11.1 – Poker face

Last month I got an opportunity to play poker with a few good friends. I was playing poker after a gap of 6 years and I was quite excited about it. The buy-in for this friendly game was Rs.1000/. For those who are not familiar with poker – it’s a card game wherein your skill and luck are tested in equal measure.

So, the game started, cards were dealt, and in the very first round I bet Rs.200/- and I saw it go away, just like that. In the next round, I bet another 200, and again saw it go away. At this stage, I convinced myself that I could make up my losses in the 3rd round, and with this thought I increased the bet size to 600, only to watch it go away! So for all practical purposes, I lost Rs.1000/- in a matter of 10 minutes! In the trading world, this is equivalent to blowing up your entire trading account.

I didn’t give up, after all, I’m supposed to know trading and poker draws many similarities to trading. I decided to ‘recover’ my initial loss and stay in the game longer. I bought it for another 1000 and started fresh. This time, I stayed on the table a bit longer – for a total of 15 minutes!

Clearly, it was not working for me. I had a better memory of me playing poker 6 years ago. Though not the best, at least, I would stay on the table until the game lasted and even win a few hands. So what was happening this time around? I was confused and I kind of didn’t believe that this was happening to me? How could I wipe my account twice in a matter of 25 minutes?

With these confusing thoughts on my past poker skills and my current gameplay, I decided to buy in again for another 1000 Rupees. This was my 3rd buy-in. In the trading world, this is equivalent to funding your account 3rd time over after successfully blowing it up twice.

What advice would you give someone who has blown up his account twice in the markets? – ‘get out of the markets immediately’, would perhaps be the best-suited advice right? Well, I didn’t pay any heed to my inner voice, gambler’s fallacy had taken over my rational thinking abilities and I bought in again for 1000 Rupees more.

For those of you who don’t know gambler’s fallacy – if you are betting on an outcome and you tend to make a long streak of losses, then at the time of quitting, your mind tells you or rather tricks you to believe that your losing streak is over and your next bet will be a winner. This is when you increase your betting size and lose a bigger chunk of money. Gamblers fallacy is one of the biggest culprits in wiping out many trading accounts clean.

Anyway, back to my poker game. This was my 3rd buying, I had already lost 2K and was betting with another 1K. I was confident I’d recover plus make some money and save myself some shame, but the boys on the table had other plans for me. They knew I was the sucker on the table and it was easy to allure me to make irrational bets. So they did and wiped me out clean over the next 7 minutes.

That was it, I called it quits and I got back more after losing 3k.

After the game, I thought through what went wrong. The answer was very clear –

- I had forgotten to recognize the odds of winning with the cards that were dealt

- I was not ‘position sizing’ my bets – my bets were way too irrational and random

After a couple of weeks, I had another invite to the game. I had set a bad precedence of giving away easy money. This time around I had decided to position size my bets well.

I bought it for 1000 and started the game. Each time the cards were dealt – I accessed my odds fairly well and if I thought my odds were fair, I bet accordingly. In the trading world, this was equivalent to following a ‘trading system’ backed by position sizing techniques. The result of this simple systematic approach had a great impact on my game –

- I won a few hands

- At the peak, I must have had about 4K of winnings

- I lasted throughout the game and had a lot of fun along the way

- Towards the end, I gave up some gains but was extremely happy with the fact that few simple techniques helped me manage my game much better

Position sizing made all the difference in this game. It always does and this is the exact reason for me to narrate this story. I do not want you to speculate in the markets without understanding your odds or without position sizing your bets. If you do, you will end up making a fool out of yourself.

Poker is played for fun but when you trade, you are essentially deploying your capital for a more serious and meaningful outcome. So please do pay attention to some of the things we will discuss over the next few chapters. I’m certain it will have a positive impact on your trading career.

At this point I have to mention this – I myself learned position sizing many years ago by reading Van Tharp’s books. Van Tharp is one of the most prominent people to bring in the concept of position sizing to traders. I’d even recommend you buy some of his books to expand your knowledge on this subject.

11.2 – Gambler’s fallacy

We briefly discussed the gambler’s fallacy early on. I guess it makes sense to discuss a little more on this at the very beginning especially in the context of markets.

Take a look at this chart –

This is the chart of Nifty – Nifty hit the magical number of 10,000 on 25th July 2017. As a trader, how would you trade this?

- Nifty is at an all-time high – 10K

- Many market participants may book profits at this point – considering it is a psychological level

- All-time high implies no resistance points

- Nifty has been in a great upwards trend over the past few weeks

- Maybe Nifty would consolidate around these levels?

- Maybe a correction of 2-3% before the rally continues?

Let us just assume that these are some valid points for now. This means a short position is justified or for that matter buying of puts. Your analysis could be as simple as this or as sophisticated as studying the time series data and modelling the same using advanced statistical or machine learning models.

Irrespective of what you do – there is no certainty in the markets. No one technique will tell you the outcome in advance. This implies that we are dealing with fairly random draws here. Of course, based on how meaningful your analysis is, your odds of winning can improve, but at the end of the day, there is no certainty and you have to acknowledge the fact that markets are indeed random.

Now imagine this – you have done a state of the art analysis and you place your bet on Nifty only to see the stop loss trigger. You do not give up, you place another trade and to your misfortune, you are stopped out again. This cycle repeats for say the next 4 trades.

You know your analysis is bang on – but then your stop-loss is continuously getting triggered. You still have money in your account to take on bets, you are still convinced that your analysis is rock solid and the markets will turn around, you still have an appetite for risk – given all these, what do you do?

- Would you stop trading?

- Would you risk the same amount of money again?

- Now that you have lost 6 consecutive bets, would you consider that your odds of making money on the 7th trade is higher and therefore increase your bet size to recover your previous losses plus reap in some profits?

Which option are you likely to take? Take a minute and answer this question honestly to yourself.

Having been through this situation myself and having interacted with many traders let me tell you – most traders would take the 3rd option, the question, however, is – why?

Traders tend to believe that long streaks will cease when they take the ‘next’ trade. For instance, in this case, the trader has faced 6 consecutive losses, but at this point, his conviction that the 7 trade will be a winner is very high. This is called ‘Gambler’s fallacy’.

In reality, when you are dealing with random draws, the odds of making a loss on the 7th trade is as high (or low) as it was when you placed your first bet. Just because you have made a series of losses, the odds of making money on the next trade does not improve.

Traders fall prey to ‘Gamblers Fallacy’ and often end up increasing their bet sizes without understanding how the odds stack up. In fact, gamblers fallacy ruins your position sizing philosophy and therefore is the biggest culprit in wiping out trading accounts.

This works on the other side as well. Imagine, that you are fortunate enough to witness a 6 or let us say 10 consecutive wins. Whatever you bet on, the trade works out in your favour. You are on your 11th trade now, which of the following are you likely to do?

- Considering that you made enough money, would you stop trading?

- Would you risk the same amount again?

- Would you increase your bet size?

- Will you take a conservative approach, maybe protect your profits, and therefore reduce your bet size?

Chances are that you will take the 4th option. You clearly want to protect your profits and do not want to give back whatever you have earned in the markets and at the same time, you would want to take a trade considering you have had a great winning streak.

This is again ‘gamblers fallacy’ at play. Being completely influenced by the outcome of the previous 10 trades, you are essentially reducing your position size for the 11th trade. In reality, this new trade has the same odds of winning or losing as the previous 10 bets.

Perhaps, this explains why some of the traders, even though get into profitable trading cycle end up making very little money.

The antidote for ‘Gambler’s Fallacy’, is position sizing.

11.3 – Recovery trauma

In the trading world, the capital we bring on the table is the raw material. If you do not have enough money to trade with, then how will you make a profit? Hence we need to not just protect the profits that we make but also protect the capital.

Extending this thought – if you risk too much capital on any one trade, then you stand a chance to risk your capital to an extent that you may burn your capital leaving you with very little money. Now if you are trading with very little money, then every trade that you take will appear to be too risky. The climb back to where you started will (in terms of capital) will be a Herculean task.

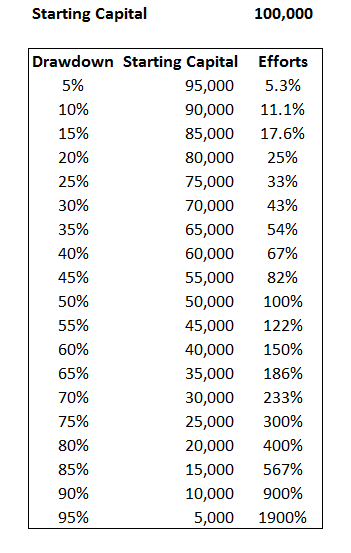

I have prepared a table to help you understand this fact. Assume you have a trading capital of Rs.100,000/-. Let us see how the numbers stack up with –

You can download the excel sheet here.

Assume you lose 5% of your capital or Rs.5000/-. Your new starting capital is Rs.95,000/-. Now, in order to recover to Rs.5000 with a capital of 95000, you need to generate a return of 5.3%, which is 0.3% more than what you lost.

Now, instead of 5%, assuming you lost 10% and your capital becomes 90000, now in order to recover 10000 or 10% of your original capital, you have to earn back 11.1%. As you can see, as the loss deepens, you will have to work really hard to bounce back to the original starting capital. For example, at 60% loss of original capital, you are staring at a 150% bounce back.

Unfortunately, the ‘recovery trauma’ affects traders with smaller account size. Assume you come to the market with Rs.50,000/- capital. Now you would have heard of stories on how Rakesh Jhunjhunwala, grew his money from 10,000 to 15K Crores. You would want to replicate at least a small portion of this success. Honestly speaking, if you can manage to grow Rs.50,000/- to say Rs.60,000 by the end of the year, you would have done a great job. This translates to a 20% return. But this is not exciting, right? I mean earning Rs.10,000/- over 1 year when you are actively trading somehow does not seem right.

So what do you do? You tend to take bigger risks and hope to make bigger gains, and if the trade goes against you, then you are essentially falling prey to the ‘recovery trauma’ phenomena.

This is exactly the reason why you should never risk too much on any one trade, especially if you have a small capital. Remember, your odds of making good money in the markets is high if you can manage to stay in-game for long and to stay for a longer period, you need to have enough capital, and to have enough capital, you need to risk the right amount of money on each trade. This really boils down to working towards longer-term ‘consistency’ in markets, and to be consistent you need to position size your trades really well.

I’m going to close this chapter with a quote from Larry Hite.

Over the next few chapter, we will dig deeper into position sizing techniques.

Key takeaways from this chapter

- Position sizing forms the corner stone of a trading system

- Gamblers fallacy is a bias highly applicable to the trading world. It makes the trader believe that a long streak of a certain outcome can break

- When there are infinite draws, the odds of making a profit or loss on the Nth trade is similar to the odds of making the same profit or loss on the 1st trade

- The recovery of capital is much more difficult task than one can imagine

- Traders with small accounts have a tendency to take larger bets, which they need to avoid

You have beautifully explained the trading scenario & psychology of a trader they lose everything without looking at their odds.

I am seeking to learn more about this in order to enlightened how to not to get carried away with gamblers fallacy.

Glad you liked it, please stay tunned for more 🙂

Great Work as always !!! Along with Risk and Psychology if something on Money management can be incorporated. Thanks a ton.

Thanks, Charles, it is on the cards, we will!

Hats off to u for enlightening us with the traders fallacy.Actually all of us fall prey to this irrespective of capital and experience.Looking forward to know more on this and how to do proper money management.

Thanks, Shankha. Planning to introduce money management technique over the next few chapters.

Whatever you wrote applies well for the Big Fund houses , Fund managers or for someone who has access to 1 Crore capital at least so that he can target 20-30% per year and which can be a significant earning. But We all know that most of Traders are under capitalized and well under 4-5 Lakhs. So they have no incentive and patience to wait for the right entries and right position sizing just to make 15-20 % return. So He lefts with no option than to take leveraged trades and all brokers encourage them to give 40-80x leverage. And that is why majority of them go bust and never come back to markets. All this Gyan of right postion sizing and Leverage comes from the people who have traded with maximum leverage in the past and today they are sitting on big profits. 🙂 and now they want to play safe in order to retain the profit.

Not really Pawan, money management applies to all sorts of traders.

Leverage is a double edged sword. You need to know how to use it well. I’ve never asked anyone ‘not’ to use leverage….but I do not encourage traders to take excess leverage. There is a difference in these two.

Given your capital, there are techniques which will help you how much leverage is acceptable for your capital size. You stand a better chance of making money if you adhere to some of these techniques.

This Larry Hite quote appeared on my Pi Login Page on the day i was going to revise my stoploss downwards and hope on for mother-luck, It helped me like anything and this write up is gonna help me more.

Have a contribution from my side too- “You are here to make money from stocks in the market, Not a single stock in the market, Never fall in love with a trade and never average it.

Glad to hear that, Rajat 🙂

That’s a nice quote, is that coming from your experience?

Sir ,ĢOOĎ I ALWAYS FOLLOWED U,I ALWAYS TRADE NIFTY OPTION ONLY 1LOT WITHOUT SL NO AVÈRAAGING AND TRADE ACCORDING AS U WROTE IS IT GOOD STATEGY PLS Advise ànd I want to ask from many days why r call option premiums cheaper compared to puts in option caluculators&fair value explain in detail

Its because of the volatility, Narasimha!

Sìr why is t+2 for equities though they r less tradeď thèn f&ò&how does it work lam not familiar to equities pls help

That’s the settlement cycle required for all the intermediaries to fulfill their obligations.

Dear Karthik,

Wonderful topic. Karthik when are u coming up with the “Financial Modelling class with excel as a tool”. Just eagerly waiting to cover this topic .

Regards,

Sonjoe Joseph.

Glad you liked it Sonjoe. The next module will be on Personal Finance (with an emphasis on MF) I guess….Fin modelling will be after that 🙂

Excellent article.Practical and informative

Glad you like it, Desai 🙂

Happy learning!

Next model we are expecting “trading strategies” sir.. Please don’t postpone that.. thank u.

Many people want a module on ‘Personal Finance, with an emphasis on MF’, so I guess the next module maybe on that 🙂

Please take Trading Strategies & Financial Modeling modules first. Thereafter you may cover Personal Finances with MF module.

Please my earnest request to you.?

Thanks & regards

Santosh Shetti

Cannot guarantee that, Santosh 🙂

sir, do you think IPO is more riskier…i was expecting a module on IPO…or any reading suggestion..books/article/websites?

IPOs in my view are risky because the company going public has an incentive to bump up the valuation. Check this chapter on IPO – https://zerodha.com/varsity/chapter/the-ipo-markets-part-1/

thanks…. yes… i read IPO market…i am varsity student.. I never miss any chapter…

Great!

Sir w8ing for you QA module

QA?

Quantitative Analysis

Ah, that will take some time, Mohan.

i am much worried about internet war…hackers….omen of next black swan…

Stay positive my friend!

Pure Brilliance.Very well explained.I am very much expecting ‘Foreign Exchange Risk Management’ topic in your next module.

I think the source of this topic is MoneyControl!

The MC article was authored by me, so the source is the same!

Great work!

Cheers!

What a beautiful explanation! I have suggested 2 of my good friends to read so that there is no need to clamor for additional reading material. Congrats on this Karthik. One cant pen down articles n explain them like this unless they have a mastery on the subject. I have a suggestion though. Please make these articles available for download in PDF format like in the older UI. People like me who do not have internet all through out the day would benefit from the offline download.

Thanks for the kind words and the encouragement 🙂

We will upload the PDF once this module is completed, which I think is still 1.5 months away.

Sir,

Why have u taken average return in excel file fro 79 counts if you are taking observation count of 127 ?

Sorry, I think the comments are getting mixed up after the site was updated. Which excel are you referring to?

Dear Mr.karthik,

your modules on options is wonderful and extremely helpful. let me share my experience..

The brokerage charges and taxes plays a very big part in profitability and most of the time eats away all the profits as they are like double edged sword. I started trading during just before satyam scam as a novice. Up course at the time zerodha was not there.

With little knowledge I had fancied options trading. I did make profits…. inf act i was employing the Technics of CALL SPREAD, PUT SPREAD. CALL RATIO BACK SPREAD AND SHORT STRADLE ETC..without systematically knowing them. I did a mistake of choosing far OTM most of the time and used to keep the option near to expiry without knowing the effect of THEATA. I could make profits but all all is wiped out aided by another major contributor for loss is brokerage… I had to leave the trading 7 years back.

Now recently i came across zerodha and immediately opened the account and started trading from 22nd July 17.

I explored your teachings and immensely thankful to you for your simple but in depth explanation. I also realized now that i was under gamblers fallacy …it is difficult to come out from it for novice traders like me. However armed with your teachings i hope to reduce that instinct..

Incidentally I made Rs.46000/ profit for about 15 days trading most of the time intraday F&O… the capital employed is about Rs.250000/- . However my other charges mostly taxes and stamp duty is 18000/. Hence profit is reduced to Rs.28000/ as per zerodha calculation

In spite of zerodha’s such a small brokerage one has to sell out 20% of profit or loss to taxes!!!

Hence i changed my strategy to option trading from Futures their by reducing the taxes to 10%. of PROFIT OR LOSS.

so it is difficult to make money. If at all one makes it will be snatched again with 30%. IT. So.. at the end of the day the net profit is abysmal. It doesn’t mean that Taxes should not be imposed but it should not wipe our Profits. PL. include all these in your position trading techniques.

regards

Thanks for the kind words and sharing your experience, Swamy.

Yes, taxes are for real and it is a serious concern for traders. This is the reason why we have dedicated an entire module for taxation. Check this https://zerodha.com/varsity/module/markets-and-taxation/

Hi,

I had placed an order for Rupeetales last week. I have not yet received the shipping details.I am not getting any response after sending an email to [email protected] . Please do the needful.

Thanks.

Which email id have you sent the email from? Can you please resend another email to hello@rupetales? Thanks.

Dear sir

PDF file disappeared after changes in website . how to get it again ?

This week.

Hi Karthik

Can you give your views of; what is the ideal, maximum & minimum percentages of returns one can expect in trading? This could give a ground reality, I presume than speculating unrealistic gains people focus on.

There is no such thing as max and min returns. This varies for each investor across each asset class. However, setting a realistic expectation on returns is the key to market longevity.

Great work Karthik. I have been on zerodha from past two months and im following your zerodha varsity articles regularly infact whatever trading knowledge i have gain is just through your articles. They are simple and easy to understand. Keep it up.

Thank you, Mozam. I’m glad you liked the content 🙂

Liked the way you present in real simple manner. Keep it up.

Cheers! Happy learning.

Dear Sir,

I have done the same many times and blown up my account more than five times. I save money from my salary and donate to the market every time. I read this and thought about this. But whenever I am in the market, I am not able to recall money management and ultimately loss my whole capital. I have been lost around 5L in market. It is vary devastating when I do not buy things and bet that money in market. I thought many time to leave this game but return back when I have sufficient saved capital.

I bet big not because I need profit, I bet big because I want to cover my whole loss and in this practice I always losses.

Do you have any advice for me?

Neeraj, its very easy to get lost in this ‘recovery’game. I’ve hardly seen anyone recover their losses. Trading is best done when there are no external pressures. From what I can understand is that you are making random trading decisions. Try and plan your trades well. Try and incorporate a plan, strategy, and be patient. I’d suggest you take a break and refresh yourself. Get back when you feel better about trading.

Which book of Van Tharp’s your referring to? Please let me know.

Thanks

Definitive guide to position sizing by Van Tharp.

Dear Karthik,

Well explained. Unfortunately in my case the things acted reversely on recovery theory.

Though it may sound funny, but is purely (100%) factual.

I have been in future trading since last 6 months. And made more of loss making trades than profiting trades. Now everytime I lost money, I have got more pressure (to recover my principal – I work on rule: never loose money in market) and ultimately over the period of time I recovered. That’s where I found it really funny, that without the pressure of recovery I am loosing a huge, say 125K on first quarter of F&O trade.

Can you help me understand this? Because its difficult to know how I earn afterwards for recovery after loss, and then again enter second leg of loss and then recover. Shall be thankful- if you can share such scenario and how to employ such emotion/situation to straight earning

Coincidentally, I’m writing about trading biases, check the last chapter in this module. Each trader’s temperament and the situation is different, Ajith. Generally speaking, a trader is not so successful when he is under major pressure to earn money – this happens when trading is the only source of income.

Nice learning sir.

Cheers.

Sir, suppose I have a strategy with 65% accuracy. BUT its risk reward ratio is 0.7,

meaning I earn 7 rupees on a profitable trade and lose 10 rupees on a losing trade, not a good risk reward ratio.

I know, Theoretically, the strategy is still profitable inspite of bad RR ratio.

But are there some ways to improve its risk reward ratio? One possible way I can think of is to wait for a pullback below theoretical entry price before taking a trade, which will improve my RR ratio.

Can you please suggest me some more ways which can improve my RR ratio.!!

Please, help me.

Thank you in advance.

In such cases, reducing the number of signals helps. Reduction in the number of signals usually implies that the trade qualifier is more stringent. This may improve the risk to reward of your strategy. Good luck.

I am sorry to bother you, but I think there is a confusion.

The strategy I am talking about is a breakout calculation based strategy for intraday. I backtested it manually for past three months data and found its win rate to be amazing 65% . Now suppose I got a buy signal in reliance at 950. Now predefined target is 959 and stoploss is 941. That means a risk reward ratio is 1:1. But after adjusting for slippage and tax, I actually get 7 rs on a winning trade and lose 10 rs on a losing trade, which makes my RR ratio 0.7. One way I can thought to improve RR is to wait for the price to pullback, say to 947, before taking entry. But then,I am afraid that a lot of profitable trades would be left and I will be taking those trades, which have more chance of losing, as a pullback can turn into a reversal.

Can you please suggest some alternative.

I would be really thankful to you

Well, one of the main things to consider when backtesting is to actually consider applicable charges. This is the key and can really skew the results – skew in the sense, it can give you a fairly accurate representation of the expected results.

Now, once the strategy is defined, you really should not do stuff which will alter its course. Every bit of optimization should be thought through before backtesting. Or in other words, optimization should be a part of back testing.

Dear Karthik

You have the Fantastic gift of putting complex ideas into simple language. Position sizing is one of the most over-looked and misunderstood ideas out there. Good to see that you also follow Van Tharp’s ideas on PS.

Keep up the great work…!

cheers

Glad you liked it, Jatinder 🙂

Keep learning!

Now I understand why Zerodha is growing so fast, they have leaders like you.

You’ve explained very well, not only this chapter but every chapter.

Thank you!

Thanks for the kind words, Raj! Hope you continue to enjoy reading Varsity 🙂

Karthik, If you can answer my few questions, it would be really helpful for me.

1. Do you guys still trade or invest?

2. If traders and investor can become successful then why did you chose to be a broker instead of sticking on trading and investing?

3. I’ve seen Bank Nifty options so many time going from down to top like hell (few days back i saw one call option going from rs. 9 to rs. 553) and these bank nifty option movements I’ve seen so many times. So, is there any key or advise you can give me to master the bank nifty index. I can do anything for this.

4. In past, I have more losses than profit and that thing demotivates me and after losses I tried to quit trading as i thought that i will never be successful here, but seeing such scope and movement I could never quit trading… Any motivation you can give for not backing off from trading.

5. How does it feel being rich 🙂

I’ll eagerly wait for your reply.

Regards,

Raj

1) I invest in both stocks and MF. My trading activity has reduced drastically, I take up positional trades once in a way

2) I’m neither a successful trader or investor. Although I think I’m better off as a patient long-term investor. I’m still trying to understand markets and it is just that we choose to share our learning with everyone else. I choose to work for Zerodha because I love this company

3) One thing is clear is that it is volatile. So instead of Bank Nifty, you should understand volatility better and its impact on BN

4) Its happened to me multiple times. The only thing that kept me on track was that nothing apart from market interests me. So I kind of knew that all the other doors were shut 🙂

5) I’m not rich. If Zerodha decides to kick me out for whatever reason, I’m back on the streets. Hope that does not happen 🙂

Thank you Karthik for answering.

I wish more success in your life for helping others 🙂

Thanks for the kind words, Raj. Good luck to you as well.

zerodha should look forward toward making a Position sizing Software .

Preferably not an excel sheet available these days

Alan, what sort of s/w do you have in mind?

hi karthik..

you have done a wonderful work which is very much important in this field..keep it up..

cheers!!!

Thanks, Maghi. Happy reading 🙂

It was very well explained Karthik. Thank you

Happy reading!

Hi Karthik,

I cant thank you enough for the huge effort you had put in to explain the concepts from scratch. I have benefitted a lot from your work. A great job indeed.

There is small typo in this chapter “phycological”. You may want to correct this.

All the best.

-Diwakar, Hyderabad

Thanks for the kind words, Diwakar. Thanks for pointing out, will do the correction.

Sir I looked for van tarp position sizing book every where both online and offline I dint get it any where,if you know where will we get it’ll be helpfull.

Will try and look out for that. I guess it’s out of print now.

“Chances are that you will take the 4th option. You clearly want to protect your profits and do not want to give back whatever you have earned in the markets and at the same time, you would want to take a trade considering you have had a great winning streak.

This is again ‘gamblers fallacy’ at play. Being completely influenced by the outcome of the previous 10 trades, you are essentially reducing your position size for the 11th trade. In reality, this new trade has the same odds of winning or losing as the previous 10 bets.”

This is a statement from this chapter. Kelly’s Criterion in the other chapter actually suggests increasing the bet size on such trades. So is it really a “gambler fallacy”?

There are multiple theories, Varun. This is not a definitive study. You will have to pick and choose 🙂

Which book of Van Tharp will you suggest to read, Karthik?

The definitive guide to position sizing, this is a classic.

It will be very kind of you Sir if you share Position sizing Excel Sheet

Thank you.

Hmm, if there is an excel, I’d have shared it here already.

Karthik, can you please explain this with an example?

Have taken up few examples in the chapter itself I guess.

OMG.

Karthik,

I’ve been trading for > 25 years.

I know almost all from this module but I have never see everything combine in one module and so clearly presented.

Thank you and great job.

May be hard for novice traders though.

Alex Gozman, PhD

Happy trading and learning, Alex 🙂

Sir I have a doubt, is the position sizing is only for intraday?

Not really, you can do this for overnight positions as well.

Averaging in cash with the right technical levels for a fundamentally strong company is always good..

Averaging for a fundamentally weak company is always a bad idea.

Perhaps, Vinayak.

But Karthik, on one side we say it’s a gambler’s fallacy to justify the probability of our next trade on the basis of outcome of previous trades. While on the other we’re estimating our future returns based on historical data.

I can agree with the viewpoint of Gambler’s Fallacy but estimating returns based on their historical movements, is practical? Isn’t it a new day everyday?

That’s the reason its called ‘expected return’, and not the actual return 🙂

Reading this at least 5 years after it was published. One of the best articles on trading I’ve read so far! Wonderful articulation with great knowledge of the concepts. I ran into it after making a biggest single-day loss in my trading career. I made up for it in less than two days – this article was super helpful in that regard. Thank you!

Thanks for letting us know, Yashas. Happy learning and I hope you stay profitable!

How can we position size for cash intraday trades

It starts by allocating cash for intraday. For example, if you have 10L total capital, then allocate 2L for intraday. Within that 2L, you cal follow all things discussed in this module to allocate funds to positions.

Sir from where you gained this vast knowledge?

Years of trading, investing, and losing money have forced me to keep learning 🙂

I really appreciate how Zerodha consistently comes up with fresh ideas and innovations. I also want to express my gratitude to Karthik Sir for his excellent teaching on psychology and trading. His concepts are easy to understand and have been incredibly helpful to me. Thank you!

Glad to hear that, Ansh. Happy learning 🙂

Hey Karthik,

Been reading your content and loved it, but I have a question

What is the difference between trading and gambling,

I asked this question to a relative of mine [ lost money in Options trading ].

He told me it was a ‘Kind of Gambling’ why? Because derivative market is a zero sum game , this was his reasoning.

I would like to know your viewpoints on this, is trading and gambling not very different?

Thank you

Happy to note that you liked the content on Varsity 🙂

There is a big difference between gambling and trading, I’d suggest you read this and also show the article to your cousin – https://zerodha.com/varsity/chapter/mindset-investor/