum while executing this strategy. Hence the need to stick to liquid contracts 🙂

I’m using the z-score to generate entry and exit signals, but I’m not sure how to filter between liquid and illiquid stocks. Each stock has different trading volumes, and since we’re trading both near and far month futures simultaneously, their volumes will also differ. That makes it difficult to set a fixed minimum volume threshold

One of the easiest way to filter is to look at the bid-ask spread. Higher the spread, lower is the liquidity. Keep liquid stocks like Infy, TCS, Reliance as the reference for liquidity.

Sir,

I thought futures contract in wrong way by candlestick pattern and stock price action.

Now I understood basics of futures.

I will do back testing calendar spread method and apply.

Thanks a lot

Good luck, and happy trading!

Hi, This strategy looks very interesting. I have small doubt here, how many days of mean or stdev would be good to take into consideration?

Take it for maybe last 30 days? Since this is a short term trade?

Hi karthik,

I tested it on Banknifty. Here when i calculate difference for current and near month(past 6 months data). Its always a positive number, so when the difference is lower than lower range or higher than the upper range, I am always getting to sell near month and buy current month(As we have to sell higher value contract and buy lower value contract). Please correct me if i am missing anything

That\’s right, always sell the higher priced one and buy the lower priced one in Arbitrage.

Great article! I found the topic very insightful. I’d love to implement calendar spreads in an Excel or Google Sheet for better tracking. Since futures data changes frequently, what would be the ideal time interval to capture the data—hourly (1hr, 2hr, 3hr) or daily? If daily, which price point should I consider (open, close, or average)?

As a Zerodha user, I couldn’t find a way to fetch futures data directly into Excel. Could you guide me on how to automate this process? Manual entry isn’t feasible, so any suggestions on integrating live data would be really helpful.

Thanks Mukesh. Why not take the futures continuous data via Kite connect APIs?

My self buy monthly pe 23000 and sell weekly 23000 pe broker square off my sell position due to market volatility and leave my buy position and market goes reverse which I suffer heavy lose what is the solution for this

You may have not had sufficient margins for this, hence the square off. You do have the right to ask your broker for an explanation.

Sir,

I have conducted a self-analysis to determine which trading system best aligns with my mindset and long-term goals. My analysis indicates that Arbitrage trading system is the most suitable system for me.

I am eager to dedicate significant time and effort to studying,researching, developing, and implementing arbitrage strategies in commodities,stocks,options,futures.

Could you please guide me on the all specific domains and topics (anything even if not from finance, may be math,calculus,stat and cs) within arbitrage that I should prioritize to maximize my results?

Thanks,

Swarnava

Swarnava, you\’ve identified the right skills needed to pull of good arbitrge trading opportunities (stats, maths)..but you also need programing skills to go along with this. I\’d suggest you get this going. Without programming skills, it wont be possible to do arbitrage.

where to get continuous future data in excel

You can get that on Kite or via Kite Connect APIs. You can download to excel. Do speak to our support desk for this.

Hi sir

Historical data of stocks can be downloaded from chart iq option available in kite application but how I can downloaded the historcoal data of future contracts ?

You can switch to continuous charts for this. I\’d suggest you call the support desk and check once.

Curious after reading this chapter,

There is an idea sparked in my mind, sharing with you

If I have 5 lac :-

If I invest that 5 lac rupees in a government bond with an yield of 7.5%.

and pledge the instrument with zerodha, I will get a cash collateral margin.

So it can be used to trade futures.

so I am getting 7.5% risk free return from the gsec annually.

if you take an example as of today.

Tech mahindra january futures are trading at 1764 rs (short) 1 lot

And Tech mahindra december futures are trading at 1754 rs (long) 1 lot

the lot size is 600

so if we multiply (10*600) = 6000 rs is the profit.

the margin required is 3,71,000 rs, fund will be blocked = around 37000rs

so there are risks associated with it :-

1) Execution risk = both the orders has to be executed same time to get the price difference and also has to be exited at same time

2) there can be a slippage and charges let\’s take it 1000rs.

I am currently doing this as paper trade in sensibull.

planning to exit this before 1 day to expiry.

Your Thoughts on about the planning and the (worst-case-scenario) risks associated with the trade ?

Sure, you seem to have factored in the 2 big risks. Add to that taxes and costs, and figure if it makes sense. Wishing you the best 🙂

I was looking at GOLD dec futures and feb2025 futures, the upper range for the spread is around 530 but as of now the spread between the two is around 750. But as we are just a week away from the expiry of dec contract. Is it worth to take the risk as prices mostly diverge near expiry.

I dont know if its worth the risk. But since this more than usual, I\’d be tempted to place a trade (but this is just me being curious and adventurous). You can choose to track the trade closely as well.

In the example above, you use continuous data for both futures contracts. However, most opportunities tend to arise near the month\’s end. Since this is continuous data, trades might close within a few days. In real-time trading, however, how should one handle these contracts when they are about to expire? For example, if we consider the current scenario, futures of November and December for a stock, say ABC, and an opportunity arises a day before expiry or on the expiry day or even a week before expiry, should we take the trade or not? If the spread does not return to its range by expiry, it could result in a loss.

Yes, if the spread does not converge, then it will return a loss, but that is the trade here. You expect the spreads to move. You can use continuous data to get a sense of historical spread movement, and then use that as a peg to estimate the current spread and figure if the current spread is worthy of taking a trade or not.

Understood. I\’ve been also thinking about it. In addition to difference in LTP, I will also check for bid & ask prices and then try to place the order accordingly. Are limit orders worth trying in this scenario? I\’m a little hesitant since there is a possibility that one of the legs might not get executed.

Yes, limit orders are good for these things :)….but there is nothing much you can do about execution risk.

Hi Karthik – I have a question regarding this approach. I’ve been using LTP to monitor spreads between two futures contracts, but I’m running into few issues. Since LTP reflects completed trades, I’m noticing that the spread I calculate doesn’t always match the current order book spread. This delay seems to be causing missed opportunities when the actual bid-ask spread widens briefly but doesn’t yet reflect in the LTP. Also, while placing market order based on the LTP, the executed trade does not always turn out in the price range needed leading to slippage.

Hmm, so one thing you can do is check for bids and asks and match it with your buys and sells. If they match, trigger and place order.

Appreciate for the quick reply. I do have subscription for the kite APIs. I did some digging and was able to find the API to get the historical data for futures. Some development is required to get the data in the right format but it\’s definitely possible. Thanks for point me in the right direction.

Sure, wishing you the best Saravana. Good luck!

Thanks for sharing this strategy. I like low risk strategies. The Calendar Spread Strategy seems to be a low risk & low returns strategy. It took me about 2-3 hours to get the data for ICICIBank for last 200 trading day and construct the current and near month prices for those 200 trading days. I downloaded the futures prices from NSE website and based on the expiry, I had to paste the prices in the current month or near month. I wanted to know if there are any other ways in Zerodha Kite to get the data quickly.

If you are comfortable using APIs, then maybe you can check this – https://kite.trade/

Hi Karthik,

Q1- Is there a way to fully or partially automate this process? I found that it can\’t be done with Strike

Q2- How do you do it, do you manually track this in Excel and execute changes as they occur, or do you use another method?

I\’m sure there are ways. Pretty much everything in this day and age can be automated :). Yeah, I\’d do it manually back then. But if I were to do it again, I\’d try anf figure ways to automate.

is there a way to automate this process (I don\’t know how to write code) or any website or tool which provides this data

Hi,

For next month and far month spread, we will download continuous data for current and next month or compare the next month and far month only?

For example, in Natural Gas, August and Sept. 2024 spread is Rs. 11 but Sept. and Oct. 2024 spread is Rs. 30.

Now if I want to sell the Sept. and Oct. 2024 spread, do I compare the average spread of August (which is current month) and September or compare the average spread of Sept. and Oct. only?

Since september month will become current month once August contract expires.

Please clarify.

Thank you.

Sept and Oct only. No point taking Aug futures into consideration, unless you do Aug-Oct.

Hi,

You mention that profit and loss is small in trading spreads. However, since the capital required to enter a spread trade is very less, the return on capital (or loss) is quite high.

Isn\’t it?

Kindly clarify.

Yes, from RoI perspective, it is not that bad 🙂

Hai Karthik,

is there any other way to find calendar spread opportunities other than (mean and standard deviation). if any please advice.

Hmm, I\’m not sure. But here is the thing, whichever way you look at it, its always linked to future pricing 🙂

Hello Karthik, Thank you for the reply.

Different question, I was searching for the approach to deploy the BOX spread strategy, however identifying a opportunity seems to be a challenge. If you don\’t mind will you pls share your thoughts on the same and advise? thank you

I think these opportunities usually arise when there is a big shift in premium and discounts with respect to futures and spot prices. Do watch out for this shift and you may spot something interesting. Good luck!

Hello Karthik,

Thanks for sharing the details, do we need to do the back test as above to find the opportunities available in the market?

do you think simply selling the current month NIFTY contract and buying the next month NIFTY would yield decent profit? I\’am happy with 1% a month so wondering will that work pls?

Harsha

Back testing always helps, Harsh. Please do that if possible before you take the trade. Good luck.

Hi Karthik, hope you\’re doing well.

If the front month contract is cheaper than the current month then what does that imply? Right now for IGL the July contract is cheaper than the June contract, so does this present a reverse calender oppurtunity?

Also does this imply something about the stock price as well or is it just a result of expiry dynamics?

I tried putting a basket trade with -1 IGL JUN FUT and +1 IGL JUL FUT in the strategy builder on sensibull but the payoff graph suggested that this would lock in a loss of -5.5K per lot and buying the more expensive contract and selling the cheaper contract would lock in a gain? I don\’t understand how this is possible.

Hope I haven\’t bombarded you with too many questions! Good day 🙂

Under normal circumstance, the current month contract will always be cheaper than the mid/far month. Mid/Far month means more time to expiry, and therefore the cost of carry is higher, which means the mid/far month will be more expensive compared to near month contract.

Got It Thank you, Karthik

Amazing and very helpful content.

Happy learning, Amit!

Hey Karthik, how can I get the continuous future data for the Banknifty contract(current and near month)as mentioned in the example….kindly help

If you are comfortable using APIs, then you can check here – https://kite.trade/

Yes, I mean let\’s assume

If stock is 440 futures OF current month is at 445 and near month at 448. Here spread is 3

Suddenly within few weeks/months it moved up to 880, now current month futures is at 888 and near month at 896

Here spread is 8

But actually it\’s normal spread or diverged spread, How to determine that?

As average of spread is changed, Standard deviation will be changed. I think this sudden move causes a skew in average and SD

One way to measure is to look at the spread as a percent rather than an absolute number. That way you will know if the spread has diverged or converged.

Hi Karthik,

So while calculating difference, If stock has moved significantly high for example From 440 to 880 it\’s double, now whatever difference occuring at 440 also increases at 880 ( costs of futures also increased) then average of difference and standard deviations will be skewed. how do we handle this?

Futures too would reflect this change, right?

in the table the current month data from 22-08-17 to 31-08-2017 is for sbi august future and near month data is September future. and 01-09-20017 to 19-09-2017 the current month future is September and near month future is October?

Yup, thats right.

Thanks a lot Sir for this wonderful and highly valuable module for us for free of cost….

Reading this module I fall in love with stats based strategies. need to explore more Sir, Need more interesting strategies like this Sir for all aspects of Stock market.

Kindly let us all know, how do you know all of this Sir :->

I mean the books or videos or any other available sources.. I want to explore more strategies Sir… I loved this risk free or less risky quant strategies..

Love You Sir :->

Thanks Suman. I\’ll keep sharing any interesting resources here if I find one.

Hi Karthik,

The spread is working fine for me. My only challenge is the charges. For example for asianpaints calender spread, to entry and exit cost is 380 rps with margin of around 40k. Which makes it 1% of the total margin. So I need to make more than that to cover my charges.

I have come up with ways as below

1. Trade with spreads having 1SD atleast 5 times the charges ( adjusted for lot size)

2. Trade only daily data and hold maximum time

Any other way to cover up the charges?

No, the only way to reduce charges is by reducing overtrading 🙂

Hey Karthik,

Any idea like from where we can download such continuous data(around 5 years or so). I would prefer to download it in python, though downloading just the complete csv is also good enough. Are you aware of any such source. In yfinance api mcx commodities are not there

thanks

You can check here and also post your query here Bill – https://kite.trade/

Great article. I am in the process of programming this type of calendar spread. I have already made money by programming pair trading and classic calendar spread.

What is the recommended stoploss for this divergence-convergence calendar spread?

You can keep a % of capital as a stop loss or maybe something like 0.5 SD.

Hi Karthik Rangappa,

Greetings from the heart of Bengaluru! I am Sarthak Sahu, representing the Innovation and Entrepreneurship Development Center (IEDC) at Dayananda Sagar College of Engineering, Bengaluru.

We are thrilled to announce our annual celebration of innovation and entrepreneurial spirit, Esummit 2023. We strongly believe that your participation as a keynote speaker, panelist, or sponsor facilitator would be immensely beneficial and enriching for the Esummit. We witnessed a footfall of 11K+ students around Bengaluru last year and this to me seems like a very good opportunity to teach young people the basics of Money etc.

We have some ideas on which we can collaborate and make learning fun and easier for college students.

Best Regards,

Sarthak Sahu

Curations at IEDC

(Proof of Work) https://www.instagram.com/p/Ckadx4dpcAo/

Sarthak, you will have to send this message to the Varsity team (Sales), please create a ticket for this 🙂

How can i track all future every day??? I don\’t know programming.. Is there any other way to find trade every day without knowing programming???

You can track the prices over via trading terminal right? Not sure if thats what you are looking for.

Sir,

(i) We sell / buy as the spread goes above mean plus 1SD/ falls below mean minus 1SD. Is there any stop-loss for the spread strategy?

(ii) Can we track this strategy on end of day basis or it rather requires more frequent watch. I have a full time job and can only watch at end of day. Pls suggest.

(iii) How many opportunities can we get in a month tentatively to trade for each of stock futures ( considering we backrest results whether to buy/ sell)?

1) Stoploss is basically on the spread itself, you need to see how the spread is behaving and set a SL as a whole.

2) Yes, maybe you can, since they are hedged. But none the less, these are futures instrument, I\’d suggest you keep an eye 🙂

3) If you are lucky, maybe 1 or 2.

Sir,

Regarding fetching continuous data, please reply if I am correct on the below understanding:

(i) To fetch continuous data of current month (Say, Nov,23): Open the future chart of Nov,23 in ChartIQ—>Under settings, we need to select the \”Continuous\”option.

(ii) To fetch continuous data of near month (Say Dec,23): Open the future chart of Dec,23 in ChartIQ—>Under settings, we need to select the \”Continuous\”option.

Thats right, but do check once with the support team if that works.

Sir,

In calendar spread, You have mentioned to download the continuous futures data for the last 200 days. Again, you have shown the data for current and near month separately. My query below-

(i) If I download the continuous futures data for the last 200 days, then there should be only one column showing the futures historic data and not two columns since all past months are same (No current or near month)…..Am I correct or missing somewhere?

(ii) Have you meant to download the historic 200 datapoints for each of the current and near month. If that is the case, please suggest way to download. I am perplexed on how this can be done.

I think it will be easier to explain this over call. I\’d suggest you call the support desk for this and take their assitance 🙂

Sir really nice article.

Can we use it for nifty options too??

Yes, you can. But you do need to back test this before using.

Zerodha has stopped zerodha pi. So now how can i download current month and near month future data continuously??

You can use Kite for this. Please call the support desk, they will help you with this.

Hi Karthik,

Need some clarification and guidance.

Did the following calendar spread in Tata Motors, it is a virtual trade.

Entry date:26-July-2023

1. Sold 27-July expiry TATAMOTORS 660 CE at 8.10 rupees

2. Bought 31-Aug-2023 expiry TATAMOTORS 660 CE at 20.90 rupees

Exit date: 27-Jul-2023

1. Squared-off July exp 660 CE at 0.5 rupees

2. Squared-off Aug exp 660 CE at 17.65 rupees

Booked around 6,000.00 rupees profit.

The question?

If I were to replicate the same trade in real, what are the nuances of physical settlements and margin requirements etc for this trade? Want to know the risks associated with entering into calendar spreads of individual stocks just a day or two prior to near month expiry date. Please help.

What if i have only 25 days data to do the math. is it sufficient data for calendar spread? can i initiate a different trade considering only 25 day data?

Not really, you need more data points 🙂

No no sir , i mean like we have given here a backtesting report for said period, lets asssume its Jan to Dec and we taken the mean and Sd on that data , and now we have found the opportunity in june , but in actualy data , july to dec data will not be present in june time , so the SD and the mean values will be different .

Ah got it. So its always better to keep your backtesting data up until the latest period. So in this case, my data period can either be Jan to June or June to June.

Sir, when we are backtesting the data we have taken the mean and sd for lets say a said perios of 1 jan 2015 to 31 jan 2015 , and backtested that in june the sd varied from the yearly sd and we took the trade, but sir in real we will not have the data from june to dec at that time, so the mean and sd will be different i guess. IF this is so sir, what should be the ideal time period of the previous data for creating the mean and the sd. like june 2014 to june 2015 , like that.

Karan, not sure if I understand this fully. Are you saying you want to backtest for 1 month, but the time of back testing in in June?

LTTS

future price-3450

and spot price – 3609

How to execute?

If you feel futures is under valued wrt to spot, then you should consider going long.

Should take trade in LTTS?

LTTS? Can you share more context?

Sir how can I download continuous futures data in Zerodha Kite?

Check this, Anant – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/charts/articles/continuous-data-kite

The next step is to calculate the difference between the two contracts. It is advisable to subtract the price of near month contract from the current month contract. This is because, all else equal, the futures price of Near month contract is always higher than the previous month contract owing to the ‘cost of carry’.

Please clarify current month, near month and previous month.

Value of near month is greater than current month so to subtract the price of near month contract from the current month contract will give a negative figure.

We are in Jan 2023. So Jan futures is the current month, Feb futures is mid-month, and March futures is the far month.

Article doesn\’t talk about the effect of implied volatility in a calendar spread position which is the most important factor that affects the profitability of this trade.

The technique discussed here employs futures. But I\’d like to learn more about this. Can you share some insights?

Hi Karthik,

Pls let me know where we can get continuous Futures data for current and Next Month Expiry for Calender Spreads other than zerodha pi.

I check on internet but only 90 days data is present. I am not getting how continuous chart is for two different expiries can be different for data greather tha 90 days.

I\’d suggest you speak to an NSE-authorised data vendor for this, Abhilash.

Hi Karthik,

What is the logic in using continuous futures data as opposed to just regular futures data?

no sir can we apply in option

You probably can, but it\’s better with futures.

sir

please confirm if spread is beyond upper range i.e 1.7205 what i will buy CE or PE

You are dealing with futures right?

Hy sir

very happy good evening to you

sir i want to ask that if we want to trade with calendar spread strategy, then its is important to get the data of 200 trading days closing price and calculate theirs mean and std deviation. If yes then where we can get this whole data.

Yash, please check with any authorized data vendor and you will get the OHLC and volume data.

Hi Karthik

How can I download these current and near month futures data from NSE website?

I quite doubt the futures data is available for downloading.

Does this also work on nifty and Banknifty Futs, or only limited to stock futures?

Amit, you can apply this on n all option contracts.

Karthik sir,

First of all thanks for this module, which is very informative; however I have two doubts. Can you please address those?

1) Which Arbitrage strategies are available to retail investors; other than

spot-future, calendar spread, pair trading, merger arbitrage & liquidation arbitrage

2) How much a risk averse investor should invest, or precisely how many Nifty futures lots( costing around 1 lac currently ) should he buy/sell if having 10 lacs to invest in futures?

Regards,

Sachhidanand Rankhambe

1) Other that I can think of are based on Volatility, but these are not easy to set up without computing skills

2) Me being super conservative, I\’d say just 1 🙂

Hi karthik

can you share any resources related to the strategies based of volatility

Rohit, we have a few programs around options and volatility, these are live programs – https://varsitylive.zerodha.com/home

Hmm, but even then there will be two orders of IOC, what if one executes and other cancels? Any other solution?

Agreed. Execution risk exists in this strategy, IOC is means to minimize it.

Hello Karthik,

Let us assume we have an opportunity,

NALCO

Near Month: 98.0

Far Month: 97.3

But there\’s a problem,

We execute the transaction on market, maybe we do not get the price that we expected. So, there are high chances of trade going into losses.

We put limit orders, one of the above gets fulfilled and other stays pending, bigger risk. OR Neither of them gets filled and the price just moves away.

How can we overcome this?

Lakshay, this is the reason why traders use Immediate or Cancel (IOC) orders for such trades.

I just want to know how to download this data ? Currently does zerdoha has this PI ? Or we need to use nse site for data

Hello karthik sir, can you please guide me from where i can download this data? i m just entering the markets now and i find your modules to be very helpful, thank you so much.

Yash, I\’d suggest you get in touch with any authorised data vendor, and you\’ll get the continuous data required for this.

In calander spread when we should exit from the bought option.e.g.

Suppose we sell one lot pe/ ce weekly option and buy one lot monthly option ( same strike price).

Now say after a week sold weekly option is closed in profit but monthly option ( showing loss) is live. So what should be done. Do we have to sell a fresh weekly option of the same strike price or different strike price?

How long we can keep on doing this. Secondly when should we exit from the monthly option. Pl guide.

The decision to exit is based on the convergence of the trade. Don\’t look at it from an individual options leg perspective.

when to place the trade? end of the day basis or what?

You don\’t have to wait for EOD to place arbitrage trades, you can place it as and when you identify it.

Hello, please tell if any software is available regarding this, which automatically indicates where any opportunity is available

Don\’t think so 🙂

how to download data as pi is not available

I\’d suggest you speak to an authorized data vendor for this or if you are comfortable, maybe use Kite connect API.

Hello Karthik, Thanks for lovely article on calendar spreads.

Where do I find the continues futures data now that Pi is not supported by Zerodha, please?

Thanks, Dnyanesh. YOu can get this on Kite Connect, else I\’d suggest you speak to an authorized data vendor for this.

Thank you Karthik for your valuable teachings.

Is that historical difference data should form normal distribution in order to consider spread that is out of the standard deviation is an opportunity?

I\’ve got this doubt as I was applying above methodology on TCS futures for last 100 days. Graph drawn with differences is not looking like a normal distribution. But the differences for above SBIN example exactly fits the normal distribution.

I doubt the spread is normally distributed, maybe not. I\’ve not tested it before.

Hello sir,

How are you ?

1) Is zerodha pi active or not available anymore.

2) For future calender spreads, do we do the first method where we calculate the fair value of each future and buy the cheaper and sell the expensive one Or do we do the second method?

3) For the second method do we have to hold till expiry or exit in 1-2 days?

Doing good, hope the same with you.

1) We have stopped supporting Pi. Please switch over to Kite, its is a far more advanced platform

2) I\’d suggest the 2nd

3) 1-2 days if fine as long as you hit the target.

Good luck!

In NSE website historical data is available like

Current

Next Month

Far month

Current

Next month

Far month

In this format,

How can I rearrange first full current,next,and far

Which funcion should one use?

Sort function in excel?

Sir finally found data for doing calender spread its available in zerodha kite ,continous future chart ,but only problem his we cant download or copy that data to excel ..I manually copied closing prices and backtested it results were good

Sir its time consuming can we copy to excel directly through kite.

I think this is possible via the Kite connect API, Chandu.

Sir I applied Future pricing formula and calculated fairvalue for July and August month contracts both,using reference rate as spot

but both are trading at discount

I read Calender spread chapter in future trading there it says only one contract should be trading at fairvalue and other at premium on back of this we take decision,but here both are trading at discount?

sir

sell spread value is 2.5

sbi may fut 250

sbi jun fut 252.5

my expiry date is 30.6.2021.

In the next day 1.7.2021 i will execute buy spread trade

but my contract is expired before 1.7.2021

then how i will execute the trade?

can i square off my both may and june future contracts and

buy june and sell july future contract

Yes, you can. Provided July offers an attractive spread.

sir

At the expiry time can we rollover only current month contract or both current and mid month contract?

You can rollover the current month since the current month is the one expiring. The mid-month will have validity.

You have calculated the mean and standard deviation for the given period but when you are taking a trade on any given day (let\’s say 31-8-2017), the mean and standard deviation that you calculated also has data points from days after 31-8-2017. So how can one assume that the difference has deviated from the mean because you have not taken data up until the trade-day but gone beyond?

The general practice is to take the values and stick to these when you initiate the trade. Backtest it with this logic before initiating trades.

I will go through it once again Sir,if any doubt head back to you🙏

Sure, please do.

Sir then where can I get this data?

NSE website is confusing over futures data

NSE is the best bet, Chandu.

Sir I read that new clients can\’t get access to zerodha pi terminal is that true,I thought I can install this in my machine for getting current month and next month contract data

We are no longer supporting Pi.

Hi Karthick Sir,

Kudos to your efforts 😊 really doing a great job.

But I personally checked the above calculation you mentioned, I can\’t agree more.

As you can see, for example 31.08.2017 is a current month expiry day. After closing, you have taken the closing price . Then how can you initiate the trade here. And how can close the trade next day. I think it\’s only possible on paper.

Sorry if am wrong, kindly clarify

Thats right, this is on a historical basis, just to illustrate how to spot and set up a trade.

in zerodha baskets, it\’s say required margin for NIFTY Apr futures contract(buy) and NIFTY may futures(sell) contracts is 18+ lackhs and it\’s say final margin is 273k . can I execute trade with this 273k margin or I should have 18+ lackhs to execute the trade(NRML orders)

YOu need to have the full margin, which will be lower once both the orders are placed.

Sir I will make an attempt to learn programming

Free Resources are available

Stay Safe Sir

Good luck and stay safe 🙂

One I need to learn programming or I need to give up both Calendar Spread and Relative pair trading strategy

But I like both strategy

But zero knowledge on programming

Sorry to ask,is there a module on programming 😂

I need Varsity for programming myself 🙂

Sir how to download current month and near month historical data in zerodha kite

Is there a way

Hmm, you will need kite connect for this along with some programing skills.

Where to get Current Month and Near month Contract Data

I\’m confused how to download futures data from nse website

Please Guide me Sir

Sir, how to get the data of current month wrt next month of past 200 days? I am confused please help!

At any given point you have the data for the next 2 months right?

Sir,

In case the calendar Spread moves otherwise what will be the stoploss to keep in mind .

You can keep 0.5% as SL.

can we do the same in options ? if so can you pls illustrate an example i f already given pls guide where can i find it,thanks

Sorry, can you please share the context?

How to download the continuous futures data from Zerodha Pi? or from where else I can get this data?

I think you can right-click and download the data on excel.

When I buy TCS June and sell TCS July, do I have to pay brokerage and taxes twice ( once for the long position, other for the short)?

Yes sir.

Thanks for the reply.

Good luck!

Hi Karthik,

Say I think TCS in the above example will go long. So I do the following

Buy TCS Futures expiring 28th June 2018 @ 1846

Sell TCS Futures expiring 28th July 2018 @ 1851

Now say I am right and TCS for June shoots up 1890. I now square off the July Futures (the short contract). Now I only have the long contract (June). I plan to hold this long contract till it reaches some predetermined profit target.

My question is because I was given lower margins for this strategy, I could buy more of these contracts.

What happens when I square off the July contracts and remain only with the June (long) contracts? Do I have to pay extra margin?

Thats right, Jay. You will have to pay full margins for the naked futures position. YOu will no longer have margin benefit.

Can you please tell me the returns you got after utilizing this strategy?

Returns were good back in the days(1.5% – 1.75% per month), with more algos coming in, this diminished. I don\’t know the currents status.

Nice work Karthik , thanks

Good luck, Jay!

Hi Karthik sir

I see this strategy as a great opportunity but the next month futures contracts of stocks doesn\’t have enough Volume and spreads are huge….how are you tackling this problem??

Cant rely always on bnf or nf futures because of less opportunities

Yeah, liquidity is an important issue. Hence the need to stick to the ones which are liquid, guess besides Nifty/BNF, the top 3-5 stock futures are liquid.

How do i get difference value of current month and near month.

By applying the futures pricing formula.

Hi Kartik sir,

As per query raised earlier of building excel model and link it with real time data whether streak will serve the purpose of execution in place of algos.

Hmm, guess you will have to get in touch with their support desk for this.

Hello Kartik sir,

I am thinking of developing an excel model for the large cap stock futures which are having enough liquidity with the help of formulas and functions and link with real time data so if there is any opportunity arise it will be seen.

So I want to ask you can a retail trader convert this model into algos so that whenever any opportunity arise it will automatically executes.

Is it possible ?? Please share your thoughts.

Algo is not permitted by regulators, Sagar. But do check out Streak.tech

Hello Karthik,

First of all, thanks a lot for your tremendous effort in building up this entire repository on stock market. It’s really detailed, interesting as well as very crisp. Be it a layman or an expert, this can definitely cater to both. Thanks again !!

Now to my question – I was trying to work this out on HDFC Bank and one thing that I observed is my mean turned out to be negative (-0.5048).

Due to this, when I calculate the upper range (SD + mean) it gives me a value 3.1706. On the other hand, the lower range comes out to 4.1802.

If you observe here, the upper range is less than the lower range.

Can I just swap the ranges and plan the trade or am I doing something wrong entirely due to which I get a negative mean. Note that I pulled the data from HDFC for 2020 (till Nov 2020).

Thanks !!

Thanks, Vinayak. This is one of the limitations of the method, i.e when you have -ve values.

How to trade weekly Calender Spreads ( Nifty / Bank Nifty)

Which spread prices to be used ? Please explian with examples.

Thats the chapter about 🙂

Thanks for the reply, I understand the mistake in the calculation I made, you are referring to the option price of the current month and the next month both set on the relevant day in the current month, I took the stock price history in the last year and matched the dates of current month and next month. I understand that I can use your method which seems to me very interesting and original, the only way I have is every day throughout the coming year (2021) to collect the option price data of the current month each day and the option prices of that day in the month of next month ( Which are of course more expensive) and only after a year when I have about 150 values can I start doing the calculations you describe in your article, unless you have a more practical way of collecting historical data of historical option prices so I can calculate average and standard deviation. or maybe collect less data for mean and s.d. I would love to hear from you.

Amir, this best works with Futures, not sure if you can apply this on options. Of course, depends on how options are structured in the market you trade. Yes, you need to have relevant historical data. Assuming you trade on NSE, then you can approach any authorized data vendor and get the current month and mid-month historical data.

Hello I have a question about the basis of the method. I took GOOG for example and checked the share price on each trading day in 2020. I subtracted the price of a certain date from the corresponding date in the following month, for example the price on 20/2/20 minus the price on 20/01/20 and so on. In total I received about 140 data. In calculating the differences there were both negative and positive results (you show only positive results in your example). The average I got was 25 and a standard deviation of 154. I asked with such a large standard deviation how to proceed with the concept test?

1) Firstly, I hope you are considering the difference between the future month and current month. This is because the future month is always considered more expensive than the current month. Despite this, the values can be -ve as well. This happens when the current month is more expensive than a future month, which is attributable to supply-demand situations or maybe dividends in the current month.

2) I cannot comment on the mean and avg. If these are the numbers, then I guess that\’s what it is. The only point you need to ensure is that you are using clean data for your calculations.

Lets say we find an opportunity below or above the range, how do we know when to square off the trade? Is it when the value falls/rises back into the range?

Thats right, when you buy (below range), you expect it to increase and go back to mean, likewise with above the range.

Unfortunately it is not possible to retrieve a sequence of data but only a single data.

Thanks

Ah ok. I\’m sorry, I\’m not aware of any other resources for the US market.

Hello

You can recommend a method to download historical data from the US market?

Thanks

I\’m not too sure about US markets, but I guess you can try Yahoo Finance.

Please go through the statement in the above article.

\”It is advisable to subtract the price of near month contract from the current month contract. \” Did you mean other way ?

thanks

No, why do you think so?

Thank you… will look forward to it 🙂

Hello Karthik

I have been through the strategies you have shared across this course and really like them. The thing I liked is that you not have tried to spoon feed but instead provided enough details to know the core strategy, but there is food for thought, for people who are genuinely interested to Analyze, Backtest and Trade the strategy.

May I request you to have a dedicated chapter only for Trading Strategies? Perhaps for categories like Intraday, Swing, Positional etc etc, and also for different Asset Classes, ie Equity, Futures, Options, Commodity, Currency…

Thanks, Nikhil. Will try and do this over time 🙂

yeah i m trying changing frequency but data is available only from 31st july 2020.

hello karthik

yeah i m able to copy the future closing price data thru zerodha pi but look back period is only upto 26 th jun 2020.not able to track before 26th jun 2020.it gives only 47 days data in time series.u have mentioned the look back period should be around 200 days.but i m not able to find out for more than 47 days.why is it so.

Did you try and increase the chart frequency and loading more data points?

hello karthik

as u have mentioned to take historical data of future closing price from zerodha pi,can u plz guide from which section on zerodha pi can we download the future price.

Ah, I think you can right click on the timeseries and say write to excel. Can you please try doing this?

I didn\’t get you, sir. opportunity universe?

Opportunity universe is the number of stocks that you track on a daily basis to identify trading opportunities. For example, my opportunity universe could be Nifty 50 and nothing beyond that.

sir, I want to ask you there are a lot of stocks how can we find the right opportunity so that it can be applied when any stock or index gives us the exact signal I mean how can we track such stocks

For that, you need to keep a close track of the opportunity universe. Ensure you have an opportunity universe which is easy for you to track.

Hey Karthik, I came across a lot of articles explaining how activities by large hedge fund and algorithmic trading firms drive the spreads to the point where it is extremely difficult for retail traders to profit from these opportunities. I have 2 questions to that respect.

1. How much truth is there in this fact? Can retail traders benefit from these opportunities or is it too futile to try?

2. What can be done to mitigate the impact? Is there a way a retail algorithmic trader can still benefit from such arbitrages strategy?

1) This is true to a certain extent. Hedge funds and similar players target short term arbitrage opportunities. End of the the day, abr strategies is all about speed of identification and execution, which further boils down to hardware and software infra, which again boils down to deep pockets and funds. These guys have endless access to capital and hence can afford to set up state of art infra to identify and execute trades at the the blink of an eye. Contrast this to a regular retail guy 🙂

That said, outside the high frequency and low latency world, the market is a level playing field for all participants.

2) If you can set up the infra, then you can do the same things. Or you need to be extremely sharp to identify new strategies which no one else is chasing. If you do, its all yours until someone else figures 🙂

Hey Karthik,

Shouldn\’t we allow room for mean spread to change as well? What I mean is, shouldn\’t we take mean of last N entries only such that N < M, where M is the total entries. For ex, we will only consider the last 60 days only to calculate the mean and STD.

Which Approach would be better and why?

Thanks,

Nikhil

Ah, Nikhil I\’m not sure. I\’ve not explored this approach, hence I cannot comment on this.

Dear Karthik sir,

One more help needed, pls help in sharing some study material / resources for Market orders, so that I can deep dive into it.

thanks

The market order is just that, you place an order and it gets executed instantly. It\’s just that you don\’t have any control over the price at which it will get executed. Of course, you can use 20 depth of level 3 data to get a sense of the price at which it will get executed. Check this – https://zerodha.com/varsity/chapter/supplementary-note-the-20-market-depth/

Thanks Karthik Sir for your help on the concern.

Happy trading, Manish!

Hello Karthik Sir,

Market orders are getting executed, but same is not solving my concern as the orders are getting executed on best available price and Not on the exact price at which I want.

You need to stick to highly liquid stocks to ensure the market price and bid ask price are close enough. However, the problem will exist, but then at least you will manage to get into the trade.

Hello Karthik sir,

Thanks for the knowledge sharing, all the Modules are wonderfully written.

I have a query, if we track bid and ask quotes and place orders on the basis of divergence, which type of orders to be placed and how to trade on exact price we want.

I have created a code which tracks the Ask and Bid quotes and place order on basis of divergence, many times orders get failed as Ask/Bid price is lower or higher than LTP, hence the order placing also depends on the LTP (which changes regularly).

So my query is How to place order on the exact price which we need, and same should not get failed.

I will be very helpful if my query get a solution.

Thanks

Have you tried placing market orders?

a bit confusion about term:

kindly sort out please

Bull Spreads

These calendar spreads are long the near term futures contract and short the longer term futures contract.

Bear Spreads

These calendar spreads are short the near term futures contract and long the longer term futures contract.

Yes, thats correct.

I wanted to backtest the strategy but I couldn\’t find a way to get historic bid-ask rates data. Are we supposed to use LTP to test for historical dates and use bid-ask spread to spot the opportunities in real-time?

If you use bid-ask to test, then you should use bid-ask to spot as well. You can check with an authorized data vendor to figure if they can provide you with historical data bid-ask.

HELLO KARTIK SIR ,

I AM USING YOUR PAIR STRATEGY AND MAKING DECENT RETURNS …BUT I HAVE DOUBT IN CALENDAR SPREAD,

EXAMPLE:

ESCORTS JUNE EXPIRY @960 SELL

ESCORTS JULY EXPIRY @950 BUY

CAN THIS BE DONE???

AND ON THE DAY OF EXPIRY JUNE CONTRACT WILL GET SQUARED OFF THEN WHAT WILL HAPPEN TO JULY CONTRACTSHOULD I SQUARE IT OFF ON SAME DAY OR NEXT TRADING DAY??

That\’s the reason why one should trade the basis and look for divergence and convergence. Invariably, you don\’t need to wait till expiry.

Hey Karthik, my code is giving me a lot of both buy spreads and sell spreads signals. I just wanted to ask what\’s the normal number of signals that you get for a particular stock for the span of 200 days. For the past 200 days (for AxisBank), I am getting around 83 signals for a range of (mean – std, mean + std) and around 25 signals for a range of (mean – 2*std, mean + 2*std).

Given the fact that I am getting many signals, is there a way I can eliminate the risky ones, and if so then what would be the measure of the risk?

Nikhil, are you using LTPs for this? If yes, then I\’d suggest you use the Bid – Ask rates and test your code.

Hey, I just finished implementing the calendar spreads in python. One peculiar thing that I observed was that a lot of stocks had a negative difference, i.e the futures price of near month was smaller than the current month. Is this an expected behaviour or this has to do with the strange times the market is going through?

Not really this is normal behaviour, if its -ve you have to do the reverse trade.

Hi Karthik,

Thanks for the reply.

I am trying to build an algorithm to detect these mis-pricing opportunities in real time. I observed that some of these opportunities only last about 4-5 sec.

4-5 sec is really a small time as what i found it takes around the same time (2-5 sec) for my order to reach exchange and get executed. By that time the opportunity has already gone.

1. How should I go about executing such trades?

2. Is it even possible to catch such mis-pricing efficiently?

3. Will having more finer data help in better performance (like minute candle data or even bid/ask price quotes for every sec)?

4. What do you think is the right amount of historic days i should consider for mean and std calculations, given that i have minute

candle data for each day (or even data for every second).

Thanks in advance for answering so many questions 🙂

Saood, this strategy eventually boils down to the speed at which you can execute. In the algo world, 4-5 seconds is a lot of time, machines do this in microseconds. For this the NSE allows colocation of serves, this is quite prohibitive for a retail trader – https://www.nseindia.com/trade/platform-services-co-location-facility

Hi Karthick,

Thanks for the post.

I was looking at the HDFC bank futures prices today (9 Jun 2020) at round 2:26 PM and i noticed the following

HDFCBANK spot price – 992.55

HDFCBANK JUN FUT – 990.85

HDFCBANK JUL FUT – 989.10

HDFCBANK AUG FUT – 988.00

The futures prices are lower than the spot price, which is something we don\’t usually expect to happen.

1. How should we go ahead initiating the trade here? Should we follow the same procedure of calculating the mean and std?

2. What can be the reason for this anomaly? Are people fearing an upcoming recession?

Thanks in Advance

1) Yes, this is usual, except if there is a corporate event expected. If there is nothing, then you can look at the mean and STDEV

2) No, as I said, this can be either attributed to some corporate event or could be just another day in markets 🙂

Thanks sir

What about SL when we should exit from loosing trade would you plz elaborate it

When the trade wither converges or diverges away from your entry point (as measured by SD).

hello sir,

nice strategy sir but can we do backtest with ltp based from nse website data with keeping few fixed points(depends on script) as slipagges and transaction cost deducting from overall profit???

Yes, you should do that if possible to understand the behaviour before placing the order.

Hello karthik

Where i can find historical price of future contracts and option also, can you tell me what\’s the best backtesting software, let me know any alternative to tradingview as this site provide as seconds data and analysis and a lot more…

Thanks

ARUN

Checkout https://www.streak.tech/ for back testing.

Hi Karthik, calendar spread strategy looks to be very risk free lucrative one on theory (for that matter pair trading strategies as well) , but what i am skeptical about is – with the presence of the institutional investors with a lot of resources and algorithm based trading system, will retail investors stand any chance to get profit out of this approach. Even if we develop code based algorithms, will all that effort will be worth it, or it is better to channelize our efforts in other strategies like trend following, momentum strategies, etc. whats your view and personal experience on this. Thanks.

True that this strategy over the years has reduced to the speed of execution, something that institutional algos ace at.

Good Morning Sir,

I just want to ask how to download the data of previous 200 days?

I have chosen BankNifty as the liquidity is quite high for BankNifty, I use Zerodha Pi, and the data available is of only May, June and July. Can I download the data of the previous months through the software ?

Also, I have created a code for identifying opportunities, I have used 1 mins candle and took a look back period of 30 days. I found quite a decent number of trades however, is this practical? As the reference is just 1 mins candle, will I miss the opportunity to actually make a trade, as most of the trades get squared off within a min. To counter this I plan to use an automated bot, which will automatically make a trade when the conditions are met. And as the time frame is really low I have also altered the signal. For now I plan to use only the +Ve Standard deviation, hence the conditions which I have used are the difference of Ask Price of the the current month, and the bid price of the next month, as when the STD is more, the near month is trading at a higher price than it should.

I have been working hard on this, though on theory everything looks perfectly fine, can you tell me how practical this is? I have made the bot which helps me identify trades, however I am yet to make the transactions automatic. Please guide me for the same.

Incase you read the names before you answer, sorry for asking questions on every module. I am just really into this and have lots of questions.

Please feel free to ask as many queries as you wish, there is no problem with it 🙂

Opportunities here depends on how fast you can spot and execute the trade. Everyone knows this is a good strategy, hence many are many bots chasing this. As far as the data is concerned, download the same from NSE\’s bhav copy.

Hi Karthik,

Superb article..Thank you for sharing knowledge.

Just one question..If any company declared dividend and say ex date announced for Near month then how this strategy works?

Because future of next month will consider dividend impact and spread will increase?

Yes, this depends on the quantum of dividend. If it is not much, you can carry on with the spread, else its best to avoid it.

Thanks for replying without delay. Sir i have held this position for about a week now but they are not converging infact they are diverging. Coming monday is expiry. Please enlighten me whether they will converge or not ?

Crudeoil April Future is trading at 1417 whereas Crudeoil May Future is trading at 2000. I brought 1 lot of April future and sold 1 lot of may future. Could you please tell the way forward ? Is this correct strategy?

Seems like, wait for convergence and close the position 🙂

Please explain strategies on Calender Spread for Option also where one can get benefit from theta decay.

Thanks

All options strategies are discussed here – https://zerodha.com/varsity/module/option-strategies/

I have saved 20000 rs and want to do this trade but i know i don\’t have capital for it but can i do it on currency futures as margin required is way low there.

Technically you can on CDS, but I\’d suggest you rather invest this amount rather than trade with it.

Sir,

If i am checking the trading signals on every tick during the day, will my lookback period to calculate mean and stdev be last 200 day closing prices or last 200 tick data points?

It will be the last 200 tick data points.

i would also like add the scenario where both near and far month futures are trading lower than the underlying\’s price

Thats fine as we always see the relation between the two and not really the individual prices.

what are consequences of trading a calendar spread where the far month future is trading lower than near-month future . is it always profitable or there are cases where it can go wrong (i tried searching on the internet but didn\’t find a viable answer.

and Thank you for these amazing books you have written like hats-off to you sir.

Its not always profitable, it really depends on the pricing and liquidity.

Karthik, Calendar spread is a trade-able idea, no doubt about it. We need to consider the Bid n Ask price, instead of LTP, which can be deceiving. Entering trades closer to the expiry is also not a good idea, as far as I have observed, since it doesnt give much space for the spread to move in favour of trade. Im reading \”Trading Spreads and Seasonals – by Joe Ross\”, not much quantitative but a bit more practical, what I felt. If you have to recommend any other indicator, other than the SD, to identify opportunity then what will you recommend?

I agree with you, these trades should be on bid-ask spreads. The key trigger can still originate from the SD though. But frankly, I\’ve not experimented with anything else besides SD. Will update this thread if I hit upon something interesting. Thanks.

Karthik, have gone through the Zerodha content – theoretically it is worth a read, but was looking for a more practical approach to the strategies. Please do share if you have a book in mind, anyways my search is ongoing.

Himanshu, this is actually a very practical approach 🙂

Can you please elaborate a bit more on why think otherwise?

Dear Karthik, Please suggest few books for FnO arbitrage strategies.

Himanshu, suggest you look through this module – https://zerodha.com/varsity/module/trading-systems/

Sir, How can I download the closing price for the FUT contract in zerodha PI?

Which scripts u have tried ?

Nifty/Bank Nifty.

Wow!!! Calendar Spread works amazingly. I did virtual trade this spread in commodities, got a excellent result. Thanks!. There a lot more to learn in the market. Looking forward for all your future article. You are doing a amazing job. Keep doing and best wishes. 🙂

Very thanks for your kind reply.

Dear karthikji

Ok. I ask only simple question. If value goes below lower range and even then current month is cheaper and next month is ezpensive, should we trade buy or sell spread according to above parameters.

2. Can we trade calendar spreads on currency futures?

1) In such a case, you should be a buyer of the spread, Rohit

2) Yes, you can trade currency futures.

you have not got my point. Lower range means near month future woube be cheaper and current month be expensive as mentioned by you in thia chapter. For example diff is 0.5 which is below 0.7335 gets opportunity to trade buy spread i.e. buy near month and sell current month but pl look into this matter near month is still more expensive than current month future then how will we trade buy spread

Rohit, how are you ascertaining that the near month is more expensive? We just have to look at the spread and make this judgment right?

As you mentioned an example in spotting opportunities in section 15.4 that upper range is 1.7205 and lower range is 0.7335. Sell the spread beyond 1.7205 i.e. sell near month and buy current month and buy the spread below 0.7335 i.e. buy near month and sell current month. My question is if value of diff is between 0.7335 and above 0 even then near month value would be expensive and current month would be cheaper because difference is positive. Then how can be possible to buy the spread unless difference is negative. Please look into the deep matter and clarify me.

If the value of the difference is beyond 0.7335, it simply means that the spread has increased beyond -3SD. You can initiate a buy trade her, just like the way you would at 0.7335.

I have checked in the nifty and banknifty 200 days back data points. None of them negative difference are got. Then how to get the current month expensive and next month cheaper whenever I get lower range. As you mentioned in the chapter that whenever lower range is got then current month should be expensive and next month be cheaper. The case of Upper range is not problem. Please clarify me. Reply would be eagerly waited.

Rohit, I\’m a bit lost with your query. Can you please elaborate this with an example if possible?

Dear Karthik,

I have a few questions:

1) Is there need exact 200 data points need for calculating mean and stdev? Cannot have more than 200 data points?

2) After calculating the mean and stdev, if there is no opportunity to trade based on upper range or lower range on calcuating day. Is there need to calculate the mean and stdev daily to get the opportunity?

Reply will be eagerly waited.

1) You can take more than 200 data points

2) Yes as the price changes, so would the mean and SD. However, the change may not be drastic.

Thanks for your response Karthik. Will look in and analyse further.

Good luck!

Hi Karthick,

Very informative knowledge share on varsity. Really appreciate the efforts.

Can we apply the same calendar spread to Nifty futures ? will it work the same way or any hidden risk in this ?

For example current month Jul Nifty future is at 11,843.50, and near month Aug future is trading at 11,901.85 and the CMP of nifty is 11788.85, around 54 points away from current month july future and around 113 points away from august month future

In additon to calender spread , I am thinking of adding covered call sell and put sell to take advantage of taking the premiums.

Can you please suggest if my approach is correct or if I am missing any hidden risk in this.

Here is my trade strategy.

Buy JULY month fut and sell 11800 JULY CE for premium of 200 rs , sell AUGUST month future, sell 11750 PE of JULY month for premium of 144 rs and close all trades just before JULY expiry — Here my approach is to take advantage of the premiums in either directions with no risk. And my rough assumption is I would be able to collect at least 100 to 150 points profit on the overall trade.

Please suggest if I am right in my way of approach.

Thanks,

Devi.

Devi, yes you certainly can apply the same to Nifty futures. However, I think the opportunities will be very few and hard to capitalize. This is ok, but I would suggest you load all the data onto an excel and visualize the payoff. The thing is it becomes quite challenging to figure out the overall effect of the directional move when you have multiple positions. When you visualize, you get a deeper perspective on the risks associated.

If possible,

please keep a sticky color-coded section at top/bottom of chapters with date of update

so that it becomes easier to follow any updated section

if it was some section added/updated (Other than typo fix)?

I think I saw this done in Market taxation module by Nitin but not sure if this is followed across all modules

Hmm, most of the fixes are typo. We have not changed the content much.

Hi Karthik,

I tested the Calendar spreads strategy that you discussed in this chapter.

Found out a small oversight in the above Calendar Spread assumptions:

For example:

If we go short on a Spread on the expiry day if the Spread is above it\’s Standard Deviation and we close out the trade the very next day when the Spread reverts to mean.

Seeing the calculations in the table provided above, we went short on a Current Month and Near Month Future Spread and then the Current Month Future expired on the expiry day.

Don\’t you think that there is no opportunity to close out the trade for the trader the next day as the Current Month contract had already expired ?

Kulbir

Yes, for this reason, one has to be doubly careful while executing calender spreads near to expiry. It\’s best if we can close all the position simultaneously. Keeping one position open defeats the purpose of a spread.

What are the futures trading strategy other than calendar spreads?

Plenty…Arbitrage, pair trading, speculative statergies etc…

thanks Karthik got the answers i am looking for. No STT only stamduty . Did a trade just to see the charges :).

Here is the link https://zerodha.com/z-connect/tradezerodha/zerodha-trader-software-version/zt-spread-orders. U can see the conversation between MK and Nithin Kamath in the comments. I guess it was a typo, instead of .01% he typed .1% for STT/CTT.

Cant believe such quick responses for zerodha team. You guys are the best.

Good luck and happy trading, Indrasena 🙂

Hi Karthik. I really like the knowledge shared on varsity.

Can we do calendar spreads on currency futures?(just making sure).

currency market seems to be safe for this strategy and fits well with my risk averse behaviour.

Yes, you can. Please make sure the 2nd-month contract has enough liquidity.

Hi Karthik