What is a trading system?

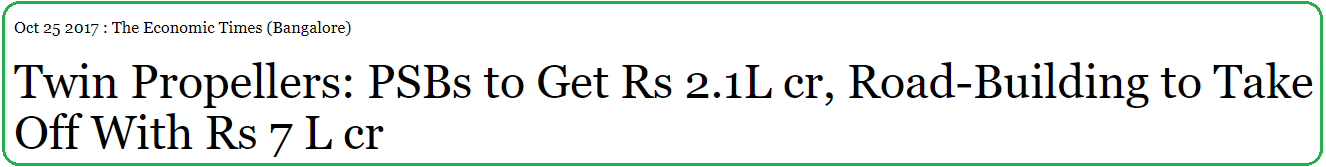

Such a glorious day to start this module! Here is the headline that rocked the stock markets today –

Yesterday i.e 24th Oct 2017, the Finance Minister announced that the Government would infuse Rs.210,000 Crore into the Public Sector banking system, which is basically an effort to save the PSU banks from the deteriorating NPAs (Non-performing assets).

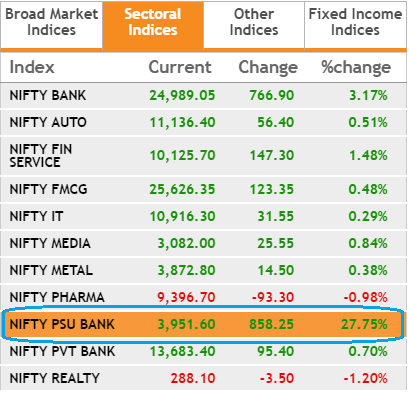

How did PSU Banks react to this announcement? After all, this is a lease of life to the PSUs. Well, they were jubilant, as expected –

As you can see, the PSU Bank index shot up 27.75% at opening.

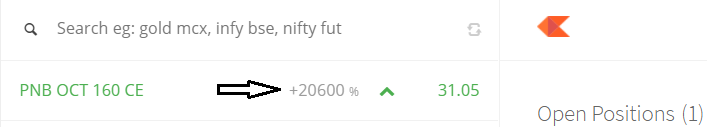

Some of the PUS stock options were on steroids, here is the hero of the day –

Punjab National Bank’s 160 Call option expiring on 26th Oct 2017, shot up 20,600% overnight! If you had bought 1Lac worth of option on 24th Oct, it would have translated to 2.02 Cr on 25th Oct morning. So clearly, there is a lot of action in the market today.

Earlier in the day, my colleague and I were looking at the way markets were behaving and trying spot an opportunity, and here is something that looked interesting –

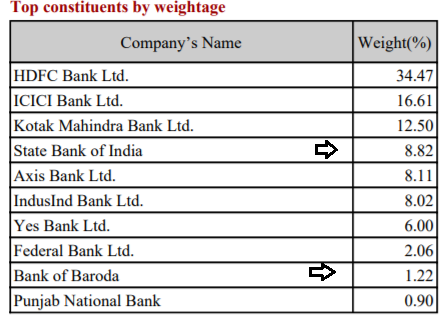

Bank Nifty Index too joined the party, with the index going up nearly 3% (look at the image of the sectoral indices above). However, a 3% move on Bank Nifty was quite questionable considering the fact that PSU banks contribute just around 10% to the Bank Nifty index, look at the index constituents and its weights below –

Considering this, my colleague and I decided to write a short strangle on Bank Nifty and collect a premium of close 253 points per lot, obviously hoping that the volatility would die and premiums would reduce.

I don’t want to debate about the reasoning of this trade – whether it’s going to make money or not is not really the concern, although I hope it does ☺

However, I want you to think about the thought process behind this trade. The trade idea originated through what I consider as ‘systematic deduction’. To make such systematic deduction and find opportunities, you need to question what is happening in the market and sometimes be willing to take contrarian positions, which is exactly what we did.

‘Systematic deduction’ is one of the most popular methods market participants adapt to trade the market. However, not all systematic deductions are right, you could, of course, succumb to biases and make systematic errors while making these deductions. Nevertheless, systematic deduction is one of the other popular techniques to trade. Other popular trading techniques being –

- Trade because your gut says so

- Trade because my friend says so

- Trade because the guy on TV says so

- Trade because my broker says so

None of the above mentioned ‘approach’ to trade the market, including the ‘systematic deduction’ can really be defined as a process. These are ad-hoc methods, which cannot really be quantified or backtested.

Any approach to trade where you cannot really define ‘the approach’ as a process is not considered as a trading system.

On the contrary, if you can define the approach and can quantify the process to trade the market, then you are essentially talking about a ‘Trading System’, which is exactly the focus of this module.

1.2 – Trading system – the Holy Grail?

The moment you talk about a trading system, people generally tend to think of these systems as a sure shot technique to make money, or in other words, they approach these systems as a money-making machine. They expect profits to roll from the first trade itself. Unfortunately, it does not really work that way.

Remember, a trading system receives a bunch of inputs from your end, performs a set of task, and gives you an output. Based on the output, you then decide (or the system itself decides) if this is a trade worth taking or not.

Here is how you can visualize this –

If you realize, for the trading system –

- You give the system the inputs

- You design the system

- You decide to trade or not to

So the onus of making money really depends on you. The advantage of a trading system, however, is that – you only have to decide the logic once and then just follow the system that you’ve designed.

Of course, as you may have sensed, I’ve dumbed down the journey of a trading system to a large extent, and this is just to give you a perspective at this stage.

1.3 – What to expect from this module?

The trading systems that we will discuss in this module will be complete, in the sense, it will have –

- The logic, which is the core of the trading system

- Input parameters

- Interpreting the output

- The decision to trade or not

At this point, I’ve planned to write about the following 4 trading systems –

- Pair trading

- Volatility based Delta hedging

- Calendar spreads

- Momentum strategy (Portfolio approach)

There two techniques to pair trade – a simple approach based on correlations and a slightly complex approach using statistical concepts – both of which we will explore. Of course, as we proceed, I may try and add other trading systems as well.

However, this module will not include the ‘backtest’ bit. The onus is on you to backtest the system and figure out if the system works for you or not. You will have to take the rules of the system and figure out how many times in the past it has worked and if it has worked, what kind of profitability pattern the system is showcased.

Remember, no trading system is complete without having the backtesting results. The only reason why I’m not including the backtesting part is that I lack programming skills. Some of these systems can be efficiently backtested if you can manage to write a piece of code. When these systems were developed, I was fortunate enough to have a fellow trader with programming skills, hence I was in a position to get greater insights into these systems. I must also tell you that these were fairly competent systems to trade – and I presume they still are.

Of course, the market conditions have changed, hence a fresh set of backtesting is justified.

However, the broader objective of this module is to showcase different systems and give you insights into how systems are developed. Hopefully, this will inspire you to develop your own system and perhaps works out to be your own money making machine!

With this hope let us proceed – onwards to Pair trading!

PS: The short strangle on Bank Nifty worked out quite well ☺

Can you please teach Python programming for trading, it\’ll be really great for traders.

I think in the world of AI, this is no longer needed 🙂

Karthik sir, correct me if I am wrong, in Delta Hedging strategy, we\’ll have to constantly add new trades so that we can keep overall delta neutral. This is not only a big task from operations perspective but also it\’s expensive from brokerage and other charges/taxes perspective hence you skipped it. (At least for retail)

One hundred percent correct. Hence, I\’m not a big fan of delta hedging 🙂

Dear sir,

Thanks for this amazing content, but sir what is this quants finance which requires coding [python an all], i was trying to get into some job related to trading and equity research. But seems like coding is a must known skill for all those.

It will be really helpful for retailers like us if you add up a module on career related things.

Regards

sir you didnt teach this trading system

Volatility based Delta hedging

its extremely important to know this trading system in detail

Delta hedging can be super complicated, Mehul. Also for most retail this wont be viable as it involves too many transactions.

Hello Sir,

I am in a dilemma.

I have 3 lakh trading capital and I trade(positional) 1% Stop loss rule in the Equity cash market which confines me to take only long trades even if it is a bear market.

Sometimes in a bearish trend even if there is no long trade, I take trades impulsively.

I think my impulsiveness will reduce if I have ample trading opportunities which gives me freedom to trade in both directions.

But now the problem is, if I take a short trade in nifty futures 1 lot (200 points SL * 50 )= 10000, which is more than my 1% (3000).

To bring 10000 to 1% I need 10 lakh rs.

I have been at breakeven for 3 years and haven’t done well.

Sometimes I think if I am not profitable I shouldn’t increase my capital, but then impulsiveness is hurting me.

I have also read that you should have a decent amount of capital to trade, but If am not doing well with 3 lakh how come I will do good with 10 lakh?

Need your guidance Sir.

Thank you.

Kartik Sir : The problem is not with not finding trading opportunities in bear market, but rather your compulsion to trade all the time. Think about it, if you are comfortable sticking to your risk management policy of not risking 1% of capital in cash market, sticking to long only trades, sticking to EQ segment…and doing good in this circumstances, then why do you really want to distrub this and find a trade that takes you away from your risk policies?

You do these trades only to dilute the returns of your well thought of long trades. What would be the logic?

Abdul : I got ur point sir, but what if there is a long bearish trend like happening right now.

What can a trader do in bearish trend who only take long trades.

Thank u.

To decide not to trade is also a trade 🙂

I was thinking of crypto too, what say ?

No idea boss.

Time to buy mutual funds ?

Yes, doing SIPs is the best. No headache of timing the market.

Sir after reading the first chapter and the headings of the other chapters, It looks like we have to know about options is well. To learn about the trading systems?

Eventually you will have to know most of these things, especially if you wish to be an active market participant 🙂

Hi karthik sir,

I have completed the technical analysis just 3 months back and currently doing swing trading. Will it be helpful to learn Trading systems at this moment? Is it important? Your suggestions please….

Yes, no learning goes waste, so don\’t hesitate 🙂

Hello Sir,

I am in a dilemma.

I have 3 lakh trading capital and I trade(positional) 1% Stop loss rule in the Equity cash market which confines me to take only long trades even if it is a bear market.

Sometimes in a bearish trend even if there is no long trade, I take trades impulsively.

I think my impulsiveness will reduce if I have ample trading opportunities which gives me freedom to trade in both directions.

But now the problem is, if I take a short trade in nifty futures 1 lot (200 points SL * 50 )= 10000, which is more than my 1% (3000).

To bring 10000 to 1% I need 10 lakh rs.

I have been at breakeven for 3 years and haven\’t done well.

Sometimes I think if I am not profitable I shouldn\’t increase my capital, but then impulsiveness is hurting me.

I have also read that you should have a decent amount of capital to trade, but If am not doing well with 3 lakh how come I will do good with 10 lakh?

Need your guidance Sir.

Thank you.

The problem is not with not finding trading opportunities in bear market, but rather your compulsion to trade all the time. Think about it, if you are comfortable sticking to your risk management policy of not risking 1% of capital in cash market, sticking to long only trades, sticking to EQ segment…and doing good in this circumstances, then why do you really want to distrub this and find a trade that takes you away from your risk policies?

You do these trades only to dilute the returns of your well thought of long trades. What would be the logic?

Aaap tower mein aa jaaeiye Kulsum khan ji

No, I want to add all the Common stocks from NSE & BSE in my watchlist and also their prices respectively, Is it possible?

Yes, you can create multiple watchlist in Kite, post-login.

Hi,

for supposue I want to track all the stocks with starting letter \”A\”, and i want to make a table with company name, \”NSE PRICE\”, \”BSE PRICE\”.

is it possible in kite for intraday

You can add a bunch of stocks on Kite\’s Marketwatch and sort them out alphabetically 🙂

Check this – https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/kite-mw/articles/save-market-watch-settings

Thanks Sir. Gave that module(Option Strategies) a full read already, some chapters repeatedly and the pdf is always with me.

I\’m yet to read this module(Trading Systems). Outwardly it seems like it is more related to stocks. Since I only trade index options, I\’m not sure whether this module is relevant to me. Would like to know your suggestion as to whether I should be reading this.

Yes, this module is largely related to futures trading. You can probably look at this Module – https://zerodha.com/varsity/module/option-strategies/

Sir

Is any way to short sell stock for too many days.

Expect futures

Thanks a lot for your guidance 🙏

Happy learning 🙂

Hello sir! I want to build system for trading. I am familiar with coding and some quantitative. But want to know the actual process of how actually trading systems are built and backtested and anything out there in system trading. I don\’t have anyone to guide me on the same. Can you please help me out?

1) What factors/things should I take care very critically in system trading?

2) How do I verify my work done? Is my built systems really valid? Any optimization needed for the same?

3) Any sources like blogs, YouTube channels you will recommend to take references from there. I am looking for quantitative based trading systems especially.

1) Broadly speaking, there are 3 things -a) data input, so make sure your data is clean (b) your core model where the logic resides. Make sure you vigorously test it (c) Output, ensure your signals are fewer with smaller drawdowns.

2) YOu will have to test it live in the market. Start with a smaller capital and then see how it goes. Scale accordingly.

3) Not sure, do check Quantinsti, they may have some stuff related to this, online.

Hello sir! I want to build system for trading. I am familiar with coding and some quantitav

Thx!

I have developed the sheet, where on can find corelated, coeffficient stocks. where one can trade, without any much worries ( worry is if that particular stock is news driven, like recently ACC, AMBUJA pair; with Adani buying it). Otherwise all fine.

Need like minded people to develop it further, may be ALGO it.

Can connect with me @ [email protected]

Thanks.

I’ve planned to write about the following 4 trading systems –

Pair trading

Volatility based Delta hedging

Calendar spreads

Momentum strategy (Portfolio approach)

We have already read Volatility based Delta hedging and Calendar spreads in Option strategies. Right? Or we are talking about something different trading system here.

Yes, we have discussed that already. In fact, except delta hedging, we have discussed everything else.

Hi Karthik…..In this chapter u mentioned , that u will be writing about 4 Trading strategies:-

1. Pair trading

2. Volatility based Delta hedging

3.Calendar spreads

4.Momentum strategy (Portfolio approach).

But I cannot find S.No 2. – Volatility based Delta hedging chapters in these modules.

Kindly clarify me if I\’m missing any contents.. or will you be posting it in future?

Thanks

Ah yes, I skipped that one thinking it would be a bit too complicated.

Thankyou . Let me try Kite connect APIs. Data from NSE site looks very expensive.

I really like your way of writing and explaining complex concept in a relatable manner.

Thanks, Pradeep. Happy learning 🙂

Thankyou Kartik for the quick revert. One more thing I tried to scan around on web for the historical data of stocks but to no avail. Can you suggest some paid sources ?

NSE has put up a list of data vendors, do check that. You can also use Kite connect APIs for historical data, but you need some programing skills for it.

Hi Karthik,

Thankyou very much for the article.

Excellent article especially for a Novice market enthusiast like \”me\”.

I have a very silly(🙃) doubt.

Do we need to check whether the data is normally distributed before getting to the stage of deciding trade basis the value of relative density for the given ratio.

Pardon me!

Hi Karthik,

Thankyou very much for the article.

Excellent article especially for a Novice market enthusiast.

I have a very silly(🙃) doubt.

Do we need to check whether the data is normally distributed before getting to the stage of deciding trade basis the value of relative density for the given ratio.

Pardon me!

Pradeep, that\’s ok, please don\’t hesitate to as any questions. Stock prices are usually normally distributed across all stock, no need to check that specifically I guess 🙂

How can i download pdf file of chapters ? I wish to take printout of the same. Printout from web page doesn\’t come out properly. Thanks.

PDF is available at the end of this page – https://zerodha.com/varsity/module/trading-systems/

Sir, I have understood the logic behind going for the short: u expected volatility to ease, but y did u decided to go for strangle, instead of straddle. Any particular reason? Please explain. I am little confused about when strangle is preferred over straddle. I have gone through the strangle chapter; however, it will be useful if u can reply in this comment. Thank u for this invaluable content once again.

One offers a range for you to profitable and the other offers a single price point. Based on the market condition you choose what you\’d want.

Respected Sir,

I was wondering whether AI machine learning model to predict stocks falls under quantitative analysis(QA) or technical analysis(TA)…

Perhaps, but I don\’t have experience with this.

hai sir when you will teach about Volatility based Delta hedging? waiting for it sir

Too many things on the list of things to do, will try and do that soon 🙂

Thank Karthik. For including System Trading into consideration.

Dose Adjustments in any trading systems or option strategies are part of any of module, I would like to request you also please elaborate something on adjustments – what ,why and how ..

Adjustments are not, but the adjustments are a very expensive affair, Sagar.

Due to name on the chart in mobile app,chart is not visible. Please make it transparent.

ulhas

Sure, passing the feedback to the team.

SIr, I found some data ticks absent in Zerodha kite but present in NSE historical data. Whom do I rely upon?

Can you please create a ticket on Zerodha support portal, someone will get back to you on this.

Nice tutorial

sir,

where RBI live reference data of currency is available which declare at 1.30 pm daily. How will get the same data at the time of declaration.

The price you see on the screen is fair representation of the daily ref price, Ulhas.

Hi Karthik ,

Please include a chapter for backtesting for retail traders as this is the biggest challenge. You can consider this for those who are well versed with programming or later can learn it .

Will try and do that. Meanwhile, do check this – streak.tech, they make back testing easy for traders.

Since, we are talking about trading systems, what are your views on scalping.

I am a 19 years old trader and my capital is low, and I can\’t afford for f&o right now. My profitable trades are increasing, but because of lack of patience I lose them.

For leverage I have to depend on intraday 🙁

What would be your advice?

Should I develop more patience or should try scalping for sometime?

Avoid scalping, develop more patience for longer terms trades 🙂

Sir,

Will Zerodha develop such charts for traders?

Regards,

Ulhas

No sir, not for now.

Sir,

This is nothing but market depth change to chart.

Means market depth chart with equity chart.

Regards

Ulhas

True.

Sir,

From this we can know how many wish to buy & how many wish sell.

Change of interest of buy or sell will change the number of buyer & seller so will know the future trend of market.

Weather such chart is is possible to add.?

Regards,

Ulhas

No, Ulhas. I don\’t think this is feasible. Btw, you can just look at the market depth for this.

Sir,

This is observed that sellers are more & market is in down trend. When sellers are began to reduce & becomes equal or less than buyers then market trend change.From this we will take position or make our self alert or book profit or exit current position.

As this is very easy for Zerodha to add this.

Regards,

Ulhas

What matters is the value of transactions, Ulhas. For example, there could be 100 buyers buying 1 share each, but there could be just 1 seller selling 100 shares. So does this mean its bullish? No right? What matters is the value of the transactions.

Sir,

Chart of number of buyers & number of sellers with respect to time.

Keep number of buyers & number of sellers on Y axis & time on X axis.

Regards,

Ulhas

Ok. But why do you think it is important. For example, if I tell you there are 30K buyers and 40K sellers for Infy as of now, what would you infer?

Sir,

Is there any chart buyer vs seller available.

If not need to created. May be very useful.

Regards,

Ulhas

Not sure what this means, Ulhas.

Sir,

Why GTT order for currency is not made available in Zerodha, as it is available in other trading platform.

Need to take positive action immediately.

Regards,

Ulhas

We will soon.

Sir what is behavioral finance and it is necessary to learn about it for stock market trading and investing

1)if necessary so pls can you upload separate module on it

Behavioural Finance is a vast topic. We are trying to cover as much as possible through these articles – https://zerodha.com/varsity/module/innerworth/

When rest of the module is available in hindi?

Sir, please translate module 10, 11 or 12 in hindi….

Yes, sir, we are working one by one.

Sir, baki ka macule bhi hindi bana do please

edit: sry for the name.

hi Karthik

Is this the module that you have referred multiple times as “trading strategies” in Future module ?

hi, nikhil,

Is this the module that you have referred multiple times as \”trading strategies\” in Future module ?

This one – https://zerodha.com/varsity/module/trading-systems/

Thank you Sir,

1. As per your guidance in previous module, I created a stock portfolio of 13 stocks but are there more ways to enhance/optimize it like hedge fund managers do ??

2.And any way to backtest that portfolio will payoff??

1) Ensure they are diversified across sectors

2) Are you comfortable with programing? if yes, maybe you can backtest.

Karthik Sir, 1.Instead of Futures and options are there any other ways to invest in Nifty 50 Index or others?Like Credit Default Swaps can I bet on Nifty Index by paying premiums for next 5 years?

2. What Are ETFs ?

It would be a lot of help if u could guide me through solutions of these questions and suggest me any material to read!!

Thank You

1) Index funds are a great way to gain index exposure

2) Exchange-traded funds, they are like a mutual fund but listed on the stocks exchange which you can buy directly

sir please translate module in hindi..module 8 to module 12

Yes, we will.

hi karthik

one suggestion needed from you. Suppose if i invest in any mid cap stock and its value is presenty 1 now, until unless it goes to 0, there will be no complete loss for me right? i mean until unless company completely gets shutdown, there will be no complete loss for me right? or is there any way i might go for complete loss?

i see getting good profit in small cap in small amount of time.

That\’s right, you will lose the entire capital when the stock price collapses to 0.

in what ways is quantitative trading better than trading by using technical analysis? (please ignore the automated trading aspect while answering this)

Its another technique to trade the markets. It\’s hard to say which one is better compared to the other.

first thank you for giving all the knowledge sir.

and i recently saw the movie called \”the big short\” which is about housing bonds .

so do we have any modules coming on bonds or do you suggests any books on it , thank you sir.

Yup, I do plan to do a mini-series on bonds and fixed income.

I have an intraday trading strategy where the signal is generated in the 3 mins timeframe only after i get confirmation from 30min timeframe and 10mins time frame. for eq. buy if in 3mins time frame price crosses above 50SMA provided price is already above 50SMA in both 10mins and 30mins timeframes. Does zerodha provide any platform where i can backtest such a strategy?

You can check out https://www.streak.tech/ for backtesting your strategies.

\”Some of the PUS stock options were on steroids, here is the hero of the day.\” it should be \”PSU stock options\”

Ah, let me recheck, thanks for pointing Vicky.

Hello sir, can you suggest books regarding trading system building and statistics involved in that?

You can check that here – https://zerodha.com/varsity/module/trading-systems/

Thanks

Dear Sir,

How much margin need for intraday nifty and bank nifty option selling per lot?

Sankar, you can check the margins applicable here – https://zerodha.com/margin-calculator/SPAN/

Dear Sir..u skipped volatility based delta hedging strategy here.. When can we expect sir?

Thought it would get too complex, Keshav. Also, it is capital intensive, so it won\’t really help a vast majority.

This article is very useful and nice. Thank you for publishing this article.

Can you provide PDF for all modules (Trading Systems)

Supriya

Supriya, the PDF can be downloaded at the end of this page – https://zerodha.com/varsity/module/trading-systems/

Can you provide PDF for Module 10 (Trading Systems)

Yes, we will try and put this up soon. Thanks.

when kite 3.0 android application launched offcially

Its in beta for now, unfortunately, I cannot comment on the timeline.

Sir, please upload a combine PDF file of all 16 chapters of Module 10. like you have uploaded in 1 to 9 Module.

Thank you.

Will get this done soon, thanks Jayesh.

Pleasure

Please collaborate and do some industry relevant certification courses..

Thanks, Mohith. Will consider this.

Thank you so much sir…

Welcome!

Just \”stumbled\” upon your website while endlessly searching for trading advices online… Glad to find that instead of falling to the ground as a result of me stumbling I instead found myself firmly \”roote\” on my feet 👍👍👍. Great work sir… I am lost for words. Honestly

Happy reading, Jonathan 🙂

Wow, brilliant and outstanding website… Kudos to you sir for this effort…

I am new to the share market world… Just want to test the waters😁. However, your insights have given me the urge to even jump into the muddy waters of the uncertain realm of the stock market… Great work sir

I\’m glad you liked the content on Varsity, Jonathan! Happy reading and keep going 😉

Will 10.TRADING SYSTEMS be getting a \”DOWNLOAD PDF\” option on its page? All other sections have such a button. 😅

Very soon, Jake.

The NA issue is occurring every now and then and each time we have to remember the average cost this is very unprofessional and callous approach of Zerodha. I do not understand why we have to do it. The system of zerodha are pathetic and is not at a Professional level of stock market trading.

Few days ago NA issue occurred in few of my scripts and i have reset the average price. Today it is showing NA in all the script. I have total of 33 scripts do you expect us to this all again.

Immediately fix up the issue so that no problems are faced.

Regards

Vikram V. Dalvi

Hey Vikram! We are looking into the issue. Will ensure this is fixed before tomorrow \’s market opening. Regret the inconvenience caused.

Hello sir, is there a way to calculate slippage cost instead of assuming some value?

That would be difficult to estimate beforehand, Mani.

Hello sir, while backtesting a trading system I found that the strategy generates nearly 800 trades in an year and average profit is around 0.08%, if I add a slippage cost of 0.1% to buy price then the total pnl becomes negative. Is it advisable to add 0.1% slippage cost to the buy price for this system with small average profits?

YOu should avoid this system, Mani. Slippages are real costs that you incur and you cannot afford to ignore these costs.

ok sir, thank you.

Welcome!

Hello Sir, I want to congratulate you and Zerodha for becoming number one brokerage firm in India, I have been with Zerodha for past 5 years, and when I look back I am amazed that, I have grown so much as a trader. Varsity is a great initiative, varsity and you sir have become an invisible mentor , guiding me.

Mani, thank you so much for your warm wishes and kind words. We are super happy and humbled at the same time. Hoping this is just the start 🙂

sir,

No PDF of this Module ( Trading Systems) is shown for downloading…..?????

Is Zerodha selling the Pdf of ALL Ten Modules…..in a Book Form…..?????

Everything is very interesting and informative…. but reading on screen is a bit uncomfortable …

a more readable BOOK form is required….

Is it available…?????

Thanking you

Tushar Mody

Tushar, the PDF for trading systems is not done yet and we dont really sell these PDFs. Everything is available for free 🙂

Happy reading!

Dear Karthik,

Can I please request you to prepare a module on Day trading ( F&O ), it will be highly appreciated if you can help us out with Day Trading strategies, how to select the stock for Day trading, ( both for futures and options ).

Also, just wondering is it any good to trade ETF\’s ? ( both day trading & swing trade ) ? Does it has enough liquidity, and is the cost to trade ETF high ??

Many thanks

Ron Kalra

However, I\’ll try and put up a module on this sometime soon. I\’d suggest you don\’t trade the ETFs, liquidity is still an issue.

Thank you very much Karthik, really appreciated

Good luck, Ron!

Please provide any link or source to know about hedge funds in india.

Unfortunately, the HF universe in India is super tiny, hence not much data points around this. Also, I dont know if there is anyone aggregating information.

Yes thats why i asked this from you .

By the way i think these are classified as category 3 Alternative investment funds.??

why i was unable to download module 10 ??

The module is not yet complete, Ricky.

Sir is there a way to hedge option writing strategies like straddle,strangle etc for black swan event?

Where one can get details about quarterly results announcement timings sir?

Check the company\’s website, in the investor\’s section.

What is a ideal backrest period for a trading strategy sir?

**backtest

Depends on the strategy. I\’d suggest you use https://www.streak.tech/ for backtesting.

I am using kite API to create my own also sir, generally my backtest period is 2 years for 1 day OHLC charts. is 2 years reasonable enough sir?

Yes, especially if you are looking at short-term trading.

Hi,

How to apply saved views or templates to multiple charts i.e. the option available under \’Display – 2/4 charts\’? It just comes out black just candles. Thanks

Works fine for us. Can you contact Support? They will be able to help resolve account specific queries

Hi,

Karthik,

why Modules 10 not Download sir

The module is not complete yet, Parmesh. PDF will be available once it is done.

Hi Karthik,

You have taken a example of PNB option. Suppose someone had purchased that option, now on next morning with 26000% return, he want to square off his position. Will he able to do it ? Or Zerodha RMS will generate some exception like \’option strike price based on ltp percentage…\’ or there is some circular from nse which prohibite broker to execute such order ? In case nse don\’t stop and Zerodha not able to execute order then by switching to some other broker like sharekhan will solve the issue ?

Thanks

Yes, you will be able to sell it without any exceptions.

But sometimes we are not able to buy far OTM bank nifty option and it generate some kind of error message. On googling that error message, got to know that Zerodha crosses uper limit of 15% from ATM, so you can place only OTM option. In that case someone with huge profit won\’t be able to square off his position.

Not really, we put a restriction on buying deep OTM option, so you won\’t be able to buy these weekly expiring, bank nifty options.

Only on buying not on selling right ? But why these kind of restrictions ? And these restrictions are only for bank nifty ? Do other brokers also put these kinds of restrictions ?

No fresh positions are allowed, Waqaar. The broker has a 15% OI restriction, which we breach, hence the restriction. Not sure if other brokers have as many active traders as Zerodha does.

Kindly, provide PDF for Module 10 i.e. Trading Systems.

The module is not complete yet, Ankur. We have suspended adding new chapters for some time.

Hello Sir, I have a doubt regarding investing my family\’s money,

currently what I am doing is that I am logging into each of my family members demat account to place trades,

1) I was thinking is it possible to form a company that would invest other peoples money(family members)?

2) What is the type or structure of company I should form?

spoke with few auditors in our town but no one was that knowledgeable about trading. I am located near a tier 3 city so your guidance would help me to move in right direction.

Mani, the only legal way to do this is by taking up a PMS license. Unfortunately, you cannot do this otherwise.

Sorry sir, was caught up with an urgent work so couldn\’t reply. Isn\’t it possible to create a company that pools other people money and invests sir, by charging some percentage say 30% of profits as fees.

No Mani, this is not possible. You need SEBI\’s approval for pooling this.

oh, k sir thanks

Good luck, Mani!

what kind of permission sir, is it cumbersome process? because I am finding it tough to keep track of markets as well as to place trades in each of the demat account.

If you intend to place trades and manage the account end to end, then you will need the PMS license. If you intend to give just advise, then an RIA license will help I guess.

Hello Sir, is the historical data provided by NSE adjusted for corporate actions?

Yes, I think so, Mani.

Sir, I have a doubt in calendar spread strategy, I have created a trading system that is able to find all the available trades and also an execution based entry system, but I am unable to find a quantitative way to determine acceptable price difference range to enter and exit trade, which I am doing manually now.

I do understand that there is doing to be a topic on calendar spread in the future but can you give me some pointers here.

Mani, once I\’m done with pair trading, I\’d take up calendar spreads. That will give you some insights into how to go about trading the calender spreads.

k sir, until which date dividend value has to be considered after its announcement to calculate the fair value

Pdf sir ?

This module is still work in progress, PDF will be available once completed.

When can we expect a module for Algorithmic trading/ HFT?

Thanks.

The present focus in on Trading Systems, Riya. I guess after this is a module on Mutual Funds. I\’m not sure if we will do a module on HFT.

Thanks Karthik.

Please plan a module on algo trading/HFT for future.

I\’ll probably have to take some external help for it, will try my best to do that, Riya.

Hi Karthik,

I had some doubt about the buy back offer. Recently Balrampur Chini announed a buy back at Rs. 150 per share, not sure when but the share price dropped to 75 as of today.

1. Why is it so, shouldn\’t the price instead of decreasing should atleast come to the price of buy back offer, because I can always buy the share at this price and sell them for buyback.

2. How complicated is the procedure and how much chances I have for the buyback.

1) This is not the best case for buyback as the shareholders if at they way to participate in the buyback, are better off buying it at a lower price in the open market.

2) Not really complicated, you can participate online…and the chances really depends on the scrip.

hi sir,

how much money do you think sufficient to make money in F & O trading? another one, is it mandatory to file returns even if my net P & L is in negative? if yes, then, is there any means of help from zerodha to get it filed?

I m a new one in this field and hv become a great fan of zerodha…thanks for being what you are…

Ruma, unfortunately, I don\’t have an answer for this. However, to be in the game for long and sustain and tide over the market volatility, you need to have a deep pocket. Yes, it is important to file your returns. I\’d suggest you get in touch with ClearTax for this – https://cleartax.in/

Good luck.

thanks karthik…

Welcome!

I can\’t find a download PDF link like Chapter 1-9, can you provide one?

The PDF will be ready once the module is complete. This module is still work in progress.

How many chapters are going to be in this Module? Do you have an approximate date by which you will make the PDF available?

Pair trade has couple of chapters more. After this, I plan to discuss Dynamic Delta Hedging with options. Can\’t really comment on how many chapters more.

Hello Sir, I am new to trading but have good python programming skill, so for starters I am trying to create a simple EMA crossover system. I backtested my strategy on NIFTY500 shares and shortlisted the ones with high %profit average and total-traded-value rank greater than 50. But I found that my selection process is correct. So how to select shares for a my strategy? Can you point me in right direction?

***correction*** Hello Sir, I am new to trading but have good python programming skill, so for starters I am trying to create a simple EMA crossover system. I backtested my strategy on NIFTY500 shares and shortlisted the ones with high %profit average and total-traded-value rank greater than 50. But I found that my selection process is not correct. So how to select shares for a my strategy? Can you point me in right direction?

Figured as much 🙂

Posted the reply to your earlier query.

Nifty 500 is perhaps the best universe as they have maximum liquidity. I\’d suggest you stick to this, but maybe you should look at tweaking few variables while back testing.

can U elaborate on \’ tweaking few variables\’ sir, I am testing for intraday 5 minute timeframes, 9 x 21 crossover, backtested for 21 days then filtered the shares like I told before, again backtested the filtered shares for next 7 days, 14 days like that, but mostly ended up with brokerage loss.

Things like these –

1) Instead on 9 x 21, maybe try 21 x 50 or 18 x 30 etc. You need to figure out the best possible combination. Also remember, what works for 1 stock may not work for another

2) Try various time frames

3) Try different risk reward ratios

can you also suggest number of back test days sir?

At least, 2-3 years.

can you also suggest number of back test days sir? what I did was, I backtested for 35 days filtered shares based on test result,then I backtested with filtered shares for next 7,14 days, is this the right method Sir?

Backtesting is best if done for at least 2-3 years.

Oh, ok sir, thanks

Welcome!

Hello Sir, regarding the Risk Reward Ratio,

Since the trading system I am trying to create is a EMA crossover system, entry and exit price are determined by the happenings of crossover, so how to find RRR if exit price is not known before hand

Mani, in case of a trading system\’, you will have to assess the risk-reward on the basis of the entire system and not really on a \’per trade\’ basis. You assess the risk reward on a trade to trade basis when you are trading based on say candlestick patterns.

Hello Sir, thank you for all the guidance so far, regarding risk reward ratio for entire trading system, how to calculate that for ema crossover system? correct me if I am wrong, if my avg pnl is 1 and my stoploss based on volatility is 0.5 then ratio is 1/0.5, is this the way or is there any other way?

Yes, you basically have to estimate the ratio which helps you understand how much risk you are taking for every 1 Rupee of reward you expect.

Sir with your help back tested and selected the stocks to trade in my EMA crossover system, I do understand that it is a beginner level trading strategy, can you suggest a trading strategy or a system(maybe 2 or three).

Also your suggestion of ‘Inside the black box’, by RIshi Narang was very helpful, gained more insights.

Mani, I would be writing about the systems in this chapter itself. Request you to please stay tuned. Thanks.

I know this is asking too much sir, but is there a way to send private message,so that I can send my detailed test results or discuss my strategy in detail.

Mani, I\’d love to look through it, but unfortunately, time does not permit me for this.

tough luck for me Sir, anyway can you suggest some books to learn quantitative mathematics for trading.

Hard to point to one book. Although not a \’Quant\’ book, I\’d suggest you get started on \’Inside the black box\’, by RIshi Narang.

Dear Karthik,

You have done a tremendous and excellent job. Thanks a billion for putting all aspects together in orderly manner. May I request you to convert Module 9 and Module 10 in PDF formats? Staring at computer screen for long time strains my eyes so it will be easier for me to read from the paper. Appreciate your help in this matter.

Thanks for the kind words. Module 9 is already in PDF, Module 10 will be in PDF once the module is completed.

Sir, exact tell which book is best of van k Tharp…..

The one on position sizing – Definitive Guide to position sizing.

I want to clarify a doubt regarding brokerage .

Suppose i had put an order for 10K shares but the order is executed in parts

My Order : 10K Shares of X Stock.

Order gets executed in parts : 5000/10000

3000/10000

2000/10000

So in this case my brokerage cost at zerodha would be Rs 20 ( As i have given a single trade entry )

or,

It would be Rs 60 ( as the trade is executed in 3 trades instead of 1 trade )

Looking forward for your answer.

Thank You

Since its a single order, the brokerage would be 20.

Hey Karthik,

Please upload the complete pdf for module 10 so that we can learn from it .

Please upload the complete pdf as soon as you can

Module 10 PDF will be done when we finish the entire module, we are still a long way from it.

Hi Karthik,

I have couple of questions regarding settlement of derivative market:

1) If I have leveraged 10 times by shorting future contract on a particular day and then next day that particular stock has gap-up opening of 20% because of uncertain situation like the above mentioned news. So, in this type of trade how is trade cash settled assuming investor who has shorted doesn\’t have money to pay. As it is zero sum game, who is gonna pay to opposite party? Is that SEBI or broker or government?

2) If I\’ve 1000 lot of PUT In the Money options and then war breaks out. In this situation, every PUT writer will try to close their position. But now, everyone has conviction that the worst situation will prevail and the worst of market is still to come. Finally because of liquidity crunch, situation is like only the OI for that particular series is 1000 lot.

Then will I be forced to close the position by regulator as the put writer is facing problem with margin amount and he is not able sustain financially that trade by putting extra required margin amount? or Is it regulator gonna take hit of lost amount?

1) The risk management team would cut your position in situations where it starts making losses over an above the margins parked.

2) If you have 1000 Put short, then there will be someone who has bought these from you. As long as you have an open position, someone else will also. So regulator will ensure money is transferred (or settled) between both the parties. Remember, the seller has margins parked already with the broker.

Sir I have a very important question about stop losses . In the above trade, say I was the option seller of PNB Oct 160 CE and I had placed a stop loss at 5 rupees below the sell price. How do I manage against drastic market changes like this? The price wouldn\’t hit my stop loss as it opened at a much higher price. How do traders protect themselves from incidents such as this?

This is a practical problem and a risk inherent in placing not just SL but any limit order. There is no guarantee of execution. This is where market order scores over limit orders, but the prices you get in mkt order can be quite dissapointing.

Just what I thought too sir. So in such cases, what can a trader do to protect himself from such black Swan events?

Nothing really 🙂

Sir I know this solution might not be feasible. But do you think holding the same number of underlying stocks bought at a much lower price say a few years back would act as a hedge for such black Swan events?

That is as good as a buy and hold strategy. Not really a hedge. But yes, in a sense, the only hedge against market volatility is time.

Hii Sir,

I want to know that in case i short sale nifty 50 index suppose on last day @2 ( 1 lot for 10700 nifty call) and before closing i wont able to buy or their are no buyer for the same then what will happen/ be consqunce. ??

( As we know nifty 10700 call will become \”0\” on expiry closing while nifty 50 is trading at 10470)

The contract will expire worthless and the premium you received is fully yours

The margin blocked for the contract will be released by the broker on T+1 day

Thanks for response, will any penalty wud be charged bcoz I haven\’t buy after short selling..??

No, no penalties

Hi sir, I\’m new into this field and um also reading your given modules. And let me tell u they R very easy to understand…

Hopefully will soon start earning..

Tx

Sir is there anything zerodha is doing about back testing, even for those who don\’t have any coding knowledge?

Yes, do keep a close watch for an announcement around this.

Hi karthik,

Sorry for posting here, but mobile kite application is not working from 2 days in android platform. Please suggest what to do??? ??

It is working like a charm, Saurav. What issues do you face?

@Karthik

Sir, First of all i wud like to thank u for all stuff, i have gone through most of the module & i found them really helpful

I am the beginner in this field & hopefully going to complete my CA in Coming Jan & want to make my career in this field but don\’t know how to start, Should i get training somewhere for this or should i start to analyze at my own ??

Waiting for Reply

Good luck for the upcoming exams in Jan, Manish.

I\’d suggest you start making your own analysis. This will always help.

Thank u Sir

Sir, i want to know how one can keep himself updated with all stuff related to companies & relevant industry apart from business news, so that i can track them

Is there any app or something.??

I personally keep the company name in Google Alerts, so whenever something happens, it shows up in my alerts.

@Karthik Rangappa

@nithin kamath

Will zerodha ever be listed on any exchange ?

Are you doing anything for making kite /PI (for options trading – currently we can\’t view live Greeks /net position Greeks in kite /pi- at least make this thing available if not rest ) as sophisticated as think and swim ?

Wait for your response >>

Monil, no one knows what the future holds 🙂

We are doing quite a bit with respect to options, hopefully, we should make some announcements soon 🙂

Sir how does one decide on what strategy the trading system should be based on? As you said there are so many trading strategies- Pairs trading, momentum etc. How should one go about selecting a trading system? Thanks.

A good trader usually has 2-3 strategies and masters them to perfection. So you always trade these strategies, based on the opportunities that come about in markets.

Thanks for the reply sir. Would you be comfortable telling what kind of trading systems you personally use? Thanks.

I use a mix of strategies, including Pair Trading, option writing, naked futures position, long-term investments, TA based trades etc.

*** correction set of stocks 🙂

hi Kartik

Momentum strategy (Portfolio approach)

by this you mean you will be doing all the calcs like 3 mnth – 12 mnth / 6mth-12 mnth / 9mth 12mth returns on a sent of scock

an then rank them as per the relative strength and select top 10 or 20 stock for your portfolio if yes can you please do that in excel and some ami broker code to go with as it will be much easier to backtest

Yes Mayur, its roughly around those lines. Will try and do this in excel.

One more thing karthik–can we have a trigger in our mail box, whenever a new topic been discussed by you.

We update this on twitter – https://twitter.com/ZerodhaVarsity

Hi Karthik,

As always great educational topics been discussed by you.

I have been trading for some time in options , using strategies.

Can we have a session on bitcoin and how to trade on bitcoin-I have been hearing a lot but know nothing on bitcoin- would request you to throw your intelligence on the subject.

Also can we form a wats app group –where you would discuss your profit making strategies ( I know I m sounding selfish).

I have no clue on Cryptos, Deepak 🙂

I\’ll excuse myself from the whatsapp group 🙂

Hi karthik,I have a doubt many People say that everything in market is manipulated by big institutional traders,that is why almost 99% retail traders lose money success percentage is very low there is also a belief that the index like nifty and bank nifty are also manipulated in their favour.is this talk really true?please explain briefly about this manipulation which is eating the retail traders wealth and health?can the index be manipulated?

There is no manipulation. People lose money because they do not have the kind of patience or discipline that the institutional investor has. Not for any other reason.

Hi,

Sir can you please make a module on trading plans and trading strategies for beginners. Especially for regular stocks rather than the Derivatives. I am new to stock trading and I want to stay away from Derivatives untill I get a hang of trading.

I would really appreciate if you such a module comes out on Varsity.

Thank you

P.S I have became a fan of Zerodha and I have started suggesting Varsity and Zerodha to everyone interested in trading stocks

Sure, Ashish. This sounds like a good idea. Will try and build some content around that. And thank you so much for helping us spread the word.

Thank you sir

Cheers!

Hi Karthik,

I know you aren\’t the right person for this, just thought you can cascade this to the right people like Nithin Kamath.

Lots of issues in current version of Kite in the past few days. What is happening with Zerodha applications? I called the support team and they weren\’t of much help except for saying some backed up-gradation work is going on. How can that be allowed to affect the front end. It affects people like me a lot.

Issue :

For example in Kite application, the positions tab is not reflecting “Average Price” and “P&L” at all and “Change” shows as NA. It shows as 0. You might want to look into the issue. I think the issue is common to many users, even my friend is facing the same problem. Also average prices are shown wrongly in the Holdings tab.

Would be great if you could escalate this issue or let me know a proper forum to discuss these

Thanks,

Ash

Ash, I think you should check out Kite 3, have you looked at this – https://tradingqna.com/t/kite-3-0-beta/25605

Team Varsity, you have done some really great work by designing such a great platform for retail trader for free. thank you very much for such great efforts.. can you launch google playstore app of Varsityzerodha. in which we read online and offline content on zerodha varsity instead of providing pdf copy.so we should read on zerodha platform instead of third party App (for pdfs). we also like to click on adds shown on this zerodha app as token of love from our side. i really want that u should design app for varsity and Q&A for greater mobility…….

once again thank you very much….

Panky, thanks for the kind words! This is something on our minds! Will try and work towards it 🙂

I read few books on trading systems and they all say that all trading systems have some edge over others. How true is this and if yes, what kind of edge are they talking about?

It really depends on what kind of intelligence you put in to build the trading system. Not all trading systems are intelligent enough 🙂

Sir sorry to bother you again. But when you say intelligence are you talking about back tested results?

Not just the backtested results, but the actual technique which triggers your buy and sell signals.

hi Karthik,

In some previous comment you said that you would look for atleast 60% win rate. But i have a question, for how many trades should we decide that the system is given 60% win rate or more?

The number of trades does not really matter, as long as 60% of the trades are winners, that\’s what I meant to say!

Hi Karthik,

Is there a module here which explains about investing in mutual funds? I was curious about Coin of Zerodha. If yes, please do comment the link for the module.

Not as of now, Satyaki. Hopefully, the next module will be on MFs!

Why not chapter 9 & 10 in pdf format

They are modules, Gunjan. Chapters are whats inside a module. PDF will be up in a months time for Module 9.

Hi Kartik,

On the same fateful day I entered a short strangle after the market opened and price of SBI stock looked to stabilize of SBI 280 PE & 320 CE and burnt my fingers badly as I had to buy back my call option at a very high price.

I think he did it towards the end of the day when prices had stabilized. Not at opening. But he did it for the index which had unusually high volatility even tough PSU\’s had less say on Bank NIFTY.

True!

Hmmmm, touching stocks which have fundamental news around it is a tough call. Its better to stay away if – especially in situations where its hard to assimilate the news flow.

Some options had better results than the PNB one.

SBI OCT 280 CE had some 27,000% and 300 CE some 40,000% gain.

There could be others too

At market close tough…

Maybe the PNB one you showed was best at market opening

Perhaps 🙂

Ah, maybe. This was the one which caught my attention 🙂

Hello Sir, an out of the context question. I am thinking to invest in Index Funds but I don\’t know how to choose one. I am aware of two factors

1) Expense ratio (Which has to be less than 0.5)

2) Tracking Error

My Questions are :

1) How do I find out tracking error for an Index Fund

2) Am I missing any of the important factors before choosing one?

1) Look out for the index fund\’s fact sheet, usually, availave on the Fund\’s homepage.

2) Make sure you invest in a direct fund 🙂 – Have you checked out Coin? – https://coin.zerodha.com/

Thanks a lot sir 🙂 I am already using coin for investing in mutual fund

Great!

Hey Karthik

This is my first post here. But I must admit I am a huge fan and follower of ur work.

Infact I have learned a lot from varsity, the very foundation of my understanding of markets is varsity. All due credits to you and team zerodha. I have an active account with zerodha and have referred a few friends to varsity and zerodha as well.

Many congratulations for the new module. Really looking forward to it..!

The appetite for knowledge of your followers has surpassed your capacity to produce quality work here. Congratulations!

Cheers

Vinit, thanks for the kind words! Hopefully, this module is worthy of people\’s expectations and time 🙂

Kartik

It is great to figure out someone who thinks like me.I am too excited by the way you write the module in easy to understand way.I some times trade on the basis of contrarian view .Well you have just given me an Idea for my P.hD thesis,which will in Behaviorial Finance and will try to figure what guts are, and to investigate the noise which affect trading decision in India.

Thanks

Happy to note that Saurabh, good luck 🙂

Sir when you gonna post pair trading module?

Starting soon..next week I\’ll try and put up the 1st chapter.

Hi Karthik, is pi quant be available on app?. Found only desktop version

Pi is a desktop application, no mobile app.

Hi Karthik.

This is my first post and I want to thank you first as I have learned most of the trading concepts and strategies from your modules at varsity.

I am eagerly looking forward to this module as I have plans to build a trading system and put my programming skills to some use.

Keep up the good work 🙂

(Just some random question)

I know it is really hard to predict the stock market moves but just asking what you think should be the ideal success rate of trading system.

Happy to note that, Ahtasham 🙂

Like you said – it is a hard question to answer. I\’d look for 60% at the least.

With 60% probability, one cannot build a career as trader

Why not?

Desperately waiting for pair trading module!

I\’m eager to deliver it as well 🙂

Its really weird that only 10% of the PSU banks contribute to the Bank Nifty Index and Bank Nifty surged 3 % !

Yes sir.

Do you think someone is manipulating Bank Nifty Index to their favor or is it actually happened because it is not possible.

Its really hard to manipulate indices like Nifty and Bank Nifty.

why can\’t we download PDF of chapter 9 and 10

Both will take some time.

Ok Thank you Sir !

Cheers!

Why I can\’t download module 10 in PDF

Work in progress, Vishant. PDF will be done once complete.

Karthik, If you don\’t mind, can you give details of the trade setup you did for the mentioned banknifty ?

Ah…it was nothing fancy… a straightforward short strangle with 24000 PE and 26000 CE.

Thanks 🙂

Cheers!

Yeah, I want to build my own trading system. It should needs rules and regulations. I eagerly awaiting to learn your lessons. hurrah!!!!

Hope your wait is worth its time!

Sir, I was expecting a module on personal finance? As you had said earlier.

There were way too many requests for Trading Systems, Umer 🙂

Im sure this too will be good 🙂

at the same time Ill wait for personal finance after this…

Thanks for the understanding, Umer.

Congrats on your bank nifty short strangle turning out right 🙂

I was taken by surprise about the rally in Banknifty.. unfortunately got on to the wrong side of the trend..Some hard lessons learnt ..1. Never do naked options.. 2. Don\’t put all eggs in single basket

Sir, where do u think the banknifty ends by Nov expiry (ball park number atleast)? Your answer will give boost to my thought process and to my existing open trade 🙂

Thats is a hard call, Ravi. Maybe you should apply the volatility concept and get a sense of where the expiry could be. Or something like max pain.

Very much excited to see the much awaited module live.I just have one question. I know you have already said that you do not trade naked options, but why not take a bull call spread or some other aggressive bullish trade on some top PSU bank\’s options, as it would give you maximum benefit or am I missing something here? I am just an option beginner and trying to know the way pros like yourself think. Thank you.

This was a call on Bank Nifty\’s irrational movement, Shashidhar 🙂

Sir u said 4 trading system will be dealt with, but in whole module ony pair trading is discussed when can we expect the other 3.

Starting work on that soon, Vinay 🙂

These will be much shorter chapters though.

sir this is great help in learning all this thing would request you to please make this chapter also available in pdf format that will be great help seriously

PDF will be available once the module is complete. This module is work in progress.