It’s the economy, stupid! A corporate tax roller coaster

We love IndiaDataHub’s weekly newsletter, ‘This Week in Data’, which neatly wraps up all major macro data stories for the week. We love it so much, in fact, that we’ve taken it upon ourselves to create a simple, digestible version of their newsletter for those of you that don’t like econ-speak. Think of us as a cover band, reproducing their ideas in our own style. Attribute all insights, here, to IndiaDataHub. All mistakes, of course, are our own.

GDP growth declines, just as one expected

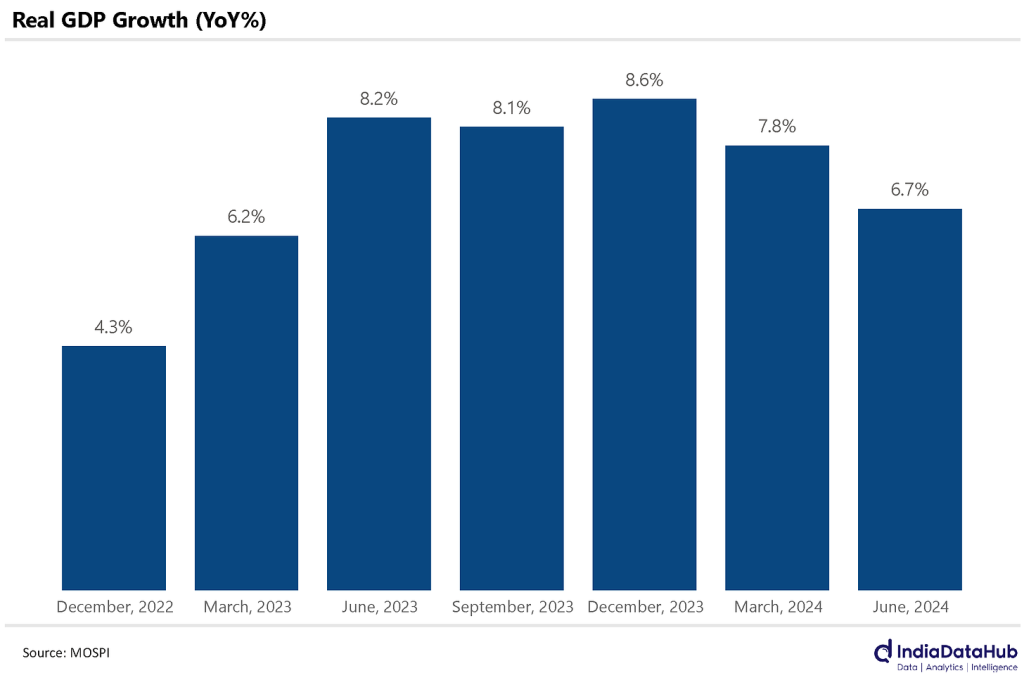

This March quarter, the Indian economy had grown to 7.8% above where it was in the March quarter last year. In the June quarter, however, the pace of our growth has flagged. The year-on-year growth of India’s GDP, over the quarter, came at 6.7%.

This drop off isn’t a surprise, though. It was clear from the high frequency data that the economy was sluggish through May and June. This could be for any number of reasons: but the terrible heatwave that continued through the summer is a prime suspect. Heat waves, after all, are known to kill productivity, as anyone that’s worked through a North Indian summer afternoon knows only too well.

Thankfully, though, things were much better in July. August’s data will soon be in too. If it’s any good, this drop off in growth will soon be forgotten as mere noise in the data.

Corporate taxes crater

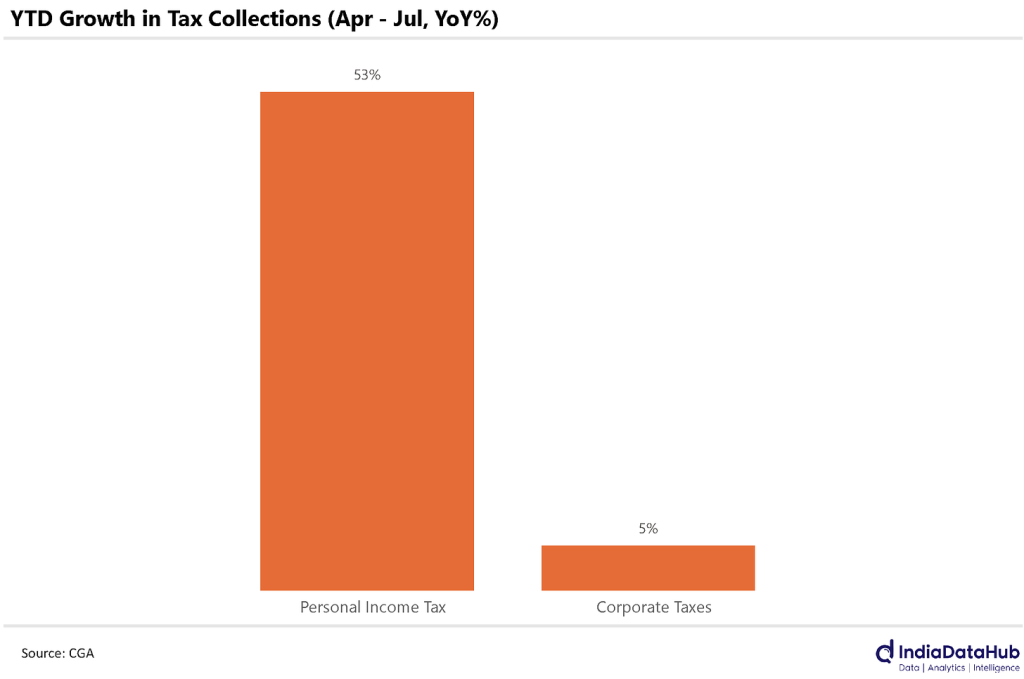

Here’s something we’ve been following for a while: a big gap’s opened up between India’s corporate tax collections and its personal tax collections.

Corporate taxes have been on a roller-coaster ride. For four consecutive months between February and May, corporate tax collections kept falling year-on-year. Then, in June, they abruptly picked up by as much as sixty percent, year-on-year. Suddenly, this year’s corporate tax collections didn’t look too bad. With June’s stellar collections, from the start of the year till the end of June, 2024’s collections were 26% higher than in the same period last year.

The roller-coaster rolled on, however. In July, corporate tax collections suddenly crashed again, to a mere quarter of where they were last July. This abrupt fall wiped away most of the growth from June. Counting from the start of the year, now, corporate tax collections are just 5% above where they were in 2023.

Compare this to personal taxes. This July, India’s personal tax collections were up more than 63% from July last year. Between April and July this year, collections have been 50% above where they were last year. This is how stark the divergence between the two is:

The changing face of credit

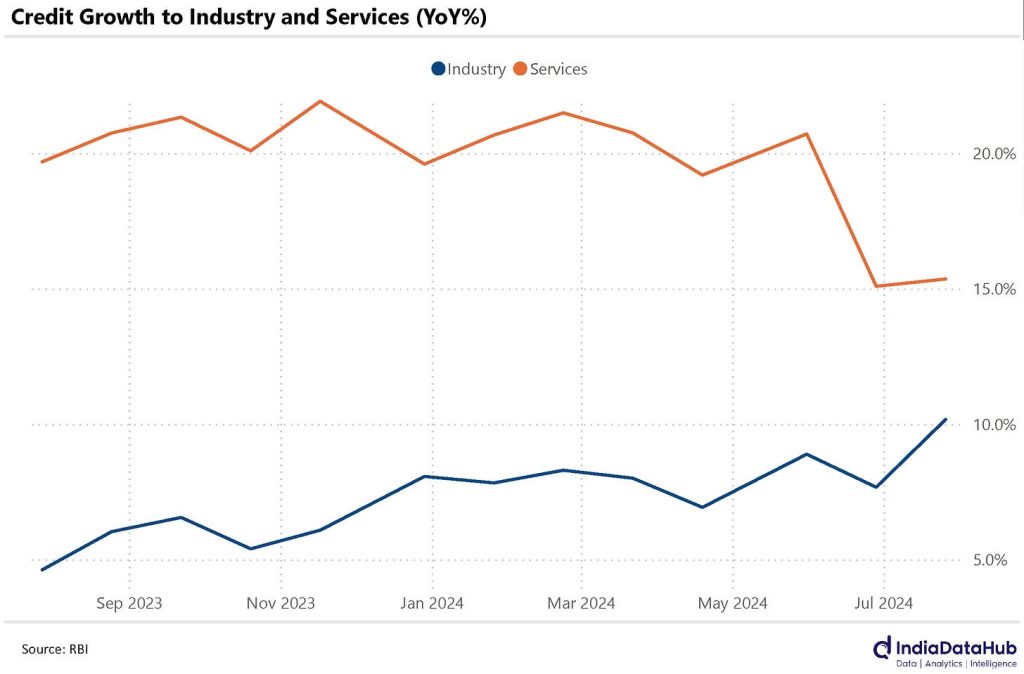

We’ve spoken before about how the Indian economy has seen an uninterrupted growth in credit for a long while. Over the last few quarters, credit has grown at a steady rate of ~15% year-on-year. But underneath this top-line figure, those receiving the credit are changing.

Over the last year, growth in the credit going to the services sector has slowed down, falling from 20% to 15%, year-on-year. To compensate, more credit is being funneled into the industrial sector. While credit to industries was growing at a mere 5% last July, the rate has now touched 10% — the highest since November last year.

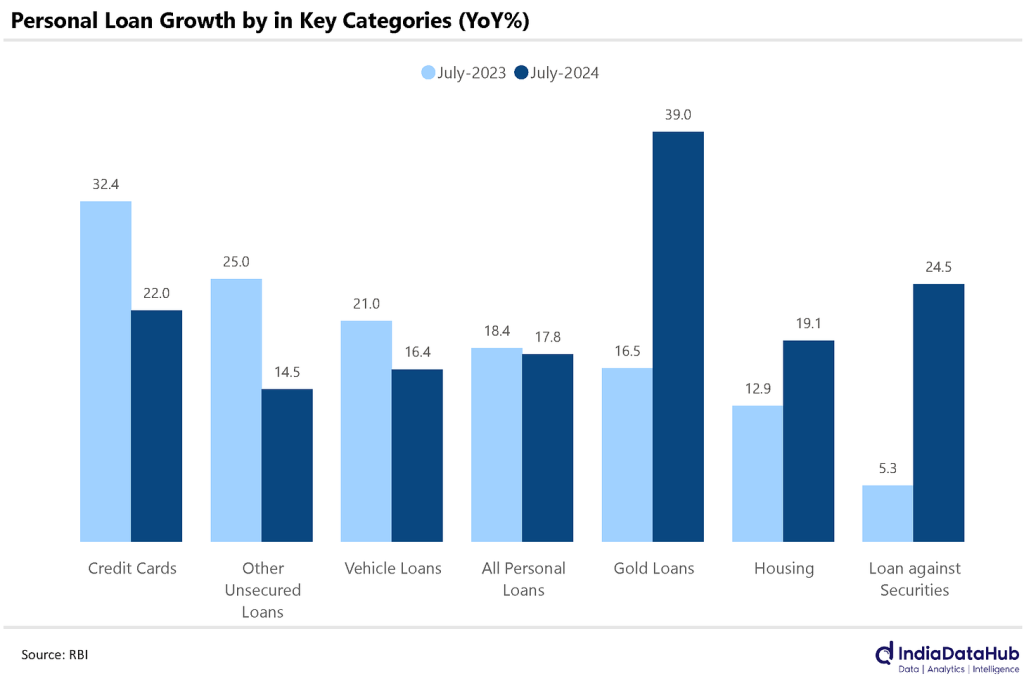

Personal loans, too, have maintained a consistent rate of growth — in the high teens. That said, a lot of these loans are being given out under different categories than before. Secured loans are where you see the biggest bump. Where home loans grew at 13% in July 2023, a year on, they’re growing at 19%. Similarly, gold loans are growing twice as fast as they did last year, their growth rate jumping from 20% to 40%, year-on-year between July 2023 and July 2024. Loans against securities, too, have grown from 5% to 25% year-on-year.

In contrast, the growth in unsecured loans — other than through credit cards — has halved, from 28% to 14%.

So, does that mean the risk in the system is coming down? After all, doesn’t a move from unsecured to secured loans create more stability?

Well, do remember RBI Governor Shaktikanta Das’ warning from last month. Banks may have ramped up their secured lending, but they aren’t being very cautious. They aren’t keeping to the letter of the law. As long as that is the case, the risk to India’s monetary stability remains.

Small wonder

You’ve probably heard about Resourceful Automobiles’ ₹12 crore SME IPO that has everyone spooked about the froth in our markets. While the automobile dealership offered shares worth a mere ₹12 crore, it received bids for 400 times as much — a total of ₹4,800 crore being bid for a relatively miniscule entity. The markets, it seems, are handing out money like candy. (That might be a slightly jaundiced perspective, to be fair. Here’s a valid counter-point by Deepak Shenoy.)

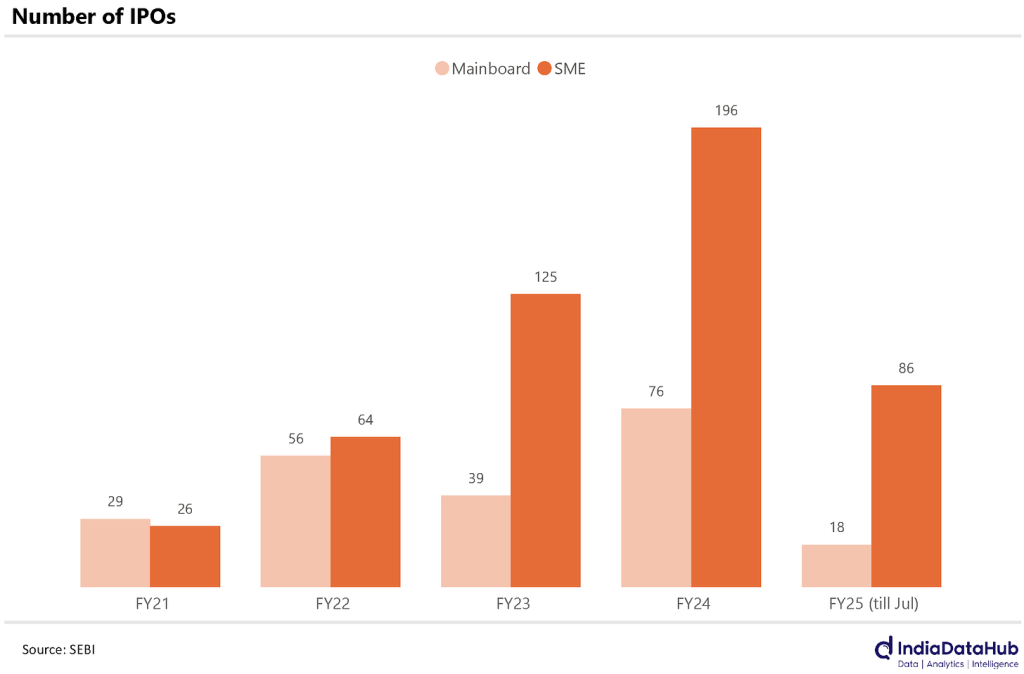

The bigger story, though, is one of how an increasing list of small businesses are turning to the capital markets for funding. Between January and April this year, 86 small businesses opted for an SME IPO. In contrast, the mainboard — the sort of classic listing that large companies go for — only saw 18 IPOs. Five years ago, this would have seemed absurd. The SME board, back then, was a capital markets backwater where few people dared to venture.

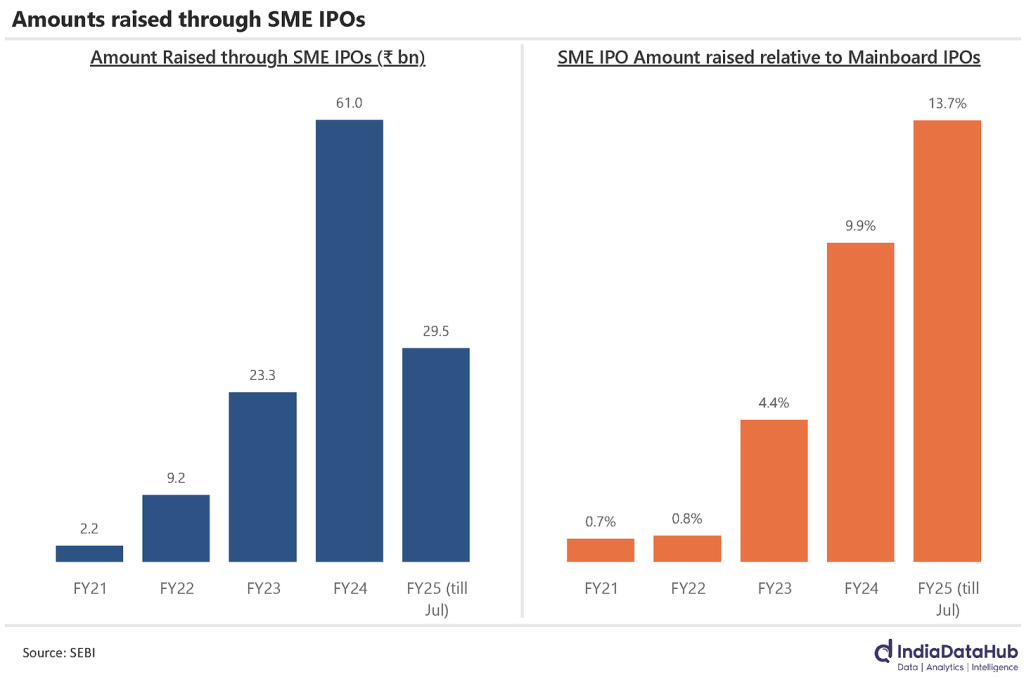

All that’s changed now. At their current run-rate, the SME board may see 50% more IPOs than last year’s already-ridiculous 196. In just the first four months of this year, they’ve pulled in a remarkable ₹3,000 crore.

Of course, it’s unfair to compare an SME IPO to one on the mainboard. After all, the average Mainboard IPO is around a hundred times as big as Resourceful Automobile’s issue.

But where SME IPOs were a negligible speck in our capital markets only a few years ago, they seem a lot less negligible now. In FY 2022, SME IPOs raised a mere 1% of the money raised on the mainboard. This year, the amount they’ve raised is an entire order of magnitude higher — making for ~14% of what was raised on the mainboard.

That’s all for the week, folks!